UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2008

COMMISSION FILE NUMBER 000-32629

PACIFIC GOLD CORP.

(Exact name of registrant as specified in charter)

| | |

NEVADA | | 98-0408708 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

848 N. Rainbow Blvd., #2987, Las Vegas, NV | | 89107 |

(Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code: (416) 214-1483

Securities registered pursuant to section 12(b) of the Act:

| | |

Title of Class | | Name of each exchange on which registered |

NONE | | NONE |

Securities registered pursuant to section 12(g) of the Act:

Common Stock, $.001 par value, 500,000,000 shares authorized

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Check whether the issuer is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. x

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Check if there is no disclosure of delinquent filers in response to Item 405 of Regulation S-B contained in this form, and no disclosure will be contained, to the best of registrant's knowledge, in definitive proxy of information statements incorporated by reference in Part 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| | |

Large accelerated filer ¨ | | Accelerated filer ¨ |

Non-accelerated filer ¨ (Do not check if a smaller reporting company) | | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company as defined in Rule 126-2 of the Exchange Act. Yes o No x

State issuer's revenues for its most recent fiscal year: $0.

State the aggregate market value of the voting stock held by non-affiliates computed by reference to the price at which the stock was sold, or the average bid and asked prices of such stock as of a specified date within the past 60 days: As of March 31, 2009, the aggregate market price of the voting stock held by non-affiliates was approximately $21,750,414.

State the number of shares outstanding of each of the issuer's classes of common equity, as of the latest practicable date: As of March 31, 2009, the Company had outstanding 217,437,267 shares of its common stock, par value $0.001.

Documents incorporated by reference: None

TABLE OF CONTENTS

| | |

ITEM NUMBER AND CAPTION | PAGE |

| | |

PART I | | 3 |

| | |

ITEM 1. | DESCRIPTION OF BUSINESS | 3 |

ITEM 2. | DESCRIPTION OF PROPERTY | 12 |

ITEM 3. | LEGAL PROCEEDINGS | 13 |

ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS | 13 |

| | |

PART II | | 14 |

| | |

ITEM 5. | MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS | 14 |

ITEM 6. | MANAGEMENT'S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION | 15 |

ITEM 7. | FINANCIAL STATEMENTS | 18 |

ITEM 8. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 39 |

ITEM 8A. | CONTROLS AND PROCEDURES | 39 |

ITEM 8B. | OTHER INFORMATION | 40 |

| | |

PART III | | 40 |

| | |

ITEM 9. | DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS; COMPLIANCE WITH SECTION 16(a) OF THE EXCHANGE ACT | 40 |

ITEM 10. | EXECUTIVE COMPENSATION | 42 |

ITEM 11. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 44 |

ITEM 12. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 44 |

ITEM 13. | EXHIBITS | 44 |

ITEM 14. | PRINCIPAL ACCOUNTANT FEES AND SERVICES | 45 |

2

PART I

ITEM 1. DESCRIPTION OF BUSINESS

BUSINESS

Pacific Gold is engaged in the identification, acquisition, exploration and development of mining prospects believed to have gold and/or tungsten mineralizations. The main objective is to explore, identify, and develop commercially viable mineralizations on prospects over which the company has rights that could produce revenues. These types of prospects may also contain mineralization of metals often found with gold and/or tungsten which also may be worth processing. Exploration and development for commercially viable mineralization of any metal includes a high degree of risk which careful evaluation, experience and factual knowledge may not eliminate, and therefore, we may never produce any significant revenues.

Pacific Gold Corp. currently owns 100% of five operating subsidiaries; Nevada Rae Gold, Inc., Oregon Gold, Inc., Pilot Mountain Resources Inc., Pacific Metals Corp., and Fernley Gold, Inc. in which it holds various prospects in Nevada and Oregon. The company intends to acquire through staking, purchasing and/or leasing arrangements additional prospects, from time to time, in which there may be gold, tungsten and/or other mineral deposit potential.

Gold Orientation

Throughout history gold has been a desired metal for monetary purposes and for jewelry. Because there is an active market for gold and consistent demand and use, we believe that if we find a viable mineralization, we will be able to sell any gold we produce with little difficulty. Of course, there is no assurance that we will find any mineralization or one that is commercially viable. Fundamentally, whether or not a mineralization is viable depends on the cost of production versus the price at which we can dispose of the metal. We believe that alluvial and placer deposits are less expensive to operate to produce saleable product. We also believe that the required filings and permits are easier to obtain for these kinds of prospects than for underground mines. Based on the current estimates of operating costs and the current price of gold in the global market, we believe these kinds of prospects can be operated profitably if there is a sufficient percentage of the mineralization in a particular prospect to be commercially viable.

We have obtained and in the future will seek prospects in areas where there have been previous mining operations. We believe that this gives some indication that there may be mineralizations within our prospects to justify the cost of staking, maintenance and exploration.

Tungsten Orientation

The word tungsten means “heavy stone” in Swedish. Tungsten is a grayish-white lustrous metal which exhibits many important physical properties including a high melting point and density, as well as good thermal and electrical conductivity, a low coefficient of expansion, excellent corrosion resistance, and exceptional strength at elevated temperatures.

Tungsten is an important strategic metal for which there is no known substitute. Tungsten is valued as the extremely hard carbide used in cutting and wear-resistant components, and as the metal or alloy for lamp and lighting filaments and electrodes, electrical and electronic contact surfaces, heat and radiation shielding in high temperature furnaces and x-ray equipment, and electrodes in certain welding methods.

Tungsten is an essential commodity and offers versatility in many everyday uses such as: light bulbs, television sets, microwave ovens, other electrical consumer products; metal cutting tools, drill bits, mining tools, military tools; and wear-resistance parts for industries such as automotive and construction.

3

Nevada Rae Gold, Inc.

The prospects held by Nevada Rae are located among the Crescent Valley placer deposits, in the bullion mining district of Lander County, Nevada. They are about two miles from the town of Crescent Valley, and some 50 miles west of Elko, Nevada. The area is about 175 miles northeast of Reno, Nevada.

The property consists of federal mining claims and leased private land. The federal mining claims are managed by the BLM and require annual renewal payments prior to September 1st. The leased ground requires the Company to pay a royalty from production with a portion paid in advance each year.

The area is accessible by state highway 306 an all-weather asphalt road and about 22 miles south from Interstate 80. The property where the prospects are located has an all weather gravel road established in the 1970’s for prior mining operations of barite. The prospects also have access to electricity and water sufficient for exploration, development and later extractive and milling activities if warranted and undertaken.

The climate is typically hot and semi-arid with temperatures rising to above 100 degrees Fahrenheit in the summer to below freezing in the winter. Freezing temperatures are only sporadically encountered in the winter months of December and January and are not likely to have serious affect on operations. Precipitation is minimal and offers little or no operational problems.

4

The nearby towns appear to have a supply of skilled workers familiar with earthmoving equipment and surface mining experience. Equipment also appears to be available for purchase or lease. In the vicinity there is electricity access and water can be obtained from wells at approximately 560 feet. We have acquired 100% of two existing wells in the area which can supply the necessary amounts of water for the operation as we intend to employ re-circulation methodologies. We have also acquired 13.67 acres of fee land available adjacent to the wells which can accommodate the mill, tailings ponds, workshop and on-site office. The wells and adjacent land are approximately three miles from the mining claims. This land and the two wells have been formally analyzed and tested by the State of Nevada and Chemrox Technologies, an environmental specialist firm that the company hired to provide it with professional services in due diligence, mine planning, groundwater modeling, water restoration, environmental permitting, and reclamation, and are determined to be in excellent condition, free of any contaminants.

Production History

Gold mineralization was first discovered in 1907 in the Crescent Valley area, and thereafter intermittent work was carried out up to World War II. In the 1930s an exploration program was carried out with a number of shafts sunk in the Mud Springs Gulch area. These studies identified quantities of gold mineralization situated close to the bedrock at the bottom of the alluvial areas. In the late 1970s there was barite mining and milling in the area using open pits. In the mid-1980s the barite mining operations were purchased and modified and there was some recovery of gold mineralization during the later 1980’s and 1990’s at low extractive rates.

History of Mining

Most of the historical work was carried out over a 3-4 mile section in Mud Springs Gulch, but there are older exploration pits throughout the company’s prospects. There appear to be about thirty exploration shafts sunk through the gravels to bedrock. This work was conducted in the 1930’s, but there are no detailed results available. Little work was done in the Black Rock Canyon during the historical period.

