- PRS Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Prudential Financial, Inc. 5.62 (PRS) DEF 14ADefinitive proxy

Filed: 22 Mar 07, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to §240.14a-12

Prudential Financial, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Prudential Financial, Inc.

751 Broad Street, Newark NJ 07102

March 22, 2007

Dear Fellow Shareholder:

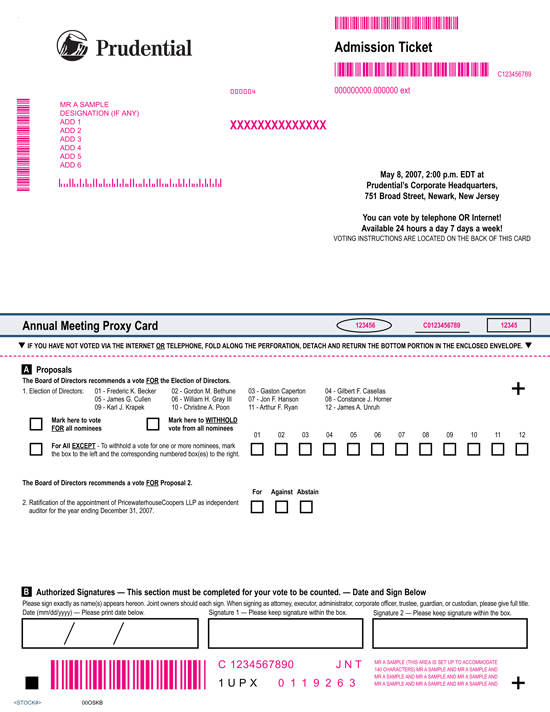

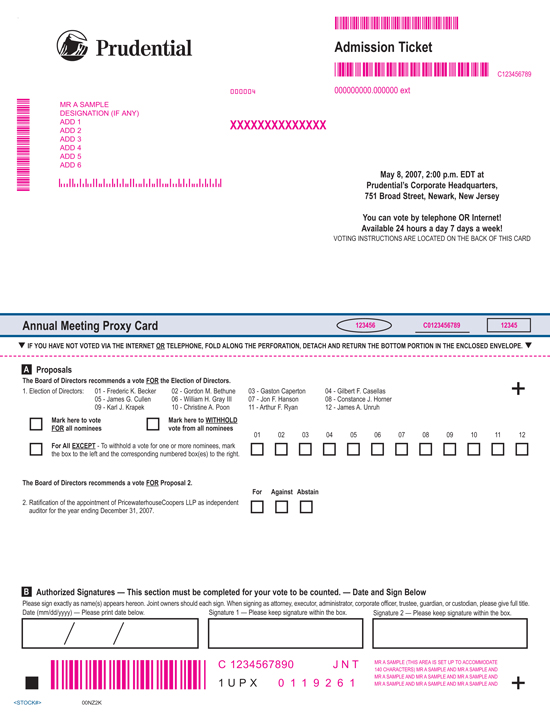

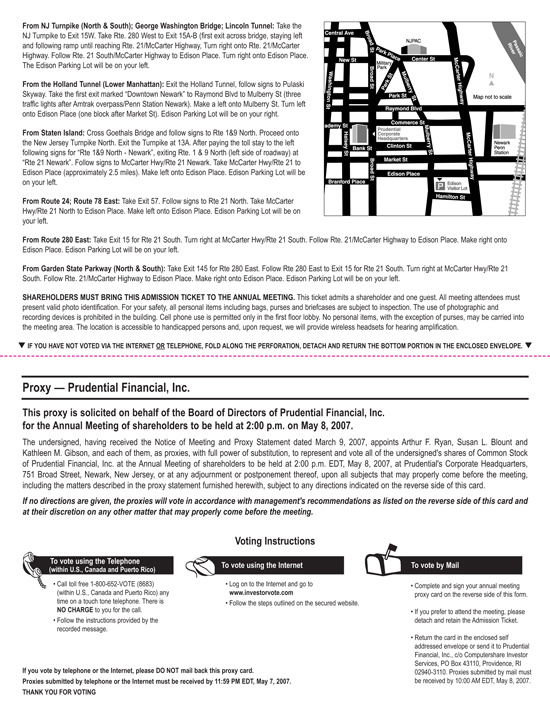

On behalf of your Board of Directors, you are cordially invited to attend the Annual Meeting of Shareholders of Prudential Financial, Inc. Your Company’s Annual Meeting will be held on May 8, 2007 at Prudential Financial’s Corporate Headquarters, 751 Broad Street, Newark, New Jersey 07102 at 2:00 p.m. The location is accessible to handicapped persons, and, upon request, we will provide wireless headsets for hearing amplification.

The Notice of Meeting and proxy statement describe the matters to be voted on at the meeting.

Your vote is important. We urge you to participate in Prudential Financial’s Annual Meeting, whether or not you plan to attend, by signing, dating and promptly mailing the enclosed proxy card. You may also vote by telephone or the Internet should you prefer. Regardless of the size of your investment, your vote is important, so please act at your earliest convenience. Finally, if you do plan to attend the meeting, you will need an admission ticket. Please refer to the instructions set forth in the Notice of Meeting, which follows this letter, or those attached to the proxy card.

We appreciate your participation, support and interest in the Company.

Sincerely,

Arthur F. Ryan

Chairman and Chief Executive Officer

Prudential Financial, Inc.

751 Broad Street, Newark NJ 07102

Notice of Annual Meeting of Shareholders

of Prudential Financial, Inc.

Date: | May 8, 2007 | |

Time: | 2:00 p.m. | |

Place: | Prudential Financial’s Corporate Headquarters 751 Broad Street Newark, NJ 07102 | |

At the 2007 Annual Meeting, shareholders will act upon the following matters:

| 1. | Election of 12 directors for a term of one year; |

| 2. | Ratification of the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm for the year ending December 31, 2007; and |

| 3. | Transaction of such other business as may properly come before the meeting. |

Information about the matters to be acted upon at the Annual Meeting is contained in the accompanying proxy statement.

Shareholders of record at the close of business on March 9, 2007 will be entitled to notice of and to vote at the Annual Meeting and at any adjournments or postponements thereof.

Shareholders will need an admission ticket and valid photo identification to attend the Annual Meeting. If your shares are registered in book entry or certificate form through our Transfer Agent, Computershare, an admission ticket is attached to the enclosed proxy card. If your shares are not registered through Computershare, you need to bring proof of your share ownership to the meeting to receive an admission ticket. Please bring either a copy of your account statement or a letter from your broker, bank or other institution reflecting your share ownership as of March 9, 2007. Please note that the use of photographic and recording devices is prohibited in the building. For your safety, we reserve the right to inspect all personal items prior to admission to the Annual Meeting.

By Order of the Board of Directors,

Kathleen M. Gibson

Vice President, Secretary and Corporate Governance Officer

March 9, 2007

Your vote is important! Please take a moment to complete, sign, date and mail the proxy card in the accompanying envelope. If you prefer, you may also vote by telephone or the Internet. Please see the instructions attached to the proxy card. Your prompt cooperation will save your Company additional solicitation costs.

| 1 | ||

| 1 | ||

| 3 | ||

Item 2: Ratification of the Appointment of the Independent Registered Public Accounting Firm | 6 | |

| 7 | ||

| 8 | ||

Policies and Procedures for the Review and Approval of Transactions with RelatedParties | 9 | |

| 12 | ||

| 13 | ||

| 14 | ||

| 15 | ||

| 16 | ||

| 24 | ||

| 24 | ||

| 27 | ||

| 28 | ||

| 29 | ||

| 30 | ||

| 33 | ||

| 34 | ||

| 40 | ||

Section 16(a)Beneficial Ownership Reporting Compliance | 41 | |

| 41 | ||

“Householding” of Proxy Materials and Elimination of Duplicates | 42 | |

| 42 | ||

| 42 | ||

| 42 | ||

| 42 | ||

2007 PROXY STATEMENT

The Board of Directors of Prudential Financial, Inc. (“Prudential Financial” or the “Company”) is providing this proxy statement and soliciting the accompanying form of proxy in connection with the Annual Meeting of Shareholders to be held on May 8, 2007 (the “Annual Meeting”) at 2:00 p.m. at Prudential Financial’s Corporate Headquarters, 751 Broad Street, Newark, New Jersey 07102, and at any adjournment or postponement thereof. The Notice of Meeting, this proxy statement, the enclosed proxy card and the enclosed Annual Report for 2006 were first sent to shareholders on or about March 22, 2007.

