UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

þ Filed by the Registrant

¨ Filed by a Party other than the Registrant

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

þ Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to §.240.14a-12

Rockwell Collins, Inc

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

þ No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

1) Title of each class of securities to which transaction applies:

2) Aggregate number of securities to which transaction applies:

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

4) Proposed maximum aggregate value of transaction:

5) Total fee paid:

¨ Fee paid previously with preliminary materials:

| |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

1) Amount previously paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

December 16, 2015

Dear Shareowner:

You are cordially invited to attend the 2016 Annual Meeting of Shareowners of the Corporation.

The meeting will be held at the Cedar Rapids Marriott, 1200 Collins Road NE, Cedar Rapids, Iowa, on Thursday, February 4, 2016, at 11:00 a.m. (Central Standard Time). At the meeting we will present a current report of the activities of the Corporation followed by discussion and action on the matters described in the proxy statement. Shareowners will have an opportunity to comment on or inquire about the affairs of the Corporation that may be of interest to shareowners generally.

If you plan to attend the meeting, please indicate your desire in one of the ways described in the box on the last page of the proxy statement.

We sincerely hope that as many shareowners as can conveniently attend will do so.

Sincerely yours,

|

| |

|

| Robert K. Ortberg |

| Chairman, President and Chief Executive Officer |

Notice of 2016 Annual Meeting of Shareowners

To the Shareowners of

ROCKWELL COLLINS, INC.:

Notice Is Hereby Given that the 2016 Annual Meeting of Shareowners of Rockwell Collins, Inc. will be held at the Cedar Rapids Marriott, 1200 Collins Road NE, Cedar Rapids, Iowa, on Thursday, February 4, 2016, at 11:00 a.m. (Central Standard Time) for the following purposes:

| |

| (1) | to elect the three nominees named in the accompanying proxy statement as members of the Board of Directors with terms expiring at the Annual Meeting in 2019; |

| |

| (2) | to consider and vote upon a proposal to approve an advisory resolution relating to executive compensation; |

| |

| (3) | to consider and vote upon a proposal to approve the selection by the Audit Committee of the Board of Directors of Deloitte & Touche LLP as independent registered public accounting firm of the Corporation for fiscal year 2016; and |

| |

| (4) | to transact such other business as may properly come before the meeting. |

Only shareowners of record at the close of business on December 7, 2015 will be entitled to notice of, and to vote at, the meeting. We will begin distributing proxy materials to shareowners on or about December 17, 2015.

By order of the Board of Directors.

Robert J. Perna

Secretary

December 16, 2015

Note: The Board of Directors solicits votes by mail or by use of our telephone or Internet voting procedures.

CONTENTS |

| | |

| Proxy Statement Summary | |

| Governance | |

| | 2016 Annual Meeting of Shareowners | |

| | Voting Securities | |

| | Election of Directors | |

| | Information as to Nominees for Directors and Continuing Directors | |

| | Corporate Governance: Board of Directors and Committees | |

| | Certain Transactions and Other Relationships | |

| | Equity Ownership of Certain Beneficial Owners and Management | |

| | Compensation of Directors | |

| Compensation | |

| | Compensation Discussion and Analysis | |

| | Compensation Committee Report | |

| | Summary Compensation Table | |

| | Grants of Plan-Based Awards | |

| | Outstanding Equity Awards at Fiscal Year End | |

| | Option Exercises and Stock Vested | |

| | Pension Benefits | |

| | Non-Qualified Deferred Compensation | |

| | Potential Payments Upon Termination or Change of Control | |

| | Advisory Vote on Executive Compensation | |

| Audit | |

| | Audit Committee Report | |

| | Proposal to Approve the Selection of Independent Auditors | |

| Additional Information | |

| | Vote Required | |

| | Voting for Directors | |

| | Other Matters | |

| | Section 16(a) Beneficial Ownership Reporting Compliance | |

| | Annual Reports | |

| | Shareowner Proposals for Annual Meeting in 2017 | |

| | Expenses of Solicitation | |

| | General Q&A About the Meeting | |

2015 Proxy Statement  | 1

| 1

PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting.

Annual Meeting of Shareowners

Date and Time: February 4, 2016, 11:00 a.m. (Central Standard Time)

Place: Cedar Rapids Marriott, 1200 Collins Road NE, Cedar Rapids, IA

Record Date: December 7, 2015

Meeting Agenda

| |

| • | Election of three director nominees |

| |

| • | Advisory vote on executive compensation |

| |

| • | Vote on the proposal to approve the selection of Deloitte & Touche LLP (Deloitte) as our independent registered public accounting firm |

| |

| • | Question and answer session |

|

| | | | | |

| Proposals for Voting | Board Vote Recommendation | Page Reference (for more details) |

| Election of three directors | FOR | 5 |

| Advisory vote on executive compensation | FOR | 54 |

| Approve Deloitte as our independent auditors | FOR | 56 |

2 |  2015 Proxy Statement

2015 Proxy Statement

Board Nominees

The following table provides summary information about each director nominee. The nominees receiving a plurality of the votes cast at the meeting will be elected as directors, unless otherwise determined in accordance with the majority voting policy described under the heading “Voting for Directors” on page 57.

|

| | | | | | |

| Name | Age | Director Since | Occupation | Experience/Qualifications | Independent | Committee Memberships |

| John A. Edwardson | 66 | 2012 | Former Chairman and Chief Executive Officer, CDW Corporation

| Leadership, Management, Aerospace | Yes | Compensation, Technology and Cybersecurity, Corporate Strategy and Finance (Chairman) |

| Andrew J. Policano | 66 | 2006 | Director, Center for Investment and Wealth Management, chaired Professor and former Dean, The Paul Merage School of Business, University of California-Irvine | Leadership, Management, Corporate Governance | Yes | Audit, Board Nominating and Governance (Chairman) |

| Jeffrey L. Turner | 64 | 2011 | Former President and Chief Executive Officer, Spirit AeroSystems Holdings, Inc.

| Leadership, Management, Aerospace | Yes | Compensation, Board Nominating and Governance, Corporate Strategy and Finance |

During the fiscal year, each nominee attended at least 92% of the meetings of the Board and Committees on which he served.

Advisory Vote on Executive Compensation

We are asking shareowners to approve a non-binding advisory resolution, often referred to as “say on pay,” relating to our named executive officer compensation for fiscal year 2015. Last year, 97.4% of the votes cast, not including abstentions and broker non-votes, voted to approve our named executive officers’ compensation. The design of our 2015 executive compensation program is largely unchanged from 2014 and continues to emphasize pay-for-performance.

Independent Registered Public Accounting Firm

We are asking shareowners to approve the selection of Deloitte as our independent registered public accounting firm for fiscal year 2016. Last year, 99% of the votes cast, not including abstentions and broker non-votes, voted to approve Deloitte.

2015 Proxy Statement  | 3

| 3

2016 ANNUAL MEETING OF SHAREOWNERS

The 2016 Annual Meeting of Shareowners will be held on February 4, 2016, for the purposes set forth in the accompanying Notice of 2016 Annual Meeting of Shareowners.

This proxy statement and the accompanying proxy, which are first being sent to shareowners on or about

December 17, 2015, are furnished in connection with the solicitation by the Board of Directors of proxies to be used at the meeting and at any adjournment thereof. If a shareowner duly executes and returns a proxy in the accompanying form or uses our telephone or Internet voting procedures to authorize the named proxies to vote the shareowner’s shares, those shares will be voted as specified. If no specification is made and your shares are registered directly in your name with our transfer agent, Wells Fargo Shareowner Services, the shares will be voted in accordance with the recommendations of the Board of Directors. If your shares are not registered in your name (i.e., they are held in “street name” through a bank or broker) and no voting specification is made to your bank or broker, your bank or broker may be able to vote your shares depending on whether the item for consideration is a discretionary or non-discretionary item. Brokers and banks are not permitted to vote on non-discretionary items and are permitted to vote on discretionary items. With the exception of the proposal to approve Deloitte as our independent registered public accounting firm, all of the items for consideration are non-discretionary items which may not be voted by brokers or banks who have not received specific voting instructions (resulting in a broker non-vote).

The proxy and any votes cast using our telephone or Internet voting procedures may be revoked prior to exercise at the meeting by delivering written notice of revocation to the Secretary of the Corporation, by executing a later dated proxy, by casting a later vote using the telephone or Internet voting procedures or by attending the meeting and voting in person.

