Prudential Financial, Inc. 2018 Tokyo Investor Day Exhibit 99.1

Prudential Financial, Inc. 2018 Tokyo Investor Day Darin Arita Senior Vice President Investor Relations

Forward-Looking Statements and Non-GAAP Measure Tokyo Investor Day 9.27.2018 Certain of the statements included in this presentation, including those related to our strategy, prospects, and returns constitute forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Words such as “expects,” “believes,” “anticipates,” “includes,” “plans,” “assumes,” “estimates,” “projects,” “intends,” “should,” “will,” “shall,” or variations of such words are generally part of forward-looking statements. Forward-looking statements are made based on management’s current expectations and beliefs concerning future developments and their potential effects upon Prudential Financial, Inc. and its subsidiaries. Prudential Financial, Inc.’s actual results may differ, possibly materially, from expectations or estimates reflected in such forward-looking statements. Certain important factors that could cause actual results to differ, possibly materially, from expectations or estimates reflected in such forward-looking statements can be found in the “Risk Factors” and “Forward-Looking Statements” sections included in Prudential Financial, Inc.’s Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q. Prudential Financial, Inc. does not undertake to update any particular forward-looking statement included in this presentation. Financial projections in this presentation consist of estimates. These estimates are forward-looking statements and may change, possibly materially, due to, among other things, changes in the composition of our business, customer behavior that differs from our expectations, market conditions, and actions Prudential Financial, Inc. may take. This presentation may also include references to adjusted operating income, adjusted book value and adjusted operating return on equity, which is based on adjusted operating income and adjusted book value. Consolidated adjusted operating income and adjusted book value are not calculated based on accounting principles generally accepted in the United States of America (GAAP). For additional information about adjusted operating income, adjusted book value and adjusted operating return on equity and the comparable GAAP measures, including reconciliations between the comparable measures, please refer to our quarterly results news releases, which are available on our Web site at www.investor.prudential.com. Reconciliations of adjusted operating income to the comparable GAAP measure are also included as part of this presentation. ____________________________________________________________________________ Prudential Financial, Inc. of the United States is not affiliated with Prudential plc which is headquartered in the United Kingdom. 1

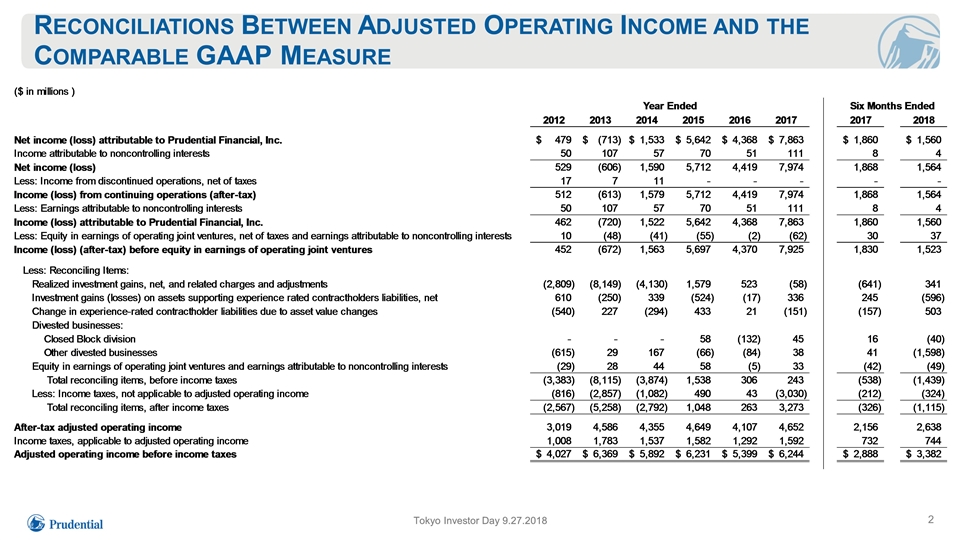

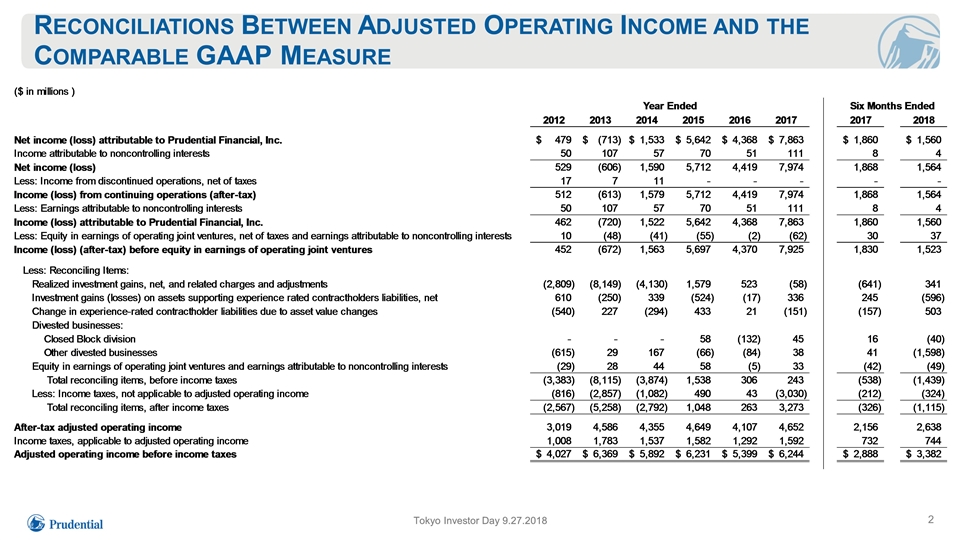

Reconciliations Between Adjusted Operating Income and the Comparable GAAP Measure Tokyo Investor Day 9.27.2018 2

PGIM Japan Disclosures © 2018 Prudential Financial, Inc. (PFI) and its related entities. QMA, Quantitative Management Associates, Jennison Associates, Jennison, PGIM Real Estate, the Prudential logo, and the Rock symbol are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide. PGIM, Inc. is the principal asset management business of PFI and is an investment advisor registered with the US Securities and Exchange Commission (SEC) in December 1984. PGIM, Inc. is a wholly-owned subsidiary of Prudential Financial, Inc. PGIM is a trading name of PGIM, Inc. and its global subsidiaries and affiliates. Prudential Financial, Inc. of the United States is not affiliated with Prudential plc, which is headquartered in the United Kingdom. In Japan, investment management services are made available by PGIM Japan, Co. Ltd., ("PGIM Japan"), a registered Financial Instruments Business Operator with the Financial Services Agency of Japan. The PGIM logo and the Rock design are service marks of PFI and its related entities, registered in many jurisdictions worldwide. These materials represent the views, opinions and recommendations of the author(s) regarding the economic conditions, asset classes, securities, issuers, or financial instruments referenced herein. Distribution of this information to any person other than the person to whom it was originally delivered and to such person’s advisers is unauthorized, and any reproduction of these materials, in whole or in part, or the divulgence of any of the contents hereof, without prior consent of PGIM, is prohibited. Certain information contained herein has been obtained from sources that PGIM believes to be reliable as of the date presented; however, PGIM cannot guarantee the accuracy of such information, assure its completeness, or warrant such information will not be changed. The information contained herein is current as of the date of issuance (or such earlier date as referenced herein) and is subject to change without notice. PGIM has no obligation to update any or all of such information; nor do we make any express or implied warranties or representations as to the completeness or accuracy or accept responsibility for errors. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any security or other financial instrument or any investment management services and should not be used as the basis for any investment decision. Past performance is not a guarantee or a reliable indicator of future results. No liability whatsoever is accepted for any loss (whether direct, indirect, or consequential) that may arise from any use of the information contained in or derived from this report. These materials do not take into account individual client circumstances, objectives, or needs, and are not intended as recommendations of particular securities, financial instruments, or strategies to particular clients or prospects. No determination has been made regarding the suitability of any securities, financial instruments, or strategies for particular clients or prospects. For any securities or financial instruments mentioned herein, the recipient(s) of this report must make its own independent decisions. Distribution of this information to any person other than the person to whom it was originally delivered is unauthorized and any reproduction of these materials, in whole and in part, without prior consent of PGIM is prohibited. These materials are for informational or educational purposes only. The information is not intended as investment, legal, accounting, and/or tax advice and is not a recommendation about managing or investing assets. In providing these materials, PGIM is not acting as your fiduciary. 3

Notes to Disclosure in Japan Tokyo Investor Day 9.27.2018 Registered Corporate Name: PGIM Japan Co., Ltd. Location: The Prudential Tower, 2-13-10, Nagatacho, Chiyoda-ku, Tokyo Chief Executive Officer: Yasuhisa Nitta Date of Establishment: April 19, 2006 Major Shareholders: Prudential International Investments Corporation (100%) Paid in Capital: JPY 219 million Primary Businesses:① Investment management business ② Investment advisory business ③ Type II Financial Instruments business Registration #:Financial Instruments Business Operator registered with Kanto Local Bureau (Registration Number; 392) Association MembershipThe Investment Trust Association, Japan Japan Investment Advisers Association 4

International Insurance Overview Charles F. Lowrey Executive Vice President and Chief Operating Officer International Businesses

Key Messages Differentiated business model with superior execution Investing strategically to enhance long-term prospects Sustained growth with strong returns and steady capital generation Tokyo Investor Day 9.27.2018 2

Consistent International Strategy a Key to Success Product Development to Meet Customer Needs Building Digital, Mobile, and Data Analytics Capabilities Complementing Organic Growth with M&A Superior Execution Distribution Expansion in Proprietary and Third-Party Channels Tokyo Investor Day 9.27.2018 3

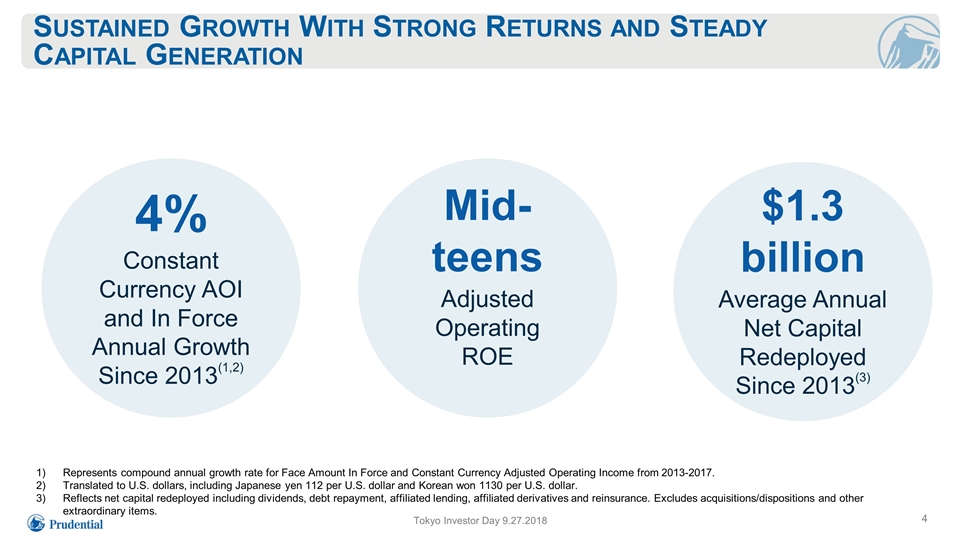

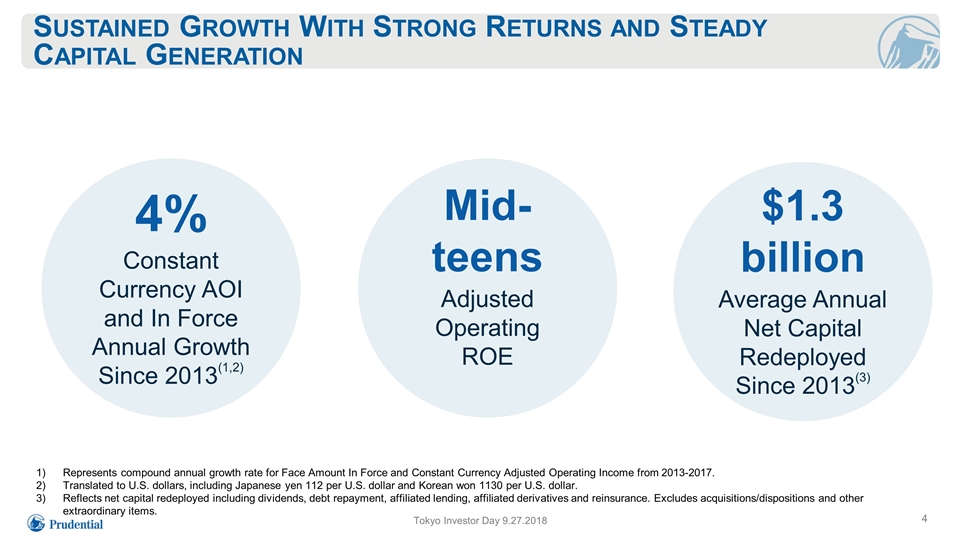

Tokyo Investor Day 9.27.2018 Sustained Growth With Strong Returns and Steady Capital Generation Represents compound annual growth rate for Face Amount In Force and Constant Currency Adjusted Operating Income from 2013-2017. Translated to U.S. dollars, including Japanese yen 112 per U.S. dollar and Korean won 1130 per U.S. dollar. Reflects net capital redeployed including dividends, debt repayment, affiliated lending, affiliated derivatives and reinsurance. Excludes acquisitions/dispositions and other extraordinary items. 4% Constant Currency AOI and In Force Annual Growth Since 2013(1,2) $1.3 billion Average Annual Net Capital Redeployed Since 2013(3) Mid-teens Adjusted Operating ROE 4

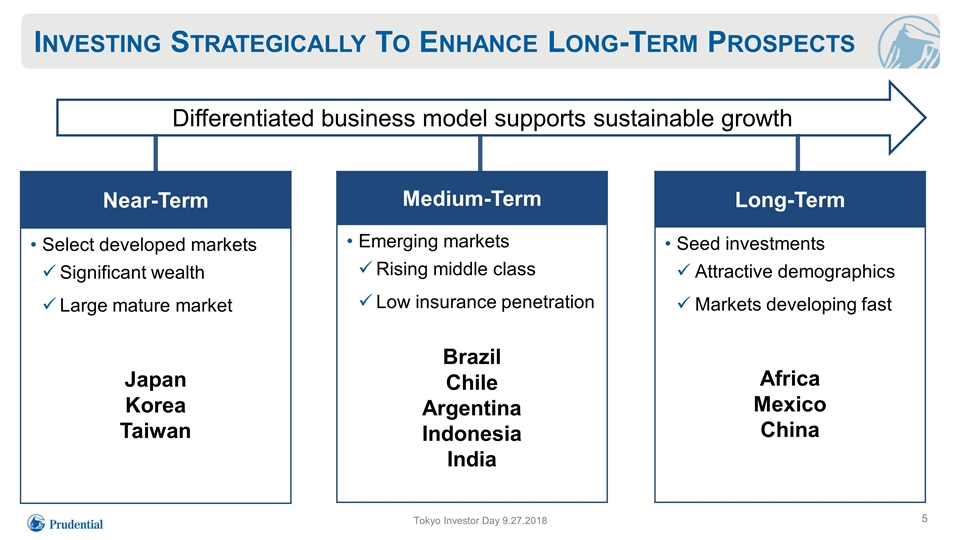

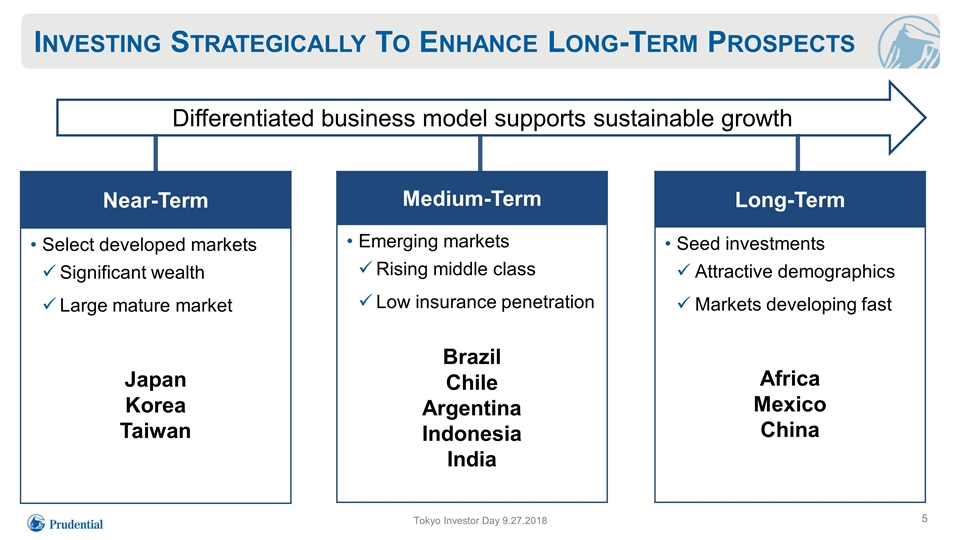

Investing Strategically To Enhance Long-Term Prospects Near-Term Select developed markets Significant wealth Large mature market Japan Korea Taiwan Medium-Term Emerging markets Rising middle class Low insurance penetration Brazil Chile Argentina Indonesia India Long-Term Seed investments Attractive demographics Markets developing fast Africa Mexico China Tokyo Investor Day 9.27.2018 Differentiated business model supports sustainable growth 5

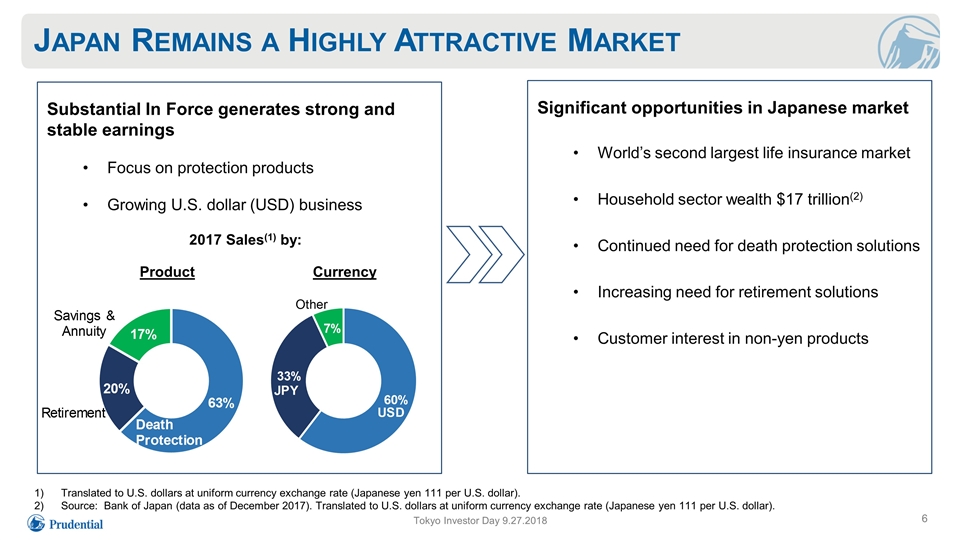

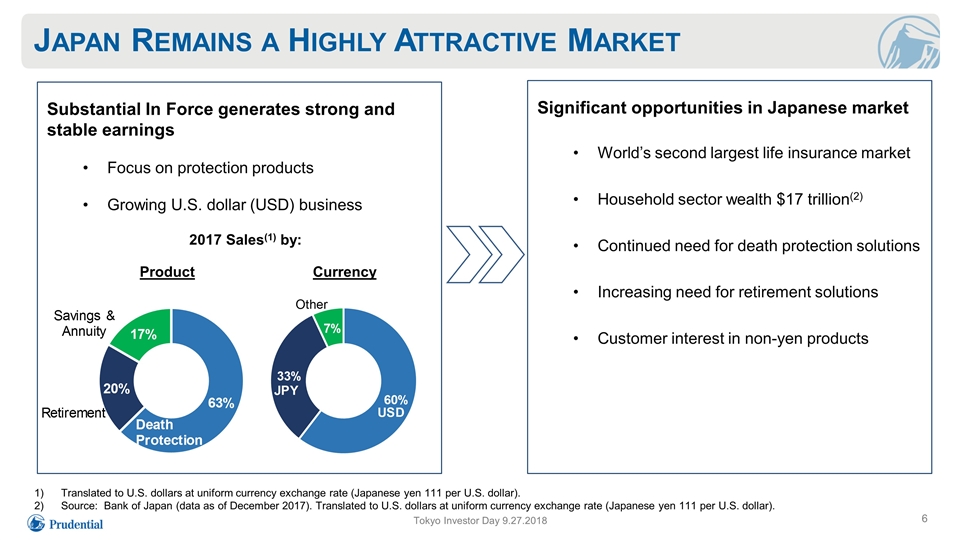

Japan Remains a Highly Attractive Market Tokyo Investor Day 9.27.2018 Translated to U.S. dollars at uniform currency exchange rate (Japanese yen 111 per U.S. dollar). Source: Bank of Japan (data as of December 2017). Translated to U.S. dollars at uniform currency exchange rate (Japanese yen 111 per U.S. dollar). Substantial In Force generates strong and stable earnings Focus on protection products Growing U.S. dollar (USD) business 2017 Sales(1) by: Significant opportunities in Japanese market World’s second largest life insurance market Household sector wealth $17 trillion(2) Continued need for death protection solutions Increasing need for retirement solutions Customer interest in non-yen products Product Currency 6

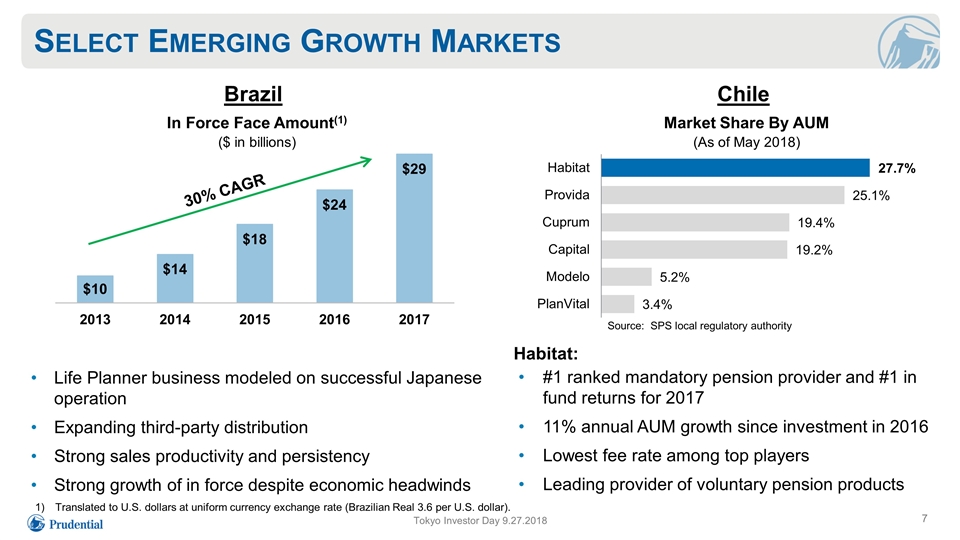

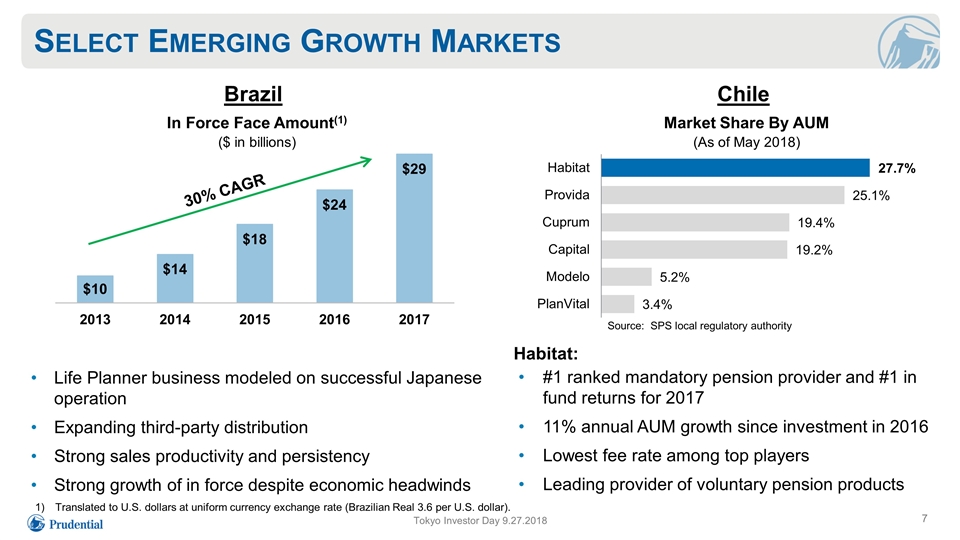

Select Emerging Growth Markets Market Share By AUM (As of May 2018) Source: SPS local regulatory authority Chile Brazil Life Planner business modeled on successful Japanese operation Expanding third-party distribution Strong sales productivity and persistency Strong growth of in force despite economic headwinds #1 ranked mandatory pension provider and #1 in fund returns for 2017 11% annual AUM growth since investment in 2016 Lowest fee rate among top players Leading provider of voluntary pension products Tokyo Investor Day 9.27.2018 30% CAGR In Force Face Amount(1) ($ in billions) Habitat: Translated to U.S. dollars at uniform currency exchange rate (Brazilian Real 3.6 per U.S. dollar). 7

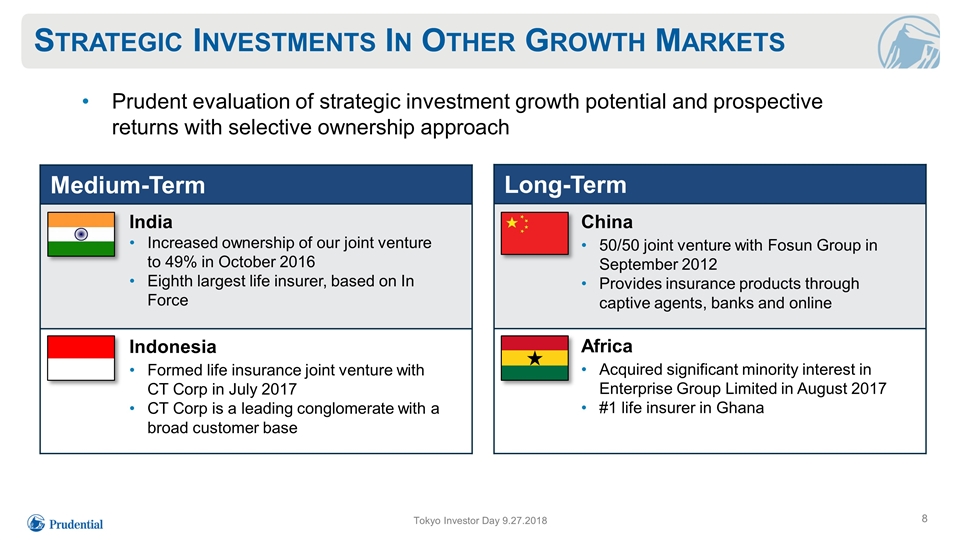

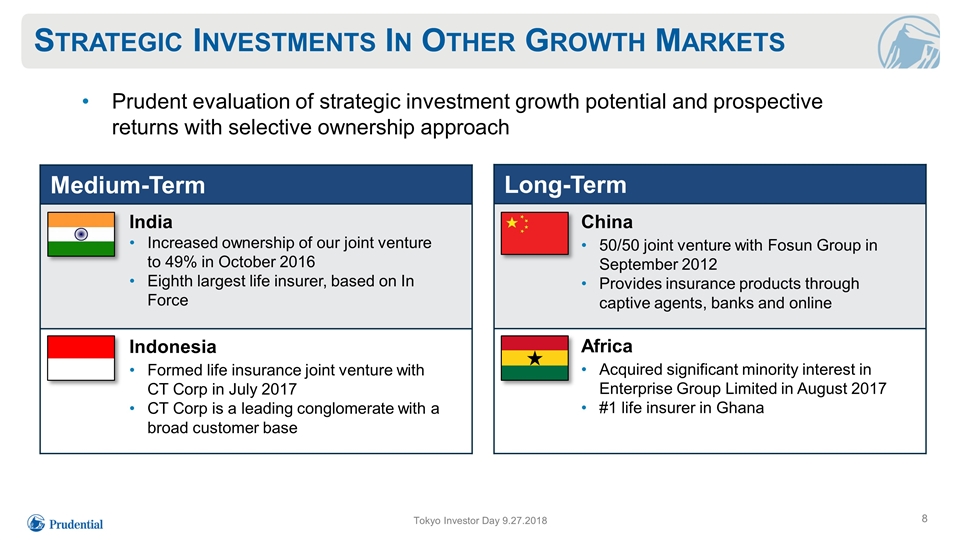

Prudent evaluation of strategic investment growth potential and prospective returns with selective ownership approach Long-Term Medium-Term Africa Acquired significant minority interest in Enterprise Group Limited in August 2017 #1 life insurer in Ghana China 50/50 joint venture with Fosun Group in September 2012 Provides insurance products through captive agents, banks and online Indonesia Formed life insurance joint venture with CT Corp in July 2017 CT Corp is a leading conglomerate with a broad customer base India Increased ownership of our joint venture to 49% in October 2016 Eighth largest life insurer, based on In Force Strategic Investments In Other Growth Markets Tokyo Investor Day 9.27.2018 8

Key Messages Differentiated business model with superior execution Investing strategically to enhance long-term prospects Sustained growth with strong returns and steady capital generation Tokyo Investor Day 9.27.2018 9

Japanese Businesses Overview Mitsuo Kurashige Chairman and Chief Executive Officer Prudential Holdings of Japan, Inc.

