Prudential Financial, inc. 2016 Financial Outlook Conference Call Presentation December 10, 2015 Exhibit 99.1

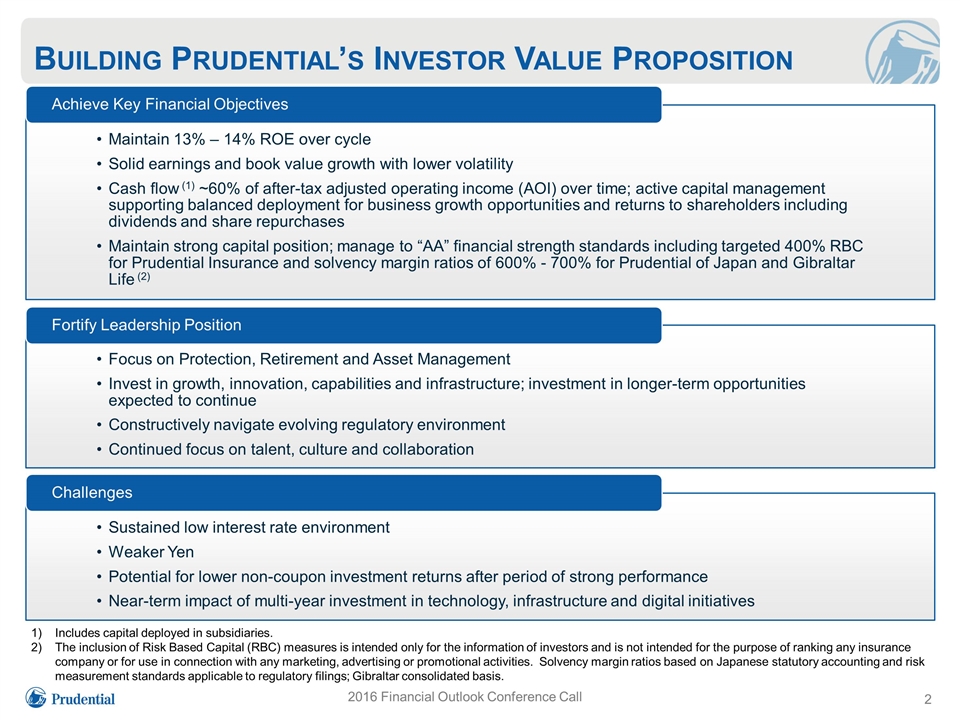

Building Prudential’s Investor Value Proposition 2016 Financial Outlook Conference Call Includes capital deployed in subsidiaries. The inclusion of Risk Based Capital (RBC) measures is intended only for the information of investors and is not intended for the purpose of ranking any insurance company or for use in connection with any marketing, advertising or promotional activities. Solvency margin ratios based on Japanese statutory accounting and risk measurement standards applicable to regulatory filings; Gibraltar consolidated basis. Achieve Key Financial Objectives Fortify Leadership Position Maintain 13% – 14% ROE over cycle Solid earnings and book value growth with lower volatility Cash flow (1) ~60% of after-tax adjusted operating income (AOI) over time; active capital management supporting balanced deployment for business growth opportunities and returns to shareholders including dividends and share repurchases Focus on Protection, Retirement and Asset Management Constructively navigate evolving regulatory environment Challenges Sustained low interest rate environment Continued focus on talent, culture and collaboration Weaker Yen Near-term impact of multi-year investment in technology, infrastructure and digital initiatives Potential for lower non-coupon investment returns after period of strong performance Maintain strong capital position; manage to “AA” financial strength standards including targeted 400% RBC for Prudential Insurance and solvency margin ratios of 600% - 700% for Prudential of Japan and Gibraltar Life (2) Invest in growth, innovation, capabilities and infrastructure; investment in longer-term opportunities expected to continue