VOTING SECURITIES

Only shareowners of record at the close of business on December 7, 2015, the record date for the meeting, are entitled to notice of, and to vote at, the meeting. On December 7, 2015, we had outstanding 131,305,763 shares of our common stock, par value $0.01 per share. Each holder of our common stock is entitled to one vote for each share held. We have no other class or series of shares currently outstanding other than our common stock.

ELECTION OF DIRECTORS

Our Restated Certificate of Incorporation provides that the Board of Directors shall generally consist of three classes of directors with overlapping three-year terms. One class of directors is to be elected each year with terms extending to the third succeeding Annual Meeting after election. The Restated Certificate of Incorporation provides that the Board of Directors shall maintain the three classes so as to be as nearly equal in number as the then total number of directors permits. The three directors in Class III who are elected at the 2016 Annual Meeting will serve for a term expiring at our Annual Meeting in the year 2019. The three directors in Class II and the three directors in Class I are serving terms expiring at our Annual Meetings in 2018 and 2017, respectively.

It is intended that proxies in the accompanying form properly executed and returned to our proxy tabulator or shares properly authorized to be voted in accordance with our telephone or Internet voting procedures will be voted at the meeting, unless authority to do so is withheld, for the election as directors of the three nominees specified in Class III - Nominees for Directors with Terms Expiring in 2019 (John A. Edwardson, Andrew J. Policano and Jeffrey L. Turner), each of whom now serves as a director with a term extending to the 2016 Annual Meeting and until a successor is elected and qualified. If for any reason any of the nominees is not a candidate (which is not expected) when the election occurs, it is expected that proxies in the accompanying form or shares properly authorized to be voted in accordance with our telephone or Internet voting procedures will be voted at the meeting for the election of a substitute nominee or, in lieu thereof, the Board of Directors may reduce the number of directors.

4 |  2015 Proxy Statement

2015 Proxy Statement

INFORMATION AS TO NOMINEES FOR DIRECTORS AND CONTINUING DIRECTORS

Shown below for each nominee for director and each continuing director as reported to us as of December 10, 2015, are the nominee’s or continuing director’s name, age and principal occupation; the position, if any, with us; the period of service as a director of our company; other public company directorships held within the past five years; the committees of the Board of Directors on which the nominee or continuing director serves; and experiences, qualifications, attributes or skills that qualify the nominee or continuing director to serve as a director. |

| | | | |

| CLASS III - NOMINEES FOR DIRECTOR WITH TERMS EXPIRING IN 2019 |

|

| | |

| | Experiences, qualifications, attributes and skills: • Management, leadership and business acumen as past Chairman and Chief Executive Officer of CDW Corporation • Aerospace and international experiences |

| John A. Edwardson | | |

| | Mr. Edwardson is the Chairman of the Corporate Strategy and Finance Committee and is a member of the Compensation Committee, Executive Committee and the Technology and Cybersecurity Committee. Mr. Edwardson was Chairman of the Board of Directors of CDW Corporation (provider of technology solutions) from 2001 to December 2012 and from 2001 to 2011 he also served as CDW’s Chief Executive Officer. Prior to joining CDW, he served as Chairman and Chief Executive Officer of Burns International Services Corporation (security company) from 1999 to 2000 and as a Director (1994-1998), President (1994-1998) and Chief Operating Officer (1995-1998) of UAL Corporation and United Airlines (passenger airline). Prior to UAL Corporation and United Airlines, he served as Executive Vice President and Chief Financial Officer of Ameritech Corporation (telecommunications). He is currently on the Board of Directors of FedEx Corporation, Ace Limited, The University of Chicago and is a member of the board of other professional and civic organizations. |

Age: 66 Director since 2012 Independent | |

Former Chairman and Chief Executive Officer, CDW Corporation

| |

2015 Proxy Statement  | 5

| 5

|

| | |

| | Experiences, qualifications, attributes and skills: • Experience in management and leadership as Dean of business schools • Significant business acumen and corporate governance knowledge

|

| | | |

| Andrew J. Policano | | Dr. Policano is the Chairman of the Board Nominating and Governance Committee and a member of the Audit Committee. Dr. Policano is on the faculty of The Paul Merage School of Business, University of California-Irvine and was the Dean of that business school from August 2004 through July 1, 2013. Prior thereto, he served on the faculty and as Dean at the School of Business, University of Wisconsin-Madison. Dr. Policano is a director of Badger Meter, Inc., a Trustee of Payden & Rygel (Investment Manager) and a former director of Physicians Insurance Company of Wisconsin. He is a member of the board of other professional and civic organizations.

|

Age: 66 Director since 2006 Independent | |

| Director, Center for Investment and Wealth Management, chaired Professor and former Dean, The Paul Merage School of Business, University of California-Irvine | |

|

| | |

| | Experiences, qualifications, attributes and skills: • Management, leadership and aerospace industry experience as past President and Chief Executive Officer of Spirit AeroSystems Holdings, Inc. • Operational, strategy and international experience |

| | | |

| Jeffrey L. Turner | | Mr. Turner is a member of the Compensation Committee, the Board Nominating and Governance Committee and the Corporate Strategy and Finance Committee. Mr. Turner was a director of Spirit AeroSystems Holdings, Inc. (commercial aerospace assemblies and components) from November 2006 to April 2014, and served as its President and Chief Executive Officer from June 2005 to April 2013; he also served as President and Chief Executive Officer of Spirit AeroSystems, Inc. Mr. Turner joined The Boeing Company (aerospace and defense) in 1973, and was appointed as Vice President/General Manager of Boeing, Wichita Division in November 1995. Prior to his appointment as Vice President/General Manager of Boeing Wichita Division, Mr. Turner held various management positions in systems development, quality, production, services and finance in Boeing Computer Services, Boeing Military Airplane Company and Boeing Commercial Airplane Company. Mr. Turner currently serves on the Board of Directors of INTRUST Financial Corporation and is a partner in the privately held Turner Nichols Group. |

Age: 64 Director since 2011 Independent | |

Former President and Chief Executive Officer, Spirit AeroSystems Holdings, Inc.

| |

6 |  2015 Proxy Statement

2015 Proxy Statement

|

| | | | |

| CLASS I - CONTINUING DIRECTORS WITH TERMS EXPIRING IN 2017 |

|

| | |

| | Experiences, qualifications, attributes and skills: • Management and leadership experience as past Chair, Chief Executive Officer, Chief Operating Officer and Chief Financial Officer of McLeodUSA, as well as Executive Vice President and Chief Financial Officer of Gulfstream • Financial and management oversight experience of portfolio investments at Forstmann Little and audit committee experience on various boards |

| Chris A. Davis | | |

| | Ms. Davis is the Chairman of the Audit Committee and a member of the Executive Committee and the Corporate Strategy and Finance Committee. She served as a General Partner with Forstmann Little & Co. (private equity firm) from October 2005 to July 2012 after having served them as a Special Limited Partner since August 2001. She served as Chairman of McLeodUSA Incorporated (telecommunications) from August 2005 to January 2006, Chairman and Chief Executive Officer of McLeodUSA from April 2002 to August 2005 and Chief Operating and Financial Officer of McLeodUSA from August 2001 to April 2002. She served as Executive Vice President, Chief Financial Officer of ONI Systems (telecommunications) from May 2000 to August 2001. She served as Executive Vice President, Chief Financial and Administrative Officer and director of Gulfstream Aerospace Corporation (business aircraft) from July 1993 to April 2000. She is a former member of the Board of Directors of Cytec Industries, Inc., Aviall, Inc., IMG Worldwide, 24 Hour Fitness, ENK International and Wolverine Tube, Inc.

|

Age: 65 Director since 2002 Independent | |

Former General Partner, Forstmann Little & Co.

| |

|

| | |

| | Experiences, qualifications, attributes and skills: • Experience in leadership, operations and technology in the U.S. Defense Department from 36 years of experience in the U.S. Air Force and senior positions in the U.S. Military, including assignments as Commander of NORAD and U.S. Northern Command • Knowledge of financial services and life insurance industries as Chairman and President of the Armed Forces Benefit Association |

| General (Retired) Ralph E. Eberhart | | |

| | General Eberhart is the Chairman of the Compensation Committee and is a member of the Technology and Cybersecurity Committee. He has been President of the Armed Forces Benefit Association since 2005 and Chairman and President since February 2009. He served as Commander of the North American Aerospace Defense Command (NORAD) and U.S. Northern Command from October 2002 to January 2005. His active military career spanned 36 years. He is a member of the Board of Directors of VSE Corporation, Jacobs Engineering Group Inc. and Triumph Group, Inc., and he is a director of several private companies. |

