Q4’FY22 Earnings Call August 10, 2022

Proprietary and Confidential Property of Accuray Safe Harbor Statement Statements in this presentation (including the oral commentary that accompanies it) that are not statements of historical fact are forward-looking statements and are subject to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements in this presentation relate, but are not limited, to: expectations regarding fiscal 2023 full-year adjusted EBITDA and revenue; our positioning and strategy for accelerating revenue growth and market share; expectations regarding our strategic pillars; expectations regarding continued momentum in investment in R&D; expectations regarding market growth rates and market trends; expectations regarding new product enhancements or offerings and partnerships; our ability to expand addressable markets; and expectations related to our revenue growth and market share going forward. Forward-looking statements generally can be identified by words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “projects,” “may,” “will be,” “will continue,” and similar expressions. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from expectations. These risks and uncertainties include, but are not limited to: the effects of the COVID-19 pandemic on our business, financial condition, results of operations or cash flows; disruptions to our supply chain, including increased logistics costs; our ability to achieve widespread market acceptance of our products, including new product offerings and improvements; our ability to develop new products or enhance existing products to meet customers’ needs and compete favorably in the market; our ability to realize the expected benefits of the joint-venture and other partnerships; risks inherent in international operations; our ability to effectively manage our growth; our ability to maintain or increase our gross margins on product sales and services; delays in regulatory approvals or the development or release of new offerings; our ability to meet the covenants under our credit facilities; our ability to convert backlog to revenue; and other risks identified under the heading “Risk Factors” in our quarterly report on Form 10-Q, filed with the Securities and Exchange Commission (the “SEC”) on April 29, 2022, and as updated periodically with our other filings with the SEC. Forward-looking statements speak only as of the date the statements are made and are based on information available to Accuray at the time those statements are made and/or management’s good faith belief as of that time with respect to future events. Accuray assumes no obligation to update forward-looking statements to reflect actual performance or results, changes in assumptions or changes in other factors affecting forward-looking information, except to the extent required by applicable securities laws. Accordingly, investors should not place undue reliance on any forward-looking statements. Non-GAAP Financial Measures This presentation also contains non-GAAP financial measures. Management believes that non-GAAP financial measures provide useful supplemental information to management and investors regarding the performance of the company and facilitates a more meaningful comparison of results for current periods with previous operating results. Additionally, these non-GAAP financial measures assist management in analyzing future trends, making strategic and business decisions, and establishing internal budgets and forecasts. A reconciliation of these non-GAAP financial measures to the most directly comparable GAAP measure is provided in the Appendix. There are limitations in using these non-GAAP financial measures because they are not prepared in accordance with GAAP and may be different from non-GAAP financial measures used by other companies. These non-GAAP financial measures should not be considered in isolation or as a substitute for GAAP financial measures. Investors and potential investors should consider non-GAAP financial measures only in conjunction with the company’s consolidated financial statements prepared in accordance with GAAP. Medical Advice Disclaimer Accuray Incorporated as a medical device manufacturer cannot and does not recommend specific treatment approaches. Individual results may vary. Forward-looking statements This presentation is intended exclusively for investors. It is not intended for use in Sales or Marketing.

Executive Team Suzanne Winter President and CEO Ali Pervaiz Senior Vice President, Chief Financial Officer Sandeep Chalke Senior Vice President, Chief Commercial Officer Jean-Philippe Pignol Senior Vice President, Chief Medical and Technology Officer Jesse Chew Senior Vice President, General Counsel Mike Hoge Senior Vice President, Global Operations Patrick Spine Senior Vice President, Chief Administrative Officer Jim Dennison Senior Vice President, Global Quality & Regulatory Affairs

