Filed pursuant to Rule 425 under the Securities Act of 1933, as amended, and deemed filed pursuant to 14-6 under the Securities Exchange Act of 1934, as amended Filing Person: Corporate Property Associates 15 Incorporated Subject Company: Corporate Property Associates 15 Incorporated Commission File No.: 000-50249 Registration File No.: 333-180328

|

Investing for the Long RunTM August 2012

|

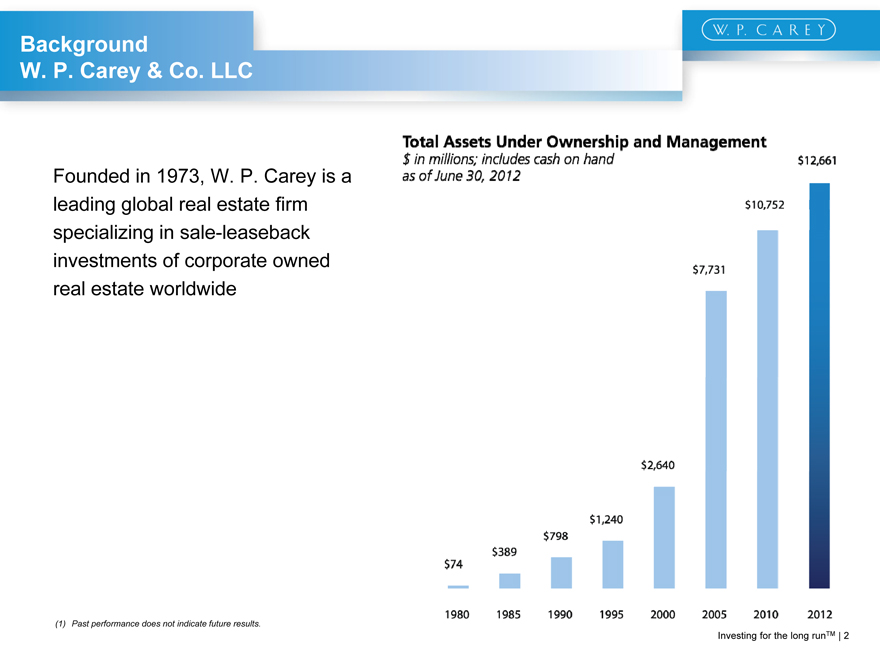

Background W. P. Carey & Co. LLC Investing for the long runTM | 2 Founded in 1973, W. P. Carey is a leading global real estate firm specializing in sale-leaseback investments of corporate owned real estate worldwide Past performance does not indicate future results.

|

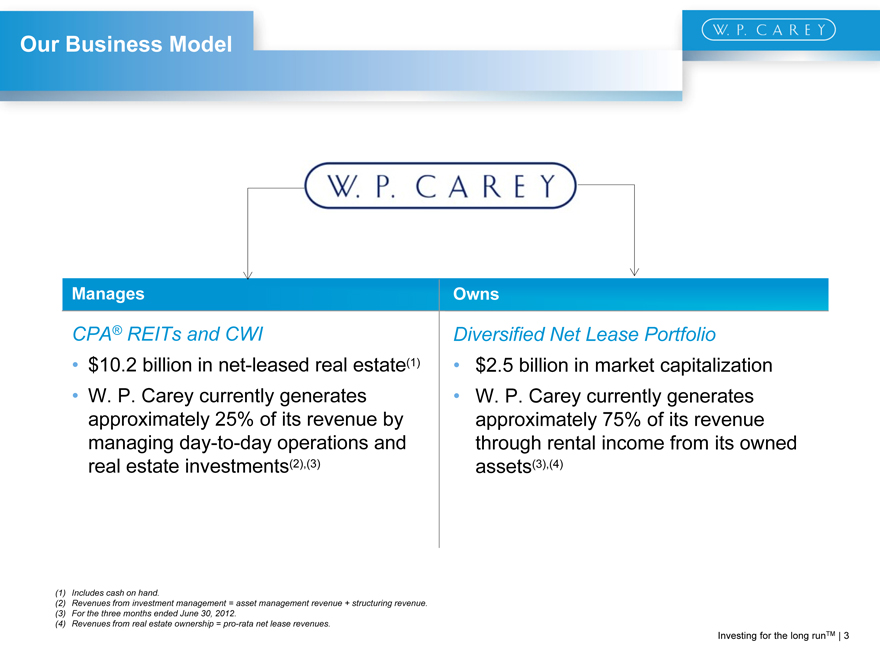

Our Business Model Investing for the long runTM | 3 Manages CPA® REITs and CWI $10.2 billion in net-leased real estate(1) W. P. Carey currently generates approximately 25% of its revenue by managing day-to-day operations and real estate investments(2),(3) Owns Diversified Net Lease Portfolio $2.5 billion in market capitalization W. P. Carey currently generates approximately 75% of its revenue through rental income from its owned assets(3),(4) Includes cash on hand. Revenues from investment management = asset management revenue + structuring revenue. For the three months ended June 30, 2012. Revenues from real estate ownership = pro-rata net lease revenues.

|

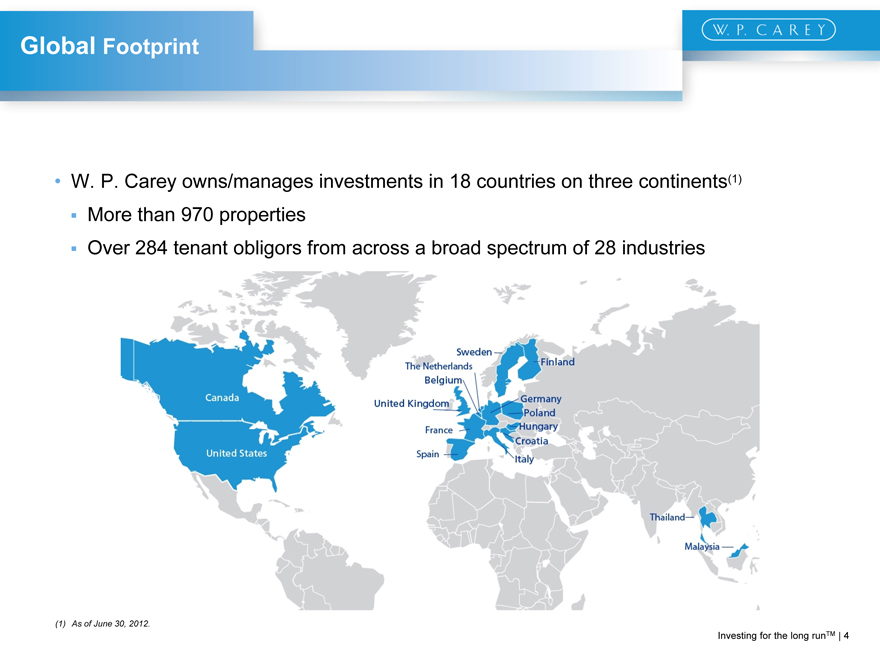

Investing for the long runTM | 4 W. P. Carey owns/manages investments in 18 countries on three continents(1) More than 970 properties Over 284 tenant obligors from across a broad spectrum of 28 industries As of June 30, 2012. Global Footprint

|

Our Business

|

Investing for the long runTM | 6 Generate attractive risk-adjusted returns by identifying growing companies with real estate assets globally Create upside through lease escalations, credit improvements and real estate appreciation Protect downside by combing credit and real estate underwriting with sophisticated structuring and direct origination Evaluate each transaction on: creditworthiness of tenant criticality of the asset the underlying value of the real estate the transaction’s structure and pricing Investment Strategy

