Q2’FY23 Earnings Call February 1, 2023

Proprietary and Confidential Property of Accuray Safe Harbor Statement Statements in this presentation (including the oral commentary that accompanies it) that are not statements of historical fact are forward-looking statements and are subject to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements in this presentation relate, but are not limited, to: expectations regarding fiscal 2023 full-year adjusted EBITDA and revenue; our positioning and strategy for accelerating revenue growth and market share; expectations regarding our strategic pillars; expectations regarding growing momentum in orders; expectations regarding market growth rates and market trends; expectations regarding new product enhancements or offerings and partnerships; our ability to expand addressable markets; expectations regarding our installed base; expectations related to our China joint venture; and expectations related to our revenue growth and market share going forward. Forward-looking statements generally can be identified by words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “projects,” “may,” “will be,” “will continue,” and similar expressions. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from expectations. These risks and uncertainties include, but are not limited to: the effects of the COVID-19 pandemic on our business, financial condition, results of operations or cash flows; disruptions to our supply chain, including increased logistics costs; our ability to achieve widespread market acceptance of our products, including new product offerings and improvements; our ability to develop new products or enhance existing products to meet customers’ needs and compete favorably in the market; our ability to realize the expected benefits of the joint-venture and other partnerships; risks inherent in international operations; our ability to effectively manage our growth; our ability to maintain or increase our gross margins on product sales and services; delays in regulatory approvals or the development or release of new offerings; our ability to meet the covenants under our credit facilities; our ability to convert backlog to revenue; and other risks identified under the heading “Risk Factors” in our quarterly report on Form 10-Q, filed with the Securities and Exchange Commission (the “SEC”) on November 3, 2022, and as updated periodically with our other filings with the SEC. Forward-looking statements speak only as of the date the statements are made and are based on information available to Accuray at the time those statements are made and/or management’s good faith belief as of that time with respect to future events. Accuray assumes no obligation to update forward-looking statements to reflect actual performance or results, changes in assumptions or changes in other factors affecting forward-looking information, except to the extent required by applicable securities laws. Accordingly, investors should not place undue reliance on any forward-looking statements. Non-GAAP Financial Measures This presentation also contains non-GAAP financial measures. Management believes that non-GAAP financial measures provide useful supplemental information to management and investors regarding the performance of the company and facilitates a more meaningful comparison of results for current periods with previous operating results. Additionally, these non-GAAP financial measures assist management in analyzing future trends, making strategic and business decisions, and establishing internal budgets and forecasts. A reconciliation of these non-GAAP financial measures to the most directly comparable GAAP measure is provided in the Appendix. There are limitations in using these non-GAAP financial measures because they are not prepared in accordance with GAAP and may be different from non-GAAP financial measures used by other companies. These non-GAAP financial measures should not be considered in isolation or as a substitute for GAAP financial measures. Investors and potential investors should consider non-GAAP financial measures only in conjunction with the company’s consolidated financial statements prepared in accordance with GAAP. Medical Advice Disclaimer Accuray Incorporated as a medical device manufacturer cannot and does not recommend specific treatment approaches. Individual results may vary. Forward-looking Statements This presentation is intended exclusively for investors. It is not intended for use in Sales or Marketing.

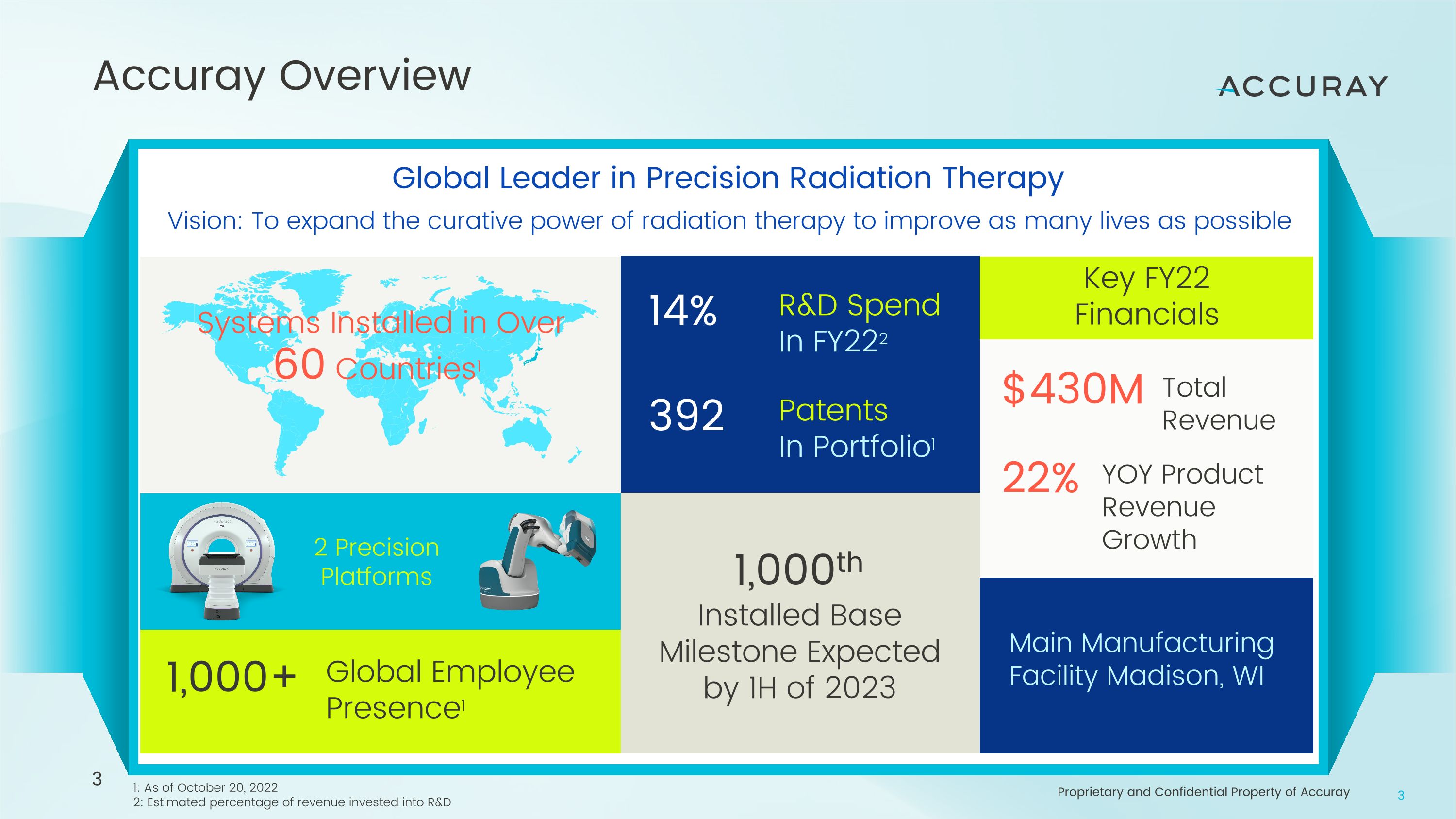

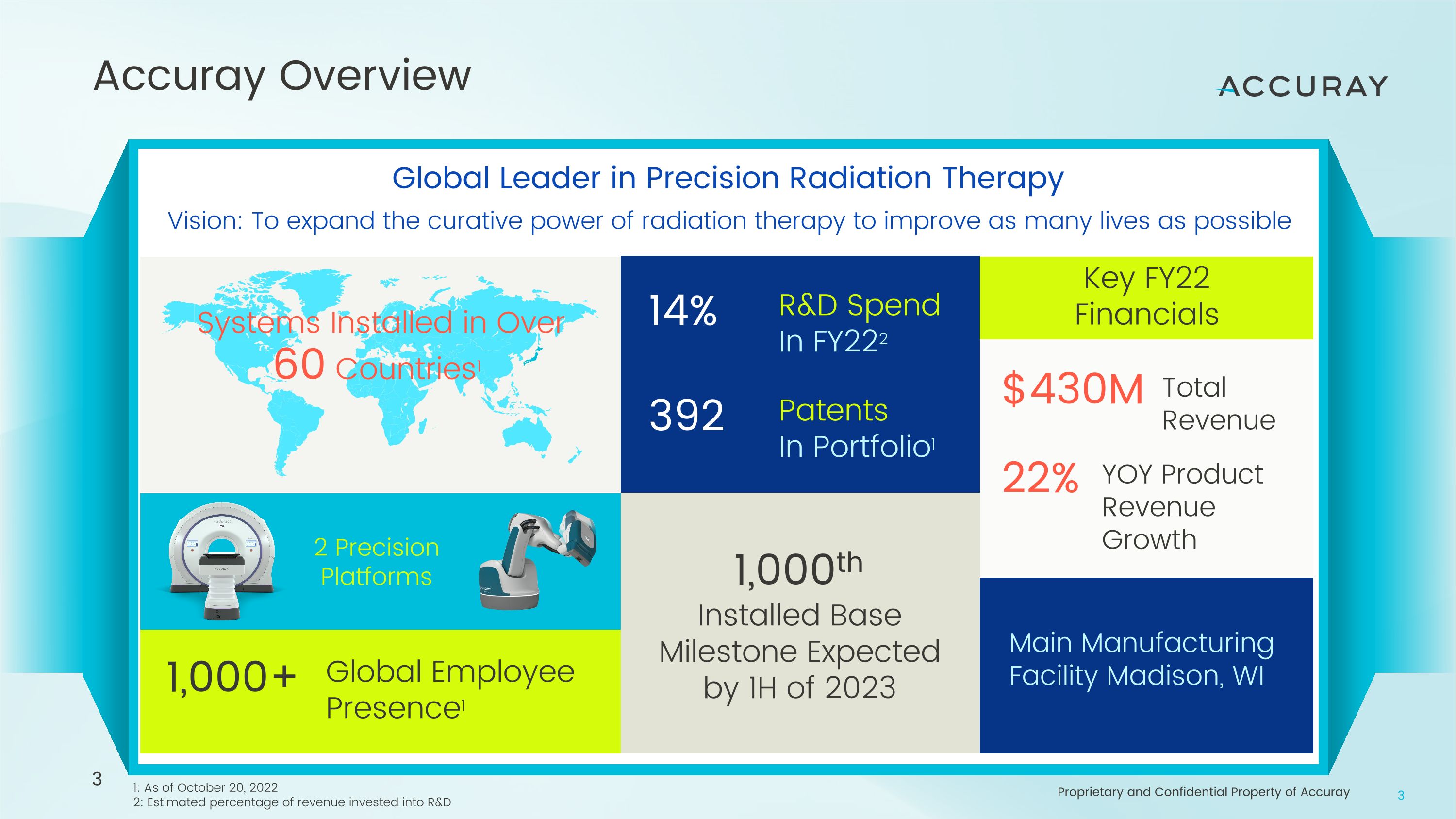

Accuray Overview Global Leader in Precision Radiation Therapy Vision: To expand the curative power of radiation therapy to improve as many lives as possible Systems Installed in Over 60 Countries1 1: As of October 20, 2022 2: Estimated percentage of revenue invested into R&D Installed Base Milestone Expected by 1H of 2023 Main Manufacturing Facility Madison, WI 22% $430M R&D Spend In FY222 Patents In Portfolio1 14% 392 Key FY22 Financials Total Revenue YOY Product Revenue Growth 1,000th 1,000+ Global Employee Presence1 3 2 Precision Platforms Proprietary and Confidential Property of Accuray 3