In 1978, Major Barite Inc. implemented an operation to mine and process barite from several small, open pits within the project area. In 1982 the barite market collapsed, and the company turned its attention to placer gold exploration and development. There was a program of bulk sampling in the drainages for gold. Trenches and pits were dug and processed from locations in Black Rock Canyon, Mud Springs Gulch, Tub Springs Gulch and Rosebud Gulch. A widespread occurrence of placer gold was discovered, but Major Barite Inc. ceased operations in 1984. In 1984, the area was taken over by Mr. John Uhalde who continued to explore and develop the placer gold resources in the project until his death in 2001. Mr. Uhalde operated his placer mine under a small miners permit.

Local Geology

The prospects are located among the easterly alluvial deposits of the Shoshone Mountain range and merge with the sediments of Crescent Valley. It is posited that this area is the remains of a large, ancient lakebed. The project consists of three main drainages: Black Rock Canyon, Mud Springs Gulch and Tub Springs Gulch. The alluvial deposits are typically 100 to 300 feet wide and with depths of up to 90 feet, but the alluvial – sedimentary material can reach thicknesses in excess of 500 feet thick in areas. The thickness of the gravels is judged to become progressively greater as one moves eastwards from the mountains. It is estimated that the gravels are between 16 and 90 feet below the surface with an average thickness of about 30 feet. The gravels are typically dry and light brown pebble and occasionally boulder gravels. Oversized material is rare. Compositionally, the coarse material is mainly rounded cherts and metavolcanics with occasional weathered and variable granodiorite. The uppermost layers, generally running about 6 to 8 feet in depth, will have to be removed to access the gravels likely to have the mineral deposits sought. It is believed that the gravels will have little clay and will present few processing problems.

5

There is no information on the vertical distribution of gold mineralization within the gravels. Through historical records from shaft-sinking suggests that the gravel becomes courser with depth, coinciding with an increase in the percentage of oversize boulders. It is believed that the best gold mineralization levels are obtained at the bedrock interface.

Prospects

Nevada Rae has staked prospects covering approximately 1,340 acres of the alluvial deposits among the Crescent Valley projects mentioned above. In addition, it has leased approximately 440 acres of land adjacent to its staked prospects from Corporate Creditors Committee LLC (now Bullion Monarch Mining), by lease dated October 1, 2003. The lease covers acreage in Section 9, Township 29 North, Range 47 East, Mount Diablo Meridian, Bullion Mining District, Lander County, Nevada. Under the lease, it has the right to the gold, silver, platinum, palladium and other precious and base metals within the placers and gravels of the leased premises, with exclusive right to prospect and explore for, mine by open pit methods, mill, prepare for market, store, sell and dispose of the same and use, occupy and disturb so much of the surface as Pacific Gold determines useful, desirable or convenient. The lease term is ten years, renewable for an additional ten years.

Operations

In 2004 and 2005 Nevada Rae permitted the mine with the Bureau of Land Management (BLM), and the Nevada State Division of Environmental Protection (NDEP). The property is now referred to as the Black Rock Canyon Mine.

During 2005, Nevada Rae built a mining and milling facility at the Black Rock Canyon Mine. The plant was newly built in 2005 and had some equipment installed in 2006. The plant is in good physical condition. The plant consists of a 60 foot by 90 foot by 30 foot steel building with offices, plumbing, electrical and a sloped floor for drainage, additionally the site has fuel storage, settling ponds, security offices and the entire are is fenced in for security along with exterior lighting and security camera’s that allow management remote access viewing of the site from any internet access point in the world. The plant equipment primarily consists of a grizzly hopper, conveyors, a 3 deck screen, trommels, Knelson gravity bowls, jigs, dewatering system, and a variety of pumps, cyclones and small equipment. The Company maintains a fleet of approximately 10 pieces of earth moving equipment including, bull dozers, haul trucks, excavators, front end loaders and other smaller pieces. The plant is serviced via power lines provided by Sierra Pacific and via two water wells that the Company owns.

In 2006 the Company began production at the Black Rock Canyon Mine. In late 2006, based on preliminary results at the Black Rock Canyon Mine, Nevada Rae began modifications to the site equipment and facilities.

In 2007 the Company made some modifications to the plant and site equipment and restarted mining operations. In the summer of 2007 the desanding system that was purchased for the plant failed to operate as anticipated and the mine was eventually shut down in November with limited production having taken place.

In 2008 the Company applied for and received permission to modify its permit to change the makeup of the processing plant. Among the changes were the removal of the three deck screen and the repositioning of the trommel. To solve the desanding difficulties, the company plans to use a series of hydrocyclones and geotextile bags. Additionally, the Company sold its haul trucks and has identified a more cost efficient truck for hauling materials. In the fourth quarter of 2008 most of the plant modifications necessary to resume operations were completed. Remaining work includes electrical, hydrocyclone and the geotextile bag installation.

In general, the operations will require the excavation of the gravel within the prospect. Typically, the vegetation and minor soil cover will be stripped and side cast for future reclamation. The mineralization bearing gravel will be dug with an excavator until bedrock is reached, and material will be prescreened and then hauled to the mill site. The mill area will be about three miles away from the mine site. The mill site is equipped with two functioning wells for process water and is connected to the power grid. The mill and trommel unit are set up on the private, fee land owned by the company.

To date the Company has invested approximately $6,500,000 into Nevada Rae Gold.

6

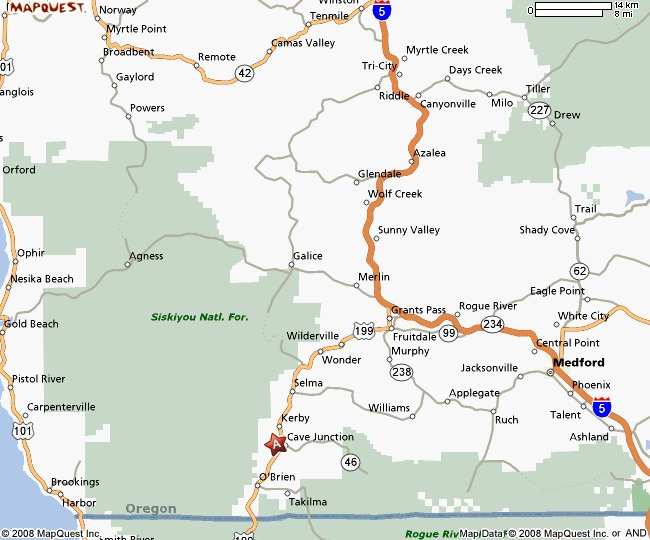

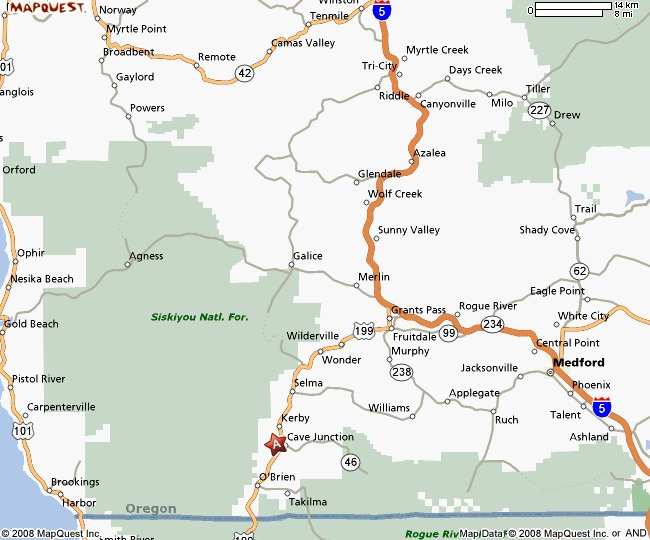

Oregon Gold, Inc.

Oregon Gold has a number of prospects in the Siskiyou National Forest, in Josephine County Oregon. These prospects cover approximately 280 acres of placer deposits in one area and another 37 acres in a second, almost contiguous area. The property is accessible from a gravel road that connects with a local paved road. Maintenance of the gravel road is moderate. In some places a stream must be forded for access. Generally, there is ample water from the perennial stream bordering the prospects available for exploratory and later implementation of the business plan. Water use is subject to meeting permitting requirements. Power will be available through generators brought to and operated onsite.