Age: 68 Director since 2007 Independent

| |

Chairman and President, Armed Forces Benefit Administration

| |

2015 Proxy Statement  | 7

| 7

|

| | |

| | Experiences, qualifications, attributes and skills: • U.S. and international management and leadership experience as past Chairman and CEO of Cytec Industries • Global business perspective, operational knowledge and financial experience |

| | | |

| David Lilley | | Mr. Lilley is a member of the Audit Committee, the Board Nominating and Governance Committee and the Corporate Strategy and Finance Committee. He served as Chairman of Cytec Industries (specialty chemicals and materials) from January 1999 to December 2008, Chief Executive Officer of Cytec Industries from May 1998 to December 2009, and Non-Executive Director of Cytec Industries from January 2009 through April 2009. He was President of Cytec Industries from January 1997 through June 2008. From 1994 until January 1997, he was a Vice President of American Home Products Corporation, responsible for its Global Medical Device business. Prior to that he was a Vice President and a member of the Executive Committee of American Cyanamid Company (medical and agricultural products). Mr. Lilley is also a director of Public Service Enterprise Group Inc. and Tesoro Corporation and a former director of Arch Chemicals, Inc. |

Age: 68 Director since 2008 Independent | |

Retired Chairman and Chief Executive Officer, Cytec Industries Inc.

| |

|

| | | | |

| CLASS II - CONTINUING DIRECTORS WITH TERMS EXPIRING IN 2018 |

|

| | |

| | Experiences, qualifications, attributes and skills: • Experience in management, leadership and manufacturing as an executive and Vice Chairman of The Dow Chemical Company • Experience with a variety of domestic and international business matters |

| | | |

| Anthony J. Carbone | | Mr. Carbone is our Lead Independent Director and a member of the Executive Committee. He served as our Non-Executive Chairman from August 2014 to November 2015 and he served as our Lead Independent Director from November 2012 until August 2014. Mr. Carbone served as Vice Chairman of the Board of Directors of The Dow Chemical Company (chemical, plastic and agricultural products) from February 2000 to October 2005 and Senior Consultant of Dow from November 2000 to October 2005. He served as Executive Vice President of Dow from November 1996 to November 2000. He is a former member of the American Chemical Society and former Board Member and Chairman of the American Plastics Council and the Society of Plastics Industries. Mr. Carbone has served on the Advisory Council of the Heritage Foundation.

|

Age: 74 Director since 2001 Independent | |

Lead Independent Director

Retired Vice Chairman of the Board and Senior Consultant, The Dow Chemical Company

| |

8 |  2015 Proxy Statement

2015 Proxy Statement

|

| | |

| | Experiences, qualifications, attributes and skills: • Leadership, management and aerospace and defense industry knowledge and experience as CEO and President of Rockwell Collins and through his previous Rockwell Collins positions • Strategic and business acumen, engineering and program management experience and operational execution |

| | | |

| Robert K. Ortberg | | Mr. Ortberg is our Chairman of the Board and is the Chairman of the Executive Committee. He has been our Chief Executive Officer since August 2013 and has served as our President since September 2012. He served as our Executive Vice President, Chief Operating Officer, Government Systems from February 2010 to September 2012 and as our Executive Vice President, Chief Operating Officer, Commercial Systems from October 2006 to February 2010. He served as a director of Bucyrus International, Inc., from July 2008 to July 2011. He serves on the Board of Governors for the Aerospace Industries Association, is a member of The Business Council, and he serves on the Board of Directors of FIRST® (For Inspiration and Recognition of Science and Technology) and the Hawkeye Council of the Boy Scouts of America. He also serves on the University of Iowa Engineering Advisory Board and on the Board of Trustees of the United Way of East Central Iowa. |

Age: 55 Director since 2013

| |

Chairman of the Board, President and Chief Executive Officer of the Corporation

| |

|

| | |

| | Experiences, qualifications, attributes and skills: • Leadership and operations experience as CEO of Global Smarts, Inc. • Experience with developing technology plans and the transition of advanced technology into business opportunities |

| | | |

| Cheryl L. Shavers | | Dr. Shavers is Chairman of the Technology and Cybersecurity Committee and a member of the Board Nominating and Governance Committee. Dr. Shavers has been the Chairman and Chief Executive Officer of Global Smarts, Inc. (business advisory services) since February 2001. She served on the Advisory Board for E.W. Scripps Company, and as Under Secretary of Commerce for Technology for the United States Department of Commerce from November 1999 to February 2001 after having served as its Under Secretary Designate from April 1999 to November 1999. She served as Sector Manager, Microprocessor Products Group for Intel Corporation prior to April 1999. She served as Non-Executive Chairman of BitArts Ltd. from 2001 to December 2003.

|

Age: 61 Director since 2002 Independent | |

Chairman and Chief Executive Officer, Global Smarts, Inc.

| |

The Board of Directors recommends that you vote “FOR” the election as directors of the three Class III nominees named above, presented as item (1) on the accompanying proxy card.

2015 Proxy Statement  | 9

| 9

CORPORATE GOVERNANCE: BOARD OF DIRECTORS AND COMMITTEES

Our Board of Directors provides oversight and direction of our business. Our Board seeks to maintain high corporate governance standards.

We continue to enhance our corporate governance structure based upon a review of recommended best practices and in light of regulatory activity. Our corporate governance documents are available free of charge on our website at www.rockwellcollins.com under the Investor Relations tab and within the Corporate Governance link. We will provide, without charge, upon written request, copies of our corporate governance documents. These documents include our Restated Certificate of Incorporation, By-Laws, Board of Directors Guidelines on Corporate Governance, Committee Charters, Board Membership Criteria, Code of Ethics, Categorical Standards and Policy for Director Independence, and Related Person Transaction Policy.

Leadership Structure

In November 2015, Mr. Ortberg, our President and CEO, was appointed Chairman of the Board. Mr. Carbone served as our independent Non-Executive Chairman for a sixteen month period until November 2015. With Mr. Ortberg's appointment as Chairman, Mr. Carbone assumed the role of Lead Independent Director, a role he held previously. The Board believes that Mr. Ortberg is well suited to handle the additional duties as our Chairman. The Board also believes that our most effective leadership structure, while Mr. Ortberg is our CEO, is one with a combined Chairman and CEO. A combined structure promotes unified leadership, a cohesive vision and strategy and clear and direct communication to the Board.

The Board does not have a specific policy regarding the separation or combination of the roles of Chairman and CEO. It believes that it is in the Corporation’s best interests to maintain flexibility to have any individual serve as Chairman based on what is in the Corporation’s best interests at a given point in time, rather than mandating a particular leadership structure. The Board believes its programs for overseeing risk, as described below under “Board's Role in Risk Oversight,” and its corporate governance structure are effective under a variety of leadership frameworks and therefore do not materially affect its choice of leadership structure.

Mr. Carbone's powers and duties as Lead Independent Director include the following:

| |

| • | Chairing executive sessions of the independent directors |

| |

| • | Serving as a liaison but not inhibiting direct communication between the Chairman/CEO and the independent directors |

| |

| • | Briefing the Chairman/CEO on the results of executive sessions of the independent directors |

| |

| • | Working with the Chairman/CEO to develop and agree to the Board agenda |

| |

| • | Working with the Chairman/CEO to develop and agree to meeting schedules and the nature of the information that will be sent to the Board in advance of meetings |

| |

| • | Having authority to call meetings of the independent directors |

| |

| • | Being available for consultation and direct communication with major shareowners when appropriate |

| |

| • | Working with the Chair of the Compensation Committee and the independent directors on the establishment of the annual goals and objectives for the Chairman/CEO |

| |

| • | Working with the Chair of the Compensation Committee to communicate to the Chairman/CEO the results of the formal evaluation of the Chairman/CEO by the independent directors |

| |

| • | Assisting with the recruitment of director candidates with the Chair of Nominating and Governance Committee and the Chairman/CEO |

| |

| • | Leading the Board’s review of the succession plan for the Chief Executive Officer |

| |

| • | Discussing key committee agenda items with relevant committee chairs as appropriate |

| |

| • | Recommending, as appropriate, that the Board retain consultants who will report directly to the Board |

10 |  2015 Proxy Statement

2015 Proxy Statement

To ensure effective independent leadership, our independent directors meet regularly in executive sessions without the presence of management. Mr. Carbone as Lead Independent Director, or a director designated by the independent directors who has the relevant background to lead the discussion of a particular matter, chairs these sessions.

