UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2007

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission file number 000-27277

RENEW ENERGY RESOURCES, INC.

f/k/a

VITALTRUST BUSINESS DEVELOPMENT CORPORATION

(Exact name of registrant as specified in its charter)

Nevada | 61-1564593 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

5025 W. Lemon Street, Suite 200, Tampa , Florida 33609

(Address of principal executive offices)

Registrant's telephone number, including area code: (813)-637-2233

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

State the issuer’s revenues for its most recent fiscal year $0.00

Indicate by check mark whether the registrant is an accelerated filer (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

Indicate by checkmark whether this Registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act). Yes o No x

State the aggregate market value of the voting stock held by non-affiliates computed by reference to the price at which the stock was sold or the average bid and ask prices as of May 1, 2008: $28,120,559.22 (based on bid of $0.18 and ask of $0.18 and 61,225,259 shares held by non-affiliates).

State the number of shares outstanding of each of the issuer's classes of common equity, as of the latest practicable date.

| Class | Outstanding at June 15, 2008 |

| | |

| Common Stock, $.001 par value | 183,817,362 |

TABLE OF CONTENTS

PART I |

| | | |

| Item 1. | Business | |

| | | |

| Item 1A. | Risk Factors | 15 |

| | | |

| Item 2. | Properties | 20 |

| | | |

| Item 3. | Legal Proceedings | 20 |

| | | |

| Item 4. | Submission of Matters to a Vote of Security Holders | 22 |

| | | |

PART II |

| | | |

| Item 5. | Market for Registrant’s Common Equity and Related Stockholders Matters | 23 |

| | | |

| Item 6. | Selected Financial Data | 24 |

| | | |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 25 |

| | | |

| Item 7A. | Quantitative and Qualitative Disclosures about Market Risk | 29 |

| | | |

| Item 8. | Financial Statements and Supplementary Data | 30 |

| | | |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 30 |

| | | |

| Item 9A. | Control and Procedures | 30 |

| | | |

PART III |

| | | |

| Item 10. | Directors and Executive Officers of the Registrant | 30 |

| | | |

| Item 11. | Executive Compensation | 34 |

| | | |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 35 |

| | | |

| Item 13. | Certain Relationships and Related Transactions | 35 |

| | | |

| Item 14. | Principal Accounting Fees and Services | 36 |

| | | |

PART IV |

| | | |

| Item 15. | Exhibits, Financial Statement Schedules | 37 |

PART I

Overview

VitalTrust Business Development Corporation (“VTBD”), also known as Renew Energy Resources, Inc. (which may be referred to as “Renew Energy Resources”, “RENEW”, “VitalTrust”, “the Company”, “we”, “us”, or “our”) announced a change in business direction and began pursing operations as a vertically integrated alternative energy company. To better depict its business strategy, VTBD has changed its name to Renew Energy Resources (ticker symbol “REER.PK”). Also consistent with its change in business direction, the Company withdrew its election as a Business Development Company under the Investment Company Act of 1940.

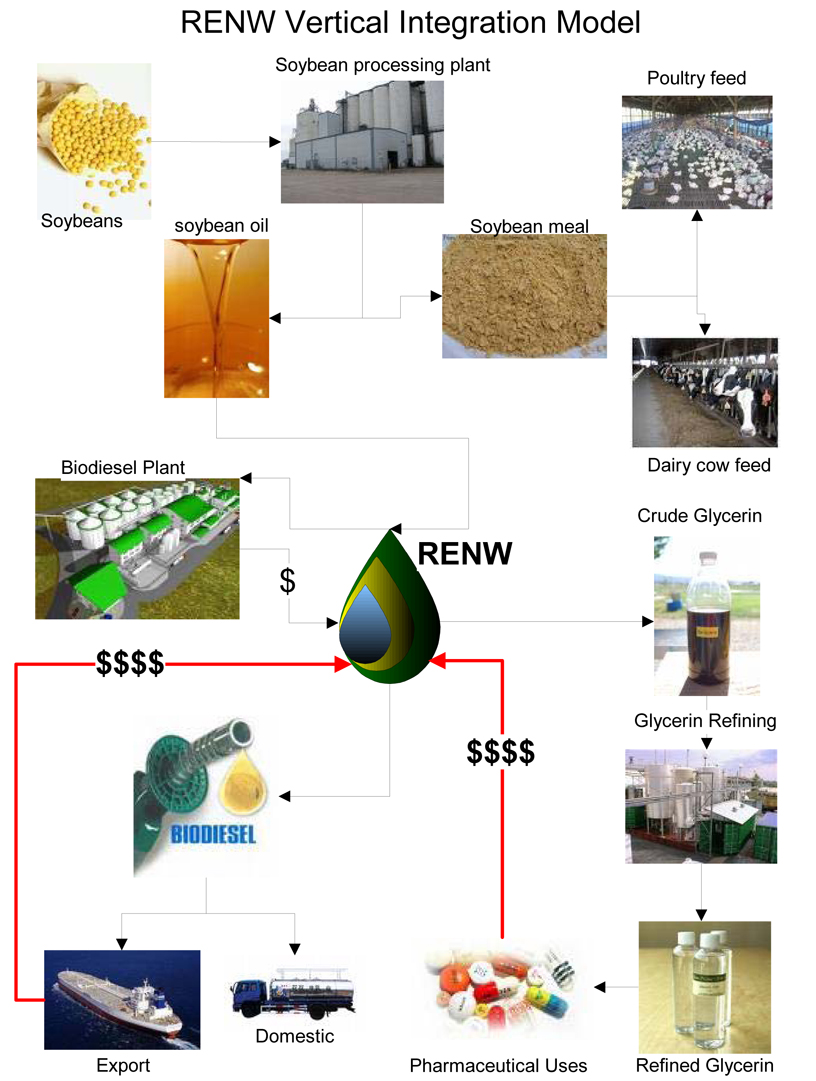

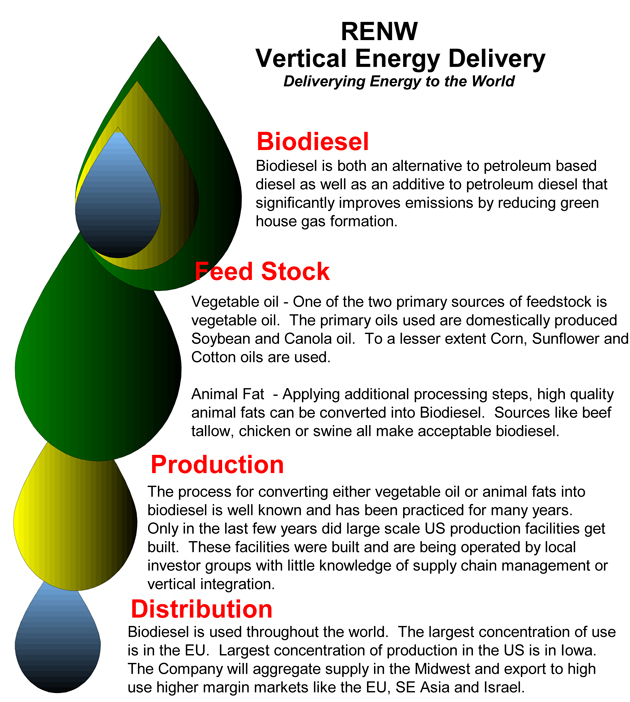

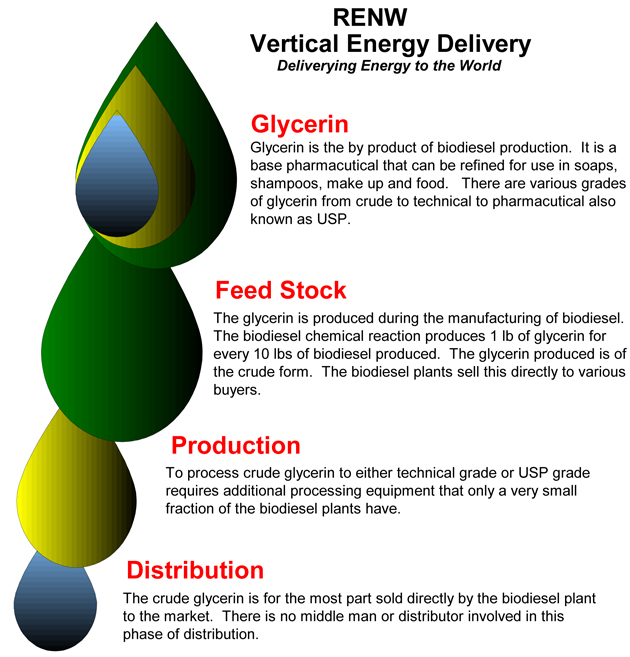

Renew Energy Resources’ mission is to vertically integrate renewable energy markets such as biodiesel, ethanol, solar and wind. Vertical integration will include facility ownership as well as facility management, strategic offtake contracts to large end users such as the department of defense, cruise lines and major trucking firms, value-added refinement of glycerin, distribution, sales, marketing and financing of domestic and export sales contracts. The Company has completed preparation for the start of vertical integration in the biodiesel market, and anticipates newly integrated ethanol markets in the later part of 2008. (Further information about the Company’s operating strategy for 2008 is discussed within Note K (subsequent events) of the footnotes.