Oregon Gold currently owns the Defiance Mine and additional claims in Josephine County, Oregon. The company operated the Defiance Mine during the summer and fall of 2004. Mining activity concluded for the winter at the end of November 2004.

In June of 2005 the Company conducted a testing program on the Bear Bench claims. The testing confirmed gold presence and indicates future testing is warranted. Currently the Company is focusing on its operations in Nevada at the Black Rock Canyon Mine.

In 2005, Pacific Gold Corp. completed a merger between Grants Pass Gold, Inc. and Oregon Gold, Inc. with Oregon Gold being the surviving entity. The Company undertook this exercise in order to consolidate its operations in the region.

In 2008, Pacific Gold Corp. began the process of spinning off Oregon Gold into its own public company. The plan calls for approximately 20% of Oregon Gold to be distributed to the shareholders of Pacific Gold Corp. by way of a share dividend. This process is expected to be completed in the first half of 2009. Once the spinoff is complete Oregon Gold plans to raise financing, reduce its debt to Pacific Gold and file for a permit application to begin mining operations.

7

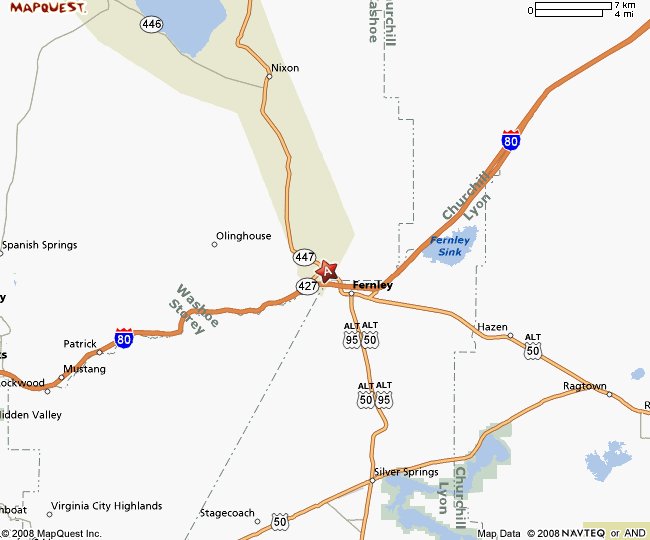

Fernley Gold, Inc.

Fernley Gold, Inc. entered into a lease agreement in 2004 for the right to mine the property and claims known as Butcher Boy and Teddy. The area known for placer gold mineralizations, and commonly referred to as the Olinghouse Placers, has a rich mining history. The lease includes two water wells and water rights. The Company is required to make monthly lease payments to the property owner and annual BLM fees in order to keep the project in good standing.

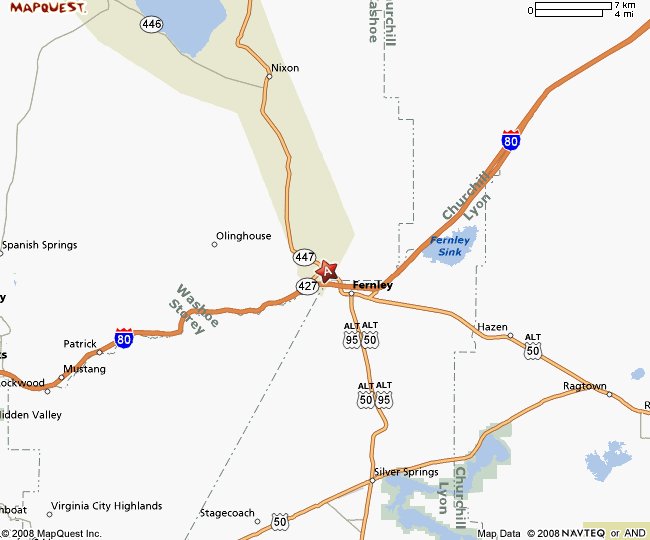

Location

The property is accessible from the junction of paved State Route 34 (447) approximately 1.5 miles north-west of the town of Wadsworth, Nevada, onto a county-maintained gravel road which runs several miles west into the Olinghouse Canyon. The mine access road begins at the midpoint of the Olinghouse road heading north approximately two miles to the site.

Regional Geology

The area is dominated by the Pah Rah mountain range which has reliefs of 6,000 feet above sea level. Frankfree Canyon drains the portion of the range immediately to the west of the mine site. Frankfree Canyon opens into an alluvial fan which spreads to the east and extends down slope for about two miles to the mine site, and then it continues to the Truckee River some five miles below the mine site. The mine is located at 4,600 feet above sea level.

The district lies within the Walker Lake structural zone, a major right-lateral shear zone that extends for several hundred miles from Southern California to southern Oregon, and is several miles wide. The Walker Lake represents the western margin of the Basin and Range structural province. Large alluvial fans including Frankfree Canyon were shed off the fault-block ranges as they were uplifted.

The Butcher Boy placer mine is hosted by a distinctive conglomerate sequence of pliopleistocene age. This conglomerate sequence was derived from erosion of the Olinghouse mining district where free gold occurs in quartz veins in prophylitized volcanic rocks.

8

The mine unit that hosts the gold ore was deposited on a bedrock of clay-altered volcanic rocks similar to those exposed in the lower foothills above the mine. Drilling and mining have shown the bedrock to be clay-altered almost everywhere in the mine area; occasional areas of silicification of the bedrock occur.

The mine unit is overlain by an overburden sequence that varies from 12–30’ in thickness.

Exploration

Previous Drilling: During the late 1930’s Goldhill Dredging, and in the 1980’s Southern Pacific completed extensive drilling and very accurate testing of the deposit. The purpose of this drilling was to delineate the placer gold reserves present. About ½ of the holes penetrated the gravel to the bedrock. The maximum hole depths were on the order of 120 feet below the surface. Drill holes within the area of the deposit were located on the least 100’ centers and 100’ line spacings.

In the 1960’s Watts, Griffith, and McQuat, a Canadian consulting firm, drilled several 30” diameter holes in the central orebody.

The most recent drilling was performed by New Gold and American Resources by Vaughn Construction in the late 1980’s and early 1990’s.

In 2006 The Company dug and sampled trenches on the property to confirm the gold grade of the reports from drilling in the 1980’s and 1990’s.

Resource Estimates

Mining of the deposit has exposed the ore gravels allowing a more accurate interpretation of the cuttings returned from drilling than before. For instance, there is a coarse boulder layer of gravel in the middle of the deposit that the results from the drilling showed low values, but when processed, this gravel was the highest grade in the zone, likely caused by the presence of nuggets.

Mining to-date has confirmed that the highest grades (0.021–0.026 ounces per cubic yard) are controlled by: 1) bends in the channels which controlled the deposition of the pay gravels; 2) bedrock faults which act as mega-riffles to concentrate gold in topographic breaks caused by the faults; and 3) intersections of bedrock channels and the bedrock faults.

The bedrock topography can predict where high grade zones will occur. These zones occur regularly throughout the deposit’s location, which is now known to be almost continuous over an area of 5,000 feet x 1,200 feet, and which (based on widely spaced drilling) may be 50% larger. Overburden depths are variable from 12’ to about 25’, yielding a lifetime waste/ore stripping ratio of 0.5/1.0.

9

Pilot Mountain Resources Inc.

In August 2005, Pacific Gold Corp. established a new subsidiary called Pilot Mountain Resources Inc. Pilot Mountain acquired Project W. Project W is primarily a tungsten project located in Mineral County, Nevada. Elevated tungsten values occur throughout the area. The property is located approximately 21 miles east of the town of Mina with access through an all-weather, county-maintained gravel road and a network of further trails. Mina is 168 miles south-east of Reno on Route 95. The claims are located at an average elevation of 6,500 feet.

Resource calculations from a 1981 pre-feasibility study completed by Kaiser Engineers place the size of Project W at 9,061,600 tons, grading 0.386% Tungsten Tri-oxide (WO3) of mineralized material, or approximately 35,000 tons of WO3.

The terms of the acquisition of Project W call for Pilot Mountain Resources Inc. to pay to Platoro West a 2% gross royalty on all mineral sales from Project W. In addition to the claims, Pilot Mountain Resources Inc. received copies of previously prepared working documents and reports regarding Project W.

Overview

Project W is primarily a tungsten project located in Mineral County, Nevada. Elevated tungsten values occur throughout this area, and there are known mineral resources within the claim area. The claims are located at an average elevation of 6,500 feet.

