Prudential Financial, Inc. 5.62 (PRS) 8-KRegulation FD Disclosure

Filed: 10 Sep 08, 12:00am

Prudential Financial, Inc. Prudential Financial, Inc. Tokyo Investor Day September 11, 2008 Tokyo Investor Day September 11, 2008 Exhibit 99.0 |

1 2008 Tokyo Investor Day Forward-Looking Statements Certain of the statements included in this presentation constitute forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. It is possible that actual results may differ materially from any expectations or predictions expressed in this presentation. Words such as “expects,” “believes,” “anticipates,” “includes,” “plans,” “assumes,” “estimates,” “projects,” “intends,” “should,” “will,” “shall,” or variations of such words are generally part of forward-looking statements. Forward-looking statements are made based on management’s current expectations and beliefs concerning future developments and their potential effects upon Prudential Financial, Inc. and its subsidiaries. There can be no assurance that future developments affecting Prudential Financial, Inc. and its subsidiaries will be those anticipated by management. These forward-looking statements are not a guarantee of future performance and involve risks and uncertainties, and there are certain important factors that could cause actual results to differ, possibly materially, from expectations or estimates reflected in such forward-looking statements, including, among others: (1) general economic, market and political conditions, including the performance and fluctuations of fixed income, equity, real estate, and other financial markets; (2) interest rate fluctuations; (3) reestimates of our reserves for future policy benefits and claims; (4) differences between actual experience regarding mortality, morbidity, persistency, surrender experience, interest rates or market returns and the assumptions we use in pricing our products, establishing liabilities and reserves or for other purposes; (5) changes in our assumptions related to deferred policy acquisition costs, valuation of business acquired or goodwill; (6) changes in our claims-paying or credit ratings; (7) investment losses and defaults; (8) competition in our product lines and for personnel; (9) changes in tax law; (10) economic, political, currency and other risks relating to our international operations; (11) fluctuations in foreign currency exchange rates and foreign securities markets; (12) regulatory or legislative changes; (13) adverse determinations in litigation or regulatory matters and our exposure to contingent liabilities, including in connection with our divestiture or winding down of businesses; (14) domestic or international military actions, natural or man-made disasters including terrorist activities or pandemic disease, or other events resulting in catastrophic loss of life; (15) ineffectiveness of risk management policies and procedures in identifying, monitoring and managing risks; (16) effects of acquisitions, divestitures and restructurings, including possible difficulties in integrating and realizing the projected results of acquisitions; (17) changes in statutory or U.S. GAAP accounting principles, practices or policies; (18) changes in assumptions for retirement expense; (19) Prudential Financial, Inc.’s primary reliance, as a holding company, on dividends or distributions from its subsidiaries to meet debt payment obligations and continue share repurchases, and the applicable regulatory restrictions on the ability of the subsidiaries to pay such dividends or distributions; and (20) risks due to the lack of legal separation between our Financial Services Businesses and our Closed Block Business. Prudential Financial, Inc. does not intend, and is under no obligation, to update any particular forward-looking statement included in this presentation. _______________________________________________________________________________ Prudential Financial, Inc. of the United States is not affiliated with Prudential PLC which is headquartered in the United Kingdom. |

2 2008 Tokyo Investor Day Non–GAAP Measure This presentation includes references to “adjusted operating income” and “return on equity” (“ROE”). ROE is determined by dividing adjusted operating income after-tax, annualized for interim periods, by average attributed equity. Adjusted operating income is a non-GAAP measure of performance of our Financial Services Businesses. Adjusted operating income excludes “Realized investment gains (losses), net,” as adjusted, and related charges and adjustments. A significant element of realized investment gains and losses are impairments and credit-related and interest rate-related gains and losses. Impairments and losses from sales of credit-impaired securities, the timing of which depends largely on market credit cycles, can vary considerably across periods. The timing of other sales that would result in gains or losses, such as interest rate- related gains or losses, is largely subject to our discretion and influenced by market opportunities as well as our tax profile. Realized investment gains (losses) representing profit or loss of certain of our businesses which primarily originate investments for sale or syndication to unrelated investors, and those associated with terminating hedges of foreign currency earnings and current period yield adjustments are included in adjusted operating income. Realized investment gains and losses from products that are free standing derivatives or contain embedded derivatives, and from associated derivative portfolios that are part of an economic hedging program related to the risk of those products, are included in adjusted operating income. Adjusted operating income excludes gains and losses from changes in value of certain assets and liabilities related to foreign currency exchange movements that have been economically hedged. Adjusted operating income also excludes investment gains and losses on trading account assets supporting insurance liabilities and changes in experience-rated contractholder liabilities due to asset value changes, because these recorded changes in asset and liability values will ultimately accrue to contractholders. Trends in the underlying profitability of our businesses can be more clearly identified without the fluctuating effects of these transactions. In addition, adjusted operating income excludes the results of divested businesses, which are not relevant to our ongoing operations. Discontinued operations, which is presented as a separate component of net income under GAAP, is also excluded from adjusted operating income. We believe that the presentation of adjusted operating income as we measure it for management purposes enhances understanding of the results of operations of the Financial Services Businesses by highlighting the results from ongoing operations and the underlying profitability of our businesses. However, adjusted operating income is not a substitute for income determined in accordance with GAAP, and the excluded items are important to an understanding of our overall results of operations. The schedule on the following page provides a reconciliation of adjusted operating income to income from continuing operations in accordance with GAAP. For additional information about adjusted operating income and the comparable GAAP measure please refer to our Annual Report on Form 10-K for the year ended December 31, 2007, our Current Report on Form 8-K dated May 16, 2008 to retrospectively adjust portions of the Company’s Annual Report on Form 10-K for the year ended December 31, 2007, and our Quarterly Report on Form 10-Q for the quarter ended June 30, 2008 located on the Investor Relations Web site at www.investor.prudential.com. Additional historical information relating to the Company’s financial performance, including its second quarter 2008 Quarterly Financial Supplement, is also located on the Investor Relations website. The information referred to above and on the prior page, as well as the risks of our businesses described in our Annual Report on Form 10-K for the year ended December 31, 2007, and our Quarterly Report on Form 10-Q for the quarter ended June 30, 2008, should be considered by readers when reviewing forward-looking statements contained in this presentation. |

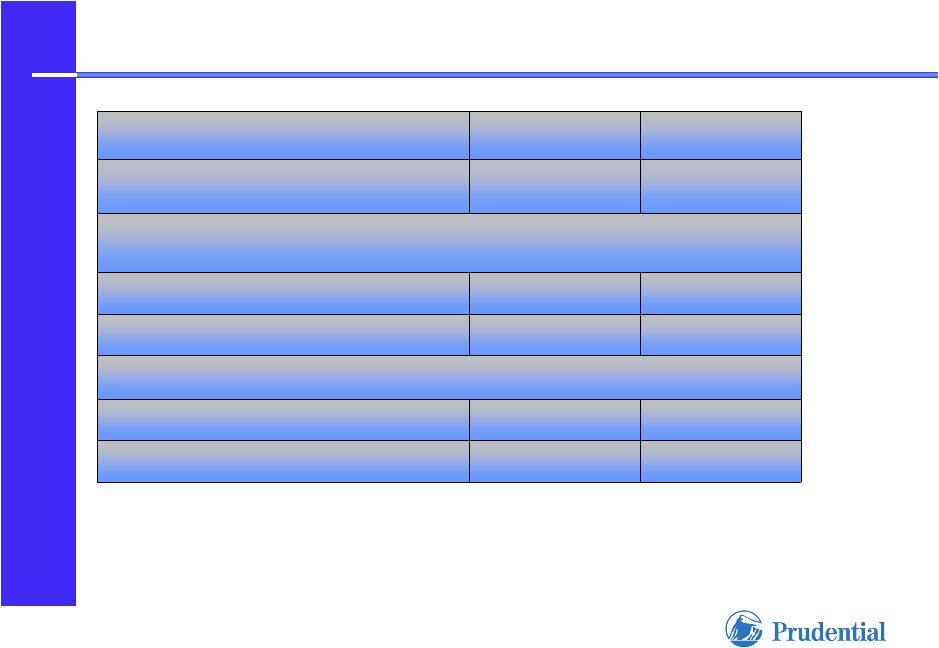

3 2008 Tokyo Investor Day International Insurance and Investments Division Reconciliation between adjusted operating income and the comparable GAAP measure International Insurance and Investments Division Reconciliation between adjusted operating income and the comparable GAAP measure (in millions) 2002 2003 2004 2005 2006 2007 2007 2008 Revenues (1): Life Planner Operations 2,354 $ 2,886 $ 3,404 $ 4,495 $ 4,884 $ 5,414 $ 2,667 $ 3,066 $ Gibraltar Life 2,715 2,749 3,004 3,187 2,851 2,844 1,441 1,588 International Investments 245 241 446 487 590 769 346 330 Total revenues 5,314 5,876 6,854 8,169 8,325 9,027 4,454 4,984 Benefits and Expenses (1): Life Planner Operations 1,975 2,437 2,889 3,674 3,946 4,394 2,145 2,495 Gibraltar Life 2,337 2,379 2,602 2,687 2,361 2,266 1,141 1,293 International Investments 245 257 369 381 447 510 241 278 Total benefits and expenses 4,557 5,073 5,860 6,742 6,754 7,170 3,527 4,066 Adjusted operating income (loss): Life Planner Operations 379 449 515 821 938 1,020 522 571 Gibraltar Life 378 370 402 500 490 578 300 295 International Investments - (16) 77 106 143 259 105 52 Total adjusted operating income before income taxes 757 803 994 1,427 1,571 1,857 927 918 Reconciling Items: Realized investment gains (losses), net, and related adjustments (172) (31) (32) 169 251 367 161 (372) Related charges (16) (35) (13) (89) (11) (64) (8) - Investment gains (losses) on trading account assets supporting insurance liabilities, net - - 56 186 28 (99) 54 (112) Change in experience-rated contractholder liabilities due to asset value changes - - (56) (186) (28) 99 (54) 112 Equity in earnings of operating joint ventures (7) (15) (14) (22) (28) (30) (16) (14) Total reconciling items (195) (81) (59) 58 212 273 137 (386) Income from continuing operations before income taxes, equity in earnings of operating joint ventures, extraordinary gain on acquisition and cumulative effect of accounting change 562 $ 722 $ 935 $ 1,485 $ 1,783 $ 2,130 $ 1,064 $ 532 $ Six months ended June 30, Year ended December 31, (1) Revenues exclude realized investment gains, net of losses and related charges and adjustments, investment gains, net of losses, on trading account assets supporting insurance liabilities; and revenues of divested businesses, and include revenues representing equity in earnings of operating joint ventures. Benefits and expenses exclude charges related to realized investment gains, net of losses; change in experience-rated contractholder liabilities due to asset value changes, and benefits and expenses of divested businesses. |

International Businesses Overview Edward P. Baird Chief Operating Officer International Businesses |

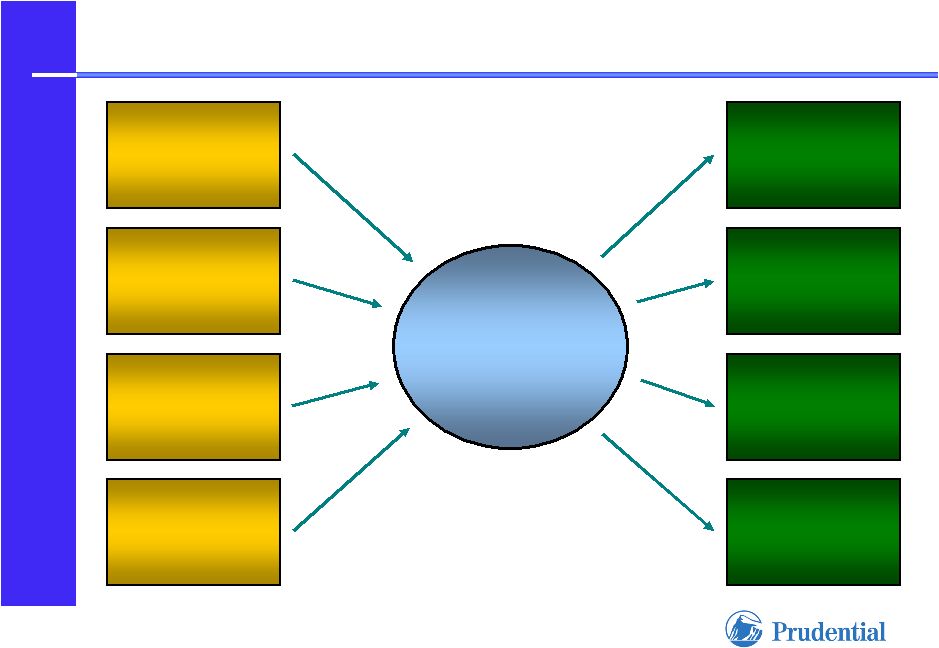

5 2008 Tokyo Investor Day International Division Organizational Structure Finance Japanese Life Planner Operations Investment Management Gibraltar Life Operations and Technology Insurance Operations Outside Japan Human Resources International Investments Businesses International Division |