Operations in 2007

Biodiesel

RENEW’s initial business line, scheduled to commence in April 2008, is to integrate the financing, production and offtake of animal fat based biodiesel for domestic distribution to fulfill open demand by large national distributors. Subsequent to the development of domestic channels of distribution, RENEW plans to integrate the finance, production and export of blended biodiesel to Europe and SE Asia. The Company has open, unexecuted contracts with 3B Biofuels, an operating division of Babcock and Brown in Germany, to export between 36 - 72 million gallons of biodiesel per year if and when acceptable pricing comes into line. The Company believes that government mandates in Europe will continue to drive the price for biodiesel upward and will eventually make the negotiated contracts viable for both 3B Biofuels and RENEW.

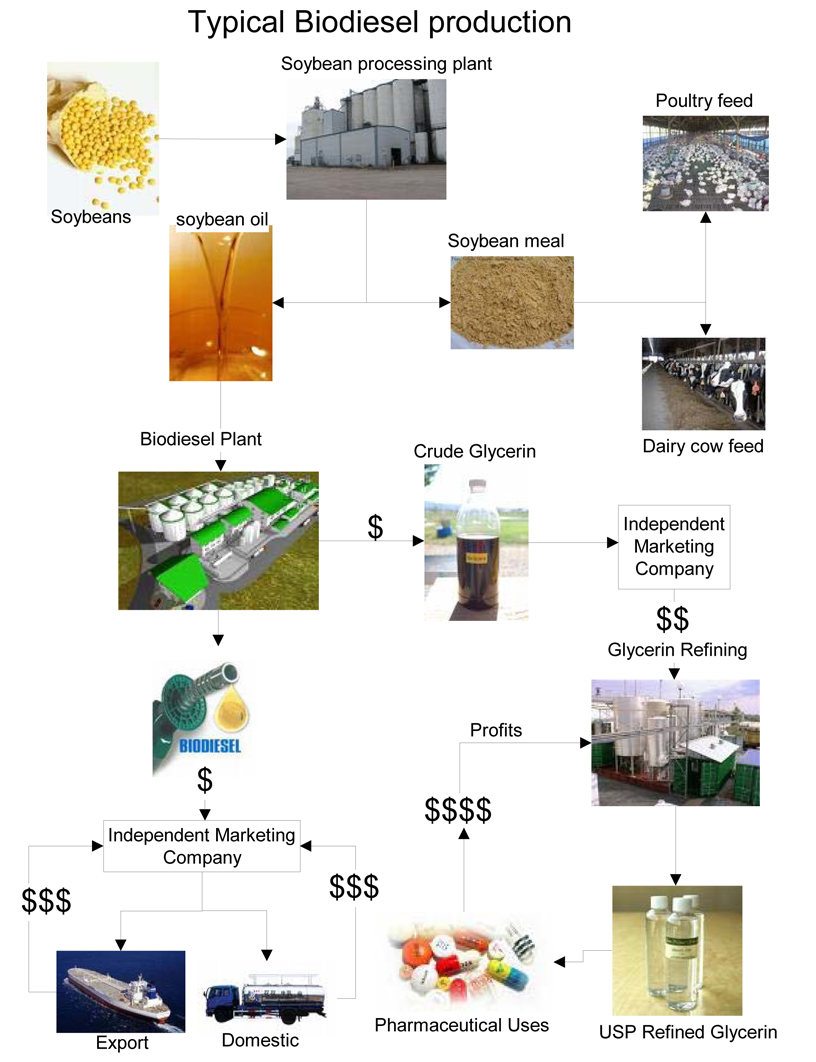

The current business model used by domestic biodiesel producers is highly fragmented with separate cost/profit centers for individual functions. The procurement of the feed stock is handled by a third party, almost always with no ownership stake in the processing plant. The biodiesel producer is focused solely on trying to make a profit selling biodiesel. Glycerin, a valuable co-product of the biodiesel production process, is sold to a separate processing facility for value-added refinement. Finally, the biodiesel producer uses a third party distributor to handle the sale of the biodiesel. This fragmented model does not lend itself to profitability at times with record high feed stock costs, a negative spread between biodiesel and petroleum diesel, and soaring demand for refined glycerin. In this model, all third party vendors and producers make money while the biodiesel plant struggles to stay in business. Vertical integration allows the procurement function to be more closely linked to the offtake that long range price projections can be used to maximize margins while minimizing risk.

Ethanol

Unlike US based ethanol companies that are subject to the volatile corn-commodities market, RENEW will focus on ethanol produced from crops that do not compete with the food chain and that can be controlled by RENEW from planting through production and distribution. This vertical integration of the ethanol production model significantly reduces commodity risk. If financing can be obtained, the Company would like to construct and operate multiple ethanol processing plants based on a relatively new energy crop called Sweet Sorghum.

The Company would eventually like to invest in projects in various Caribbean nations that have ideal economic, political and energy climates for these types of vertically integrated ethanol/electric facilities. If developed, the ethanol produced would be exported and the electricity produced during the process would be sold to the respective countries’ power system. Sweet Sorghum has great potential as there are many semi-arid climates across the world where this crop can be grown to provide renewable electricity as well as ethanol.

The proprietary Sweet Sorghum hybrid has developed through 20 years of extensive research and experiments all over the world by Alexander Grobman of Ethano Peru. Mike LoCascio, Chief Technology Officer of the Company, has been working with Ethano Peru since its inception to oversee the design of the production process to include the electrical generation station.

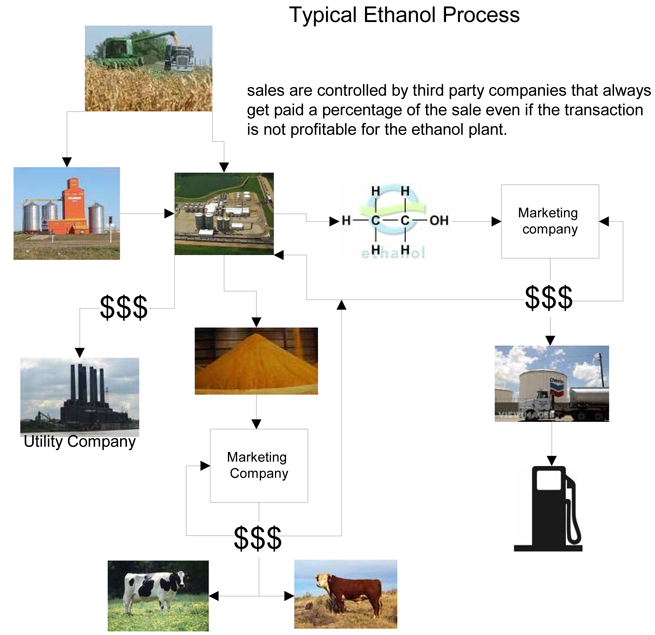

In the typical business model, corn is either sold to a grain elevator or directly to the ethanol plant. The ethanol plant does not own the production of the crop and is susceptible to commodity risk. The co product from the dry mill ethanol process is distiller’s grain. It is a corn feed product that is primarily fed to cattle and to a much smaller extent poultry and swine. The market for distiller’s grains is saturated. As the volume of distillers increases with more dry mill ethanol plants coming on line, supply is outstripping demand. In addition to commodity risk, the ethanol plants have also been negatively impacted by increased natural gas and electricity costs; the second largest input cost after corn.

The production of ethanol from Sweet Sorghum eliminates the commodity risk because, under its current business plan, the Company will own and control the production of the Sorghum used. The production process continually produces excess electricity that can be sold to the power grid. Because the production process does not consume non- renewable sources of energy like coal or natural gas, the process will qualify for carbon credits.

Renewable Electric

The demand for renewable electric from solar, wind and now biomass is growing. There are mandates coming from various states that will require utilities to produce a certain percentage of their electricity from a renewable source. Typically renewable projects are developed as stand- alone plants and rely heavily on subsidies to offset the high cost of production. The heavily regulated utilities continue to develop “clean” coal, oil and natural gas power plants due to the lower capital cost and known operating costs. Production of renewable electricity from biomass as an integrated model has significant revenue potential. As a power plant must be built to operate the ethanol production facility anyway, significant economies of scale can be achieved by constructing a marginally larger power plant to generate more electricity than the ethanol plant requires. The excess electricity is sold to the power grid, thus providing substantial revenue to the ethanol plant and reducing the cost of production of both the ethanol and the electricity. Waste heat from the power plant drives the ethanol plant and helps reduce production cost further.

COMPANY STRATEGY

Generate Immediate Cash Flow with low risk domestic distribution - The Company’s immediate focus is on integrating supply, production and sales to domestic distributors. Vertical integration of the domestic supply chain requires less working capital and involves less risk. There are several identified animal fat biodiesel producers struggling with limited working capital, technology issues and lack of good sales contracts. RENEW intends to bring additional working capital to these plants through a management partnership that will correct production problems and increase the volume of product that can be processed. Finally RENEW will deliver the biodiesel to distributors based on petroleum index based pricing. Index pricing is not prevalent in the biodiesel industry and makes it very difficult to predict and control margins. Simply put, because plants cannot predict what their finished product will sell for, they can’t determine what they should or can pay for feed stock. RENEW’s vertically integrated business model address this industry-wide problem.