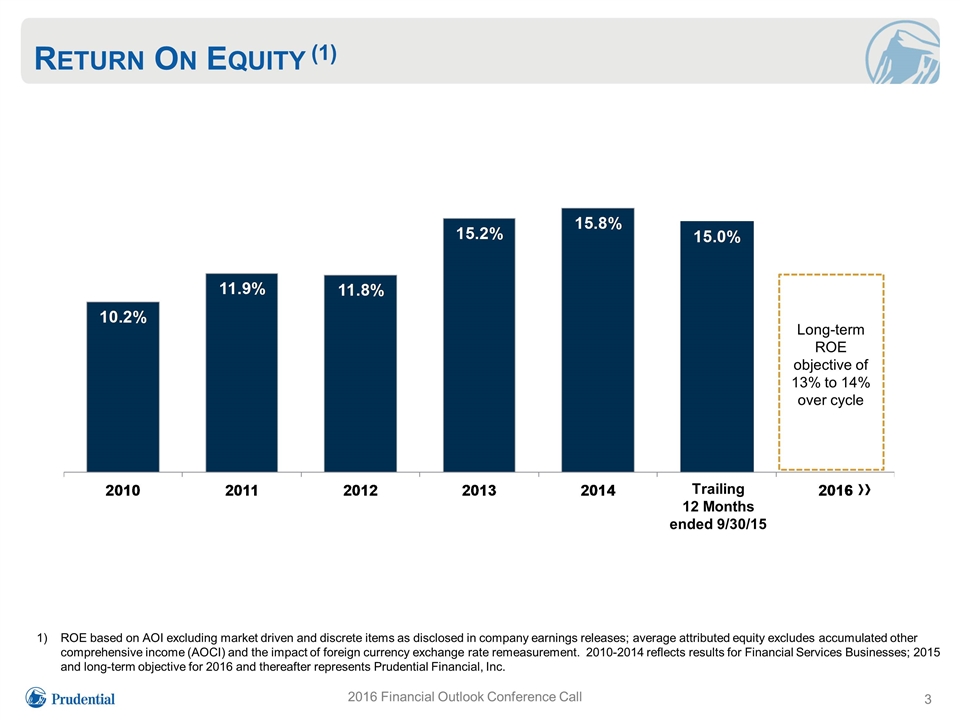

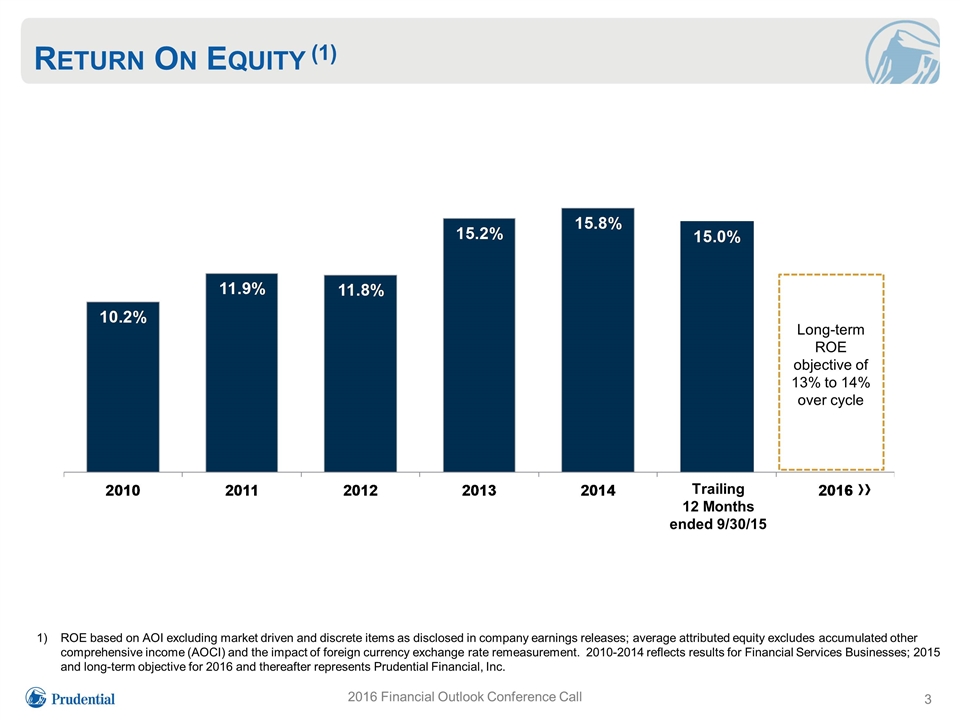

Return On Equity (1) 2016 Financial Outlook Conference Call Long-term ROE objective of 13% to 14% over cycle Trailing 12 Months ended 9/30/15 ROE based on AOI excluding market driven and discrete items as disclosed in company earnings releases; average attributed equity excludes accumulated other comprehensive income (AOCI) and the impact of foreign currency exchange rate remeasurement. 2010-2014 reflects results for Financial Services Businesses; 2015 and long-term objective for 2016 and thereafter represents Prudential Financial, Inc.

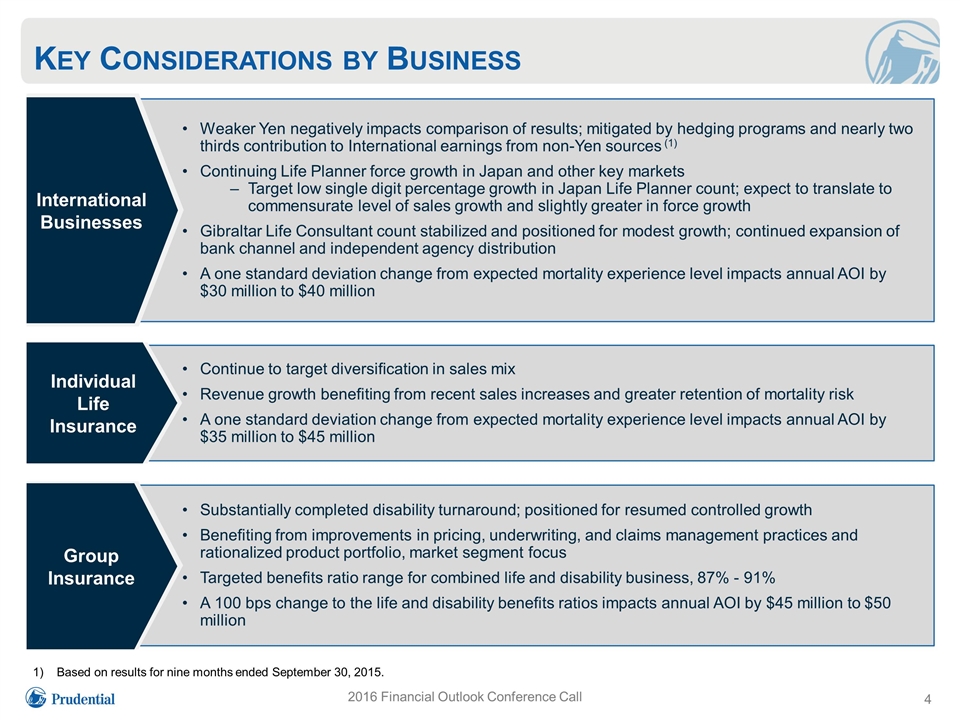

Key Considerations by Business 2016 Financial Outlook Conference Call International Businesses Weaker Yen negatively impacts comparison of results; mitigated by hedging programs and nearly two thirds contribution to International earnings from non-Yen sources (1) Continuing Life Planner force growth in Japan and other key markets Target low single digit percentage growth in Japan Life Planner count; expect to translate to commensurate level of sales growth and slightly greater in force growth Gibraltar Life Consultant count stabilized and positioned for modest growth; continued expansion of bank channel and independent agency distribution A one standard deviation change from expected mortality experience level impacts annual AOI by $30 million to $40 million Individual Life Insurance Continue to target diversification in sales mix Revenue growth benefiting from recent sales increases and greater retention of mortality risk A one standard deviation change from expected mortality experience level impacts annual AOI by $35 million to $45 million Group Insurance Substantially completed disability turnaround; positioned for resumed controlled growth Benefiting from improvements in pricing, underwriting, and claims management practices and rationalized product portfolio, market segment focus Targeted benefits ratio range for combined life and disability business, 87% - 91% A 100 bps change to the life and disability benefits ratios impacts annual AOI by $45 million to $50 million Based on results for nine months ended September 30, 2015.

