- PRS Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Prudential Financial, Inc. 5.62 (PRS) DEF 14ADefinitive proxy

Filed: 17 Apr 03, 12:00am

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

| o | Preliminary Proxy Statement | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ý | Definitive Proxy Statement | |

| o | Definitive Additional Materials | |

| o | Soliciting Material Pursuant to §240.14a-12 | |

Prudential Financial, Inc. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| ý | No fee required | |||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| o | Fee paid previously with preliminary materials. | |||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

![]()

Prudential Financial, Inc.

751 Broad Street, Newark NJ 07102

April 17, 2003

Dear Fellow Shareholder:

On behalf of your Board of Directors, you are cordially invited to attend the Annual Meeting of shareholders of Prudential Financial, Inc. Your Company's Annual Meeting will be held on June 3, 2003 at the New Jersey Performing Arts Center ("NJPAC"), One Center Street, Newark, New Jersey 07102 at 2:00 p.m.

At the meeting, shareholders will vote on four proposals: the election of four Directors, the ratification of the appointment of PricewaterhouseCoopers LLP as the Company's independent auditors for 2003, the ratification of the Deferred Compensation Plan for Non-Employee Directors and the approval of the Omnibus Incentive Plan. Your Board of Directors recommends a vote "for" these proposals.

Your vote is important. We urge you to participate in Prudential Financial's Annual Meeting, whether or not you plan to attend, by signing, dating and promptly mailing your enclosed proxy card. You may also vote by telephone or the Internet should you prefer. Regardless of the size of your investment your vote is important, so please act

at your earliest convenience. Finally, if you do plan to attend the meeting you will need an admission ticket. Please refer to the instructions set forth in the Notice of Meeting, which follows this letter, or those attached to your proxy card.

We appreciate your participation, support and interest in your Company.

Sincerely,

Arthur F. Ryan

Chairman and Chief Executive Officer

![]()

Prudential Financial, Inc.

751 Broad Street, Newark NJ 07102

Notice of Annual Meeting of Shareholders

of Prudential Financial, Inc.

| Date: | June 3, 2003 | |

Time: | 2:00 p.m. | |

Place: | NJPAC One Center Street Newark, NJ 07102 |

At the 2003 Annual Meeting, shareholders will act upon the following matters:

Information about the matters to be acted upon at the Annual Meeting is contained in the accompanying proxy statement.

Shareholders of record at the close of business on April 8, 2003 will be entitled to notice of and to vote at the Annual Meeting and at any adjournments or postponements thereof.

Shareholders will need an admission ticket to attend the Annual Meeting. If you are a Holder of Record, an admission ticket is attached to your proxy card for this purpose. If you received shares of Common Stock in our demutualization and such shares are held through EquiServe (or if subsequently you have been issued a certificate for your shares), you are a Holder of Record of those shares. If your shares are not registered in your own name, you need to bring proof of your share ownership to the meeting to receive an admission ticket. Please bring either a copy of your account statement or a letter from your broker, bank or other institution reflecting your share ownership as of April 8, 2003. Please note that no cameras or recording devices will be permitted at the meeting. For your safety, we reserve the right to inspect all packages prior to admission to the Annual Meeting.

By Order of the Board of Directors,

![]()

Kathleen M. Gibson

Vice President and Secretary

April 8, 2003

Your vote is important! Please take a moment to complete, sign, date and mail your proxy in the accompanying envelope. If you prefer, you may also vote by telephone or the Internet. Please see the instructions attached to your proxy card. Your prompt cooperation will save your Company additional solicitation costs.

Prudential Financial, Inc.

751 Broad Street

Newark, NJ 07102

Proxy Statement for

Annual Meeting of Shareholders

to be held June 3, 2003

| General Information | 1 | |

Voting Instructions and Information | 1 | |

Item 1: Election of Class II Directors | 3 | |

Item 2: Ratification of the Appointment of Independent Auditors | 5 | |

Item 3: Ratification of the Deferred Compensation Plan for Non-Employee Directors | 6 | |

Item 4: Approval of the Omnibus Incentive Plan | 11 | |

Corporate Governance | 18 | |

Committees of the Board of Directors | 19 | |

Compensation of Directors | 20 | |

Compensation Committee Interlocks and Insider Participation | 21 | |

Certain Relationships and Related Transactions | 21 | |

Report of the Audit Committee | 21 | |

Compensation Committee Report on Executive Compensation | 23 | |

Compensation of Executive Officers | 26 | |

Summary Compensation Table | 27 | |

Retirement Plans | 27 | |

Prudential Severance and Senior Executive Severance Plan; Change of Control Program | 29 | |

Long-Term Compensation Table | 31 | |

Option Grant Table | 31 | |

Equity Compensation Plan Table | 32 | |

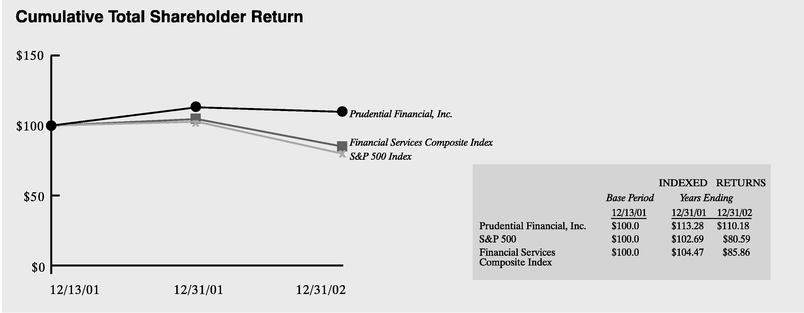

Performance Graph | 33 | |

Voting Securities and Principal Holders Thereof | 34 | |

Compliance with Section 16(a) of the Exchange Act | 35 | |

Shareholder Proposals | 35 | |

"Householding" of Proxy Materials and Elimination of Duplicates | 36 | |

Annual Report on Form 10-K | 36 | |

Incorporation by Reference | 36 | |

Other Matters | 36 | |

Appendix A: Prudential Financial, Inc. Audit Committee Charter | 37 | |

Appendix B: Prudential Financial, Inc. Corporate Governance Principles and Practices | 40 |

The Board of Directors of Prudential Financial, Inc. ("Prudential Financial" or the "Company") is furnishing this proxy statement and soliciting the accompanying form of proxy in connection with the Annual Meeting of shareholders to be held on June 3, 2003 (the "Annual Meeting") at 2:00 p.m. at NJPAC, One Center Street, Newark, New Jersey 07102, and at any adjournment or postponement thereof. The Notice of Meeting, this proxy statement, the enclosed proxy card and the enclosed Annual Report for 2002 were first sent to shareholders on or about April 17, 2003.

Voting Instructions and Information

Who Can Vote?

You are entitled to vote or direct the voting of your Prudential Financial Common Stock if you were a shareholder on April 8, 2003, the record date for the Annual Meeting. Shareholders of our Class B Stock as of April 8, 2003, are also entitled to vote their shares. At the close of business on that date, approximately 551,870,000 shares of Common Stock and 2,000,000 shares of Class B Stock were outstanding and entitled to notice of and to vote at the Annual Meeting. Each share of Prudential Financial Common Stock and Class B Stock is entitled to one vote, and the Common Stock and Class B Stock vote together as a single class on the matters submitted for a vote at this Annual Meeting.

Who Is the Holder of Record?

You may own Common Stock either (1) directly in your name as the shareholder of record, which includes shares acquired as part of demutualization and through other demutualization related programs, in which case you are the Holder of Record, or (2) indirectly through a broker, bank or other nominee.

If your shares are registered directly in your name, you are the Holder of Record of these shares, and we are sending these proxy materials directly to you.

How Do I Vote?

Your vote is important. We encourage you to vote promptly. You may vote in one of the following ways: Holders of Record

Stock Held by Brokers, Banks and Nominees

Page 1

How Many Votes Are Required?

