FOURTH QUARTER 2024 FINANCIAL RESULTS February 27, 2025

2© 2025 Infinera. All rights reserved. Safe Harbor This presentation contains forward-looking statements, including those related to Infinera’s expectations regarding its Infinera's design wins; CHIPS Act and other potential government funding; and statements related to the proposed acquisition by Nokia Corporation (“Nokia”), including the future performance and benefits of the combined business. All statements other than statements of historical fact could be deemed forward looking, including, but not limited to, statements made about future market, financial and operating performance; statements regarding future products or technology, as well as the timing to market of any such products or technology; any statements about historical results that may suggest trends for Infinera’s business; and any statements of assumptions underlying any of the items mentioned. These forward-looking statements are based on estimates and information available to Infinera at the time of this presentation and are not guarantees of actual or future performance; actual results could differ materially from those stated or implied due to risks and uncertainties. The risks and uncertainties that could cause Infinera’s results to differ materially from those expressed or implied by such forward-looking statements include, among other things, risks related to whether the proposed acquisition by Nokia pursuant to an Agreement and Plan of Merger, dated as of June 27, 2024 (the “Merger Agreement”), by and among Infinera, Nokia and Neptune of American Corporation, a wholly owned subsidiary of Nokia (“Merger Sub”) (the “Merger”), is completed or if completion is delayed, and if the Merger Agreement is terminated, there may be a required payment of a significant termination fee by either party; the receipt of necessary approvals to complete the Merger; the possibility that due to the Merger, and uncertainty regarding the Merger, Infinera’s customers, suppliers or strategic partners may delay or defer entering into contracts or making other decisions concerning Infinera; the significance and timing of costs related to the Merger; the impact on us of litigation or other stockholder action related to the Merger; the effects on us and our stockholders if the Merger is not completed; demand growth for additional network capacity and the level and timing of customer capital spending and excess inventory held by customers beyond normalized levels; delays in the development, introduction or acceptance of new products or in releasing enhancements to existing products; aggressive business tactics by Infinera’s competitors and new entrants and Infinera's ability to compete in a highly competitive market; supply chain and logistics issues and their impact on our business, and Infinera's dependency on sole source, limited source or high-cost suppliers; dependence on a small number of key customers; product performance problems; the complexity of Infinera's manufacturing process; Infinera's ability to identify, attract, upskill and retain qualified personnel; challenges with our contract manufacturers and other third-party partners; the effects of customer and supplier consolidation; dependence on third-party service partners; Infinera’s ability to respond to rapid technological changes; failure to accurately forecast Infinera's manufacturing requirements or customer demand; failure to secure the funding contemplated by grants Infinera has or may receive from governments, agencies or research organizations, or failure to comply with the terms of those grants; Infinera’s future capital needs and its ability to generate the cash flow or otherwise secure the capital necessary to meet such capital needs; the effect of global and regional economic conditions on Infinera’s business, including effects on purchasing decisions by customers; the adverse impact inflation and higher interest rates may have on Infinera by increasing costs beyond what it can recover through price increases; the effects of tariffs;, restrictions to our operations resulting from loan or other credit agreements; the impacts of any restructuring plans or other strategic efforts on our business; Infinera’s international sales and operations; the impacts of foreign currency fluctuations; the effective tax rate of Infinera, which may increase or fluctuate; potential dilution from the issuance of additional shares of common stock in connection with the conversion of Infinera's convertible senior notes; Infinera’s ability to protect its intellectual property; claims by others that Infinera infringes on their intellectual property rights; security incidents, such as data breaches or cyber-attacks; Infinera's ability to comply with various rules and regulations, including with respect to export control and trade compliance, environmental, social, governance, privacy and data protection matters; events that are outside of Infinera's control, such as natural disasters, acts of war or terrorism, or other catastrophic events that could harm Infinera's operations; Infinera’s ability to remediate its disclosed material weaknesses in internal control over financial reporting in a timely and effective manner; and other risks and uncertainties detailed in Infinera’s SEC filings from time to time. More information on potential factors that may impact Infinera’s business are set forth in Infinera's periodic reports filed with the SEC, including its Annual Report on Form 10-K for the year ended December 28, 2024, as well as subsequent reports filed with or furnished to the SEC from time to time. These reports are available on Infinera’s website at www.infinera.com and the SEC’s website at www.sec.gov. Infinera assumes no obligation to, and does not currently intend to, update any such forward-looking statements. This presentation includes non-GAAP financial measures such as non-GAAP net income, non-GAAP gross margin, non-GAAP operating expenses, non-GAAP operating margin, non-GAAP diluted EPS, Adjusted EBITDA and free cash flow. We present non-GAAP financial measures in addition to, and not as a substitute for, financial measures calculated in accordance with generally accepted accounting principles (“GAAP”). Non-GAAP measures should not be considered in isolation or as alternatives to GAAP measures. In addition, the non-GAAP measures we use, as presented, may not be comparable to similar measures used by other companies. Infinera believes these adjustments are appropriate to enhance an overall understanding of its underlying financial performance and also its prospects for the future and are considered by management for the purpose of making operational decisions. See the Appendix to this presentation for reconciliations to the most comparable GAAP financial measures. Forward Looking Statements