Board Independence

The Board of Directors has determined that no director other than Mr. Ortberg has a material relationship with us. Accordingly, eight of our nine current directors are “independent” directors based on an affirmative determination by our Board of Directors in accordance with the listing standards of the New York Stock Exchange (NYSE) and Securities and Exchange Commission (SEC) rules.

The standards relied upon by the Board in affirmatively determining whether a director is independent are primarily comprised of those objective standards set forth in the NYSE and SEC rules. In addition to these rules, the Board has adopted Categorical Standards and Policy for Director Independence, which is available in the Investor Relations section of our website at www.rockwellcollins.com, to assist it in making determinations regarding the independence of its members.

Board Meetings and Attendance

In fiscal year 2015, the Board of Directors held six meetings and acted on three occasions by unanimous written consent in lieu of a meeting. All of our directors attended at least 92 percent of the meetings of the Board and the Committees on which they served. In addition, non-Committee directors routinely attend and participate in discussions at Committee meetings. Directors are expected to attend the Annual Meeting of Shareowners. Last year, all of our directors attended the Annual Meeting.

Board Committees

The Board has established six Committees whose principal functions are briefly described below. The specific functions and responsibilities of each Committee are outlined in more detail in its charter, which is available in the Investor Relations section of our website at www.rockwellcollins.com.

|

| |

| Audit Committee |

| The Audit Committee has three independent directors. It assists the Board in overseeing (i) the Corporation’s accounting and financial reporting processes; (ii) the integrity and audits of its financial statements; (iii) its compliance with legal and regulatory requirements; (iv) the qualifications and independence of independent auditors; and (v) the performance of internal and independent auditors. The Audit Committee: | Committee Members: Chris A. Davis (C,I) David Lilley (I) Andrew J. Policano (I)

|

• has sole authority to appoint or replace our independent auditors, with that appointment being subject to shareowner approval; • has sole authority to approve in advance the fees, scope and terms of all audit and non-audit engagements with our independent auditors; • reviews and discusses policies with respect to risk management as well as internal controls over financial reporting; • monitors compliance of our employees with our standards of business conduct and conflicts of interest policies; • meets at least quarterly with our senior executive officers, the head of our internal audit department and our independent auditors; and • reviews and approves at least annually our policies on the use of financial derivative contracts and related hedging strategies. The Committee met 7 times in 2015. |

| C: Chairman; I: Independent | |

2015 Proxy Statement  | 11

| 11

|

| | |

| | Compensation Committee |

| | The Compensation Committee has three independent directors. The principal functions of the Compensation Committee are to: | Committee Members: Ralph E. Eberhart (C,I) John A. Edwardson (I) Jeffrey L. Turner (I) |

| | • evaluate the performance of the CEO and other senior executives; • determine compensation for the CEO and other senior executives; • review and approve the design and competitiveness of compensation plans, executive benefits and perquisites; • review and approve goals under the annual and long-term incentive plans; • oversee the Corporation’s annual and long-term incentive plans and deferred compensation plans; • review and evaluate compensation arrangements to assess whether they could encourage unreasonable risk taking; • periodically review and make recommendations to the Board regarding the competitiveness of director compensation; • retain, compensate and terminate, in its sole discretion, an independent compensation consultant used to assist in the evaluation of director, CEO or senior executive compensation; • oversee submissions to shareowners for approval relating to compensation; and • consider the most recent advisory vote on executive compensation. The Committee met 4 times in 2015. |

| |

| | C: Chairman; I: Independent |

|

| | |

| | Board Nominating and Governance Committee |

| | The Board Nominating and Governance Committee has four independent directors. For more information regarding the Committee’s role in director nominations, see “Director Nominations” below. The principal functions of the Committee are to: | Committee Members: Andrew J. Policano (C,I) David Lilley (I) Cheryl L. Shavers (I) Jeffery L. Turner (I) |

| | • seek, consider and recommend qualified candidates for election as directors and recommend nominees for election as directors at the Annual Meeting; • periodically prepare and submit to the Board for adoption the Committee’s selection criteria for director nominees (“Board Membership Criteria”); • review and make recommendations on matters involving the general operation of the Board and our corporate governance; • annually recommend nominees for each committee of the Board; • annually facilitate the assessment of the Board’s performance as a whole and of the individual directors and reporting thereon to the Board; and • retain and terminate any search firm to be used to identify director candidates. The Committee met 4 times in 2015. |

| |

| | C: Chairman; I: Independent |

12 |  2015 Proxy Statement

2015 Proxy Statement

|

| | |

| | Technology and Cybersecurity Committee |

| | The Technology and Cybersecurity Committee has three independent directors. The principal functions of the Technology and Cybersecurity Committee are to: | Committee Members: Cheryl L. Shavers (C,I) Ralph E. Eberhart (I) John A. Edwardson (I) |

| | • review and provide guidance on important technology-related issues; • review our technology competitiveness; • review the strength and competitiveness of our engineering processes and disciplines; • review our cybersecurity and other information technology risks, controls and procedures, including the threat landscape and our strategy to mitigate risks and potential breaches; • periodically consult with the Board and the Audit Committee regarding information technology systems and processes, including, but not limited to, those relating to cybersecurity; • review our technology planning processes to support our growth objectives; and • review our focus on engineering leadership and critical technologies development and replacement planning. The Committee met 2 times in 2015. |

| |

| | C: Chairman; I: Independent |

|

| | |

| | Corporate Strategy and Finance Committee |

| | The Corporate Strategy and Finance Committee has four independent directors. The principal functions of the Corporate Strategy and Finance Committee are to: | Committee Members: John A. Edwardson (C,I) Chris A. Davis (I) David Lilley (I) Jeffery L. Turner (I) |

| | • review and advise management regarding our preliminary annual operating plan; • review our capital structure strategies including dividend policy, share repurchase plans, and debt and financing strategies; • as requested, review and advise management on proposed acquisitions and divestitures, strategic investments, and other transactions or financial matters; • provide input regarding our strategic direction, including the development of our strategic plan; and • act as advisors in assessing our strategies and the action plans designed to meet our strategic objectives. The Committee was formed in September 2015 and did not meet in 2015. |

| |

| | C: Chairman; I: Independent |

2015 Proxy Statement  | 13

| 13

|

| | |

| | Executive Committee |

| | The Executive Committee has three directors. The principal function of the Executive Committee is to discharge certain responsibilities of the Board of Directors between meetings of the Board of Directors. The Committee may exercise all of the powers of the Board of Directors, except it has no power or authority to: | Committee Members: Robert K. Ortberg (C) Anthony J. Carbone (I) Chris A. Davis (I) John A. Edwardson (I) |

| | • adopt, amend or repeal any sections or articles of our By-Laws or Restated Certificate of Incorporation; • elect or remove officers, or fill vacancies in the Board of Directors or in committees; • fix compensation for officers, directors or committee members; • amend or rescind prior resolutions of the Board; • make recommendations to shareowners or approve transactions that require shareowner approval; • issue additional stock of the Corporation or fix or determine the designations and any of the rights and preferences of any series of stock (other than pursuant to a specific delegation of authority from the Board related to a shelf registration statement); or • take certain other actions specifically reserved for the Board. The Committee met one time in 2015. |

| |

| | C: Chairman; I: Independent |

The membership of each committee as of December 10, 2015 is listed below. |

| | | | | | |

| | Audit | Compensation | Board Nominating and Governance | Technology and Cybersecurity | Corporate Strategy and Finance | Executive |

| Anthony J. Carbone | | | | | | ● |

| Chris A. Davis | C | | | | ● | ● |

| Ralph E. Eberhart | | C | | ● | | |

| John A. Edwardson | | ● | | ● | C | ● |

| David Lilley | ● | | ● | | ● | |

| Robert K. Ortberg | | | | | | C |

| Andrew J. Policano | ● | | C | | | |

| Cheryl L. Shavers | | | ● | C | | |

| Jeffrey L. Turner | | ● | ● | | ● | |

C: Chairman

Director Nominations

The Board Nominating and Governance Committee is responsible for identifying individuals who meet the Board’s membership criteria and recommending to the Board the election of such individuals. The Committee identifies qualified candidates in many ways including using outside search firms and by receiving suggestions from directors, management and shareowners. Shareowners wishing to recommend director candidates for consideration by the Committee can do so by writing to the Board Nominating and Governance Committee, c/o the Secretary of the Corporation at our corporate headquarters in Cedar Rapids, Iowa, giving the candidate’s name, biographical data and qualifications. Any such recommendation must be accompanied by a written statement from the individual of his or her consent to be named as a candidate and, if nominated and elected, to serve as a director. In addition to recommending nominees to the Committee, shareowners may also propose nominees for consideration at shareowner meetings. These nominee proposals must be provided timely and otherwise meet the requirements set forth in our By-Laws. See “Shareowner Proposals for Annual Meeting in 2017” set forth later in this proxy statement. 14 |  2015 Proxy Statement