Suzanne Winter President and CEO Ali Pervaiz Senior Vice President, Chief Financial Officer Sandeep Chalke Senior Vice President, Chief Commercial Officer Jesse Chew Senior Vice President, General Counsel Mike Hoge Senior Vice President, Global Operations Patrick Spine Senior Vice President, Chief Administrative Officer Jim Dennison Senior Vice President, Global Quality & Regulatory Affairs Accuray Executive Leadership Team 4

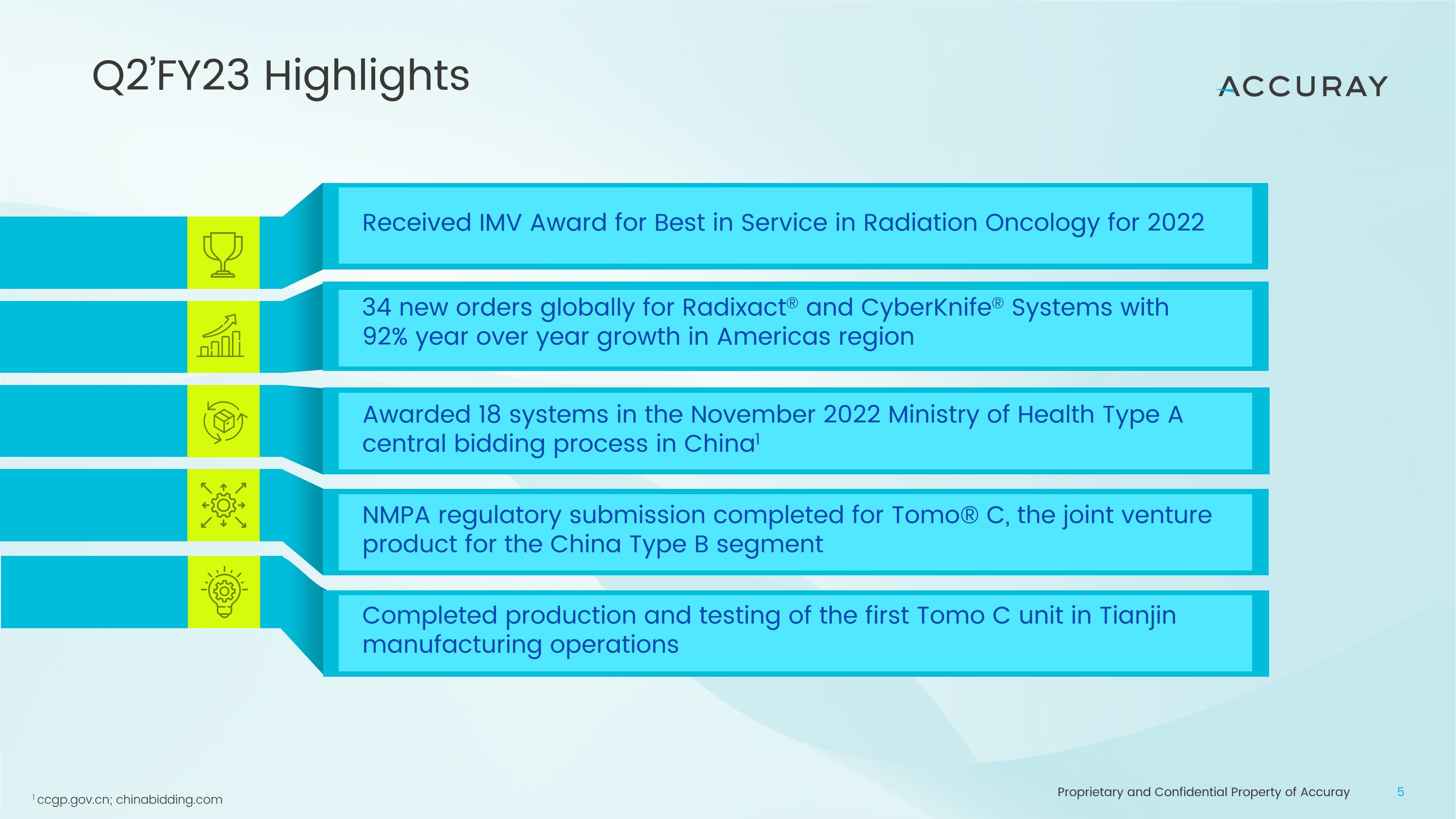

Q2’FY23 Highlights Accuray - Genolier Innovation Hub partnership NMPA regulatory submission completed for Tomo® C, the joint venture product for the China Type B segment Awarded 18 systems in the November 2022 Ministry of Health Type A�central bidding process in China1 Received IMV Award for Best in Service in Radiation Oncology for 2022 Completed production and testing of the first Tomo C unit in Tianjin manufacturing operations 34 new orders globally for Radixact® and CyberKnife® Systems with�92% year over year growth in Americas region 1 ccgp.gov.cn; chinabidding.com