Key Messages 2 Tokyo Investor Day 9.27.2018 Customer-focused, differentiated distribution models result in attractive returns Needs-based selling and quality people drive leading market position Adapting to market changes through multiple growth opportunities

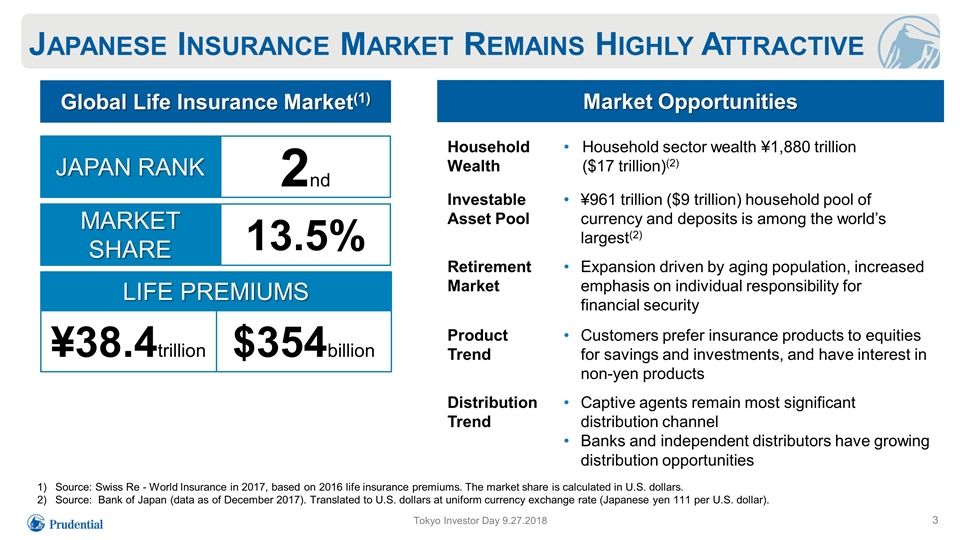

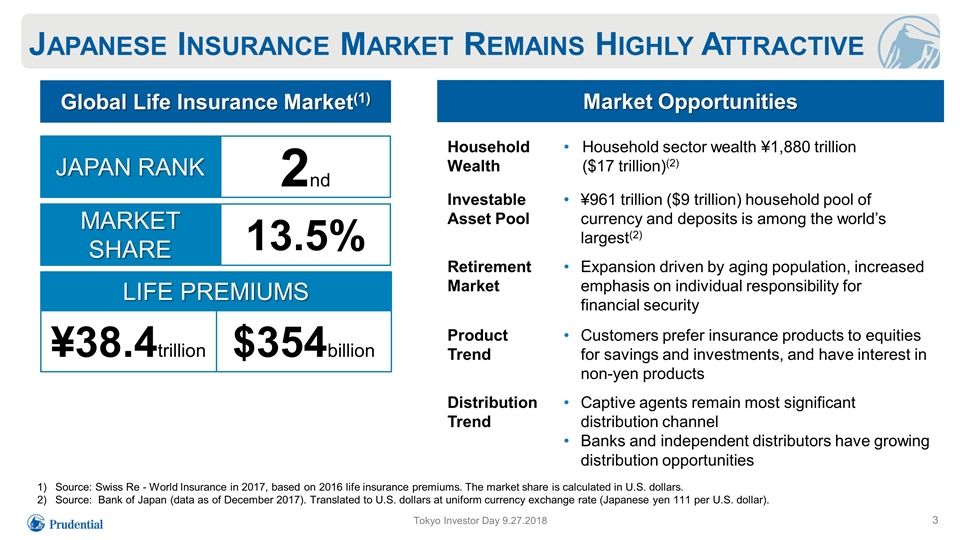

Japanese Insurance Market Remains Highly Attractive Household Wealth Household sector wealth ¥1,880 trillion ($17 trillion)(2) Investable Asset Pool ¥961 trillion ($9 trillion) household pool of currency and deposits is among the world’s largest(2) Retirement Market Expansion driven by aging population, increased emphasis on individual responsibility for financial security Product Trend Customers prefer insurance products to equities for savings and investments, and have interest in non-yen products Distribution Trend Captive agents remain most significant distribution channel Banks and independent distributors have growing distribution opportunities Source: Swiss Re - World Insurance in 2017, based on 2016 life insurance premiums. The market share is calculated in U.S. dollars. Source: Bank of Japan (data as of December 2017). Translated to U.S. dollars at uniform currency exchange rate (Japanese yen 111 per U.S. dollar). Tokyo Investor Day 9.27.2018 $354billion MARKET SHARE 13.5% LIFE PREMIUMS ¥38.4trillion Global Life Insurance Market(1) JAPAN RANK 2nd Market Opportunities 3

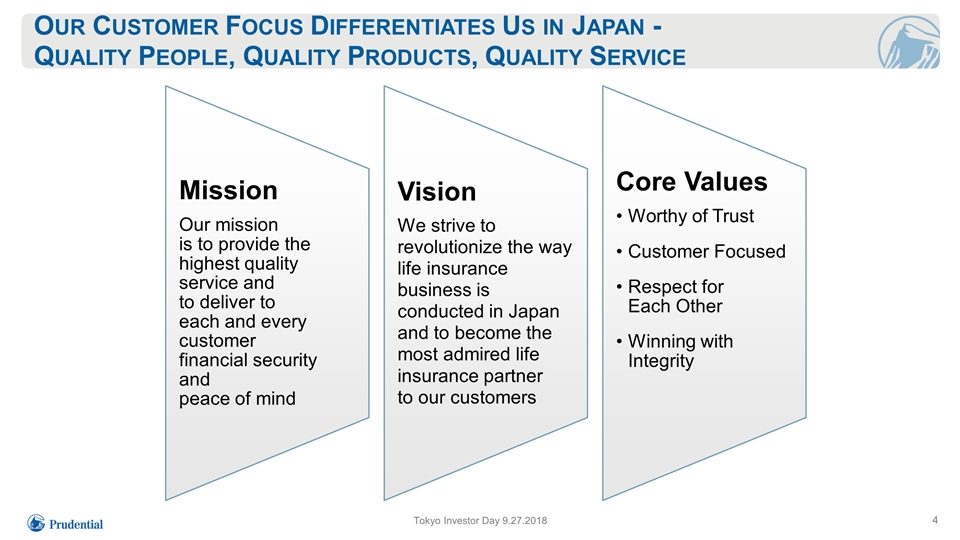

Our Customer Focus Differentiates Us in Japan - Quality People, Quality Products, Quality Service Tokyo Investor Day 9.27.2018 4 Mission Our mission is to provide the highest quality service and to deliver to each and every customer financial security and peace of mind Vision We strive to revolutionize the way life insurance business is conducted in Japan and to become the most admired life insurance partner to our customers Core Values Worthy of Trust Customer Focused Respect for Each Other Winning with Integrity

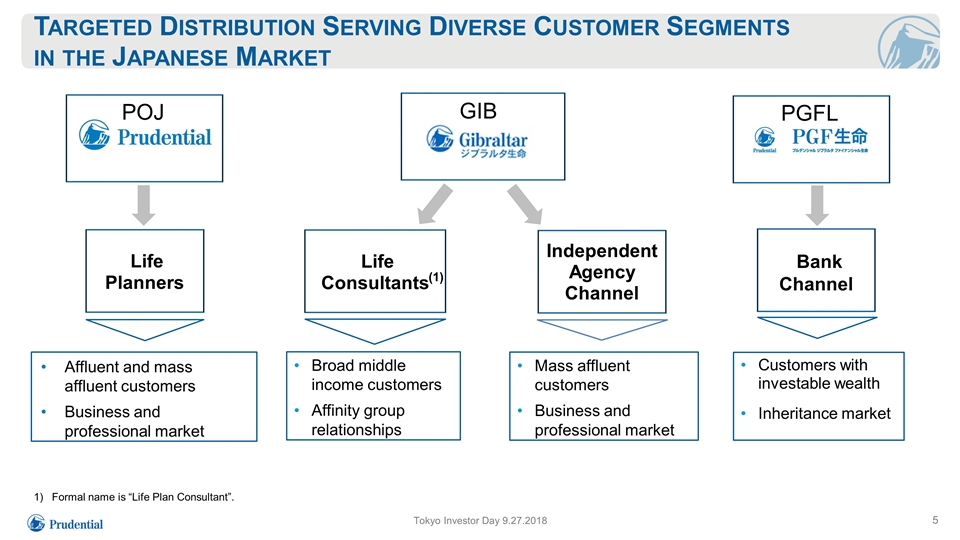

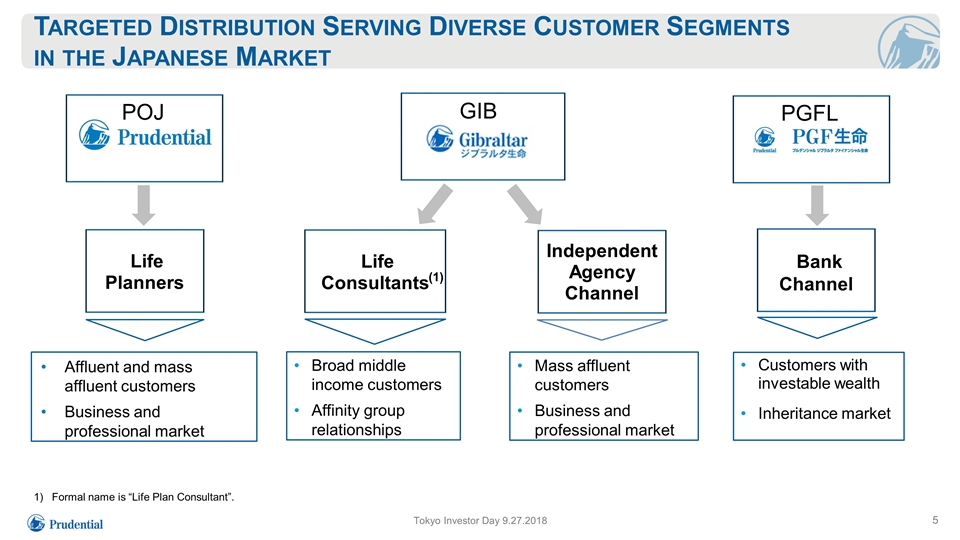

Targeted Distribution Serving Diverse Customer Segments in the Japanese Market Affluent and mass affluent customers Business and professional market Broad middle income customers Affinity group relationships Life Planners Life Consultants Bank Channel Independent Agency Channel Customers with investable wealth Inheritance market POJ GIB PGFL (1) Formal name is “Life Plan Consultant”. Mass affluent customers Business and professional market Tokyo Investor Day 9.27.2018 5

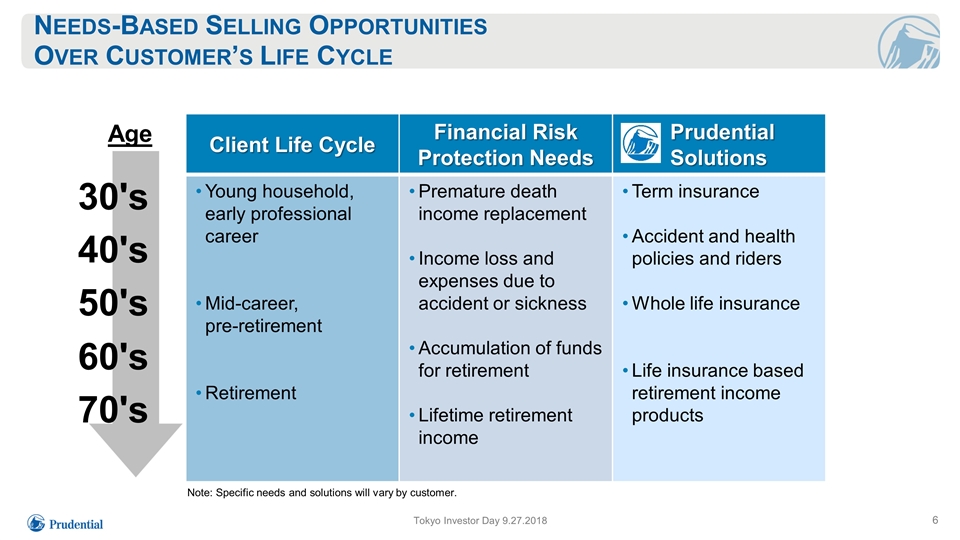

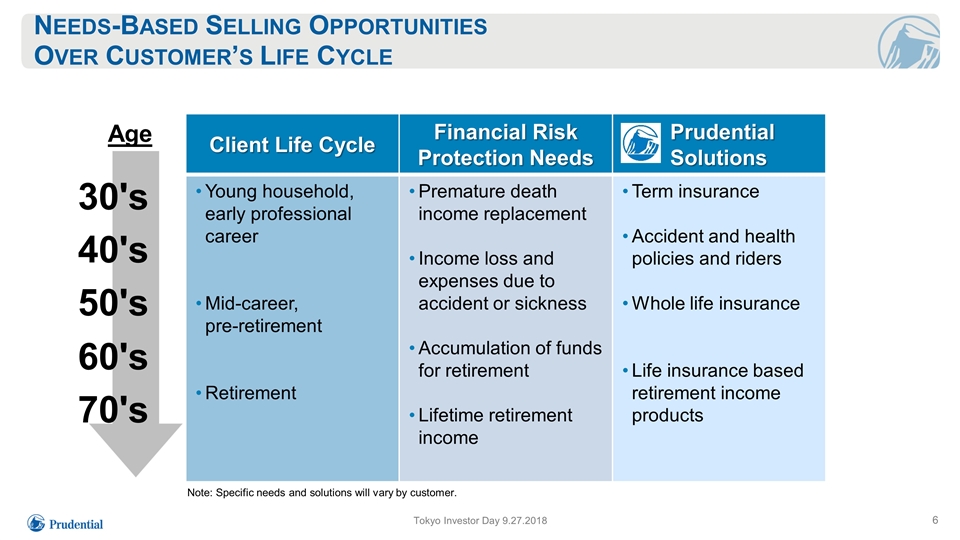

Needs-Based Selling Opportunities Over Customer’s Life Cycle Note: Specific needs and solutions will vary by customer. Tokyo Investor Day 9.27.2018 Age 30's 40's 50's 60's 70's Client Life Cycle Financial Risk Protection Needs Prudential Solutions Young household, early professional career Mid-career, pre-retirement Retirement Premature death income replacement Income loss and expenses due to accident or sickness Accumulation of funds for retirement Lifetime retirement income Term insurance Accident and health policies and riders Whole life insurance Life insurance based retirement income products 6

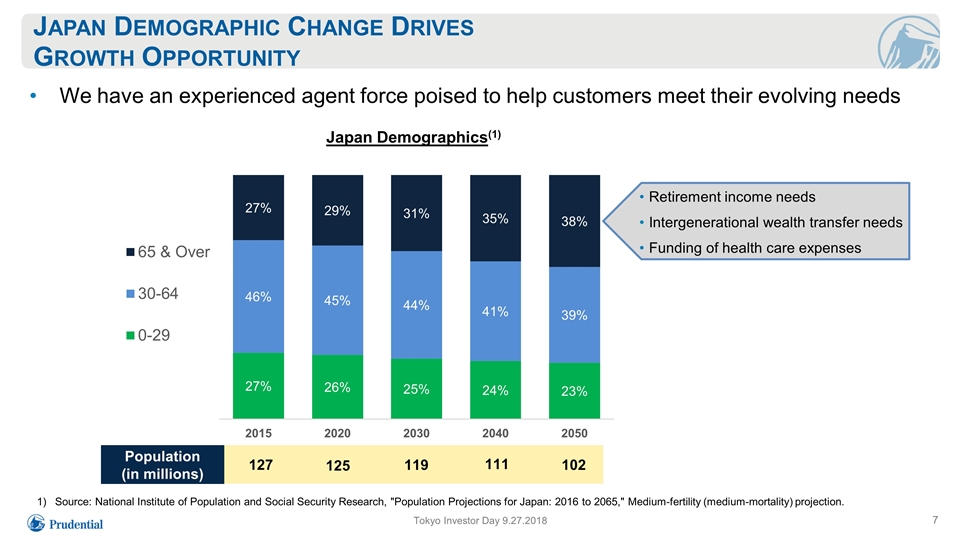

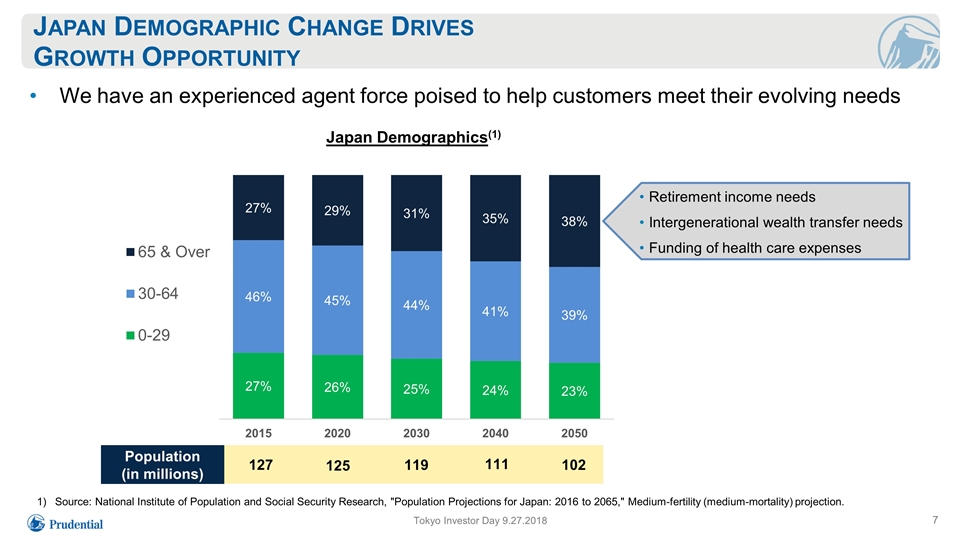

Japan Demographic Change Drives Growth Opportunity Source: National Institute of Population and Social Security Research, "Population Projections for Japan: 2016 to 2065," Medium-fertility (medium-mortality) projection. Japan Demographics(1) We have an experienced agent force poised to help customers meet their evolving needs Population (in millions) 127 125 119 111 102 Retirement income needs Intergenerational wealth transfer needs Funding of health care expenses Tokyo Investor Day 9.27.2018 7

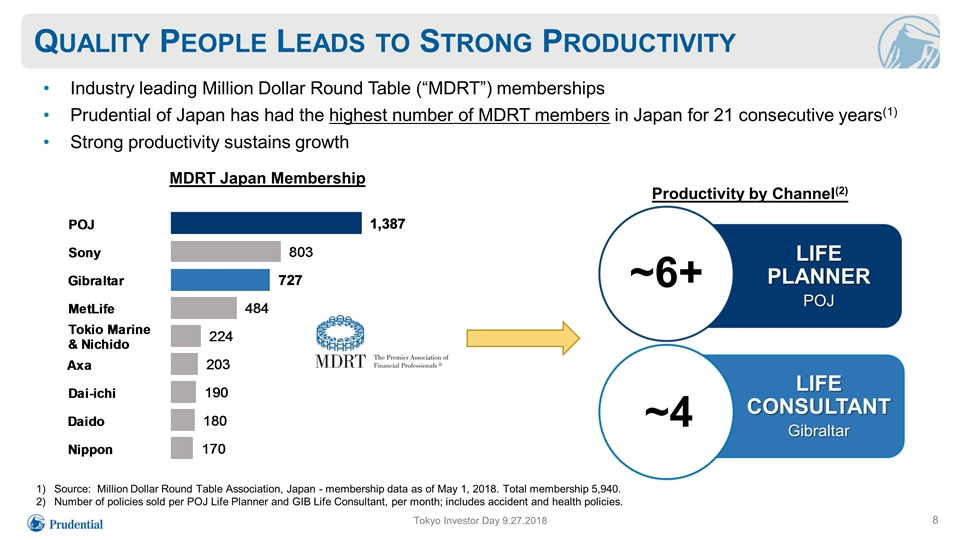

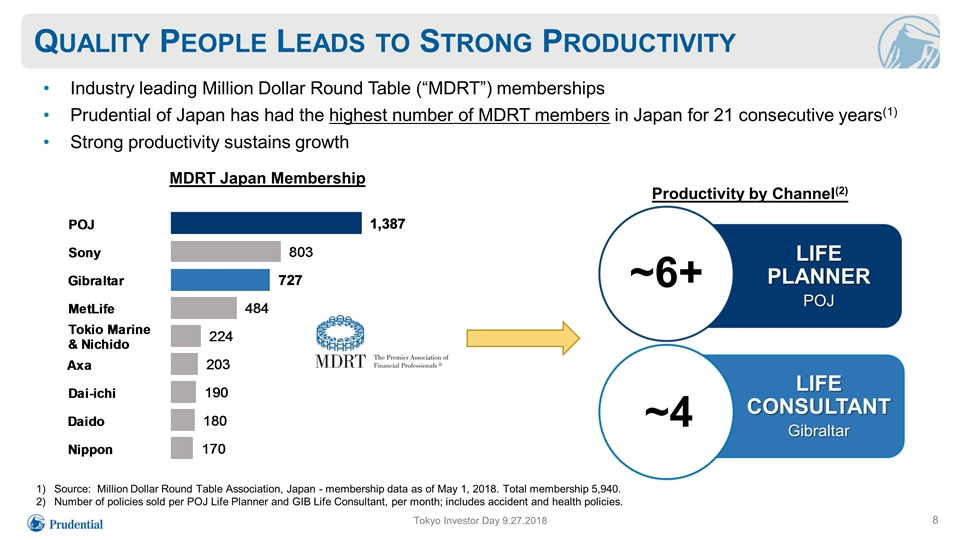

LIFE PLANNER POJ Industry leading Million Dollar Round Table (“MDRT”) memberships Prudential of Japan has had the highest number of MDRT members in Japan for 21 consecutive years(1) Strong productivity sustains growth Quality People Leads to Strong Productivity Source: Million Dollar Round Table Association, Japan - membership data as of May 1, 2018. Total membership 5,940. Number of policies sold per POJ Life Planner and GIB Life Consultant, per month; includes accident and health policies. Tokyo Investor Day 9.27.2018 MDRT Japan Membership Productivity by Channel(2) LIFE CONSULTANT Gibraltar ~6+ ~4 8

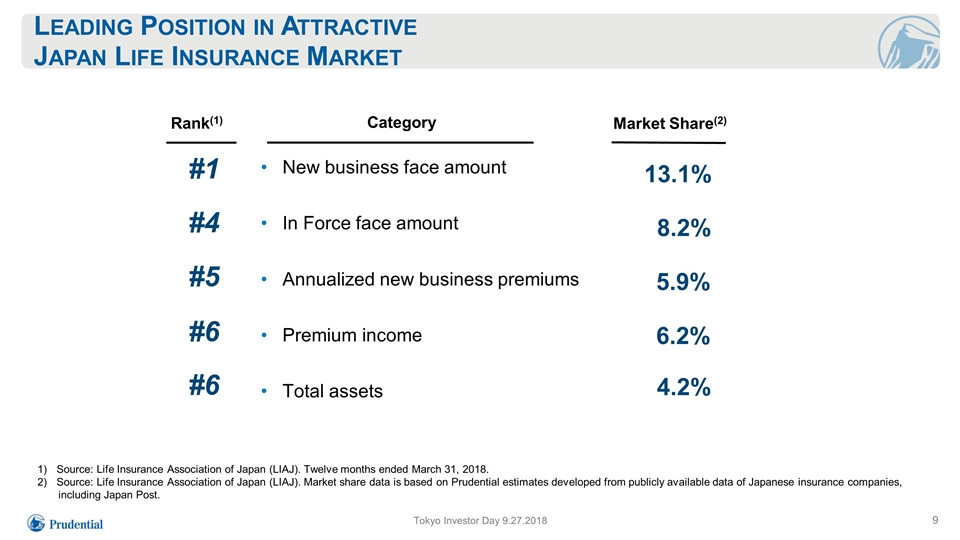

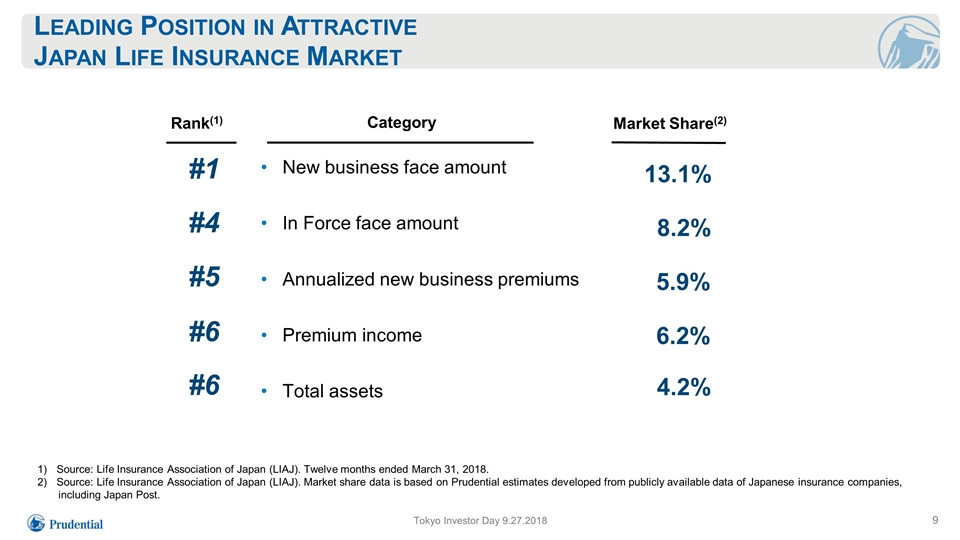

Leading Position in Attractive Japan Life Insurance Market Source: Life Insurance Association of Japan (LIAJ). Twelve months ended March 31, 2018. Source: Life Insurance Association of Japan (LIAJ). Market share data is based on Prudential estimates developed from publicly available data of Japanese insurance companies, including Japan Post. New business face amount In Force face amount Annualized new business premiums Premium income Total assets Category 13.1% 8.2% 5.9% 6.2% 4.2% Market Share(2) Tokyo Investor Day 9.27.2018 Rank(1) #1 #4 #5 #6 #6 9

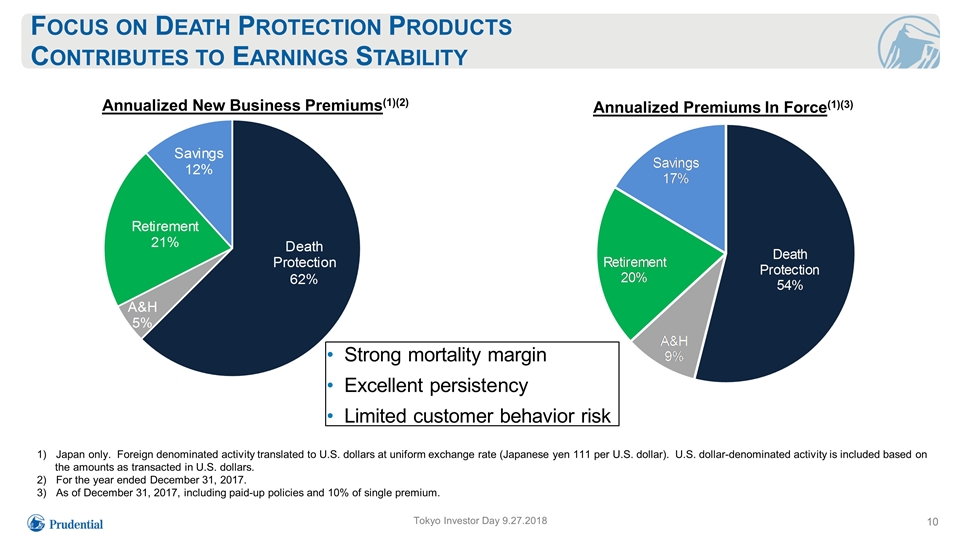

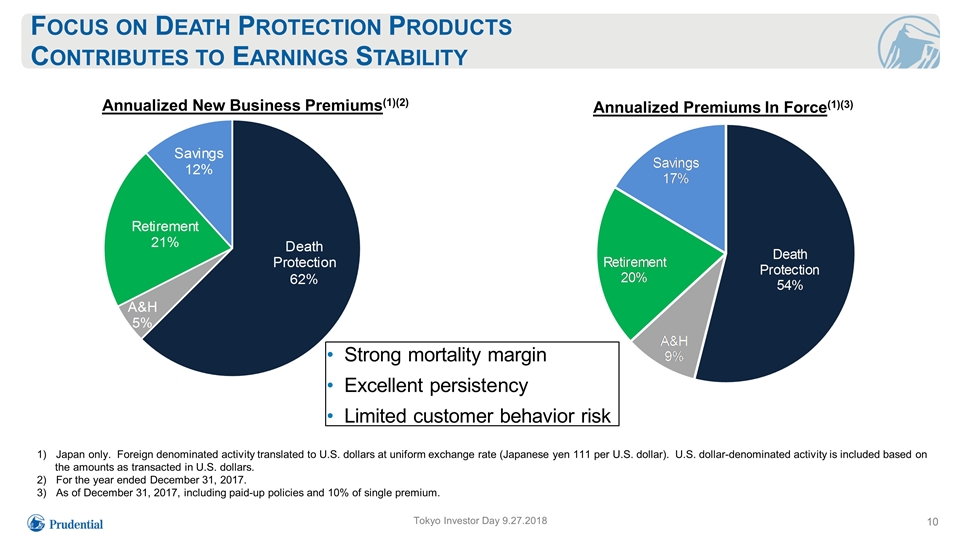

Focus on Death Protection Products Contributes to Earnings Stability Japan only. Foreign denominated activity translated to U.S. dollars at uniform exchange rate (Japanese yen 111 per U.S. dollar). U.S. dollar-denominated activity is included based on the amounts as transacted in U.S. dollars. For the year ended December 31, 2017. As of December 31, 2017, including paid-up policies and 10% of single premium. Annualized Premiums In Force(1)(3) Annualized New Business Premiums(1)(2) Strong mortality margin Excellent persistency Limited customer behavior risk Tokyo Investor Day 9.27.2018 10