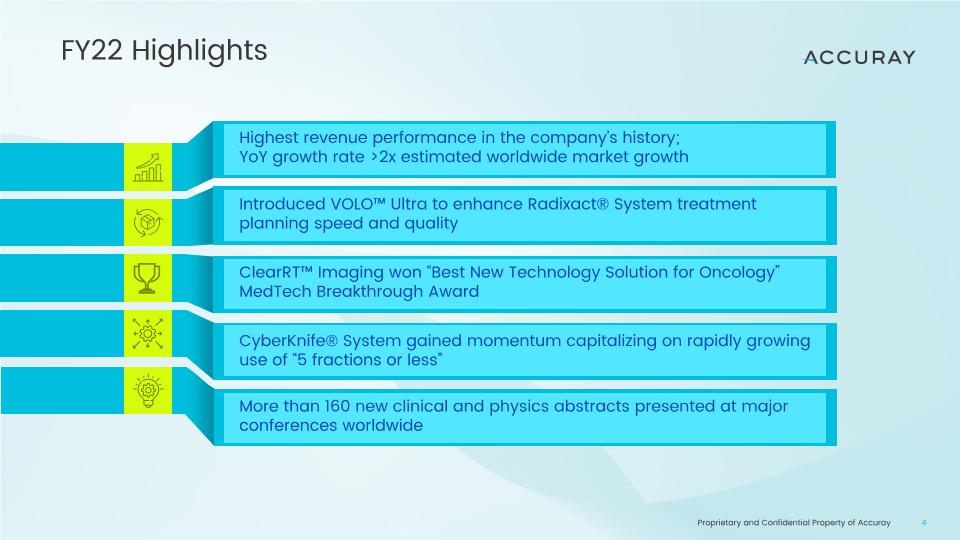

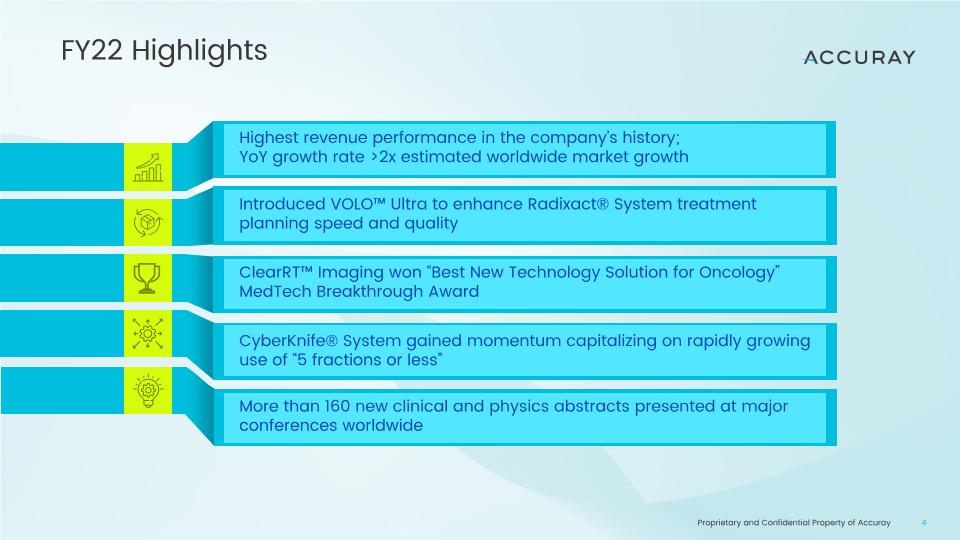

FY22 Highlights More than 160 new clinical and physics abstracts presented at major conferences worldwide CyberKnife® System gained momentum capitalizing on rapidly growing use of “5 fractions or less” ClearRT™ Imaging won “Best New Technology Solution for Oncology” MedTech Breakthrough Award Introduced VOLO™ Ultra to enhance Radixact® System treatment planning speed and quality Highest revenue performance in the company’s history;�YoY growth rate >2x estimated worldwide market growth

