Table of Contents

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Rockwell Collins, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

December 17, 2003

Dear Shareowner:

You are cordially invited to attend the 2004 Annual Meeting of Shareowners of the Corporation.

The meeting will be held at the Collins Plaza Hotel, 1200 Collins Road NE, Cedar Rapids, Iowa, on Tuesday, February 10, 2004, at 10:00 a.m. (Central Standard Time). At the meeting we will present a current report of the activities of the Corporation followed by discussion and action on the matters described in the Proxy Statement. Shareowners will have an opportunity to comment on or inquire about the affairs of the Corporation that may be of interest to shareowners generally.

If you plan to attend the meeting, please request an admittance card in one of the ways described in the box on the last page of the Proxy Statement, and an admittance card will be forwarded to you promptly.

We sincerely hope that as many shareowners as can conveniently attend will do so.

Sincerely yours,

Clayton M. Jones

Chairman, President and Chief Executive Officer

Table of Contents

| ROCKWELL COLLINS, INC. |

| 400 Collins Road NE, Cedar Rapids, Iowa 52498 |

Notice of 2004 Annual Meeting of Shareowners

To the Shareowners of ROCKWELL COLLINS, INC.:

Notice Is Hereby Given that the 2004 Annual Meeting of Shareowners of Rockwell Collins, Inc. will be held at the Collins Plaza Hotel, 1200 Collins Road NE, Cedar Rapids, Iowa, on Tuesday, February 10, 2004, at 10:00 a.m. (Central Standard Time) for the following purposes:

| (1) | to elect two members of the Board of Directors of the Corporation with terms expiring at the Annual Meeting in 2007; |

| (2) | to consider and vote upon a proposal to approve the selection by the Audit Committee of the Board of Directors of the firm of Deloitte & Touche LLP as auditors of the Corporation for fiscal year 2004; and |

| (3) | to transact such other business as may properly come before the meeting. |

Only shareowners of record at the close of business on December 15, 2003 will be entitled to notice of, and to vote at, the meeting.

By order of the Board of Directors.

Gary R. Chadick

Secretary

December 17, 2003

Note: The Board of Directors solicits votes by the execution and prompt return of the accompanying proxy in the enclosed return envelope or by use of our

telephone or Internet voting procedures.

Table of Contents

ROCKWELL COLLINS, INC. PROXY STATEMENT

Table of Contents

| 1 | ||

| 1 | ||

| 1 | ||

Information As To Nominees For Directors And Continuing Directors | 2 | |

| 5 | ||

| 7 | ||

| 7 | ||

Equity Ownership Of Certain Beneficial Owners And Management | 9 | |

| 11 | ||

| 12 | ||

| 12 | ||

| 13 | ||

| 13 | ||

| 14 | ||

| 16 | ||

| 17 | ||

| 18 | ||

| 18 | ||

Compliance With Section 16(A) Of The Securities Exchange Act | 18 | |

| 18 | ||

| 19 | ||

| 19 | ||

| 19 | ||

| 20 | ||

| A-1 |

- i -

Table of Contents

The 2004 Annual Meeting of Shareowners of Rockwell Collins, Inc. will be held on February 10, 2004, for the purposes set forth in the accompanying Notice of 2004 Annual Meeting of Shareowners. This will be our third Annual Meeting of Shareowners since we began operations as an independent, publicly-held company. We became a publicly-held company through the pro rata distribution by Rockwell Automation, Inc. (formerly Rockwell International Corporation) (“Rockwell”) of all the outstanding shares of our Common Stock, par value $.01 per share (“Common Stock”), to Rockwell’s shareowners on June 29, 2001 (the “Distribution”).

This statement and the accompanying proxy, which are first being sent to shareowners on or about December 26, 2003, are furnished in connection with the solicitation by the Board of Directors of proxies to be used at the meeting and at any adjournment thereof. If a shareowner duly executes and returns a proxy in the accompanying form or uses our telephone or Internet voting procedures to authorize the named proxies to vote the shareowner’s shares, those shares will be voted as specified, and if no specification is made, the shares will be voted in accordance with the recommendations of the Board of Directors. The proxy and any votes cast using our telephone or Internet voting procedures may be revoked prior to exercise at the meeting by delivering written notice of revocation to the Secretary of the Corporation, by executing a later dated proxy, by casting a later vote using the telephone or Internet voting procedures or by attending the meeting and voting in person.

Only shareowners of record at the close of business on December 15, 2003, the record date for the meeting, are entitled to notice of, and to vote at, the meeting. On December 15, 2003, we had outstanding 178,056,428 shares of Common Stock. Each holder of Common Stock is entitled to one vote for each share held. We have no class or series of shares currently outstanding other than our Common Stock.

Our Board of Directors currently consists of eight members. Our Restated Certificate of Incorporation provides that the Board of Directors shall consist of three classes of directors with overlapping three-year terms. One class of directors is to be elected each year with terms extending to the third succeeding Annual Meeting after election. The Restated Certificate of Incorporation provides that the Board of Directors shall maintain the three classes so as to be as nearly equal in number as the then total number of directors permits. The two directors in Class III who are elected at the 2004 Annual Meeting will serve for a term expiring at our Annual Meeting in the year 2007. The three directors in Class I and the three directors in Class II are serving terms expiring at our Annual Meeting in 2005 and 2006, respectively.

It is intended that proxies in the accompanying form properly executed and returned to our proxy tabulator or shares properly authorized to be voted in accordance with our telephone or Internet voting procedures will be voted at the meeting, unless authority to do so is withheld, for the election as directors of the two nominees specified inClass III — Nominees for Directors with Terms Expiring in 2007 below, each of whom now serves as a director with a term extending to the 2004 Annual Meeting and until a successor is elected and qualified. If for any reason any of the nominees is not a candidate (which is not expected) when the election occurs, it is expected that proxies in the accompanying form or shares properly authorized to be voted with our telephone or Internet voting procedures will be voted at the meeting for the election of a substitute nominee or, in lieu thereof, the Board of Directors may reduce the number of directors.

- 1 -

Table of Contents

INFORMATION AS TO NOMINEES FOR

DIRECTORS AND CONTINUING DIRECTORS

There is shown below for each nominee for director and each continuing director, as reported to us as of December 1, 2003, the name, age and principal occupation; the position, if any, with us; the period of service as a director of our company; other public company directorships held; and the committees of the Board of Directors on which the nominee or continuing director serves.

| CLASS III — NOMINEES FOR DIRECTORS WITH TERMS EXPIRING IN 2007 | ||||

| Donald R. Beall | Age 65 | ||

Retired Chairman and Chief Executive Officer, Rockwell. Mr. Beall has been a director of our company since June 2001 and served as non-executive Chairman of the Board from June 2001 to June 2002. He is the Chairman of the Executive Committee and a member of the Technology Committee. Mr. Beall is the retired Chairman and CEO of Rockwell (electronic controls and communications) and was a director of Rockwell from 1978 to February 2001. He served as Chairman/CEO of Rockwell from 1988 to February 1998 and President from 1979 to 1988. Mr. Beall serves on the boards of Conexant Systems, Skyworks Solutions, Mindspeed Technologies, Jazz Semiconductor and CT Realty. He is a former director of Procter & Gamble, Times Mirror, Amoco and ArvinMeritor. He is a trustee of California Institute of Technology, a member of various University of California – Irvine supporting organizations and an Overseer of the Hoover Institution at Stanford. He is an investor, director and/or advisor with several venture capital groups, private companies and investment partnerships. | ||||

| Richard J. Ferris | Age 67 | ||

Retired Co-Chairman, Doubletree Corporation. Mr. Ferris has been a director of our company since June 2001. He is the Chairman of the Compensation Committee and a member of the Audit Committee. Mr. Ferris served as Co-Chairman of Doubletree Corporation (hotel services) and Co-Chairman of Doubletree Partners from 1993 to 1997. He is the former Chairman, President and Chief Executive Officer of UAL Corporation (travel related services), a position he held from April 1976 to June 1987. He was a private investor for more than five years following his resignation from UAL. Mr. Ferris is Chairman, Policy Board of PGA Tour Inc., Co-Chairman of Pebble Beach Co. and is a former director of The Procter & Gamble Company and British Petroleum (BP PLC). | ||||

