UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-10325

VANECK VECTORS ETF TRUST

(Exact name of registrant as specified in charter)

666 Third Avenue, New York, NY 10017

(Address of principal executive offices) (Zip code)

Van Eck Associates Corporation

666 Third Avenue, New York, NY 10017

(Name and address of agent for service)

Registrant's telephone number, including area code: (212) 293-2000

Date of fiscal year end: DECEMBER 31

Date of reporting period: JUNE 30, 2017

Item 1. Report to Shareholders

| SEMI-ANNUAL REPORT June 30, 2017 (unaudited) |

| VANECK VECTORS® | |

| Africa Index ETF | AFK® |

| Brazil Small-Cap ETF | BRF® |

| ChinaAMC CSI 300 ETF | PEK® |

| ChinaAMC SME-ChiNext ETF | CNXT® |

| Egypt Index ETF | EGPT® |

| India Small-Cap Index ETF | SCIF® |

| Indonesia Index ETF | IDX® |

| Israel ETF | ISRA® |

| Poland ETF | PLND® |

| Russia ETF | RSX® |

| Russia Small-Cap ETF | RSXJ® |

| Vietnam ETF | VNM® |

| 800.826.2333 | vaneck.com |

The information contained in this report represents the opinions of VanEck and may differ from other persons. This information is not intended to be a forecast of future events, a guarantee of future results or investment advice. The information contained herein regarding each index has been provided by the relevant index provider. Also, unless otherwise specifically noted, any discussion of the Funds’ holdings and the Funds’ performance, and the views of VanEck are as of June 30, 2017.

VANECK VECTORS ETFs

June 30, 2017 (unaudited)

The first six months of 2017 were outstanding for the suite of VanEck Vectors Country/Regional ETFs. Only one fund, VanEck Vectors Russia ETF (NYSE Arca: RSX) failed to provide a positive return for the period. Particularly satisfying was to see both our China ETFs back in the black. VanEck Vectors ChinaAMC CSI 300 ETF (NYSE Arca: PEK) and VanEck Vectors ChinaAMC SME-ChiNext ETF (NYSE Arca: CNXT) posted returns of 14.83%* and 7.36%,* respectively.

China is an important part of the world economy and we believe the country continues to offer interesting investment opportunities. The good news at the end of the first half was the decision by MSCI starting in June 2018 to include 222 China A-share stocks in its MSCI Emerging Markets Index1 and other indices.

The weights may initially be low, but they are a beginning. At the end of June 2017, based on MSCI’s estimates (5% Inclusion Factor2), the pro forma weights of China A-shares will be 0.73% of MSCI Emerging Markets Index, 0.83% of MSCI AC Asia ex Japan Index,3 and 0.1% of MSCI ACWI Index.4 In an indication of what this may mean, even at these low levels, Goldman Sachs estimated that the inclusion is expected to trigger about US$12 billion of net buying from emerging markets mandates.

We believe that VanEck Vectors ChinaAMC CSI 300 ETF may be an excellent way not only to capture this thematic opportunity, but also access the stocks eventually to be included by MSCI.

A High Correlation between the CSI 300 Index and the Proposed MSCI Constituents

Of the proposed 222 MSCI constituents, 199 are CSI 300 Index5 constituents. Those overlapping constituents weight approximately 80% in the CSI 300 Index and approximately 95% in MSCI.

Based on a static simulated list of June 19, 2017 released by MSCI, the one year performance correlation between the simulated list and the CSI 300 Index is as high as 0.99.

Proposed MSCI Constituents are Highly Similar to the CSI 300 Index in Terms of Sector Allocation

| GICS Sector Name | Proposed MSCI Constituents | CSI 300 Index | ||

| 1 | Consumer Discretionary | 10.23% | 11.76% | |

| 2 | Consumer Staples | 9.18% | 6.52% | |

| 3 | Energy | 2.38% | 2.41% | |

| 4 | Financials | 36.52% | 34.53% | |

| 5 | Health Care | 4.28% | 5.16% | |

| 6 | Industrials | 15.54% | 15.18% | |

| 7 | Information Technology | 5.73% | 8.80% | |

| 8 | Materials | 7.10% | 6.57% | |

| 9 | Real Estate | 4.68% | 5.49% | |

| 10 | Telecommunication Services | 0.15% | 0.82% | |

| 11 | Utilities | 4.21% | 2.75% |

Source: MSCI, ChinaAMC. Data as of June 19, 2017.

VanEck continues to be an industry leader in offering single-country and region-specific equity ETFs. When performance varies so widely between countries and regions, it is all the more important to be able to select your focus; the suite of VanEck Vectors country and regional ETFs gives you the flexibility to do just that. We at VanEck continue to look for ways to enhance your access to the markets you choose and to seek out and evaluate the most attractive opportunities for you as a shareholder in the international space.

Access investment and market insights from VanEck’s investment professionals by subscribing to our commentaries. To subscribe to these updates, please contact us at 800.826.2333 or visit vaneck.com/subscription/to register.

| 1 |

VANECK VECTORS ETFs

(unaudited) (continued)

On the following pages, you will find the performance record of each of the funds for the six month period ending June 30, 2017. You will also find their financial statements. As always, we value your continued confidence in us and look forward to helping you meet your investment goals in the future.

Jan F. van Eck

Trustee and President

VanEck Vectors ETF Trust

July 19, 2017

Past performance is no guarantee of future results. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Current market conditions may not continue.

All indices are unmanaged and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in the fund. An index’s performance is not illustrative of the fund’s performance. Indices are not securities in which investments can be made. Results reflect past performance and do not guarantee future results.

* Returns based on each fund’s net asset value (NAV).

| 1 | Morgan Stanley Capital International (MSCI) Emerging Markets Index captures large- and mid-cap representation across 24 Emerging Markets (EM) countries. With 845 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. |

| 2 | Inclusion Factor. MSCI defines the free float of a security as the proportion of shares outstanding that are deemed to be available for purchase in the public equity markets by international investors. |

| 3 | MSCI AC Asia ex Japan Index captures large- and mid-cap representation across 2 of 3 Developed Markets (DM) countries (excluding Japan) and 9 Emerging Markets (EM) countries in Asia. With 639 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. |

| 4 | MSCI ACWI Index captures large- and mid-cap representation across 23 Developed Markets (DM) and 24 Emerging Markets (EM) countries. With 2,501 constituents, the index covers approximately 85% of the global investable equity opportunity set. |

| 5 | CSI 300 Index (CSIR0300) is a modified free-float market capitalization-weighted index compiled and managed by China Securities Index Co., Ltd. Considered to be the leading index for the Chinese equity market, the CSI 300 is a diversified index consisting of 300 constituent stocks listed on the Shenzhen Stock Exchange and/or the Shanghai Stock Exchange. |

| 2 |

Management Discussion (unaudited)

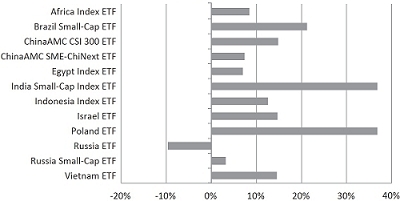

All except one fund in the suite of VanEck Vectors Country/Regional ETFs posted positive returns during the six month period ending June 30, 2017. The top two performing funds produced solid performance: VanEck Vectors India Small-Cap ETF (NYSE Arca: SCIF) (+36.83%) and VanEck Vectors Poland ETF (NYSE Arca: PLND) (+36.81%).

The two bottom performing funds were both Russia-focused: VanEck Vectors Russia ETF (NYSE Arca: RSX) (-9.60%) and VanEck Vectors Russia Small-Cap ETF (NYSE Arca: RSXJ) (+3.17%).

January 1 through June 30, 2017

VanEck Vectors Country/Regional ETFs Total Return

Source: VanEck. Returns based on each fund’s net asset value (NAV). The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for certain funds reflect temporary waivers of expenses and/or fees. Had these funds incurred all expenses, investment returns would have been reduced. Investment return and value of the shares of the funds will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted.

Country/Regional Overviews

Africa

The financial sector, followed by the materials sector, were the two greatest contributors to the performance of the Fund (+7.07%) for the six month period. As a consequence of the fall in crude oil prices in the period under review, the energy sector was the largest detractor from performance. Midcap companies contributed the most to performance. Geographically, Canadian and U.K. gold mining companies operating in Africa, a South African media company, and Egyptian financial companies were among the most significant contributors to positive performance. Some companies outside Africa, including companies domiciled in Indonesia, the Netherlands, Switzerland, and the U.K., were detractors from performance. Additionally, the depreciation of the Nigerian naira against the U.S. dollar, coupled with Nigerian capital controls experienced earlier in the period that delayed the Fund’s ability to repatriate its Nigerian naira, had a negative impact on performance.

Brazil

Despite both the economic and political challenges Brazil continues to face, the first six months of 2017 were an excellent period, bringing with it a Fund return of 21.24%. On the economic front, the first three months of the year were notable for the fact that, after eight consecutive quarters of contraction, the economy expanded by 1%.1 This was the first expansion after one of the worst recessions the country has ever experienced. The boost to the economy came from a smaller drag from consumer spending and a jump in exports. However investment continued to contract and public spending fell.2 On the political front, serious challenges remain and the position of President Temer could hardly be described as secure. In the last week of June, Brazil’s top prosecutor indicted the president, accusing him of taking bribes from JBS, the largest meatpacker in the world.3 Consequently, increasing doubt surrounds the prospect of success for the various reform measures, in particular those involving social security, he and his administration have planned.

| 3 |

VANECK VECTORS ETFs

(unaudited) (continued)

Perhaps continuing to anticipate a brighter future for the country, both Brazilian mid-cap and small-cap companies performed well over the period under review. The consumer discretionary sector, followed by the healthcare and materials sectors, all delivered healthy performance. Not one sector detracted from performance, but the energy sector contributed the least.

China

After the uncertainties faced by the two VanEck Vectors China-focused ETFs in 2016, the first six months of 2017 reversed the double digit declines seen by both, with VanEck Vectors ChinaAMC SME-ChiNext ETF (CNXT) and VanEck Vectors ChinaAMC CSI 300 ETF (PEK) returning 7.36% and 14.83%, respectively. China began the year at a furious pace. At the end of June, this led the International Monetary Fund to raise its 2017 growth outlook for the country from its 6.6% forecast in April to 6.7%. However it did recommend that the country accelerate reforms and rein in credit.4

CNXT seeks to provide not only exposure primarily to China’s market for innovative, non-government owned companies, but also to the sectors that are increasingly underpinning the growth of China’s “New Economy”. It is, therefore, not surprising that the vast majority of the Fund’s gains during the six month period came from companies in the information technology sector. Companies in the consumer discretionary sector detracted the most from performance.

