Q3 2019 Performance Highlights November 12, 2019

Safe Harbor Forward-Looking Statements This presentation contains forward-looking statements related to Infinera’s expectations regarding integration, market opportunities, growth opportunities, products and customers; the level of synergies to be achieved; its ability to return to non-GAAP profitability and positive cash flow in the fourth quarter of 2019; its ability to deliver 800G products in 2020; and its financial outlook for the fourth quarter of 2019. All statements other than statements of historical fact could be deemed forward-looking, including, but not limited to, statements made about future market and financial performance; statements regarding future products or technology as well as the timing to market of any such products or technology; any statements about historical results that may suggest trends for our business; and any statements of assumptions underlying any of the items mentioned. These statements are based on estimates and information available to us at the time of this presentation and are not guarantees of future performance. These statements are based on information available to Infinera as of the date hereof and actual results could differ materially from those stated or implied due to risks and uncertainties. The risks and uncertainties that could cause Infinera’s results to differ materially from those expressed or implied by such forward-looking statements include, the combined company's ability to successfully complete the integration of the businesses; Infinera's ability to realize synergies in a timely manner; Infinera’s future capital needs and its ability to generate the cash flow or otherwise secure the capital necessary to make anticipated capital expenditures; Infinera's ability to service its debt obligations and pursue its strategic plan; market acceptance of Infinera’s end-to-end portfolio; Infinera’s ability to successfully integrate its enterprise resource planning system and other management systems; the diversion of management time on issues related to the integration and the implementation of its enterprise resource planning system; delays in the development and introduction of new products or updates to existing products and market acceptance of these products; fluctuations in demand, sales cycles and prices for products and services, including discounts given in response to competitive pricing pressures, as well as the timing of purchases by Infinera's key customers; the effect that changes in product pricing or mix, and/or increases in component costs could have on Infinera’s gross margin; Infinera’s ability to respond to rapid technological changes; aggressive business tactics by Infinera’s competitors; Infinera's reliance on single and limited source suppliers; the effects of customer consolidation; Infinera’s ability to protect Infinera’s intellectual property; claims by others that Infinera infringes their intellectual property; the effect of global macroeconomic conditions, including tariffs, on Infinera's business; war, terrorism, public health issues, natural disasters and other circumstances that could disrupt the supply, delivery or demand of Infinera's products; and other risks and uncertainties detailed in Infinera’s SEC filings from time to time. More information on potential factors that may impact Infinera’s business are set forth in its Quarterly Report on Form 10-Q for the quarter ended on June 29, 2019 as filed with the SEC on August 8, 2019, as well as subsequent reports filed with or furnished to the SEC from time to time. These reports are available on Infinera’s website at www.infinera.com and the SEC’s website at www.sec.gov. Infinera assumes no obligation to, and does not currently intend to, update any such forward-looking statements. © 2019 Infinera. All rights reserved. Company Confidential. 2

Q3’19 Key Highlights COMPLETE INTEGRATION CONTINUE INNOVATING GROW $200M of Synergies OPTICAL INNOVATION 10 New T1 Scale (2X original goal) • 600G in deployments Customers YTD • 800G on-track for 2H20 (ICE6) • Edge disruption (XR optics) 50% Supply Chain Book to bill > 1.0 – Simplification OPEN DISAGREGATION Record Q3 bookings (fixed to variable) • Growing moment w/ 4th consecutive quarter disaggregated router (DRX) of growing backlog • Strong growth in CM revenue TargetProject non to-GAAP be non - (Groove/XT) OperatingGAAP profitable Profitability in in Q4 Q4 PRACTICAL AUTOMATION Continued process • Gaining traction with innovated improvements Integration Completion Target app-based approach & multi- NOV-2019 layer capabilities • Several key customer wins © 2019 Infinera. All rights reserved. Company Confidential. 3