- 2 -

Table of Contents

| CLASS I — CONTINUING DIRECTORS WITH TERMS EXPIRING IN 2005 | ||||

| General Michael P.C. Carns (U.S. Air Force, Ret.) | Age 66 | ||

Vice Chairman, PrivaSource, Inc.General Carns has been a director of our company since September 2001. He is the Chairman of the Technology Committee and a member of the Board Nominating and Governance Committee. He has been Vice Chairman of PrivaSource Inc. (software firm) since May 2001. He served in the United States Air Force for 35 years until his retirement in September 1994. From May 1991 until his retirement General Carns served as Vice Chief of Staff, United States Air Force. Prior thereto, he served as Director of the Joint Staff, Joint Chiefs of Staff from September 1989. General Carns served as President and Executive Director of the Center for International Political Economy from 1995 to February 2000. General Carns is a director of Engineered Support Systems, Inc., Mission Research Corporation and Mykrolis Corporation and is a former director of DynCorp. Inc. He is also a member of the Department of Defense Science Board and numerous professional and civic organizations. | ||||

| Chris A. Davis | Age 53 | ||

Chairman and Chief Executive Officer, McLeodUSA Incorporated. Ms. Davis has been a director of our company since February 2002. She is a member of the Compensation Committee. Ms. Davis has been Chairman of the Board of Directors and Chief Executive Officer of McLeodUSA Incorporated (telecommunications) since April 2002. She served as Chief Operating and Financial Officer of McLeodUSA from August 2001 to April 2002. She served as Executive Vice President, Chief Financial and Administrative Officer of ONI Systems (telecommunications) from May 2000 to August 2001. She served as Executive Vice President, Chief Financial and Administrative Officer and director of Gulfstream Aerospace Corporation (business aircraft) from 1993 to April 2000. Ms. Davis also serves on the boards of directors of Cytec Industries, Inc. and Wolverine Tube, Inc. and is a Special Limited Partner with Forstmann Little & Co. | ||||

| Joseph F. Toot, Jr. | Age 68 | ||

Retired President and Chief Executive Officer, The Timken Company. Mr. Toot has been a director of our company since June 2001. He is the Chairman of the Audit Committee and a member of the Compensation Committee. Mr. Toot is the retired President and Chief Executive Officer of The Timken Company (tapered roller bearings and specialty steel). He joined The Timken Company in 1962 and served in various senior executive positions until his election as Executive Vice President in 1973, President in 1979 and Chief Executive Officer in 1992. He retired as President and Chief Executive Officer of Timken in December 1997 and then served as Chairman of the Executive Committee from July 1998 until April 2000. Mr. Toot is a director of Timken and Rockwell. He is a member of the Supervisory Board of PSA Peugeot Citroën. Mr. Toot has also served as a director, officer, trustee or member of various community, charitable and philanthropic organizations. | ||||

- 3 -

Table of Contents

CLASS II — CONTINUING DIRECTORS WITH TERMS EXPIRING IN 2006 | ||||

| Anthony J. Carbone | Age 62 | ||

Vice Chairman of the Board and Senior Consultant, The Dow Chemical Company. Mr. Carbone has been a director of our company since June 2001. He is the Chairman of the Board Nominating and Governance Committee and a member of the Audit Committee and the Executive Committee. Mr. Carbone has been Vice Chairman of the Board of Directors of The Dow Chemical Company (chemical, plastic and agricultural products) since February 2000 and Senior Consultant of Dow since November 2000. He served as Executive Vice President of Dow from November 1996 to November 2000 and has served as a director of Dow since 1995. He is a member of the American Chemical Society and former board member and Chairman of the American Plastics Council and the Society of Plastics Industries. Mr. Carbone has also served on the Advisory Council of the Heritage Foundation. | ||||

| Clayton M. Jones | Age 54 | ||

Chairman, President and Chief Executive Officer of the Corporation. Mr. Jones has been a director of our company since March 2001. He has been our Chairman of the Board since June 2002 and President and Chief Executive Officer since June 2001. Mr. Jones is a member of the Executive Committee. He served as Senior Vice President of Rockwell and President of Rockwell Collins, Inc., then a subsidiary of Rockwell, from January 1999 to May 2001. He served as Executive Vice President of Rockwell Collins, Inc. from November 1996 to January 1999. Mr. Jones is a former Air Force fighter pilot. He also serves as a director or member of a number of professional and civic organizations. | ||||

| Cheryl L. Shavers | Age 49 | ||

Chairman and Chief Executive Officer, Global Smarts, Inc. Dr. Shavers has been a director of our company since September 2002. She is a member of the Technology Committee. Dr. Shavers has been the Chairman and Chief Executive Officer of Global Smarts, Inc. (content development) since February 2001. She served as Under Secretary of Commerce for Technology for the United States Department of Commerce from November 1999 to February 2001 after having served as its Under Secretary Designate from April 1999 to November 1999. She served as Sector Manager, Microprocessor Products Group for Intel Corporation (chip maker) prior to April 1999. She also served as non-executive chairman of BitArts Ltd. (software development) from 2001 to the end of December 2003. | ||||

The Board of Directors recommends that you vote “FOR” the election as directors of the two Class III nominees named above, which is presented as item (1) on the accompanying proxy card.

- 4 -

Table of Contents

BOARD OF DIRECTORS AND COMMITTEES

Our business is managed through the oversight and direction of the Board of Directors. Our Board seeks to maintain high corporate governance standards. A substantial majority of our directors are “independent” directors, with independence being defined in a manner consistent with current and amended listing standards of the New York Stock Exchange. The directors regularly keep informed about our business at meetings of the Board and its Committees and through various supplemental reports and communications. Our non-management directors meet regularly in executive sessions without the presence of any corporate officers. These executive sessions are chaired by the Chair of the Executive Committee (currently Mr. Beall) or a director designated by the independent directors who has the relevant background to lead the discussion of a particular matter.

Our corporate governance structure was initially established in 2001 in connection with our becoming an independent, publicly-held company. We continue to enhance our corporate governance structure from time to time in light of recent regulatory activity and based upon a review of recommended best practices. Our corporate governance documents are available on our website atwww.rockwellcollins.com. These documents include our Restated Certificate of Incorporation, By-Laws, Board of Directors Guidelines on Corporate Governance, Committee Charters, Board Membership Criteria and Code of Ethics.

In fiscal year 2003, the Board of Directors held nine meetings and acted on two occasions by unanimous written consent in lieu of a meeting. Average attendance by directors at Board and Committee meetings was over 90%. All of the directors attended 75% or more of the meetings of the Board and the Committees on which they served.

The Board has established five committees whose principal functions are briefly described below.

TheAudit Committee is composed of three independent directors. It assists the Board in overseeing (i) our accounting and financial reporting processes; (ii) the integrity and audits of our financial statements; (iii) our compliance with legal and regulatory requirements; (iv) the qualifications and independence of our independent auditors; and (v) the performance of our internal and independent auditors. The Audit Committee also:

| · | has sole authority to appoint or replace our independent auditors, with that appointment being subject to shareowner approval; |

| · | has sole authority to approve in advance the fees, scope and terms of all audit and non-audit engagements with our independent auditors; |

| · | monitors compliance of our employees with our standards of business conduct and conflict of interest policies; and |

| · | meets at least quarterly with our senior executive officers, internal audit staff and our independent auditors in separate executive sessions. |

The specific functions and responsibilities of the Audit Committee are set forth in the Audit Committee Charter, which is attached as Exhibit A to this Proxy Statement. The Committee met six times during fiscal year 2003.