A quorum is required to transact business at the Annual Meeting. We will have a quorum and be able to conduct the business of the Annual Meeting if the holders of 40 percent of the shares entitled to vote are present at the meeting, either in person or by proxy.

If a quorum is present, a plurality of votes cast is required to elect Directors. Thus, a Director may be elected even if the Director receives less than a majority of the shares represented at the meeting. To ratify the selection of independent auditors and the Deferred Compensation Plan for Non-Employee Directors and to approve the Omnibus Incentive Plan, an affirmative vote of a majority of the votes cast is required.

How Are Votes Counted?

All shares that have been properly voted, and not revoked, will be voted at the Annual Meeting in accordance with your instructions. If you sign and return your proxy card, but do not specify how you wish your shares to be voted, your shares represented by that proxy will be voted as recommended by the Board of Directors:"for" all the nominees for Class II Directors;"for" ratification of the appointment of PricewaterhouseCoopers LLP as our independent auditors for 2003;"for" ratification of the Deferred Compensation Plan for Non-Employee Directors and"for" the approval of the Omnibus Incentive Plan.

Proxies marked as abstaining and any proxies returned by brokers as "non-votes" on behalf of shares held in street names because beneficial owners' discretion has been withheld or brokers are not permitted to vote on their behalf as to one or more matters to be acted upon at the Annual Meeting, will be treated as present for purposes of determining whether a quorum is present at the Annual Meeting. However, any shares not voted as a result of a marked abstention or a broker non-vote will not be counted as voting for or against a particular matter. Accordingly, marked abstentions and broker non-votes will have no effect on the outcome of a vote.

How Can I Revoke My Proxy or Change My Vote?

You can revoke your proxy at any time before it is voted at the 2003 Annual Meeting by:

Holders of Record

Stock Held by Brokers, Banks and Nominees

Who Will Count the Vote?

The Board of Directors has appointed IVS Associates, Inc. to act as the Inspector of Election at the 2003 Annual Meeting.

Who Is the Proxy Solicitor?

D.F. King & Co., Inc. has been retained by Prudential Financial to assist with the Annual Meeting, including the distribution of proxy materials and solicitation of votes, for a fee of $25,000 plus reimbursement of expenses to be paid by the Company. In addition, our Directors, officers or employees may solicit proxies for us in person or by telephone, facsimile, Internet or other electronic means.

Page 2

Item 1 — Election of Class II Directors

Prudential Financial's Board of Directors is divided into three classes. One class is elected each year to hold office for a term of three years.

At the Annual Meeting, Class II Directors are to be elected to hold office until the Annual Meeting of shareholders to be held in the year 2006 and until their successors are duly elected or appointed. Each of the nominees is currently serving as a Director. Directors will be elected by a plurality of the votes cast at the Annual Meeting either in person or by proxy. The remaining Directors of Prudential Financial will continue to serve in accordance with their previous election.

Unless authority is withheld by the shareholder, it is the intention of persons named by Prudential Financial as proxies on its proxy card to vote for the nominees listed and, in the event that any nominees are unable or decline to serve (an event not now anticipated), to vote for the balance of the nominees and for any substitutes selected by the Board of Directors. The name, age, principal occupation and other information concerning each Director is set forth below.

Burton G. Malkiel, who has served as a Director of Prudential Financial since January 2001 and of its subsidiary The Prudential Insurance Company of America ("Prudential Insurance") since 1978, is not standing for re-election in accordance with the Board of Director's retirement policy. As a result, the Board of Directors will, subsequent to the Annual Meeting, be reduced from 15 to 14 members and only four Class II Directors will be subject to election.

The Board of Directors recommends that shareholders vote "for" all of the nominees.

Nominees for Class II Directors

for Terms to Expire in 2006

| Frederic K. Becker was elected as a Director of Prudential Financial in January 2001 and was appointed by the Chief Justice of the New Jersey Supreme Court as a Director of Prudential Insurance in June 1994. He has served as President of the law firm of Wilentz Goldman & Spitzer, P.A. since 1989 and has practiced law with the firm since 1960. Age 67. | |

| William H. Gray III was elected as a Director of Prudential Financial in January 2001 and has been a Director of Prudential Insurance since September 1991. He has served as President and Chief Executive Officer of The College Fund/UNCF (philanthropic foundation) since 1991. Mr. Gray was a member of the U.S. House of Representatives from 1979 to 1991. Other Directorships include: Viacom, Inc., Electronic Data Systems Corporation, Rockwell International Corporation, JP Morgan Chase & Co., Dell Computer Corporation, Pfizer Inc. and Visteon Corporation. Age 61. | |

| Jon F. Hanson was elected as a Director of Prudential Financial in January 2001 and was appointed by the Chief Justice of the New Jersey Supreme Court as a Director of Prudential Insurance in April 1991. He has served as Chairman of The Hampshire Companies (real estate investment and property management) since 1976. Mr. Hanson served as the Chairman and Commissioner of the New Jersey Sports and Exposition Authority from 1982 to 1994. Other Directorships include: CD&L, Inc., HealthSouth Corp. (since September 2002) and Pascack Community Bank. Age 66. | |

| Constance J. Horner was elected as a Director of Prudential Financial in January 2001 and has been a Director of Prudential Insurance since April 1994. She has been a Guest Scholar at The Brookings Institution (non-partisan research institute) since 1993, after serving as Assistant to the President of | |

Page 3

| the United States and Director, Presidential Personnel from 1991 to 1993; Deputy Secretary, U.S. Department of Health and Human Services from 1989 to 1991; and Director, U.S. Office of Personnel Management from 1985 to 1989. Mrs. Horner was a Commissioner, U.S. Commission on Civil Rights from 1993 to 1998 and taught at Princeton University in 1994 and Johns Hopkins University in 1995. Other Directorships include: Foster Wheeler Ltd., Ingersoll-Rand Company Ltd. and Pfizer Inc. Age 61. | ||

| Continuing Class III Directors Whose Terms Expire in 2004 | ||

| Arthur F. Ryan is Chairman of the Board, Chief Executive Officer and President of Prudential Financial. He joined Prudential Insurance as the Chairman of the Board, Chief Executive Officer and President and as a Director in December 1994. In December 1999, at the time of its incorporation, he was named Director of Prudential Financial; in January 2000 he was named to its first slate of officers as President and Chief Executive Officer; in December 2000 he took his current title. Prudential Financial became a public company in December 2001. From 1972 until he joined Prudential Insurance, Mr. Ryan was with Chase Manhattan Bank, serving in various executive positions including President and Chief Operating Officer from 1990 to 1994. Other Directorships include Regeneron Pharmaceuticals. Age 60. | |

| Franklin E. Agnew was elected as a Director of Prudential Financial in January 2001 and was appointed by the Chief Justice of the New Jersey Supreme Court as a Director of Prudential Insurance in June 1994. He has been an independent business consultant since January 1987. From 1989 through 1990, he served as the court appointed trustee in the reorganization of the Sharon Steel Corporation. Mr. Agnew was the Chief Financial Officer of H.J. Heinz Co. from July 1971 to June 1973 and a Senior Vice President and Group Executive from July 1973 through 1986. Other Directorships include Bausch & Lomb, Inc. Age 68. | |

| Gilbert F. Casellas was elected as a Director of Prudential Financial in January 2001 and has been a Director of Prudential Insurance since April 1998. He is President of Casellas & Associates, LLC, a consulting firm. During 2001, he served as President and Chief Executive Officer of Q-linx, Inc. (software development). He served as the President and Chief Operating Officer of The Swarthmore Group, Inc. (investment company) from January 1999 to December 2000. Mr. Casellas was a partner in the law firm of McConnell Valdes LLP from 1998 to 1999; Chairman, U.S. Equal Employment Opportunity Commission from 1994 to 1998; and General Counsel, U.S. Department of the Air Force from 1993 to 1994. Age 50. | |

| Allan D. Gilmour was elected as a Director of Prudential Financial in January 2001 and has been a Director of Prudential Insurance since April 1995. He was named Vice Chairman and Chief Financial Officer of Ford Motor Company (automotive industry) in 2002; he previously retired from Ford Motor Company as Vice Chairman in 1995. During his 35-year career with Ford Motor Company, Mr. Gilmour held a number of executive positions, including President of Ford Automotive Group. Other Directorships include: DTE Energy Company and Whirlpool Corporation. Age 68. | |

| Ida F. S. Schmertz was elected as a Director of Prudential Financial in January 2001 and was appointed by the Chief Justice of the New Jersey Supreme Court as a Director of Prudential Insurance in April 1997. She has been a Principal of Microleasing LLC since 2001 and Chairman of the Volkhov International Business Incubator since 1995. Ms. Schmertz was a Principal of Investment Strategies International (investment consultant) from 1994 to 2000 and was with American Express Company from 1979 to 1994, holding several management positions including Senior Vice President, Corporate Affairs. Age 68. | |

