Filed by Rockwell Collins, Inc.

pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Filer: Rockwell Collins, Inc.

Subject Company: B/E Aerospace, Inc.

SEC File No.: 0-18348

Date: October 27, 2016

Explanatory Note: The following is an article dated October 23, 2016, which is linked in the above posting.

Rockwell Collins Bets on Smart Jets With $6.4 Billion Deal

Rockwell Collins Inc. is making its biggest-ever acquisition in a bet that airplanes will get smarter, as everything from lie-flat seats to toilet valves send live data to inflight crews and maintenance workers.

The $6.4 billion purchase of B/E Aerospace Inc. eclipses the 83-year-old avionics maker’s takeover of Arinc Inc. in 2013. That deal, just 11 days after Kelly Ortberg was named chief executive officer, provided new ways to pipe data into planes. With B/E Aerospace, Ortberg gains the largest equipment supplier for aircraft cabins — and the chance to provide reams of new information to airline operators.

“It sets us up for the future,” Ortberg said in an interview Sunday. “We’ve made major investments in next-generation airplanes. That trend is going to translate into the interiors of aircraft.”

The transaction vastly broadens a product portfolio that has been centered on aircraft communications and computing equipment since Cedar Rapids, Iowa-based company was spun out of Rockwell International in 2001. The deal, which is slated to close in early 2017, is the latest in a spate of mergers involving suppliers to Boeing Co. and Airbus Group SE, which are squeezing costs as they brace for slower growth following a decade-long sales cycle.

“It’s an opportunity to build a smarter plane,” Richard Aboulafia, an aerospace analyst at Teal Group, said by telephone. “Given the pricing pressure you’ll probably see more deals like this.”

Share Reaction

B/E Aerospace investors will get $34.10 in cash and $27.90 in shares of Rockwell Collins common stock, for a total consideration of $62 a share, the companies said in a statement Sunday. That’s a 23 percent premium over B/E Aerospace’s closing price on Friday. With the assumption of $1.9 billion of debt, the purchase comes to $8.3 billion, according to the statement.

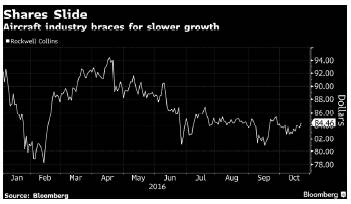

B/E Aerospace jumped 16 percent to $58.70 at 9:36 a.m. Monday in New York, while Rockwell Collins fell as much as 4.2 percent to $80.88 for the biggest intraday decline in six months. B/E Aerospace gained almost 20 percent this year through Friday, while Rockwell Collins had declined 8.5 percent.

“Considering that the commercial aerospace cycle is mature, the deal price is not cheap,” Ronald Epstein, an analyst at Bank of America Corp., said in a note to clients.

B/E Aerospace is the largest supplier of aircraft cabin equipment, ranging from modular lavatories to luxurious seats as expensive as a Ferrari. On a pro-forma basis, the combined manufacturer would have had almost 30,000 employees, $8.1 billion in revenue and $1.9 billion in earnings before interest, taxes, debt and amortization for the 12 months ended Sept. 30, 2016, according to the statement.

The savings flowing from the merger, pegged at about $160 million, would mostly come from combining suppliers and eliminating overlapping headquarters functions, Ortberg said. Those so-called synergies don’t include the potential boost to sales that would open up when the companies are combined, Ortberg said.

“At first glance, we find it difficult to clearly see how Rockwell Collins could extract $160 million,” Epstein said.

‘Smart Cabin’

Rockwell Collins has a base of business-aviation dealers that could offer to retrofit private jets with B/E Aerospace’s interiors. The Wellington, Florida-based company has very strong ties with airline customers that Rockwell Collins may be able to leverage to sell more of its avionics equipment and inflight entertainment systems.