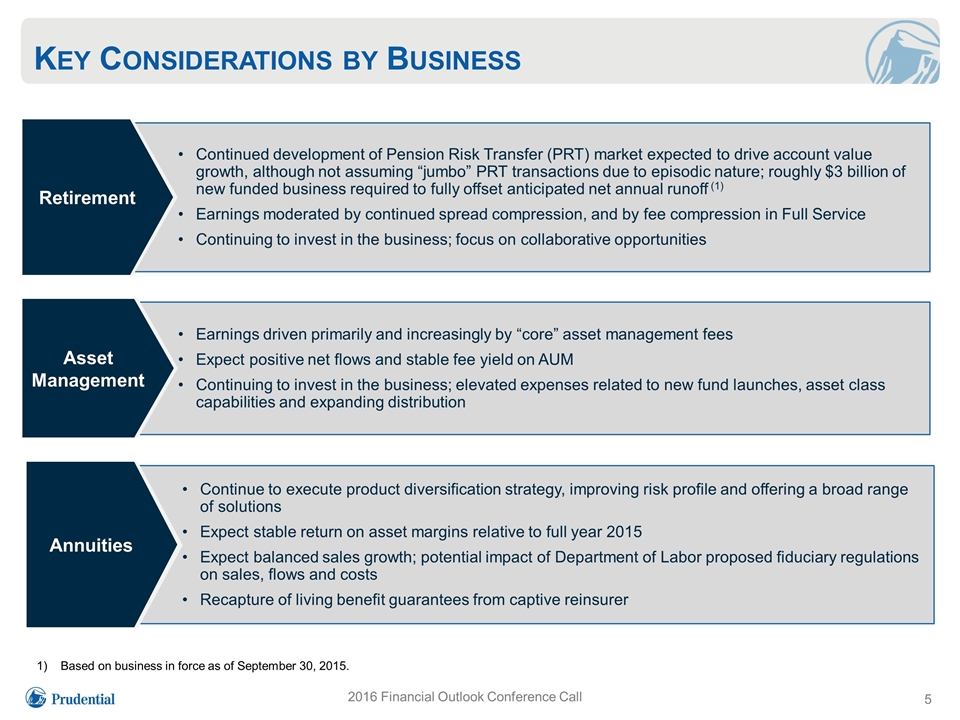

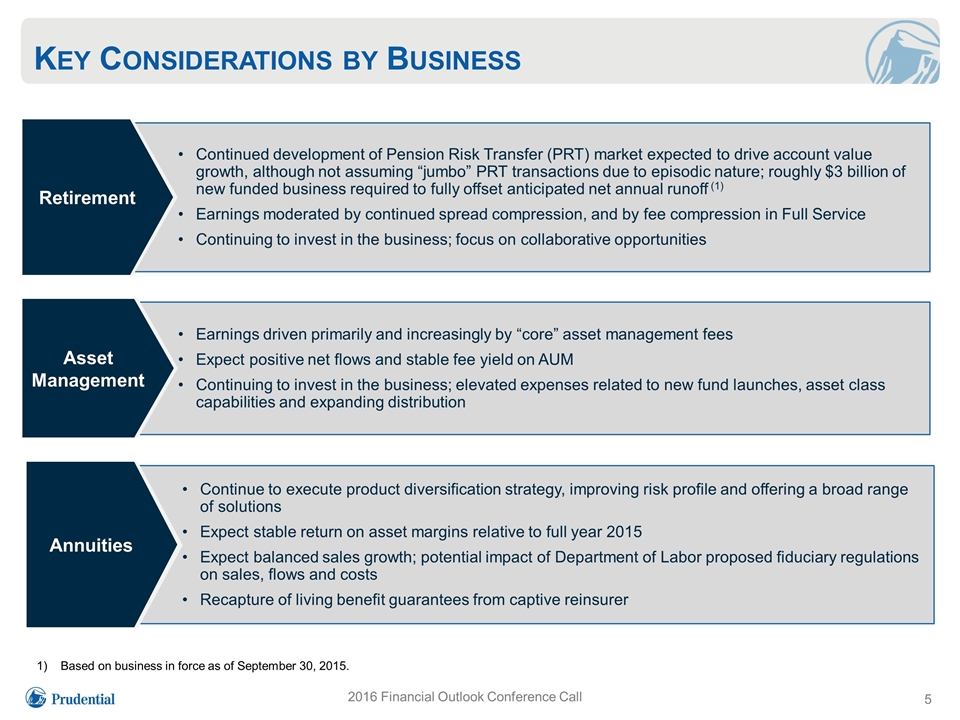

Key Considerations by Business 5 2016 Financial Outlook Conference Call Retirement Continued development of Pension Risk Transfer (PRT) market expected to drive account value growth, although not assuming “jumbo” PRT transactions due to episodic nature; roughly $3 billion of new funded business required to fully offset anticipated net annual runoff (1) Earnings moderated by continued spread compression, and by fee compression in Full Service Continuing to invest in the business; focus on collaborative opportunities Annuities Continue to execute product diversification strategy, improving risk profile and offering a broad range of solutions Expect stable return on asset margins relative to full year 2015 Expect balanced sales growth; potential impact of Department of Labor proposed fiduciary regulations on sales, flows and costs Recapture of living benefit guarantees from captive reinsurer Asset Management Earnings driven primarily and increasingly by “core” asset management fees Expect positive net flows and stable fee yield on AUM Continuing to invest in the business; elevated expenses related to new fund launches, asset class capabilities and expanding distribution Based on business in force as of September 30, 2015.

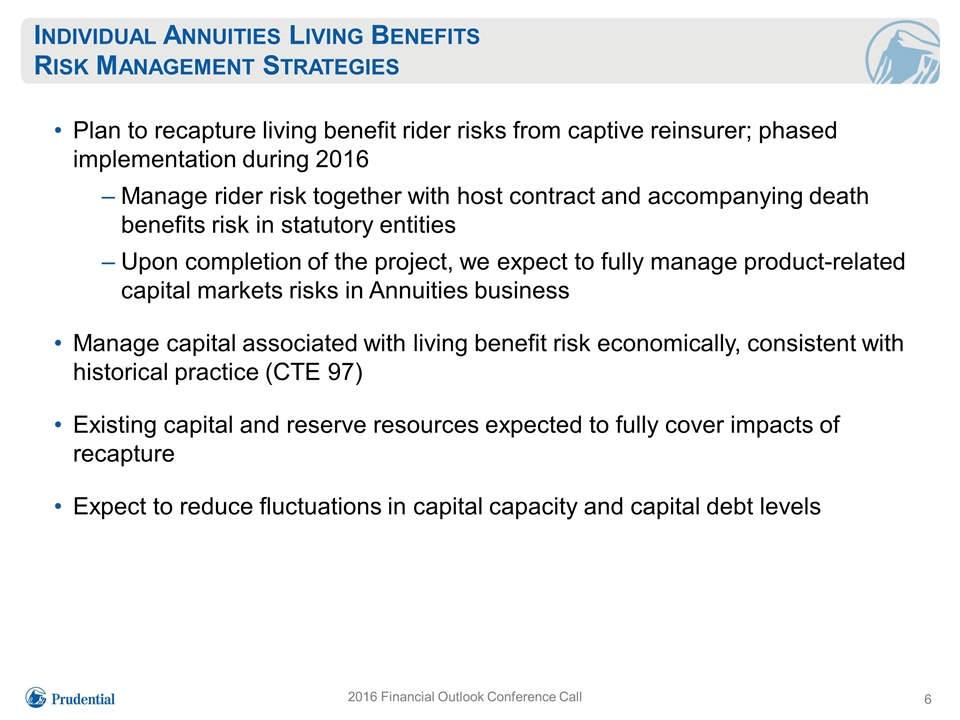

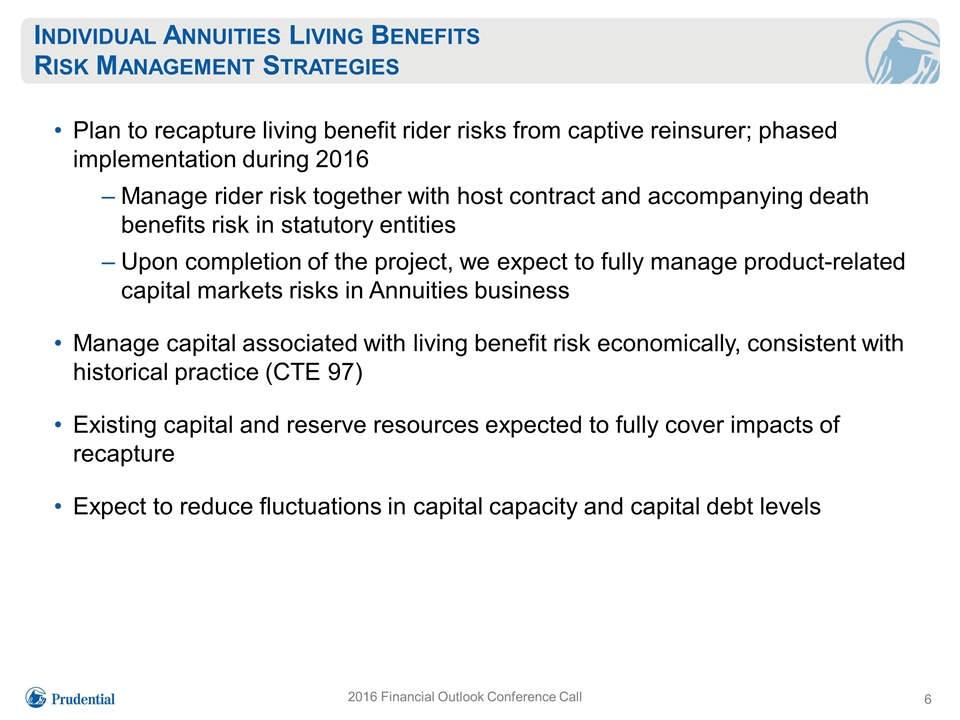

Individual Annuities Living Benefits Risk Management Strategies 2016 Financial Outlook Conference Call Plan to recapture living benefit rider risks from captive reinsurer; phased implementation during 2016 Manage rider risk together with host contract and accompanying death benefits risk in statutory entities Upon completion of the project, we expect to fully manage product-related capital markets risks in Annuities business Manage capital associated with living benefit risk economically, consistent with historical practice (CTE 97) Existing capital and reserve resources expected to fully cover impacts of recapture Expect to reduce fluctuations in capital capacity and capital debt levels