Page 4

| Continuing Class I Directors Whose Terms Expire in 2005 | ||

| James G. Cullen was elected as a Director of Prudential Financial in January 2001 and was appointed by the Chief Justice of the New Jersey Supreme Court as a Director of Prudential Insurance in April 1994. He served as the President and Chief Operating Officer of Bell Atlantic Corporation (global telecommunications) from December 1998 until his retirement in June 2000. Mr. Cullen was the President and Chief Executive Officer, Telecom Group, Bell Atlantic Corporation from 1997 to 1998; Vice Chairman of Bell Atlantic Corporation from 1995 to 1997; and President of Bell Atlantic Corporation from 1993 to 1995. Other Directorships include: Johnson & Johnson and Agilent Technologies, Inc. Age 60. | |

| Glen H. Hiner was elected as a Director of Prudential Financial in January 2001 and has been a Director of Prudential Insurance since April 1997. He served as the Chairman and Chief Executive Officer of Owens Corning (advanced glass and building material systems) from 1992 until his retirement in April 2002. Owens Corning filed for protection under the federal bankruptcy code on October 5, 2000. Prior to joining Owens Corning, Mr. Hiner worked at General Electric Company starting in 1957. He served as Senior Vice President and Group Executive, Plastics Group from 1983 to 1991. Other Directorships include Dana Corporation. Age 68. | |

| Richard M. Thomson was elected as a Director of Prudential Financial in January 2001 and has been a Director of Prudential Insurance since April 1976. He retired as Chairman of The Toronto-Dominion Bank (banking and financial services) in 1998, having retired as the Chief Executive Officer in 1997. He had served as Chairman and Chief Executive Officer since 1978. Prior to that time, Mr. Thomson held other management positions at The Toronto-Dominion Bank, which he joined in 1957. Other Directorships include: The Toronto-Dominion Bank, Nexen Inc., INCO, Limited, The Thomson Corporation, Trizec Properties, Inc. and Stuart Energy Systems, Inc. Age 69. | |

| James A. Unruh was elected as a Director of Prudential Financial in January 2001 and has been a Director of Prudential Insurance since April 1996. He became a founding member of Alerion Capital Group, LLC (private equity investment group) in 1998. Mr. Unruh was with Unisys Corporation (information technology services, hardware and software) from 1987 to 1997, serving as its Chairman and Chief Executive Officer from 1990 to 1997. Age 62. | |

| Stanley C. Van Ness was elected as a Director of Prudential Financial in January 2001 and was appointed by the Chief Justice of the New Jersey Supreme Court as a Director of Prudential Insurance in April 1990. He has been a partner in the law firm of Herbert, Van Ness, Cayci & Goodell since 1998. From 1990 to 1998, Mr. Van Ness was a partner in the law firm Picco Herbert Kennedy and from 1984 to 1990 was a partner with Jamieson, Moore, Peskin and Spicer. He was a professor at Seton Hall University Law School from 1982 to 1984. Prior to that time, he served as the first Public Advocate for the State of New Jersey. Other Directorships include Jersey Central Power & Light. Age 69. | |

Item 2 — Ratification of the Appointment of Independent Auditors

The Audit Committee of the Board of Directors has appointed PricewaterhouseCoopers LLP ("PricewaterhouseCoopers") as the Company's independent auditors for 2003. We are not required to have the shareholders ratify the selection of PricewaterhouseCoopers as our independent auditors. We are doing so because we believe it is a matter of good corporate practice. If the shareholders do not ratify the selection, the Audit Committee will reconsider whether or not to retain PricewaterhouseCoopers, but may retain such independent auditors. Even if the selection is

Page 5

ratified, the Audit Committee, in its discretion, may change the appointment at any time during the year if it determines that such a change would be in the best interests of Prudential Financial and its shareholders. Representatives of PricewaterhouseCoopers are expected to be present at the Annual Meeting with an opportunity to make a statement if they desire to do so and to be available to respond to appropriate questions.

The following is a summary and description of fees for services provided by PricewaterhouseCoopers in 2002 and 2001.

Audit Fees

The aggregate fees for professional services rendered for the audits of the consolidated financial statements of Prudential Financial and, as required, of various domestic and international subsidiaries, the issuance of comfort letters, agreed-upon procedures required by regulation, consents and assistance with review of documents filed with the Securities and Exchange Commission were $25,781,192 for 2002 and $29,438,519 for 2001.

Audit Related Fees

The aggregate fees for assurance and related services including due diligence, internal control reports, benefit plan audits and consultation on acquisitions were $4,247,998 for 2002 and $14,207,676 for 2001.

Tax Fees

The aggregate fees for services rendered by PricewaterhouseCoopers' tax department for tax return preparation, tax advice related to mergers and acquisitions and other international, federal and state projects, employee benefit plans, compliance services for expatriate employees and requests for rulings were $5,922,866 in 2002 and $6,477,853 in 2001.

All Other Fees

The aggregate fees for all other services rendered by PricewaterhouseCoopers, including financial information systems and design and non-recurring services in support of Prudential Insurance's demutualization, were $5,714,603 for 2002 and $25,830,952 for 2001.

The Audit Committee has advised Prudential Financial that in its opinion the non-audit services rendered by PricewaterhouseCoopers during the most recent fiscal year are compatible with maintaining their independence.

The Board of Directors recommends that shareholders vote "for" ratification of the appointment of PricewaterhouseCoopers as the Company's independent auditors for 2003.

Item 3 — Ratification of the Deferred Compensation Plan for Non-Employee Directors

The Deferred Compensation Plan for Non-Employee Directors (the "Deferred Compensation Plan") was originally adopted by Prudential Insurance, effective as of July 1, 1974, to provide a means of deferring payment of fees, as fixed from time to time by the Prudential Insurance Board of Directors, to non-employee directors of Prudential Insurance. In addition to the Deferred Compensation Plan, Prudential Insurance also adopted, effective April 1, 1985, the Prudential Pension Plan for Non-Employee Directors (the "Pension Plan"), a nonqualified defined benefit pension plan that obligated Prudential Insurance to pay an annual cash payment of $30,000 to each retired non-employee director, terminating upon his or her death, upon the satisfaction of five years of service with the Prudential Insurance Board of Directors.

As of January 1, 2002, both the Deferred Compensation Plan and the Pension Plan were amended to transfer sponsorship from Prudential Insurance to Prudential Financial, and to reflect the change in corporate structure resulting from the demutualization of Prudential Insurance and the establishment of Prudential Financial as the publicly-held parent company of Prudential Insurance.