|

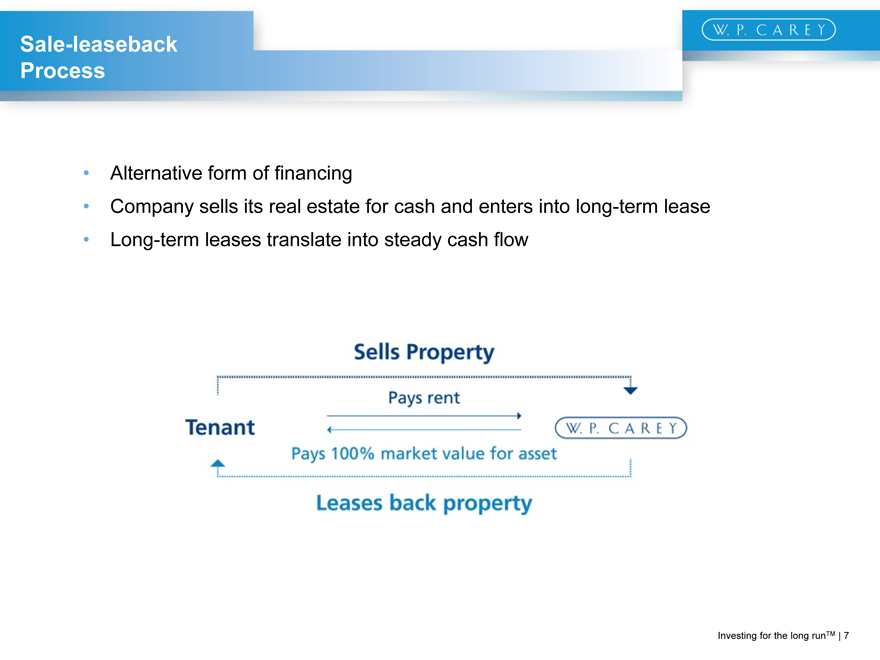

Investing for the long runTM | 7 Alternative form of financing Company sells its real estate for cash and enters into long-term lease Long-term leases translate into steady cash flow Sale-leaseback Process

|

Investing for the long runTM | 8 Blue Cross and Blue Shield of Minnesota Facility Type Six-building headquarters campus and two additional properties Purchase Price $169 million Location Minneapolis, Aurora, and Virginia, MN Blue Cross of Minnesota was chartered in 1933 as Minnesota’s first health plan Blue Cross health plan is the largest health plan in Minnesota with $2.8 billion in total revenues and 41% market share The company is a conservatively run organization with strong capitalization and no long term debt Investment Strategy

|

Investing for the long runTM | 9 The New York Times Company Facility Type Global Headquarters Purchase Price $234 million Location New York City Constructed for approximately $500 million in 2007 Purchased for $234 million—40% of the appraised value of the asset 15-year lease, initial cap rate of 10.75%, fixed annual escalations Facility houses NYT’s senior executive team and main news desk – critical to the entire enterprise Transaction closed in March 2009 Investment Strategy

|

Investing for the long runTM | 10 C1000 B.V. Facility Type Portfolio of 6 logistics properties leased on a long-term triple net basis Purchase Price $208 million Location Netherlands C1000 B.V. is a leading Dutch supermarket with 371 stores across the Netherlands Portfolio of 6 logistics properties represents the complete distribution network of C1000, supplying all of its supermarket stores in the country C1000 and its franchisee network comprise the second largest food retailer in the Netherlands Annual sales of €3.7 billion Investment Strategy

|

Investing for the long runTM | 11 Metro A.G. Facility Type 20 cash and carry stores Purchase Price $396 million Location Throughout Italy Lease is guaranteed by its German parent company, Metro A.G. Metro A.G. is the world’s largest cash and carry operator and third largest retailer, with 2011 revenues totaling €66 billion Facilities represent half of Metro’s Italian presence Investment Strategy

|

Investing for the long runTM | 12 Agrokor Facility Type Three modern retail sites Purchase Price $57 million Location Croatia 100% of funds needed for the construction of the three retail sites provided by W. P. Carey Upon completion, these sites will be long-term triple-net leased to Konzum, a member of Agrokor Group, the largest private company in Croatia The Agrokor Group employs more than 35,000 people and its core businesses include the production and distribution of food and beverages as well as retail stores Investment Strategy

|

Investing for the long runTM | 13 A-American Self Storage Properties in California and Hawaii managed by Extra Space Storage, while properties in Illinois will be managed by SecurCare Self Storage The A-American portfolio acquired to date comprises of 43 properties totaling approximately 2.9 million square feet Investment Strategy Facility Type 43 self-storage facilities Purchase Price $166 million Location California, Illinois and Hawaii

|

Investing for the long runTM | 14 Flanders Flanders is one of the largest manufacturers of air filters and related products in the United States Products are utilized by many industries including those associated with commercial and residential heating, ventilation and air conditioning systems, semiconductor manufacturing, biotechnology, pharmaceuticals, synthetics, nuclear power and nuclear materials processing Investment Strategy Facility Type Four industrial facilities Purchase Price $51 million Location Florida, Illinois, Oklahoma, North Carolina

|

Financial Results

|

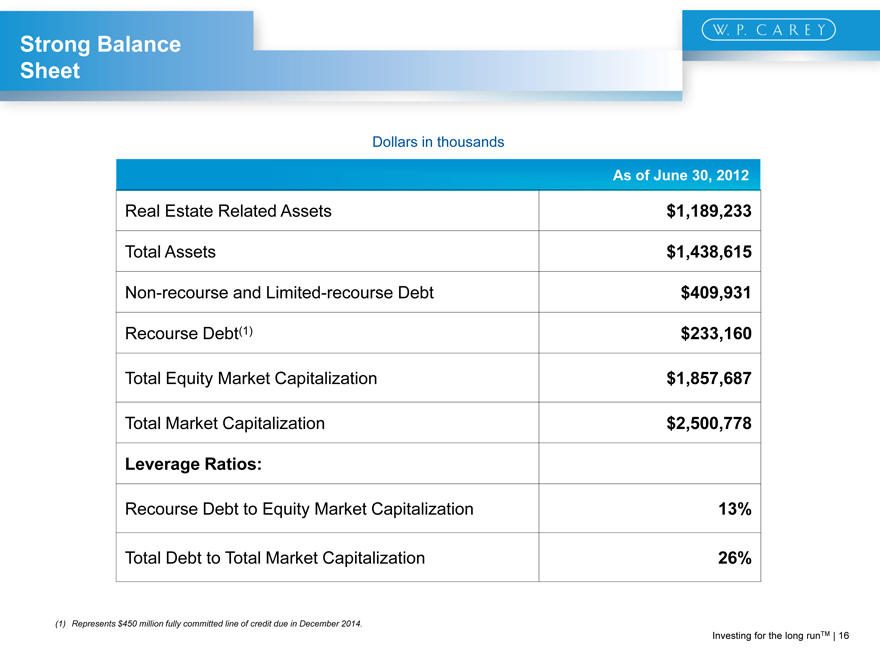

Investing for the long runTM | 16 Represents $450 million fully committed line of credit due in December 2014. Strong Balance Sheet Dollars in thousands Dollars in thousands Real Estate Related Assets $1,189,233 Total Assets $1,438,615 Non-recourse and Limited-recourse Debt $409,931 Recourse Debt(1) $233,160 Total Equity Market Capitalization $1,857,687 Total Market Capitalization $2,500,778 Leverage Ratios: Recourse Debt to Equity Market Capitalization 13% Total Debt to Total Market Capitalization 26% As of June 30, 2012

|

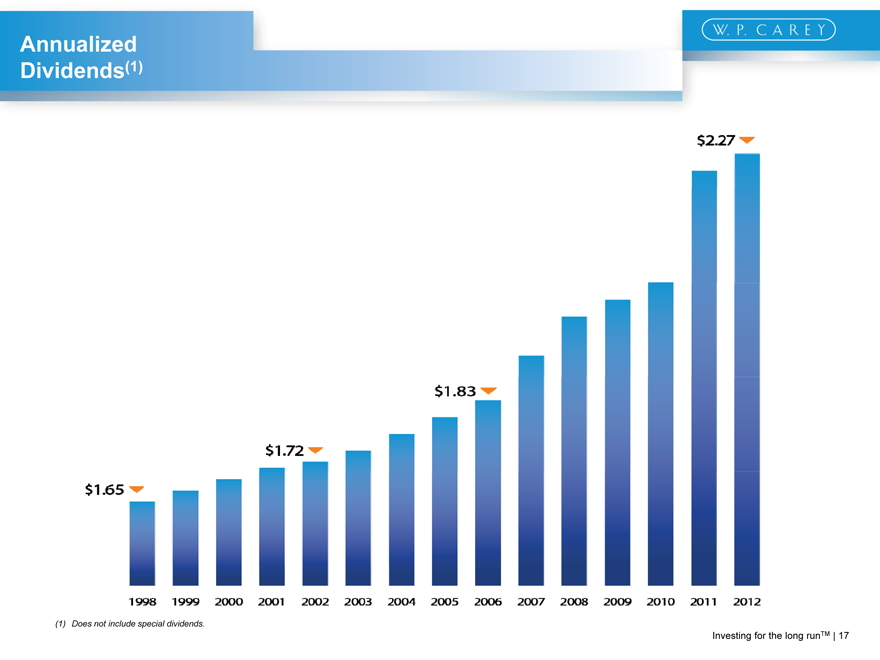

Investing for the long runTM | 17 Does not include special dividends. Annualized Dividends(1)

