UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-10325

VANECK ETF TRUST

(Exact name of registrant as specified in charter)

666 Third Avenue, New York, NY 10017

(Address of principal executive offices) (Zip code)

Van Eck Associates Corporation

666 Third Avenue, New York, NY 10017

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 293-2000

Date of fiscal year end: APRIL 30

Date of reporting period: OCTOBER 31, 2024

| Item 1. | REPORTS TO STOCKHOLDERS. |

Principal U.S. Listing Exchange: NYSE Arca, Inc.

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about the VanEck BDC Income ETF for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investment |

|---|

| VanEck BDC Income ETF | $21 | 0.42%Footnote Reference(a) |

| Footnote | Description |

Footnote(a) | Annualized |

- Total Net Assets$1,218,985,319

- Number of Portfolio Holdings29

- Portfolio Turnover Rate10%

- Advisory Fees Paid$2,339,543

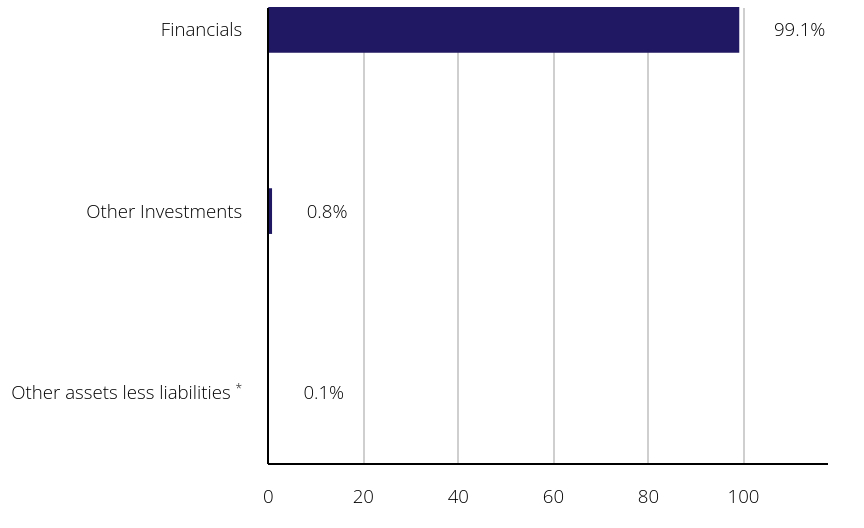

What did the Fund invest in?

Portfolio Composition (% of Total Net Assets)

| Value | Value | Value |

|---|

Other assets less liabilitiesFootnote Reference* | | 0.1% |

| Other Investments | | 0.8% |

| Financials | | 99.1% |

| Footnote | Description |

Footnote* | Includes unrealized appreciation (depreciation) on total return swap contracts of 0.0% |

Top Ten Holdings (% of Total Net Assets)

| Ares Capital Corp. | | 21.6% |

| FS KKR Capital Corp. | | 9.2% |

| Blue Owl Capital Corp. | | 8.9% |

| Blackstone Secured Lending Fund | | 8.7% |

| Hercules Capital, Inc. | | 4.7% |

| Main Street Capital Corp. | | 4.7% |

| Golub Capital BDC, Inc. | | 4.6% |

| Sixth Street Specialty Lending, Inc. | | 3.6% |

| Prospect Capital Corp. | | 3.6% |

| Morgan Stanley Direct Lending Fund | | 3.0% |

Need Additional Information?

If you wish to view additional information about the Fund including but not limited to financial statements, prospectus or holdings please scan the QR code or visit https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/.

VanEck CEF Muni Income ETF

Principal U.S. Listing Exchange: Cboe BZX Exchange, Inc.

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about the VanEck CEF Muni Income ETF for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investment |

|---|

| VanEck CEF Muni Income ETF | $21 | 0.41%Footnote Reference(a) |

| Footnote | Description |

Footnote(a) | Annualized |

- Total Net Assets$228,610,728

- Number of Portfolio Holdings56

- Portfolio Turnover Rate5%

- Advisory Fees Paid$462,613

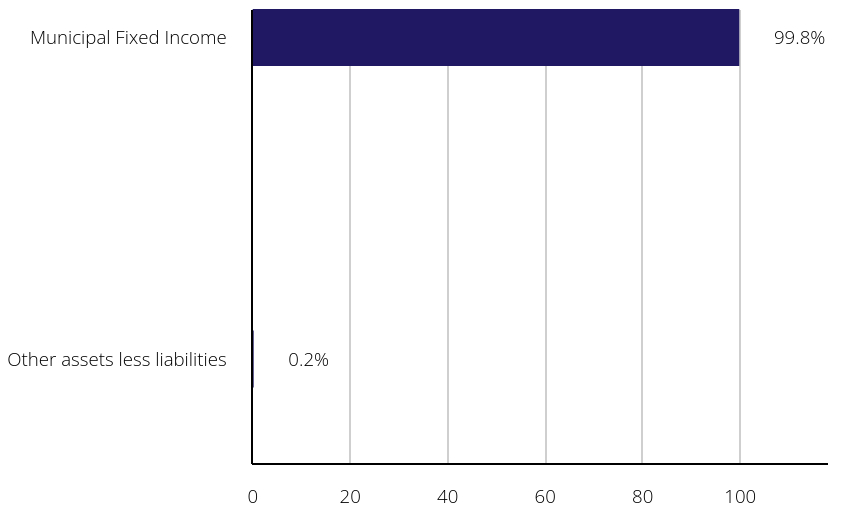

What did the Fund invest in?

Portfolio Composition (% of Total Net Assets)

| Value | Value | Value |

|---|

| Other assets less liabilities | | 0.2% |

| Municipal Fixed Income | | 99.8% |

Top Ten Holdings (% of Total Net Assets)

| Nuveen Quality Municipal Income Fund | | 8.0% |

| Nuveen AMT-Free Quality Municipal Income Fund | | 8.0% |

| Nuveen AMT-Free Municipal Credit Income Fund | | 7.9% |

| Nuveen Municipal Credit Income Fund | | 7.8% |

| BlackRock Municipal 2030 Target Term Trust | | 5.1% |

| Nuveen Municipal Value Fund, Inc. | | 4.7% |

| Nuveen Municipal High Income Opportunity Fund | | 2.7% |

| BlackRock MuniYield Quality Fund III, Inc. | | 2.4% |

| BlackRock Municipal Income Fund, Inc. | | 2.3% |

| BlackRock MuniYield Quality Fund, Inc. | | 2.3% |

Need Additional Information?

If you wish to view additional information about the Fund including but not limited to financial statements, prospectus or holdings please scan the QR code or visit https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/.

Principal U.S. Listing Exchange: NYSE Arca, Inc.

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about the VanEck China Bond ETF for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investment |

|---|

| VanEck China Bond ETF | $26 | 0.50%Footnote Reference(a) |

| Footnote | Description |

Footnote(a) | Annualized |

- Total Net Assets$22,430,460

- Number of Portfolio Holdings35

- Portfolio Turnover Rate68%

- Advisory Fees Paid$-

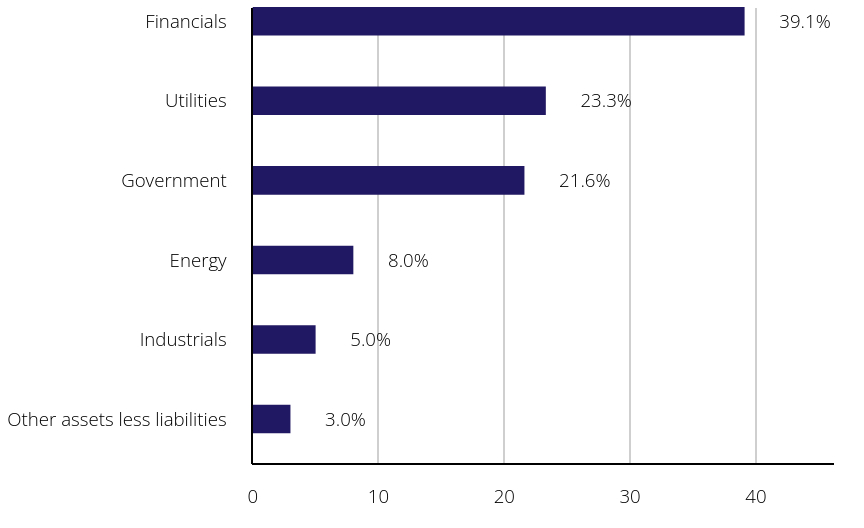

What did the Fund invest in?

Portfolio Composition (% of Total Net Assets)

| Value | Value | Value |

|---|

| Other assets less liabilities | | 3.0% |

| Industrials | | 5.0% |

| Energy | | 8.0% |

| Government | | 21.6% |

| Utilities | | 23.3% |

| Financials | | 39.1% |

Top Ten Holdings (% of Total Net Assets)

| Guangdong Hengjian Investment Holding Co. Ltd., 3.28%, 1/14/2027 | | 6.4% |

| China Government Bond, 2.29%, 12/25/2024 | | 5.6% |

| China Everbright Bank Co. Ltd., 2.72%, 9/25/2026 | | 5.0% |

| Bank of Communications Co. Ltd., 2.70%, 9/26/2026 | | 5.0% |

| China Railway Group Ltd., 2.58%, 8/3/2025 | | 5.0% |

| China Government Bond, 1.99%, 4/9/2025 | | 4.9% |

| China Three Gorges Corp., 4.15%, 5/11/2026 | | 4.7% |

| China Huaneng Group Co. Ltd., 3.95%, 4/21/2026 | | 4.7% |

| China Government Bond, 2.67%, 11/25/2033 | | 4.5% |

| China Petroleum & Chemical Corp., 3.20%, 7/27/2026 | | 4.2% |

Need Additional Information?

If you wish to view additional information about the Fund including but not limited to financial statements, prospectus or holdings please scan the QR code or visit https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/.

VanEck Emerging Markets High Yield Bond ETF

Principal U.S. Listing Exchange: NYSE Arca, Inc.

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about the VanEck Emerging Markets High Yield Bond ETF for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investment |

|---|

| VanEck Emerging Markets High Yield Bond ETF | $21 | 0.40%Footnote Reference(a) |

| Footnote | Description |

Footnote(a) | Annualized |

- Total Net Assets$409,490,994

- Number of Portfolio Holdings522

- Portfolio Turnover Rate16%

- Advisory Fees Paid$774,628

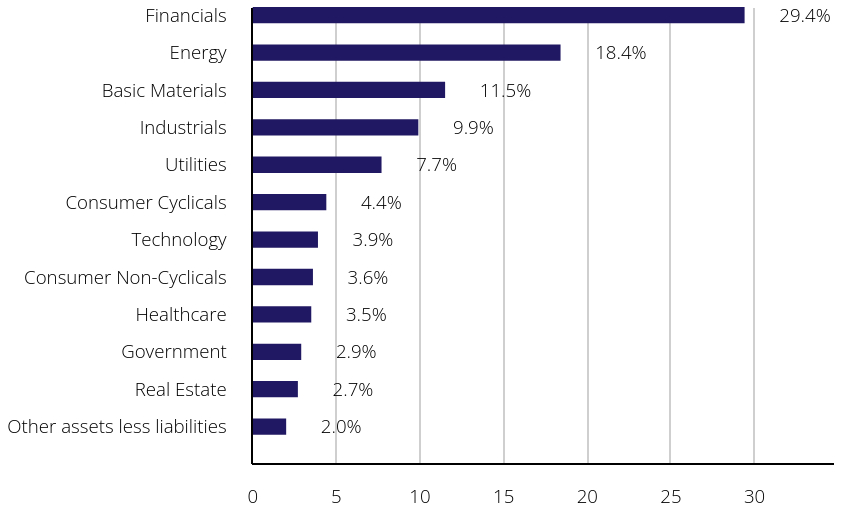

What did the Fund invest in?

Portfolio Composition (% of Total Net Assets)

| Value | Value | Value |

|---|

| Other assets less liabilities | | 2.0% |

| Real Estate | | 2.7% |

| Government | | 2.9% |

| Healthcare | | 3.5% |

| Consumer Non-Cyclicals | | 3.6% |

| Technology | | 3.9% |

| Consumer Cyclicals | | 4.4% |

| Utilities | | 7.7% |

| Industrials | | 9.9% |

| Basic Materials | | 11.5% |

| Energy | | 18.4% |

| Financials | | 29.4% |

Top Ten Holdings (% of Total Net Assets)

| Industrial & Commercial Bank of China Ltd., 3.20% (Perpetual) | | 2.2% |

| Provincia de Buenos Aires, 6.62%, 9/1/2037 | | 1.3% |

| Bank of Communications Co. Ltd., 3.80% (Perpetual) | | 1.0% |

| Teva Pharmaceutical Finance Netherlands III BV, 3.15%, 10/1/2026 | | 1.0% |

| Southern Gas Corridor CJSC, 6.88%, 3/24/2026 | | 0.8% |

| Samarco Mineracao SA, 9.00%, 6/30/2031 | | 0.6% |

| First Quantum Minerals Ltd., 9.38%, 3/1/2029 | | 0.6% |

| DP World Salaam, 6.00% (Perpetual) | | 0.6% |

| First Quantum Minerals Ltd., 6.88%, 10/15/2027 | | 0.6% |

| Ecopetrol SA, 8.88%, 1/13/2033 | | 0.6% |

Need Additional Information?