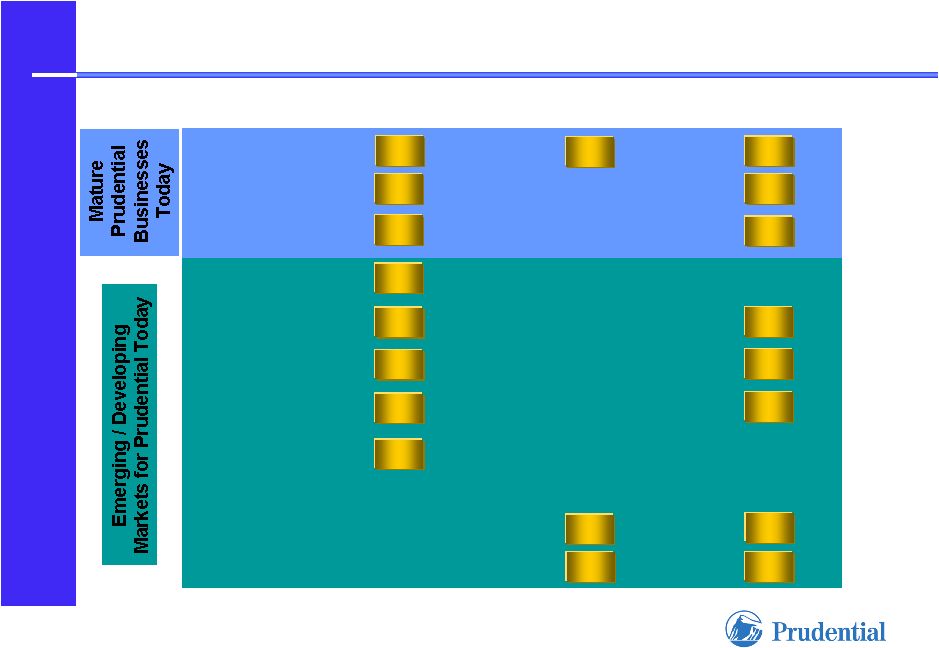

6 2008 Tokyo Investor Day • Grow organically and through complementary distribution channels and opportunistic acquisitions • Increasing emphasis on meeting retirement needs Key Elements of Our International Strategy • Needs-based selling • Continue building proprietary distribution: recruiting and selection • Historical focus on life insurance • Concentrate on a limited number of attractive countries • Target the affluent and mass affluent consumer • Expanding asset management business |

7 2008 Tokyo Investor Day • Sustainable AOI growth at solid double-digit rates • Sustainable 20% ROE’s • Strong free cash flow • Complementary group of International businesses with short and long-term growth potential International Divisional Goals |

8 2008 Tokyo Investor Day International Division Today Italy Poland Brazil Argentina China India Mexico Taiwan Korea Life Planning Insurance Japan International Investments Traditional Insurance |

9 2008 Tokyo Investor Day International Division Key Milestones for International Insurance 2006 2005 2004 2003 2001 1987 TRADITIONAL BUSINESS LIFE PLANNER BUSINESSES U.S. DOLLAR LIFE INSURANCE PRODUCT ACQUIRED AOBA LIFE INSURANCE CO., LTD. U.S. DOLLAR RETIREMENT INCOME PRODUCT BANK CHANNEL / U.S. DOLLAR FIXED ANNUITY |

10 2008 Tokyo Investor Day Emerging Markets: China • Established China Rep Office in Beijing in 1998 • Minority Interest in China Pacific Life, China’s third largest life insurance company – Investment through a consortium of investors in 2005 – Shares converted to China Pacific Group in 2007 by the consortium • Everbright Pramerica Fund Management Co. Ltd. – Formed in 2004 with Everbright Securities – 5 funds with total assets under management, $5 billion (1) 1) As of June 27, 2008 (U.S. dollar equivalent, translated at the December 28, 2007 FX rate, 7.3RMB/1USD) |

11 2008 Tokyo Investor Day Emerging Markets: India 2 strategic partnerships with DLF, India’s largest real estate development company • DLF Pramerica Life Insurance Company Ltd. (DPLI) – Granted R3 license by the Insurance Regulatory and Development Authority (IRDA) of India, allowing DPLI to start life insurance operations • DLF Pramerica Asset Managers Private Ltd. – Formed in December 2007 – Awaiting approvals from the Securities and Exchange Board of India (SEBI) and the Registrar of Companies (RoC) |

12 2008 Tokyo Investor Day 2007 Six months ended June 30, 2008 International Division Financial Performance 1) Based on annualized after-tax adjusted operating income for the six months ended June 30, 2008 Adjusted operating income pre-tax: Life Planner Business Gibraltar Life International Insurance International Investments International Division $515 402 917 77 $994 $821 500 1,321 106 $1,427 $938 490 1,428 143 $1,571 $1,020 578 1,598 259 $1,857 $571 295 866 52 $918 Year Ended December 31, 2004 2005 2006 ($millions) 23.9% ROE (1) |

13 2008 Tokyo Investor Day Competitive Advantage Life Planning Insurance • Life Planner profile similar to customer profile • Life Planner maintains contact with client, as trusted professional • Identify protection needs before discussing products • Protection life insurance purchased as a solution to identified need • Variable compensation structure • Rewards productivity and persistency Life Planners • Very selective recruiting • Highly trained career professional Needs Based Selling • Financial planning approach • Emphasis on protection products Compensation structure • Aligns customer/agent/company interest |