TheBoard Nominating and Governance Committee, which is composed of two independent directors, has as part of its principal functions seeking, considering and recommending to the Board qualified candidates for election as directors and recommending a slate of nominees for election as directors at the Annual Meeting. It also periodically prepares and submits to the Board for adoption the Committee’s selection criteria for director nominees. It reviews and makes recommendations on matters involving general operation of the Board and our corporate governance, and it annually recommends to the Board nominees for each committee of the Board. In addition, the Committee annually facilitates the assessment of the Board of Directors’ performance as a whole

- 5 -

Table of Contents

and of the individual directors and reports thereon to the Board. The Committee has the sole authority to retain and terminate any search firm to be used to identify director candidates. The Committee members met informally several times during the year and acted on one occasion by unanimous written consent during fiscal year 2003. The Committee will consider nominees for director recommended by shareowners. Shareowners wishing to recommend director candidates for consideration by the Committee can do so by writing to the Board Nominating and Governance Committee, c/o the Secretary of the Corporation at our corporate headquarters in Cedar Rapids, Iowa, giving the candidate’s name, biographical data and qualifications. Any such recommendation must be accompanied by a written statement from the individual of his or her consent to be named as a candidate and, if nominated and elected, to serve as a director.

TheCompensation Committee is composed of three independent directors, who are ineligible to participate in any of the plans or programs which are administered by the Committee, except our Directors Stock Plan. The principal functions of the Compensation Committee are to evaluate the performance of our senior executives; review and approve senior executive compensation plans, policies and programs; consider the design and competitiveness of our compensation plans; administer and review changes to our incentive, deferred compensation, stock option and long-term incentives plans pursuant to the terms of the respective plans; and produce an annual report on executive compensation for inclusion in our proxy statement. The Committee also reviews and approves corporate goals and objectives relevant to CEO compensation, evaluates the CEO’s performance in light of those goals and objectives, and after receiving input from the Board, determines the CEO’s compensation. The Committee has the sole authority to retain and terminate any compensation consultant to be used to assist in the evaluation of CEO or senior executive compensation. The Committee met three times during fiscal year 2003.

TheExecutive Committee is composed of Mr. Jones and two non-management directors. The principal functions of the Executive Committee are to discharge certain responsibilities of the Board of Directors between meetings of the Board of Directors. The Committee may exercise all of the powers of the Board of Directors except it has no power or authority to adopt, amend or repeal any sections or articles of our By-Laws or Restated Certificate of Incorporation; elect or remove officers, directors or committee members; fix compensation for officers, directors or committee members; amend or rescind prior resolutions of the Board; make recommendations to shareowners or approve transactions which require shareowner approval; issue additional stock of the Corporation or fix or determine the designations and any of the rights and preferences of any series of stock or take certain other actions specifically reserved for the Board. The Committee met once during fiscal year 2003.

TheTechnology Committee is composed of three non-management directors. The principal functions of the Technology Committee are to review and oversee important technology-based issues, including the assessment of (i) our investments in technology, research resources and product development; (ii) our technology leadership based upon benchmarking against other recognized technology centers (corporate, government and universities); (iii) the strength and integrity of our engineering and manufacturing processes and disciplines; (iv) the application of information and other advanced technologies in our business to enhance productivity and competitiveness; and (v) the quality of our research and engineering intellectual capital and any related trends. The Committee met two times during fiscal year 2003.

Compensation of Directors

The non-employee directors currently receive a retainer fee at the rate of $74,000 per year for service on the Board of Directors. This annual retainer fee was increased from $50,000 effective July 1, 2003. No additional retainer is paid for service on Committees. Under the Directors Stock Plan, one-half of the retainer is paid in cash quarterly in advance and one-half is paid in restricted shares of Common Stock valued at the closing price of the Common Stock on the date the initial installment of the cash portion of the annual retainer payment is to be made (generally October 1). Under the Directors Stock Plan, each non-employee director is entitled to defer all or any part of the cash portion of his or her retainer by electing to receive additional restricted shares of Common Stock

- 6 -

Table of Contents

valued at the closing price of the Common Stock on the New York Stock Exchange — Composite Transactions Reporting System on the date the cash portion of the retainer payment or fees would otherwise be paid.

Under the Directors Stock Plan, each non-employee director is granted an option to purchase 10,000 shares of Common Stock effective concurrently with the director’s election to our Board. Following the completion of one year of service on the Board, each non-employee director is granted an option to purchase 5,000 shares of Common Stock immediately after each Annual Meeting of Shareowners of the Corporation. All options granted under the Directors Stock Plan are exercisable at the closing price of the Common Stock on the New York Stock Exchange-Composite Transactions Reporting System on the date of grant, and become exercisable in three substantially equal installments on the first, second and third anniversaries of the grant date.

Mr. Beall received, in addition to the standard non-employee director retainer fees described above, a consulting fee of $150,000 for the twelve months ending June 30, 2003 and receives a consulting fee of $50,000 for the twelve months ending June 30, 2004 pursuant to a transition agreement entered into when he ceased serving as our non-executive Chairman. Mr. Beall also currently receives directly or indirectly approximately $19,000 per month for office, telecommunication and administrative services. Payment for these office, telecommunication and administrative services are benefits granted by Rockwell that were assumed by us in the Distribution and are not compensation for services provided to us as a director. Mr. Beall also receives various retirement benefits associated with his years of service with Rockwell that were assumed by us in the Distribution. Mr. Beall, as our then non-executive Chairman of the Board, received a special one-time grant of an option to purchase 150,000 shares of Common Stock effective concurrently with the first grant of options under the 2001 Long-Term Incentives Plan on July 5, 2001. The options are exercisable in three substantially equal installments on the first, second and third anniversaries of the grant date.

CERTAIN TRANSACTIONS AND OTHER RELATIONSHIPS

In connection with the Distribution, we entered into several agreements with Rockwell, including agreements relating to services to be provided by Rockwell to us and by us to Rockwell following the Distribution. At the time these agreements were negotiated and executed, certain of our directors and executive officers also served as directors and executive officers of Rockwell. We believe the terms of these agreements to be fair.

There are no other material transactions or other relationships between us and our directors, executive officers or principal shareowners (or any persons or entities affiliated with them), except for director compensation, Mr. Beall’s consulting arrangements and Mr. Beall’s Rockwell benefits assumed by us, as described above under the heading “Corporate Governance; Board of Directors and Committees — Compensation of Directors” or except as set forth below in connection with executive compensation matters.

Ms. Davis joined McLeodUSA in August 2001 as Chief Operating and Financial Officer and as a director of the company to effect a turnaround. On January 31, 2002 McLeodUSA filed for a pre-negotiated restructuring under Chapter 11 of the Federal Bankruptcy Code. The bankruptcy court approved the restructuring plan on April 5, 2002 and McLeodUSA emerged from Chapter 11 on April 16, 2002.

The Audit Committee of the Board of Directors, which consists entirely of directors who have been deemed “audit committee financial experts” (as defined by applicable Securities and Exchange Commission rules) by our Board and who meet the current and amended independence and other requirements of the New York Stock Exchange and applicable law, has furnished the following report:

We assist the Board of Directors in overseeing and monitoring the integrity of our financial reporting process, our compliance with legal and regulatory requirements and the quality of our internal and external audit

- 7 -

Table of Contents

processes. Our role and responsibilities are set forth in a written Charter adopted by the Board of Directors, which is attached as Exhibit A to this Proxy Statement. We review and reassess the Charter annually and recommend any changes to the Board for approval.

We are responsible for overseeing our overall financial reporting process. In fulfilling our responsibilities for the financial statements for fiscal year 2003, we:

| · | Reviewed and discussed the audited financial statements for the fiscal year ended September 30, 2003 with management and Deloitte & Touche LLP (“Deloitte”), the Corporation’s independent auditors; |

| · | Discussed with Deloitte the matters required to be discussed by Statement on Auditing Standards No. 61 relating to the conduct of the audit; and |

| · | Received written disclosures and the letter from Deloitte regarding its independence as required by Independence Standards Board Standard No. 1. We discussed with Deloitte the independence of Deloitte, and considered whether the provision of non-audit services by Deloitte is compatible with maintaining the independence of Deloitte. All audit and non-audit services provided to the Corporation in fiscal year 2003 by Deloitte were pre-approved by us. |

Based on our review of the audited financial statements and discussions with management and Deloitte, we recommended to the Board of Directors that the audited financial statements be included in our Annual Report on Form 10-K for the fiscal year ended September 30, 2003 for filing with the Securities and Exchange Commission.

We selected Deloitte as auditors of the Corporation for the fiscal year ending September 30, 2004, subject to the approval of shareowners.