If you wish to view additional information about the Fund including but not limited to financial statements, prospectus or holdings please scan the QR code or visit https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/.

VanEck Fallen Angel High Yield Bond ETF

Principal U.S. Listing Exchange: The NASDAQ Stock Market LLC

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about the VanEck Fallen Angel High Yield Bond ETF for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investment |

|---|

| VanEck Fallen Angel High Yield Bond ETF | $13 | 0.25%Footnote Reference(a) |

| Footnote | Description |

Footnote(a) | Annualized |

- Total Net Assets$3,048,697,553

- Number of Portfolio Holdings123

- Portfolio Turnover Rate12%

- Advisory Fees Paid$3,837,587

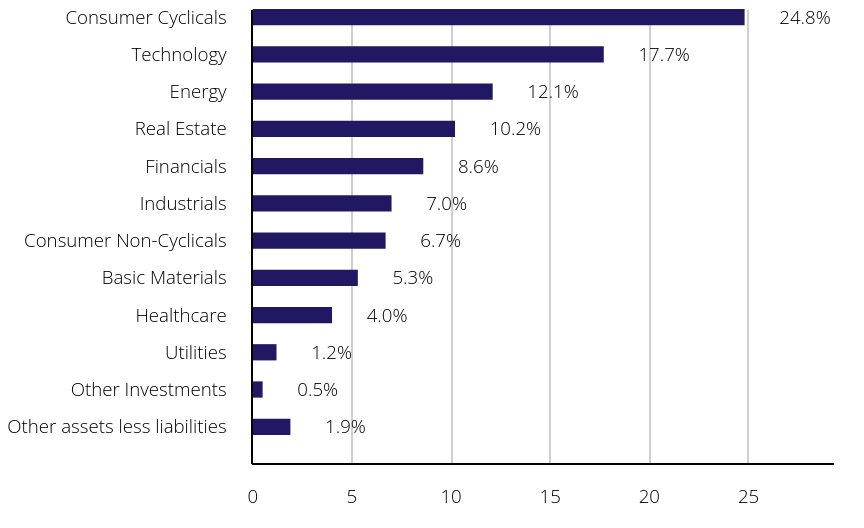

What did the Fund invest in?

Portfolio Composition (% of Total Net Assets)

| Value | Value | Value |

|---|

| Other assets less liabilities | | 1.9% |

| Other Investments | | 0.5% |

| Utilities | | 1.2% |

| Healthcare | | 4.0% |

| Basic Materials | | 5.3% |

| Consumer Non-Cyclicals | | 6.7% |

| Industrials | | 7.0% |

| Financials | | 8.6% |

| Real Estate | | 10.2% |

| Energy | | 12.1% |

| Technology | | 17.7% |

| Consumer Cyclicals | | 24.8% |

Top Ten Holdings (% of Total Net Assets)

| Vodafone Group Plc, 7.00%, 4/4/2079 | | 3.8% |

| Newell Brands, Inc., 5.70%, 4/1/2026 | | 3.6% |

| Entegris, Inc., 4.75%, 4/15/2029 | | 2.8% |

| Walgreens Boots Alliance, Inc., 3.45%, 6/1/2026 | | 2.5% |

| Dresdner Funding Trust I, 8.15%, 6/30/2031 | | 2.0% |

| Resorts World Las Vegas LLC / RWLV Capital, Inc., 4.62%, 4/16/2029 | | 1.6% |

| EQM Midstream Partners LP, 5.50%, 7/15/2028 | | 1.5% |

| Standard Chartered Plc, 7.01%, 7/30/2037 | | 1.4% |

| Rogers Communications, Inc., 5.25%, 3/15/2082 | | 1.3% |

| Nordstrom, Inc., 5.00%, 1/15/2044 | | 1.3% |

Need Additional Information?

If you wish to view additional information about the Fund including but not limited to financial statements, prospectus or holdings please scan the QR code or visit https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/.

Principal U.S. Listing Exchange: NYSE Arca, Inc.

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about the VanEck Green Bond ETF for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investment |

|---|

| VanEck Green Bond ETF | $10 | 0.20%Footnote Reference(a) |

| Footnote | Description |

Footnote(a) | Annualized |

- Total Net Assets$106,809,265

- Number of Portfolio Holdings410

- Portfolio Turnover Rate7%

- Advisory Fees Paid$100,074

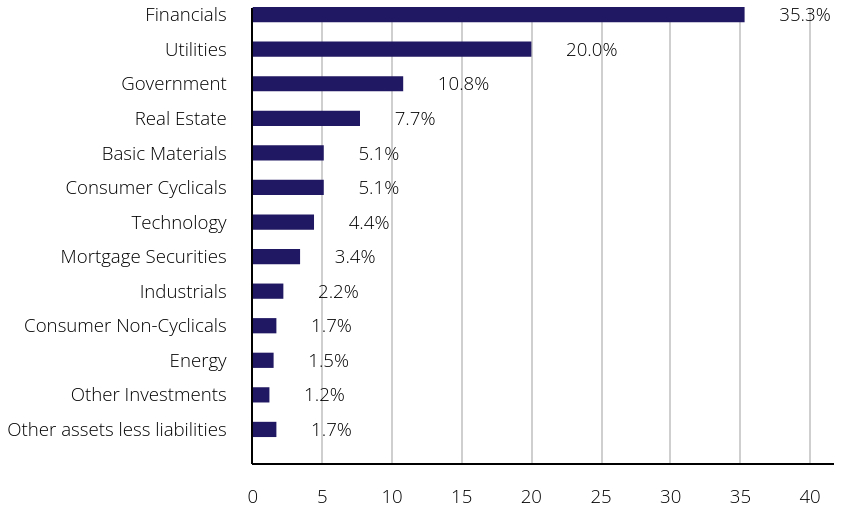

What did the Fund invest in?

Portfolio Composition (% of Total Net Assets)

| Value | Value | Value |

|---|

| Other assets less liabilities | | 1.7% |

| Other Investments | | 1.2% |

| Energy | | 1.5% |

| Consumer Non-Cyclicals | | 1.7% |

| Industrials | | 2.2% |

| Mortgage Securities | | 3.4% |

| Technology | | 4.4% |

| Consumer Cyclicals | | 5.1% |

| Basic Materials | | 5.1% |

| Real Estate | | 7.7% |

| Government | | 10.8% |

| Utilities | | 20.0% |

| Financials | | 35.3% |

Top Ten Holdings (% of Total Net Assets)

| European Investment Bank, 3.75%, 2/14/2033 | | 1.3% |

| European Investment Bank, 4.38%, 10/10/2031 | | 1.1% |

| Kreditanstalt fuer Wiederaufbau, 1.00%, 10/1/2026 | | 1.0% |

| Ford Motor Co., 3.25%, 2/12/2032 | | 0.9% |

| Gaci First Investment Co., 5.25%, 10/13/2032 | | 0.8% |

| Industrial & Commercial Bank of China Ltd., 5.44%, 10/25/2026 | | 0.8% |

| Turkiye Government International Bond, 9.12%, 7/13/2030 | | 0.7% |

| European Investment Bank, 2.88%, 6/13/2025 | | 0.7% |

| JPMorgan Chase & Co., 6.07%, 10/22/2027 | | 0.7% |

| Hong Kong Government International Bond, 4.00%, 6/7/2033 | | 0.6% |

Need Additional Information?

If you wish to view additional information about the Fund including but not limited to financial statements, prospectus or holdings please scan the QR code or visit https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/.

VanEck High Yield Muni ETF

Principal U.S. Listing Exchange: Cboe BZX Exchange, Inc.

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about the VanEck High Yield Muni ETF for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investment |

|---|

| VanEck High Yield Muni ETF | $16 | 0.32%Footnote Reference(a) |

| Footnote | Description |

Footnote(a) | Annualized |

- Total Net Assets$3,135,101,594

- Number of Portfolio Holdings1,487

- Portfolio Turnover Rate7%

- Advisory Fees Paid$4,958,017

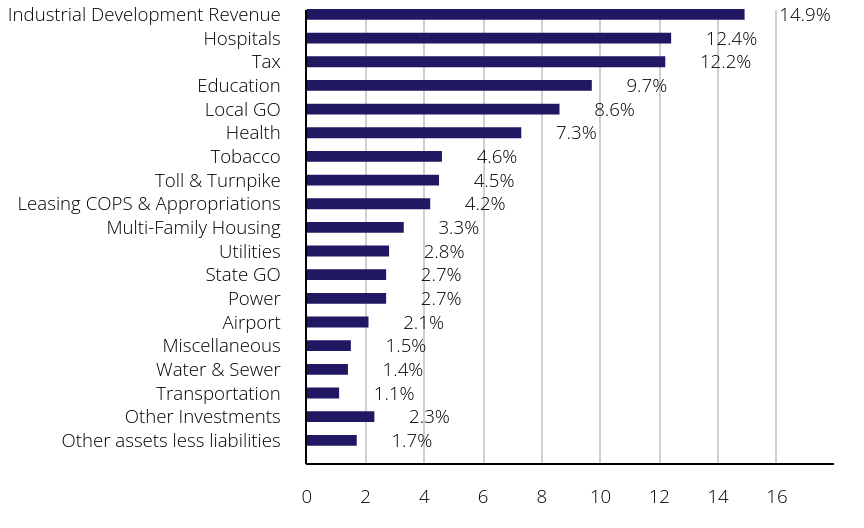

What did the Fund invest in?

Portfolio Composition (% of Total Net Assets)

| Value | Value | Value |

|---|

| Other assets less liabilities | | 1.7% |

| Other Investments | | 2.3% |

| Transportation | | 1.1% |

| Water & Sewer | | 1.4% |

| Miscellaneous | | 1.5% |

| Airport | | 2.1% |

| Power | | 2.7% |

| State GO | | 2.7% |

| Utilities | | 2.8% |

| Multi-Family Housing | | 3.3% |

| Leasing COPS & Appropriations | | 4.2% |

| Toll & Turnpike | | 4.5% |

| Tobacco | | 4.6% |

| Health | | 7.3% |

| Local GO | | 8.6% |

| Education | | 9.7% |

| Tax | | 12.2% |

| Hospitals | | 12.4% |

| Industrial Development Revenue | | 14.9% |

Top Ten Holdings (% of Total Net Assets)

| Puerto Rico Sales Tax Financing Corp., 5.00%, 7/1/2058 | | 1.2% |

| Buckeye Tobacco Settlement Financing Authority, 5.00%, 6/1/2055 | | 1.0% |

| Puerto Rico Sales Tax Rev Restructed BDS Cofina A-1, 0.00%, 7/1/2051 | | 0.9% |

| Puerto Rico Sales Tax Financing Corp., 4.33%, 7/1/2040 | | 0.8% |

| Puerto Rico Sales Tax Financing Corp., 4.75%, 7/1/2053 | | 0.8% |

| City of Houston, Texas Airport System Special Facilities, United Airlines, Inc., 4.00%, 7/15/2041 | | 0.7% |

| Arkansas Development Finance Authority, Environmental Improvement, United States Steel Corporation Project, 5.45%, 9/1/2052 | | 0.7% |

| Inland Empire Tobacco Securitization Authority, Series C-2, 0.00%, 6/1/2047 | | 0.6% |

| California Municipal Finance Authority, United Airlines, Inc., International Airport Project, 4.00%, 7/15/2029 | | 0.6% |

| Tobacco Settlement Financing Corp., 5.00%, 6/1/2046 | | 0.6% |

Need Additional Information?

If you wish to view additional information about the Fund including but not limited to financial statements, prospectus or holdings please scan the QR code or visit https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/.

VanEck HIP Sustainable Muni ETF

Principal U.S. Listing Exchange: Cboe BZX Exchange, Inc.

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about the VanEck HIP Sustainable Muni ETF for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investment |

|---|

| VanEck HIP Sustainable Muni ETF | $12 | 0.24%Footnote Reference(a) |

| Footnote | Description |

Footnote(a) | Annualized |

- Total Net Assets$11,575,483

- Number of Portfolio Holdings36

- Portfolio Turnover Rate4%

- Advisory Fees Paid$14,936

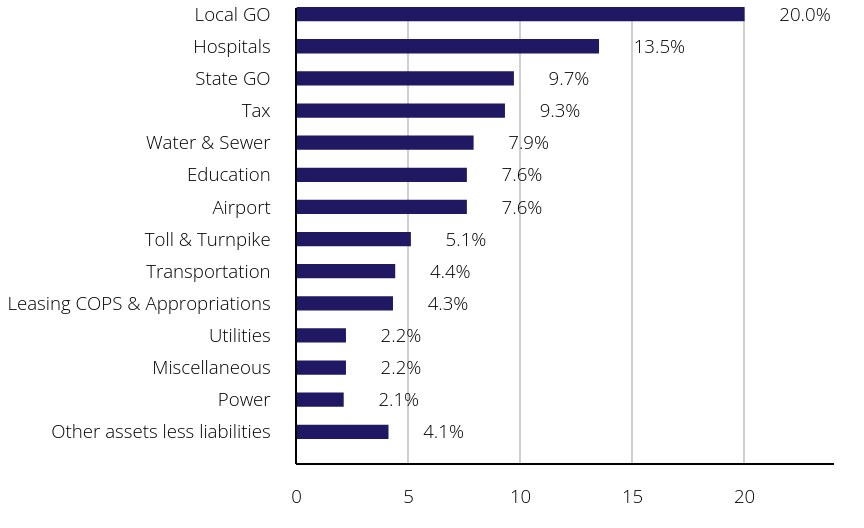

What did the Fund invest in?