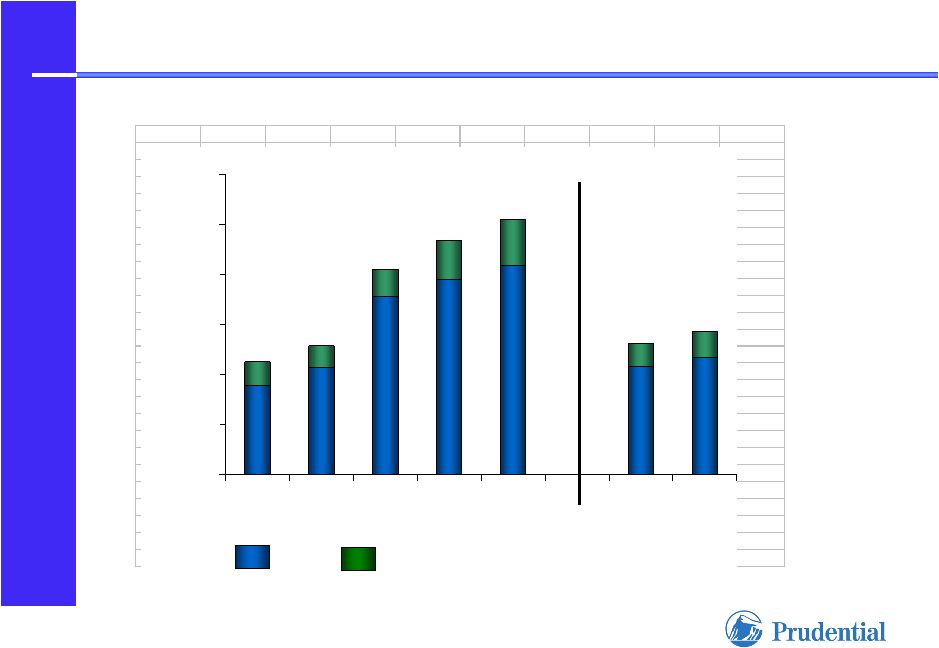

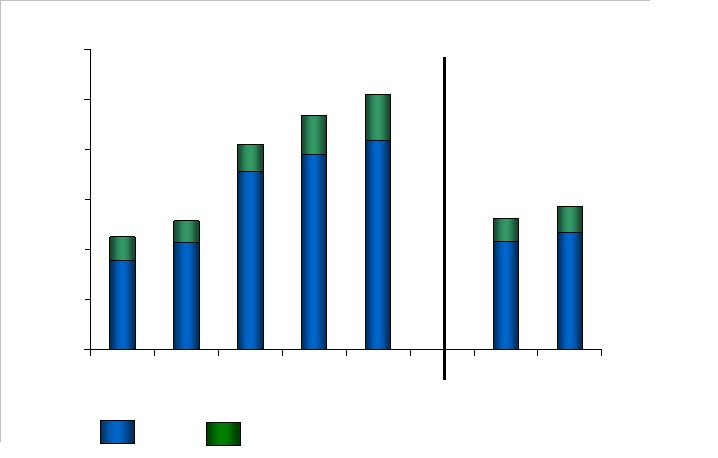

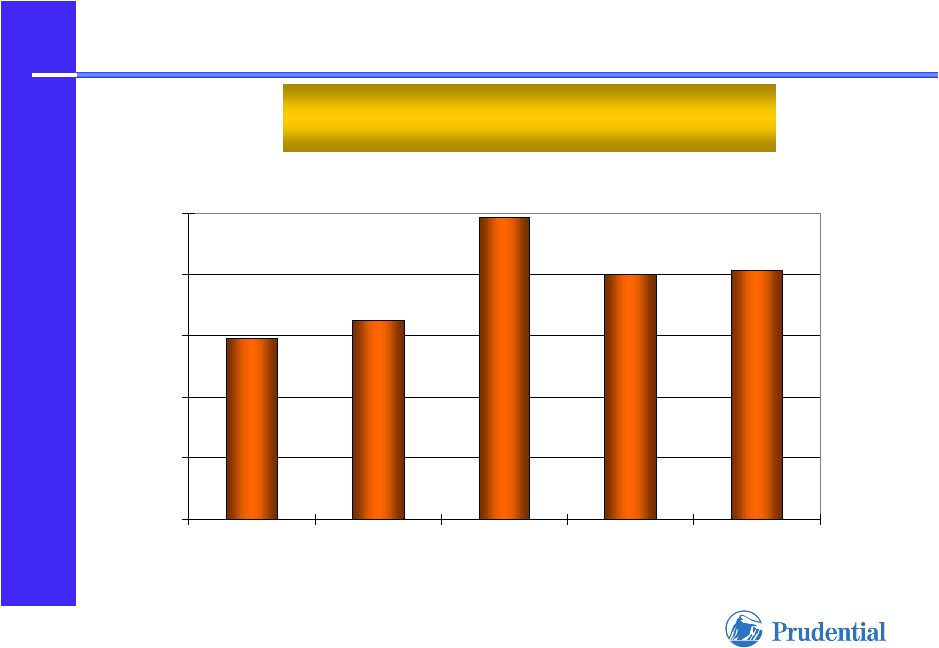

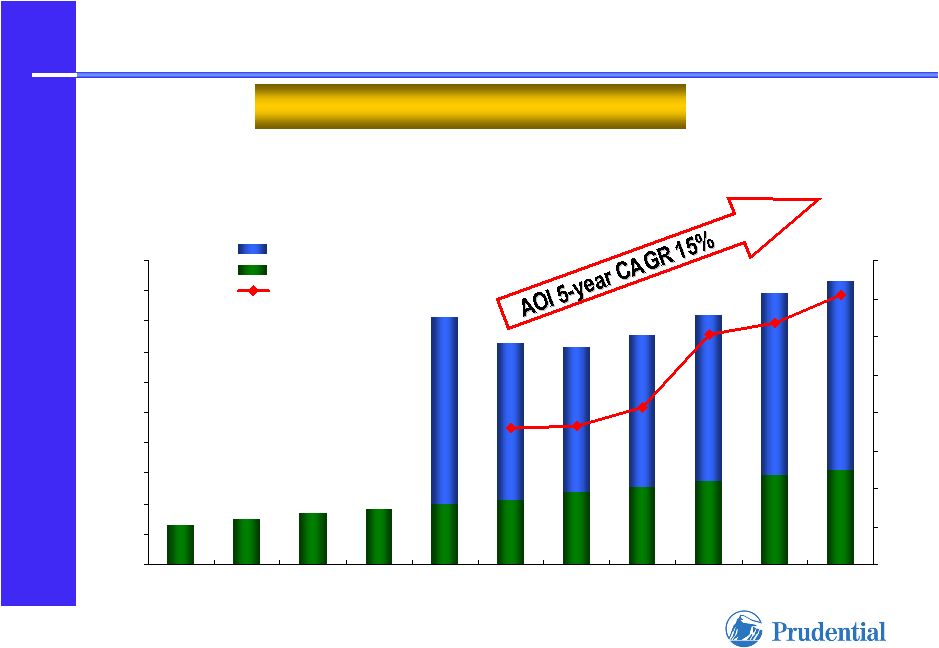

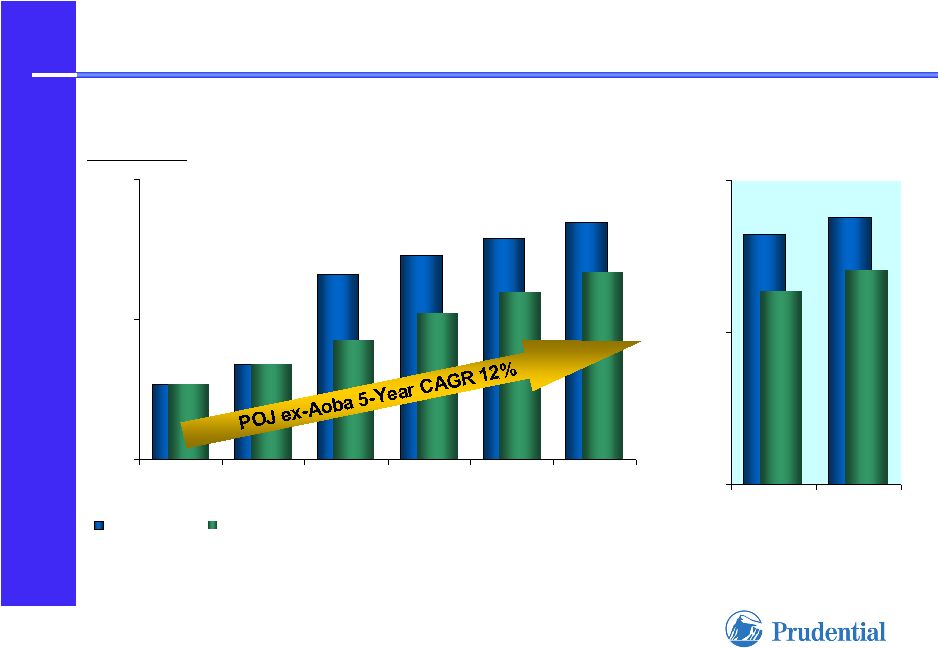

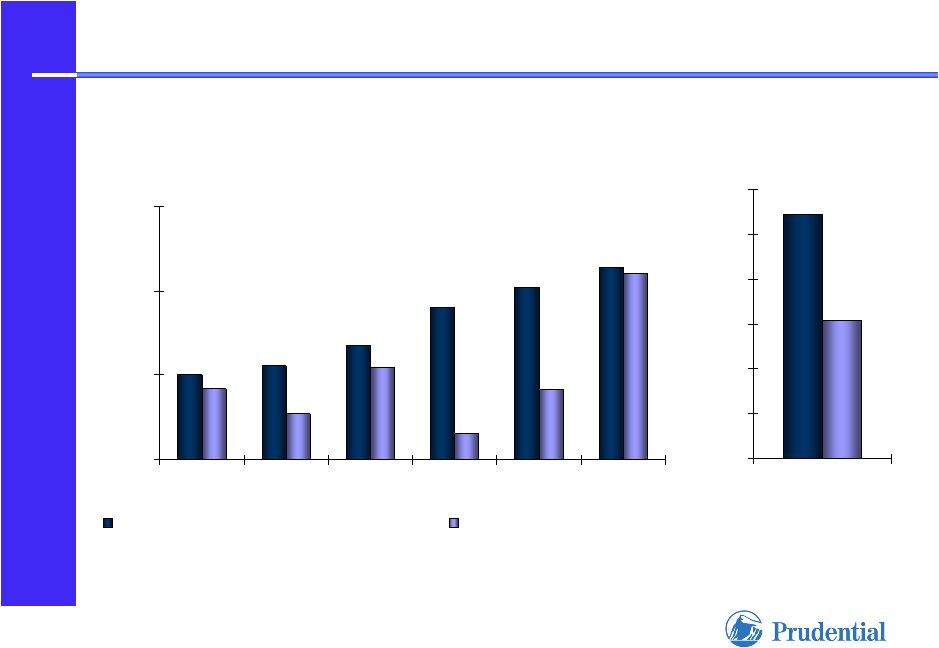

14 2008 Tokyo Investor Day $0 $200 $400 $600 $800 $1,000 $1,200 2003 2004 2005 2006 2007 2Q 07 2Q 08 Life Planner Businesses Pre-Tax AOI ($millions) 449 515 821 938 1,020 522 571 YTD POJ All Other |

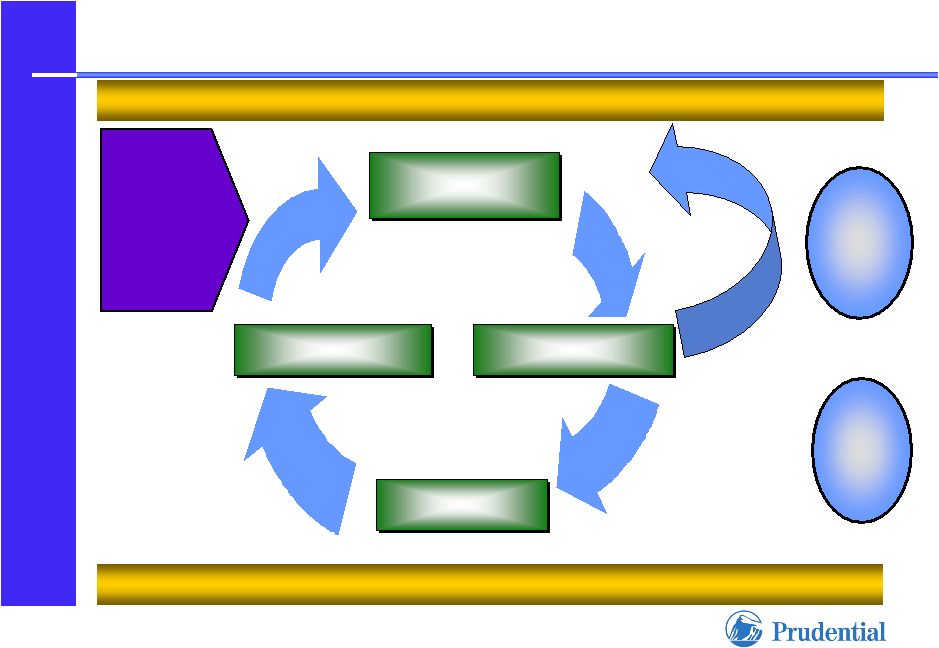

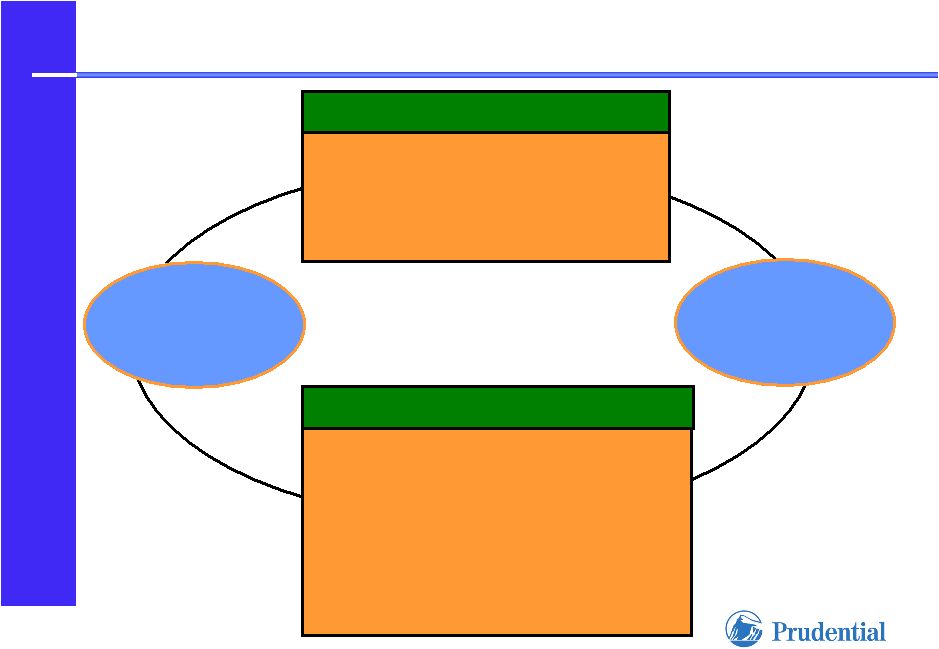

15 2008 Tokyo Investor Day The Beneficial Cycle Proven Execution Track Record Products Satisfy Customer Needs Sales Managers Drive Recruiting, Support Prospecting Life-Long Customer Relationships High Life Planner Income High Customer Satisfaction High Quality Referral More Quality Recruits Favorable Growth Prospects Superior ROE High Life Planner Needs-Based Selling Retention Retention Productivity Productivity High Life Planner Persistency Persistency High Policy |

16 2008 Tokyo Investor Day Gibraltar Life: “Prudentialized” Traditional Model Japanese Life Insurance Company • Variable agent compensation • Life Planner training principles adapted to traditional field force • Needs-based selling of protection and retirement products • Introduce products targeted to customer base • Maintain and cultivate strong affinity group relationships • Evolving third party distribution for selected products |

17 2008 Tokyo Investor Day 370 402 500 490 578 300 295 $0 $100 $200 $300 $400 $500 $600 $700 2003 2004 2005 2006 2007 2Q 07 2Q 08 Gibraltar Life Pre-Tax AOI ($millions) YTD |

18 2008 Tokyo Investor Day Enhancing Returns Through Proven Strategies Investment Portfolio • U.S. dollar investments • Extending duration • Asset class diversification Access to Prudential Resources • Product and distribution channel skills • Experience in the U.S. Retirement business Opportunities for Expense Synergies • Shared management resources • System integration • Common back office platforms |

19 2008 Tokyo Investor Day Positioned for International Market Developments Prudential Positioning Market Development Lifetime client relationships Well-established in Retirement Market through Associations Innovative, successful U.S. dollar retirement products Growing Demand for Retirement Accumulation Products |

20 2008 Tokyo Investor Day Current Population: 127 Million People % of 65+ Age Group: 22% in 2008 30% in 2030 (1) 36% in 2050 (1) Japan’s Demographic Change 14% 14% 11% 11% 11% 11% 64% 64% 59% 59% 53% 53% 22% 22% 30% 30% 36% 36% 0% 25% 50% 75% 100% 2008 2030 2050 Age 0-14 Age 15-64 Age 65+ 1) Source: Population Projections from Japan’s National Institute of Population and Social Security Research Rapidly growing pre-Retirement/ Retirement Markets |