VOTING INSTRUCTIONS AND INFORMATION

Who Can Vote?

You are entitled to vote or direct the voting of your Prudential Financial Common Stock if you were a shareholder on March 9, 2007, the record date for the Annual Meeting. Shareholders of our Class B Stock, as of March 9, 2007, are also entitled to vote their shares. On that date, 467,990,284 shares of Common Stock and 2,000,000 shares of Class B Stock were outstanding and entitled to notice of and to vote at the Annual Meeting. Each share of Prudential Financial Common Stock and Class B Stock is entitled to one vote, and the Common Stock and Class B Stock vote together as a single class on the matters submitted for a vote at this Annual Meeting.

Who Is the Holder of Record?

You may own shares of Common Stock either (1) directly registered in your name at our transfer agent, Computershare; or (2) indirectly through a broker, bank or other nominee.

If your shares are registered directly in your name at Prudential’s transfer agent, Computershare, you are the Holder of Record of these shares, and we are sending these proxy materials directly to you. If you hold shares indirectly through a broker, bank or other nominee, these materials are being sent to you by or on behalf of that entity.

How Do I Vote?

Your vote is important. We encourage you to vote promptly. You may vote in one of the following ways:

Holders of Record

| • | By Telephone. You can vote your shares by telephone, by calling 1-800-652-VOTE (8683). This toll-free number is also on the enclosed proxy card. Telephone voting is available 24 hours a day. If you vote by telephone, you do not need to return the proxy card. Your vote by telephone must be received by 11:59 p.m. EDT, May 7, 2007. |

| • | By Internet. You can also vote on the Internet. The website address for Internet voting iswww.investorvote.com and can also be found on the enclosed proxy card. Internet voting is available 24 hours a day. If you vote by Internet, you do not need to return the proxy card. Your vote by Internet must be received by 11:59 p.m. EDT, May 7, 2007. |

| • | By Mail. If you choose to vote by mail, mark the enclosed proxy card, date and sign it, and return it in the postage-paid envelope provided. Your vote by mail must be received by 10:00 a.m. EDT, May 8, 2007, the date of the Annual Meeting. |

| • | By Attending the Annual Meeting. If you attend the Annual Meeting, you can vote your shares in person. You will need to have an admission ticket or other proof of ownership and valid photo identification with you at the Annual Meeting. Please refer to the instructions attached to the enclosed proxy card. |

Shares Held by Brokers, Banks and Nominees

| • | If your shares of Common Stock are held through a broker, bank or other nominee, you will receive instructions from that entity in connection with the voting of your shares. |

| • | If you plan to attend the Annual Meeting and vote in person, you will need to contact your broker, bank or other nominee to obtain a “legal proxy” to permit you to vote by written ballot at the Annual Meeting. |

Page 1

PRUDENTIAL FINANCIAL, INC.

How Many Votes Are Required?

A quorum is required to transact business at the Annual Meeting. We will have a quorum and be able to conduct the business of the Annual Meeting if the holders of 50% of the shares entitled to vote are present at the meeting, either in person or by proxy.

If a quorum is present, a plurality of votes cast is required to elect Directors. Thus, a Director may be elected even if the Director receives less than a majority vote of the shares represented at the meeting. However, the Board’s Corporate Governance Principles and Practices provide that any Director who receives more votes “withheld” than votes “for” will tender his or her resignation for the consideration of the Committee. The Committee will then make a recommendation to the Board with respect to the offer of resignation.

To ratify the selection of the independent auditor, an affirmative vote of a majority of the votes cast is required.

How Are Votes Counted?

All shares that have been properly voted, and not revoked, will be voted at the Annual Meeting in accordance with your instructions. If you sign and return the proxy card but do not specify how you wish your shares to be voted, your shares represented by that proxy will be voted as recommended by the Board of Directors:“for” all the nominees for Director; and“for” ratification of the appointment of PricewaterhouseCoopers LLP as our independent auditor for 2007.

A New York Stock Exchange (“NYSE”) member broker who holds shares in street name for a customer has the authority to vote on certain items if the broker does not receive instructions from the customer. NYSE rules permit member brokers who do not receive instructions to vote on the election of Directors and the proposal to ratify the appointment of our independent auditor. Proxies that are counted as abstentions and any proxies returned by brokers as “non-votes” on behalf of shares held in street names (because beneficial owners’ discretion has been withheld) will be treated as presentfor purposes of determining whether a quorum is present at the Annual Meeting. However, any shares not voted as a result of an abstention or a broker non-vote will not be counted as voting for or against a particular matter. Accordingly, abstentions and broker non-votes will have no effect on the outcome of a vote.

How Can I Revoke My Proxy or Change My Vote?

You can revoke your proxy or change your vote by:

Holders of Record

| • | Sending written notice of revocation to the Secretary of Prudential Financial; |

| • | Submitting another timely and later dated proxy by mail or, prior to 11:59 p.m., EDT, on May 7, 2007, by telephone or Internet; or |

| • | Attending the 2007 Annual Meeting and voting in person by written ballot. |

Stock Held by Brokers, Banks and Nominees

| • | Contacting your broker, bank or other nominee to obtain instructions to revoke your proxy, change your vote or obtain a “legal proxy” will permit you to attend the Annual Meeting and vote in person by written ballot. |

Who Will Count the Vote?

The Board of Directors has appointed IVS Associates, Inc. to act as the Inspector of Election at the 2007 Annual Meeting.

Who Is the Proxy Solicitor?

D.F. King & Co., Inc. has been retained by Prudential Financial to assist with the Annual Meeting, including the distribution of proxy materials and solicitation of votes, for a fee of $30,000 plus reimbursement of expenses to be paid by the Company. In addition, our Directors, officers or employees, who will receive no additional compensation for soliciting, may solicit proxies for us in person or by telephone, facsimile, Internet or other electronic means.

Page 2

2007 PROXY STATEMENT

ITEM 1 — ELECTION OF DIRECTORS

At the Annual Meeting, 12 Directors are to be elected to hold office for a one-year term until the Annual Meeting of Shareholders to be held in 2008 and until their successors are duly elected or appointed.

Unless authority is withheld by the shareholder, it is the intention of persons named by Prudential Financial as proxies on its proxy card to vote “for” the nominees listed and, in the event that any nominees are unable or decline to serve (an event not now anticipated), to vote “for” the balance of the nominees and “for” any substitutes selected by the Board of Directors. The name, age, principal occupation and other information concerning each Director is set forth below.

Each of the nominees currently is a Director, and each has been recommended for re-election to the Board of Directors by the Corporate Governance and Business Ethics Committee and approved and nominated for re-election by the Board of Directors.

The Board of Directors recommends that shareholders vote “FOR” all of the nominees.