Value Added Processing of Biodiesel Co-Products - Glycerin is produced during the manufacturing of biodiesel. Glycerin sold as unrefined or crude can fetch as much as 0.28/lb, but usually brings less than that depending on the quality of the crude glycerin. Glycerin that is refined into either technical or pharmaceutical grade will increase the selling price substantially. Only a handful of plants in the US have the capacity to refine the glycerin to technical or pharmaceutical grade. Refining glycerin is technically challenging and requires additional capital, which the biodiesel plants lack.

Fulfill larger International Contracts as Working Capital becomes more available - After the Company demonstrates the success of the integrated model, RENEW will replicate the model with European biodiesel traders and distributors. Moving large volumes of biodiesel to Europe creates a new series of challenges, not the least of which is the significant amount of working capital required to support the transaction.

The sale of the hybrid Sweet Sorghum seed as a replacement for sugar cane based ethanol production - Management expects Sweet Sorghum to replace sugar cane as a biofuels feed stock in many countries around the world for a number of reasons: Sweet Sorghum has a shorter growing cycle, requiring as few as 90 days in equatorial climates to reach maturity as compared to 18 months for new first growth Sugar cane. Depending on the region it is grown, Sweet Sorghum can produce up to two times the ethanol per area planted vs. sugar cane and as much as four times more ethanol per area vs. corn. Sweet Sorghum requires significantly less water to grow which, given sparse water resources in many developing countries, is a powerful advantage. Early trials in Peru suggest that with the proper irrigation the volume of water can be 1/3 of that required by sugar cane. Prior to harvesting sugar cane, the field must be burned to allow manual harvesting, which in turn destroys some of the recuperative sugars that reduces alcohol production and generates significant air pollution. The burning of sugar cane fields is a practice that is getting critical scrutiny from many countries, and there is political pressure building to ban this process. Sweet Sorghum can be mechanically harvested and the leaves separated and used for animal forage thus eliminating the air pollution and providing an additional value added animal feed product.

Develop and control strong intellectual property portfolio- The Company expects to develop a strong intellectual property portfolio which will be used to manage the process control software that controls the ethanol production process. Together with the know-how associated with the manufacture and cultivation of the Sweet Sorghum seed, the Company expects to tightly control the knowledge base of its manufacturing base - a strategy similar to a few primary technology firms such as ICM of Wichita KS and Poet Bio-refining of Sioux Falls SD. (These two firms account for 85% of all dry mill ethanol production in the United States.)

Portfolio Holdings

As of December 31, 2007, the Company was a business development company (“BDC”). As discussed elsewhere in this report, in early 2008 the Company decided to terminate its status as a BDC and pursue its current business plan.

As discussed further in the Company’s December 28, 2007 Schedule 14C Information Statement filing, the Company issued preferred stock in exchange for an interest in the shares of several companies. Under the terms of the arrangement, the Company is entitled to a percentage of any gain recognized on the ultimate sale of those shares in excess of a floor price set for each of these stocks. (70% of the market value on (a) May 4, 2007, excepting (b) US Energy Initiatives Corporation and Online Sales Strategies, Inc., which have a valuation date of June 29, 2007.) Each of the companies in whom the Company received these rights is described further in Note B of the accompanying Notes to the Financial Statements.

Item 1A. Risk Factors

"SAFE HARBOR" STATEMENT UNDER

THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

We believe that it is important to communicate our plans and expectations about the future to our stockholders and to the public. Investors are cautioned that some of the statements in this document as well as some statements in periodic press releases and some oral statements of Company officials are “forward-looking statements” within the meaning of the Private Securities Reform Act of 1995 (“the 1995 Act”). These statements include, but are not limited to, statements about our plans and expectations of what may happen in the future, including in particular the statements about our plans and expectations under the headings “Item 1. Business” and “Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.” Statements that are not historical facts are forward-looking statements. These forward-looking statements are made pursuant to the “safe-harbor” provisions of the 1995 Act. Forward-looking statements include statements which are predictive in nature, which depend upon or refer to future events or conditions, which include words such as “can,” “may,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” or “continue” or the negative of these terms and other similar expressions. In addition, any statements concerning future financial performance (including future revenues earnings or growth rates), ongoing business strategies or prospects, and possible future actions, which may be provided by management, are also forward-looking statements as defined by the 1995 Act.

Although we believe that the plans and expectations reflected in or suggested by our forward-looking statements are reasonable, those statements are based only on the current beliefs and assumptions of our management and on information currently available to us and, therefore, they involve uncertainties and risks as to what may happen in the future. Accordingly, we cannot guarantee you that our plans and expectations will be achieved. Our actual results and stockholder values could be very different from and worse than those expressed in or implied by any forward-looking statement in this report as a result of many known and unknown factors, many of which are beyond our ability to predict or control. These factors include, but are not limited to, those contained in “Item 1A. Risk Factors” and elsewhere in this report. All written and oral forward-looking statements attributable to us are expressly qualified in their entirety by these cautionary statements.

Our forward-looking statements speak only as of the date they are made and should not be relied upon as representing our plans and expectations as of any subsequent date. Although we may elect to update or revise forward-looking statements at some time in the future, we specifically disclaim any obligation to do so, even if our plans and expectations change.

You should not invest in our securities unless you can afford to lose your investment in its entirety. The Company is subject to various risks that may materially harm our business, financial condition and results of operations. Should any of the following factors materialize, the trading price of the Company's securities could materially decline and you could lose all or part of your investment.

Trends, Risks and Uncertainties

We have sought to identify what we believe to be the most significant risks to our business. However, we cannot predict whether, or to what extent, any of such risks may be realized nor can we guarantee that we have identified all possible risks that might arise. You should not consider the risks and assumptions identified in this report to be a complete discussion of all potential risks and uncertainties affecting the Company. Investors should carefully consider all risk factors before making an investment decision with respect to our Common Stock.

Cautionary Factors that may affect Future Results

We provide the following cautionary discussion of risks, uncertainties and possible inaccurate assumptions relevant to our business. These are factors that we think could cause our actual results to differ materially from expected results. Other factors besides those listed here could adversely affect us.

We require additional financing in order to continue in business as a going concern, the availability of which is uncertain. We may be forced by business and economic conditions to accept financing terms which will require us to issue our securities at a discount, which could result in further dilution to our existing stockholders.

As discussed under the heading, "Management's Discussion and Analysis - Liquidity and Capital Resources," we require additional financing to fund our operations. There can be no assurance that additional financing will be available to us when needed or, if available, that it can be obtained on commercially reasonable terms. In addition, any additional equity financing may involve substantial dilution to our stockholders. If we fail to raise sufficient financing to meet our immediate cash needs, we will be forced to scale down or perhaps even cease the operation of our business, which may result in the loss of some or all of your investment in our common stock.

In addition, in seeking debt or equity private placement financing, we may be forced by business and economic conditions to accept terms which will require us to issue our securities at a discount from the prevailing market price or face amount, which could result in further dilution to our existing stockholders.

Liquidity and Working Capital Risks; Need for Additional Capital to Finance Growth and Capital Requirements

Throughout 2007, related parties have provided funding that has allowed the Company to continue. Our capital needs through loans and capital contributions. These related parties are under no obligation to continue such funding. In the event these related parties should discontinue their support, we will likely have difficulty in continuing our operations. In such an event, stockholders could lose their investment in its entirety. Related party loans may, but are not required, be exchanged for shares of the Company’s common stock, which would cause dilution of existing shareholders.

In addition, we may continue to seek to raise capital from public or private equity or debt sources to provide working capital to meet our general and administrative costs until net revenues make the business self-sustaining. We cannot guarantee that we will be able to raise any such capital on terms acceptable to us or at all. Such financing may be upon terms that are dilutive or potentially dilutive to our stockholders. If alternative sources of financing are required, but are insufficient or unavailable, we will be required to modify our growth and operating plans in accordance with the extent of available funding.

Limited Operating History Anticipated Losses; Uncertainty of Future Results

We have a limited operating history upon which an evaluation of our Company and our prospects can be based. Our prospects must be evaluated with a view to the risks encountered by companies in early stages of development, particularly in light of the uncertainties relating to the new and evolving biodiesel and ethanol products which we intend to develop and market, and the acceptance of our business model. We will be incurring costs to: (i) establish relationships with suppliers, producers, distributors, and end-users of our products, (ii) develop and market our products; and (iii) build an organization. To the extent that such expenses are not subsequently followed by commensurate revenues, our business, results of operations and financial condition will be materially adversely affected. We, therefore, cannot insure that we will be able to immediately generate sufficient revenues. We expect negative cash flow from operations to continue for at least the next 12 months as we continue to develop and market our business. If cash generated by operations is insufficient to satisfy our liquidity, we may be required to sell additional equity or debt securities. The sale of additional equity or convertible debt securities would result in additional dilution to our stockholders. Our initial operations may not be profitable, since time will be required to build our business to the point that our revenues will be sufficient to cover our total operating costs and expenses. Our reaching a sufficient level of sales revenues will depend upon a large number of factors, including availability of sufficient working capital, the number of customers we are able to attract and the costs of continuing development of our product line. It is possible that the Company will never be profitable.

Acceptance of Products in the Marketplace is Uncertain.

