Q3’FY23 Earnings Call April 26, 2023

Safe Harbor Statement Statements in this presentation (including the oral commentary that accompanies it) that are not statements of historical fact are forward-looking statements and are subject to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements in this presentation relate, but are not limited, to: expectations regarding fiscal 2023 full-year adjusted EBITDA and revenue; our positioning and strategy for accelerating revenue growth and market share; expectations regarding our strategic areas of focus; expectations regarding market growth rates and market trends; and expectations related to our revenue growth and market share going forward. Forward-looking statements generally can be identified by words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “projects,” “may,” “will be,” “will continue,” and similar expressions. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from expectations. These risks and uncertainties include, but are not limited to: the effects of the COVID-19 pandemic on our business, financial condition, results of operations or cash flows; disruptions to our supply chain, including increased logistics costs; our ability to achieve widespread market acceptance of our products, including new product offerings and improvements; our ability to develop new products or enhance existing products to meet customers’ needs and compete favorably in the market; our ability to realize the expected benefits of the joint-venture and other partnerships; risks inherent in international operations; our ability to effectively manage our growth; our ability to maintain or increase our gross margins on product sales and services; delays in regulatory approvals or the development or release of new offerings; our ability to meet the covenants under our credit facilities; our ability to convert backlog to revenue; and other risks identified under the heading “Risk Factors” in our quarterly report on Form 10-Q, filed with the Securities and Exchange Commission (the “SEC”) on February 2, 2023, and as updated periodically with our