Exhibit 99.0

Investor Day

December 2, 2004

Investor Day 12.02.04 0

Prudential Financial Investor Day

December 2, 2004

Eric Durant

Senior Vice President, Investor Relations

Investor Day 12.02.04 1

Forward-Looking Statements

Certain of the statements included in the following presentation constitute forward-looking statements within the meaning of the U. S. Private Securities Litigation Reform Act of 1995. Words such as “expects,” “believes,” “anticipates,” “includes,” “plans,” “assumes,” “estimates,” “projects,” “intends,” or variations of such words are generally part of forward-looking statements. Forward-looking statements are made based on management’s current expectations and beliefs concerning future developments and their potential effects upon Prudential Financial, Inc. and its subsidiaries. There can be no assurance that future developments affecting Prudential Financial, Inc. and its subsidiaries will be those anticipated by management. These forward-looking statements are not a guarantee of future performance and involve risks and uncertainties, and there are certain important factors that could cause actual results to differ, possibly materially, from expectations or estimates reflected in such forward-looking statements, including those set forth in this presentation and without limitation: general economic, market and political conditions, including the performance of financial markets, interest rate fluctuations and the economic environment; various domestic or international military or terrorist activities or conflicts; volatility in the securities markets; reestimates of our reserves for future policy benefits and claims; changes in our assumptions related to deferred policy acquisition costs; our exposure to contingent liabilities; catastrophe losses; investment losses and defaults; changes in our claims-paying or credit ratings; competition in our product lines and for personnel; fluctuations in foreign currency exchange rates and foreign securities markets; risks to our international operations; the impact of changing regulation or accounting practices; Prudential Financial, Inc.’s primary reliance, as a holding company, on dividends from its subsidiaries to meet debt payment obligations and the applicable regulatory restrictions on the ability of the subsidiaries to pay such dividends; adverse litigation results; and changes in tax law. Prudential Financial, Inc. does not intend, and is under no obligation, to update any particular forward-looking statement included in this presentation. The information referred to above, as well as the risks of our businesses described in our Annual Report on Form 10-K for the year ended December 31, 2003, and our Quarterly Report on Form 10-Q for the quarter ended September 30, 2004, should be considered by readers when reviewing forward-looking statements contained in this presentation.

Investor Day 12.02.04 2

Non–GAAP Measure

In managing our businesses, we use a non-GAAP measure we call “adjusted operating income” to measure the performance of our Financial Services Businesses (FSB). Our goals for return on equity (ROE) and earnings per share (EPS) are based on FSB after-tax adjusted operating income and attributed equity. Adjusted operating income, which is not measured in accordance with generally accepted accounting principles (GAAP), excludes net realized investment gains and losses. A significant element of realized losses is impairments and losses from sales of credit-impaired securities, the timing of which depends largely on market credit cycles and can vary considerably across periods. The timing of other sales that would result in gains or losses is largely subject to our discretion and influenced by market opportunities. Similarly, adjusted operating income excludes investment gains and losses on trading account assets supporting insurance liabilities and changes in experience-rated contractholder liabilities due to asset value changes, because these recorded changes in asset and liability values will ultimately inure to contractholders. Trends in the underlying profitability of our businesses can be more clearly identified without the fluctuating effects of these transactions. Adjusted operating income also excludes the results of divested businesses, which are not relevant to our ongoing operations. Because we do not predict future realized investment gains/losses or recorded changes in asset and liability values that will ultimately inure to contractholders, we cannot provide a measure of our Common Stock earnings per share expectation based on income from continuing operations of the Financial Services Businesses, which is the GAAP measure most comparable to adjusted operating income. We believe that the presentation of adjusted operating income as we measure it for management purposes enhances the understanding of our results of operations by highlighting the results from ongoing operations and the underlying profitability factors of our businesses.

ROE based on annualized after-tax adjusted operating income is determined by dividing annualized after-tax adjusted operating income (giving effect to the direct equity adjustment), by average FSB attributed equity excluding unrealized gains and losses on investments. An alternative measure to ROE based on after-tax adjusted operating income is return on average equity (based on income from continuing operations). Return on average equity (based on income from continuing operations) represents annualized after-tax income from continuing operations as determined in accordance with GAAP (giving effect to the direct equity adjustment), divided by average FSB total attributed equity. Return on average equity (based on income from continuing operations) was 9.76% and 3.89% for the nine months ended September 30, 2004 and 2003, respectively. FSB attributed equity, including unrealized gains and losses on investments, was $20.457 billion and $20.541 billion as of September 30, 2004 and 2003, respectively.

For additional information about adjusted operating income and the comparable GAAP measure please refer to our Annual Report on Form 10-K for the year ended December 31, 2003, and our Quarterly Report on Form 10-Q for the quarter ended September 30, 2004, on the Investor Relations Web site at www.investor.prudential.com. Reconciliations between adjusted operating income and the comparable GAAP measure for the nine month periods ended September 30, 2004 and 2003, are included in this presentation. Additional historical information relating to the Company’s financial performance, including its third quarter 2004 Quarterly Financial Supplement, is also located on the Investor Relations Web site.

Investor Day 12.02.04 3

Reconciliation between adjusted operating income

and the comparable GAAP measure

Prudential Financial, Inc.

FINANCIAL HIGHLIGHTS

(in millions, except per share data)

| | | | | | |

| | | Nine months ended September 30,

| |

| | | 2003

| | | 2004

| |

Financial Services Businesses: | | | | | | |

Pre-tax adjusted operating income by division: | | | | | | |

Insurance Division | | 582 | | | 694 | |

Investment Division | | 233 | | | 244 | |

International Insurance and Investments Division | | 618 | | | 733 | |

Corporate and other operations | | 49 | | | 144 | |

| | |

|

| |

|

|

Total pre-tax adjusted operating income | | 1,482 | | | 1,815 | |

Income taxes, applicable to adjusted operating income | | 482 | | | 481 | |

| | |

|

| |

|

|

Financial Services Businesses after-tax adjusted operating income | | 1,000 | | | 1,334 | |

| | |

|

| |

|

|

| | |

Items excluded from adjusted operating income: | | | | | | |

Realized investment gains (losses), net, and related charges and adjustments | | (170 | ) | | 182 | |

Investment gains (losses) on trading account assets supporting insurance liabilities, net | | — | | | (64 | ) |

Change in experience-rated contractholder liabilities due to asset value changes | | — | | | 33 | |

Divested businesses | | (450 | ) | | (53 | ) |

| | |

|

| |

|

|

Total items excluded from adjusted operating income, before income taxes | | (620 | ) | | 98 | |

Income taxes, applicable to items excluded from adjusted operating income | | (187 | ) | | 9 | |

| | |

|

| |

|

|

Total items excluded from adjusted operating income, after income taxes | | (433 | ) | | 89 | |

| | |

|

| |

|

|

Income from continuing operations (after-tax) of Financial Services Businesses before extraordinary gain on acquisition and cumulative effect of accounting change | | 567 | | | 1,423 | |

Loss from discontinued operations, net of taxes | | (23 | ) | | (8 | ) |

Extraordinary gain on acquisition, net of taxes | | — | | | 21 | |

Cumulative effect of accounting change, net of taxes | | — | | | (79 | ) |

| | |

|

| |

|

|

Net income of Financial Services Businesses | | 544 | | | 1,357 | |

| | |

|

| |

|

|

Earnings per share of Common Stock (diluted): | | | | | | |

Financial Services Businesses after-tax adjusted operating income | | 1.90 | | | 2.63 | |

Items excluded from adjusted operating income: | | | | | | |

Realized investment gains (losses), net, and related charges and adjustments | | (0.31 | ) | | 0.34 | |

Investment gains (losses) on trading account assets supporting insurance liabilities, net | | — | | | (0.12 | ) |

Change in experience-rated contractholder liabilities due to asset value changes | | — | | | 0.06 | |

Divested businesses | | (0.82 | ) | | (0.10 | ) |

| | |

|

| |

|

|

Total items excluded from adjusted operating income, before income taxes | | (1.13 | ) | | 0.18 | |

Income taxes, applicable to items excluded from adjusted operating income | | (0.34 | ) | | 0.02 | |

| | |

|

| |

|

|

Total items excluded from adjusted operating income, after income taxes | | (0.79 | ) | | 0.16 | |

| | |

|

| |

|

|

Income from continuing operations (after-tax) of Financial Services Businesses before extraordinary gain on acquisition and cumulative effect of accounting change | | 1.11 | | | 2.79 | |

Loss from discontinued operations, net of taxes | | (0.04 | ) | | (0.01 | ) |

Extraordinary gain on acquisition, net of taxes | | — | | | 0.04 | |

Cumulative effect of accounting change, net of taxes | | — | | | (0.15 | ) |

| | |

|

| |

|

|

Net income of Financial Services Businesses | | 1.07 | | | 2.67 | |

| | |

|

| |

|

|

Weighted average number of outstanding Common shares (diluted basis) | | 550.5 | | | 532.5 | |

| | |

Reconciliation to Consolidated Net Income of Prudential Financial, Inc: | | | | | | |

Net income of Financial Services Businesses (above) | | 544 | | | 1,357 | |

Net income of Closed Block Business | | 145 | | | 321 | |

| | |

|

| |

|

|

Consolidated net income | | 689 | | | 1,678 | |

| | |

|

| |

|

|

Direct equity adjustments for earnings per share calculations | | 45 | | | 64 | |

Reconciliation between adjusted operating income

and the comparable GAAP measure (continued)

Prudential Financial, Inc.

COMBINED STATEMENTS OF OPERATIONS—FINANCIAL SERVICES BUSINESSES

(in millions)

| | | | | | |

| | | Nine months ended September 30,

| |

| | | 2003

| | | 2004

| |

Revenues (1): | | | | | | |

Premiums | | 5,876 | | | 6,577 | |

Policy charges and fee income | | 1,448 | | | 1,735 | |

Net investment income | | 3,717 | | | 3,979 | |

Commissions, investment management fees, and other income | | 2,648 | | | 2,497 | |

| | |

|

| |

|

|

Total revenues | | 13,689 | | | 14,788 | |

| | |

|

| |

|

|

Benefits and Expenses (1): | | | | | | |

Insurance and annuity benefits | | 6,113 | | | 6,699 | |

Interest credited to policyholders' account balances | | 1,263 | | | 1,543 | |

Interest expense | | 143 | | | 193 | |

Deferral of acquisition costs | | (917 | ) | �� | (1,056 | ) |

Amortization of acquisition costs | | 452 | | | 585 | |

General and administrative expenses | | 5,153 | | | 5,009 | |

| | |

|

| |

|

|

Total benefits and expenses | | 12,207 | | | 12,973 | |

| | |

|

| |

|

|

Adjusted operating income before income taxes | | 1,482 | | | 1,815 | |

| | |

|

| |

|

|

Items excluded from adjusted operating income before income taxes: | | | | | | |

Realized investment gains (losses), net, and related adjustments | | (145 | ) | | 214 | |

Related charges | | (25 | ) | | (32 | ) |

| | |

|

| |

|

|

Total realized investment gains (losses), net, and related charges and adjustments | | (170 | ) | | 182 | |

| | |

|

| |

|

|

Investment gains (losses) on trading account assets supporting insurance liabilities, net | | — | | | (64 | ) |

Change in experience-rated contractholder liabilities due to asset value changes | | — | | | 33 | |

Divested businesses | | (450 | ) | | (53 | ) |

| | |

|

| |

|

|

Total items excluded from adjusted operating income before income taxes | | (620 | ) | | 98 | |

| | |

|

| |

|

|

Income from continuing operations before income taxes, extraordinary gain on acquisition and cumulative effect of accounting change | | 862 | | | 1,913 | |

Income tax expense | | 295 | | | 490 | |

| | |

|

| |

|

|

Income from continuing operations before extraordinary gain on acquisition and cumulative effect of accounting change | | 567 | | | 1,423 | |

| | |

|

| |

|

|

| (1) | | Revenues exclude realized investment gains, net of losses and related charges and adjustments, investment gains, net of losses, on trading account assets supporting insurance liabilities, and revenues of divested businesses. Benefits and expenses exclude charges related to realized investment gains, net of losses; changes in experience-rated contractholder liabilities due to asset value changes, and benefits and expenses of divested businesses. |

Investor Day

December 2, 2004

Investor Day 12.02.04 6

Prudential Financial, Inc.

Art Ryan

Chairman and CEO

Investor Day 12.02.04 7

ROE levers: 2001—2005

Expense cuts

Resolve underperforming businesses Grow high return businesses Redeploy capital

Investor Day 12.02.04 8

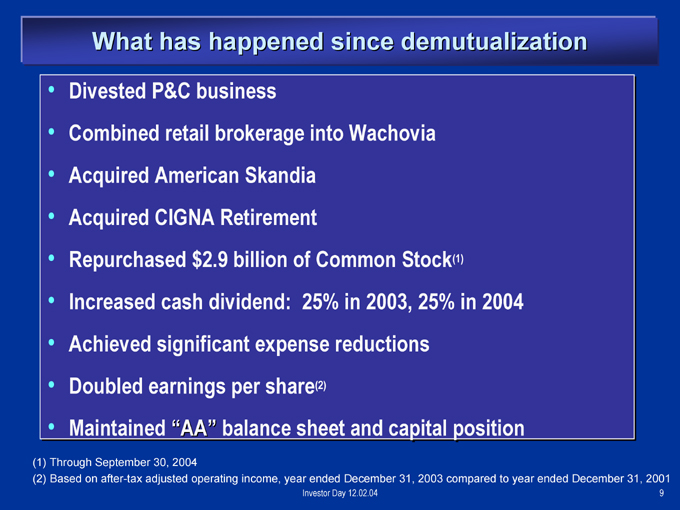

What has happened since demutualization

Divested P&C business

Combined retail brokerage into Wachovia Acquired American Skandia Acquired CIGNA Retirement Repurchased $2.9 billion of Common Stock(1) Increased cash dividend: 25% in 2003, 25% in 2004 Achieved significant expense reductions Doubled earnings per share(2) Maintained “AA” balance sheet and capital position

(1) Through September 30, 2004

(2) Based on after-tax adjusted operating income, year ended December 31, 2003 compared to year ended December 31, 2001

Investor Day 12.02.04 9

After 2005 …

Two substantial growth opportunities:

International businesses

Domestic retirement and savings businesses

Evolving multi-channel distribution strategy Substantial operating cash flows enable share repurchases, growing cash dividends Opportunistic acquisitions

Investor Day 12.02.04 10

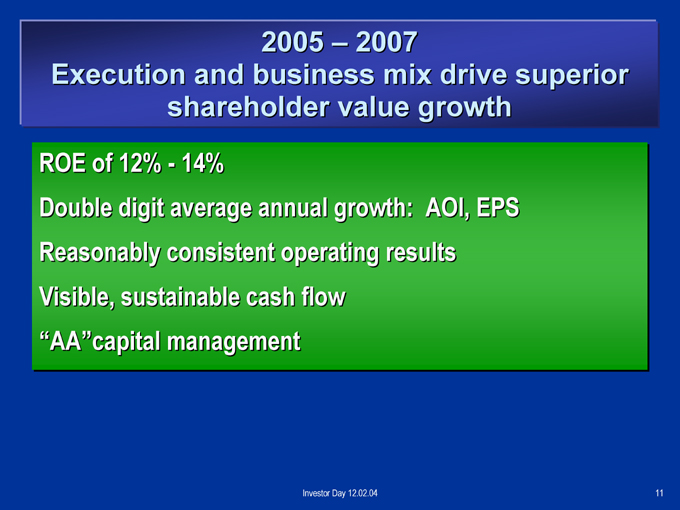

2005 — 2007

Execution and business mix drive superior shareholder value growth

ROE of 12% - 14%

Double digit average annual growth: AOI, EPS Reasonably consistent operating results Visible, sustainable cash flow “AA”capital management

Investor Day 12.02.04 11

Investor Day

December 2, 2004

Investor Day 12.02.04 12

Prudential Financial, Inc.

Mark Grier

Vice Chairman, Financial Management

Investor Day 12.02.04 13

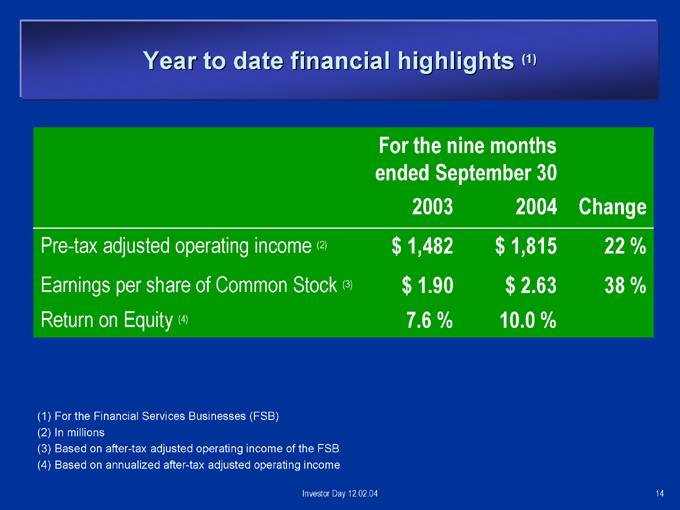

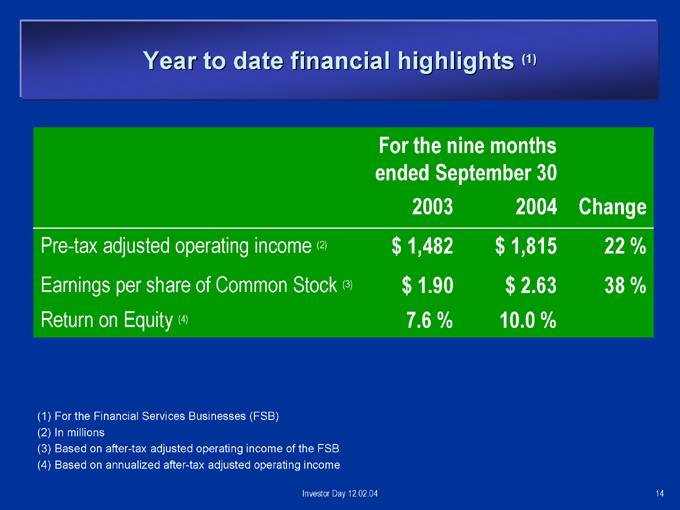

Year to date financial highlights (1)

For the nine months

ended September 30

2003 2004 Change

Pre-tax adjusted operating income (2) $1,482 $1,815 22%

Earnings per share of Common Stock (3) $1.90 $2.63 38%

Return on Equity (4) 7.6% 10.0%

(1) For the Financial Services Businesses (FSB) (2) In millions

(3) Based on after-tax adjusted operating income of the FSB (4) Based on annualized after-tax adjusted operating income

Investor Day 12.02.04 14

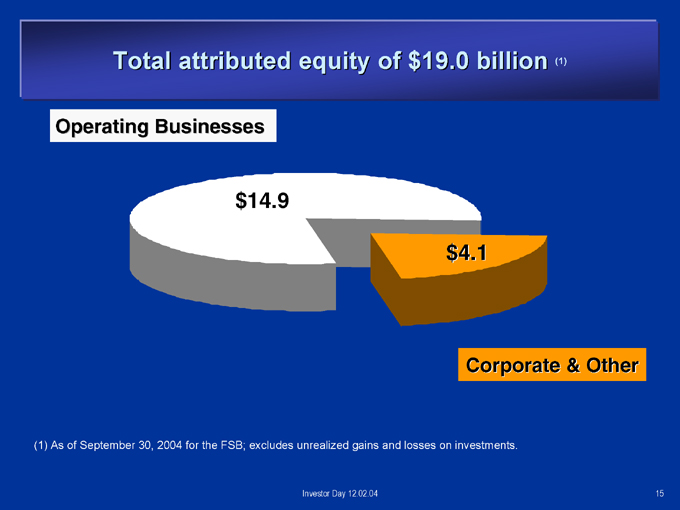

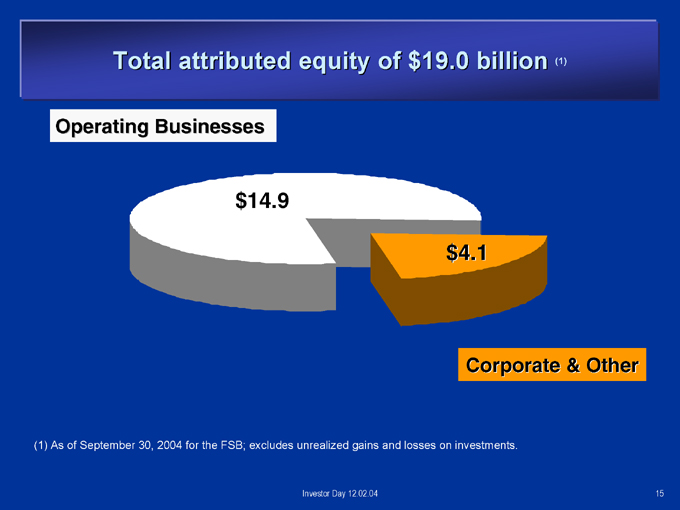

Total attributed equity of $19.0 billion (1)

Operating Businesses $14.9 $4.1

Corporate & Other

(1) As of September 30, 2004 for the FSB; excludes unrealized gains and losses on investments.