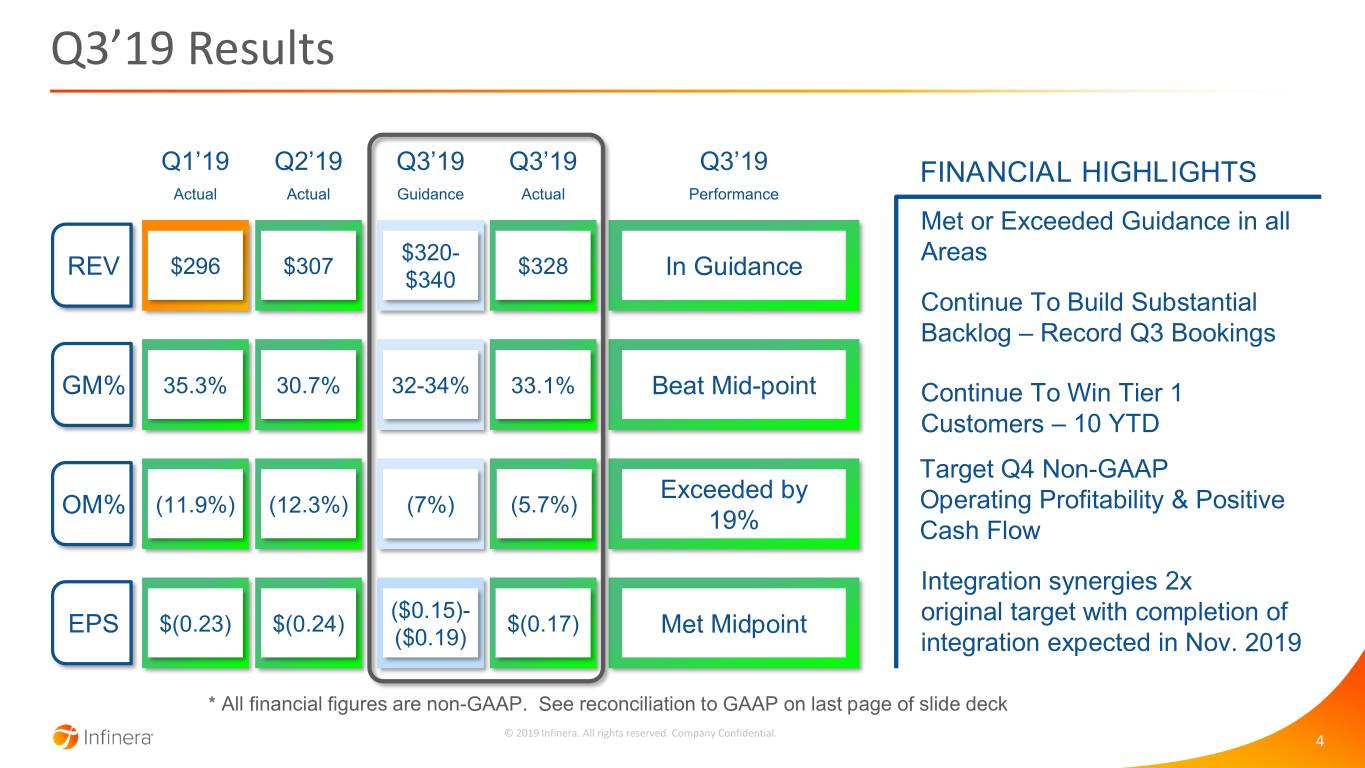

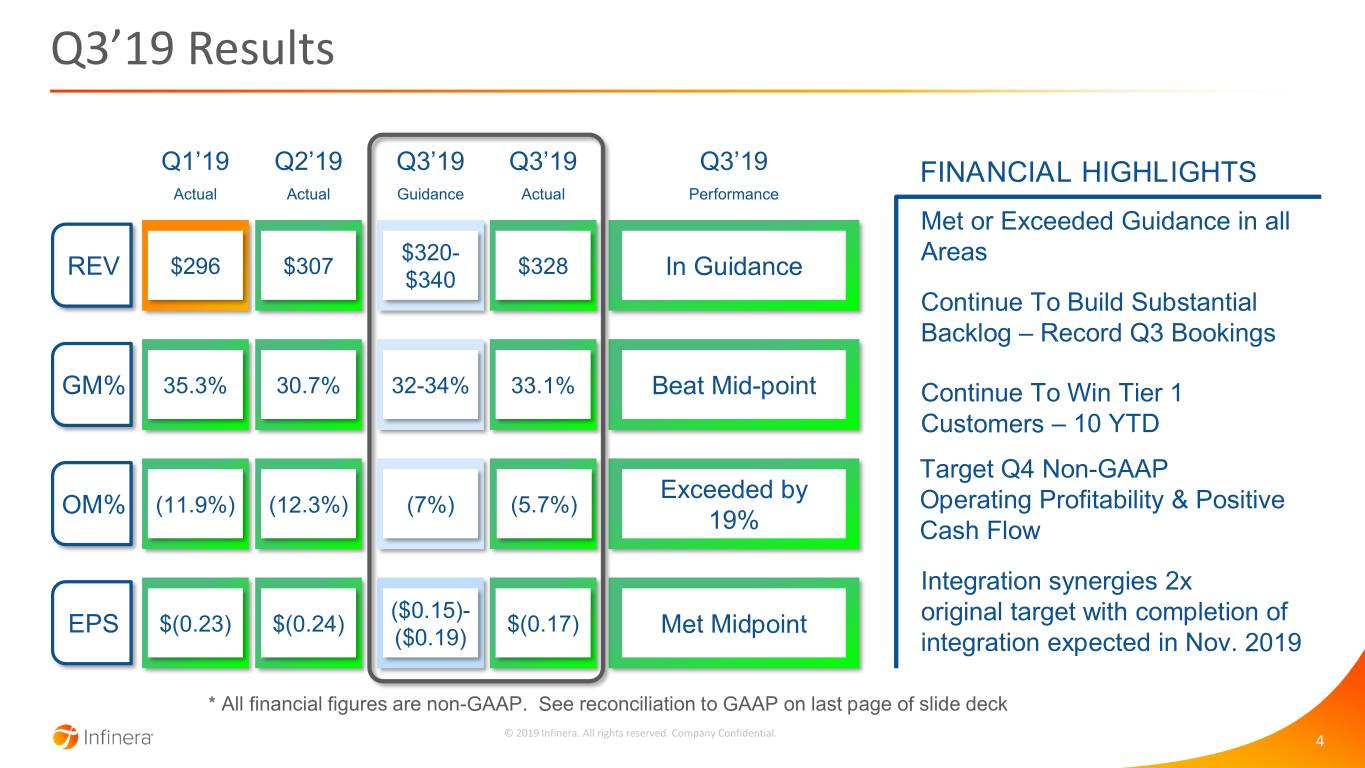

Q3’19 Results Q1’19 Q2’19 Q3’19 Q3’19 Q3’19 FINANCIAL HIGHLIGHTS Actual Actual Guidance Actual Performance Met or Exceeded Guidance in all $320- Areas REV $296 $307 $300 $307$328 BeatIn Guidance midpoint $340 Continue To Build Substantial Backlog – Record Q3 Bookings GM% 35.3% 30.7% 3230.0%-34% 30.7%33.1% BeatBeat Midby 70bps-point Continue To Win Tier 1 Customers – 10 YTD Target Q4 Non-GAAP OpExceeded Inc Exceeded by by OM% (11.9%)(11.9%) (12.3%)(12.3%) (15.0%)(7%) (12.3%)(5.7%) Operating Profitability & Positive 1916%% Cash Flow Integration synergies 2x ($0.15)- original target with completion of EPS $(0.23)$(0.23) $(0.24)$(0.24) $(0.28) $(0.24)$(0.17) ExceededMet Midpoint by $.04 ($0.19) integration expected in Nov. 2019 * All financial figures are non-GAAP. See reconciliation to GAAP on last page of slide deck © 2019 Infinera. All rights reserved. Company Confidential. 4

Geographic & Vertical Mix © 2019 Infinera. All rights reserved. Company Confidential. 5