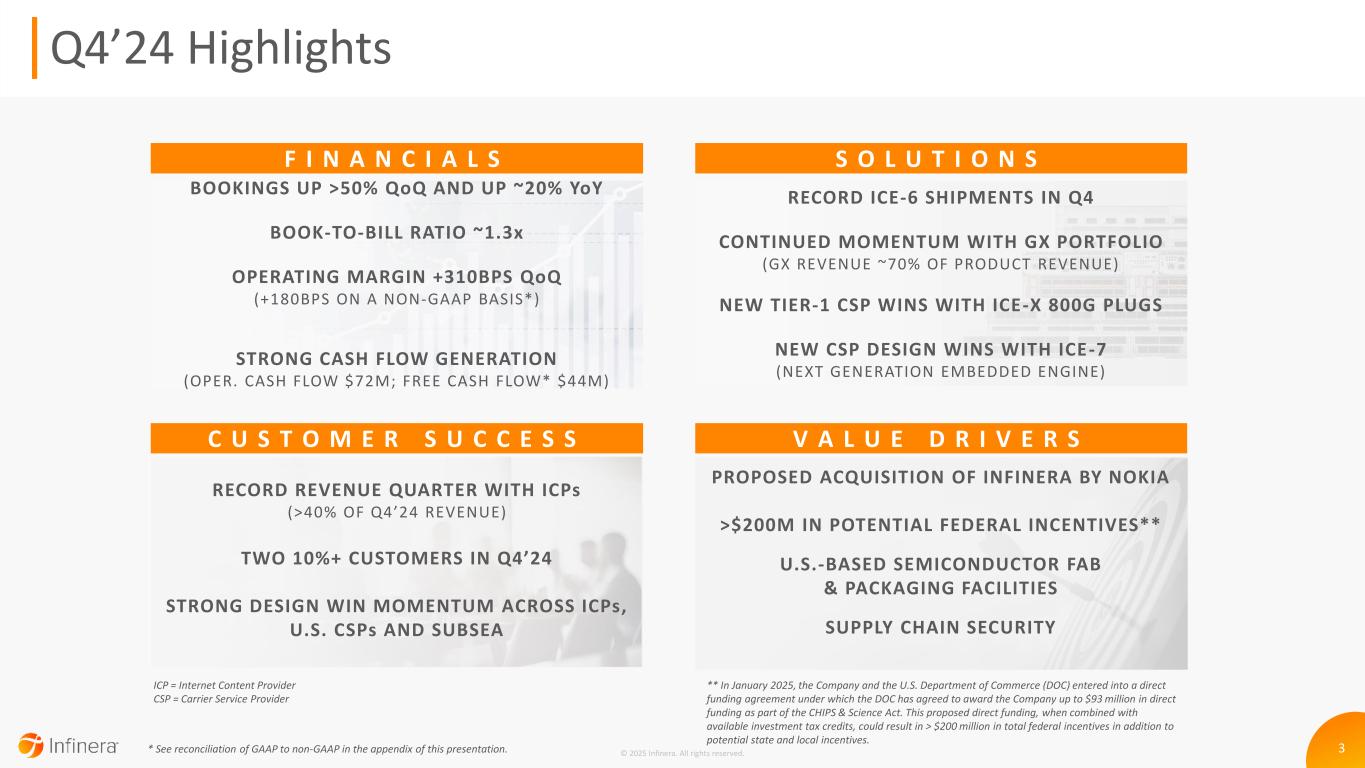

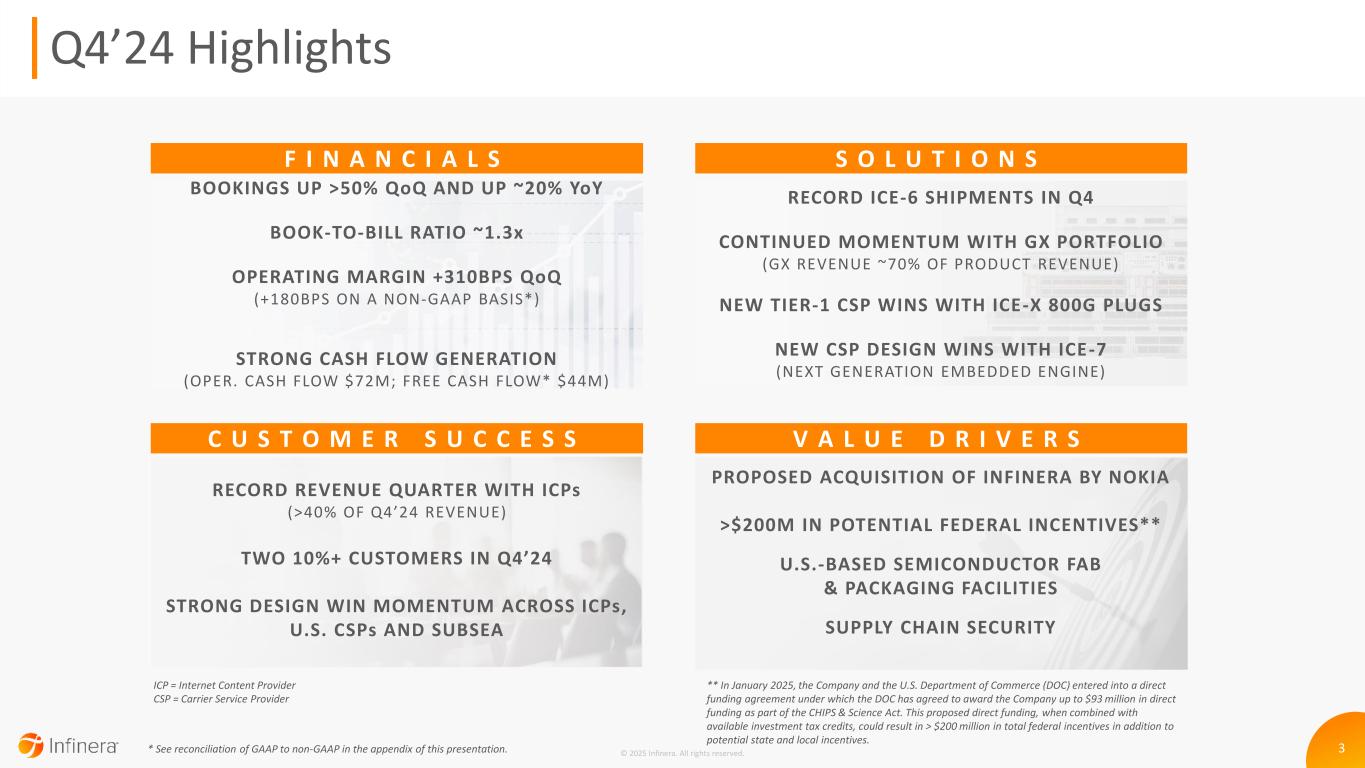

3© 2025 Infinera. All rights reserved. Q4’24 Highlights F I N A N C I A L S BOOKINGS UP >50% QoQ AND UP ~20% YoY BOOK-TO-BILL RATIO ~1.3x OPERATING MARGIN +310BPS QoQ (+180BPS ON A NON-GAAP BASIS*) STRONG CASH FLOW GENERATION (OPER. CASH FLOW $72M; FREE CASH FLOW* $44M) RECORD ICE-6 SHIPMENTS IN Q4 CONTINUED MOMENTUM WITH GX PORTFOLIO (GX REVENUE ~70% OF PRODUCT REVENUE) NEW TIER-1 CSP WINS WITH ICE-X 800G PLUGS NEW CSP DESIGN WINS WITH ICE-7 (NEXT GENERATION EMBEDDED ENGINE) S O L U T I O N S RECORD REVENUE QUARTER WITH ICPs (>40% OF Q4’24 REVENUE) TWO 10%+ CUSTOMERS IN Q4’24 STRONG DESIGN WIN MOMENTUM ACROSS ICPs, U.S. CSPs AND SUBSEA C U S T O M E R S U C C E S S PROPOSED ACQUISITION OF INFINERA BY NOKIA >$200M IN POTENTIAL FEDERAL INCENTIVES** U.S.-BASED SEMICONDUCTOR FAB & PACKAGING FACILITIES SUPPLY CHAIN SECURITY V A L U E D R I V E R S ICP = Internet Content Provider CSP = Carrier Service Provider ** In January 2025, the Company and the U.S. Department of Commerce (DOC) entered into a direct funding agreement under which the DOC has agreed to award the Company up to $93 million in direct funding as part of the CHIPS & Science Act. This proposed direct funding, when combined with available investment tax credits, could result in > $200 million in total federal incentives in addition to potential state and local incentives. * See reconciliation of GAAP to non-GAAP in the appendix of this presentation.

