Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

GXDX similar filings

- 26 Jan 11 Genoptix Announces Agreement to be Acquired by Novartis

- 21 Dec 10 Departure of Directors or Certain Officers

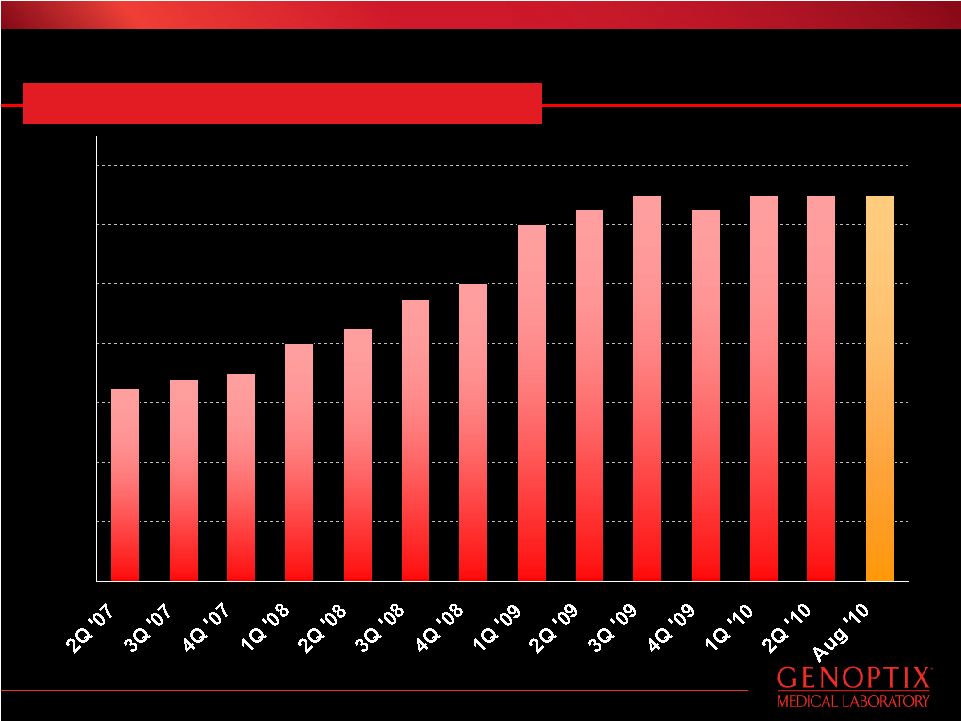

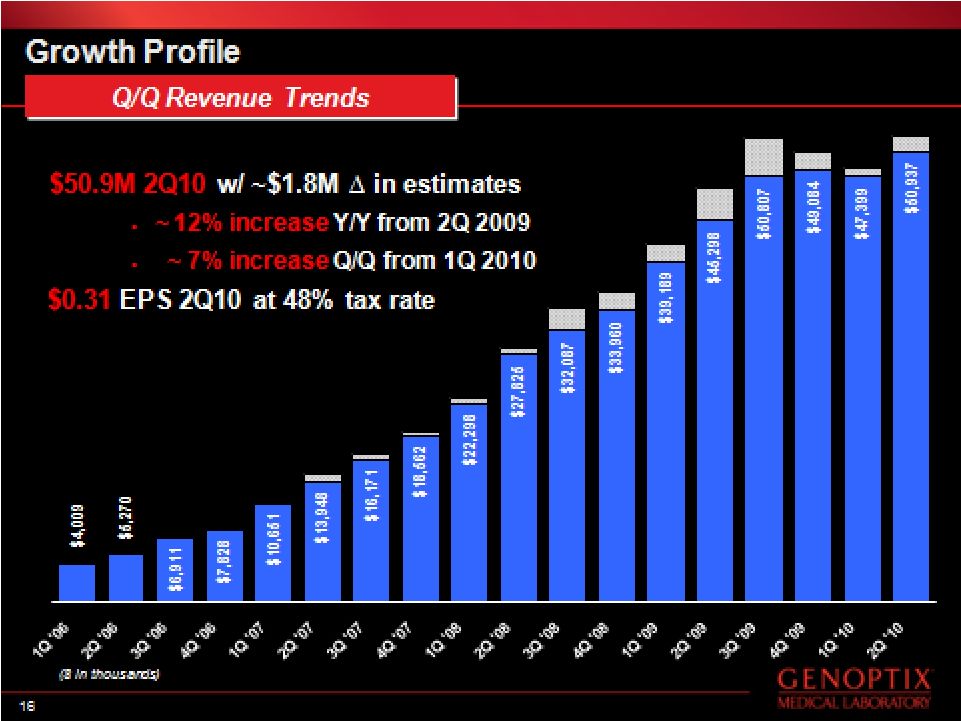

- 4 Nov 10 Genoptix Reports Operating Results for the Third Quarter and First Nine

- 21 Sep 10 Regulation FD Disclosure

- 29 Jul 10 Genoptix Reports Operating Results for the Second Quarter 2010

- 1 Jun 10 Submission of Matters to a Vote of Security Holders

- 6 May 10 Genoptix Reports Solid Results for the First Quarter 2010

Filing view

External links