THIRD QUARTER 2022 FINANCIAL RESULTS November 2, 2022

2 Safe Harbor Forward-Looking Statements This presentation contains forward-looking statements, including those related to Infinera’s expectations regarding its business model and strategy, market opportunities and trends, competition, and customers; capacity growth; the shift to open architecture; market adoption of coherent optical engines; expectations regarding industry-wide supply chain challenges, the macroeconomic environment and ongoing COVID-19 pandemic impacts; and Infinera’s financial outlook for the fourth quarter of 2022. All statements other than statements of historical fact could be deemed forward looking, including, but not limited to, statements made about future market, financial and operating performance; statements regarding future products or technology, as well as the timing to market of any such products or technology; any statements about historical results that may suggest trends for Infinera’s business; and any statements of assumptions underlying any of the items mentioned. These forward-looking statements are based on estimates and information available to Infinera at the time of this presentation and are not guarantees of future performance; actual results could differ materially from those stated or implied due to risks and uncertainties. The risks and uncertainties that could cause Infinera’s results to differ materially from those expressed or implied by such forward- looking statements include supply chain issues, including delays, shortages and increased costs, and Infinera's dependency on sole source, limited source or high-cost suppliers; the adverse impact inflation may have on Infinera by increasing costs beyond what it can recover through price increases; delays in the development, introduction or acceptance of new products or updates to existing products; fluctuations in demand, sales cycles and prices for products and services, including discounts given in response to competitive pricing pressures, as well as the timing of purchases by Infinera's key customers; aggressive business tactics by Infinera’s competitors and new entrants and Infinera's ability to compete in a highly competitive market; the effect of the COVID-19 pandemic and the macroeconomic environment on Infinera’s business, results of operations, financial condition, stock price and personnel; produce performance problems; Infinera's ability to identify, attract and retain qualified personnel; the partial or complete loss of Infinera's manufacturing facilities, a reduction in yield of PICs or an inability to scale to meet customer demands; the effects of customer and supplier consolidation; Infinera’s ability to respond to rapid technological changes; failure to accurately forecast Infinera's manufacturing requirements or customer demand; Infinera’s future capital needs and its ability to generate the cash flow or otherwise secure the capital necessary to meet such capital needs; research and development investments; the effect of global and regional economic conditions on Infinera’s business, including effects on purchasing decisions by customers; risks and compliance obligations relating to Infinera's international operations as well as actions by the U.S. or foreign governments, including with respect to Russia's military operations in Ukraine; the effective tax rate of Infinera, which may increase or fluctuate; the impacts of foreign currency fluctuations; Infinera's ability to service its debt obligations and pursue its strategic plan; potential dilution from the issuance of additional shares of common stock in connection with the conversion of Infinera's convertible senior notes; Infinera’s ability to protect its intellectual property; claims by others that Infinera infringes on their intellectual property rights; security incidents, such as data breaches or cyber-attacks; Infinera's ability to comply with various rules and regulations, including with respect to export control and trade compliance, environmental, social, governance, privacy and data protection matters; events that are outside of Infinera's control, such as natural disasters, human violence or other catastrophic events that could harm Infinera's operations; and other risks and uncertainties detailed in Infinera’s SEC filings from time to time. More information on potential factors that may impact Infinera’s business are set forth in Infinera's periodic reports filed with the SEC, including its Annual Report on Form 10-K for the year ended on December 25, 2021, as filed with the SEC on February 23, 2022, and its Quarterly Report on Form 10-Q for the quarter ended June 25, 2022, as filed with the SEC on July 28, 2022, as well as subsequent reports filed with or furnished to the SEC from time to time. These reports are available on Infinera’s website at www.infinera.com and the SEC’s website at www.sec.gov. Infinera assumes no obligation to, and does not currently intend to, update any such forward-looking statements. This presentation includes certain non-GAAP financial measures such as non-GAAP revenue, non-GAAP gross margin, non-GAAP operating expenses, non-GAAP operating margin, non-GAAP diluted EPS and free cash flow. We present non-GAAP financial measures in addition to, and not as a substitute for, financial measures calculated in accordance with generally accepted accounting principles (“GAAP”). Non- GAAP measures should not be considered in isolation or as alternatives to GAAP measures. In addition, the non-GAAP measures we use, as presented, may not be comparable to similar measures used by other companies. Infinera believes these adjustments are appropriate to enhance an overall understanding of its underlying financial performance and also its prospects for the future and are considered by management for the purpose of making operational decisions. See the last two slides in this presentation for reconciliations to the most comparable GAAP financial measures. © 2022 Infinera. All rights reserved.