All sectors contributed positively to the performance of PEK. While financial and consumer discretionary companies contributed the most to returns, telecommunications companies and energy contributed the least.

Egypt

Following a difficult year in 2016, things started to look up for Egypt in the first six months of 2017 and, in contrast with the prior 12 months, the Fund returned a respectable 6.96%. In the first quarter of 2017, the country’s economy appeared to have stabilized. According to the Ministry of Planning, GDP increased 3.9% year-on-year. This is up from the 3.8% expansion in the fourth quarter of 2016 and above the 3.7% increase the first quarter in 2016.5 A further sign of potential improvement was the 1.67% increase in urban consumer prices in May. This was down slightly from April’s 1.69% increase. Perhaps demonstrating that the impact of the significant depreciation experienced by the Egyptian pound at the end of 2016 is beginning to diminish, May’s figure was the lowest in eight months.6 However, on June 27, in a move to help comply with the terms of the country’s $12 billion loan from the International Monetary Fund, but which could also stoke inflation and test the popularity of the country’s president, Abdel Fattah al-Sisi, fuel prices were hiked by up to 50%. While expected, the rise was more than expected.7

The top two performing sectors were materials and financials. The two greatest detractors were energy and telecommunications services. Small-cap companies, with the largest average weighting during the period under review, contributed by far the most to performance. Only large-cap companies, with the smallest average weighting over the period under review, detracted from performance.

India

Despite the fact that economic growth in India slowed down sharply in the first quarter of 2017, VanEck Vectors India Small-Cap Index ETF still returned a noteworthy 36.83% for the six month period under review. At 6.1%, growth in the March quarter fell to its lowest in two years. (In the fourth quarter of 2014 growth dropped to 6.0%.)8 Although many expected to see at least some residual effects of November’s demonetization (when 1,000 rupee and 500 rupee notes, reportedly some 86% of all currency in circulation9 at the time, were banned) in early 2017 economic activity, the sharpness of the slowdown came as a surprise. Capital investments fell an annual 2.1% during the quarter and the drivers of growth remain government and consumer spending.10 Finally after 10 years, on Saturday, July 1, India will have a new system of taxes—the Goods and Services Tax (GST). Instead of a collection of duties, fees, and central and state tariffs, all goods and services will be placed in one of five different tax brackets, with each product now subject to a single tax rate across the country.11 Going forward, the move is generally seen as being positive for the country’s economy.

The consumer discretionary, industrial, and financial sectors all provided excellent returns. While still both making positive contributions, the telecommunications services and energy sectors contributed the least to performance.

| 4 |

Indonesia

The Fund enjoyed a rewarding six month period, returning 12.48%. As if to confirm the good news at the end of December last year that Fitch Ratings had revised the country’s credit rating outlook to positive and praised Indonesian policy makers for “strong structural reform,”12 the World Bank’s “June 2017 Indonesia Economic Quarterly”13 described the country’s economy as beginning 2017 on a “strong footing.” In May, S&P Global Ratings raised Indonesia’s credit rating to investment grade.14 First quarter GDP growth in 2017 rose to 5.0% from 4.9% in the last quarter of 2016. It was lifted by a rebound in government consumption and surging exports. Private consumption growth in the country has been robust, supported muted inflation and a stable rupiah. “Investment growth continues to be strong on the back of the ongoing recovery in commodity prices, continued reforms to improve the business environment, lower financing rates, and better business sentiment.”15 In an encouraging sign, while Indonesia’s consumer price index rose year-on-year in June, the annual core inflation rate (i.e., excluding government-controlled and volatile food prices) fell to 3.13% from 3.20% in May.16

All sectors, except industrials and utilities, contributed positively to performance, with financials, followed by consumer staples and telecommunication services, contributing the most. The utilities sector detracted the most from performance.

Israel

Despite economic growth in the first quarter of 2017 being slower than expected, at the end of May the Bank of Israel stated that the country’s economy was continuing to grow at a solid pace.17 The Fund returned a healthy 14.64% for the first six months of the year. On an annualized basis, Israel’s economy grew at 1.4% in the first three months of the year with the improvement in the growth of exports continuing.18 However, this contrasted with an annualized growth rate of 4.7% during the last quarter of 2016. In May, exports rose 13.0% compared to May 2016. The highest for eight months, this figure contrasted with the 5.1% drop seen in April.19

Over the period under review, the performances of all sectors, except healthcare and telecommunication services, contributed positively to performance. Healthcare companies detracted the most from performance. By far the greatest contribution came from companies in the information technology sector with the largest average weighting over the period under review. Mid-cap companies made the greatest contribution to the Fund’s performance.

Poland

The Fund had an excellent six months, returning 36.81% in the first half of 2017. While the fourth quarter of 2016 was good for Poland’s economy, with growth of 4%, the first quarter of 2017 was even better.20 Drivers of this growth were private consumption (because of a tight labor market) and a recovery in EU-funded investment.21 While exports grew during the quarter, so did imports—on the back of a stronger zloty. Fiscal results during the first quarter were also commendable. The country’s estimated fiscal deficit for January-May was only 0.3% of the annual plan. It was reassuring, too, that such strong performance was driven by better-than-expected tax collection, signaling that domestic activity was robust.22

All sectors except one contributed positively to performance. The financial sector was by far the greatest contributor to total returns. The real estate sector was the only sector to detract from performance and, then, only minimally.

Russia

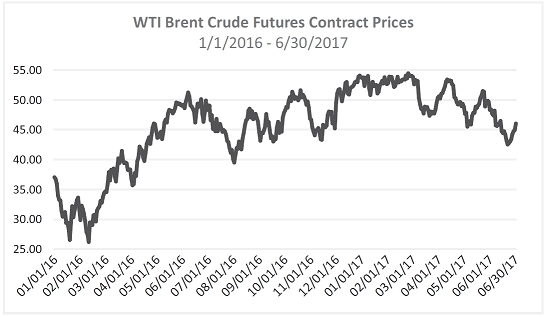

After recording excellent positive returns for calendar year 2016, the first six months of 2017 were difficult not only for VanEck Vectors Russia Small-Cap ETF (RSXJ) and its peer investing in larger cap Russian stocks, VanEck Vectors Russia ETF (RSX), but also Russia’s economy. While the former fund returned a positive 3.17% for the first six months of the year, the latter lost 9.60% over the same period.

Two major factors contributing to the economy’s poor performance have, not least, been the fall in oil prices and the apparent evaporation of any hope that the election of Donald Trump as U.S. president would lead to an improvement in U.S.-Russia relations. As if to confirm this last, toward the end of June, the U.S. Senate passed a bill that would, according to the Financial Times, “tighten existing sanctions and threatens to broaden the restrictions from energy and banking to metals, mining, railways and shipping.”23 By the end of June, however,

| 5 |

VANECK VECTORS ETFs

(unaudited) (continued)

the bill remained stuck in Congress, needing technical changes passed by the Senate to be passed by the House. It looked unlikely, therefore, that the legislation would be passed before President Trump had his face-to-face meeting with Russia’s President Putin in early July.24

Energy companies were by far the most significant detractors from performance in RSX, the large-cap fund. Only the information technology sector contributed positively to performance. For the small-cap fund, RSXJ, companies in the information technology and industrial sectors performed particularly well. However, similarly sized companies in the materials were the largest detractors from performance.

Vietnam

In welcome contrast to its performance in 2016, the Fund returned +14.49% for the six month period under review. Despite a slow start to the year25 (growth declined to 5.1%26 in the first quarter partially as a result of reduced smartphone production by Samsung and the condition of the oil market), in April and May the figures for both retail sales and industrial production were strong.27 According to figures from the country’s statistics office, quoted by Bloomberg, inflation eased to a nine-month low of 3.19% in May. In the first five months of the year exports rose 17.4% from a year earlier, and pledged foreign direct investment increased 10.4%.28 Figures published at the end of June for the second quarter of the year showed that, on the back of a surge in exports, Vietnam had rejoined the group of those countries with a GDP growth of 6% or more.29

Small-cap companies, with the greatest average weighting, performed far better than either mid- or large-cap companies over the reporting period. The financial sector was the largest positive contributor to total returns. The energy sector was the only sector to detract from performance.

| 1 | Trading Economics: Brazil GDP Growth Rate, https://tradingeconomics.com/brazil/gdp-growth |

| 2 | Ibid. |

| 3 | Financial Times: Brazil’s corruption probe reaches the presidency, https://www.ft.com/content/986d1376-5c08-11e7-b553-e2df1b0c3220?mhq5j=e3 |

| 4 | Reuters: China’s economy holds up in May but slowing investment points to cooling, https://www.reuters.com/article/us-china-economy-idUSKBN1950J4 |

| 5 | FocusEconomics: Egypt: The economy is back on its feet, growth increases in January-March period, http://www.focus-economics.com/countries/egypt/news/gdp/the-economy-is-back-on-its-feet-growth-increases-in-january-march-period |

| 6 | FocusEconomics: Egypt: In May inflation mercifully peaks at last, albeit at an excruciatingly high rate, http://www.focus-economics.com/countries/egypt/news/inflation/in-may-inflation-mercifully-peaks-at-last-albeit-at-an-excruciatingly |

| 7 | Reuters: UPDATE 3-Egypt raises fuel prices by up to 50 percent under IMF deal, https://www.reuters.com/article/egypt-economy-idUSL8N1JQ1G5 |

| 8 | Reuters: India loses fastest growing economy tag after sharp growth slowdown, http://in.reuters.com/article/india-economy-gdp-idINKBN18S3V4 |

| 9 | The Wall Street Journal: Why India’s Attack on Cash is Good for Bonds, http://blogs.wsj.com/indiarealtime/2016/11/15/why-indias-attack-on-cash-is-good-for-bonds/ |

| 10 | Reuters: India loses fastest growing economy tag after sharp growth slowdown, http://in.reuters.com/article/india-economy-gdp-idINKBN18S3V4 |