|

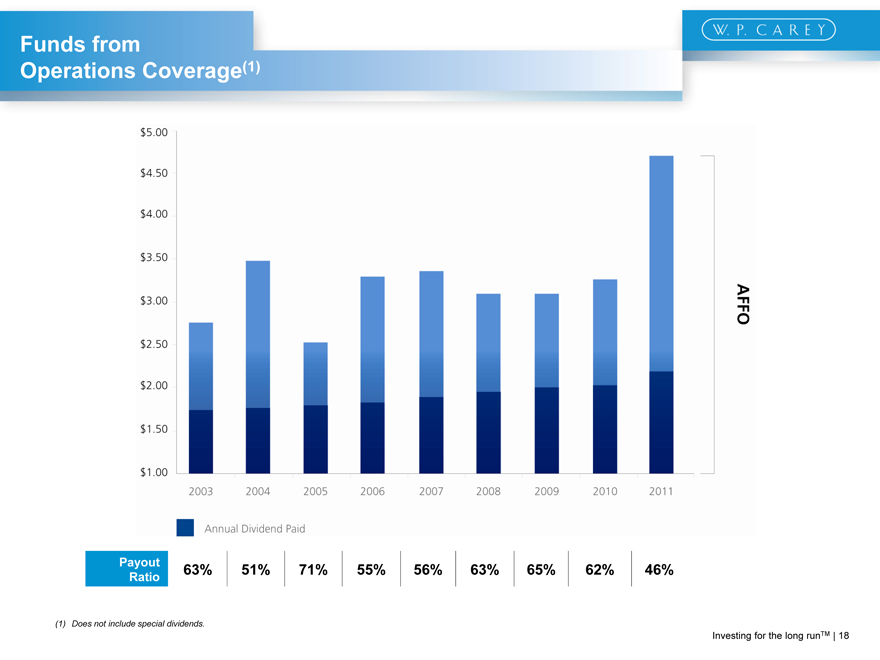

Investing for the long runTM | 18 Does not include special dividends. Funds from Operations Coverage(1) Payout Ratio 63% 51% 71% 55% 56% 63% 65% 62% 46%

|

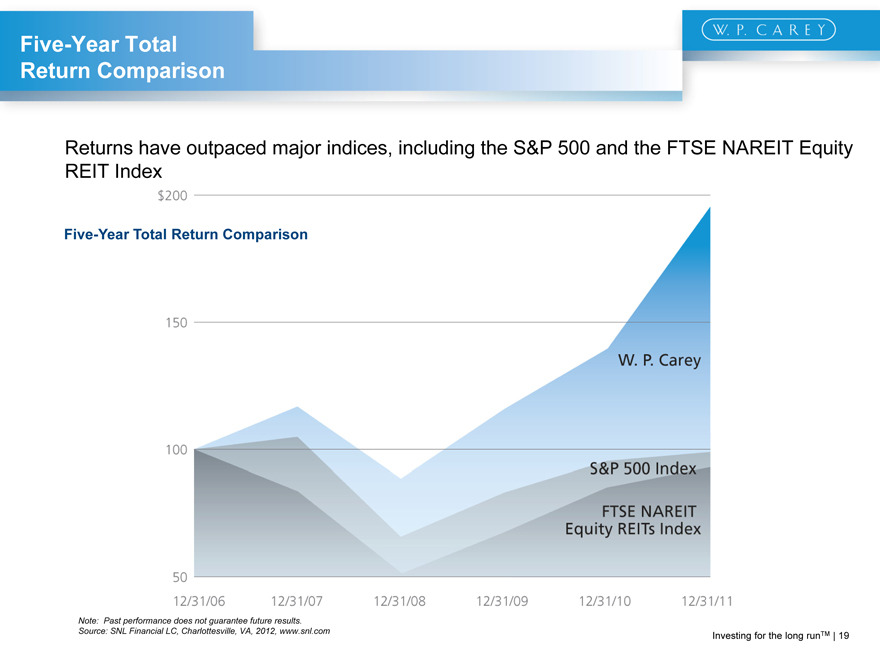

Investing for the long runTM | 19 Note: Past performance does not guarantee future results. Source: SNL Financial LC, Charlottesville, VA, 2012, www.snl.com Returns have outpaced major indices, including the S&P 500 and the FTSE NAREIT Equity REIT Index Five-Year Total Return Comparison Five-Year Total Return Comparison

|

Proposed REIT Conversion & Merger Transaction

|

W. P. Carey & Co. LLC (NYSE: WPC) is acquiring Corporate Property Associates 15 Incorporated (“CPA®:15”), one of its managed non-traded REITs Immediately prior to the CPA®:15 acquisition, W. P. Carey will convert to a REIT These transactions are part of a larger transformation that implements W. P. Carey’s overall business strategy of growing real estate assets under ownership Investing for the long runTM | 21 Transaction Overview

|

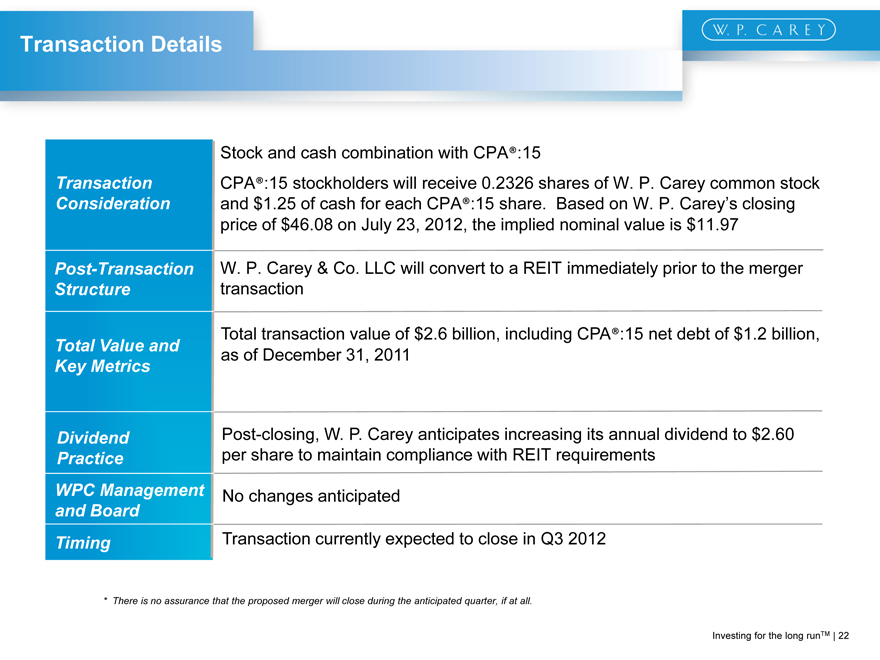

Transaction Consideration Stock and cash combination with CPA®:15 CPA®:15 stockholders will receive 0.2326 shares of W. P. Carey common stock and $1.25 of cash for each CPA®:15 share. Based on W. P. Carey’s closing price of $46.08 on July 23, 2012, the implied nominal value is $11.97 W. P. Carey & Co. LLC will convert to a REIT immediately prior to the merger transaction Investing for the long runTM | 22 Total Value and Key Metrics Total transaction value of $2.6 billion, including CPA®:15 net debt of $1.2 billion, as of December 31, 2011 Dividend Practice Post-closing, W. P. Carey anticipates increasing its annual dividend to $2.60 per share to maintain compliance with REIT requirements WPC Management and Board No changes anticipated Timing Transaction currently expected to close in Q3 2012 Post-Transaction Structure Transaction Details * There is no assurance that the proposed merger will close during the anticipated quarter, if at all.