Investor Day 12.02.04 15

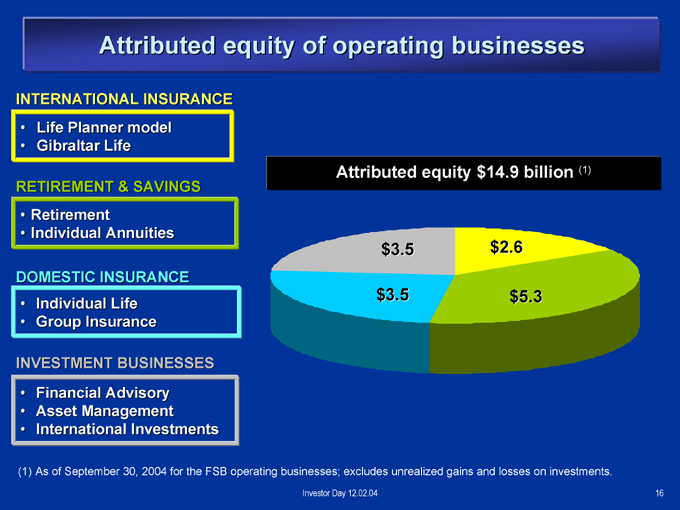

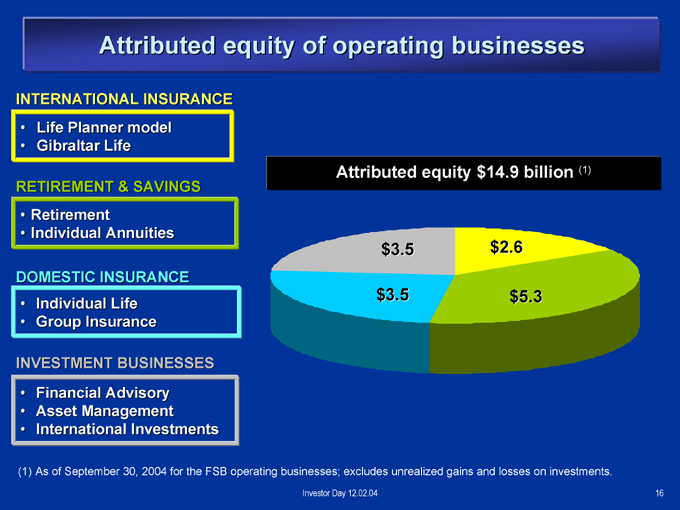

Attributed equity of operating businesses

INTERNATIONAL INSURANCE

Life Planner model

Gibraltar Life

RETIREMENT & SAVINGS

Retirement

Individual Annuities

DOMESTIC INSURANCE

Individual Life

Group Insurance

INVESTMENT BUSINESSES

Financial Advisory

Asset Management

International Investments

Attributed equity $14.9 billion (1) $2.6 $3.5 $5.3 $3.5

(1) As of September 30, 2004 for the FSB operating businesses; excludes unrealized gains and losses on investments.

Investor Day 12.02.04

16

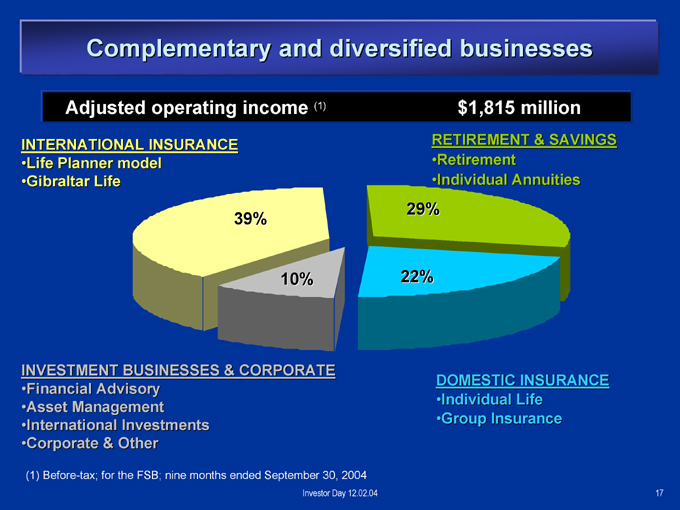

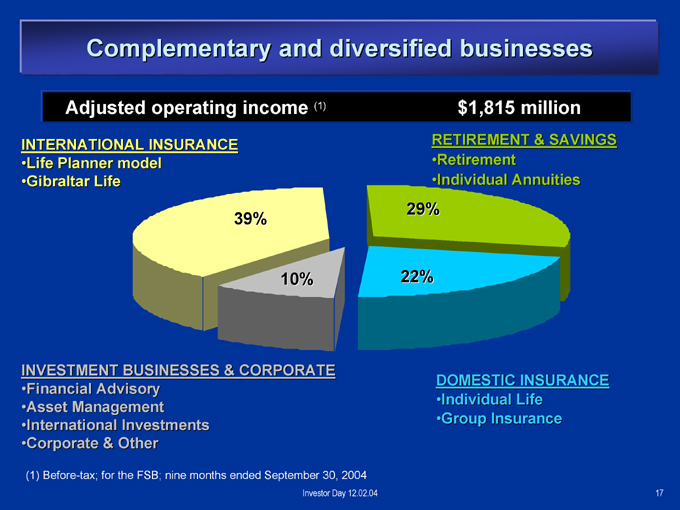

Complementary and diversified businesses

Adjusted operating income(1) $1,815 million

RETIREMENT & SAVINGS

Retirement

Individual Annuities

INTERNATIONAL INSURANCE

Life Planner model

Gibraltar Life

29% 39%

10% 22%

INVESTMENT BUSINESSES & CORPORATE

Financial Advisory

Asset Management International

Investments Corporate & Other

DOMESTIC INSURANCE

Individual Life

Group Insurance

(1) Before-tax; for the FSB; nine months ended September 30, 2004

Investor Day 12.02.04

17

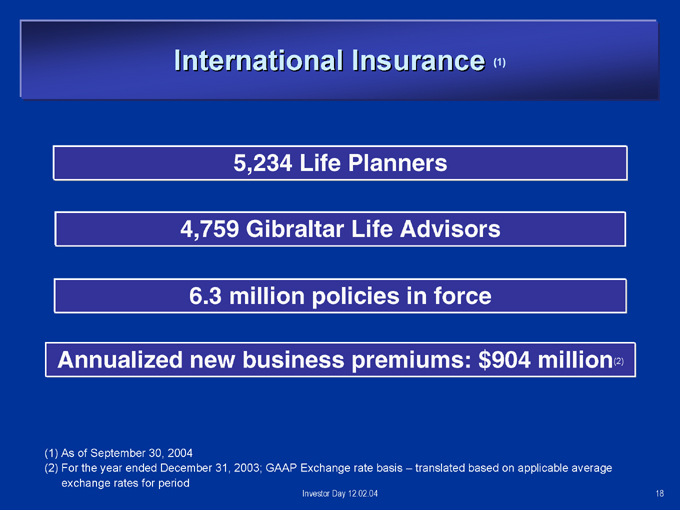

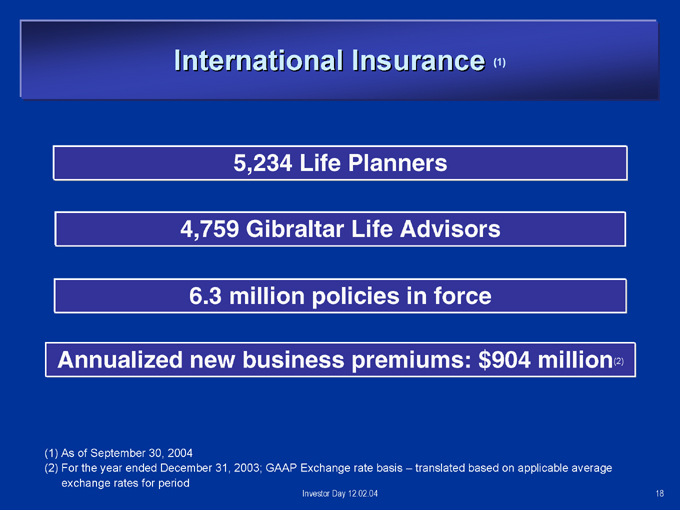

International Insurance (1)

5,234 Life Planners

4,759 Gibraltar Life Advisors

6.3 million policies in force

Annualized new business premiums: $904 million(2)

(1) As of September 30, 2004

(2) For the year ended December 31, 2003; GAAP Exchange rate basis – translated based on applicable average exchange rates for period

Investor Day 12.02.04

18

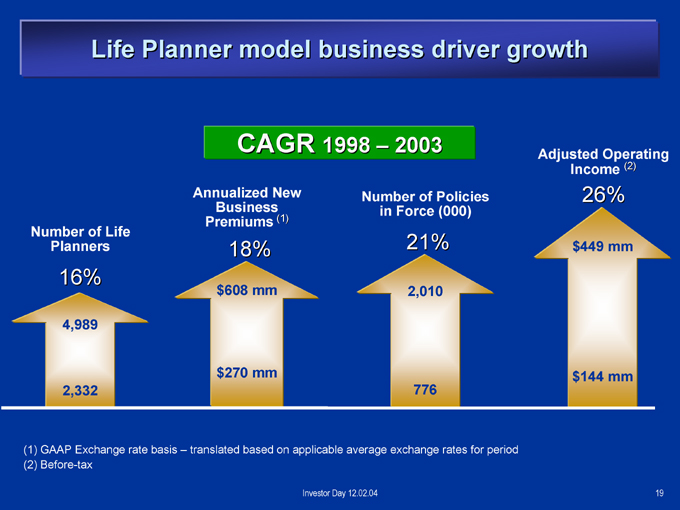

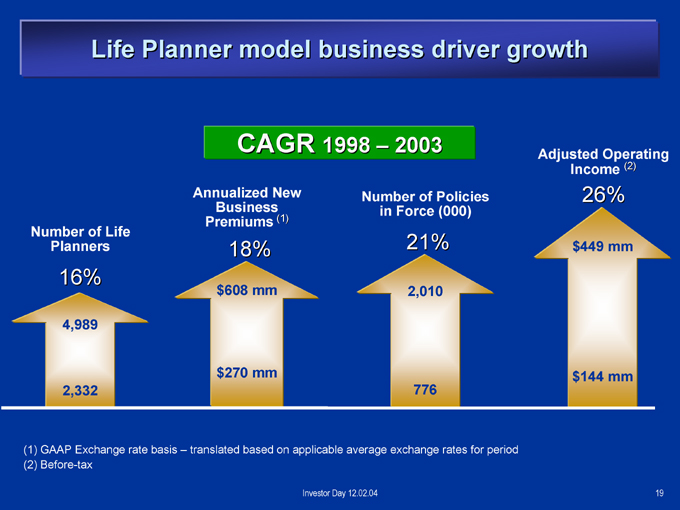

Life Planner model business driver growth

CAGR 1998 – 2003 Adjusted Operating Income (2)

Annualized New Number of Policies

Business in Force (000)

Premiums (1)

Number of Life 21% 26%

Planners 18% 16%

$608 mm 2,010 $449 mm 4,989

$270 mm 2,332 776 $144 mm

(1) GAAP Exchange rate basis – translated based on applicable average exchange rates for period

(2) Before-tax

Investor Day 12.02.04

19

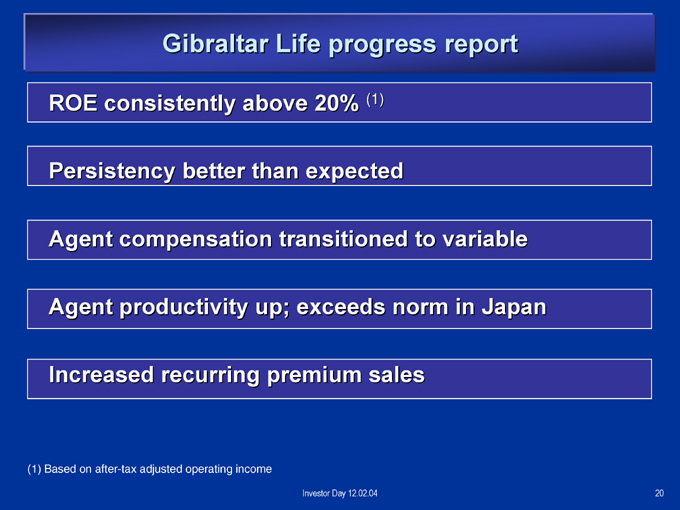

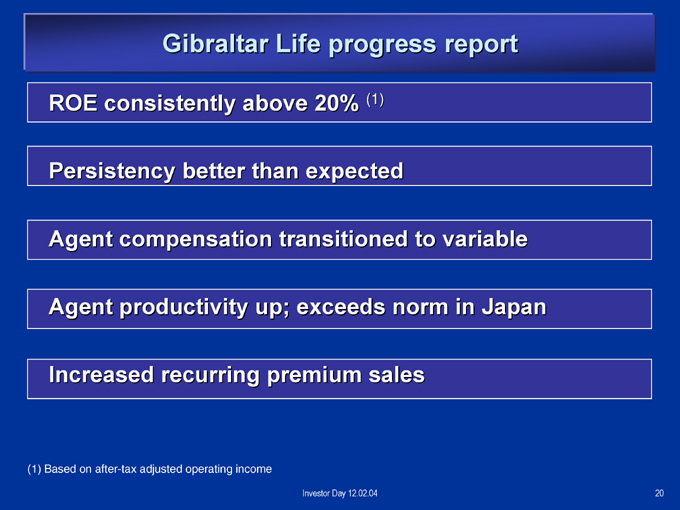

Gibraltar Life progress report

ROE consistently above 20% (1)

Persistency better than expected

Agent compensation transitioned to variable

Agent productivity up; exceeds norm in Japan

Increased recurring premium sales

(1) Based on after-tax adjusted operating income

Investor Day 12.02.04

20

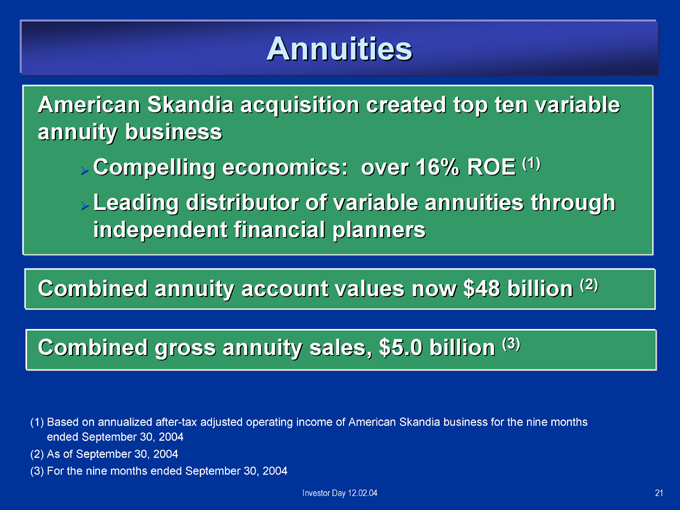

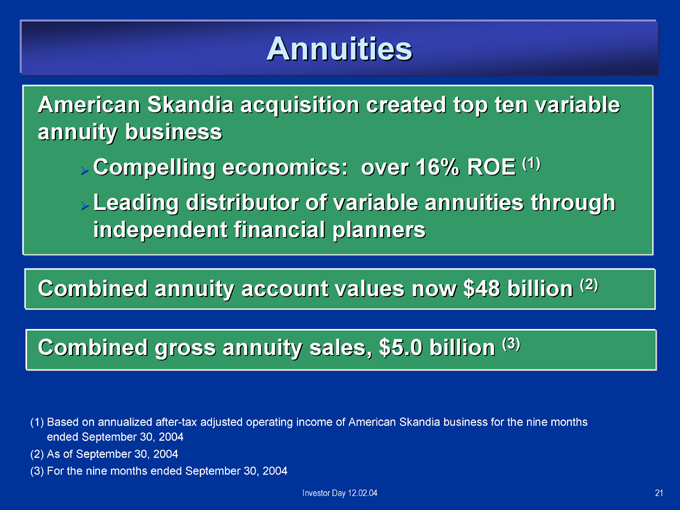

Annuities

American Skandia acquisition created top ten variable annuity business ?Compelling economics: over 16% ROE (1) ?Leading distributor of variable annuities through independent financial planners

Combined annuity account values now $48 billion (2)

Combined gross annuity sales, $5.0 billion (3)

(1) Based on annualized after-tax adjusted operating income of American Skandia business for the nine months ended September 30, 2004

(2) As of September 30, 2004

(3) For the nine months ended September 30, 2004

Investor Day 12.02.04

21

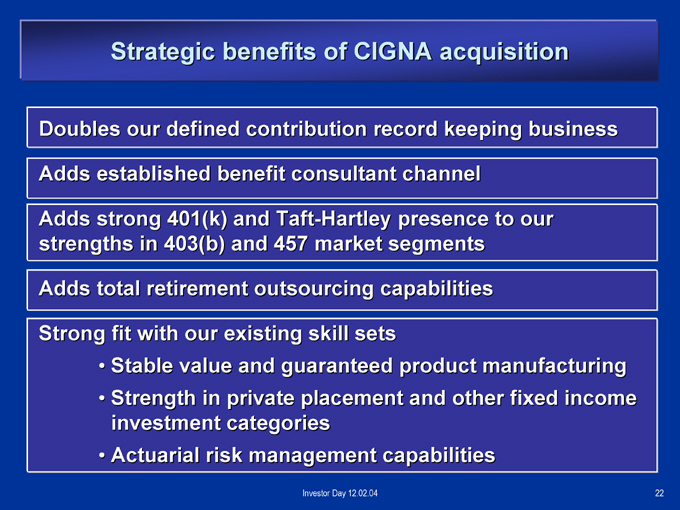

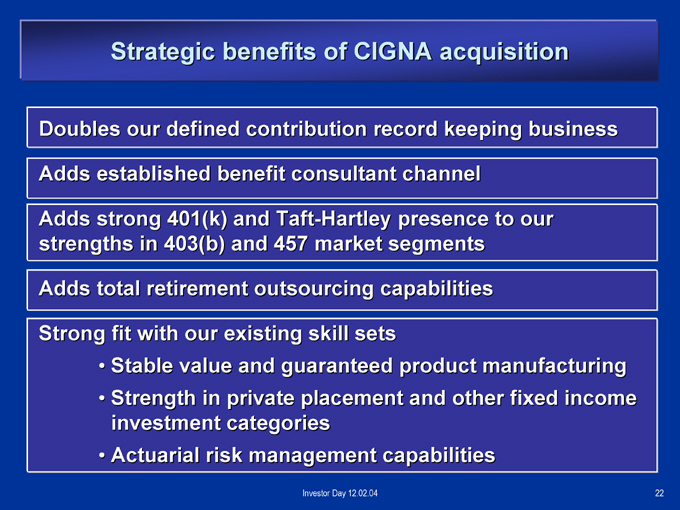

Strategic benefits of CIGNA acquisition

Doubles our defined contribution record keeping business

Adds established benefit consultant channel

Adds strong 401(k) and Taft-Hartley presence to our strengths in 403(b) and 457 market segments

Adds total retirement outsourcing capabilities

Strong fit with our existing skill sets

Stable value and guaranteed product manufacturing Strength in private placement and other fixed income investment categories Actuarial risk management capabilities