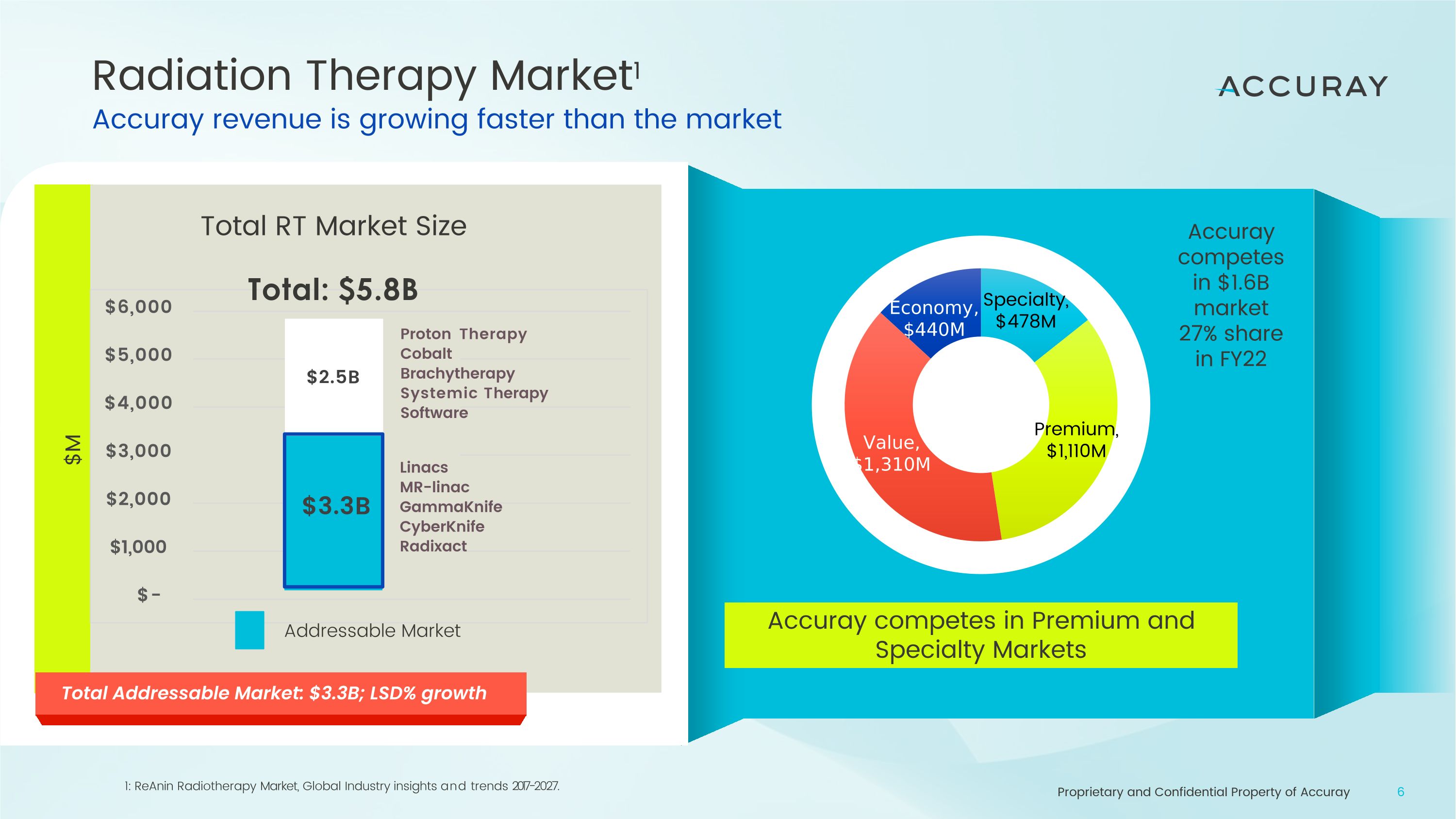

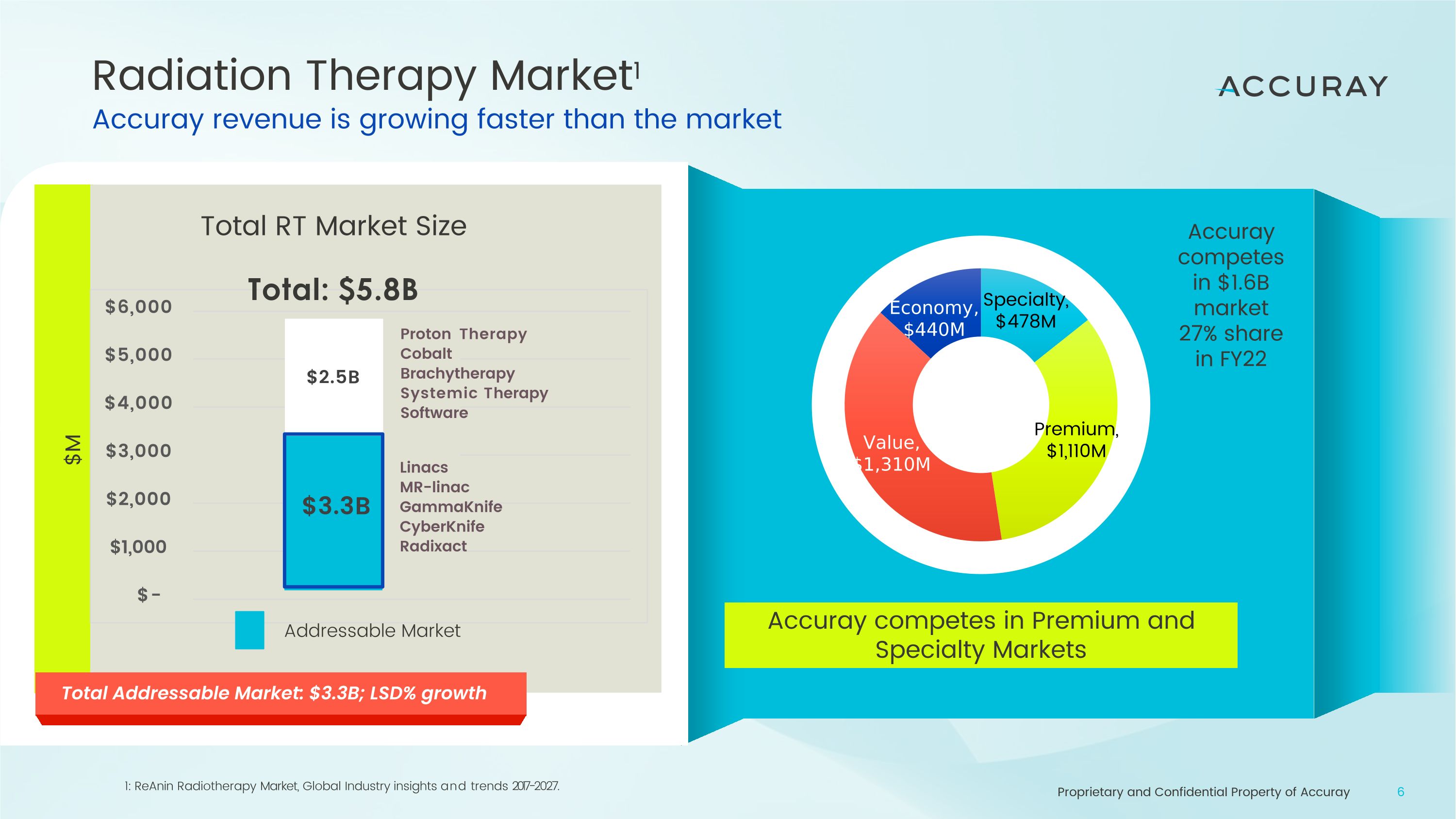

Radiation Therapy Market1 Accuray revenue is growing faster than the market 1: ReAnin Radiotherapy Market, Global Industry insights and trends 2017-2027. $3.3B $2.5B $- $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 Proton Therapy Cobalt Brachytherapy Systemic Therapy Software Total: $5.8B $M Accuray competes in Premium and Specialty Markets Proprietary and Confidential Property of Accuray Accuray competes in $1.6B market�27% share�in FY22 Total Addressable Market: $3.3B; LSD% growth Linacs MR-linac GammaKnife CyberKnife Radixact Addressable Market Total RT Market Size 6

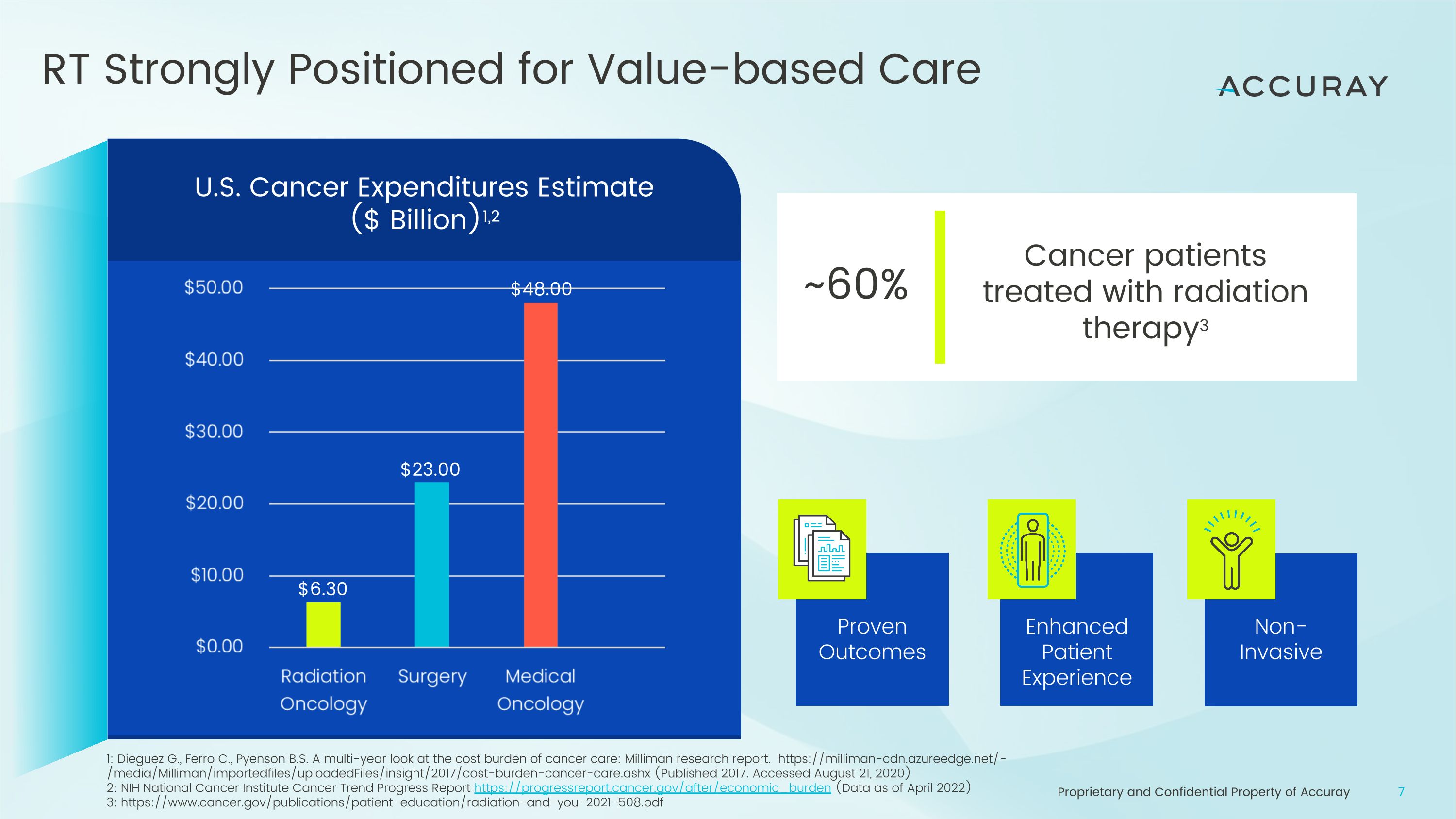

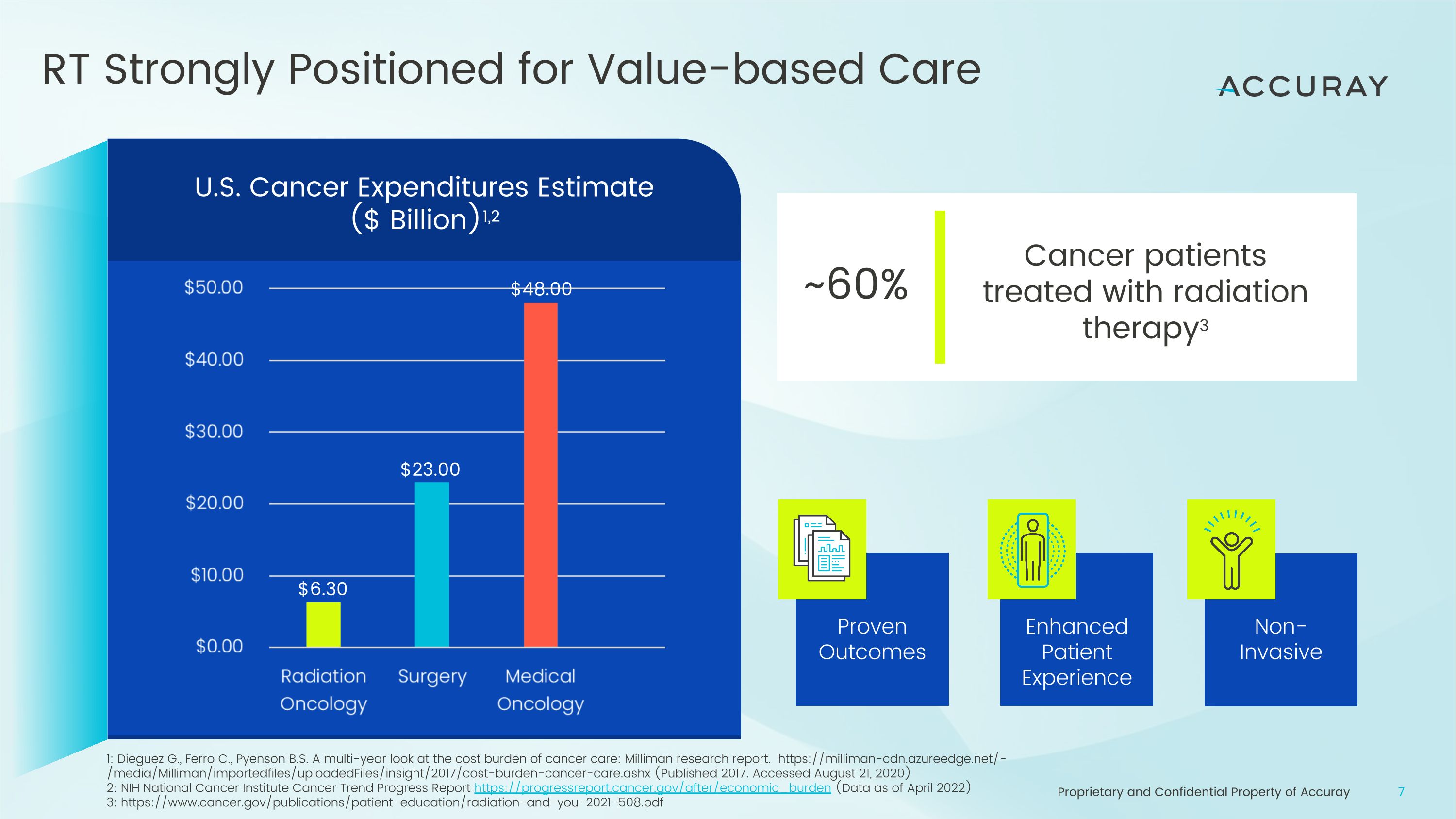

RT Strongly Positioned for Value-based Care U.S. Cancer Expenditures Estimate�($ Billion)1,2 1: Dieguez G., Ferro C., Pyenson B.S. A multi-year look at the cost burden of cancer care: Milliman research report. https://milliman-cdn.azureedge.net/-/media/Milliman/importedfiles/uploadedFiles/insight/2017/cost-burden-cancer-care.ashx (Published 2017. Accessed August 21, 2020) 2: NIH National Cancer Institute Cancer Trend Progress Report https://progressreport.cancer.gov/after/economic_burden (Data as of April 2022) 3: https://www.cancer.gov/publications/patient-education/radiation-and-you-2021-508.pdf Proven Outcomes Enhanced Patient Experience Non-Invasive Cancer patients treated with radiation therapy3 ~60% $6.30 $23.00 $48.00 7