2015 Proxy Statement

The Committee evaluates the qualifications of candidates properly submitted by shareowners under the same criteria and in the same manner as potential nominees it identifies. Director candidates are reviewed by the Committee as authorized under the Committee’s Charter using various general guidelines set forth in the Board Membership Criteria, a copy of which is attached to the Board Nominating and Governance Committee Charter. Candidates are chosen with the primary goal of ensuring that the entire Board is balanced and collectively serves the interests of our shareowners. While the Committee does not have a formal policy with respect to diversity, the guidelines include taking into account such factors as diversity, background and experience, age and specialized expertise in the selection of candidates. In addition to the general guidelines, the Committee has identified the following minimum qualifications for Board membership: each nominee for director should be an individual of the highest character and integrity, have solid leadership skills, have experience at strategy/policy setting, have good communication skills, have a reputation for working constructively with others, have sufficient time available to devote to the affairs of the Corporation, be free of any conflict of interests that would interfere with the proper performance of the responsibilities of a director and be under the age of 74 as of the meeting of shareowners at which he or she will stand for election.

Board’s Role In Risk Oversight

The Board oversees the management of risks inherent in the operation of the Corporation’s businesses and the implementation of its strategic plan. The Board reviews the risks associated with the Corporation’s strategic plan at an annual strategic planning session and periodically throughout the year as part of its consideration of the strategic direction of the Corporation. In addition, the Board addresses the primary risks associated with the business of the Corporation on an ongoing basis at regular meetings of the Board.

Each of the Board’s Committees also oversees the management of risks that fall within the Committee’s areas of responsibility. In performing this function, each Committee has full access to management, as well as the ability to engage advisors. Non-Committee directors routinely attend each of the Committee meetings to help facilitate the Board’s oversight role. The following paragraphs highlight risk matters overseen by two of the Board’s Committees.

The Audit Committee oversees the operation of our Enterprise Risk Management program, including a review of the status of matters involving the primary risks for the Corporation. The Vice President and General Auditor, who regularly provides reports to the Audit Committee, assists in identifying, evaluating and monitoring risk management controls to address identified risks. Key risk topics, such as cybersecurity and anti-bribery, have been periodically reviewed and discussed. Responsibility for reviewing cybersecurity risks was reassigned in September 2015 to the Technology and Cybersecurity Committee. The Audit Committee also oversees and monitors management’s internal controls over financial reporting and its preparation of the Corporation’s financial statements. The Committee oversees internal and external audits including the risk based approach used in the selection of audit matters. The Audit Committee provides reports to the Board that include these activities.

As part of its oversight of the Corporation’s executive compensation program, the Compensation Committee, with the assistance of its independent compensation consultant, annually conducts a risk assessment of the Corporation’s compensation policies and practices and reviews the internal controls and processes as they apply to compensation decisions and policies. The Compensation Committee provides reports to the Board that include its risk assessment and compensation decisions. Based upon its risk assessment, the Committee has identified several mitigating factors that help reduce the likelihood of undue risk taking related to compensation arrangements including, but not limited to, the use of multiple measures (operating margin, sales, return on sales, operating cash flow and total shareowner return) in a balanced mix of annual and long-term incentive plans, use of multiple types of incentives (cash, stock options and performance shares), use of incentive payout caps in our annual and long-term incentive plans and executive stock ownership requirements that help to align incentives with long-term growth in equity values. Based on its review, the Compensation Committee has concluded that the Corporation’s compensation policies and procedures do not encourage unreasonable risk taking by management.

2015 Proxy Statement  | 15

| 15

Communicating With Board Members

As discussed above, the Lead Independent Director generally presides at regular executive sessions of our independent directors. Any shareowner or other interested party may communicate directly with the Lead Independent Director by sending an email to leadindependentdirector@rockwellcollins.com or writing to: Lead Independent Director, Rockwell Collins, Inc., 400 Collins Road NE, Cedar Rapids, IA 52498. Communications by shareowners or other interested parties may also be sent to non-employee directors, as a group or individually, by sending an email to boardofdirectors@rockwellcollins.com or by writing to Board of Directors (or one or more directors by name), Attn: Corporate Secretary, Rockwell Collins, Inc., 400 Collins Road NE, Cedar Rapids, IA 52498. Upon receipt of any communication, the Corporate Secretary will determine the nature of the communication and, as appropriate, facilitate direct communication with the appropriate director.

Shareowner Engagement

We interact with our shareowners on a regular basis through a variety of ways. Shareowner engagements include quarterly earnings calls and periodic investor conferences with time for questions and answers, numerous group and individual meetings with institutional investors, annual report and proxy statement distribution to all shareowners and various other interactions tailored to the circumstances. Members of the Board have been directly involved with shareowner engagement in appropriate circumstances.

CERTAIN TRANSACTIONS AND OTHER RELATIONSHIPS

The Board’s Related Person Transaction Policy requires the review and approval or ratification by the Audit Committee of certain transactions or relationships involving Rockwell Collins and its directors, executive officers, certain shareowners and their affiliates. The Audit Committee is responsible for reviewing these transactions and takes into account the pertinent facts and circumstances presented, and any other information it deems appropriate, to determine what is in the best interests of the Corporation.

This written policy sets forth procedures for the review, approval or ratification and monitoring of transactions involving Rockwell Collins and “related persons.” For the purposes of the policy, “related persons” include executive officers, directors and director nominees or their immediate family members, or shareowners owning five percent or greater of Rockwell Collins’ outstanding stock. The Related Person Transaction Policy defines “related person transactions” in accordance with applicable SEC rules as any transaction in which the Corporation was or is to be a participant, and in which a related person has a material direct or indirect interest that exceeds $120,000. The policy requires these related person transactions to be reviewed and approved or ratified by the Audit Committee. In addition, this policy requires related persons to disclose to the Audit Committee the material terms of the related person transaction, including the approximate dollar value of the amount involved in the transaction and the related person’s direct or indirect material interest in, or relationship to, the related person transaction.

16 |  2015 Proxy Statement

2015 Proxy Statement

EQUITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Principal Shareowners

The following table provides information about each shareowner known to us to own beneficially more than five percent of the outstanding shares of our common stock. |

| | | | | |

| | Name and Address of Beneficial Owner | Shares | Percent of Class(1) |

|

| | Capital World Investors(2) 333 South Hope Street

Los Angeles, CA 90071 | 12,315,000 |

| 9.4 | % |

| |

| |

| | The Vanguard Group(2) 100 Vanguard Blvd.