Investor Day 12.02.04 22

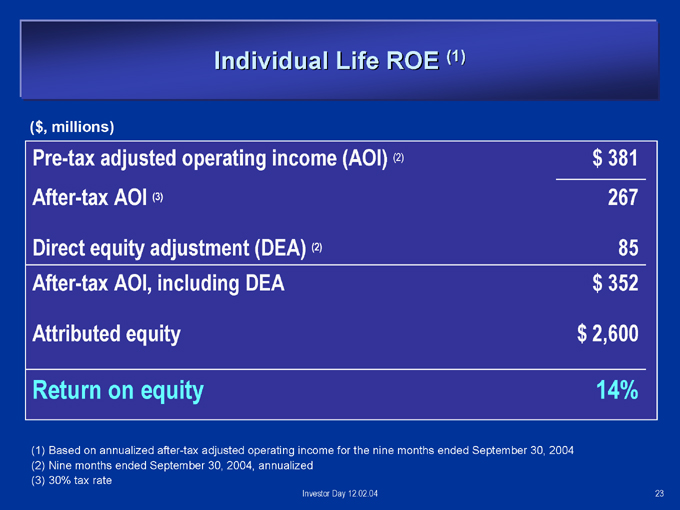

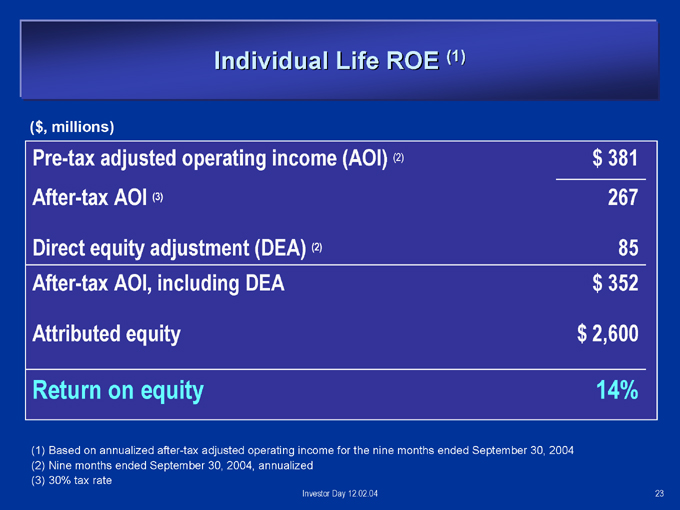

Individual Life ROE (1)

($, millions)

Pre-tax adjusted operating income (AOI) (2) $ 381

After-tax AOI (3) 267

Direct equity adjustment (DEA) (2) 85

After-tax AOI, including DEA $ 352

Attributed equity $ 2,600

Return on equity 14%

(1) Based on annualized after-tax adjusted operating income for the nine months ended September 30, 2004 (2) Nine months ended September 30, 2004, annualized (3) 30% tax rate

Investor Day 12.02.04 23

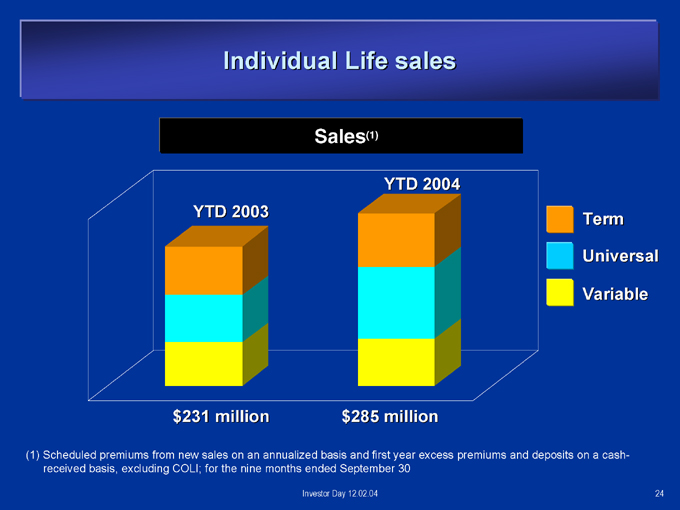

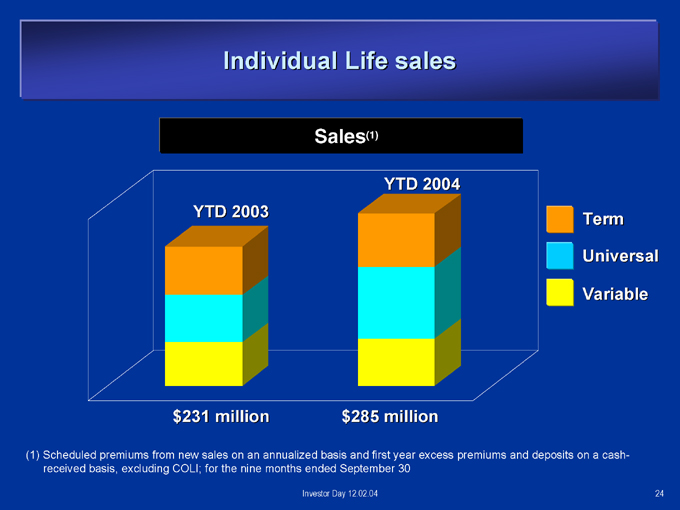

Individual Life sales

Sales(1)

YTD 2003

YTD 2004

Term Universal Variable $231 million $285 million

(1) Scheduled premiums from new sales on an annualized basis and first year excess premiums and deposits on a cash-received basis, excluding COLI; for the nine months ended September 30

Investor Day 12.02.04 24

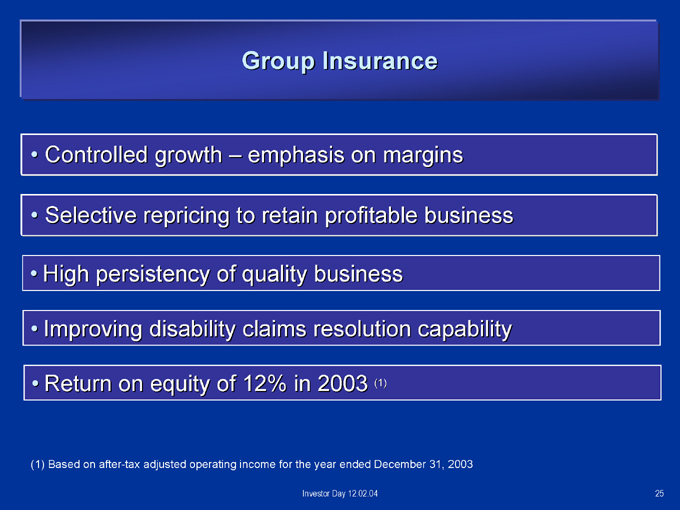

Group Insurance

Controlled growth – emphasis on margins Selective repricing to retain profitable business High persistency of quality business Improving disability claims resolution capability Return on equity of 12% in 2003 (1)

(1) Based on after-tax adjusted operating income for the year ended December 31, 2003

Investor Day 12.02.04 25

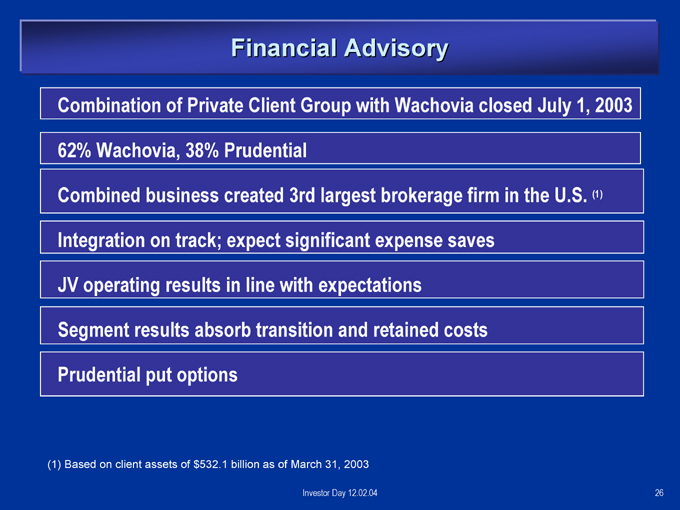

Financial Advisory

Combination of Private Client Group with Wachovia closed July 1, 2003 62% Wachovia, 38% Prudential Combined business created 3rd largest brokerage firm in the U.S. (1) Integration on track; expect significant expense saves JV operating results in line with expectations Segment results absorb transition and retained costs Prudential put options

(1) Based on client assets of $532.1 billion as of March 31, 2003

Investor Day 12.02.04 26

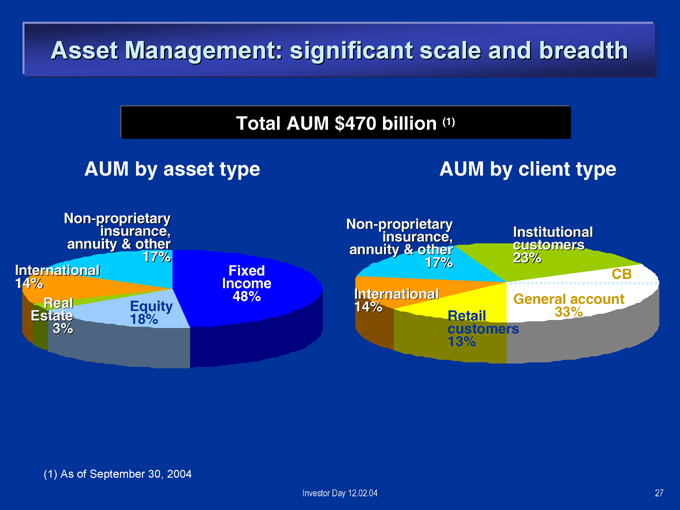

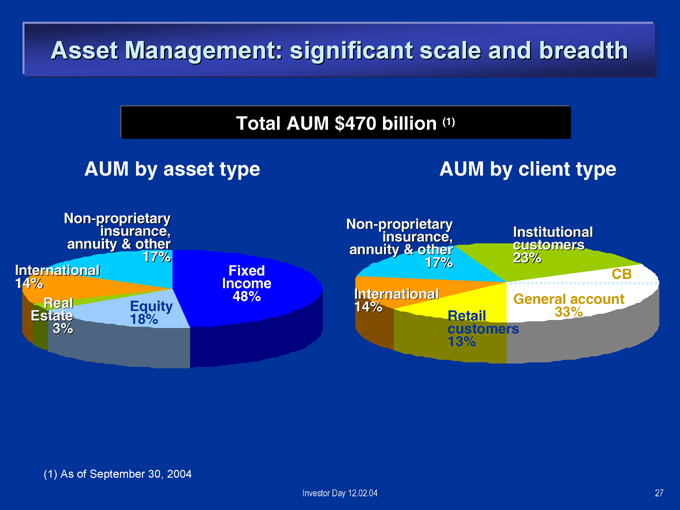

Asset Management: significant scale and breadth

Total AUM $470 billion (1)

AUM by asset type

AUM by client type

Non-proprietary insurance, annuity & other 17%

International Fixed 14% Real Income 48% Equity 18% Estate 3%

Non-proprietary insurance, Institutional customers annuity & other 17% 23%

CB International 14% General account 33% Retail customers 13%

(1) As of September 30, 2004

Investor Day 12.02.04 27

Financial strength (1)

Attributed equity (excl FAS 115, in millions) $ 18,987

Corporate Debt/Capital (2) 14.1 %

Fixed Maturities (in millions)

Gross unrealized gains $ 4,705

Gross unrealized losses $ 429

Net unrealized gains $ 4,276

(1) Financial Services Businesses; as of September 30, 2004 (2) Based on definition in the Quarterly Financial Supplement

Investor Day 12.02.04 28

Update on 12% ROE goal

2005 timeframe

Grow high performing businesses Integration of CIGNA Retirement business

Achieve expected expense saves from Wachovia JV Manage margins and returns

Continue share repurchases

Investor Day 12.02.04 29

Investor Day

December 2, 2004

Investor Day 12.02.04 30

Retirement and Annuities: Key Businesses in a Growing Market

John Strangfeld

Vice Chairman, Investment Division

Investor Day 12.02.04

31

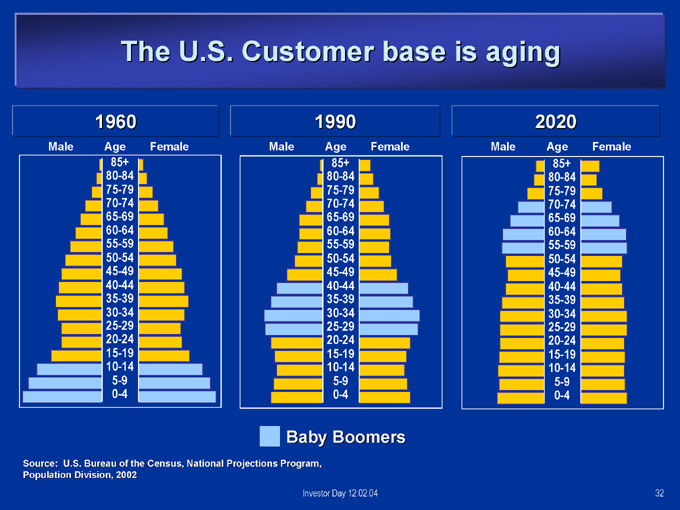

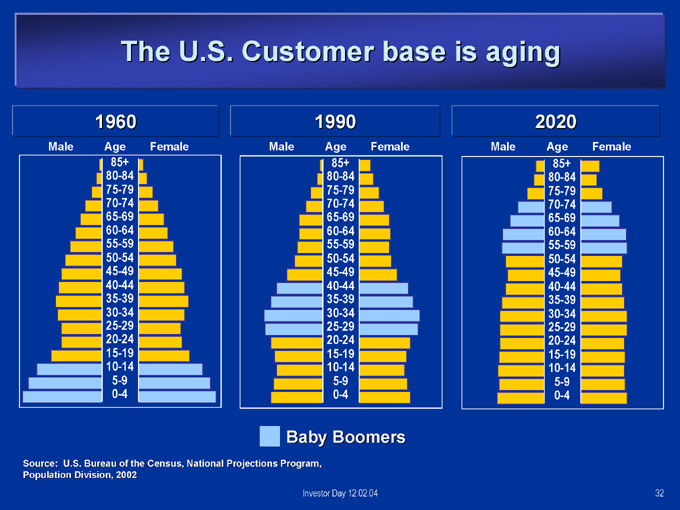

The U.S. Customer base is aging

1960

Male Age Female

85+ 80-84 75-79 70-74 65-69 60-64 55-59 50-54 45-49 40-44 35-39 30-34 25-29 20-24 15-19 10-14 5-9 0-4

1990

Male Age Female

85+ 80-84 75-79 70-74 65-69 60-64 55-59 50-54 45-49 40-44 35-39 30-34 25-29 20-24 15-19 10-14 5-9 0-4

2020

Male Age Female

85+ 80-84 75-79 70-74 65-69 60-64 55-59 50-54 45-49 40-44 35-39 30-34 25-29 20-24 15-19 10-14 5-9 0-4

Baby Boomers

Source: U.S. Bureau of the Census, National Projections Program, Population Division, 2002

Investor Day 12.02.04 32

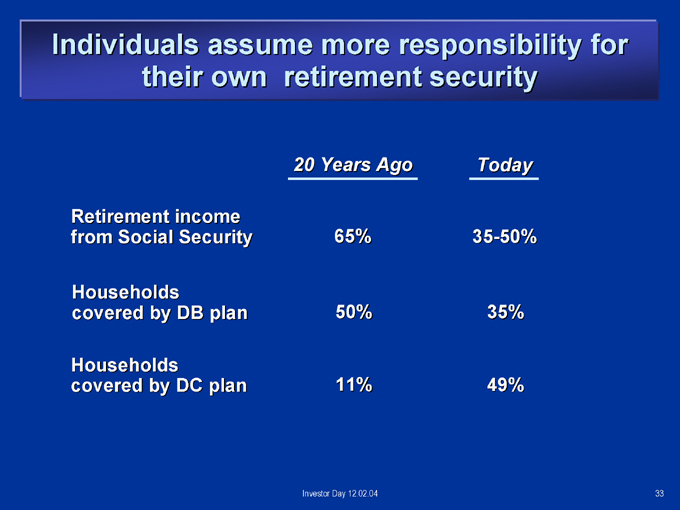

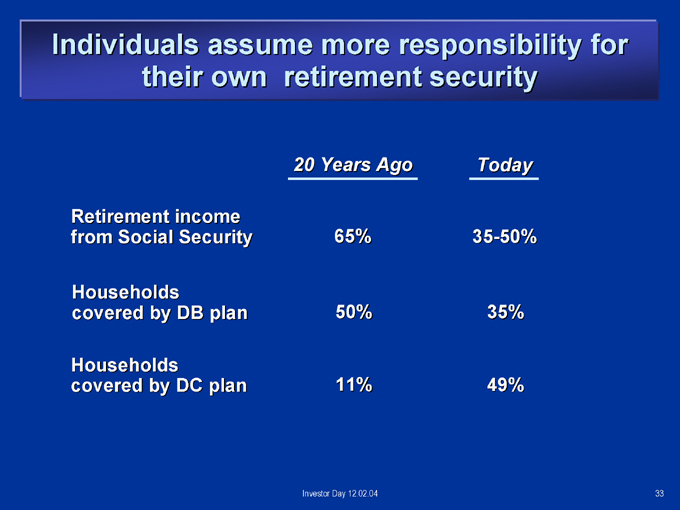

Individuals assume more responsibility for their own retirement security

20 Years Ago Today

Retirement income

from Social Security 65% 35-50%

Households

covered by DB plan 50% 35%

Households

covered by DC plan 11% 49%

Investor Day 12.02.04 33

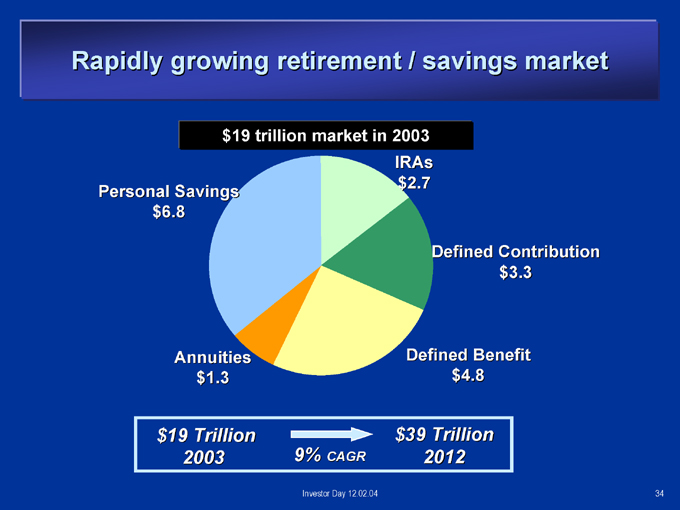

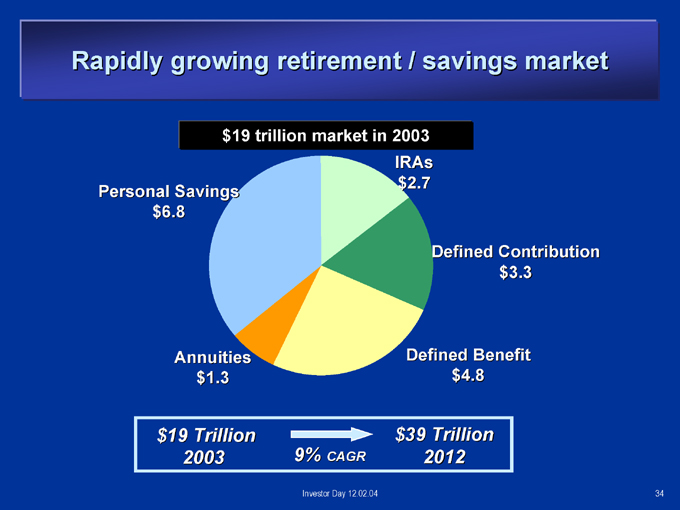

Rapidly growing retirement / savings market

$19 trillion market in 2003 IRAs $2.7 Personal Savings $6.8

Defined Contribution $3.3

Annuities Defined Benefit $1.3 $4.8 $19 Trillion 2003

9% CAGR

$39 Trillion 2012

Investor Day 12.02.04 34

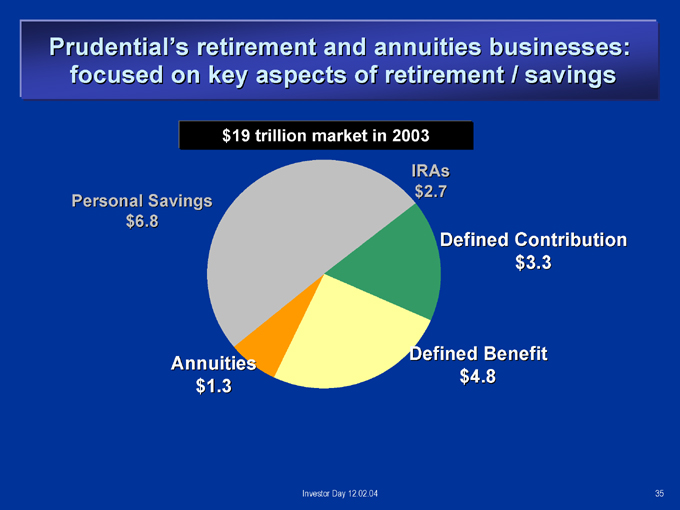

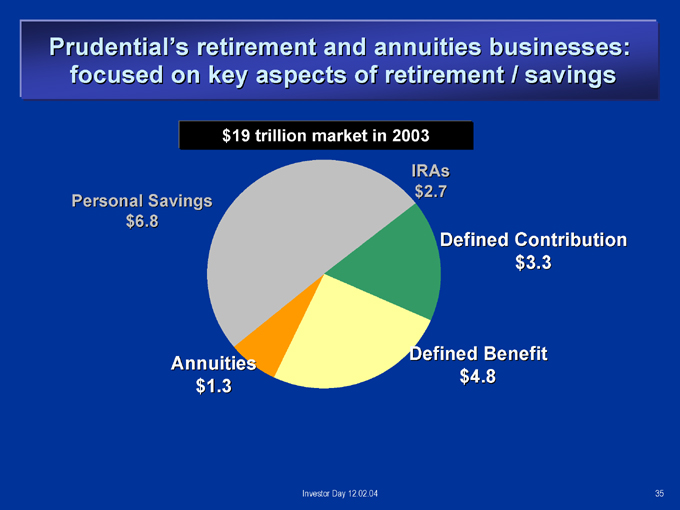

Prudential’s retirement and annuities businesses: focused on key aspects of retirement / savings