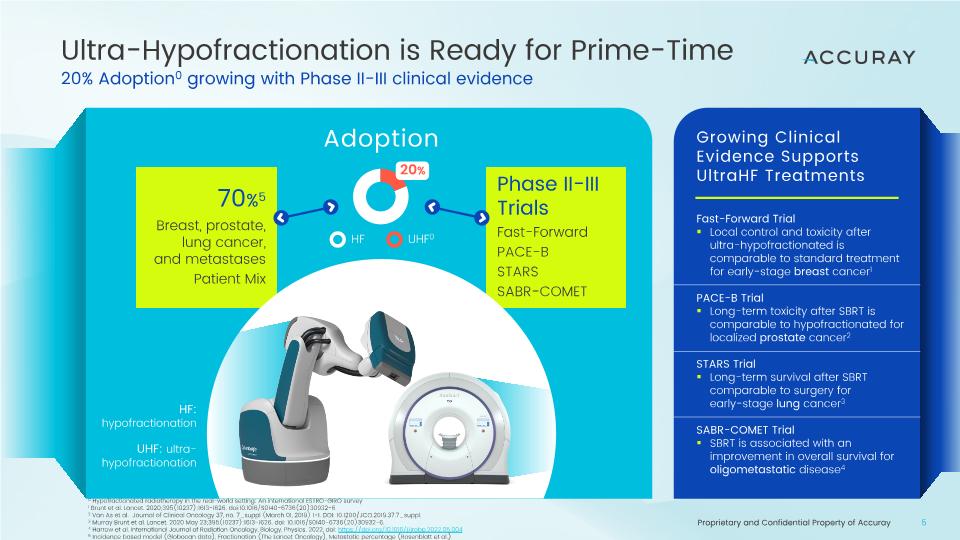

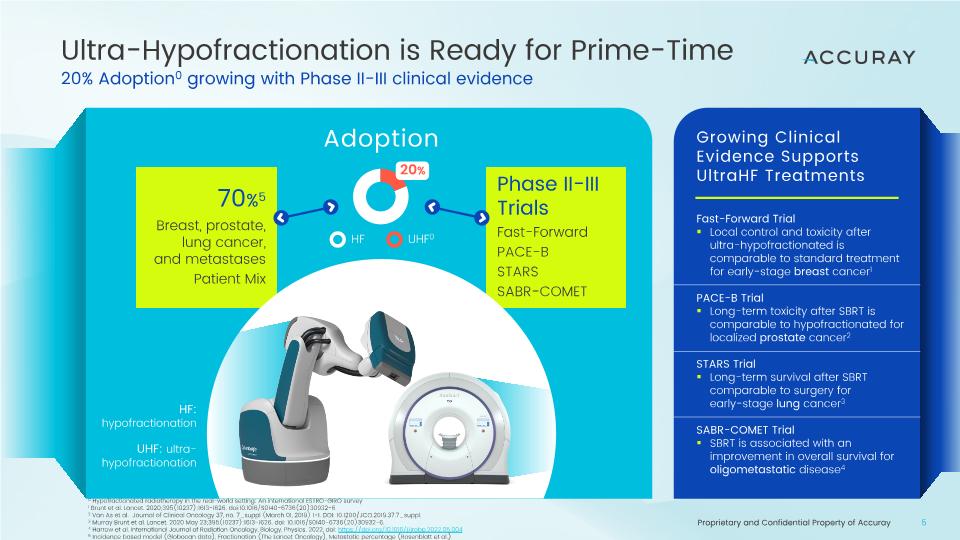

Ultra-Hypofractionation is Ready for Prime-Time 20% Adoption0 growing with Phase II-III clinical evidence 70%5 Breast, prostate, lung cancer,�and metastases Patient Mix Phase II-III Trials Fast-Forward PACE-B STARS SABR-COMET Adoption 20% HF UHF0 HF: hypofractionation UHF: ultra-hypofractionation Fast-Forward Trial Local control and toxicity after ultra-hypofractionated is comparable to standard treatment for early-stage breast cancer1 PACE-B Trial Long-term toxicity after SBRT is comparable to hypofractionated for localized prostate cancer2 STARS Trial Long-term survival after SBRT comparable to surgery for�early-stage lung cancer3 SABR-COMET Trial SBRT is associated with an improvement in overall survival for oligometastatic disease4 Growing Clinical Evidence Supports UltraHF Treatments 0 Hypofractionated radiotherapy in the real-world setting: An international ESTRO-GIRO survey 1 Brunt et al. Lancet. 2020;395(10237):1613-1626. doi:10.1016/S0140-6736(20)30932-6 2 Van As et al. Journal of Clinical Oncology 37, no. 7_suppl (March 01, 2019) 1-1. DOI: 10.1200/JCO.2019.37.7_suppl. 3 Murray Brunt et al. Lancet. 2020 May 23;395(10237):1613-1626. doi: 10.1016/S0140-6736(20)30932-6. 4 Harrow et al. International Journal of Radiation Oncology, Biology, Physics. 2022, doi: https://doi.org/10.1016/j.ijrobp.2022.05.004 5 Incidence based model (Globocan data), Fractionation (The Lancet Oncology), Metastatic percentage (Rosenblatt et al.)