Audit Committee

Joseph F. Toot, Jr.,Chairman

Anthony J. Carbone

Richard J. Ferris

- 8 -

Table of Contents

EQUITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Principal Shareowners

The following table provides information about each shareowner known to us to own beneficially more than 5% of the outstanding shares of our Common Stock and information about the ownership of Common Stock under our Savings Plans.

Name and Address of Beneficial Owner | Shares | Percent of Class(1) | |||

Barclay Global Investor International | 15,134,139 | 8.5 | % | ||

45 Fremont Street | |||||

San Francisco, CA 94105(2) | |||||

T. Rowe Price Associates, Inc. | 13,663,963 | 7.7 | % | ||

100 E. Pratt Street | |||||

Baltimore, MD 21202(3) | |||||

Wells Fargo Bank, N.A. | 13,627,891 | 7.7 | % | ||

Los Angeles, CA | |||||

(as trustee under Rockwell Automation’s Savings Plans)(4) | |||||

Fidelity Management Trust Company | 5,187,864 | 2.9 | % | ||

Boston, MA | |||||

(as trustee under our Savings Plans)(5) | |||||

| (1) | Percent of class calculation is based on 178,056,428 shares of Common Stock outstanding as of December 15, 2003. |

| (2) | This information is based on a Schedule 13F filed with the Securities and Exchange Commission (“SEC”) by this shareowner reporting that it beneficially owned 15,134,139 shares of Common Stock as of September 30, 2003. |

| (3) | This information is based on a Schedule 13F filed with the SEC by this shareowner reporting that it beneficially owned 13,663,963 shares of Common Stock as of September 30, 2003. In a Schedule 13G filed with the SEC in February 2003 reporting beneficial ownership data, the shareowner reported that it held sole voting power with respect to 2,631,552 shares of Common Stock and sole dispositive power with respect to 11,987,793 shares of Common Stock. |

| (4) | This information is based on data provided by the trustee as of December 15, 2003. Shares held by the trustee under these Savings Plans on account of the participants in such plans will be voted by the trustee in accordance with written instructions from the participants, or instructions given by the participant pursuant to our telephone or Internet voting procedures, and where no instructions are received, as the trustee deems proper. |

| (5) | This information is based on data provided by the trustee as of December 15, 2003. Shares held by the trustee under these Savings Plans on account of the participants in such plans will be voted by the trustee in accordance with written instructions from the participants, or instructions given by the participant pursuant to our telephone or Internet voting procedures, and where no instructions are received, the trustee will vote such shares in the same proportion on each issue as it votes those shares for which it has received voting directions from participants. |

- 9 -

Table of Contents

Management Equity Ownership

The following table shows the beneficial ownership, reported to us as of December 1, 2003, of our Common Stock, including shares as to which a right to acquire ownership within 60 days exists (for example, through the exercise of stock options or through various trust arrangements) within the meaning of Rule 13d-3(d)(1) under the Securities Exchange Act of 1934, as amended, of each director, each executive officer listed in the table on page 11 and of such persons and other executive officers as a group.

| Beneficial Ownership on December 1, 2003 | |||||

Name | Shares(1) | Percent of Class(2) | |||

Clayton M. Jones | 842,860(3,4 | ) | —* | ||

Donald R. Beall | 860,660(4,5,6 | ) | —* | ||

Anthony J. Carbone | 14,494(4,5 | ) | —* | ||

Michael P.C. Carns | 12,577(4,5 | ) | —* | ||

Chris A. Davis | 6,745(4,5 | ) | —* | ||

Richard J. Ferris | 14,494(4,5 | ) | —* | ||

Cheryl L. Shavers | 6,071(4,5 | ) | —* | ||

Joseph F. Toot, Jr. | 36,728(4,5 | ) | —* | ||

Robert M. Chiusano | 202,242(3,4 | ) | —* | ||

Gregory S. Churchill | 91,255(3,4 | ) | |||

Lawrence A. Erickson | 222,725(3,4,7 | ) | —* | ||

Gary R. Chadick | 76,885(3,4 | ) | —* | ||

All of the above and other executive | 2,881,810(3,4,5,6,7 | ) | 1.6 | ||

| * | Less than 1% |

| (1) | Each person has sole voting and investment power with respect to the shares listed unless otherwise indicated. |

| (2) | The shares owned by each person, and by the group, and the shares included in the number of shares outstanding have been adjusted, and the percentage of shares owned has been computed, in accordance with Rule 13d-3(d)(1) under the Securities Exchange Act of 1934. |

| (3) | Includes shares held under our Savings Plan as of December 1, 2003. Does not include 4,686 share equivalents for Mr. Jones, 1,901 share equivalents for Mr. Chiusano, 209 share equivalents for Mr. Churchill, 500 share equivalents for Mr. Erickson, 120 share equivalents for Mr. Chadick and 8,202 share equivalents for the group, held under our Supplemental Savings Plan as of December 1, 2003. |

| (4) | Includes shares which may be acquired upon the exercise of outstanding stock options that are or will become exercisable within 60 days as follows: 766,882 for Mr. Jones, 690,797 for Mr. Beall, 6,666 for Mr. Carbone, 6,666 for Gen. Carns, 3,333 for Ms. Davis, 6,666 for Mr. Ferris, 3,333 for Dr. Shavers, 17,379 for Mr. Toot, 199,359 for Mr. Chiusano, 84,853 for Mr. Churchill, 204,883 for Mr. Erickson, 73,332 for Mr. Chadick and 2,506,534 for the group. |

| (5) | Includes 17,252 shares for Mr. Beall, 7,828 shares for Mr. Carbone, 5,911 shares for Gen. Carns, 3,412 shares for Ms. Davis, 7,828 shares for Mr. Ferris, 2,738 shares for Dr. Shavers and 8,149 shares for Mr. Toot granted as restricted stock as compensation for services as directors. |

| (6) | Includes shares held under Rockwell’s Savings Plan as of December 1, 2003. |

| (7) | Includes 6,183 shares held by Mr. Erickson’s spouse. |

- 10 -

Table of Contents

The following table sets forth information concerning the annual and long-term compensation, from all sources, of our chief executive officer and our other four most highly compensated executive officers at September 30, 2003 (the “Named Executive Officers”) for services rendered in all capacities to us and our subsidiaries or to Rockwell and its subsidiaries for the fiscal years noted. This table does not reflect the compensation to be paid to our executive officers in the future.

Summary Compensation Table

| Annual Compensation | Long-Term Compensation | All Other Compensation(7) | |||||||||||||||||

Name and Principal Position | Year | Salary(1) | Bonus(2) | Other Annual Compensation(3) | Stock Options (Shares)(4)(5) | Long- Term Incentive Payouts(6) | |||||||||||||

Clayton M. Jones | 2003 2002 | $

| 700,000 550,000 441,250 | $

| 525,000 500,000 310,000 | $ | 32,678 33,128 | — 250,000 | $

| 2,475,000 — — | $ | 42,000 33,000 | |||||||

Robert M. Chiusano | 2003 2002 |

| 331,250 275,000 |

| 142,000 150,000 |

| 27,834 27,603 | — 100,000 |

| 843,750 — — |

| 19,875 16,500 | |||||||

Lawrence A. Erickson | 2003 2002 |

| 306,250 250,000 |

| 137,000 125,000 |

| 25,403 23,701 | — 90,000 |

| 843,750 — — |

| 18,375 15,000 | |||||||

Gregory S. Churchill(8) | 2003 2002 2001 |

| 285,000 200,000 |

| 135,000 68,000 |

| 23,229 33,958 — | — 115,000 |

| 677,250 — — |

| 17,100 12,000 | |||||||

Gary R. Chadick(9) | 2003 2002 2001 | | 280,000 250,000 49,295 | | 110,000 105,000 24,000 | | 24,200 20,200 17,485 | — 50,000 |

| 479,250 — — |

| 16,800 — | |||||||

| (1) | Salaries were generally frozen for all employees, including executives, in fiscal year 2002 as part of cost-saving measures undertaken in response to the anticipated decline in sales resulting from the events of September 11, 2001. Effective January 1, 2003, the annual salaries of Messrs. Jones, Chiusano, Erickson, Churchill and Chadick were set at $750,000, $350,000, $325,000, $300,000 and $290,000, respectively. |