$19 trillion market in 2003

IRAs $2.7 Personal Savings $6.8

Defined Contribution $3.3

Defined Benefit Annuities $4.8 $1.3

Investor Day 12.02.04 35

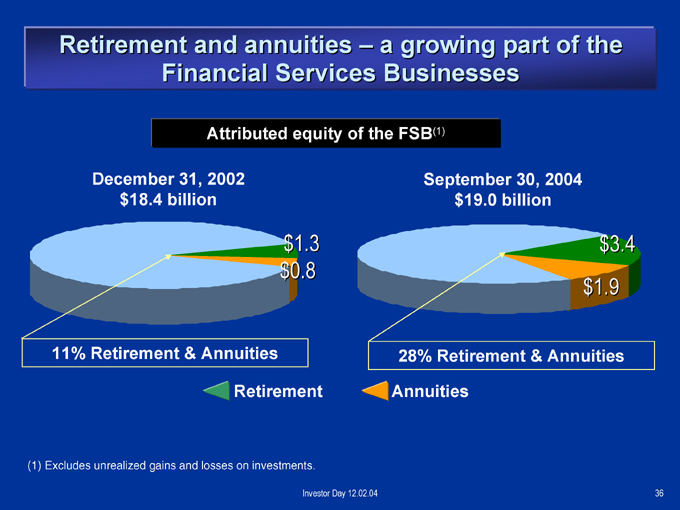

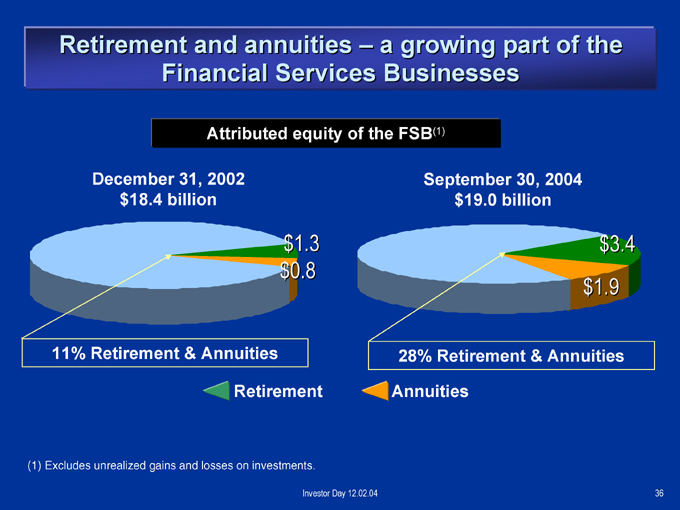

Retirement and annuities – a growing part of the Financial Services Businesses

Attributed equity of the FSB(1)

December 31, 2002 September 30, 2004 $18.4 billion $19.0 billion

$1.3 $3.4 $0.8 $1.9

11% Retirement & Annuities 28% Retirement & Annuities Retirement Annuities

(1) Excludes unrealized gains and losses on investments.

Investor Day 12.02.04 36

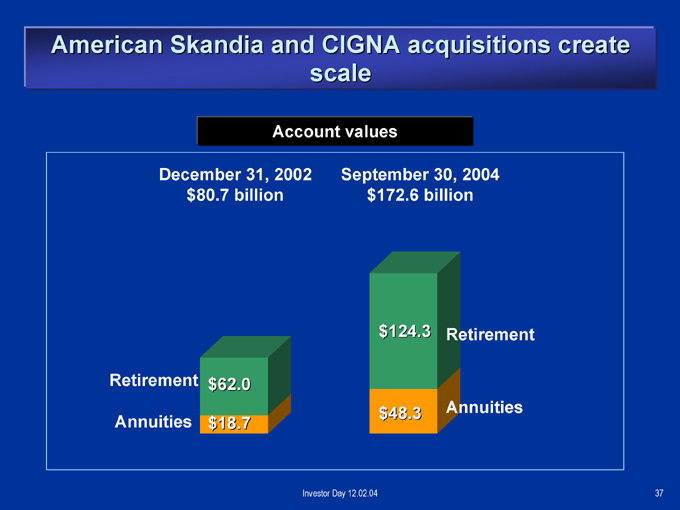

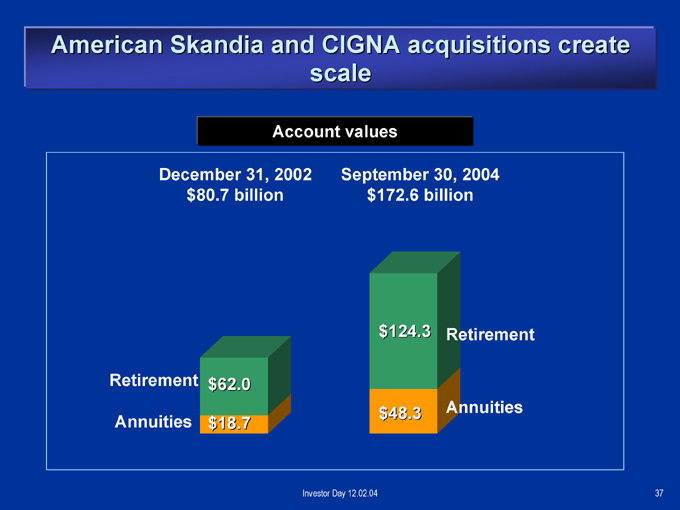

American Skandia and CIGNA acquisitions create scale

Account values

December 31, 2002 September 30, 2004 $80.7 billion $172.6 billion

$124.3 Retirement

Retirement $62.0 $48.3 Annuities Annuities $18.7

Investor Day 12.02.04 37

Retirement and annuities – a growing contribution to earnings results

Adjusted operating income of the FSB (1)

Year ended December 31, 2002 $1.7 billion

Nine months ended September 30, 2004 (2) $1.8 billion

6% Retirement & Annuities

29% Retirement & Annuities

(1) Pre-tax

(2) Includes results of retirement business acquired from CIGNA commencing on acquisition date April 1, 2004

Investor Day 12.02.04 38

Drivers of growth

Full product suites in retirement and annuities Attractive stable value retirement products Complementary distribution channels Ratings upgrades enhance attractiveness Strengthening a major brand in retirement / savings

Investor Day 12.02.04

39

Summary

Retirement / Savings is a key domestic growth market Prudential has added scale and breadth to its expertise in the Retirement and Annuities businesses Product / Distribution / Service strengths support growth potential… ratings upgrades a plus A strong brand in a growing market

Investor Day 12.02.04

40

Investor Day

December 2, 2004

Investor Day 12.02.04 41

Prudential Retirement

John Kim

President, Prudential Retirement

Investor Day 12.02.04

42

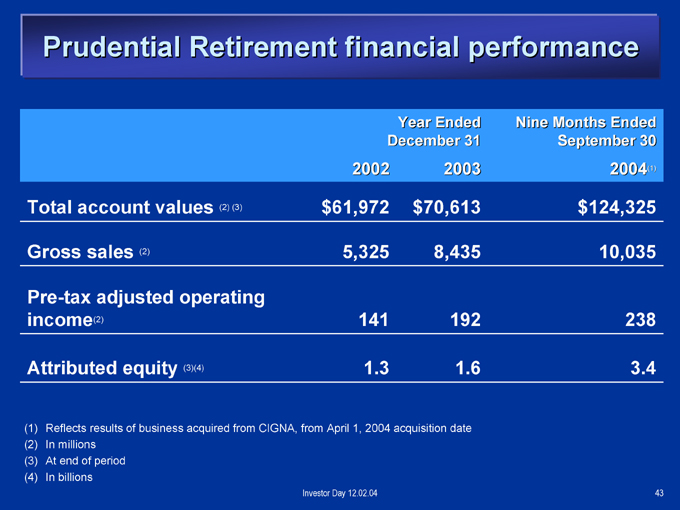

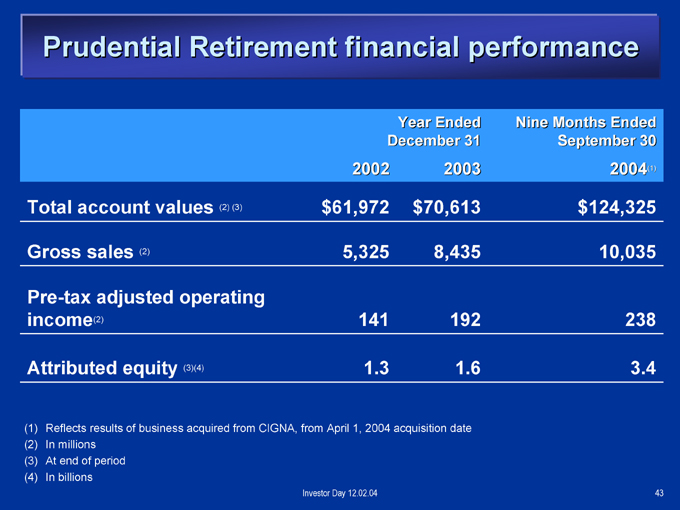

Prudential Retirement financial performance

Year Ended Nine Months Ended

December 31 September 30

2002 2003 2004(1)

Total account values (2) (3) $61,972 $70,613 $124,325

Gross sales (2) 5,325 8,435 10,035

Pre-tax adjusted operating

income(2) 141 192 238

Attributed equity (3)(4) 1.3 1.6 3.4

(1) Reflects results of business acquired from CIGNA, from April 1, 2004 acquisition date (2) In millions (3) At end of period (4) In billions

Investor Day 12.02.04 43

A Growing Part of “Grow and Protect”

Retirement market increasingly important in asset gathering •CIGNA acquisition creates a leading retirement market provider •Total retirement services capability provides market advantage •Stable value products offer attractive returns with limited risk Complementary distribution channels address selected markets •Ratings upgrades enhancing market position Opportunities for increased asset gathering

Investor Day 12.02.04 44

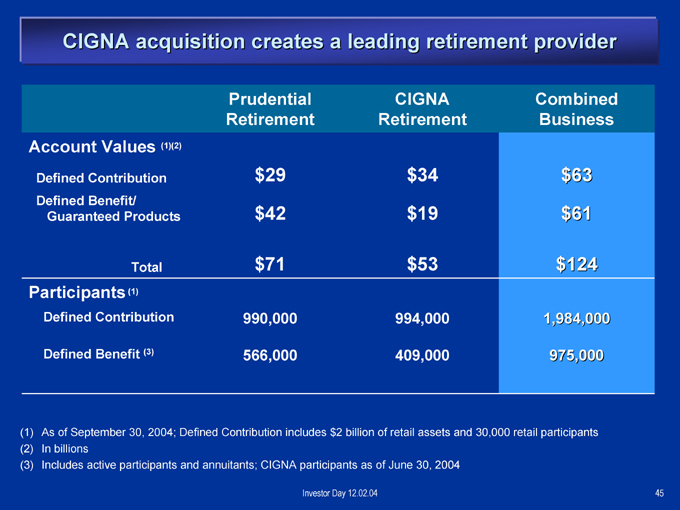

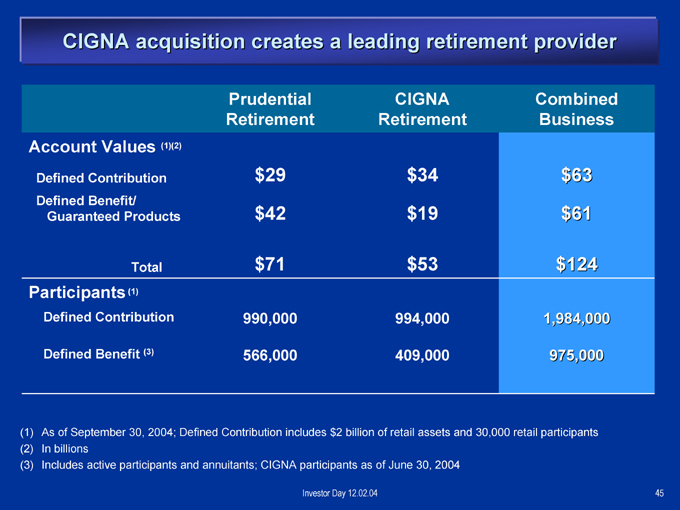

CIGNA acquisition creates a leading retirement provider

Prudential CIGNA Combined

Retirement Retirement Business

Account Values (1)(2)

Defined Contribution $29 $34 $63

Defined Benefit/

Guaranteed Products $42 $19 $61

Total $71 $53 $124

Participants(1)

Defined Contribution 990,000 994,000 1,984,000

Defined Benefit (3) 566,000 409,000 975,000

(1) As of September 30, 2004; Defined Contribution includes $2 billion of retail assets and 30,000 retail participants (2) In billions (3) Includes active participants and annuitants; CIGNA participants as of June 30, 2004

Investor Day 12.02.04 45

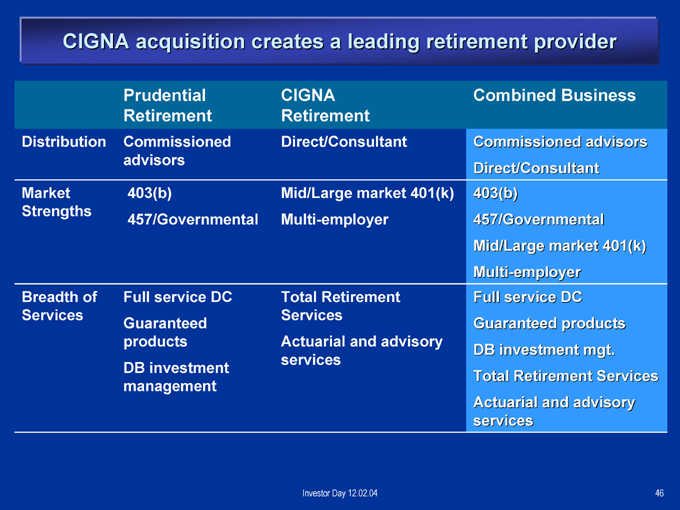

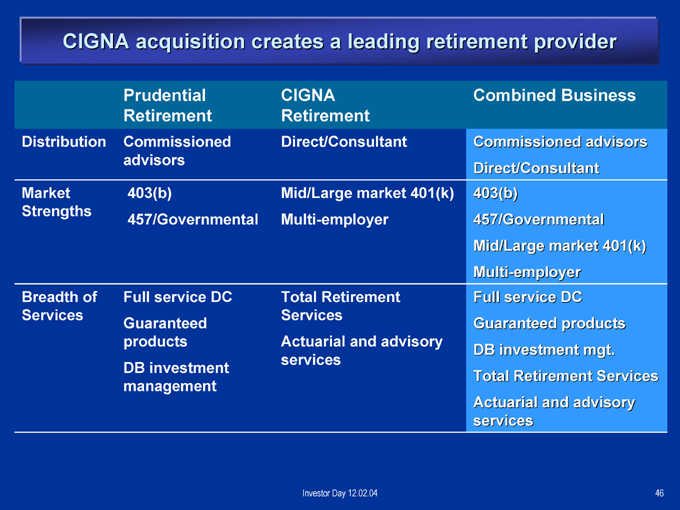

CIGNA acquisition creates a leading retirement provider

Prudential CIGNA Combined Business

Retirement Retirement

Distribution Commissioned Direct/Consultant Commissioned advisors

advisors

Direct/Consultant

Market 403(b) Mid/Large market 401(k) 403(b)

Strengths

457/Governmental Multi-employer 457/Governmental

Mid/Large market 401(k)

Multi-employer

Breadth of Full service DC Total Retirement Full service DC

Services Services

Guaranteed Guaranteed products

products Actuarial and advisory

DB investment mgt.

services

DB investment

Total Retirement Services

management

Actuarial and advisory

services

Investor Day 12.02.04 46

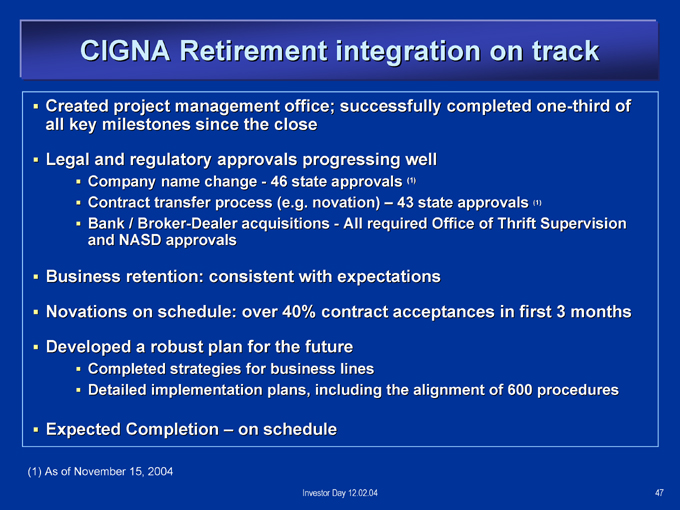

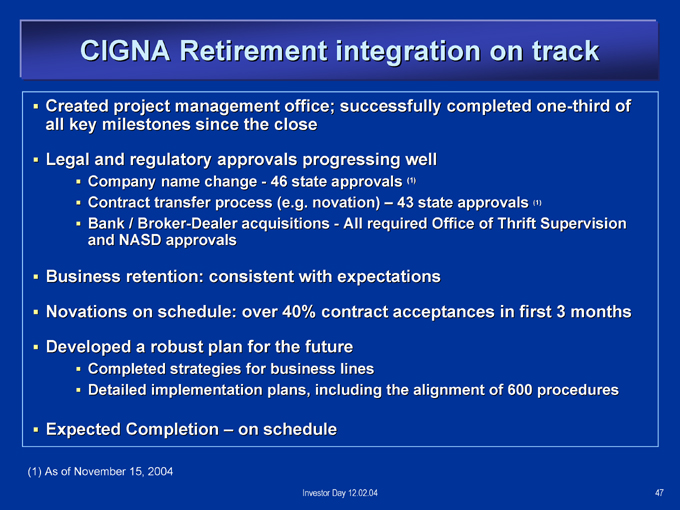

CIGNA Retirement integration on track

Created project management office; successfully completed one-third of all key milestones since the close

Legal and regulatory approvals progressing well

Company name change—46 state approvals (1)

Contract transfer process (e.g. novation) – 43 state approvals (1)

Bank / Broker-Dealer acquisitions—All required Office of Thrift Supervision and NASD approvals