Positive Press Showcasing Impact of the CyberKnife® System on Patients’ Lives 1 Printed June 30, 2022; https://www.futureofpersonalhealth.com/prostate-and-urological-health/making-prostate-cancer-easier-for-patients-and-their-families/ Coverage in Multiple�Media Outlets USA Today Insert1 Owner of Arkansas Derby & Haskell Stakes winner named horse after the�life-changing CyberKnife System�used to treat his cancer Features Rear Admiral�Garry Hall sharing his CyberKnife System treatment story Photo credit: EQUI-PHOTO Unique Robotic Platform Moving or Stationary Targets Submillimeter Accuracy 5 or Fewer Treatment Sessions CyberKnife System

ClearRT™: Rapid Adoption of New Standard of Imaging for Radixact® CT-Linac Helical fan-beam kVCT imaging 115 orders and 73 shipments since�introduction 18 months ago MedTech Breakthrough Award: “Best New Oncology Technology Solution” Highlights

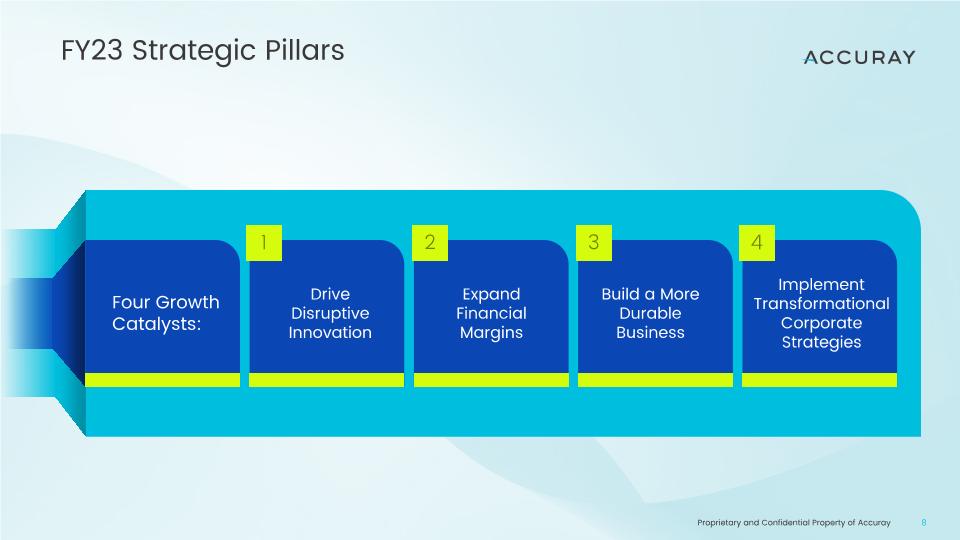

FY23 Strategic Pillars Four Growth Catalysts: Drive Disruptive Innovation Expand Financial Margins Build a More Durable Business Implement Transformational Corporate Strategies 1 2 3 4