The property is located approximately 21 miles east of the town of Mina with access through an all-weather, county-maintained gravel road and a network of further trails. Mina is 168 miles southeast of Reno on Route 95.

The company has claims within the project area covering approximately 900 acres.

10

History

Project W encompasses three distinct occurrences of tungsten mineralization – Desert Scheelite, Gunmetal and Garnet. During the 1970's and early 1980's, diamond drilling conducted by both the Duval Corporation and Union Carbide Corporation resulted in these three principal areas being delineated. Reports addressing the occurrences of tungsten mineralization and estimates of resources of Project W have been written by personnel of Duval Corporation, Union Carbide Corporation and independent consultants including Kaiser Engineers, Inc. and David S. Robertson and Associates. Pilot Mountain Resources Inc. has access to these reports through its agreement with Platoro West Incorporated.

In 1981, the project was the subject of a feasibility study undertaken by Kaiser Engineers Inc. While the study concluded that a combination of open-pit and underground mining would return an acceptable profit, the tungsten market collapsed shortly thereafter and the project remained idle until the demise of the Metals and Mining Division of Union Carbide during the late 1980's.

Geology

The tungsten ore occurs principally in the form of the mineral scheelite within garnetiferous tactites adjacent to contacts of quartz monzonite and granodiorite intrusions. The tactites are genetically related to the intrusives and are products of metasomatically altered carbonate rocks of the upper Luning Formation which locally contain potentially important amounts of sphalerite, chalcopyrite, molybdenite and argentiferous galena.

Project W is composed essentially of layered rocks of the Permian to Lower Jurassic ages which have a combined maximum thickness of over 20,000 feet. The oldest unit exposed on the property is the Mina Formation which consists principally of chert, sandy argillite and a number of tuffaceous units which are exposed as high, jagged cliffs to the south of the Desert Scheelite tungsten occurrence across a prominent fault scarp. The Mina Formation is overlain by the Luning Formation, the host unit for the tungsten mineralization on the property. The Luning Formation is made up of three, equally thick members with a collective thickness of approximately 8,000 feet. The upper member consists predominantly of limestone and to a much lesser extent, fine grained clastic sediments. The middle member is composed of a uniform sequence of conglomerates, quartzites and mudstones and the lower member consists of carbonate and clastic sediments. Most of the known tungsten occurrences and deposits on the property are confined to the upper member of the Luning Formation.

The tactites, metasomatic replacement bodies which host the tungsten occurrences on the property, are stratigraphically controlled and generally are proximal to quartz monzonite and/or granodiorite intrusives. Two groups of tactites are recognized: a dark-colored, iron-rich, brown garnet group, which hosts most of the tungsten mineralization, and a light-colored, low-iron group which contains tan-colored garnets. The tactites generally occur in a number of parallel horizons. Scheelite is the only significant tungsten-bearing mineral on the property. It is yellow in color and can contain minor amounts of molybdenum.

Other Projects

Through its other subsidiaries the company has other federal mining claims that at this point in time the Company has deemed to be non-material for the purposes of this report. Once such claims have been thoroughly examined and detailed reports prepared, if the projects are deemed to be material, the Company will add descriptions of the properties to future reports and filings.

Regulation

The exploration and development of a mining prospect is subject to regulation by a number of federal and state government authorities. These include the United States Environmental Protection Agency and the Bureau of Land Management as well as the various state environmental protection agencies. The regulations address many environmental issues relating to air, soil and water contamination and apply to many mining related activities including exploration, mine construction, mineral extraction, ore milling, water use, waste disposal and use of toxic substances. In addition, we are subject to regulations relating to labor standards, occupational health and safety, mine safety, general land use, export of minerals and taxation. Many of the regulations require permits or licenses to be obtained and the filing of Notices of Intent and Plans of Operations, the absence of which or inability to obtain will adversely affect the ability for us to conduct our exploration, development and operation activities. The failure to comply with the regulations and terms of permits and licenses may result in fines or other penalties or in revocation of a permit or license or loss of a prospect.

11

We must comply with the annual staking and patent maintenance requirements of the States of Nevada and Oregon and the United States Bureau of Land Management. We must also comply with the filing requirements of our proposed exploration and development, including Notices of Intent and Plans of Operations. In connection with our exploration and assessment activities, we have pursued necessary permits where exemptions have not been available although, to date, most of these activities have been done under various exemptions. We will need to file for water use and other extractive-related permits in the future.

Competition

We expect to compete with many mining and exploration companies in identifying and acquiring claims with gold mineralization. We believe that most of our competitors have greater resources than us. We also expect to compete for qualified geological and environmental experts to assist us in our exploration of mining prospects, as well as any other consultants, employees and equipment that we may require in order to conduct our operations. We cannot give any assurances that we will be able to compete without adequate financial resources.

ITEM 2. DESCRIPTION OF PROPERTY

All mining claims owned or leased by Pacific Gold Corp. and its subsidiaries are federal mining claims under the jurisdiction of the BLM and/or the U.S. Forest Service. The claims are valid for one year and require a renewal prior to September 1st of each year.

Pacific Gold Corp.

The head office of Pacific Gold is located at 477 Richmond Street West Suite 301, Toronto Ontario, M5V 3E7. The Company currently has a five-year lease that expires in January, 2012. Pacific Gold pays $6,867 Canadian dollars (approximately $5,700 US dollars) per month in rent.

Nevada Rae Gold, Inc.

Nevada Rae Gold, Inc. has staked 67 placer claims and 13 lode claims (BLM file no. NMC851395 and NMC0927489) covering approximately 1,340 acres in Lander County, Nevada. The Company also owns 13.67 acres of land in Lander County, Nevada.

In addition, the Company has leased approximately 440 acres of privately owned land adjacent to its staked prospects from Corporate Creditors Committee LLC (now Bullion Monarch Mining), by lease dated October 1, 2003. Nevada Rae paid an advance royalty of $7,500 for the first year, which amount is increased by $2,500 in each of the next five years to be $20,000 in the sixth year. For the last four years of the lease, the advance royalty is $20,000 per year. If the lease is renewed, the annual advance royalty is $20,000. The advance royalty is credited to and recoverable from the production rental amounts. The royalty is the greater of a 4% net smelter royalty or $0.50 per yard of material processed. The lease is for 10 years with a renewal option for another 10 years.

Oregon Gold, Inc.

Oregon Gold, Inc. has 14 placer claims (BLM file no. ORMC 158063, 157905, 157701, 25199, 152700, 153832, 82639, 82640, 154000, 148130, 144909 and 142540) covering approximately 280 acres in Josephine County, Oregon. Included in these claims is the Defiance Mine, a fully permitted, previously operational mine located in southwestern Oregon. The Defiance Mine is approximately 37.5 acres in size. The Company has a 5% net smelter royalty payable only on the 37.5 acres covered by the Defiance Mine.

Fernley Gold, Inc.

Fernley Gold leased 640 acres, including 35 placer claims (BLM file no. NMC48238 and NMC242196), with the exclusive right to mine for placer, lode and other minerals and metals, located 34 miles east of Reno, Nevada. The lease includes two water wells and water rights. The initial agreement is for a period of five years, with Fernley Gold having the exclusive right to renew the lease on the existing terms. Fernley Gold made a one-time payment of $10,000 to acquire the lease, followed by two quarterly payments of $500, and currently makes payments of $1,000 each month. The monthly payments are applied towards the royalty fees that will become due to the Lessor. According to the royalty fee structure, the Company will pay 6% of the gross value of the recovered ore, less smelter expenses, when the price of spot gold is below $400 per ounce on the world market. When gold is above the $400 threshold, the Company will pay a 10% royalty.

12

Pilot Mountain Resources, Inc.

The company owns 45 lode claims (BLM file no. NMC 111111) that were purchased in August 2005, within the project area covering approximately 900 acres. In connection with its acquisition of the claims, Pacific Gold and Pilot Mountain are required to pay Platoro West Incorporated a 2% gross royalty on all mineral sales from the project.

Employees

Pacific Gold has three employees who are the executive officers, mining engineers and internal financial persons and Nevada Rae Gold has one employee, who is site management. We expect to hire heavy machinery operators, geological experts, engineers and other operations consultants and independent contractors and laborers from time to time, for differing periods to facilitate the implementation of our business plan.