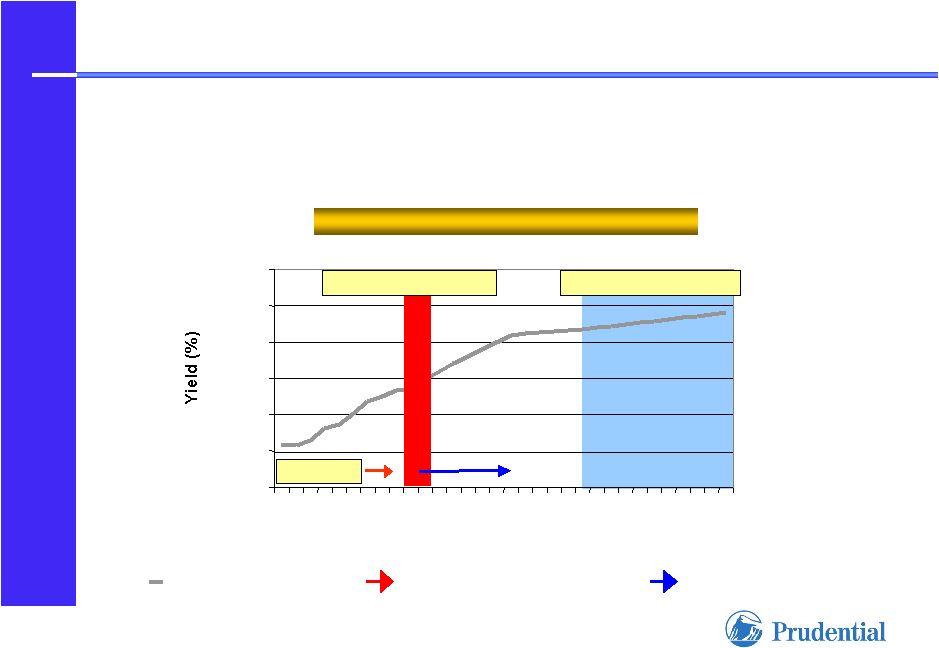

21 2008 Tokyo Investor Day Needs-Based Selling Over a Lifetime 20 60+ Client Age Prudential Solutions Premature Death Premature Death Retirement Retirement Accumulation Accumulation Financial Risk Protection Needs Young Household Pre-Retiree Retirement Life Cycle Term Insurance Whole Life U.S. Dollar Retirement Income Innovative Annuity Products Retirement Income Retirement Income |

22 2008 Tokyo Investor Day $0 $50 $100 $150 $200 $250 2003 2004 2005 2006 2007 Life Planners Serving Client Needs Through a Lifetime Prudential of Japan Second Sales to Existing Customers (1) 1) Translated based on constant exchange rate of 106 Japanese yen per U.S. dollar for all periods presented New Annualized Premiums ($millions) |

23 2008 Tokyo Investor Day Positioned for International Market Developments Greater Regulatory Standards Govern Product Distribution Full-time, college-educated Life Planner force Proven training for all channels Superior agent retention Prudential Positioning Market Development Growing Demand for Retirement Accumulation Products Lifetime client relationships Well-established in Retirement Market through Associations Innovative, successful U.S. dollar retirement products |

24 2008 Tokyo Investor Day Positioned for International Market Developments Expanding Distribution Channels Established bank distribution relationships Gibraltar distributors “seconded” to Bank Channel Greater Regulatory Standards Govern Product Distribution Full-time, college-educated Life Planner force Proven training for all channels Superior agent retention Prudential Positioning Market Development Growing Demand for Retirement Accumulation Products Lifetime client relationships Well-established in Retirement Market through Associations Innovative, successful U.S. dollar retirement products |

25 2008 Tokyo Investor Day Gibraltar Life Beyond the Life Advisor Channel • Strengthening bank channel distribution by transferring Life Planners to bank branch based sales • Banks now commencing sales of life insurance in addition to annuity products • Well-established relationship with Teachers Association positions Gibraltar Life to meet the needs of teachers, including retirement planning • New product development opportunities |

26 2008 Tokyo Investor Day Where We Are Today • Leadership positions in life planning • Gibraltar generates high ROE’s and cash flows • Growing asset management platforms • Profitability dominated by Japan and Korea • Acquisitions potentially additive • Expect to achieve our financial goals • Expanding retirement businesses • Developing multi-channel capabilities |

Japanese Insurance Operations Kazuo Maeda Co-President Prudential International Insurance |

28 2008 Tokyo Investor Day Life Insurance Market in Japan • • Total population of Japan is 127 Total population of Japan is 127 million million (#10 in the world) (#10 in the world) (1) • • Total GDP is $4.3 trillion (#2) Total GDP is $4.3 trillion (#2) (2) • • Total life insurance premium is Total life insurance premium is $362 billion (#2 $362 billion (#2) (3) • • Total life insurance premium is Total life insurance premium is 8.3% of GDP 8.3% of GDP (3) • • 88% of households have 88% of households have life insurance life insurance (4) 1) As of July 1, 2008; provisional estimate, Statistics Bureau, Ministry of Internal Affairs and Communications. (Japanese government) 2) For the year ended December 31, 2006; nominal gross domestic product, based on Annual Report on National Accounts, Cabinet Office. (Japanese government) 3) For the year ended March 31, 2007; based on Sigma Report No. 4 /2007, World Insurance in 2006, Swiss Reinsurance Company. 4) As of April-June 2006, according to Japan Institute of Life Insurance. |

29 2008 Tokyo Investor Day INDUSTRY Business in-force down 19% in five-year period (1) Number of in-force policies up 80% in five-year period (1) Annuity account balances up 29% in five year period (1) Life Insurance Industry in Japan Death Protection “Third- Sector” Medical Coverage Retirement and Savings 1) Based on Japanese statutory reporting; comparison for fiscal years ended March 31, 2008 and March 31, 2003. 2) Based on annualized new business premiums at constant exchange rate of 106 Japanese yen per U.S. dollar PRUDENTIAL Business in-force up 10% in five year period (1) Number of in-force riders and policies up 58% in five-year period (1) U.S. dollar retirement income and fixed annuities: none in 2003, 27% of new business in 2007 (2) |

30 2008 Tokyo Investor Day Japanese Life Insurance Industry Developments • Growing demand for retirement and savings products • Current regulatory environment requires higher standards for distributing insurance products • Recent regulations allow growth of bancassurance |

31 2008 Tokyo Investor Day Japanese Life Insurance Industry Developments • • U.S. dollar fixed annuities offer U.S. dollar fixed annuities offer attractive value proposition for attractive value proposition for customers and favorable returns customers and favorable returns for Prudential for Prudential • • Prudential resources and experience Prudential resources and experience in U.S. retirement market support in U.S. retirement market support development of innovative development of innovative retirement solutions retirement solutions • • Needs-based selling principles applied Needs-based selling principles applied to retirement market to retirement market • • Life Planners cultivate lifetime Life Planners cultivate lifetime customer relationships customer relationships • • Associations offer effective Associations offer effective distribution platform distribution platform Growing demand for retirement Growing demand for retirement and savings products and savings products • • Japanese “baby boomer” Japanese “baby boomer” demographics: demographics: expect more than 40% increase expect more than 40% increase in 65+ age cohort over in 65+ age cohort over 25 25 years years (1) (1) • • Strains on government pension Strains on government pension programs lead to growing programs lead to growing individual responsibility individual responsibility for retirement for retirement Prudential Positioning Development 1) Source: Population Projections from Japan’s National Institute of Population and Social Security Research |

32 2008 Tokyo Investor Day Japanese Life Insurance Industry Developments • • Professional fulltime Life Planners Professional fulltime Life Planners • • Life Planner training principles adapted Life Planner training principles adapted to Life Advisors to Life Advisors • • Needs-based selling principles cover Needs-based selling principles cover both death protection and retirement both death protection and retirement Current regulatory environment Current regulatory environment requires higher standards for requires higher standards for distributing insurance products distributing insurance products • • Suitability: documented Suitability: documented communications to protect communications to protect customer’s interests customer’s interests • • Illustrations: professional skills Illustrations: professional skills required to explain risks and required to explain risks and benefits, avoid customer benefits, avoid customer misunderstandings misunderstandings Prudential Positioning Development |

33 2008 Tokyo Investor Day Japanese Life Insurance Industry Developments • • Successful bank relationships Successful bank relationships established based on U.S. dollar established based on U.S. dollar fixed annuity products fixed annuity products • • Specially-trained Life Advisors Specially-trained Life Advisors assigned to bank channel assigned to bank channel • • Protection products introduced in Protection products introduced in bank channel, 2008 bank channel, 2008 Recent regulations allow growth Recent regulations allow growth of bancassurance of bancassurance • • Annuity and savings products Annuity and savings products (2002) (2002) • • Single premium whole life and Single premium whole life and endowment (2005) endowment (2005) • • “Protection” insurance insurance products- products- e.g. term (2007) e.g. term (2007) Prudential Positioning Development “Protection” “Protection” |

34 2008 Tokyo Investor Day 4,197 4,197 9 9 4,861 4,861 6 6 6. Prudential 6. Prudential 124,121 66,727 Industry Total (3) 100,686 52,274 Subtotal 3,709 10 2,334 10 10. Fukoku 2,038 13 2,615 9 9. Tokyo Marine Holdings 3,537 11 3,803 8 8. Sony Life 16,086 4 4,483 7 7. Meiji-Yasuda 2,602 2,602 2,808 2,808 (POJ) (POJ) 1,595 1,595 2,053 2,053 (Gibraltar) (Gibraltar) 4,533 8 5,191 5 5. AIG 7,316 6 6,202 4 4. T&D Financial 25,243 1 6,451 3 3. Nippon 16,166 3 7,431 2 2. Sumitomo 17,862 2 8,904 1 1. Dai ichi Billion Yen Ranking Billion Yen Ranking Ranking by New Business Amount (2) FY2007 (Individual + Annuity) (1) FY2002 (Individual + Annuity) (1) 1) New business on Individual life and annuity contracts including net increase by conversions 2) According to Life Insurance Association of Japan 3) Excluding Japan Post Insurance Overall Position – New Business (Face Amount) |

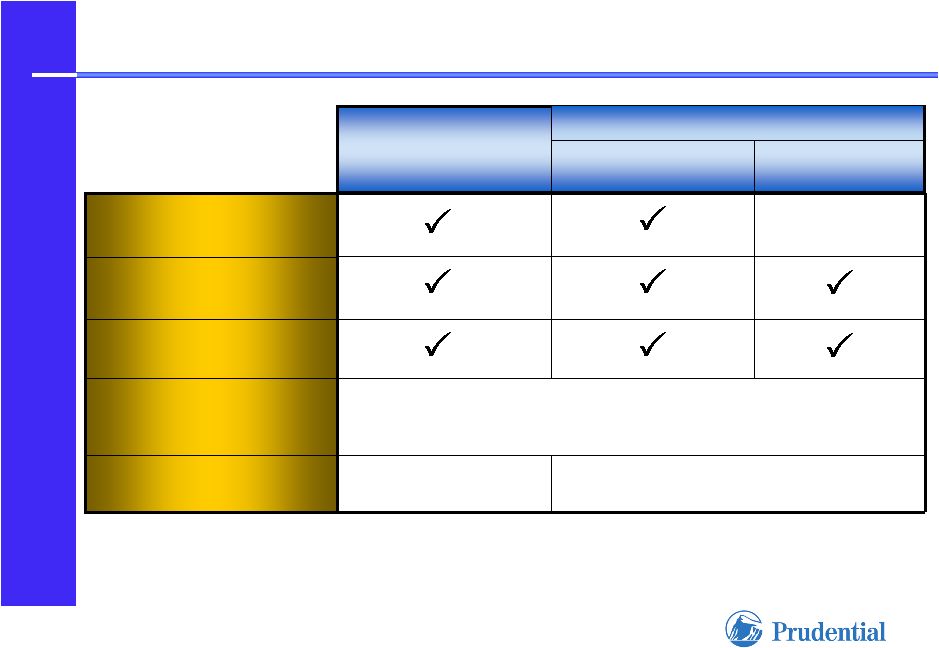

35 2008 Tokyo Investor Day Maintain Two Distinct Brands • • Expand bank distribution Expand bank distribution from successful U.S. dollar from successful U.S. dollar fixed annuity base to fixed annuity base to protection products protection products • • Platform for further Platform for further expansion of products expansion of products and distribution and distribution Protection life insurance and Protection life insurance and retirement/savings products retirement/savings products sold by Life Advisors to mid- sold by Life Advisors to mid- market and affinity groups market and affinity groups Gibraltar Life Gibraltar Life Prudential Prudential of Japan of Japan Needs-based sales of Needs-based sales of retirement/savings retirement/savings products to mass affluent products to mass affluent and affluent markets and affluent markets Opportunities Opportunities Protection life insurance Protection life insurance sold by full-time Life sold by full-time Life Planners to mass affluent Planners to mass affluent and affluent markets and affluent markets Market Market Emphasis Emphasis |