| 11 | CNN Money: India finally gets its ‘big bang’ tax reform, http://money.cnn.com/2017/06/30/news/economy/india-gst-tax-reform-rollout/index.html |

| 12 | The Business Times: Fitch revises Indonesia credit outlook to ‘positive’, http://www.businesstimes.com.sg/government-economy/fitch-revises-indonesia-credit-outlook-to-positive |

| 13 | The World Bank: June 2017 Indonesia Economic Quarterly, http://www.worldbank.org/en/country/indonesia/publication/indonesia-economic-quarterly-june-2017 |

| 6 |

| 14 | Bloomberg: Indonesia Raised to Investment Grade by S&P on Budget Curbs, https://www.bloomberg.com/news/articles/2017-05-19/s-p-upgrades-indonesia-to-investment-grade-amid-stronger-growth |

| 15 | The World Bank: June 2017 Indonesia Economic Quarterly, http://www.worldbank.org/en/country/indonesia/publication/indonesia-economic-quarterly-june-2017 |

| 16 | The Business News: Indonesia’s inflation rate picks up slightly in June, http://www.businesstimes.com.sg/government-economy/indonesias-inflation-rate-picks-up-slightly-in-june |

| 17 | Reuters: Israel central bank holds rates as economy growing at ’solid pace’, http://www.reuters.com/article/us-israel-cenbank-rates-idUSKBN18P0VR |

| 18 | Ibid. |

| 19 | FocusEconomics: Israel Trade May 2017, http://www.focus-economics.com/countries/israel/news/trade/exports-rebound-in-may |

| 20 | FocusEconomics: Poland Economic Outlook, http://www.focus-economics.com/countries/poland |

| 21 | Ibid. |

| 22 | VanEck Research/Bloomberg |

| 23 | Financial Times: US sanctions bill dashes investor hopes for Russian recovery, https://www.ft.com/content/2ded55d6-55cf-11e7-9fed-c19e2700005f?mhq5j=e3 |

| 24 | CNN politics: Russia sanctions bill still stuck in Congress before Trump-Putin meeting, http://www.cnn.com/2017/06/29/politics/russia-sanctions-bill-senate/index.html |

| 25 | Central and Eastern European Chamber of Commerce in Vietnam: Vietnam’s economy to stay strong in 2017, http://ceecvn.org/vietnams-economy-stay-strong-2017/ |

| 26 | Bloomberg: Vietnam’s Prime Minister Says He’s Confident of 6.7% Growth Goal, https://www.bloomberg.com/news/articles/2017-05-28/vietnam-s-prime-minister-says-he-s-confident-of-6-7-growth-goal |

| 27 | FocusEconomics: Vietnam Economic Outlook, http://www.focus-economics.com/countries/vietnam |

| 28 | Bloomberg: Vietnam’s Prime Minister Says He’s Confident of 6.7% Growth Goal, https://www.bloomberg.com/news/articles/2017-05-28/vietnam-s-prime-minister-says-he-s-confident-of-6-7-growth-goal |

| 29 | Bloomberg: Vietnam Rejoins Club of 6%-GDP-Growth Nations as Exports Surge, https://www.bloomberg.com/news/articles/2017-06-29/vietnam-s-economy-expands-at-faster-pace-in-second-quarter |

| 7 |

VANECK VECTORS ETF TRUST

June 30, 2017 (unaudited) (continued)

VANECK VECTORS AFRICA INDEX ETF

| Average Annual Total Returns | Cumulative Total Returns | |||||||||||||||||||||||

| Share Price | NAV | MVAFKTR1 | Share Price | NAV | MVAFKTR1 | |||||||||||||||||||

| Six Months | 9.15 | % | 8.41 | % | 11.53 | % | 9.15 | % | 8.41 | % | 11.53 | % | ||||||||||||

| One Year | 10.65 | % | 10.63 | % | 16.03 | % | 10.65 | % | 10.63 | % | 16.03 | % | ||||||||||||

| Five Year | (2.29 | )% | (2.05 | )% | (0.18 | )% | (10.93 | )% | (9.86 | )% | (0.88 | )% | ||||||||||||

| Life* | (4.59 | )% | (4.50 | )% | (2.91 | )% | (34.38 | )% | (33.87 | )% | (23.29 | )% | ||||||||||||

| * | Commencement of Fund: 7/10/08; First Day of Secondary Market Trading: 7/14/08 |

| 1 | MVISTM GDP Africa Index (MVAFKTR) tracks the performance of the largest and most liquid companies in Africa. The weighting of a country in the index is determined by the size of its gross domestic product. |

Index data prior to June 21, 2013 reflects that of the Dow Jones Africa Titans 50 IndexSM. From June 21, 2013, forward, the index data reflects that of the MVISTM GDP Africa Index (MVAFKTR). All Index history reflects a blend of the performance of the aforementioned Indexes.

VANECK VECTORS BRAZIL SMALL-CAP ETF

| Average Annual Total Returns | Cumulative Total Returns | |||||||||||||||||||||||

| Share Price | NAV | MVBRFTR1 | Share Price | NAV | MVBRFTR1 | |||||||||||||||||||

| Six Months | 22.09 | % | 21.24 | % | 21.65 | % | 22.09 | % | 21.24 | % | 21.65 | % | ||||||||||||

| One Year | 34.95 | % | 34.62 | % | 35.44 | % | 34.95 | % | 34.62 | % | 35.44 | % | ||||||||||||

| Five Year | (9.15 | )% | (9.01 | )% | (8.31 | )% | (38.11 | )% | (37.65 | )% | (35.21 | )% | ||||||||||||

| Life* | 1.40 | % | 1.48 | % | 2.16 | % | 11.98 | % | 12.74 | % | 18.98 | % | ||||||||||||

| * | Commencement of Fund: 5/12/09; First Day of Secondary Market Trading: 5/14/09 |

| 1 | MVISTM Brazil Small-Cap Index (MVBRFTR) is a rules-based, modified market capitalization-weighted, float-adjusted index comprised of publicly traded small-capitalization companies that are domiciled and primarily listed on an exchange in Brazil, or that generate at least 50% of their revenues in Brazil. |

VANECK VECTORS CHINAAMC CSI 300 ETF

| Average Annual Total Returns | Cumulative Total Returns | |||||||||||||||||||||||

| Share Price | NAV | CSIR03001 | Share Price | NAV | CSIR03001 | |||||||||||||||||||

| Six Months | 15.03 | % | 14.83 | % | 14.62 | % | 15.03 | % | 14.83 | % | 14.62 | % | ||||||||||||

| One Year | 16.01 | % | 15.75 | % | 16.87 | % | 16.01 | % | 15.75 | % | 16.87 | % | ||||||||||||

| Five Year | 7.48 | % | 7.44 | % | 9.24 | % | 43.44 | % | 43.19 | % | 55.57 | % | ||||||||||||

| Life* | 1.97 | % | 2.08 | % | 3.76 | % | 14.01 | % | 14.80 | % | 28.15 | % | ||||||||||||

| * | Commencement of Fund: 10/13/10; First Day of Secondary Market Trading: 10/14/10 |

| 1 | CSI 300 Index (CSIR0300) is a modified free-float market capitalization weighted index comprised of the largest and most liquid stocks in the Chinese A-share market. Constituent stocks for the Index must have been listed for more than three months (unless the stock’s average daily A-share market capitalization since its initial listing ranks among the top 30 of all A-shares) and must not be experiencing what the Index Provider believes to be obvious abnormal fluctuations or market manipulation. |

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

See “About Fund Performance” on page 12 for more information.

| 8 |

VANECK VECTORS CHINAAMC SME-CHINEXT ETF

| Average Annual Total Returns | Cumulative Total Returns | |||||||||||||||||||||||

| Share Price | NAV | SZ3996111 | Share Price | NAV | SZ3996111 | |||||||||||||||||||

| Six Months | 8.84 | % | 7.36 | % | 7.60 | % | 8.84 | % | 7.36 | % | 7.60 | % | ||||||||||||

| One Year | (6.72 | )% | (7.44 | )% | (5.23 | )% | (6.72 | )% | (7.44 | )% | (5.23 | )% | ||||||||||||

| Life* | 8.53 | % | 8.49 | % | 11.54 | % | 27.19 | % | 27.03 | % | 37.82 | % | ||||||||||||

| * | Commencement of Fund: 7/23/14; First Day of Secondary Market Trading: 7/24/14 |

| 1 | The SME-ChiNext 100 Index (SZ399611) is a modified, free-float adjusted index intended to track the performance of the 100 largest and most liquid stocks listed and trading on the Small and Medium Enterprise (“SME”) Board and the ChiNext Board of the Shenzhen Stock Exchange. The Index is comprised of A-shares. |

VANECK VECTORS EGYPT INDEX ETF

| Average Annual Total Returns | Cumulative Total Returns | |||||||||||||||||||||||

| Share Price | NAV | MVEGPTTR1 | Share Price | NAV | MVEGPTTR1 | |||||||||||||||||||

| Six Months | 5.34 | % | 6.96 | % | 6.90 | % | 5.34 | % | 6.96 | % | 6.90 | % | ||||||||||||

| One Year | (21.35 | )% | (21.85 | )% | (7.18 | )% | (21.35 | )% | (21.85 | )% | (7.18 | )% | ||||||||||||

| Five Year | (8.45 | )% | (8.41 | )% | (4.36 | )% | (35.69 | )% | (35.56 | )% | (20.00 | )% | ||||||||||||

| Life* | (11.45 | )% | (11.46 | )% | (9.29 | )% | (59.18 | )% | (59.21 | )% | (51.23 | )% | ||||||||||||

| * | Commencement of Fund: 2/16/10; First Day of Secondary Market Trading: 2/18/10 |

| 1 | MVISTM Egypt Index (MVEGPTTR) is a rules-based, modified market capitalization-weighted, float-adjusted index comprised of publicly traded companies that are domiciled and primarily listed on an exchange in Egypt, or that generate at least 50% of their revenues in Egypt. |