Nominees for Director

| Frederic K. Becker was elected as a Director of Prudential Financial in January 2001 and was appointed by the Chief Justice of the New Jersey Supreme Court as a Director of Prudential Insurance in June 1994. He has served as President of | |

| the law firm of Wilentz Goldman & Spitzer, P.A. since 1989 and has practiced law with the firm since 1960. Mr. Becker’s primary expertise is in the area of law. Age 71. | ||

| Gordon M. Bethune was elected as a Director of Prudential Financial in February 2005. Mr. Bethune joined Continental Airlines, Inc. (international commercial airline company) in February 1994 as President and Chief Operating | |

| Officer. He was elected President and Chief Executive Officer in November 1994 and Chairman of the Board and Chief Executive Officer in 1996. He retired from Continental on December 31, 2004. Prior to joining Continental, Mr. Bethune held senior management positions with The Boeing Company, Piedmont Airlines, Western Air Lines, Inc. and Braniff Airlines. Mr. Bethune’s primary expertise is in the area of business operations. Other Directorships include: Honeywell International, Inc., Sprint Nextel and Willis Group Holdings. Age 65. | ||

| Gaston Caperton was elected as a Director of Prudential Financial in June 2004. He has served as the President of The College Board (nonprofit membership association of schools, colleges, universities and other educational organizations) since 1999. | |

| He was the founder and executive director of Columbia University’s Institute on Education & Government at Teachers College from 1997 to 1999 and a fellow at Harvard University’s John F. Kennedy Institute of Politics from 1996 to 1997. Mr. Caperton served as the Governor of West Virginia from 1988 to 1996. Prior to his governorship, Mr. Caperton was an entrepreneur in the insurance business and was one of the principal owners of a privately held insurance brokerage firm. Mr. Caperton’s areas of expertise include insurance, public policy and education. Other Directorships include: Owens Corning and United Bankshares, Inc. Age 67. | ||

Page 3

PRUDENTIAL FINANCIAL, INC.

| Gilbert F. Casellas was elected as a Director of Prudential Financial in January 2001 and has been a Director of Prudential Insurance since April 1998. He has been a member of the law firm of Mintz Levin Cohn Ferris Glovsky & Popeo, PC since | |

| June 2005. He served as President of Casellas & Associates, LLC, a consulting firm, from 2001 to 2005. During 2001, he served as President and Chief Executive Officer of Q-linx, Inc. (software development). He served as the President and Chief Operating Officer of The Swarthmore Group, Inc. (investment company) from January 1999 to December 2000. Mr. Casellas served as Chairman, U.S. Equal Employment Opportunity Commission from 1994 to 1998; and General Counsel, U.S. Department of the Air Force from 1993 to 1994. Mr. Casellas’ areas of expertise include law, public policy, investments and education. Age 54. | ||

| James G. Cullen was elected as a Director of Prudential Financial in January 2001 and was appointed by the Chief Justice of the New Jersey Supreme Court as a Director of Prudential Insurance in April 1994. He served as the President and | |

| Chief Operating Officer of Bell Atlantic Corporation (global telecommunications) from December 1998 until his retirement in June 2000. Mr. Cullen was the President and Chief Executive Officer, Telecom Group, Bell Atlantic Corporation from 1997 to 1998 and served as Vice Chairman of Bell Atlantic Corporation from 1995 to 1997. Mr. Cullen’s areas of expertise include business operations and sales and marketing. Other Directorships include: Agilent Technologies, Inc., Johnson & Johnson and NeuStar, Inc. Age 64. | ||

| William H. Gray III was elected as a Director of Prudential Financial in January 2001 and has been a Director of Prudential Insurance since September 1991. He has served as Chairman of the Amani Group (a government affairs firm) since | |

| September 2004. He served as President and Chief Executive Officer of The College Fund/UNCF (philanthropic foundation) from 1991 until his retirement in 2004. Mr. Gray was a member of the U.S. House of Representatives from 1979 to 1991. Mr. Gray’s areas of expertise include public policy and education. Other Directorships include: Dell Inc., JP Morgan Chase & Co., Pfizer Inc. and Visteon Corporation. Age 65. | ||

| Jon F. Hanson was elected as a Director of Prudential Financial in January 2001 and was appointed by the Chief Justice of the New Jersey Supreme Court as a Director of Prudential Insurance in April 1991. He has served as Chairman of The Hampshire | |

| Companies (a real estate investment fund management company) since 1976. Mr. Hanson served as the Chairman and Commissioner of the New Jersey Sports and Exposition Authority from 1982 to 1994. Mr. Hanson’s areas of expertise include real estate, investments, government and business operations. Other Directorships include: HealthSouth Corporation and Pascack Community Bank. Age 70. | ||

| Constance J. Horner was elected as a Director of Prudential Financial in January 2001 and has been a Director of Prudential Insurance since April 1994. She served as a Guest Scholar at The Brookings Institution (non-partisan research institute) | |

| from 1993 to 2005, after serving as Assistant to the President of the United States and Director, Presidential Personnel from 1991 to 1993; Deputy Secretary, U.S. Department of Health and Human Services from 1989 to 1991; and Director, U.S. Office of Personnel Management from 1985 to 1989. Mrs. Horner was a Commissioner, U.S. Commission on Civil Rights from 1993 to 1998. Mrs. Horner’s areas of expertise include public policy and government. Other Directorships include: Ingersoll-Rand Company Ltd. and Pfizer Inc. Age 65. | ||

Page 4

2007 PROXY STATEMENT

| Karl J. Krapek was elected as a Director of Prudential Financial in January 2004. He served as the President and Chief Operating Officer of United Technologies Corporation (global technology) from 1999 until his retirement in January 2002. | |

| Prior to that time, Mr. Krapek held other management positions at United Technologies Corporation, which he joined in 1982. Mr. Krapek’s areas of expertise include domestic and international business operations. Other Directorships include: Delta Airlines, Inc., Alcatel- Lucent, The Connecticut Bank & Trust Company and Visteon Corporation. Age 58. | ||

| Christine A. Poon was elected as a Director of Prudential Financial in September 2006. Ms. Poon is Vice Chair and Worldwide Chair, Medicines and Nutritionals, at Johnson & Johnson. She is also a member of Johnson | |

| & Johnson’s Board of Directors. Ms. Poon joined Johnson & Johnson in 2000 as Company Group Chair in the Pharmaceuticals Group. She became a member of Johnson & Johnson’s Executive Committee and Worldwide Chair, Pharmaceuticals Group, in 2001, and was named to her current position as Worldwide Chair, Medicines and Nutritionals in 2003. Ms. Poon was appointed Vice Chair and a member of Johnson & Johnson’s Board of Directors in 2005. Prior to joining Johnson & Johnson, she served in various management positions at Bristol-Myers Squibb for 15 years. Ms. Poon’s areas of expertise include domestic and international business operations and sales and marketing. Other Directorships include: Johnson & Johnson. Age 54. | ||

| Arthur F. Ryan is Chairman of the Board, Chief Executive Officer and President of Prudential Financial. He joined Prudential Insurance as the Chairman of the Board, Chief Executive Officer and President and as a Director in December 1994. In | |

| December 1999, at the time of the Company’s incorporation, he was named Director of Prudential Financial; in January 2000 he was named to its first slate of officers as President and Chief Executive Officer; in December 2000 he took his current title. Prudential Financial became a public company in December 2001. From 1972 until he joined Prudential Insurance, Mr. Ryan was with Chase Manhattan Bank, serving in various executive positions including President and Chief Operating Officer from 1990 to 1994. Other Directorships include Regeneron Pharmaceuticals, Inc. Age 64. | ||

| James A. Unruh was elected as a Director of Prudential Financial in January 2001 and has been a Director of Prudential Insurance since April 1996. He became a founding member of Alerion Capital Group, LLC (private equity investment | |

| group) in 1998. Mr. Unruh was with Unisys Corporation (information technology services, hardware and software) from 1987 to 1997, serving as its Chairman and Chief Executive Officer from 1990 to 1997. He also held executive positions with financial management responsibility, including serving as Senior Vice President, Finance, Burroughs Corporation, from 1982 to 1987. Mr. Unruh’s areas of expertise include finance, business operations, sales and marketing, technology and investments. Other Directorships include: CSG Systems International, Inc., Qwest Communications International, Inc. and Tenet Healthcare Corporation. Age 65. | ||

Page 5

PRUDENTIAL FINANCIAL, INC.

ITEM 2 — RATIFICATION OF THE APPOINTMENT OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board of Directors has appointed PricewaterhouseCoopers LLP (“PricewaterhouseCoopers”) as the Company’s independent registered public accounting firm (independent auditor) for 2007. We are not required to have the shareholders ratify the selection of PricewaterhouseCoopers as our independent auditor. We nonetheless are doing so because we believe it is a matter of good corporate practice. If the shareholders do not ratify the selection, the Audit Committee will reconsider whether or not to retain PricewaterhouseCoopers, but may retain such independent auditor. Even if the selection is ratified, the Audit Committee, in its discretion, may change the appointment at any time during the year if it determines that such a change would be in the best interests of Prudential Financial and its shareholders. Representatives of PricewaterhouseCoopers are expected to be present at the Annual Meeting with an opportunity to make a statement if they desire to do so and to be available to respond to appropriate questions.