|

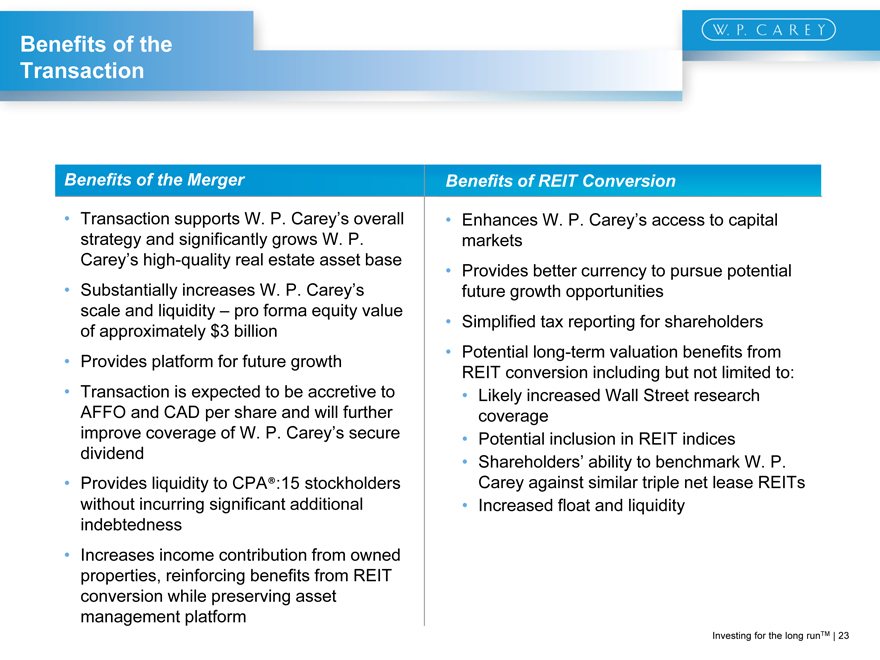

Benefits of the Merger Transaction supports W. P. Carey’s overall strategy and significantly grows W. P. Carey’s high-quality real estate asset base Substantially increases W. P. Carey’s scale and liquidity – pro forma equity value of approximately $3 billion Provides platform for future growth Transaction is expected to be accretive to AFFO and CAD per share and will further improve coverage of W. P. Carey’s secure dividend Provides liquidity to CPA®:15 stockholders without incurring significant additional indebtedness Increases income contribution from owned properties, reinforcing benefits from REIT conversion while preserving asset management platform Benefits of REIT Conversion Enhances W. P. Carey’s access to capital markets Provides better currency to pursue potential future growth opportunities Simplified tax reporting for shareholders Potential long-term valuation benefits from REIT conversion including but not limited to: Likely increased Wall Street research coverage Potential inclusion in REIT indices Shareholders’ ability to benchmark W. P. Carey against similar triple net lease REITs Increased float and liquidity Investing for the long runTM | 23 Benefits of the Transaction

|

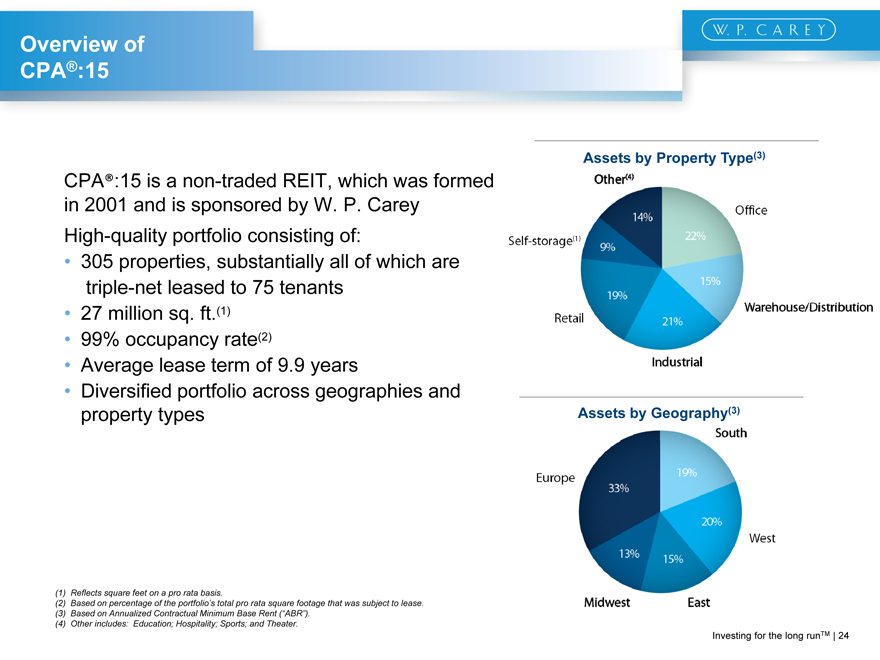

CPA®:15 is a non-traded REIT, which was formed in 2001 and is sponsored by W. P. Carey High-quality portfolio consisting of: 305 properties, substantially all of which are triple-net leased to 75 tenants 27 million sq. ft.(1) 99% occupancy rate(2) Average lease term of 9.9 years Diversified portfolio across geographies and property types Investing for the long runTM | 24 Assets by Property Type(3) Assets by Geography(3) (1) Reflects square feet on a pro rata basis. (2) Based on percentage of the portfolio’s total pro rata square footage that was subject to lease. (3) Based on Annualized Contractual Minimum Base Rent (“ABR”). (4) Other includes: Education; Hospitality; Sports; and Theater. Overview of CPA®:15

|

Combined Company

|

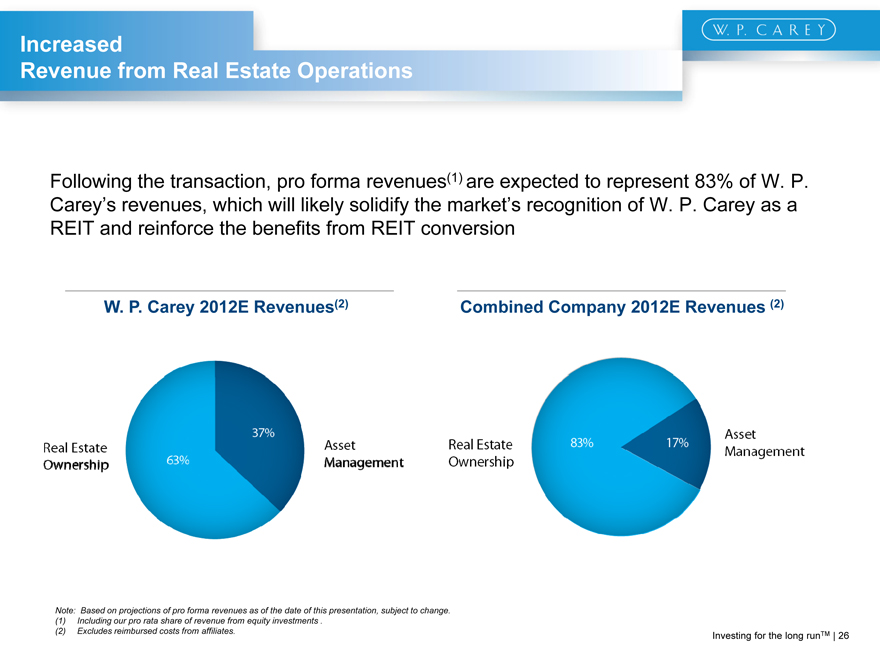

Following the transaction, pro forma revenues(1) are expected to represent 83% of W. P. Carey’s revenues, which will likely solidify the market’s recognition of W. P. Carey as a REIT and reinforce the benefits from REIT conversion Investing for the long runTM | 26 W. P. Carey 2012E Revenues(2) Combined Company 2012E Revenues (2) Note: Based on projections of pro forma revenues as of the date of this presentation, subject to change. Including our pro rata share of revenue from equity investments . Excludes reimbursed costs from affiliates. Increased Revenue from Real Estate Operations