ITEM 3. LEGAL PROCEEDINGS

Oregon Gold, Inc. went to trial in February 2008 regarding its Claim against Mr. Myron Corcoran in connection with the equipment Grants Pass Gold purchased from him. Many pieces of the equipment proved not to work and in many instances the machinery had to be completely replaced. In March 2008 the Company was awarded a judgment for part of the amount sought and legal fees in this case. The final settlement of approximately $50,000 was received by the Company in July 2008.

Pacific Gold Corp. has initiated a Statement of Claim, in Nevada, against Fabick Caterpillar (“Fabick”) in connection with equipment bought from Fabick. The equipment was not delivered in the condition as promised and proved not to be operable. Pacific Gold is suing for the monies paid for the equipment and additional expenses. Fabick is attempting to have the claim removed from the state of Nevada. The Nevada court determined that the case should be brought in Missouri and the Company is currently in the process of employing a Missouri attorney.

Perry Crane initiated a Statement of Claim against the Company on August 7, 2007, for the amount of $149,087. The Company has settled this claim with Perry Crane by a payment of $130,000 plus interest which is due on March 15, 2011.

On December 12, 2007 Nevada Rae Gold, Inc. filed suit against Geoinformatics regarding placer mining claims that are owned by Nevada Rae Gold, Inc. that have been staked over top with new lode claims by Geoinformatics. Nevada Rae Gold, Inc. is seeking remedy to have the new lode claims declared invalid or transferred into the name of the Company.

On April 30, 2008 Komatsu Equipment (“Komatsu”) filed an action against the Company in connection with repair work done on the Company’s trucks. The Company is disputing certain amounts invoiced and will be defending the action. All invoices submitted to the Company have been accrued in its trade payables on the financial statements. The case is in its preliminary stages and no indication of the outcome can be made at this time.

From time to time the Company is involved in minor trade, employment and other operational disputes, none of which have or are expected to have a material impact on the current or future financial statements or operations.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

None

13

PART II

ITEM 5. MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

The common stock is traded in the over-the-counter market and quoted on the OTC BB under the symbol "PCFG" and quoted in the pink sheets published by the National Quotations Bureau.

Our common shares are designated as “penny stock”. The SEC has adopted rules (Rules 15g-2 through l5g-6 of the Exchange Act), which regulate broker-dealer practices in connection with transactions in “penny stocks.” Penny stocks generally are any non-NASDAQ equity securities with a price of less than $5.00, subject to certain exceptions. The penny stock rules require a broker-dealer to deliver a standardized risk disclosure document prepared by the SEC, to provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, monthly account statements showing the market value of each penny stock held in the customer’s account, to make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for a stock that is subject to the penny stock rules. Since our common shares are subject to the penny stock rules, persons holding or receiving such shares may find it more difficult to sell their shares. The market liquidity for the shares could be severely and adversely affected by limiting the ability of broker-dealers to sell the shares and the ability of shareholders to sell their stock in any secondary market.

The trading volume in the common stock has been and is extremely limited. The limited nature of the trading market can create the potential for significant changes in the trading price for the common stock as a result of relatively minor changes in the supply and demand for common stock and perhaps without regard to our business activities.

The market price of our common stock may be subject to significant fluctuations in response to numerous factors, including: variations in our annual or quarterly financial results or those of our competitors; conditions in the economy in general; announcements of key developments by competitors; loss of key personnel; unfavorable publicity affecting our industry or us; adverse legal events affecting us; and sales of our common stock by existing stockholders.

Subject to the above limitations, we believe that during the eight fiscal quarters preceding the date of this filing, the high and low sales prices for the common stock during each quarter are as set forth in the table below (such prices are without retail mark-up, mark-down, or commissions):

| | | | | | |

QUARTER ENDED | | HIGH | | LOW |

December 31, 2008 | | $ | 0.02 | | $ | 0.003 |

September 30, 2008 | | | 0.019 | | | .0055 |

June 30, 2008 | | | 0.033 | | | 0.0102 |

March 31, 2008 | | | 0.10 | | | 0.02 |

December 31, 2007 | | | 0.15 | | | 0.04 |

September 30, 2007 | | | 0.25 | | | 0.12 |

June 30, 2007 | | | 0.40 | | | 0.14 |

March 31, 2007 | | | 0.25 | | | 0.15 |

We have not paid any dividends to date. We can give no assurance that our proposed operations will result in sufficient revenues to enable profitable operations or to generate positive cash flow. For the foreseeable future, we anticipate that we will use any funds available to finance the growth of our operations and that we will not pay cash dividends to stockholders. The payment of dividends, if any, in the future is within the discretion of the Board of Directors and will depend on our earnings, capital requirements, restrictions imposed by lenders and financial condition and other relevant factors.

14

As of March 31, 2009 the Company believes that there are well over 1,000 shareholders of record and beneficial holders of our common stock who hold through brokerage and similar accounts.

Equity Compensation Plan Information

| | | | | | | | |

Plan Category | | Plan Name | | Number of securities to be issued upon exercise of outstanding warrants, options and rights. | | Weighted average exercise price of outstanding warrants, options and rights. | | Number of Securities Remaining available for future issuance under equity compensation plans. |

Equity Compensation Plans approved by security holders | | 2002 Equity Performance Plan | | 3,000,000 | | $0.30 | | 81,287 |

| | 2006 Equity Performance Plan | | 10,000,000 | | $0.30 | | 410,879 |

| | 2007 Equity Performance Plan | | 20,000,000 | | N/A | | 14,175,000 |

Equity Compensation Plans not approved by security holders | | N/A | | N/A | | N/A | | N/A |

Totals: | | | | 33,000,000 | | $0.30 | | 14,667,166 |

Subsequent to year-end, 5,000,000 shares of common stock were issued under the 2007 Equity Performance Plan.

RECENT SALES OF UNREGISTERED SECURITIES

During the fourth quarter upon conversion of outstanding promissory notes, Pacific Gold issued from time to time an aggregate of 9,189,250 shares of common stock at a conversion price ranging between $0.0042 to $0.0099 in transactions qualifying under Section 4(2) of the Securities Act to accredited investors.

ITEM 6. MANAGEMENT'S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

Forward Looking Statements

From time to time, we or our representatives have made or may make forward-looking statements, orally or in writing. Such forward-looking statements may be included in, but not limited to, press releases, oral statements made with the approval of an authorized executive officer or in various filings made by us with the Securities and Exchange Commission. Words or phrases "will likely result", "are expected to", "will continue", "is anticipated", "estimate", "project or projected", or similar expressions are intended to identify "forward-looking statements". Such statements are qualified in their entirety by reference to and are accompanied by the above discussion of certain important factors that could cause actual results to differ materially from such forward-looking statements.

Management is currently unaware of any trends or conditions other than those mentioned in this management's discussion and analysis that could have a material adverse effect on the Company's consolidated financial position, future results of operations, or liquidity. However, investors should also be aware of factors that could have a negative impact on the Company's prospects and the consistency of progress in the areas of revenue generation, liquidity, and generation of capital resources. These include: (i) variations in revenue, (ii) possible inability to attract investors for its equity securities or otherwise raise adequate funds from any source should the Company seek to do so, (iii) increased governmental regulation, (iv) increased competition, (v) unfavorable outcomes to litigation involving the Company or to which the Company may become a party in the future and (vi) a very competitive and rapidly changing operating environment.

The risks identified here are not all inclusive. New risk factors emerge from time to time and it is not possible for management to predict all of such risk factors, nor can it assess the impact of all such risk factors on the Company's business or the extent to which any factor or combination of factors may cause actual results to differ materially from those contained in any forward-looking statements. Accordingly, forward-looking statements should not be relied upon as a prediction of actual results.

The financial information set forth in the following discussion should be read with the financial statements of Pacific Gold included elsewhere herein.

15

Financial Condition and Changes in Financial Condition

Overall Operating Results:

The Company had no revenues from the sale of gold for the year ended December 31, 2008 with a negative gross margin of $579,312.

Operating expenses for the year ended December 31, 2008 totaled $1,764,552. The Company incurred labor costs associated with the various mining activities. Labor costs were $622,392 for the year. Equipment operating costs, tools and materials of $64,540 were incurred primarily to prepare the plant and equipment at Black Rock Canyon for operations. Legal and professional fees of $180,401 were incurred for services performed with respect to acquisitions and mining prospect evaluation, as well as SEC reporting compliance and accounting fees. The Company also incurred expenses related to geological studies, fieldwork, site visits, preparation of mining permit applications and consulting fees of $49,963. Advertising and public relations expenses totaled $52,631. Interest expense totaled $1,772,288for the year; of this amount, $989,900 was a non-cash expense that included amounts for accelerated interest and interest on the Series A, B and C Convertible Debentures that were not paid out in cash. The remaining expenses relate to office, general administrative and stock transfer agent fees. We believe we will incur substantial expenses for the near term as we resume operations at Black Rock Canyon and progress with our evaluations of future mining prospects.