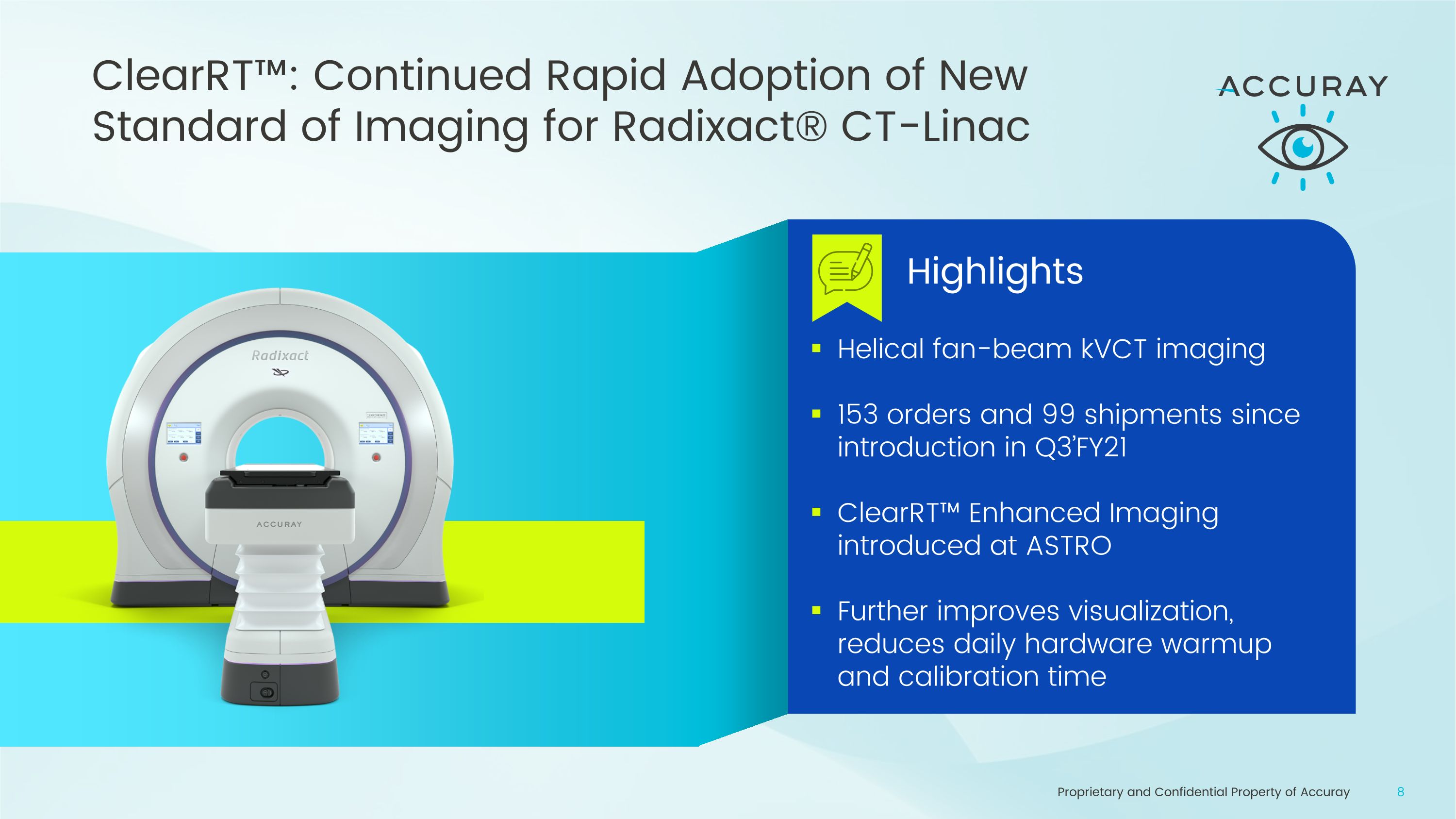

ClearRT™: Continued Rapid Adoption of New Standard of Imaging for Radixact® CT-Linac Helical fan-beam kVCT imaging 153 orders and 99 shipments since introduction in Q3’FY21 ClearRT™ Enhanced Imaging introduced at ASTRO Further improves visualization, reduces daily hardware warmup�and calibration time Highlights

Strategic Areas of Focus Proprietary and Confidential Property of Accuray Drive market share through disruptive innovation Expand service business Transform through strategic partnerships Drive margin and profitability initiatives 9