Page 6

After a review of the Prudential Financial Board of Directors' compensation programs and policies, and reflecting the desire to align more closely the Board of Directors' compensation practices with those of other public financial institutions and the interests of shareholders, the Board of Directors adopted changes to its compensation and retirement programs in 2002, the effect of which is to link a substantial portion of a director's compensation to the performance of the Company's Common Stock during his or her service on the Board of Directors. First, members of the Board of Directors, effective as of January 1, 2003, began to receive 50% of their annual fees (including, if applicable annual service fees, meeting fees and committee fees) in the form of a Common Stock equivalent ("Stock Based Fees") with each unit representing a notional share of Common Stock ("Deferred Stock Unit") and 50% of their annual fees in the form of cash ("Cash Based Fees"). Second, effective as of December 31, 2002, the Pension Plan was frozen, which means that the Pension Plan was closed to new participants, all current participants were fully vested in their accrued benefits and no additional pension benefits could be accrued. Third, eligible Pension Plan participants had a one-time opportunity to elect to transfer accrued benefits from the Pension Plan to the Deferred Compensation Plan ("Pension Plan Rollover Deferrals"), and the Board of Directors provided that the Pension Plan will terminate once the last payment to Pension Plan participants (including for these purposes any transfer of accrued benefits from the Pension Plan to the Deferred Compensation Plan) has occurred.

Finally, the Deferred Compensation Plan was amended and restated, with changes generally to be effective as of January 1, 2003, to provide for the deferral of Stock Based Fees and Cash Based Fees, to provide for certain additional notional investment options under the Deferred Compensation Plan related to the deferral of such fees and to address the suspension of, and rollover of accrued amounts under, the Pension Plan. Pension Plan Rollover Deferral Amounts and Stock Based Fees must remain allocated in Deferred Stock Units while held under the Deferred Compensation Plan. While the Deferred Compensation Plan is not required to be approved by shareholders under current New York Stock Exchange ("NYSE") rules since the Company intends to use treasury shares to meet plan distribution requirements, the Board of Directors is requesting shareholder ratification of the Deferred Compensation Plan in the interest of sound corporate governance. In the event that shareholders do not ratify the Deferred Compensation Plan, Prudential Financial reserves the right to allow deferrals under the Deferred Compensation Plan in accordance with its terms.

Overview

Under the Deferred Compensation Plan, each participant has a recordkeeping account (a "Deferred Compensation Account"), which, after January 1, 2003, is automatically credited with Deferred Stock Units representing the Stock Based Fees that must be held in that form at least until retirement, except as described in the Distributions section below. A participant may also elect to defer some or all Cash Based Fees which are then credited to his or her Deferred Compensation Account. These cash-based deferrals, as well as any amounts previously deferred under the Deferred Compensation Plan prior to 2003, may be allocated either to Deferred Stock Units or to "Fixed Units". In addition, active directors and directors who retired from January 1, 2002 through December 31, 2002, were offered a one-time election in 2002 to either receive a grant of $225,000 in Deferred Stock Units in lieu of their benefits under the Pension Plan, or to continue to be eligible to receive pension benefits under the terms of the Pension Plan. Directors who join the Board of Directors on or after January 1, 2003 will receive a one-time grant of $100,000 in Deferred Stock Units under the Deferred Compensation Plan rather than any pension benefits.

While each participant has a Deferred Compensation Account, such accounts are established for recordkeeping purposes only. Prudential Financial is not required to fund such accounts at any time or to otherwise segregate or earmark assets to fund its obligations under the Deferred Compensation Plan.

Eligibility and Participation

After January 1, 2003, all active non-employee directors automatically participate in the Deferred Compensation Plan through the deferral of their Stock Based Fees into Deferred Stock Units. In addition, participants may also elect to defer all or a portion of the Cash Based Fees to be earned during a plan period (which is the calendar year). Finally, current and former non-employee directors who have accrued a pension under the terms of the Pension Plan the value of which is to be transferred to the Deferred Compensation Plan pursuant to the suspension and subsequent termination of the Pension Plan, are also participants under the Deferred Compensation Plan.

Page 7

Administration

The Board of Directors has appointed a committee (the "Deferred Compensation Committee") to administer the Deferred Compensation Plan, which is comprised of the following three persons: the Vice President and Secretary of Prudential Financial (the "Secretary"), the Vice President, Total Compensation of Prudential Financial's (or, as the case may be, Prudential Insurance's) Human Resources Department, and a Vice President and Corporate Counsel of Prudential Financial's Law Department (with the Secretary serving, where appropriate, as the primary contact for questions related to the Deferred Compensation Plan's operation by participants).

The Deferred Compensation Committee has the exclusive right, power and authority to interpret, in its sole discretion, any and all of the provisions of the Deferred Compensation Plan.

Shares Subject to the Plan

A maximum of 500,000 shares of Common Stock may be distributed under the Deferred Compensation Plan, except as may be adjusted in the event of a stock split or recapitalization.

Elections

Although deferral of Stock Based Fees into Deferred Stock Units is mandatory, the timing of the distribution of those fees at or after his or her Retirement Date (as defined below) is subject to election by the participant annually. In addition, each participant has an annual election to defer all or a portion of his or her Cash Based Fees for the next plan period, as well as the election of the form and timing of any distributions of those fees. All such elections are made by written notice to the Secretary not later than the last day of the open trading window under Prudential Financial's insider trading policy ("Open Trading Window") immediately preceding the first day of a plan period. In the case of a participant who first becomes eligible during such plan period, election must be made by written notice not later than 30 days after such participant first becomes eligible; provided, however, that with respect to such initial election, no fees attributable to the period before which the election is made and presented to the Secretary are eligible for deferral. Each election will be irrevocable, unless the participant amends his or her election form in the manner provided below.

Each participant may, no later than the last day of the last Open Trading Window in the year prior to the year of his or her anticipated "Retirement Date" (the first day of the month following the month in which the participant terminates his or her services as a non-employee director), amend his or her election forms to change the previously elected form of distribution or to change the starting date for commencement of all payments.

With respect to Pension Plan Rollover Deferrals, participants have previously elected the form and timing of any distributions. Participants who become participants by virtue of such Pension Plan Rollover who were in active service with the Board of Directors as of December 31, 2002, had to specify the form (lump sum or installment) and timing of any distribution of such Pension Plan Rollover Deferrals. Participants and other non-employee directors who become participants by virtue of such Pension Plan Rollover who were in active service with the Board of Directors as of December 31, 2001, but had retired from the Board of Directors prior to December 31, 2002, could elect only five or ten annual installment payments of such amounts, to commence on or after January 1, 2003. No other election was permitted with respect to Pension Plan Rollover Deferrals, except in the case of a change of control (as described below).

Deferred Compensation Accounts

A participant's Deferred Compensation Account will be credited with notional interest, earnings, and, where applicable, notional investment gain or loss that are intended to mirror the investment performance and results of the two notional investment options (Deferred Stock Units and Fixed Units) offered under the Deferred Compensation Plan. Effective for plan periods beginning on or after January 1, 2003, the two available notional investment options under the Deferred Compensation Plan are intended to mirror the performance of two of the actual investment options available to participants of Prudential Insurance's 401(k) plan, as follows: (a) the Fixed Rate Fund (in the case of the Fixed Units), and (b) the Prudential Financial Common Stock Fund (in the case of the Deferred Stock Units). With respect to amounts deemed allocated to the Fixed Units under the Deferred Compensation Plan, such amounts will be credited with interest in the same general manner as interest would be credited to amounts invested in the actual Fixed Rate Fund. With respect to amounts deemed allocated to the Deferred Stock Units, such amounts will be credited under the Deferred Compensation Plan as if the participant had actually purchased shares of Common Stock on the date of such deferral. If dividends on the Common Stock are declared while the participant holds Deferred Stock Units in his or her Deferred

Page 8

Compensation Account, additional Deferred Stock Units will be credited to such Account in the following manner. First, a notional value equal to the cash value of dividends that would be paid upon the same number of whole shares of Common Stock as the participant has Deferred Stock Units in his or her Deferred Compensation Account on the dividend crediting date (e.g., the date such dividend is payable) will be calculated. Second, such notional value will be deemed to be allocated to the participant's Deferred Compensation Account and credited as a corresponding number of Deferred Stock Units to such Account (in whole or fractional units), as of the same date, as soon as administratively practicable. To the extent that the Fixed Rate Fund or Common Stock Fund is amended or removed from the 401(k) plan, comparable changes will be made to the notional investment options under the Deferred Compensation Plan.