The following is a summary and description of fees for services provided by PricewaterhouseCoopers in 2006 and 2005.

| Worldwide Fees (in millions) | ||||||

Service | 2006 | 2005 | ||||

Audit (A) | $ | 31.8 | $ | 28.1 | ||

Audit-Related (B) | $ | 3.7 | $ | 3.7 | ||

Tax (C) | $ | 1.7 | $ | 1.8 | ||

All Other (D) | — | — | ||||

Total | $ | 37.2 | $ | 33.6 | ||

(A) The aggregate fees for professional services rendered for the audits of the consolidated financial statements of Prudential Financial and, as required, of various domestic and international subsidiaries, the issuance of comfort letters, agreed-upon procedures required by regulation, consents and assistance with review of documents filed with the Securities and Exchange Commission. Audit fees also include fees for the audits of (i) management’s assessment of the effectiveness of internal control over financial reporting and (ii) the effectiveness of internal control over financial reporting.

(B) The aggregate fees for assurance and related services including internal control and financial compliance reports, agreed-upon procedures not required by regulation, employee benefit plan audits (in 2005 only) and accounting consultation on acquisitions.

(C) The aggregate fees for services rendered by PricewaterhouseCoopers’ tax department for tax return preparation, tax advice related to mergers and acquisitions and other international, federal and state projects, and requests for rulings. In 2005 only, this also included services related to employee benefit plans and compliance services for expatriate employees. In 2006, tax compliance and preparation fees total $1.4M and tax advisory fees total $0.3M, and in 2005, tax compliance and preparation fees total $1.4M and tax advisory fees total $0.4M.

(D) The aggregate fees for all other services rendered by PricewaterhouseCoopers, including software license fees, totaled less than $0.1M.

The Audit Committee has advised the Board of Directors that in its opinion the non-audit services rendered by PricewaterhouseCoopers during the most recent fiscal year are compatible with maintaining their independence.

The Audit Committee has established a policy requiring its pre-approval of all audit and permissible non-audit services provided by the independent auditor. The policy identifies the guiding principles that must be considered by the Audit Committee in approving services to ensure that the independent auditor’s independence is not impaired; describes the Audit, Audit-Related, Tax and All Other services that may be provided and the non-audit services that may not be performed; and sets forth the pre-approval requirements for all permitted services. The policy provides for the general pre-approval of specific types of Audit, Audit-Related and Tax services and a limited fee estimate range for such services on an annual basis. The policy requires specific pre-approval of all other permitted services. The independent auditor is required to report periodically to the full Audit Committee regarding the extent of services provided in accordance with this pre-approval and the fees for the services performed to date. The Audit Committee’s policy delegates to its Chairman the authority to address requests for pre-approval of services with fees up to a maximum of $100,000 between Audit Committee meetings if the Chief Auditor deems it reasonably necessary to begin the services before the next scheduled meeting of the Audit

Page 6

2007 PROXY STATEMENT

Committee, and the Chairman must report any pre-approval decisions to the Audit Committee at its next scheduled meeting. The Audit Committee may not delegate to management the Audit Committee’s responsibility to pre-approve permitted services of the independent auditor.

All Audit, Audit-Related, Tax and All Other fees described above were approved by the Audit Committee before services were rendered.

The Board of Directors recommends that shareholders vote “FOR” ratification of the appointment of PricewaterhouseCoopers as the Company’s independent auditor for 2007.

In accordance with its written Charter, which was approved in its current form by the Board of Directors on November 14, 2006, the Audit Committee assists the Board of Directors in its oversight of the accounting, auditing and financial reporting practices of Prudential Financial. The Charter is located on our website atwww.investor.prudential.com.

The Audit Committee consists of four members who, in the business judgment of the Board of Directors, are independent within the meaning of the rules of both the NYSE and the SEC and financially literate as defined by the rules of the NYSE. In addition, the Board of Directors has determined that at least one member of the Audit Committee, Mr. Unruh, satisfies the financial expertise requirements of the NYSE and has the requisite experience to be designated an audit committee financial expert as that term is defined by rules of the SEC. Specifically, Mr. Unruh has accounting and financial management expertise, which he gained through his experience as Senior Vice President, Finance, of a NYSE listed company, as well as experience in financial management positions in other organizations and other similar positions.

Management is responsible for the preparation, presentation and integrity of the financial statements of Prudential Financial and for maintaining appropriate accounting and financial reporting policies and practices and internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. PricewaterhouseCoopers is responsible for auditing the financial statements of Prudential Financial and expressing an opinion as totheir fair presentation in accordance with accounting principles generally accepted in the United States, as well as expressing an opinion on (i) management’s assessment of the effectiveness of internal control over financial reporting and (ii) the effectiveness of internal control over financial reporting.

In performing its oversight function, the Audit Committee reviewed and discussed the audited Consolidated Financial Statements of Prudential Financial as of and for the year ended December 31, 2006 and Management’s Annual Report on Internal Control Over Financial Reporting with management and Prudential Financial’s independent registered public accounting firm (independent auditor). The Audit Committee also discussed with Prudential Financial’s independent auditor the matters required to be discussed by Public Company Accounting Oversight Board Auditing Standard AU Section 380, “Communication with Audit Committees,” and Rule 2-07 of Regulation S-X promulgated by the SEC, as modified or supplemented.

The Audit Committee received from the independent auditor formal written statements as required by Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees,” and the NYSE Corporate Governance rules, as currently in effect. The Audit Committee also considered whether the provision to Prudential Financial of non-audit services by PricewaterhouseCoopers is compatible with maintaining the independence of PricewaterhouseCoopers and has discussed with the independent auditor the auditor’s independence.

The Audit Committee has discussed with, and received regular status reports from, Prudential Financial’s Chief Auditor and the independent auditor regarding the overall scope and plans for their audits of Prudential Financial, including their scope and plans over management’s assessment of the effectiveness of internal control over financial reporting. The Audit Committee meets with the Chief Auditor and the independent auditor, with and without management present, to discuss the results of their respective examinations. In determining whether to reappoint PricewaterhouseCoopers as Prudential Financial’s independent auditor, the Audit Committee took into consideration a number of factors, including the quality of the Audit Committee’s ongoing discussions with PricewaterhouseCoopers and an assessment of the

Page 7

PRUDENTIAL FINANCIAL, INC.

professional qualifications and past performance of the Lead Audit Partner and PricewaterhouseCoopers.

In addition, the Audit Committee reviewed and amended its Charter and received reports as required by its policy for the receipt, retention and treatment of financial reporting concerns received from external and internal sources.

Based on the reports and discussions described in this report and subject to the limitations on the roles and responsibilities of the Audit Committee referred to above and in its Charter, the Audit Committee recommended to the Board of Directors that the audited Consolidated Financial Statements of Prudential Financial and Management’s Annual Report on Internal Control Over Financial Reporting be included in the Annual Report on Form 10-K for the fiscal year ended December 31, 2006 for filing with the SEC.

THE AUDIT COMMITTEE

Frederic K. Becker (Chairman)

Gilbert F. Casellas

James G. Cullen

James A. Unruh

The Board of Directors reviews Prudential Financial’s policies and business strategies and advises and counsels the Chairman and Chief Executive Officer and the other executive officers who manage Prudential Financial’s businesses. The Board currently consists of 12 Directors, including the Chairman and Chief Executive Officer, 11 of whom the Board has determined are “independent” as that term is defined in the listing standards of the NYSE and in Prudential Financial’s Corporate Governance Principles and Practices (“Corporate Governance Principles”). Mr. Ryan is the only Director who is not independent. The full text of the Corporate Governance Principles, as well as the charters of the Corporate Governance and Business Ethics, Compensation and Audit Committees, the Code of Business Conduct and Ethics and the Related Party Transaction Approval Policy can be found atwww.investor.prudential.com. Copies of these documents also may be obtained from the Secretary of Prudential Financial.