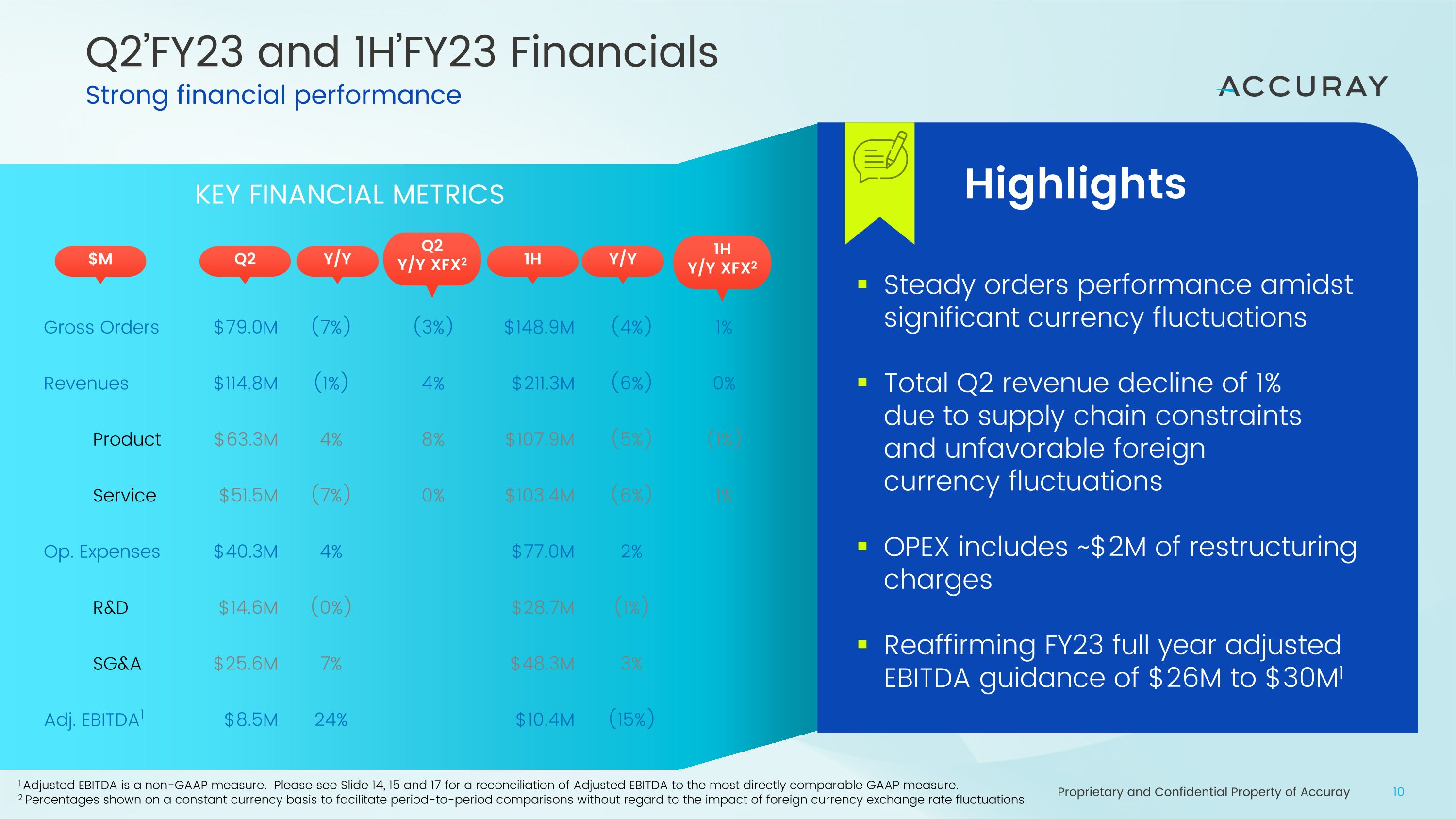

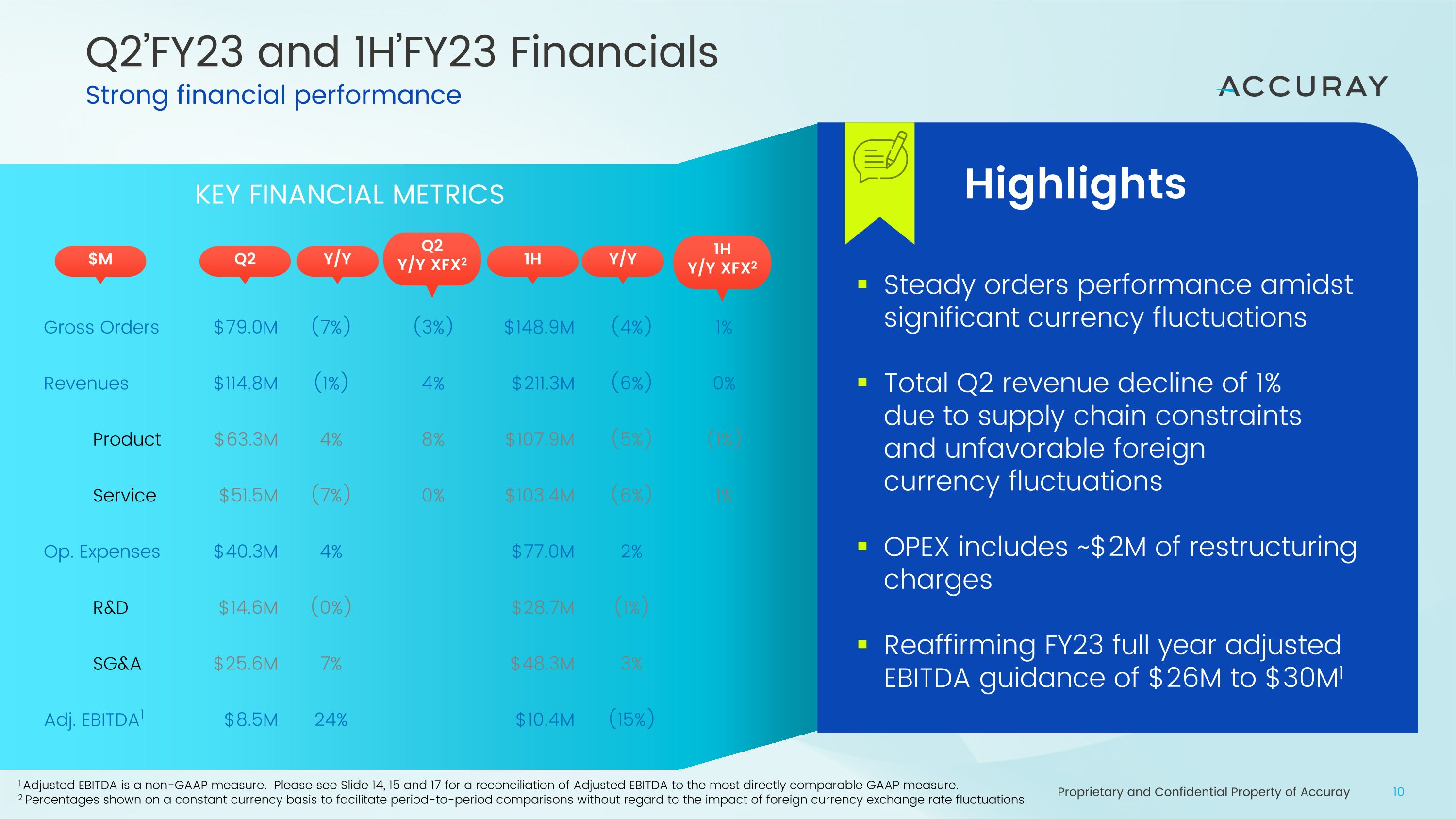

Q2’FY23 and 1H’FY23 Financials Strong financial performance KEY FINANCIAL METRICS $M Q2 Y/Y Highlights Steady orders performance amidst significant currency fluctuations Total Q2 revenue decline of 1%�due to supply chain constraints�and unfavorable foreign�currency fluctuations OPEX includes ~$2M of restructuring charges Reaffirming FY23 full year adjusted EBITDA guidance of $26M to $30M1 1 Adjusted EBITDA is a non-GAAP measure. Please see Slide 14, 15 and 17 for a reconciliation of Adjusted EBITDA to the most directly comparable GAAP measure. 2 Percentages shown on a constant currency basis to facilitate period-to-period comparisons without regard to the impact of foreign currency exchange rate fluctuations. 1H Y/Y Q2�Y/Y XFX2 1H�Y/Y XFX2 Gross Orders $79.0M (7%) (3%) $148.9M (4%) 1% Revenues $114.8M (1%) 4% $211.3M (6%) 0% Product $63.3M 4% 8% $107.9M (5%) (1%) Service $51.5M (7%) 0% $103.4M (6%) 1% Op. Expenses $40.3M 4% $77.0M 2% R&D $14.6M (0%) $28.7M (1%) SG&A $25.6M 7% $48.3M 3% Adj. EBITDA1 $8.5M 24% $10.4M (15%)

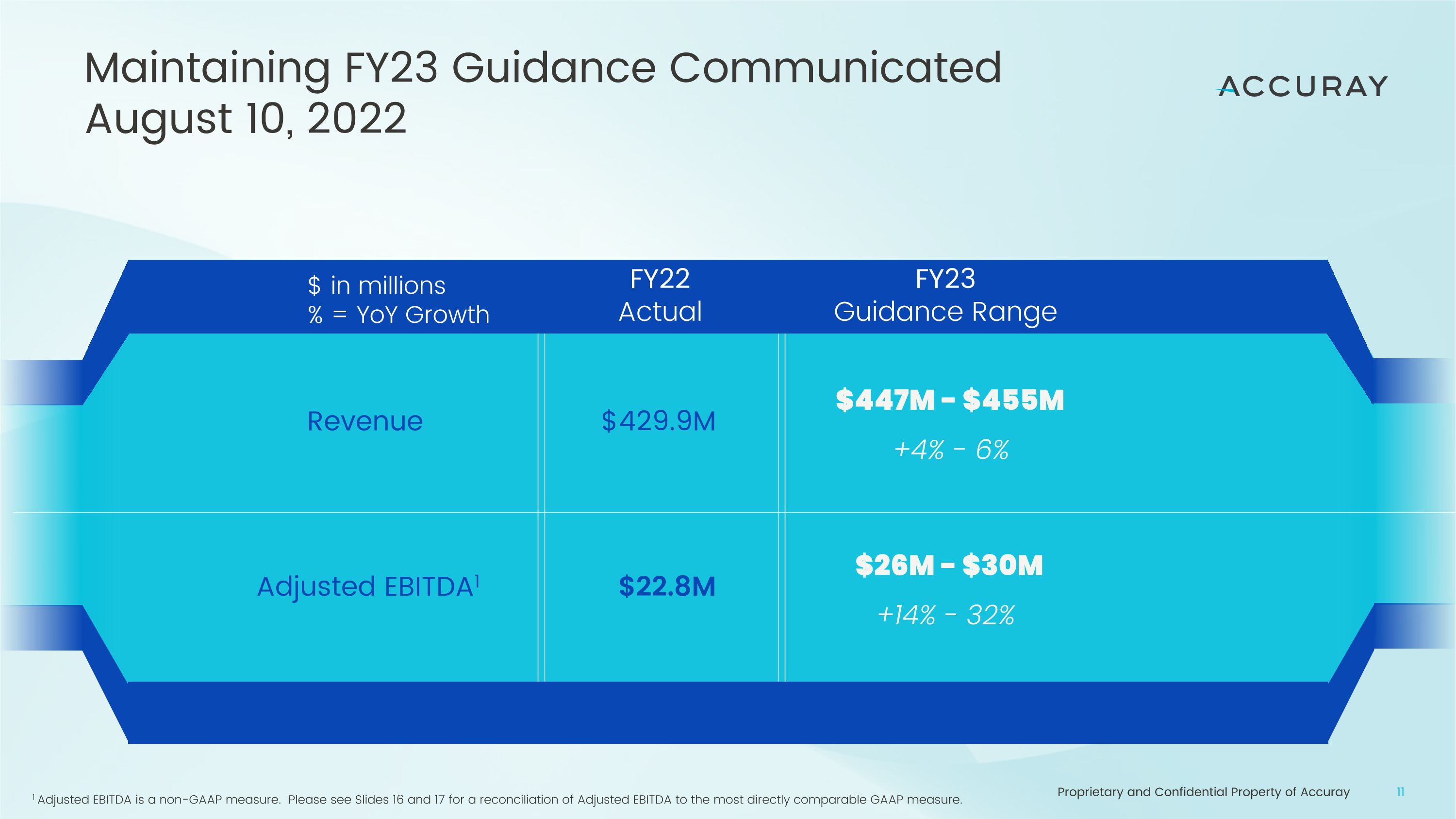

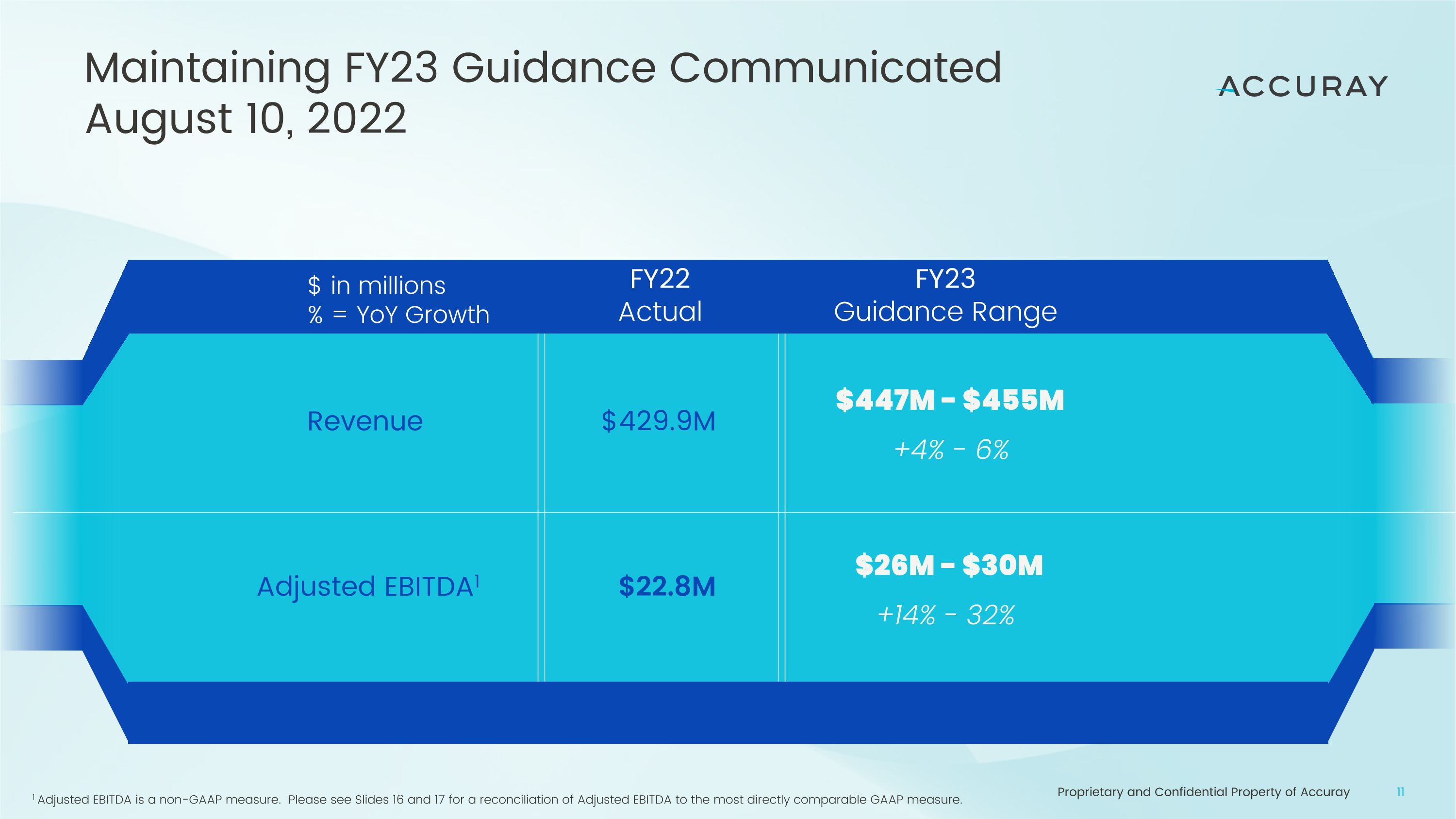

Maintaining FY23 Guidance Communicated�August 10, 2022 Revenue Adjusted EBITDA1 $429.9M $22.8M FY23 Guidance Range FY22 Actual $ in millions % = YoY Growth $447M - $455M +4% - 6% $26M - $30M +14% - 32% 1 Adjusted EBITDA is a non-GAAP measure. Please see Slides 16 and 17 for a reconciliation of Adjusted EBITDA to the most directly comparable GAAP measure.