36 2008 Tokyo Investor Day Synergy Initiatives Management Efficiency Gibraltar Life Prudential of Japan Financial Performance • Systems integration • Common platform for: • Insurance administration • Financial reporting • Risk management • Compliance & Internal controls • Human Resources • Business strategy – two distinct brands • Shared resources – senior management and marketing officers |

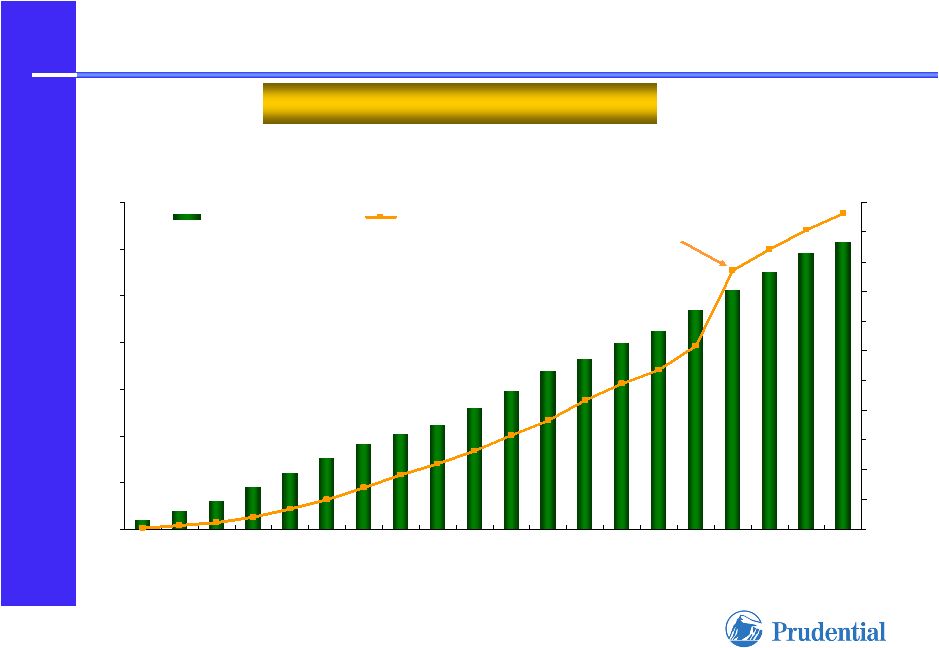

37 2008 Tokyo Investor Day Growth in Japan Operations Adjusted Operating Income ($ millions) Number of Number of LPs & LAs LPs & LAs POJ and Gibraltar Combined 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 10,000 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 0 200 400 600 800 1,000 1,200 1,400 1,600 # of LA # of LP Adjusted Operating Income |

38 2008 Tokyo Investor Day Distribution Strength in Selected Markets Prudential of Japan Life Planners Gibraltar Life Advisors First half 2008 : $528 million new business annualized premiums (1) 1) Translated based on constant exchange rate of 106 Japanese yen per U.S. dollar 41% 54% 5% Bank Distribution |

39 2008 Tokyo Investor Day Japanese Insurance Operations Overview 1) In millions 2) At end of period 3) Translated based on constant exchange rate of 106 Japanese yen per U.S. dollar for all periods presented $528 $459 $890 $892 Annualized new business premiums (1)(3) 8,978 8,827 9,332 8,900 Number of Life Planners/ Life Advisors (2) $762 $730 $1,418 $1,273 295 300 578 490 Gibraltar Life $467 $430 $840 $783 Prudential of Japan 2008 2007 2007 2006 Pre-tax adjusted operating income (1) Six months ended June 30, |

40 2008 Tokyo Investor Day Prudential of Japan • • Face amount in force, $244 billion Face amount in force, $244 billion (1) (2) • • $24.8 billion in assets $24.8 billion in assets (1) (2) • • 84 agency offices 84 agency offices (1) • • Ratings: Standard & Poor’s, AA Ratings: Standard & Poor’s, AA • • Ranked #1 in Japan for number of Ranked #1 in Japan for number of Million Dollar Round Table Million Dollar Round Table members in each of members in each of the past 11 years the past 11 years 1) As of June 30, 2008 2) Translated based on exchange rate of 106 Japanese yen per U.S. dollar – Agency Offices |

41 2008 Tokyo Investor Day Business Model Life Planner – Needs-Based Selling • Life Planner – a selective, high quality sales force • Only about 3 out of 100 candidates are hired • Well trained and professional • Customer focused • Disciplined, and demonstrates “missionary zeal” • Profile of a typical POJ new Life Planner – Age 32 years old – College graduate – Good sales experience outside the life insurance industry – Married with children – First job change – POJ policyholder – Referred by another POJ Life Planner – Annual income in the previous job was about $50,000 |

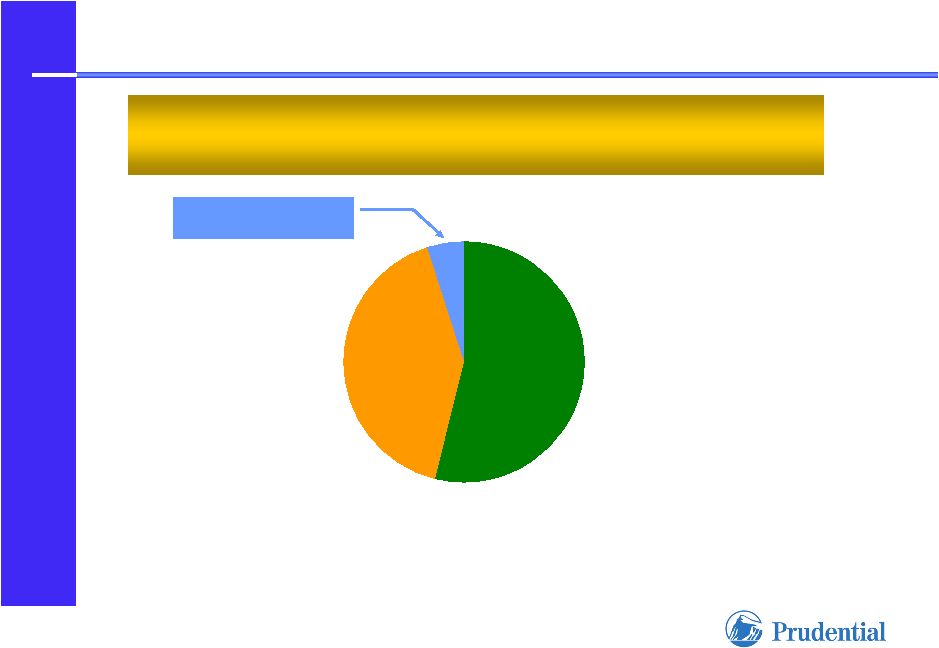

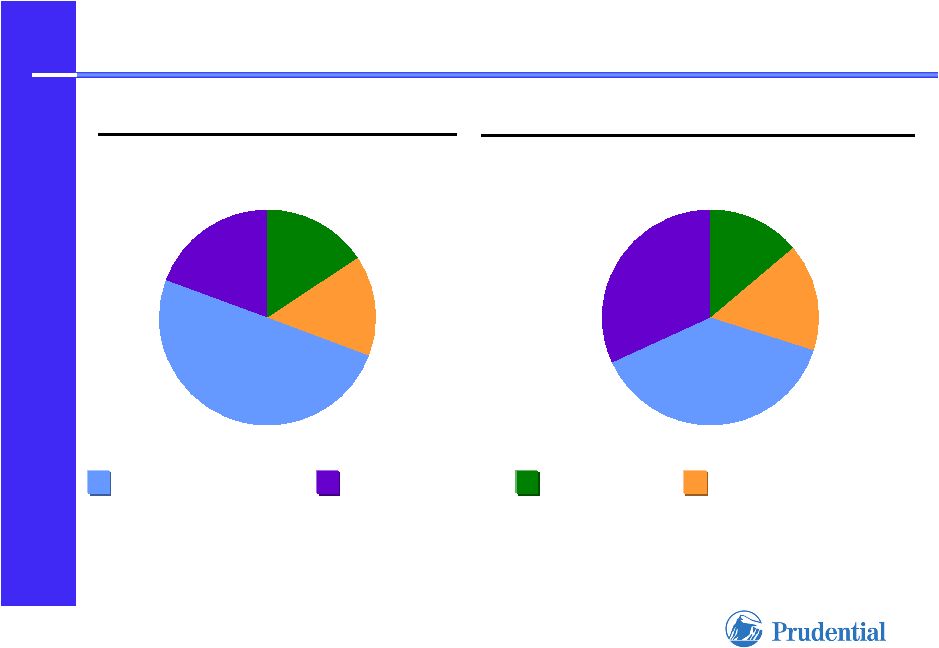

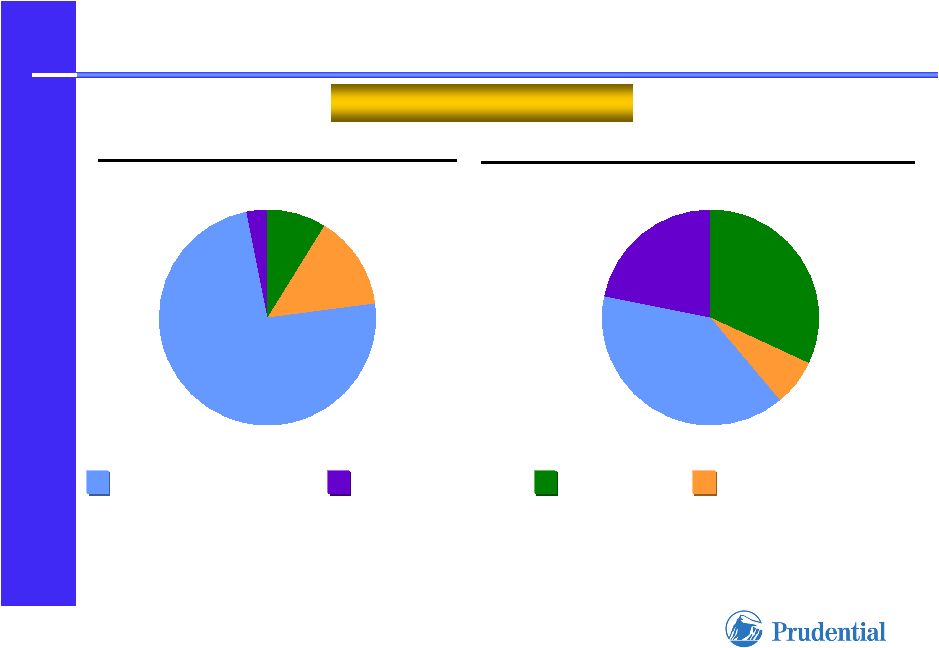

42 2008 Tokyo Investor Day Yen-based protection products (2) Yen-based savings and retirement income products (5) U.S. Dollar-based products (3) In-force Annualized Premium Mix as of June 30, 2008 (1) New Business Annualized Premium Mix 6 months ended June 30, 2008 (1) Third Sector (4) 19% 50% 16% 15% 32% 38% 14% 16% 1) Includes single premium business at 10% 2) Primarily whole life and term 3) Primarily whole life and retirement income 4) Cancer, medical, accident and sickness; primarily riders 5) Primarily retirement income Prudential of Japan Emphasis on Protection Products |