Business retention: consistent with expectations

Novations on schedule: over 40% contract acceptances in first 3 months

Developed a robust plan for the future

Completed strategies for business lines

Detailed implementation plans, including the alignment of 600 procedures

Expected Completion – on schedule

(1) As of November 15, 2004

Investor Day 12.02.04

47

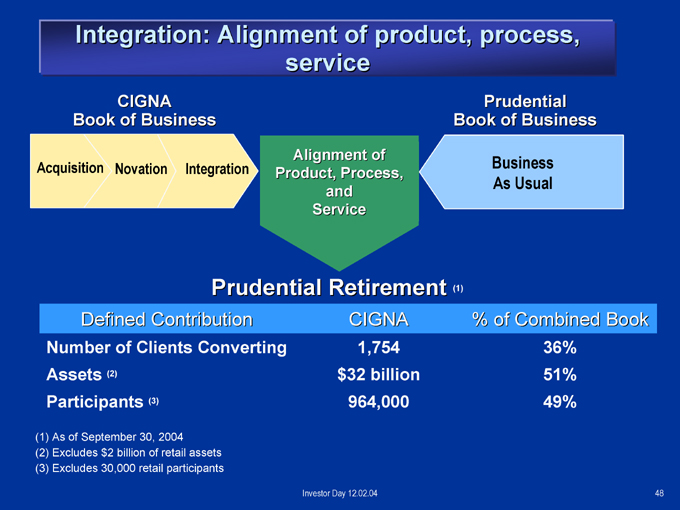

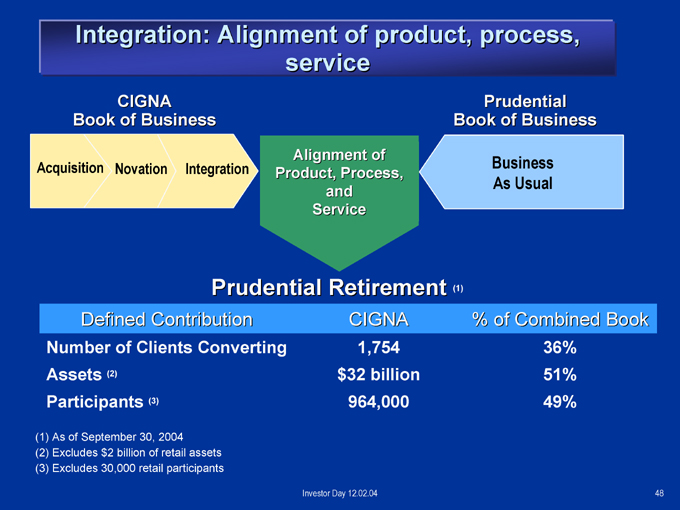

Integration: Alignment of product, process, service

CIGNA Book of Business

Acquisition Novation Integration

Alignment of Product, Process, and Service

Prudential Book of Business

Business As Usual

Prudential Retirement (1)

Defined Contribution CIGNA % of Combined Book

Number of Clients Converting 1,754 36%

Assets (2) $32 billion 51%

Participants (3) 964,000 49%

(1) As of September 30, 2004 (2) Excludes $2 billion of retail assets (3) Excludes 30,000 retail participants

Investor Day 12.02.04 48

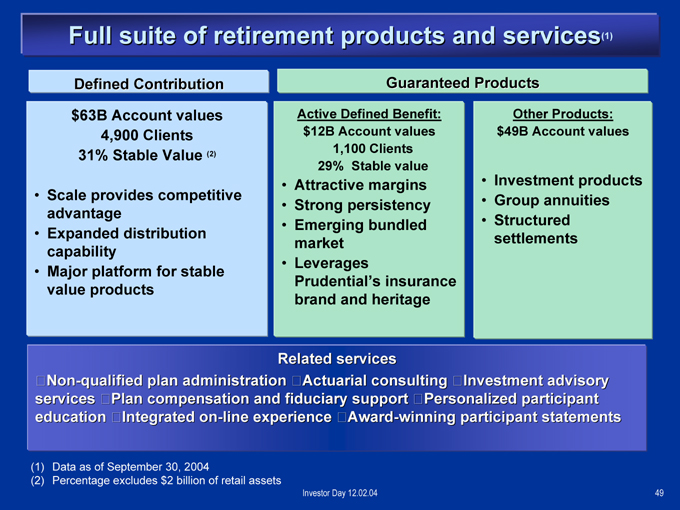

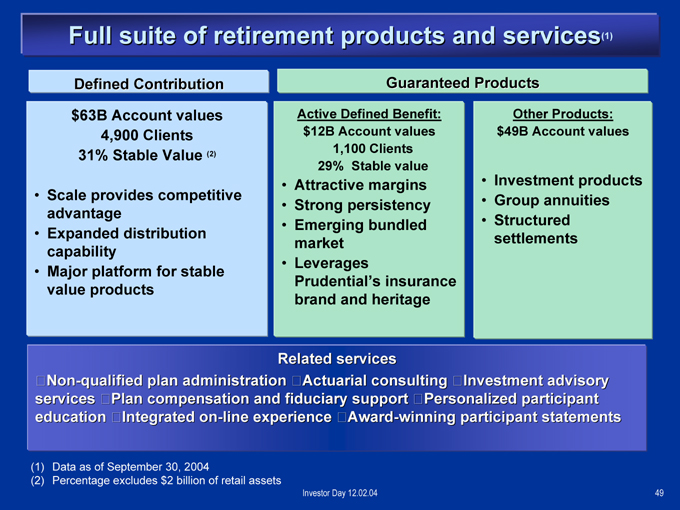

Full suite of retirement products and services(1)

Defined Contribution $63B Account values 4,900 Clients 31% Stable Value (2)

Scale provides competitive advantage Expanded distribution capability Major platform for stable value products

Guaranteed Products

Active Defined Benefit: $12B Account values 1,100 Clients 29% Stable value

Attractive margins Strong persistency Emerging bundled market Leverages Prudential’s insurance brand and heritage

Other Products: $49B Account values

Investment products Group annuities Structured settlements

Related services

_Non-qualified plan administration _Actuarial consulting _Investment advisory services _Plan compensation and fiduciary support _Personalized participant education _Integrated on-line experience _Award-winning participant statements

(1) Data as of September 30, 2004

(2) Percentage excludes $2 billion of retail assets

Investor Day 12.02.04 49

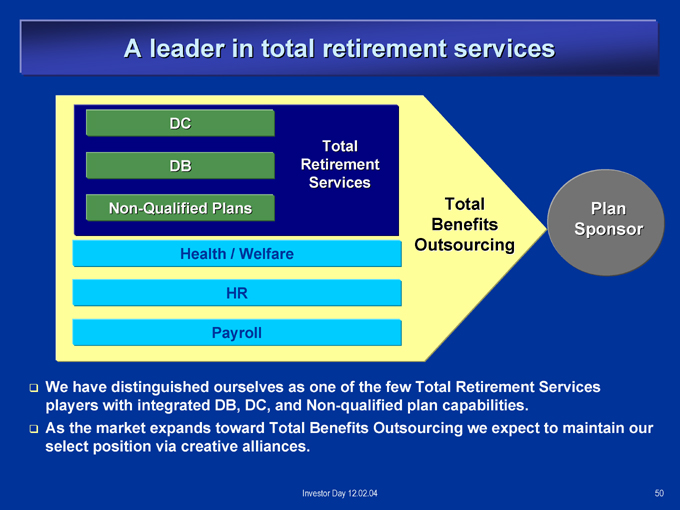

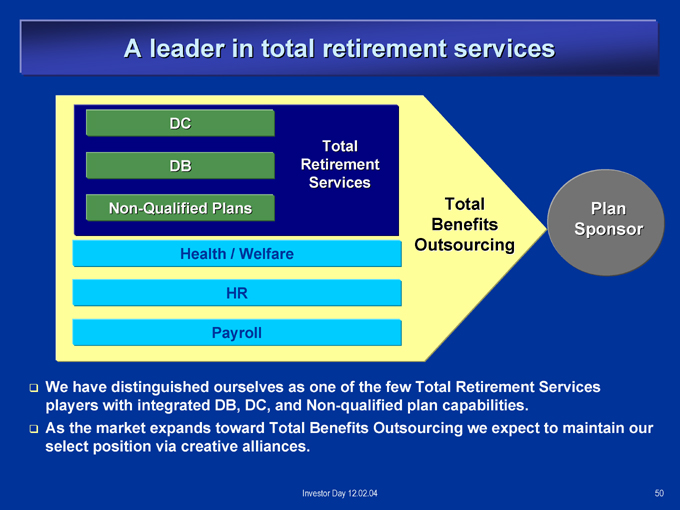

A leader in total retirement services

DC

Total DB Retirement

Services

Non-Qualified Plans Total Plan Benefits Sponsor Outsourcing

Health / Welfare

HR

Payroll

We have distinguished ourselves as one of the few Total Retirement Services players with integrated DB, DC, and Non-qualified plan capabilities.

As the market expands toward Total Benefits Outsourcing we expect to maintain our select position via creative alliances.

Investor Day 12.02.04 50

Market leading capabilities across product offerings

“Total Retirement Services” Full suite of stable value products

Offer access to both separate account and mutual fund platforms Award winning participant communications capabilities and highest independent ratings Extensive fiduciary support capabilities and ancillary services Scale of combined operations produces ability to offer competitive pricing

Investor Day 12.02.04 51

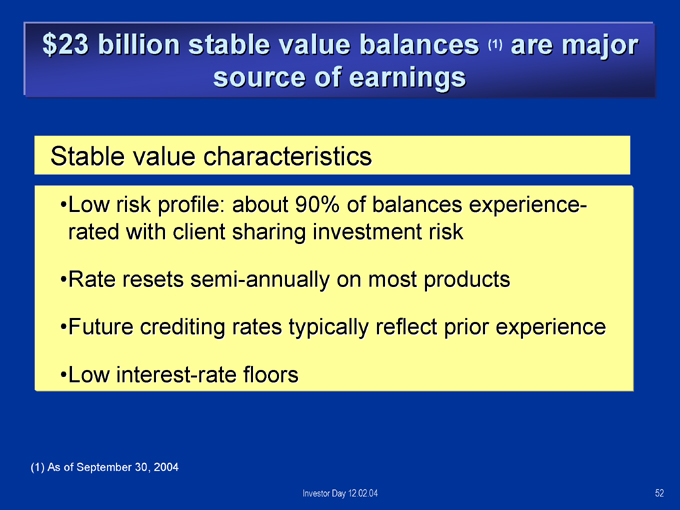

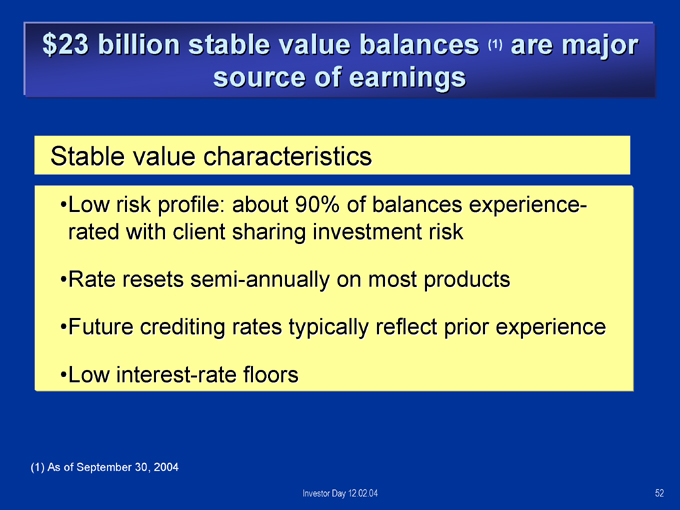

$23 billion stable value balances (1) are major source of earnings

Stable value characteristics

Low risk profile: about 90% of balances experience-rated with client sharing investment risk

Rate resets semi-annually on most products

Future crediting rates typically reflect prior experience

Low interest-rate floors

(1) As of September 30, 2004

Investor Day 12.02.04

52

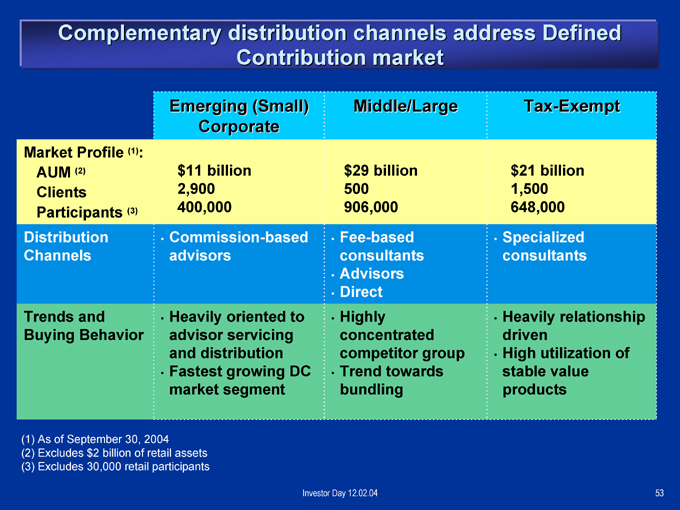

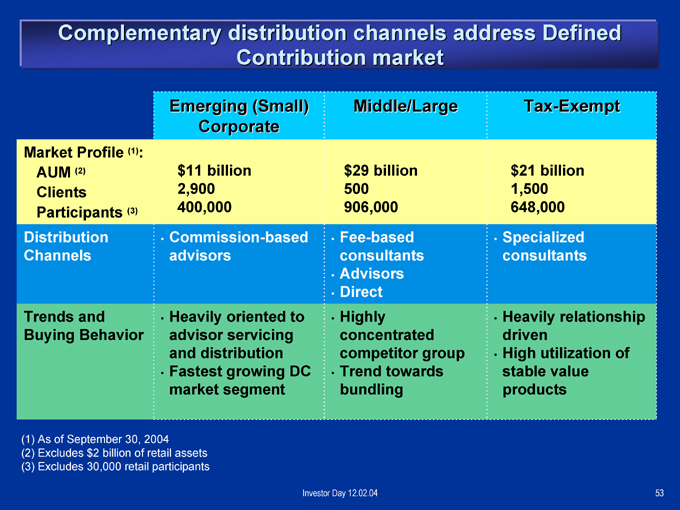

Complementary distribution channels address Defined Contribution market

Emerging (Small) Middle/Large Tax-Exempt

Corporate

Market Profile (1):

AUM (2) $11 billion $29 billion $21 billion

Clients 2,900 500 1,500

Participants (3) 400,000 906,000 648,000

Distribution Commission-based Fee-based Specialized

Channels advisors consultants consultants

Advisors

Direct

Trends and Heavily oriented to Highly Heavily relationship

Buying Behavior advisor servicing concentrated driven

and distribution competitor group High utilization of

Fastest growing DC Trend towards stable value

market segment bundling products

(1) As of September 30, 2004 (2) Excludes $2 billion of retail assets (3) Excludes 30,000 retail participants

Investor Day 12.02.04 53

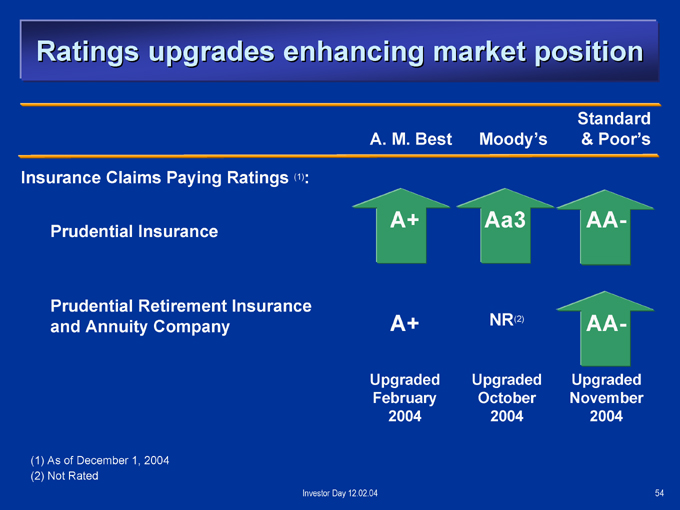

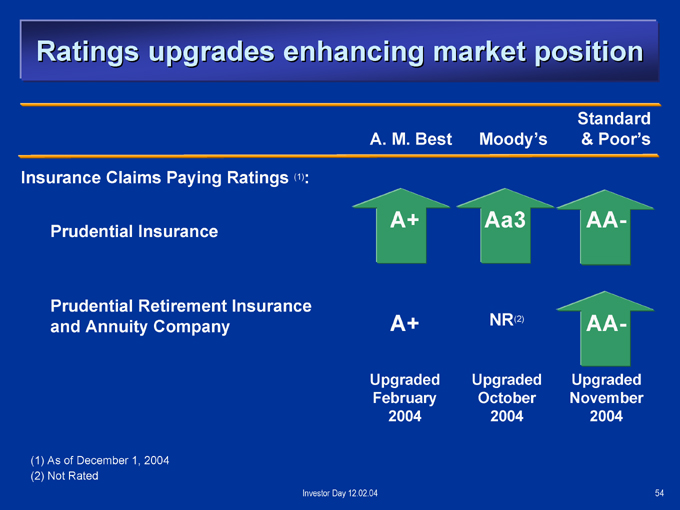

Ratings upgrades enhancing market position

Standard A. M. Best Moody’s & Poor’s

Insurance Claims Paying Ratings (1):

Prudential Insurance

Prudential Retirement Insurance and Annuity Company

A+ Aa3 AA-

A+ NR(2) AA-

Upgraded Upgraded Upgraded February October November 2004 2004 2004

(1) As of December 1, 2004 (2) Not Rated

Investor Day 12.02.04

54

Opportunities for increased asset gathering

Rollover Assets

Income Protection Products Health Savings Accounts

Investor Day 12.02.04 55

Summary

Retirement market increasingly important in asset gathering CIGNA acquisition creates a leading retirement market provider; integration on track Total retirement services capability provides market advantage Stable value products offer attractive returns with limited risk Complementary distribution channels address selected markets Ratings upgrades enhancing market position Opportunities for increased asset gathering

Investor Day 12.02.04

56

Investor Day

December 2, 2004

Investor Day 12.02.04

57

Individual Annuities

David Odenath

President, Prudential Annuities

Investor Day 12.02.04 58

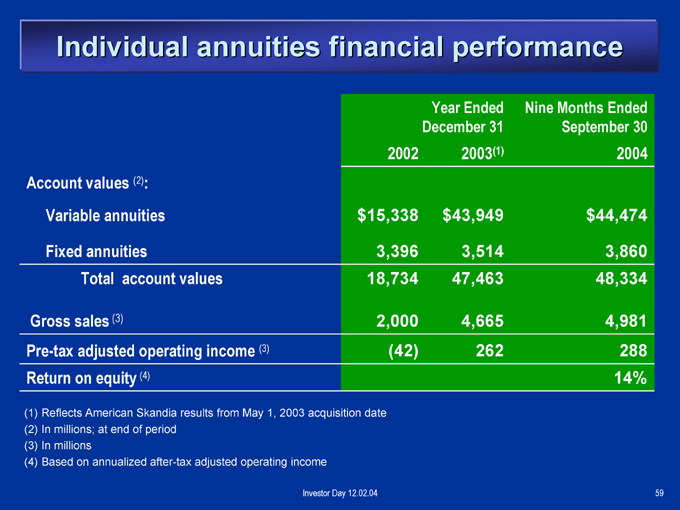

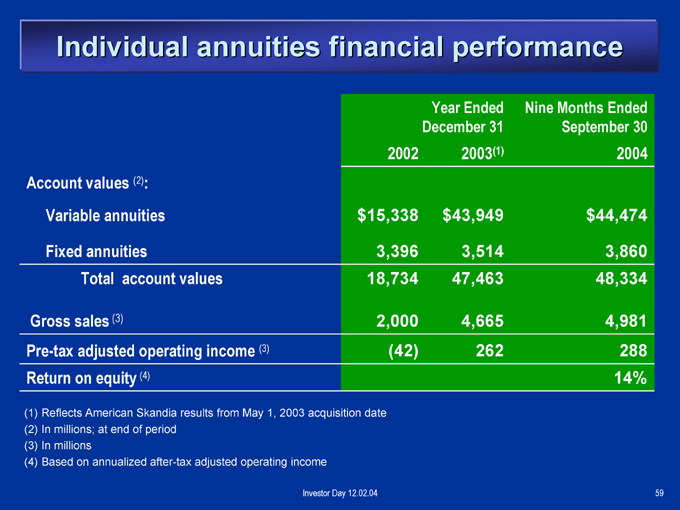

Individual annuities financial performance

Year Ended Nine Months Ended

December 31 September 30

2002 2003(1) 2004

Account values (2):

Variable annuities $ 15,338 $ 43,949 $ 44,474

Fixed annuities 3,396 3,514 3,860

Total account values 18,734 47,463 48,334

Gross sales (3) 2,000 4,665 4,981

Pre-tax adjusted operating income (3) (42) 262 288

Return on equity (4) 14%

(1) Reflects American Skandia results from May 1, 2003 acquisition date (2) In millions; at end of period (3) In millions (4) Based on annualized after-tax adjusted operating income

Investor Day 12.02.04

59

Successful acquisition builds a market leader

Business strengthened by American Skandia acquisition; integration successfully completed

Variable annuity emphasis complemented by fixed annuities

Net sales positive and growing

Complementary distribution channels; a leader with independent financial planners