In Summary Growing momentum with�34 orders in the quarter Strongest product portfolio and pipeline in company’s history Multiple growth catalysts and global commercial execution Focused on margin expansion and free cash flow Positioned for Long-Term Revenue Growth and Market Share Gain

Thank you

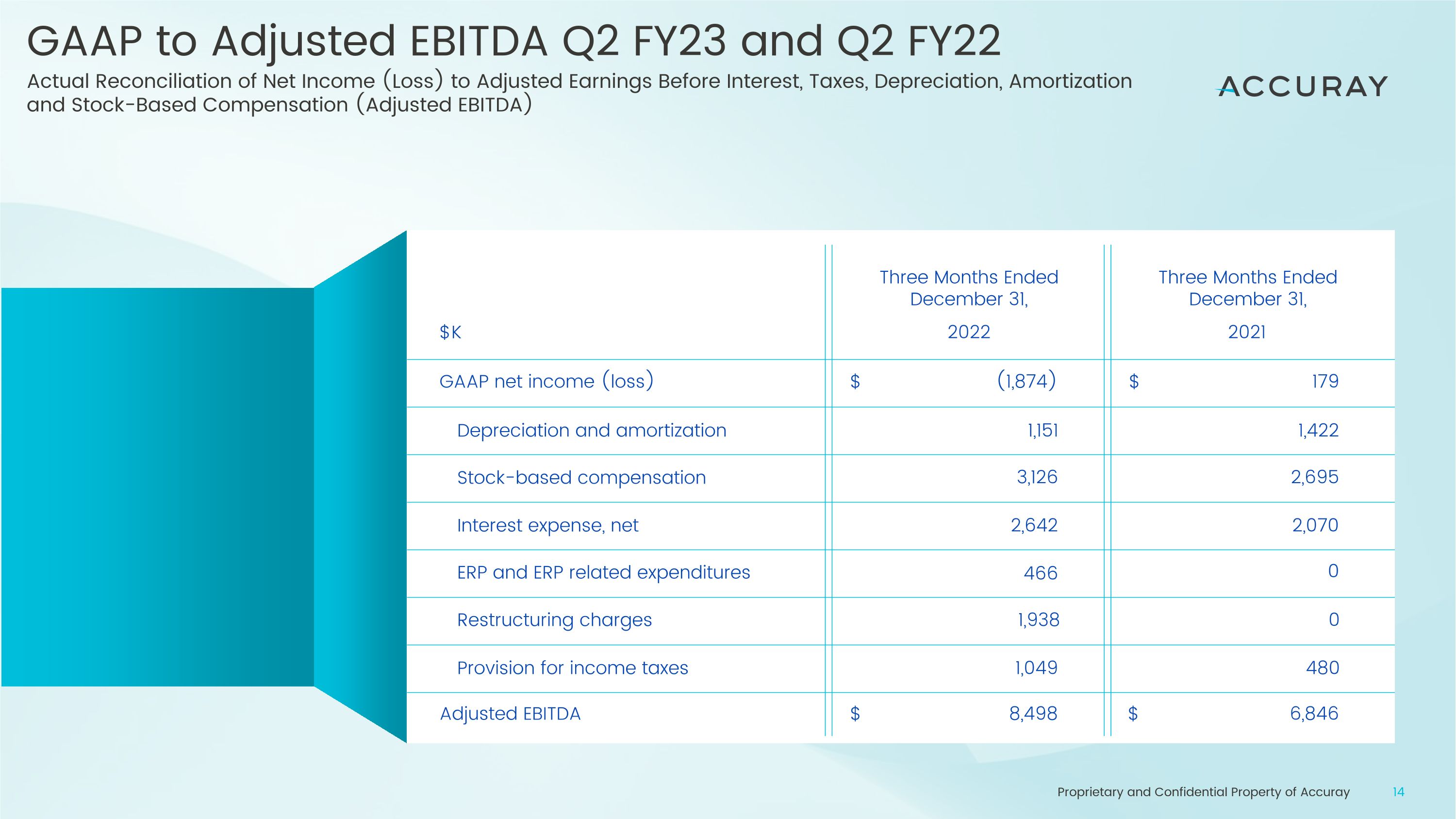

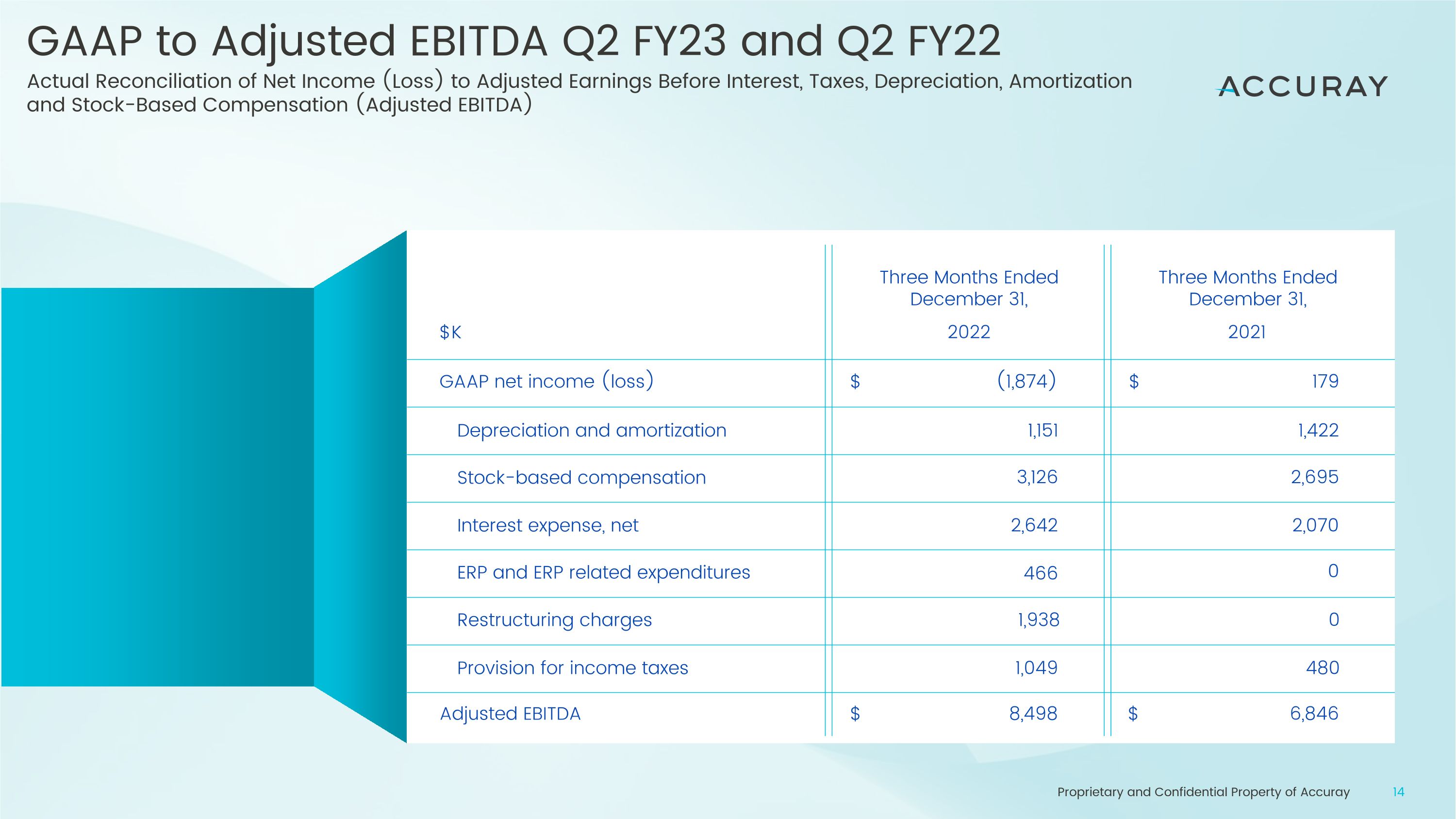

$K GAAP net income (loss) Stock-based compensation Interest expense, net Provision for income taxes Adjusted EBITDA Depreciation and amortization Three Months Ended December 31, Three Months Ended December 31, 2021 2022 $ $ $ $ (1,874) 1,151 3,126 2,642 1,049 8,498 179 1,422 2,695 2,070 480 6,846 ERP and ERP related expenditures 466 Restructuring charges 1,938 0 0 GAAP to Adjusted EBITDA Q2 FY23 and Q2 FY22 Actual Reconciliation of Net Income (Loss) to Adjusted Earnings Before Interest, Taxes, Depreciation, Amortization and Stock-Based Compensation (Adjusted EBITDA)