The Company had revenues from the sale of gold for the year ended December 31, 2007 of $123,455 with a negative gross margin of $994,661.

Operating expenses for the year ended December 31, 2007 totaled $2,856,360. The Company incurred labor costs associated with the various mining activities. Labor costs were $466,729 for the year. Equipment operating costs, tools and materials of $229,988 were incurred primarily to prepare the plant and equipment at Black Rock Canyon for operations. Legal and professional fees of $340,584 were incurred for services performed with respect to acquisitions and mining prospect evaluation, as well as SEC reporting compliance and accounting fees. The Company also incurred expenses related to geological studies, fieldwork, site visits, preparation of mining permit applications and consulting fees of $199,800. Advertising and public relations expenses totaled $85,741. Interest expense totaled $3,486,586 for the year; of this amount, $3,206,587 was a non-cash expense that included amounts for accelerated interest and interest on the Series A, B and C Convertible Debentures that were not paid out in cash. The remaining expenses relate to office, general administrative and stock transfer agent fees.

Liquidity and Capital Resources:

Since inception to December 31, 2008, we have funded our operations from the sale of securities, issuance of debt and loans from a shareholder. At December 31, 2008, we had unsecured loans from a shareholder in an aggregate amount of $1,742,346 including accrued interest. The note bears interest at the rate of 10% and is due on

December 31, 2009. Pursuant to the agreement with the holder of the February 2007 debentures described below, repayment of the principal and interest on the shareholder loan is limited based on operational income.

As of December 31, 2008, our assets totaled $2,208,021, which consisted primarily of mineral rights, land and water rights, and related equipment. Our total liabilities were $4,188,985 which primarily consisted of notes payable and accrued interest to a shareholder of $1,742,346, accounts payable and accrued expenses of $1,507,722 convertible debt of $700,661 and derivative liability of $9,839. We had an accumulated deficit of $23,393,043. Pacific Gold had negative working capital at December 31, 2008.

On April 12, 2006 the company borrowed $6,100,000 in principal amount evidenced by original discount debentures, in which it received $3,812,500. These notes were convertible into common stock at the option of the holders, who during 2006, 2007 and 2008 elected to convert part of the outstanding principal. The company issued 9,350,000 shares on conversion in 2006, 2007 and 2008. As of October 21, 2008, there was outstanding $97,000 in principal amount, which at this time was assigned for valuable consideration to a third party. The balance of the note remains due on April 12, 2009 and no other changes to the terms of the note were made at that time. The warrants attached to the note were not assigned as part of the agreement.

16

On February 26, 2007, the Company sold $2,440,000 in principal amount of convertible debentures and warrants. The Company paid approximately $299,000 in commissions and expenses. The debentures are due on February 26, 2009 and bear interest at a rate of 10%. The debentures and warrants were sold, and the common stock issued on conversion and exercise will be sold, under Section 4(2) of the Securities Act of 1933, as amended, on a private placement basis, to an institutional, accredited investor. The Company received the funds from the debentures in three installments, the first of which for $1,035,000 received on February 26, 2007 at the closing of financing. The Company used $540,000 from the first installment to retire $2,700,000 of the outstanding original discount debentures issued April 12, 2006. The second installment of these debentures, $800,000 was paid upon filing of a registration statement for the resale by the holder of the debenture of the shares issuable on conversion and the third installment of $600,000 was paid immediately prior to such registration statement going effective. The company has issued 76,622,222 shares on conversion in 2007 and 2008. An additional 43,706,570 shares were issued on conversion from January to March of 2009.

On October 5, 2007 the Company sold $450,000 in principal amount of convertible debentures and warrants. The debentures are due on October 5, 2010. The debentures and warrants were sold, and the common stock issued on conversion and exercise will be sold, under Section 4(2) of the Securities Act of 1933, as amended, on a private placement basis, to an institutional, accredited investor. The Company received $300,000 which was used for working capital. During 2008 the Company issued 2,020,202 shares on conversion.

Our independent auditors, in their report on the financial statements, have indicated that the Company has experienced recurring losses from operations and may not have enough cash and working capital to fund its operations beyond the very near term, which raises substantial doubt about our ability to continue as a going concern. Management has made a similar note in the financial statements. As indicated herein, we have need of capital for the implementation of our business plan, and we will need additional capital for continuing our operations. We do not have sufficient revenues to pay our expenses of operations. Unless the company is able to raise working capital, it is likely that the Company either will have to cease operations or substantially change its methods of operations or change its business plan.

New Accounting Pronouncements

Pacific Gold does not expect the adoption of recently issued accounting pronouncements to have a significant impact on Pacific Gold’s results of operations, financial position, or cash flow.

Critical Accounting Principals

The Company accounts for its convertible debentures under the guidelines established by APB Opinion No. 14 “Accounting for Convertible Debt and Debt issued with Stock Purchase Warrants”. The Company records a beneficial conversion feature (“BCF”) related to the issuance of convertible debt that have conversion features at fixed or adjustable rates and records the fair value of warrants issued with those instruments. The BCF for the convertible instruments is recognized and measured by allocating a portion of the proceeds to warrants and as a reduction to the carrying amount of the convertible instrument equal to the intrinsic value of the conversion features, both of which are credited to paid-in-capital. The Company calculates fair value using the Black-Scholes valuation method using assumptions pertinent to the warrants or convertible note.

The derivative liability related to convertible notes and warrants arises because the conversion price of the Company’s convertible notes is discounted from the market price of the Company’s common stock. Thus, the number of shares that may be issued upon conversion of such notes is indeterminate, which gives rise to the possibility that the Company may not be able to fully settle its convertible note and warrant obligations by the issuance of common stock. The Company has adjusted to fair value at each date that a note is converted and at each reporting date using the Black-Scholes valuation model. Adjustments in fair value arising because of changes in the market conditions are recorded as a gain or loss. To the extent the derivative liability is reduced as a consequence of the conversion of notes or the exercise of warrants, such reduction is recognized as additional paid-in-capital.

The Company records stock-based compensation according to the provisions of SFAS 123(R) which requires fair value compensation cost relating to share based payments be recognized in the financial statements. Fair value is measured at the grant date and recorded at the fair value of the award. Stock options are measured using the Black-Scholes valuation model.

Off Balance Sheet Arrangements

None.

17

ITEM 7. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

INDEX TO FINANCIAL STATEMENTS

TABLE OF CONTENTS

| |

Report of Independent Registered Public Accounting Firm | F-1 |

Consolidated Balance Sheets for the years ended December 31, 2008 and 2007 | F-3 |

Consolidated Statements of Operations for the years ended December 31, 2008 and December 31, 2007 | F-4 |

Consolidated Statements of Stockholders’ Equity/(Deficit) for the years ended December 31, 2008 and December 31, 2007 | F-5 |

Consolidated Statements of Cash Flows for the years ended December 31, 2008 and December 31, 2007 | F-6 |

Notes to Financial Statements | F-7 |

18

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and

Stockholders of Pacific Gold, Corp.

We have audited the accompanying consolidated balance sheet of Pacific Gold, Corp. as of December 31, 2008, and the related consolidated statement of operations, stockholders’ equity, and cash flows for the year ended December 31, 2008. Pacific Gold, Corp.’s management is responsible for these financial statements. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Pacific Gold, Corp. as of December 31, 2008, and the results of its operations and its cash flows for the year ended December 31, 2008 in conformity with accounting principles generally accepted in the United States of America.

These accompanying financial statements referred to above have been prepared assuming that the Company will continue as a going concern. As more fully described in Note 12, the Company has negative working capital and a stockholders’ deficit and losses to date of approximately $23 million. These conditions raise substantial doubts about the Company’s ability to continue as a going concern. Management’s plans to these matters are also described in Note 12. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ Jewett, Schwartz, Wolfe & Associates

Hollywood, FL 33021

March 11, 2011

200 South Park Road, Suite 150 • Hollywood, Florida 33021 • Main 954.922.5885 • Fax 954.922.5957 • www.jsw-cpa.com

Member - American Institute of Certified Public Accountants • Florida Institute of Certified Public Accountants

Private Companies Practice Section of the AICPA • Registered with the Public Company Accounting Oversight Board of the SEC

F-1

Mantyla McReynolds LLC

Certified Public Accountants

America counts on CPAs™

Report of Independent Registered Public Accounting Firm

The Board of Directors and Shareholders

Pacific Gold Corp.