The end result may translate to better inflight service. For example, sensors in luxury seats in first- and business-class cabins, could notify flight attendants when a passenger is waking up on a long-haul flight and ready for a hot towel or glass of orange juice.

“The smart cabin is here,” Amin Khoury, co-founder and chairman of B/E Aerospace, said in an interview Sunday. “It’s not something that may happen in the future. It’s happening now.”

The boards of both companies have approved the transaction, which will still need to pass muster with shareholders. Werner Lieberherr, B/E Aerospace’s chief executive, will be named executive vice-president and chief operating officer of a newly created aircraft interiors division after the merger closes. Khoury will stay on as a consultant to Ortberg.

Fourth-Quarter Earnings

Separately, Rockwell Collins said profit from continuing operations in its fiscal fourth quarter rose to $1.58 a share, up from $1.38 a year earlier, according to a statement on Sunday. Analysts expected adjusted earnings of $1.57, according to the average of 17 estimates compiled by Bloomberg.

Sales in the period rose 4.4 percent from a year earlier to $1.45 billion, trailing the average analyst estimate of $1.48 billion. Equipment sales were hurt by lower planemaker production rates, including Airbus’s A330 widebody jetliner, the company said. For its 2017 fiscal year, the company said it expects revenue between $5.3 billion and $5.4 billion — that’s on a standalone basis, and doesn’t account for the deal with B/E Aerospace.

Safe Harbor Statement

This communication contains statements, including statements regarding certain projections, business trends, and the proposed acquisition of B/E Aerospace that are forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those projected as a result of certain risks and uncertainties, including but not limited to the financial condition of our customers and suppliers, including bankruptcies; the health of the global economy, including potential deterioration in economic and financial market conditions; adjustments to the commercial OEM production rates and the aftermarket; the impacts of natural disasters and pandemics, including operational disruption, potential supply shortages and other economic impacts; cybersecurity threats, including the potential misappropriation of assets or sensitive information, corruption of data or operational disruption; delays related to the award of domestic and international contracts; delays in customer programs, including new aircraft programs entering service later than anticipated; the continued support for military transformation and modernization programs; potential impact of volatility in oil prices, currency exchange rates or interest rates on the commercial aerospace industry or our business; the impact of terrorist events on the commercial aerospace industry; changes in domestic and foreign government spending, budgetary, procurement and trade policies adverse to our businesses; market acceptance of our new and existing technologies, products and services; reliability of and customer satisfaction with our products and services; potential unavailability of our mission-critical data and voice communication networks; unfavorable outcomes on or potential cancellation or restructuring of contracts, orders or program priorities by our customers; recruitment and retention of qualified personnel; regulatory restrictions on air travel due to environmental concerns; effective negotiation of collective bargaining agreements by us, our

customers, and our suppliers; performance of our customers and subcontractors; risks inherent in development and fixed-price contracts, particularly the risk of cost overruns; risk of significant reduction to air travel or aircraft capacity beyond our forecasts; our ability to execute to internal performance plans such as restructuring activities, productivity and quality improvements and cost reduction initiatives; achievement of ARINC integration and synergy plans as well as our other acquisition and related integration plans; continuing to maintain our planned effective tax rates; our ability to develop contract compliant systems and products on schedule and within anticipated cost estimates; risk of fines and penalties related to noncompliance with laws and regulations including compliance requirements associated with U.S. Government work, export control and environmental regulations; risk of asset impairments; our ability to win new business and convert those orders to sales within the fiscal year in accordance with our annual operating plan; and the uncertainties of the outcome of lawsuits, claims and legal proceedings, risk that one or more closing conditions to the acquisition of B/E Aerospace, including certain regulatory approvals, may not be satisfied or waived, on a timely basis or otherwise, including that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the proposed transaction, may require conditions, limitations or restrictions in connection with such approvals or that the required approval by the shareholders of each of B/E Aerospace and Rockwell Collins may not be obtained; risk of unexpected costs, charges or expenses resulting from the proposed acquisition of B/E Aerospace; uncertainty of the expected financial performance of the combined company following completion of the proposed acquisition of B/E Aerospace; failure to realize the anticipated benefits of the proposed acquisition of B/E Aerospace, including as a result of delay in completing the proposed transaction or integrating the businesses of Rockwell Collins and B/E Aerospace; risk to the ability of the combined company to implement its business strategy; risk of an occurrence of any event that could give rise to termination of the merger agreement; risk that stockholder litigation in connection with the proposed transaction may affect the timing or occurrence of the contemplated merger or result in significant costs of defense, indemnification and liability as well as other risks and uncertainties, including but not limited to those detailed herein and from time to time in our Securities and Exchange Commission filings. These forward-looking statements are made only as of the date hereof and the company assumes no obligation to update any forward-looking statement.