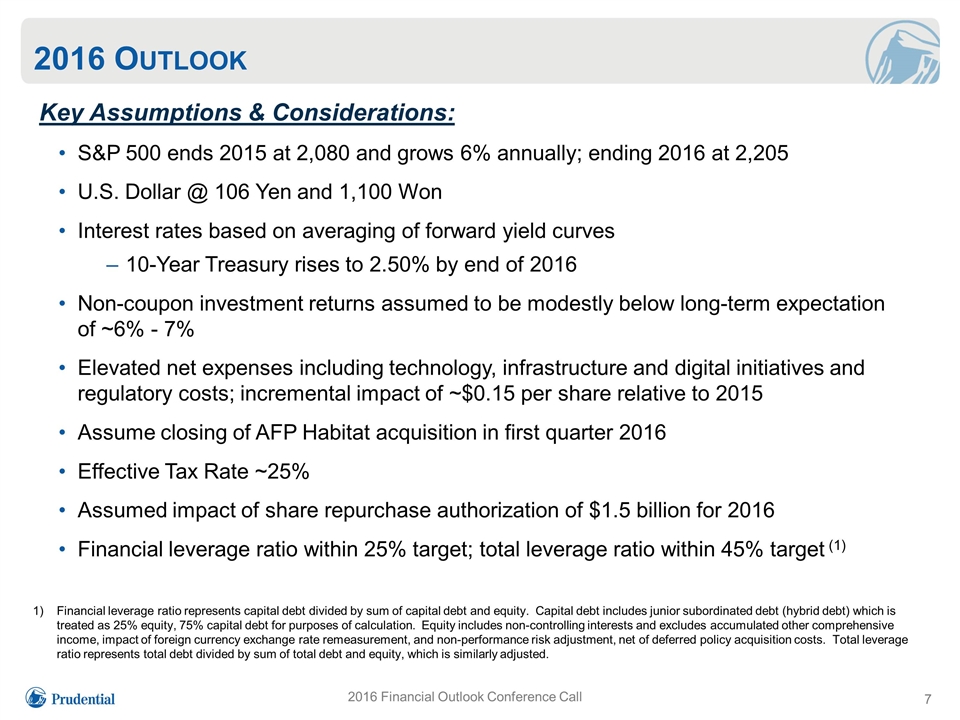

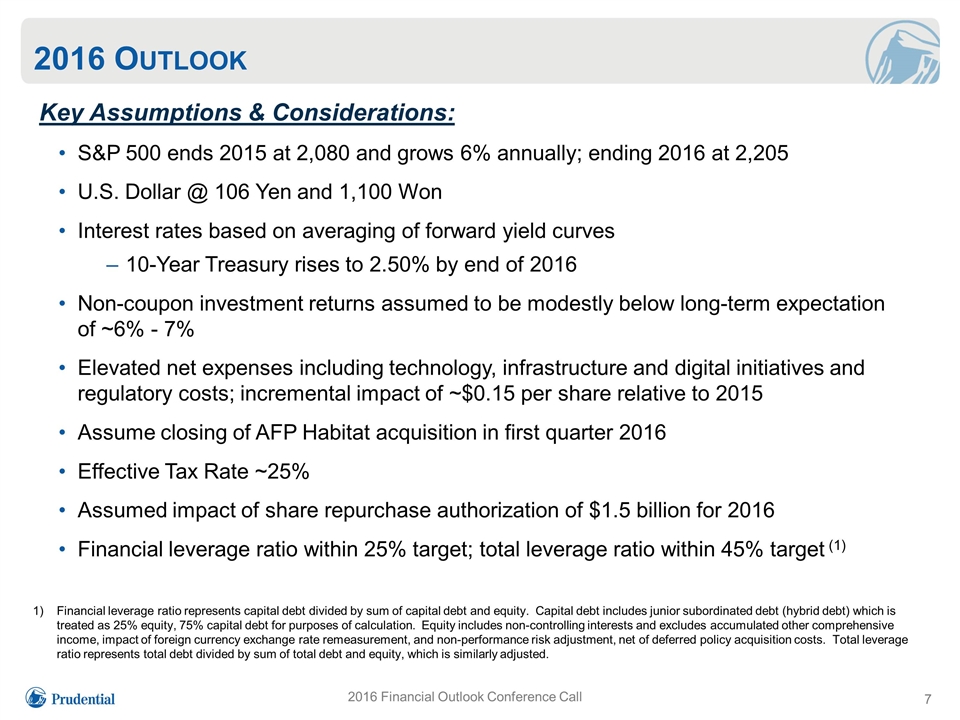

2016 Outlook 7 2016 Financial Outlook Conference Call Key Assumptions & Considerations: S&P 500 ends 2015 at 2,080 and grows 6% annually; ending 2016 at 2,205 U.S. Dollar @ 106 Yen and 1,100 Won Interest rates based on averaging of forward yield curves 10-Year Treasury rises to 2.50% by end of 2016 Non-coupon investment returns assumed to be modestly below long-term expectation of ~6% - 7% Elevated net expenses including technology, infrastructure and digital initiatives and regulatory costs; incremental impact of ~$0.15 per share relative to 2015 Assume closing of AFP Habitat acquisition in first quarter 2016 Effective Tax Rate ~25% Assumed impact of share repurchase authorization of $1.5 billion for 2016 Financial leverage ratio within 25% target; total leverage ratio within 45% target (1) Financial leverage ratio represents capital debt divided by sum of capital debt and equity. Capital debt includes junior subordinated debt (hybrid debt) which is treated as 25% equity, 75% capital debt for purposes of calculation. Equity includes non-controlling interests and excludes accumulated other comprehensive income, impact of foreign currency exchange rate remeasurement, and non-performance risk adjustment, net of deferred policy acquisition costs. Total leverage ratio represents total debt divided by sum of total debt and equity, which is similarly adjusted.