Generally, a participant may elect a combination of the two available notional investment options with respect to the amount of fees deferred under the Deferred Compensation Plan, subject to the following limitations. With respect to any Stock Based Fees and Pension Plan Rollover Deferrals, such amounts (and any notional dividends paid with respect to such amounts) may only be allocated to the Deferred Stock Units. With respect to any Cash Based Fees and any fee deferrals credited before December 31, 2002, such amounts (including, in the case of Cash Based Fees, any earnings) may be allocated (in 5% increments) to either the Fixed Units or the Deferred Stock Units.

Subject to the allocation limitations described above, a participant may change how notional amounts reflected in his or her Deferred Compensation Account are deemed invested during an Open Trading Window under the Insider Trading Policy and in no event more than one time per calendar quarter. Charges are effective the first of the following month.

Account Valuations

For purposes of Deferred Compensation Account recordkeeping, periodic updates of the notional value of each participant's Deferred Compensation Account (and of the aggregate unfunded liabilities of the Deferred Compensation Plan as a whole) are made at the direction of the Deferred Compensation Committee (in any event, no less frequently than as of the end of each calendar quarter). With respect to any distribution for a participant's account, the aggregate value of any such distribution is calculated by reference to the notional value of the Deferred Compensation Account as of the last day of the month prior to the month in which such distribution is either anticipated to commence or has been requested to commence by the participant.

Distributions

Participants will receive distributions from the Deferred Compensation Plan in the following forms: (i) shares of Common Stock for account balances attributable to Pension Plan Rollover Amounts and Stock Based Fees, and (ii) at the election of the participant, either cash or shares of Common Stock for the balance.

On an annual basis, participants specify how and when distributions of amounts to be deferred in the subsequent year, are ultimately payable, i.e., in either a lump sum or in installments (either five or ten years of annual installments, for all amounts deferred under the Deferred Compensation Plan, or 60 or 120 monthly installments, for distributions in cash only) as elected by the participant in his or her deferral election form, to begin on (i) a date prior to the participant's Retirement Date for Cash Based Fees, provided that such date is no earlier than January 1 in the year following the plan period during which such fees would otherwise have been payable to the participant if no deferral election had been made, (ii) the participant's Retirement Date, or (iii) such later date as selected by the participant (provided, however, that in any event distributions from the Deferred Compensation Plan must commence no later than the year such participant attains age 701/2). In the event an installment option is chosen, such installments shall be as nearly equal as practicable and shall continue even if the participant again serves on the Board of Directors. Participants, however, do have an opportunity to make a one-time election in the year prior to Retirement to consolidate prior elections, and participants may accelerate the payment of their account balances (i) in the event of hardship (in an amount necessary to satisfy the hardship), (ii) for any reason with respect to Cash Based Fees, subject to the imposition of a 10% penalty, and (iii) in the event of a change of control of Prudential Financial. For purposes of the Deferred Compensation Plan, a "hardship" is an unanticipated emergency caused by an event beyond the control of the participant or a beneficiary that would result in severe financial hardship to the participant or beneficiary.

Change of Control

In the event of a "change of control" where Prudential Financial is not the surviving entity,

Page 9

any successor to Prudential Financial may elect to continue or to terminate the Deferred Compensation Plan (in either event, assuming any and all liabilities for such Deferred Compensation Plan).

In the event of a "change of control", participants will have the ability to make a one-time election to commence payment of their Deferred Compensation Account balance, in whatever manner (lump sum or installment) previously chosen by such participant, no earlier than January 1 of the year following the plan period during which such change of control occurred. For purposes of the Deferred Compensation Plan, "change of control" means: (i) the acquisition, directly or indirectly, of securities of Prudential Financial representing at least 25% of the combined voting power of the outstanding securities of Prudential Financial by a "person" within the meaning of Section 3(a)(9) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"); (ii) within any 24-month period, a change in the majority of the Board of Directors of Prudential Financial in existence at the beginning of such period; (iii) the consummation of certain mergers and consolidations, share exchanges or the division or sale or other disposition of all or substantially all of Prudential Financial's assets; or (iv) any other event which the Board of Directors declares a "change of control". Notwithstanding the foregoing, a change of control will not be deemed to have occurred merely as a result of an underwritten offering of the equity securities of Prudential Financial where no person acquires more than 25% of the beneficial ownership interests in such securities.

Amendment

The Deferred Compensation Committee has the authority to adopt minor amendments to the Deferred Compensation Plan without prior approval by the Board of Directors that: (i) are necessary or advisable for purposes of complying with applicable laws and regulations; (ii) relate to administrative practices under the Deferred Compensation Plan (including, but not limited to, the establishment of any procedures or processes or accounts related to the distribution of Common Stock or other amounts under the Deferred Compensation Plan); (iii) relate to the selection or deletion of additional notional investment options for participants in their accounts; or (iv) have an insubstantial financial effect on the Deferred Compensation Plan. The Board of Directors has the authority to adopt any other amendments to the Deferred Compensation Plan not encompassed under the terms of the preceding sentence, except that shareholder approval is required for any amendment to increase the number of shares to be distributed.

Prudential Financial reserves the right to amend or terminate the Deferred Compensation Plan in any respect and at any time, without the consent of participants or beneficiaries; provided, however, that such amendment or termination may not adversely affect the rights of any participant or beneficiary to receive benefits earned and accrued under the Deferred Compensation Plan prior to such amendment or termination. Participant consent is not required for: (i) any alteration of the notional investment options under the Deferred Compensation Plan; (ii) any acceleration of payments of amounts accrued under the Deferred Compensation Plan by action of the Deferred Compensation Committee or the Corporate Governance Committee of the Board of Directors or by operation of the Deferred Compensation Plan's terms; or (iii) any decision by the Deferred Compensation Committee or the Corporate Governance Committee of the Board of Directors to limit participation (or other features of the Deferred Compensation Plan) prospectively under the Deferred Compensation Plan.

Miscellaneous

The right of a participant to receive a payment under the Deferred Compensation Plan is an unsecured claim against the general assets of Prudential Financial or any successor thereto and all payments under the Deferred Compensation Plan shall be made from the general funds of Prudential Financial or any successor thereto. Prudential Financial is not required to set aside money or any other property to fund its obligations under the Deferred Compensation Plan, and all amounts that may be set aside by Prudential Financial prior to the distribution of account balances under the terms of the Deferred Compensation Plan remain the property of Prudential Financial (or, if applicable, any successor thereto).

No interest of any person or entity in, or right to receive a benefit or distribution under, the Deferred Compensation Plan shall be subject in any manner to sale, transfer, anticipation, assignment, pledge, attachment, garnishment or other alienation or encumbrance of any kind; nor may such interest or right to receive a distribution be taken, either voluntarily or involuntarily, for the satisfaction of the debts of, or other obligations or claims against, such person or entity, including

Page 10

claims for alimony, support, separate maintenance and claims in bankruptcy proceedings.

The full text of the Deferred Compensation Plan is available atwww.investor.prudential.com/shareOwner.cfm. You may also request a copy of the Deferred Compensation Plan, provided without charge, by calling 1-877-998-ROCK (7625).

The Board of Directors recommends that shareholders vote "for" ratification of the Deferred Compensation Plan for Non-Employee Directors.