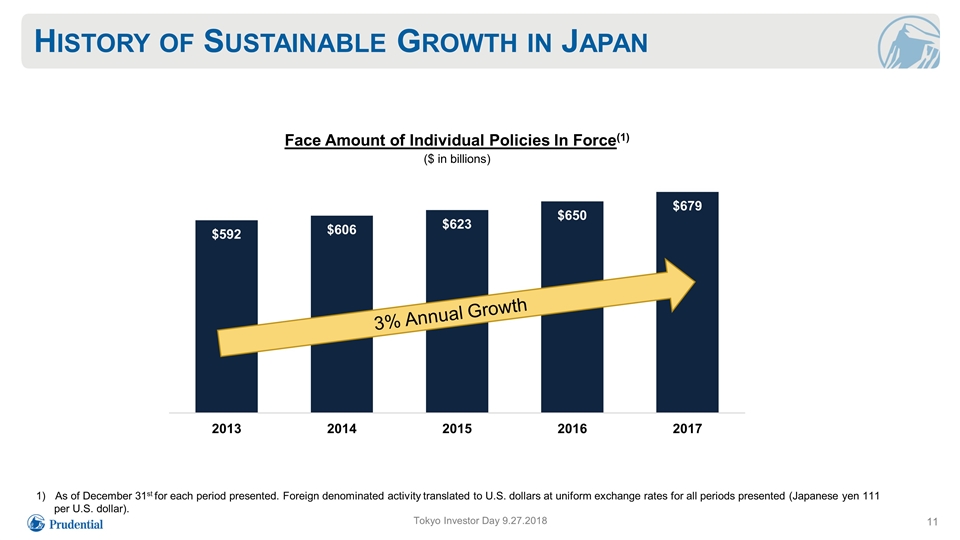

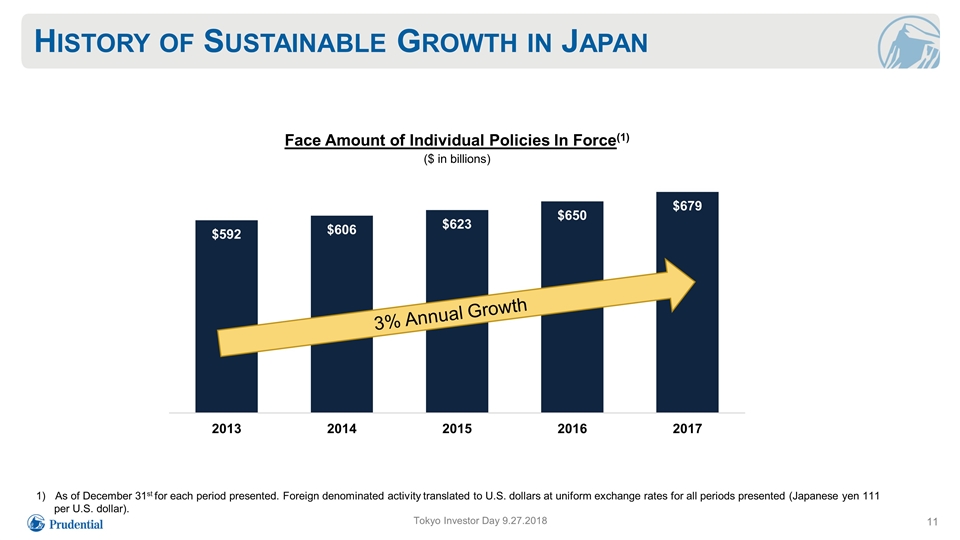

History of Sustainable Growth in Japan Face Amount of Individual Policies In Force(1) As of December 31st for each period presented. Foreign denominated activity translated to U.S. dollars at uniform exchange rates for all periods presented (Japanese yen 111 per U.S. dollar). ($ in billions) Tokyo Investor Day 9.27.2018 3% Annual Growth 11

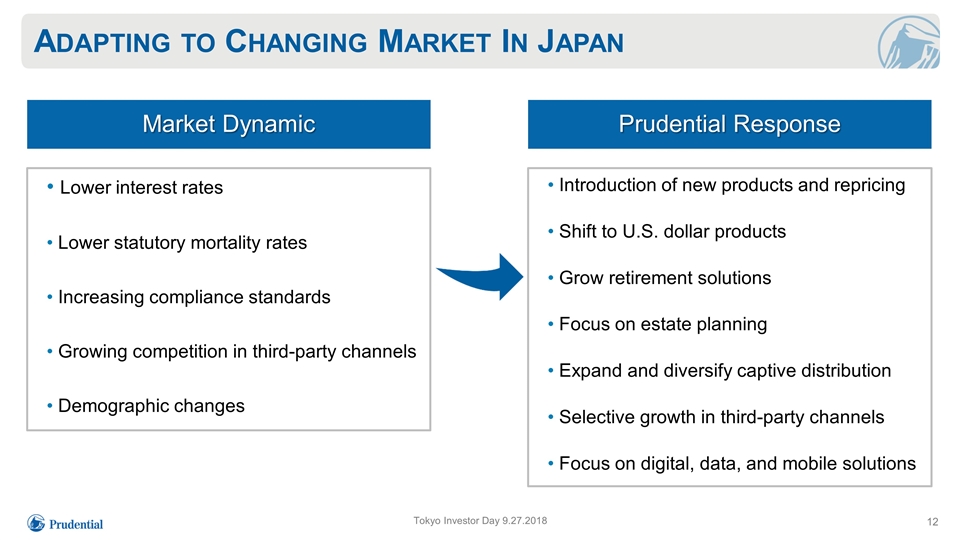

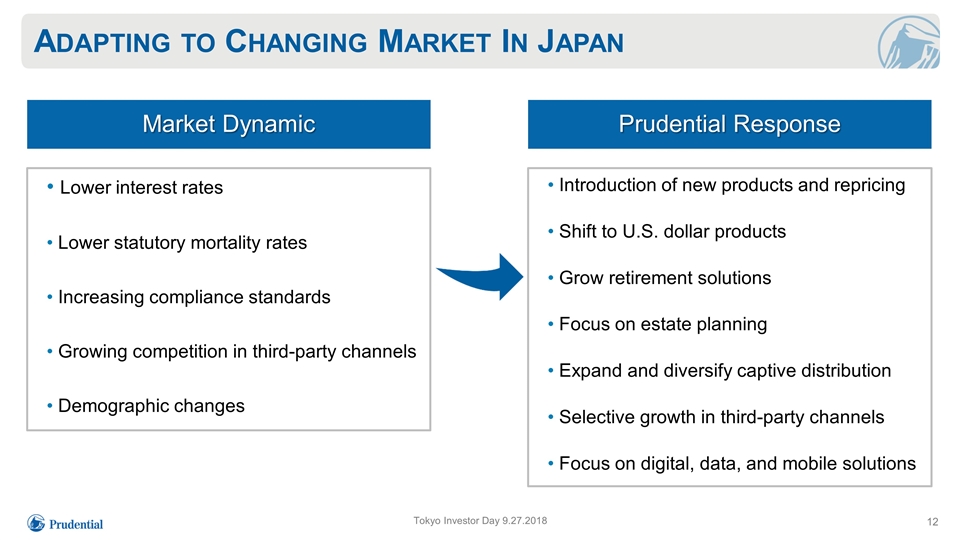

Adapting to Changing Market In Japan Introduction of new products and repricing Shift to U.S. dollar products Grow retirement solutions Focus on estate planning Expand and diversify captive distribution Selective growth in third-party channels Focus on digital, data, and mobile solutions elective growth in third party channels Lower interest rates Lower statutory mortality rates Increasing compliance standards Growing competition in third-party channels Demographic changes Prudential Response Market Dynamic Tokyo Investor Day 9.27.2018 12

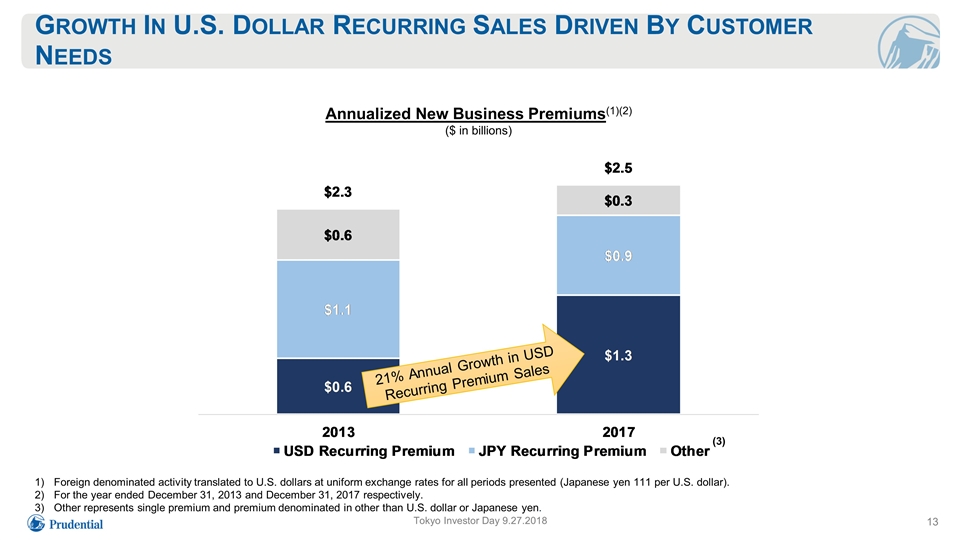

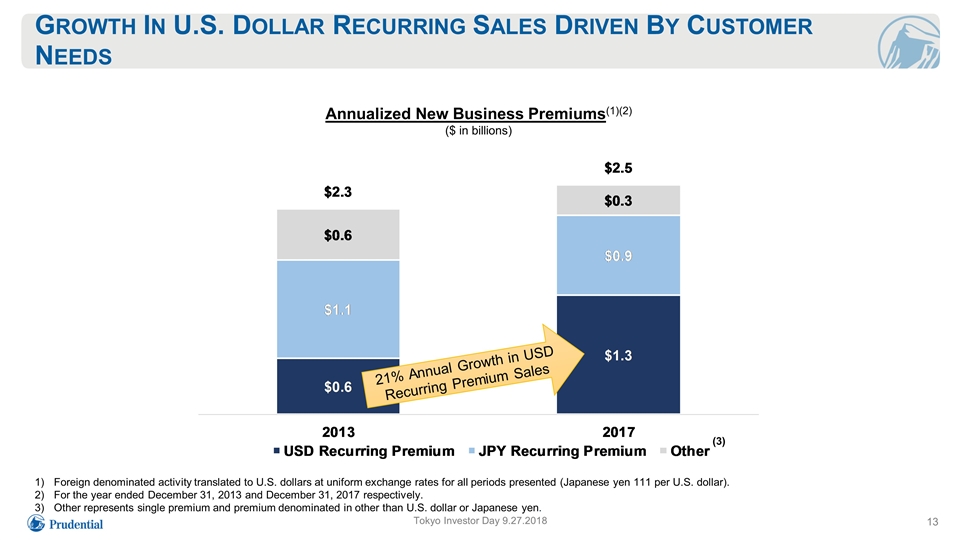

(3) Growth In U.S. Dollar Recurring Sales Driven By Customer Needs Foreign denominated activity translated to U.S. dollars at uniform exchange rates for all periods presented (Japanese yen 111 per U.S. dollar). For the year ended December 31, 2013 and December 31, 2017 respectively. Other represents single premium and premium denominated in other than U.S. dollar or Japanese yen. Tokyo Investor Day 9.27.2018 Annualized New Business Premiums(1)(2) ($ in billions) 13

Building Digital and Mobile Capabilities Initiatives to enhance customer experience and support growth include: Deploy digital solutions to achieve customer experience excellence Digital empowerment that helps maximize sales activities and post-issue services Digitize back-end processes and platforms Tokyo Investor Day 9.27.2018 14

Key Messages Tokyo Investor Day 9.27.2018 Customer-focused, differentiated distribution models results in attractive returns Needs-based selling and quality people drive leading market position Adapting to market changes through multiple growth opportunities 15

Japanese Life Planner Business Motofusa Hamada President and Chief Executive Officer Prudential of Japan

Key Messages Growing Life Planner model, driven primarily by high quality field management, reinforces sustainable competitive advantage Lifetime client relationships driven by recognized quality service Tokyo Investor Day 9.27.2018 Adapting products to market changes and customer needs supports growth 2

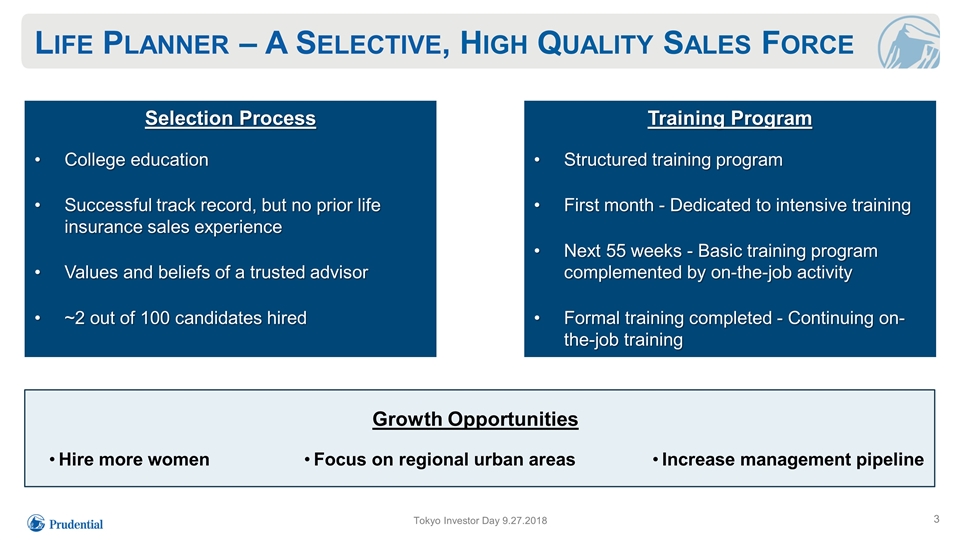

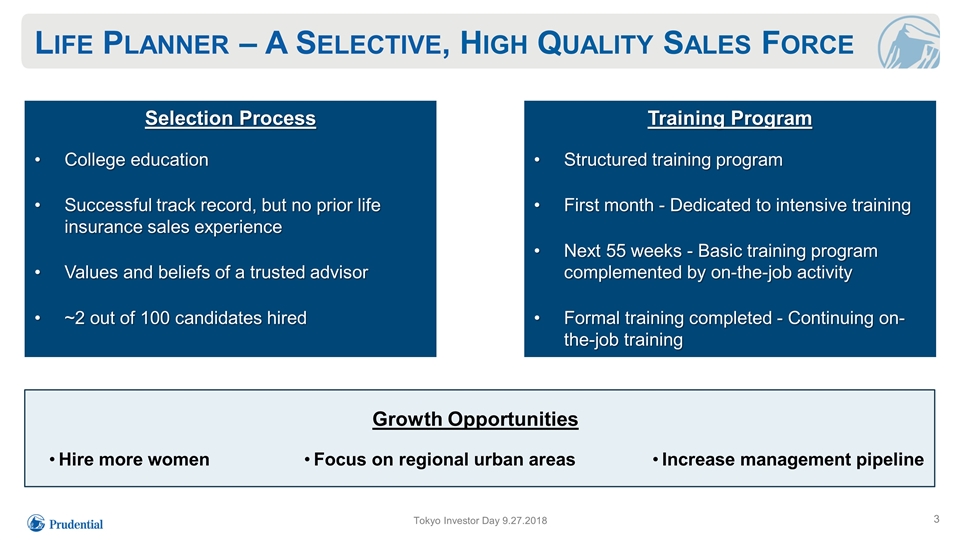

Life Planner – A Selective, High Quality Sales Force Selection Process College education Successful track record, but no prior life insurance sales experience Values and beliefs of a trusted advisor ~2 out of 100 candidates hired Training Program Structured training program First month - Dedicated to intensive training Next 55 weeks - Basic training program complemented by on-the-job activity Formal training completed - Continuing on-the-job training Tokyo Investor Day 9.27.2018 Growth Opportunities Hire more women Focus on regional urban areas Increase management pipeline 3

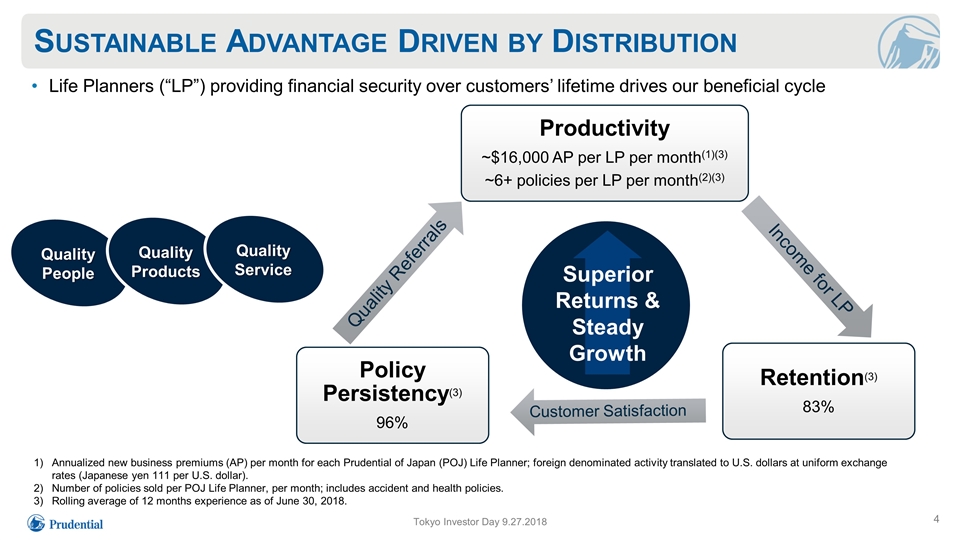

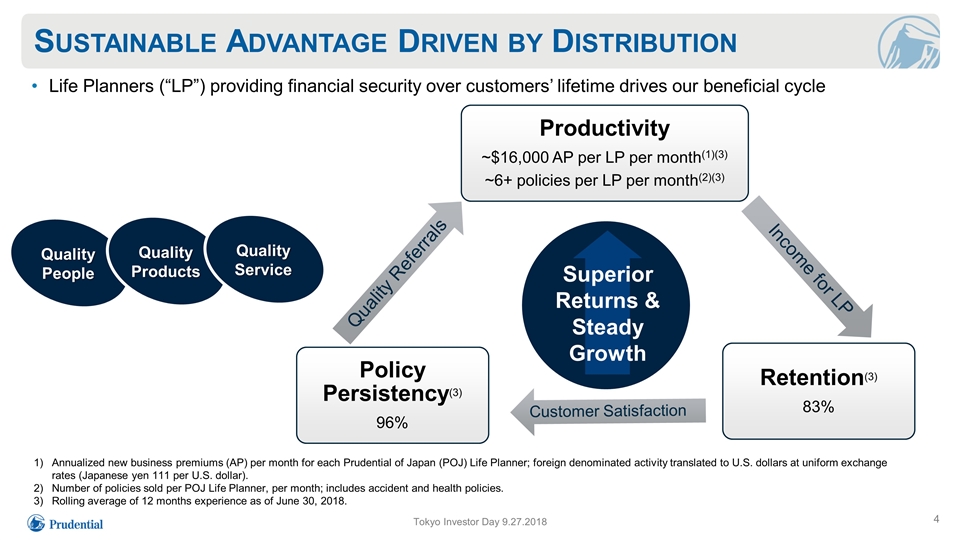

Superior Returns & Steady Growth Quality People Quality Products Quality Service Sustainable Advantage Driven by Distribution Tokyo Investor Day 9.27.2018 Life Planners (“LP”) providing financial security over customers’ lifetime drives our beneficial cycle Annualized new business premiums (AP) per month for each Prudential of Japan (POJ) Life Planner; foreign denominated activity translated to U.S. dollars at uniform exchange rates (Japanese yen 111 per U.S. dollar). Number of policies sold per POJ Life Planner, per month; includes accident and health policies. Rolling average of 12 months experience as of June 30, 2018. 4 Productivity ~$16,000 AP per LP per month (1)(3) ~6+ policies per LP per month (2)(3) Income for LP Retention (3) 83% Customer Satisfaction Policy Persistency (3) 96% Quality Referrals

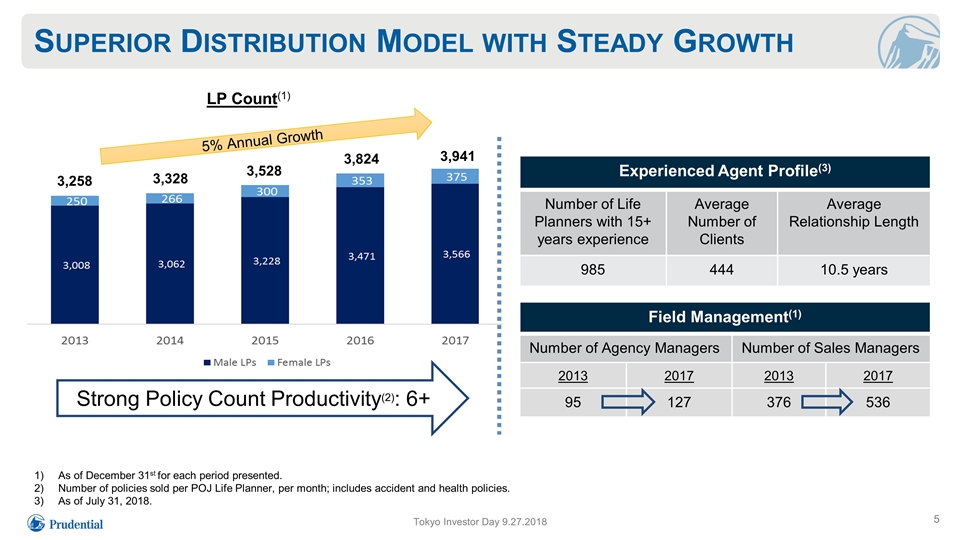

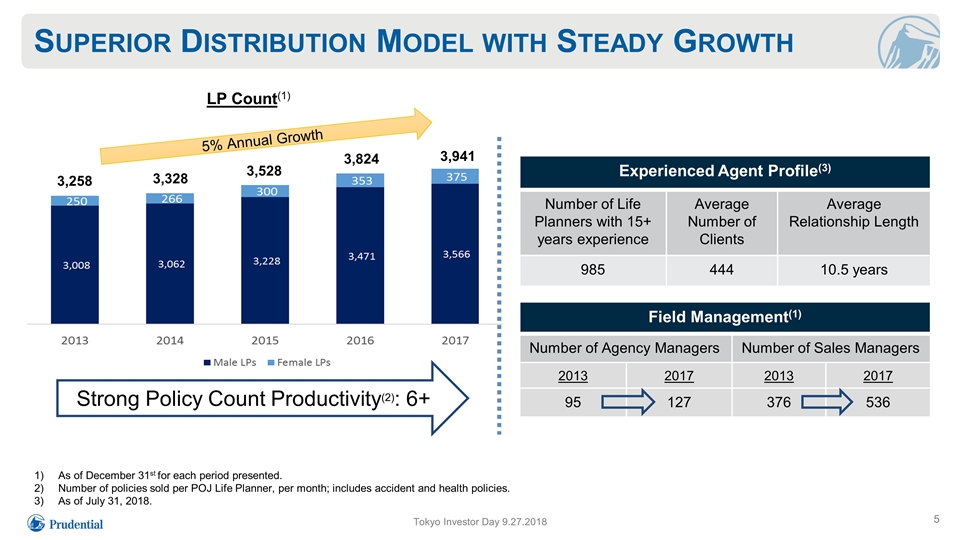

Strong Policy Count Productivity(2): 6+ Superior Distribution Model with Steady Growth Experienced Agent Profile(3) Number of Life Planners with 15+ years experience Average Number of Clients Average Relationship Length 985 444 10.5 years As of December 31st for each period presented. Number of policies sold per POJ Life Planner, per month; includes accident and health policies. As of July 31, 2018. Tokyo Investor Day 9.27.2018 Field Management(1) Number of Agency Managers Number of Sales Managers 2013 2017 2013 2017 95 127 376 536 3,258 3,528 3,328 3,824 3,941 LP Count(1) 5% Annual Growth 5

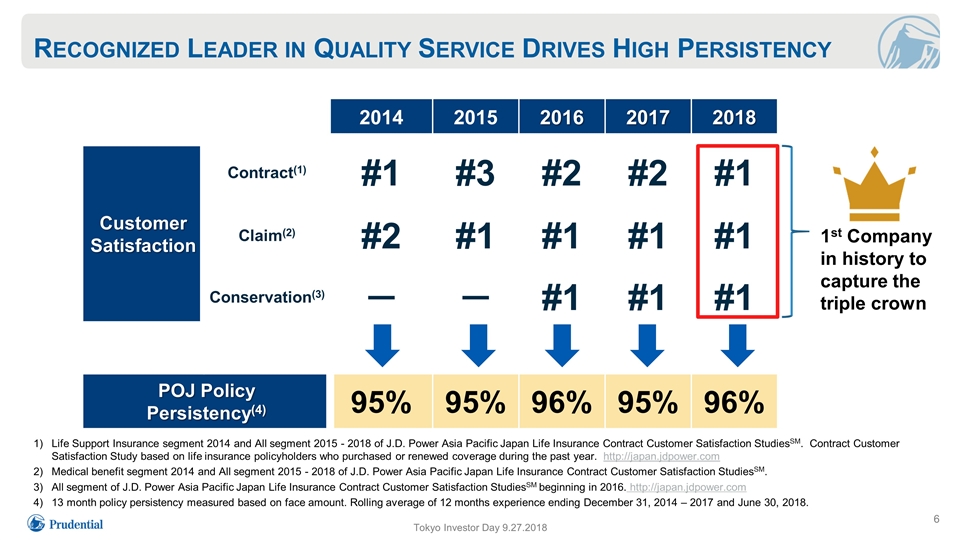

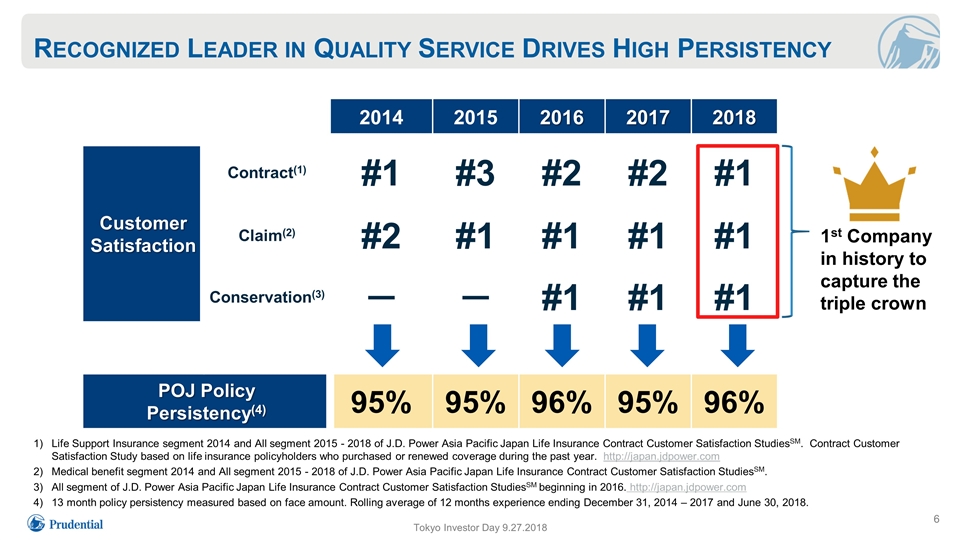

Recognized Leader in Quality Service Drives High Persistency Life Support Insurance segment 2014 and All segment 2015 - 2018 of J.D. Power Asia Pacific Japan Life Insurance Contract Customer Satisfaction StudiesSM. Contract Customer Satisfaction Study based on life insurance policyholders who purchased or renewed coverage during the past year. http://japan.jdpower.com Medical benefit segment 2014 and All segment 2015 - 2018 of J.D. Power Asia Pacific Japan Life Insurance Contract Customer Satisfaction StudiesSM. All segment of J.D. Power Asia Pacific Japan Life Insurance Contract Customer Satisfaction StudiesSM beginning in 2016. http://japan.jdpower.com 13 month policy persistency measured based on face amount. Rolling average of 12 months experience ending December 31, 2014 – 2017 and June 30, 2018. 2014 2015 2016 2017 2018 Customer Satisfaction Contract(1) #1 #3 #2 #2 #1 Claim(2) #2 #1 #1 #1 #1 Conservation(3) - - #1 #1 #1 POJ Policy Persistency(4) 95% 95% 96% 95% 96% Tokyo Investor Day 9.27.2018 1st Company in history to capture the triple crown 6