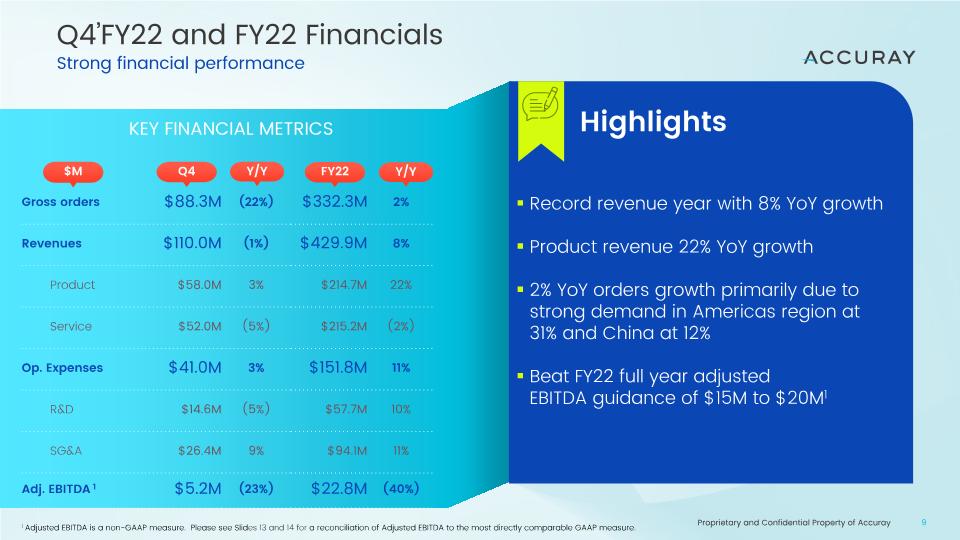

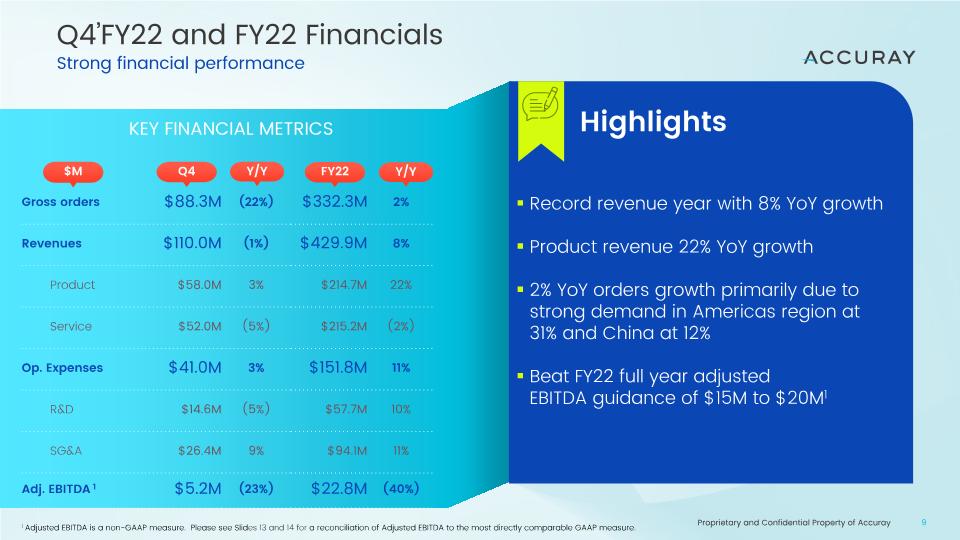

Q4’FY22 and FY22 Financials Strong financial performance Gross orders $88.3M (22%) $332.3M 2% Revenues $110.0M (1%) $429.9M 8% Product $58.0M 3% $214.7M 22% Service $52.0M (5%) $215.2M (2%) Op. Expenses $41.0M 3% $151.8M 11% R&D $14.6M (5%) $57.7M 10% SG&A $26.4M 9% $94.1M 11% Adj. EBITDA 1 $5.2M (23%) $22.8M (40%) KEY FINANCIAL METRICS $M Q4 Y/Y Highlights Record revenue year with 8% YoY growth Product revenue 22% YoY growth 2% YoY orders growth primarily due to strong demand in Americas region at�31% and China at 12% Beat FY22 full year adjusted�EBITDA guidance of $15M to $20M1 1 Adjusted EBITDA is a non-GAAP measure. Please see Slides 13 and 14 for a reconciliation of Adjusted EBITDA to the most directly comparable GAAP measure. FY22 Y/Y