Director Independence

The definition of independence adopted by the Board is set forth below:

The Prudential Financial Board believes that a significant majority of the Board should be independent directors. For this purpose, a director shall be considered to be “independent” only if the Board affirmatively determines that the director does not have any direct or indirect material relationship with Prudential Financial that may impair, or appear to impair, the director’s ability to make independent judgments. With respect to each Director, the Board’s assessment and determination of such Director’s independence shall be made by the remaining members of the Board. In each case, the Board shall broadly consider all relevant facts and circumstances and shall apply the following standards:

An independent director is one who within the preceding three years:

| • | has not been an employee, and whose immediate family member has not been an executive officer, of the corporation; |

| • | has not (nor has a member of his or her immediate family) received during any 12 month period more than $100,000 in direct compensation from the corporation, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service); |

| • | has not (nor has a member of his or her immediate family) been employed by or affiliated with the corporation’s independent auditor in a professional capacity; |

| • | has not been employed as an executive officer of another company where any of the corporation’s present executives serve on that company’s compensation committee; |

| • | has not had any other relationship with the corporation or its subsidiaries, either personally or through his employer, which, in the opinion of the board, would adversely affect the director’s ability to exercise his or her independent judgment as a director. |

Page 8

2007 PROXY STATEMENT

The following relationships will not be considered to be relationships that would impair, or appear to impair, a director’s ability to make independent judgments:

| • | The director, or an immediate family member of a director, is an executive officer of a company that does business with Prudential Financial and the other company’s annual sales to, or purchases from, Prudential Financial are less than two percent of the annual revenues of Prudential Financial and less than two percent of the annual revenues of such other company; |

| • | The director is an executive officer of a company that is indebted to Prudential Financial or is an executive officer of a company to which Prudential Financial is indebted and, in either case, the aggregate amount of such debt is less than two percent of the total consolidated assets of Prudential Financial and less than two percent of the total consolidated assets of such other company; |

| • | The director, or an immediate family member of a director, serves as an executive officer of a non-profit entity to which Prudential Financial or the Prudential Foundation makes discretionary contributions (i.e., excluding matching gifts) or other payments and all such discretionary contributions or other payments to such entity are less than two percent of that entity’s total annual charitable receipts and other revenues. |

The Board will review annually all commercial and non-profit relationships between each director and Prudential Financial during the preceding three years and make a determination of such director’s independence, and Prudential Financial will disclose the Board’s determinations in the proxy statement.

Because Prudential Financial is a major financial institution, directors or companies with which they are affiliated will sometimes be borrowers from Prudential Financial or one of its subsidiaries or otherwise have a business relationship (e.g., investment management services, group insurance) with Prudential Financial or its subsidiaries. Directors and companies with which they are affiliated will not be given special treatment in these relationships, and borrowings by institutions affiliated with a director, other than publicly-offered debt instruments, must be specifically approved by the Investment Committee.

To help maintain the independence of the Board, all directors are required to deal at arm’s length with Prudential Financial and its subsidiaries and to disclose circumstances material to the director that might be perceived as a conflict of interest.

In making its affirmative determination for 2006 that all of the non-employee Directors were independent, the Board considered ordinary course investment transactions or relationships between the Company and Johnson & Johnson that were immaterial under the standards described above.

Policies and Procedures for the Review and Approval of Transactions with Related Parties

The Board of Directors and Prudential Financial’s management have implemented a number of policies and procedures for the avoidance of conflicts of interest and the review and approval of transactions with Directors, executive officers and their immediate family members.

The Company’s Code of Business Conduct and Ethics provides a general framework within which Prudential Financial associates are expected to conduct themselves. This policy applies to all full or part-time employees, employee agents, interns, officers and Directors of Prudential Financial, its subsidiaries and affiliates, and also applies to certain conduct by their family members. Under the Company’s Code of Business Conduct and Ethics, all Prudential Financial associates are prohibited from engaging in any activity that “would create, or appear to create, a potential or actual conflict of interest with respect to their ability to make decisions and/or act regarding Prudential’s business.” The ethics policy also provides procedures for disclosure and/or approval of matters governed by the policy, which varies according to the person’s position and level. Prudential Financial’s Code of Business Conduct and Ethics broadly covers activities such as:

| • | Involvement in Outside Business; |

| • | Financial Transactions; |

| • | Transactions and Relationships with Suppliers; |

| • | Family or Household Member Business with Prudential Financial; and |

| • | Gifts and Entertainment. |

Page 9

PRUDENTIAL FINANCIAL, INC.

In addition to its ethics policy, which applies to all Prudential Financial associates, the Company has also adopted a Related Party Transaction Approval Policy. The Related Party Transaction Approval Policy applies to:

| • | any transaction or series of transactions in which the Company or a subsidiary is a participant; |

| • | the amount involved exceeds $120,000; and |

| • | a related party (a director or executive officer of the Company, any nominee for director, any shareholder owning an excess of 5% of the total equity of the Company and any immediate family member of any such person) has a direct or indirect material interest. |

The policy is administered by the Corporate Governance and Business Ethics Committee. The Committee will consider all of the relevant facts and circumstances in determining whether or not to approve such transaction, and shall approve only those transactions that are, in the Committee’s judgment, appropriate or desirable under the circumstances.

Both the Company’s Code of Business Conduct and Ethics and the Related Party Transaction Approval Policy can be found on our website atwww.investor.prudential.com.

Presiding Director

The Board has designated the Chair of the Executive Committee, currently Jon Hanson, to chair meetings of the independent Directors, unless the subject matter of the discussion makes it more appropriate for the chairperson of a specific Board committee to chair the session. The independent Directors hold executive sessions at least four times per year, but typically meet in executive session at each Board meeting.

Communication with Directors

Interested parties, including shareholders, may communicate with any of the independent Directors, including Committee Chairs, by using the following address:

Prudential Financial, Inc.

Board of Directors

c/o Vice President, Secretary and

Corporate Governance Officer

751 Broad Street

21st Floor

Newark, NJ 07102

The Secretary of Prudential Financial serves as the agent for the independent Directors with respect to communication from shareholders. Communication from shareholders that pertains to non-financial matters will be forwarded to the Directors as soon as practicable. Communication received from interested parties regarding accounting or auditing matters will be forwarded to the appropriate Board members in accordance with the time frames established by the Audit Committee for the receipt of communications dealing with these matters. In addition, communication that involves customer service matters will be forwarded to the Directors in accordance with internal procedures for responding to such matters.

Criteria for Director Selection

The Prudential Financial Board and the Corporate Governance and Business Ethics Committee believe that Prudential Financial Directors should be individuals with substantial accomplishments, who have been associated with institutions noted for excellence and who have broad experience and the ability to exercise sound business judgment. Each Director is expected to serve the best interests of all shareholders. In selecting Directors, the Board generally seeks a combination of active or former CEOs or Presidents of major complex businesses (from different industry sectors and having varied experience in areas such as manufacturing, finance, marketing and technology), leading academics and individuals with substantial records of government service or other leadership roles in the not-for-profit sector, with a sensitivity to diversity. In light of the increasing complexity of the duties of Audit Committee members, recruiting Directors with financial acumen is also a focus. Information regarding the areas of expertise of our non-employee Directors is included on pages 3-5.

The Board believes that a significant majority of its members should be independent Directors. The Board’s definition of independence is set forth on pages 8-9.

Process for Selecting Directors

The Board believes that Directors should be recommended for Board approval by the Corporate Governance and Business Ethics Committee, which consists entirely of independent Directors as defined by the NYSE. While the Board expects the Corporate Governance and Business Ethics Committee to consider

Page 10

2007 PROXY STATEMENT

the views of the Chairman and CEO in making appointments, it is the Corporate Governance and Business Ethics Committee’s responsibility to make Director recommendations to the Board for submission to the shareholders each year in connection with Prudential Financial’s annual meeting.

The Corporate Governance and Business Ethics Committee will consider nominations submitted by shareholders in accordance with the procedures set forth in our By-laws, as discussed in “Shareholder Proposals” on page 41. Such nominations will be evaluated in accordance with the criteria for director selection described above. Nominations should be sent to the attention of the Secretary of Prudential Financial, Inc. at 751 Broad Street, Newark, NJ 07102.