| (2) | Amounts awarded, even if deferred, under our Annual Incentive Compensation Plans for fiscal years 2003, 2002 and 2001. |

| (3) | Includes the aggregate incremental cost to us of providing perquisites and personal benefits to the Named Executive Officers for each of the last three years. The amounts reported in this column, which represent at least 25% of the total amount reported, are as follows: Mr. Jones $25,200 in 2003, $24,800 in 2002 and $20,400 in 2001 for automobile allowance and $8,751 in 2001 for tax-gross up for social clubs; Mr. Chiusano $20,400 in 2003, $20,200 in 2002 and $18,000 in 2001 for automobile allowance; Mr. Erickson $20,400 in 2003, $20,200 in 2002 and $18,000 in 2001 for automobile allowance; Mr. Churchill $20,400 in 2003 and $17,300 in 2002 for automobile allowance and $16,463 in 2002 for tax-gross up for social clubs; and Mr. Chadick $20,400 in 2003 and $20,200 in 2002 for automobile allowance and $13,660 in 2001 for tax-gross up for social clubs. |

| (4) | References to “stock options” relate to awards of options under our 2001 Long-Term Incentives Plan and under Rockwell’s 2000 Long-Term Incentives Plan. Options awarded under the Rockwell plan were assumed by us and, after certain adjustments to reflect the effect of the Distribution and to preserve the intrinsic value of the options, now relate to our Common Stock and are deemed to have been granted under our 2001 Stock Option Plan. |

| (5) | There were no grants of options to purchase Common Stock during the fiscal year ended September 30, 2003. However, grants of options were made to the Named Executive Officers in November 2003. Option grants have generally been made annually, but the fourteen month period between the grants made in September 2002 and those made in November 2003 spanned more than the full fiscal year 2003. |

| (6) | Cash and market value of Rockwell Collins common stock issued in respect of performance units granted under long-term incentive plans for the two-year performance period ended September 30, 2003. |

| (7) | Amounts contributed or accrued for the Named Executive Officers under the Rockwell and Rockwell Collins savings plans and the related supplemental savings plans, and the Rockwell and Rockwell Collins deferred compensation plans. |

| (8) | Mr. Churchill was elected an executive officer in June 2002. |

| (9) | Mr. Chadick became an executive officer in September 2001 after joining us in July 2001. |

- 11 -

Table of Contents

We have entered into change of control employment agreements with each of the Named Executive Officers and with certain other executives. Each employment agreement is set to expire in or near July 2005 and becomes effective upon a “change of control” of the Corporation during the term. Each employment agreement provides for the continuing employment of the executive for three years after the change of control on terms and conditions no less favorable than those in effect before the change of control. If the executive’s employment is terminated by us without “cause” or if the executive terminates his or her own employment for “good reason” within that three year period, the executive is entitled to severance benefits equal to a multiple of his or her annual compensation, including bonus, and continuation of other benefits for a number of years equal to the multiple. The multiple is 3 for each of the Named Executive Officers and 3 or 2 for the other executives. In addition, if the executive terminates his or her own employment for any reason during the 30-day window period beginning one year after the change of control, the executive is also entitled to these severance benefits. The executives are entitled to an additional payment, if necessary, to make them whole as a result of any excise tax imposed by the Internal Revenue Code on these change of control payments, unless the safe harbor amount above which the excise tax is imposed is not exceeded by more than 10%, in which event the payments will be reduced to avoid the excise tax.

There were no grants to the Named Executive Officers of options to purchase Common Stock during the fiscal year ended September 30, 2003. However, grants of options were made to the Named Executive Officers in November 2003. Option grants have generally been made annually, but the fourteen month period between the grants made in September 2002 and those made in November 2003 spanned more than the full fiscal year 2003. Information about the November 2003 grants to the Named Executive Officers has been reported on Forms 4 filed with the SEC for these officers.

LONG-TERM INCENTIVES PLAN — AWARDS IN LAST FISCAL YEAR

There were no multi-year performance units awarded to the Named Executive Officers during the fiscal year ended September 30, 2003. However, such awards were granted to the Named Executive Officers in November 2003. Awards have generally been made annually, but the fourteen month period between the awards made in September 2002 and those made in November 2003 spanned more than the full fiscal year 2003.

- 12 -

Table of Contents

AGGREGATED OPTION EXERCISES AND FISCAL YEAR-END VALUES

The following table shows (i) exercises by the Named Executive Officers during fiscal year 2003 of options to purchase Common Stock granted under our 2001 Long-Term Incentives Plan or deemed to have been granted under our 2001 Stock Option Plan; and (ii) unexercised options to purchase Common Stock granted to the Named Executive Officers in fiscal year 2003 and prior years under such plans and held by them at September 30, 2003.

| Shares Acquired on Exercise | Value Realized | Number of Unexercised Options Held At September 30, 2003(1) | Value of Unexercised In-the-Money Options At September 30, 2003(1)(2) | ||||||||||||

| Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||||

Clayton M. Jones | 8,801 | $ | 45,467 | 772,052 | 404,568 | $ | 2,775,991 | $ | 1,068,667 | ||||||

Robert M. Chiusano | 29,011 | $ | 193,883 | 190,235 | 137,867 | $ | 465,120 | $ | 402,130 | ||||||

Gregory S. Churchill | — | — | 82,599 | 92,970 | $ | 276,029 | $ | 310,271 | |||||||

Lawrence A. Erickson | — | — | 196,833 | 127,712 | $ | 623,777 | $ | 384,236 | |||||||

Gary R. Chadick | — | — | 73,332 | 61,668 | $ | 422,660 | $ | 318,340 | |||||||

| (1) | Includes options that were granted by Rockwell prior to the Distribution that were converted into options to purchase our Common Stock, on the same terms and vesting schedule as the Rockwell options but with adjustments to the exercise price and the number of shares for which such options are exercisable to preserve the aggregate intrinsic value of the options. |

| (2) | The value of unexercised options is based on the difference between the exercise price and the closing price of our Common Stock on September 30, 2003 ($25.25), the last trading day in fiscal year 2003. |

All of the Named Executive Officers participate in a defined benefit pension plan which qualifies under Section 401(a) of the Internal Revenue Code.

The following table shows the estimated annual retirement benefits payable on a straight life annuity basis to executive officers, in the earnings and years of service classifications indicated, under our retirement plans on a noncontributory basis. The executive officers are covered by enhanced, early build-up retirement benefit provisions broadly available to the other plan participants hired before 1993. The retirement benefits reflect a reduction to recognize in part our cost of Social Security benefits related to service for us and Rockwell. The plans also provide for the payment of benefits to an employee’s surviving spouse or other beneficiary based upon the employee’s election at retirement. Employees and their beneficiaries receive reduced annual benefits if the surviving spouse or other beneficiary benefits apply.

| Average Annual Earnings | Estimated Annual Retirement Benefits for Retirements in 2004 For Years of Credited Service | |||||||||||||||||||||

| 5 Years | 10 Years | 15 Years | 20 Years | 25 Years | 30 Years | 35 or More Years | ||||||||||||||||

| $ | 250,000 | $ | 32,388 | $ | 64,806 | $ | 97,195 | $ | 102,895 | $ | 108,596 | $ | 114,296 | $ | 119,996 | |||||||

| 500,000 | 65,713 | 131,481 | 197,195 | 209,145 | 221,096 | 233,046 | 244,996 | |||||||||||||||

| 750,000 | 99,038 | 198,156 | 297,195 | 315,395 | 333,596 | 351,796 | 369,996 | |||||||||||||||

| 1,000,000 | 132,363 | 264,831 | 397,195 | 421,645 | 446,096 | 470,546 | 494,996 | |||||||||||||||

| 1,500,000 | 199,013 | 398,181 | 597,195 | 634,145 | 671,096 | 708,046 | 744,996 | |||||||||||||||

Covered compensation includes salary and annual bonus. The calculation of retirement benefits under the plans generally is based upon average earnings for the highest five years of the ten years preceding retirement. Such average compensation as of September 30, 2003 for Mr. Jones was $725,667; for Mr. Chiusano was $354,110; for Mr. Erickson was $313,737; for Mr. Churchill was $210,866; and for Mr. Chadick was $244,898.