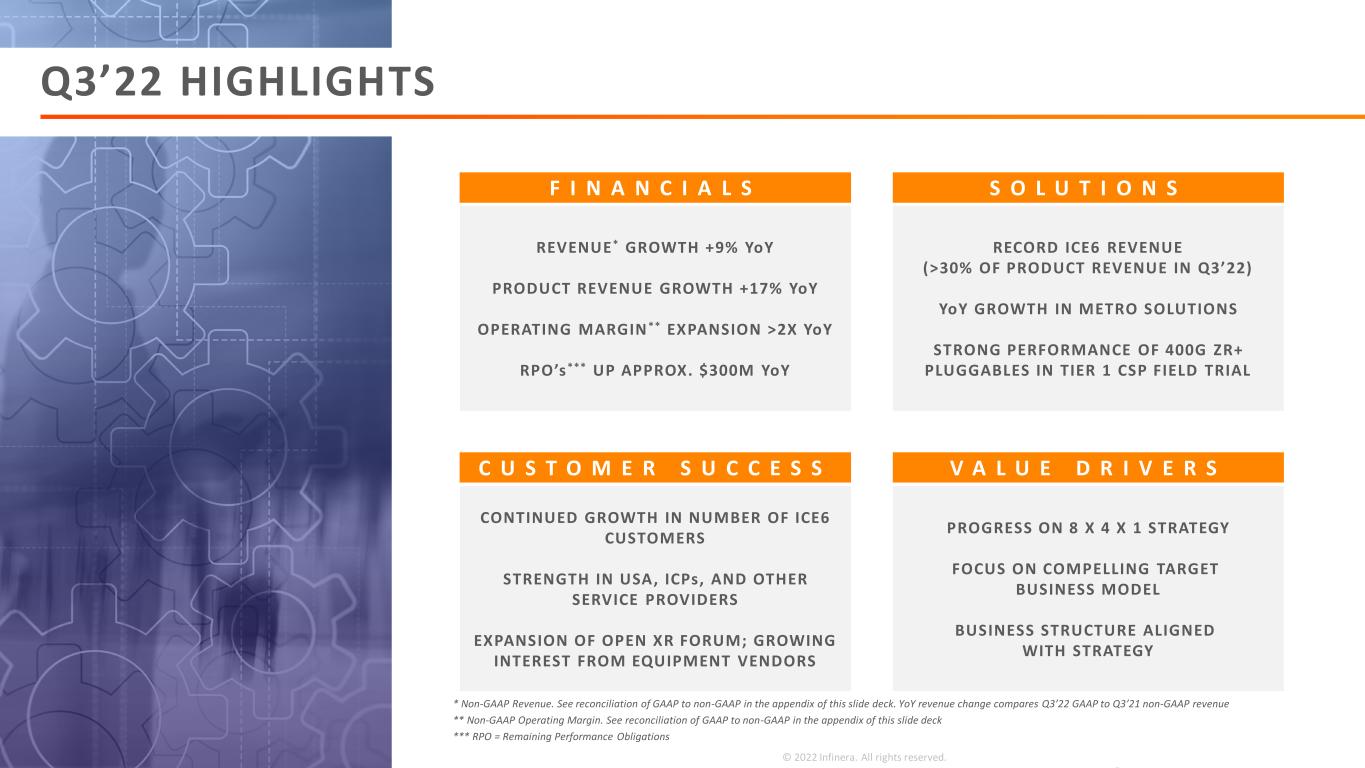

3 Q3’22 HIGHLIGHTS CONTINUED GROWTH IN NUMBER OF ICE6 CUSTOMERS STRENGTH IN USA, ICPs, AND OTHER SERVICE PROVIDERS EXPANSION OF OPEN XR FORUM; GROWING INTEREST FROM EQUIPMENT VENDORS C U S T O M E R S U C C E S S REVENUE* GROWTH +9% YoY PRODUCT REVENUE GROWTH +17% YoY OPERATING MARGIN ** EXPANSION >2X YoY RPO’s*** UP APPROX. $300M YoY F I N A N C I A L S PROGRESS ON 8 X 4 X 1 STRATEGY FOCUS ON COMPELLING TARGET BUSINESS MODEL BUSINESS STRUCTURE ALIGNED WITH STRATEGY V A L U E D R I V E R S RECORD ICE6 REVENUE (>30% OF PRODUCT REVENUE IN Q3’22) YoY GROWTH IN METRO SOLUTIONS STRONG PERFORMANCE OF 400G ZR+ PLUGGABLES IN TIER 1 CSP FIELD TRIAL S O L U T I O N S © 2022 Infinera. All rights reserved. * Non-GAAP Revenue. See reconciliation of GAAP to non-GAAP in the appendix of this slide deck. YoY revenue change compares Q3’22 GAAP to Q3’21 non-GAAP revenue ** Non-GAAP Operating Margin. See reconciliation of GAAP to non-GAAP in the appendix of this slide deck *** RPO = Remaining Performance Obligations