The Corporate Governance and Business Ethics Committee regularly reviews the composition and size of the Board and the skill sets and experience of its members. The Company’s By-laws provide that the size of the Board may range from 10 to 24 members. The Board’s current view is that the optimal size is between 10 and 15 members. In anticipation of retirements over the next several years, the Committee is seeking one ormore candidates who meet the criteria described above. The Corporate Governance and Business Ethics Committee is being assisted with its recruitment efforts by independent search firms under retainer to recommend candidates that satisfy the Board’s criteria. The search firms also provide research and other pertinent information regarding candidates, as requested. In 2006, the Corporate Governance and Business Ethics Committee recommended and the Board approved the election of Christine A. Poon, Vice Chairman, Johnson & Johnson to the Board. Ms. Poon’s nomination was initially recommended by one of the Board’s independent Directors.

Director Attendance

During 2006, the Board of Directors held 10 meetings. Each of the incumbent Directors of the Board attended at least 96% of the combined total meetings of the Board and the committees on which he or she served in 2006. The average attendance of all Directors in 2006 was 99%. Directors are expected to attend the Annual Meeting of Shareholders. In 2006, all of the non-retiring Directors attended the Annual Meeting.

Page 11

PRUDENTIAL FINANCIAL, INC.

COMMITTEES OF THE BOARD OF DIRECTORS

The Board of Directors has established various committees to assist in discharging its duties, including standing Audit, Compensation, Corporate Governance and Business Ethics, Finance and Investment Committees. The primary responsibilities of each of the standing committees of Prudential Financial’s Board of Directors are set forth below, together with their current membership. In accordance with applicable regulations, the charters of the Audit, Compensation and Corporate Governance and Business Ethics Committee can be found on our website atwww.investor.prudential.com.

Audit Committee

Members: Directors Becker (Chair), Casellas, Cullen and Unruh.

Number of Meetings in 2006: 14

The primary purpose of the Audit Committee, which consists solely of independent Directors as defined by the rules of the NYSE and the Securities and Exchange Commission (“SEC”), is to assist the Board of Directors in its oversight of: the Company’s accounting and financial reporting and disclosure processes; the adequacy of the systems of disclosure and internal control established by management; and the audit of the Company’s financial statements. Among other things the Audit Committee: appoints the independent auditor and evaluates their independence and performance; reviews the audit plans for and results of the independent audit and internal audits; and reviews reports related to processes established by management to provide compliance with legal and regulatory requirements.

Compensation Committee

Members: Directors Cullen (Chair), Bethune and Horner.

Number of Meetings in 2006: 7

The Compensation Committee of the Board of Directors is composed solely of Directors who are considered to be independent under the rules of the NYSE. The Compensation Committee is directly responsible to the Board of Directors, and through it to the Company’s shareholders, for overseeing the development and administration of Prudential Financial’s compensation and benefits policies and programs.

Corporate Governance and Business Ethics Committee

Members: Directors Gray (Chair), Bethune and Horner.

Number of Meetings in 2006: 8

The primary responsibilities of the Corporate Governance and Business Ethics Committee, which consists solely of independent Directors as defined by the rules of the NYSE, are to oversee, on behalf of the Board, the Company’s corporate governance issues and practices, including the recommendations of individuals for seats on the Board, and to oversee the Company’s ethics and conflict of interest policies.

Executive Committee

Members: Directors Hanson (Chair), Becker, Cullen, Gray and Ryan.

Number of Meetings in 2006: 1

The Executive Committee is authorized to exercise the corporate powers of the Company between meetings of the Board, except for those powers reserved to the Board of Directors by the By-laws or otherwise.

Finance Committee

Members: Directors Hanson (Chair), Caperton and Krapek.

Number of Meetings in 2006: 7

The primary responsibility of the Finance Committee is to oversee and take actions with respect to the capital structure of Prudential Financial, including borrowing levels, subsidiary structure and major capital expenditures.

Investment Committee

Members: Directors Hanson (Chair), Caperton and Krapek.

Number of Meetings in 2006: 9

The primary responsibilities of the Investment Committee are: overseeing and taking actions with respect to the acquisition, management and disposition of invested assets; reviewing the investment performance of the pension plan and funded employee benefit plans; and reviewing investment risks and exposures, as well as the investment performance of products and accounts managed on behalf of third parties.

Page 12

2007 PROXY STATEMENT

Director Compensation

| |||||||||

Name | Fees Paid in Cash($) | Stock Awards($)1 | Total($) | ||||||

Frederic K. Becker | $ | 100,000 | $ | 90,000 | $ | 190,000 | |||

Gordon M. Bethune | $ | 85,000 | $ | 85,000 | $ | 170,000 | |||

Gaston Caperton | $ | 87,500 | $ | 87,500 | $ | 175,000 | |||

Gilbert F. Casellas | $ | 91,250 | $ | 87,500 | $ | 178,750 | |||

James G. Cullen | $ | 100,000 | $ | 90,000 | $ | 190,000 | |||

William H. Gray III | $ | 92,500 | $ | 82,500 | $ | 175,000 | |||

Jon F. Hanson | $ | 118,750 | $ | 85,000 | $ | 203,750 | |||

Constance J. Horner | $ | 88,750 | $ | 85,000 | $ | 173,750 | |||

Karl J. Krapek | $ | 87,500 | $ | 87,500 | $ | 175,000 | |||

Christine A. Poon2 | $ | 26,667 | $ | 126,667 | $ | 153,334 | |||

James A. Unruh | $ | 87,500 | $ | 87,500 | $ | 175,000 | |||

(1) Represents amounts that are automatically deferred in units of Prudential Financial Common Stock and recognized as expense for financial statement reporting purposes on the date of grant. As further explained below, Directors may also choose to defer the cash portion of their fees in stock units. As of December 31, 2006, the aggregate balance in each of the non-employee Directors accounts in the Deferred Compensation Plan denominated in units of Prudential Financial Common Stock (which includes all deferrals from prior years) and the year-end values under FAS123R were as follows: Mr. Becker: 24,263 and $2,083,479; Mr. Bethune: 4,126 and $354,331; Mr. Caperton: 8,783 and $754,209; Mr. Casellas: 13,719 and $1,177,942; Mr. Cullen: 20,653 and $1,773,398; Mr. Gray: 13,609 and $1,168,500; Mr. Hanson: 65,093 and $5,588,954; Ms. Horner: 13,669 and $1,173,638; Mr. Krapek: 10,615 and $911,502; Ms. Poon: 1,703 and $146,273; and Mr. Unruh: 13,738 and $1,179,612.

(2) Ms. Poon joined the Board on September 1, 2006 and was granted 1,367 deferred units of Prudential Financial Common Stock in accordance with the Non-Employee Director Deferred Compensation Plan.

The Corporate Governance and Business Ethics Committee reviews Director compensation approximately every two years and recommends any changes to the Board. There were no changes made to Director compensation in 2006. In 2005, the Committee conducted a review of Director compensation and recommended several modifications, including the institution of committee retainer fees. The Committee sought the advice of Frederic W. Cook, & Co., an independent consultant, during the course of its review. The Director Compensation program reflects the view of the Board that a significant amount of annual compensation should be in the form of Prudential Financial stock units. In addition, the Board has adopted stock ownership guidelines for Directors that encourage Directors to have an ownership interest.

The primary components of compensation for the non-employee Directors as represented in the table above are as follows:

| • | Each Director receives an annual retainer of $80,000 in cash, which may be deferred, at the Director’s option, in the Deferred Compensation Plan summarized below. |

• | Each Director receives $80,000 per year in the form of stock units of Prudential Financial that are required to be deferred until the earlier of termination of service on the Board or age 70 1/2. |

| • | Each member of the Audit Committee receives an annual retainer of $15,000 for service on that Committee, half of which is required to be deferred in stock units. |

Page 13

PRUDENTIAL FINANCIAL, INC.

| • | Members of all other Board Committees (including any non-standing committee of Directors that may be established from time to time, but excluding the Executive Committee) receive an annual retainer of $5,000 for committee service, half of which is required to be deferred in stock units. |

| • | The chairperson of each committee receives an additional annual retainer fee of $10,000. |

| • | Members of Prudential Financial’s Community Resources Committee, a committee composed of members of management and the Board of Directors, receive a fee of $1,250 per meeting attended. This Committee typically meets on a day separate from Board and Board Committee meetings. The members of this Committee currently include Messrs. Casellas and Hanson and Ms. Horner. The Community Resources Committee met three times in 2006. |

• | Each new Director receives a one-time grant of $100,000 in the form of Prudential Financial stock units that is required to be deferred until the earlier of termination of service on the Board or age 70 1/2. |

The Deferred Compensation Plan for Non-Employee Directors was ratified by shareholders in 2003 and is designed to align Director and shareholder interests. As noted above, $80,000 per year is automatically deferred in a notional account that replicates an investment in the Prudential Financial Common Stock Fund under the Prudential Employee Savings Plan (“PESP”). In addition, a Director may elect to invest his or her retainer and chairperson fees in notional accounts that replicate investments in either the Prudential Financial Common Stock Fund or the Fixed Rate Fund, which accrues interest in the same manner as funds invested in the Fixed Rate Fund offered under the PESP. Each Director receives dividend equivalents on the share units contained in his or her deferral account, which are equal in value to dividends paid on the Company’s Common Stock. The dividend equivalents credited to the account are then reinvested in the form of additional share units.