Portfolio Composition (% of Total Net Assets)

| Value | Value | Value |

|---|

| Other assets less liabilities | | 4.1% |

| Power | | 2.1% |

| Miscellaneous | | 2.2% |

| Utilities | | 2.2% |

| Leasing COPS & Appropriations | | 4.3% |

| Transportation | | 4.4% |

| Toll & Turnpike | | 5.1% |

| Airport | | 7.6% |

| Education | | 7.6% |

| Water & Sewer | | 7.9% |

| Tax | | 9.3% |

| State GO | | 9.7% |

| Hospitals | | 13.5% |

| Local GO | | 20.0% |

Top Ten Holdings (% of Total Net Assets)

| Wylie Independent School District, 5.00%, 8/15/2039 | | 4.8% |

| City and County of Honolulu, Wastewater System, 4.00%, 7/1/2033 | | 4.4% |

| Port Authority of New York & New Jersey, 5.00%, 11/15/2042 | | 4.4% |

| City of Los Angeles Department of Airports, 5.00%, 5/15/2051 | | 4.3% |

| Dallas Independent School District, Unlimited Tax School Building, 4.00%, 2/15/2054 | | 4.2% |

| New York City Municipal Water Finance Authority, Water & Sewer System, 5.00%, 6/15/2039 | | 3.5% |

| San Francisco City & County, International Airport, 5.00%, 5/1/2034 | | 3.4% |

| Commonwealth of Massachusetts, 5.00%, 11/1/2024 | | 3.1% |

| Arizona Industrial Development Authority, Educational Facility, KIPP NYC Public Charter Schools - Macombs Facility Project, 4.00%, 7/1/2051 | | 3.1% |

| Pennsylvania Turnpike Commission, 5.00%, 12/1/2051 | | 3.0% |

Need Additional Information?

If you wish to view additional information about the Fund including but not limited to financial statements, prospectus or holdings please scan the QR code or visit https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/.

VanEck IG Floating Rate ETF

Principal U.S. Listing Exchange: NYSE Arca, Inc.

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about the VanEck IG Floating Rate ETF for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investment |

|---|

| VanEck IG Floating Rate ETF | $7 | 0.14%Footnote Reference(a) |

| Footnote | Description |

Footnote(a) | Annualized |

- Total Net Assets$1,742,854,322

- Number of Portfolio Holdings294

- Portfolio Turnover Rate54%

- Advisory Fees Paid$1,169,624

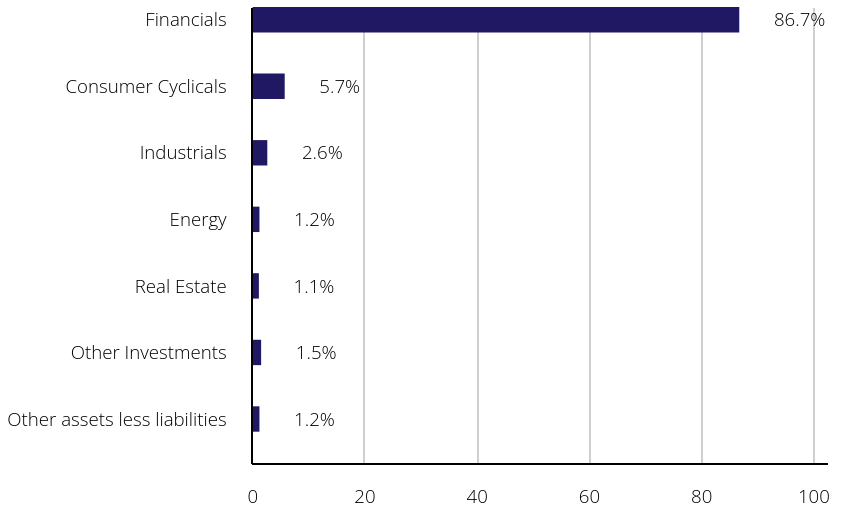

What did the Fund invest in?

Portfolio Composition (% of Total Net Assets)

| Value | Value | Value |

|---|

| Other assets less liabilities | | 1.2% |

| Other Investments | | 1.5% |

| Real Estate | | 1.1% |

| Energy | | 1.2% |

| Industrials | | 2.6% |

| Consumer Cyclicals | | 5.7% |

| Financials | | 86.7% |

Top Ten Holdings (% of Total Net Assets)

| JPMorgan Chase & Co., 6.20%, 2/24/2028 | | 1.5% |

| Goldman Sachs Group, Inc., 6.63%, 10/28/2027 | | 1.4% |

| Wells Fargo & Co., 5.91%, 4/22/2028 | | 1.4% |

| Morgan Stanley Bank NA, 5.53%, 10/15/2027 | | 1.2% |

| Morgan Stanley Bank NA, 5.78%, 7/14/2028 | | 1.2% |

| Australia & New Zealand Banking Group Ltd., 5.65%, 1/18/2027 | | 1.2% |

| National Australia Bank Ltd., 5.53%, 6/11/2027 | | 1.2% |

| Goldman Sachs Bank USA, 5.78%, 5/21/2027 | | 1.2% |

| Macquarie Bank Ltd., 5.77%, 7/2/2027 | | 1.1% |

| Banco Santander SA, 5.96%, 7/15/2028 | | 1.0% |

Need Additional Information?

If you wish to view additional information about the Fund including but not limited to financial statements, prospectus or holdings please scan the QR code or visit https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/.

VanEck Intermediate Muni ETF

Principal U.S. Listing Exchange: Cboe BZX Exchange, Inc.

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about the VanEck Intermediate Muni ETF for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investment |

|---|

| VanEck Intermediate Muni ETF | $9 | 0.18%Footnote Reference(a) |

| Footnote | Description |

Footnote(a) | Annualized |

- Total Net Assets$1,934,557,419

- Number of Portfolio Holdings1,294

- Portfolio Turnover Rate6%

- Advisory Fees Paid$1,666,012

What did the Fund invest in?

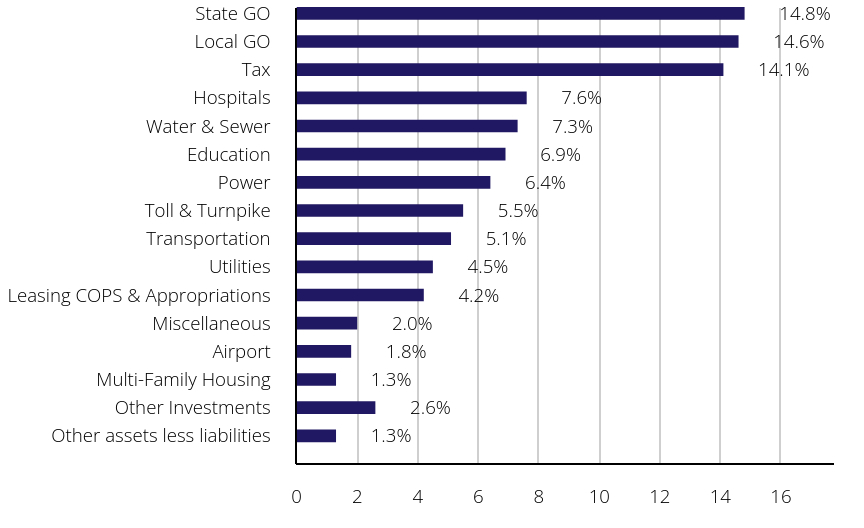

Portfolio Composition (% of Total Net Assets)

| Value | Value | Value |

|---|

| Other assets less liabilities | | 1.3% |

| Other Investments | | 2.6% |

| Multi-Family Housing | | 1.3% |

| Airport | | 1.8% |

| Miscellaneous | | 2.0% |

| Leasing COPS & Appropriations | | 4.2% |

| Utilities | | 4.5% |

| Transportation | | 5.1% |

| Toll & Turnpike | | 5.5% |

| Power | | 6.4% |

| Education | | 6.9% |

| Water & Sewer | | 7.3% |

| Hospitals | | 7.6% |

| Tax | | 14.1% |

| Local GO | | 14.6% |

| State GO | | 14.8% |

Top Ten Holdings (% of Total Net Assets)

| California Community Choice Financing Authority, Clean Energy, 5.00%, 8/1/2055 | | 0.6% |

| State of California, Various Purpose, 4.00%, 3/1/2036 | | 0.5% |

| California Community Choice, Financing Authority Clean Energy Project, 4.00%, 2/1/2052 | | 0.5% |

| State of California, 5.25%, 8/1/2032 | | 0.3% |

| California Community Choice Financing Authority, Clean Energy Project, 5.25%, 1/1/2054 | | 0.3% |

| New York City Transitional Finance Authority, Future Tax Secured Subordinate-1, 4.00%, 11/1/2030 | | 0.3% |

| New York City Municipal Water Finance Authority, 5.00%, 6/15/2034 | | 0.3% |

| California Housing Finance Agency, 3.75%, 3/25/2035 | | 0.3% |

| Energy Southeast A Cooperative District, Energy Supply, 5.50%, 11/1/2053 | | 0.3% |

| South Carolina Jobs-Economic Development Authority, Novant Health, Inc., 5.00%, 11/1/2034 | | 0.3% |

Need Additional Information?

If you wish to view additional information about the Fund including but not limited to financial statements, prospectus or holdings please scan the QR code or visit https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/.

VanEck International High Yield Bond ETF

Principal U.S. Listing Exchange: NYSE Arca, Inc.

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about the VanEck International High Yield Bond ETF for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investment |

|---|

| VanEck International High Yield Bond ETF | $21 | 0.40%Footnote Reference(a) |

| Footnote | Description |

Footnote(a) | Annualized |

- Total Net Assets$25,407,224

- Number of Portfolio Holdings382

- Portfolio Turnover Rate14%

- Advisory Fees Paid$54,190

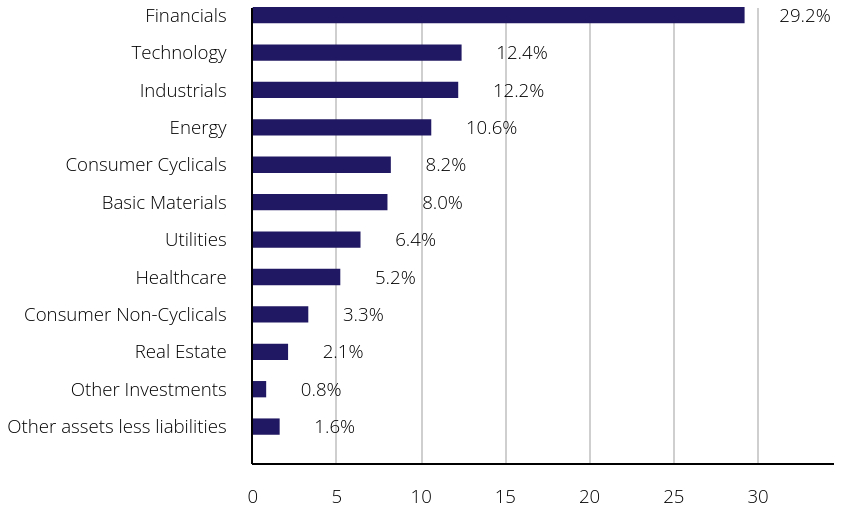

What did the Fund invest in?

Portfolio Composition (% of Total Net Assets)

| Value | Value | Value |

|---|

| Other assets less liabilities | | 1.6% |

| Other Investments | | 0.8% |

| Real Estate | | 2.1% |

| Consumer Non-Cyclicals | | 3.3% |

| Healthcare | | 5.2% |

| Utilities | | 6.4% |

| Basic Materials | | 8.0% |

| Consumer Cyclicals | | 8.2% |

| Energy | | 10.6% |

| Industrials | | 12.2% |

| Technology | | 12.4% |

| Financials | | 29.2% |

Top Ten Holdings (% of Total Net Assets)

| Industrial & Commercial Bank of China Ltd., 3.20% (Perpetual) | | 1.2% |

| UniCredit SpA, 2.73%, 1/15/2032 | | 0.8% |

| Electricite de France SA, 3.38% (Perpetual) | | 0.8% |

| SoftBank Group Corp., 6.88% (Perpetual) | | 0.8% |

| SoftBank Group Corp., 5.12%, 9/19/2027 | | 0.8% |

| Huarong Finance 2017 Co. Ltd., 4.25%, 11/7/2027 | | 0.8% |

| Virgin Media Vendor Financing Notes III DAC, 4.88%, 7/15/2028 | | 0.7% |

| Vodafone Group Plc, 8.00%, 8/30/2086 | | 0.6% |

| Petrobras Global Finance BV, 6.25%, 12/14/2026 | | 0.5% |

| Jerrold Finco Plc, 5.25%, 1/15/2027 | | 0.5% |

Need Additional Information?