43 2008 Tokyo Investor Day Prudential of Japan Positioned for Second Sales Serving Retirement Needs 20 30 40 50 60+ Client Age Death Protection Needs Focused Focused on on Mass Mass Affluent/ Affluent/ Affluent Affluent Market Market • Lifetime client relationships • Needs-based selling through client lifecycles • Innovative products serve evolving needs Retirement Income Needs |

44 2008 Tokyo Investor Day Prudential of Japan History of Growth Growth of Business and LPs Number of life insurance Number of life insurance policies in force policies in force (thousands) (thousands) Number of LPs Number of LPs 0 500 1,000 1,500 2,000 2,500 3,000 3,500 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 0 200 400 600 800 1,000 1,200 1,400 1,600 1,800 2,000 2,200 Number of LPs Number of Policies Aoba Life adds Aoba Life adds 350,000 life 350,000 life insurance insurance policies policies |

45 2008 Tokyo Investor Day Prudential of Japan Key Drivers (1) 6.7 Productivity (2) 71.3% 24 – month 82.7% 12 – month Life Planner Retention 90.5% 25 – month 95.0% 13 – month Policy Persistency (Face-amount) 1) Measured as of or for the year ended December 31, 2007 2) Policies sold per Life Planner, per month; includes medical and cancer policies. |

46 2008 Tokyo Investor Day Prudential of Japan Outlook • Continued demand for death protection insurance • Customers increasingly selective of insurers • Evolving strategies • “Business insurance” continues to be sales growth opportunity for mass affluent and affluent markets Medical insurance, nursing care, and Medical insurance, nursing care, and variable annuities variable annuities Death Protection Death Protection (market) (market) Needs-based, innovative retirement Needs-based, innovative retirement accumulation products (e.g. U.S. Dollar accumulation products (e.g. U.S. Dollar Retirement Income) support “second sales” Retirement Income) support “second sales” Death Protection Death Protection (POJ) (POJ) |

47 2008 Tokyo Investor Day Gibraltar Life • • Strong affinity group relationships • Growing bancassurance business • Face amount in force, $184 billion (1) (2) • • $35 billion in assets (1) (2) • 499 sub-branch offices (1) • Ratings: Standard & Poor’s, AA Moody’s, Aa3 1) As of June 30, 2008 2) Translated based on exchange rate of 106 Japanese yen per U.S. Dollar - Sub-branch Offices |

48 2008 Tokyo Investor Day Business Model Life Advisor – Strong Affinity Group Relationship • Acquired by Prudential Financial in 2001 • Expanded Life Advisor distribution • Leveraging Life Planner model to improve key drivers • Wider geographic coverage than POJ to meet market needs and affinity group reach • Teachers Association market generates steady mortality gain (term insurance) and opportunity to capture retirement money • Offering wide range of products to customers (Death Protection, Medical, Endowment and U.S. Dollar Fixed Annuities) |

49 2008 Tokyo Investor Day Life Advisor Distribution • Selection criteria designed for sales in affinity group market • Candidates often introduced by successful Life Advisors Selective Recruiting Standards Training: Adapted From Life Planner System • Basic training adapted from Prudential of Japan • Tailored to accommodate affinity group Assignment to Affinity Groups |

50 2008 Tokyo Investor Day Affinity Group Relationships Teachers Association • Relationship since 1952 • Approximately 500,000 members and retirees • Access to over 1 million teachers and 37,000 schools Other associations, including: • Shoko (Small Business Owners Association) • Food Hygiene Association • Japanese Social Welfare Foundation • Beauticians Association • Self Defense Force |

51 2008 Tokyo Investor Day Business Model Third Party Distribution – Expansion of Bank Channel • Commenced bank distribution in 2005 • Disciplined entry and expansion in the bancassurance market • U.S. dollar fixed annuities: a bank channel success story • Regulatory changes provide upside business opportunities for other retirement products and death protection products • Needs-based selling model is a key credential in the bank channel |

52 2008 Tokyo Investor Day First Half 2007 First Half 2008 New Business Annualized Premiums (1) Bank Distribution 1) Translated based on constant exchange rate for all periods presented of 106 Japanese yen per U.S. dollar; single premium business included at 10% credit 2) Term, recurring premium whole life, riders 3) U.S. dollar whole life and retirement income 4) Single premium life; endowment Yen-based protection Yen-based protection products products (2) (2) U.S. dollar-based U.S. dollar-based protection products protection products (3) (3) Yen-based savings Yen-based savings and retirement and retirement income products income products (4) (4) U.S. dollar fixed U.S. dollar fixed annuities annuities $176M $243M Bank Distribution Gibraltar Life: U.S. Dollar Fixed Annuities Complement Product Line |

53 2008 Tokyo Investor Day Gibraltar Life “Prudentialized” Key Drivers (1) Gibraltar Gibraltar POJ POJ 31.1% 71.3% 24 – month 52.7% 82.7% 12 – month Life Advisor Retention 87.9% 90.5% 25 – month 91.7% 95.0% 13 – month Policy Persistency (Face-amount) 3.5 6.7 Productivity (2) 1) Measured as of or for the year ended December 31, 2007 2) Policies sold per Life Planner / Life Advisor, per month; includes medical and cancer policies |

54 2008 Tokyo Investor Day Bank Business Overview • Competitive U.S. dollar fixed annuity product formed foundation for relationships • Developing channel access for full deregulation opportunities – Leveraging Prudential’s third-party channel expertise to complement annuities with death protection products – Over 100 POJ Life Planners transferred to Gibraltar Life, 2007 – 2008; now assuming full-time bank channel sales responsibilities • Seeking expansion of bank network |

55 2008 Tokyo Investor Day Summary • Life Planner model offers sustainable competitive advantages • Needs-based selling, emphasis on protection products • Capture additional sales by emphasizing retirement needs of existing and new customers • Superior policy persistency contributes to returns • Gibraltar Life leverages Life Planner model attributes in affinity group and mid-market customer base • Growing distribution through banks and associations • Business model well-suited to changing landscape |

International Insurance Finance John Hanrahan Chief Financial Officer International Businesses |

57 2008 Tokyo Investor Day Drivers of Sustainable Financial Performance • Favorable mortality margins drive strong returns • High ROE products generate substantial excess capital • Capital management opportunities enhance overall returns • Duration lengthening supported by long-term nature of liabilities contributes to returns • U.S. dollar investing: Natural hedge for Prudential, enhancing portfolio returns • Strong persistency drives revenue growth • Margins earned throughout in-force period • Business growth increases scale benefits Needs-Based Selling Capital Management Emphasis on Protection Products Investment Portfolio Strategies |

58 2008 Tokyo Investor Day YTD Prudential of Japan Number of Individual Policies In-force In thousands 1) Individual Life and Annuities (1) 2,258 2,144 1,914 1,774 500 1,500 2,500 2Q 07 2Q 08 1,820 1,956 2,074 2,194 1,348 1,690 1,838 1,180 1,037 1,538 500 1,500 2,500 2002 2003 2004 2005 2006 2007 Total POJ POJ excluding Aoba business |

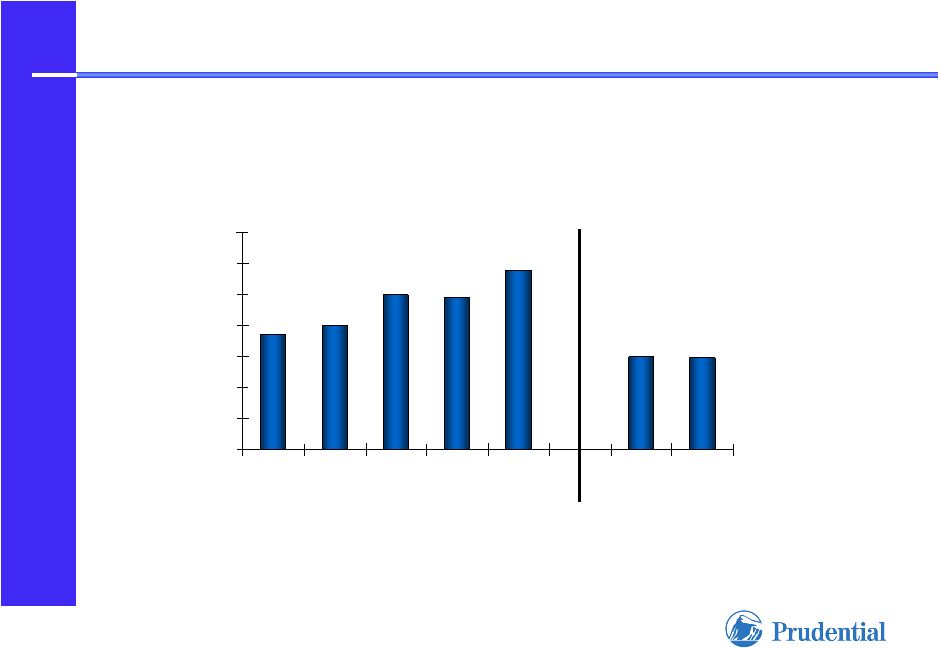

59 2008 Tokyo Investor Day $ millions International Insurance Pre-Tax AOI 1,598 1,428 1,321 917 819 757 $0 $500 $1,000 $1,500 $2,000 2002 2003 2004 2005 2006 2007 Life Planner Business Gibraltar Life 866 822 $0 $500 $1,000 $1,500 $2,000 2Q 07 2Q 08 YTD |

60 2008 Tokyo Investor Day Yen-based protection products Yen-based savings and retirement income products U.S. Dollar-based products In-force Annualized Premium Mix as of June 30, 2008 (1) New Business Annualized Premium Mix 6 months ended June 30, 2008 (1) Third Sector 19% 50% 16% 15% 32% 38% 14% 16% 1) Includes single premium business at 10% 2) Primarily whole life and term 3) Primarily whole life and retirement income 4) Cancer, medical, accident and sickness; primarily riders 5) Primarily retirement income Life Planner Business Emphasis on Protection Products Prudential of Japan (2) (3) (4) (5) |

61 2008 Tokyo Investor Day Yen-based protection products Yen-based savings and retirement income products U.S. Dollar-based insurance products In-force Annualized Premium Mix as of June 30, 2008 (1) New Business Annualized Premium Mix 6 months ended June 30, 2008 (1) U.S. Dollar fixed annuities 3% 74% 9% 14% 22% 39% 32% 7% 1) Includes single premium business at 10% 2) Includes third sector products Gibraltar Life Emphasis on Protection Products Gibraltar Life (2) (2) |

62 2008 Tokyo Investor Day Investment Portfolio Opportunities Access to Prudential skill sets – commercial mortgages, corporate credit Equities support portion of long-dated risks Asset Class Diversification Extending asset duration reduces risk profile relative to long-dated liabilities while increasing yield Duration Lengthening “Natural hedge” for GAAP equity Additional U.S. dollar exposure related to economic value U.S. Dollar Investment Exposure |

63 2008 Tokyo Investor Day U.S. Dollar Product and Investment Strategies U.S. Dollar Investments U.S. Dollar Denominated Products Enhanced portfolio yield Natural hedge for Prudential Financial, Inc. Favorable value proposition Favorable expected returns |