other filings with the SEC. Forward-looking statements speak only as of the date the statements are made and are based on information available to Accuray at the time those statements are made and/or management’s good faith belief as of that time with respect to future events. Accuray assumes no obligation to update forward-looking statements to reflect actual performance or results, changes in assumptions or changes in other factors affecting forward-looking information, except to the extent required by applicable securities laws. Accordingly, investors should not place undue reliance on any forward-looking statements. Non-GAAP Financial Measures This presentation also contains non-GAAP financial measures. Management believes that non-GAAP financial measures provide useful supplemental information to management and investors regarding the performance of the company and facilitates a more meaningful comparison of results for current periods with previous operating results. Additionally, these non-GAAP financial measures assist management in analyzing future trends, making strategic and business decisions, and establishing internal budgets and forecasts. A reconciliation of these non-GAAP financial measures to the most directly comparable GAAP measure is provided in the Appendix. Accuray has also reported certain operating results on a constant currency basis in order to facilitate period-to-period comparisons of its results without regard to the impact of foreign currency exchange rate fluctuations. Management believes disclosure of non-GAAP constant currency results is helpful to investors because it facilitates period-to-period comparisons of the company's results by increasing the transparency of the underlying performance by excluding the impact of foreign currency exchange rate fluctuations. Accuray calculates the constant currency amounts by translating local currency amounts in the current period using the same foreign translation rate used in the prior period being compared against rather than the actual exchange rate in effect during the current period. There are limitations