If you wish to view additional information about the Fund including but not limited to financial statements, prospectus or holdings please scan the QR code or visit https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/.

VanEck J.P. Morgan EM Local Currency Bond ETF

Principal U.S. Listing Exchange: NYSE Arca, Inc.

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about the VanEck J.P. Morgan EM Local Currency Bond ETF for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investment |

|---|

| VanEck J.P. Morgan EM Local Currency Bond ETF | $16 | 0.30%Footnote Reference(a) |

| Footnote | Description |

Footnote(a) | Annualized |

- Total Net Assets$2,821,773,154

- Number of Portfolio Holdings435

- Portfolio Turnover Rate19%

- Advisory Fees Paid$3,698,643

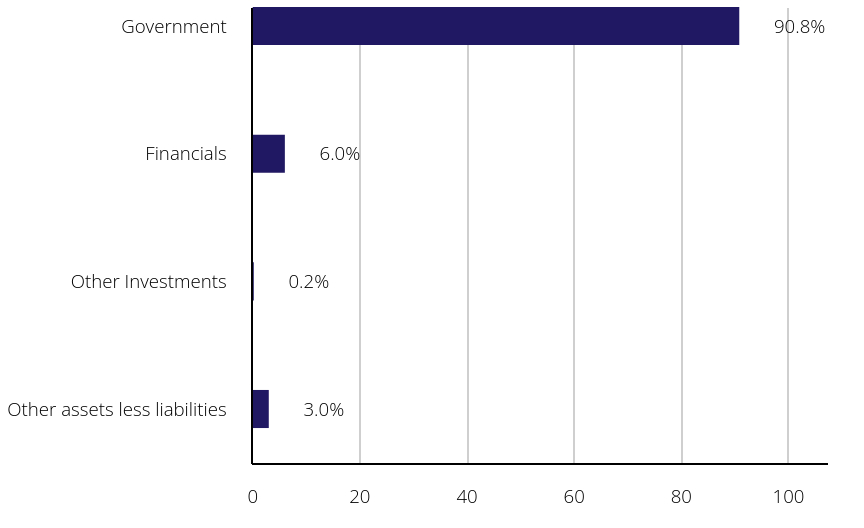

What did the Fund invest in?

Portfolio Composition (% of Total Net Assets)

| Value | Value | Value |

|---|

| Other assets less liabilities | | 3.0% |

| Other Investments | | 0.2% |

| Financials | | 6.0% |

| Government | | 90.8% |

Top Ten Holdings (% of Total Net Assets)

| Brazil Letras do Tesouro Nacional, 0.00%, 7/1/2026 | | 1.1% |

| Brazil Letras do Tesouro Nacional, 0.00%, 1/1/2026 | | 1.0% |

| Republic of South Africa Government Bond, 8.75%, 2/28/2048 | | 0.8% |

| Republic of South Africa Government Bond, 8.00%, 1/31/2030 | | 0.8% |

| Brazil Notas do Tesouro Nacional, 10.00%, 1/1/2029 | | 0.8% |

| Turkiye Government Bond, 26.20%, 10/5/2033 | | 0.8% |

| Brazil Notas do Tesouro Nacional, 10.00%, 1/1/2027 | | 0.8% |

| Republic of South Africa Government Bond, 8.88%, 2/28/2035 | | 0.8% |

| Brazil Letras do Tesouro Nacional, 0.00%, 7/1/2025 | | 0.7% |

| Republic of South Africa Government Bond, 8.25%, 3/31/2032 | | 0.7% |

Need Additional Information?

If you wish to view additional information about the Fund including but not limited to financial statements, prospectus or holdings please scan the QR code or visit https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/.

Principal U.S. Listing Exchange: Cboe BZX Exchange, Inc.

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about the VanEck Long Muni ETF for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investment |

|---|

| VanEck Long Muni ETF | $12 | 0.24%Footnote Reference(a) |

| Footnote | Description |

Footnote(a) | Annualized |

- Total Net Assets$539,094,072

- Number of Portfolio Holdings593

- Portfolio Turnover Rate4%

- Advisory Fees Paid$597,518

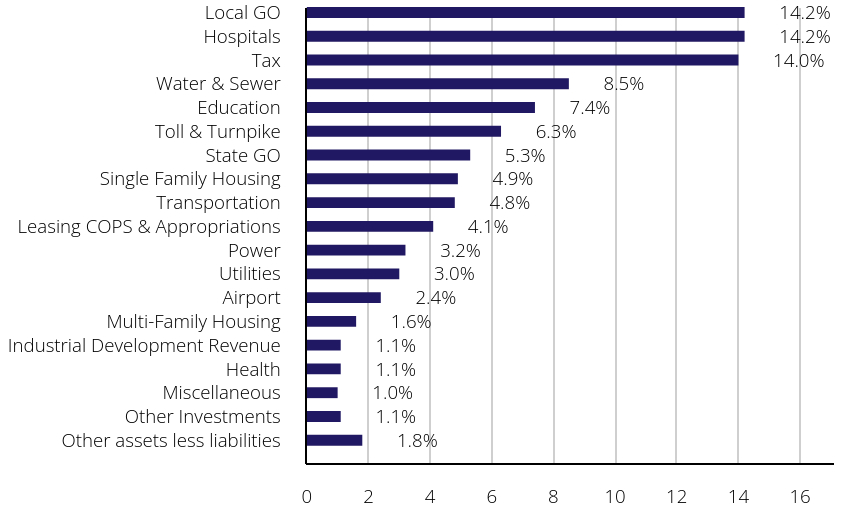

What did the Fund invest in?

Portfolio Composition (% of Total Net Assets)

| Value | Value | Value |

|---|

| Other assets less liabilities | | 1.8% |

| Other Investments | | 1.1% |

| Miscellaneous | | 1.0% |

| Health | | 1.1% |

| Industrial Development Revenue | | 1.1% |

| Multi-Family Housing | | 1.6% |

| Airport | | 2.4% |

| Utilities | | 3.0% |

| Power | | 3.2% |

| Leasing COPS & Appropriations | | 4.1% |

| Transportation | | 4.8% |

| Single Family Housing | | 4.9% |

| State GO | | 5.3% |

| Toll & Turnpike | | 6.3% |

| Education | | 7.4% |

| Water & Sewer | | 8.5% |

| Tax | | 14.0% |

| Hospitals | | 14.2% |

| Local GO | | 14.2% |

Top Ten Holdings (% of Total Net Assets)

| North Carolina Turnpike Authority, Triangle Expressway System, 5.00%, 1/1/2058 | | 0.7% |

| Los Angeles County, Public Works Financing Authority, 5.25%, 12/1/2041 | | 0.7% |

| New York State Dormitory Authority, White Plants Hospital, 5.50%, 10/1/2054 | | 0.5% |

| Dallas Fort Worth International Airport, 4.00%, 11/1/2045 | | 0.5% |

| New York Transportation Development Corp., Terminal 4 John F. Kennedy International Airport Project, 4.00%, 12/1/2041 | | 0.4% |

| New York City Transitional Finance Authority, Future Tax Secured Subordinate, 5.50%, 5/1/2052 | | 0.4% |

| State of California, Various Purpose, 5.00%, 9/1/2048 | | 0.4% |

| Lamar Consolidated Independent School District, 5.50%, 2/15/2058 | | 0.4% |

| City of San Antonio, Texas Electric & Gas Systems, 5.25%, 2/1/2054 | | 0.4% |

| Triborough Bridge and Tunnel Authority, Payroll Mobility Tax, 5.25%, 5/15/2054 | | 0.4% |

Need Additional Information?

If you wish to view additional information about the Fund including but not limited to financial statements, prospectus or holdings please scan the QR code or visit https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/.

VanEck Moody's Analytics BBB Corporate Bond ETF

Principal U.S. Listing Exchange: Cboe BZX Exchange, Inc.

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about the VanEck Moody's Analytics BBB Corporate Bond ETF for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investment |

|---|

| VanEck Moody's Analytics BBB Corporate Bond ETF | $13 | 0.26%Footnote Reference(a) |

| Footnote | Description |

Footnote(a) | Annualized |

- Total Net Assets$9,685,269

- Number of Portfolio Holdings211

- Portfolio Turnover Rate31%

- Advisory Fees Paid$11,002

What did the Fund invest in?

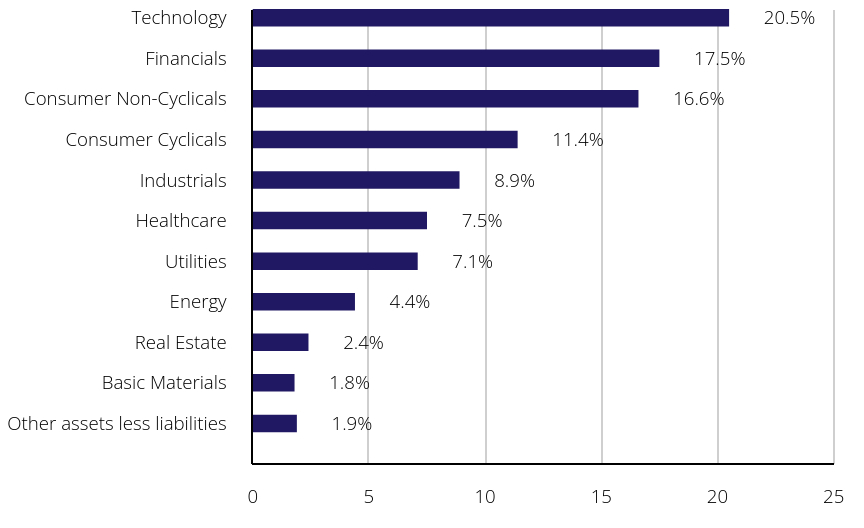

Portfolio Composition (% of Total Net Assets)

| Value | Value | Value |

|---|

| Other assets less liabilities | | 1.9% |

| Basic Materials | | 1.8% |

| Real Estate | | 2.4% |

| Energy | | 4.4% |

| Utilities | | 7.1% |

| Healthcare | | 7.5% |

| Industrials | | 8.9% |

| Consumer Cyclicals | | 11.4% |

| Consumer Non-Cyclicals | | 16.6% |

| Financials | | 17.5% |

| Technology | | 20.5% |

Top Ten Holdings (% of Total Net Assets)

| T-Mobile USA, Inc., 3.75%, 4/15/2027 | | 1.5% |

| Charter Communications Operating LLC / Charter Communications Operating Capital, 6.48%, 10/23/2045 | | 1.5% |

| McDonald's Corp., 2.12%, 3/1/2030 | | 1.4% |

| Verizon Communications, Inc., 4.33%, 9/21/2028 | | 1.3% |

| Oracle Corp., 5.38%, 7/15/2040 | | 1.3% |

| McDonald's Corp., 4.88%, 12/9/2045 | | 1.2% |

| Time Warner Cable LLC, 7.30%, 7/1/2038 | | 1.1% |

| Sabine Pass Liquefaction LLC, 5.88%, 6/30/2026 | | 1.0% |

| Kroger Co., 4.90%, 9/15/2031 | | 1.0% |

| Fiserv, Inc., 3.20%, 7/1/2026 | | 1.0% |

Need Additional Information?

If you wish to view additional information about the Fund including but not limited to financial statements, prospectus or holdings please scan the QR code or visit https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/.

VanEck Moody's Analytics IG Corporate Bond ETF

Principal U.S. Listing Exchange: Cboe BZX Exchange, Inc.

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about the VanEck Moody's Analytics IG Corporate Bond ETF for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investment |

|---|

| VanEck Moody's Analytics IG Corporate Bond ETF | $11 | 0.21%Footnote Reference(a) |

| Footnote | Description |

Footnote(a) | Annualized |

- Total Net Assets$16,605,820

- Number of Portfolio Holdings313

- Portfolio Turnover Rate29%

- Advisory Fees Paid$13,446

What did the Fund invest in?