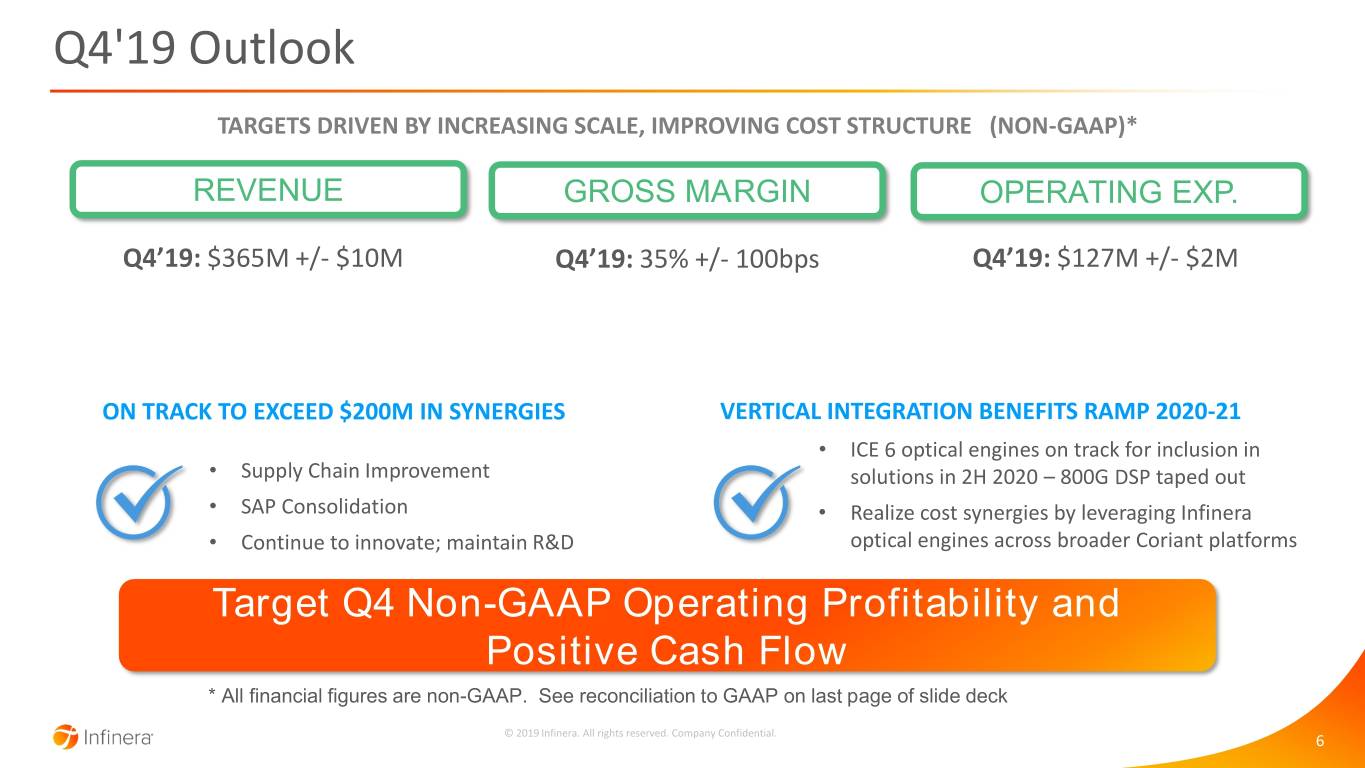

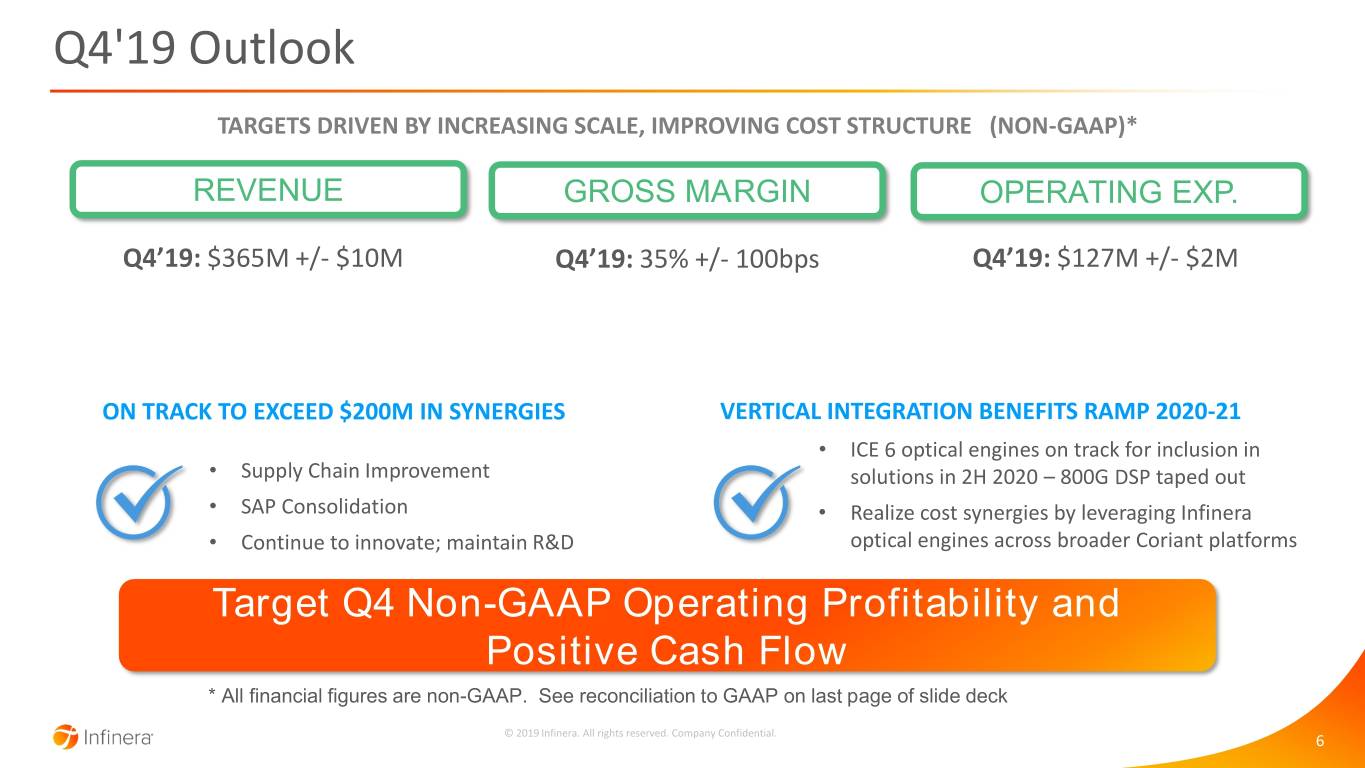

Q4'19 Outlook TARGETS DRIVEN BY INCREASING SCALE, IMPROVING COST STRUCTURE (NON-GAAP)* REVENUERevenue GROSS MARGIN OPERATING EXP. Q4’19: $365M +/- $10M Q4’19: 35% +/- 100bps Q4’19: $127M +/- $2M ON TRACK TO EXCEED $200M IN SYNERGIES VERTICAL INTEGRATION BENEFITS RAMP 2020-21 • ICE 6 optical engines on track for inclusion in • Supply Chain Improvement solutions in 2H 2020 – 800G DSP taped out • SAP Consolidation • Realize cost synergies by leveraging Infinera • Continue to innovate; maintain R&D optical engines across broader Coriant platforms Target Q4 Non-GAAP Operating Profitability and Positive Cash Flow * All financial figures are non-GAAP. See reconciliation to GAAP on last page of slide deck © 2019 Infinera. All rights reserved. Company Confidential. 6

GAAP to Non-GAAP Reconciliation Infinera Corporation GAAP to Non-GAAP Reconciliation (in millions, except percentages and per share data) (Unaudited) Q4'19 Q3'19 Actual Outlook Reconciliation of Revenue: U.S. GAAP as reported $ 325.3 363 Acquisition-related deferred revenue adjustment $ 2.3 2 Non-GAAP as adjusted $ 327.6 $ 365 Reconciliation of Gross Margin: U.S. GAAP $ 86.8 26.7% 32% Stock-based compensation $ 1.8 - Amortization of acquired