VANECK VECTORS INDIA SMALL-CAP INDEX ETF

| Average Annual Total Returns | Cumulative Total Returns | |||||||||||||||||||||||

| Share Price | NAV | MVSCIFTR1 | Share Price | NAV | MVSCIFTR1 | |||||||||||||||||||

| Six Months | 36.69 | % | 36.83 | % | 34.92 | % | 36.69 | % | 36.83 | % | 34.92 | % | ||||||||||||

| One Year | 33.36 | % | 34.08 | % | 33.48 | % | 33.36 | % | 34.08 | % | 33.48 | % | ||||||||||||

| Five Year | 7.51 | % | 7.71 | % | 8.08 | % | 43.65 | % | 44.96 | % | 47.50 | % | ||||||||||||

| Life* | (3.83 | )% | (3.73 | )% | (3.53 | )% | (23.47 | )% | (22.94 | )% | (21.80 | )% | ||||||||||||

| * | Commencement of Fund: 8/24/10; First Day of Secondary Market Trading: 8/25/10 |

| 1 | MVISTM India Small-Cap Index (MVSCIFTR) is a rules-based, modified market capitalization-weighted, float-adjusted index comprised of publicly traded small-capitalization companies that are headquartered in India or that generate the majority of their revenues in India. |

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

See “About Fund Performance” on page 12 for more information.

| 9 |

VANECK VECTORS ETF TRUST

PERFORMANCE COMPARISON

June 30, 2017 (unaudited) (continued)

VANECK VECTORS INDONESIA INDEX ETF

| Average Annual Total Returns | Cumulative Total Returns | |||||||||||||||||||||||

| Share Price | NAV | MVIDXTR1 | Share Price | NAV | MVIDXTR1 | |||||||||||||||||||

| Six Months | 13.33 | % | 12.48 | % | 12.51 | % | 13.33 | % | 12.48 | % | 12.51 | % | ||||||||||||

| One Year | 11.56 | % | 11.55 | % | 13.19 | % | 11.56 | % | 11.55 | % | 13.19 | % | ||||||||||||

| Five Year | (0.48 | )% | (0.44 | )% | 0.42 | % | (2.37 | )% | (2.18 | )% | 2.11 | % | ||||||||||||

| Life* | 15.25 | % | 15.21 | % | 16.07 | % | 232.10 | % | 230.94 | % | 252.47 | % | ||||||||||||

| * | Commencement of Fund: 1/15/09; First Day of Secondary Market Trading: 1/20/09 |

| 1 | MVISTM Indonesia Index (MVIDXTR) is a rules-based, modified market capitalization-weighted, float-adjusted index comprised of publicly traded companies that are domiciled and primarily listed on an exchange in Indonesia, or that generate at least 50% of their revenues in Indonesia. |

| Average Annual Total Returns | Cumulative Total Returns | |||||||||||||||||||||||

| Share Price | NAV | BLSNTR1 | Share Price | NAV | BLSNTR1 | |||||||||||||||||||

| Six Months | 15.14 | % | 14.64 | % | 14.96 | % | 15.14 | % | 14.64 | % | 14.96 | % | ||||||||||||

| One Year | 18.40 | % | 17.27 | % | 18.18 | % | 18.40 | % | 17.27 | % | 18.18 | % | ||||||||||||

| Life* | 6.65 | % | 6.56 | % | 7.04 | % | 29.50 | % | 29.03 | % | 31.37 | % | ||||||||||||

| * | Commencement of Fund: 6/25/13; First Day of Secondary Market Trading: 6/26/13 |

| 1 | BlueStar Israel Global IndexTM (BLSNTR) is a rules-based index intended to track the overall performance of publicly traded companies that are generally considered by the Indexer to be Israeli and Israeli linked companies. It primarily includes the largest and the most liquid companies, as well as mid-cap and small-cap companies that display sufficient liquidity. |

| Average Annual Total Returns | Cumulative Total Returns | |||||||||||||||||||||||

| Share Price | NAV | MVPLNDTR1 | Share Price | NAV | MVPLNDTR1 | |||||||||||||||||||

| Six Months | 38.15 | % | 36.81 | % | 33.16 | % | 38.15 | % | 36.81 | % | 33.16 | % | ||||||||||||

| One Year | 46.05 | % | 45.80 | % | 41.89 | % | 46.05 | % | 45.80 | % | 41.89 | % | ||||||||||||

| Five Year | 2.83 | % | 2.85 | % | 2.53 | % | 14.99 | % | 15.11 | % | 13.32 | % | ||||||||||||

| Life* | (0.97 | )% | (1.02 | )% | (1.09 | )% | (7.17 | )% | (7.52 | )% | (8.02 | )% | ||||||||||||

| * | Commencement of Fund: 11/24/09; First Day of Secondary Market Trading: 11/25/09 |

| 1 | MVISTM Poland Index (MVPLNDTR) is a rules-based, modified market capitalization-weighted, float-adjusted index comprised of publicly traded companies that are domiciled and primarily listed in Poland, or that generate at least 50% of their revenues in Poland. |

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

See “About Fund Performance” on page 12 for more information.

| 10 |

| Average Annual Total Returns | Cumulative Total Returns | |||||||||||||||||||||||

| Share Price | NAV | MVRSXTR1 | Share Price | NAV | MVRSXTR1 | |||||||||||||||||||

| Six Months | (9.64 | )% | (9.60 | )% | (9.63 | )% | (9.64 | )% | (9.60 | )% | (9.63 | )% | ||||||||||||

| One Year | 11.86 | % | 10.66 | % | 11.65 | % | 11.86 | % | 10.66 | % | 11.65 | % | ||||||||||||

| Five Year | (3.25 | )% | (3.38 | )% | (3.36 | )% | (15.23 | )% | (15.79 | )% | (15.72 | )% | ||||||||||||

| Ten Year | (5.16 | )% | (5.14 | )% | (5.37 | )% | (41.11 | )% | (41.01 | )% | (42.39 | )% | ||||||||||||

| * | Commencement of Fund: 4/24/07; First Day of Secondary Market Trading: 4/30/07 |

| 1 | MVISTM Russia Index (MVRSXTR) is a rules-based, modified market capitalization-weighted, float-adjusted index comprised of publicly traded small-capitalization companies that are domiciled and primarily listed in Russia, or that generate at least 50% of their revenues in Russia. |

VANECK VECTORS RUSSIA SMALL-CAP ETF

| Average Annual Total Returns | Cumulative Total Returns | |||||||||||||||||||||||

| Share Price | NAV | MVRSXJTR1 | Share Price | NAV | MVRSXJTR1 | |||||||||||||||||||

| Six Months | 2.71 | % | 3.17 | % | 3.32 | % | 2.71 | % | 3.17 | % | 3.32 | % | ||||||||||||

| One Year | 48.79 | % | 49.74 | % | 51.08 | % | 48.79 | % | 49.74 | % | 51.08 | % | ||||||||||||

| Five Year | 0.55 | % | 0.60 | % | 0.94 | % | 2.78 | % | 3.05 | % | 4.81 | % | ||||||||||||

| Life* | (8.26 | )% | (8.22 | )% | (8.02 | )% | (41.48 | )% | (41.32 | )% | (40.52 | )% | ||||||||||||

| * | Commencement of Fund: 4/13/11; First Day of Secondary Market Trading: 4/14/11 |

| 1 | MVISTM Russia Small-Cap Index (MVRSXJTR) is a rules-based, modified market capitalization-weighted, float-adjusted index comprised of publicly traded small-capitalization companies that are domiciled and primarily listed in Russia, or that generate at least 50% of their revenues in Russia. |

| Average Annual Total Returns | Cumulative Total Returns | |||||||||||||||||||||||

| Share Price | NAV | MVVNMTR1 | Share Price | NAV | MVVNMTR1 | |||||||||||||||||||

| Six Months | 14.49 | % | 14.49 | % | 15.09 | % | 14.49 | % | 14.49 | % | 15.09 | % | ||||||||||||

| One Year | 4.67 | % | 3.73 | % | 5.09 | % | 4.67 | % | 3.73 | % | 5.09 | % | ||||||||||||

| Five Year | (1.33 | )% | (1.11 | )% | 0.29 | % | (6.47 | )% | (5.43 | )% | 1.45 | % | ||||||||||||

| Life* | (4.35 | )% | (4.40 | )% | (3.56 | )% | (29.60 | )% | (29.85 | )% | (24.88 | )% | ||||||||||||

| * | Commencement of Fund: 8/11/09; First Day of Secondary Market Trading: 8/14/09 |

| 1 | MVISTM Vietnam Index (MVVNMTR) is a rules-based, modified market capitalization-weighted, float-adjusted index comprised of publicly traded companies that are domiciled and primarily listed in Vietnam, or that generate at least 50% of their revenues in Vietnam. |

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

See “About Fund Performance” on page 12 for more information.

| 11 |

VANECK VECTORS ETF TRUST

ABOUT FUND PERFORMANCE

(unaudited)

The price used to calculate market return (Share Price) is determined by using the closing price listed on its primary listing exchange. Since the shares of each Fund did not trade in the secondary market until after each Fund’s commencement, for the period from commencement to the first day of secondary market trading in shares of each Fund, the NAV of each Fund is used as a proxy for the secondary market trading price to calculate market returns.

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for certain Funds reflect temporary waivers of expenses and/or fees. Had these Funds incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of each Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Fund returns reflect reinvestment of dividends and capital gains distributions. Performance current to the most recent month-end is available by calling 800.826.2333 or by visiting vaneck.com.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Shares may trade at a premium or discount to their NAV in the secondary market.

The “Net Asset Value” (NAV) of a VanEck Vectors exchange-traded fund (ETF) is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the total number of shares outstanding. The NAV is not necessarily the same as the ETF’s intraday trading value. VanEck Vectors ETF investors should not expect to buy or sell fund shares at NAV.

All indices are unmanaged and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in the Fund. Certain indices may take into account withholding taxes. An index’s performance is not illustrative of the Fund’s performance. Indices are not securities in which investments can be made. Results reflect past performance and do not guarantee future results.

The Africa Index, Brazil Small-Cap Index, Egypt Index, India Small-Cap Index, Indonesia Index, Poland Index, Russia Index, Russia Small-Cap Index, and Vietnam Index are published by MV Index Solutions GmbH (MVIS), which is a wholly owned subsidiary of the Adviser, Van Eck Associates Corporation. The CSI 300 Index is published by China Securities Index Co., Ltd. and the SME-ChiNext Index is published by the Shenzhen Securities Information Co., Ltd, which is a subsidiary of the Shenzhen Stock Exchange. The Israel Index is published by BlueStar Global Investors, LLC (BlueStar).

BlueStar, CSI 300 Index, MVIS, and SME-ChiNext Index are “Index Providers.” The Index Providers do not sponsor, endorse, or promote the Funds and bear no liability with respect to the Funds or any security.