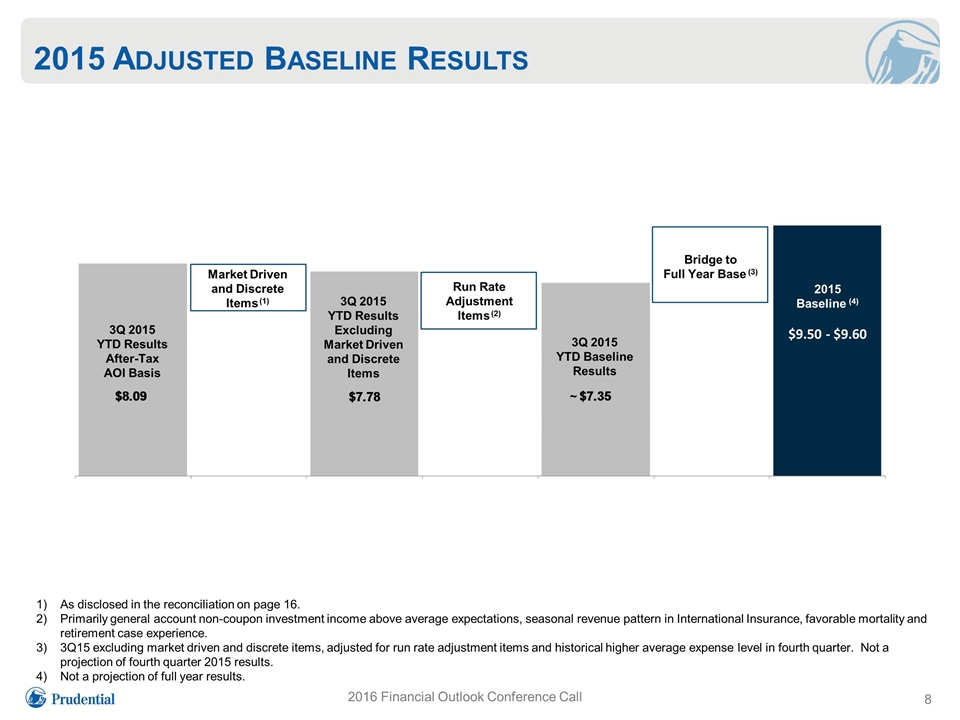

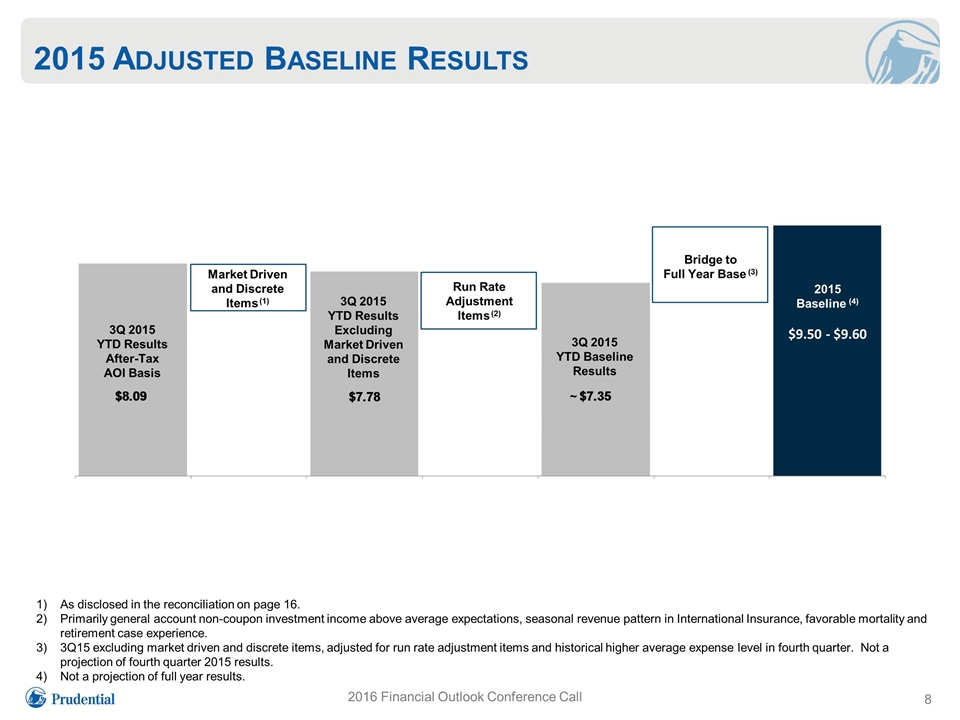

2015 Adjusted Baseline Results 8 2016 Financial Outlook Conference Call 2015 Baseline (4) $9.50 - $9.60 Market Driven and Discrete Items (1) 3Q 2015 YTD Results After-Tax AOI Basis 3Q 2015 YTD Results Excluding Market Driven and Discrete Items Run Rate Adjustment Items (2) Bridge to Full Year Base (3) 3Q 2015 YTD Baseline Results As disclosed in the reconciliation on page 16. Primarily general account non-coupon investment income above average expectations, seasonal revenue pattern in International Insurance, favorable mortality and retirement case experience. 3Q15 excluding market driven and discrete items, adjusted for run rate adjustment items and historical higher average expense level in fourth quarter. Not a projection of fourth quarter 2015 results. Not a projection of full year results. ~

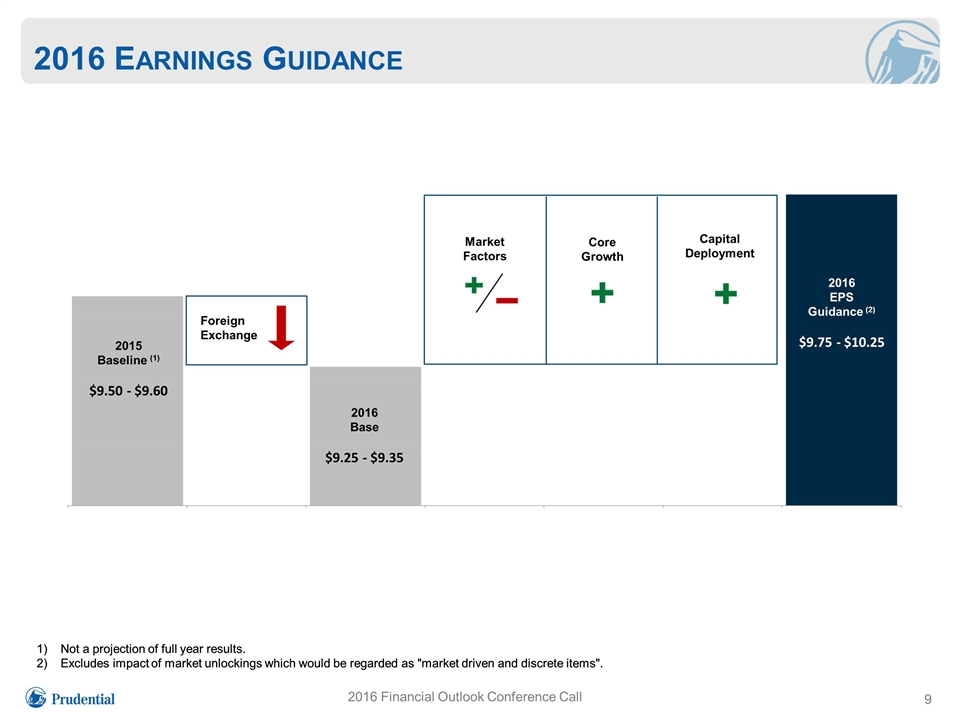

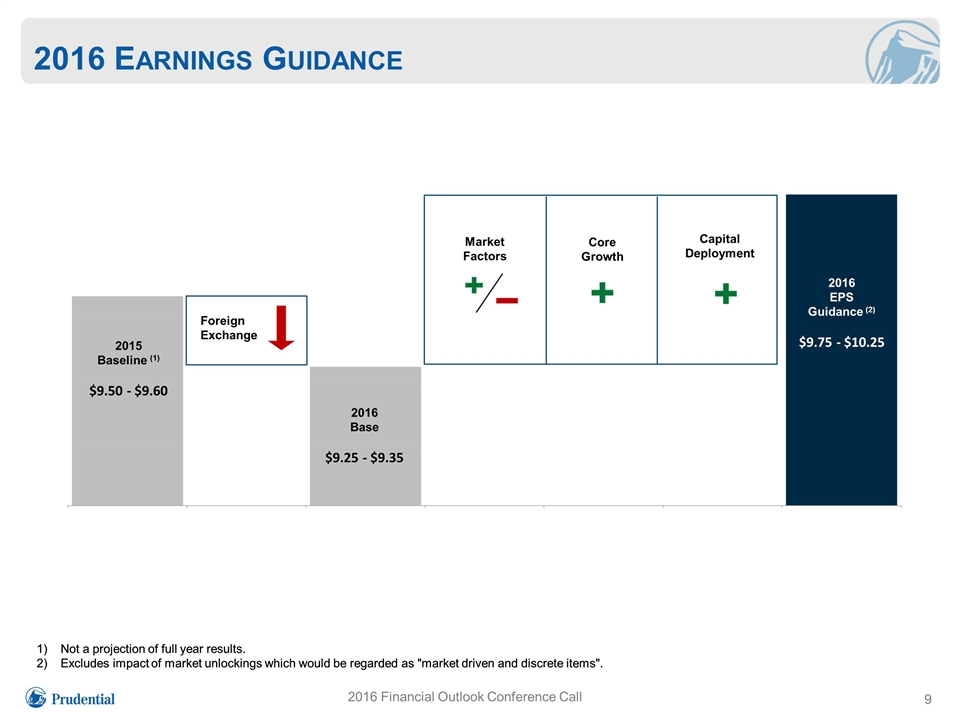

2016 Earnings Guidance 9 2016 Financial Outlook Conference Call Not a projection of full year results. Excludes impact of market unlockings which would be regarded as "market driven and discrete items". Not a projection of full year results. Excludes impact of market unlockings which would be regarded as "market driven and discrete items". 2016 EPS Guidance (2) $9.75 - $10.25 2014 9 Months Annualized Capital Deployment Core Growth Market Factors 2015 Baseline (1) $9.50 - $9.60 2016 Base $9.25 - $9.35 Foreign Exchange