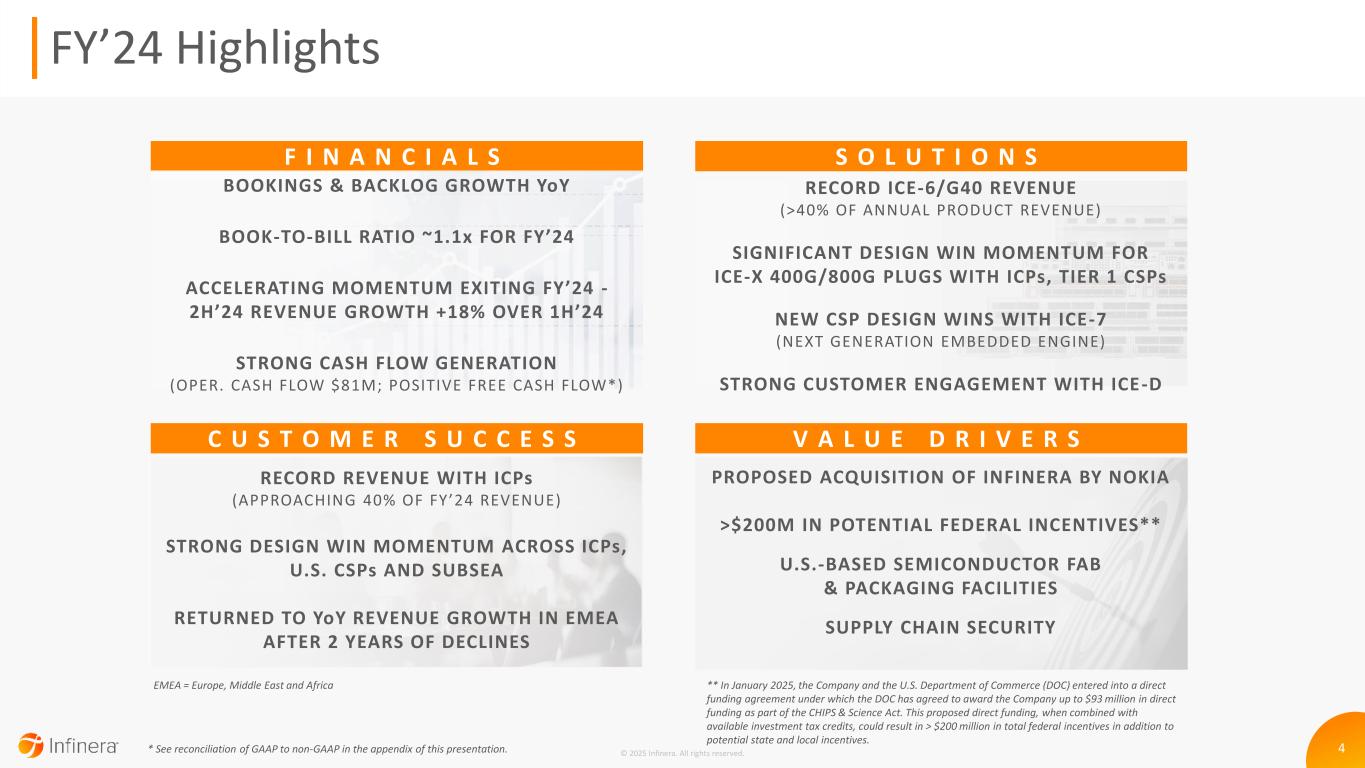

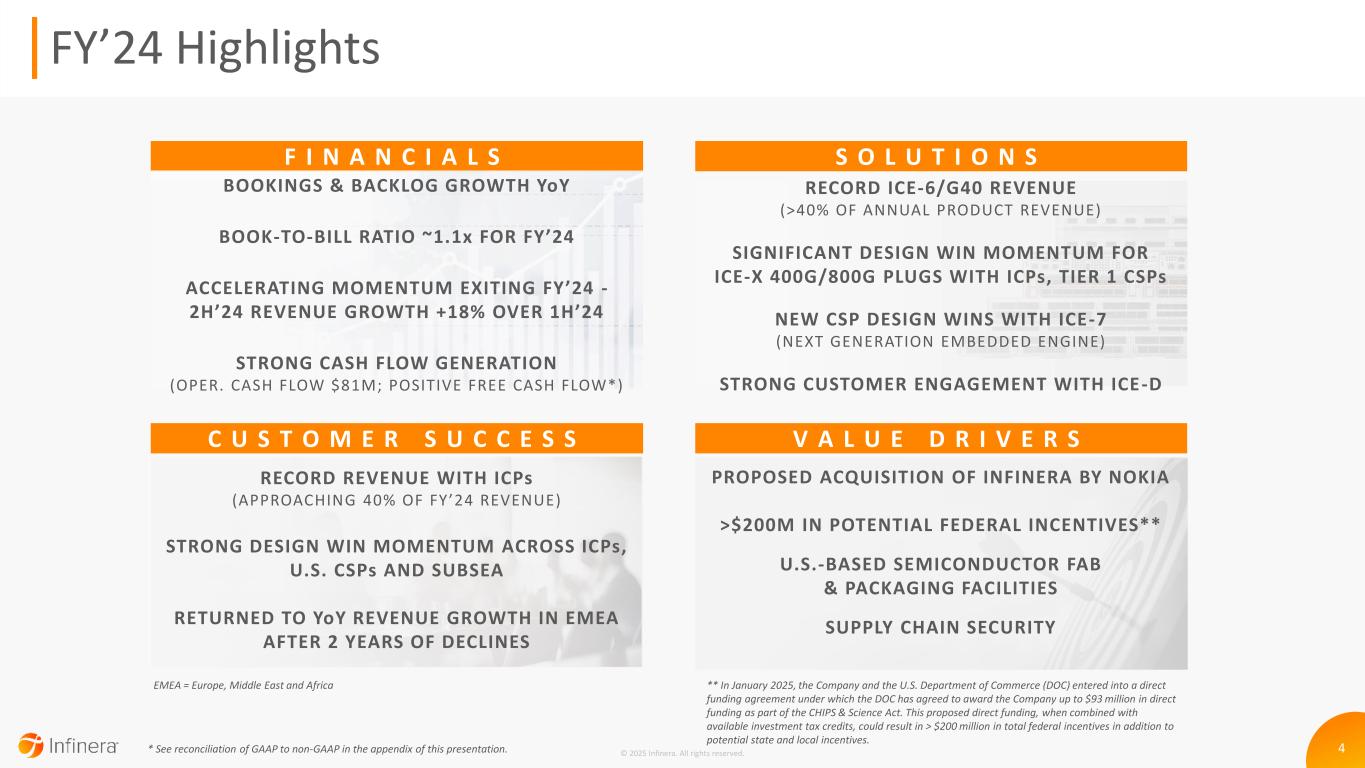

4© 2025 Infinera. All rights reserved. FY’24 Highlights F I N A N C I A L S BOOKINGS & BACKLOG GROWTH YoY BOOK-TO-BILL RATIO ~1.1x FOR FY’24 ACCELERATING MOMENTUM EXITING FY’24 - 2H’24 REVENUE GROWTH +18% OVER 1H’24 STRONG CASH FLOW GENERATION (OPER. CASH FLOW $81M; POSITIVE FREE CASH FLOW*) RECORD ICE-6/G40 REVENUE (>40% OF ANNUAL PRODUCT REVENUE) SIGNIFICANT DESIGN WIN MOMENTUM FOR ICE-X 400G/800G PLUGS WITH ICPs, TIER 1 CSPs NEW CSP DESIGN WINS WITH ICE-7 (NEXT GENERATION EMBEDDED ENGINE) STRONG CUSTOMER ENGAGEMENT WITH ICE-D S O L U T I O N S RECORD REVENUE WITH ICPs (APPROACHING 40% OF FY’24 REVENUE) STRONG DESIGN WIN MOMENTUM ACROSS ICPs, U.S. CSPs AND SUBSEA RETURNED TO YoY REVENUE GROWTH IN EMEA AFTER 2 YEARS OF DECLINES C U S T O M E R S U C C E S S PROPOSED ACQUISITION OF INFINERA BY NOKIA >$200M IN POTENTIAL FEDERAL INCENTIVES** U.S.-BASED SEMICONDUCTOR FAB & PACKAGING FACILITIES SUPPLY CHAIN SECURITY V A L U E D R I V E R S EMEA = Europe, Middle East and Africa ** In January 2025, the Company and the U.S. Department of Commerce (DOC) entered into a direct funding agreement under which the DOC has agreed to award the Company up to $93 million in direct funding as part of the CHIPS & Science Act. This proposed direct funding, when combined with available investment tax credits, could result in > $200 million in total federal incentives in addition to potential state and local incentives. * See reconciliation of GAAP to non-GAAP in the appendix of this presentation.