- 13 -

Table of Contents

The credited years of service as of September 30, 2003 of Messrs. Jones, Chiusano, Erickson, Churchill and Chadick are 24, 25, 28, 23 and 2 years, respectively.

Sections 401(a)(17) and 415 of the Internal Revenue Code limit the annual benefits which may be paid from a tax-qualified retirement plan. As permitted by the Employee Retirement Income Security Act of 1974, we have established a non-qualified supplemental pension plan which authorizes the payment of any benefits calculated under provisions of the applicable retirement plan which may be above the limits under these sections.

The Named Executive Officers also participate in or are eligible to participate in our non-qualified supplemental savings plan and deferred compensation plan. We have established a master rabbi trust relating to these non-qualified plans and the non-qualified pension plan. The master rabbi trust requires that, upon a change of control, we fund the trust in a cash amount equal to the unfunded accrued liabilities of these non-qualified plans as of such time.

The company announced on August 7, 2003 that its U.S. qualified and non-qualified defined benefit pension plans would no longer accrue benefits for salary increases and service rendered after September 30, 2006. This change affects all the company’s domestic pension plans covering salaried and hourly employees not covered by collective bargaining agreements, including the Named Executive Officers.

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Compensation Committee of the Board of Directors, which consists entirely of independent directors, has furnished the following report on executive compensation:

Compensation Philosophy

We have developed and implemented compensation policies, plans and programs intended to “pay for performance”. We set base salaries and incentive compensation to be competitive with other major U.S. industrial and peer companies. We consider the total compensation (earned or potentially available) of each of the Named Executive Officers and the other designated senior executives in establishing each element of compensation. In our review, we consider the following: (1) industry, peer group and national surveys of other major U.S. industrial companies; (2) reports of the independent compensation consultants who advise us on our compensation programs in comparison with those of other companies which the consultants believe compete with us for executive talent; and (3) performance judgments as to the past and expected future contributions.

Compensation for Fiscal Year 2003

· Base Salary — The base salaries of the senior executives, including the Named Executive Officers, had been frozen for fiscal year 2002 as part of the cost-saving actions undertaken in response to the sudden and severe decline in anticipated sales volumes in the commercial air transport market resulting from the September 11, 2001 terrorist acts. The base salaries of these senior executives were increased by us effective January 1, 2003 after consultation with our independent compensation advisors. The recommended base salaries were based on data from industry, peer group and national surveys of other major U.S. industrial companies that are believed to compete with us for executive talent.

· Annual Incentives — Each year, we review with the Chief Executive Officer the company goals and objectives tied to annual incentives. These include measurable financial return and shareowner value creation objectives as well as long-term leadership goals that in part require more subjective assessments. We also establish annually the target payouts for the individual executives based on levels of responsibilities and consultation with our independent compensation advisors. After the end of the fiscal year, we evaluate corporate

- 14 -

Table of Contents

and business unit or shared service performance and consider the results together with the contributions made by the individual executives in awarding annual incentive compensation.

We assessed our fiscal year 2003 performance in November 2003, evaluated the assessment by our Chief Executive Officer of individual performance of key employees other than himself, applied the methodology set for that year and granted annual incentive compensation awards (see the column headed “Bonus” in the Summary Compensation Table underExecutive Compensation above) to the Named Executive Officers and other designated senior executives. The company’s financial performance against the sales, earnings per share and working capital goals yielded payouts for participants at 75% of each person’s target (subject to adjustment for reporting unit and individual performance). Our Annual Incentive Compensation Plan for Senior Executive Officers (Senior Executive ICP), approved by shareowners at the 2002 Annual Meeting, provides for a maximum amount for the awards that can be allocated each year to our Chief Executive Officer and to the other Named Executive Officers.

· Long Term Incentives— Annually we evaluate the type of long-term incentives we believe are most likely to achieve our total compensation objectives. Our present intention is to provide long-term incentives through the annual grant of stock options and multi-year performance unit awards, denominated in cash and/or stock (LTIPs). We consider these stock option and LTIP grants to executives to be an important component of our pay for performance philosophy. The awards are designed to align management’s interests with those of our shareowners and to reward outstanding performance. We believe that the stock option and LTIP grants serve as an important retention tool because the stock options vest in three equal installments over a three year period and each cash LTIP is paid after a multi-year performance period.

Although no stock options or LTIPs were granted during fiscal year 2003, we did determine in November 2003 the payouts for the two year LTIP covering fiscal years 2002 and 2003. This LTIP was established at the spin-off in 2001 to focus executive management of the new company on the achievement of free cash flow goals. The generation of significant free cash flow is critical to the long-term success of Rockwell Collins as a public company and to the creation of shareowner value. This focus on free cash flow resulted in achievements which were over 250% greater than the free cash flow generated by the company in the prior two-year period. In addition, the executives exceeded the two-year goal for free cash flow by over 50%. This outstanding achievement resulted in a payment of the maximum award to approximately 100 executives of the company based on the formula established for this award. Consistent with our desire to link compensation with the longer-term interests of shareowners and for the executives to have significant stock ownership in the company, we offered them the choice to elect to receive some or all of their LTIP, net of tax withholding, in Rockwell Collins stock.

Compensation of the Chief Executive Officer

Mr. Jones’ base salary of $750,000 was effective January 1, 2003 after having been frozen since June 2001 (seeCompensation for Fiscal Year 2003 — Base Salary above). We believe this salary is in line with our compensation philosophy for the Named Executive Officers and was determined after consultation with our independent compensation advisors.

In determining Mr. Jones’ annual incentive for the fiscal year 2003 and the LTIP payout for the fiscal years 2002 and 2003, we assessed his individual performance against his personal goals and the enterprise goals for fiscal year 2003 and otherwise used the same criteria as for the other four Named Executive Officers (seeCompensation for Fiscal Year 2003 above). The $525,000 annual incentive amount awarded Mr. Jones in November 2003 was determined by us after consultation with our independent compensation consultant and without any recommendation from management.

In accordance with the terms of the two-year cash LTIP covering fiscal years 2002 and 2003, and based on the same award formula as for approximately 100 other executives, the payout for the FY02-FY03 LTIP award

- 15 -

Table of Contents

for Mr. Jones was made at the maximum level. Consistent with our stock ownership requirements, Mr. Jones elected to use 67% of the LTIP payment, net of tax withholding, to purchase Rockwell Collins stock.

Compensation Deductibility

Under Internal Revenue Code Section 162(m), a publicly held company may not deduct in any taxable year compensation in excess of one million dollars paid in that year to its Named Executive Officers unless the compensation is “performance based”. Awards under the Senior Executive ICP, grants of stock options and grants of LTIPs are designed to be “performance based” compensation. Since we retain discretion with respect to base salaries and certain other compensation awards, those elements would not qualify as “performance based” compensation for these purposes. For fiscal year 2003, we believe that all of the compensation for the Named Executive Officers is deductible under this provision.

Compensation Committee

Richard J. Ferris,Chairman

Joseph F. Toot, Jr.