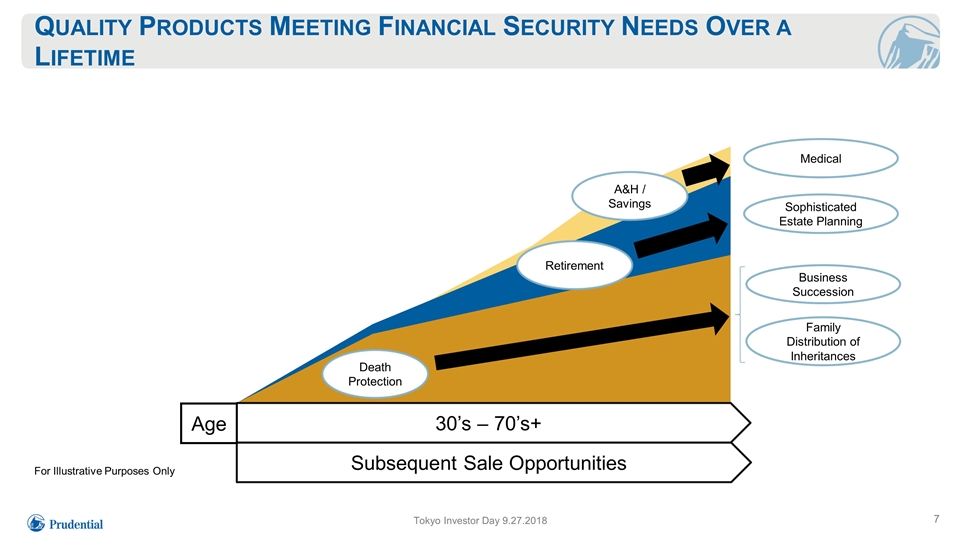

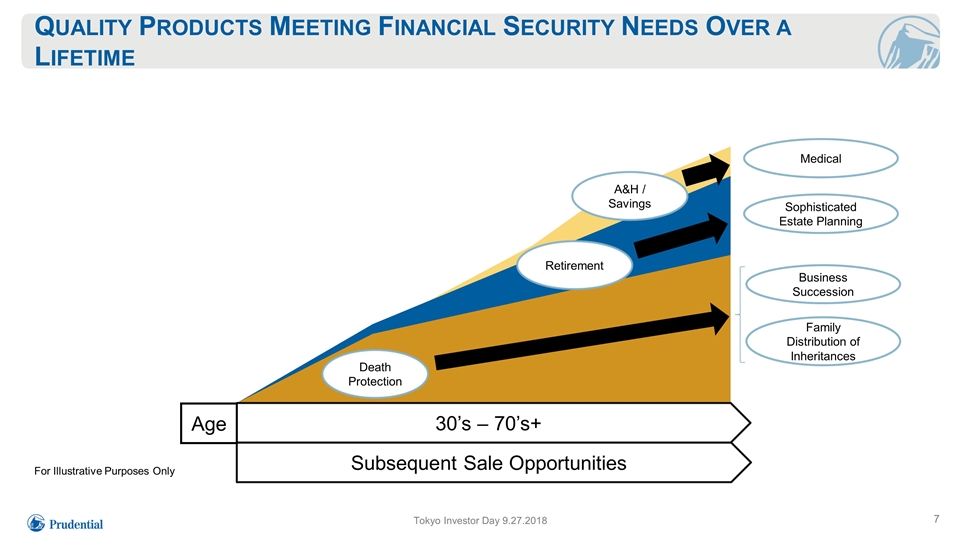

Quality Products Meeting Financial Security Needs Over a Lifetime Age 30’s – 70’s+ Death Protection Retirement A&H / Savings Sophisticated Estate Planning Business Succession Family Distribution of Inheritances Medical Subsequent Sale Opportunities Tokyo Investor Day 9.27.2018 For Illustrative Purposes Only 7

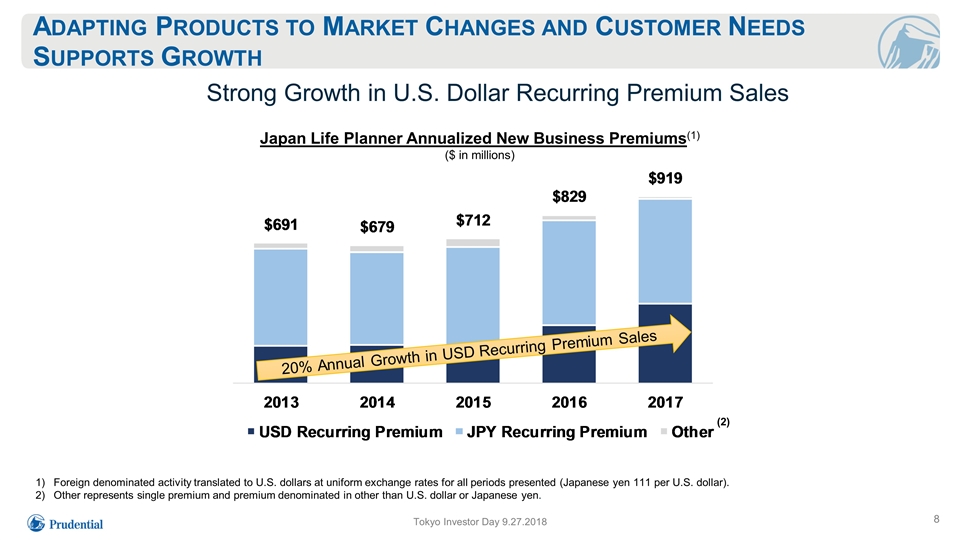

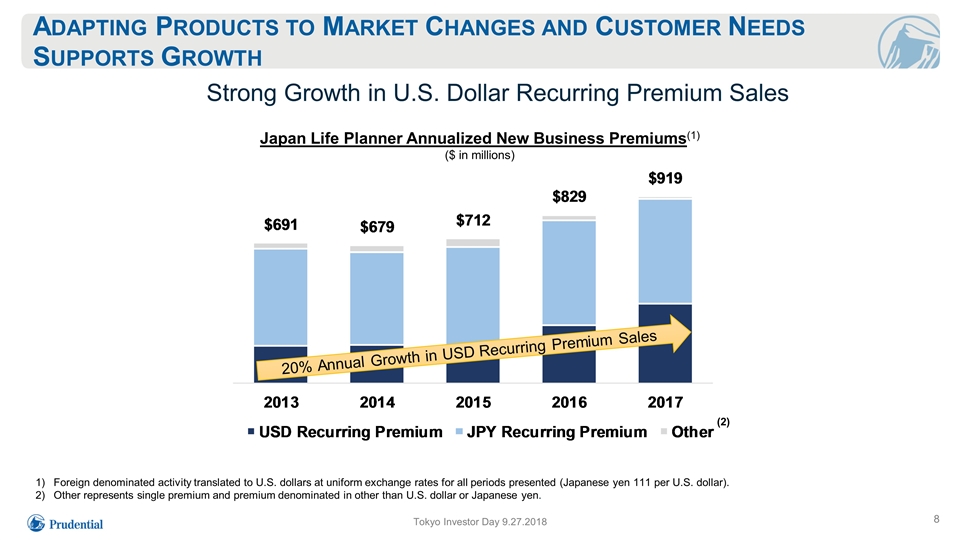

Foreign denominated activity translated to U.S. dollars at uniform exchange rates for all periods presented (Japanese yen 111 per U.S. dollar). Other represents single premium and premium denominated in other than U.S. dollar or Japanese yen. Tokyo Investor Day 9.27.2018 Adapting Products to Market Changes and Customer Needs Supports Growth Strong Growth in U.S. Dollar Recurring Premium Sales Japan Life Planner Annualized New Business Premiums(1) ($ in millions) (2) 8

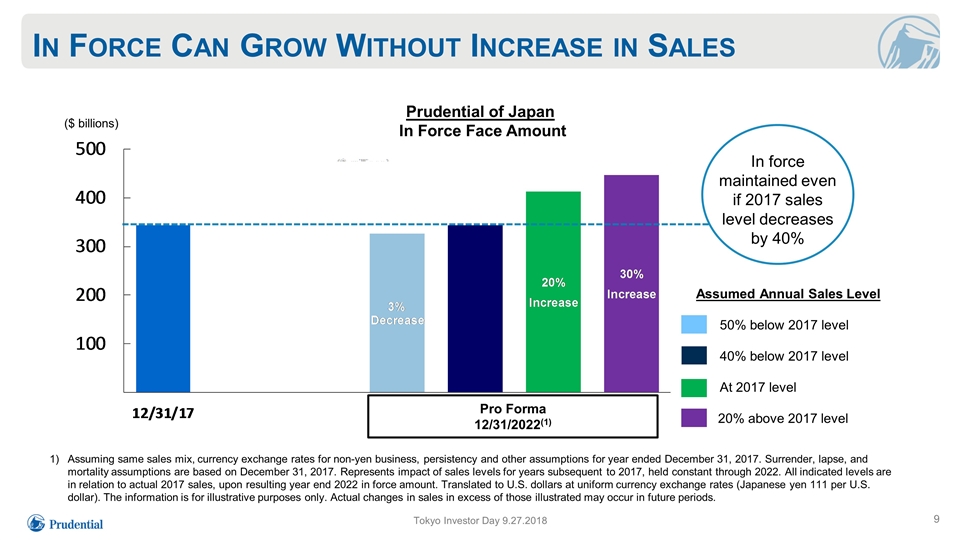

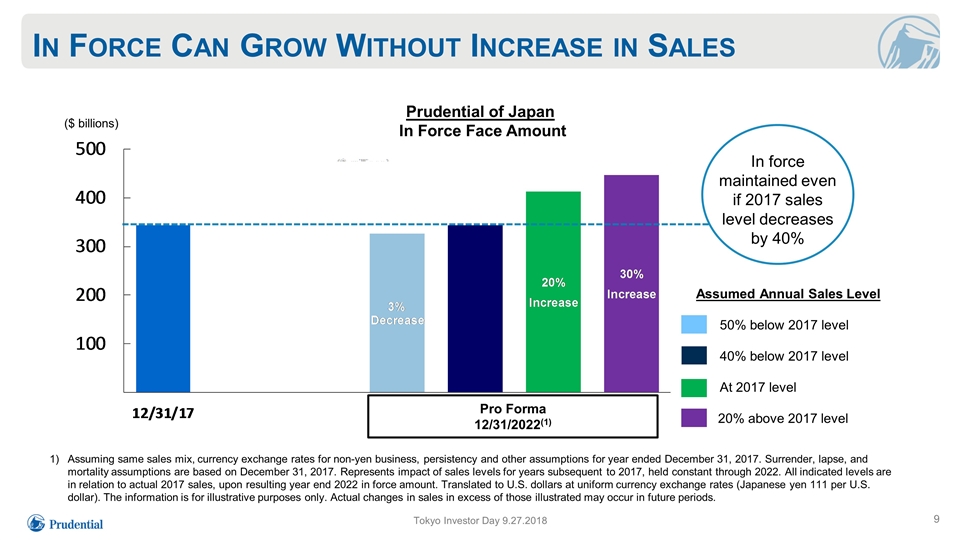

In Force Can Grow Without Increase in Sales Assumed Annual Sales Level 50% below 2017 level 40% below 2017 level At 2017 level 20% above 2017 level Prudential of Japan In Force Face Amount ($ billions) Tokyo Investor Day 9.27.2018 Pro Forma 12/31/2022(1) In force maintained even if 2017 sales level decreases by 40% Assuming same sales mix, currency exchange rates for non-yen business, persistency and other assumptions for year ended December 31, 2017. Surrender, lapse, and mortality assumptions are based on December 31, 2017. Represents impact of sales levels for years subsequent to 2017, held constant through 2022. All indicated levels are in relation to actual 2017 sales, upon resulting year end 2022 in force amount. Translated to U.S. dollars at uniform currency exchange rates (Japanese yen 111 per U.S. dollar). The information is for illustrative purposes only. Actual changes in sales in excess of those illustrated may occur in future periods. 9

Key Messages Growing Life Planner model, driven primarily by high quality field management, reinforces sustainable competitive advantage Lifetime client relationships driven by recognized quality service Tokyo Investor Day 9.27.2018 Adapting products to market changes and customer needs supports growth 10

Life Consultant and Independent Agency Channel Kazuhiro Yamauchi President and Chief Executive Officer Gibraltar Life

Key Messages Broad distribution through productive Life Consultants and growing Independent Agencies Adapting products to market changes and customer needs supports growth Tokyo Investor Day 9.27.2018 Distinctive affinity relationship with Japanese Teachers Association 2

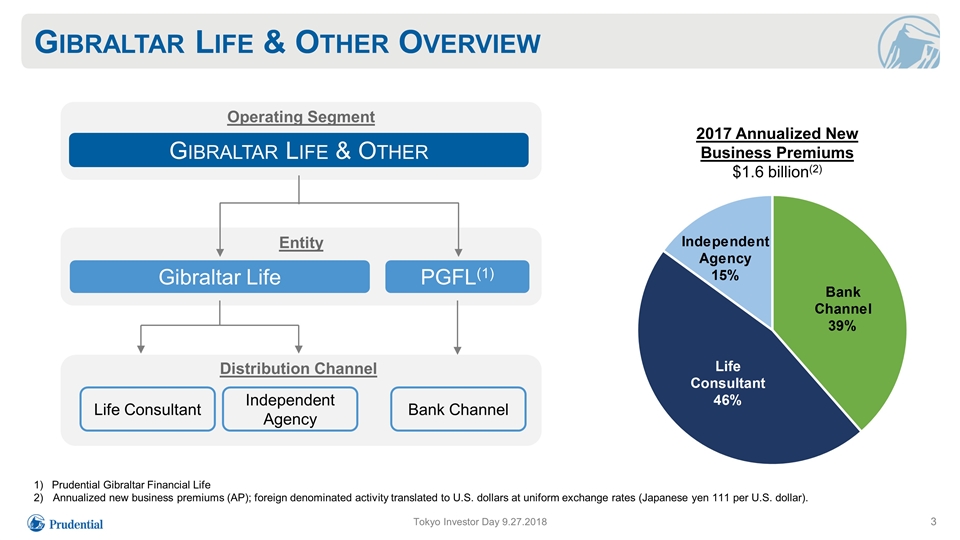

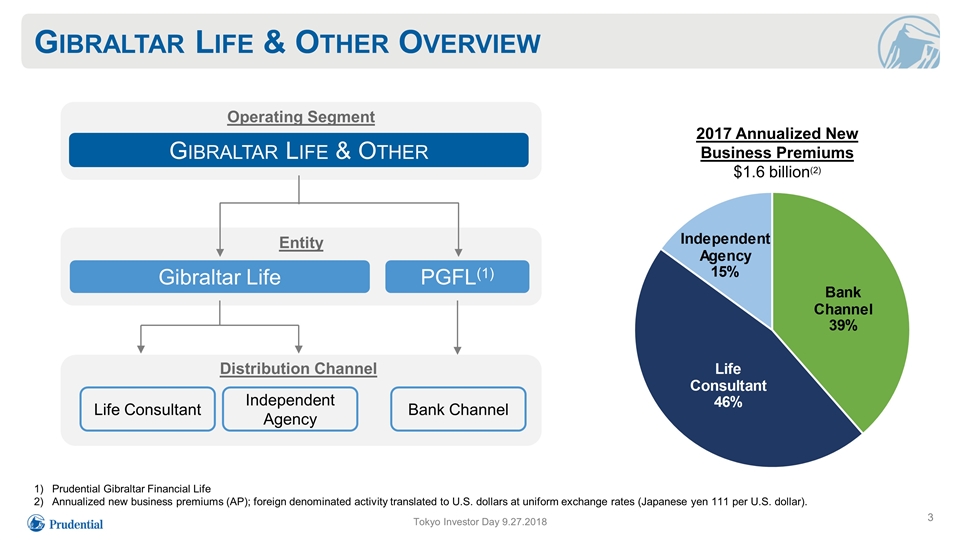

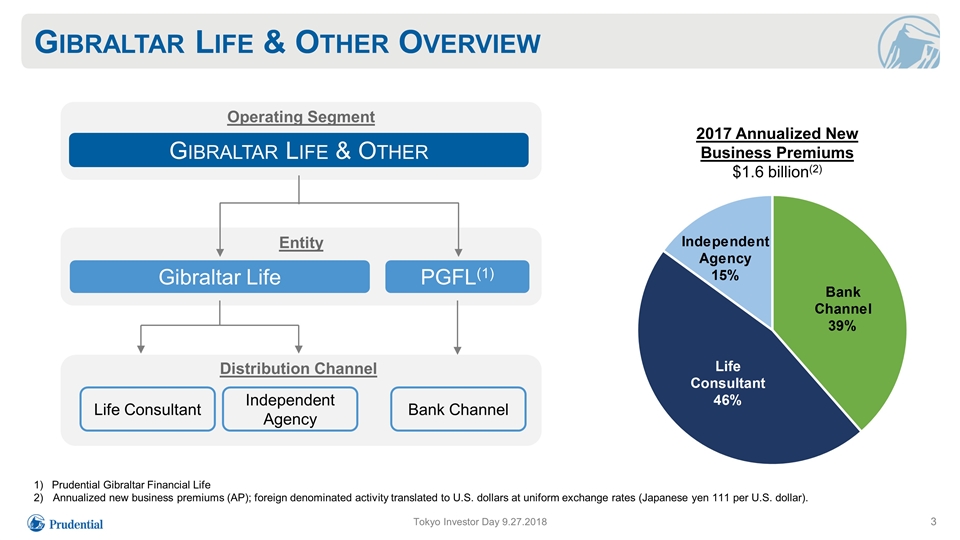

Operating Segment Entity Gibraltar Life & Other Life Consultant Gibraltar Life & Other Overview Bank Channel Gibraltar Life PGFL(1) Tokyo Investor Day 9.27.2018 Independent Agency 15% Independent Agency Distribution Channel 2017 Annualized New Business Premiums $1.6 billion(2) Prudential Gibraltar Financial Life Annualized new business premiums (AP); foreign denominated activity translated to U.S. dollars at uniform exchange rates (Japanese yen 111 per U.S. dollar). 3

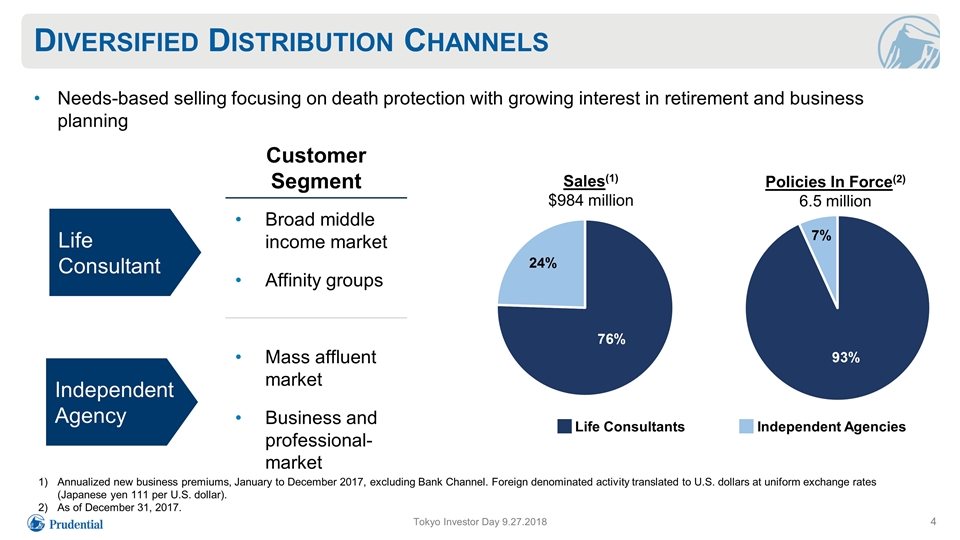

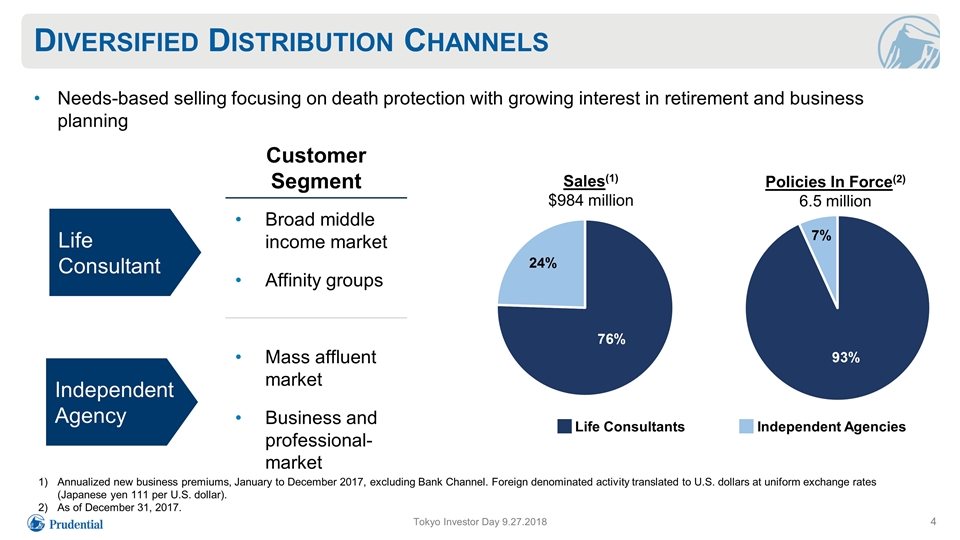

Customer Segment Broad middle income market Affinity groups Mass affluent market Business and professional-market Diversified Distribution Channels Independent Agency Life Consultant Tokyo Investor Day 9.27.2018 Needs-based selling focusing on death protection with growing interest in retirement and business planning Annualized new business premiums, January to December 2017, excluding Bank Channel. Foreign denominated activity translated to U.S. dollars at uniform exchange rates (Japanese yen 111 per U.S. dollar). As of December 31, 2017. Sales(1) $984 million Policies In Force(2) 6.5 million Life Consultants Independent Agencies 4

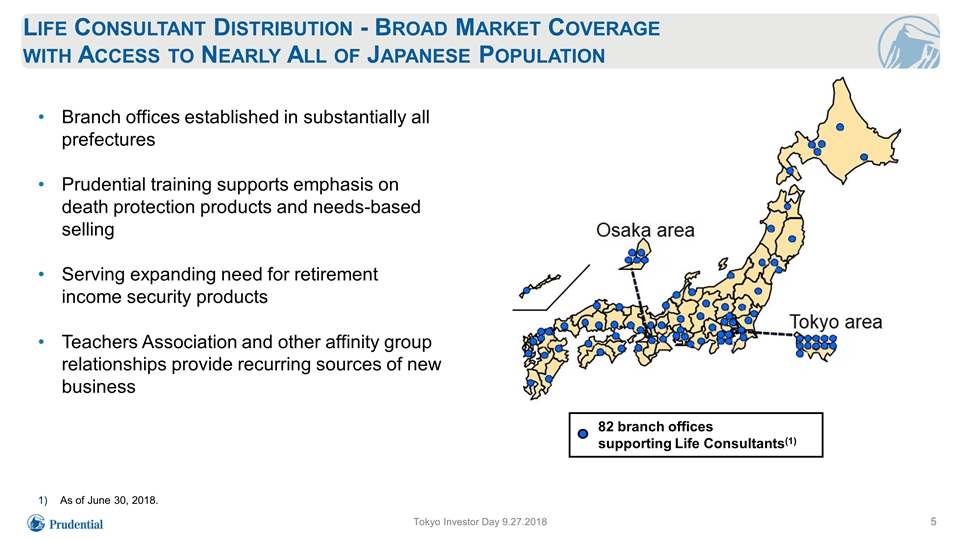

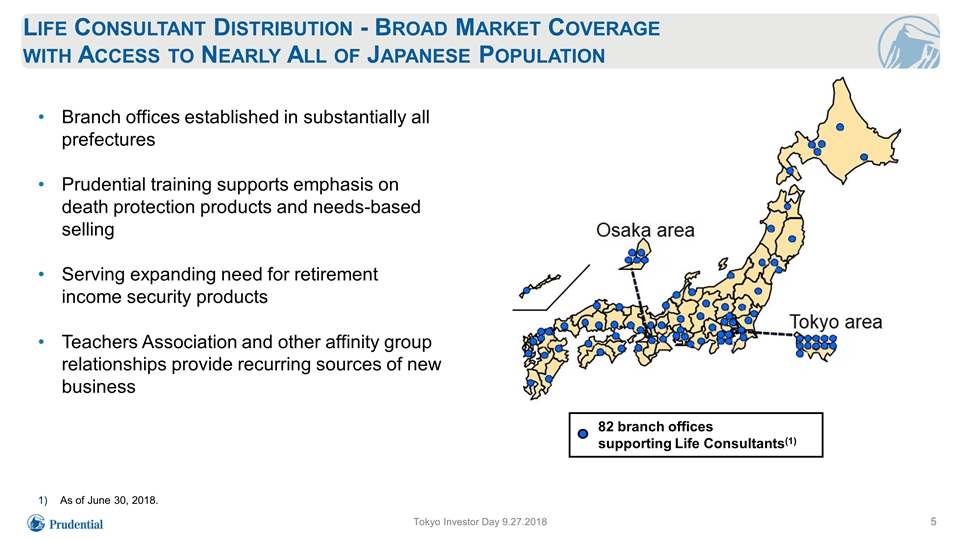

Life Consultant Distribution - Broad Market Coverage with Access to Nearly All of Japanese Population 82 branch offices supporting Life Consultants(1) Branch offices established in substantially all prefectures Prudential training supports emphasis on death protection products and needs-based selling Serving expanding need for retirement income security products Teachers Association and other affinity group relationships provide recurring sources of new business As of June 30, 2018. Tokyo Investor Day 9.27.2018 5

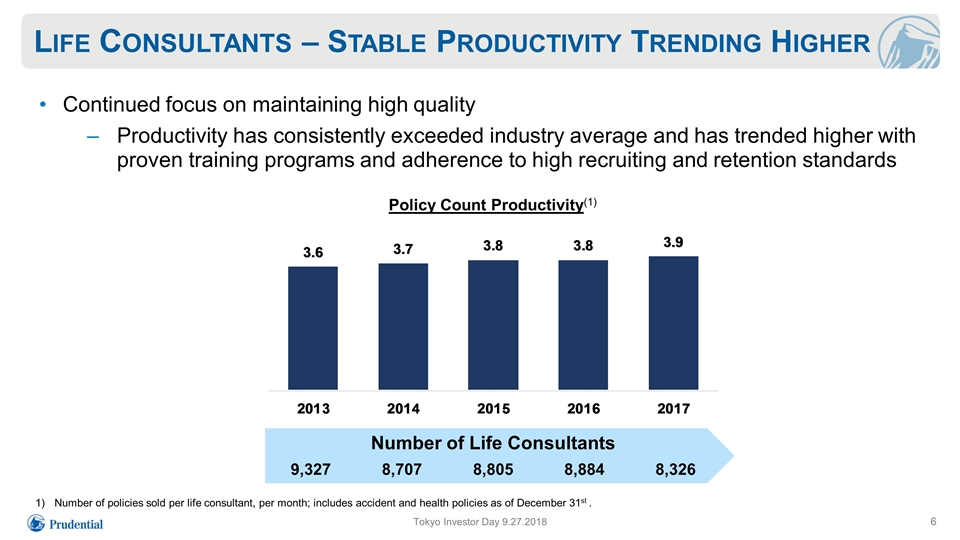

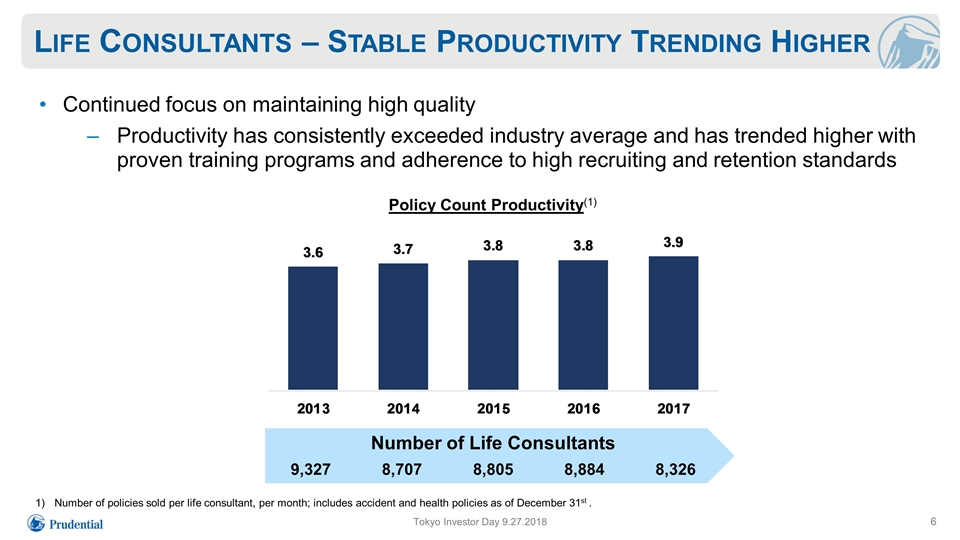

Life Consultants – Stable Productivity Trending Higher Tokyo Investor Day 9.27.2018 Continued focus on maintaining high quality Productivity has consistently exceeded industry average and has trended higher with proven training programs and adherence to high recruiting and retention standards Number of policies sold per life consultant, per month; includes accident and health policies as of December 31st . Number of Life Consultants 9,327 8,707 8,805 8,884 8,326 Policy Count Productivity(1) 6