We have audited the accompanying consolidated balance sheet of Pacific Gold Corp., and subsidiaries as of December 31, 2007 and the related consolidated statements of operations, stockholders’ equity, and cash flows for the year ended December 31, 2007. These consolidated financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on the financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform an audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Pacific Gold Corp. as of December 31, 2007 and the results of its operations and its cash flows for the year ended December 31, 2007, in conformity with accounting principles generally accepted in the United States of America.

/s/ Mantyla McReynolds, LLC

Salt Lake City, Utah

March 31, 2008

F-2

| | | |

Pacific Gold Corp. |

Consolidated Balance Sheets |

| | | |

| December 31, | | December 31, |

| 2008 | | 2007 |

| Audited | | Audited |

ASSETS | | | |

Current Assets: | | | |

Cash | $ 1,000 | | $ 14,934 |

Restricted Cash | 20,627 | | 30,542 |

Inventory | 30,222 | | 30,222 |

Prepaid Expenses | 24,500 | | 205,103 |

Total Current Assets | 76,349 | | 280,801 |

| | | |

Mineral Rights, Plant and Equipment | | | |

Mineral rights, net | 500,122 | | 442,171 |

Plant and Equipment, net | 1,320,804 | | 3,036,043 |

Water Rights and Wells | 90,000 | | 90,000 |

Land | 13,670 | | 13,670 |

Total Mineral Rights, Plant and Equipment, net | 1,924,596 | | 3,581,884 |

| | | |

Other Assets: | | | |

Deposits | 17,858 | | 22,982 |

Reclamation Bond | 189,218 | | 189,218 |

Total Other Assets | 207,076 | | 212,200 |

TOTAL ASSETS | $ 2,208,021 | | $ 4,074,885 |

| | | |

LIABILITIES AND STOCKHOLDERS' DEFICIT | | | |

Current Liabilities: | | | |

Accounts Payable | $ 732,897 | | $ 700,683 |

Accrued Expenses | 774,825 | | 357,952 |

Accrued Interest | 575,763 | | 348,286 |

Convertible Debentures – Short-Term Portion | 328,017 | | - |

Notes Payable – Shareholder | 1,395,000 | | 1,395,000 |

Total Current Liabilities | 3,806,502 | | 2,801,921 |

| | | |

Long Term Liabilities: | | | |

Convertible Debentures | 372,644 | | 1,673,223 |

Derivative Liability | 9,839 | | 111,594 |

Total Liabilities | 4,188,985 | | 4,586,738 |

| | | |

Stockholders’ Deficit: | | | |

Preferred Stock - $0.001 par value; 5,000,000 shares authorized, no shares issued and outstanding | - | | - |

Common Stock - $0.001 par value; 500,000,000 shares authorized, 160,700,394, and 75,127,363 shares issued and outstanding at December 31, 2008 and December 31, 2007 respectively | 160,700 | | 75,127 |

Additional Paid-in Capital | 21,251,379 | | 19,178,410 |

Retained Deficit | (23,393,043) | | (19,765,390) |

Total Stockholders’ Deficit | (1,980,964) | | (511,853) |

TOTAL LIABILITIES AND STOCKHOLDERS’ DEFICIT | $ 2,208,021 | | $ 4,074,885 |

See accompanying notes to financial statements

F-3

| | | | | |

Pacific Gold Corp. |

Consolidated Statements of Operations |

| | | | | |

| Year Ended |

| December 31, | | December 31, |

| 2008 | | 2007 |

Revenue: | | | | | |

Total Revenue | $ | - | | $ | 123,455 |

Production Costs | | | | | |

Production Costs | | - | | | 316,339 |

Depreciation | | 579,312 | | | 801,777 |

Gross Margin | | (579,312) | | | (994,661) |

| | | | | |

Operating Expenses: | | | | | |

Mineral Rights Expense | | 5,194 | | | 617 |

General and Administrative | | 1,373,517 | | | 2,162,289 |

Loss on Sale of Assets | | 231,986 | | | 313,988 |

Asset Write Down | | 153,855 | | | 379,466 |

Total Operating Expenses | | 1,764,552 | | | 2,856,360 |

| | | | | |

Net Loss from Operations | | (2,343,864) | | | (3,851,021) |

| | | | | |

Other Expense | | | | | |

Interest Expense | | (1,772,288) | | | (3,486,586) |

Total Other Income/Expenses | | (1,772,288) | | | (3,486,586) |

| | | | | |

Other Income/(Loss) | | | | | |

Gain/(Loss) on Extinguishment of Debt | | 377,192 | | | (190,185) |

Other Income | | 1,289 | | | - |

Interest Income | | 85 | | | 1,121 |

Settlement of Lawsuit | | 50,396 | | | - |

Change in Fair Value of Derivative Liability | | 59,537 | | | 2,903,255 |

| | 488,499 | | | 2,714,191 |

Net Income/(Loss) | $ | (3,627,653) | | $ | (4,623,416) |

| | | | | |

Basic and Diluted Earnings/(Loss) per Share | $ | (0.03) | | $ | (0.07) |

| | | | | |

Weighted Average Shares Outstanding: | | | | | |

Basic and Diluted | | 120,013,133 | | | 62,521,497 |

See accompanying notes to financial statements

F-4

| | | | | | | | | | | | | | |

Pacific Gold Corp. |

Consolidated Statements of Stockholders' Equity |

For the Years ended December 31, 2008 and 2007 |

| | | | | | | | | | | | | | |

| | Common Stock | | Additional paid in | | Accumulated | | | |

| | Shares | | Amount | | Capital | | Deficit | | Total |

| | | | | | | | | | | | | | |

Balance, December 31, 2006 | | 55,671,797 | | $ | 55,672 | | $ | 15,052,666 | | $ | (15,141,974) | | $ | (33,636) |

| | | | | | | | | | | | | | |

Issuance of convertible note Series C Warrants | | 800,000 | | | 800 | | | 159,200 | | | | | | 160,000 |

Issuance of common stock for services | | 4,711,173 | | | 4,711 | | | 825,847 | | | | | | 830,558 |

Stock option expense | | | | | | | | 35,000 | | | | | | 35,000 |

Conversion of Series C note | | 2,800,000 | | | 2,800 | | | 1,055,200 | | | | | | 1,058,000 |

Conversion of Series D note | | 11,144,394 | | | 11,144 | | | 1,905,305 | | | | | | 1,916,449 |

Issuance of Series E note | | | | | | | | 145,192 | | | | | | 145,192 |

Net loss year-to-date | | | | | | | | | | | (4,623,416) | | | (4,627,916) |

| | | | | | | | | | | | | | |

Balance, December 31, 2007 | | 75,127,364 | | $ | 75,127 | | $ | 19,178,410 | | $ | (19,765,390) | | $ | (511,853) |

| | | | | | | | | | | | | | |

Issuance of common stock for services | | 12,825,000 | | | 12,825 | | | 240,175 | | | - | | | 253,000 |

Conversion of Series C note | | 5,250,000 | | | 5,250 | | | 939,750 | | | - | | | 945,000 |

Conversion of Series D note | | 65,477,828 | | | 65,478 | | | 875,064 | | | - | | | 940,542 |

Conversion of Series E note | | 2,020,202 | | | 2,020 | | | 17,980 | | | | | | 20,000 |

Net loss to December 31, 2008 | | | | | | | | | | | (3,627,653) | | | (3,627,653) |

| | | | | | | | | | | | | | |

Balance, December 31, 2008 | | 160,700,394 | | $ | 160,700 | | $ | 21,251,379 | | $ | (23,393,043) | | $ | (1,980,964) |

See accompanying notes to financial statements

F-5

| | | | | |

Pacific Gold Corp. |

Consolidated Statements of Cash Flows |

| | | |

| For the Year Ended |

| December 31, | | December 31, |

| 2008 | | 2007 |

CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | |

Net Loss | $ | (3,627,653) | | $ | (4,623,416) |

Adjustments to Reconcile Net Loss to Net Cash Used in Operating Activities: | | | | | |