Item 4 — Approval of the Omnibus Incentive Plan

On March 11, 2003, the Board of Directors of Prudential Financial formally adopted a new Prudential Financial, Inc. Omnibus Incentive Plan (the "Omnibus Plan") and proposed the merger of the Prudential Financial, Inc. Stock Option Plan, previously adopted by Prudential Financial on January 9, 2001 (the "Option Plan"), into the Omnibus Plan, both steps subject to shareholder approval. If the Omnibus Plan is not approved by shareholders, no grants will be made under the plan and the Option Plan will remain in effect.

The Omnibus Plan provides for equity-based compensation incentives through the grant of stock options and stock appreciation rights, as does the Option Plan. The Omnibus Plan also provides for the grant of restricted stock, restricted stock units and dividend equivalents, as well as cash and equity-based performance awards. Any authorized shares of Common Stock not used under the Option Plan will be available for the grant of awards under the Omnibus Plan. After the Option Plan is merged into the Omnibus Plan, all outstanding award grants under the Option Plan shall continue in full force and effect, subject to their original terms under the Option Plan.

Overview

The purpose of the Omnibus Plan, like the Option Plan, is to foster and promote the long-term financial success of Prudential Financial, align the interests of shareholders and employees and materially increase shareholder value by (a) motivating superior employee performance by means of performance-related incentives, (b) encouraging and providing for the acquisition of an ownership interest in Prudential Financial by employees of Prudential Financial and its subsidiaries, and (c) enabling Prudential Financial to attract and retain the services of employees upon whose judgment, interest and effort the successful conduct of its operation is largely dependent. Awards under the Omnibus Plan (each, an "Award") are intended to represent a significant portion of the total compensation value provided to participants. Future Awards are intended to be based upon the recipient's individual performance, level of responsibility and potential to make significant contributions to Prudential Financial. Generally, the Omnibus Plan will terminate as of (a) the date when no more shares of Common Stock are available for issuance under the Omnibus Plan, or, if earlier, (b) the date the Plan is terminated by the Board of Directors.

The Omnibus Plan is being submitted to shareholders, among other reasons, so that the compensation relating to certain Awards made to certain executive officers will be tax deductible under Section 162(m) of the Internal Revenue Code of 1986, as amended (the "Code"). Section 162(m) limits tax deductions to $1 million per year per "covered employee" for certain compensation paid to such employees unless certain conditions are met, including shareholder approval of the plan under which compensation is paid and the satisfaction of certain "performance-based" criteria set forth in the Code. A "covered employee" generally is defined as the corporation's chief executive officer and the other four highest paid officers whose compensation is reported in the corporation's annual proxy. Prudential Financial reserves the right to provide, under the Omnibus Plan and any other plans, payments and benefits to employees, including covered employees, that may not be tax deductible.

Administration

The Compensation Committee of the Board of Directors, or such other committee as the Board of Directors may designate (the "Committee"), shall administer the Omnibus Plan. The Committee shall consist of two or more members, each of whom shall be a "non-employee director" within the meaning of Section 16b-3 of the Exchange Act, an "outside director" within the meaning of Section 162(m) of the Code and an "independent director" under Section 303A of the NYSE's Listed Company Manual.

The Committee has full authority to interpret and administer the Omnibus Plan in order to carry out its provisions and purposes. The Committee has the authority to determine those eligible to receive Awards and to establish the terms and conditions of any Awards. The Committee may delegate, subject to such terms or conditions or guidelines

Page 11

as it shall determine, to any employee or group of employees any portion of its authority and powers with respect to Awards to officers of Prudential Financial or any subsidiary who are not subject to the reporting requirements under Section 16(a) of the Exchange Act ("Executive Officers"). Only the Committee or the Board of Directors may exercise authority in respect of Awards granted to Executive Officers.

The Committee may also generally make any rules, determinations or modifications it deems advisable with respect to participants based outside the United States and newly eligible participants. The Committee may also condition the grant of any Award on entering into a written agreement containing covenants not to compete, not to solicit Prudential Financial's employees and customers and not to disclose confidential information.

Eligibility

Awards may be made to any individual who is either an employee (including each officer) of, or an insurance agent (whether or not a common law employee or a full-time life insurance salesperson within the meaning of Section 3121(d)(3)(B) of the Code) of, Prudential Financial or any subsidiary.

Types of Awards

The Omnibus Plan provides for grants of incentive stock options qualifying for special tax treatment under Code Section 422 ("ISOs"), nonstatutory stock options ("Nonstatutory Options"), stock appreciation rights ("SARs"), restricted stock units ("Restricted Units"), restricted stock ("Restricted Stock"), dividend equivalents ("Dividend Equivalents"), long-term performance units ("Long-Term Performance Units"), performance shares ("Performance Shares") and annual incentive awards ("Annual Incentive Awards"), whether granted singly, in combination or in tandem, pursuant to which Common Stock, cash or other property may be delivered to the Award recipient. Awards also include awards of Common Stock or Restricted Units (including any associated Dividend Equivalents) made in conjunction with other incentive programs established by Prudential Financial or its subsidiaries and so designated by the Committee.

Shares Subject to the Plan; Other Limitations of Awards

The maximum number of shares of Common Stock issuable under the Omnibus Plan shall be 50,000,000 plus any unused shares of Common Stock available for awards under the Option Plan as of the effective date of the merger of the Option Plan with the Omnibus Plan, which is estimated to be approximately another 12,100,000 (approximately 20,600,000 shares as of December 31, 2002, reduced by option grants made in February and March 2003).

For purposes of calculating available shares of Common Stock under the Omnibus Plan, any shares issued in connection with Awards that are ISOs or Nonstatutory Options (collectively, "Options") or SARs shall be counted against the limit as one share for every one share issued; for awards other than Options and SARs, any shares issued shall be counted as two shares for every one share issued.

To the extent that any shares of Common Stock subject to an Award (including an Award granted under the Option Plan prior to its date of merger with the Omnibus Plan) are not issued because the Award expires without having been exercised, is cancelled, terminated, forfeited or is settled without issuance of Common Stock (including, but not limited to, shares tendered to exercise outstanding Options, shares tendered or withheld for taxes on Awards or shares issued in connection with a Restricted Stock or Restricted Unit Award that are subsequently forfeited), such shares will be available again for grants of Awards under the Omnibus Plan. (This includes any award made under the Option Plan prior to the effective date of the Omnibus Plan and the merger of the Option Plan into the Omnibus Plan). The shares to be delivered under the Omnibus Plan may consist, in whole or in part, of Common Stock purchased by the Company for the purpose of such Awards, treasury Common Stock or authorized but unissued Common Stock not reserved for any other purpose.

The Omnibus Plan has various limits that apply to individual and aggregate awards, designed in part to comply with the requirements of Code Section 162(m) governing the deductibility of compensation paid to executive officers of a publicly-traded company. In order to satisfy these requirements, shareholders must approve any "performance-based plan", that sets maximum limits on the amount of any award granted to a particular executive. No individual may receive under the Omnibus Plan more than an aggregate of 2,500,000 Options and SARs during any three calendar year period. For all participants who are "covered employees" within the meaning of Code Section 162(m) and are eligible to receive Annual Incentive Awards under this Plan (the "Covered Employees"), the maximum amount of such Annual Incentive Awards that may be paid or

Page 12

made available to any such individuals in any year may not exceed six-tenths of one percent (0.6%) of Adjusted Operating Income ("Covered Employees Annual Incentive Award Pool"). For purposes of the Omnibus Plan, "Adjusted Operating Income" means the income from continuing operations before income taxes of the Company's Financial Services Businesses, excluding: realized investment gains, net of losses and related charges and adjustments; sales practices remedies and costs; demutualization costs and expenses; and the contribution to income/loss of divested businesses that we sold or exited by the Company but that did not qualify for "discontinued operations" accounting treatment under generally accepted accounting principles. "Financial Services Businesses" means the businesses in the Company's three operating divisions of Insurance, Investment and International Insurance and Investments, as well as the Company's Corporate and Other operations.