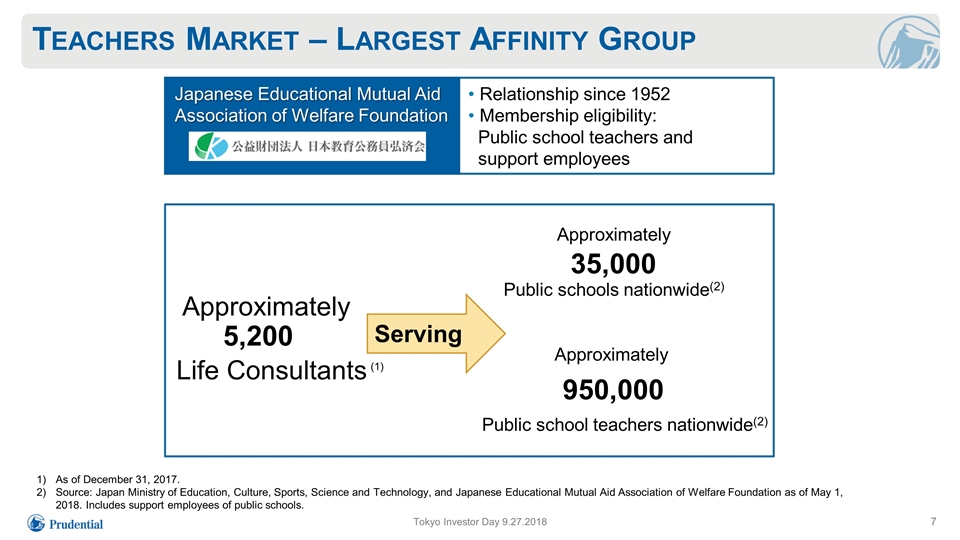

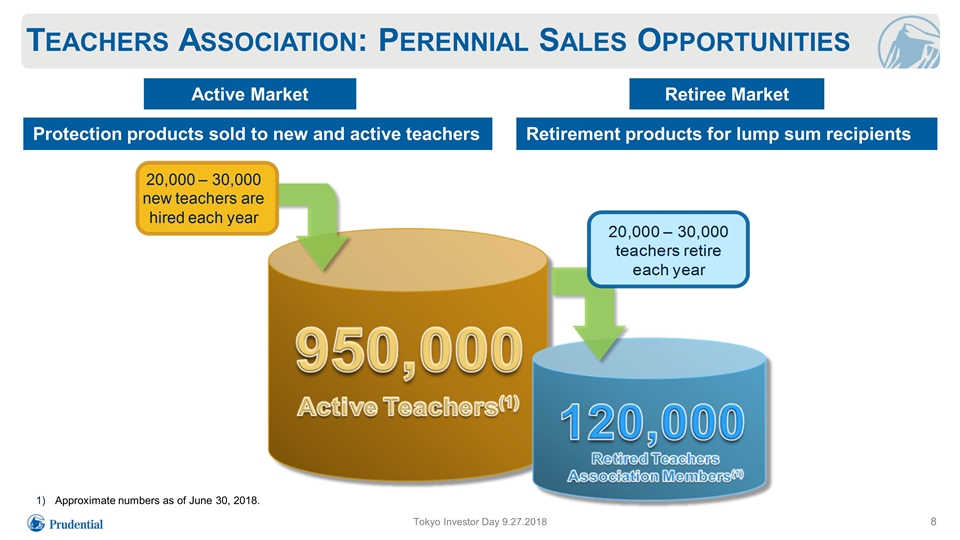

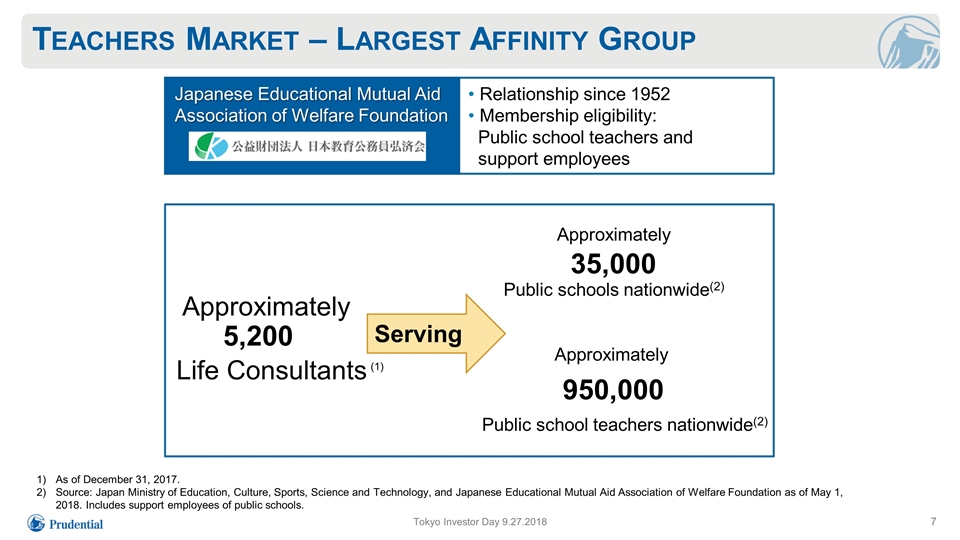

Serving Teachers Market – Largest Affinity Group Approximately Life Consultants Approximately Public schools nationwide(2) As of December 31, 2017. Source: Japan Ministry of Education, Culture, Sports, Science and Technology, and Japanese Educational Mutual Aid Association of Welfare Foundation as of May 1, 2018. Includes support employees of public schools. Approximately Public school teachers nationwide(2) Relationship since 1952 Membership eligibility: Public school teachers and support employees Japanese Educational Mutual Aid Association of Welfare Foundation 5,200 35,000 950,000 (1) Tokyo Investor Day 9.27.2018 7

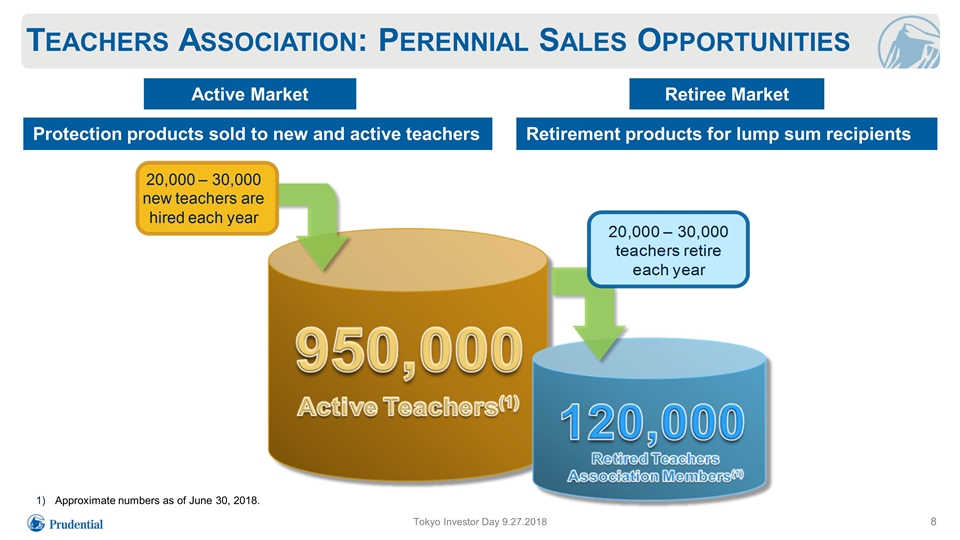

Teachers Association: Perennial Sales Opportunities Approximate numbers as of June 30, 2018. Active Market Retiree Market Protection products sold to new and active teachers Retirement products for lump sum recipients Tokyo Investor Day 9.27.2018 8

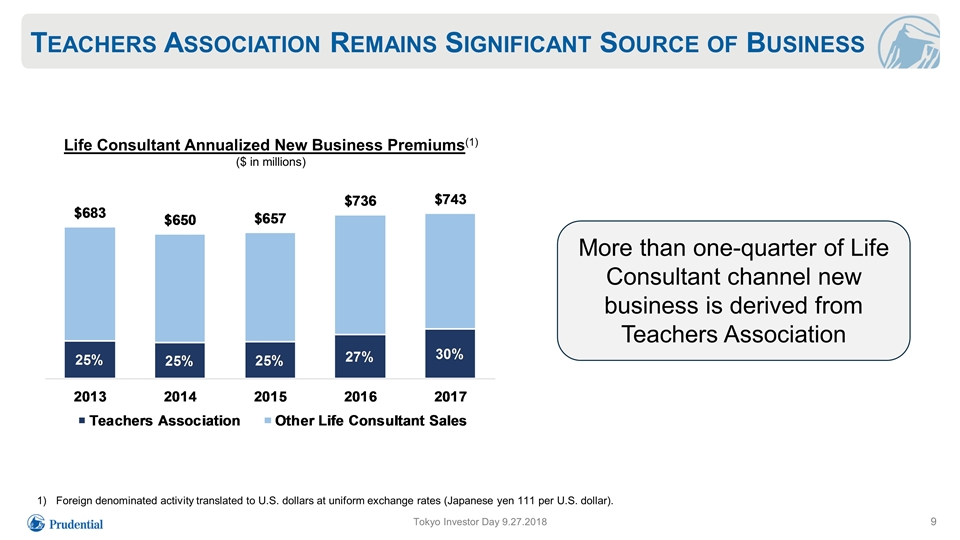

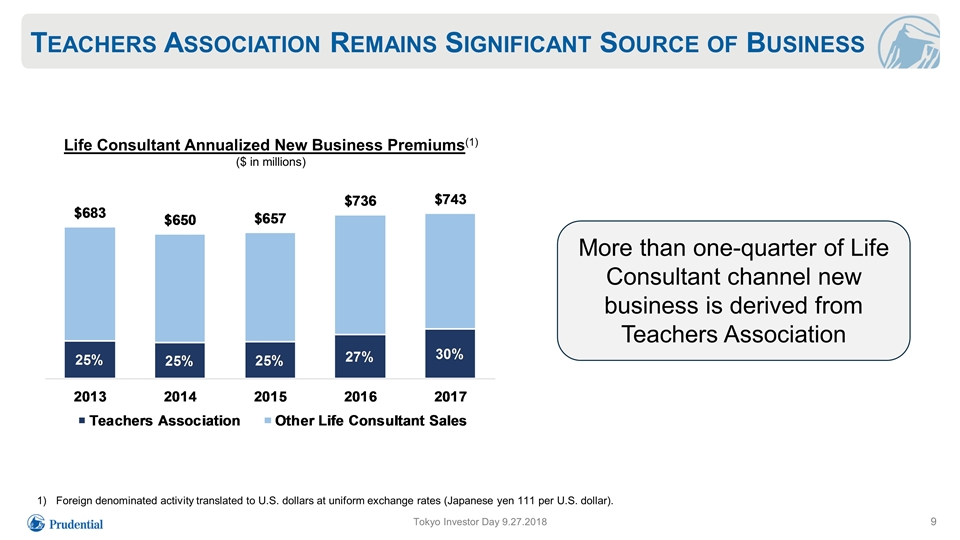

More than one-quarter of Life Consultant channel new business is derived from Teachers Association Teachers Association Remains Significant Source of Business Foreign denominated activity translated to U.S. dollars at uniform exchange rates (Japanese yen 111 per U.S. dollar). Life Consultant Annualized New Business Premiums(1) ($ in millions) Tokyo Investor Day 9.27.2018 9

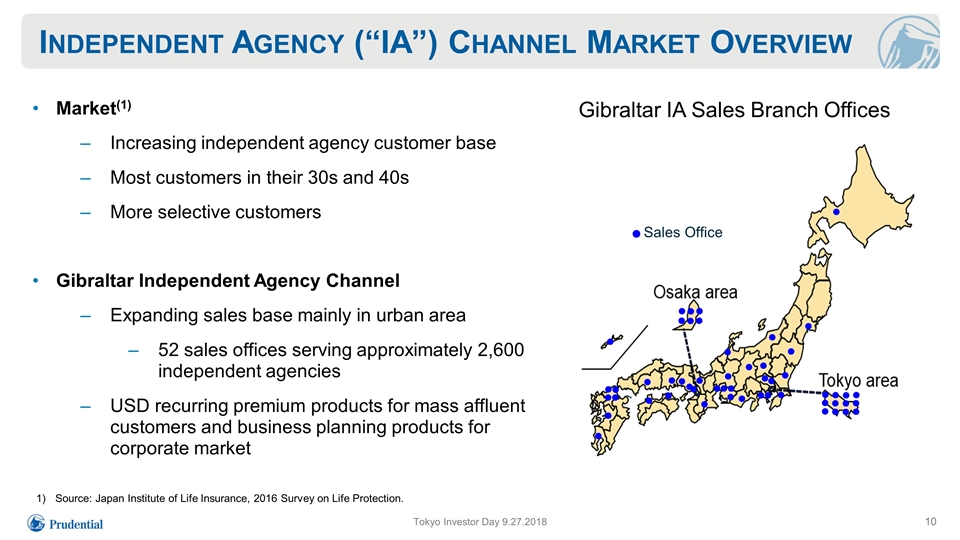

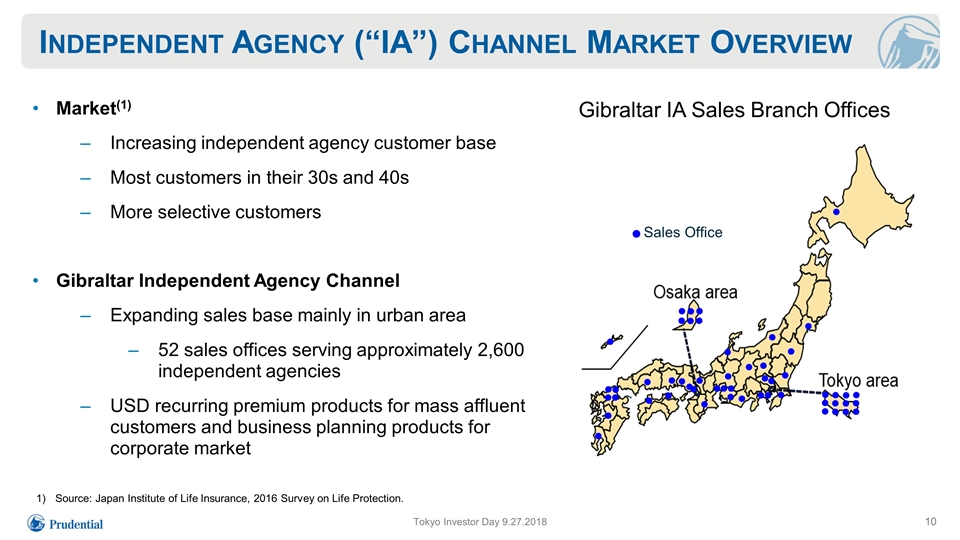

Market(1) Increasing independent agency customer base Most customers in their 30s and 40s More selective customers Gibraltar Independent Agency Channel Expanding sales base mainly in urban area 52 sales offices serving approximately 2,600 independent agencies USD recurring premium products for mass affluent customers and business planning products for corporate market Gibraltar IA Sales Branch Offices Source: Japan Institute of Life Insurance, 2016 Survey on Life Protection. ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● Sales Office Independent Agency (“IA”) Channel Market Overview Tokyo Investor Day 9.27.2018 10

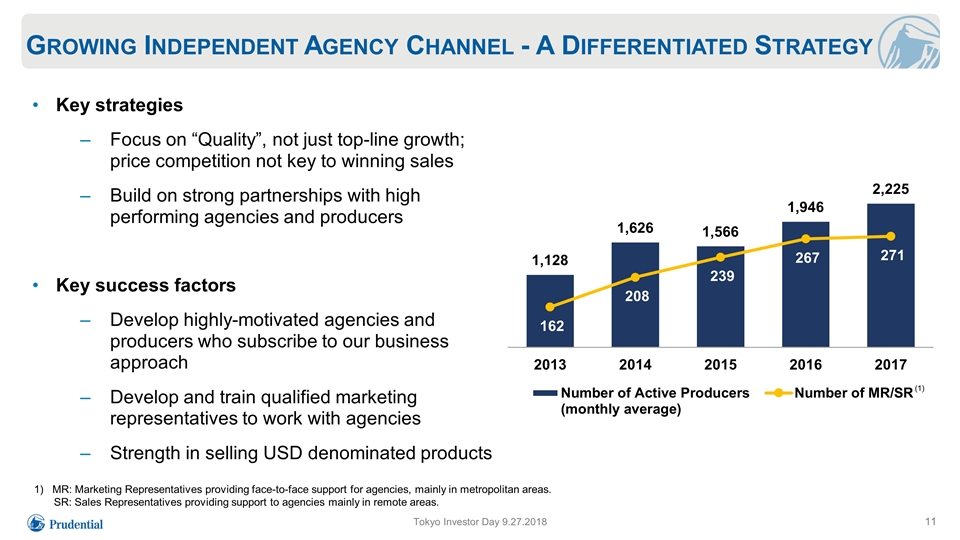

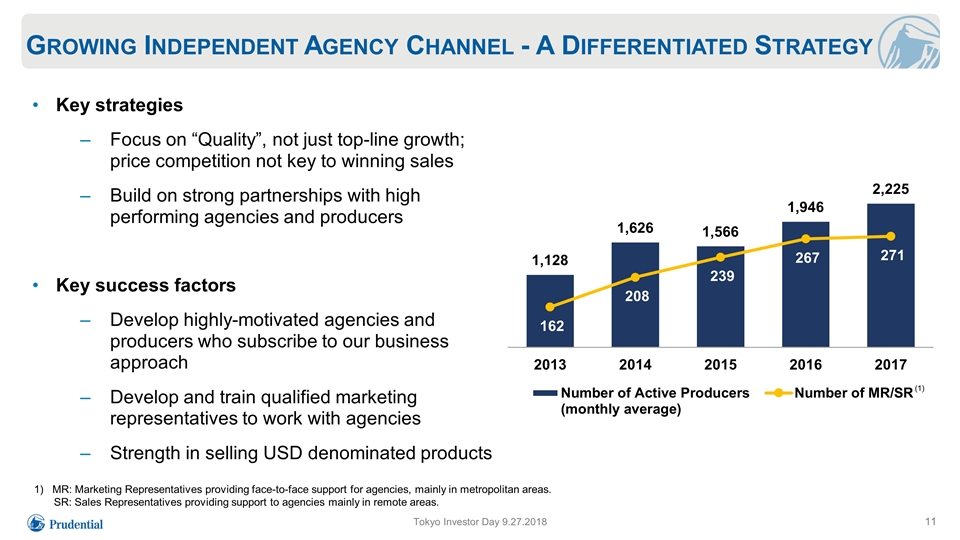

MR: Marketing Representatives providing face-to-face support for agencies, mainly in metropolitan areas. SR: Sales Representatives providing support to agencies mainly in remote areas. (1) Growing Independent Agency Channel - A Differentiated Strategy Key strategies Focus on “Quality”, not just top-line growth; price competition not key to winning sales Build on strong partnerships with high performing agencies and producers Key success factors Develop highly-motivated agencies and producers who subscribe to our business approach Develop and train qualified marketing representatives to work with agencies Strength in selling USD denominated products Tokyo Investor Day 9.27.2018 11

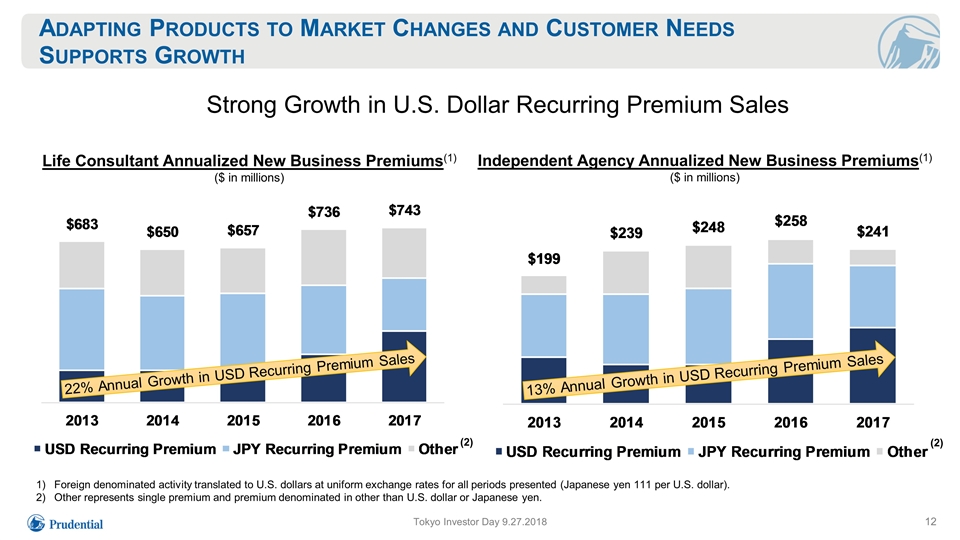

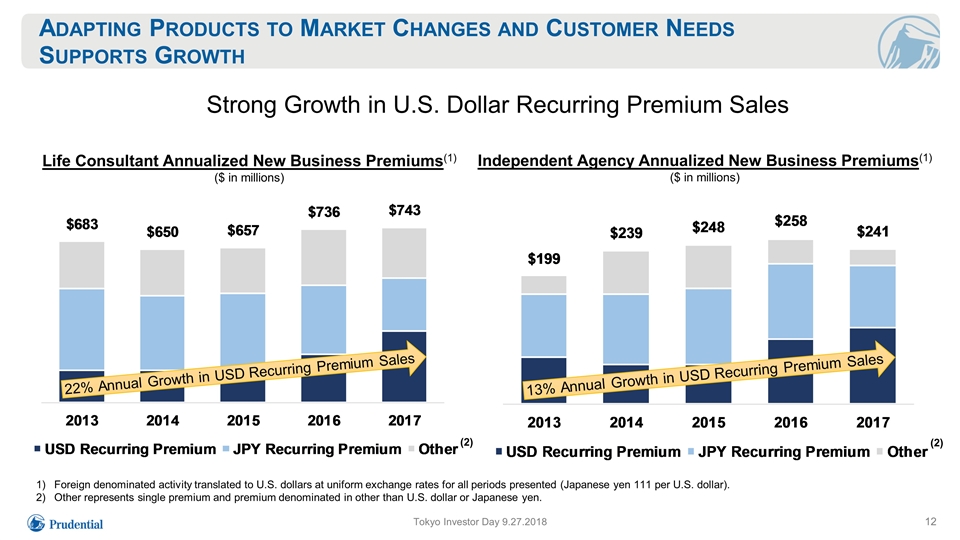

Adapting Products to Market Changes and Customer Needs Supports Growth Strong Growth in U.S. Dollar Recurring Premium Sales Foreign denominated activity translated to U.S. dollars at uniform exchange rates for all periods presented (Japanese yen 111 per U.S. dollar). Other represents single premium and premium denominated in other than U.S. dollar or Japanese yen. Life Consultant Annualized New Business Premiums(1) ($ in millions) Independent Agency Annualized New Business Premiums(1) ($ in millions) Tokyo Investor Day 9.27.2018 (2) (2) 12

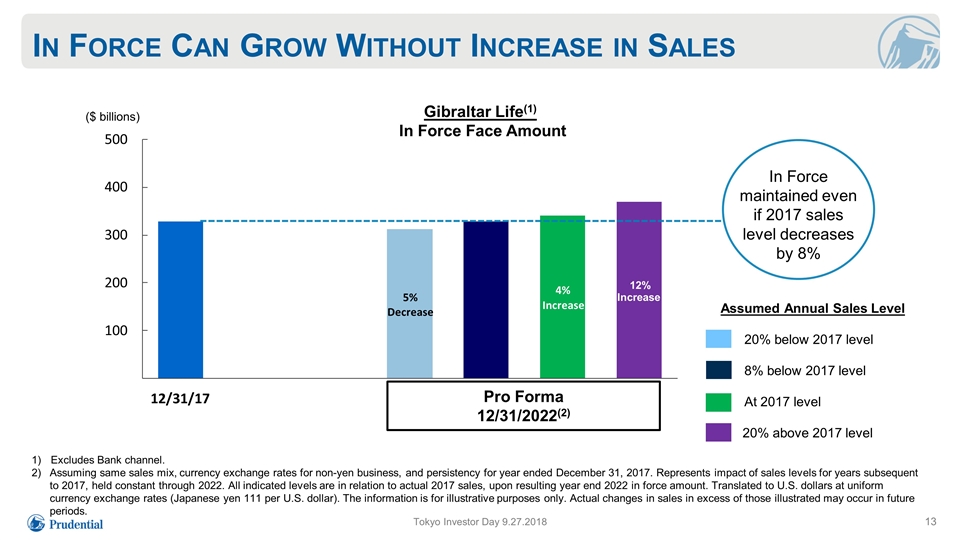

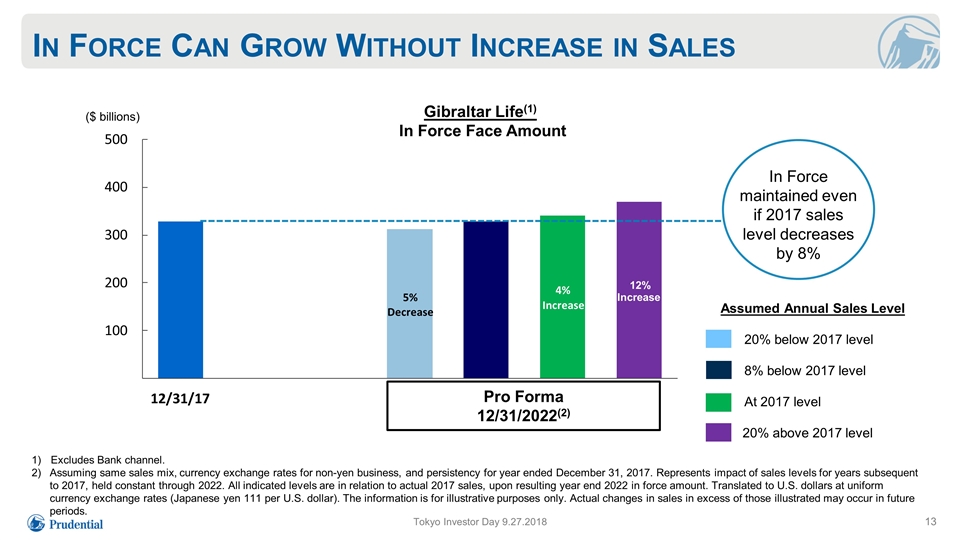

Excludes Bank channel. Assuming same sales mix, currency exchange rates for non-yen business, and persistency for year ended December 31, 2017. Represents impact of sales levels for years subsequent to 2017, held constant through 2022. All indicated levels are in relation to actual 2017 sales, upon resulting year end 2022 in force amount. Translated to U.S. dollars at uniform currency exchange rates (Japanese yen 111 per U.S. dollar). The information is for illustrative purposes only. Actual changes in sales in excess of those illustrated may occur in future periods. Assumed Annual Sales Level 20% below 2017 level 8% below 2017 level At 2017 level 20% above 2017 level In Force maintained even if 2017 sales level decreases by 8% In Force Can Grow Without Increase in Sales Tokyo Investor Day 9.27.2018 13 5% Decrease 4% Increase 12% Increase 100 200 300 400 500 12/31/17 ($ billions) Pro Forma 12/31/2022(2) Gibraltar Life(1) In Force Face Amount

Key Messages Broad distribution through productive Life Consultants and growing Independent Agencies Adapting products to market changes and customer needs supports growth Tokyo Investor Day 9.27.2018 Distinctive affinity relationship with Japanese Teachers Association 14

Bank Channel Takeshi Soeda President and Chief Executive Officer Prudential Gibraltar Financial Life

Key Messages Differentiated high quality distribution in bank channel market Strengthening bank relationships provides additional sales opportunities Tokyo Investor Day 9.27.2018 Adapting products to market changes and customer needs 2

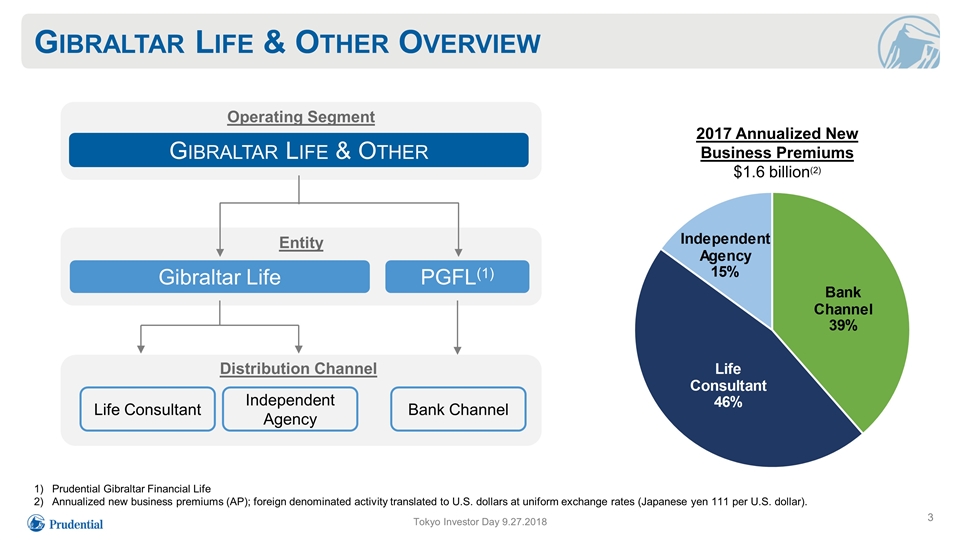

Operating Segment Entity Gibraltar Life & Other Life Consultant Gibraltar Life & Other Overview Bank Channel Gibraltar Life PGFL(1) Tokyo Investor Day 9.27.2018 Independent Agency 15% Independent Agency Distribution Channel 2017 Annualized New Business Premiums $1.6 billion(2) Prudential Gibraltar Financial Life Annualized new business premiums (AP); foreign denominated activity translated to U.S. dollars at uniform exchange rates (Japanese yen 111 per U.S. dollar). 3

Significant Financial Assets in Bank Channel Market Attractive sales opportunity driven by: Substantial concentration of wealth among Banks’ primary customers age 50 years and older Primary customers expected to increase as a percentage of the population(2) Tokyo Investor Day 9.27.2018 Banks’ Primary Customers Household financial assets in Japan: $17 trillion(1) Source: Bank of Japan (data as of December 2017). Translated to U.S. dollars at uniform currency exchange rate (Japanese yen 111 per U.S. dollar). Source: National Institute of Population and Social Security Research, "Population Projections for Japan: 2016 to 2065," Medium-fertility (medium-mortality) projection. 4