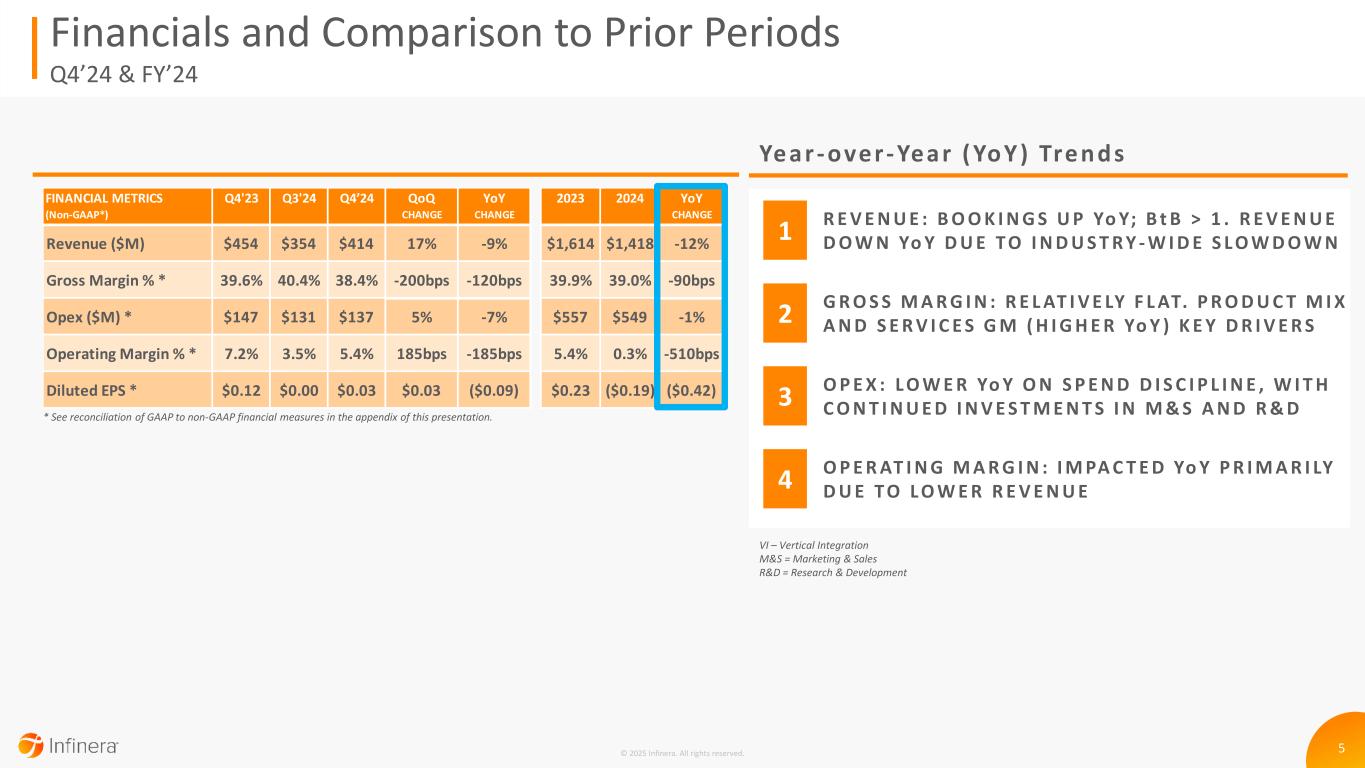

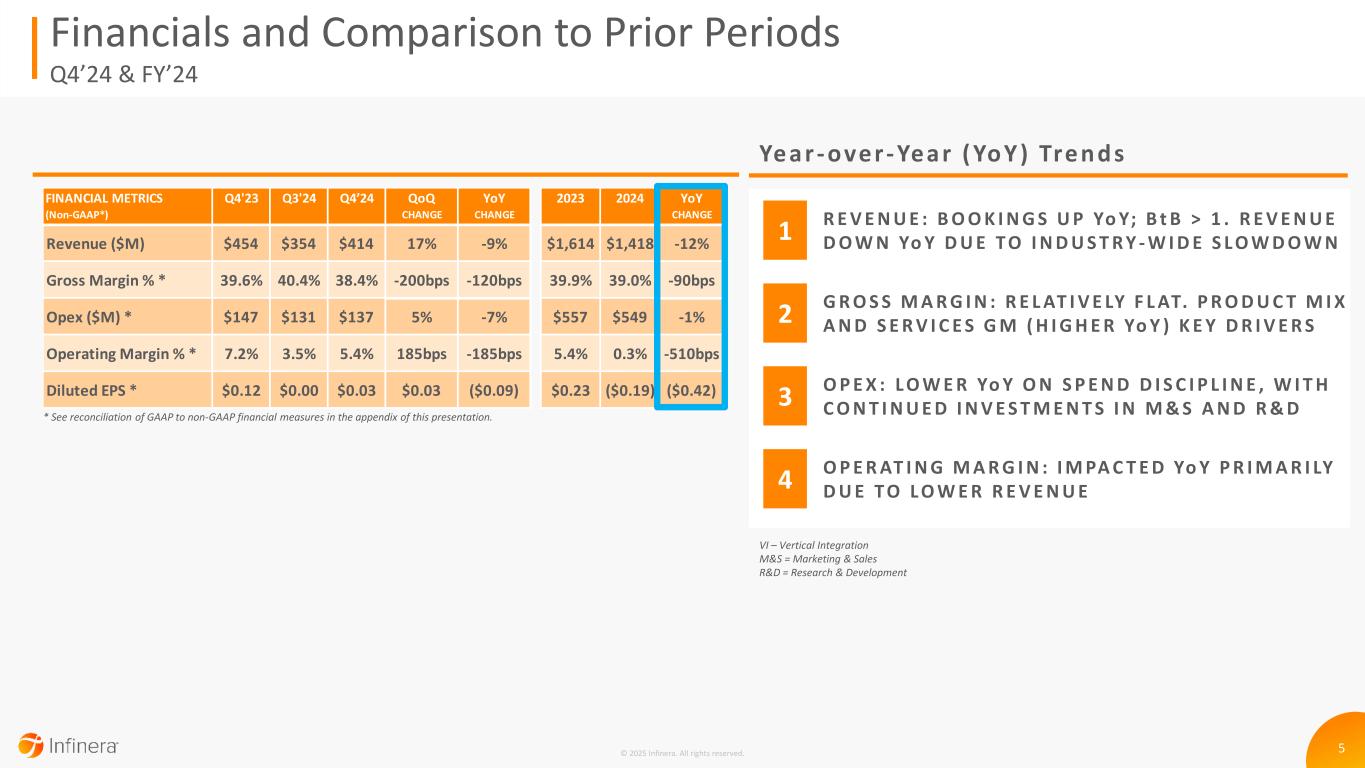

5 R E V E N U E : B O O K I N G S U P Yo Y; B t B > 1 . R E V E N U E D O W N Yo Y D U E T O I N D U S T R Y - W I D E S L O W D O W N1 G R O S S M A R G I N : R E L AT I V E LY F L AT. P R O D U C T M I X A N D S E R V I C E S G M ( H I G H E R Yo Y ) K E Y D R I V E R S2 O P E R AT I N G M A R G I N : I M PA C T E D Yo Y P R I M A R I LY D U E T O L O W E R R E V E N U E4 O P E X : L O W E R Yo Y O N S P E N D D I S C I P L I N E , W I T H C O N T I N U E D I N V E S T M E N T S I N M & S A N D R & D3 © 2025 Infinera. All rights reserved. Financials and Comparison to Prior Periods Q4’24 & FY’24 * See reconciliation of GAAP to non-GAAP financial measures in the appendix of this presentation. Ye ar - over- Year ( Yo Y) Tre n d s VI – Vertical Integration M&S = Marketing & Sales R&D = Research & Development FINANCIAL METRICS QoQ YoY YoY (Non-GAAP*) CHANGE CHANGE CHANGE Revenue ($M) $454 $354 $414 17% -9% $1,614 $1,418 -12% Gross Margin % * 39.6% 40.4% 38.4% -200bps -120bps 39.9% 39.0% -90bps Opex ($M) * $147 $131 $137 5% -7% $557 $549 -1% Operating Margin % * 7.2% 3.5% 5.4% 185bps -185bps 5.4% 0.3% -510bps Diluted EPS * $0.12 $0.00 $0.03 $0.03 ($0.09) $0.23 ($0.19) ($0.42) Q4'23 Q3'24 Q4’24 2023 2024