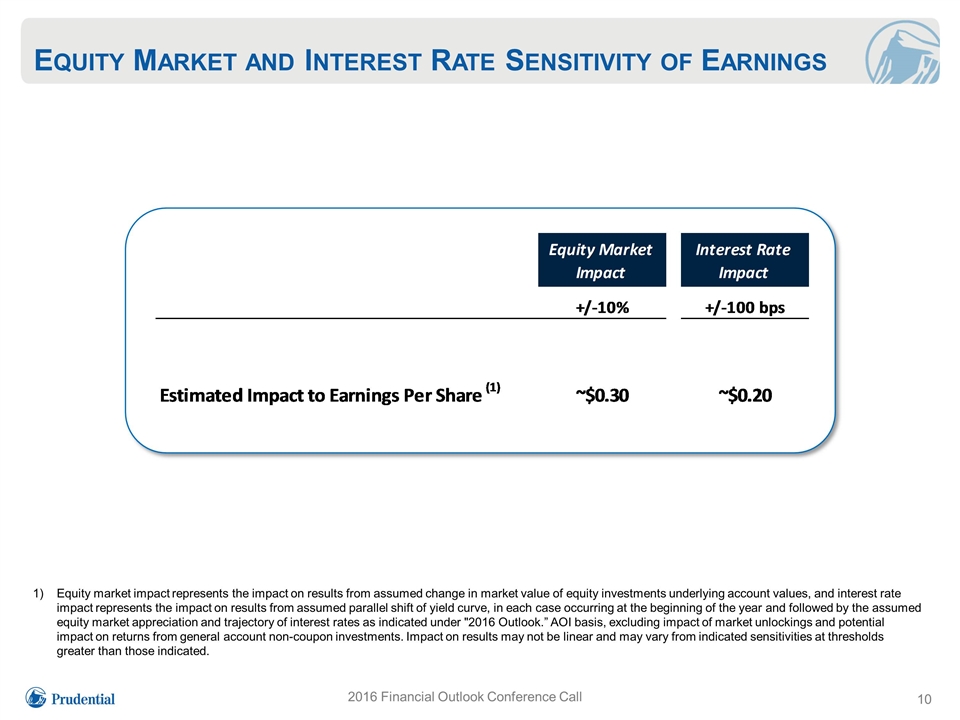

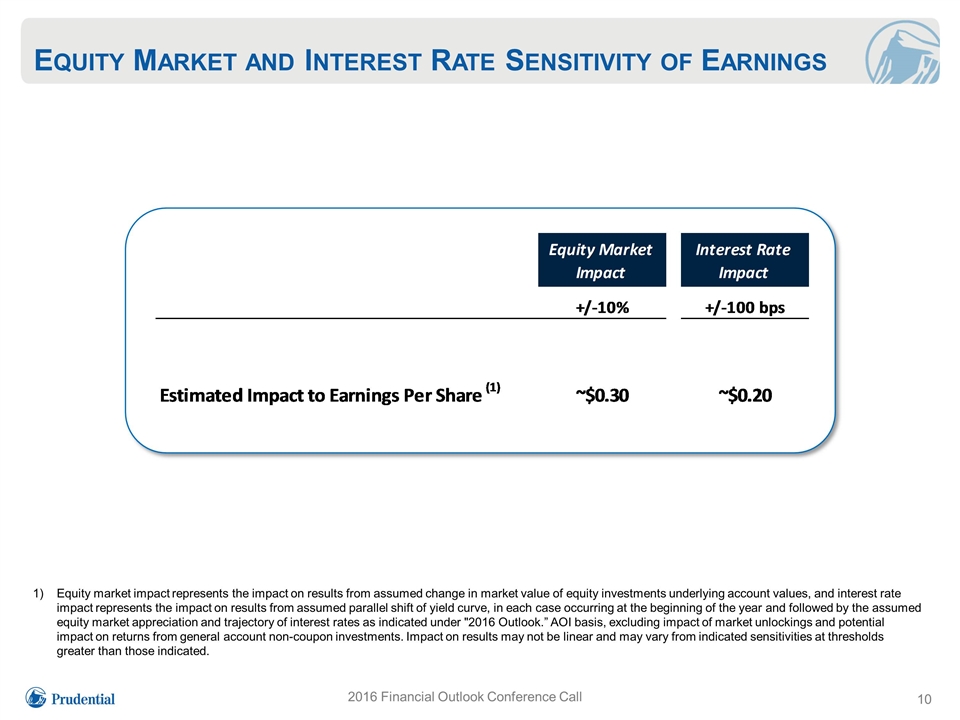

Equity Market and Interest Rate Sensitivity of Earnings 2016 Financial Outlook Conference Call Equity market impact represents the impact on results from assumed change in market value of equity investments underlying account values, and interest rate impact represents the impact on results from assumed parallel shift of yield curve, in each case occurring at the beginning of the year and followed by the assumed equity market appreciation and trajectory of interest rates as indicated under "2016 Outlook.” AOI basis, excluding impact of market unlockings and potential impact on returns from general account non-coupon investments. Impact on results may not be linear and may vary from indicated sensitivities at thresholds greater than those indicated.

Key Takeaways 11 2016 Financial Outlook Conference Call Business mix and solid fundamentals continue to produce attractive financial profile; continuing to invest in longer-term opportunities Base EPS growth despite headwinds from interest rates, currencies, etc. Top-tier ROE: long-term target of 13% to 14% over cycle Quarterly common stock dividend increased 21% in fourth quarter 2015 Share repurchase authorization increased to $1.5 billion for 2016 Greater financial flexibility resulting from: Business momentum driving solid capital generation Cash flow ~60% of after-tax AOI over time Restructuring of Variable Annuity living benefit risk management Lower volatility in capital capacity and financial leverage

Prudential Financial, inc. 2016 Financial Outlook Conference Call Presentation Questions and Answers December 10, 2015