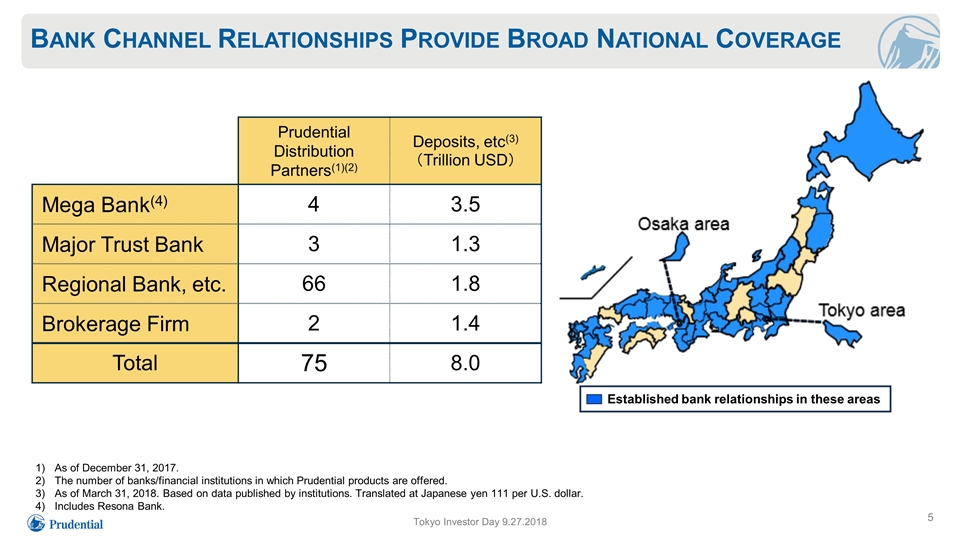

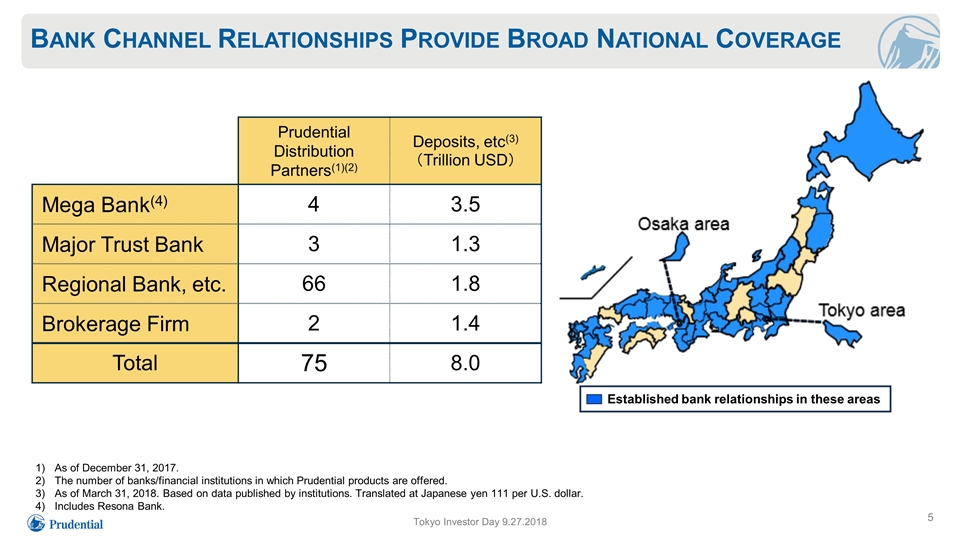

Bank Channel Relationships Provide Broad National Coverage Tokyo Investor Day 9.27.2018 Prudential Distribution Partners(1)(2) Deposits, etc(3) (Trillion USD) Mega Bank(4) 4 3.5 Major Trust Bank 3 1.3 Regional Bank, etc. 66 1.8 Brokerage Firm 2 1.4 Total 75 8.0 As of December 31, 2017. The number of banks/financial institutions in which Prudential products are offered. As of March 31, 2018. Based on data published by institutions. Translated at Japanese yen 111 per U.S. dollar. Includes Resona Bank. Established bank relationships in these areas 5

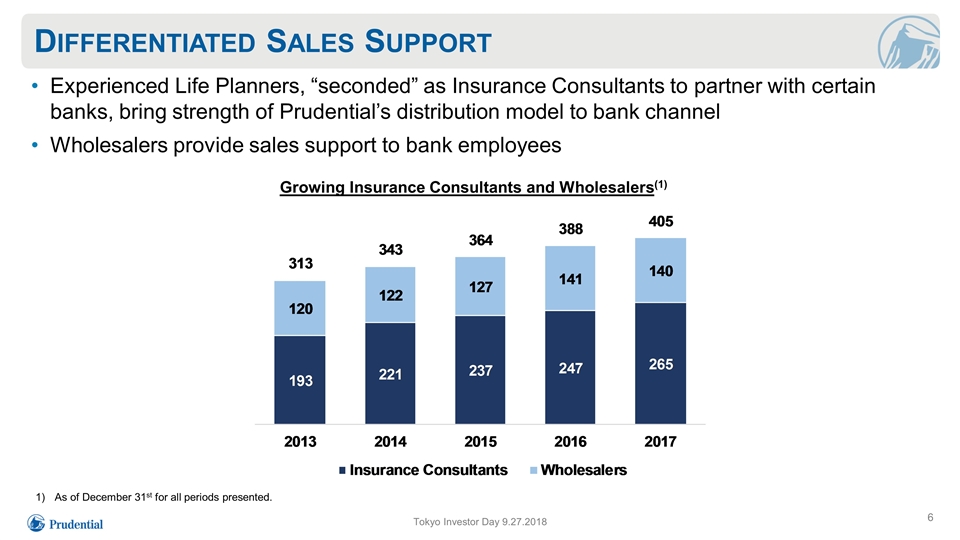

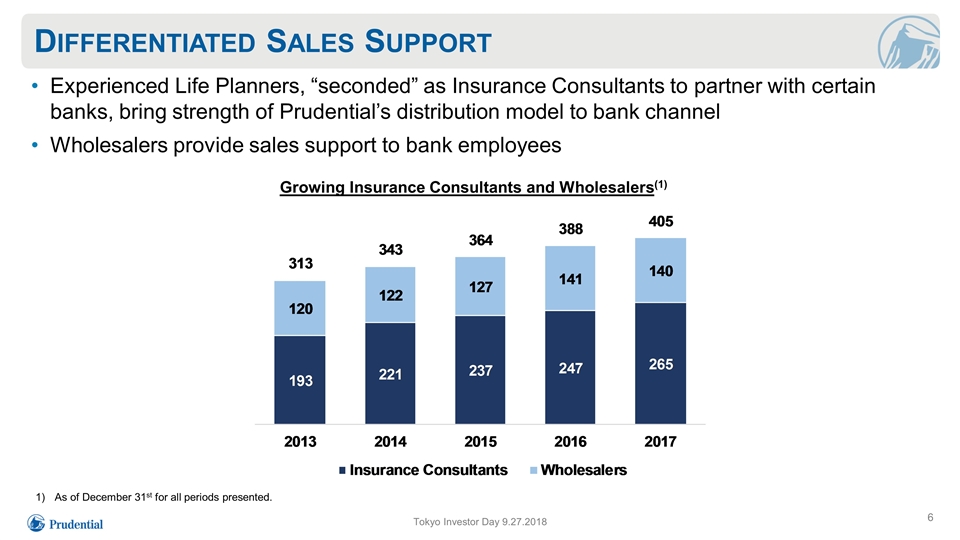

Differentiated Sales Support Tokyo Investor Day 9.27.2018 Experienced Life Planners, “seconded” as Insurance Consultants to partner with certain banks, bring strength of Prudential’s distribution model to bank channel Wholesalers provide sales support to bank employees As of December 31st for all periods presented. Growing Insurance Consultants and Wholesalers(1) 6

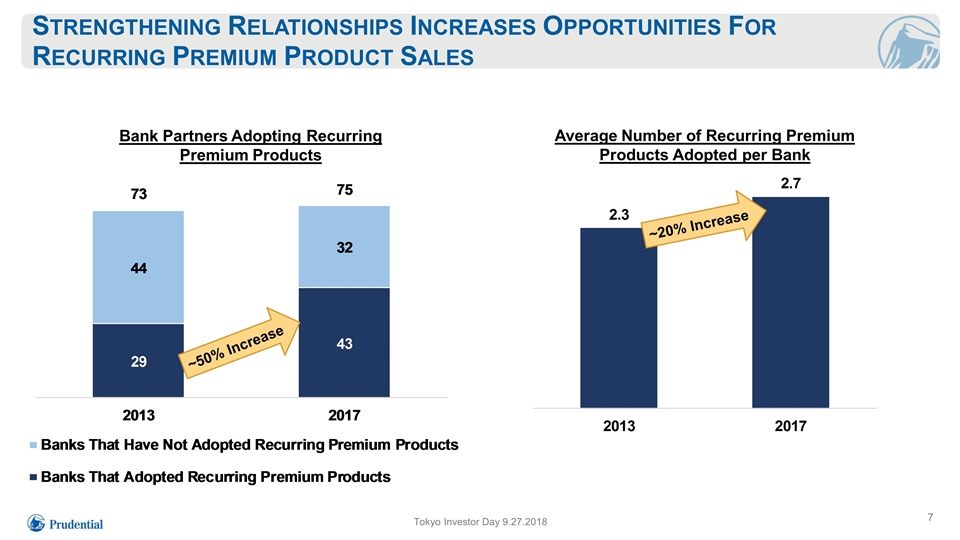

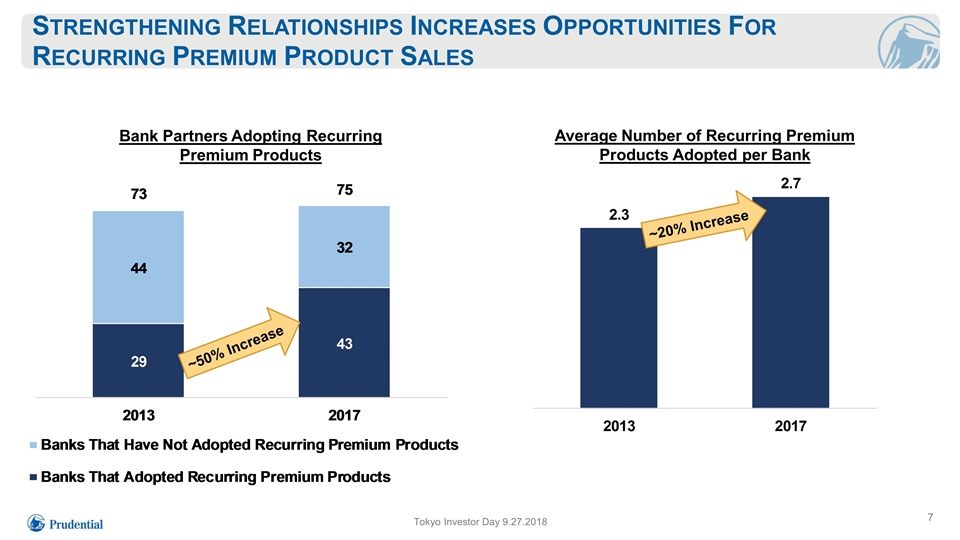

Tokyo Investor Day 9.27.2018 Strengthening Relationships Increases Opportunities For Recurring Premium Product Sales ~50% Increase ~20% Increase Bank Partners Adopting Recurring Premium Products Average Number of Recurring Premium Products Adopted per Bank 7

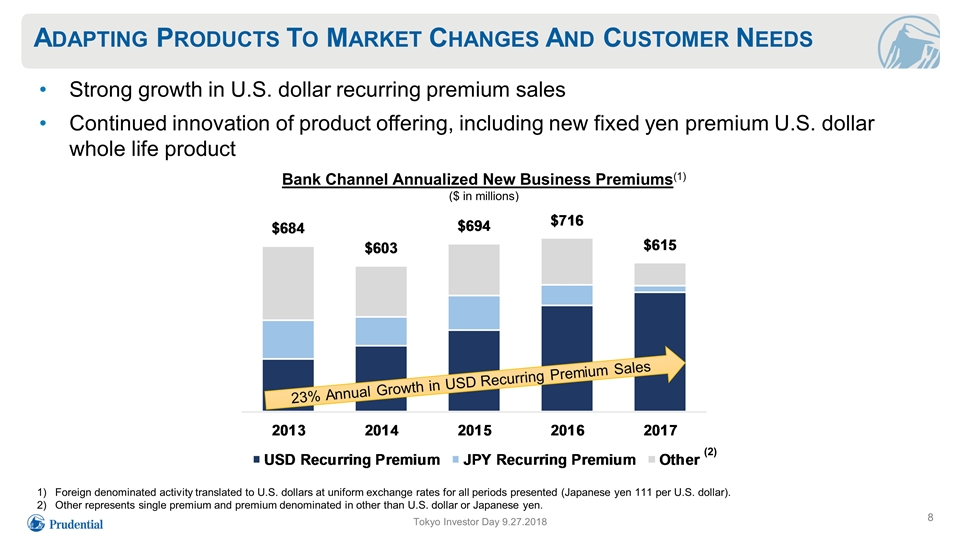

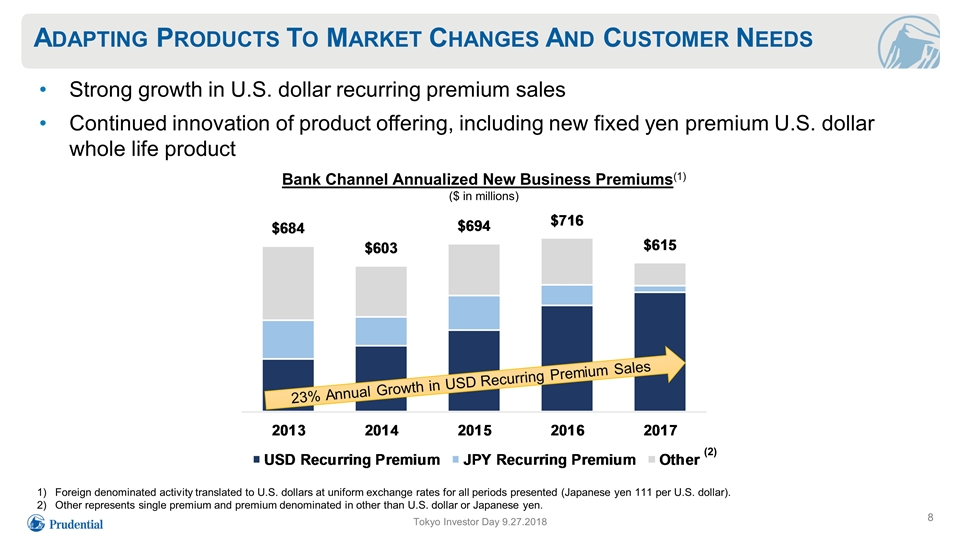

Foreign denominated activity translated to U.S. dollars at uniform exchange rates for all periods presented (Japanese yen 111 per U.S. dollar). Other represents single premium and premium denominated in other than U.S. dollar or Japanese yen. Tokyo Investor Day 9.27.2018 Adapting Products To Market Changes And Customer Needs Strong growth in U.S. dollar recurring premium sales Continued innovation of product offering, including new fixed yen premium U.S. dollar whole life product Bank Channel Annualized New Business Premiums(1) ($ in millions) (2) 8

Key Messages Differentiated high quality distribution in bank channel market Strengthening bank relationships provides additional sales opportunities Tokyo Investor Day 9.27.2018 Adapting products to market changes and customer needs 9

PGIM Japan Yasuhisa Nitta President and Chief Executive Officer PGIM Japan Co., Ltd.

Key Messages Well positioned in an attractive market Generating significant growth Long-term focus to fuel sustainable growth Tokyo Investor Day 9.27.2018 2

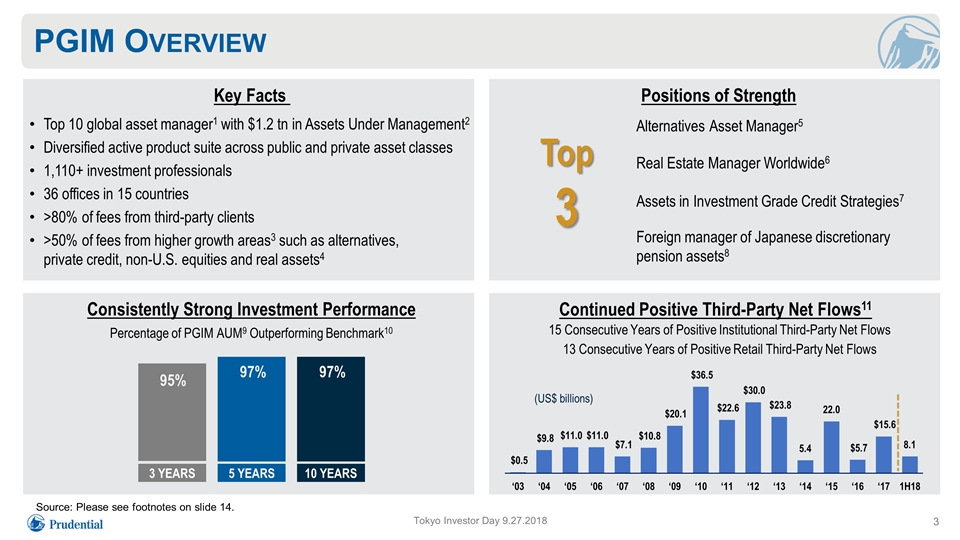

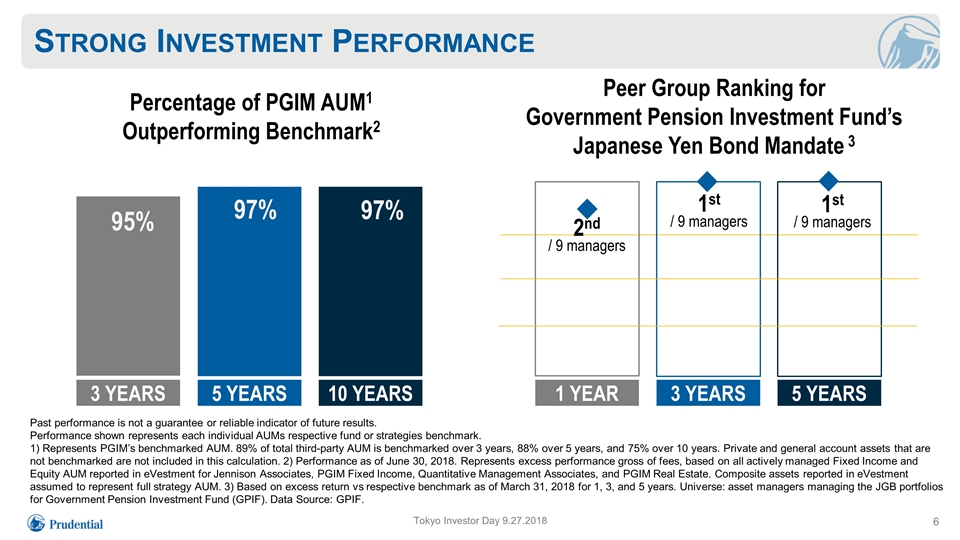

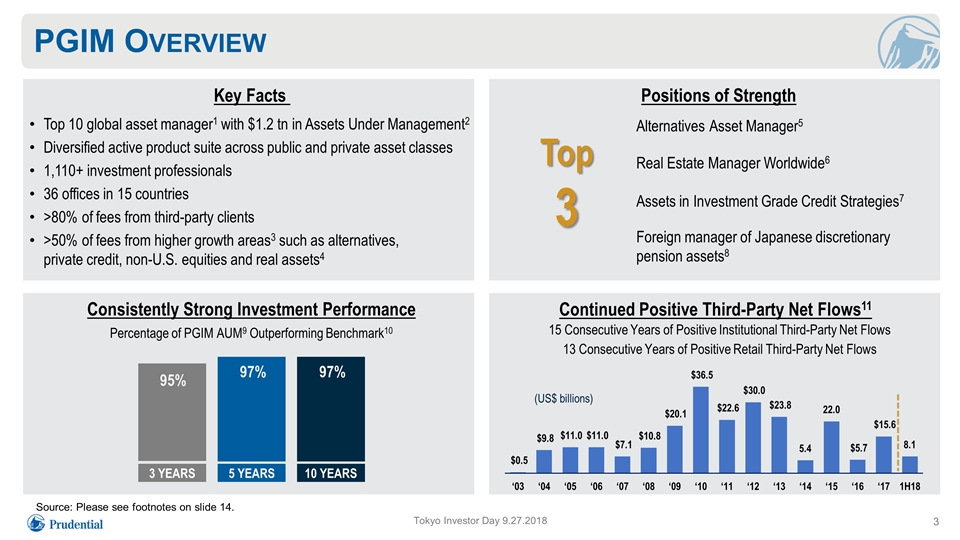

PGIM Overview Tokyo Investor Day 9.27.2018 Top 10 global asset manager1 with $1.2 tn in Assets Under Management2 Diversified active product suite across public and private asset classes 1,110+ investment professionals 36 offices in 15 countries >80% of fees from third-party clients >50% of fees from higher growth areas3 such as alternatives, private credit, non-U.S. equities and real assets4 3 YEARS 5 YEARS 10 YEARS 95% 97% 97% Top 3 Real Estate Manager Worldwide6 Assets in Investment Grade Credit Strategies7 Alternatives Asset Manager5 Foreign manager of Japanese discretionary pension assets8 Positions of Strength Key Facts Consistently Strong Investment Performance Continued Positive Third-Party Net Flows11 15 Consecutive Years of Positive Institutional Third-Party Net Flows 13 Consecutive Years of Positive Retail Third-Party Net Flows Source: Please see footnotes on slide 14. Percentage of PGIM AUM9 Outperforming Benchmark10 (US$ billions) 3

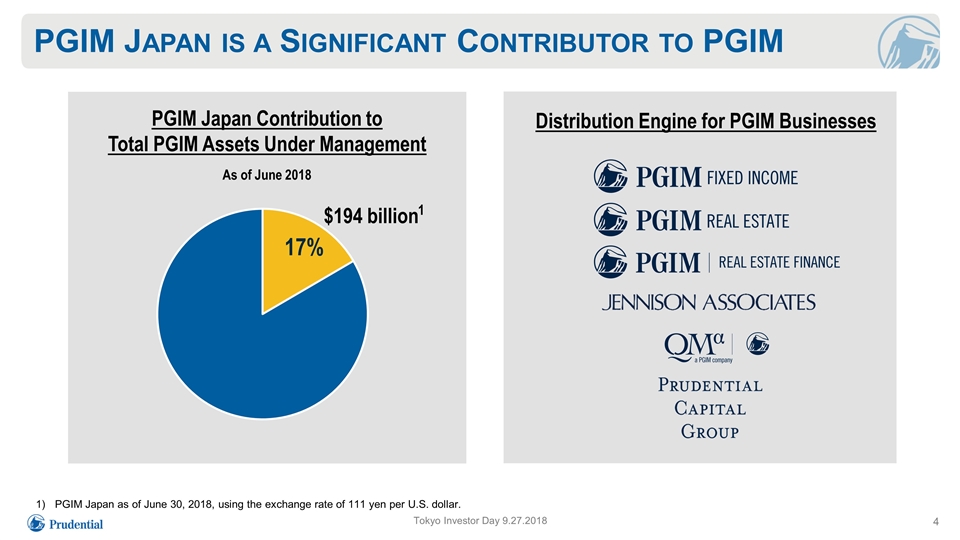

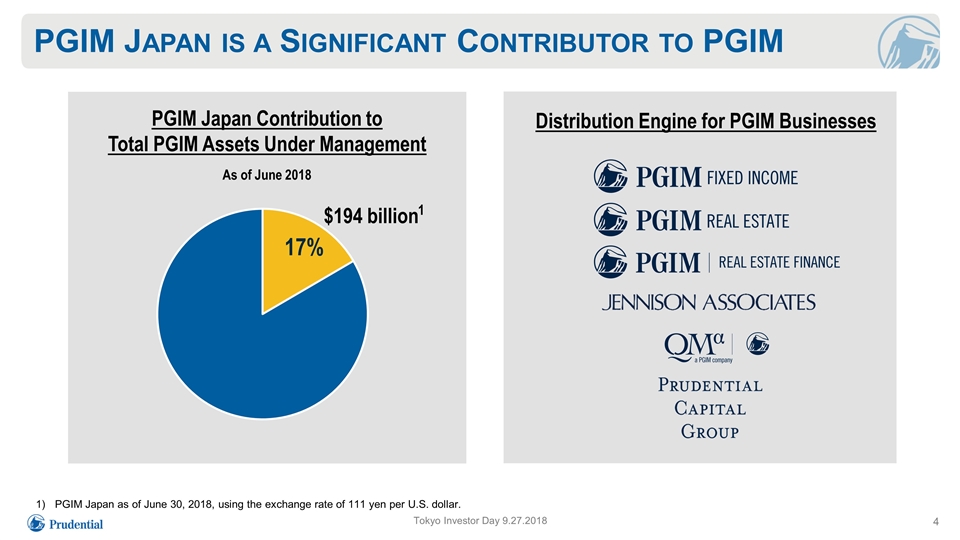

PGIM Japan is a Significant Contributor to PGIM Tokyo Investor Day 9.27.2018 PGIM Japan Contribution to Total PGIM Assets Under Management PGIM Japan as of June 30, 2018, using the exchange rate of 111 yen per U.S. dollar. Distribution Engine for PGIM Businesses As of June 2018 $194 billion 1 4

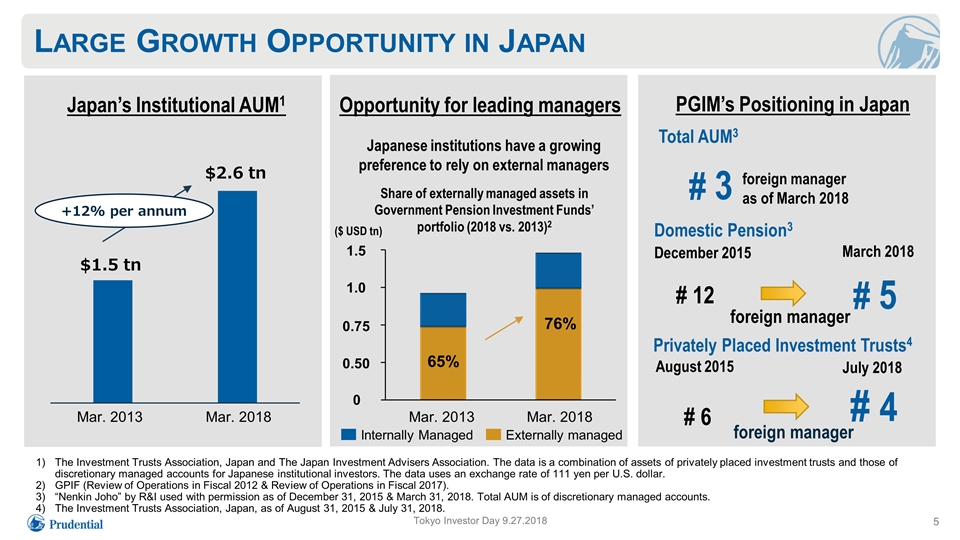

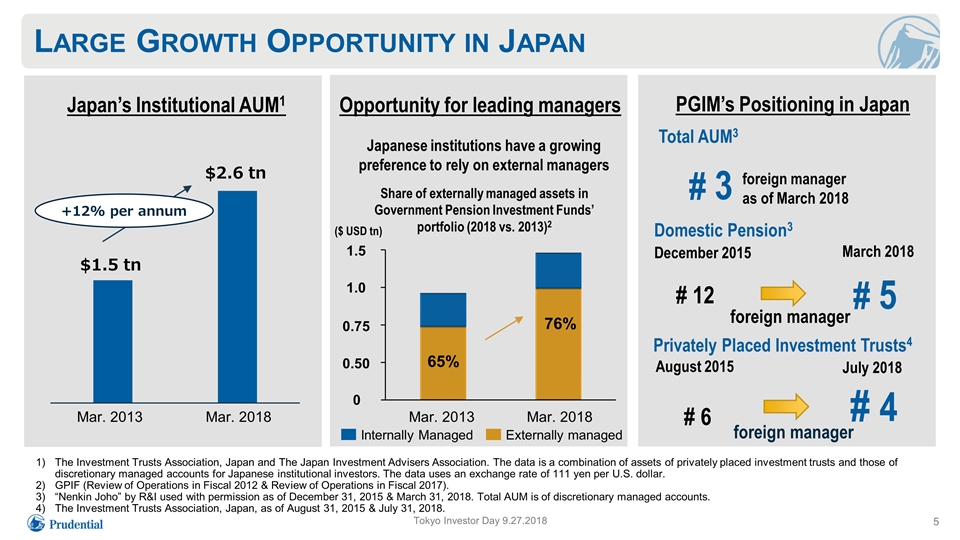

Large Growth Opportunity in Japan Tokyo Investor Day 9.27.2018 The Investment Trusts Association, Japan and The Japan Investment Advisers Association. The data is a combination of assets of privately placed investment trusts and those of discretionary managed accounts for Japanese institutional investors. The data uses an exchange rate of 111 yen per U.S. dollar. GPIF (Review of Operations in Fiscal 2012 & Review of Operations in Fiscal 2017). “Nenkin Joho” by R&I used with permission as of December 31, 2015 & March 31, 2018. Total AUM is of discretionary managed accounts. The Investment Trusts Association, Japan, as of August 31, 2015 & July 31, 2018. PGIM’s Positioning in Japan Domestic Pension3 December 2015 # 12 Privately Placed Investment Trusts4 August 2015 # 6 foreign manager foreign manager # 3 Total AUM3 foreign manager as of March 2018 # 5 July 2018 # 4 March 2018 Opportunity for leading managers Japanese institutions have a growing preference to rely on external managers Share of externally managed assets in Government Pension Investment Funds’ portfolio (2018 vs. 2013)2 76% 65% ($ USD tn) 1.5 1.0 0.75 0.50 0 Japan’s Institutional AUM1 $2.6 tn Mar.2018 Mar. $1.5 tn +12% per annum Mar. 2013 Mar. 2013 Mar. 2018 Mar. 2018 Internally Managed 5