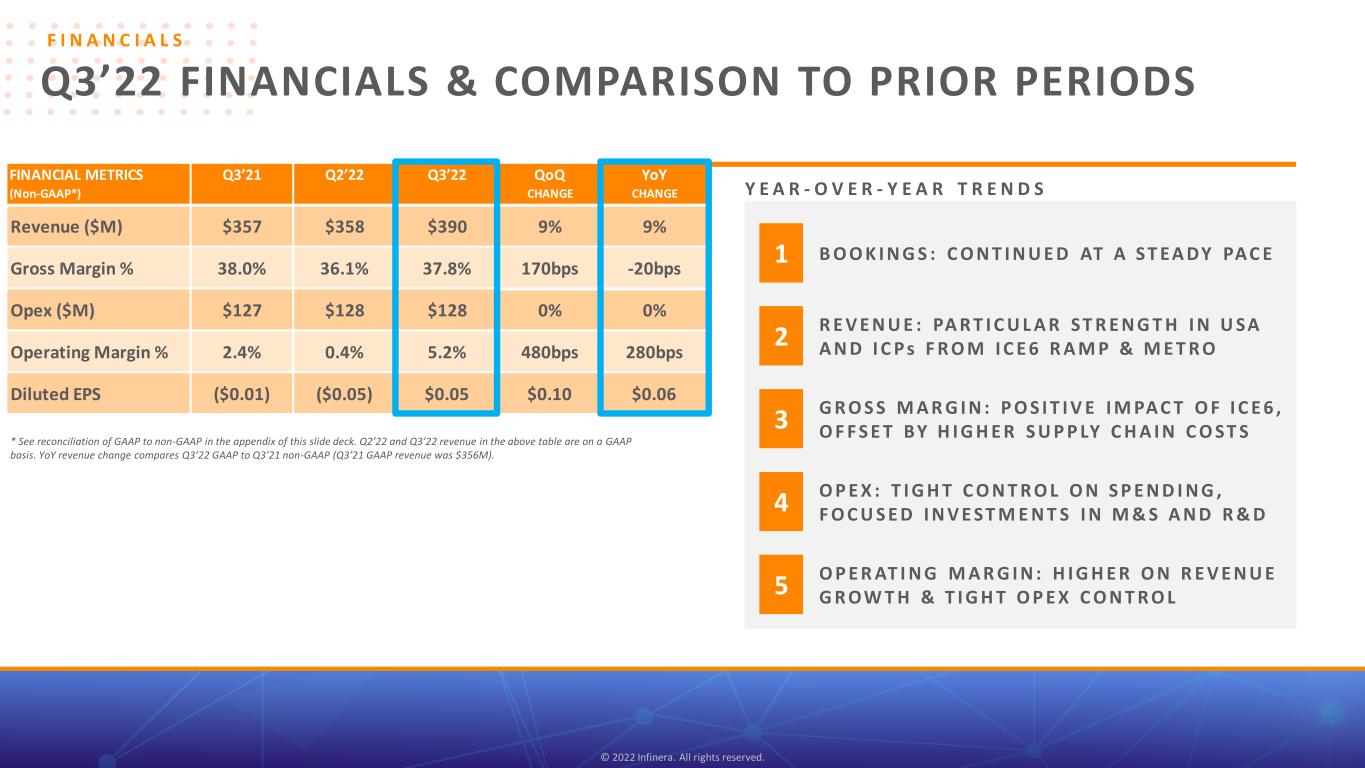

4 FINANCIAL METRICS QoQ YoY (Non-GAAP*) CHANGE CHANGE Revenue ($M) $357 $358 $390 9% 9% Gross Margin % 38.0% 36.1% 37.8% 170bps -20bps Opex ($M) $127 $128 $128 0% 0% Operating Margin % 2.4% 0.4% 5.2% 480bps 280bps Diluted EPS ($0.01) ($0.05) $0.05 $0.10 $0.06 Q3’21 Q2’22 Q3’22 * See reconciliation of GAAP to non-GAAP in the appendix of this slide deck. Q2’22 and Q3’22 revenue in the above table are on a GAAP basis. YoY revenue change compares Q3’22 GAAP to Q3’21 non-GAAP (Q3’21 GAAP revenue was $356M). B O O K I N G S : C O N T I N U E D AT A ST EA DY PA C E1 R E V E N U E : PA R T I C U L A R ST R E N G T H I N U SA A N D I C P s F R O M I C E 6 R A M P & M E T R O2 O P E X : T I G H T C O N T R O L O N S P E N D I N G , F O C U S E D I N V E ST M E N T S I N M & S A N D R & D4 O P E R AT I N G M A R G I N : H I G H E R O N R E V E N U E G R O W T H & T I G H T O P E X C O N T R O L5 G R O S S M A R G I N : P O S I T I V E I M PA C T O F I C E 6 , O F F S E T BY H I G H E R S U P P LY C H A I N C O ST S 3 Y E A R - O V E R - Y E A R T R E N D S F I N A N C I A L S Q3’22 FINANCIALS & COMPARISON TO PRIOR PERIODS © 2022 Infinera. All rights reserved.

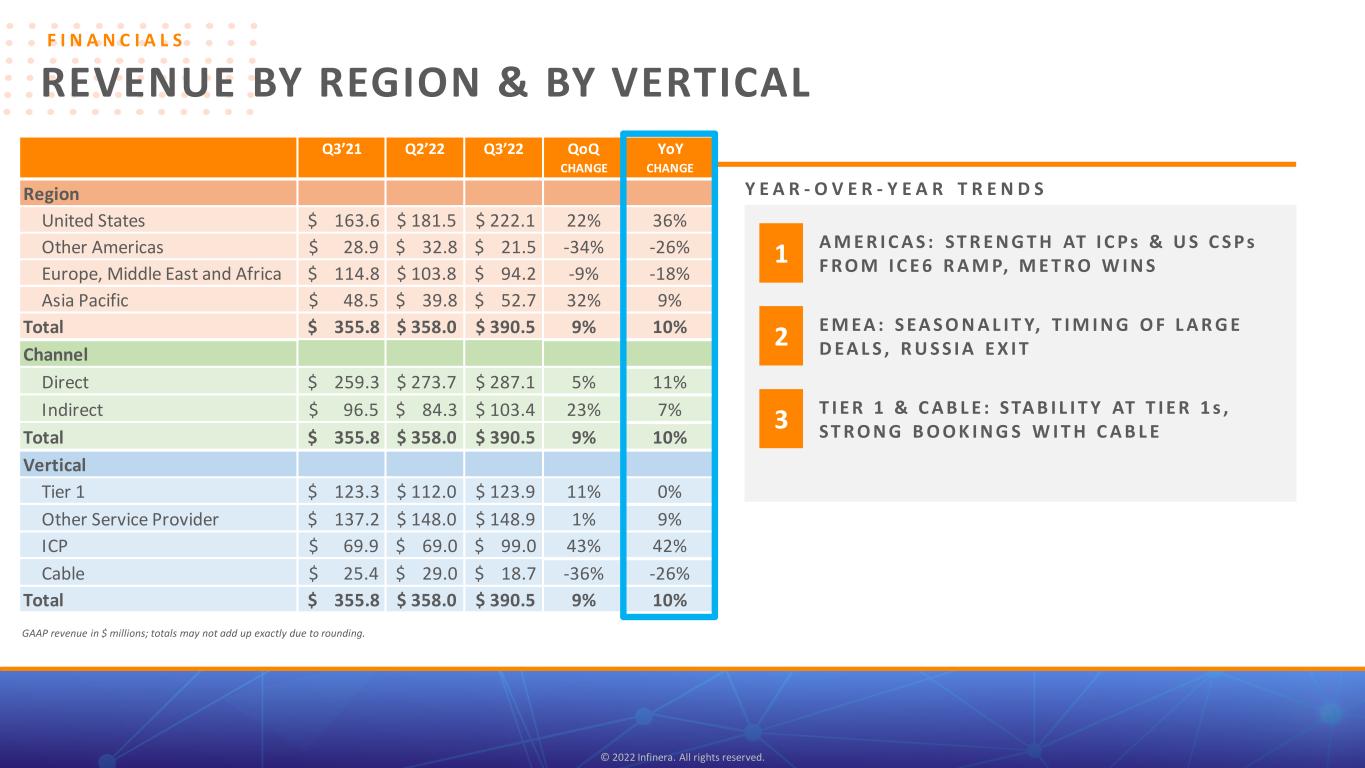

5 QoQ YoY CHANGE CHANGE Region United States $ 163.6 $ 181.5 $ 222.1 22% 36% Other Americas $ 28.9 $ 32.8 $ 21.5 -34% -26% Europe, Middle East and Africa $ 114.8 $ 103.8 $ 94.2 -9% -18% Asia Pacific $ 48.5 $ 39.8 $ 52.7 32% 9% Total $ 355.8 $ 358.0 $ 390.5 9% 10% Channel Direct $ 259.3 $ 273.7 $ 287.1 5% 11% Indirect $ 96.5 $ 84.3 $ 103.4 23% 7% Total $ 355.8 $ 358.0 $ 390.5 9% 10% Vertical Tier 1 $ 123.3 $ 112.0 $ 123.9 11% 0% Other Service Provider $ 137.2 $ 148.0 $ 148.9 1% 9% ICP $ 69.9 $ 69.0 $ 99.0 43% 42% Cable $ 25.4 $ 29.0 $ 18.7 -36% -26% Total $ 355.8 $ 358.0 $ 390.5 9% 10% Q3’21 Q2’22 Q3’22 F I N A N C I A L S REVENUE BY REGION & BY VERTICAL © 2022 Infinera. All rights reserved. GAAP revenue in $ millions; totals may not add up exactly due to rounding. A M E R I C A S : ST R E N G T H AT I C P s & U S C S P s F R O M I C E 6 R A M P, M E T R O W I N S1 E M E A : S E A S O N A L I T Y, T I M I N G O F L A R G E D E A L S , R U S S I A E X I T2 T I E R 1 & C A B L E : STA B I L I T Y AT T I E R 1 s , ST R O N G B O O K I N G S W I T H C A B L E3 Y E A R - O V E R - Y E A R T R E N D S