No Offer or Solicitation

This communication is for informational purposes only and not intended to and does not constitute an offer to subscribe for, buy or sell, the solicitation of an offer to subscribe for, buy or sell or an invitation to subscribe for, buy or sell any securities or the solicitation of any vote or approval in any jurisdiction pursuant to or in connection with the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

Additional Information and Where to Find It

In connection with the proposed transaction, Rockwell Collins will prepare a registration statement on Form S-4 that will include a joint proxy statement/prospectus (the “Joint Proxy Statement/Prospectus”) for the stockholders of B/E Aerospace and Rockwell Collins to be filed with the SEC, and each will mail the Joint Proxy Statement/Prospectus to their respective

stockholders and file other documents regarding the proposed transaction with the SEC. This communication is not a substitute for any proxy statement, registration statement, proxy statement/prospectus or other document Rockwell Collins and/or B/E Aerospace may file with the SEC in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ CAREFULLY AND IN THEIR ENTIRETY THE JOINT PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE, ANY AMENDMENTS OR SUPPLEMENTS TO THE JOINT PROXY STATEMENT/PROSPECTUS, AND OTHER DOCUMENTS FILED BY ROCKWELL COLLINS OR B/E AEROSPACE WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION, BECAUSE THESE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION. The Joint Proxy Statement/Prospectus (when available) will be mailed to stockholders of Rockwell Collins and B/E Aerospace. Investors and security holders will be able to obtain free copies of Joint Proxy Statement/Prospectus and other documents filed with the SEC by Rockwell Collins and/or B/E Aerospace through the website maintained by the SEC at www.sec.gov. Investors and security holders will also be able to obtain free copies of the documents filed by Rockwell Collins with the SEC on Rockwell Collins’ internet website at http://www.rockwellcollins.com or by contacting Rockwell Collins’ Investor Relations at Rockwell Collins, 400 Collins Rd. NE, Cedar Rapids, IA 52498 or by calling (319) 295-7575. Investors and security holders will also be able to obtain free copies of the documents filed by B/E Aerospace with the SEC on B/E Aerospace’s internet website at http://www.beaerospace.com or by contacting B/E Aerospace’s Investor Relations at B/E Aerospace, Inc., 1400 Corporate Center Way, Wellington, FL or by calling (561) 791-5000.

Participants in the Solicitation

Rockwell Collins, B/E Aerospace, their respective directors, executive officers and other members of its management and employees may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of proxies in connection with the proposed transaction, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the Joint Proxy Statement/Prospectus and other relevant materials when it is filed with the SEC. Information regarding the directors and executive officers of Rockwell Collins is contained in Rockwell Collins’ proxy statement for its 2016 annual meeting of stockholders, filed with the SEC on December 16, 2015, and Rockwell Collins’ Current Report on Form 8-K filed with the SEC on April 29, 2016. Information regarding the directors and executive officers of B/E Aerospace is contained in B/E Aerospace’s proxy statement for its 2016 annual meeting of stockholders, filed with the SEC on April 28, 2016. These documents can be obtained free of charge from the sources indicated above.