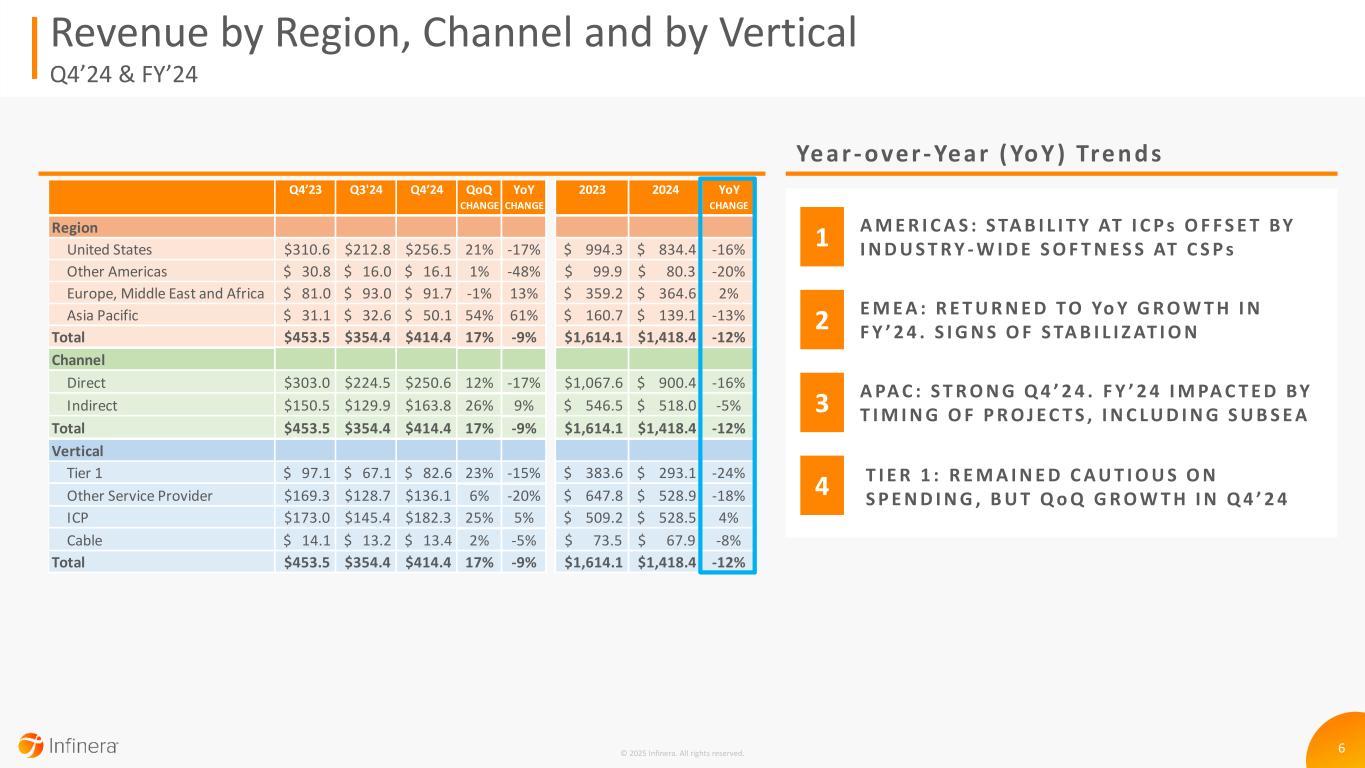

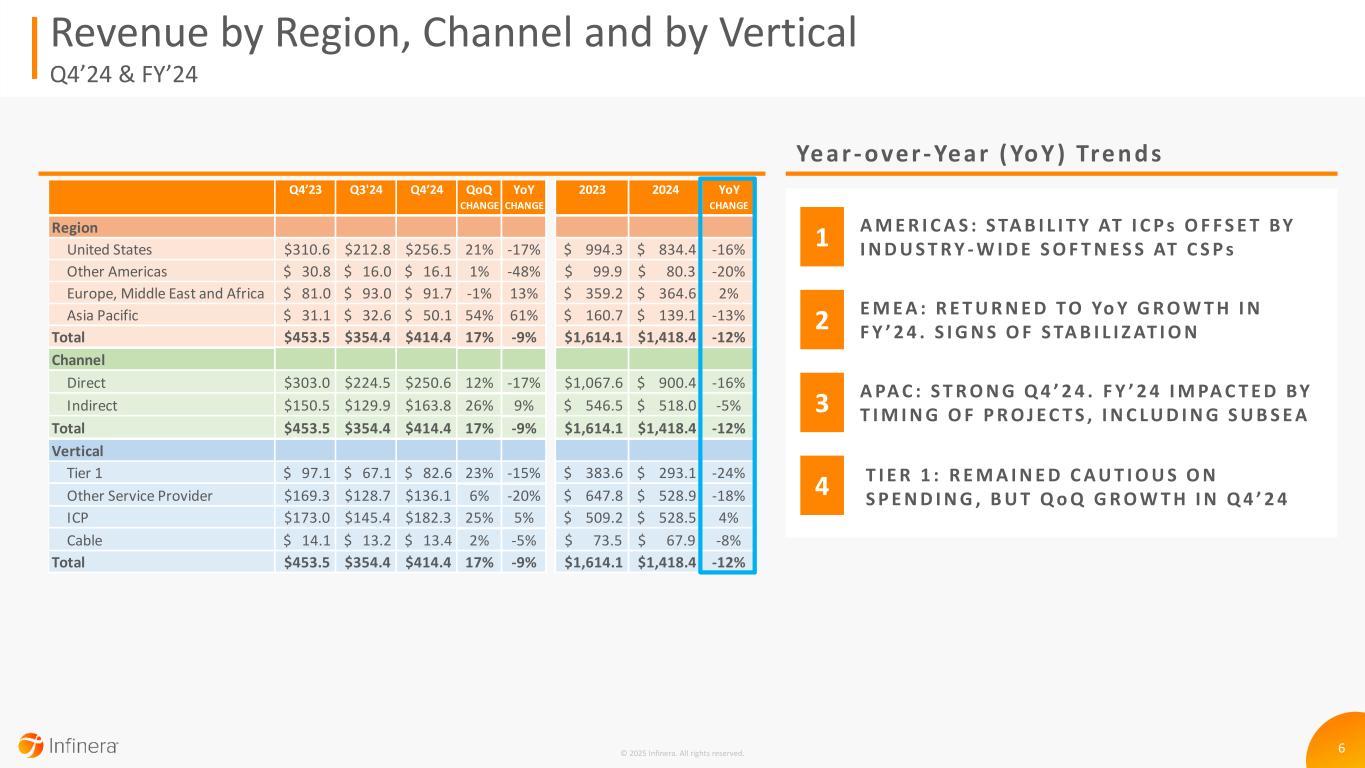

6© 2025 Infinera. All rights reserved. Revenue by Region, Channel and by Vertical Q4’24 & FY’24 GAAP revenue in $ millions; totals may not add up exactly due to rounding. A M E R I C A S : S TA B I L I T Y AT I C P s O F F S E T BY I N D U S T R Y - W I D E S O F T N E S S AT C S P s1 E M E A : R E T U R N E D T O Yo Y G R O W T H I N F Y ’ 2 4 . S I G N S O F S TA B I L I Z AT I O N2 A PA C : S T R O N G Q 4 ’ 2 4 . F Y ’ 2 4 I M PA C T E D BY T I M I N G O F P R O J E C T S , I N C L U D I N G S U B S E A3 Ye ar - over - Year ( Yo Y) Tre n d s 4 T I E R 1 : R E M A I N E D C A U T I O U S O N S P E N D I N G , B U T Q o Q G R O W T H I N Q 4 ’ 2 4 QoQ YoY YoY CHANGE CHANGE CHANGE Region United States $310.6 $212.8 $256.5 21% -17% $ 994.3 $ 834.4 -16% Other Americas $ 30.8 $ 16.0 $ 16.1 1% -48% $ 99.9 $ 80.3 -20% Europe, Middle East and Africa $ 81.0 $ 93.0 $ 91.7 -1% 13% $ 359.2 $ 364.6 2% Asia Pacific $ 31.1 $ 32.6 $ 50.1 54% 61% $ 160.7 $ 139.1 -13% Total $453.5 $354.4 $414.4 17% -9% $1,614.1 $1,418.4 -12% Channel Direct $303.0 $224.5 $250.6 12% -17% $1,067.6 $ 900.4 -16% Indirect $150.5 $129.9 $163.8 26% 9% $ 546.5 $ 518.0 -5% Total $453.5 $354.4 $414.4 17% -9% $1,614.1 $1,418.4 -12% Vertical Tier 1 $ 97.1 $ 67.1 $ 82.6 23% -15% $ 383.6 $ 293.1 -24% Other Service Provider $169.3 $128.7 $136.1 6% -20% $ 647.8 $ 528.9 -18% ICP $173.0 $145.4 $182.3 25% 5% $ 509.2 $ 528.5 4% Cable $ 14.1 $ 13.2 $ 13.4 2% -5% $ 73.5 $ 67.9 -8% Total $453.5 $354.4 $414.4 17% -9% $1,614.1 $1,418.4 -12% 2023 2024Q4’23 Q3'24 Q4’24