|

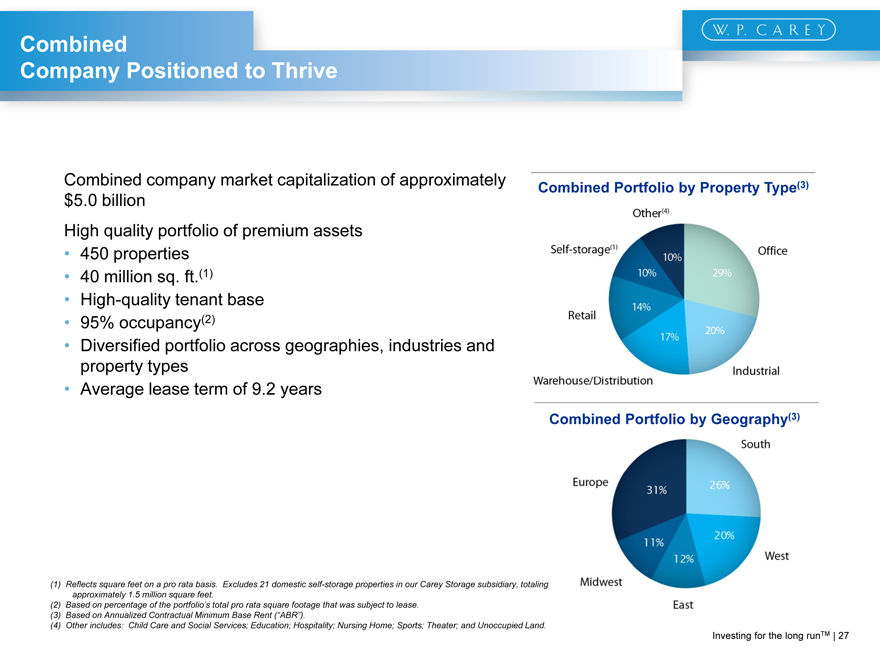

Combined company market capitalization of approximately $5.0 billion High quality portfolio of premium assets 450 properties 40 million sq. ft.(1) High-quality tenant base 95% occupancy(2) Diversified portfolio across geographies, industries and property types Average lease term of 9.2 years Investing for the long runTM | 27 Combined Portfolio by Property Type(3) Combined Portfolio by Geography(3) (1) Reflects square feet on a pro rata basis. Excludes 21 domestic self-storage properties in our Carey Storage subsidiary, totaling approximately 1.5 million square feet. (2) Based on percentage of the portfolio’s total pro rata square footage that was subject to lease. (3) Based on Annualized Contractual Minimum Base Rent (“ABR”). (4) Other includes: Child Care and Social Services; Education; Hospitality; Nursing Home; Sports; Theater; and Unoccupied Land. Combined Company Positioned to Thrive

|

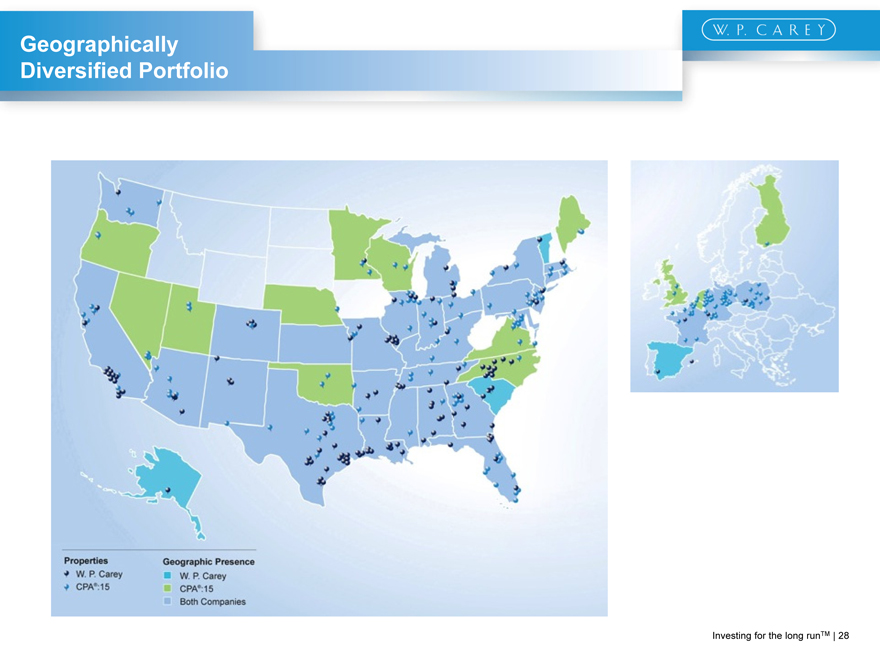

Investing for the long runTM | 28 Geographically Diversified Portfolio

|

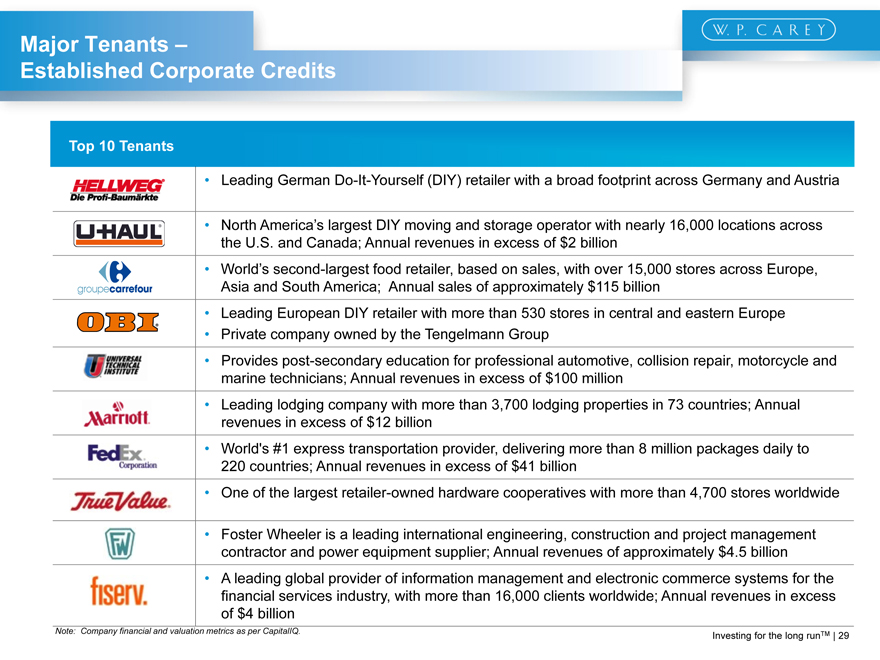

Investing for the long runTM | 29 Note: Company financial and valuation metrics as per CapitalIQ. Leading German Do-It-Yourself (DIY) retailer with a broad footprint across Germany and Austria North America’s largest DIY moving and storage operator with nearly 16,000 locations across the U.S. and Canada; Annual revenues in excess of $2 billion World’s second-largest food retailer, based on sales, with over 15,000 stores across Europe, Asia and South America; Annual sales of approximately $115 billion Leading European DIY retailer with more than 530 stores in central and eastern EuropePrivate company owned by the Tengelmann Group Provides post-secondary education for professional automotive, collision repair, motorcycle and marine technicians; Annual revenues in excess of $100 million Leading lodging company with more than 3,700 lodging properties in 73 countries; Annual revenues in excess of $12 billion World’s #1 express transportation provider, delivering more than 8 million packages daily to 220 countries; Annual revenues in excess of $41 billion One of the largest retailer-owned hardware cooperatives with more than 4,700 stores worldwide Foster Wheeler is a leading international engineering, construction and project management contractor and power equipment supplier; Annual revenues of approximately $4.5 billion A leading global provider of information management and electronic commerce systems for the financial services industry, with more than 16,000 clients worldwide; Annual revenues in excess of $4 billion Major Tenants – Established Corporate Credits Top 10 Tenants