Premium/discount information regarding how often the closing trading price of the Shares of each Fund were above (i.e., at a premium) or below (i.e., at a discount) the NAV of the Fund for each of the four previous calendar quarters and the immediately preceding five years (if applicable) can be found at www.vaneck.com.

| 12 |

VANECK VECTORS ETF TRUST

(unaudited)

Hypothetical $1,000 investment at beginning of period

As a shareholder of a Fund, you incur operating expenses, including management fees and other Fund expenses. This disclosure is intended to help you understand the ongoing costs (in dollars) of investing in your Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The disclosure is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, January 1, 2017 to June 30, 2017.

Actual Expenses

The first line in the table below provides information about account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period.”

Hypothetical Example for Comparison Purposes

The second line in the table below provides information about hypothetical account values and hypothetical expenses based on your Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| 13 |

VANECK VECTORS ETF TRUST

EXPLANATION OF EXPENSES

(unaudited) (continued)

| Beginning | Ending | Annualized | Expenses Paid | |||||||||||||

| Account | Account | Expense | During the Period* | |||||||||||||

| Value | Value | Ratio | January 1, 2017 — | |||||||||||||

| January 1, 2017 | June 30, 2017 | During Period | June 30, 2017 | |||||||||||||

| Africa Index ETF | ||||||||||||||||

| Actual | $ | 1,000.00 | $ | 1,084.10 | 0.89 | % | $4.60 | |||||||||

| Hypothetical** | $ | 1,000.00 | $ | 1,020.38 | 0.89 | % | $4.46 | |||||||||

| Brazil Small-Cap ETF | ||||||||||||||||

| Actual | $ | 1,000.00 | $ | 1,212.40 | 0.60 | % | $3.29 | |||||||||

| Hypothetical** | $ | 1,000.00 | $ | 1,021.82 | 0.60 | % | $3.01 | |||||||||

| ChinaAMC CSI 300 ETF | ||||||||||||||||

| Actual | $ | 1,000.00 | $ | 1,148.30 | 0.74 | % | $3.94 | |||||||||

| Hypothetical** | $ | 1,000.00 | $ | 1,021.12 | 0.74 | % | $3.71 | |||||||||

| ChinaAMC SME-ChiNext ETF | ||||||||||||||||

| Actual | $ | 1,000.00 | $ | 1,073.60 | 0.80 | % | $4.11 | |||||||||

| Hypothetical** | $ | 1,000.00 | $ | 1,020.83 | 0.80 | % | $4.01 | |||||||||

| Egypt Index ETF | ||||||||||||||||

| Actual | $ | 1,000.00 | $ | 1,069.60 | 0.94 | % | $4.82 | |||||||||

| Hypothetical** | $ | 1,000.00 | $ | 1,020.13 | 0.94 | % | $4.71 | |||||||||

| India Small-Cap Index ETF | ||||||||||||||||

| Actual | $ | 1,000.00 | $ | 1,368.30 | 0.71 | % | $4.17 | |||||||||

| Hypothetical** | $ | 1,000.00 | $ | 1,021.27 | 0.71 | % | $3.56 | |||||||||

| Indonesia Index ETF | ||||||||||||||||

| Actual | $ | 1,000.00 | $ | 1,124.80 | 0.57 | % | $3.00 | |||||||||

| Hypothetical** | $ | 1,000.00 | $ | 1,021.97 | 0.57 | % | $2.86 | |||||||||

| Israel ETF | ||||||||||||||||

| Actual | $ | 1,000.00 | $ | 1,146.40 | 0.59 | % | $3.14 | |||||||||

| Hypothetical** | $ | 1,000.00 | $ | 1,021.87 | 0.59 | % | $2.96 | |||||||||

| Poland ETF | ||||||||||||||||

| Actual | $ | 1,000.00 | $ | 1,368.10 | 0.64 | % | $3.76 | |||||||||

| Hypothetical** | $ | 1,000.00 | $ | 1,021.62 | 0.64 | % | $3.21 | |||||||||

| Russia ETF | ||||||||||||||||

| Actual | $ | 1,000.00 | $ | 904.00 | 0.65 | % | $3.07 | |||||||||

| Hypothetical** | $ | 1,000.00 | $ | 1,021.57 | 0.65 | % | $3.26 | |||||||||

| Russia Small-Cap ETF | ||||||||||||||||

| Actual | $ | 1,000.00 | $ | 1,031.70 | 0.76 | % | $3.83 | |||||||||

| Hypothetical** | $ | 1,000.00 | $ | 1,021.03 | 0.76 | % | $3.81 | |||||||||

| Vietnam ETF | ||||||||||||||||

| Actual | $ | 1,000.00 | $ | 1,144.90 | 0.68 | % | $3.62 | |||||||||

| Hypothetical** | $ | 1,000.00 | $ | 1,021.42 | 0.68 | % | $3.41 | |||||||||

| * | Expenses are equal to the Fund’s annualized expense ratio (for the six months ended June 30, 2017) multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year divided by the number of days in the fiscal year (to reflect the one-half year period). | |

| ** | Assumes annual return of 5% before expenses |

| 14 |

VANECK VECTORS AFRICA INDEX ETF

June 30, 2017 (unaudited)

| Number of Shares | Value | |||||||

| COMMON STOCKS: 98.1% | ||||||||

| Canada: 11.2% | ||||||||

| 495,529 | Africa Oil Corp. (SEK) * # | $ | 741,769 | |||||

| 208,500 | B2Gold Corp. (USD) * | 585,885 | ||||||

| 224,774 | First Quantum Minerals Ltd. | 1,898,645 | ||||||

| 418,867 | IAMGOLD Corp. (USD) * | 2,161,354 | ||||||

| 602,526 | Ivanhoe Mines Ltd. * | 1,934,653 | ||||||

| 264,410 | Semafo, Inc. * | 608,752 | ||||||

| 7,931,058 | ||||||||

| Egypt: 13.4% | ||||||||

| 1,291,879 | Commercial International Bank Egypt SAE (GDR) Reg S | 5,813,456 | ||||||

| 377,744 | Egyptian Financial Group-Hermes Holding Co. (GDR) Reg S | 985,912 | ||||||