Our future financial performance will depend, at least in part, upon the introduction and customer acceptance of our proposed products. Our products may not achieve market acceptance, and such adverse marketing results could materially harm the Company.

Key Man Life Insurance

We do not maintain key man life insurance on the life of any officer, director, employee, or independent contractor.

Legal actions.

The Company has entered into a settlement agreement as described further in Item 3. Adhering to the terms of this settlement may adversely affect the Company’s business plan.

Fluctuations in energy prices could adversely affect the Company’s operating results.

Under the Company’s new business plan, the Company will produce products for use as alternative fuels. The cost to produce such fuels, as well as the selling price for the finished product, is significantly influenced by energy costs. Changes in energy prices could have significant adverse affects on the profitability of the Company. In addition, a decline in the price of petroleum or other alternative sources of energy could cause the Company’s products to be less attractive financially to the end user.

The availability and price of the agricultural commodities to be used in the Company’s operations can be affected by weather, disease, government programs, and various factors beyond the Company’s control and could adversely affect the Company’s operating results.

The availability and price of agricultural commodities are subject to wide fluctuations due to unpredictable factors such as weather, plantings, government (domestic and foreign) farm programs and policies, and changes in demand. As more agricultural products are committed to the production of biodiesel and ethanol, it is likely to cause an increase in the cost of these agricultural products for use as a feedstock.

Government policies and regulations, in general, and specifically affecting the energy and agricultural sectors, could adversely affect the Company’s operating results.

Government policies concerning energy and agriculture could adversely impact the Company’s operations. For example, the government currently allows an excise tax credit for producers of biodiesel and ethanol products. The repeal or reduction of such credits could adversely affect the decision of end users between these products and other sources of energy. Also, changes in regulations and rules affecting production facilities could also significantly affect the Company’s operations.

The Company is required to comply with numerous laws and regulations administered by United States federal, state, local, and foreign government agencies relating to, but not limited to, the processing, transporting, and storage of products to be used as feedstock, as well as the products produced. Any failure to comply with applicable laws and regulations could subject the Company to administrative penalties and injunctive relief, civil remedies, including fines, injunctions, and similar actions.

Item 1A. Risk Factors (continued)

The Company is exposed to potential business disruption, including but not limited to transportation services, and other serious adverse impacts resulting from acts of terrorism or war, natural disasters and severe weather conditions, and accidents which could adversely affect the Company’s operating results.

The assets and operations of the Company are subject to damage and disruption from various events which include, but are not limited to, acts of terrorism or war, natural disasters and severe weather conditions, accidents, explosions, and fires.

The potential affects of these events could include, but are not limited to, extended business interruption, extensive property damage, personal injuries or death, and damage to the environment. The Company’s operations could also be adversely affected on the affects of these events on its ability to acquire commodities for use as a feedstock at competitive prices and the ability to transport its raw materials and finished products.

The Company’s Common Stock may be affected by limited trading volume and may fluctuate significantly. The Company’s Common Stock trades through the over-the-counter bulletin board quotation service which may make it more difficult for investors to resell their shares.

A limited public market for the Company’s common stock will likely continue and there can be no assurance that an active trading market will develop or if developed, can be maintained. Further, the Company’s common stock trades on the over-the-counter bulletin board (“the OTCBB”). Many broker-dealers decline to trade in the Company’s securities because of this trading venue and low price given the market for such securities is typically limited and subject to volatile swings in price. These factors may reduce the potential market for the Company’s common stock by reducing the number of potential investors. It is also possible that the Company may not meet the requirements for trading on the OTCBB resulting in its shares being traded on the pink sheets.

Investing in the Company’s stock is highly speculative and an investor could lose some or all of the amount invested

The value of the Company’s common stock may decline and may be affected by numerous market conditions, which could result in the loss of some or the entire amount invested in its shares. The securities markets frequently experience extreme price and volume fluctuations, which affect market prices for securities of companies generally, and very small capitalization companies in particular. The price of its common stock may be higher or lower than the price you pay for your shares, depending on many factors, some of which are beyond the Company’s control and may not be directly related to operating performance. These factors include the following:

Item 1A. Risk Factors (continued)

| · | Price and volume fluctuations in the overall stock market from time to time; which are often unrelated to the operating performance of particular companies; |

| · | Significant volatility in the market price and trading volume of securities of business development companies or other financial service companies; which is not necessarily related to the operating performance of these companies; |

| · | Changes in the regulatory policies or tax guidance with respect to business development companies; |

| · | Actual or anticipated changes in the Company’s earnings or fluctuations in its operating results or changes in the experience of securities analysts; |

| · | Loss of business development company (BDC) status; |

| · | Changes in the value of our portfolio of investments; |

| · | Operating performance of comparable companies; |

Fluctuations in the trading prices of the Company’s shares may adversely affect the liquidity of the trading market of these shares and, if the Company seeks to raise capital through future equity financings, its ability to raise such equity capital may be limited.

The Company‘s business depends on key personnel

The Company depends on the continued service of its executive officers. If the Company were to lose any of these officers, such a loss could result in inefficiencies in the Company’s operations and the loss of business opportunities. The Company does not maintain any key man life insurance on any of its officers or employees.

Item 2. Properties

The Company’s executive management operating in a virtual environment and owns no properties and is not a party to any real estate lease.

The Company previously reported that on March 22, 2005, a civil suit was filed in Orange County Circuit Court, Orlando, Florida against the former CEO of the Company, Walter H. Roder, II. The Company also previously reported that counterclaims were filed by Mr. Roder and related entities alleging non-payment of purported obligations which the Company believed to be without merit. On March 5-6, 2007, the Orange County Circuit Court declined to grant reconsideration of a summary judgment, and also entered a separate final judgment, against the Company in the aggregate amount of $1,307,685. The Court also found Roder entitled to recover post-judgment interest and attorney’s fees and costs, with the amount of attorney’s fees and costs not being determined yet. The Company appealed to the Fifth District Court of Appeal in Daytona Beach, Florida on March 7, 2007, and the appellate court entered a March 22, 2007 Order of Referral to Mediation. The Company contends that the Trial Court erred in entering summary judgment in favor of Roder despite the existence of legal and factual issues that demonstrated the sued-upon indebtedness no longer resided with the Company. On August 2, 2007, the District Court of Appeal approved an order that the appeal be dismissed. As a result of this order, the Company has provided a litigation liability for the judgment, interest, and related costs of approximately $1,395,000 as of December 31, 2007. Subsequently, the Company and Mr. Roder entered into a Settlement Agreement on April 29, 2008. The Settlement Agreement provides for an aggregate payment of $1,700,000 to be paid by the Company to Roder over 420 days, with partial payments every 30 days. The initial payment, on May 19 in the amount of $50,000, increases to $75,000 for the second payment, then later to $100,000 for the third through fifth payment. The sixth through 13th payments, beginning on October 26, 2008 and ending on May 24, 2009, consist of $150,000 payments. The final scheduled payment is on June 23, 2009, in the amount of $75,000.

As security for the Roder settlement, the Company has issued 8,500,000 shares of common stock (“Settlement Stock”) in the Company. The Company has agreed to take appropriate action necessary to permit trading 181 days after issuance and to remove restrictions specifies by Rule 144 of the Securities act of 1933. The Company has the option, but not the obligation to redeem . Settlement Stock at a per share price of 16 cents prior to July 28, 2008, at 20 cents per share from July 28th to October 26, 2008, and at 25 cents thereafter.

As additional security for the Settlement Agreement, Roder has been granted a first position security interest (however, provided that such position by Roder will be subordinated to a third-party commercial lender) in a Stock Portfolio titled to the Company consisting of the following shares of common stock:

| Online Sales Strategies, Inc. | 385,369,360 shares |

| EarthFirst Technologies, Inc. | 120,000,000 shares |

| Nanobac Pharmaceuticals, Inc. | 20,000,000 shares |

| US Energy Initiatives, Inc. | 57,593,800 shares |

| 225,000,000 shares |

| Nano-Chemical Systems, Inc. | 36,000,000 shares |

Furthermore, the Settlement Agreement provides for the Company’s indemnification of Roder from all claims and liabilities asserted by creditors of the Company including $130,000 in credit card debts, two promissory notes totaling $85,000 owed by American Card Services to Edward S. Frohling, and a U.S. Bancorp equipment lease in the amount of $11,421.

In return for the Company’s performance under the Settlement Agreement, Roder has agreed to release all claims against the Company.

On July 9, 2007, the Company commenced litigation in Hillsborough County, Florida against U.S. Sustainable Energy, Inc. (“USSE”) (one of its portfolio investments), its directors and officers and its transfer agent, for failing to issue a one for one stock dividend of 225,000,000 shares of its stock to the Company. The case is Case #07-008271- Div G. Management of USSE contends that the agreement for this issuance of these shares was breeched and that USSE has the right to retire these shares. The Company believes that it is entitled to these shares, however it has chosen to abandon the case in Hillsborough County and is pursuing this litigation in Adams County, Mississippi.

Since the Company believes that it owns all of the shares of USSE in question, the value of the Company’s investment in USSE is reflected on its financial statements. Adverse resolution of this matter could result in the Company removing the value of these shares from its financial statements in a future period.