Chris A. Davis

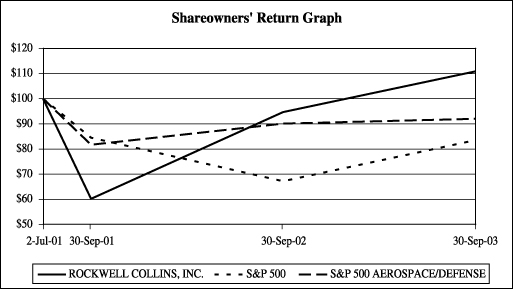

SHAREOWNER RETURN PERFORMANCE PRESENTATION

Comparison of Twenty-Seven-Month Cumulative Total Return

Rockwell Collins, Inc., S&P Composite-500, S&P Aerospace and Defense

The cumulative total returns on our Common Stock and each index as of the dates set forth below and plotted in the above graph are as follows:

| Cumulative Total Returns | ||||||||||||

| 7/2/01 | 9/30/01 | 9/30/02 | 9/30/03 | |||||||||

Rockwell Collins, Inc. | $ | 100.00 | $ | 60.28 | $ | 94.77 | $ | 110.83 | ||||

S&P Composite-500 | 100.00 | 84.47 | 67.17 | 83.55 | ||||||||

S&P Aerospace and Defense | 100.00 | 81.69 | 90.15 | 91.98 | ||||||||

Closing market price at specified date | 23.66 | 14.20 | 21.94 | 25.25 | ||||||||

- 16 -

Table of Contents

PROPOSAL TO APPROVE THE SELECTION OF AUDITORS

The Audit Committee of our Board of Directors has selected the firm of Deloitte & Touche LLP (“Deloitte”) as our auditors for fiscal year 2004, subject to the approval of our shareowners. Deloitte has acted as our auditors since our inception as a public company in June 2001.

Before the Audit Committee selected Deloitte, it carefully considered the qualifications of that firm, including their prior performance and their reputation for integrity and for competence in the fields of accounting and auditing. Representatives of the auditors are expected to be present at the annual meeting, they will have an opportunity to make a statement if they desire to do so, and they are expected to respond to appropriate questions.

Fees Paid to Independent Auditors

The aggregate fees billed by Deloitte in fiscal years 2003 and 2002 were as follows (in thousands):

| 2003 | 2002 | |||||

Audit Fees(1) | $ | 1,748 | $ | 1,397 | ||

Audit-Related Fees(2) | 254 | 526 | ||||

Tax Fees(3) | 2,433 | 2,295 | ||||

All Other Fees | 0 | 0 | ||||

Total | $ | 4,435 | $ | 4,218 | ||

| (1) | For professional services performed by Deloitte for the audit of our annual financial statements and review of financial statements included in our quarterly reports on Form 10-Q and services that are normally provided in connection with statutory and regulatory filings or engagements. |

| (2) | For assurance and related services performed by Deloitte that are reasonably related to the performance of the audit or review of our financial statements. This includes: employee benefit and compensation plan audits; due diligence related to mergers and acquisitions; attestations by Deloitte that are not required by statute or regulations; and consulting on financial accounting and reporting standards. |

| (3) | For professional services performed by Deloitte with respect to tax compliance, tax advice and tax planning. This includes preparation of original and amended tax returns; refund claims; payment planning; tax audit assistance; and tax work stemming from audit-related items. |

The Audit Committee has adopted a pre-approval policy requiring it to pre-approve the audit and permissible non-audit services performed by the independent auditor in order to assure that the provision of such services does not impair the auditor’s independence. The Audit Committee pre-approved all the fiscal year 2003 services provided by Deloitte. The Audit Committee also pre-approved in November 2003 certain audit and non-audit services contemplated to be performed by Deloitte in fiscal year 2004. The pre-approval policy requires that the details be provided to the Audit Committee of the particular service or category of service contemplated to be performed and such services are generally subject to a specific budget. The Audit Committee may also pre-approve separately services to be performed on a case-by-case basis. The Audit Committee may delegate pre-approval authority to one or more of its members, but not to management. Any pre-approvals by a member under this delegation are to reported to the Audit Committee at its next scheduled meeting. Management and Deloitte are required to periodically report to the Audit Committee on the extent of services provided by Deloitte pursuant to the pre-approval, including the fees for the services performed to date.

The Board of Directors recommends that you vote “FOR” the selection of Deloitte & Touche LLP as our auditors, which is presented as item (2) on the accompanying proxy card.

- 17 -

Table of Contents

The two nominees for election as directors to serve until the 2007 Annual Meeting of Shareowners who receive the greatest number of votes cast for the election of directors at the meeting by the holders of our Common Stock entitled to vote at the meeting, a quorum being present, shall become directors at the conclusion of the tabulation of votes. An affirmative vote of the holders of a majority of the voting power of our Common Stock present in person or represented by proxy and entitled to vote at the meeting, a quorum being present, is necessary to approve the selection of Deloitte as our auditors as proposed in item (b) of the accompanying Notice of 2004 Annual Meeting of Shareowners. The presence, in person or by proxy, of the holders of at least a majority of the shares of our Common Stock issued and outstanding on the record date set for the meeting is necessary to have a quorum for the annual meeting.

Under Delaware law and our Restated Certificate of Incorporation and By-Laws, the aggregate number of votes entitled to be cast by all shareowners present in person or represented by proxy at the meeting, whether those shareowners vote “for”, “against” or abstain from voting (including broker non-votes), will be counted for purposes of determining the minimum number of affirmative votes required for approval of item (b) and the total number of votes cast “for” that matter will be counted for purposes of determining whether sufficient affirmative votes have been cast. The shares of a shareowner who abstains from voting on a matter or whose shares are not voted by reason of a broker non-vote on a particular matter will be counted for purposes of determining whether a quorum is present at the meeting so long as the shareowner is present in person or represented by proxy. An abstention from voting or a broker non-vote on a matter by a shareowner present in person or represented by proxy at the meeting has no effect in the election of directors (assuming a quorum is present) and has the same legal effect as a vote “against” any other matter even though the shareowner or interested parties analyzing the results of the voting may interpret such a vote differently.

The Board of Directors does not know of any other matters which may be presented at the meeting. Our By-Laws required notice by November 14, 2003 for any matter to be brought before the meeting by a shareowner. In the event of a vote on any matters other than those referred to in items (a) and (b) of the accompanying Notice of 2004 Annual Meeting of Shareowners, it is intended that proxies in the accompanying form will be voted thereon in accordance with the judgment of the person or persons voting such proxies.

COMPLIANCE WITH SECTION 16(a) OF THE SECURITIES EXCHANGE ACT

Section 16(a) of the Securities Exchange Act requires our executive officers and directors, and persons who own more than ten percent of a registered class of equity securities, to file reports of ownership and changes in ownership on Forms 3, 4 and 5 with the SEC and the New York Stock Exchange. Officers, directors and greater than ten percent shareowners are required by SEC regulation to furnish us with copies of all Forms 3, 4 and 5 they file.

Based solely on our review of copies of such forms we have received and written representations from certain reporting persons confirming that they were not required to file Forms 5 for fiscal year 2003, we believe that all of our officers, directors and greater than ten percent beneficial owners complied with all filing requirements applicable to them with respect to transactions during fiscal year 2003.

Our 2003 Annual Report to Shareowners, including financial statements for the fiscal year ended September 30, 2003, is being mailed to shareowners together with this Proxy Statement.

- 18 -

Table of Contents

We will provide to shareowners, without charge, upon written request, a copy of our Annual Report on Form 10-K for the fiscal year ended September 30, 2003, as filed with the SEC (without exhibits). Exhibits to the Form 10-K will be furnished upon written request and payment of a fee of ten cents per page covering our costs. Written requests should be directed to us at 400 Collins Road NE, Cedar Rapids, Iowa 52498, Attention: Investor Relations.

Our 2003 Annual Report to Shareowners, our Form 10-K for the fiscal year ended September 30, 2003 and this Proxy Statement are also available on our website atwww.rockwellcollins.com. All reports we file with the SEC are also available free of charge via EDGAR through the SEC’s website atwww.sec.gov.

SHAREOWNER PROPOSALS FOR ANNUAL MEETING IN 2005

To be eligible for inclusion in our proxy statement, shareowner proposals for our 2005 Annual Meeting of Shareowners must be received by us on or before August 19, 2004 at the Office of the Secretary at our corporate headquarters, 400 Collins Road NE, Cedar Rapids, Iowa 52498. In addition, our By-Laws require a shareowner desiring to propose any matter for consideration of the shareowners at our 2005 Annual Meeting of Shareowners to notify our Secretary in writing at the address listed in the preceding sentence on or after October 11, 2004 and on or before November 11, 2004. If the number of directors to be elected to the Board at our 2005 Annual Meeting of Shareowners is increased and there is no public announcement by us naming all of the nominees for director or specifying the increased size of the Board on or before November 1, 2004, a shareowner proposal with respect to nominees for any new position created by such increase will be considered timely if received by our Secretary not later than the tenth day following such public announcement by us.