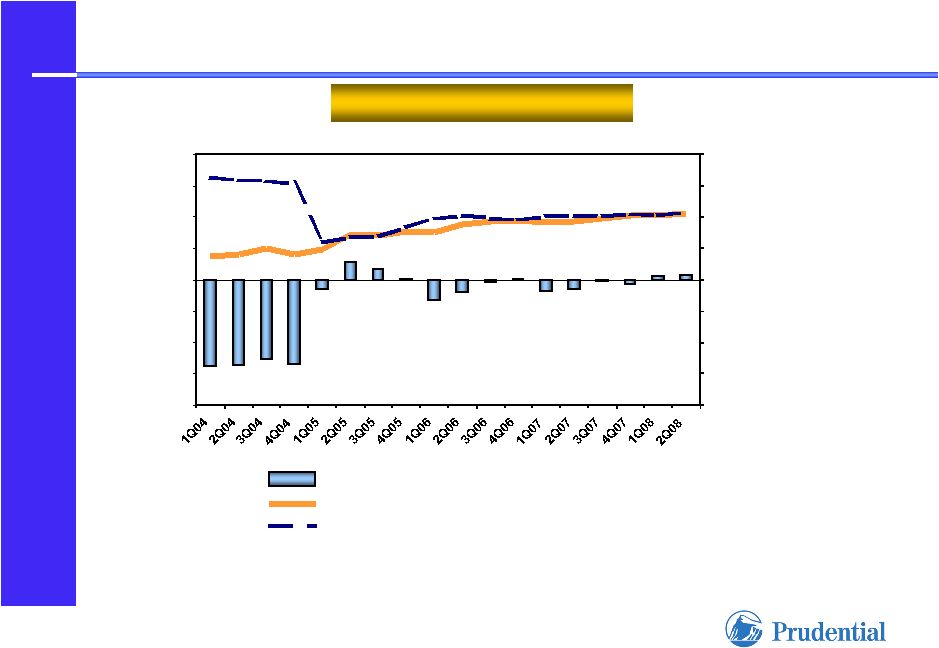

64 2008 Tokyo Investor Day Improving Investment Portfolio Returns (1) 1) Excludes U.S. dollar reinsurance activity, Prudential’s Tokyo office building, and one-time activities 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% $(40) $(30) $(20) $(10) - $10 $20 $30 $40 Normalized Investment Spread Amount ($ millions) Yield Crediting Rate Prudential of Japan |

65 2008 Tokyo Investor Day Japan Government Bond Yields Japanese Portfolio Duration – AOI Enhancement Opportunities • Gibraltar and POJ have increased their yen portfolio duration to reduce interest rate risk relative to the liabilities. • Due to the upward sloping yield curve, increasing duration improves investment yield. • The impact on the yield varies with the location on the curve of the assets that are bought and sold. - 0.50 1.00 1.50 2.00 2.50 3.00 1 6 11 16 21 26 31 Maturity (Years) June 2008 Japan Government Bond Yield Curve Gibraltar Portfolio Duration Change 4Q04 – 2Q08 POJ Portfolio Duration Change 4Q04 – 2Q08 POJ liability duration range Gib liability duration range Asset Duration |

66 2008 Tokyo Investor Day Prudential International Insurance Japan Portfolios (1) Yen Portfolio Duration: 8 years Yen Portfolio Duration: 11 years U.S. Treasury Bonds Government/Government related (primarily Japanese Government Bonds) Investment Grade Corporate Bonds (Aaa, Aa, A) Investment Grade Corporate Bonds (Baa or BBB) Commercial Loans Below Investment Grade Corporate Bonds Real Estate Equity Securities Short Term Policy Loans Other (2) December 31, 2004 June 30, 2008 1) Includes U.S. dollar reinsurance activity 2) “Other” category includes Trading Account Assets and Other Long-term Investments 0% 21% 9% 1% 2% 3% 2% 2% 3% 7% 50% 1% 23% 8% 2% 2% 5% 0% 2% 4% 6% 47% |

67 2008 Tokyo Investor Day Foreign Currency Income Hedges • Yen income hedging plan on 12 quarter rolling basis • A strengthening yen helps earnings over the long term • Yen forward rates imply future strengthening of the yen versus the dollar • Hedging smoothes the impact on earnings, but does not eliminate it • 2008 yen income hedged at a rate of 106 yen / dollar • As we generate more income in U.S. dollar (U.S. dollar investment, U.S. dollar product sales) we have less exposure to FX movement 4 Yr Forward 3 Yr Forward 2 Yr Forward 1 Yr Forward Spot Rate Rate as of 06/30/08 106.0 103.7 101.0 97.9 95.0 Yen / U.S.$ |

68 2008 Tokyo Investor Day Foreign Currency Hedging Program 1) Japanese yen for U.S. dollar 2) Through June 30, 2008 "Rolling Hedge" Program (1) 2008 Average Spot FX 116 110 108 2007 2006 2005 2004 2008 (2) 106 100 N/A Average 105 118 112 2009 104 N/A N/A ? 102 109 108 101 99 106 102 2007 Hedge Rate |

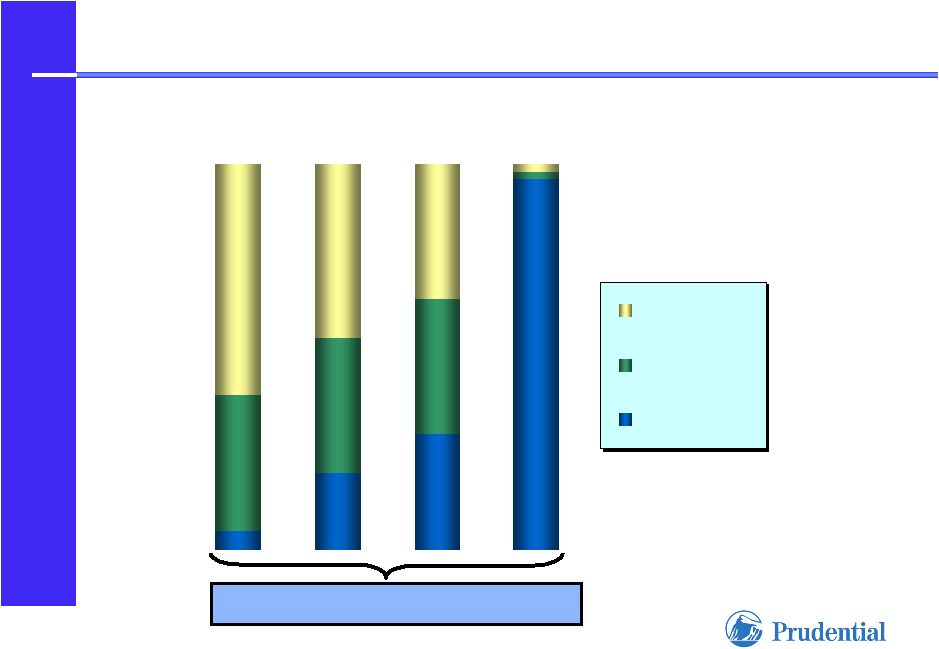

69 2008 Tokyo Investor Day U.S. Dollar Retirement Products Attractive Value Proposition in a Growing Market 45% 24% Rates offered reflect yields on U.S. dollar investments; compare favorably to Japanese yen-based products U.S.$ Fixed Annuity U.S.$ Denominated Retirement Income Prudential of Japan U.S.$ Denominated Retirement Income Gibraltar Life % of First Half 2008 Sales (1) Attractive Yields for Japanese Market Flexibility Retirement Accumulation Death Protection Benefits 1) Based on annualized new business premiums; translation of Japanese yen-based sales at 106 Japanese yen per U.S. dollar |

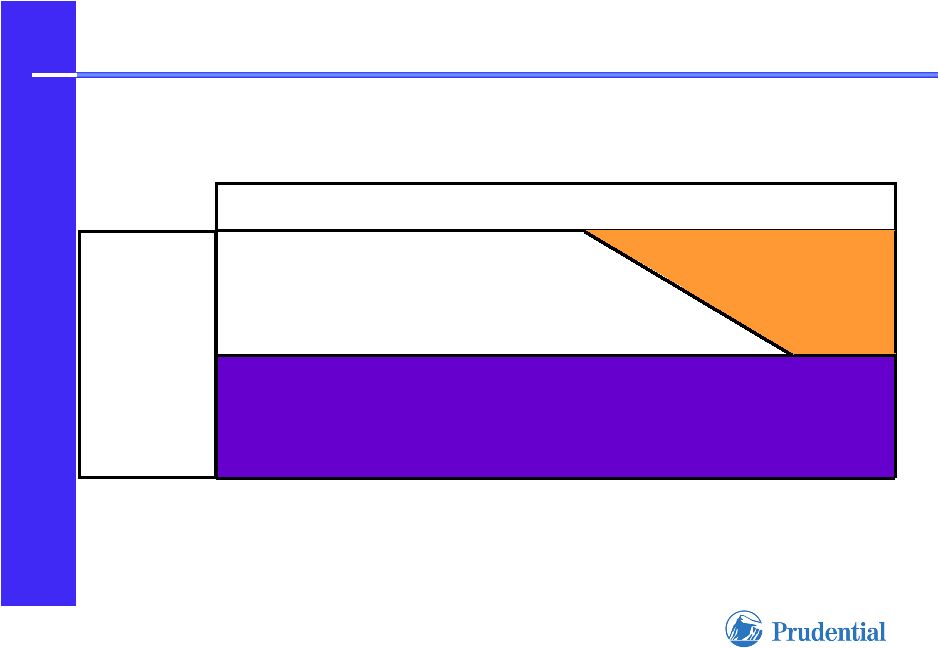

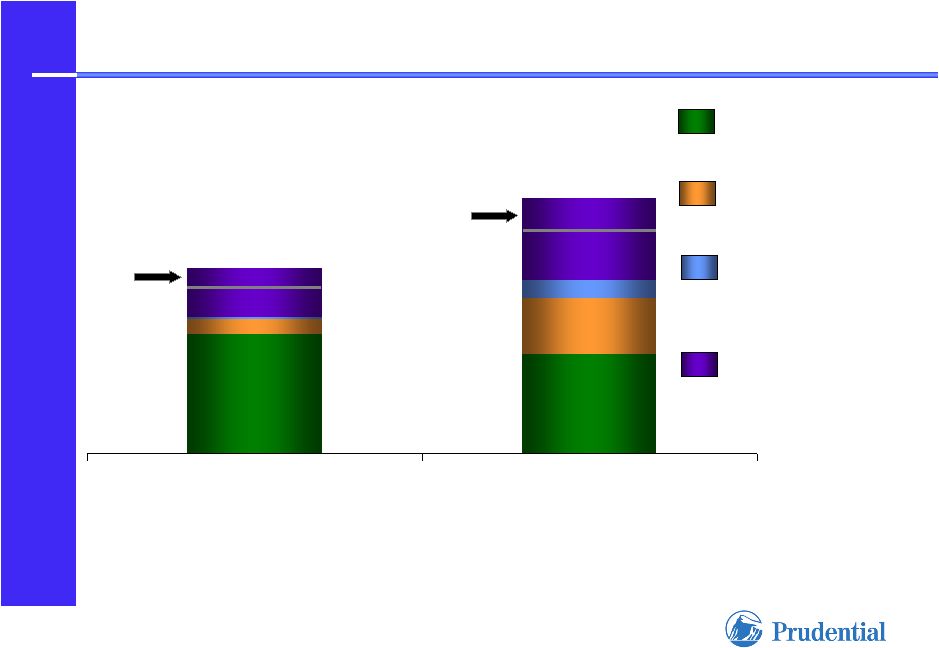

70 2008 Tokyo Investor Day Mortality Expense Investment Retirement Accumulation Products Contribute to High Product Portfolio ROE Potential Targeted 20+% ROE Portfolio USD Whole Life Term USD Annuity USD Retirement Income |

71 2008 Tokyo Investor Day Well Capitalized Companies Moody’s (1) Standard & Poor’s (1) AA AA Aa3 Gibraltar Life NR Prudential of Japan • High ROE business generates significant excess capital • “Net level premium reserves” achieved at POJ in 2005; first dividend paid in 2006 • Gibraltar Life: full amortization of “statutory goodwill” enhances capital generating capacity Strong Capital Generation 1) Insurance claims-paying ratings as of September 2, 2008 |

72 2008 Tokyo Investor Day Prudential International Insurance Capital Redeployment 552 1,021 1,142 672 505 905 419 273 541 151 414 1,104 $0 $500 $1,000 $1,500 2002 2003 2004 2005 2006 2007 After-Tax Adjusted Operating Income Capital Redeployment 5,438 3,098 $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 Cumulative 2002 - 06/30/08 $ millions |

73 2008 Tokyo Investor Day Prudential International Insurance Capital Management Opportunities • Cross entity investments • Acquisition and expansion funding • Gibraltar subordinated debt repayment • Reinsurance • Dividends |