in using these non-GAAP financial measures because they are not prepared in accordance with GAAP and may be different from non-GAAP financial measures used by other companies. These non-GAAP financial measures should not be considered in isolation or as a substitute for GAAP financial measures. Investors and potential investors should consider non-GAAP financial measures only in conjunction with the company’s consolidated financial statements prepared in accordance with GAAP. Medical Advice Disclaimer Accuray Incorporated as a medical device manufacturer cannot and does not recommend specific treatment approaches. Individual results may vary. Forward-looking Statements This presentation is intended exclusively for investors. It is not intended for use in Sales or Marketing. 2 Proprietary and Confidential Property of Accuray

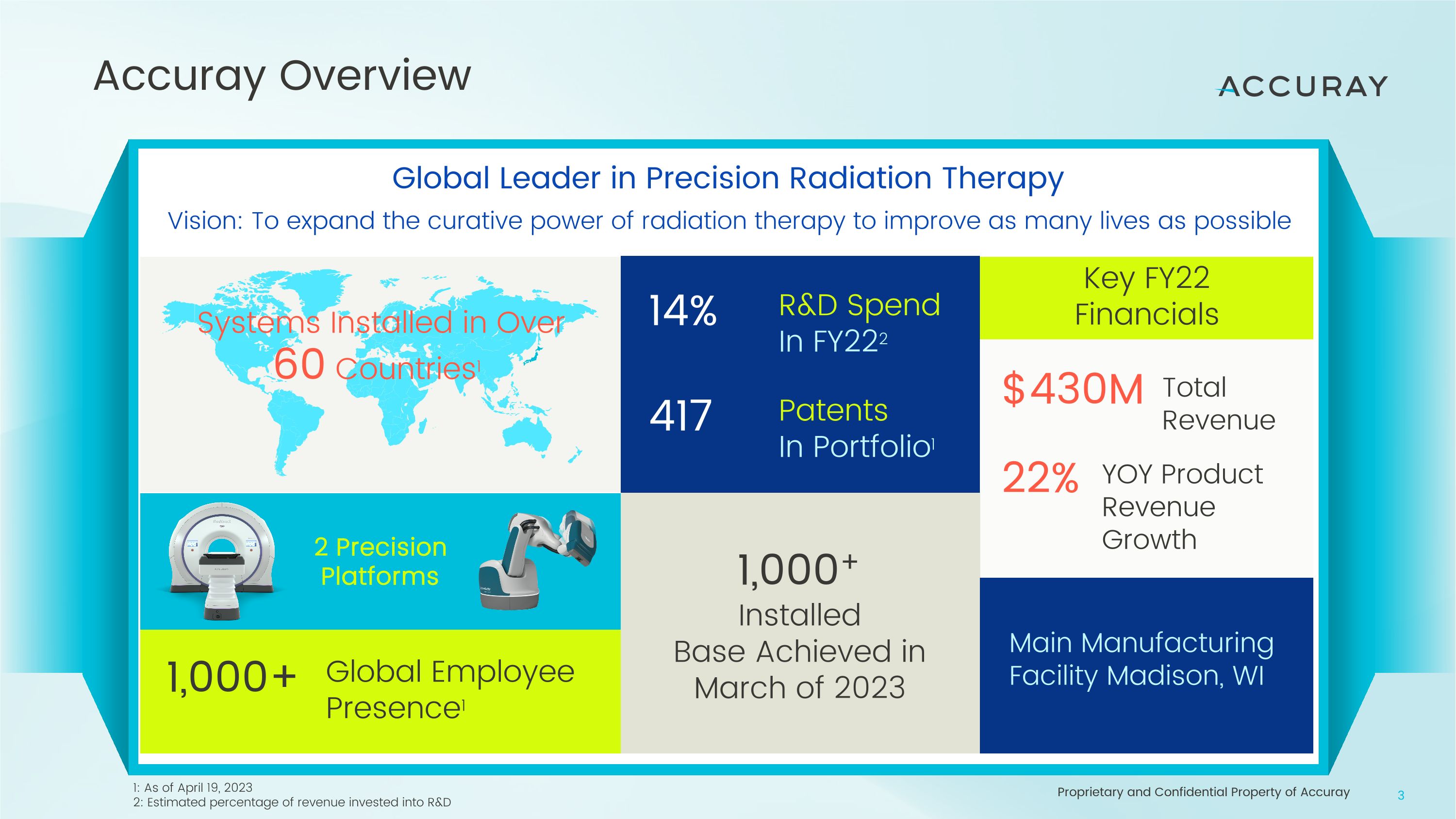

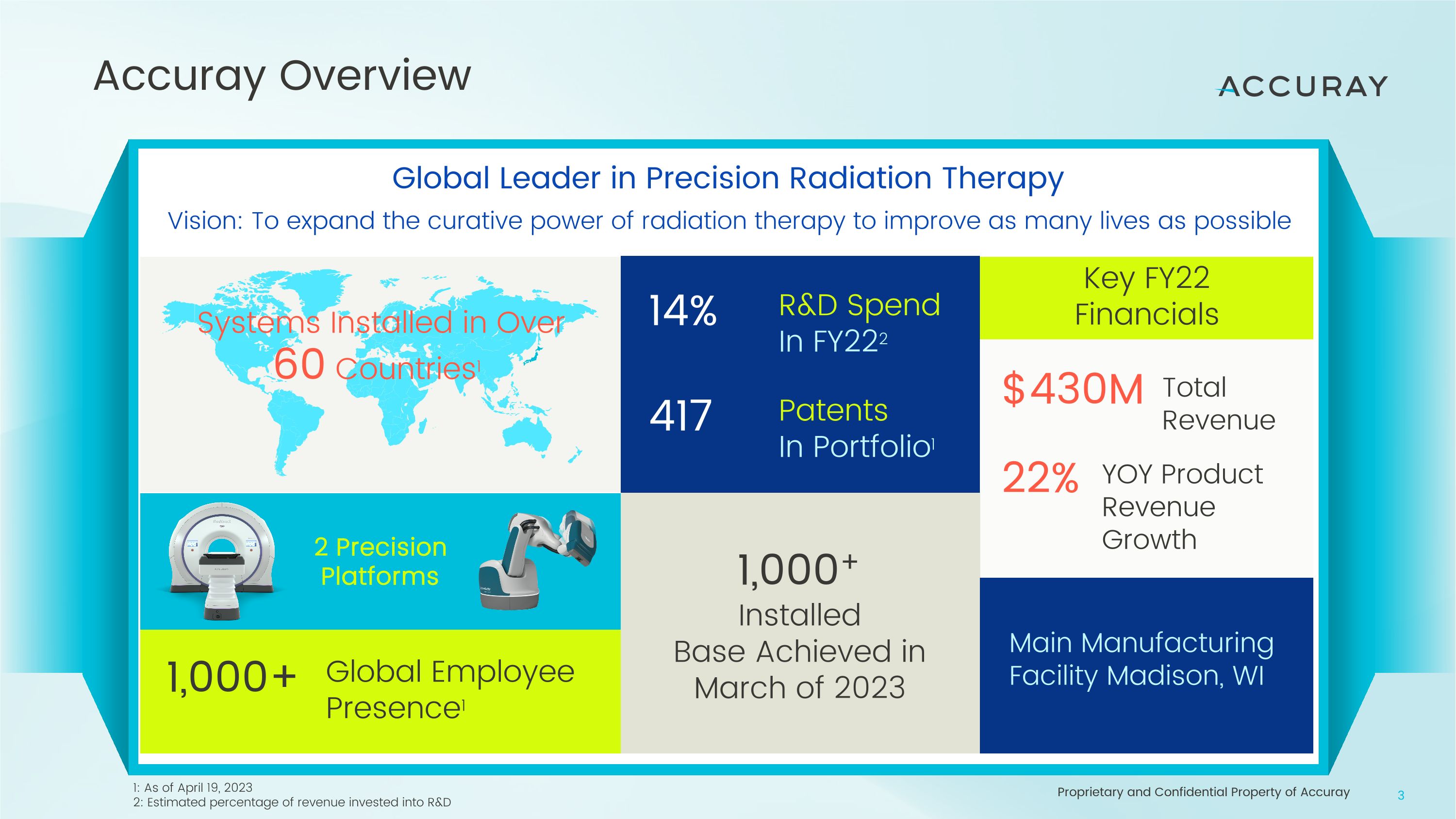