Appendix

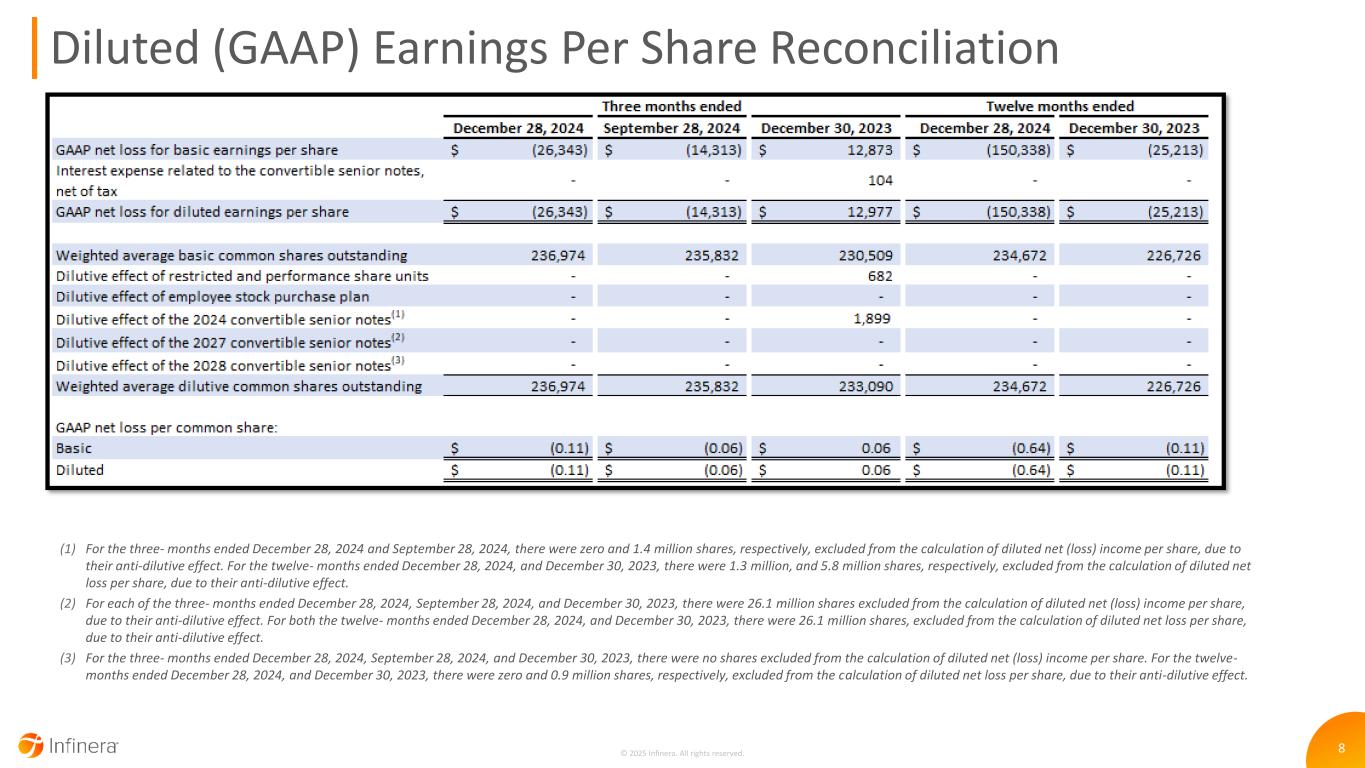

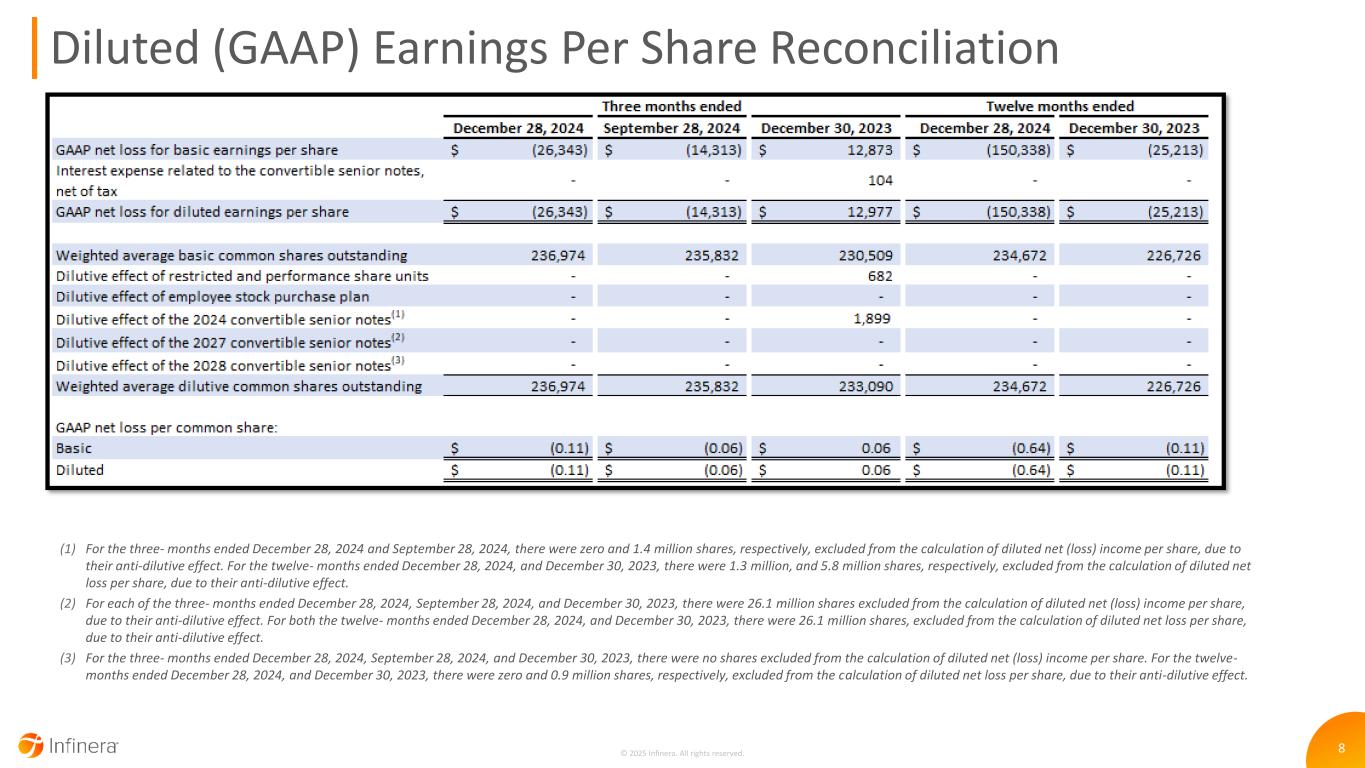

8 Diluted (GAAP) Earnings Per Share Reconciliation (1) For the three- months ended December 28, 2024 and September 28, 2024, there were zero and 1.4 million shares, respectively, excluded from the calculation of diluted net (loss) income per share, due to their anti-dilutive effect. For the twelve- months ended December 28, 2024, and December 30, 2023, there were 1.3 million, and 5.8 million shares, respectively, excluded from the calculation of diluted net loss per share, due to their anti-dilutive effect. (2) For each of the three- months ended December 28, 2024, September 28, 2024, and December 30, 2023, there were 26.1 million shares excluded from the calculation of diluted net (loss) income per share, due to their anti-dilutive effect. For both the twelve- months ended December 28, 2024, and December 30, 2023, there were 26.1 million shares, excluded from the calculation of diluted net loss per share, due to their anti-dilutive effect. (3) For the three- months ended December 28, 2024, September 28, 2024, and December 30, 2023, there were no shares excluded from the calculation of diluted net (loss) income per share. For the twelve- months ended December 28, 2024, and December 30, 2023, there were zero and 0.9 million shares, respectively, excluded from the calculation of diluted net loss per share, due to their anti-dilutive effect. © 2025 Infinera. All rights reserved.