The cost of the solicitation of proxies will be borne by us. In addition to the use of the mail, proxies may be solicited personally, or by telephone, facsimile or e-mail, by a few of our regular employees without additional compensation. We will reimburse brokers and other persons holding stock in their names, or in the names of nominees, for their expenses for sending proxy material to principals and obtaining their proxies.

ELECTRONIC DELIVERY OF PROXY MATERIALS

As an alternative to receiving printed copies of annual reports and proxy materials in future years, we offer shareowners the opportunity to receive annual report and proxy mailings electronically. One of our main goals is to maximize shareowner value. In addition to aligning our businesses to focus on the unique issues and needs of our customers, we are leveraging technology to maximize cost savings. By consenting to electronic delivery of future annual reports and proxy statements, you will help us reduce printing and postage costs.

To take advantage of this offer, please indicate your consent by following the instructions provided on the accompanying proxy card or as you vote by telephone or Internet. You can also elect to receive all materials, including voting instructions, via e-mail for future meetings by following the instructions when voting by Internet or you can enroll atwww.investordelivery.com. Please have the proxy card you received in hand when making this election. If you are a record owner, you may go to the websitewww.melloninvestor.com, click on Investor ServiceDirect and follow the prompts. If you own your shares through a broker or bank or other nominee, you may contact them directly to request electronic delivery. You must have access to a computer and the Internet and expect to have such access in the future to be eligible.Selecting this option means that you will no longer receive a printed copy of our annual report and proxy statement unless you request one. Each year you will receive information regarding the Internet website containing the annual report and proxy statement and voting instructions. If you consent to electronic delivery, you will be responsible for your usual telephone

- 19 -

Table of Contents

and Internet charges (e.g., online fees) in connection with the electronic delivery of the proxy materials and annual report.

Your consent to electronic delivery will be effective until you revoke it. You may cancel your consent at no cost to you at any time by calling 1-888-253-4522, by written notification to Mellon Investor Services LLC, PO Box 3315, South Hackensack, NJ 07606 or through the Internet websitewww.melloninvestor.com orwww.investordelivery.com or by contacting your broker, bank or other nominee.

Why are you receiving this proxy statement? We are furnishing this proxy statement to you in connection with the solicitation of proxies by the Board of Directors of Rockwell Collins, Inc. for use at the 2004 Annual Meeting of Shareowners to be held on February 10, 2004, and at any adjournments thereof.

On December 26, 2003, we commenced mailing to our shareowners: (1) this proxy statement, (2) the accompany proxy card, and (3) a copy of our 2003 Annual Report to Shareowners.

What is a proxy? A proxy is your legal designation of another person to vote the shares you own. That other person is called a proxy. If you designate someone as your proxy in a written document, that document is also called a proxy or a proxy card.

What is a proxy statement? This document is a proxy statement. It is a document that we are required by law to give you when we ask you to name a proxy to vote your shares. We encourage you to read this proxy statement carefully. In addition, you may obtain information about Rockwell Collins, Inc. from the 2003 Annual Report delivered with this proxy statement.

What is the purpose of the meeting? The purpose of the 2004 Annual Meeting of Shareowners is to obtain shareowner action on the matters outlined in the notice of meeting included with this proxy statement. These matters include the election of two directors and approval of the selection of Deloitte & Touche LLP as our independent auditors for fiscal year 2004. This proxy statement provides you with detailed information about each of these matters.

Who can vote? Shareowners of record as of the close of business on December 15, 2003 are entitled to vote. On that day, 178,056,428 shares of Common Stock were outstanding and eligible to vote. Each share is entitled to one vote on each matter presented at the Annual Meeting.

What is the difference between a record owner and an owner holding shares in “street name”? If your shares are registered in your name, you are a record owner. If your shares are in the name of your broker or bank or other nominee, your shares are held in “street name”.

How do you vote if your shares are held in your name as a record owner? You have a choice of voting by:

| · | Internet; |

| · | Telephone; |

| · | Mail; or |

| · | In person at the Annual Meeting. |

Voting on the Internet is easy and fast. Go to the website referenced on the enclosed proxy card and follow the instructions. Please have the proxy card in hand when going online. This vote will be counted immediately, and there is no need to send in the proxy card.

- 20 -

Table of Contents

Voting by telephone is also simple and fast. Call the toll-free number on the proxy card and listen for further instructions. In order to respond to the questions, you must have a touch-tone phone and the proxy card in hand. This vote will be counted immediately, and there is no need to send in the proxy card.

If you are a shareowner of record, you can save us money by voting by telephone or on the Internet. Alternatively, you can vote by mail by completing, signing, dating and mailing the enclosed proxy card.

If you plan to attend the Annual Meeting, you can vote in person. In order to vote in person at the Annual Meeting, you will need to bring proper identification with you to the meeting.

As long as your shares are registered in your name, you may revoke your proxy at any time before it is exercised. There are several ways you can do this:

| · | By filing a written notice of revocation with our Corporate Secretary; |

| · | By duly signing and delivering a proxy that bears a later date; |

| · | By subsequently voting by telephone or Internet as described above; or |

| · | By attending the Annual Meeting and voting in person. |

How do you vote if your shares are held in “street name”? If your shares are registered in the name of your broker or nominee, you should vote your shares using the method directed by that broker or other nominee. A large number of banks and brokerage firms are participating in the ADP Investor Communication Services online program. This program provides eligible “street” name shareowners the opportunity to vote via the Internet or by telephone. Voting forms will provide instructions for shareowners whose banks or brokerage firms are participating in ADP’s program. If you plan to attend the Annual Meeting and to vote in person, you should contact your broker or nominee to obtain a broker’s proxy card and bring it, together with proper identification and your account statement or other evidence of your share ownership, with you to the Annual Meeting. If your shares are held in street name, you must contact your broker or nominee to revoke your proxy.

How do you vote if you participate in our Direct Stock Purchase and Dividend Reinvestment Plan?Shareowners participating in the Mellon Bank, N.A. Investor Services Program for Rockwell Collins shareowners that allows for direct stock purchases and dividend reinvestment are record owners, and Mellon Bank will vote the shares that it holds for the participant’s account only in accordance with the proxy returned by the participant to Mellon, or in accordance with instructions given pursuant to our telephone or Internet voting procedures.

How do you vote shares held in the Rockwell Collins Savings Plans and the Rockwell Automation Savings Plans? If you are a participant in the Rockwell Collins Savings Plans and/or Rockwell Automation Savings Plans, the card entitled “Direction Card” will serve as the voting instruction card to the trustee of the plans for all shares of our Common Stock you own through the plan(s).

Will your vote be confidential? It is our policy to keep confidential the proxy cards, ballots and voting tabulations that identify individual shareowners, except as may be necessary to meet any applicable legal requirements and, in the case of any contested proxy solicitation, as may be necessary to permit proper parties to verify the propriety of proxies presented by any person and the results of the voting. The judges of election and any employees associated with processing proxy cards or ballots and tabulating the vote are required to acknowledge their responsibility to comply with this policy of confidentiality.

What are your voting choices and what is the required vote? By giving us your proxy, you authorize our management to vote your shares at the Annual Meeting or any adjournments thereof in the manner you indicate.

- 21 -

Table of Contents

Proposal 1: Election of Directors. With respect to the election of nominees for director, you may:

| · | Vote “for” the election of both of the nominees for director named in this proxy statement; |

| · | “Withhold” authority to vote for both of the nominees; or |

| · | Withhold authority to vote for any individual nominee by writing that nominee’s number in the space provided. |

If a quorum is present at the Annual Meeting, the two nominees receiving the greatest number of votes will be elected to serve as directors. Because of this, non-voted shares and shares whose votes are withheld will not affect the outcome of the election for directors. Shareowners may not vote for more than two nominees.

Proposal 2: Approval of Selection of Auditors. With respect to the proposal to approve the appointment of Deloitte & Touche LLP as our independent auditors for fiscal year 2004, you may:

| · | Vote “for” the selection of auditors; |

| · | Vote “against” the selection of auditors; or |

| · | “Abstain” from voting on the proposal. |