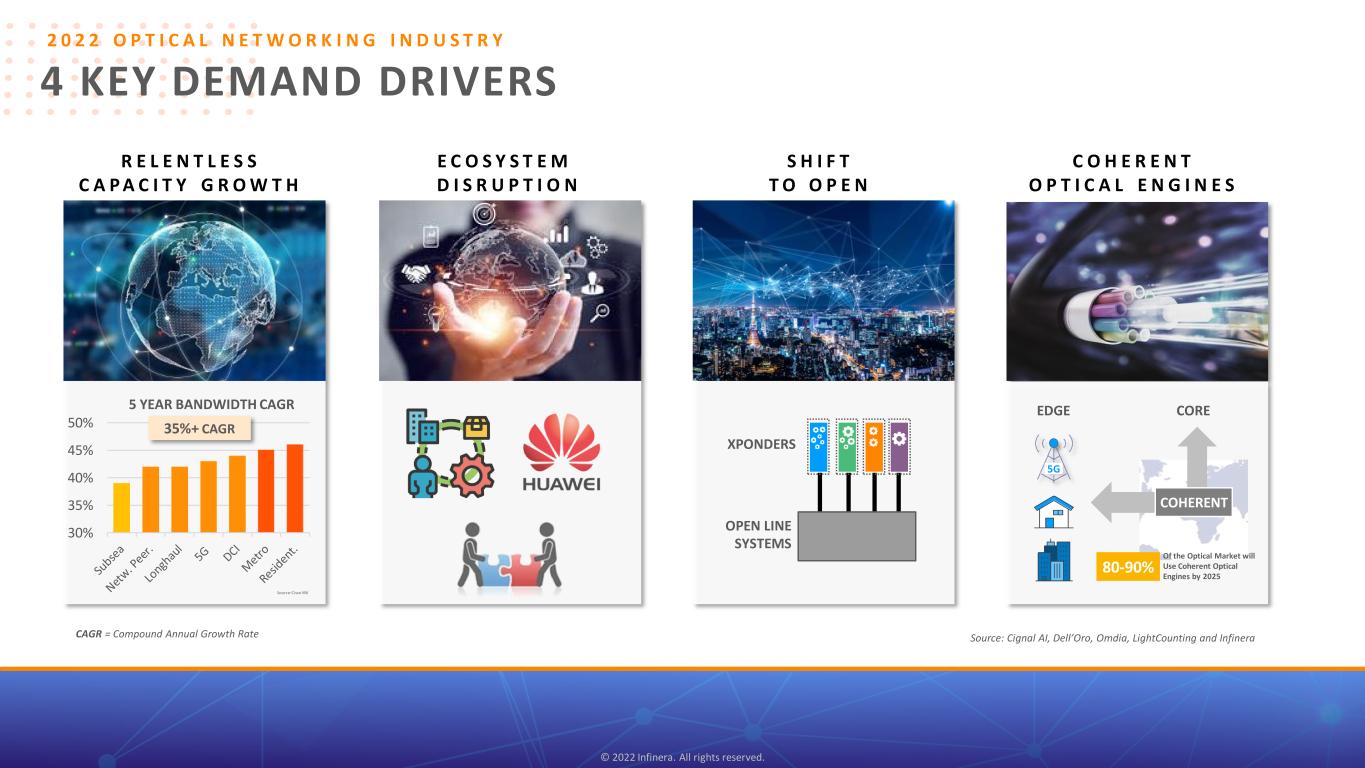

6 2 0 2 2 O P T I C A L N E T W O R K I N G I N D U S T R Y 4 KEY DEMAND DRIVERS C O H E R E N T O P T I C A L E N G I N E S COREEDGE COHERENT 5G 80-90% Of the Optical Market will Use Coherent Optical Engines by 2025 S H I F T T O O P E N OPEN LINE SYSTEMS XPONDERS R E L E N T L E S S C A P A C I T Y G R O W T H 30% 35% 40% 45% 50% 5 YEAR BANDWIDTH CAGR 35%+ CAGR Source: Cisco VNI E C O S Y S T E M D I S R U P T I O N CAGR = Compound Annual Growth Rate © 2022 Infinera. All rights reserved. Source: Cignal AI, Dell’Oro, Omdia, LightCounting and Infinera