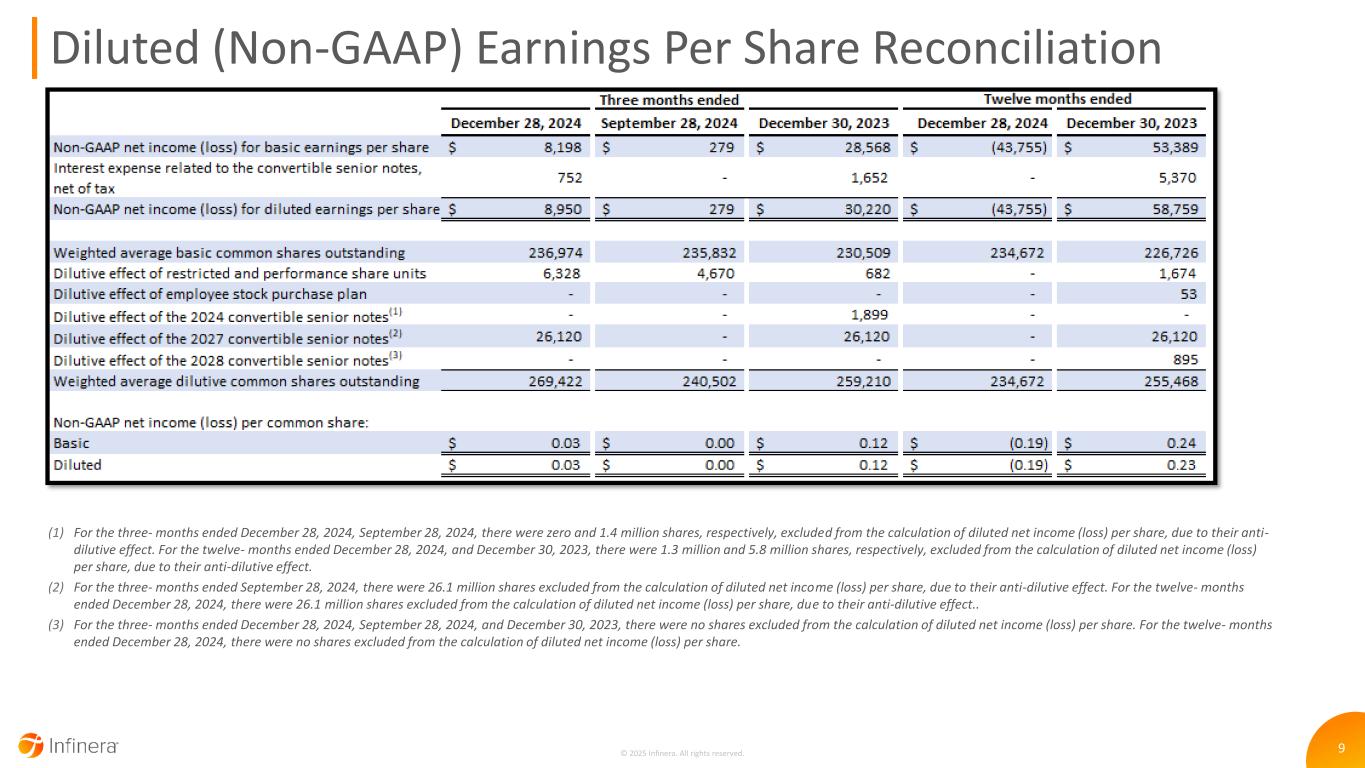

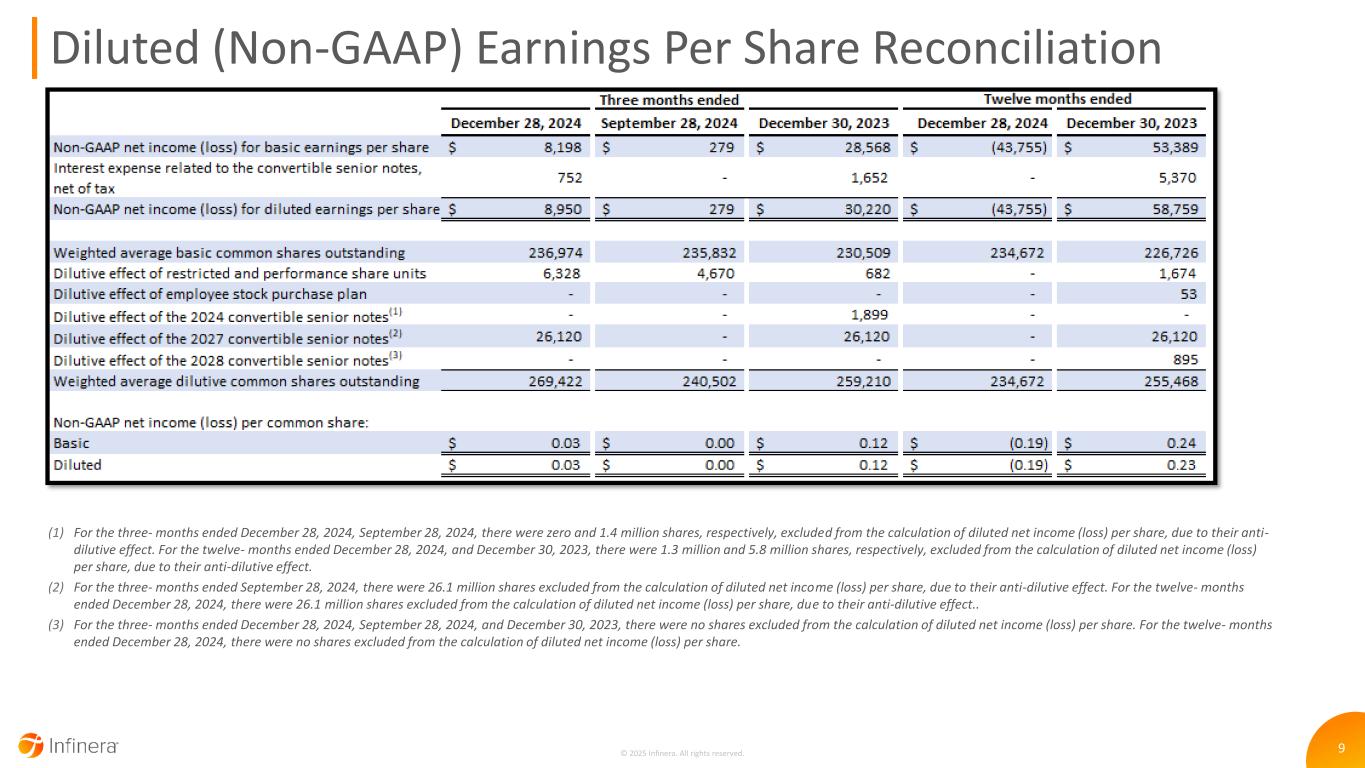

9 Diluted (Non-GAAP) Earnings Per Share Reconciliation (1) For the three- months ended December 28, 2024, September 28, 2024, there were zero and 1.4 million shares, respectively, excluded from the calculation of diluted net income (loss) per share, due to their anti- dilutive effect. For the twelve- months ended December 28, 2024, and December 30, 2023, there were 1.3 million and 5.8 million shares, respectively, excluded from the calculation of diluted net income (loss) per share, due to their anti-dilutive effect. (2) For the three- months ended September 28, 2024, there were 26.1 million shares excluded from the calculation of diluted net income (loss) per share, due to their anti-dilutive effect. For the twelve- months ended December 28, 2024, there were 26.1 million shares excluded from the calculation of diluted net income (loss) per share, due to their anti-dilutive effect.. (3) For the three- months ended December 28, 2024, September 28, 2024, and December 30, 2023, there were no shares excluded from the calculation of diluted net income (loss) per share. For the twelve- months ended December 28, 2024, there were no shares excluded from the calculation of diluted net income (loss) per share. © 2025 Infinera. All rights reserved.