Increase the Number of Authorized Shares of the Company

The terms of the additional shares of Common Stock is identical to those of the currently outstanding shares of Common Stock. However, because holders of Common Stock have no preemptive rights to purchase or subscribe for any unissued stock of the Company, the issuance of additional shares of Common Stock will reduce the current stockholders' percentage ownership interest in the total outstanding shares of Common Stock. This amendment and the creation of additional shares of authorized Common Stock will not alter the current number of issued shares. The relative rights and limitations of the shares of Common Stock will remain unchanged under this amendment.

The proposed increase in the authorized number of shares of Common Stock could have a number of effects on the Company's stockholders depending upon the exact nature and circumstances of any actual issuances of authorized but unissued shares. The increase could have an anti-takeover effect, in that additional shares could be issued (within the limits imposed by applicable law) in one or more transactions that could make a change in control or takeover of the Company more difficult. For example, additional shares could be issued by the Company so as to dilute the stock ownership or voting rights of persons seeking to obtain control of the Company, even if the persons seeking to obtain control of the Company offer an above-market premium that is favored by a majority of the independent shareholders. Similarly, the issuance of additional shares to certain persons allied with the Company's management could have the effect of making it more difficult to remove the Company's current management by diluting the stock ownership or voting rights of persons seeking to cause such removal. The Company does not have any other provisions in its articles or incorporation, by-laws, employment agreements, credit agreements or any other documents that have material anti-takeover consequences. Additionally, the Company has no plans or proposals to adopt other provisions or enter into other arrangements, except as disclosed below, that may have material anti-takeover consequences. The Board is not aware of any attempt, or contemplated attempt, to acquire control of the Company, and this proposal is not being presented with the intent that it be utilized as a type of anti- takeover device.

There are currently no plans, arrangements, commitments or understandings for the issuance of the additional shares of Common Stock which are proposed to be authorized.

AUTHORIZATION TO THE BOARD TO WITHDRAW THE COMPANY'S ELECTION TO BE TREATED AS A BUSINESS DEVELOPMENT COMPANY ("BDC") UNDER THE INVESTMENT COMPANY ACT OF 1940, AS AMENDED

On November 9, 2007, the Board of Directors took action by unanimous written consent whereby it was determined that in the best interest of the Company and its shareholders to withdraw its election to be regulated as a business development company (“BDC”) under the Investment Company Act of 1940, as amended (the “1940 Act”). In accordance with Section 2(a)(42) of the 1940 Act, the holders of a majority of the voting power of the Company’s outstanding common stock have voted to approve the recommendation of the Board. In accordance with Section 18(i) of the 1940 Act, each share of the Company’s common stock is entitled to one vote per share.

The company is no longer a BDC.

PART II

Renew common stock, par value, $.001 per share (“Common Stock”) is traded on the Over the-Counter Pink Sheets (“OTC”) under the symbol “REER” The following table sets forth, for the period indicated, the range of high and low closing prices reported by the OTC. Such quotations represent prices between dealers and may not include markups, markdowns, or commissions and may not necessarily represent actual transactions.

| | | HIGH | | LOW | |

2007 Quarter Ended | | | | | | | |

December 31st | | $ | 0.15 | | $ | 0.05 | |

September 31st | | $ | 0.25 | | $ | 0.08 | |

June 30th | | $ | 0.54 | | $ | 0.27 | |

March 31st(1) | | $ | 0.30 | | $ | 0.03 | |

| | | | | | | | |

2006 Quarter Ended | | | | | | | |

December 31st(1) | | $ | 0.05 | | $ | 0.03 | |

September 30th(1) | | $ | 0.10 | | $ | 0.02 | |

June 30th(1) | | $ | 0.08 | | $ | 0.04 | |

March 31st(1) | | $ | 0.41 | | $ | 0.07 | |

(1) Prices quoted reflect a 1,250:1 reverse stock split and are not reflective of actual trading prices.

As of December 31, 2007 the authorized capital of the company is 250,000,000 shares of common voting stock with a par value $.001 per share. The Company also has authorized three classes of Preferred Stock: (1) Class A- 10,000,000 shares of convertible preferred with a par value of $.001 per share; (2) Class B- 10,000,000 shares of preferred stock with a par value of $.001; and (3) Class C- 10,000,000 shares of preferred stock with a par value of $.001.

Dividends

During the past two years, the Company has not paid any cash dividends on its common or preferred stock.

Purchase of Equity Securities by the Issuer

None.

The selected financial data should be read in conjunction with the Company’s “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Financial Statements and notes thereto. The Company experienced a 1,250 to 1 reverse stock split in 2005 and a 40 to 1 reverse stock split in 2004.

| | | Year Ended December 31 | |

| | | | | | | | | | |

| | | 2007 | | 2006 | | 2005 | | 2004 | |

| | | | | | | | | | | | | | |

| Net Revenues | | $ | 0 | | $ | 40,000 | | $ | 0 | | $ | 47,177 | |

| | | | | | | | | | | | | | |

| Operating Loss | | $ | (3,840,826 | ) | $ | (939,002 | ) | $ | (1,548,825 | ) | $ | (2,772,499 | ) |

| | | | | | | | | | | | | | |

| Operating Loss per Common Share | | $ | (1.39 | ) | $ | (0.12 | ) | $ | (1.00 | ) | $ | (7.59 | ) |

| | | | | | | | | | | | | | |

| Total Assets | | $ | 16,208,108 | | $ | 1,187,686 | | $ | 3,207,275 | | $ | 3,413 | |

| | | | | | | | | | | | | | |

| Total Liabilities | | $ | 5,065,030 | | $ | 762,527 | | $ | 408,896 | | $ | 576,697 | |

| | | | | | | | | | | | | | |

| Stockholders' Equity (Deficit) | | $ | (45,314,922 | ) | $ | 425,159 | | $ | (2,798,379 | ) | $ | (573,284 | ) |

| | | | | | | | | | | | | | |

Unrealized Appreciation (Depreciation) on Investments | | $ | (83,659,616 | ) | $ | (3,344,151 | ) | $ | (898,958 | ) | $ | (898,958 | ) |

The following table sets forth certain quarterly financial information for each of the fiscal quarters during the years ending December 31, 2007 and 2006. This information was derived from the Company’s unaudited financial statements. Results for any quarter are not necessarily indicative of results for the full year.

| | | Year Ended December 31, 2007 | |

| | | | | | | | | | |

| | | Quarter | | Quarter | | Quarter | | Quarter | |

| | | Ended | | Ended | | Ended | | Ended | |

| | | Dec 31 | | Sep 30 | | June 30 | | March 31 | |

| | | | | | | | | | | | | | |

| Net Revenues | | $ | 0 | | $ | 0 | | $ | 0 | | $ | 0 | |

| Net Unrealized Gains (Losses) on Investments | | | (32,989,604 | ) | | 21,140,622 | | | (29,595,000 | ) | | 3,158,093 | |

| Net Income (Loss) Available to Common Stockholders | | | (31,254,966 | ) | | (23,639,816 | ) | | (32,456,450 | ) | | (149,210 | ) |

| Net Income (Loss) Available to Common Stockholders per share, Basic | | $ | (0.42 | ) | $ | (0.32 | ) | $ | (0.46 | ) | $ | (0.003 | ) |

| Weighted Average Shares Outstanding, Basic | | | 73,694,282 | | | 73,062,000 | | | 69,942,458 | | | 44,482,256 | |

| Net Income (Loss) Available to Common Stockholders per share, Diluted | | $ | (0.42 | ) | $ | (0.32 | ) | $ | (0.46 | ) | $ | (0.003 | ) |

| Weighted Average Shares Outstanding, Diluted | | | 73,694,282 | | | 73,062,000 | | | 69,942,458 | | | 44,482,256 | |

| | | Year Ended December 31, 2006 | |

| | | | | | | | | | |

| | | Quarter | | Quarter | | Quarter | | Quarter | |

| | | Ended | | Ended | | Ended | | Ended | |

| | | December 31 | | September 30 | | June 30 | | March 31 | |

| | | | | | | | | | | | | | |

| Net Revenues | | $ | 0 | | $ | 0 | | $ | 0 | | $ | 40,000 | |

| Net Unrealized Gains (Losses) on Investments | | | (2,999,684 | ) | | 83,133 | | | (8,313 | ) | | (419,287 | ) |

| Net Loss Available to Common Stockholders | | | (3,378,835 | ) | | (82,406 | ) | | (217,998 | ) | | (598,319 | ) |

Net Income (Loss) Available to Common Stockholders per Share, Basic | | $ | (.08 | ) | $ | 0 | | $ | (0.01 | ) | $ | (0.11 | ) |

| Net Income (Loss) Available to Common Stockholders per share, Diluted | | $ | (.08 | ) | $ | 0 | | $ | (0.01 | ) | $ | (0.11 | ) |

Weighted Average Shares Outstanding, Basic | | | 41,027,209 | | | 41,027,209 | | | 41,707,209 | | | 5,450,822 | |

| Weighted Average Shares Outstanding, Diluted | | | 41,027,209 | | | 41,027,209 | | | 41,707,209 | | | 5,450,822 | |

The following information should be read in conjunction with our financial statements and notes thereto appearing elsewhere in this Form 10-K.