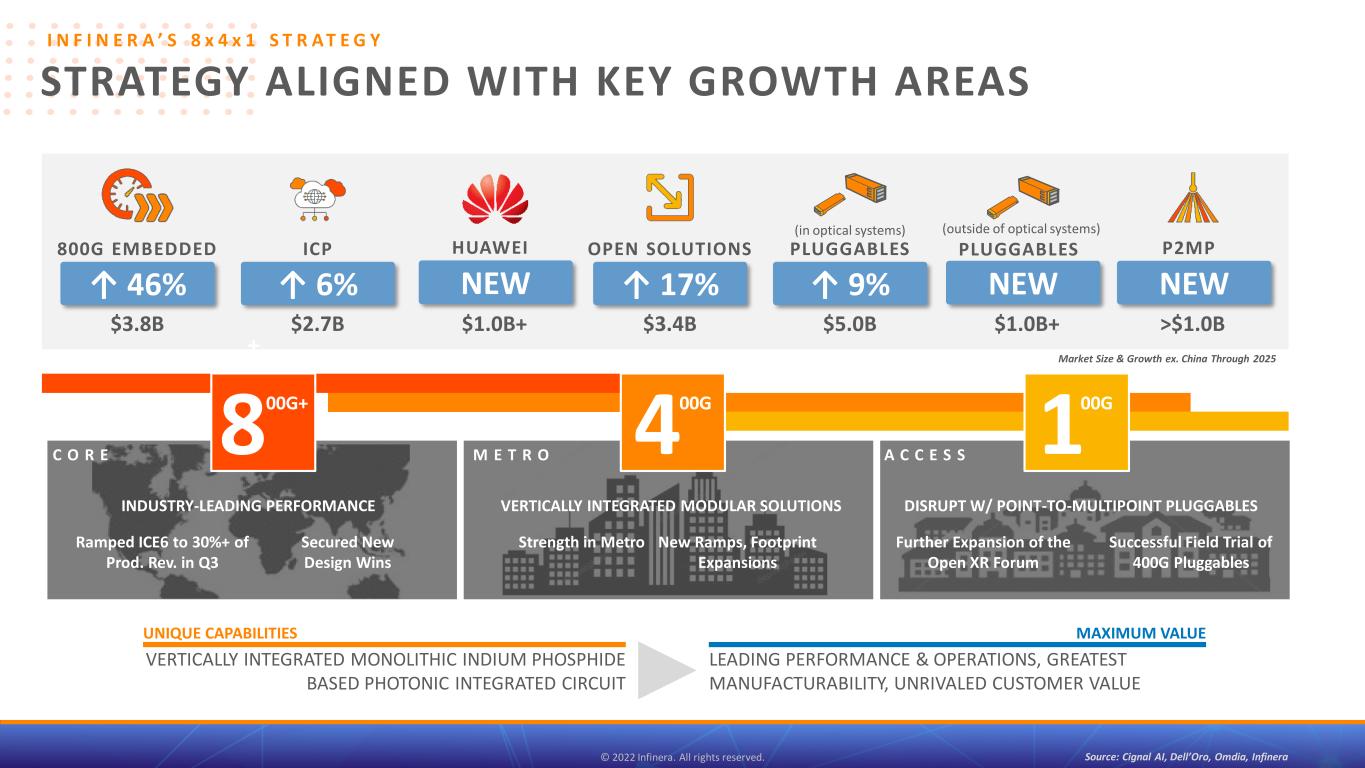

7 I N F I N E R A ’ S 8 x 4 x 1 S T R A T E G Y STRATEGY ALIGNED WITH KEY GROWTH AREAS INDUSTRY-LEADING PERFORMANCE Market Size & Growth ex. China Through 2025 ICP $2.7B ↑ 6% 800G EMBEDDED $3.8B ↑ 46% PLUGGABLES (in optical systems) $5.0B ↑ 9% PLUGGABLES (outside of optical systems) NEW $1.0B+ P2MP NEW >$1.0B OPEN SOLUTIONS ↑ 17% $3.4B HUAWEI NEW $1.0B+ + 8 4 1 VERTICALLY INTEGRATED MODULAR SOLUTIONS DISRUPT W/ POINT-TO-MULTIPOINT PLUGGABLES VERTICALLY INTEGRATED MONOLITHIC INDIUM PHOSPHIDE BASED PHOTONIC INTEGRATED CIRCUIT UNIQUE CAPABILITIES LEADING PERFORMANCE & OPERATIONS, GREATEST MANUFACTURABILITY, UNRIVALED CUSTOMER VALUE MAXIMUM VALUE © 2022 Infinera. All rights reserved. Source: Cignal AI, Dell’Oro, Omdia, Infinera C O R E M E T R O A C C E S S 00G00G+ 00G Strength in Metro New Ramps, Footprint Expansions Further Expansion of the Open XR Forum Successful Field Trial of 400G Pluggables Ramped ICE6 to 30%+ of Prod. Rev. in Q3 Secured New Design Wins

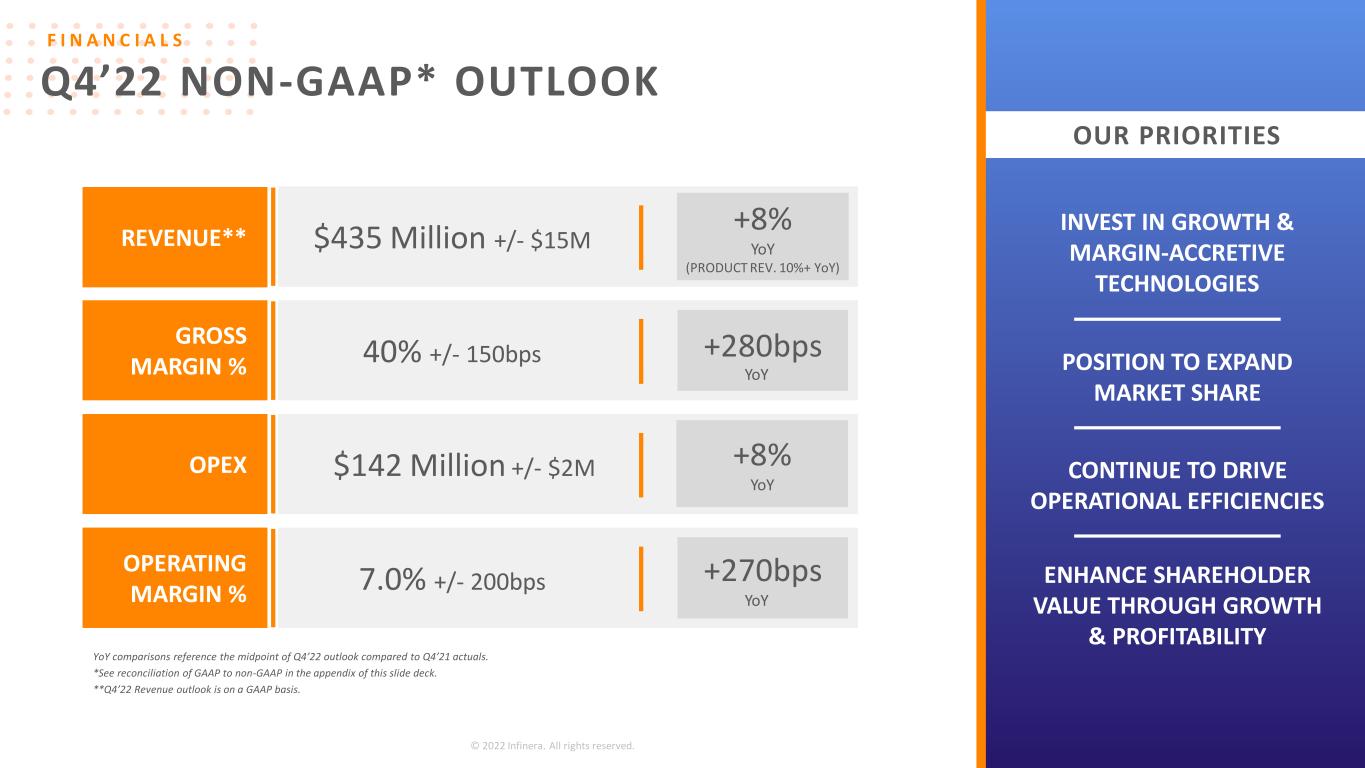

8© 2022 Infinera. All rights reserved. OUR PRIORITIES INVEST IN GROWTH & MARGIN-ACCRETIVE TECHNOLOGIES CONTINUE TO DRIVE OPERATIONAL EFFICIENCIES ENHANCE SHAREHOLDER VALUE THROUGH GROWTH & PROFITABILITY POSITION TO EXPAND MARKET SHARE YoY comparisons reference the midpoint of Q4’22 outlook compared to Q4’21 actuals. *See reconciliation of GAAP to non-GAAP in the appendix of this slide deck. **Q4’22 Revenue outlook is on a GAAP basis. $435 Million +/- $15M +8% YoY (PRODUCT REV. 10%+ YoY) OPERATING MARGIN % 7.0% +/- 200bps +270bps GROSS MARGIN % 40% +/- 150bps +280bps OPEX $142 Million +/- $2M YoY YoY F I N A N C I A L S Q4’22 NON-GAAP* OUTLOOK REVENUE** +8% YoY