Accuray Overview Global Leader in Precision Radiation Therapy Vision: To expand the curative power of radiation therapy to improve as many lives as possible Systems Installed in Over 60 Countries1 1: As of April 19, 2023 2: Estimated percentage of revenue invested into R&D Installed Base Achieved in March of 2023 Main Manufacturing Facility Madison, WI 22% $430M R&D Spend In FY222 Patents In Portfolio1 14% 417 Key FY22 Financials Total Revenue YOY Product Revenue Growth 1,000+ 1,000+ Global Employee Presence1 2 Precision Platforms Proprietary and Confidential Property of Accuray 3

Executive Team Suzanne Winter President and CEO Ali Pervaiz Senior Vice President, Chief Financial Officer Sandeep Chalke Senior Vice President, Chief Commercial Officer Seth Blacksburg Senior Vice President,�Chief Medical Officer Jesse Chew Senior Vice President, Chief Legal Officer Mike Hoge Senior Vice President, Global Operations Patrick Spine Senior Vice President, Chief Administrative Officer Jim Dennison Senior Vice President, Global Quality & Regulatory Affairs

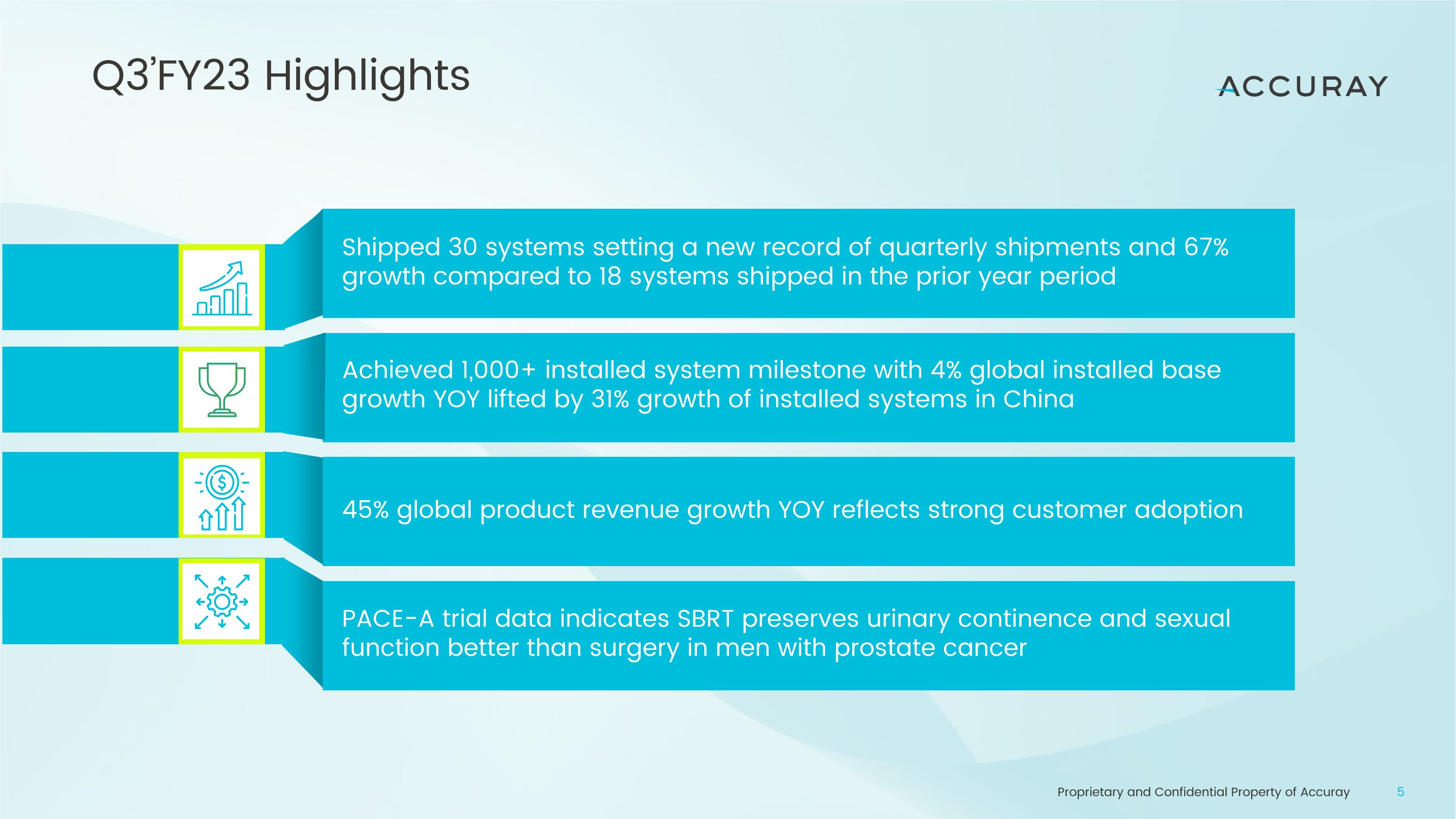

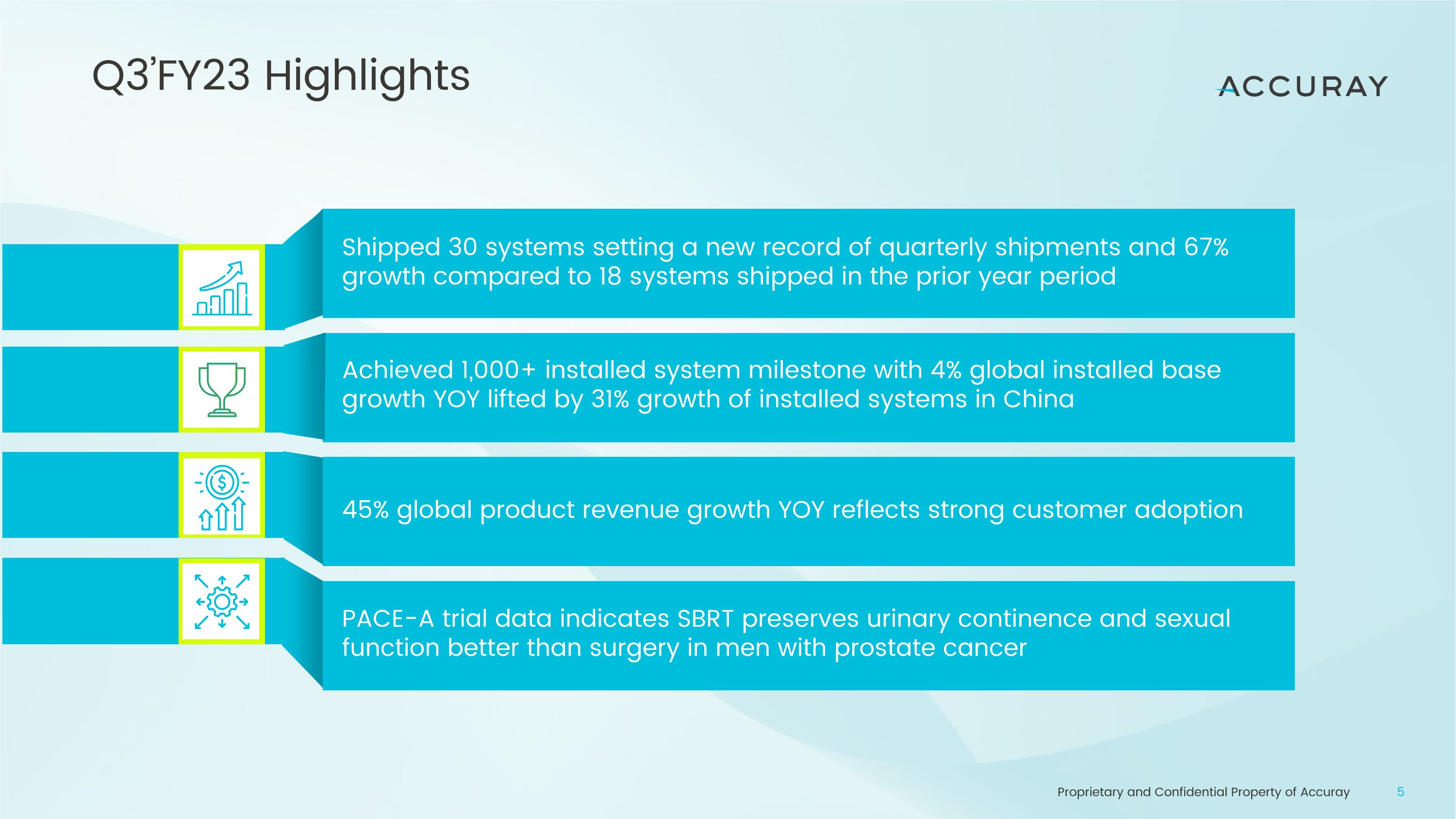