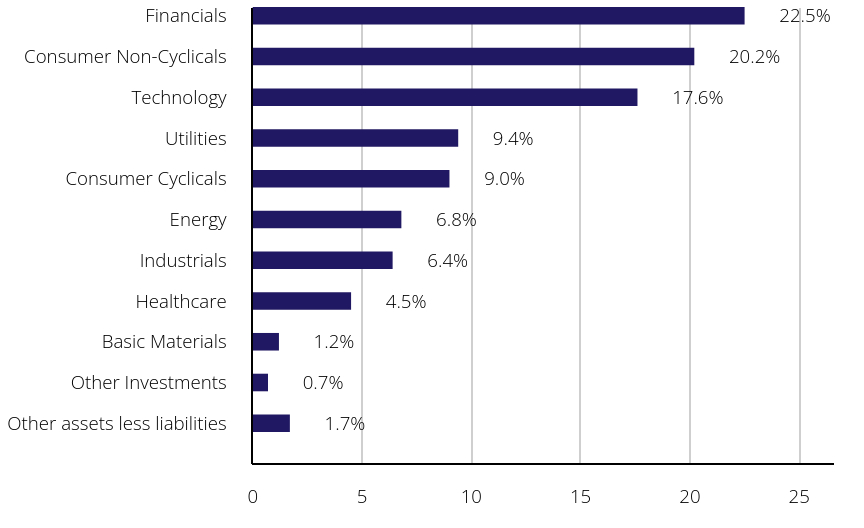

Portfolio Composition (% of Total Net Assets)

| Value | Value | Value |

|---|

| Other assets less liabilities | | 1.7% |

| Other Investments | | 0.7% |

| Basic Materials | | 1.2% |

| Healthcare | | 4.5% |

| Industrials | | 6.4% |

| Energy | | 6.8% |

| Consumer Cyclicals | | 9.0% |

| Utilities | | 9.4% |

| Technology | | 17.6% |

| Consumer Non-Cyclicals | | 20.2% |

| Financials | | 22.5% |

Top Ten Holdings (% of Total Net Assets)

| BNP Paribas SA, 5.12%, 1/13/2029 | | 1.4% |

| AT&T, Inc., 3.80%, 12/1/2057 | | 1.1% |

| Berkshire Hathaway Finance Corp., 4.20%, 8/15/2048 | | 1.0% |

| Verizon Communications, Inc., 4.02%, 12/3/2029 | | 1.0% |

| Visa, Inc., 3.15%, 12/14/2025 | | 0.9% |

| Societe Generale SA, 1.49%, 12/14/2026 | | 0.9% |

| T-Mobile USA, Inc., 3.88%, 4/15/2030 | | 0.9% |

| Saudi Arabian Oil Co., 4.25%, 4/16/2039 | | 0.8% |

| Centene Corp., 3.00%, 10/15/2030 | | 0.8% |

| Sprint LLC, 7.62%, 3/1/2026 | | 0.8% |

Need Additional Information?

If you wish to view additional information about the Fund including but not limited to financial statements, prospectus or holdings please scan the QR code or visit https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/.

VanEck Mortgage REIT Income ETF

Principal U.S. Listing Exchange: NYSE Arca, Inc.

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about the VanEck Mortgage REIT Income ETF for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investment |

|---|

| VanEck Mortgage REIT Income ETF | $23 | 0.43%Footnote Reference(a) |

| Footnote | Description |

Footnote(a) | Annualized |

- Total Net Assets$292,026,173

- Number of Portfolio Holdings26

- Portfolio Turnover Rate17%

- Advisory Fees Paid$575,179

What did the Fund invest in?

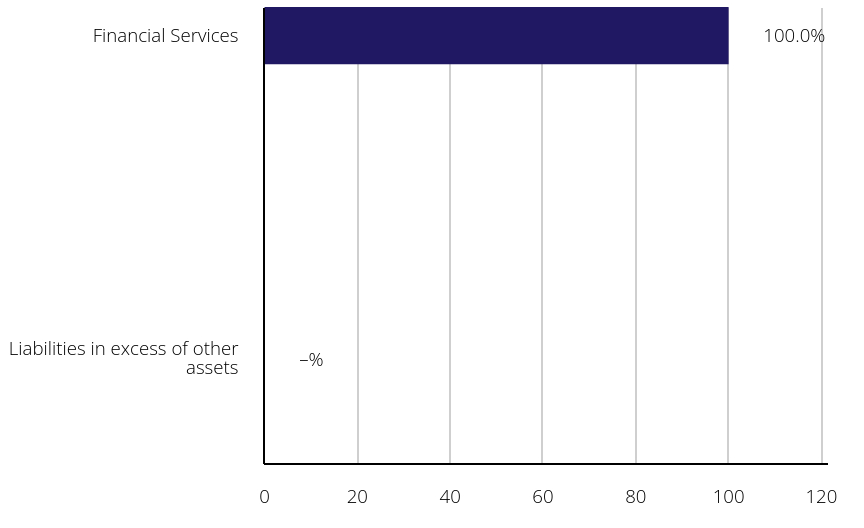

Portfolio Composition (% of Total Net Assets)

| Value | Value | Value |

|---|

| Liabilities in excess of other assets | | -% |

| Financial Services | | 100.0% |

Top Ten Holdings (% of Total Net Assets)

| Annaly Capital Management, Inc. | | 12.4% |

| AGNC Investment Corp. | | 10.9% |

| Starwood Property Trust, Inc. | | 8.9% |

| Rithm Capital Corp. | | 7.3% |

| HA Sustainable Infrastructure Capital, Inc. | | 5.4% |

| Blackstone Mortgage Trust, Inc. | | 5.1% |

| Arbor Realty Trust, Inc. | | 5.1% |

| Ladder Capital Corp. | | 3.8% |

| Chimera Investment Corp. | | 3.3% |

| MFA Financial, Inc. | | 3.2% |

Need Additional Information?

If you wish to view additional information about the Fund including but not limited to financial statements, prospectus or holdings please scan the QR code or visit https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/.

VanEck Preferred Securities ex Financials ETF

Principal U.S. Listing Exchange: NYSE Arca, Inc.

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about the VanEck Preferred Securities ex Financials ETF for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investment |

|---|

| VanEck Preferred Securities ex Financials ETF | $21 | 0.40%Footnote Reference(a) |

| Footnote | Description |

Footnote(a) | Annualized |

- Total Net Assets$1,953,653,010

- Number of Portfolio Holdings100

- Portfolio Turnover Rate14%

- Advisory Fees Paid$3,584,784

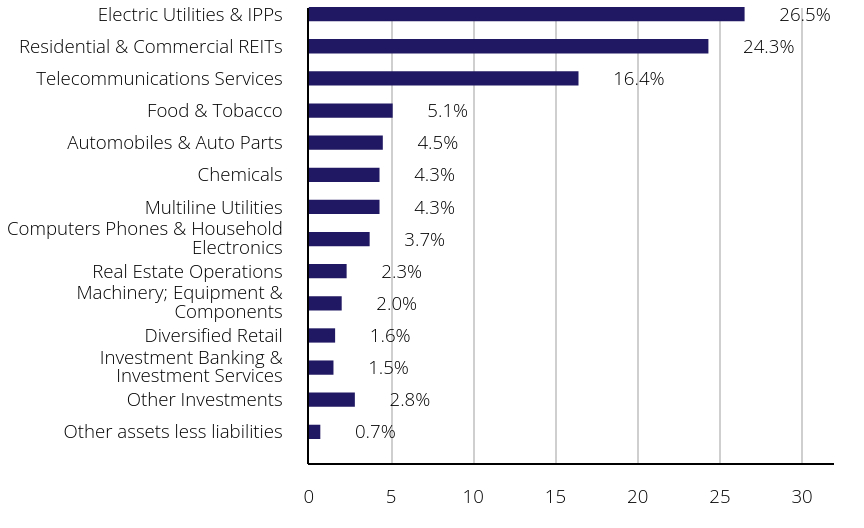

What did the Fund invest in?

Portfolio Composition (% of Total Net Assets)

| Value | Value | Value |

|---|

| Other assets less liabilities | | 0.7% |

| Other Investments | | 2.8% |

| Investment Banking & Investment Services | | 1.5% |

| Diversified Retail | | 1.6% |

| Machinery; Equipment & Components | | 2.0% |

| Real Estate Operations | | 2.3% |

| Computers Phones & Household Electronics | | 3.7% |

| Multiline Utilities | | 4.3% |

| Chemicals | | 4.3% |

| Automobiles & Auto Parts | | 4.5% |

| Food & Tobacco | | 5.1% |

| Telecommunications Services | | 16.4% |

| Residential & Commercial REITs | | 24.3% |

| Electric Utilities & IPPs | | 26.5% |

Top Ten Holdings (% of Total Net Assets)

| NextEra Energy, Inc., 7.30%, 6/1/2027 | | 4.5% |

| Albemarle Corp., 7.25%, 3/1/2027 | | 4.3% |

| NextEra Energy, Inc., 6.93%, 9/1/2025 | | 3.8% |

| Hewlett Packard Enterprise Co., 7.62%, 9/1/2027 | | 3.7% |

| AT&T, Inc., 4.75% | | 3.0% |

| AT&T, Inc., 5.35%, 11/1/2066 | | 2.7% |

| AT&T, Inc., 5.00% | | 2.2% |

| Duke Energy Corp., 5.75% | | 2.1% |

| Southern Co., 4.95%, 1/30/2080 | | 1.9% |

| AT&T, Inc., 5.62%, 8/1/2067 | | 1.7% |

Need Additional Information?

If you wish to view additional information about the Fund including but not limited to financial statements, prospectus or holdings please scan the QR code or visit https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/.

VanEck Short High Yield Muni ETF

Principal U.S. Listing Exchange: Cboe BZX Exchange, Inc.

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about the VanEck Short High Yield Muni ETF for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investment |

|---|

| VanEck Short High Yield Muni ETF | $18 | 0.36%Footnote Reference(a) |

| Footnote | Description |

Footnote(a) | Annualized |

- Total Net Assets$308,943,221

- Number of Portfolio Holdings423

- Portfolio Turnover Rate15%

- Advisory Fees Paid$558,342

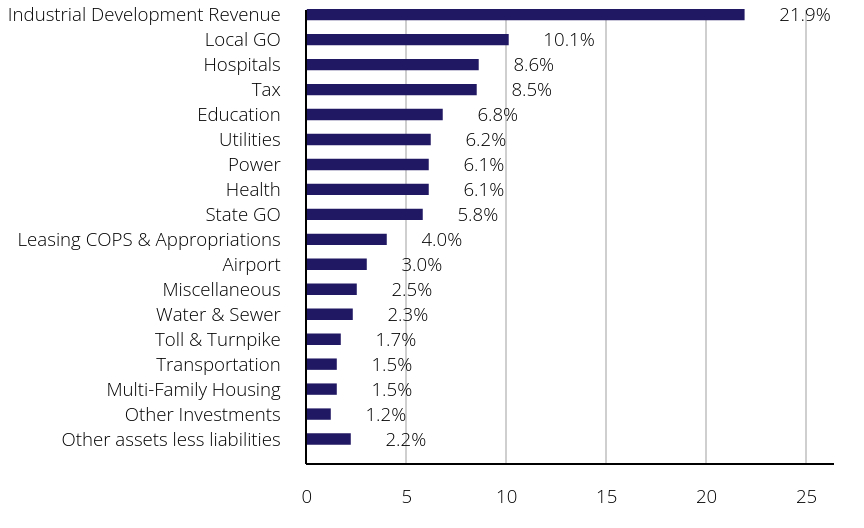

What did the Fund invest in?

Portfolio Composition (% of Total Net Assets)

| Value | Value | Value |

|---|

| Other assets less liabilities | | 2.2% |

| Other Investments | | 1.2% |

| Multi-Family Housing | | 1.5% |

| Transportation | | 1.5% |

| Toll & Turnpike | | 1.7% |

| Water & Sewer | | 2.3% |

| Miscellaneous | | 2.5% |

| Airport | | 3.0% |

| Leasing COPS & Appropriations | | 4.0% |

| State GO | | 5.8% |

| Health | | 6.1% |

| Power | | 6.1% |

| Utilities | | 6.2% |

| Education | | 6.8% |

| Tax | | 8.5% |

| Hospitals | | 8.6% |

| Local GO | | 10.1% |

| Industrial Development Revenue | | 21.9% |

Top Ten Holdings (% of Total Net Assets)

| California Municipal Finance Authority, United Airlines, Inc., International Airport Project, 4.00%, 7/15/2029 | | 2.1% |

| Puerto Rico Commonwealth, 5.75%, 7/1/2031 | | 1.4% |

| New York Transportation Development Corp., American Airlines, Inc. John F. Kennedy International Airport Project, 5.00%, 8/1/2031 | | 1.4% |

| Puerto Rico Commonwealth, 4.00%, 7/1/2033 | | 1.3% |

| New York Transportation Development Corp., American Airlines, Inc. John F. Kennedy International Airport Project, 5.25%, 8/1/2031 | | 1.1% |

| Puerto Rico Commonwealth, 5.62%, 7/1/2029 | | 1.1% |

| California Community Choice Financing Authority, Clean Energy Project, 5.25%, 1/1/2054 | | 1.0% |

| Puerto Rico Commonwealth Aqueduct and Sewer Authority, 5.00%, 7/1/2030 | | 1.0% |

| City of Houston, Airport System, United Airlines, Inc. Terminal E Project, 5.00%, 7/1/2029 | | 1.0% |

| California Housing Finance Agency, 4.00%, 3/20/2033 | | 0.9% |

Need Additional Information?

If you wish to view additional information about the Fund including but not limited to financial statements, prospectus or holdings please scan the QR code or visit https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/.

Principal U.S. Listing Exchange: Cboe BZX Exchange, Inc.