APPENDIX

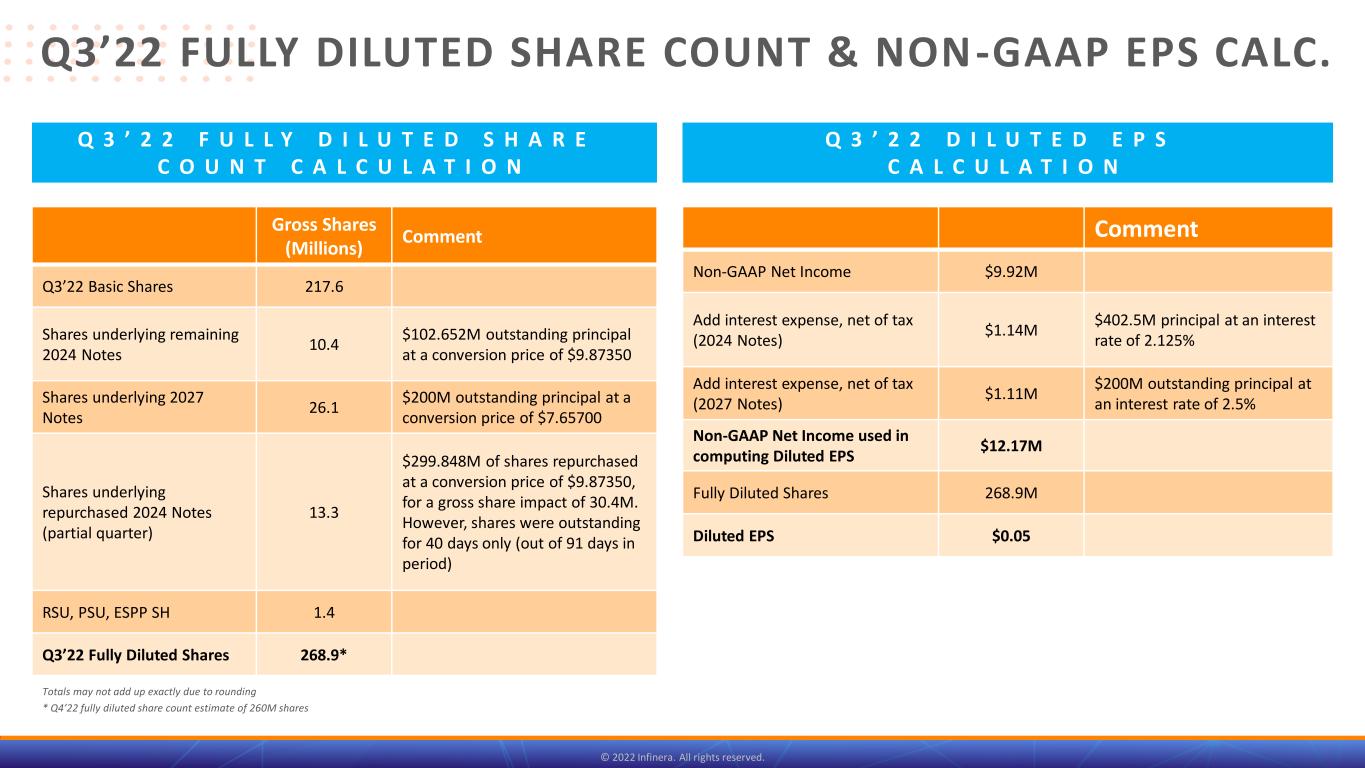

10 © 2022 Infinera. All rights reserved. Company Confidential. © 2022 Infinera. All rights reserved. Q3’22 FULLY DILUTED SHARE COUNT & NON -GAAP EPS CALC. Gross Shares (Millions) Comment Q3’22 Basic Shares 217.6 Shares underlying remaining 2024 Notes 10.4 $102.652M outstanding principal at a conversion price of $9.87350 Shares underlying 2027 Notes 26.1 $200M outstanding principal at a conversion price of $7.65700 Shares underlying repurchased 2024 Notes (partial quarter) 13.3 $299.848M of shares repurchased at a conversion price of $9.87350, for a gross share impact of 30.4M. However, shares were outstanding for 40 days only (out of 91 days in period) RSU, PSU, ESPP SH 1.4 Q3’22 Fully Diluted Shares 268.9* Comment Non-GAAP Net Income $9.92M Add interest expense, net of tax (2024 Notes) $1.14M $402.5M principal at an interest rate of 2.125% Add interest expense, net of tax (2027 Notes) $1.11M $200M outstanding principal at an interest rate of 2.5% Non-GAAP Net Income used in computing Diluted EPS $12.17M Fully Diluted Shares 268.9M Diluted EPS $0.05 Q 3 ’ 2 2 F U L L Y D I L U T E D S H A R E C O U N T C A L C U L A T I O N Q 3 ’ 2 2 D I L U T E D E P S C A L C U L A T I O N Totals may not add up exactly due to rounding * Q4’22 fully diluted share count estimate of 260M shares