Commencing in January 2008, the Company began the process of accumulating a management team to carry out its objective. The Company is assembling a team with technical, financial, and distribution expertise to achieve economies and efficiencies not generally attained in the current producer market for these products and services. By assembling these resources, the Company anticipates being able to enjoy competitive advantages in producing Renewable Energy Products that will result in value to its shareholders.

As part of its initial development, the Company is seeking to enter into long-term contracts with small to intermediate size distributors for the sale of Renewable Energy Products. The Company will then seek to fulfill such contracts by entering into agreements with third parties owning biodiesel and ethanol production facilities in proximity to the end users. The Company anticipates being able to leverage its expertise in the production of Renewable Energy Products by contracting with the producers of raw materials for the production of biodiesel and ethanol products and value-added byproducts. The Company will also provide expertise in the production of the Renewable Energy Products enabling it to produce these products at more competitive prices than the owners of the existing production facilities.

We anticipate that the agreements entered into with third party facilities owners will provide a revenue sharing arrangement allowing the Company to receive a portion of the benefit that our expertise provides in the operation of the third party owner’s biodiesel / ethanol production facility.

Prior to January 2008, the Company operated as a Business Development Corporation (“BDC”). As part of its efforts, the Company issued preferred stock for an interest in the shares of the common stock of several small publicly traded entities. Under the agreement, the Company is entitled to share a percentage of the profit ultimately recognized from the sale of these securities to the extent the sales proceeds exceed certain base amounts.

Management Service Agreements Entered Into By Prior Management

The Company entered into management agreements with PatienTree, Inc. a facilitator of medical communications technologies and procedures; Inteligy Corporation, an entity formed to become a facilitator of telephone systems for small to medium sized corporations, and; Calgenex Corporation (see discussion of Pangenex Corporation under Portfolio Investments in Item 1 above) a facilitator of products and systems to reduce the amount of calcium in the human body. Inteligy was formed on April 3, 2007 by Mark Clancy and Charles Broes, who were the Chief Operating Officer and Chief Executive Officer respectively of the Company at the time. Calgenex was formed on February 15, 2006 by one of the members of our board of directors and another individual. As of this time, the Company does not provide management services to any of these entities.

Prior management formed Resource Command Incorporated on March 21, 2007. It was intended that this entity acquire up to a 49% interest in Service-Related Disabled Veteran Owned Small Businesses (SDVO). SDVOs are companies a which (51%) must be owned by a disabled American veteran. These efforts have been discontinued by new management.

Critical Accounting Policies and Estimates

The Company prepared its financial statements in accordance with accounting principles generally accepted in the United States for investment companies. For a summary of all of its significant accounting policies, including the critical accounting policies, see Note A to the financial statements in Item 8.

The increasing complexity of the business environment and applicable authoritative accounting guidance requires the Company to closely monitor its accounting policies. The Company has identified three critical accounting policies that require significant judgment. The following summary of the Company’s critical accounting policies is intended to enhance your ability to assess its financial condition and results of operations and the potential volatility due to changes in estimates.

Valuation of Investments

For our privately-held portfolio companies, management will determine the quarter-to-quarter changes in value. Any changes in estimated fair value are recorded in the Statements of Operations as “Net unrealized appreciation (depreciation) on investments.”

Valuation of Equity Securities

Securities that are traded in the over-the-counter market or on a stock exchange will generally be valued at the prevailing bid price on the valuation date. However, restricted and unrestricted publicly traded securities may be valued at discounts from the public market value due to restrictions on sale, the size of its investment or market liquidity concerns.

Valuation of Loans and Debt Securities

As a general rule, the Company does not value its loans or debt securities above cost, but loans and debt securities will be subject to fair value write-downs when the asset is considered impaired.

Financial Condition

The Company’s total assets at December 31, 2007 increased to $16,207,108 from $1,187,686 at December 31, 2006. The increase in total assets can be attributed to the Company’s increase in investments in portfolio company investments and the valuation of those investments.

Through the conclusion of 2007, the Company’s financial condition was dependent on the performance of its portfolio holdings. Many of the businesses the Company invests in tend to be thinly capitalized.. The following summarizes the Company’s investment portfolio as of December 31, 2007 and December 31, 2006, respectively, as a business development company.

| | | December 31, 2007 | | December 31, 2006 | |

| | | | | | | | |

| Investment at Cost | | $ | 102,656,903 | | $ | 6,915,608 | |

| | | | | | | | |

| | | | | | | | |

| Investment at Fair Value | | $ | 15,890,427 | | $ | 1,000,000 | |

Since BDC election, the Company has valued its equity and investment holdings in accordance with the established valuation policies (see “Valuation of Investments and Equity Holdings”) above.

Cash approximated less than 1% of net assets of the Company at December 31, 2007 and less than 1% of the net assets of the Company at December 31, 2006, respectively.

Results of Operations

The results of operations for the years ending December 31, 2007 and 2006 reflect the results as a business development company under the Investment Company Act of 1940. The results of operations prior to August 3, 2004 reflect the results of operations prior to operating as a business development company under the Investment Company Act of 1940. The principal differences between these two reporting periods relate to accounting for investments. See Note A to the financial statements. In addition, certain prior year items have been reclassified to conform to the current year presentation as a business development company.

From 2004 through 2007, the Company had minimal revenues and no consistent operations. For 2007, and virtually all of 2006, the Company had no meaningful operations and no employees. During 2005 and early 2006, the Company underwent a major restructuring. A comparative discussion of changes in revenues or expenses beyond the financial statements and notes which are included as exhibits to this Form 10K would not be meaningful.

Dividends and Interest

There were no dividends or interest income on investments for the years ended December 31, 2007, 2006, 2005, and 2004 respectively.

Management Fees

There was no Management fee income for the years ended December 31, 2007, 2006, 2005, and 2004 respectively.

Expenses

Expenses in 2007 reflect operations as a Business Development Company. Management notes that the company’s 2008 business strategy and fiscal operations are materially different.

Total expenses for the years ended December 31, 2007, 2006 and 2005 were $3,840,826, $979,002, and $1,548,825 respectively. The largest expense was a debt restructuring fee totaling $1,876,563. This loss was recorded by prior management at 9/30/07 and was in connection with the exchange of common stock of the Company for the extinguishment of the Convertible Debentures and the Unsecured Promissory Notes. The second largest expense, litigation, accrued $1,308,000 at 12/31/07. Also, interest expense in 2007 increased substantially compared to the previous year, from $27,057 in 2006 to $100,326 in 2007.

Liquidity and Capital Resources

At December 31, 2007 and 2006, the Company had $0 and $5,226 and respectively in cash and cash equivalents.

The Company has been funding operations through cash received from the sale of our liquid securities and from proceeds of stock and debt financing. The Company expects to continue funding its operations in this manner until its operations can support its operating expenses. The Company generally funds new originations using cash on hand and equity financing and outside investments. In May 2008, the company obtained a $2,500,000 working capital line of credit. Management expects to draw on this line to maintain liquidity until operations are sufficient to generate positive cash flow.

Going Concern

The accompanying financial statements assume the Company will continue as a going concern. As shown in the accompanying financial statements, the Company had net losses of $90,576,471, $4,277,558, and $4,040,058 for the three years ended December 31, 2007, 2006 and 2005, respectively. The future of the Company is dependent upon its ability to continue to obtain financing and upon future profitable operations from the operation of its business. Management plans to seek additional capital through debt and/or equity financing. The financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts of and classification of liabilities that might be necessary in the event the Company cannot continue its existence.

The Company’s investment activities contain elements of risk. The portion of the Company’s investment portfolio consisting of equity or equity-linked debt securities in private companies is subject to valuation risk. Because there is typically no public market for the equity and equity-linked debt securities in which it invests, the valuation of the equity interest in the portfolio is stated at “fair value” and determined in good faith by the Board of Directors on a quarterly basis in accordance with the Company’s investment valuation policy.

In the absence of a readily ascertainable market value, the estimated value of the Company’s portfolio may differ significantly from the value that would be placed on the portfolio if a ready market for the investments existed. Any changes in valuation are recorded in the Company’s Statement of Operations as “Net unrealized appreciation (depreciation) on investments”.

At times, a portion of the Company’s portfolio may include marketable securities traded in the over-the-counter market. In addition, there may be a portion of the Company’s portfolio for which no regular trading market exists. In order to realize the full value of a security, the market must trade in an orderly fashion or a willing purchaser must be available when a sale is to be made. Should an economic or other event occur that would not allow the markets to trade in an orderly fashion, the Company may not be able to realize the fair value of its marketable investments or other investments in a timely manner.

As of December 31, 2007 and 2006, the Company did not have any off-balance sheet investments or hedging investments.

Impact of Inflation

The Company does not believe that its business is materially affected by inflation, other than the impact inflation may have on the securities markets, the valuations of business enterprises and the relationship of such valuation to underlying earnings, all of which will influence the value of the Company’s investments.

Financial Statements together with Footnotes are included as Exhibits to this Form 10K.

As of the date of this Report, there have been no changes in or disagreements with the auditors on the accounting, reporting or financial disclosures contained in this report during the fiscal years ended December 31, 2007 and 2006, respectively.