| 4,910,612 | Orascom Telecom Holding SAE * | 1,880,775 | ||||||

| 1,845,893 | Talaat Moustafa Group | 803,758 | ||||||

| 9,483,901 | ||||||||

| India: 1.2% | ||||||||

| 26,019 | Makemytrip Ltd. (USD) * | 872,937 | ||||||

| Kenya: 4.2% | ||||||||

| 13,419,700 | Safaricom Ltd. | 2,944,052 | ||||||

| Mauritius: 1.3% | ||||||||

| 352,997 | Rockcastle Global Real Estate Co. Ltd. (ZAR) | 961,262 | ||||||

| Morocco: 10.6% | ||||||||

| 52,127 | Attijariwafa Bank | 2,375,519 | ||||||

| 65,696 | Banque Centrale Populaire # | 1,976,999 | ||||||

| 47,666 | Banque Marocaine du Commerce Exterieur # | 1,076,581 | ||||||

| 141,763 | Maroc Telecom | 2,061,951 | ||||||

| 7,491,050 | ||||||||

| Nigeria: 8.8% | ||||||||

| 27,865,821 | Guaranty Trust Bank Plc | 2,576,463 | ||||||

| 270,179 | Nestle Nigeria Plc | 646,398 | ||||||

| 3,528,466 | Nigerian Breweries Plc | 1,508,465 | ||||||

| 27,051,211 | Zenith Bank Ltd. | 1,500,543 | ||||||

| 6,231,869 | ||||||||

| Singapore: 1.4% | ||||||||

| 3,639,600 | Golden Agri-Resources Ltd. # | 991,271 | ||||||

| South Africa: 30.2% | ||||||||

| 24,404 | Al Noor Hospitals Group Plc (GBP) # | 235,426 | ||||||

| 5,301 | Anglo American Platinum Ltd. * # | 121,252 | ||||||

| 28,188 | AngloGold Ashanti Ltd. (ADR) | 273,987 | ||||||

| 28,962 | Aspen Pharmacare Holdings Ltd. # | 634,523 | ||||||

| 21,945 | AVI Ltd. | 159,113 | ||||||

| 32,578 | Barclays Africa Group Ltd. # | 357,663 | ||||||

| 9,694 | Barloworld Ltd. # | 80,432 | ||||||

| 22,781 | Bid Corp Ltd. # | 519,599 | ||||||

| 23,980 | Bidvest Group Ltd. # | 288,336 | ||||||

| 4,753 | Capitec Bank Holdings Ltd. # | 301,086 | ||||||

| 15,387 | Clicks Group Ltd. # | 164,199 | ||||||

| 21,570 | Coronation Fund Managers Ltd. # | 107,333 | ||||||

| 28,326 | Discovery Ltd. # | 276,582 | ||||||

| 10,999 | EOH Holdings Ltd. | 105,604 | ||||||

| 15,723 | Exxaro Resources Ltd. # | 111,536 | ||||||

| 280,737 | FirstRand Ltd. # | 1,010,884 | ||||||

| Number of Shares | Value | |||||||

| South Africa: (continued) | ||||||||

| 10,594 | Foschini Group Ltd. # | $ | 111,004 | |||||

| 52,183 | Gold Fields Ltd. (ADR) | 181,597 | ||||||

| 30,863 | Impala Platinum Holdings Ltd. * # | 86,872 | ||||||

| 10,741 | Imperial Holdings Ltd. # | 131,679 | ||||||

| 16,956 | Investec Ltd. # | 124,783 | ||||||

| 48,205 | Investec PCL (GBP) # | 359,219 | ||||||

| 11,766 | Liberty Holdings Ltd. # | 101,035 | ||||||

| 79,841 | Life Healthcare Group Holdings Ltd. † # | 156,165 | ||||||

| 84,474 | MMI Holdings Ltd. | 130,491 | ||||||

| 9,305 | Mondi Ltd. # | 240,618 | ||||||

| 16,210 | Mr Price Group Ltd. † # | 192,956 | ||||||

| 117,877 | MTN Group Ltd. # | 1,026,018 | ||||||

| 28,380 | Naspers Ltd. # | 5,580,423 | ||||||

| 14,706 | Nedbank Group Ltd. # | 234,458 | ||||||

| 75,824 | Netcare Ltd. # | 148,881 | ||||||

| 32,303 | Pick n Pay Stores Ltd. # | 145,388 | ||||||

| 12,298 | Pioneer Foods Ltd. | 127,133 | ||||||

| 9,722 | PSG Group Ltd. | 178,079 | ||||||

| 52,479 | Rand Merchant Investment Holdings Ltd. # | 156,178 | ||||||

| 34,999 | Remgro Ltd. # | 570,048 | ||||||

| 55,512 | RMB Holdings Ltd. # | 249,010 | ||||||

| 129,723 | Sanlam Ltd. # | 641,520 | ||||||

| 25,355 | Sappi Ltd. # | 168,475 | ||||||

| 40,210 | Sasol Ltd. (ADR) † | 1,123,870 | ||||||

| 35,928 | Shoprite Holdings Ltd. # | 547,009 | ||||||

| 30,870 | Sibanye Gold Ltd. (ADR) † | 142,928 | ||||||

| 10,328 | Spar Group Ltd. # | 121,516 | ||||||

| 98,329 | Standard Bank Group Ltd. # | 1,081,210 | ||||||

| 250,353 | Steinhoff International Holdings NV # | 1,280,834 | ||||||

| 23,076 | Telkom SA SOC Ltd. # | 108,383 | ||||||

| 11,672 | Tiger Brands Ltd. # | 327,663 | ||||||

| 22,914 | Truworths International Ltd. # | 124,994 | ||||||

| 30,585 | Vodacom Group Ltd. # | 383,732 | ||||||

| 69,293 | Woolworths Holdings Ltd. # | 326,336 | ||||||

| 21,358,060 | ||||||||

| United Kingdom: 13.9% | ||||||||

| 91,335 | Anglo American Plc * # | 1,216,931 | ||||||

| 1,468,742 | Cenatamin Plc # | 2,958,695 | ||||||

| 326,378 | Old Mutual Plc # | 821,199 | ||||||

| 26,147 | Randgold Resources Ltd. (ADR) | 2,312,964 | ||||||

| 1,278,265 | Tullow Oil Plc † # | 2,506,064 | ||||||

| 9,815,853 | ||||||||

| United States: 1.9% | ||||||||

| 133,219 | Kosmos Energy Ltd. * † | 853,934 | ||||||

| 4,283 | Royal Caribbean Cruises Ltd. | 467,832 | ||||||

| 1,321,766 | ||||||||

| Total Common Stocks (Cost: $60,703,621) | 69,403,079 | |||||||

| REAL ESTATE INVESTMENT TRUSTS: 1.7% | ||||||||

| South Africa: 1.7% | ||||||||

| 62,553 | Fortress Income Fund Ltd. # | 165,730 | ||||||

| 211,675 | Growthpoint Properties Ltd. # | 395,379 | ||||||

| 19,095 | Hyprop Investments Ltd. | 170,146 | ||||||

| 318,113 | Redefine Properties Ltd. # | 255,441 | ||||||

| 21,516 | Resilient REIT Ltd. # | 200,059 | ||||||

See Notes to Financial Statements

| 15 |

VANECK VECTORS AFRICA INDEX ETF

SCHEDULE OF INVESTMENTS

(unaudited) (continued)

| Number of Shares | Value | |||||||

| Total Real Estate Investment Trusts (Cost: $1,170,960) | $ | 1,186,755 | ||||||

| Total Investments Before Collateral for Securities Loaned: 99.8% (Cost: $61,874,581) | 70,589,834 | |||||||

| Principal | ||||||||

| Amount | ||||||||

| SHORT-TERM INVESTMENTS HELD AS COLLATERAL FOR SECURITIES LOANED: 1.6% | ||||||||

| Repurchase Agreements: 1.6% | ||||||||

| $ | 1,000,000 | Repurchase agreement dated 6/30/17 with Daiwa Capital Markets America, Inc., 1.15%, due 7/3/17, proceeds $1,000,096; (collateralized by various U.S. government and agency obligations, 0.00% to 6.50%, due 7/13/17 to 12/1/51, valued at $1,020,000 including accrued interest) | 1,000,000 | |||||

| Principal Amount | Value | |||||||

| Repurchase Agreements: (continued) | ||||||||

| $ | 59,174 | Repurchase agreement dated 6/30/17 with HSBC Securities USA, Inc., 1.06%, due 7/3/17, proceeds $59,179; (collateralized by various U.S. government and agency obligations, 0.00% to 7.25%, due 7/15/17 to 1/15/37, valued at $60,358 including accrued interest) | $ | 59,174 | ||||

| 96,241 | Repurchase agreement dated 6/30/17 with Nomura Securities International, Inc., 1.13%, due 7/3/17, proceeds $96,250; (collateralized by various U.S. government and agency obligations, 0.00% to 9.50%, due 7/10/17 to 6/20/67, valued at $98,166 including accrued interest) | 96,241 | ||||||

| Total Short-Term Investments Held as Collateral for Securities Loaned (Cost: $1,155,415) | 1,155,415 | |||||||

| Total Investments: 101.4% (Cost: $63,029,996) | 71,745,249 | |||||||

| Liabilities in excess of other assets: (1.4)% | (975,223 | ) | ||||||

| NET ASSETS: 100.0% | $ | 70,770,026 | ||||||

| ADR | American Depositary Receipt |

| GBP | British Pound |

| GDR | Global Depositary Receipt |

| SEK | Swedish Krona |

| USD | United States Dollar |

| ZAR | South African Rand |

| * | Non-income producing |

| † | Security fully or partially on loan. Total market value of securities on loan is $1,088,279. |

| # | Indicates a fair valued security which has been valued in good faith pursuant to guidelines established by the Board of Trustees. The aggregate value of fair valued securities is $32,241,376 which represents 45.6% of net assets. |

| Reg S | Security was purchased pursuant to Regulation S under the Securities Act of 1933, which exempts from registration securities offered and sold outside of the United States. Such a security cannot be sold in the United States without either an effective registration statement filed pursuant to the Securities Act of 1933, or pursuant to an exemption from registration. |

| Summary of Investments by Sector Excluding Collateral for Securities Loaned | % of Investments | Value | ||||||

| Consumer Discretionary | 12.9 | % | $ | 9,088,995 | ||||

| Consumer Staples | 7.4 | 5,257,754 | ||||||

| Energy | 6.0 | 4,213,303 | ||||||

| Financials | 32.6 | 23,006,251 | ||||||

| Health Care | 1.7 | 1,174,995 | ||||||

| Industrials | 0.5 | 368,768 | ||||||

| Information Technology | 0.1 | 105,604 | ||||||

| Materials | 22.7 | 16,017,478 | ||||||

| Real Estate | 4.2 | 2,951,775 | ||||||

| Telecommunication Services | 11.9 | 8,404,911 | ||||||

| 100.0 | % | $ | 70,589,834 | |||||

See Notes to Financial Statements

| 16 |

The summary of inputs used to value the Fund’s investments as of June 30, 2017 is as follows:

| Level 2 | Level 3 | ||||||||||||||||

| Level 1 | Significant | Significant | |||||||||||||||

| Quoted | Observable | Unobservable | |||||||||||||||

| Prices | Inputs | Inputs | Value | ||||||||||||||

| Common Stocks | |||||||||||||||||

| Canada | $ | 7,189,289 | $ | 741,769 | $ | — | $ | 7,931,058 | |||||||||

| Egypt | 9,483,901 | — | — | 9,483,901 | |||||||||||||

| India | 872,937 | — | — | 872,937 | |||||||||||||

| Kenya | 2,944,052 | — | — | 2,944,052 | |||||||||||||

| Mauritius | 961,262 | — | — | 961,262 | |||||||||||||

| Morocco | 4,437,470 | 3,053,580 | — | 7,491,050 | |||||||||||||

| Nigeria* | 6,231,869 | — | — | 6,231,869 | |||||||||||||

| Singapore | — | 991,271 | — | 991,271 | |||||||||||||

| South Africa | 2,422,802 | 18,935,258 | — | 21,358,060 | |||||||||||||

| United Kingdom | 2,312,964 | 7,502,889 | — | 9,815,853 | |||||||||||||

| United States | 1,321,766 | — | — | 1,321,766 | |||||||||||||

| Real Estate Investment Trusts | |||||||||||||||||

| South Africa | 170,146 | 1,016,609 | — | 1,186,755 | |||||||||||||

| Repurchase Agreements | — | 1,155,415 | — | 1,155,415 | |||||||||||||

| Total | $ | 38,348,458 | $ | 33,396,791 | $ | — | $ | 71,745,249 | |||||||||

| * | The Nigerian securities were valued using Level 1 quoted prices, and used the Nigerian Autonomous Foreign Exchange Rate Fixing (NAFEX) to translate the Nigerian naira into U.S. dollars. |

During the period ended June 30, 2017, transfers of securities from Level 1 to Level 2 were $3,258,042 and transfers from Level 2 to Level 1 were $14,151,649. These transfers resulted primarily from changes in certain foreign securities valuation methodologies between the last close of the securities’ primary market (Level 1) and valuation by a pricing service (Level 2), which takes into account market direction or events occurring before the Fund’s pricing time but after the last local close, as described in the Notes to Schedules of Investments.