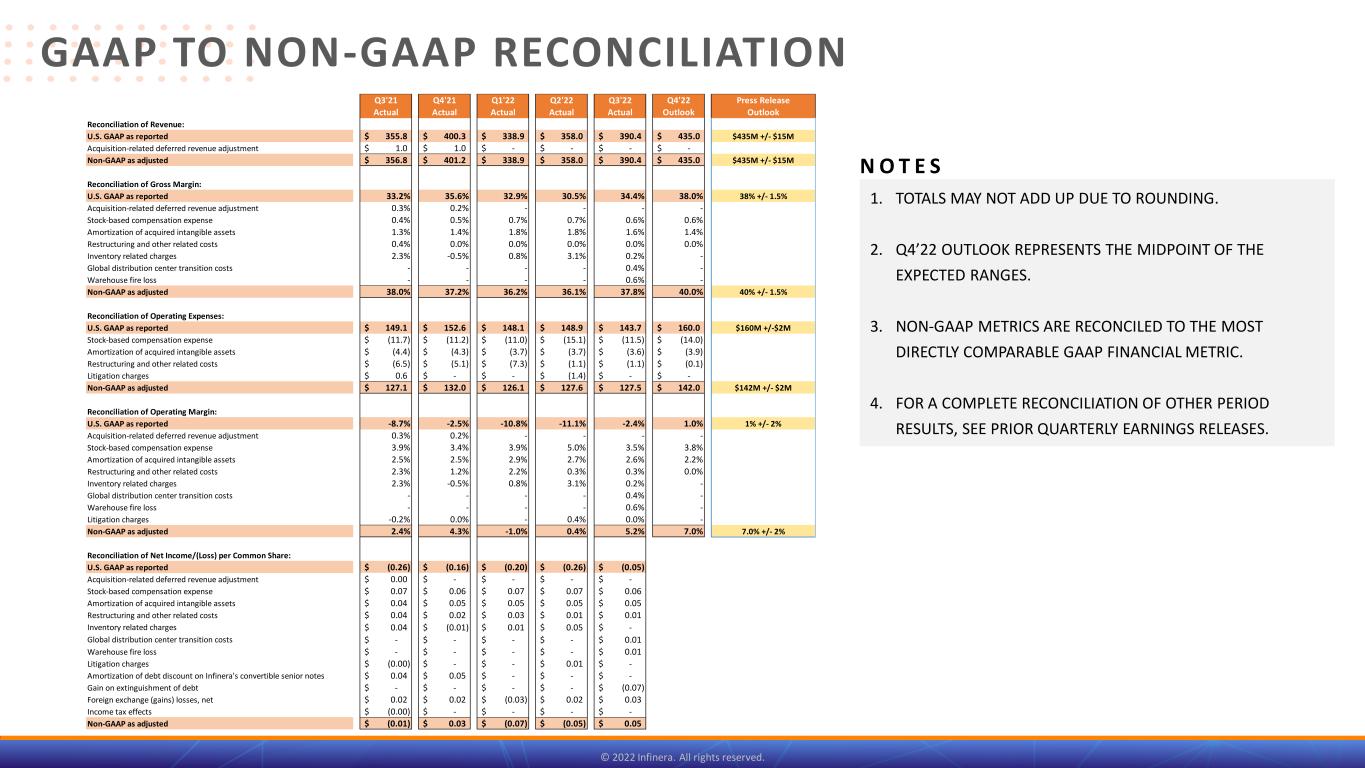

11 1. TOTALS MAY NOT ADD UP DUE TO ROUNDING. 2. Q4’22 OUTLOOK REPRESENTS THE MIDPOINT OF THE EXPECTED RANGES. 3. NON-GAAP METRICS ARE RECONCILED TO THE MOST DIRECTLY COMPARABLE GAAP FINANCIAL METRIC. 4. FOR A COMPLETE RECONCILIATION OF OTHER PERIOD RESULTS, SEE PRIOR QUARTERLY EARNINGS RELEASES. © 2022 Infinera. All rights reserved. Company Confidential. © 2022 Infinera. All rights reserved. GAAP TO NON-GAAP RECONCILIATION N O T E S Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Press Release Actual Actual Actual Actual Actual Outlook Outlook Reconciliation of Revenue: U.S. GAAP as reported 355.8$ 400.3$ 338.9$ 358.0$ 390.4$ 435.0$ $435M +/- $15M Acquisition-related deferred revenue adjustment 1.0$ 1.0$ -$ -$ -$ -$ Non-GAAP as adjusted 356.8$ 401.2$ 338.9$ 358.0$ 390.4$ 435.0$ $435M +/- $15M Reconciliation of Gross Margin: U.S. GAAP as reported 33.2% 35.6% 32.9% 30.5% 34.4% 38.0% 38% +/- 1.5% Acquisition-related deferred revenue adjustment 0.3% 0.2% - - - - Stock-based compensation expense 0.4% 0.5% 0.7% 0.7% 0.6% 0.6% Amortization of acquired intangible assets 1.3% 1.4% 1.8% 1.8% 1.6% 1.4% Restructuring and other related costs 0.4% 0.0% 0.0% 0.0% 0.0% 0.0% Inventory related charges 2.3% -0.5% 0.8% 3.1% 0.2% - Global distribution center transition costs - - - - 0.4% - Warehouse fire loss - - - - 0.6% - Non-GAAP as adjusted 38.0% 37.2% 36.2% 36.1% 37.8% 40.0% 40% +/- 1.5% Reconciliation of Operating Expenses: U.S. GAAP as reported 149.1$ 152.6$ 148.1$ 148.9$ 143.7$ 160.0$ $160M +/-$2M Stock-based compensation expense (11.7)$ (11.2)$ (11.0)$ (15.1)$ (11.5)$ (14.0)$ Amortization of acquired intangible assets (4.4)$ (4.3)$ (3.7)$ (3.7)$ (3.6)$ (3.9)$ Restructuring and other related costs (6.5)$ (5.1)$ (7.3)$ (1.1)$ (1.1)$ (0.1)$ Litigation charges 0.6$ -$ -$ (1.4)$ -$ -$ Non-GAAP as adjusted 127.1$ 132.0$ 126.1$ 127.6$ 127.5$ 142.0$ $142M +/- $2M Reconciliation of Operating Margin: U.S. GAAP as reported -8.7% -2.5% -10.8% -11.1% -2.4% 1.0% 1% +/- 2% Acquisition-related deferred revenue adjustment 0.3% 0.2% - - - - Stock-based compensation expense 3.9% 3.4% 3.9% 5.0% 3.5% 3.8% Amortization of acquired intangible assets 2.5% 2.5% 2.9% 2.7% 2.6% 2.2% Restructuring and other related costs 2.3% 1.2% 2.2% 0.3% 0.3% 0.0% Inventory related charges 2.3% -0.5% 0.8% 3.1% 0.2% - Global distribution center transition costs - - - - 0.4% - Warehouse fire loss - - - - 0.6% - Litigation charges -0.2% 0.0% - 0.4% 0.0% - Non-GAAP as adjusted 2.4% 4.3% -1.0% 0.4% 5.2% 7.0% 7.0% +/- 2% Reconciliation of Net Income/(Loss) per Common Share: U.S. GAAP as reported (0.26)$ (0.16)$ (0.20)$ (0.26)$ (0.05)$ Acquisition-related deferred revenue adjustment 0.00$ -$ -$ -$ -$ Stock-based compensation expense 0.07$ 0.06$ 0.07$ 0.07$ 0.06$ Amortization of acquired intangible assets 0.04$ 0.05$ 0.05$ 0.05$ 0.05$ Restructuring and other related costs 0.04$ 0.02$ 0.03$ 0.01$ 0.01$ Inventory related charges 0.04$ (0.01)$ 0.01$ 0.05$ -$ Global distribution center transition costs -$ -$ -$ -$ 0.01$ Warehouse fire loss -$ -$ -$ -$ 0.01$ Litigation charges (0.00)$ -$ -$ 0.01$ -$ Amortization of debt discount on Infinera's convertible senior notes 0.04$ 0.05$ -$ -$ -$ Gain on extinguishment of debt -$ -$ -$ -$ (0.07)$ Foreign exchange (gains) losses, net 0.02$ 0.02$ (0.03)$ 0.02$ 0.03$ Income tax effects (0.00)$ -$ -$ -$ -$ Non-GAAP as adjusted (0.01)$ 0.03$ (0.07)$ (0.05)$ 0.05$

