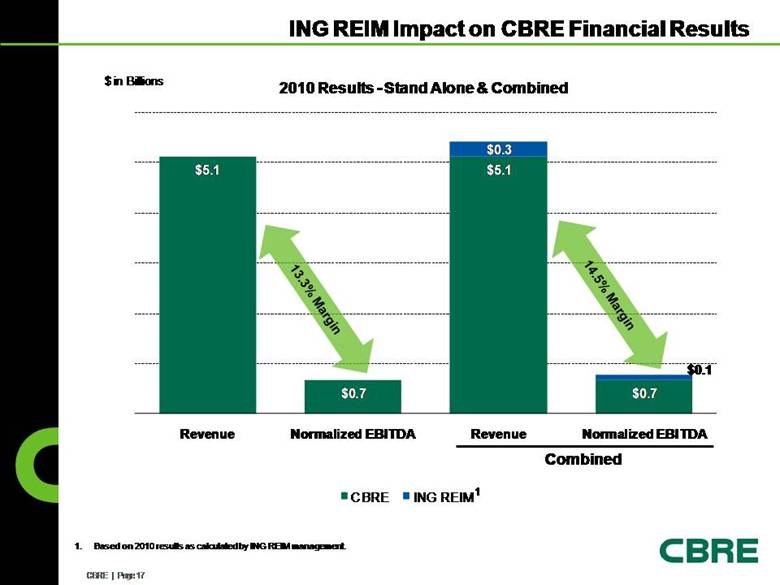

| Reconciliation of Normalized EBITDA to EBITDA to Net Income (Loss) Notes: Includes EBITDA related to discontinued operations of $3.0 million for the twelve months ended September 30, 2011, $16.4 million for the year ended December 31, 2010, $16.9 million for the year ended December 31, 2008 and $6.5 million for the year ended December 31, 2007. Includes interest income related to discontinued operations of $0.1 million for the year ended December 31, 2008 and $0.01 million for the year ended December 31, 2007. Includes depreciation and amortization related to discontinued operations of $0.9 million for the twelve months ended September 30, 2011, $0.6 million for the year ended December 31, 2010, $0.1 million for the year ended December 31, 2008 and $0.4 million for the year ended December 31, 2007. Includes interest expense related to discontinued operations of $1.9 million for the twelve months ended September 30, 2011, $1.6 million for the year ended December 31, 2010, $0.6 million for the year ended December 31, 2008 and $1.8 million for the year ended December 31, 2007. Includes provision for income taxes related to discontinued operations of $0.4 million for the twelve months ended September 30, 2011, $5.4 million for the year ended December 31, 2010, $6.0 million for the year ended December 31, 2008 and $1.6 million for the year ended December 31, 2007. Includes revenue related to discontinued operations of $4.6 million for the twelve months ended September 30, 2011, $3.9 million for the year ended December 31, 2010, $1.3 million for the year ended December 31, 2008 and $2.1 million for the year ended December 31, 2007. ($ in millions) LTM Q3 2011 2010 2009 2008 2007 2006 Normalized EBITDA 1 740.9 $ 681.3 $ 453.9 $ 601.2 $ 970.1 $ 652.5 $ Less: Integration and other costs related to acquisitions 28.0 7.2 5.7 16.4 45.2 7.6 Write-down of impaired assets 10.3 11.3 32.5 100.4 - - Cost containment expenses 3.5 15.3 43.6 27.4 - - Merger-related charges - - - - 56.9 - Loss (gain) on trading securities acquired in the Trammell Crow Company acquisition - - - - 33.7 (8.6) EBITDA 1 699.1 647.5 372.1 457.0 834.3 653.5 Add: Interest income 2 9.2 8.4 6.1 17.9 29.0 9.8 Less: Depreciation and amortization 3 109.8 109.0 99.5 102.9 113.7 67.6 Interest expense 4 150.2 192.7 189.1 167.8 164.8 45.0 Write-off of financing costs 18.1 18.1 29.3 - - 33.8 Goodwill and other non-amortizable intangible asset impairments - - - 1,159.4 - - Provision for income taxes 5 175.7 135.8 27.0 56.9 194.3 198.3 Net income (loss) attributable to CBRE Group, Inc. 254.5 $ 200.3 $ 33.3 $ (1,012.1) $ 390.5 $ 318.6 $ Revenue 6 5,797.7 5,119.2 4,165.8 5,130.1 6,036.3 4,032.0 Normalized EBITDA Margin 12.8% 13.3% 10.9% 11.7% 16.1% 16.2% Year Ended December 31, 1. 2. 3. 4. 5. 6. |