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about the VanEck Short Muni ETF for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/. You can also request this information by contacting us at 800.826.2333 or info@vaneck.com.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a % of a $10,000 investment |

|---|

| VanEck Short Muni ETF | $4 | 0.07%Footnote Reference(a) |

| Footnote | Description |

Footnote(a) | Annualized |

- Total Net Assets$265,878,231

- Number of Portfolio Holdings338

- Portfolio Turnover Rate11%

- Advisory Fees Paid$91,573

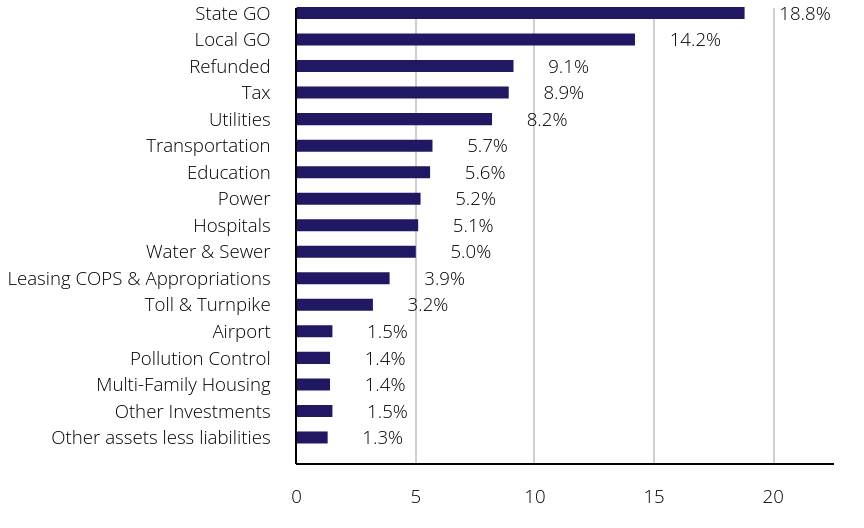

What did the Fund invest in?

Portfolio Composition (% of Total Net Assets)

| Value | Value | Value |

|---|

| Other assets less liabilities | | 1.3% |

| Other Investments | | 1.5% |

| Multi-Family Housing | | 1.4% |

| Pollution Control | | 1.4% |

| Airport | | 1.5% |

| Toll & Turnpike | | 3.2% |

| Leasing COPS & Appropriations | | 3.9% |

| Water & Sewer | | 5.0% |

| Hospitals | | 5.1% |

| Power | | 5.2% |

| Education | | 5.6% |

| Transportation | | 5.7% |

| Utilities | | 8.2% |

| Tax | | 8.9% |

| Refunded | | 9.1% |

| Local GO | | 14.2% |

| State GO | | 18.8% |

Top Ten Holdings (% of Total Net Assets)

| State of California, Various Purpose, 5.00%, 4/1/2030 | | 1.2% |

| Black Belt Energy Gas District Gas, Project No. 4, 4.00%, 12/1/2049 | | 0.9% |

| California Statewide Communities Development Authority, Pollution Control, Southern California Edison Company, 1.75%, 9/1/2029 | | 0.8% |

| County of King, Limited Tax, 4.00%, 7/1/2030 | | 0.8% |

| City of Chicago, 5.00%, 1/1/2030 | | 0.8% |

| Commonwealth of Pennsylvania, 5.00%, 2/15/2027 | | 0.8% |

| Metropolitan Transportation Authority, 5.00%, 11/15/2048 | | 0.8% |

| Los Angeles Unified School District, 5.00%, 7/1/2030 | | 0.7% |

| Golden State Tobacco Securitization Corp., Enhanced Tobacco Settlement, 5.00%, 6/1/2045 | | 0.7% |

| Tennessee Energy Acquisition Corp., Gas Project, 4.00%, 11/1/2049 | | 0.7% |

Need Additional Information?

If you wish to view additional information about the Fund including but not limited to financial statements, prospectus or holdings please scan the QR code or visit https://www.vaneck.com/us/en/etf-mutual-fund-finder/etfs/documents/.

Not applicable for semi-annual reports.

| Item 3. | AUDIT COMMITTEE FINANCIAL EXPERT. |

Not applicable for semi-annual reports.

| Item 4. | PRINCIPAL ACCOUNTANT FEES AND SERVICES. |

Not applicable for semi-annual reports.

| Item 5. | AUDIT COMMITTEE OF LISTED REGISTRANTS. |

Not applicable for semi-annual reports.

Information included in Item 7.

| Item 7. | FINANCIAL STATEMENTS AND FINANCIAL HIGHLIGHTS FOR OPEN-END MANAGEMENT INVESSTMENT COMPANIES. |

| SEMI-ANNUAL FINANCIAL STATEMENTS

AND OTHER INFORMATION

October 31, 2024

(unaudited) |

| CEF Muni Income ETF | XMPT |

| High Yield Muni ETF | HYD |

| HIP Sustainable Muni ETF | SMI |

| Intermediate Muni ETF | ITM |

| Long Muni ETF | MLN |

| Short High Yield Muni ETF | SHYD |

| Short Muni ETF | SMB |

VANECK CEF MUNI INCOME ETF

SCHEDULE OF INVESTMENTS

October 31, 2024 (unaudited)

| | | Number

of Shares | | | Value | |

| CLOSED-END FUNDS: 99.8%(a) | | | | | | | | |

| abrdn National Municipal Income Fund | | | 100,217 | | | $ | 1,075,328 | |

| Alliance Bernstein National Municipal Income Fund, Inc. | | | 236,280 | | | | 2,672,327 | |

| BlackRock 2037 Municipal Target Term Trust | | | 35,664 | | | | 887,142 | |

| BlackRock Investment Quality Municipal Trust, Inc. | | | 100,330 | | | | 1,231,049 | |

| BlackRock Long-Term Municipal Advantage Trust | | | 68,041 | | | | 698,101 | |

| BlackRock MuniAssets Fund, Inc. | | | 163,123 | | | | 1,903,645 | |

| BlackRock Municipal 2030 Target Term Trust | | | 548,010 | | | | 11,623,292 | |

| BlackRock Municipal Income Fund, Inc. | | | 428,179 | | | | 5,330,829 | |

| BlackRock Municipal Income Quality Trust | | | 188,153 | | | | 2,167,523 | |

| BlackRock Municipal Income Trust | | | 324,697 | | | | 3,315,156 | |

| BlackRock Municipal Income Trust II | | | 352,985 | | | | 3,826,357 | |

| BlackRock MuniHoldings Fund, Inc. | | | 381,552 | | | | 4,662,565 | |

| BlackRock MuniHoldings Quality Fund II, Inc. | | | 177,731 | | | | 1,837,738 | |

| BlackRock MuniVest Fund II, Inc. | | | 169,754 | | | | 1,865,596 | |

| BlackRock MuniVest Fund, Inc. | | | 454,687 | | | | 3,328,309 | |

| BlackRock MuniYield Fund, Inc. | | | 331,189 | | | | 3,659,638 | |

| BlackRock MuniYield Quality Fund II, Inc. | | | 163,113 | | | | 1,691,482 | |

| BlackRock MuniYield Quality Fund III, Inc. | | | 477,880 | | | | 5,385,708 | |

| BlackRock MuniYield Quality Fund, Inc. | | | 411,205 | | | | 5,148,287 | |

| BNY Mellon Municipal Bond Infrastructure Fund, Inc. | | | 151,197 | | | | 1,622,344 | |

| BNY Mellon Municipal Income, Inc. | | | 122,516 | | | | 890,691 | |

| BNY Mellon Strategic Municipal Bond Fund, Inc. | | | 402,629 | | | | 2,423,827 | |

| BNY Mellon Strategic Municipals, Inc. | | | 509,716 | | | | 3,231,599 | |

| DWS Municipal Income Trust | | | 228,821 | | | | 2,233,293 | |

| Eaton Vance Municipal Bond Fund | | | 416,029 | | | | 4,355,824 | |

| | | Number

of Shares | | | Value | |

| Eaton Vance Municipal Income 2028 Term Trust | | | 47,326 | | | $ | 882,157 | |

| Eaton Vance Municipal Income Trust | | | 230,711 | | | | 2,427,080 | |

| Eaton Vance National Municipal Opportunities Trust | | | 112,085 | | | | 1,972,696 | |

| Invesco Advantage Municipal Income Trust II | | | 323,680 | | | | 2,926,067 | |

| Invesco Municipal Income Opportunities Trust | | | 201,030 | | | | 1,324,788 | |

| Invesco Municipal Opportunity Trust | | | 493,461 | | | | 4,929,675 | |

| Invesco Municipal Trust | | | 409,141 | | | | 4,128,233 | |

| Invesco Quality Municipal Income Trust | | | 386,305 | | | | 3,897,817 | |

| Invesco Trust for Investment Grade Municipals | | | 399,974 | | | | 4,143,731 | |

| Invesco Value Municipal Income Trust | | | 278,310 | | | | 3,456,610 | |

| MFS Municipal Income Trust | | | 336,330 | | | | 1,883,448 | |

| Neuberger Berman Municipal Fund, Inc. | | | 218,567 | | | | 2,369,266 | |

| Nuveen AMT-Free Municipal Credit Income Fund | | | 1,407,440 | | | | 18,001,158 | |

| Nuveen AMT-Free Municipal Value Fund | | | 131,913 | | | | 1,832,272 | |

| Nuveen AMT-Free Quality Municipal Income Fund | | | 1,580,699 | | | | 18,336,108 | |

| Nuveen Dynamic Municipal Opportunities Fund | | | 299,870 | | | | 3,214,606 | |

| Nuveen Municipal Credit Income Fund | | | 1,396,890 | | | | 17,726,534 | |

| Nuveen Municipal High Income Opportunity Fund | | | 544,752 | | | | 6,073,985 | |

| Nuveen Municipal Value Fund, Inc. | | | 1,203,269 | | | | 10,721,127 | |

| Nuveen Quality Municipal Income Fund | | | 1,530,375 | | | | 18,349,196 | |

| Nuveen Select Tax-Free Income Portfolio | | | 205,593 | | | | 3,026,329 | |

| PIMCO Municipal Income Fund | | | 127,266 | | | | 1,228,117 | |

| PIMCO Municipal Income Fund II | | | 320,463 | | | | 2,820,074 | |

| PIMCO Municipal Income Fund III | | | 168,331 | | | | 1,323,082 | |

See Notes to Financial Statements

VANECK CEF MUNI INCOME ETF

SCHEDULE OF INVESTMENTS

(unaudited) (continued)

| | | Number

of Shares | | | Value | |

| Pioneer Municipal High Income Advantage Fund, Inc. | | | 171,473 | | | $ | 1,478,097 | |

| Pioneer Municipal High Income Fund Trust | | | 165,089 | | | | 1,551,837 | |

| Pioneer Municipal High Income Opportunities Fund, Inc. | | | 121,425 | | | | 1,472,254 | |

| Putnam Managed Municipal Income Trust | | | 334,588 | | | | 2,101,213 | |

| Putnam Municipal Opportunities Trust | | | 231,049 | | | | 2,423,704 | |

| Western Asset Managed Municipals Fund, Inc. | | | 407,217 | | | | 4,239,129 | |

| Western Asset Municipal High Income Fund, Inc. | | | 109,015 | | | | 763,105 | |

Total Closed-End Funds: 99.8%

(Cost: $246,240,102) | | | | | | | 228,091,145 | |

| Other assets less liabilities: 0.2% | | | | | | | 519,583 | |

| NET ASSETS: 100.0% | | | | | | $ | 228,610,728 | |

Footnotes:

| (a) | Each underlying fund’s shareholder reports and registration documents are available free of charge on the SEC’s website at https://www.sec.gov. |

The summary of inputs used to value the Fund’s investments as of October 31, 2024 is as follows:

| | | Level 1

Quoted

Prices | | | Level 2

Significant

Observable

Inputs | | | Level 3

Significant

Unobservable

Inputs | | | Value | |

| Closed-End Funds | | $ | 228,091,145 | | | $ | — | | | $ | — | | | $ | 228,091,145 | |

See Notes to Financial Statements

VANECK HIGH YIELD MUNI ETF

SCHEDULE OF INVESTMENTS

October 31, 2024 (unaudited)

| | | Par

(000’s | ) | | Value | |

| MUNICIPAL BONDS: 98.3% | | | | | | | | |

| Alabama: 2.2% | | | | | | | | |

| Alabama Special Care Facilities Financing Authority, Methodist Home for Aging (RB) | | | | | | | | |

| 5.75%, 06/01/35 (c) | | $ | 1,400 | | | $ | 1,403,272 | |

| 5.75%, 06/01/45 (c) | | | 2,000 | | | | 1,900,478 | |

| 6.00%, 06/01/50 (c) | | | 5,900 | | | | 5,676,138 | |

| Alabama State Port Authority Docks Facilities, Series A (RB) (AGM) | | | | | | | | |

| 5.00%, 10/01/29 (c) | | | 1,675 | | | | 1,733,201 | |

| 5.00%, 10/01/34 (c) | | | 1,000 | | | | 1,020,376 | |

Black Belt Energy Gas District, Project No. 8, Series A (RB) 4.00%, 12/01/52 (c) (p) | | | 10,000 | | | | 9,971,811 | |

Black Belt Energy Gas District, Series A (RB) 5.25%, 01/01/54 (c) (p) | | | 5,000 | | | | 5,384,577 | |

| County of Jefferson AL Sewer Revenue (RB) | | | | | | | | |

| 5.00%, 10/01/39 (c) | | | 2,500 | | | | 2,700,258 | |

| 5.50%, 10/01/53 (c) | | | 3,000 | | | | 3,250,303 | |

County of Jefferson, Alabama Sewer Warrants (RB) 5.25%, 10/01/49 (c) | | | 7,140 | | | | 7,622,081 | |

| Homewood Educational Building Authority (RB) | | | | | | | | |

| 5.50%, 10/01/54 (c) | | | 1,000 | | | | 1,051,822 | |

| 5.50%, 10/01/54 (c) | | | 1,000 | | | | 1,051,822 | |

Hoover Industrial Development Board, United States Steel Corp. Project (RB) 6.38%, 11/01/50 (p) | | | 1,180 | | | | 1,345,050 | |