|

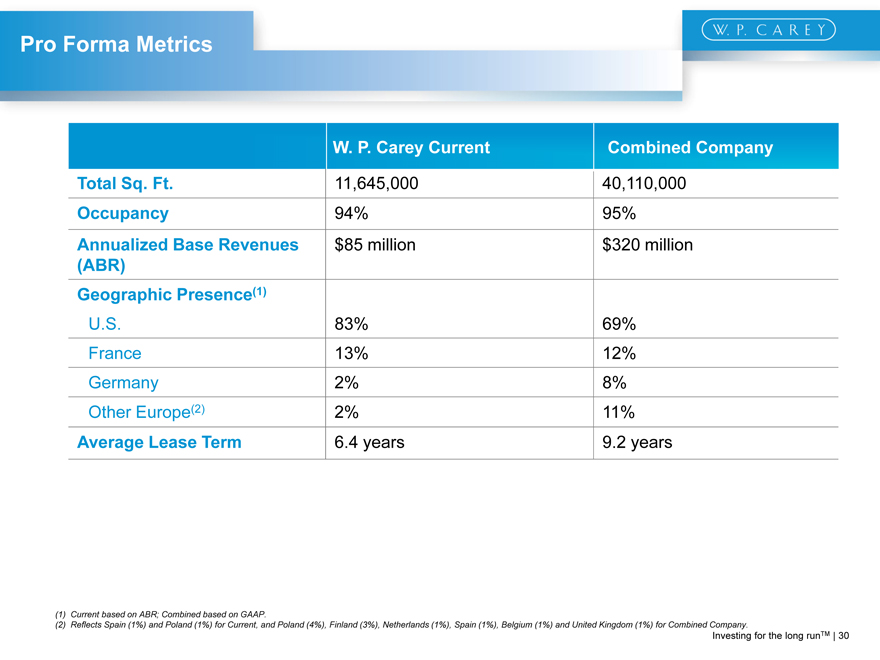

Investing for the long runTM | 30 (1) Current based on ABR; Combined based on GAAP. (2) Reflects Spain (1%) and Poland (1%) for Current, and Poland (4%), Finland (3%), Netherlands (1%), Spain (1%), Belgium (1%) and United Kingdom (1%) for Combined Company. Pro Forma Metrics Total Sq. Ft. 11,645,000 40,110,000 Occupancy 94% 95% Annualized Base Revenues (ABR) $85 million $320 million Geographic Presence(1) U.S. 83% 69% France 13% 12% Germany 2% 8% Other Europe(2) 2% 11% Average Lease Term 6.4 years 9.2 years W. P. Carey Current Combined Company

|

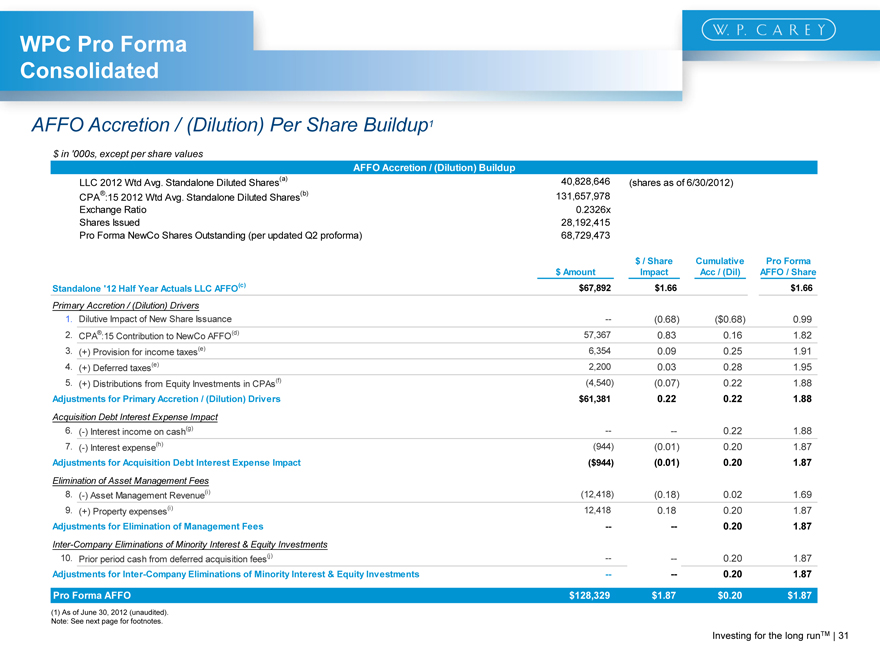

Investing for the long runTM | 31 WPC Pro Forma Consolidated AFFO Accretion / (Dilution) Per Share Buildup1 (1) As of June 30, 2012 (unaudited). Note: See next page for footnotes.

|

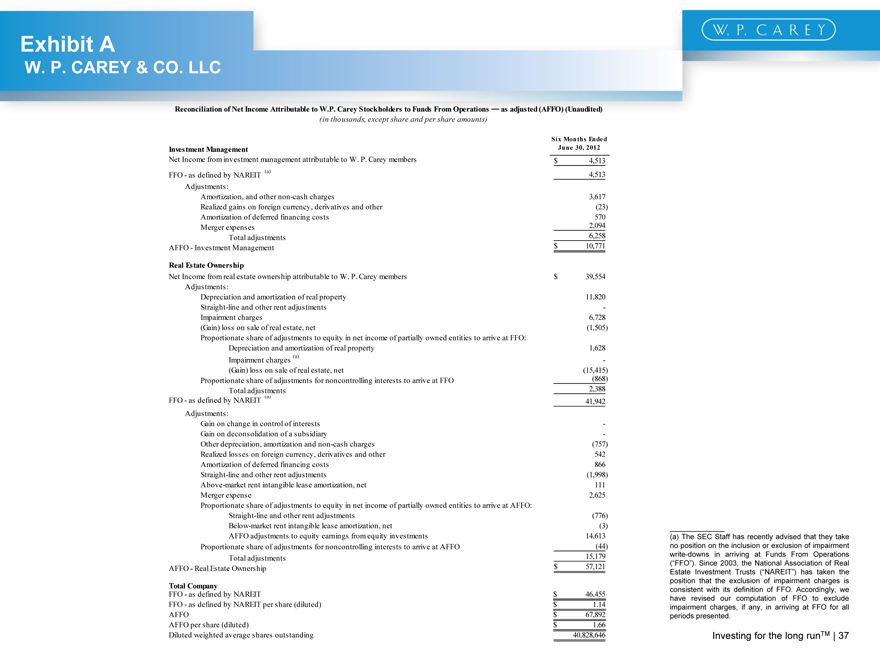

Per W.P. Carey’s Form 10-Q for the period ended June 30, 2012. Per CPA®:15’s Form 10-Q for the period ended June 30, 2012. See Exhibit A for a reconciliation of W.P. Carey’s Net Income for the six months ended June 30, 2012 to Funds from Operations – as Adjusted (AFFO), as disclosed in its Form 10-Q for the period ended June 30, 2012. CPA®:15’s contribution to NewCo AFFO represents MFFO of $57.5 million as filed in CPA®:15’s Form 10-Q for the period ended June 30, 2012, adjusted by $0.2 million related to acquisition expenses and accretion of discounts and amortization of premiums on debt investments. See Exhibit B for a reconciliation of CPA®:15’s Net Income Attributable to CPA®:15 Stockholders for the six months ended June 30, 2012 to Modified Funds from Operations (MFFO), as disclosed in its Form 10-Q for the period ended June 30, 2012. As a result of the merger of CPA®:15 and W.P. Carey, asset management and other taxable revenues have been eliminated. The adjustments of $6.4 million and $2.2 million for the six months ended June 30, 2012 reflect tax benefits related to the elimination of these transactions. Reflects adjustment to eliminate the impact on AFFO of distributions from W.P. Carey’s equity investment in CPA®:15 pursuant to the merger. Reflects adjustment to interest income that will no longer be earned on the cash component of the merger consideration. It is not practicable at this time to estimate the amount of this foregone interest income. Reflects an increase in interest expense of $0.9 million for the six months ended June 30, 2012 from the $175 million new line of credit and expected repayment of $113 million of the pre-existing line of credit. In the event that W.P. Carey does not obtain the term loan, it will draw on its existing line of credit to pay the cash component of the merger consideration. The interest rate under the existing line of credit is not materially different than the interest rate under the contemplated term loan. Reflects adjustments to eliminate activities between W.P. Carey and CPA®:15 in the respective historical financial statements, as all such revenues, expenses and interests would have been eliminated in consolidation had the merger occurred on January 1, 2011. As a result of the merger of CPA®:15 and W.P. Carey, the payment of deferred transaction fees by CPA®:15 will be eliminated. It is not practicable at this time to estimate the amount of this foregone payment. Investing for the long runTM | 32 WPC Pro Forma Consolidated: Footnotes