The following table reconciles the valuation of the Fund’s Level 3 investment securities and related transactions during the period ended June 30, 2017:

| Common Stocks | |||||

| South Africa | |||||

| Balance as of December 31, 2016 | $ | 0 | |||

| Realized gain (loss) | (90,343 | ) | |||

| Net change in unrealized appreciation (depreciation) | 93,562 | ||||

| Purchases | — | ||||

| Sales | (3,219 | ) | |||

| Transfers in and/or out of level 3 | — | ||||

| Balance as of June 30, 2017 | $ | — | |||

See Notes to Financial Statements

| 17 |

VANECK VECTORS BRAZIL SMALL-CAP ETF

SCHEDULE OF INVESTMENTS

June 30, 2017 (unaudited)

| Number of Shares | Value | |||||||

| COMMON STOCKS: 79.0% | ||||||||

| Automobiles & Components: 1.6% | ||||||||

| 124,700 | Mahle-Metal Leve SA Industria e Comercio | $ | 732,112 | |||||

| 158,900 | Tupy SA | 762,628 | ||||||

| 1,494,740 | ||||||||

| Capital Goods: 1.6% | ||||||||

| 296,225 | Iochpe Maxion SA | 1,487,876 | ||||||

| Commercial & Professional Services: 1.3% | ||||||||

| 35,906 | Atento SA (USD) * | 400,352 | ||||||

| 179,940 | Valid Solucoes SA | 804,404 | ||||||

| 1,204,756 | ||||||||

| Consumer Durables & Apparel: 10.8% | ||||||||

| 113,350 | Arezzo Industria e Comercio SA | 1,119,164 | ||||||

| 569,750 | Cyrela Brazil Realty SA Empreendimentos e Participacoes | 1,884,892 | ||||||

| 291,550 | Even Construtora e Incorporadora SA | 347,618 | ||||||

| 272,694 | EZ Tec Empreendimentos e Participacoes SA | 1,461,052 | ||||||

| 301,850 | Grendene SA | 2,335,240 | ||||||

| 705,000 | MRV Engenharia e Participacoes SA | 2,877,117 | ||||||

| 10,025,083 | ||||||||

| Consumer Services: 4.9% | ||||||||

| 308,950 | CVC Brasil Operadora e Agencia de Viagens SA | 3,020,583 | ||||||

| 117,950 | GAEC Educacao SA | 583,181 | ||||||

| 121,600 | Ser Educacional SA Reg S 144A | 899,273 | ||||||

| 4,503,037 | ||||||||

| Energy: 5.3% | ||||||||

| 474,395 | Cosan Ltd. (USD) | 3,040,872 | ||||||

| 63,800 | Modec, Inc. # | 1,421,874 | ||||||

| 258,350 | QGEP Participacoes SA | 467,898 | ||||||

| 4,930,644 | ||||||||

| Food, Beverage & Tobacco: 5.0% | ||||||||

| 196,614 | Adecoagro SA (USD) * | 1,964,174 | ||||||

| 503,050 | Marfrig Alimentos SA * | 1,026,478 | ||||||

| 245,650 | Minerva SA | 912,781 | ||||||

| 108,900 | SLC Agricola SA | 693,589 | ||||||

| 4,597,022 | ||||||||

| Health Care Equipment & Services: 4.5% | ||||||||

| 137,900 | Alliar Medicos A Frente SA * | 730,105 | ||||||

| 101,900 | Instituto Hermes Pardini SA | 738,205 | ||||||

| 774,400 | Odontoprev SA | 2,723,221 | ||||||

| 4,191,531 | ||||||||

| Insurance: 1.4% | ||||||||

| 222,700 | Wiz Solucoes e Corretagem de Seguros SA | 1,236,886 | ||||||

| Materials: 3.7% | ||||||||

| 1,120,375 | Duratex SA | 2,762,976 | ||||||

| 59,450 | Magnesita Refratarios SA | 660,376 | ||||||

| 3,423,352 | ||||||||

| Number of Shares | Value | |||||||

| Media: 3.2% | ||||||||

| 164,400 | Smiles SA | $ | 2,996,309 | |||||

| Real Estate: 4.5% | ||||||||

| 223,223 | Aliansce Shopping Centers SA | 1,015,416 | ||||||

| 241,500 | BR Properties SA | 656,801 | ||||||

| 251,750 | Iguatemi Empresa de Shopping Centers SA | 2,501,618 | ||||||

| 4,173,835 | ||||||||

| Retailing: 7.3% | ||||||||

| 468,898 | B2W Cia Global Do Varejo * | 1,655,983 | ||||||

| 203,750 | Cia Hering SA | 1,214,665 | ||||||

| 24,550 | Magazine Luiza SA | 1,897,069 | ||||||

| 613,450 | Via Varejo SA | 2,014,651 | ||||||

| 6,782,368 | ||||||||

| Software & Services: 7.7% | ||||||||

| 354,450 | Linx SA | 1,909,787 | ||||||

| 1,297,865 | Sonda SA | 2,127,965 | ||||||

| 343,450 | Totvs SA | 3,126,702 | ||||||

| 7,164,454 | ||||||||

| Telecommunication Services: 0.9% | ||||||||

| 692,400 | Oi SA * | 844,365 | ||||||

| Transportation: 3.7% | ||||||||

| 651,540 | EcoRodovias Infraestrutura e Logistica SA | 2,035,509 | ||||||

| 57,974 | Gol Linhas Aereas Inteligentes SA (ADR) * † | 658,585 | ||||||

| 59,150 | Julio Simoes Logistica SA * | 124,981 | ||||||

| 194,859 | Prumo Logistica SA * | 617,592 | ||||||

| 3,436,667 | ||||||||

| Utilities: 11.6% | ||||||||

| 662,600 | AES Tiete Energia SA | 2,730,082 | ||||||

| 711,837 | Alupar Investimento SA | 3,886,966 | ||||||

| 201,196 | Cia de Saneamento de Minas Gerais SA | 2,429,243 | ||||||

| 250,950 | Light SA * | 1,697,543 | ||||||

| 10,743,834 | ||||||||

| Total Common Stocks (Cost: $59,923,850) | 73,236,759 | |||||||

| PREFERRED STOCKS: 19.2% | ||||||||

| Banks: 1.1% | ||||||||

| 198,253 | Banco ABC Brasil SA | 1,004,760 | ||||||

| Capital Goods: 2.2% | ||||||||

| 1,512,250 | Marcopolo SA | 1,296,384 | ||||||

| 542,100 | Randon Implementos e Participacoes SA * | 752,712 | ||||||

| 2,049,096 | ||||||||

| Consumer Durables & Apparel: 1.8% | ||||||||

| 400,355 | Alpargatas SA | 1,656,816 | ||||||

| Materials: 7.0% | ||||||||

| 620,900 | Bradespar SA | 3,860,829 | ||||||

| 1,794,600 | Metalurgica Gerdau SA * | 2,692,252 | ||||||

| 6,553,081 | ||||||||

See Notes to Financial Statements

| 18 |

| Number of Shares | Value | |||||||

| Utilities: 7.1% | ||||||||

| 48,192 | Cia de Gas de Sao Paulo | $ | 672,497 | |||||

| 913,800 | Cia de Saneamento do Parana | 3,006,556 | ||||||

| 403,050 | Cia Energetica de Sao Paulo | 1,883,309 | ||||||

| 263,750 | Eletropaulo Metropolitana Eletricidade de Sao Paulo SA | 1,007,105 | ||||||

| 6,569,467 | ||||||||

| Total Preferred Stocks (Cost: $12,597,620) | 17,833,220 | |||||||

| REAL ESTATE INVESTMENT TRUST: 1.8% (Cost: $1,773,796) | ||||||||

| Real Estate: 1.8% | ||||||||

| 53,551 | FII BTG Pactual Corporate Office Fund | 1,630,987 | ||||||

| WARRANTS: 0.0% (Cost: $0) | ||||||||

| Capital Goods: 0.0% | ||||||||

| 7,727 | Iochpe Maxion SA Warrants (BRL 12.70, expiring 06/03/19)* | 15,837 | ||||||

| Total Investments Before Collateral for Securities Loaned: 100.0% (Cost: $74,295,266) | 92,716,803 | |||||||

| Principal Amount | Value | |||||||

| SHORT-TERM INVESTMENTS HELD AS COLLATERAL FOR SECURITIES LOANED: 0.0% | ||||||||

| Repurchase Agreements: 0.0% | ||||||||

| $ | 2,201 | Repurchase agreement dated 6/30/17 with Daiwa Capital Markets America, Inc., 1.15%, due 7/3/17, proceeds $2,201; (collateralized by various U.S. government and agency obligations, 0.00% to 6.50%, due 7/13/17 to 12/1/51, valued at $2,245 including accrued interest) | $ | 2,201 | ||||

| 119 | Repurchase agreement dated 6/30/17 with HSBC Securities USA, Inc., 1.06%, due 7/3/17, proceeds $119; (collateralized by various U.S. government and agency obligations, 0.00% to 7.25%, due 7/15/17 to 1/15/37, valued at $121 including accrued interest) | 119 | ||||||

| Total Short-Term Investments Held as Collateral for Securities Loaned (Cost: $2,320) | 2,320 | |||||||

| Total Investments: 100.0% (Cost: $74,297,586) | 92,719,123 | |||||||

| Other assets less liabilities: 0.0% | 9,767 | |||||||

| NET ASSETS: 100.0% | $ | 92,728,890 | ||||||

| ADR | American Depositary Receipt |

| BRL | Brazilian Real |

| USD | United States Dollar |

| * | Non-income producing |

| † | Security fully or partially on loan. Total market value of securities on loan is $2,204. |

| # | Indicates a fair valued security which has been valued in good faith pursuant to guidelines established by the Board of Trustees. The aggregate value of fair valued securities is $1,421,874 which represents 1.5% of net assets. |

| Reg S | Security was purchased pursuant to Regulation S under the Securities Act of 1933, which exempts from registration securities offered and sold outside of the United States. Such a security cannot be sold in the United States without either an effective registration statement filed pursuant to the Securities Act of 1933, or pursuant to an exemption from registration. |

| 144A | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended, or otherwise restricted. These securities may be resold in transactions exempt from registration, unless otherwise noted, and the value amounted to $899,273, or 1.0% of net assets. |

| Summary of Investments by Sector Excluding Collateral for Securities Loaned | % of Investments | Value | ||||||

| Consumer Discretionary | 29.6 | % | $ | 27,458,353 | ||||

| Consumer Staples | 5.0 | 4,597,022 | ||||||

| Energy | 5.3 | 4,930,644 | ||||||

| Financials | 4.2 | 3,872,633 | ||||||

| Health Care | 4.5 | 4,191,531 | ||||||

| Industrials | 8.8 | 8,194,232 | ||||||

| Information Technology | 7.7 | 7,164,454 | ||||||

| Materials | 10.8 | 9,976,433 | ||||||

| Real Estate | 4.5 | 4,173,835 | ||||||

| Telecommunication Services | 0.9 | 844,365 | ||||||

| Utilities | 18.7 | 17,313,301 | ||||||

| 100.0 | % | $ | 92,716,803 | |||||

See Notes to Financial Statements

| 19 |

VANECK VECTORS BRAZIL SMALL-CAP ETF

SCHEDULE OF INVESTMENTS

(unaudited) (continued)