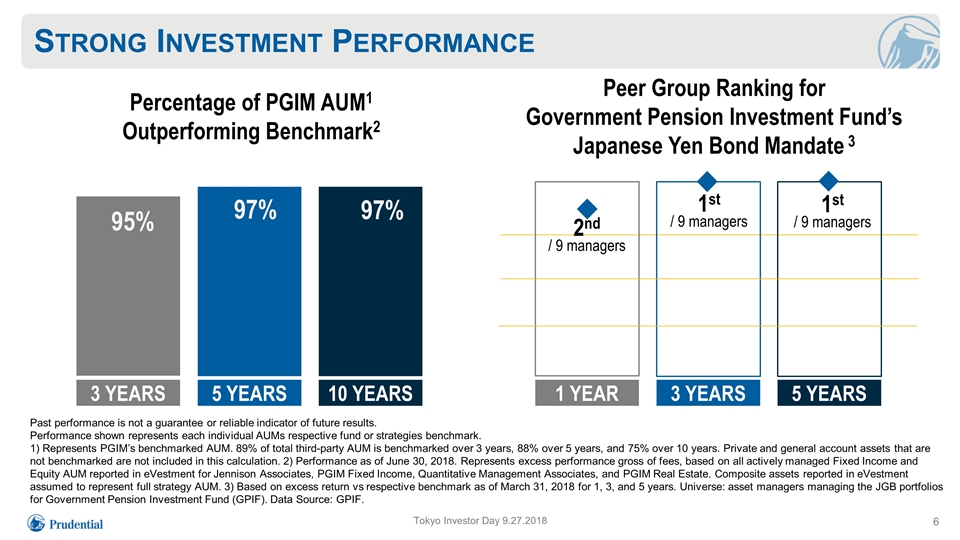

Past performance is not a guarantee or reliable indicator of future results. Performance shown represents each individual AUMs respective fund or strategies benchmark. 1) Represents PGIM’s benchmarked AUM. 89% of total third-party AUM is benchmarked over 3 years, 88% over 5 years, and 75% over 10 years. Private and general account assets that are not benchmarked are not included in this calculation. 2) Performance as of June 30, 2018. Represents excess performance gross of fees, based on all actively managed Fixed Income and Equity AUM reported in eVestment for Jennison Associates, PGIM Fixed Income, Quantitative Management Associates, and PGIM Real Estate. Composite assets reported in eVestment assumed to represent full strategy AUM. 3) Based on excess return vs respective benchmark as of March 31, 2018 for 1, 3, and 5 years. Universe: asset managers managing the JGB portfolios for Government Pension Investment Fund (GPIF). Data Source: GPIF. Strong Investment Performance Tokyo Investor Day 9.27.2018 Percentage of PGIM AUM1 Outperforming Benchmark2 3 YEARS 5 YEARS 95% 97% 10 YEARS 97% Peer Group Ranking for Government Pension Investment Fund’s Japanese Yen Bond Mandate 3 1 YEAR 3 YEARS 5 YEARS 1st / 9 managers 1st / 9 managers 2nd / 9 managers 6

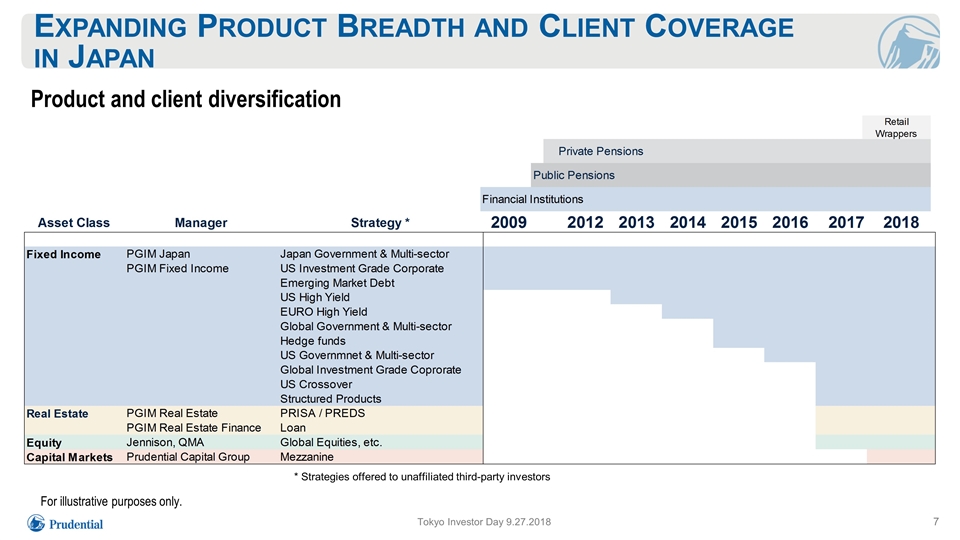

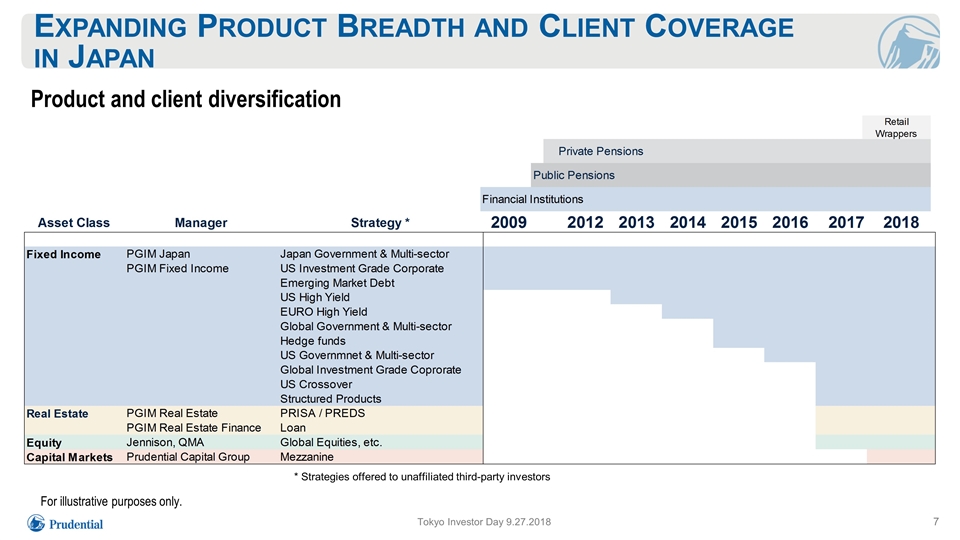

Expanding Product Breadth and Client Coverage in Japan Tokyo Investor Day 9.27.2018 Product and client diversification * Strategies offered to unaffiliated third-party investors For illustrative purposes only. 7

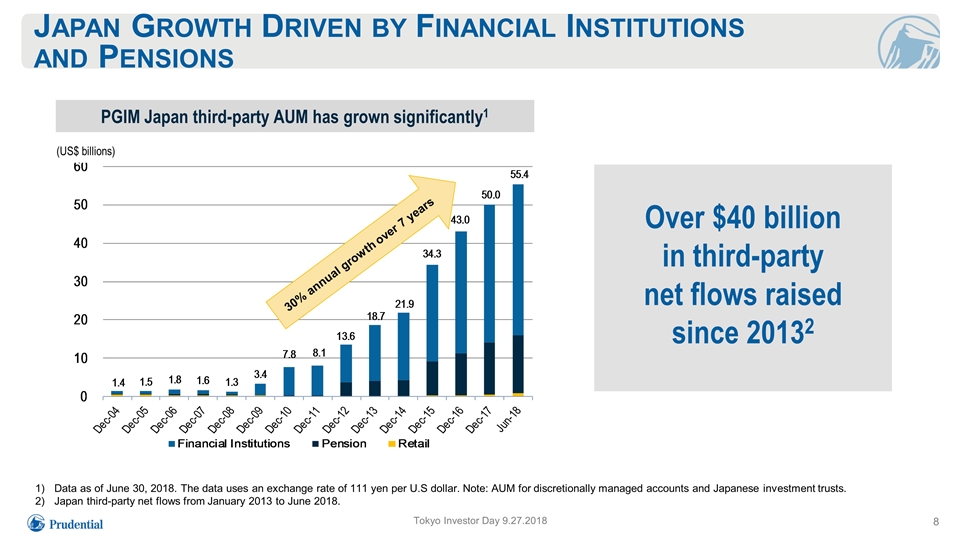

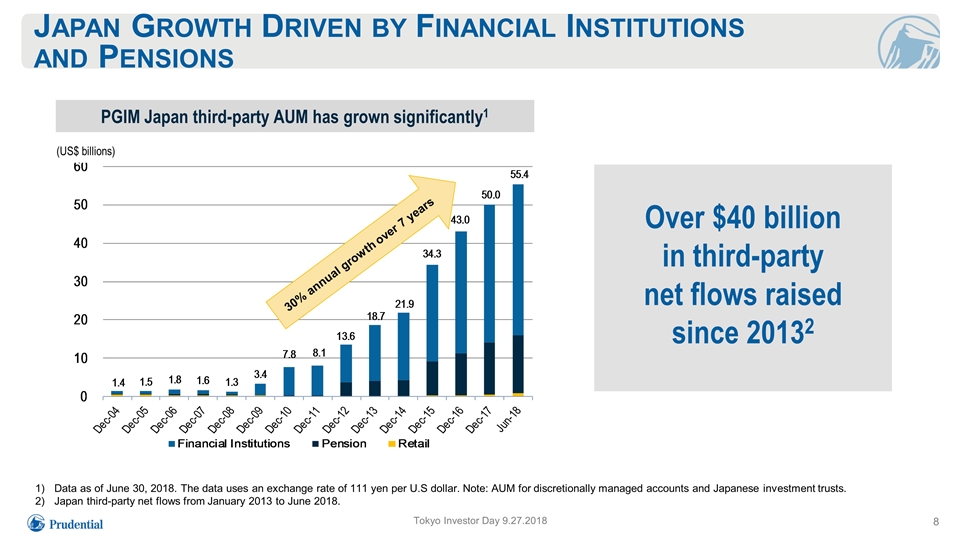

Japan Growth Driven by Financial Institutions and Pensions Tokyo Investor Day 9.27.2018 PGIM Japan third-party AUM has grown significantly1 26% annual growth over 8 years Data as of June 30, 2018. The data uses an exchange rate of 111 yen per U.S dollar. Note: AUM for discretionally managed accounts and Japanese investment trusts. Japan third-party net flows from January 2013 to June 2018. Over $40 billion in third-party net flows raised since 20132 (US$ billions) 30% annual growth over 7 years 8

PGIM Japan Strategy Tokyo Investor Day 9.27.2018 Diversify client base Leverage our multi-asset capabilities Invest to drive future growth 9

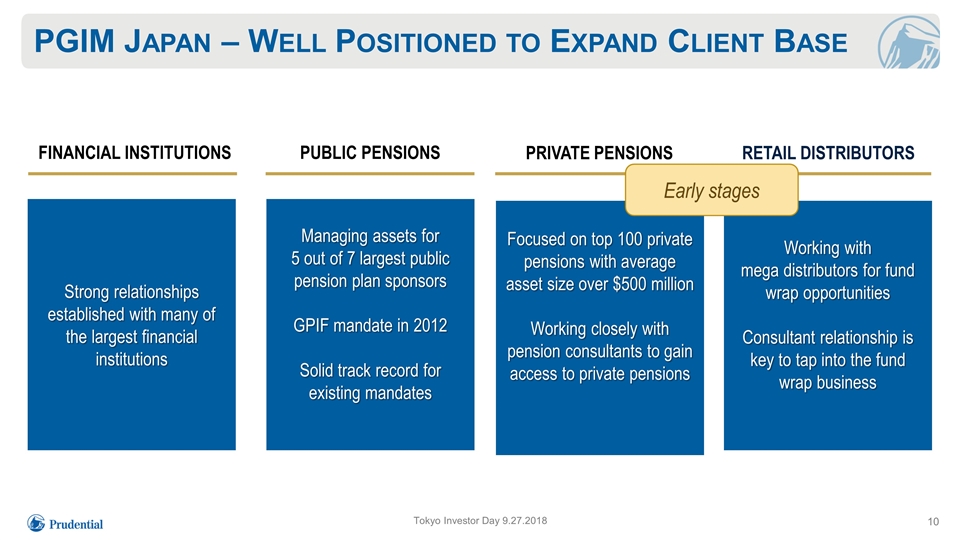

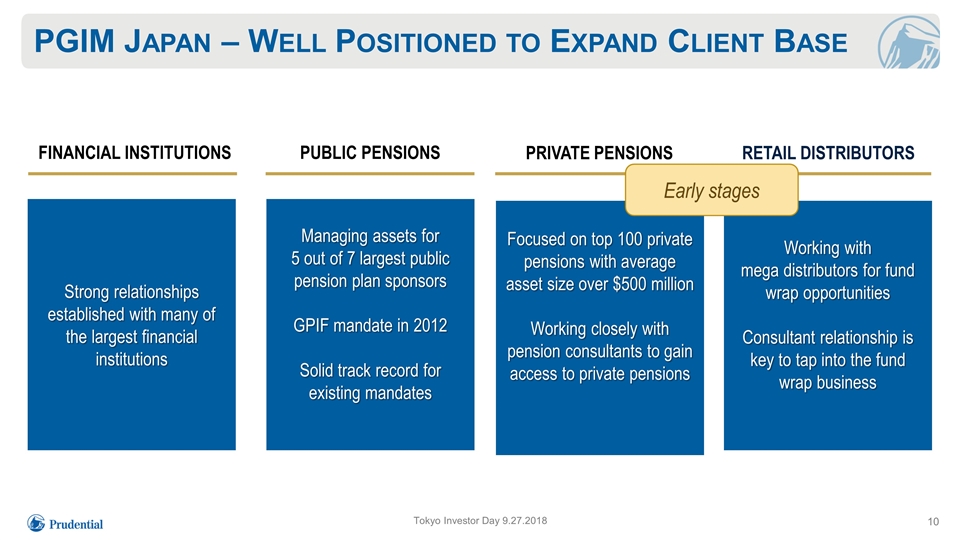

PGIM Japan – Well Positioned to Expand Client Base Tokyo Investor Day 9.27.2018 FINANCIAL INSTITUTIONS PRIVATE PENSIONS PUBLIC PENSIONS RETAIL DISTRIBUTORS Managing assets for 5 out of 7 largest public pension plan sponsors GPIF mandate in 2012 Solid track record for existing mandates Strong relationships established with many of the largest financial institutions Focused on top 100 private pensions with average asset size over $500 million Working closely with pension consultants to gain access to private pensions Working with mega distributors for fund wrap opportunities Consultant relationship is key to tap into the fund wrap business Early stages 10

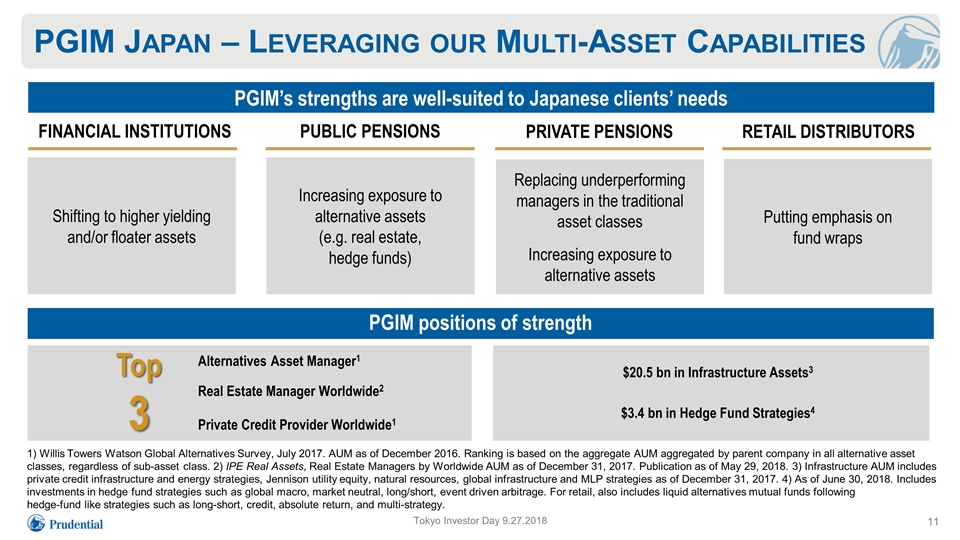

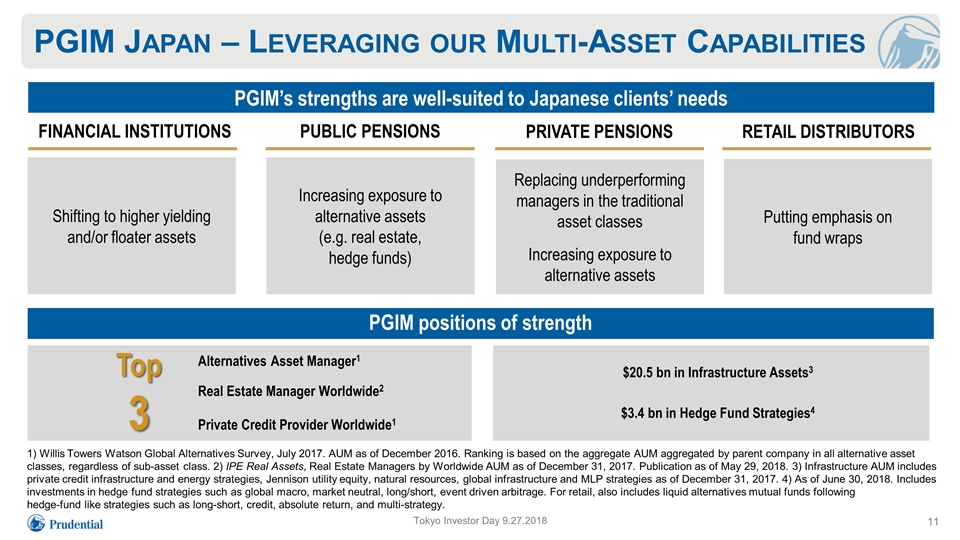

PGIM Japan – Leveraging our Multi-Asset Capabilities Tokyo Investor Day 9.27.2018 PGIM’s strengths are well-suited to Japanese clients’ needs FINANCIAL INSTITUTIONS PRIVATE PENSIONS PUBLIC PENSIONS RETAIL DISTRIBUTORS PGIM positions of strength Top 3 Real Estate Manager Worldwide2 Private Credit Provider Worldwide1 Alternatives Asset Manager1 1) Willis Towers Watson Global Alternatives Survey, July 2017. AUM as of December 2016. Ranking is based on the aggregate AUM aggregated by parent company in all alternative asset classes, regardless of sub-asset class. 2) IPE Real Assets, Real Estate Managers by Worldwide AUM as of December 31, 2017. Publication as of May 29, 2018. 3) Infrastructure AUM includes private credit infrastructure and energy strategies, Jennison utility equity, natural resources, global infrastructure and MLP strategies as of December 31, 2017. 4) As of June 30, 2018. Includes investments in hedge fund strategies such as global macro, market neutral, long/short, event driven arbitrage. For retail, also includes liquid alternatives mutual funds following hedge-fund like strategies such as long-short, credit, absolute return, and multi-strategy. $20.5 bn in Infrastructure Assets3 $3.4 bn in Hedge Fund Strategies4 Increasing exposure to alternative assets (e.g. real estate, hedge funds) Shifting to higher yielding and/or floater assets Replacing underperforming managers in the traditional asset classes Increasing exposure to alternative assets Putting emphasis on fund wraps 11

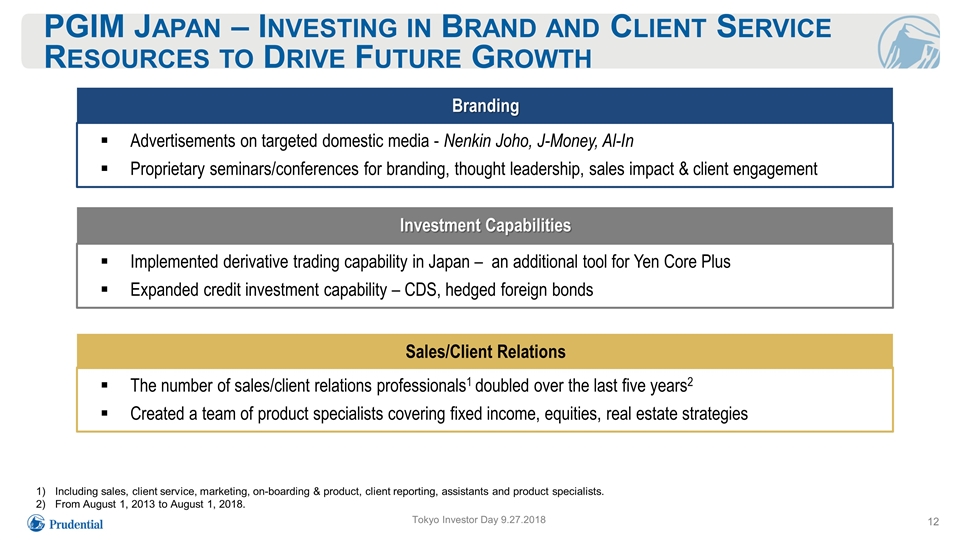

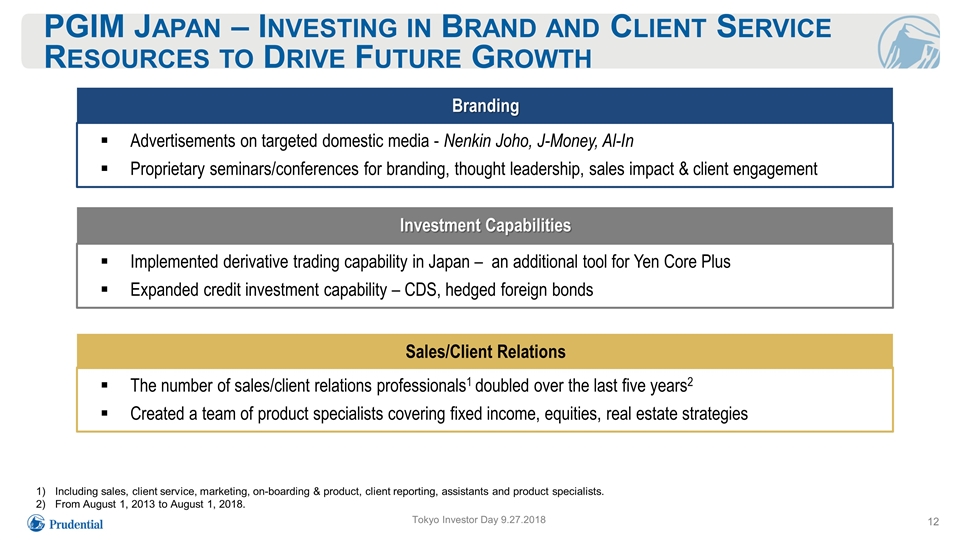

PGIM Japan – Investing in Brand and Client Service Resources to Drive Future Growth Tokyo Investor Day 9.27.2018 Branding Sales/Client Relations Including sales, client service, marketing, on-boarding & product, client reporting, assistants and product specialists. From August 1, 2013 to August 1, 2018. Investment Capabilities Advertisements on targeted domestic media - Nenkin Joho, J-Money, Al-In Proprietary seminars/conferences for branding, thought leadership, sales impact & client engagement Implemented derivative trading capability in Japan – an additional tool for Yen Core Plus Expanded credit investment capability – CDS, hedged foreign bonds The number of sales/client relations professionals1 doubled over the last five years2 Created a team of product specialists covering fixed income, equities, real estate strategies 12

Key Messages Well positioned in an attractive market Generating significant growth Long-term focus to fuel sustainable growth Tokyo Investor Day 9.27.2018 13

Appendix: Footnotes for PGIM Overview Tokyo Investor Day 9.27.2018 1) Pensions & Investments Top Money Manager’s list, May 28, 2018; based on Prudential Financial total worldwide assets under management as of December 31, 2017. 2) Worldwide AUM include assets managed by Prudential’s Asset Management business and non-proprietary AUM. 3) As of December 31, 2017. Categories may overlap; represents asset management fees from all PGIM revenue sources. 4) Includes real estate, infrastructure, energy, and natural resources strategies. 5) Willis Towers Watson Global Alternatives Survey, July 2017. AUM as of December 2016. Ranking is based on the aggregate AUM aggregated by parent company in all alternative assets classes, regardless of sub-asset class. 6) IPE Real Assets, Real Estate Managers by Worldwide AUM as of December 31, 2017. Publication as of May 29, 2018. 7) Investment Grade Credit Manager Survey, IPE International Publishers Limited, January 2018. 8) Nenkin Joho by R&I, The Investment Trusts Association, Japan. January 2018. AUM as of September 30, 2017. Performance shown represents each individual AUMs respective fund or strategies benchmark. 9) Represents PGIM’s benchmarked AUM. 89% of total third party AUM is benchmarked over 3 years, 88% over 5 years, and 75% over 10 years. Private and general account assets that are not benchmarked are not included in this calculation. 10) Performance as of June 30, 2018. Represents excess performance gross of fees, based on all actively managed Fixed Income and Equity AUM reported in eVestment for Jennison Associates, PGIM Fixed Income, Quantitative Management Associates, and PGIM Real Estate. Composite assets reported in eVestment assumed to represent full strategy AUM. 11) Represents unaffiliated third party net flows; excludes flows from the General Account and other affiliated Prudential businesses. 2003 and 2004 third party net flows shown in chart represent only institutional third party net flows. 14

Prudential International Insurance Financial Overview Rob Falzon Executive Vice President and Chief Financial Officer Prudential Financial, Inc.

Key Messages Impacts from currency and interest rate headwinds are subsiding Tokyo Investor Day 9.27.2018 Sustained growth with strong returns and attractive risk profile Strong capital generation and redeployment 2

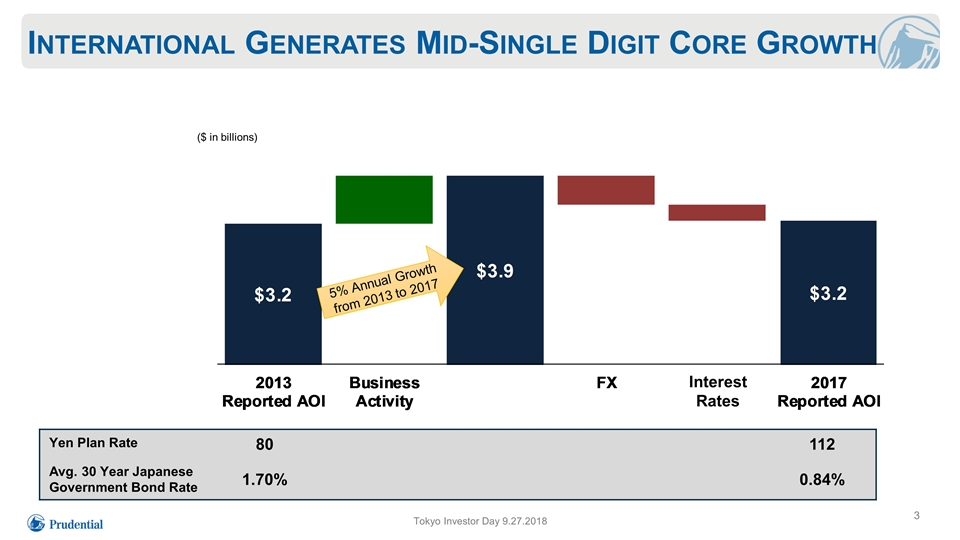

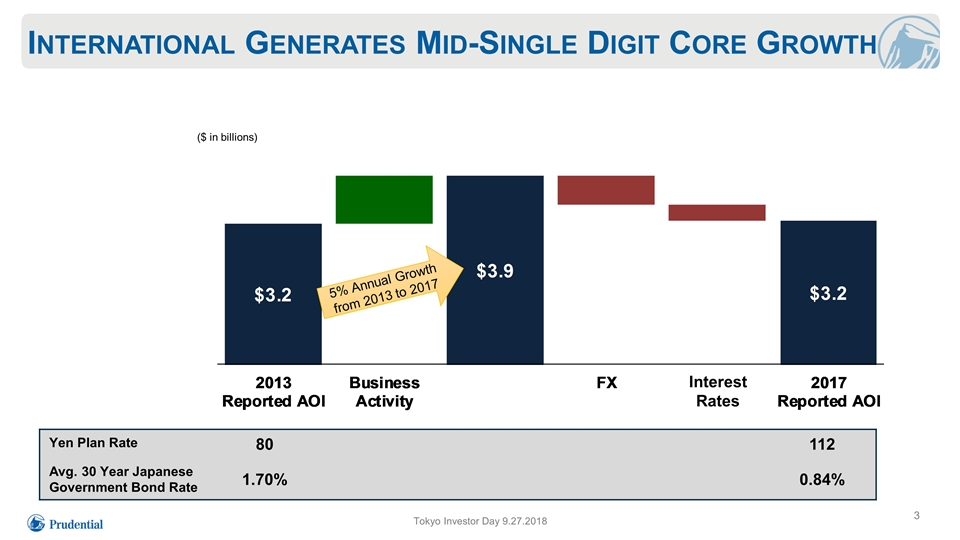

Tokyo Investor Day 9.27.2018 ($ in billions) Yen Plan Rate 80 112 Avg. 30 Year Japanese Government Bond Rate 1.70% 0.84% International Generates Mid-Single Digit Core Growth 5% Annual Growth from 2013 to 2017 Interest Rates 3

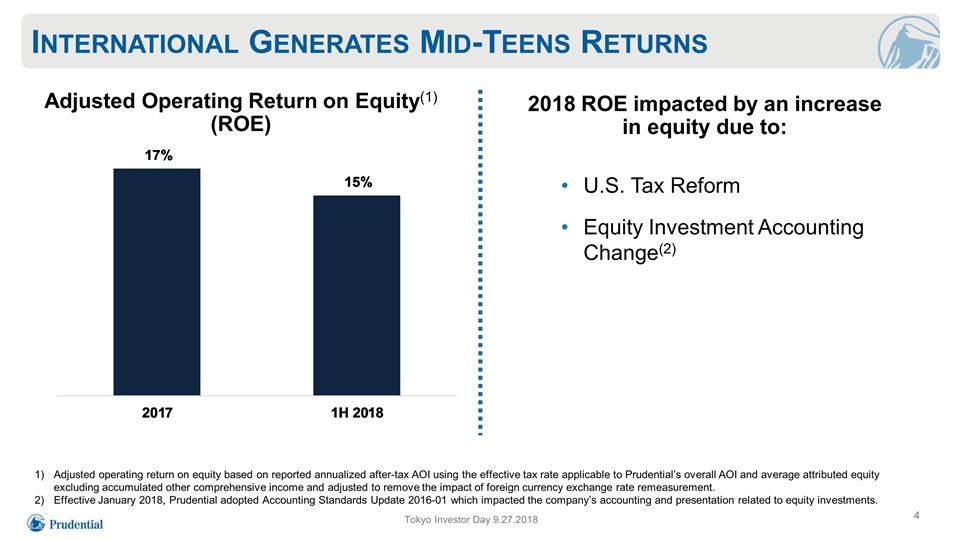

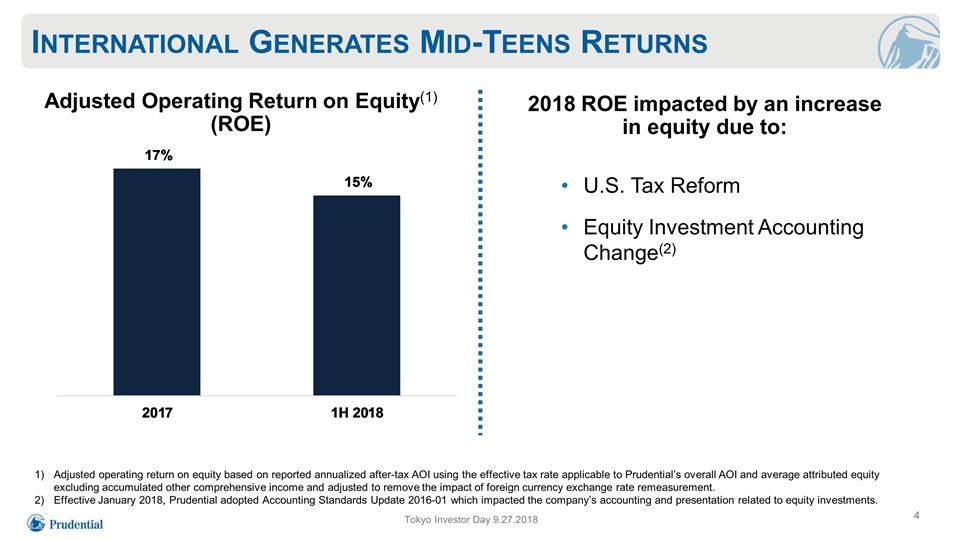

International Generates Mid-Teens Returns Adjusted operating return on equity based on reported annualized after-tax AOI using the effective tax rate applicable to Prudential’s overall AOI and average attributed equity excluding accumulated other comprehensive income and adjusted to remove the impact of foreign currency exchange rate remeasurement. Effective January 2018, Prudential adopted Accounting Standards Update 2016-01 which impacted the company’s accounting and presentation related to equity investments. Tokyo Investor Day 9.27.2018 U.S. Tax Reform Equity Investment Accounting Change(2) 2018 ROE impacted by an increase in equity due to: Adjusted Operating Return on Equity(1) (ROE) 4