|

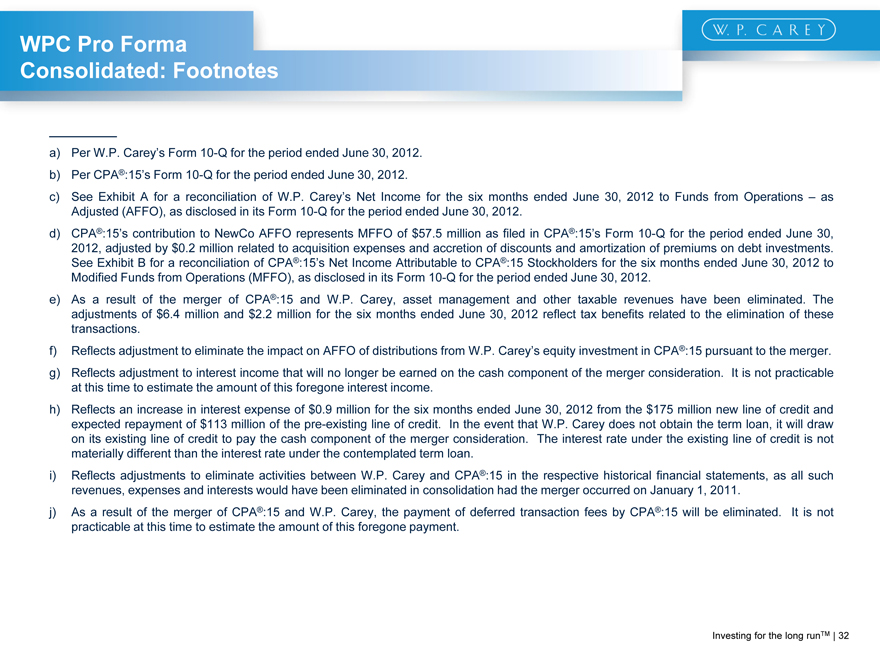

Investing for the long runTM | 33 Strong Combined Capitalization Equity Market Capitalization $1.8 billion $3.1 billion Total Net Debt $0.6 billion $1.9 billion Total Capitalization $2.5 billion $5.0 billion Selected Metrics Net Debt / Total Cap. 26% 38% Net Debt / 2012E EBITDA 4.1x 4.6x W. P. Carey Current Combined Company

|

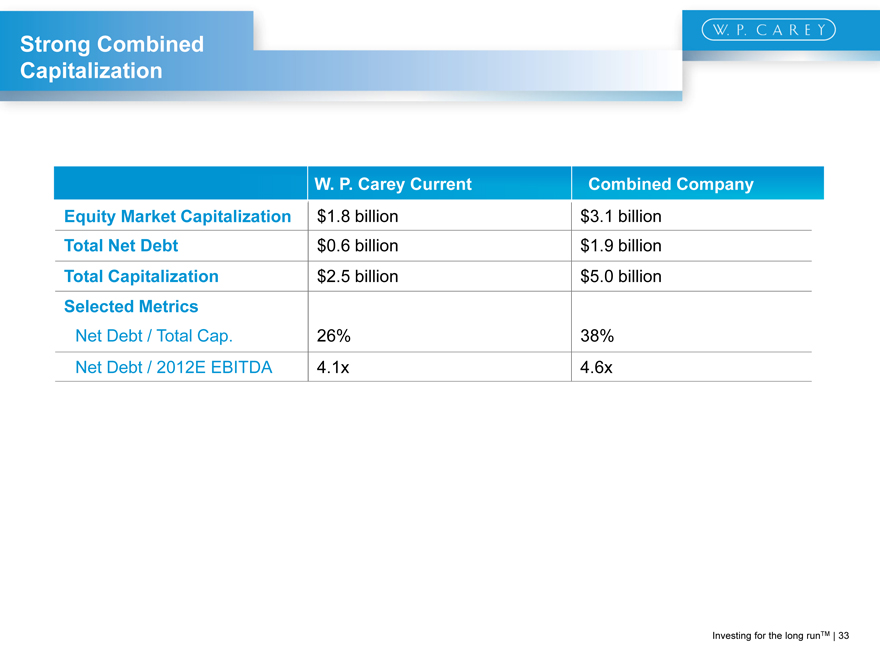

Investing for the long runTM | 34 Historical Growth W. P. Carey has increased its dividend every year since going public in 1998 Quarterly dividends have increased each of the past 44 quarters Annual dividend growth has averaged 2.4% from 1998 – 2011 Payout Ratio Payout ratio of 68%, based on year-to-date results and current dividend of $2.27 per share Pro forma dividend of $2.60 supported by a strong payout ratio of 70%(1) Transaction Impact Transaction expected to be accretive to AFFO per share and CAD per share, and provides for continuation of stable dividend growth Annualized Dividend per Share Note: Annualized dividend per share reflects annualized fourth quarter dividend per share for the respective year. Reflects anticipated pro forma annual dividend per share following transaction close to maintain compliance with REIT requirements. Subject to modification. Transaction Supports Continued Dividend Growth

|

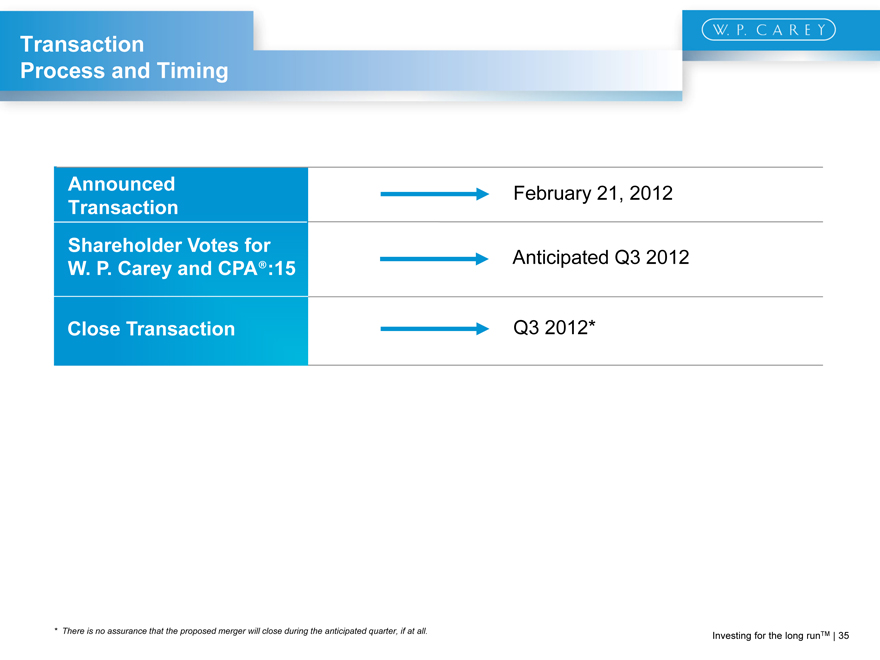

Investing for the long runTM | 35 * There is no assurance that the proposed merger will close during the anticipated quarter, if at all. Announced Transaction February 21, 2012 Shareholder Votes for W. P. Carey and CPA®:15 Close Transaction Anticipated Q3 2012 Q3 2012* Transaction Process and Timing

|

Creating Value for WPC and CPA®:15 Investors Transformational transaction that creates a net lease company with significant scale and liquidity Provides liquidity to CPA®:15 stockholders without significant additional indebtedness Transaction is expected to be accretive to AFFO per share and CAD per share, providing for continuation of stable dividend growth Provides platform for future growth with strong acquisition currency Improves W. P. Carey’s access to capital High quality combined real estate portfolio of premium assets that is well-diversified across tenants, geographies and property type Enhances W. P. Carey’s world-class asset management platform Potential for long-term valuation benefits as a result of REIT conversion Investing for the long runTM | 36 Compelling Transaction

|

Investing for the long runTM | 37 Exhibit A W. P. CAREY & CO. LLC (a) The SEC Staff has recently advised that they take no position on the inclusion or exclusion of impairment write-downs in arriving at Funds From Operations (“FFO”). Since 2003, the National Association of Real Estate Investment Trusts (“NAREIT”) has taken the position that the exclusion of impairment charges is consistent with its definition of FFO. Accordingly, we have revised our computation of FFO to exclude impairment charges, if any, in arriving at FFO for all periods presented.