The summary of inputs used to value the Fund’s investments as of June 30, 2017 is as follows:

| Level 1 Quoted Prices | Level 2 Significant Observable Inputs | Level 3 Significant Unobservable Inputs | Value | ||||||||||||||

| Common Stocks | |||||||||||||||||

| Automobiles & Components | $ | 1,494,740 | $ | — | $ | — | $ | 1,494,740 | |||||||||

| Capital Goods | 1,487,876 | — | — | 1,487,876 | |||||||||||||

| Commercial & Professional Services | 1,204,756 | — | — | 1,204,756 | |||||||||||||

| Consumer Durables & Apparel | 10,025,083 | — | — | 10,025,083 | |||||||||||||

| Consumer Services | 4,503,037 | — | — | 4,503,037 | |||||||||||||

| Energy | 3,508,770 | 1,421,874 | — | 4,930,644 | |||||||||||||

| Food, Beverage & Tobacco | 4,597,022 | — | — | 4,597,022 | |||||||||||||

| Health Care Equipment & Services | 4,191,531 | — | — | 4,191,531 | |||||||||||||

| Insurance | 1,236,886 | — | — | 1,236,886 | |||||||||||||

| Materials | 3,423,352 | — | — | 3,423,352 | |||||||||||||

| Media | 2,996,309 | — | — | 2,996,309 | |||||||||||||

| Real Estate | 4,173,835 | — | — | 4,173,835 | |||||||||||||

| Retailing | 6,782,368 | — | — | 6,782,368 | |||||||||||||

| Software & Services | 7,164,454 | — | — | 7,164,454 | |||||||||||||

| Telecommunication Services | 844,365 | — | — | 844,365 | |||||||||||||

| Transportation | 3,436,667 | — | — | 3,436,667 | |||||||||||||

| Utilities | 10,743,834 | — | — | 10,743,834 | |||||||||||||

| Preferred Stock* | 17,833,220 | — | — | 17,833,220 | |||||||||||||

| Real Estate Investment Trust* | 1,630,987 | — | — | 1,630,987 | |||||||||||||

| Warrants* | 15,837 | — | — | 15,837 | |||||||||||||

| Repurchase Agreements | — | 2,320 | — | 2,320 | |||||||||||||

| Total | $ | 91,294,929 | $ | 1,424,194 | $ | — | $ | 92,719,123 | |||||||||

| * | See Schedule of Investments for security type and industry sector breakouts. |

During the period ended June 30, 2017, transfers of securities from Level 2 to Level 1 were $6,454,420. These transfers resulted primarily from changes in certain foreign securities valuation methodologies between the last close of the securities’ primary market (Level 1) and valuation by a pricing service (Level 2), which takes into account market direction or events occurring before the Fund’s pricing time but after the last local close, as described in the Notes to Schedules of Investments.

See Notes to Financial Statements

| 20 |

VANECK VECTORS CHINAAMC CSI 300 ETF

SCHEDULE OF INVESTMENTS

June 30, 2017 (unaudited)

| Number of Shares | Value | |||||||

| COMMON STOCKS: 100.2% | ||||||||

| Automobiles & Components: 3.0% | ||||||||

| 30,481 | Byd Co. Ltd. # | $ | 224,569 | |||||

| 19,509 | China Shipbuilding Industry Group Power Co. Ltd. # | 72,775 | ||||||

| 109,885 | Chongqing Changan Automobile Co. Ltd. # | 233,719 | ||||||

| 10,200 | Chongqing Sokon Industry Group Co. Ltd. # | 30,006 | ||||||

| 79,100 | Fuyao Glass Industry Group Co. Ltd. # | 303,861 | ||||||

| 67,774 | Great Wall Motor Co. Ltd. # | 132,857 | ||||||

| 88,673 | Huayu Automotive Systems Co. Ltd. # | 317,071 | ||||||

| 197,663 | SAIC Motor Corp. Ltd. # | 905,513 | ||||||

| 13,600 | Shandong Linglong Tyre Co. Ltd. | 44,989 | ||||||

| 13,600 | Triangle Tyre Co. Ltd. * | 52,752 | ||||||

| 77,592 | Wanxiang Qianchao Co. Ltd. # | 121,532 | ||||||

| 23,400 | Wuhu Shunrong Sanqi Interactive Entertainment Network Technology Co. Ltd. # | 88,184 | ||||||

| 17,500 | Zhejiang Century Huatong Group Co. Ltd. | 93,585 | ||||||

| 2,621,413 | ||||||||

| Banks: 17.1% | ||||||||

| 2,153,600 | Agricultural Bank of China Ltd # | 1,118,342 | ||||||

| 685,346 | Bank of Beijing Co. Ltd. # | 926,906 | ||||||

| 1,187,400 | Bank of China Ltd. # | 647,848 | ||||||

| 1,547,716 | Bank of Communications Co. Ltd. # | 1,406,488 | ||||||

| 38,700 | Bank of Guiyang Co. Ltd. | 90,237 | ||||||

| 22,500 | Bank of Hangzhou Co. Ltd. | 49,278 | ||||||

| 71,400 | Bank of Jiangsu Co. Ltd. | 97,826 | ||||||

| 204,837 | Bank of Nanjing Co. Ltd. # | 338,778 | ||||||

| 109,804 | Bank of Ningbo Co. Ltd. # | 312,684 | ||||||

| 37,300 | Bank of Shanghai Co. Ltd. * | 140,498 | ||||||

| 172,800 | China CITIC Bank Corp. Ltd. # | 160,308 | ||||||

| 378,200 | China Construction Bank Corp. # | 343,075 | ||||||

| 897,100 | China Everbright Bank Co. Ltd. # | 535,837 | ||||||

| 580,860 | China Merchants Bank Co. Ltd. # | 2,048,453 | ||||||

| 1,331,755 | China Minsheng Banking Corp. Ltd. # | 1,614,588 | ||||||

| 361,056 | Huaxia Bank Co. Ltd. # | 490,979 | ||||||

| 1,215,104 | Industrial & Commercial Bank of China Ltd. # | 941,152 | ||||||

| 702,291 | Industrial Bank Co. Ltd. # | 1,746,615 | ||||||

| 11,100 | Jiangsu Zhangjiagang Rural Commercial Bank Co. Ltd. # | 25,775 | ||||||

| 483,509 | Ping An Bank Co. Ltd. # | 669,579 | ||||||

| 633,413 | Shanghai Pudong Development Bank Co. Ltd. # | 1,181,960 | ||||||

| 14,887,206 | ||||||||

| Capital Goods: 11.3% | ||||||||

| 25,900 | AVIC Aero-Engine Controls Co. Ltd. # | 74,728 | ||||||

| 78,000 | AVIC Aircraft Co. Ltd. # | 212,106 | ||||||

| 55,100 | AVIC Aviation Engine Corp. Plc # | 221,771 | ||||||

| 13,400 | AVIC Helicopter Co. Ltd. | 90,454 | ||||||

| 29,799 | China Avionics Systems Co. Ltd. # | 76,350 | ||||||

| 120,975 | China Baoan Group Co. Ltd. # | 144,405 | ||||||

| 86,024 | China Communications Construction Co. Ltd. # | 201,729 | ||||||

| 38,600 | China CSSC Holdings Ltd. * # | 130,254 | ||||||

| 155,700 | China Gezhouba Group Co. Ltd. # | 258,317 | ||||||

| Number of Shares | Value | |||||||

| Capital Goods: (continued) | ||||||||

| 111,300 | China National Chemical Engineering Co. Ltd. # | $ | 114,781 | |||||

| 29,700 | China Nuclear Engineering Corp. Ltd. * | 52,431 | ||||||

| 259,000 | China Railway Construction Corp. Ltd. # | 459,855 | ||||||

| 420,008 | China Railway Group Ltd. # | 537,378 | ||||||

| 580,600 | China Shipbuilding Industry Co. Ltd. * # § | 555,401 | ||||||

| 33,400 | China Spacesat Co. Ltd. # | 137,189 | ||||||

| 845,091 | China State Construction Engineering Corp. Ltd. # | 1,206,771 | ||||||

| 84,200 | CITIC Heavy Industries Co. Ltd. # § | 62,787 | ||||||

| 548,145 | CRRC Corp. Ltd. # | 818,302 | ||||||

| 18,300 | CSSC Offshore and Marine Engineering Group Co. Ltd. | 73,897 | ||||||

| 29,800 | Guoxuan High-Tech Co. Ltd. # | 138,764 | ||||||

| 48,000 | Han’s Laser Technology Co. Ltd. # | 245,262 | ||||||

| 62,800 | Jiangsu Zhongnan Construction Group Co. Ltd. # | 60,342 | ||||||

| 120,800 | Jiangsu Zhongtian Technology Co. Ltd. # | 214,687 | ||||||

| 47,675 | Luxshare Precision Industry Co. Ltd. # | 205,121 | ||||||

| 301,700 | Metallurgical Corp of China Ltd. * # | 223,097 | ||||||

| 82,111 | NARI Technology Co. Ltd. # | 213,905 | ||||||

| 258,700 | Power Construction Corp. of China Ltd. # | 302,283 | ||||||

| 215,700 | Sany Heavy Industry Co. Ltd. # | 258,639 | ||||||

| 250,648 | Shanghai Construction Group Co. Ltd. # | 141,229 | ||||||

| 194,100 | Shanghai Electric Group Co. Ltd. * # § | 221,426 | ||||||

| 106,300 | Shanghai Tunnel Engineering Co. Ltd. # | 158,365 | ||||||

| 56,249 | Shenzhen Inovance Technology Co. Ltd. # | 212,011 | ||||||

| 61,600 | Siasun Robot & Automation Co. Ltd. * # | 177,194 | ||||||

| 89,361 | Suzhou Gold Mantis Construction Decoration Co. Ltd. # | 144,823 | ||||||

| 216,307 | TBEA Co. Ltd. # | 329,450 | ||||||

| 136,600 | Weichai Power Co. Ltd. # | 266,034 | ||||||

| 236,900 | XCMG Construction Machinery Co. Ltd. # | 130,952 | ||||||

| 79,651 | Xiamen C & D, Inc. # | 151,932 | ||||||

| 88,000 | Xinjiang Goldwind Science and Technology Co. Ltd. # | 200,708 | ||||||

| 24,000 | Zhejiang Chint Electrics Co. Ltd. | 71,110 | ||||||

| 74,953 | Zhengzhou Yutong Bus Co. Ltd. # | 242,980 | ||||||