PROCESSES FOR DETERMINING EXECUTIVE COMPENSATION

The Compensation Committee is responsible to the Board of Directors for overseeing the development and administration of the Company’s compensation andbenefits policies and programs. The Compensation Committee consists of three directors who, in the business judgment of the Board of Directors, are independent under the rules of the NYSE.

The Committee is supported in its work by the head of the Human Resources Department and her staff. The Compensation Committee has also engaged Frederic W. Cook, & Co. (“Consultant”) for advice on matters of senior executive compensation. The current scope of the Consultant’s services to the Committee include: providing an annual competitive evaluation of total compensation for the Chief Executive Officer and Vice Chairs; providing recommendations on Chief Executive Officer compensation; reviewing with the Chief Executive Officer his compensation recommendations with respect to the Vice Chairs; reviewing Committee meeting agendas and supporting materials; and providing such other services as directed by the Committee. The Consultant does not provide any services to Prudential Financial except for work related to issues that are subject to review by the Compensation Committee. The Compensation Committee retains sole authority to hire the Consultant, approve its compensation, determine the nature and scope of its responsibilities, evaluate its performance and terminate its services.

The Consultant presents its recommendations regarding compensation for the Chief Executive Officer to the Compensation Committee for its consideration. Following considerable review and discussion, the Compensation Committee presents its recommendations regarding compensation for the Chief Executive Officer to the Board for approval. As part of the process, the presiding outside director conducts an evaluation of the Chief Executive Officer, the results of which are discussed with the Chair of the Compensation Committee in advance of the Compensation Committee’s deliberations regarding compensation for the Chief Executive Officer.

The Chief Executive Officer, with input from the Consultant, makes compensation recommendations annually for the Vice Chairmen to the Compensation Committee. In addition, he submits his recommendations for compensation for other executives at the senior vice president level to the Committee. Following review and discussion, the Compensation Committee submits its recommendations for compensation for these executives to the Board for approval.

Page 14

2007 PROXY STATEMENT

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee is or ever has been one of our officers or employees. In addition, none of our executive officers are members of boards or compensation committees of any entity that has one of its executive officers serving as a member of our Board of Directors or Compensation Committee.

Process for Approving Equity Grants

Prudential Financial became a public company in December 2001. The timing of our first grant of stock options to executives was subject to approval by insurance regulators and occurred in December of 2002. Since that time, it has been our practice for the Compensation Committee to approve equity grants (including stock options, performance shares and restricted stock) on an annual basis at the regularly scheduled February Committee meeting.

The Compensation Committee has delegated authority to management to approve equity grants in connection with new hires and promotions of individuals below the level of senior vice president, which occur during other times of the year. These grants are effective on the 15th of the month following the hiring or promotion. The Compensation Committee approves any grants to newly hired or promoted senior executives. The grant date for these equity awards is the applicable meeting date of the Compensation Committee at which the grants are approved.

Under the terms of our Omnibus Incentive Plan (the “Omnibus Plan”), which was approved by shareholders in 2003, stock options are required to be priced at “fair market value,” which is the closing price of the stock on the date of grant. While we do not have a policy that addresses the specific issue of whether equity grants may be approved prior to the release of material information, our practice of approving equity grants at our regularly scheduled February meeting of the Compensation Committee is designed so that grants closely follow our public disclosure by press release of our year-end results and to minimize any discretion in the timing of grants.

The Compensation Committee has reviewed and discussed with management the contents of the Compensation Discussion and Analysis set forth below. Based on its review and discussion, the Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this Proxy Statement and incorporated by reference into the Company’s Annual Report on Form 10-K for the year ended December 31, 2006.

THE COMPENSATION COMMITTEE

James G. Cullen (Chairman)

Gordon M. Bethune

Constance J. Horner

Page 15

PRUDENTIAL FINANCIAL, INC.

COMPENSATION DISCUSSION AND ANALYSIS

The following compensation discussion and analysis contains information regarding future performance targets and goals. These targets and goals are disclosed in the limited context of Prudential Financial’s compensation programs and should not be understood to be statements of management’s performance expectations or guidance or anticipated results. Investors should not apply these performance targets and goals to other contexts.

Objectives, Philosophy and Strategy of Compensation Program

The philosophy behind our compensation program is to provide an attractive, flexible and market-based total compensation program tied to performance and aligned with shareholder interests. Our goal is to recruit and retain the caliber of executives and key employees necessary to deliver sustained high performance to our shareholders, customers and communities where we have a strong presence. Our compensation programs are an important component of these overall human resources policies. Equally important, we view compensation practices as a means for communicating our goals and standards of conduct and performance and for motivating and rewarding employees in relation to their achievements.

Overall, the same principles that govern the compensation of all our salaried associates apply to the compensation of Prudential Financial’s executives. Within this framework, we believe:

| • | All associates should have base salaries and employee benefits that are market competitive and that permit us to hire and retain high-caliber associates at all levels; |

| • | A significant portion of annual compensation should vary with annual business performance and each individual’s contribution to that performance; |

| • | Executives should be rewarded for achieving long-term results, and such rewards should be aligned with shareholder interests; |

| • | A significant portion of executives’ compensation should be tied to measures of performance of the Financial Services Businesses of Prudential Financial; |

| • | The interests of executives should be linked with those of shareholders through the risks and rewards of the ownership of Prudential Financial Common Stock; and |

| • | Special benefits and perquisites for management should be minimized and based on a business purpose. |

Competitive Benchmarking

Prudential Financial competes in several different businesses, most of which are involved in helping individuals and institutions grow and protect their assets. These businesses draw their key people from different segments of the marketplace. Therefore, our compensation programs are designed with the flexibility to be competitive and motivational within the different marketplaces in which we compete for talent, while being subject to centralized design, approval and control.

To assess the competitiveness of executive compensation, we use a peer group that is comprised of companies in the Standard & Poor’s 500 Index in the insurance, asset management and other diversified financial services industries. We believe this group represents the industries with similar lines of business with which we currently compete for executive talent. The current compensation peer group consists of the following companies: Aflac Incorporated, American International Group, Inc., American Express Company, Ameriprise Financial, Inc., Bank of America Corporation, Bank of New York Company, Inc., Capital One Financial Corporation, Citigroup Inc., Franklin Resources, Inc., Genworth Financial, Inc., The Hartford Financial Services Group, Inc., JP Morgan Chase & Co, Legg Mason, Inc., Loews Corporation, Manulife Financial Corporation, Mellon Financial Corporation, MetLife, Inc., Northern Trust Corporation, State Street Corporation, Sun Life Financial, Inc., U.S. Bancorp, UnumProvident Corporation, Wachovia Corporation and Wells Fargo & Company. For reference purposes, we compare each executive’s compensation in relation to the median and the 75th percentile of the comparator group, while taking into account various factors such as Prudential’s size and performance within the peer group, the unique characteristics of the individual’s position and retention considerations.

Linking Compensation to Performance

Our strategy to correlate compensation and performance is to construct a balanced mix of both quantitative and qualitative performance criteria and directly link a portion of compensation to shareholder interests. Reflecting this strategy, several of the elements of executive compensation are based on growth in adjusted

Page 16

2007 PROXY STATEMENT

operating income, or “AOI,” growth in earnings per share based on after-tax AOI, or “EPS,” and/or return on equity based on after-tax AOI, or “ROE,” for our Financial Services Businesses.1 For example, at the time Prudential Financial became a publicly traded company in December 2001, we announced to shareholders our goal of achieving a 12% ROE by the end of 2005. The Compensation Committee used this goal to form the payment scale for performance shares that were granted to executive officers. Each year, the Compensation Committee adjusts the payment scale to align to goals communicated to investors for ROE and, since 2005, growth in EPS.