Evaluation of Disclosure Control and Procedures

The Company’s management, with the participation of our principal executive officer and principal financial officer, has evaluated the effectiveness of our disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)), as of the end of the period covered by this Annual Report on Form 10-K. Based on such evaluation, reports that are filed or submitted under the Exchange Act are recorded, processed, summarized and reported within the time periods specified in applicable SEC rules and forms were effective. The new controls designed by the principal executive officer and principal financial officer are effective in ensuring that reports that are filed or submitted under the Exchange Act are accurate and do not contain any material misstatements..

Changes in Internal Control Over Financial Reporting

There have been no significant changes in our internal control or in other factors that could significantly affect those controls subsequent to our evaluation, including corrective actions with regard to significant deficiencies and material weaknesses.

PART III

Compliance with Section 16(a) of the Exchange Act The following table sets forth the names, ages, and offices held with the Company by its directors and executive officers:

Name | | Position | | Director/Officer Since | | Age |

| John Stanton | | Chairman of the Board of Directors | | May, 2007 | | 59 |

| Alex H. Edwards | | Chief Executive Officer, Director | | January 2007 | | 43 |

| Stephen C. Steckel | | Chief Financial Officer, Treasurer, and Secretary | | March 2008 | | 48 |

| Steven C. Rockefeller, Jr. | | Director | | February 2008 | | 47 |

Any non-employee director of the Company is reimbursed for expenses incurred for attendance at meetings of the Board of Directors and any committee of the Board of Directors. The Executive Committee of the Board of Directors, to the extent permitted, exercises all of the power and authority of the Board of Directors in the management of the business and affairs of the Company between meetings of the Board of Directors. Each executive officer serves at the discretion of the Board of Directors.

The business experience of each of the persons listed above during the past five years is as follows:

John Stanton - Chairman Board of Directors- Mr. Stanton became a member of the Company’s Board of Directors on May 8, 2007. From 1987 through the present, Mr. Stanton served as the President and CEO of a private company headquartered in Tampa Florida engaged in the business of manufacturing residential concrete construction products. Mr. Stanton has served as Chairman of the Board of Directors of publicly-traded EarthFirst Technologies, Incorporated from May 15, 2000 through the present. Mr. Stanton is also the Chief Executive Officer and a member of the Board of Directors for Nanobac Pharmaceuticals, Incorporated. Mr. Stanton was one of the founders of Calgenex Corporation and VitalTrust Solutions, Inc. Mr. Stanton serves on the Board of Directors of publicly traded Medical Technology Systems, Inc., and several other public companies. Mr. Stanton worked as an auditor with the international professional services firm that is now known as Ernst & Young, LLP from 1973 through 1981. Mr. Stanton, a Vietnam veteran of the United States Army, graduated from the University of South Florida with a Bachelors Degree in Marketing and Accounting in 1972, and with an MBA in 1973. Mr. Stanton earned the designation of Certified Public Accountant in 1974 and was a Sells Award winner in the CPA examination.

Alexander H. Edwards III - Chief Executive Officer and Director - Mr. Edwards became the Company’s Chief Executive Officer and a member of the Board of Directors in January 2008. Previously, Mr. Edwards had provided consulting services for the Company.

Mr. Edwards was the Chief Executive Officer and Chief Financial Officer of Nano Chemical Systems Holdings, Inc., (now known as PanGenex Corporation) from 2007 through January 2008. Mr. Edwards was the managing member of Trident Consulting Partners, LLC from August 2006 through 2007.

Mr. Edwards is a member of the Board of Directors of Nanobac Pharmaceuticals, Incorporated (“Nanobac”). From January 2004 through July 2004, Mr. Edwards served as the Chief Executive Officer of Nanobac. From March 2003 through January 2004, Mr. Edwards served as the Executive Vice President and Chief Operating Officer of Nanobac.

From May 2002 through December 2004, Mr. Edwards was a managing partner of 360 Partners as well as president and CEO of 360 Degree Energy, Inc. and 360 Sports, Inc. From January 1997 to May 2002, Edwards was an executive with SRI/Surgical Express, Inc. He served in roles that ranged from vice-president/general manager to spending his last year with the company as president. From February 1993 through December 1996, he worked in sales and marketing with Dianon Systems, Inc. His positions included sales and sales management roles as well as field and corporate marketing. Mr. Edwards also served as an officer in the United States Navy with duty assignments ranging from shipboard divisional leadership to executive assistant for the Naval Surface Group Commander in Norfolk, Virginia. Mr. Edwards is a 1987 graduate of the United States Naval Academy.

Stephen C. Steckel, Chief Financial Officer, Corporate Treasurer and Secretary - Mr. Steckel joined the Company on March 1, 2008 and was previously employed as Vice President, Senior Relationship Manager and Credit Officer for KeyBank, Cleveland, Ohio. As Relationship Manger he focused on underperforming small and middle-market companies. Prior to that Mr. Steckel was head of the Special Credits Department at National City Bank, Cleveland, Ohio. He also held positions at Mitsubishi Trust, Kyowa Saitama Bank, and Cantor Fitzgerald Securities, New York, Los Angeles and Tokyo. He holds a MBA in Finance, University of Wisconsin-Madison, a BA in International Studies, the Johns Hopkins University, and is conversant in Japanese.

Steven C. Rockefeller, Jr., Director - On February 20, 2008, the Board of Directors appointed Steven C. Rockefeller, Jr. as a director of the Company. Mr. Rockefeller is the President of Education Adventures, which creates family friendly entertainment to empower children to make better safety-related decisions. Prior to this Mr. Rockefeller served as a Managing Director for Deutsche Bank Private Wealth Management. He was a key participant in the creation of the Deutsche Bank Microcredit Development Fund, a unique partnership between the bank and its clients to support microcredit programs worldwide. Mr. Rockefeller also serves on the Board of Directors of the Soros Economic Development Fund and the Deutsche Bank Microcredit Development Fund. In addition, he serves on the Board of the Rockefeller Philanthropy Advisors, and is a member of The Rockefeller University Council and the YMCA-YWCA Camping Services Council. He holds a Master's Degree of Public and Private Management for Yale University and A Bachelor of Arts from Fairfield University.

Code of Ethics

At a Special Meeting of the Board of Directors held March 3, 2007, we adopted our Code of Ethics. We post our Code of Ethics through our internet web site at http://www.vital-trust.com.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16 of the Exchange Act requires the Company's directors and officers and persons who own more than 10% of a registered class of the Company's equity securities, to file initial reports of ownership and reports of changes in ownership with the SEC. Such persons are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file.

Item 11. Executive Compensation

Compensation Discussion and Analysis

While we have not compensated our executive officers in 2007 and 2006, we intend to develop a compensation plan, our goal is to provide our named executive officers with salary and possibly incentives that are aligned with the performance of our business and intended to be competitive with similarly situated companies.

Committee Report on Executive Compensation

Since we do not have a compensation committee and no executive officers were compensated during 2007 and 2006, there was no discussion of any committee of the Company for the fiscal year ended December 31, 2007 regarding executive compensation.

None of the Company's executive officers were compensated during 2007 or 2006, other than as disclosed in Note J to the accompanying financial statements..

The Company had no outstanding grants or other plan-based awards as of 2007 and 2006.

There were no outstanding equity awards at the fiscal year end 2007 or 2006

There were no options outstanding or exercised during 2007 or 2006.

There were no pension benefit plans during 2007 or 2006.

There was no non-qualified deferred compensation at fiscal year end 2007 or 2006.

Director Compensation

No directors were compensated during 2007.

Employment Agreements

See Note J to the accompanying financial statements.

The following table sets forth certain information regarding the ownership of the Company’s common stock as of March 31, 2008 by: (i) each director and nominee for director, (ii) all executive officers and directors of the Company as a group; and (iii) all those known by the Company to be beneficial owners of more than five percent of its common stock.

| | | Beneficial Ownership | | | | | |

Name and Address | | Number of Shares | | Percent of Total | | Title of Class | |

| | | | | | | | |

Alex H. Edwards (1) Chief Executive Officer President, Director 5025 West Lemon St. Tampa, FL 33607 | | | 36,000,070 | | | 19.58 | % | | Common | |

| | | | | | | | | | | |

Stephen C. Steckel (2) Chief Financial Officer and Senior VP 5025 West Lemon St. Tampa, FL 33607 | | | 5,000,000 | | | 2.72 | % | | Common | |

| | | | | | | | | | | |

John Stanton (3) Director 5025 West Lemon St. Tampa, FL 33607 | | | 46,350,000 | | | 25.22 | % | | Common | |

| | | | | | | | | | | |

| All Officers and Directors as a groups (4) | | | 90,850,070 | | | 49.42 | % | | Common | |

| | (1) | Mr. Edwards assumed these positions on January 28, 2008. |

| | (2) | Mr. Steckel assumed these positions on March 1, 2008. |

| | (3) | Includes entities affiliated with Mr. Stanton. |

| | (4) | Total includes 3,500,000 shares allocated for Director Steven C. Rockefeller, Jr. |

Item 13. Certain Relationships and Related Transactions

Item 14. Principal Accounting Fees and Services

On March 2, 2007, the Company engaged Rotenberg, Meril, Solomon, Bertiger, & Guttilla P.C. as its new principal independent accountant. The company has audited financials for fiscal year 2006. Financials for 2007 are on an unaudited basis.