Attractive full product suite

Balanced, manageable product risks

Investor Day 12.02.04

60

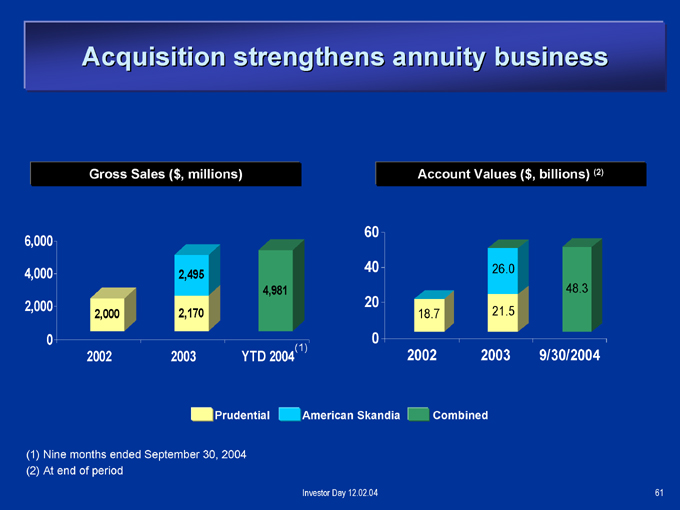

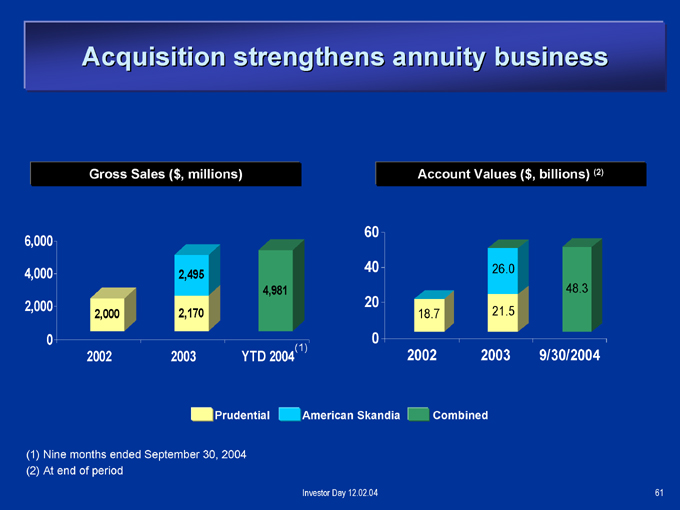

Acquisition strengthens annuity business

Gross Sales ($, millions)

6,000 4,000 2,000 0

2,000

2002

2,495

2,170

2003

4,981

YTD 2004(1)

Account Values ($, billions) (2)

60 40 20 0

18.7

2002

26.0

21.5

2003

48.3

9/30/2004

Prudential

American Skandia

Combined

(1) Nine months ended September 30, 2004 (2) At end of period

Investor Day 12.02.04

61

Market share has climbed as a result of the acquisition

Prudential variable annuity market share (1) (2)

6.00% 5.00% 4.00% 3.00% 2.00%

5.2%

5.0% 4.9% 5.0% 4.2% 4.6% 4.6% 4.6% 4.4% 4.5% 4.2% 4.1% 4.0% 3.4% 3.4%

1Q’01 2Q’01 3Q’01 4Q’01 1Q’02 2Q’02

Prior to acquisition 3Q’

02 4Q’02 1Q’03 2Q’03 3Q’03 4Q’

Post-acquisition 03

1Q’04 2Q’04 3Q’04

(1) According to VARDS (reflects total variable annuity industry)

(2) Prudential and American Skandia combined for all periods

Investor Day 12.02.04 62

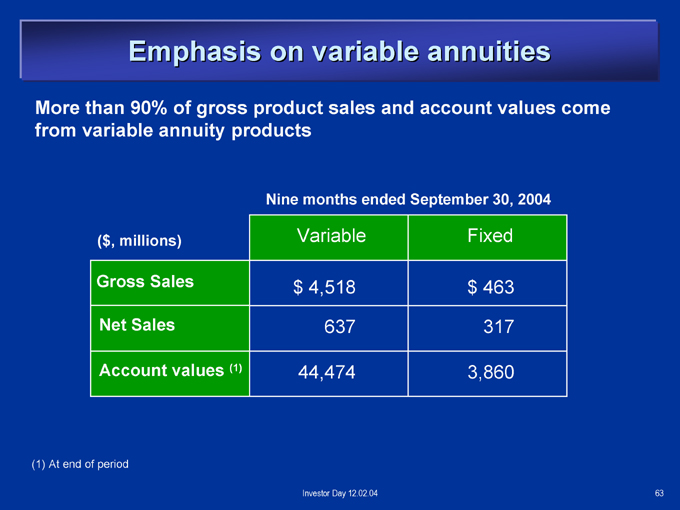

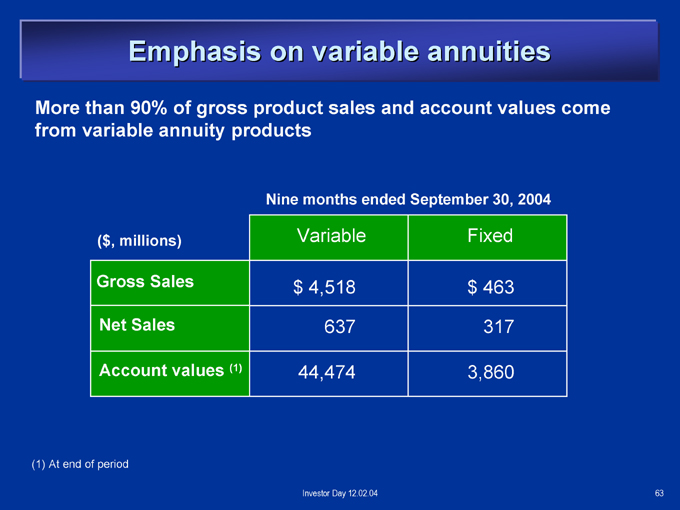

Emphasis on variable annuities

More than 90% of gross product sales and account values come from variable annuity products

Nine months ended September 30, 2004

($, millions) Variable Fixed

Gross Sales $ 4,518 $ 463

Net Sales 637 317

Account values (1) 44,474 3,860

(1) At end of period

Investor Day 12.02.04

63

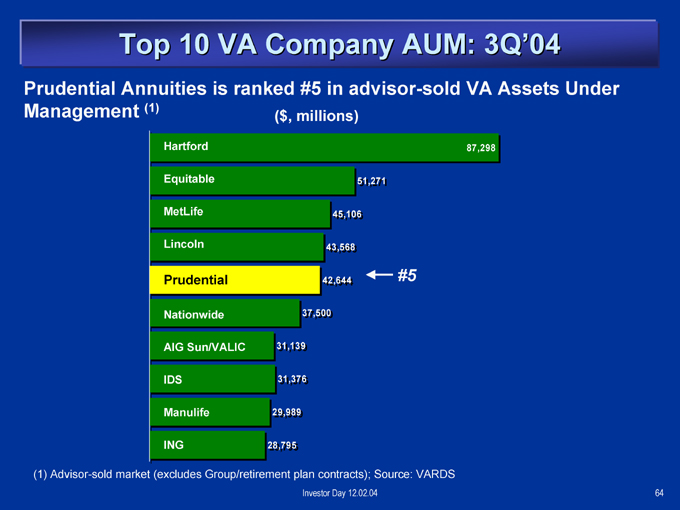

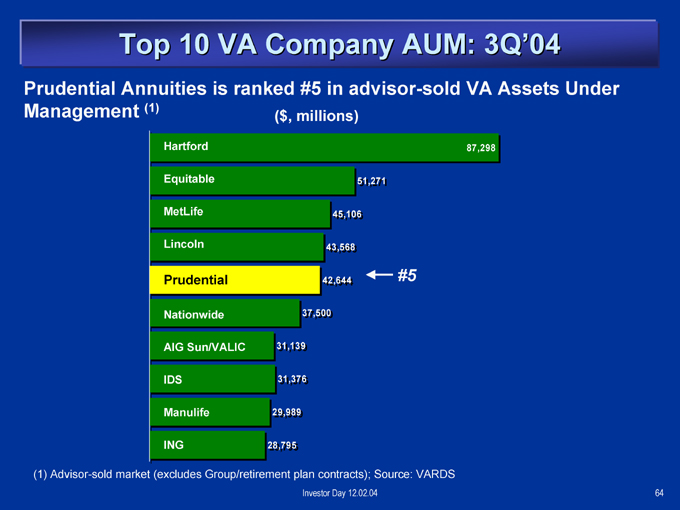

Top 10 VA Company AUM: 3Q’04

Prudential Annuities is ranked #5 in advisor-sold VA Assets Under

Management (1) ($, millions)

Hartford 87,298

Equitable 51,271

MetLife 45,106

Lincoln 43,568

Prudential 42,644 #5

Nationwide 37,500

AIG Sun/VALIC 31,139

IDS 31,376

Manulife 29,989

ING 28,795

(1) Advisor-sold market (excludes Group/retirement plan contracts); Source: VARDS

Investor Day 12.02.04 64

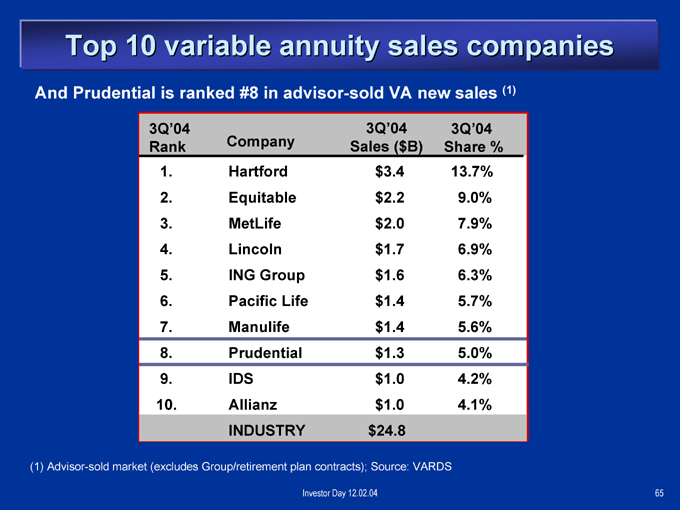

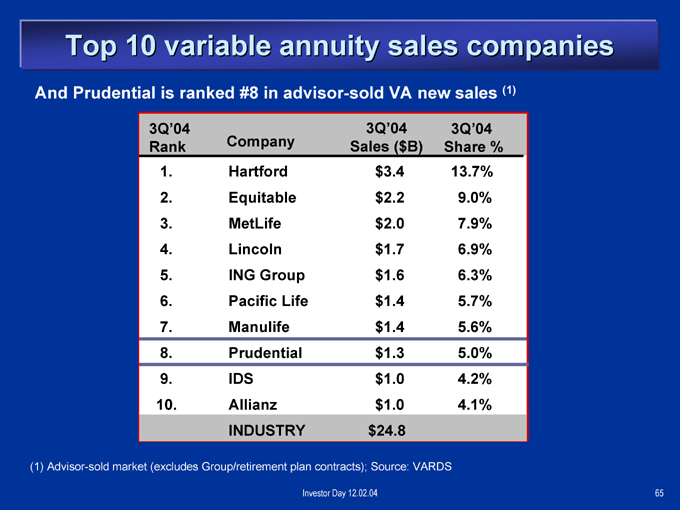

Top 10 variable annuity sales companies

And Prudential is ranked #8 in advisor-sold VA new sales (1)

3Q’04 3Q’04 3Q’04

Rank Company Sales ($B) Share%

1. Hartford $3.4 13.7%

2. Equitable $2.2 9.0%

3. MetLife $2.0 7.9%

4. Lincoln $1.7 6.9%

5. ING Group $1.6 6.3%

6. Pacific Life $1.4 5.7%

7. Manulife $1.4 5.6%

8. Prudential $1.3 5.0%

9. IDS $1.0 4.2%

10. Allianz $1.0 4.1%

INDUSTRY $24.8

(1) Advisor-sold market (excludes Group/retirement plan contracts); Source: VARDS

Investor Day 12.02.04

65

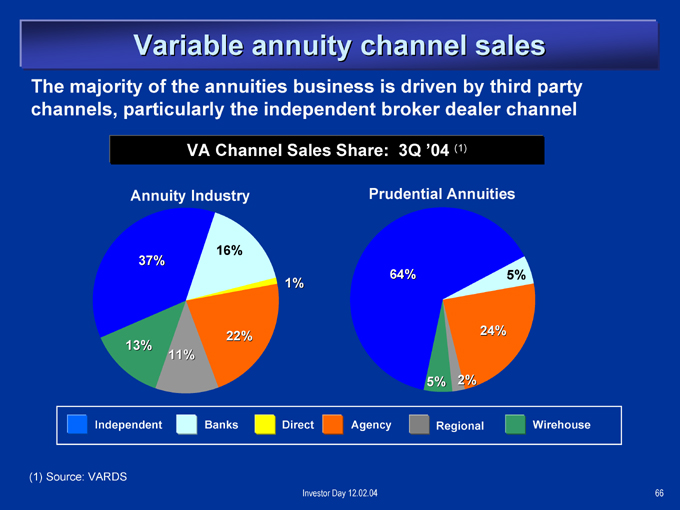

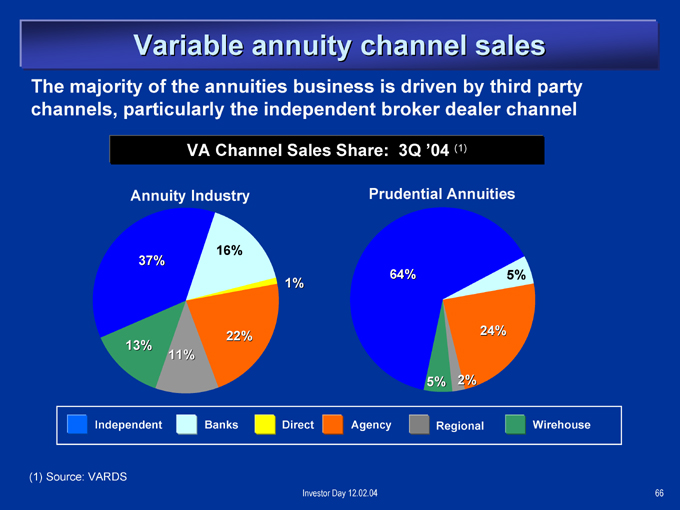

Variable annuity channel sales

The majority of the annuities business is driven by third party channels, particularly the independent broker dealer channel

VA Channel Sales Share: 3Q ‘04 (1)

Annuity Industry

16% 37%

1%

22% 13% 11%

Prudential Annuities

64% 5%

24%

5% 2%

Independent Banks Direct Agency Regional Wirehouse

(1) Source: VARDS

Investor Day 12.02.04

66

Net sales in positive territory and growing

Annuity net sales ($, millions)

1000 0 -1000

($174) $808 $484 $954

Year Ended Year Ended 9 Months Ended 9 Months Ended 12/31/02 12/31/03 9/30/03 9/30/04

Investor Day 12.02.04

67

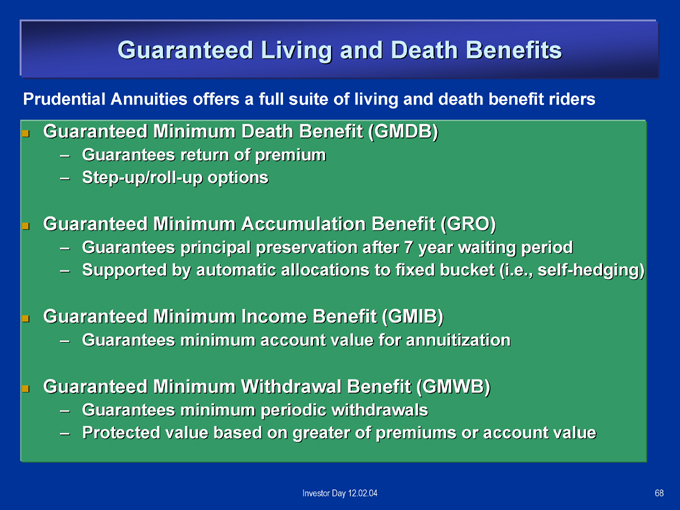

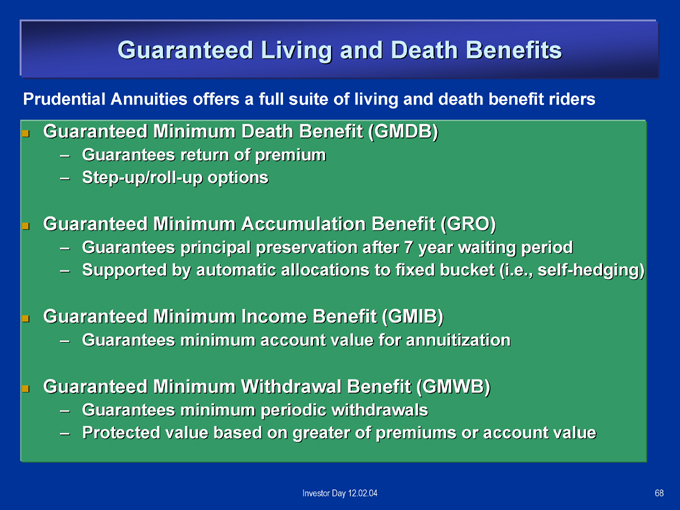

Guaranteed Living and Death Benefits

Prudential Annuities offers a full suite of living and death benefit riders

Guaranteed Minimum Death Benefit (GMDB)

Guarantees return of premium

Step-up/roll-up options

Guaranteed Minimum Accumulation Benefit (GRO)

Guarantees principal preservation after 7 year waiting period

Supported by automatic allocations to fixed bucket (i.e., self-hedging)

Guaranteed Minimum Income Benefit (GMIB)

Guarantees minimum account value for annuitization

Guaranteed Minimum Withdrawal Benefit (GMWB)

Guarantees minimum periodic withdrawals

Protected value based on greater of premiums or account value

Investor Day 12.02.04

68

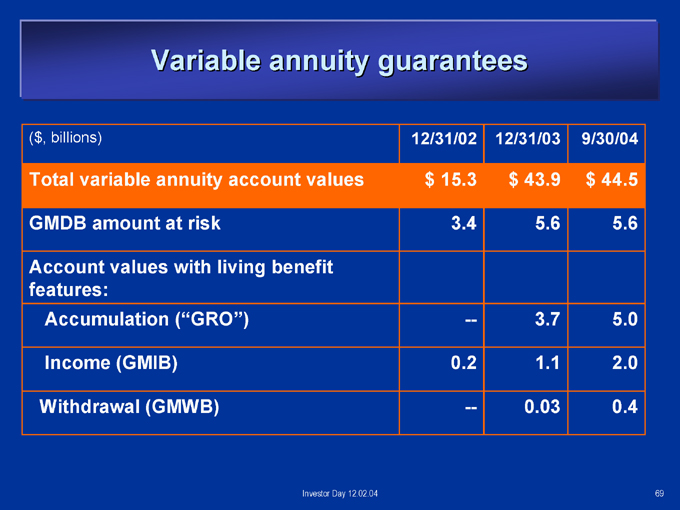

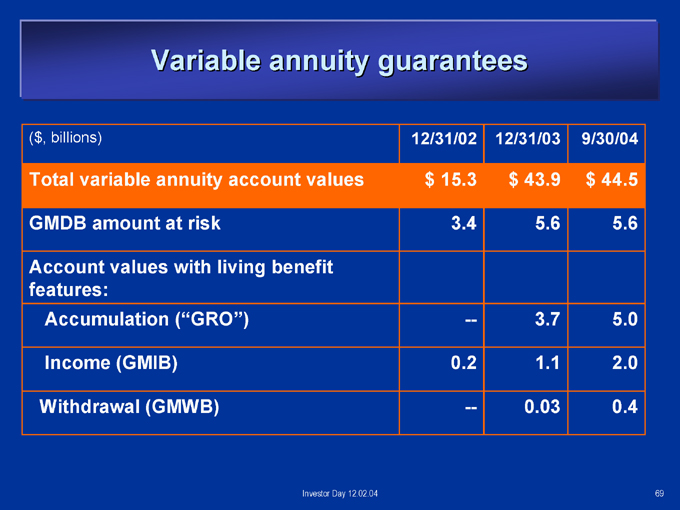

Variable annuity guarantees

($, billions) 12/31/02 12/31/03 9/30/04

Total variable annuity account values $ 15.3 $ 43.9 $ 44.5

GMDB amount at risk 3.4 5.6 5.6

Account values with living benefit

features:

Accumulation (“GRO”) — 3.7 5.0

Income (GMIB) 0.2 1.1 2.0

Withdrawal (GMWB) — 0.03 0.4

Investor Day 12.02.04 69

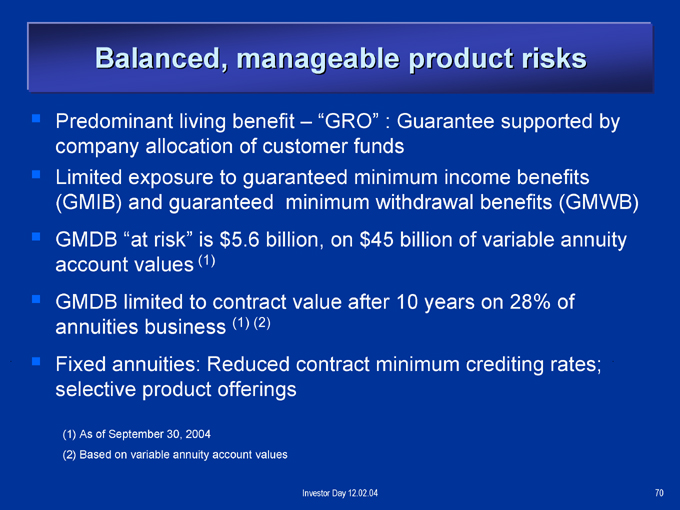

Balanced, manageable product risks

Predominant living benefit – “GRO” : Guarantee supported by company allocation of customer funds