Hoover Industrial Development Board, United States Steel Corp. Project (RB) (SD CRED PROG) 5.75%, 10/01/49 (c) | | | 8,540 | | | | 8,929,196 | |

Jefferson County, Alabama Sewer Revenue (RB) 5.25%, 10/01/45 (c) | | | 2,175 | | | | 2,347,341 | |

Montgomery Alabama Medical Clinic Board of Health Care Facility, Jackson Hospital and Clinic (RB) 5.00%, 03/01/33 (c) (d) * | | | 1,350 | | | | 918,000 | |

Southeast Energy Authority, A Cooperative District Energy Supply, Series C (RB) 5.00%, 11/01/55 (c) (p) | | | 2,000 | | | | 2,151,566 | |

The Southeast Alabama Gas Supply District, Project No. 2, Series B (RB) 5.00%, 06/01/49 (c) (p) | | | 2,600 | | | | 2,782,437 | |

| | | Par

(000’s | ) | | Value | |

| Alabama (continued) | | | | | | | | |

Tuscaloosa County Industrial Development Authority, Hunt Refining Project, Series A (RB) 5.25%, 05/01/44 (c) | | $ | 7,000 | | | $ | 7,123,304 | |

| | | | | | | | 68,363,033 | |

| Alaska: 0.0% | | | | | | | | |

Northern Tobacco Securitization Corp., Series B-2 (RB) 0.00%, 06/01/66 (c) ^ | | | 3,000 | | | | 392,686 | |

| American Samoa: 0.1% | | | | | | | | |

| American Samoa Economic Development Authority, Series A (RB) | | | | | | | | |

| 5.00%, 09/01/38 (c) | | | 3,250 | | | | 3,245,050 | |

| 6.62%, 09/01/35 (c) | | | 1,000 | | | | 1,017,922 | |

| | | | | | | | 4,262,972 | |

| Arizona: 2.7% | | | | | | | | |

| Arizona Industrial Development Authority (RB) | | | | | | | | |

| 4.00%, 07/15/51 (c) | | | 500 | | | | 420,868 | |

| 5.00%, 07/01/51 (c) | | | 2,420 | | | | 2,235,700 | |

| 5.00%, 07/01/51 (c) | | | 1,000 | | | | 923,843 | |

| 5.00%, 07/01/54 (c) | | | 1,000 | | | | 952,446 | |

Arizona Industrial Development Authority, Academies of Math and Science (RB) 5.00%, 07/01/39 (c) | | | 1,000 | | | | 1,011,541 | |

Arizona Industrial Development Authority, Academies of Math and Science, Series B (RB) 5.00%, 07/01/29 (c) | | | 200 | | | | 202,782 | |

| Arizona Industrial Development Authority, American Charter School Foundation Project (RB) | | | | | | | | |

| 6.00%, 07/01/37 (c) | | | 1,195 | | | | 1,234,025 | |

| 6.00%, 07/01/47 (c) | | | 2,940 | | | | 3,006,422 | |

Arizona Industrial Development Authority, Arizona Agribusiness and Equine Center, Inc. Project, Series B (RB) 5.00%, 03/01/37 (c) | | | 1,545 | | | | 1,551,776 | |

| Arizona Industrial Development Authority, Basis School Project, Series A (RB) | | | | | | | | |

| 5.12%, 07/01/37 (c) | | | 250 | | | | 252,578 | |

| 5.25%, 07/01/47 (c) | | | 500 | | | | 502,147 | |

| Arizona Industrial Development Authority, Basis School Project, Series D (RB) | | | | | | | | |

| 5.00%, 07/01/47 (c) | | | 270 | | | | 270,156 | |

| 5.00%, 07/01/51 (c) | | | 515 | | | | 511,961 | |

Arizona Industrial Development Authority, Basis School Project, Series G (RB) (AGM) 5.00%, 07/01/47 (c) | | | 500 | | | | 500,289 | |

See Notes to Financial Statements

VANECK HIGH YIELD MUNI ETF

SCHEDULE OF INVESTMENTS

(unaudited) (continued)

| | | Par

(000’s | ) | | Value | |

| Arizona (continued) | | | | | | | | |

Arizona Industrial Development Authority, Benjamin Franklin Charter School Projects, Series A (RB) 5.25%, 07/01/53 (c) | | $ | 1,000 | | | $ | 1,002,898 | |

Arizona Industrial Development Authority, Education Facility, Leman Academy of Excellence, East and Central Tucson Projects, Series A (RB) 4.00%, 07/01/29 (c) | | | 400 | | | | 394,956 | |

Arizona Industrial Development Authority, Education Facility, Leman Academy of Excellence, Series A (RB) 4.50%, 07/01/54 (c) | | | 1,000 | | | | 881,154 | |

Arizona Industrial Development Authority, Education Facility, Series A (RB) 5.25%, 07/01/37 (c) | | | 2,650 | | | | 2,678,013 | |

Arizona Industrial Development Authority, Kaizen Education Project (RB) 5.70%, 07/01/47 (c) | | | 1,000 | | | | 1,012,579 | |

Arizona Industrial Development Authority, Point 320 LLC, Series A (RB) 3.62%, 05/20/33 | | | 6,356 | | | | 6,039,427 | |

Arizona Industrial Development Authority, Somerset Academy of Las Vegas, Series A (RB) 4.00%, 12/15/51 (c) | | | 1,400 | | | | 1,157,140 | |

Chandler Industrial Development Authority (RB) 4.00%, 06/01/49 (c) (p) | | | 2,000 | | | | 2,001,631 | |

City of Phoenix Civic Improvement Corp., Series B (RB) (BAM) 5.00%, 07/01/44 (c) | | | 2,990 | | | | 3,062,796 | |

| Glendale Industrial Development Authority, Beatitudes Campus Project (RB) | | | | | | | | |

| 4.00%, 11/15/27 (c) | | | 250 | | | | 241,458 | |

| 5.00%, 11/15/40 (c) | | | 1,000 | | | | 900,741 | |

Glendale Industrial Development Authority, Royal Oaks Inspirata Pointe Project, Series A (RB) 5.00%, 05/15/56 (c) | | | 1,340 | | | | 1,264,998 | |

| Industrial Development Authority of the City of Phoenix, Basis Schools, Inc. Project, Series A (RB) | | | | | | | | |

| 4.00%, 07/01/25 | | | 105 | | | | 104,763 | |

| 5.00%, 07/01/35 (c) | | | 900 | | | | 903,993 | |

| 5.00%, 07/01/45 (c) | | | 500 | | | | 500,200 | |

| 5.00%, 07/01/46 (c) | | | 1,000 | | | | 1,000,213 | |

| | | Par

(000’s | ) | | Value | |

| Arizona (continued) | | | | | | | | |

Industrial Development Authority of the City of Phoenix, Downtown Student Housing, Series A (RB) 5.00%, 07/01/42 (c) | | $ | 1,250 | | | $ | 1,266,564 | |

Industrial Development Authority of the City of Phoenix, Legacy Traditional School Project (RB) 5.00%, 07/01/45 (c) | | | 4,435 | | | | 4,438,556 | |

Industrial Development Authority of the City of Phoenix, Legacy Traditional School Project, Series A (RB) 5.00%, 07/01/36 (c) | | | 750 | | | | 757,290 | |

Maricopa County Arizona Industrial Development Authority, Commercial Metals Company Project (RB) 4.00%, 10/15/47 (c) | | | 4,300 | | | | 3,824,483 | |

Maricopa County Arizona Industrial Development Authority, Valley Christian Schools Project, Series A (RB) 6.38%, 07/01/58 (c) | | | 1,000 | | | | 1,026,849 | |

Maricopa County Industrial Development Authority, Benjamin Franklin Charter School Projects, Series A (RB) 6.00%, 07/01/52 (c) | | | 1,000 | | | | 1,027,989 | |

| Maricopa County Industrial Development Authority, Legacy Traditional Schools Projects, Series A (RB) (SD CRED PROG) | | | | | | | | |

| 5.00%, 07/01/49 (c) | | | 1,300 | | | | 1,320,515 | |

| 5.00%, 07/01/54 (c) | | | 1,400 | | | | 1,416,822 | |

| Maricopa County Industrial Development Authority, Legacy Traditional Schools Projects, Series B (RB) | | | | | | | | |

| 5.00%, 07/01/39 (c) | | | 500 | | | | 507,316 | |

| 5.00%, 07/01/49 (c) | | | 1,990 | | | | 1,989,971 | |

| 5.00%, 07/01/54 (c) | | | 500 | | | | 493,218 | |

Maricopa County Industrial Development Authority, Paradise School Project (RB) 5.00%, 07/01/47 (c) | | | 1,750 | | | | 1,752,365 | |

Phoenix Arizona Industrial Development Authority, Falcon Properties LLC, Project, Series A (RB) 4.15%, 12/01/57 (c) | | | 5,000 | | | | 3,599,155 | |

Phoenix Arizona Industrial Development Authority, Guam Facilities Foundation, Inc. Project (RB) 5.12%, 02/01/34 (c) | | | 1,000 | | | | 948,598 | |

See Notes to Financial Statements

| | | Par

(000’s | ) | | Value | |

| Arizona (continued) | | | | | | | | |

Phoenix Arizona Industrial Development Authority, Provident Group - Falcon Properties LLC, Project, Series A (RB) 4.00%, 12/01/51 (c) | | $ | 1,000 | | | $ | 738,850 | |

Pima County Industrial Development Authority, American Leadership Academy Project (RB) 5.62%, 06/15/45 (c) | | | 1,250 | | | | 1,254,724 | |

| Pima County Industrial Development Authority, Edkey Charter Schools Project (RB) | | | | | | | | |

| 5.25%, 07/01/36 (c) | | | 250 | | | | 251,999 | |

| 5.38%, 07/01/46 (c) | | | 250 | | | | 250,578 | |

| 5.50%, 07/01/51 (c) | | | 250 | | | | 250,676 | |

Pima County, Industrial Development Authority, Edkey Charter School Project (RB) 5.00%, 07/01/30 (c) | | | 1,000 | | | | 1,023,564 | |

Sacramento County, Community Facilities District No. 2005-2 (RB) 5.00%, 12/01/32 | | | 2,000 | | | | 2,151,728 | |

| Salt Verde Financial Corp. (RB) | | | | | | | | |

| 5.00%, 12/01/37 | | | 7,105 | | | | 7,710,887 | |

| 5.25%, 12/01/25 | | | 265 | | | | 269,335 | |

| 5.25%, 12/01/27 | | | 215 | | | | 225,818 | |

| 5.25%, 12/01/28 | | | 245 | | | | 259,535 | |

Sierra Vista Industrial Development Authority (RB) 6.38%, 06/15/64 (c) | | | 1,000 | | | | 999,990 | |

Tempe Industrial Development Authority, Friendship Village of Tempe (RB) 5.00%, 12/01/54 (c) | | | 355 | | | | 344,770 | |

| Tempe Industrial Development Authority, Mirabella at ASU Project, Series A (RB) | | | | | | | | |

| 6.00%, 10/01/37 (c) | | | 1,200 | | | | 868,399 | |

| 6.12%, 10/01/52 (c) | | | 600 | | | | 367,342 | |

| The Industrial Development Authority of the City of Sierra Vista, American Leadership Academy Project (RB) | | | | | | | | |

| 5.00%, 06/15/44 (c) | | | 1,000 | | | | 1,006,341 | |

| 5.00%, 06/15/54 (c) | | | 1,000 | | | | 992,301 | |

| 5.00%, 06/15/59 (c) | | | 750 | | | | 737,056 | |

| 5.00%, 06/15/64 (c) | | | 3,000 | | | | 2,921,132 | |

| | | | | | | | 83,718,210 | |

| Arkansas: 1.3% | | | | | | | | |

| Arkansas Development Finance Authority, Big River Steel Project (RB) | | | | | | | | |

| 4.50%, 09/01/49 (c) | | | 12,520 | | | | 12,244,378 | |

| 4.75%, 09/01/49 (c) | | | 6,000 | | | | 5,913,970 | |

| | | Par

(000’s | ) | | Value | |

| Arkansas (continued) | | | | | | | | |

| Arkansas Development Finance Authority, Environmental Improvement, United States Steel Corporation Project (RB) | | | | | | | | |

| 5.45%, 09/01/52 (c) | | $ | 19,750 | | | $ | 20,496,738 | |

| 5.70%, 05/01/53 (c) | | | 3,205 | | | | 3,388,243 | |

| | | | | | | | 42,043,329 | |

| California: 13.4% | | | | | | | | |

Alameda Corridor Transportation Authority (RB) (AGM) 0.00%, 10/01/53 (c) ^ | | | 1,905 | | | | 491,107 | |

| Alameda Corridor Transportation Authority, Second Subordinate Lien, Series B (RB) | | | | | | | | |

| 5.00%, 10/01/34 (c) | | | 3,000 | | | | 3,064,260 | |

| 5.00%, 10/01/35 (c) | | | 1,650 | | | | 1,683,772 | |

| 5.00%, 10/01/36 (c) | | | 2,230 | | | | 2,274,944 | |

| 5.00%, 10/01/37 (c) | | | 5,535 | | | | 5,644,082 | |

| Anaheim Community Facilities District No. 08-1 (ST) | | | | | | | | |

| 4.00%, 09/01/36 (c) | | | 160 | | | | 158,315 | |

| 4.00%, 09/01/41 (c) | | | 615 | | | | 586,199 | |

| 4.00%, 09/01/46 (c) | | | 420 | | | | 385,430 | |

Anaheim Public Financing Authority, Anaheim Public Improvement Project, Series A (RB) (BAM) 5.00%, 09/01/36 (c) | | | 2,000 | | | | 2,067,532 | |