intangible assets $ 7.8 2% Acquisition and integration costs $ 8.4 - Acquisition-related deferred revenue adjustment $ 2.3 1% Restructuring and related $ 1.2 - Non-GAAP $ 108.4 33.1% 35% Reconciliation of Operating Expenses: U.S. GAAP $ 156.1 151 Stock-based compensation $ (8.2) (9) Amortization of acquired intangible assets $ (6.9) (7) Acquisition and integration costs $ (12.0) (7) Restructuring and related $ (2.2) (1) Litigation charges $ (0.1) - Non-GAAP $ 126.9 $ 127 Reconciliation of Operating margin: U.S. GAAP $ (69,287) (21.3%) (10%) Acquisition-related deferred revenue adjustment 2305 1% Stock-based compensation 9,946 2% Amortization of acquired intangible assets 14,657 5% Acquisition and integration costs 20,409 2% Restructuring and related 3,366 1% Litigation charges 50 0% Non-GAAP $ (18,554) (5.7%) 1% Net Loss per Common Share: U.S. GAAP $ (0.47) $ (0.26) Acquisition-related deferred revenue adjustment 0.01 0.01 Stock-based compensation 0.08 0.06 Amortization of acquired intangible assets 0.08 0.08 Acquisition and integration costs 0.11 0.04 Restructuring and related 0.02 0.02 Amortization of debt discount - 0.02 Non-GAAP $ (0.17) $ (0.03) *Note: Amounts represent the midpoint of the expected range. © 2019 Infinera. All rights reserved. Company Confidential. 7

Thank You