Forward-Looking Statements Certain of the statements included in this presentation constitute forward-looking statements within the meaning of the U. S. Private Securities Litigation Reform Act of 1995. Words such as “expects,” “believes,” “anticipates,” “includes,” “plans,” “assumes,” “estimates,” “projects,” “intends,” “should,” “will,” “shall,” or variations of such words are generally part of forward-looking statements. Forward-looking statements are made based on management’s current expectations and beliefs concerning future developments and their potential effects upon Prudential Financial, Inc. and its subsidiaries. There can be no assurance that future developments affecting Prudential Financial, Inc. and its subsidiaries will be those anticipated by management. These forward-looking statements are not a guarantee of future performance and involve risks and uncertainties, and there are certain important factors that could cause actual results to differ, possibly materially, from expectations or estimates reflected in such forward-looking statements, including, among others: (1) general economic, market and political conditions, including the performance and fluctuations of fixed income, equity, real estate and other financial markets; (2) the availability and cost of additional debt or equity capital or external financing for our operations; (3) interest rate fluctuations or prolonged periods of low interest rates; (4) the degree to which we choose not to hedge risks, or the potential ineffectiveness or insufficiency of hedging or risk management strategies we do implement; (5) any inability to access our credit facilities; (6) reestimates of our reserves for future policy benefits and claims; (7) differences between actual experience regarding mortality, morbidity, persistency, utilization, interest rates or market returns and the assumptions we use in pricing our products, establishing liabilities and reserves or for other purposes; (8) changes in our assumptions related to deferred policy acquisition costs, value of business acquired or goodwill; (9) changes in assumptions for our pension and other postretirement benefit plans; (10) changes in our financial strength or credit ratings; (11) statutory reserve requirements associated with term and universal life insurance policies under Regulation XXX and Guideline AXXX; (12) investment losses, defaults and counterparty non-performance; (13) competition in our product lines and for personnel; (14) difficulties in marketing and distributing products through current or future distribution channels; (15) changes in tax law; (16) economic, political, currency and other risks relating to our international operations; (17) fluctuations in foreign currency exchange rates and foreign securities markets; (18) regulatory or legislative changes, including the Dodd-Frank Wall Street Reform and Consumer Protection Act; (19) inability to protect our intellectual property rights or claims of infringement of the intellectual property rights of others; (20) adverse determinations in litigation or regulatory matters and our exposure to contingent liabilities, including in connection with our divestiture or winding down of businesses; (21) domestic or international military actions, natural or man-made disasters including terrorist activities or pandemic disease, or other events resulting in catastrophic loss of life; (22) ineffectiveness of risk management policies and procedures in identifying, monitoring and managing risks; (23) our ability to execute, and the effects of, acquisitions, divestitures and restructurings, including possible difficulties in integrating and realizing projected results of these transactions; (24) interruption in telecommunication, information technology or other operational systems or failure to maintain the security, confidentiality or privacy of sensitive data on such systems; (25) changes in statutory or U.S. GAAP accounting principles, practices or policies; and (26) Prudential Financial, Inc.’s primary reliance, as a holding company, on dividends or distributions from its subsidiaries to meet debt payment obligations and the ability of the subsidiaries to pay such dividends or distributions in light of our ratings objectives and/or applicable regulatory restrictions. Prudential Financial, Inc. does not intend, and is under no obligation, to update any particular forward-looking statement included in this presentation. See “Risk Factors” included in Prudential Financial, Inc.’s Annual Report on Form 10-K for discussion of certain risks relating to our businesses and investment in our securities. ______________________________________________________________________________ Prudential Financial, Inc. of the United States is not affiliated with Prudential PLC which is headquartered in the United Kingdom. 2016 Financial Outlook Conference Call

Non-GAAP Measure This presentation includes references to “adjusted operating income” and return on equity, which is based on adjusted operating income. Adjusted operating income is a non-GAAP measure of performance. Adjusted operating income excludes “Realized investment gains (losses), net,” as adjusted, and related charges and adjustments. A significant element of realized investment gains and losses are impairments and credit-related and interest rate-related gains and losses. Impairments and losses from sales of credit-impaired securities, the timing of which depends largely on market credit cycles, can vary considerably across periods. The timing of other sales that would result in gains or losses, such as interest rate-related gains or losses, is largely subject to our discretion and influenced by market opportunities as well as our tax and capital profile. Realized investment gains (losses) within certain of our businesses for which such gains (losses) are a principal source of earnings, and those associated with terminating hedges of foreign currency earnings and current period yield adjustments are included in adjusted operating income. Adjusted operating income excludes realized investment gains and losses from products that contain embedded derivatives, and from associated derivative portfolios that are part of a hedging program related to the risk of those products. Adjusted operating income also excludes gains and losses from changes in value of certain assets and liabilities relating to foreign currency exchange movements that have been economically hedged or considered part of our capital funding strategies for our international subsidiaries, as well as gains and losses on certain investments that are classified as other trading account assets. Adjusted operating income also excludes investment gains and losses on trading account assets supporting insurance liabilities and changes in experience-rated contractholder liabilities due to asset value changes, because these recorded changes in asset and liability values are expected to ultimately accrue to contractholders. Trends in the underlying profitability of our businesses can be more clearly identified without the fluctuating effects of these transactions. In addition, adjusted operating income excludes the results of divested businesses, which are not relevant to our ongoing operations. Discontinued operations, which are presented as a separate component of net income under GAAP, are also excluded from adjusted operating income. We believe that the presentation of adjusted operating income as we measure it for management purposes enhances the understanding of the results of operations by highlighting the results from ongoing operations and the underlying profitability of our businesses. However, adjusted operating income is not a substitute for income determined in accordance with GAAP, and the adjustments made to derive adjusted operating income are important to an understanding of our overall results of operations. For additional information about adjusted operating income and the comparable GAAP measure, including a reconciliation between the two, please refer to our Annual Report on Form 10-K for the year ended December 31, 2014, and subsequent Quarterly Reports on Form 10-Q. Additional historical information relating to our financial performance is located on our Web site at www.investor.prudential.com. 2016 Financial Outlook Conference Call