Life Planners: Lifetime Relationships Built on Skill and Trust Nick Miyazaki Chief Marketing Officer |

75 2008 Tokyo Investor Day Business Model Founded on Values and Beliefs Values Values Worthy of trust, customer-focused, Worthy of trust, customer-focused, helping society, “winning” helping society, “winning” for company for company Vision Vision Most trusted and admired Most trusted and admired life insurance company life insurance company Mission Mission Help customers achieve financial Help customers achieve financial security and peace of mind security and peace of mind Strategy Strategy Fulfill protection needs in Fulfill protection needs in customer focused distribution customer focused distribution and service based model and service based model |

76 2008 Tokyo Investor Day Life Planner Values and Beliefs • Life insurance protection serves society’s greater good • Financial security and peace of mind are of great value • Customer needs come first; products serve those needs • Continuing, caring service is part of the customer relationship • • The Life Planner is a trusted advisor The Life Planner is a trusted advisor |

77 2008 Tokyo Investor Day Critical Success Factors • Character and Integrity • IQ – Mental alertness • Achievement drive • High level of energy • Money motivation • Staying power |

78 2008 Tokyo Investor Day Life Planner Selection Process Only the Strong Survive 3% 3% HIRE HIRE 3% 3% Targeted Selection Interview 2 Targeted Selection Interview 2 7% 7% Targeted Selection Interview 1 Targeted Selection Interview 1 11% 11% Career Info Program 3 Career Info Program 3 16% 16% Career Info Program 2 Career Info Program 2 29% 29% Career Info Program 1 Career Info Program 1 100% 100% Orientation Orientation Percentage of Percentage of Initial Group Initial Group |

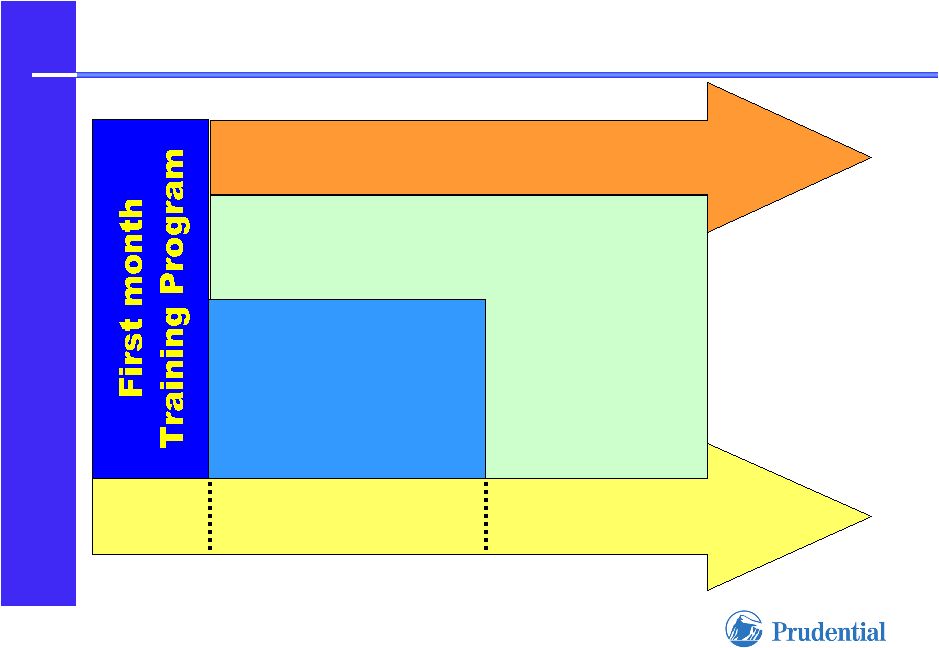

79 2008 Tokyo Investor Day Comprehensive Training Supports Needs-Based Selling STRUCTURED TRAINING PROGRAM Weeks 1 - 4 Weeks 5 - 50 Weeks 51 - 100 Basic Training Program Continuing Continuing On the On the Job Job Training Training |

80 2008 Tokyo Investor Day Role of the Sales Manager Life Planner’s Personal Trainer and Coach • Performance planning and review • “Training by objective” • Joint sales activity and monitoring • Role-play skill building The Life Planner’s Success The Life Planner’s Success is is The Sales Manager’s Success The Sales Manager’s Success |

81 2008 Tokyo Investor Day “KASH” Formula • Knowledge • Attitude • Skills • Habits |

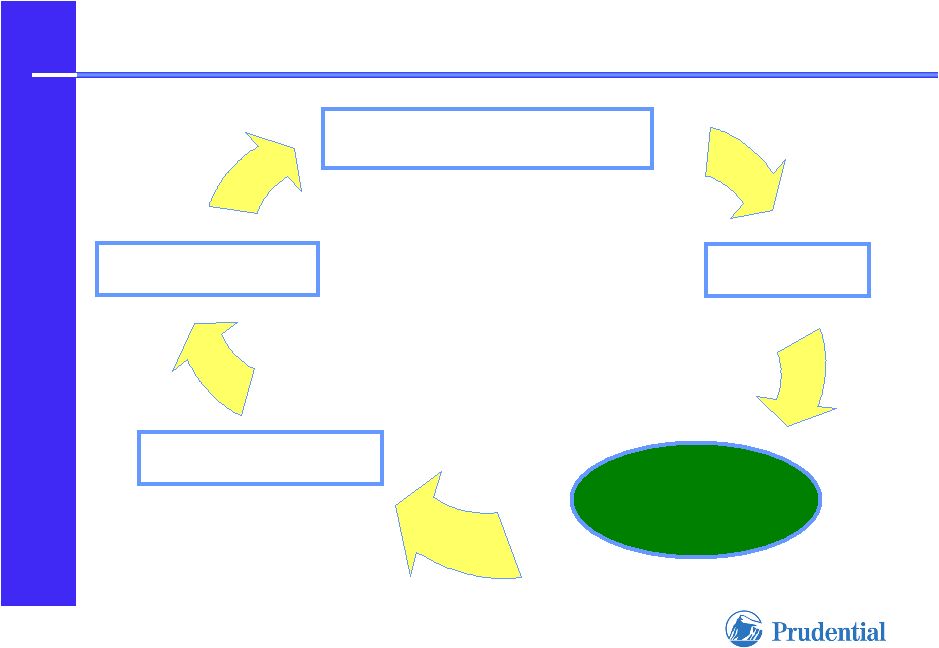

82 2008 Tokyo Investor Day Sales Cycle Prospecting Prospecting Review Review Preparation Preparation Sales Interviews Sales Interviews Telephoning Telephoning |

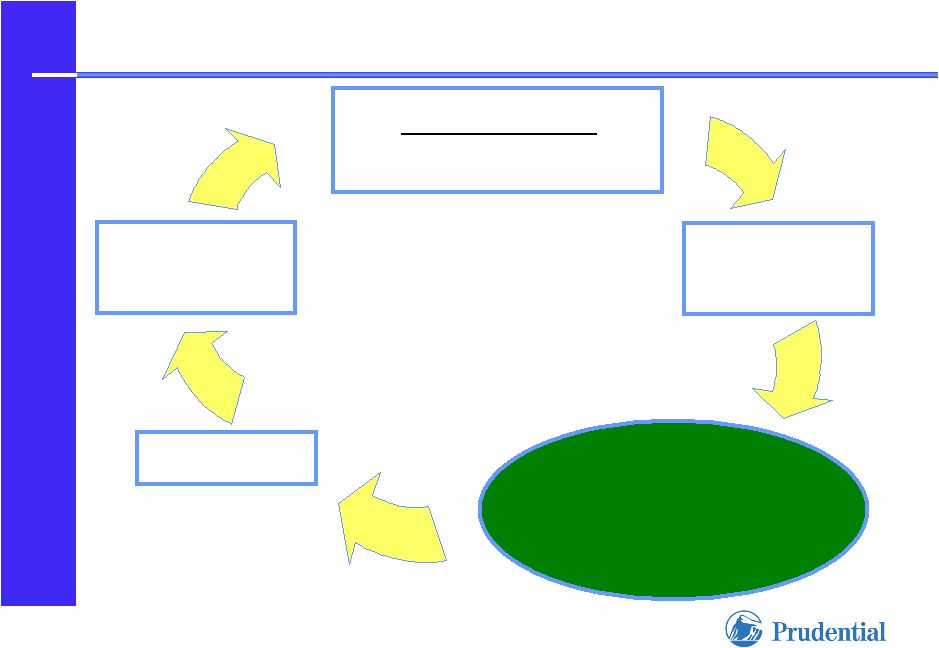

83 2008 Tokyo Investor Day Training Cycle Performance Review Performance Review Role Play Role Play Review Review Sit Plan Sit Plan Role Play Role Play Review Review Joint Work Joint Work (Monitoring) (Monitoring) |

84 2008 Tokyo Investor Day Compensation System C = C C = C Compensation = Contribution |

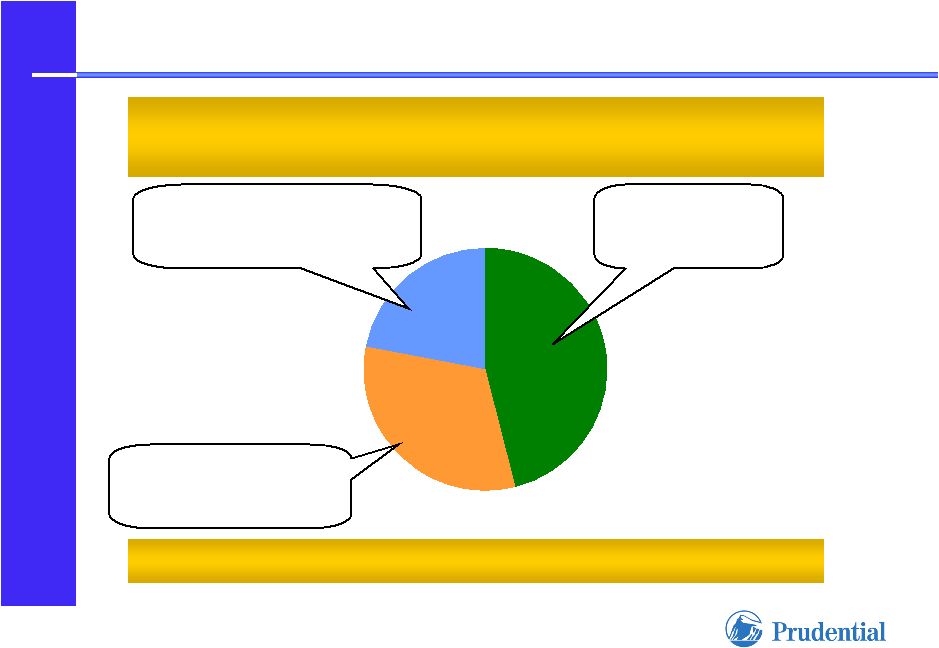

85 2008 Tokyo Investor Day Life Planner Compensation Rewards Productivity and Persistency 32% 22% 46% Percentage of Overall Life Planner Compensation (1) Compensation = Contribution 1) Based on year ended December 31, 2007 for Life Planners beyond initial training allowance period First Year Commission Renewal Commissions Productivity & Persistency Bonus |

86 2008 Tokyo Investor Day Standing Behind The Client For a Lifetime Model Pattern of Lifecycle Income and Expenses Model Pattern of Lifecycle Income and Expenses College Employed; Married Primary Secondary School School Life Cycle of Pre- second child School College Employed; Married Primary Secondary School School Life Cycle of Pre- first child School 52 62 32 42 Wife age 22 55 65 35 45 Husband age 25 Period of return to life as married couple only (“empty nest”) Education of the children, period in which they become independent Marriage Birth of Children Pattern of Income Pattern of Expenses |

87 2008 Tokyo Investor Day The Life Planner Career • Strong values and beliefs: protection life insurance serves society • A career that’s “right” for 3 out of 100 candidates • Comprehensive, ongoing training • Customer needs drive sales • Compensation rewards productivity, persistency • Entrepreneurial success while “making the world a better place” |