Malvern, PA 19355 | 9,798,353 |

| 7.5 | % |

| |

| |

| | BlackRock, Inc.(2) 55 East 52 Street

New York, NY 10022 | 7,296,003 |

| 5.6 | % |

| |

| |

| |

| (1) | Percent of class calculation is based on shares of common stock outstanding as of December 7, 2015. |

| |

| (2) | Based on a Schedule 13G filed with the SEC by this shareowner reporting beneficial ownership of these shares as of December 31, 2014. |

Management and Director Equity Ownership

The following table shows the beneficial ownership, reported to us as of December 1, 2015, of our common stock, including shares as to which a right to acquire ownership within 60 days of that date exists (for example, through the exercise of stock options or through various trust arrangements) within the meaning of Rule 13d-3(d)(1) under the Securities Exchange Act of 1934, as amended, of each director, each executive officer listed in the Summary Compensation Table on page 41 and of such persons and other executive officers as a group. |

| | | |

| Name | Beneficial Ownership on December 1, 2015 |

Shares(1) | Percent of Class(2) |

| Robert K. Ortberg | 518,297 | (3,4,5) | * |

| Anthony J. Carbone | 63,451 | (6,7) | * |

| Chris A. Davis | 52,702 | (6,7) | * |

| Ralph E. Eberhart | 17,051 | (7) | * |

| John A. Edwardson | 9,897 | (7) | * |

| David Lilley | 28,489 | (7) | * |

| Andrew J. Policano | 21,979 | (7) | * |

| Cheryl L. Shavers | 23,428 | (6,7) | * |

| Jeffrey L. Turner | 8,117 | (7) | * |

| Patrick E. Allen | 303,788 | (3,4,5) | * |

| Philip J. Jasper | 120,626 | (3,4,5) | * |

| Jeffrey D. MacLauchlan | 7,522 | (3,4,5) | * |

| Kent L. Statler | 121,919 | (3,4,5) | * |

| All of the above and other executive officers as a group (22 persons) | 1,712,891 | (3,4,5,6,7) | 1.3% |

* Less than one percent

(1) Each person has sole voting and investment power with respect to the shares listed unless otherwise indicated.

2015 Proxy Statement  | 17

| 17

(2) The shares owned by each person, and by the group, and the shares included in the number of shares outstanding have been adjusted, and the percentage of shares owned has been computed, in accordance with Rule 13d-3(d)(1) under the Securities Exchange Act of 1934, as amended.

(3) Includes shares held under our Retirement Savings Plan as of December 1, 2015. Does not include, 3,181 share equivalents for Mr. Ortberg, 2,759 share equivalents for Mr. Allen, 1,019 share equivalents for Mr. Jasper, 67 share equivalents for Mr. MacLauchlan, 2,599 share equivalents for Mr. Statler and 19,505 share equivalents for the entire group, in each case, held under our Non-Qualified Savings Plan as of December 1, 2015. Share equivalents under the Non-Qualified Savings Plan are settled in cash in connection with retirement or termination of employment and may not be voted or transferred.

(4) Includes shares that may be acquired upon the exercise of outstanding stock options that are or will become exercisable within 60 days as follows: 441,332 for Mr. Ortberg, 250,666 for Mr. Allen, 106,066 for Mr. Jasper, 7,166 for Mr. MacLauchlan, 73,599 for Mr. Statler and 1,197,686 for the entire group.

(5) Does not include performance shares held by such persons for which shares of our common stock may be issued following the completion of any open three-year performance period, which shares are dependent on the level of achievement of our performance goals and our total shareowner return relative to certain Aerospace and Defense companies.

(6) Includes 11,984 shares for Mr. Carbone, 6,413 shares for Ms. Davis, and 4,632 shares for Dr. Shavers granted as restricted stock as compensation for service as directors.

(7) Includes 38,376 shares for Mr. Carbone, 37,911 shares for Ms. Davis, 17,051 shares for General Eberhart, 9,897 shares for Mr. Edwardson, 28,489 shares for Mr. Lilley, 21,979 shares for Dr. Policano, 18,796 shares for Dr. Shavers and 8,117 shares for Mr. Turner granted as restricted stock units as compensation for service as directors.

COMPENSATION OF DIRECTORS

2015 DIRECTOR COMPENSATION TABLE

The following table sets forth information regarding compensation for each of our non-employee directors for fiscal year 2015. Mr. Ortberg, who is the Chairman of the Board, our President and Chief Executive Officer, does not participate in the compensation program for non-employee directors. |

| | | | | | | | | | | | | | | | | | | | | |

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | Change in Pension Value and Non-Qualified Deferred Compensation Earnings ($) | All Other Compensation ($) | Total ($) |

| Anthony J. Carbone | $ | 158,333 |

| $ | 206,219 |

| $ | — |

| $ | — |

| $ | — |

| $ | 16,100 |

| $ | 380,652 |

|

| Chris A. Davis | $ | 120,000 |

| $ | 156,008 |

| $ | — |

| $ | — |

| $ | — |

| $ | 8,080 |

| $ | 284,088 |

|

| Ralph E. Eberhart | $ | 117,500 |

| $ | 130,873 |

| $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | 248,373 |

|

| John A. Edwardson | $ | 100,000 |

| $ | 121,198 |

| $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | 221,198 |

|

| David Lilley | $ | 105,000 |

| $ | 144,372 |

| $ | — |

| $ | — |

| $ | — |

| $ | 5,000 |

| $ | 254,372 |

|

| Andrew J. Policano | $ | 115,000 |

| $ | 137,158 |

| $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | 252,158 |

|

| Cheryl L. Shavers | $ | 110,000 |

| $ | 133,182 |

| $ | — |

| $ | — |

| $ | — |

| $ | 5,836 |

| $ | 249,018 |

|

| Jeffery L. Turner | $ | 100,000 |

| $ | 119,847 |

| $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | 219,847 |

|

The following is an explanation of the above table:

Fees. All non-employee directors receive an annual retainer fee of $100,000 that they may elect to receive in cash or restricted stock units (RSUs) in lieu of cash. Mr. Carbone was also entitled to additional fees for his service as Non-Executive Chairman. Please see “Cash Compensation” below for a description of director fees that are paid in addition to the annual retainer. Generally, fees may be paid in cash or in RSUs in lieu of cash, at the election of each non-employee director. For fiscal 2015, deferrals of cash fees into RSUs were as follows: Mr. Carbone deferred $137,500 of his cash fees, Ms. Davis deferred all of her cash fees, General Eberhart deferred $11,250 of his cash fees, Mr. Edwardson deferred $75,000 of his cash fees and Mr. Lilley deferred $78,750 of his cash fees.

18 |  2015 Proxy Statement

2015 Proxy Statement

Stock Awards and Options. The dollar value for stock awards represents the aggregate grant date fair value of the RSUs determined in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718 (FASB ASC Topic 718) and does not reflect a reduction for possible forfeitures. Under our Long-Term Incentives Plan, non-employee directors receive an annual grant of RSUs determined by dividing $110,000 by our closing stock price on the date of the Annual Meeting. Dividend equivalents on RSUs accrue quarterly and are included in this column. For more information see “Stock-Based Compensation” below. No options have been awarded to non-employee directors since 2005 and none of these previously awarded options remain outstanding.

The outstanding equity awards held at the end of fiscal year 2015 by each non-employee director are shown in the following table.

|

| | | | |

| Name | Restricted Stock | RSUs |

| Anthony J. Carbone | 11,984 |

| 37,927 |

|

| Chris A. Davis | 6,413 |

| 37,552 |

|

| Ralph E. Eberhart | — |

| 17,006 |

|

| John A. Edwardson | — |

| 9,598 |

|

| David Lilley | — |

| 28,175 |

|

| Andrew J. Policano | — |

| 21,979 |

|

| Cheryl L. Shavers | 4,632 |

| 18,796 |

|

| Jeffrey L. Turner | — |

| 8,117 |

|

All Other Compensation. For Ms. Davis and Dr. Shavers, the amounts shown in the 2015 Director Compensation Table under the column “All Other Compensation” include dividends paid on restricted stock. We began granting our non-employee directors RSUs in lieu of restricted stock in 2006. For Mr. Carbone, the amount is comprised of dividends paid on restricted stock and a $1,000 matching gift under our charitable matching gift program. For Mr. Lilley, the amount is a matching gift under our charitable matching gift program.

Director Compensation Design

Our non-employee director compensation program is reviewed on a periodic basis by the Compensation Committee’s independent consultant. The Compensation Committee recommends compensation program changes to the Board of Directors. The components of the program are described below.