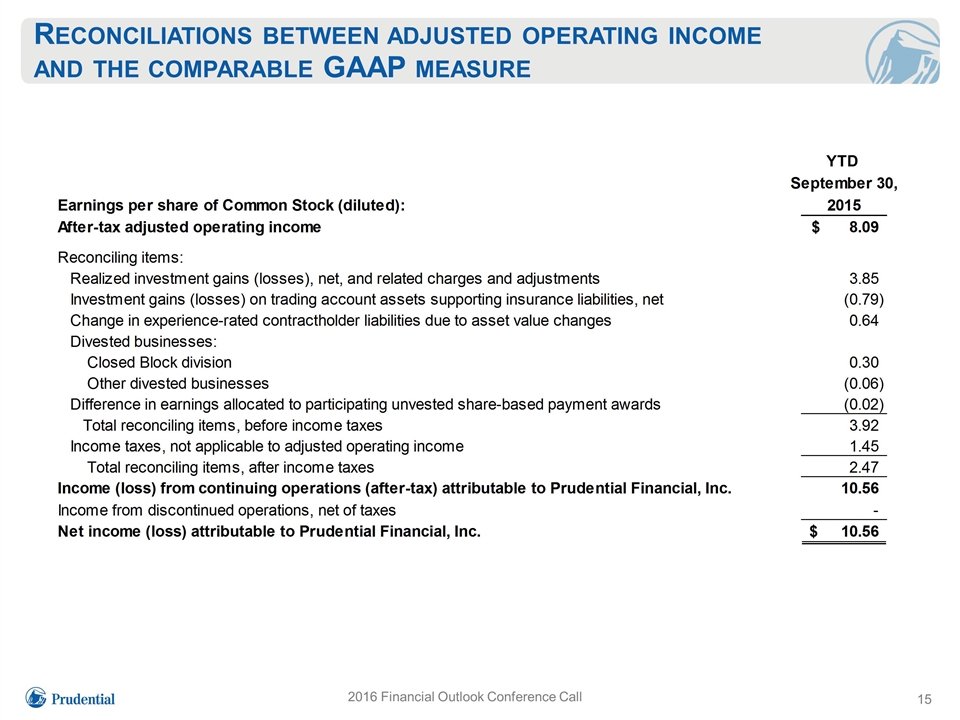

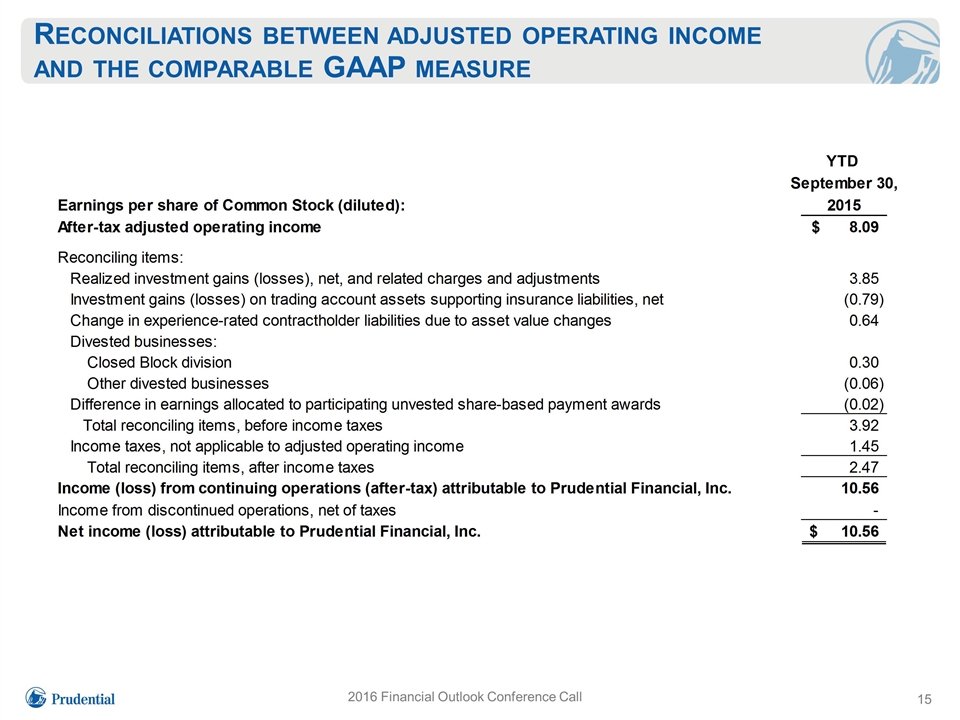

Reconciliations between adjusted operating income and the comparable GAAP measure 2016 Financial Outlook Conference Call

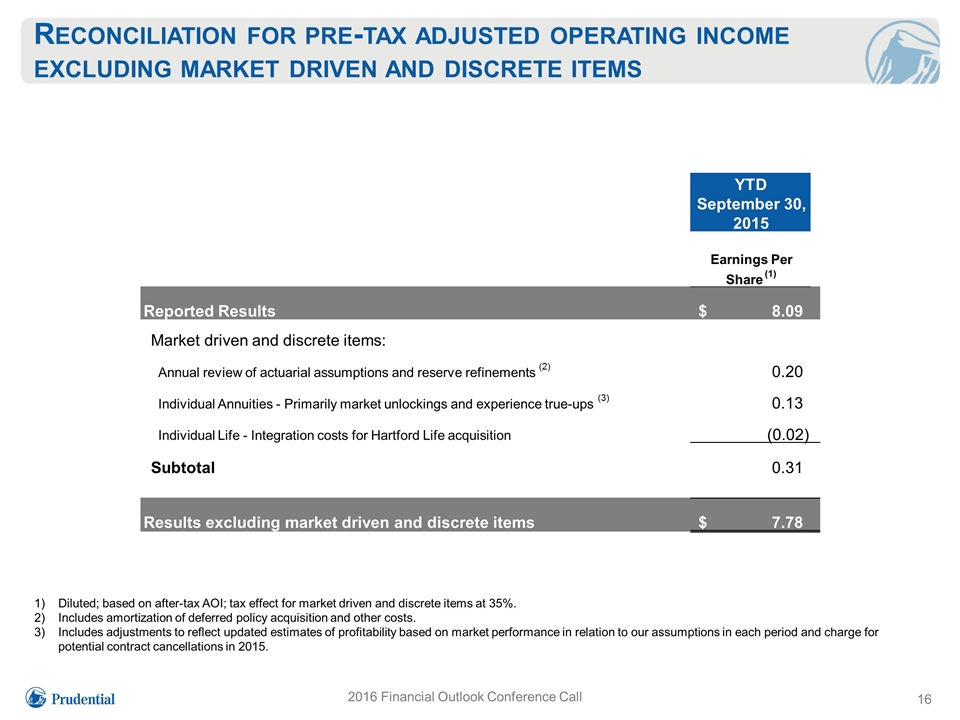

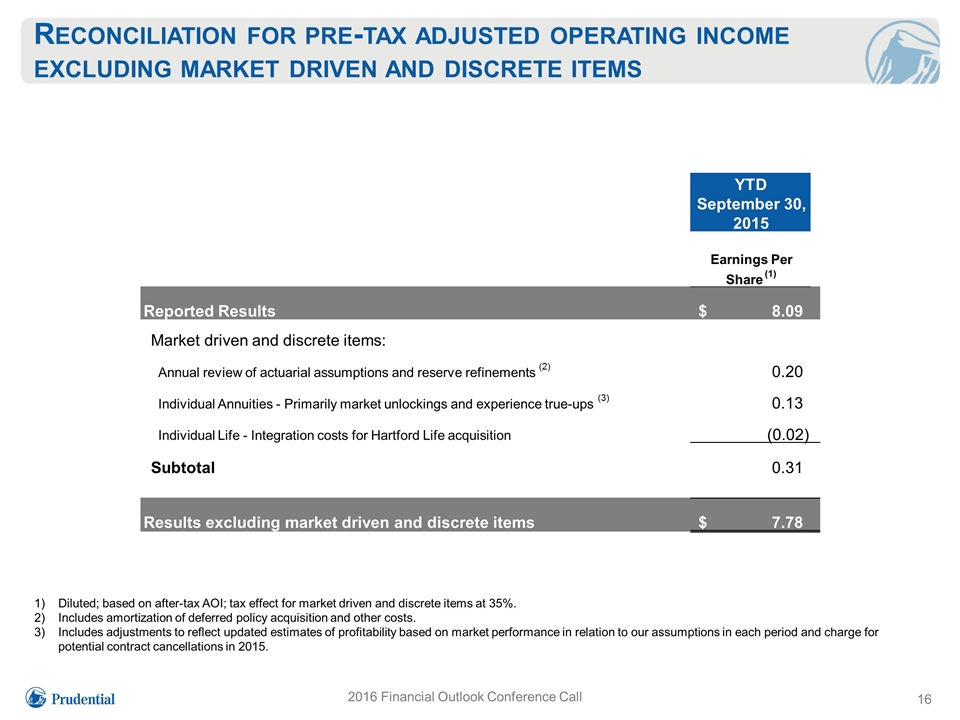

Reconciliation for pre-tax adjusted operating income excluding market driven and discrete items Diluted; based on after-tax AOI; tax effect for market driven and discrete items at 35%. Includes amortization of deferred policy acquisition and other costs. Includes adjustments to reflect updated estimates of profitability based on market performance in relation to our assumptions in each period and charge for potential contract cancellations in 2015. 2016 Financial Outlook Conference Call Earnings Per Share (1) Reported Results 8.09 $ Market driven and discrete items: Annual review of actuarial assumptions and reserve refinements (2) 0.20 Individual Annuities - Primarily market unlockings and experience true-ups (3) 0.13 Individual Life - Integration costs for Hartford Life acquisition (0.02) Subtotal 0.31 Results excluding market driven and discrete items 7.78 $ YTD September 30, 2015