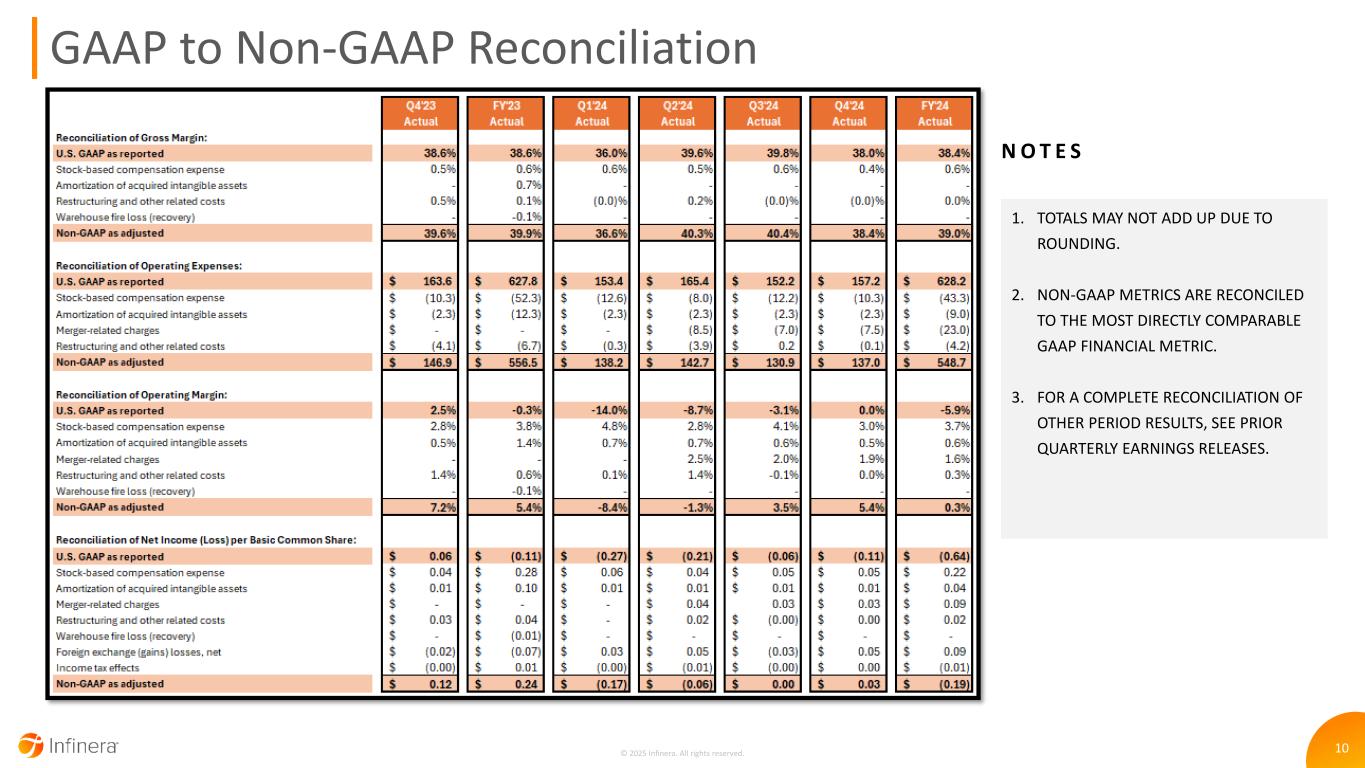

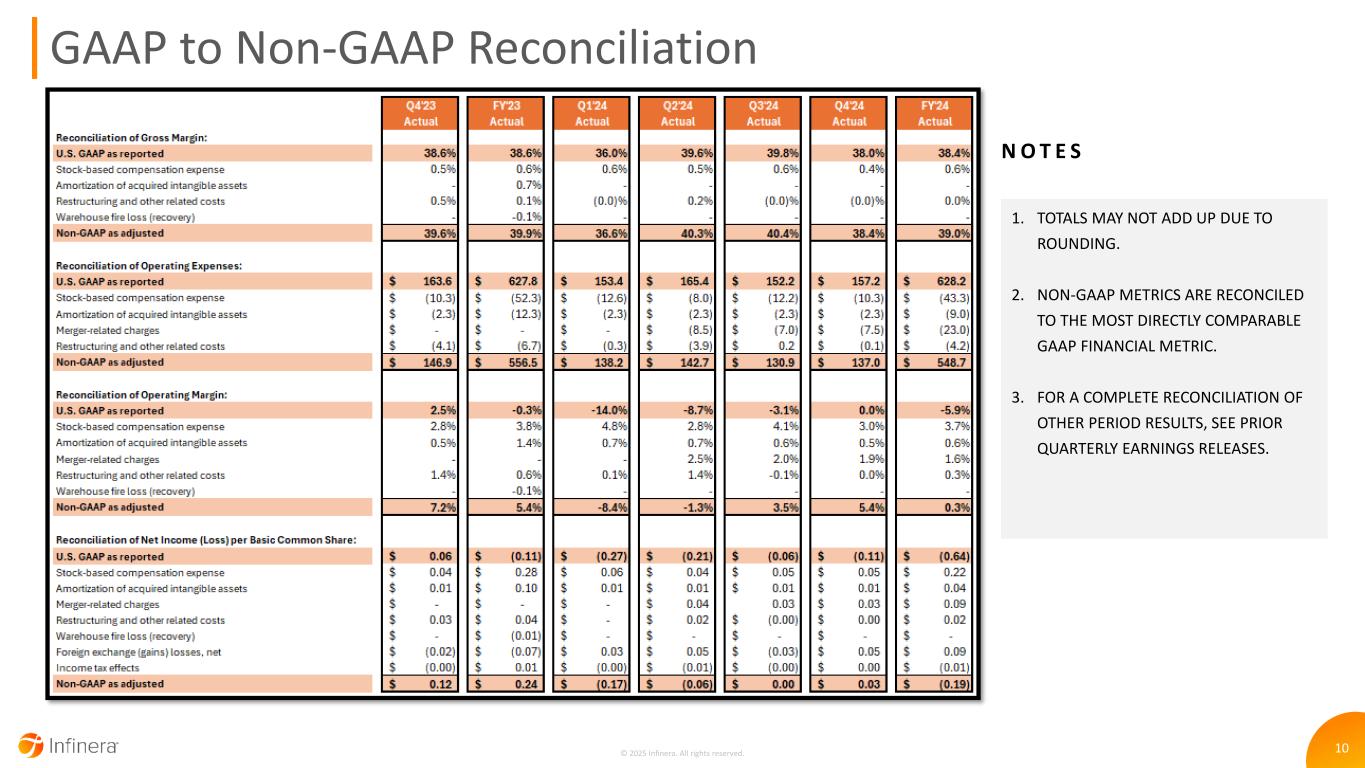

10 GAAP to Non-GAAP Reconciliation 1. TOTALS MAY NOT ADD UP DUE TO ROUNDING. 2. NON-GAAP METRICS ARE RECONCILED TO THE MOST DIRECTLY COMPARABLE GAAP FINANCIAL METRIC. 3. FOR A COMPLETE RECONCILIATION OF OTHER PERIOD RESULTS, SEE PRIOR QUARTERLY EARNINGS RELEASES. N O T E S © 2025 Infinera. All rights reserved.

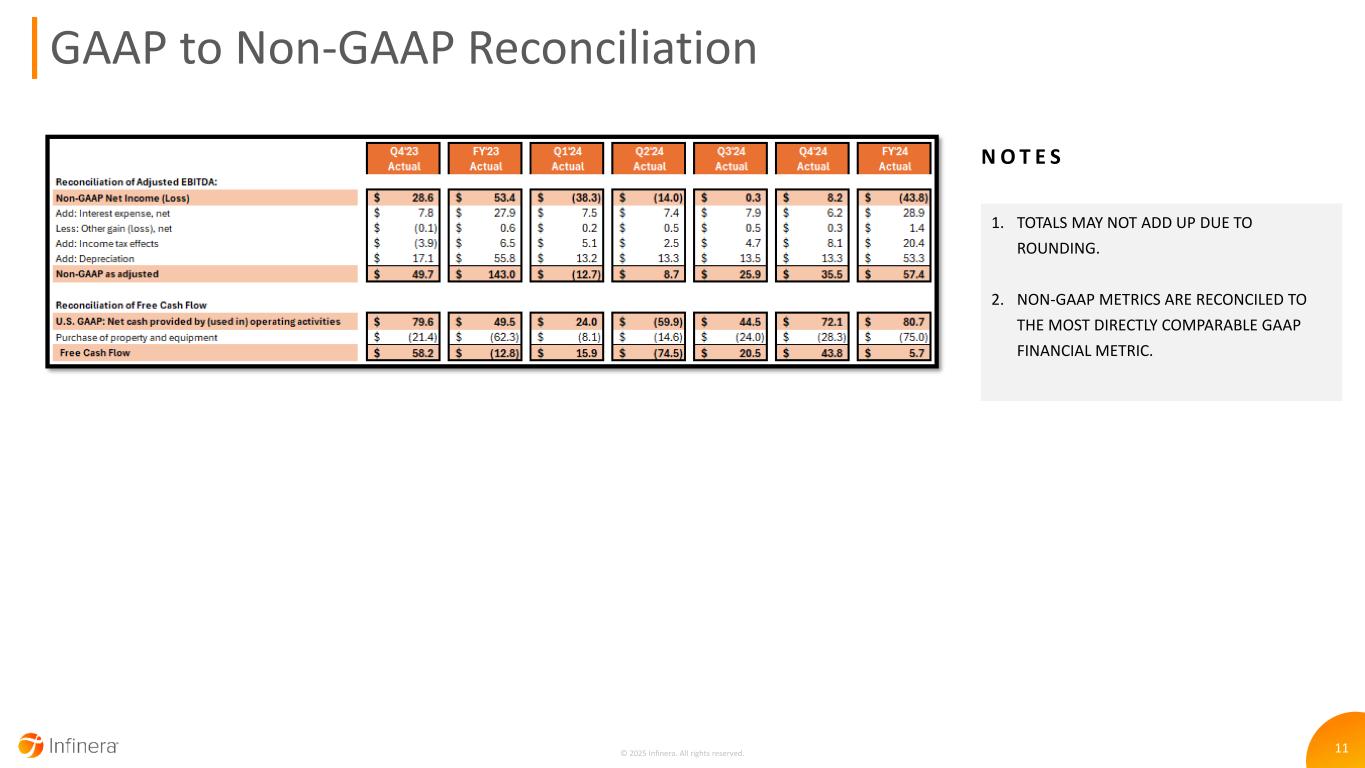

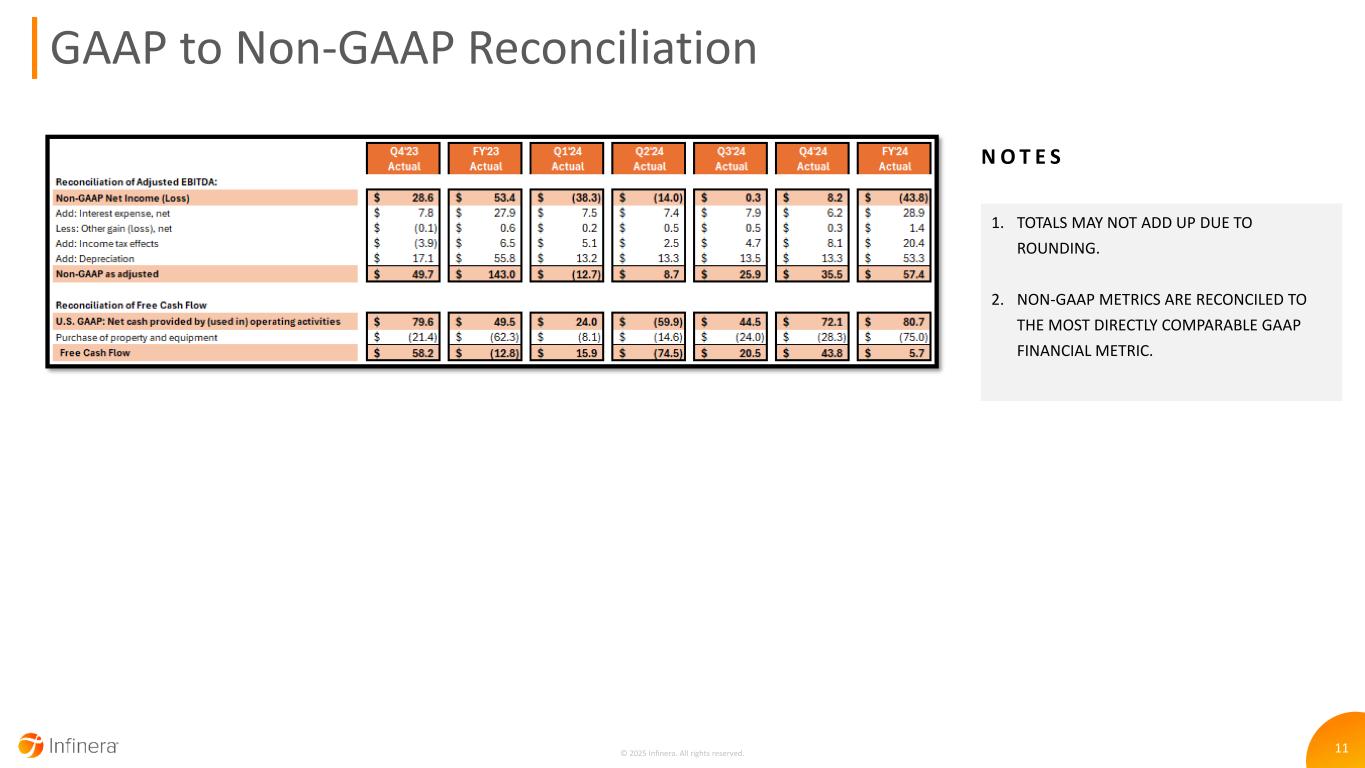

11 GAAP to Non-GAAP Reconciliation 1. TOTALS MAY NOT ADD UP DUE TO ROUNDING. 2. NON-GAAP METRICS ARE RECONCILED TO THE MOST DIRECTLY COMPARABLE GAAP FINANCIAL METRIC. N O T E S © 2025 Infinera. All rights reserved.