Cash Compensation

All non-employee directors receive an annual retainer as described above. Additional annual retainers are paid to the Lead Independent Director, to the chairs of certain board committees and to the members of the Audit Committee as shown in the table below. For his service as Non-Executive Chairman, Mr. Carbone received an additional annual retainer of $50,000. Each annual retainer is payable in advance in equal quarterly installments. |

| | | |

| Lead Independent Director | $ | 30,000 |

|

| Audit Committee Chair | $ | 20,000 |

|

| Compensation Committee Chair | $ | 15,000 |

|

| Technology and Cybersecurity Committee Chair | $ | 15,000 |

|

| Board Nominating and Governance Chair | $ | 10,000 |

|

| Corporate Strategy and Finance Committee Chair | $ | 10,000 |

|

| Audit Committee Member | $ | 5,000 |

|

Under our Long-Term Incentives Plan, each director has the option each year to determine whether to defer all or any part of his or her retainer fees by electing to receive RSUs valued at the closing price on the date the cash retainer payment would otherwise be paid. Non-employee directors are reimbursed for all reasonable expenses associated with attending

2015 Proxy Statement  | 19

| 19

Board and Committee meetings and otherwise relating to their director duties. Non-employee directors are also eligible to receive up to $5,000 in matching charitable gifts under our matching gift program.

Stock-Based Compensation

In addition to the retainer fees described above, each non-employee director is granted RSUs under our Long-Term Incentives Plan concurrently with the director’s initial election to our Board. The value of the RSUs at initial election is equal to $100,000 plus a prorated amount determined by multiplying $110,000 by a fraction, the numerator of which is the number of days remaining until the next Annual Meeting of Shareowners and the denominator of which is 365. Following each Annual Meeting, continuing non-employee directors are granted RSUs with a $110,000 value as of the date of the meeting. RSUs, which do not have voting rights, entitle the directors to a contractual right to receive at a future date the number of shares of common stock specified. Pursuant to the terms of the directors’ RSUs, dividend equivalents in the form of additional RSUs accumulate on the date we otherwise pay dividends on our common stock and directors receive unrestricted shares of our common stock in payment for RSUs upon termination of their Board service. For his service as Non-Executive Chairman, Mr. Carbone received an additional annual RSU grant with a value of $50,000.

Director Stock Ownership Guidelines

Each non-employee director is required to own shares of our common stock with a market value of at least five times the annual retainer amount within six years of joining the Board. All of our non-employee directors meet the stock ownership guidelines. The director stock ownership guidelines were changed in 2015. Previously directors were required to own three times the annual retainer amount within four years of joining the Board. The following are counted for purposes of meeting these ownership guidelines: shares owned outright (including in trusts and those held by a spouse), shares of restricted stock and RSUs. The Compensation Committee’s independent consultant reviews the ownership guidelines on a periodic basis to ensure that they remain competitive with market practice.

20 |  2015 Proxy Statement

2015 Proxy Statement

COMPENSATION DISCUSSION AND ANALYSIS

Table of Contents

The following section reviews the elements and objectives of our compensation program and how they align with our performance and the decisions we made during 2015 for our Named Executive Officers (NEOs) included in the Summary Compensation Table. |

| | | |

| Introduction | 22 |

|

| Executive Summary | 22 |

|

| Results of 2015 Shareowner Advisory Vote on Executive Compensation | 23 |

|

| Executive Compensation Governance Practices | 23 |

|

| Executive Compensation - Roles and Responsibilities | 24 |

|

| Executive Compensation Design | 25 |

|

| What Our Compensation is Intended to Reward | 26 |

|

| Market Assessment | 26 |

|

| Comprehensive Compensation Review | 28 |

|

| Elements of Our 2015 Compensation Program | 28 |

|

| Compensation Earned | 34 |

|

| Employee and Other Benefits | 37 |

|

| Executive Policies and Practices | 37 |

|

2015 Proxy Statement  | 21

| 21

Introduction

In the discussion that follows, we provide:

•an explanation of our compensation philosophy and governance practices;

•an overview and analysis of our executive compensation program;

•a review of the compensation decisions made for our NEOs; and

•the factors considered in making those decisions.

Included within the Compensation Discussion and Analysis you will find a series of tables containing specific information about the compensation earned or paid in fiscal 2015 (October 4, 2014 to October 2, 2015) to our NEOs. Unless otherwise noted, references to years in this discussion are to our fiscal years.

Our NEOs for 2015 were: |

| |

| Robert K. Ortberg | Chairman, President and Chief Executive Officer (CEO) |

| Patrick E. Allen | Senior Vice President, Chief Financial Officer (CFO) |

| Kent L. Statler | Executive Vice President, Chief Operating Officer, Commercial Systems |

| Philip J. Jasper | Executive Vice President, Chief Operating Officer, Government Systems |

| Jeffrey D. MacLauchlan | Senior Vice President, Corporate Development |

Executive Summary

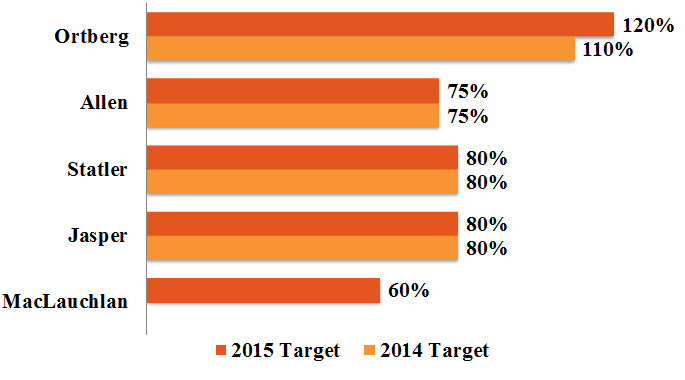

The Compensation Committee (Committee) believes in pay-for-performance and approves programs that are aligned with corporate and shareowner goals. To attract and retain top talent, target compensation is set around the median of the competitive market with the opportunity to achieve greater compensation if superior performance is achieved. Payments under our annual incentives and long-term performance shares are 100% performance-based and dependent on the achievement of annual and long-term performance goals approved by the Committee. For 2015, our annual incentive plan paid out at 106% of target and our performance shares paid out at 77% of target, as described in the following paragraphs.

2015 Annual Incentive Plan Results

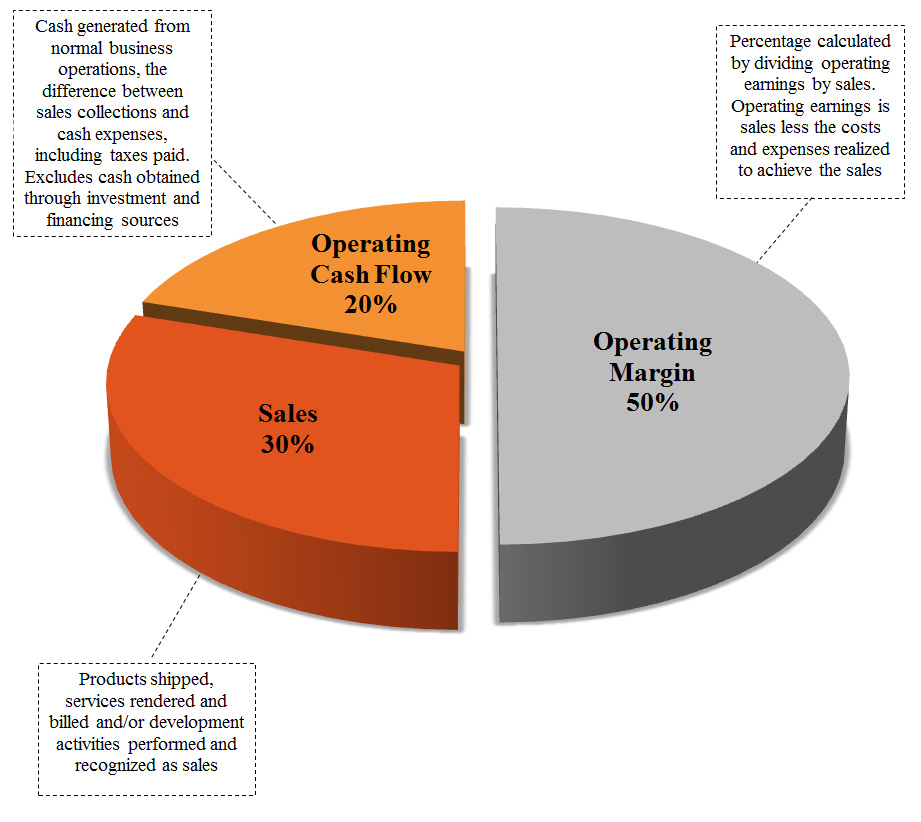

Annual incentive plan payments for 2015 were dependent on our performance against the operating margin, sales and operating cash flow goals established by the Committee. Annual incentive plan payments were paid at 106% of target for 2015. Details of our performance as calculated under the plan are as follows:

•Operating margin was 21.17%, which was above the target of 21.05% compared to operating margin of 20.98% in 2014;

•Total sales of $5.24 billion, which was below the target of $5.25 billion, compared to total sales of $4.64 billion in 2014; and

•Operating cash flow of $752 million, which was above the target of $725 million, compared to operating cash flow of $609 million in 2014.