Additional discussion regarding the criteria used in determining executive compensation is included below in the sections describing the Elements of Executive Compensation.

(1) “Adjusted operating income,” or AOI, is a non-GAAP measure of performance of our Financial Services Businesses. For a description of how we calculate pre-tax AOI and for a reconciliation of pre-tax AOI to the nearest comparable GAAP measure, see the notes to the consolidated financial statements included in our filings with the Securities and Exchange Commission on Form 10-K and Form 10-Q, which can be found on our website atwww.investor.prudential.com. After-tax AOI is adjusted operating income before taxes, less the income tax effect applicable to pre-tax AOI, as publicly disclosed in Prudential Financial’s Quarterly Financial Supplements, also available on our website. Return on equity, or ROE, is “Operating return on average equity (based on after-tax adjusted operating income),” as defined and publicly disclosed in Prudential Financial’s Quarterly Financial Supplements. Earnings per share, or EPS, is “Earnings Per Share of Common Stock (diluted): Financial Services Businesses after-tax adjusted operating income,” as publicly disclosed in Prudential Financial’s Quarterly Financial Supplements.

Elements of Executive Compensation

Prudential Financial’s compensation program consists of the four principal elements described below.

1. Base Salaries

Base salaries for executives are determined by considering the relative importance of the position, the competitive marketplace and the individual’s performance and contribution. Salaries are reviewed annually. However, reflecting practices in the financial community, most of our focus is on annual and long-term incentives. Thus, it is common for an executive to have his or her salary increased only infrequently and then mostly related to job changes. For example, Mr. Ryan’s salary has not been increased since he washired in 1994, reflecting the philosophy that increases in his total compensation should be performance-based.

2. Annual Incentives

Annual incentives for executives are paid through an incentive pool, whose initial size is the aggregate of the funding amounts for each participant established in the previous year. The initial pool is then adjusted based on the average of performance relative to the prior year and relative to the Board-approved financial plan for the current year.

We currently use the change in the following four financial measures for determining the adjustment to the incentive pool for executive officers:

| • | pre-tax AOI—30% weighting; |

| • | ROE—30% weighting; |

| • | operating revenues (AOI basis)—15% weighting; and |

| • | EPS—25% weighting. |

After the calculation of the incentive pool using these measures, the pool may be adjusted up or down to reflect additional quantitative and qualitative factors, such as total shareholder return, employee satisfaction measures and strategic positioning relative to competitors.

While the criteria used for funding of the annual incentive pool may provide guidance for the Compensation Committee, these criteria are not determinative of the amount of an individual’s award in a given year. The Compensation Committee determines the amount of an individual executive’s annual incentive award based on his or her individual contributions during the year with reference to market data for the individual’s position in the peer group. Factors used in determining awards for the named executive officers for 2006 (the “Named Executive Officers” or “NEOs”) are discussed below in the section on 2006 Results and Compensation of Named Executive Officers.

The Omnibus Plan contains an overall limit on compensation paid to executive officers to comply with the conditions for determining performance-based compensation under Section 162(m) of the Internal Revenue Code (the “Code”). Section 162(m) generally disallows a tax deduction to public companies for compensation over $1,000,000 paid to a company’s named executive officers as reported in the proxy statement. Under the terms of the Omnibus Plan, the total amount paid to a Named Executive Officer in a given year under the annual

Page 17

PRUDENTIAL FINANCIAL, INC.

incentive plan and the performance share program cannot exceed 0.6% of the Company’s pre-tax AOI for that year. The Compensation Committee monitors compliance with this limit on an annual basis.

3. Long-Term Incentives

Components. Our current practice is to provide a balanced mix of long-term equity incentive awards in the form of stock options and performance shares to executives at the level of senior vice president and above. We provide competitive equity grants that take into account individual performance, potential and retention considerations. The actual value realized by executives is based on stock price performance as well as attainment of specific performance goals that contribute to shareholder value. For awards that were granted in 2006, 50% of the awards for the Named Executive Officers were in the form of stock options with 50% in the form of performance shares. For awards that were granted in 2007, 40% of the awards were in stock options and 60% in performance shares.

Performance Criteria. Performance shares are units denominated in Prudential Financial Common Stock. Each year, the Compensation Committee awards a target number of units to the executive. For performance shares awards granted in 2006, the actual number of shares earned at the end of the applicable three-year performance period will vary from 50% to 150% of the target shares awarded based on ROE and EPS achievement over the performance period. The award range for the performance shares awards granted in February 2007 was changed to 0% to 150% of the target number of shares. Half of the number of shares earned is based on average ROE performance and the other half is based on EPS growth for the applicable three-year performance period. The Compensation Committee determines the actual number of shares to be received by the executive at the February meeting following the completion of the performance period. The Compensation Committee may adjust the final award for significant one-time charges or benefits that in the Compensation Committee’s opinion do not accurately reflect the operating performance of the Company’s businesses.

Employee Stock Ownership. Summarized below are various policies, plans and practices to facilitate stock ownership by employees.

| • | Stock Ownership Guidelines. We have adopted stock ownership guidelines for our senior executivesto encourage them to build their ownership position in our stock over time by direct market purchases, making investments available through the PESP and the Deferred Compensation Plan and retaining shares they earn through our equity incentive and option plans. These guidelines are stated as stock value as a percent of base salary and are 200% for senior vice presidents, 300% for vice chairmen and executive vice presidents and 500% for our CEO. It is expected that these guidelines be achieved within five years of the date they become applicable to the executive. As of February 14, 2007, all of the Named Executive Officers have met their share ownership guidelines. |

| • | Stock Retention Guidelines. In 2003, we adopted stock retention requirements for executive officers. Each executive officer is required to retain 50% of the net shares (after payment of the applicable exercise price, if any, applicable fees and applicable taxes) acquired upon the exercise of stock options or the vesting of any performance shares. The executive is required to hold such shares until the later of (i) one year following the date of acquisition of such shares or (ii) the date that the executive satisfies the ownership guidelines. |

| • | Employee Stock Purchase Plan. In 2005, shareholders approved an Employee Stock Purchase Plan that provides employees below the level of senior vice president the opportunity to purchase the Company’s Common Stock on terms that comply with Section 423(b) of the Code and local laws. |

| • | Associates Grants.In 2001, the Compensation Committee approved a broad-based grant of stock options to employees below the level of vice president. In 2006, the Committee approved a grant of restricted stock units to employees below the level of vice president in recognition of the Company’s achievement of its goal to achieve 12% ROE by the end of 2005. In addition, vice presidents below the level of senior vice president receive annual grants of stock options and restricted stock. |

Policy on Hedging. All employees are subject to the Company’s Personal Securities Trading Policy. Under this policy, employees are prohibited from selling short including “short sales against the box” and from hedging their equity-based awards.

Page 18

2007 PROXY STATEMENT

4. Benefits

The benefits described below are divided into the following categories:

| • | Retirement; |

| • | Severance and Change of Control; and |

| • | Perquisites. |

Retirement Benefits

Prudential Insurance, an indirectly wholly owned subsidiary of Prudential Financial, sponsors four defined benefit pension and profit sharing retirement plans which are available to U.S. employees, including the Named Executive Officers:

| • | The Prudential Merged Retirement Plan (“Merged Retirement Plan”); |

| • | Prudential Supplemental Retirement Plan (“Supplemental Retirement Plan”); |

| • | The Prudential Employee Savings Plan (“PESP”); and |

| • | Prudential Supplemental Employee Savings Plan (“SESP”). |

In addition, certain executives, including the Named Executive Officers, are eligible for additional benefits under the Prudential Insurance Supplemental Executive Retirement Plan or the PFI Supplemental Executive Retirement Plan (collectively, “SERPs”) and the Prudential Insurance Company of America Deferred Compensation Plan (“Deferred Compensation Plan.”).