|

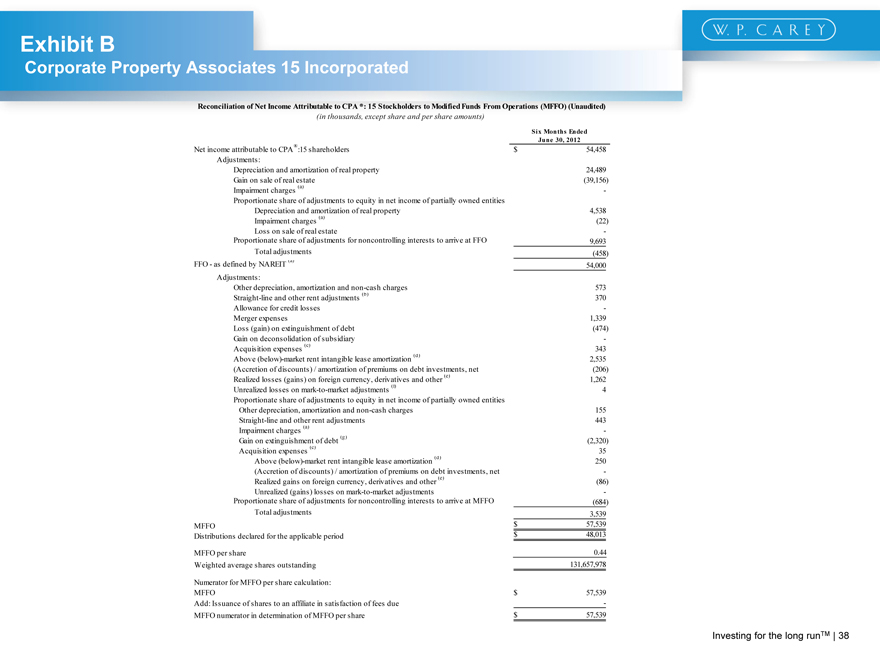

Investing for the long runTM | 38 Exhibit B Corporate Property Associates 15 Incorporated

|

Investing for the long runTM | 39 Exhibit B Corporate Property Associates 15 Incorporated The SEC Staff has recently stated that they take no position on the inclusion or exclusion of impairment write-downs in arriving at FFO. Since 2003, the National Association of Real Estate Investment Trusts, Inc., or NAREIT, an industry trade group, has taken the position that the exclusion of impairment charges is consistent with its definition of FFO. Accordingly, we have revised our computation of FFO to exclude impairment charges, if any, in arriving at FFO for all periods presented. Under GAAP, rental receipts are allocated to periods using various methodologies. This may result in income recognition that is significantly different than underlying contract terms. By adjusting for these items (to reflect such payments from a GAAP accrual basis to a cash basis of disclosing the rent and lease payments), management believes that MFFO provides useful supplemental information on the realized economic impact of lease terms and debt investments, provides insight on the contractual cash flows of such lease terms and debt investments, and aligns results with management’s analysis of operating performance. In evaluating investments in real estate, management differentiates the costs to acquire the investment from the operations derived from the investment. Such information would be comparable only for non-listed REITs that have completed their acquisition activity and have other similar operating characteristics. By excluding expensed acquisition costs, management believes MFFO provides useful supplemental information that is comparable for each type of real estate investment and is consistent with management’s analysis of the investing and operating performance of our properties. Acquisition fees and expenses include payments to our advisor or third parties. Acquisition fees and expenses under GAAP are considered operating expenses and as expenses included in the determination of net income and income from continuing operations, both of which are performance measures under GAAP. All paid and accrued acquisition fees and expenses will have negative effects on returns to stockholders, the potential for future distributions, and cash flows generated by us, unless earnings from operations or net sales proceeds from the disposition of properties are generated to cover the purchase price of the property, these fees and expenses and other costs related to the property. Under GAAP, certain intangibles are accounted for at cost and reviewed at least annually for impairment, and certain intangibles are assumed to diminish predictably in value over time and amortized, similar to depreciation and amortization of other real estate related assets that are excluded from FFO. However, because real estate values and market lease rates historically rise or fall with market conditions, management believes that by excluding charges relating to amortization of these intangibles, MFFO provides useful supplemental information on the performance of the real estate. Management believes that adjusting for fair value adjustments for derivatives provides useful information because such fair value adjustments are based on market fluctuations and may not be directly related or attributable to our operations. Management believes that adjusting for mark-to-market adjustments is appropriate because they are items that may not be reflective of on-going operations and reflect unrealized impacts on value based only on then current market conditions, although they may be based upon current operational issues related to an individual property or industry or general market conditions. The need to reflect mark-to-market adjustments is a continuous process and is analyzed on a quarterly and/or annual basis in accordance with GAAP. Relates to our share of gain on the extinguishment of debt recognized by a jointly-owned investment.

|

Cautionary Statement Concerning Forward-Looking Statements: Certain of the matters discussed in this communication constitute forward-looking statements within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934, both as amended by the Private Securities Litigation Reform Act of 1995. The forward-looking statements include, among other things, statements regarding the intent, belief or expectations of W. P. Carey and CPA®:15 and can be identified by the use of words such as “may,” “will,” “should,” “would,” “assume,” “outlook,” “seek,” “plan,” “believe,” “expect,” “anticipate,” “intend,” “estimate,” “forecast” and other comparable terms. These forward-looking statements include, but are not limited to, statements regarding the benefits of the proposed REIT Conversion and Merger, annualized dividends, funds from operations coverage, integration plans and expected synergies, the expected benefits of the proposed REIT Conversion and Merger, anticipated future financial and operating performance and results, including estimates of growth, and the expected timing of completion of the proposed REIT Conversion and Merger. These statements are based on the current expectations of the management of W. P Carey. It is important to note that the combined company’s actual results could be materially different from those projected in such forward-looking statements. There are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements. Other unknown or unpredictable factors could also have material adverse effects on future results, performance or achievements of the combined company. Discussions of some of these other important factors and assumptions are contained in W. P. Carey’s filings with the SEC and are available at the SEC’s website at http://www.sec.gov, including Item 1A. Risk Factors in our Annual Report on Form 10-K for the year ended December 31, 2011 as filed with the SEC on February 29, 2012. These risks, as well as other risks associated with the proposed REIT Conversion and Merger, are more fully discussed in the Joint Proxy Statement/Prospectus that is included in the Registration Statement on Form S-4 that W. P. Carey Inc. filed with the SEC in connection with the proposed REIT Conversion and Merger on March 23, 2012, as amended. In light of these risks, uncertainties, assumptions and factors, the forward-looking events discussed in this communication may not occur. Readers are cautioned not to place undue reliance on these forward- looking statements, which speak only as of the date of this communication, unless noted otherwise. Except as required under the federal securities laws and the rules and regulations of the SEC, none of W. P. Carey, CPA®:15 or W. P. Carey Inc. undertakes any obligation to release publicly any revisions to the forward-looking statements to reflect events or circumstances after the date of this communication or to reflect the occurrence of unanticipated events. Investing for the long runTM | 40 Disclosures

|

Additional Information and Where to find it: This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Act. W. P. Carey has mailed its Joint Proxy Statement/Prospectus and other relevant documents to its security holders in connection with the proposed REIT Conversion and Merger. WE URGE INVESTORS TO READ THE JOINT PROXY STATEMENT / PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS FILED BY W. P. CAREY, CPA®:15 AND W. P. CAREY INC., BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT W. P. CAREY, CPA®:15, W. P. CAREY INC. AND THE PROPOSED REIT CONVERSION AND MERGER. INVESTORS ARE URGED TO READ THESE DOCUMENTS CAREFULLY AND IN THEIR ENTIRETY. Investors are able to obtain these materials and other documents filed with the SEC free of charge at the SEC’s website (http://www.sec.gov). In addition, these materials are also available free of charge by accessing W. P. Carey’s website (http://www.wpcarey.com) or by accessing CPA®:15’s website (http://www.cpa15.com). Investors may also read and copy any reports, statements and other information filed by W. P. Carey, CPA®:15 or W. P. Carey Inc., with the SEC, at the SEC public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 or visit the SEC’s website for further information on its public reference room. Participants in the Proxy Solicitation: Information regarding W. P. Carey’s directors and executive officers is available in its proxy statement filed with the SEC by W. P. Carey on April 30, 2012 in connection with its 2012 annual meeting of shareholders, and information regarding CPA®:15’s directors and executive officers is available in its Annual Report on Form 10-K filed with the SEC by CPA®:15 on March 5, 2012. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, is contained in the Joint Proxy Statement/Prospectus and other relevant materials filed with the SEC. Investing for the long runTM | 41 Disclosures