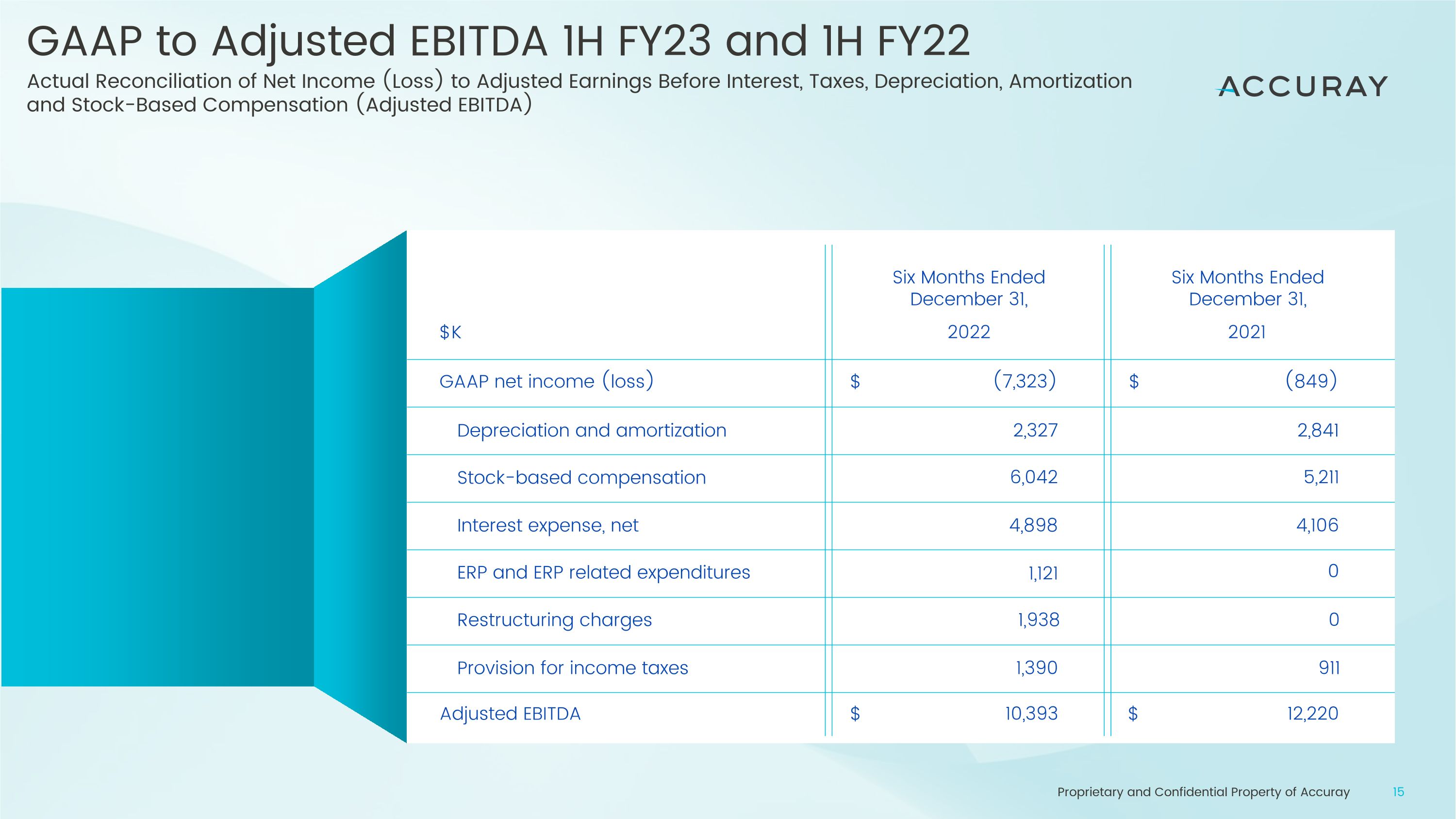

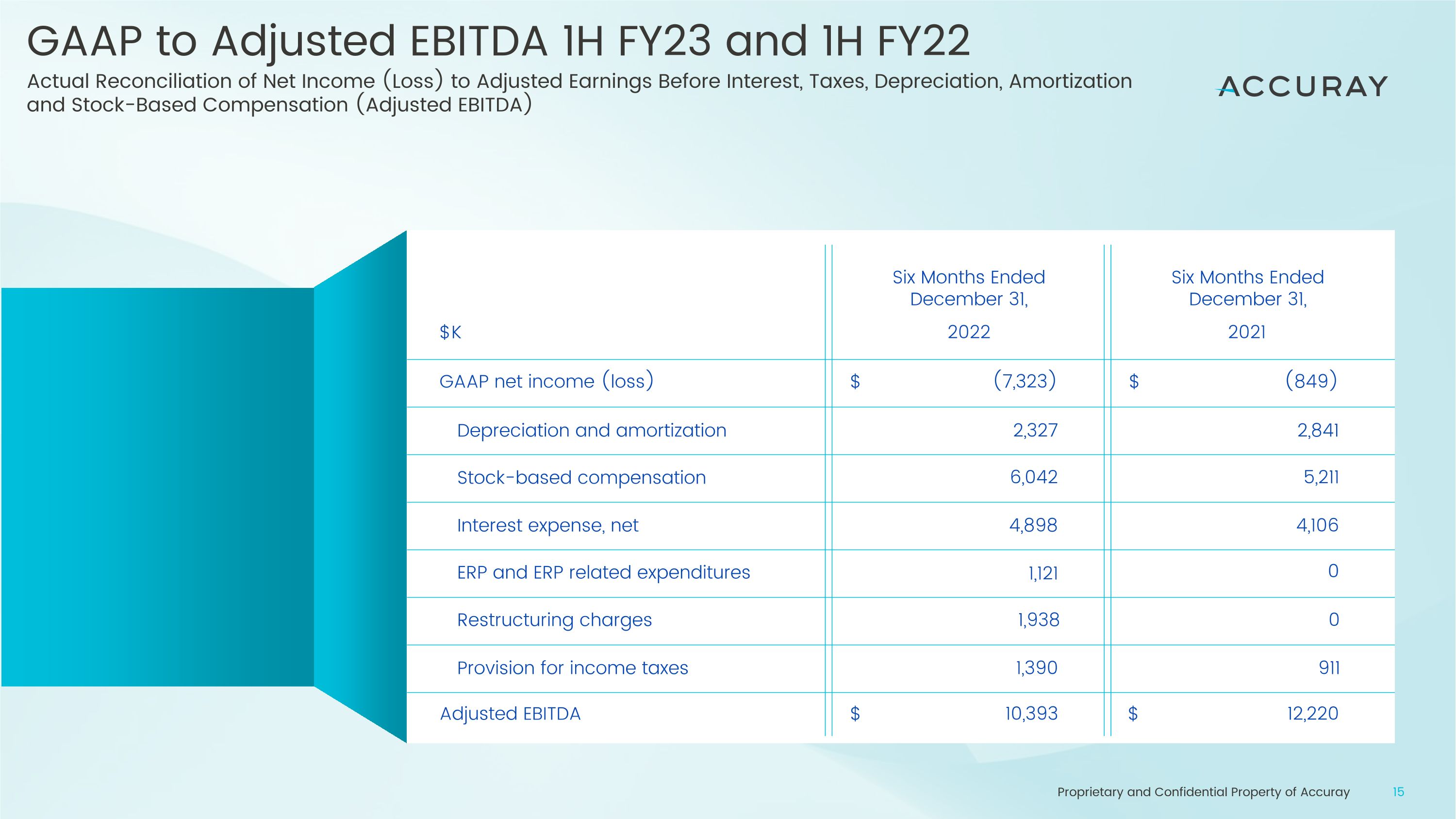

$K GAAP net income (loss) Stock-based compensation Interest expense, net Provision for income taxes Adjusted EBITDA Depreciation and amortization Six Months Ended December 31, Six Months Ended December 31, 2021 2022 $ $ $ $ (7,323) 2,327 6,042 4,898 1,390 10,393 (849) 2,841 5,211 4,106 911 12,220 ERP and ERP related expenditures 1,121 Restructuring charges 1,938 0 0 GAAP to Adjusted EBITDA 1H FY23 and 1H FY22 Actual Reconciliation of Net Income (Loss) to Adjusted Earnings Before Interest, Taxes, Depreciation, Amortization and Stock-Based Compensation (Adjusted EBITDA)