Depreciation and Depletion | | 579,312 | | | 801,777 |

Amortization | | 147,000 | | | 122,500 |

Change in Fair Value of Derivative Liability | | 59,537 | | | (2,903,255) |

Non-cash Portion of Interest Paid on Convertible Debt | | 1,425,517 | | | 3,206,587 |

Loss on Sales of Equipment | | 231,986 | | | 313,988 |

Asset Write-down | | 7,609 | | | 379,466 |

(Gain)/Loss on Extinguishment of Debt | | (355,222) | | | 190,185 |

Common Stock Issued for Services | | 253,000 | | | 830,558 |

Stock Based Compensation | | - | | | 35,000 |

Changes in: | | | | | |

Accounts Receivable | | - | | | 407 |

Inventory | | - | | | (318,074) |

Prepaid Expenses | | 33,603 | | | 18,423 |

Deposits | | 5,124 | | | 39,810 |

Accounts Payable | | 32,214 | | | 38,962 |

Accrued Expenses | | 416,873 | | | (250,423) |

Accrued Interest | | 227,477 | | | 279,940 |

NET CASH (USED) IN OPERATING ACTIVITIES | | (563,623) | | | (1,837,565) |

| | | | | |

CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | |

Purchases and Development of Property and Equipment | $ | (81,579) | | $ | (579,648) |

Proceeds from Restricted Cash Account | | 9,915 | | | 56,963 |

Investment in Reclamation Bond | | - | | | 19,501 |

Proceeds from Sale of Equipment | | 919,960 | | | 202,830 |

NET CASH PROVIDED BY /(USED) IN INVESTING ACTIVITIES | | 848,296 | | | (300,354) |

| | | | | |

CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | |

Payments on Convertible Notes | | (298,607) | | | - |

Proceeds from Exercise of Warrants | | - | | | 160,000 |

Proceeds from Convertible Debt, net | | - | | | 1,906,000 |

NET CASH PROVIDED/(USED) IN FINANCING ACTIVITIES | | (298,607) | | | 2,066,000 |

| | | | | |

NET CHANGE IN CASH | $ | (13,934) | | $ | (71,919) |

| | | | | |

CASH AT BEGINNING OF PERIOD | | 14,934 | | | 86,853 |

| | | | | |

CASH AT END OF PERIOD | $ | 1,000 | | $ | 14,934 |

| | | | | |

Cash paid during the year for: | | | | | |

Interest | | - | | | - |

Income Taxes | | - | | | - |

| | | | | |

Non-cash financing and investing activities: | | | | | |

Conversion of Notes Payable | | 1,905,542 | | | 2,050,276 |

See accompanying notes to financial statements

F-6

Pacific Gold Corp.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2008 and 2007

NOTE 1 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Pacific Gold Corp. (“Pacific Gold”) was originally incorporated in Nevada on December 31, 1996 under the name of Demand Financial International, Ltd. On October 3, 2002, Demand Financial International, Ltd. changed its name to Blue Fish Entertainment, Inc. On August 5, 2003, the name was changed to Pacific Gold Corp. Pacific Gold is engaged in the identification, acquisition, exploration and mining of prospects believed to have gold mineralization. Pacific Gold through its subsidiaries currently owns claims, property and leases in Nevada, Oregon and Colorado. Its Defiance Mine property in Oregon began producing gold in commercial quantities in mid-2004; its Black Rock Canyon Mine in Nevada began producing gold in commercial quantities in the third quarter of 2006.

The accompanying consolidated financial statements include all of the accounts of Pacific Gold Corp. and its wholly-owned subsidiaries, Oregon Gold, Inc., Nevada Rae Gold, Inc., Fernley Gold, Inc., Pilot Mountain Resources, Inc. and Pacific Metals Corp. All significant inter-company accounts and transactions have been eliminated.

Use of Estimates. In preparing financial statements, management makes estimates and assumptions that affect the reported amounts of assets and liabilities in the balance sheet and revenue and expenses in the statement of expenses. Actual results could differ from those estimates.

Cash and Cash Equivalents. For purposes of the statement of cash flows, Pacific Gold considers all highly liquid investments purchased with an original maturity of three months or less to be cash equivalents. The Company has no cash in excess of FDIC federally insured limits as of December 31, 2008.

Revenue Recognition. Pacific Gold recognizes revenue from the sale of gold when persuasive evidence of an arrangement exists, services have been rendered, the sales price is fixed or determinable, and collection is reasonably assured, which is determined when it places a sale order of gold from its inventory on hand with the refinery. There were no sales in the year ended December 31, 2008.

Accounts Receivable/Bad Debt. The allowance for doubtful accounts is maintained at a level sufficient to provide for estimated credit losses based on evaluating known and inherent risks in the receivables portfolio. Management evaluates various factors including expected losses and economic conditions to predict the estimated realization on outstanding receivables. As of December 31, 2008, and 2007 there were no accounts receivable.

Inventories. Inventories are stated at the lower of average cost or net realizable value. Costs included are limited to those directly related to mining. There was inventory as of December 31, 2008 of $30,222 consisting of metals inventory and stockpile ore.

The major classes of inventories as of December 31, 2008 and 2007 were:

| | |

Finished Goods | $ | 0 |

Stockpile Ore | | 30,222 |

Total | $ | 30,222 |

Property and Equipment. Property and equipment are valued at cost. Additions are capitalized and maintenance and repairs are charged to expense as incurred. Gains and losses on dispositions of equipment are reflected in operations. Depreciation is provided using the straight-line method over the estimated useful lives of the assets, which are 2 to 10 years.

Mineral Rights

All mine-related costs, other than acquisition costs, are expensed prior to the establishment of proven or probable reserves. Reserves designated as proven and probable are supported by a final feasibility study, indicating that the reserves have had the requisite geologic, technical and economic work performed and are legally extractable at the time of reserve determination. Once proven or probable reserves are established, all development and other site-specific costs are capitalized.

F-7

Capitalized development costs and production facilities are depleted using the units-of-production method based on the estimated gold which can be recovered from the ore reserves processed. There has been no change to the estimate of proven and probable reserves. Lease development costs for non-producing properties are amortized over their remaining lease term if limited. Maintenance and repairs are charged to expense as incurred.

We were not in mining in 2008 and thus we did not amortize any of our mineral rights.

Impairment of Long-Lived Assets. Pacific Gold reviews the carrying value of its long-lived assets annually or whenever events or changes in circumstances indicate that the historical cost-carrying value of an asset may no longer be appropriate. Pacific Gold assesses recoverability of the carrying value of the asset by estimating the undiscounted future net cash flows, which depend on estimates of metals to be recovered from proven and probable ore reserves, and also identified resources beyond proven and probable reserves, future production costs and future metals prices over the estimated remaining mine life. If undiscounted cash flows are less that the carrying value of a property, an impairment loss is recognized based upon the estimated expected future net cash flows from the property discounted at an interest rate commensurate with the risk involved. If the future net cash flows are less than the carrying value of the asset, an impairment loss is recorded equal to the difference between the asset’s carrying value and fair value.

The fair value of an asset retirement obligation is recognized in the period in which it is incurred if a reasonable estimate of fair value can be made. The present value of the estimated asset retirement costs is capitalized as part of the carrying amount of the long-lived asset. For Pacific Gold, asset retirement obligations primarily relate to the abandonment of ore-producing property and facilities.

We review the carrying value of our interest in each mineral claim on a quarterly basis to determine whether impairment has incurred in accordance with ASC 360 (formerly SFAS No. 144, “Accounting for the Impairment or Disposal of Long-Lived Assets.”)

Where information and conditions suggest impairment, we write-down these properties to net recoverable amount, based on estimated discounted future cash flows. Our estimate of gold price, mineralized materials, operating capital, and reclamation costs are subject to risks and uncertainties affecting the recoverability of our investment in property, plant, and equipment. Although we have made our best estimate of these factors based on current conditions, it is possible that changes could occur in the near term that could adversely affect our estimate of net cash flows expected to be generated from our operating properties and the need for possible asset impairment write-downs.

Where estimates of future net operating cash flows are not available and where other conditions suggest impairment, we assess if carrying value can be recovered from net cash flows generated by the sale of the asset or other means.

Income taxes. Pacific Gold recognizes deferred tax assets and liabilities based on differences between the financial reporting and tax bases of assets and liabilities using the enacted tax rates and laws that are expected to be in effect when the differences are expected to be recovered. Pacific Gold provides a valuation allowance for deferred tax assets for which it does not consider realization of such assets to be more likely than not.