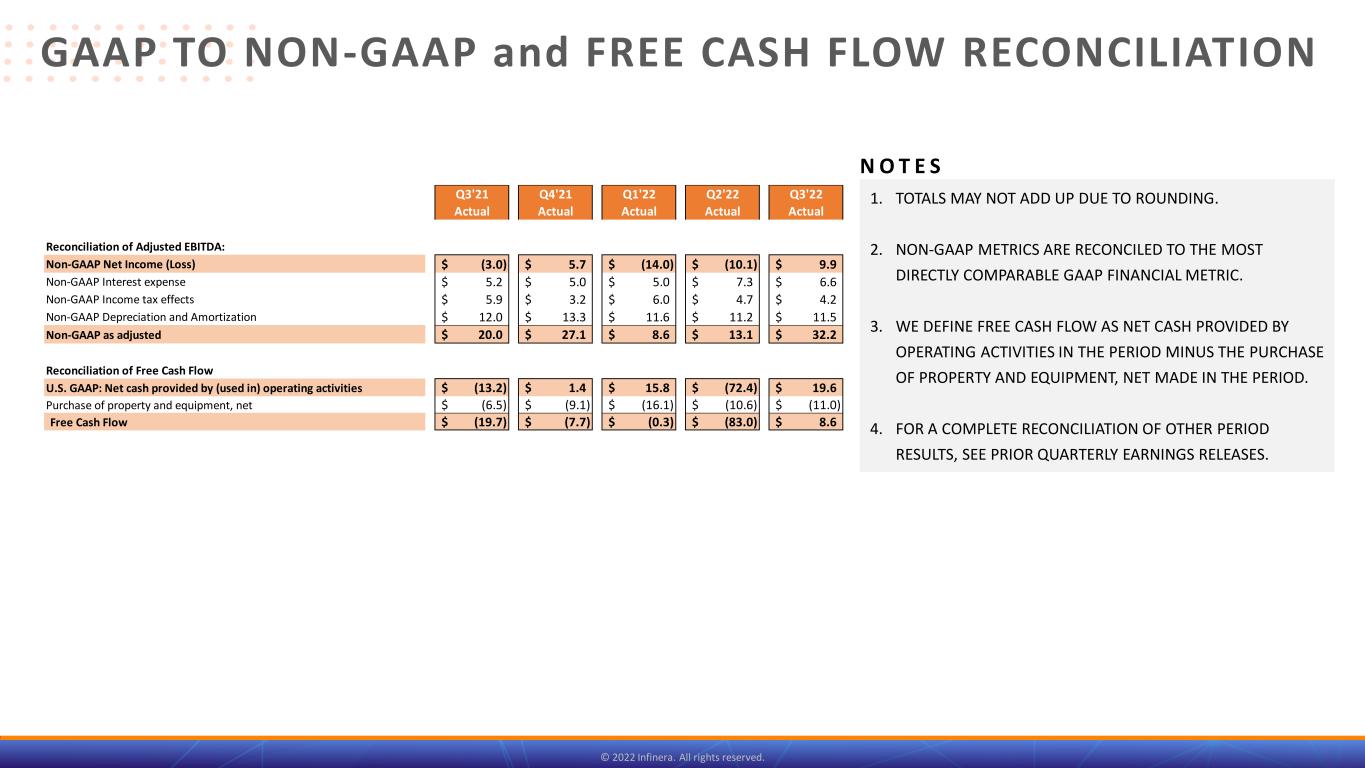

12 1. TOTALS MAY NOT ADD UP DUE TO ROUNDING. 2. NON-GAAP METRICS ARE RECONCILED TO THE MOST DIRECTLY COMPARABLE GAAP FINANCIAL METRIC. 3. WE DEFINE FREE CASH FLOW AS NET CASH PROVIDED BY OPERATING ACTIVITIES IN THE PERIOD MINUS THE PURCHASE OF PROPERTY AND EQUIPMENT, NET MADE IN THE PERIOD. 4. FOR A COMPLETE RECONCILIATION OF OTHER PERIOD RESULTS, SEE PRIOR QUARTERLY EARNINGS RELEASES. © 2022 Infinera. All rights reserved. Company Confidential. © 2022 Infinera. All rights reserved. GAAP TO NON-GAAP and FREE CASH FLOW RECONCILIATION N O T E S Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Actual Actual Actual Actual Actual Reconciliation of Adjusted EBITDA: Non-GAAP Net Income (Loss) (3.0)$ 5.7$ (14.0)$ (10.1)$ 9.9$ Non-GAAP Interest expense 5.2$ 5.0$ 5.0$ 7.3$ 6.6$ Non-GAAP Income tax effects 5.9$ 3.2$ 6.0$ 4.7$ 4.2$ Non-GAAP Depreciation and Amortization 12.0$ 13.3$ 11.6$ 11.2$ 11.5$ Non-GAAP as adjusted 20.0$ 27.1$ 8.6$ 13.1$ 32.2$ Reconciliation of Free Cash Flow U.S. GAAP: Net cash provided by (used in) operating activities (13.2)$ 1.4$ 15.8$ (72.4)$ 19.6$ Purchase of property and equipment, net (6.5)$ (9.1)$ (16.1)$ (10.6)$ (11.0)$ Free Cash Flow (19.7)$ (7.7)$ (0.3)$ (83.0)$ 8.6$

Thank You