These financial measures are not reported in accordance with Generally Accepted Accounting Principles (GAAP). For more information on the 2015 annual incentive plan payments and a reconciliation of these non-GAAP financial measures to GAAP, see “2015 Annual Incentive Performance Results” on pages 34-35.

2013-2015 Performance Share Results

Our performance shares provide our executives with the opportunity to earn shares based upon our achievement of cumulative sales, return on sales and relative total shareowner return (TSR) over a three-year performance period. Performance shares represent 50% of the annual target award value under our long-term incentive program. The remaining 50% is granted in the form of stock options.

22 |  2015 Proxy Statement

2015 Proxy Statement

Our performance during the 2013-2015 performance period resulted in return on sales of 12.9%, which was above the target of 11.7%, and cumulative sales of $15.02 billion, which was below the target of $16.34 billion. This would have resulted in a payout of 86%. The payout was then reduced to 77% due to the impact of the TSR modifier. These financial measures are not reported in accordance with GAAP. For more information, including how our acquisition of ARINC in December 2013 impacted the payout and a reconciliation of these non-GAAP financial measures to GAAP, see “2013-2015 Performance Period Share Payments” on pages 35-36.

Results of 2015 Shareowner Advisory Vote on Executive Compensation

Each year, in accordance with its charter, the Committee considers the outcome of the shareowner advisory vote on executive compensation when making future decisions relating to the compensation of the NEOs and our executive compensation program and policies. The Committee also considers feedback from our shareowners. In 2015, our executive compensation program was approved by 97.4% of the votes cast by shareowners (not counting abstentions and broker non-votes). The Committee believes this conveys our shareowners’ continued strong support of the philosophy, strategy and objectives of our executive compensation program. Nonetheless, the Committee continues to assess our executive compensation program and policies, based on our strategic needs and external market practices. For 2015, the executive compensation program remained largely unchanged.

Executive Compensation Governance Practices

Additional features that strengthen our executive compensation governance practices are as follows:

What We Do

| |

| √ | We believe in pay for performance. As shown on page 29 between 70% and 85% of the target annual compensation opportunity of our NEOs is tied to performance. |

| |

| √ | We annually assess our executive compensation program to ensure that it remains well balanced and that it does not encourage unreasonable risk taking. For more information, see “Board’s Role in Risk Oversight” on page15. |

| |

| √ | Our stock ownership guidelines help align our executive officers’ interests with those of our other shareowners. The Committee monitors the stock held by our executive officers. For more information, see “Stock Ownership Guidelines” on page 37. |

| |

| √ | We have “double trigger” change in control agreements that require a change in control and a qualifying termination before benefits can be payable. For more information, see “Employment, Severance and Change of Control Agreements” on page 38. |

| |

| √ | We have a robust clawback policy and other compensation recovery policies to allow us to recover compensation as appropriate. For more information, see “Payment Recovery Provisions” on page 39. |

| |

| √ | We use an independent compensation consultant to advise the Committee and to keep it abreast of compensation best practices |

What We Don’t Do

| |

| × | We do not allow hedging of our common stock by our officers and directors. |

| |

| × | We do not allow pledging of our common stock by our key executives or directors without prior approval. |

| |

| × | We do not provide tax gross-ups to executive officers, except in connection with a relocation or international assignment, which is generally provided to all employees. |

| |

| × | We do not reprice stock options. |

| |

| × | We do not pay change of control excise tax gross-ups. |

| |

| × | We do not provide excessive perquisites. |

2015 Proxy Statement  | 23

| 23

Executive Compensation - Roles and Responsibilities

Compensation Committee

The Committee, which consists entirely of independent directors, has responsibility for the development and oversight of our executive compensation program. The Committee's duties and responsibilities are described under “Compensation Committee” on page 12. Independent Compensation Consultant

The Committee selects and retains the services of a compensation consultant to provide professional advice on our executive compensation program and the non-employee director compensation program. The Committee assesses the consultant’s independence and whether there are any conflicts of interest annually. In determining that the consultant was independent, the Committee considered the factors set forth in Rule 10C-1(b) of the Securities Exchange Act of 1934. The independent consultant, a managing director at Semler Brossy Consulting Group, LLC, is retained directly by the Committee and provides no other service to us other than those related to executive and director compensation. The independent consultant interacts directly with the Committee's chairman in preparation for meetings, provides advice in Committee meetings, assists with the design of compensation arrangements and provides an independent market assessment of peer companies and general industry compensation and practices. The independent consultant meets with new Committee members to orient them to the policies, plans and programs managed by the Committee. The independent consultant meets with management to collect information, to solicit management's input and to fully understand our plans, goals and actual performance. The consulting relationship is reviewed by the Committee annually to determine its satisfaction with the services and advice provided by the independent consultant.

Management

The CEO provides the Committee with his assessment of the performance of the Corporation, our business units and of other executive officers. He also discusses the operational and financial plans for future performance periods (annual and long-term) as they relate to compensation decisions. The CEO provides input on the design of compensation programs and policies and makes recommendations for compensation changes for the other NEOs. The CFO provides input on the metrics to use in our compensation programs and on the setting of performance goals. The Senior Vice President, Human Resources provides support, analysis and counsel with respect to the administration of the programs under the supervision of the Committee. Certain members of management, including the CEO, regularly attend Committee meetings. The CEO is delegated authority to approve the compensation arrangements other than for our executive officers and other designated senior executives, with limitations that are established by the Committee. The Committee meets for a portion of its meetings in executive session, with its independent consultant and without the CEO or other members of management. The Committee's deliberations on CEO compensation are held during a non-management executive session of the Committee that typically includes all non-employee board members.

24 |  2015 Proxy Statement

2015 Proxy Statement

Executive Compensation Design

The design principles of our executive compensation program and how the actions we take are aligned with those principles are shown below: |

| |

| Design Principles | Alignment to Key Compensation Elements |

| Aligned with Shareowner Interests |

| The interests of our executives should align with the interests of our shareowners by using performance measures that correlate well with shareowner value. | Our short-term and long-term incentive plans use financial performance measures that correlate well with shareowner value. |

| Supportive of Our Vision |

| Our compensation should support what we hope to achieve and how we work together to achieve our goals and meet customer and shareowner expectations. | Our plans are aligned with our growth objectives and encourage collaboration to meet our customer commitments. The value of our long-term incentives is tied to our stock’s performance on both an absolute and relative basis. |

| Competitive |

| Our total compensation package should be competitive with the general industry peer group and at a level appropriate to attract, retain and motivate highly qualified executives capable of leading us to greater performance. | Our base salary and annual incentives provide a competitive annual total cash compensation opportunity and our equity incentives provide a competitive opportunity over the long-term. Both support our need to attract and retain executive talent. |

| Performance-Based |

| A significant portion of NEO compensation should be at risk and tied to corporate, business unit and individual performance. | A substantial portion of our executive pay is at risk and paid only on the achievement of specific pre-established performance goals. Annual incentive payouts are subject to adjustment based upon business unit and/or individual performance. Performance shares and stock options are performance-based and at risk. |

| Balanced |

| Our compensation plan design should promote an appropriate balance between annual and long-term business results. | Our compensation program is balanced in that it provides both annual and long-term incentives dependent on business results. However, as illustrated on page 29, more emphasis is given to long-term incentives because they align an executive's performance with our long-term success. |

Factors that we use to assess NEO compensation include:

| |

| • | Operational and financial performance; |

| |

| • | Results of the most recent shareowner advisory vote on executive compensation; |

| |

| • | The executive’s individual record of performance; |

| |

| • | Compensation history, including experience in the position; |

| |

| • | Relative level of responsibility and the impact of his or her position on our performance; |

| |

| • | The executive’s long-term leadership potential and associated retention risk; |

| |