Options

Options entitle the recipient to purchase shares of Common Stock at the exercise price specified by the Committee in the recipient's Option agreement. As under the existing Option Plan, the Omnibus Plan permits the grant of both ISOs and Nonstatutory Options. The Committee will generally determine the terms and conditions of all Options granted; provided, however, that, generally, Options must be granted with an exercise price at least equal to the fair market value of a share of Common Stock on the date of grant, Options shall not be exercisable for more than 10 years after the date of grant (except in the event of death) and no Option that is intended to be an ISO may be granted after the tenth anniversary of the date the Omnibus Plan was approved by the Board of Directors. Options generally become exercisable in one-third increments on each of the first three anniversaries of the date of grant, and the Committee may establish performance-based criteria for the exercisability of any Option. For purposes of the Omnibus Plan, "fair market value" generally means, on any given date, the price of the last trade, regular way, in the Common Stock on such date on the NYSE (or if not listed on the NYSE, on such other recognized quotation system on which trading prices of the Common Stock are then quoted). If there are no trades on the relevant date, the "fair market value" for that date means the closing price on the immediately preceding date on which Common Stock transactions were reported.

The Committee does not have the power or authority to reduce the exercise price of any outstanding option or to grant any new Options in substitution for or upon the cancellation of Options previously granted. There are exceptions for some foreign jurisdictions to meet regulatory requirements.

Stock Appreciation Rights (SARs)

A SAR is a contractual right granted to the participant to receive, either in cash or Common Stock, an amount equal to the appreciation of one share of Common Stock from the date of grant. SARs may be granted as freestanding Awards, or in tandem with other types of grants. Unless the Committee otherwise determines, the terms and conditions applicable to (i) SARs granted in tandem with Options will be substantially identical to the terms and conditions applicable to the tandem Options, and (ii) freestanding SARs will be substantially identical to the terms and conditions that would have been applicable were the grant of the SARs a grant of Options. SARs that are granted in tandem with an Option may only be exercised upon surrender of the right to exercise such Option for an equivalent number of shares. The Committee may cap any SAR payable in cash.

Restricted Stock, Restricted Units and Dividend Equivalents

The Omnibus Plan provides for the grant of Restricted Stock, Restricted Units and Dividend Equivalents, which are converted to shares of Common Stock upon the lapse of restrictions. The Committee may, in its discretion, pay the value of Restricted Units and Dividend Equivalents in Common Stock, cash or a combination of both.

A share of Restricted Stock is a share of Common Stock that is subject to certain transfer restrictions and forfeiture provisions for a period of time as specified by the Committee in the recipient's Award agreement. A Restricted Unit is an unfunded, unsecured right (which is subject to forfeiture and transfer restrictions) to receive a share of Common Stock at the end of a period of time specified by the Committee in the recipient's Award agreement. A Dividend Equivalent represents an unfunded and unsecured promise to pay an amount equal to all or any portion of the regular cash dividends that would be paid on a specified number of shares of Common Stock if such shares were owned by the Award recipient. Dividend Equivalents may be granted in connection with a grant of Restricted Units, Options and/or SARs.

Page 13

Unless otherwise determined by the Committee at the time of grant, the restrictions on Restricted Stock and Restricted Units will generally lapse on the third anniversary of the date of grant, and the Committee may provide for vesting to accelerate based on attaining specified performance objectives determined by the Committee.

Generally, a participant will, subject to any restrictions and conditions specified by the Committee, have all the rights of a shareholder with respect to shares of Restricted Stock, including but not limited to, the right to vote and the right to receive dividends. A participant will not have the rights of a shareholder with respect to Restricted Units or Dividend Equivalents.

Annual Incentive Awards

At the direction of the Committee, Awards with a performance cycle of one year or less may be made to participants and, unless determined otherwise by the Committee, shall be paid in cash based on achievement of specified performance goals.

Long-Term Performance Unit Awards

At the discretion of the Committee, Long-Term Performance Unit Awards, payable in cash, may be made to participants. Performance cycles are generally multiple years, where performance may be measured by objective criteria other than the appreciation or depreciation of Common Stock value.

Performance Shares

The Committee also has the discretion to grant "Performance Share Awards", which are Awards of units denominated in Common Stock. The number of such units is determined over the performance period based on the satisfaction of performance goals relating to the Common Stock price. Performance Share Awards are payable in Common Stock.

Treatment of Awards on Termination of Employment

Under the Omnibus Plan, generally, unless the Committee determines otherwise as of the date of a grant of any Award or thereafter, Awards are treated as follows upon a participant's termination of employment.

Resignation. If a participant voluntarily terminates employment from the Company or any Affiliate:

Termination for Cause. If a participant's employment is terminated for "cause":

For purposes of the Omnibus Plan (as under the Option Plan), "cause" includes dishonesty, fraud or misrepresentation; inability to obtain or retain appropriate licenses; violation of any rule or regulation of any regulatory or self-regulatory agency or of any policy of Prudential Financial or any subsidiary; commission of a crime; breach of a written covenant or agreement not to misuse property or information; or any act or omission detrimental to the conduct of Prudential Financial's or any subsidiary's business in any way.

Page 14

Approved Retirement. If a participant's employment terminates by reason of "Approved Retirement":

For purposes of the Omnibus Plan (as for the Option Plans), "Approved Retirement" generally means termination of a participant's employment, other than for "cause": (i) on or after the normal retirement date or any early retirement date established under any defined benefit pension plan maintained by the Company or a subsidiary and in which the participant participates, or (ii) on or after attaining age 50 and completing such period of service, as the Committee shall determine from time to time, when the participant does not participate in any such defined benefit pension plan maintained by the Company or a subsidiary.

Death or Disability. The Omnibus Plan also has default provisions for the treatment of Awards following termination of a participant's employment due to death or disability.

Termination for Other Reasons. If a participant's employment terminates for any reason other than resignation, termination for cause, approved retirement, death or disability, outstanding Awards are treated in the same manner as in the case of a resignation except that Options/SARs and associated Dividend Equivalents that are exercisable on the date of such termination may be exercised at any time prior to the expiration date of the term of the Options or the 90th day following termination of employment, whichever period is shorter; and, in the case of Long-Term Performance Unit Awards/Performance Share Awards, a prorated payment of the participant's Long-Term Performance Unit Award and Performance Share Award will be made as if the target performance goals for the performance cycle had been achieved.

Non-Transferability of Awards

Generally, no Awards granted under the Omnibus Plan may be sold, transferred, pledged, assigned, or otherwise alienated or hypothecated, other than by will or by the laws of descent and distribution. The Committee may, in the Award agreement or otherwise, permit transfers of Nonstatutory Options with or without tandem SARs and freestanding SARs to certain family members.

Adjustment in Capitalization

If an "adjustment event" occurs, the Committee, in its discretion, shall adjust appropriately (a) the aggregate number of shares of Common Stock available for Awards, (b) the aggregate limitations on the number of shares that may be awarded as a particular type of Award or that may be awarded to any particular participant in any particular period, and (c) the aggregate number of shares subject to outstanding Awards and the respective exercise prices or base prices applicable to outstanding Awards. To the extent deemed equitable and appropriate by the Committee, and subject to any required action by Prudential Financial's shareholders, with respect to any "adjustment event" that is a merger, consolidation, reorganization, liquidation, dissolution or similar transaction, any Award granted under the Omnibus Plan shall be deemed to pertain to the securities and other property, including cash, which a holder of the number of shares of Common Stock covered by the Award would have been entitled to receive in connection with such an "adjustment event". For purposes of the Omnibus Plan, "adjustment event" means any stock dividend, stock split or share combination of, or extraordinary cash dividend on, the Common Stock or recapitalization, reorganization, merger, consolidation, split-up, spin-off, combination, dissolution, liquidation, exchange of shares, warrants or rights offering to purchase Common Stock at a price substantially below fair market value, or other similar event affecting the Common Stock. Any shares of stock or cash or other property received with respect to any

Page 15

Restricted Stock Award or Restricted Unit Award as a result of any adjustment event or any distribution of property shall (except in the case of a change of control or as otherwise provided by the Committee) be subject to the same terms, conditions and restrictions as are applicable to such shares of Restricted Stock or Restricted Units.