Limited exposure to guaranteed minimum income benefits (GMIB) and guaranteed minimum withdrawal benefits (GMWB)

GMDB “at risk” is $5.6 billion, on $45 billion of variable annuity account values (1) GMDB limited to contract value after 10 years on 28% of annuities business (1) (2)

Fixed annuities: Reduced contract minimum crediting rates; selective product offerings

(1) As of September 30, 2004

(2) Based on variable annuity account values

Investor Day 12.02.04

70

Summary

Business strengthened by American Skandia acquisition; integration successfully completed Variable annuity emphasis complemented by fixed annuities Net sales positive and growing Complementary distribution channels; a leader with independent financial planners Attractive full product suite Balanced, manageable product risks

Investor Day 12.02.04

71

Investor Day

December 2, 2004

Investor Day 12.02.04

72

International Division

Rodger Lawson

Vice Chairman, International Insurance and Investments Division

Investor Day 12.02.04

73

International Division financial performance

Year Ended Nine Months

December 31 Ended September 30

$, millions) 2002 2003 2004

Pre-tax adjusted operating income:

International Insurance excluding Gibraltar Life $ 379 $ 449 $ 389

Gibraltar Life 378 370 309

27% ROE (1) 698

International Investments (6) (17) 35

$ 751 $ 802 $ 733

(1) Based on annualized after-tax adjusted operating income

Investor Day 12.02.04 74

Key elements of our international strategy

Focus on limited number of attractive countries Prioritize the affluent and mass affluent individual markets Develop business platforms based on Life Insurance or Investment Management or both Pursue opportunistic acquisitions Maintain very strict financial discipline

Investor Day 12.02.04

75

Life Planning insurance

Value Proposition – Life Planners

– A highly trained, professional field force focused on providing life insurance plans tailored to the specific needs of each individual client

Competitive Advantage

– Client focus

– Needs based selling

– Industry leadership service capability

Product Strategy

– Focuses on protection life insurance in a predominantly standardized product environment

Investor Day 12.02.04 76

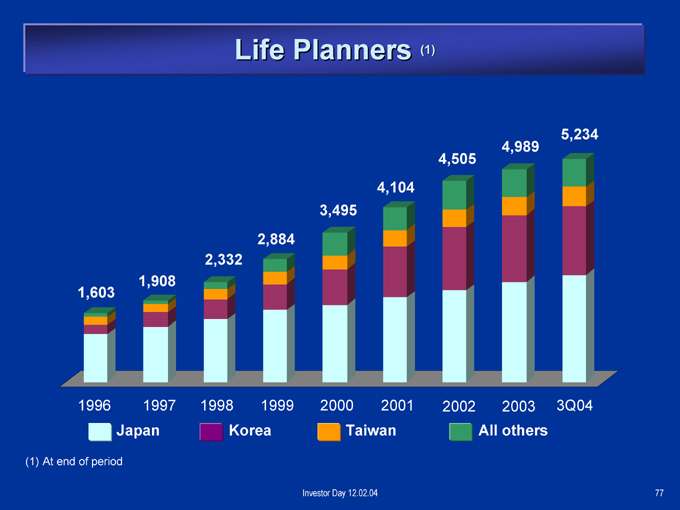

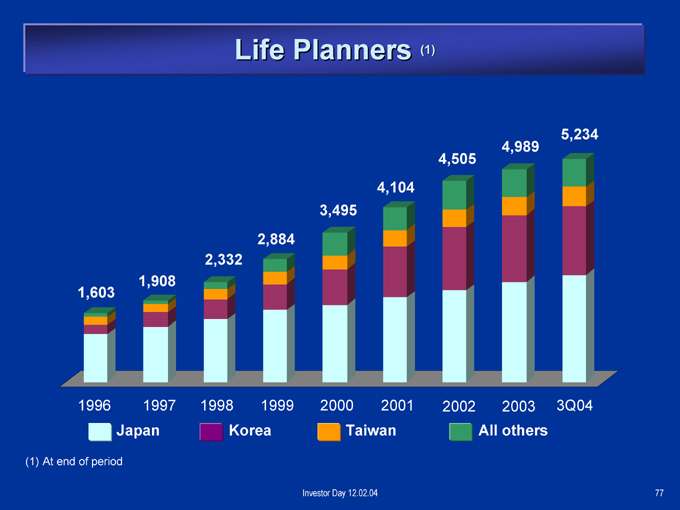

Life Planners (1)

5,234 4,989 4,505 4,104 3,495 2,884 2,332 1,908 1,603

1996 1997 1998 1999 2000 2001 2002 2003 3Q04

Japan Korea Taiwan All others

(1) At end of period

Investor Day 12.02.04 77

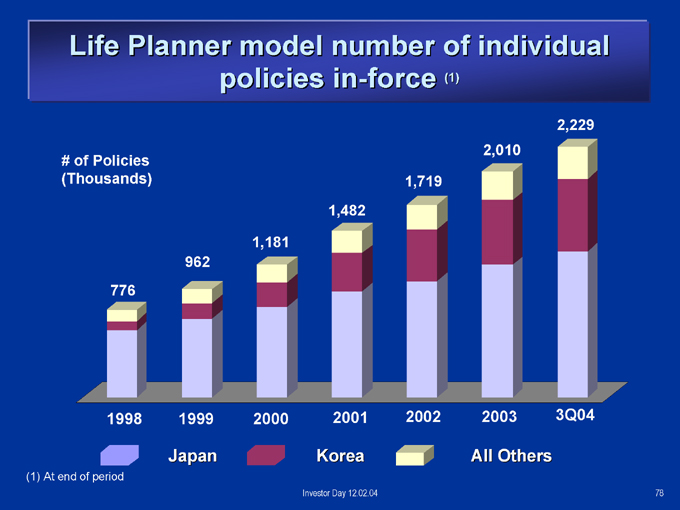

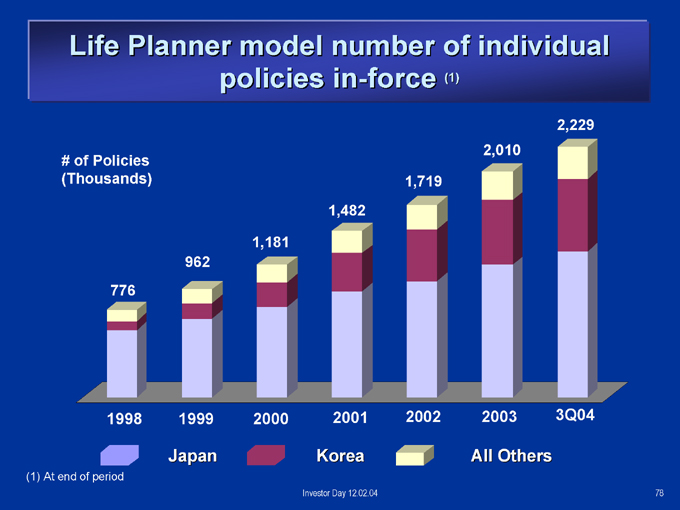

Life Planner model number of individual policies in-force (1)

2,229 2,010 # of Policies (Thousands) 1,719 1,482

1,181 962 776

1998 1999 2000 2001 2002 2003 3Q04

Japan Korea All Others

(1) At end of period

Investor Day 12.02.04 78

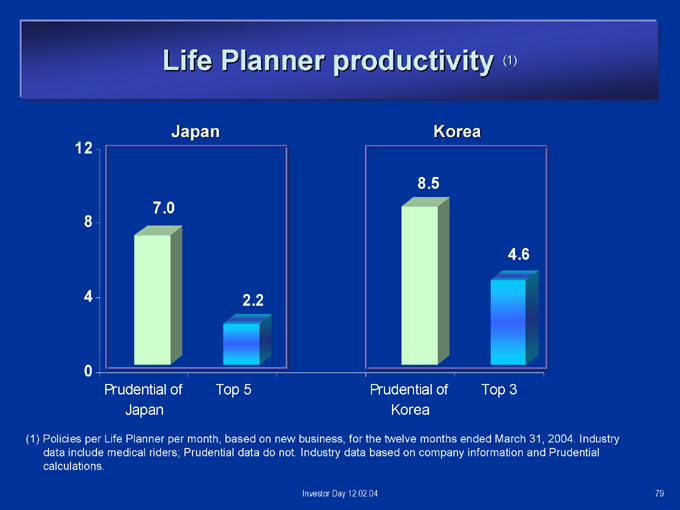

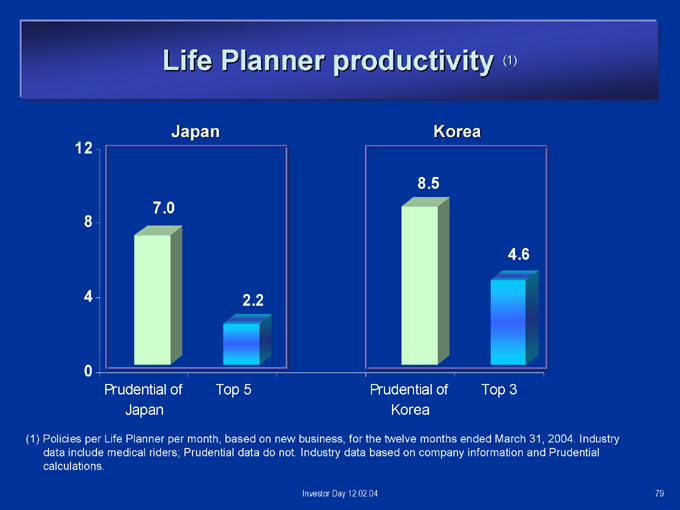

Life Planner productivity (1)

Japan

Korea

8.5

4.6

12 8 4 0

7.0 2.2

Prudential of Japan Top 5

Prudential of Korea Top 3

(1) Policies per Life Planner per month, based on new business, for the twelve months ended March 31, 2004. Industry data include medical riders; Prudential data do not. Industry data based on company information and Prudential calculations.

Investor Day 12.02.04

79

Life Planner retention and policy persistency

Life Planner model 2000 2001 2002 2003 3Q04

12-month Retention 75% 66% 72% 75% 74%

24-month Retention 65% 61% 55% 57% 58%

13-month policy

94% 93% 93% 93% 93%

persistency(1)

25-month policy

88% 88% 86% 87% 86%

persistency(1)

Renewal policy

95% 94% 95% 94% 94%

persistency(1)

(1) Persistency is reported on a face amount basis

Investor Day 12.02.04

80

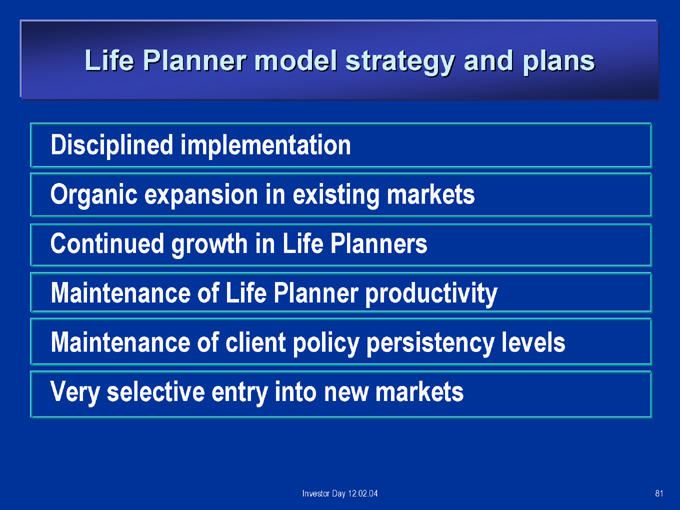

Life Planner model strategy and plans

Disciplined implementation

Organic expansion in existing markets Continued growth in Life Planners Maintenance of Life Planner productivity Maintenance of client policy persistency levels Very selective entry into new markets

Investor Day 12.02.04 81

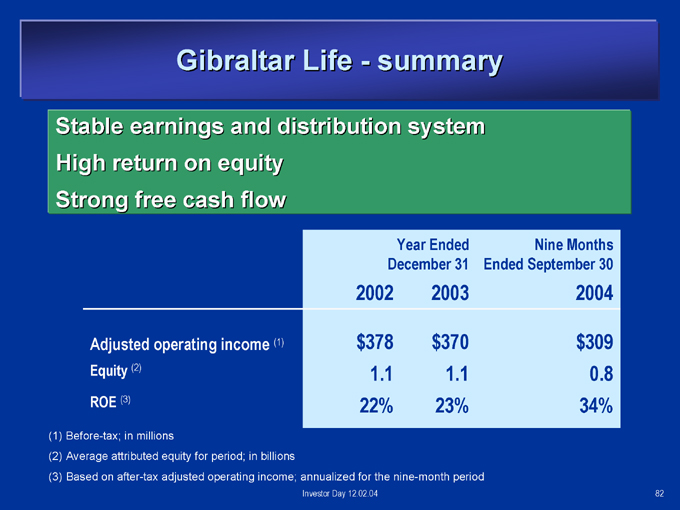

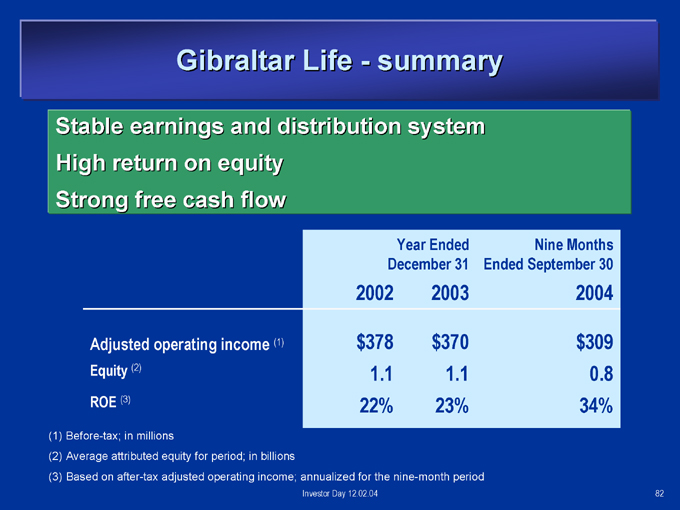

Gibraltar Life—summary

Stable earnings and distribution system High return on equity Strong free cash flow

Year Ended Nine Months

December 31 Ended September 30

2002 2003 2004

Adjusted operating income (1) $378 $370 $309

Equity (2) 1.1 1.1 0.8

ROE (3) 22% 23% 34%

(1) Before-tax; in millions

(2) Average attributed equity for period; in billions

(3) Based on after-tax adjusted operating income; annualized for the nine-month period

Investor Day 12.02.04 82

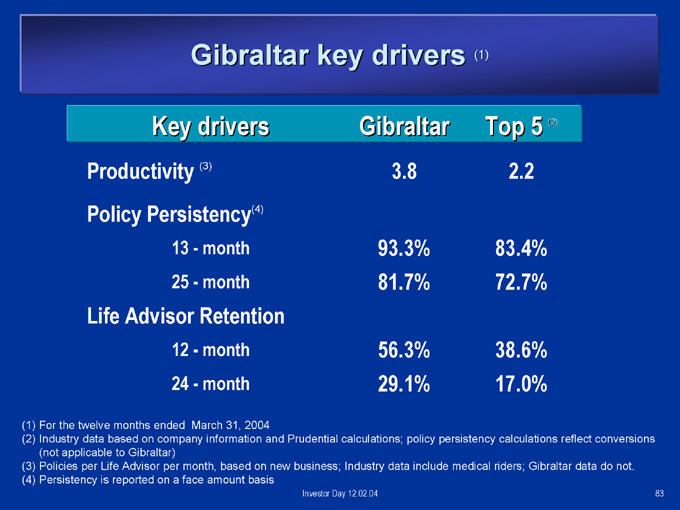

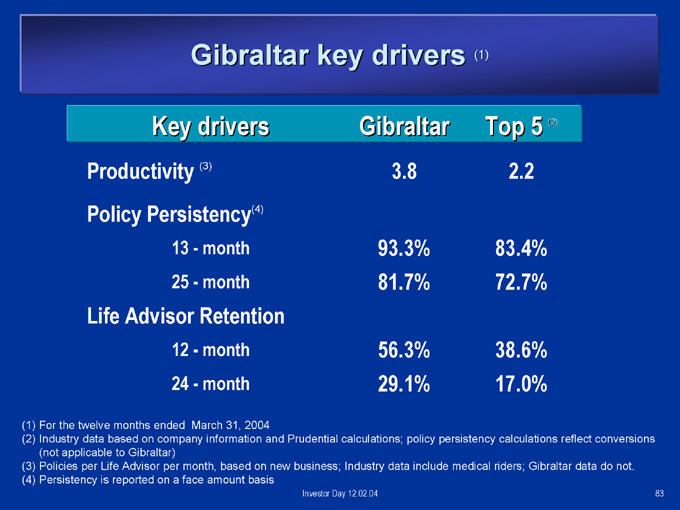

Gibraltar key drivers (1)

Key drivers Gibraltar Top 5 (2)

Productivity (3) 3.8 2.2

Policy Persistency(4)

13—month 93.3% 83.4%

25—month 81.7% 72.7%

Life Advisor Retention

12—month 56.3% 38.6%

24—month 29.1% 17.0%

(1) For the twelve months ended March 31, 2004

(2) Industry data based on company information and Prudential calculations; policy persistency calculations reflect conversions (not applicable to Gibraltar) (3) Policies per Life Advisor per month, based on new business; Industry data include medical riders; Gibraltar data do not. (4) Persistency is reported on a face amount basis

Investor Day 12.02.04 83

Where we are today—summary

Leadership positions in life planning

Gibraltar generates high ROEs and cash flows Developing asset management platforms Profitability dominated by Japan and Korea Management depth; country expertise Acquisitions potentially additive

Investor Day 12.02.04

84

Investor Day

December 2, 2004

Investor Day 12.02.04

85

International Insurance Finance

John Hanrahan

Chief Financial Officer, International Insurance

Investor Day 12.02.04

86

Sources of financial performance

Sales

Persistency

Growth in business in-force Emphasis on protection products Improving investment spreads Strengthening Yen

Investor Day 12.02.04 87

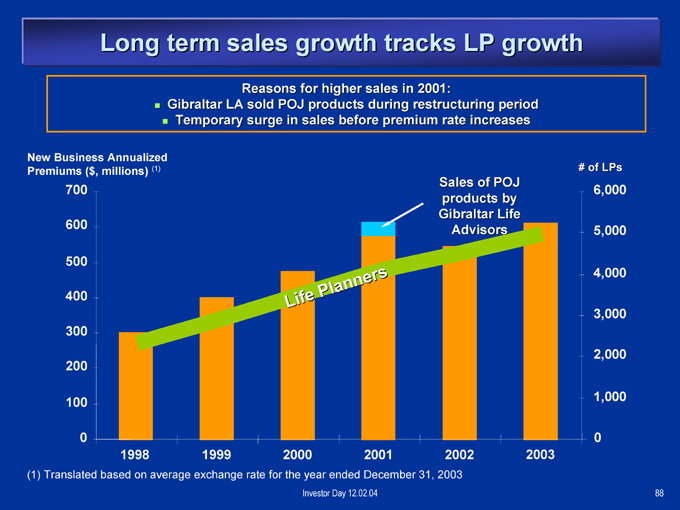

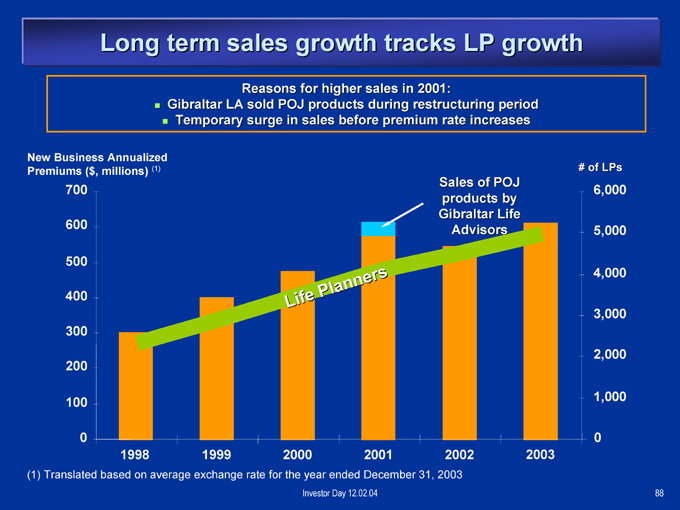

Long term sales growth tracks LP growth

Reasons for higher sales in 2001:

Gibraltar LA sold POJ products during restructuring period

Temporary surge in sales before premium rate increases

New Business Annualized Premiums ($, millions) (1)

700

600

500 400 300 200

100

0

L i f e

P l a n n e r s

Sales of POJ products by Gibraltar Life Advisors

1998 1999 2000 2001 2002 2003

# of LPs

6,000 5,000 4,000 3,000 2,000 1,000 0

(1) Translated based on average exchange rate for the year ended December 31, 2003

Investor Day 12.02.04

88

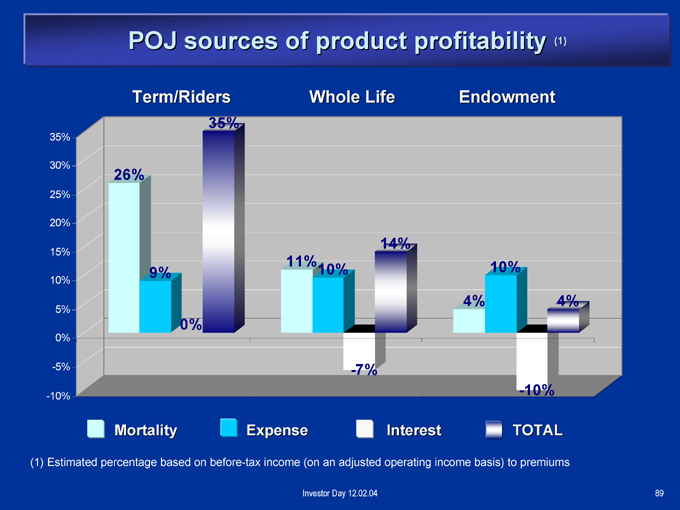

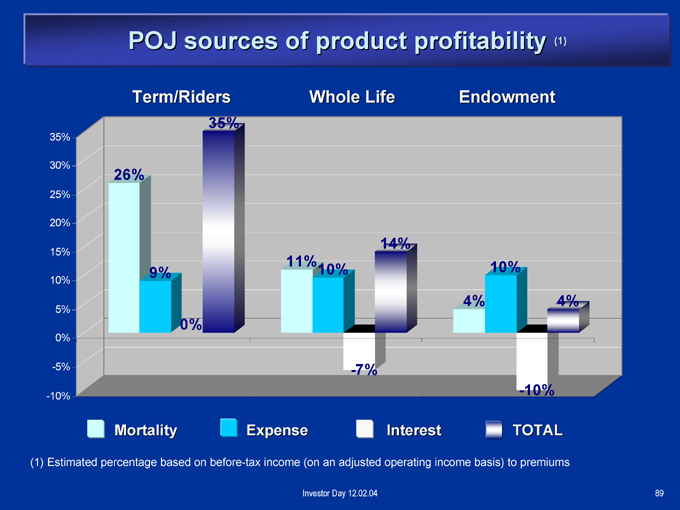

POJ sources of product profitability (1)

Term/Riders Whole Life Endowment

35%

30%

25%

20%

15%

10%

5%

0%

-5%

-10%

35%

26%

9%

0%

11%10%

14%

4%

10%

4%

-7%

-10%

Mortality

Expense

Interest

TOTAL

(1) Estimated percentage based on before-tax income (on an adjusted operating income basis) to premiums

Investor Day 12.02.04

89

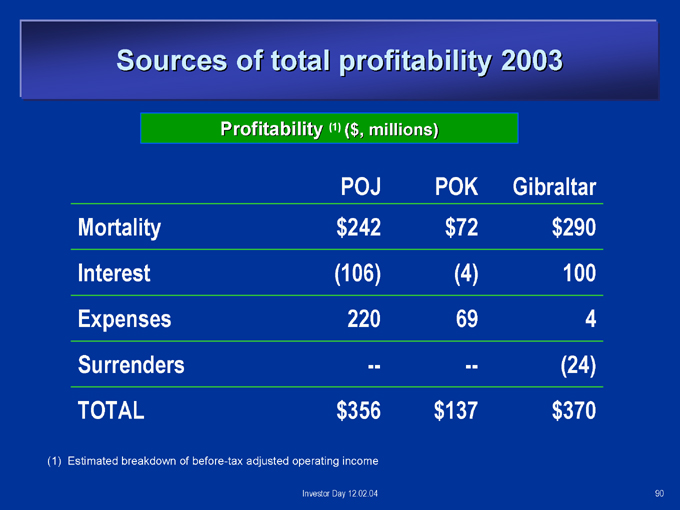

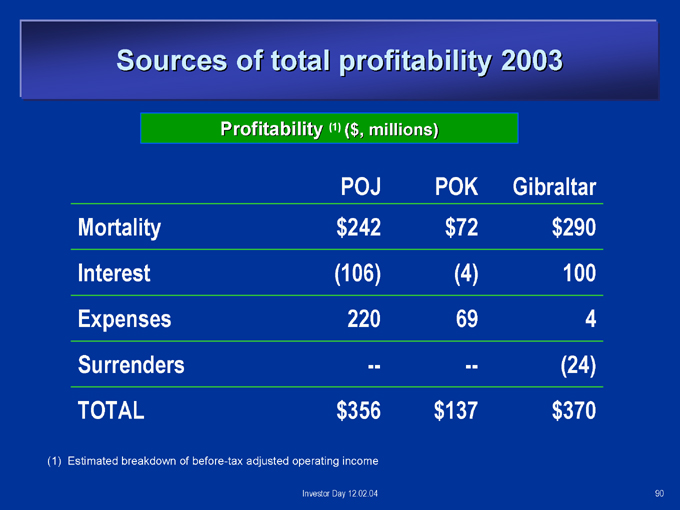

Sources of total profitability 2003

Profitability (1) ($, millions)

POJ POK Gibraltar

Mortality $ 242 $ 72 $ 290

Interest (106) (4) 100

Expenses 220 69 4

Surrenders — — (24)

TOTAL $ 356 $ 137 $ 370

(1) Estimated breakdown of before-tax adjusted operating income

Investor Day 12.02.04

90

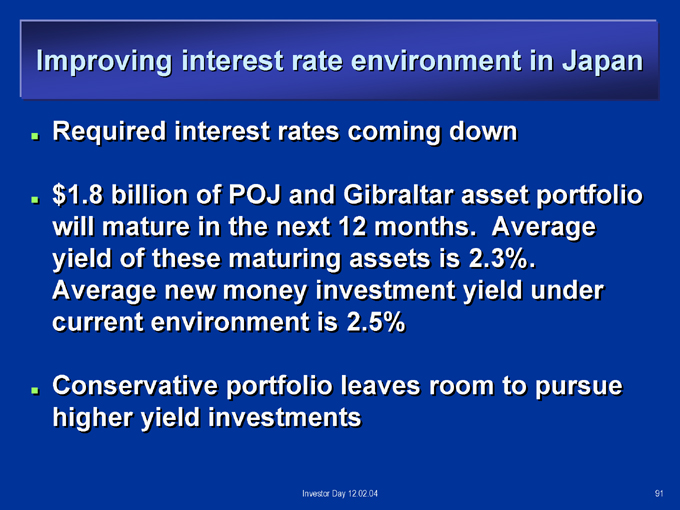

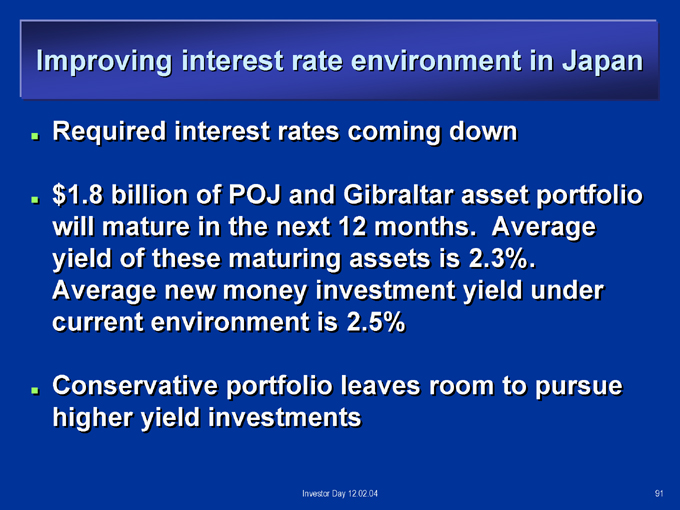

Improving interest rate environment in Japan

Required interest rates coming down

$1.8 billion of POJ and Gibraltar asset portfolio will mature in the next 12 months. Average yield of these maturing assets is 2.3%. Average new money investment yield under current environment is 2.5%

Conservative portfolio leaves room to pursue higher yield investments

Investor Day 12.02.04

91

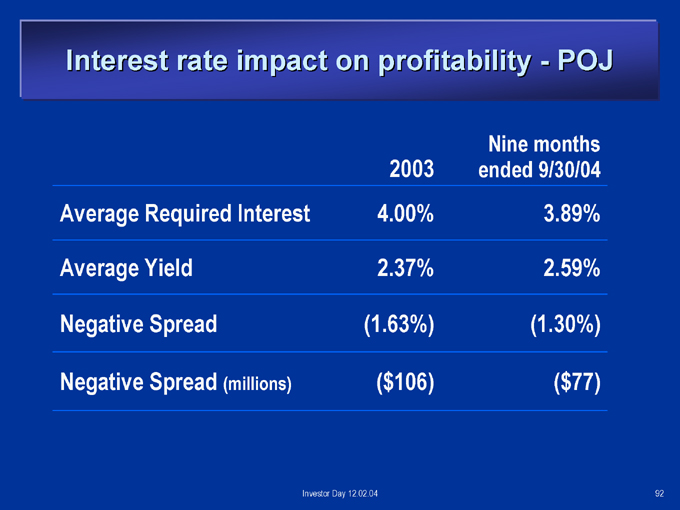

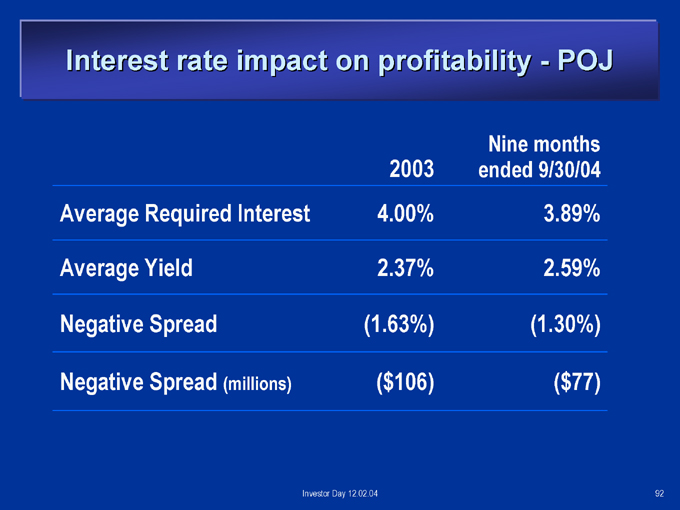

Interest rate impact on profitability—POJ

Nine months

2003 ended 9/30/04

Average Required Interest 4.00% 3.89%

Average Yield 2.37% 2.59%

Negative Spread (1.63%) (1.30%)

Negative Spread (millions) ($106) ($77)

Investor Day 12.02.04

92

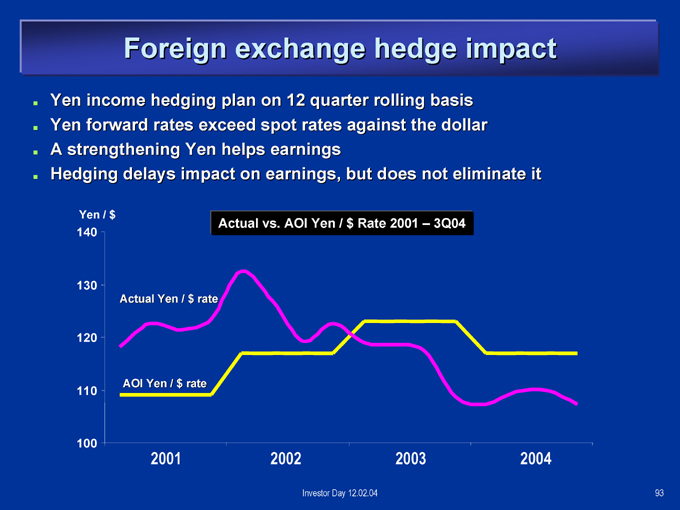

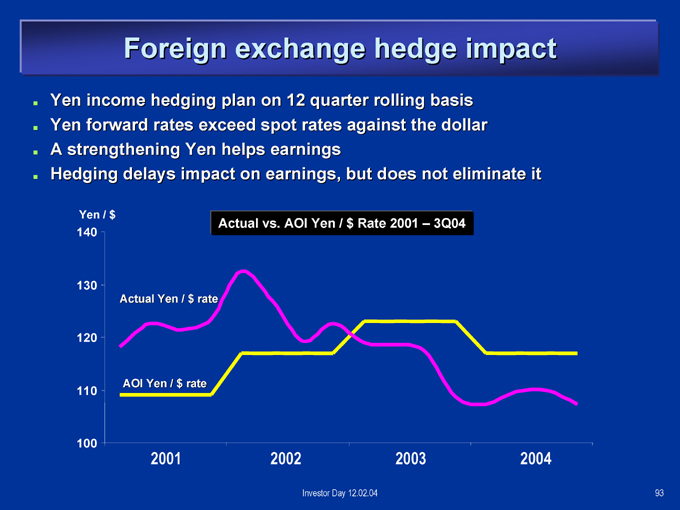

Foreign exchange hedge impact

Yen income hedging plan on 12 quarter rolling basis Yen forward rates exceed spot rates against the dollar A strengthening Yen helps earnings Hedging delays impact on earnings, but does not eliminate it

Yen / $

Actual vs. AOI Yen / $ Rate 2001 – 3Q04

140

130

Actual Yen / $ rate

120

AOI Yen / $ rate

110

100

2001 2002 2003 2004

Investor Day 12.02.04

93

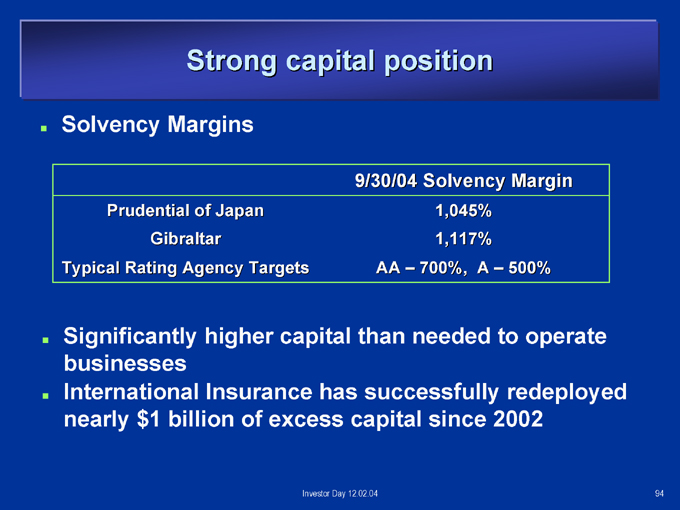

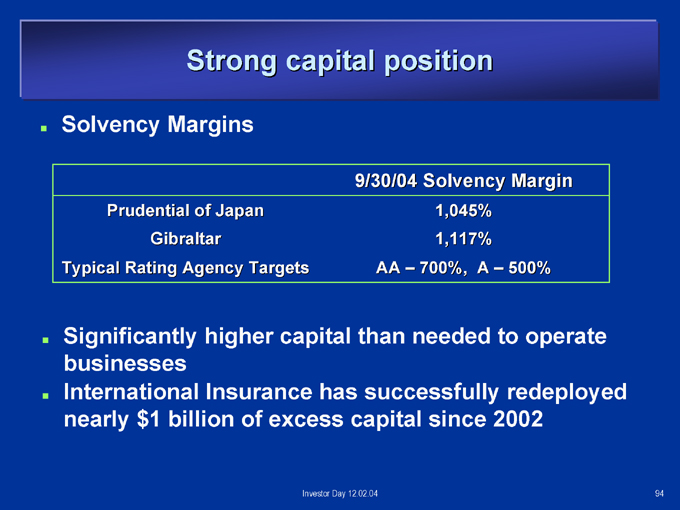

Strong capital position

Solvency Margins

9/30/04 Solvency Margin

Prudential of Japan Gibraltar Typical Rating Agency Targets

1,045% 1,117% AA – 700%, A – 500%

Significantly higher capital than needed to operate businesses International Insurance has successfully redeployed nearly $1 billion of excess capital since 2002

Investor Day 12.02.04

94

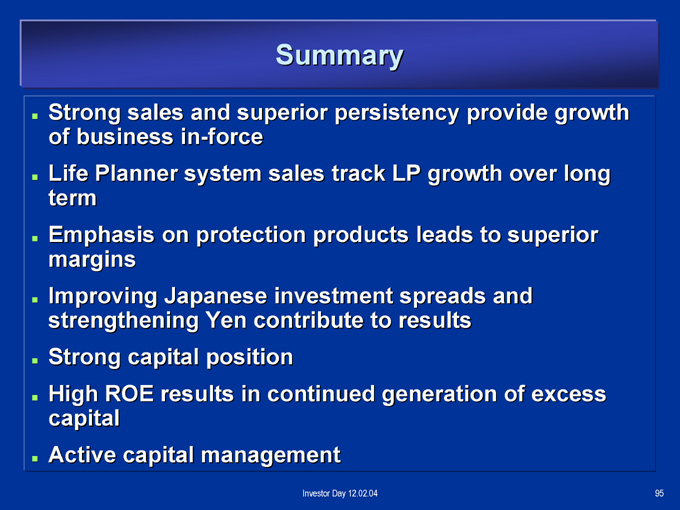

Summary

Strong sales and superior persistency provide growth of business in-force Life Planner system sales track LP growth over long term Emphasis on protection products leads to superior margins Improving Japanese investment spreads and strengthening Yen contribute to results Strong capital position High ROE results in continued generation of excess capital Active capital management

Investor Day 12.02.04

95

Investor Day

December 2, 2004

Investor Day 12.02.04 96

Financial Outlook

Richard J. Carbone

Chief Financial Officer

Investor Day 12.02.04

97

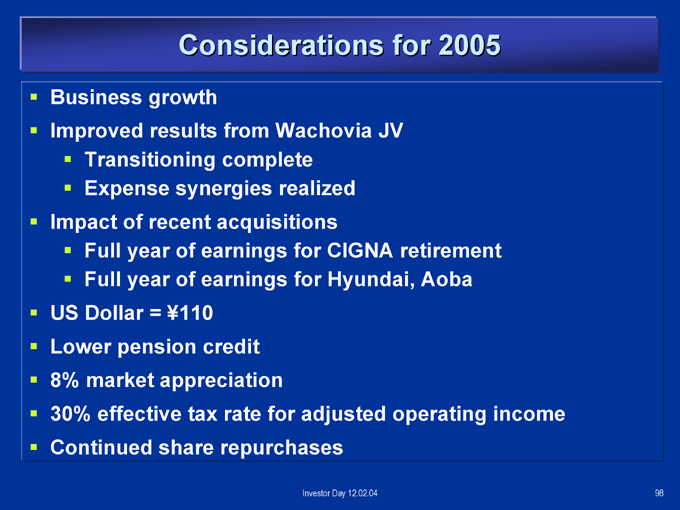

Considerations for 2005

Business growth

Improved results from Wachovia JV

Transitioning complete Expense synergies realized

Impact of recent acquisitions

Full year of earnings for CIGNA retirement Full year of earnings for Hyundai, Aoba

US Dollar = ¥110 Lower pension credit 8% market appreciation

30% effective tax rate for adjusted operating income Continued share repurchases

Investor Day 12.02.04

98

FSB full year 2005 earnings guidance (1)

Capital management

Strengthening yen

Recent acquisitions CIGNA

Hyundai, Aoba

Wachovia JV

Business growth • international • domestic

2004 guidance (1) $3.30—$3.40

(1) Based on after-tax adjusted operating income for the Financial Services Businesses

Investor Day 12.02.04 99

Investor Day

December 2, 2004

Investor Day 12.02.04

100

Closing Comments

Art Ryan

Chairman and CEO

Investor Day 12.02.04 101

Investor Day

December 2, 2004

Investor Day 12.02.04 102