PART IV

Financial Statement Schedules

Balance Sheet as of December 31, 2007 and 2006

Statement of Operations for the years ended December 31, 2006, 2005 and 2004

Statement of Cash Flows for the years ended December 31, 2006, 2005 and 2004

Statement of Changes in Stockholders’ Equity (Deficit) for the years ended December 31, 2006, 2005 and 2004

Schedule of Portfolio Company Investments for the years ended December 31 2006 and 2005

Exhibits

| 31.1 | Certification of chief executive officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| 31.2 | Certification of chief financial officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| 32.1 | Certification of chief executive officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

| 32.2 | Certification of chief financial officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

In accordance with the requirements of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

RENEW ENERGY RESOURCES, INC., (F.K.A. VITALTRUST BUSINESS DEVELOPMENT CORPORATION)

| Date: June 27, 2008 | By: /s/ Alexander H. Edwards |

| | Alexander H. Edwards |

| | Chief Executive Officer (Principal Executive Officer) |

| | |

| Date: June 27, 2008 | By: /s/ Stephen C. Steckel |

| | Stephen C. Steckel |

| | Chief Financial Officer (Principal Financial Officer and Principal Accounting Officer) |

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| Name | | Position | | Date |

| | | | | |

/s/ Alexander H. Edwards Alexander H. Edwards | | Chief Executive Officer (Principal Executive Officer), President, and Director | | June 27, 2008 |

| | | | | |

/s/ Stephen C. Steckel Stephen C. Steckel | | Chief Financial Officer (Principal Financial Officer and Principal Accounting Officer) | | June 27, 2008 |

RENEW ENERGY RESOURCES, INC

CONSOLIDATED BALANCE SHEETS

AS OF DECEMBER 31, 2007 and 2006

| | | 12/31/2007 | | 12/31/2006 | |

| | | (Unaudited) | | (Audited) | |

ASSETS | | | | | | | |

| Investments in portfolio companies, at fair value (cost of $102,656,903 and $6,915,608) | | $ | 15,890,427 | | $ | 1,000,000 | |

| Investment in related management company, at fair value (cost of $ 0 and $450,000) | | | - | | | 166,265 | |

| Cash | | | - | | | 5,226 | |

| Due from related parties | | | 314,597 | | | 14,650 | |

| Fixed assets, net of accumulated depreciation | | | 2,084 | | | 1,545 | |

| Total Assets | | $ | 16,207,108 | | $ | 1,187,686 | |

| | | | | | | | |

LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | | | |

| | | | | | | | |

LIABILITIES | | | | | | | |

| Accounts payable and accrued expenses | | $ | 307,974 | | $ | 175,330 | |

| Litigation accrual | | | 1,395,000 | | | - | |

| Dividend payable on preferred stock - related party | | | 3,006,029 | | | - | |

| Liability for shares to be issued | | | - | | | - | |

| Accrued fees to officers | | | 140,000 | | | - | |

| Due to related parties | | | 15,227 | | | 243,279 | |

| Notes payables | | | - | | | 343,918 | |

| Total Liabilities | | | 4,864,230 | | | 762,527 | |

| | | | | | | | |

COMMITMENTS AND CONTINGENCIES | | | - | | | - | |

| | | | | | | | |

TEMPORARY EQUITY | | | 56,457,000 | | | - | |

| | | | | | | | |

SHAREHOLDERS' EQUITY | | | | | | | |

Common Stock, $.001 par value, 250,000,000 and 80,000,000 shares authorized at December 31, 2007 and December 31, 2006, respectively; 75,313,304 shares issued and outstanding at December 31, 2007; and 41,447,209 shares issued and 41,027,209 outstanding at December 31, 2006; respectively | | | 75,313 | | | 41,447 | |

| Additional paid-in capital | | | 53,133,857 | | | 11,024,685 | |

| Share reserve account | | | - | | | (420 | ) |

| Stock subscriptions receivable | | | (238,897 | ) | | (56,600 | ) |

| Accumulated deficit | | | (98,084,395 | ) | | (10,583,953 | ) |

TOTAL SHAREHOLDERS' EQUITY | | | (45,114,122 | ) | | 425,159 | |

| | | | | | | | |

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | | $ | 16,207,108 | | $ | 1,187,686 | |

See accompanying notes to consolidated financial statements.

RENEW ENERGY RESOURCES, INC

CONSOLIDATED STATEMENTS OF OPERATIONS

FOR THE YEARS ENDED December 31, 2007, 2006 AND 2005

| | | (Unaudited) | | (Audited) | | (Audited) | |

| | | For the Year | | For the Year | | For the Year | |

| | | Ended 12/31/07 | | Ended 12/31/06 | | Ended 12/31/05 | |

| | | | | | | | |

INVESTMENT INCOME | | | | | | | | | | |

| Interest and dividend income | | $ | - | | $ | - | | $ | - | |

| Fees and other income | | | - | | | 40,000 | | | - | |

TOTAL INCOME | | | - | | | 40,000 | | | - | |

| | | | | | | | | | | |

EXPENSES | | | | | | | | | | |

| Professional fees | | | 252,529 | | | 394,318 | | | 146,901 | |

| Professional fees- related parties | | | 242,900 | | | 439,791 | | | 1,145,000 | |

| Litigation settlement expense | | | 1,308,000 | | | - | | | - | |

| General and administrative | | | 60,030 | | | 93,514 | | | 10,640 | |

| Interest expense | | | 100,326 | | | 27,057 | | | 12,426 | |

| Debt restructuring fee | | | 1,876,563 | | | - | | | - | |

| Amortization of beneficial conversion feature convertible debt | | | - | | | 23,552 | | | 233,858 | |

| Depreciation | | | 477 | | | 770 | | | - | |

TOTAL EXPENSES | | | 3,840,826 | | | 979,002 | | | 1,548,825 | |

| | | | | | | | | | | |

NET INVESTMENT LOSS | | | (3,840,826 | ) | | (939,002 | ) | | (1,548,825 | ) |

| | | | | | | | | | | |

REALIZED AND UNREALIZED GAIN (LOSS) FROM INVESTMENTS | | | | | | | | | | |

| | | | | | | | | | | |

| Net realized gain (loss) from investments | | | (3,092,483 | ) | | 5,595 | | | - | |

| | | | | | | | | | | |

| Net (increase) in unrealized depreciation on investments | | | (80,567,133 | ) | | (3,344,151 | ) | | (2,241,233 | ) |

NET REALIZED AND UNREALIZED LOSS FROM INVESTMENTS | | | (83,659,616 | ) | | (3,338,556 | ) | | (2,241,233 | ) |

| | | | | | | | | | | |

NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (87,500,442 | ) | $ | (4,277,558 | ) | $ | (3,790,058 | ) |

| | | | | | | | | | | |

DIVIDEND ON PREFERRED STOCK | | | 3,076,029 | | | - | | | (250,000 | ) |

| | | | | | | | | | | |

NET DECREASE IN NET ASSETS RESULTING FROM OPERATONS AVAILABLE TO COMMON STOCKHOLDERS | | $ | (90,576,471 | ) | $ | (4,277,558 | ) | $ | (4,040,058 | ) |

| | | | | | | | | | | |

NET LOSS AVAILABLE TO COMMON STOCKHOLDERS PER SHARE BASIC AND DILUTED | | $ | (1.37 | ) | $ | (0.12 | ) | $ | (1.00 | ) |

| | | | | | | | | | | |

WEIGHTED AVERAGE COMMON SHARES BASIC AND DILUTED | | | 66,013,602 | | | 35,842,243 | | | 4,052,800 | |

See accompanying notes to consolidated financial statements.

RENEW ENERGY RESOURCES, INC.

CONSOLIDATED STATEMENTS OF CHANGES IN NET ASSETS

FOR THE YEARS ENDED DECEMBER 31, 2007, 2006 AND 2005

| | | (Unaudited) | | (Audited) | | (Audited) | |

| | | For the Year | | For the Year | | For the Year | |

| | | Ended 12/31/07 | | Ended 12/31/06 | | Ended 12/31/05 | |

| | | | | | | | | | | |

| Increase (decrease) in net assets from operations: | | | | | | | | | | |

| Investment (loss) - net | | $ | (3,840,826 | ) | $ | (939,002 | ) | $ | (1,548,825 | ) |

| Net realized gain (loss) from investments | | | (3,092,483 | ) | | 5,595 | | | - | |

Net (increase) decrease in unrealized depreciation on investments | | | (80,567,133 | ) | | (3,344,151 | ) | | (2,241,233 | ) |

| | | | | | | | | | | |

| Net decrease in net assets resulting from operations | | | (87,500,442 | ) | | (4,277,558 | ) | | (3,790,058 | ) |

| | | | | | | | | | | |

| Preferred stock issued | | | 42,153,651 | | | - | | | - | |

| | | | | | | | | | | |

| Issuance of preferred stock and warrants to retire debt of portfolio company | | | - | | | - | | | 1,357,069 | |

| | | | | | | | | | | |

| Issuance of preferred stock and warrants to retire other debt | | | - | | | - | | | 461,032 | |

| | | | | | | | | | | |

| Beneficial conversion feature of convertible preferred stock issued | | | - | | | - | | | 250,000 | |

| | | | | | | | | | | |

| Beneficial conversion feature of convertible debt | | | - | | | - | | | 257,410 | |

| | | | | | | | | | | |