Antelope Valley Healthcare District, Series A (RB) 5.25%, 03/01/36 (c) | | | 1,480 | | | | 1,492,788 | |

California Community Choice Financing Authority (RB) 5.00%, 07/01/53 (c) (p) | | | 1,580 | | | | 1,671,297 | |

California Community Choice Financing Authority, Clean Energy Project, Series C (RB) 5.25%, 01/01/54 (c) (p) | | | 10,970 | | | | 11,784,572 | |

California Community Choice Financing Authority, Clean Energy, Series B (RB) 5.00%, 01/01/55 (c) (p) | | | 3,000 | | | | 3,224,059 | |

California Community Choice Financing Authority, Clean Energy, Series C (RB) 5.00%, 08/01/55 (c) (p) | | | 5,000 | | | | 5,361,287 | |

California Community Choice Financing Authority, Clean Energy, Series D (RB) 5.50%, 05/01/54 (c) (p) | | | 10,000 | | | | 10,692,714 | |

California Community Choice Financing Authority, Clean Energy, Series E (RB) 5.00%, 02/01/55 (c) (p) | | | 3,000 | | | | 3,210,386 | |

See Notes to Financial Statements

VANECK HIGH YIELD MUNI ETF

SCHEDULE OF INVESTMENTS

(unaudited) (continued)

| | | Par

(000’s | ) | | Value | |

| California (continued) | | | | | | | | |

California Community College Financing Authority, Orange Coast College Project (RB) 5.25%, 05/01/53 (c) | | $ | 1,695 | | | $ | 1,741,817 | |

| California Community Housing Agency (RB) | | | | | | | | |

| 3.00%, 02/01/57 (c) | | | 1,000 | | | | 697,328 | |

| 3.00%, 02/01/57 (c) | | | 2,000 | | | | 1,425,201 | |

California Community Housing Agency, Essential Housing, Arbors, Series A (RB) 5.00%, 08/01/50 (c) | | | 2,985 | | | | 2,880,043 | |

California Community Housing Agency, Essential Housing, Glendale Properties, Series A-1 (RB) 4.00%, 02/01/56 (c) | | | 2,000 | | | | 1,705,800 | |

California Community Housing Agency, Essential Housing, Glendale Properties, Series A-2 (RB) 3.00%, 08/01/56 (c) | | | 4,000 | | | | 2,953,250 | |

California Community Housing Agency, Essential Housing, Serenity at Larkspur, Series A (RB) 5.00%, 02/01/50 (c) | | | 3,000 | | | | 2,264,301 | |

California Community Housing Agency, Essential Housing, Summit at Sausalito Apartments, Series A-2 (RB) 4.00%, 02/01/50 (c) | | | 2,000 | | | | 1,554,359 | |

California Community Housing Agency, Series A-1 (RB) 4.00%, 02/01/56 (c) | | | 4,500 | | | | 3,971,917 | |

California Community Housing Agency, Stoneridge Apartments, Series A (RB) 4.00%, 02/01/56 (c) | | | 4,000 | | | | 3,306,674 | |

California County Tobacco Securitization Agency, Golden Gate Tobacco, Series A (RB) 5.00%, 06/01/36 (c) | | | 15 | | | | 14,831 | |

California County Tobacco Securitization Agency, Series A (RB) 4.00%, 06/01/49 (c) | | | 1,050 | | | | 972,370 | |

| California Enterprise Development Authority, The Rocklin Academy Project (RB) | | | | | | | | |

| 5.00%, 06/01/54 (c) | | | 500 | | | | 512,649 | |

| 5.00%, 06/01/64 (c) | | | 1,000 | | | | 1,020,171 | |

| California Health Facilities Financing Authority (RB) | | | | | | | | |

| 5.00%, 12/01/31 | | | 2,500 | | | | 2,757,823 | |

| 5.25%, 12/01/49 (c) | | | 7,230 | | | | 7,871,669 | |

| | | Par

(000’s | ) | | Value | |

| California (continued) | | | | | | | | |

California Health Facilities Financing Authority, Adventist Health System, Series A (RB) 5.25%, 12/01/44 (c) | | $ | 3,175 | | | $ | 3,429,034 | |

California Health Facilities Financing Authority, Adventist Health System. Series A (RB) 5.00%, 12/01/34 (c) | | | 2,000 | | | | 2,223,923 | |

| California Health Facilities Financing Authority, Children’s Hospital, Series A (RB) | | | | | | | | |

| 4.00%, 08/15/49 (c) | | | 250 | | | | 222,356 | |

| 4.20%, 08/15/42 (c) | | | 500 | | | | 485,845 | |

| 5.00%, 08/15/37 (c) | | | 460 | | | | 472,179 | |

| 5.00%, 08/15/42 (c) | | | 990 | | | | 1,008,456 | |

| California Health Facilities Financing Authority, Commonspirit Health, Series A (RB) | | | | | | | | |

| 4.00%, 04/01/49 (c) | | | 1,450 | | | | 1,384,018 | |

| 4.00%, 04/01/49 (c) | | | 50 | | | | 53,416 | |

California Health Facilities Financing Authority, Series A (RB) 4.00%, 03/01/39 (c) | | | 1,910 | | | | 1,874,343 | |

California Health Facilities Financing Authority, Sutter Health, Series A (RB) 5.00%, 11/15/48 (c) | | | 590 | | | | 605,131 | |

| California Housing Finance Agency, Series A (RB) | | | | | | | | |

| 3.25%, 08/20/36 | | | 1,909 | | | | 1,773,564 | |

| 3.50%, 11/20/35 | | | 2,364 | | | | 2,268,227 | |

| 4.00%, 03/20/33 | | | 6,437 | | | | 6,494,471 | |

California Infrastructure & Economic Development Bank, California Science Center Phase III Project, Series A (RB) 4.00%, 05/01/55 (c) | | | 2,300 | | | | 2,198,952 | |

California Infrastructure & Economic Development Bank, California State Teachers Retirement System (RB) 5.00%, 08/01/32 (c) | | | 1,085 | | | | 1,181,437 | |

California Infrastructure & Economic Development Bank, Charter School Portfolio Project, Series A-1 (RB) 5.00%, 01/01/55 (c) | | | 1,000 | | | | 999,931 | |

California Infrastructure & Economic Development Bank, La Scuola International School Project (RB) 5.00%, 07/01/44 (c) | | | 500 | | | | 499,966 | |

See Notes to Financial Statements

| | | Par

(000’s | ) | | Value | |

| California (continued) | | | | | | | | |

| California Infrastructure & Economic Development Bank, Senior National Charter School, Series B (RB) | | | | | | | | |

| 5.00%, 11/01/49 (c) | | $ | 1,000 | | | $ | 1,074,091 | |

| 5.00%, 11/01/59 (c) | | | 1,180 | | | | 1,247,677 | |

California Infrastructure and Economic Development Bank, Brightline West Passenger Rail Project, Series A-4 (RB) 8.00%, 01/01/50 (c) (p) | | | 3,000 | | | | 3,091,505 | |

| California Municipal Finance Authority (RB) | | | | | | | | |

| 5.00%, 09/01/54 (c) | | | 1,000 | | | | 1,073,969 | |

| 5.88%, 05/01/59 (c) | | | 570 | | | | 592,903 | |

California Municipal Finance Authority (RB) (AGM) 5.00%, 12/31/33 (c) | | | 3,800 | | | | 3,920,721 | |

| California Municipal Finance Authority, California Baptist University, Series A (RB) | | | | | | | | |

| 5.50%, 11/01/45 (c) | | | 500 | | | | 504,251 | |

| 6.12%, 11/01/33 (c) | | | 1,000 | | | | 1,002,218 | |

California Municipal Finance Authority, Charter School Santa Rosa Academy Project, (RB) 5.00%, 07/01/62 (c) | | | 1,000 | | | | 1,001,193 | |

California Municipal Finance Authority, CHF-Davis I, LLC - West Village Student Housing Project (RB) 5.00%, 05/15/38 (c) | | | 500 | | | | 520,730 | |

California Municipal Finance Authority, CHF-Davis I, LLC - West Village Student Housing Project (RB) (BAM) 4.00%, 05/15/48 (c) | | | 150 | | | | 141,422 | |

California Municipal Finance Authority, CHF-Davis II, LLC - Orchard Park Student Housing Project (RB) (BAM) 4.00%, 05/15/46 (c) | | | 5,000 | | | | 4,872,149 | |

California Municipal Finance Authority, CHF-Davis II, LLC - Orchard Park Student Housing Project, Series A (RB) (BAM) 4.00%, 05/15/41 (c) | | | 1,500 | | | | 1,503,730 | |

California Municipal Finance Authority, Community Medical Centers, Series A (RB) 4.00%, 02/01/42 (c) | | | 1,165 | | | | 1,120,935 | |

| California Municipal Finance Authority, Eisenhower Medical Center, Series A (RB) | | | | | | | | |

| 5.00%, 07/01/30 (c) | | | 200 | | | | 207,013 | |

| 5.00%, 07/01/31 (c) | | | 250 | | | | 257,985 | |

| | | Par

(000’s | ) | | Value | |

| California (continued) | | | | | | | | |

| California Municipal Finance Authority, John Adams Academies Lincoln Project, Series A (RB) | | | | | | | | |

| 5.00%, 10/01/39 (c) | | $ | 500 | | | $ | 501,724 | |

| 5.00%, 10/01/49 (c) | | | 500 | | | | 482,041 | |

| 5.00%, 10/01/57 (c) | | | 500 | | | | 473,760 | |

California Municipal Finance Authority, Julian Charter School Project, Series A (RB) 5.62%, 03/01/45 (c) | | | 2,390 | | | | 2,285,303 | |

| California Municipal Finance Authority, LINXS APM Project, Series A (RB) | | | | | | | | |

| 5.00%, 06/30/28 | | | 65 | | | | 67,732 | |

| 5.00%, 06/30/29 (c) | | | 600 | | | | 624,698 | |

| 5.00%, 12/31/29 (c) | | | 500 | | | | 520,166 | |

| 5.00%, 12/31/43 (c) | | | 7,675 | | | | 7,757,841 | |

| California Municipal Finance Authority, LINXS APM Project, Series A (RB) (AGM) | | | | | | | | |

| 3.00%, 12/31/30 (c) | | | 1,950 | | | | 1,823,746 | |

| 5.00%, 06/30/31 (c) | | | 1,035 | | | | 1,072,446 | |

| 5.00%, 12/31/34 (c) | | | 700 | | | | 720,913 | |

| 5.00%, 12/31/37 (c) | | | 1,000 | | | | 1,025,057 | |

California Municipal Finance Authority, Northbay Healthcare Group, Series A (RB) 5.25%, 11/01/47 (c) | | | 230 | | | | 230,478 | |

| California Municipal Finance Authority, Palmdale Aerospace Academy, Series A (RB) | | | | | | | | |

| 5.00%, 07/01/38 (c) | | | 130 | | | | 131,466 | |

| 5.00%, 07/01/41 (c) | | | 500 | | | | 500,995 | |

| 5.00%, 07/01/49 (c) | | | 1,000 | | | | 998,524 | |

| California Municipal Finance Authority, PRS-California Obligated Group Projects, Series A (RB) | | | | | | | | |

| 5.00%, 11/15/44 (c) | | | 1,000 | | | | 1,070,889 | |

| 5.00%, 04/01/54 (c) | | | 1,000 | | | | 1,047,106 | |

California Municipal Finance Authority, Social Bonds - Healthright 360, Series A (RB) 5.00%, 11/01/49 (c) | | | 3,000 | | | | 2,722,460 | |

California Municipal Finance Authority, UCR Dundee-Glasgow Student Housing Project (RB) (BAM) 4.00%, 05/15/48 (c) | | | 250 | | | | 235,704 | |

California Municipal Finance Authority, United Airlines, Inc., International Airport Project (RB) 4.00%, 07/15/29 | | | 19,000 | | | | 18,990,042 | |

See Notes to Financial Statements

VANECK HIGH YIELD MUNI ETF

SCHEDULE OF INVESTMENTS

(unaudited) (continued)

| | | Par

(000’s | ) | | Value | |

| California (continued) | | | | | | | | |

California Pollution Control Financing Authority, Poseidon Resources LP Desalination Project (RB) (ACA) 5.00%, 07/01/37 (c) | | $ | 5,000 | | | $ | 5,004,021 | |

| California Pollution Control Financing Authority, Solid Waste Disposal, CalPlant I Project (RB) | | | | | | | | |

| 7.00%, 07/01/22 (d) * | | | 1,000 | | | | 13,500 | |