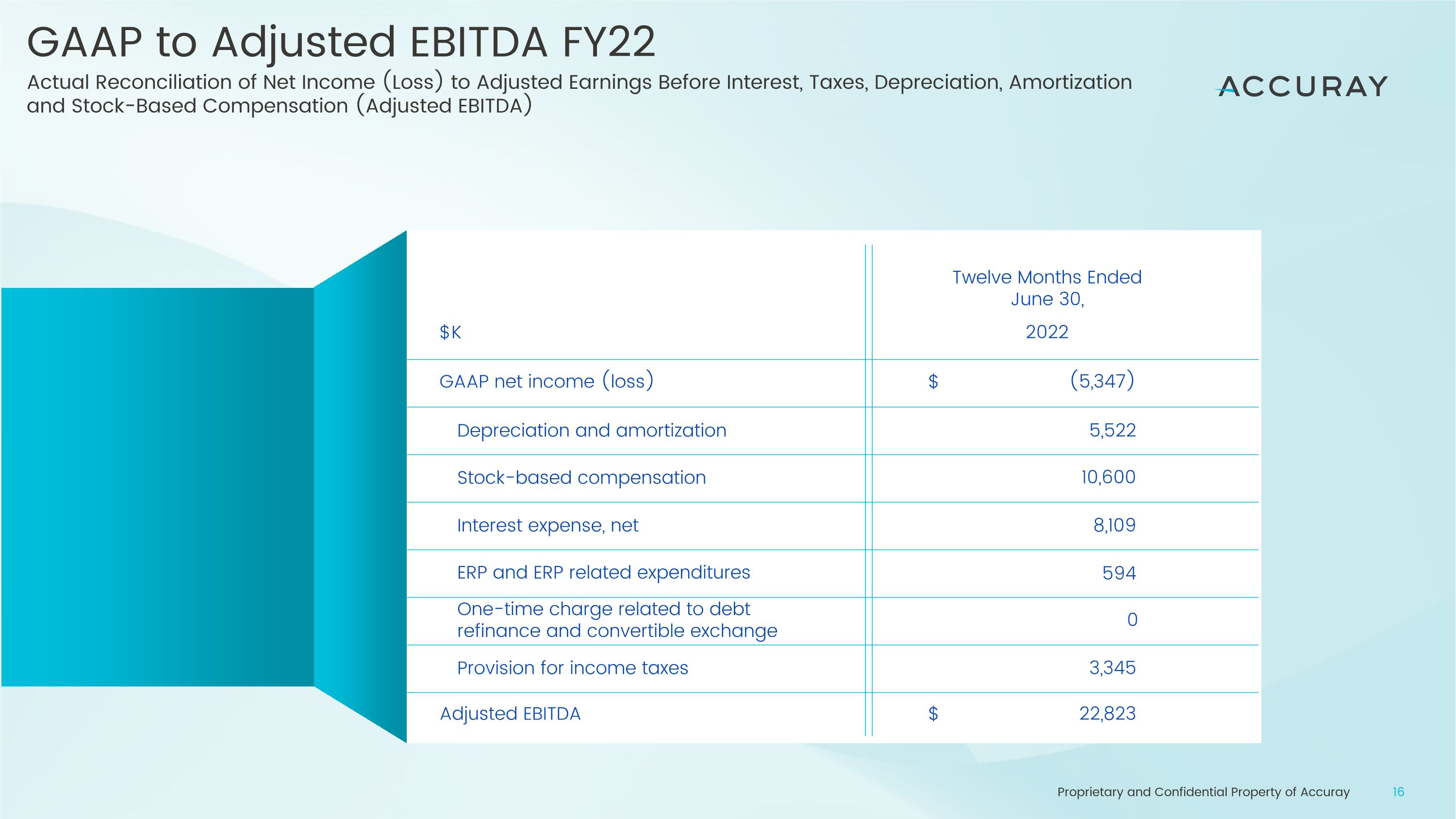

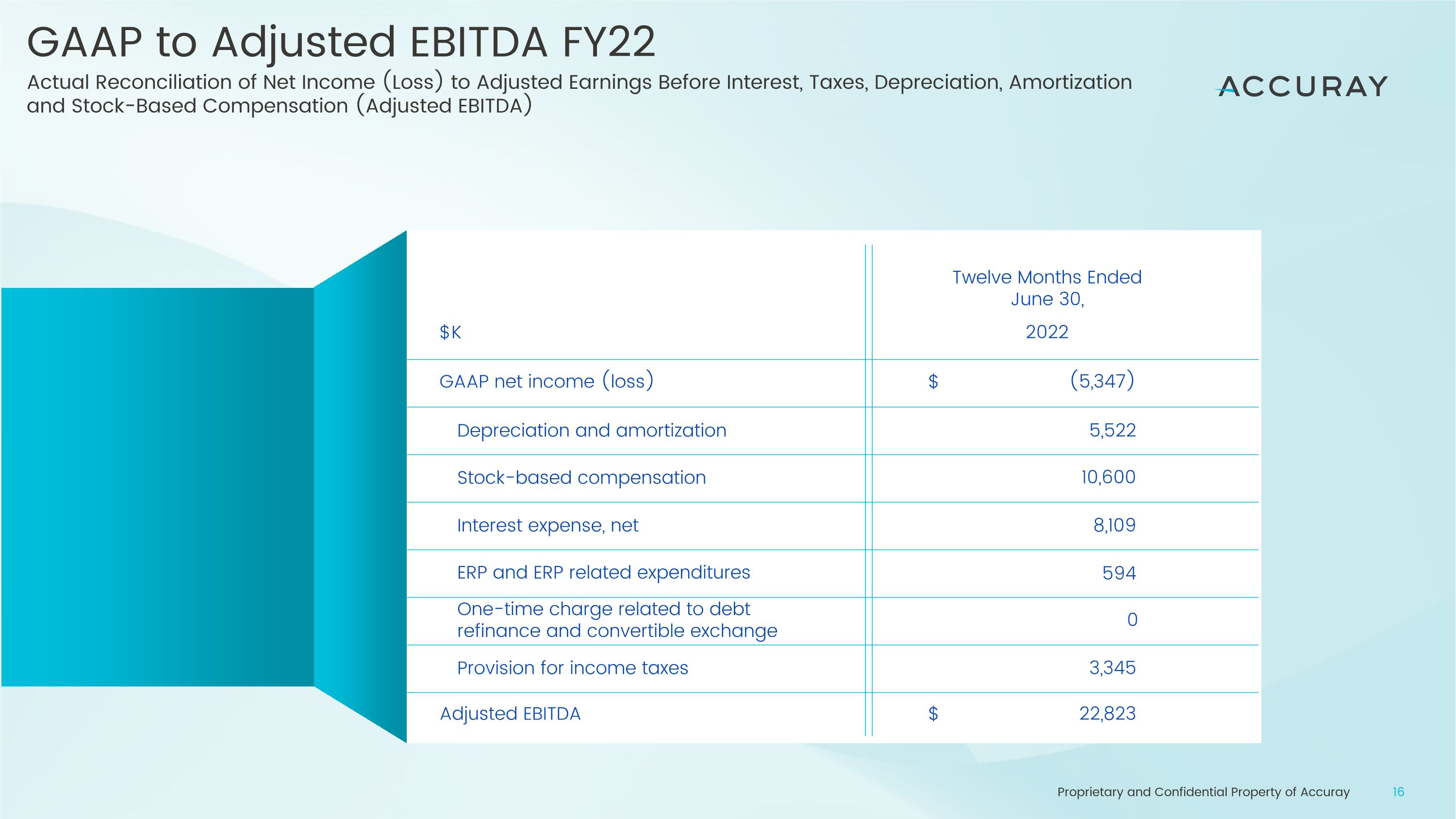

GAAP to Adjusted EBITDA FY22 Actual Reconciliation of Net Income (Loss) to Adjusted Earnings Before Interest, Taxes, Depreciation, Amortization and Stock-Based Compensation (Adjusted EBITDA) $K GAAP net income (loss) Stock-based compensation Interest expense, net Provision for income taxes Adjusted EBITDA Depreciation and amortization Twelve Months Ended June 30, 2022 $ $ (5,347) 5,522 10,600 8,109 3,345 22,823 ERP and ERP related expenditures 594 One-time charge related to debt refinance and convertible exchange 0

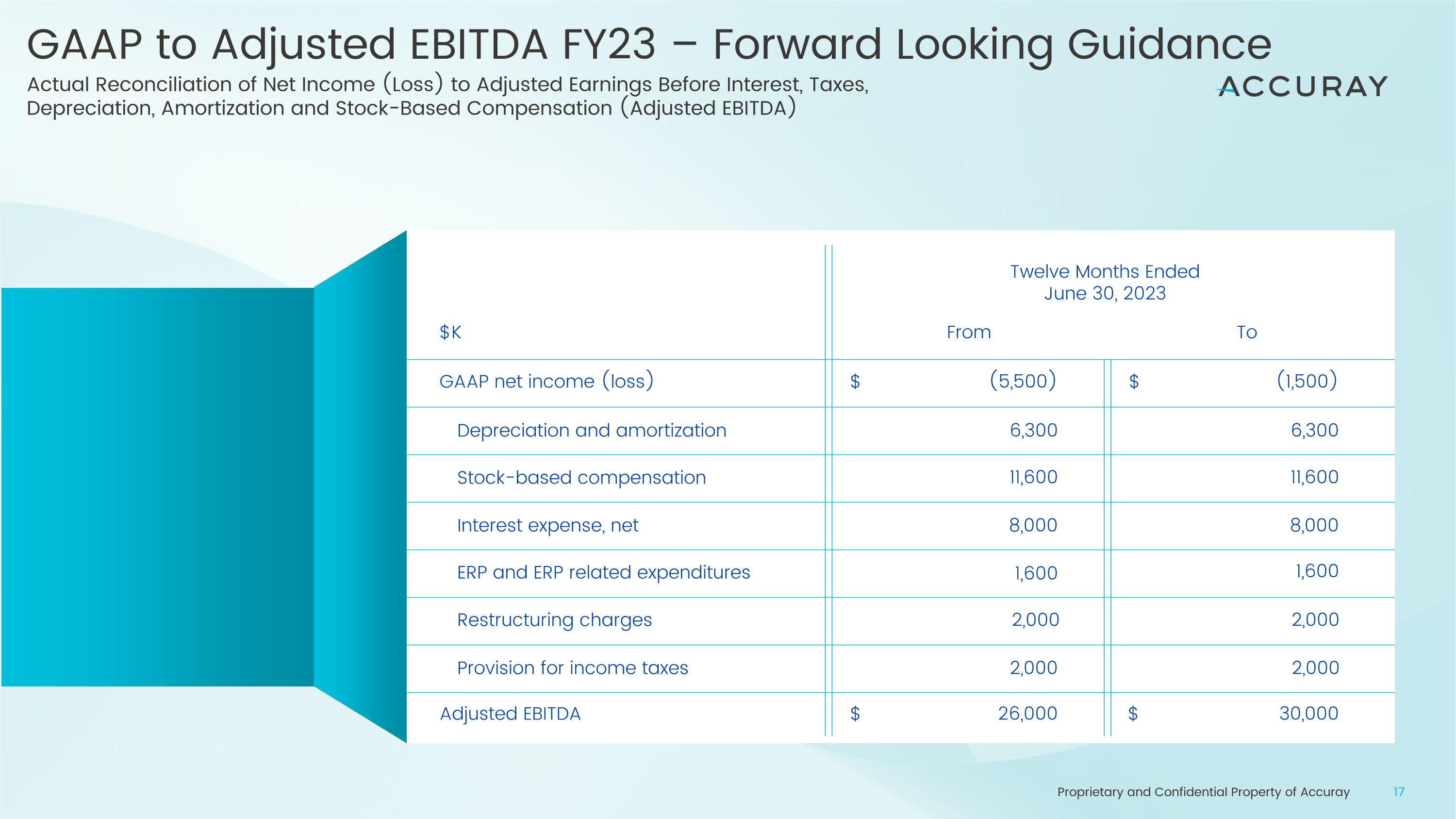

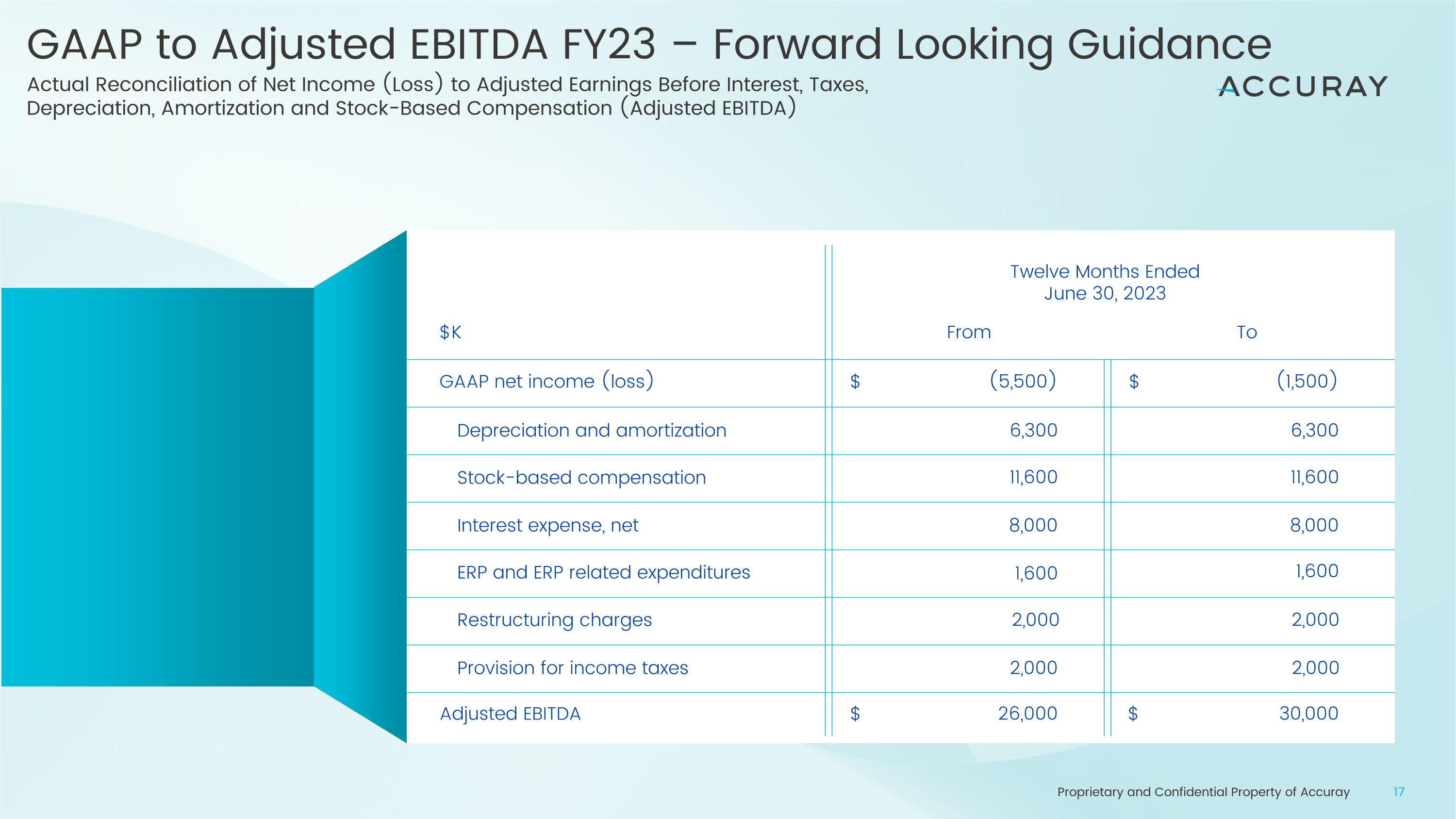

$K GAAP net income (loss) Stock-based compensation Interest expense, net Provision for income taxes Adjusted EBITDA Depreciation and amortization To From $ $ $ $ (5,500) 6,300 11,600 8,000 2,000 26,000 (1,500) 6,300 11,600 8,000 2,000 30,000 ERP and ERP related expenditures 1,600 Restructuring charges 2,000 1,600 2,000 GAAP to Adjusted EBITDA FY23 – Forward Looking Guidance Actual Reconciliation of Net Income (Loss) to Adjusted Earnings Before Interest, Taxes, Depreciation, Amortization and Stock-Based Compensation (Adjusted EBITDA) Twelve Months Ended June 30, 2023