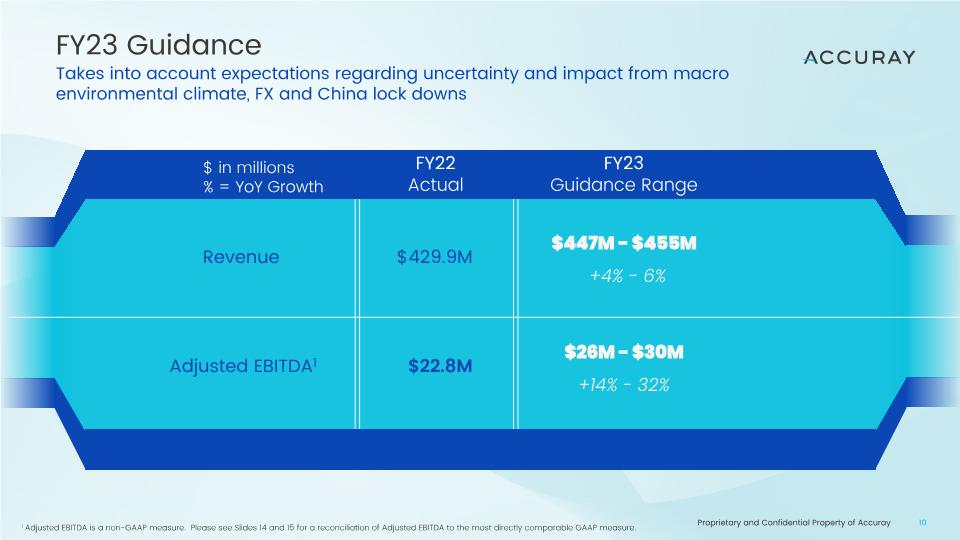

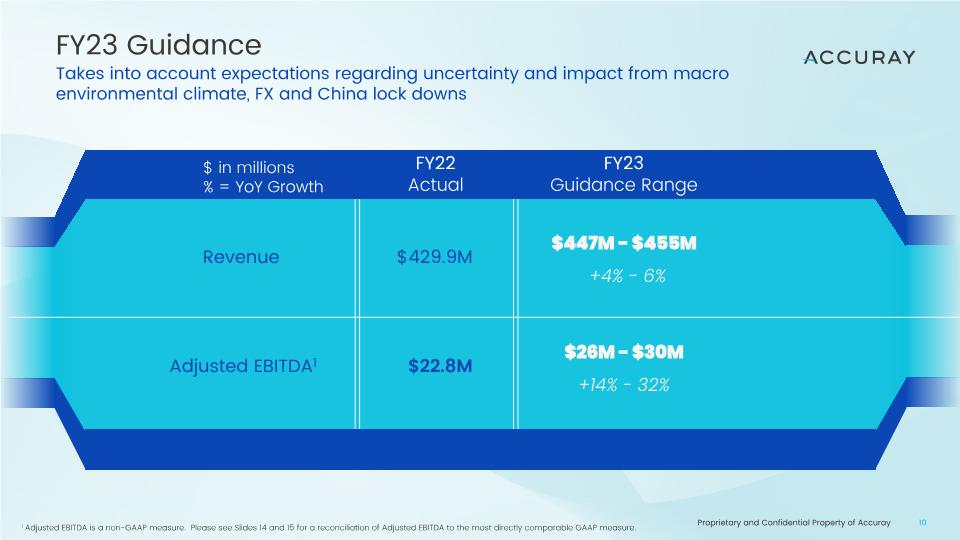

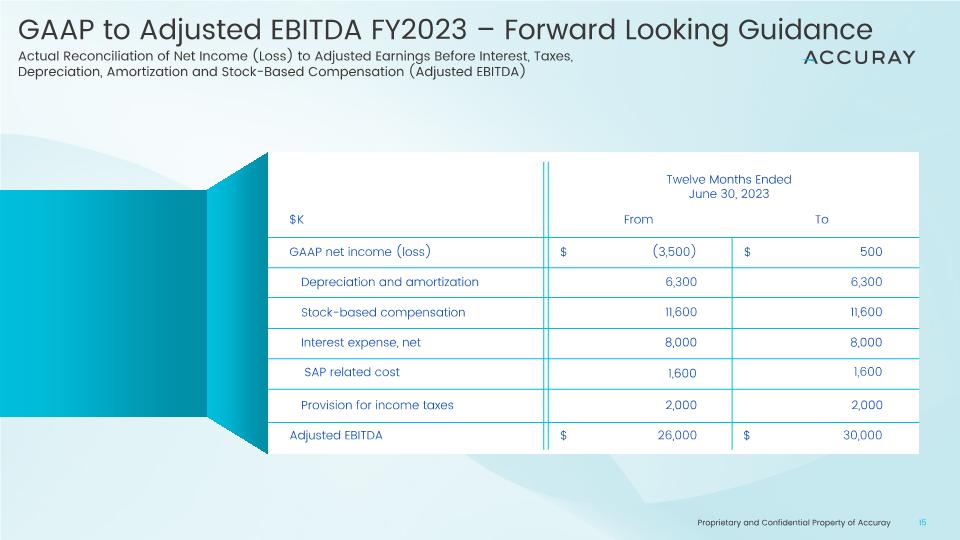

FY23 Guidance Takes into account expectations regarding uncertainty and impact from macro environmental climate, FX and China lock downs Revenue Adjusted EBITDA1 $429.9M $22.8M FY23 Guidance Range FY22 Actual $ in millions % = YoY Growth $447M - $455M +4% - 6% $26M - $30M +14% - 32% 1 Adjusted EBITDA is a non-GAAP measure. Please see Slides 14 and 15 for a reconciliation of Adjusted EBITDA to the most directly comparable GAAP measure.

In Summary Growing Momentum with Record Revenue Strongest Product Portfolio and Pipeline in Company’s History Multiple Growth Catalysts and Global Commercial Execution Focused on Margin Expansion and Free Cash Flow Positioned for Growth Faster Than the Market and Share Gain

Thank you

GAAP to Adjusted EBITDA Q4 FY2022 and Q4 FY2021 Actual Reconciliation of Net Income (Loss) to Adjusted Earnings Before Interest, Taxes, Depreciation, Amortization and Stock-Based Compensation (Adjusted EBITDA) $K GAAP net income (loss) Stock-based compensation Interest expense, net Provision for income taxes Adjusted EBITDA Depreciation and amortization Three Months Ended June 30 Three Months Ended June 30 2021 2022 $ $ $ $ (3,452) 1,275 2,694 2,028 2,027 5,166 (11,092) 1,498 2,236 3,734 400 6,724 SAP related cost 594 One-time charge related to debt refinance and convertible exchange 0 0 9,948