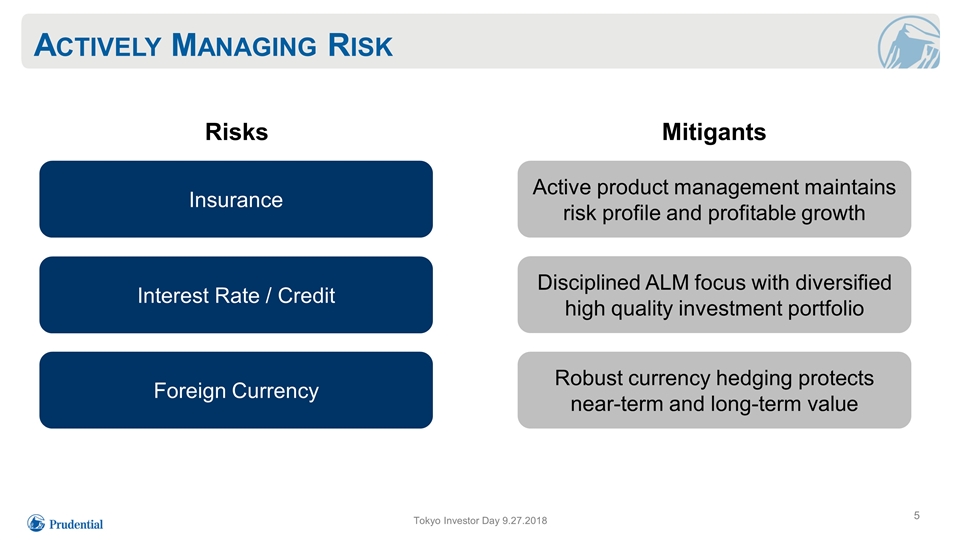

Actively Managing Risk Tokyo Investor Day 9.27.2018 Financial Discipline & Risk Mgmt. Risks Mitigants Disciplined ALM focus with diversified high quality investment portfolio Active product management maintains risk profile and profitable growth Robust currency hedging protects near-term and long-term value Insurance Interest Rate / Credit Foreign Currency 5

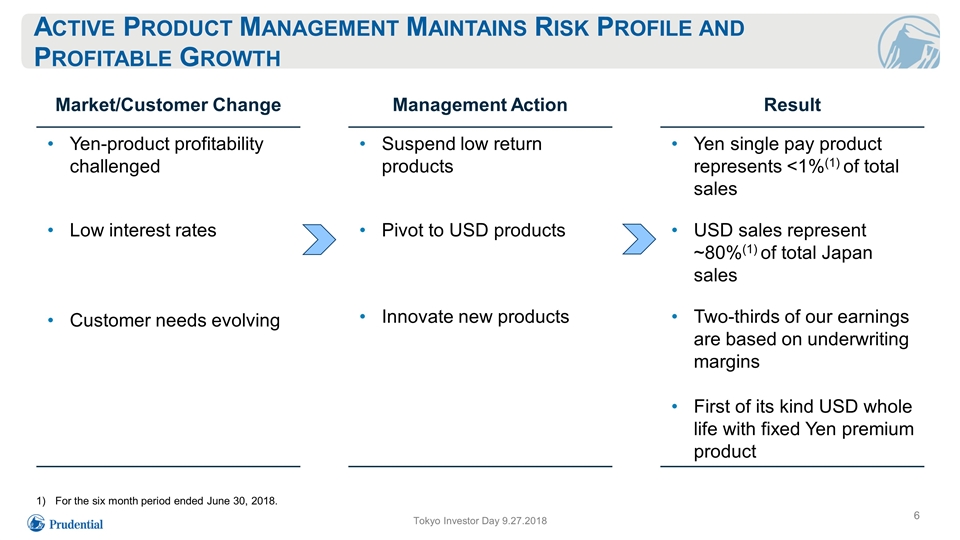

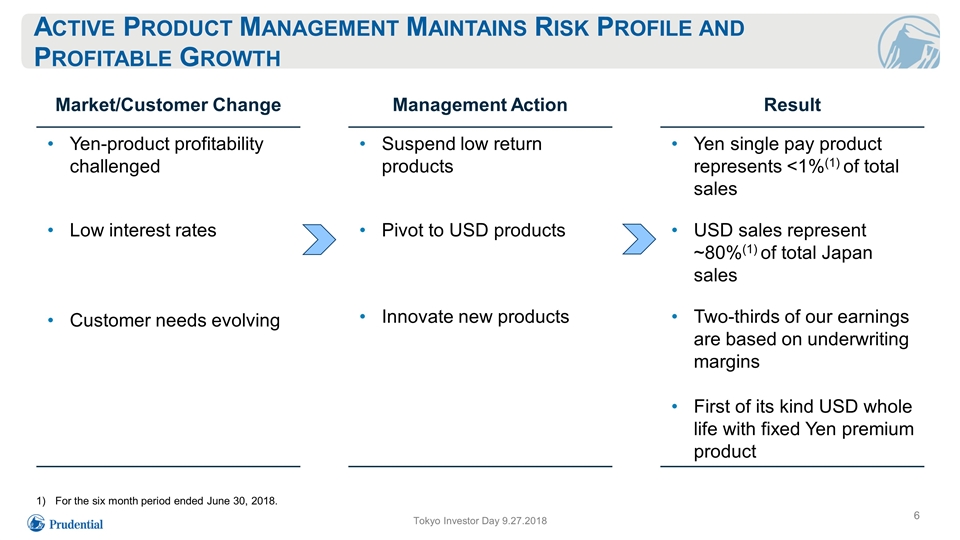

Active Product Management Maintains Risk Profile and Profitable Growth Tokyo Investor Day 9.27.2018 For the six month period ended June 30, 2018. Market/Customer Change Management Action Result Yen-product profitability challenged Suspend low return products Yen single pay product represents <1%(1) of total sales Low interest rates Customer needs evolving Pivot to USD products USD sales represent ~80%(1) of total Japan sales Innovate new products Two-thirds of our earnings are based on underwriting margins First of its kind USD whole life with fixed Yen premium product 6

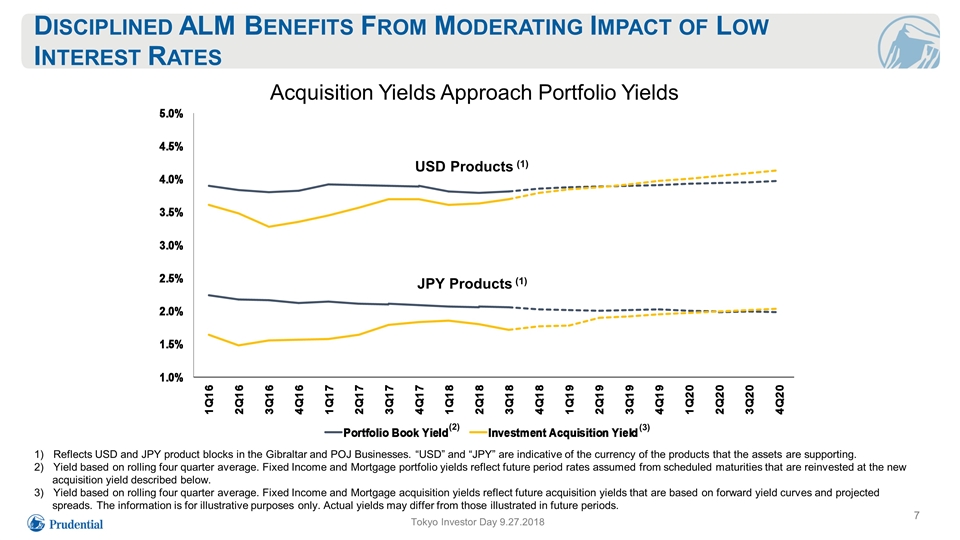

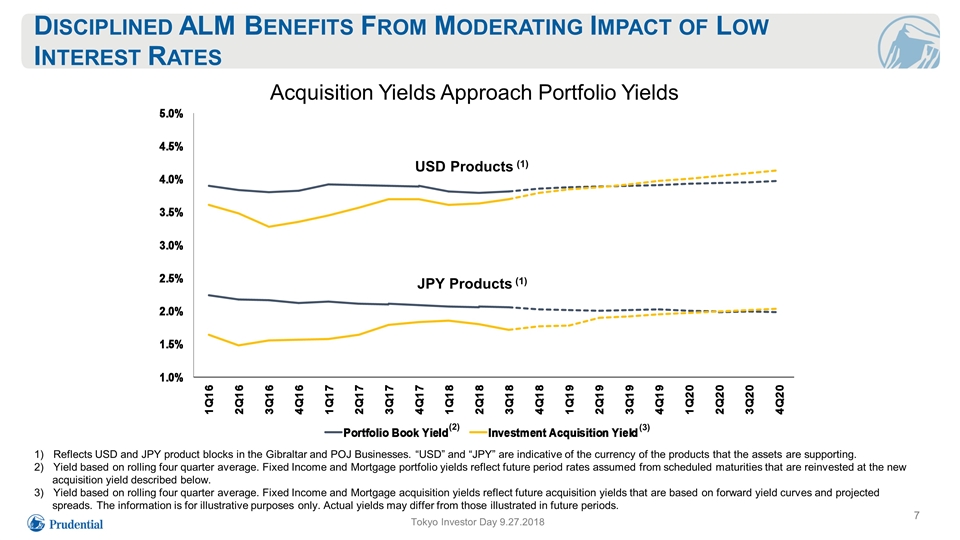

Tokyo Investor Day 9.27.2018 Reflects USD and JPY product blocks in the Gibraltar and POJ Businesses. “USD” and “JPY” are indicative of the currency of the products that the assets are supporting. Yield based on rolling four quarter average. Fixed Income and Mortgage portfolio yields reflect future period rates assumed from scheduled maturities that are reinvested at the new acquisition yield described below. Yield based on rolling four quarter average. Fixed Income and Mortgage acquisition yields reflect future acquisition yields that are based on forward yield curves and projected spreads. The information is for illustrative purposes only. Actual yields may differ from those illustrated in future periods. JPY Products (1) Disciplined ALM Benefits From Moderating Impact of Low Interest Rates USD Products (1) JPY Products (1) (2) (3) Acquisition Yields Approach Portfolio Yields 7

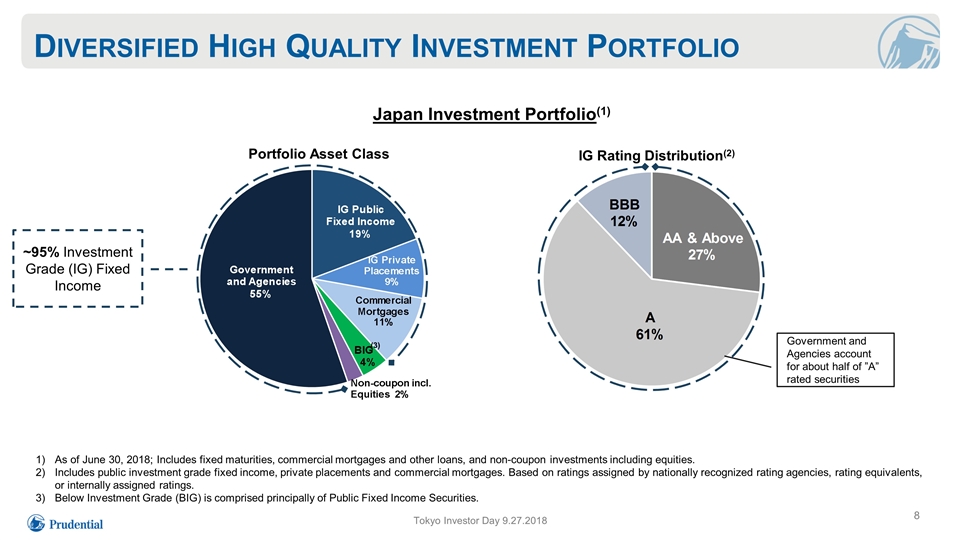

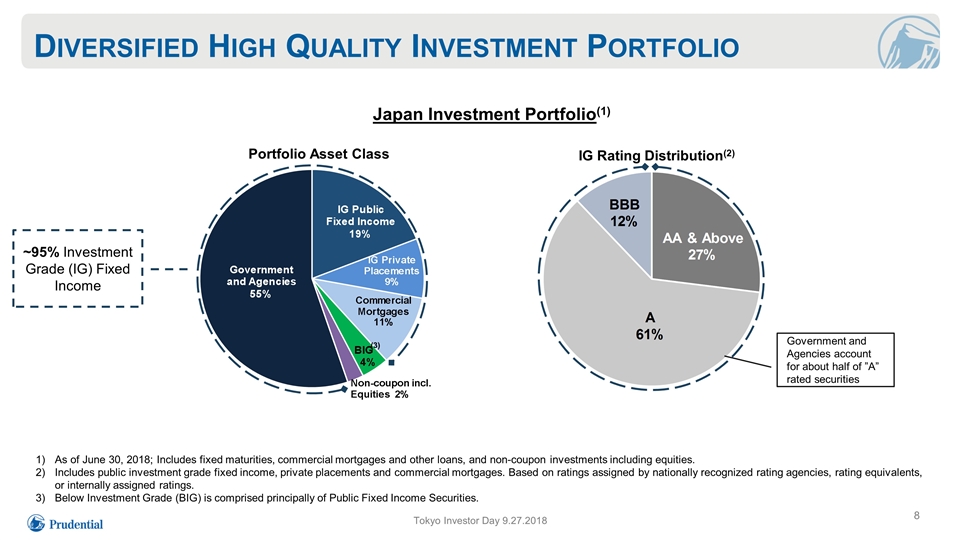

Tokyo Investor Day 9.27.2018 Portfolio Asset Class IG Rating Distribution(2) Japan Investment Portfolio(1) (3) Government and Agencies account for about half of ”A” rated securities ~95% Investment Grade (IG) Fixed Income As of June 30, 2018; Includes fixed maturities, commercial mortgages and other loans, and non-coupon investments including equities. Includes public investment grade fixed income, private placements and commercial mortgages. Based on ratings assigned by nationally recognized rating agencies, rating equivalents, or internally assigned ratings. Below Investment Grade (BIG) is comprised principally of Public Fixed Income Securities. Diversified High Quality Investment Portfolio 8

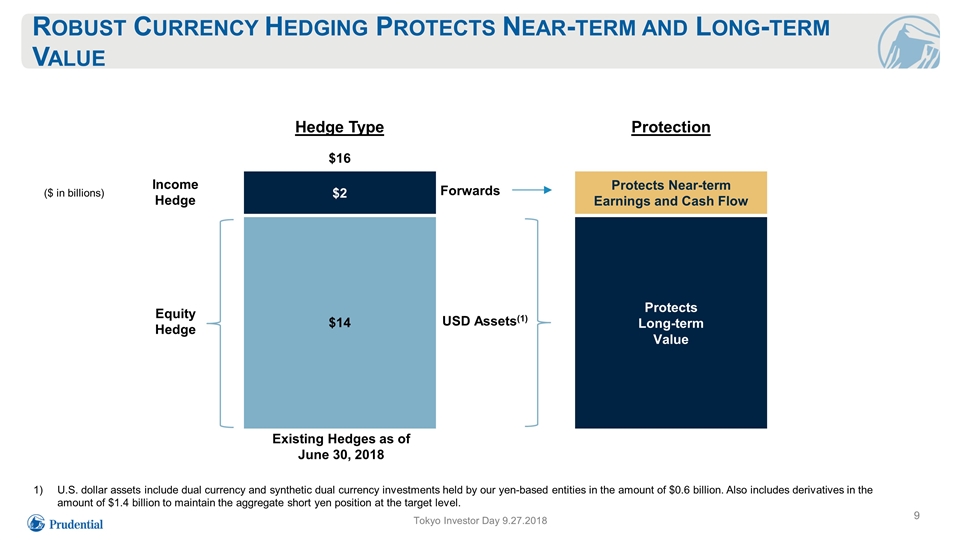

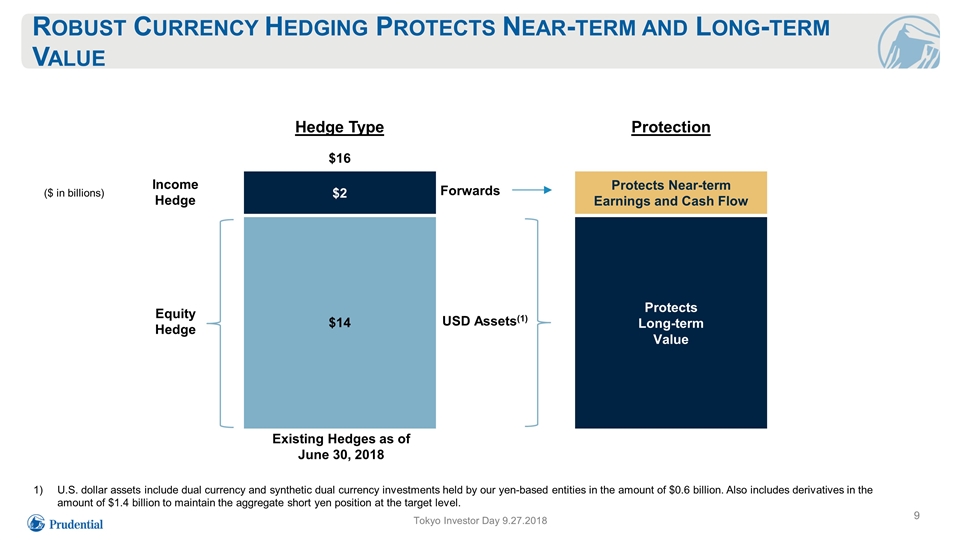

Tokyo Investor Day 9.27.2018 U.S. dollar assets include dual currency and synthetic dual currency investments held by our yen-based entities in the amount of $0.6 billion. Also includes derivatives in the amount of $1.4 billion to maintain the aggregate short yen position at the target level. ($ in billions) Protects Near-term Earnings and Cash Flow Protects Long-term Value Protection Hedge Type Existing Hedges as of June 30, 2018 Income Hedge Equity Hedge $2 USD Assets(1) Forwards $16 $14 Robust Currency Hedging Protects Near-term and Long-term Value 9

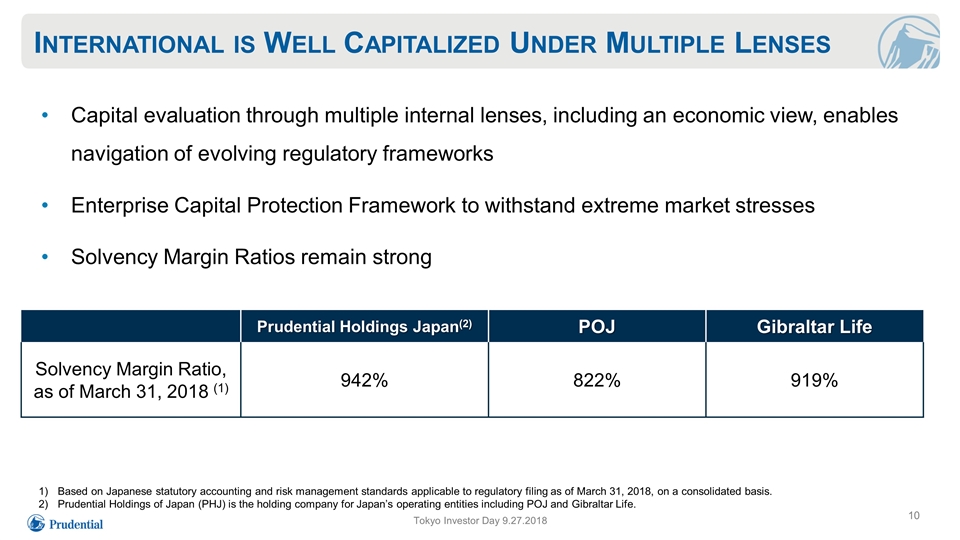

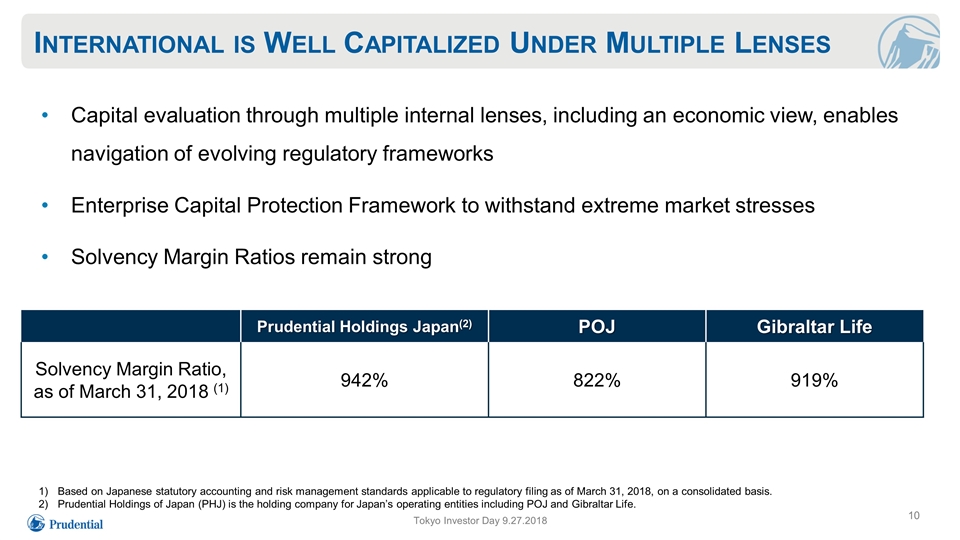

Capital evaluation through multiple internal lenses, including an economic view, enables navigation of evolving regulatory frameworks Enterprise Capital Protection Framework to withstand extreme market stresses Solvency Margin Ratios remain strong Prudential Holdings Japan(2) POJ Gibraltar Life Solvency Margin Ratio, as of March 31, 2018 (1) 942% 822% 919% Based on Japanese statutory accounting and risk management standards applicable to regulatory filing as of March 31, 2018, on a consolidated basis. Prudential Holdings of Japan (PHJ) is the holding company for Japan’s operating entities including POJ and Gibraltar Life. International is Well Capitalized Under Multiple Lenses Tokyo Investor Day 9.27.2018 10

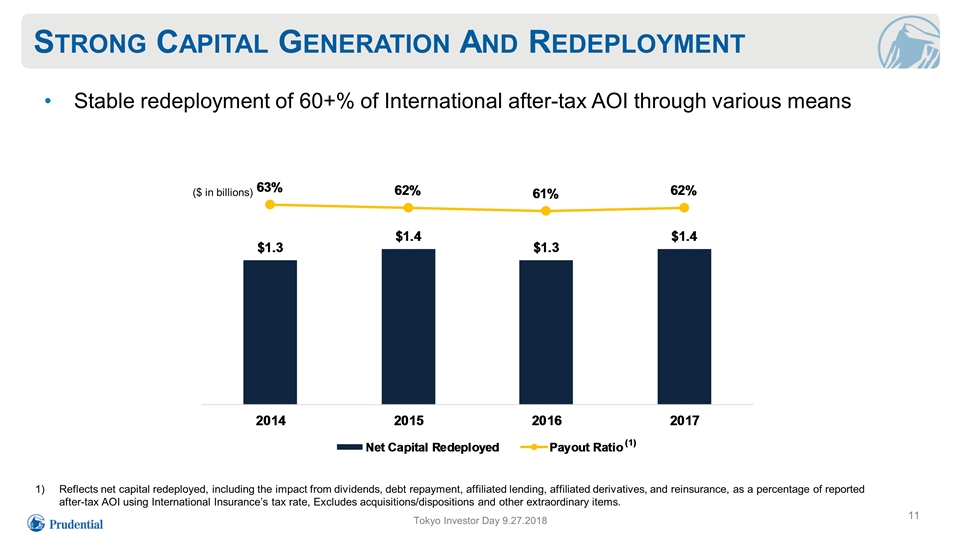

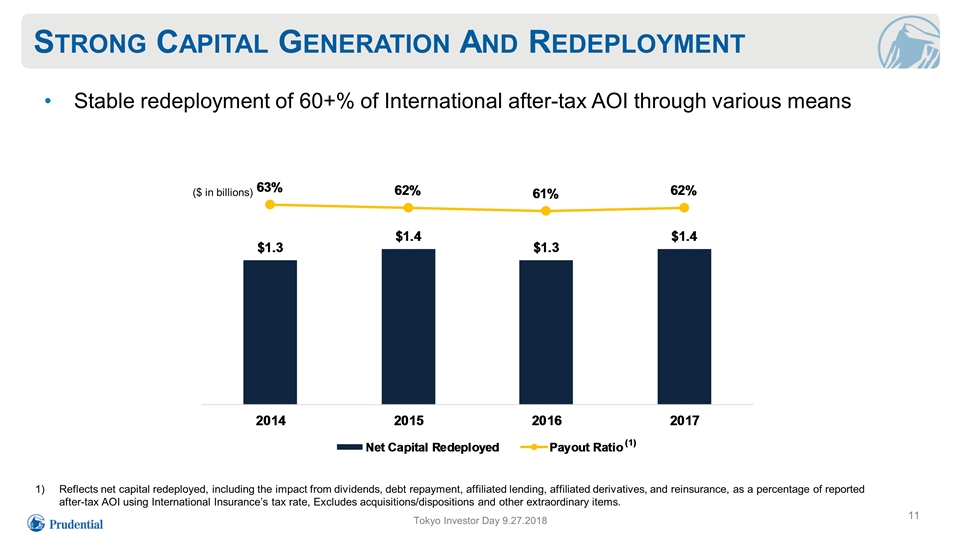

Strong Capital Generation And Redeployment Tokyo Investor Day 9.27.2018 ($ in billions) Stable redeployment of 60+% of International after-tax AOI through various means 11 Reflects net capital redeployed, including the impact from dividends, debt repayment, affiliated lending, affiliated derivatives, and reinsurance, as a percentage of reported after-tax AOI using International Insurance’s tax rate, Excludes acquisitions/dispositions and other extraordinary items.

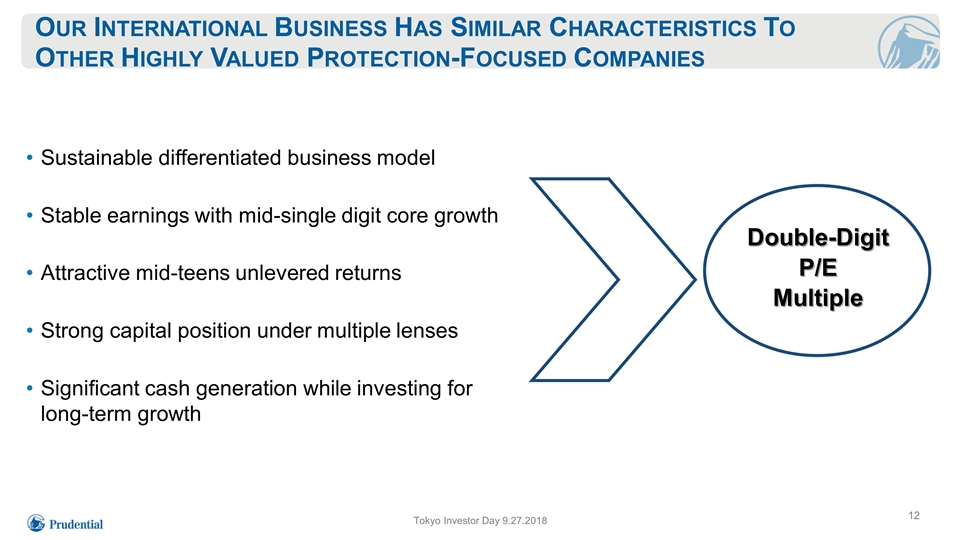

Our International Business Has Similar Characteristics To Other Highly Valued Protection-Focused Companies Tokyo Investor Day 9.27.2018 Sustainable differentiated business model Stable earnings with mid-single digit core growth Attractive mid-teens unlevered returns Strong capital position under multiple lenses Significant cash generation while investing for long-term growth Double-Digit P/E Multiple 12

Key Messages Impacts from currency and interest rate headwinds are subsiding Tokyo Investor Day 9.27.2018 Sustained growth with strong returns and attractive risk profile Strong capital generation and redeployment 13