Change of Control

Upon the occurrence of a change of control of Prudential Financial, each outstanding Option and SAR shall become fully exercisable and all restrictions on outstanding Restricted Stock and Restricted Units shall lapse. In addition, any Long-Term Performance Unit Awards and Performance Share Awards outstanding will be paid in full at target. Such payments shall be made within 30 days of the change of control, and the participants may opt to receive such payments in cash. The Committee may, in its discretion, provide for cancellation of each Option, SAR, Restricted Stock and Restricted Stock Unit in exchange for a cash payment per share based upon the change of control price. This change of control price is the highest share price offered in conjunction with any transaction resulting in a change of control (or, if there is no such price, the highest trading price during the 30 days preceding the change of control event). Notwithstanding the foregoing, no acceleration of vesting or exercisability, cancellation, cash payment or other settlement shall occur with respect to any Option, SAR, Restricted Stock, Restricted Unit, Long-Term Performance Unit Award or Performance Share Award if the Committee reasonably determines in good faith prior to the change of control that such Awards will be honored or assumed or equitable replacement awards will be made by a successor employer immediately following the change of control and that such Awards will vest and payments will be made if a participant is involuntarily terminated without cause.

For purposes of the Omnibus Plan, "change of control" means: (i) the acquisition, directly or indirectly, of securities of Prudential Financial representing at least 25% of the combined voting power of the outstanding securities of Prudential Financial by any "person" (within the meaning of Section 3(a)(9) of the Exchange Act) other than by Prudential Financial, its subsidiaries or any employee benefit plan of Prudential Financial or its subsidiaries; (ii) within any 24-month period, a change in the majority of the Board of Directors of Prudential Financial in existence at the beginning of such period; (iii) the consummation of certain mergers, consolidations, recapitalizations or reorganizations, share exchanges, divisions, sales, plans of complete liquidation or dissolution, or other dispositions of all or substantially all of Prudential Financial's assets, which have been approved by Prudential Financial's shareholders, if Prudential Financial's shareholders do not hold a majority of the voting power of the surviving, resulting or acquiring corporation immediately thereafter; or (iv) any other event the Board of Directors determines to be a "change of control". Notwithstanding the foregoing, a change of control will not be deemed to have occurred merely as a result of an underwritten offering of the equity securities of Prudential Financial where no person acquires more than 25% of the beneficial ownership interests in such securities being offered.

Amendment

The Board of Directors may, at any time amend, modify, suspend or terminate the Omnibus Plan, in whole or in part, without notice to or the consent of any participant or employee; provided, however, that any amendment which would (i) increase the number of shares available for issuance under the Omnibus Plan, (ii) lower the minimum exercise price at which an Option (or the base price at which a SAR may be granted), or (iii) change the individual Award limits shall be subject to the approval of Prudential Financial's shareholders. No amendment, modification or termination of the Omnibus Plan may in any manner adversely affect any Award theretofore granted under the Omnibus Plan, without the consent of the participant. However, for purposes of this provision, any payments made in accordance with the change of control provision, described above, other accelerations of payments under the Plan, or any decision by the Committee to limit participation or other features of the Plan prospectively will not be deemed, an "adverse amendment" of the Omnibus Plan.

No Limitation on Compensation; Scope of Liabilities

Nothing in the Omnibus Plan limits the right of Prudential Financial to establish other plans if and to the extent permitted by applicable law. The liability of Prudential Financial, its subsidiaries and affiliates under the Omnibus Plan is limited to the obligations expressly set forth in the Plan.

Page 16

New Plan Benefits

In January 2003, the Compensation Committee of the Board of Directors confirmed the appropriateness of adopting a 2003 long-term incentive program generally consisting of 50% stock options (under the Option Plan) and 50% in Restricted Stock (under the Omnibus Plan). In February 2003, the Committee approved the total value of 2003 long-term compensation for executives at or above the level of senior vice president. The Committee also approved option grants under the Option Plan to eligible individuals, including the Named Executives. The number of options granted was determined in accordance with a methodology intended to provide 50% of the value of each individual's long-term compensation.

In March 2003, the Board of Directors adopted the Omnibus Plan, subject to shareholder approval. The following chart indicates the current anticipated type and amount of participant Awards for the current fiscal year (which runs from January 1, 2003 through December 31, 2003), if the Omnibus Plan is approved. The actual benefits under the Omnibus Plan may change, depending upon further Committee action, the fair market value of the Common Stock at various future dates and other factors described below. Thus, it is not possible to determine currently the precise dollar amount of benefits that would be received by participants in the Omnibus Plan if such plan is approved by shareholders.

Prudential Financial, Inc. Omnibus Incentive Plan (2003 Executive Grants)

| Name and Position | Types of Awards | Number of Units/Shares | ||

|---|---|---|---|---|

| Arthur F. Ryan Chairman and Chief Executive Officer | Performance Shares | 76,4301 | ||

| John R. Strangfeld, Jr. Vice Chairman, Investments Division | Performance Shares | 45,8581 | ||

| Vivian L. Banta Vice Chairman, Insurance Division | Performance Shares | 45,8581 | ||

| Rodger A. Lawson Vice Chairman, International Division | Performance Shares | 38,2151 | ||

| Mark B. Grier Vice Chairman, Financial Management | Performance Shares | 30,5721 | ||

| Executive Group (Including the Named Executives) | Performance Shares/Restricted Stock/Restricted Units2 | 291,2002 | ||

| Non-Employee Director Group | N/A | N/A | ||

| Non-Executive Employee Group | Restricted Stock/Restricted Units | 1,998,764 |

(1) The number of Performance Shares to be granted to the Named Executives is an estimate of the target number of Performance Shares to be granted. The actual number of Performance Shares granted, and the terms, conditions and value of any ultimate payment of such Awards, will be subject to performance standards determined and approved by the Compensation Committee in accordance with the Omnibus Plan's terms and to satisfy the requirements of Code Section 162(m).

(2) The Named Executives will receive Performance Shares as described above; all other grants for the members of the Executive Group and the Non-Executive Employee Group will be either Restricted Stock or Restricted Units (with associated Dividend Equivalents).

Page 17

U.S. Federal Tax Implications for Certain Awards

The following is a brief description of the U.S. federal income tax consequences generally arising with respect to the grant of Options and SARs under the Omnibus Plan.

The grant of an Option or SAR will create no tax consequences for the recipient or Prudential Financial. A recipient will not recognize taxable income upon exercising an ISO (except that the alternative minimum tax may apply). Upon exercising a Nonstatutory Option or SAR, the recipient generally will recognize ordinary income equal to the excess of the fair market value of the freely transferable and nonforfeitable shares (and/or cash or other property) acquired on the date of exercise over the exercise price. The grant of an associated Dividend Equivalent will not result in taxable income to the participant unless and until actual cash payments are made to such participant from such Award.

Upon a disposition of shares acquired upon exercise of an ISO before the end of the applicable ISO holding periods, the recipient generally will recognize ordinary income equal to the lesser of (i) the excess of the fair market value of the shares at the date of exercise of the ISO over the exercise price, or (ii) the amount realized upon the disposition of the ISO shares over the exercise price. Otherwise, a recipient's disposition of shares acquired upon the exercise of an Option (including an ISO for which the ISO holding periods are met) or SAR generally will result in short-term or long-term (which will always be the case for ISOs if the holding periods are met) capital gain or loss measured by the difference between the sale price and the recipient's tax basis in such shares (the tax basis in option shares generally being the exercise price plus any amount recognized as ordinary income in connection with the exercise of the Option).