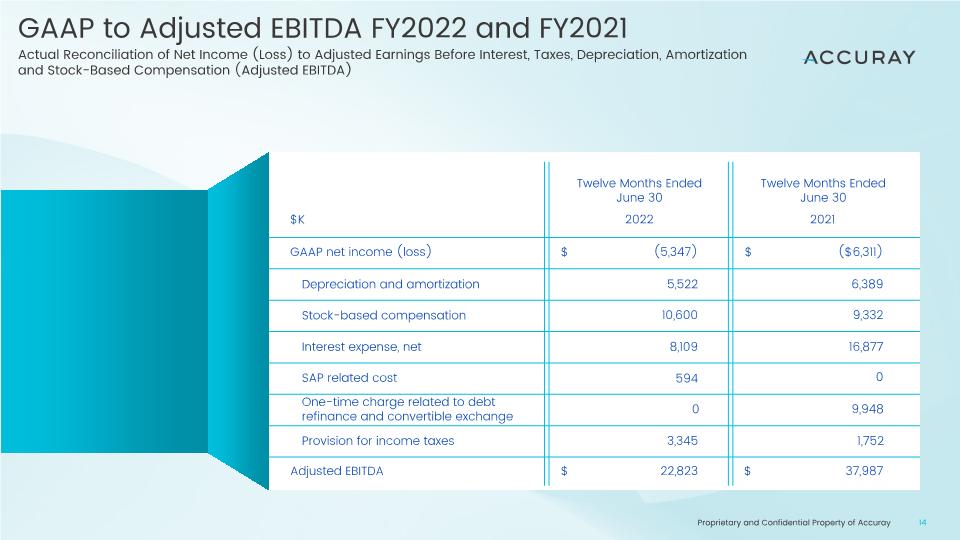

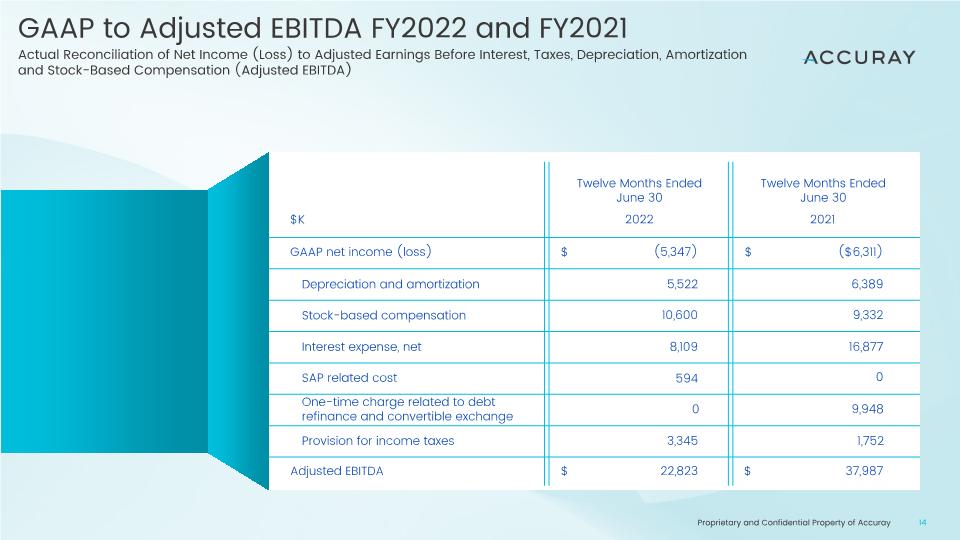

GAAP to Adjusted EBITDA FY2022 and FY2021 Actual Reconciliation of Net Income (Loss) to Adjusted Earnings Before Interest, Taxes, Depreciation, Amortization and Stock-Based Compensation (Adjusted EBITDA) $K GAAP net income (loss) Stock-based compensation Interest expense, net Provision for income taxes Adjusted EBITDA Depreciation and amortization Twelve Months Ended June 30 Twelve Months Ended June 30 2021 2022 $ $ $ $ (5,347) 5,522 10,600 8,109 3,345 22,823 ($6,311) 6,389 9,332 16,877 1,752 37,987 SAP related cost 594 One-time charge related to debt refinance and convertible exchange 0 0 9,948

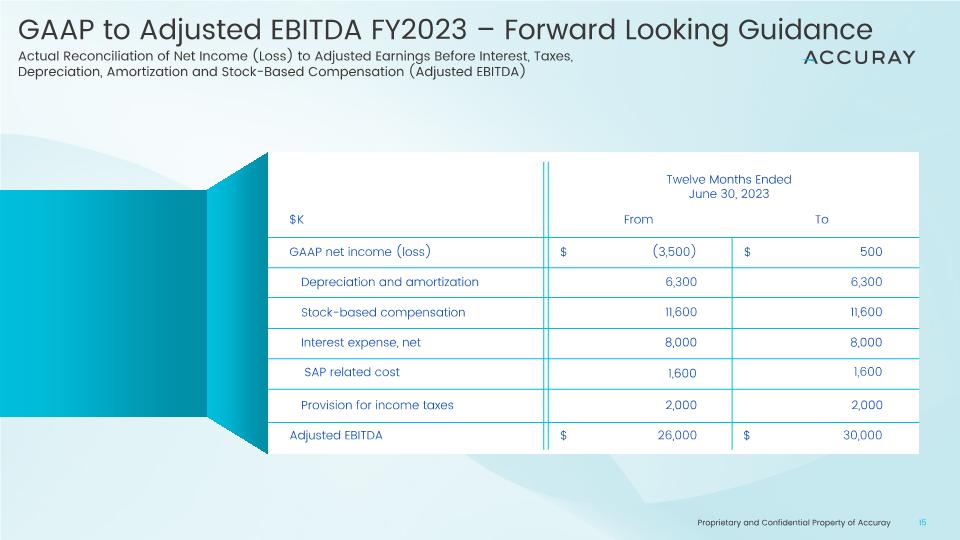

GAAP to Adjusted EBITDA FY2023 – Forward Looking Guidance Actual Reconciliation of Net Income (Loss) to Adjusted Earnings Before Interest, Taxes, Depreciation, Amortization and Stock-Based Compensation (Adjusted EBITDA) $K GAAP net income (loss) Stock-based compensation Interest expense, net Provision for income taxes Adjusted EBITDA Depreciation and amortization Twelve Months Ended June 30, 2023 To From $ $ $ $ (3,500) 6,300 11,600 8,000 2,000 26,000 500 6,300 11,600 8,000 2,000 30,000 SAP related cost 1,600 1,600