Q3’FY23 Highlights PACE-A trial data indicates SBRT preserves urinary continence and sexual function better than surgery in men with prostate cancer 45% global product revenue growth YOY reflects strong customer adoption Achieved 1,000+ installed system milestone with 4% global installed base growth YOY lifted by 31% growth of installed systems in China Shipped 30 systems setting a new record of quarterly shipments and 67% growth compared to 18 systems shipped in the prior year period

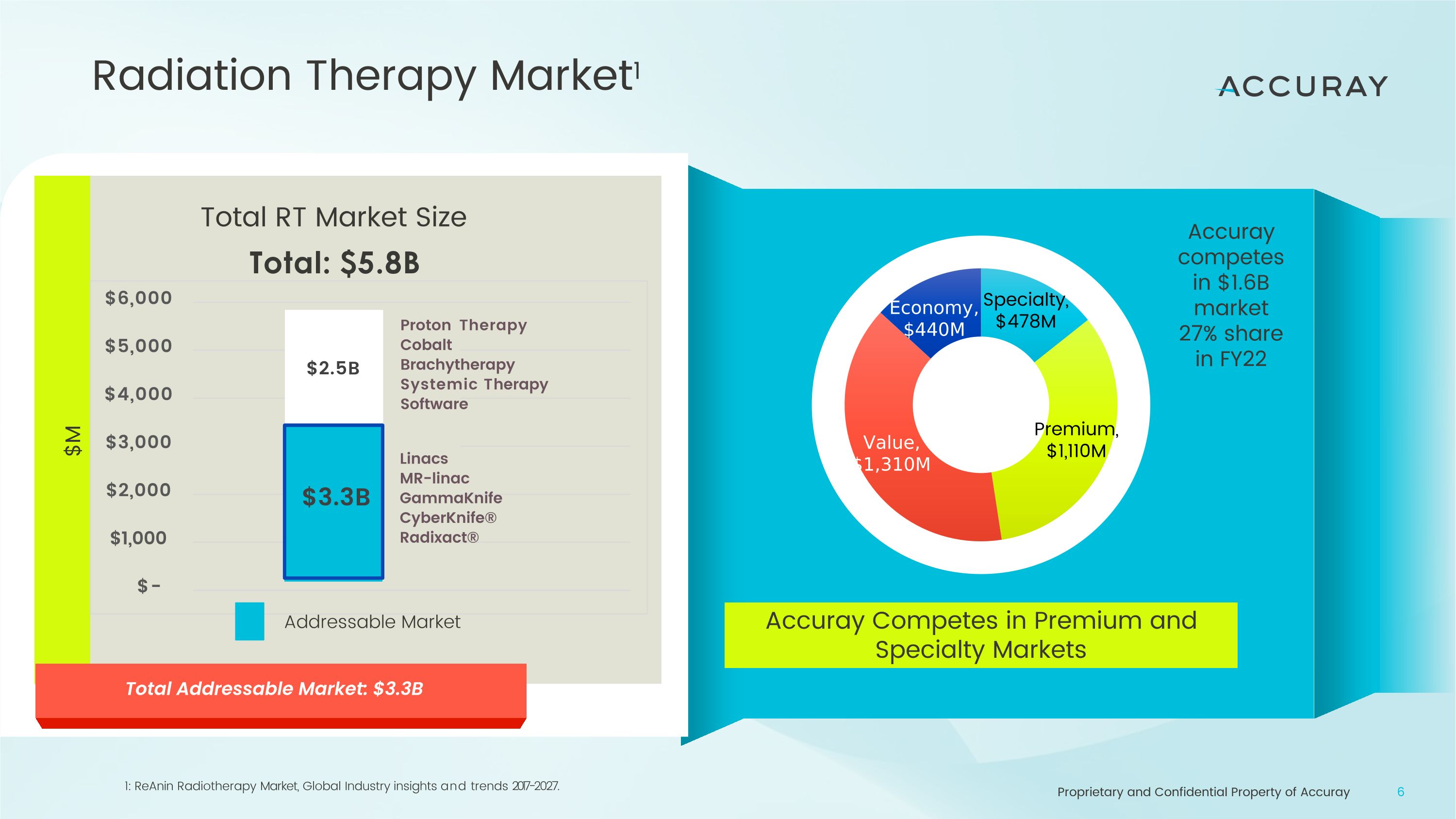

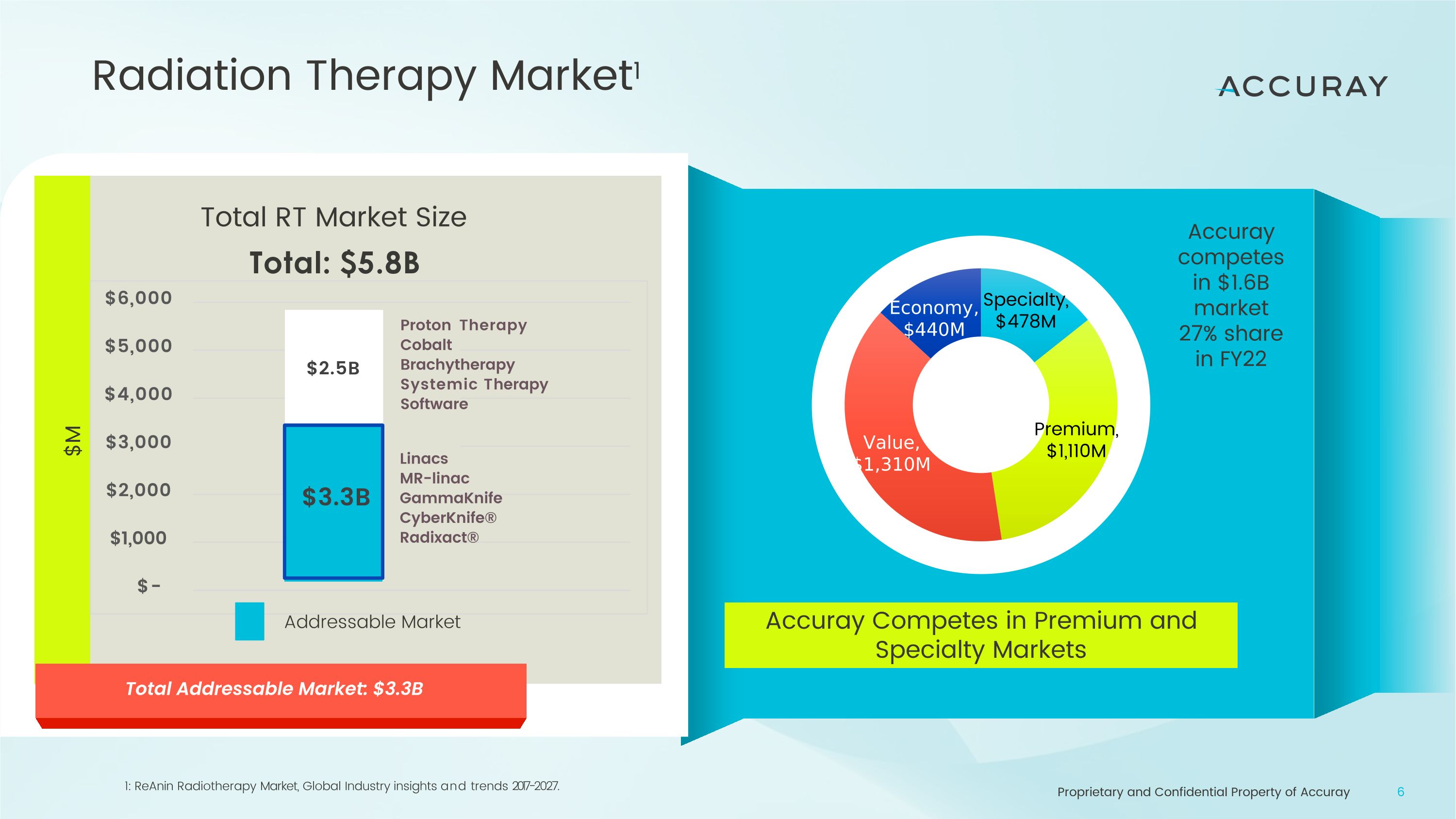

Radiation Therapy Market1 1: ReAnin Radiotherapy Market, Global Industry insights and trends 2017-2027. $3.3B $2.5B $- $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 Proton Therapy Cobalt Brachytherapy Systemic Therapy Software Total: $5.8B $M Accuray Competes in Premium and Specialty Markets Proprietary and Confidential Property of Accuray Accuray competes in $1.6B market�27% share�in FY22 Total Addressable Market: $3.3B Linacs MR-linac GammaKnife CyberKnife® Radixact® Addressable Market Total RT Market Size 6

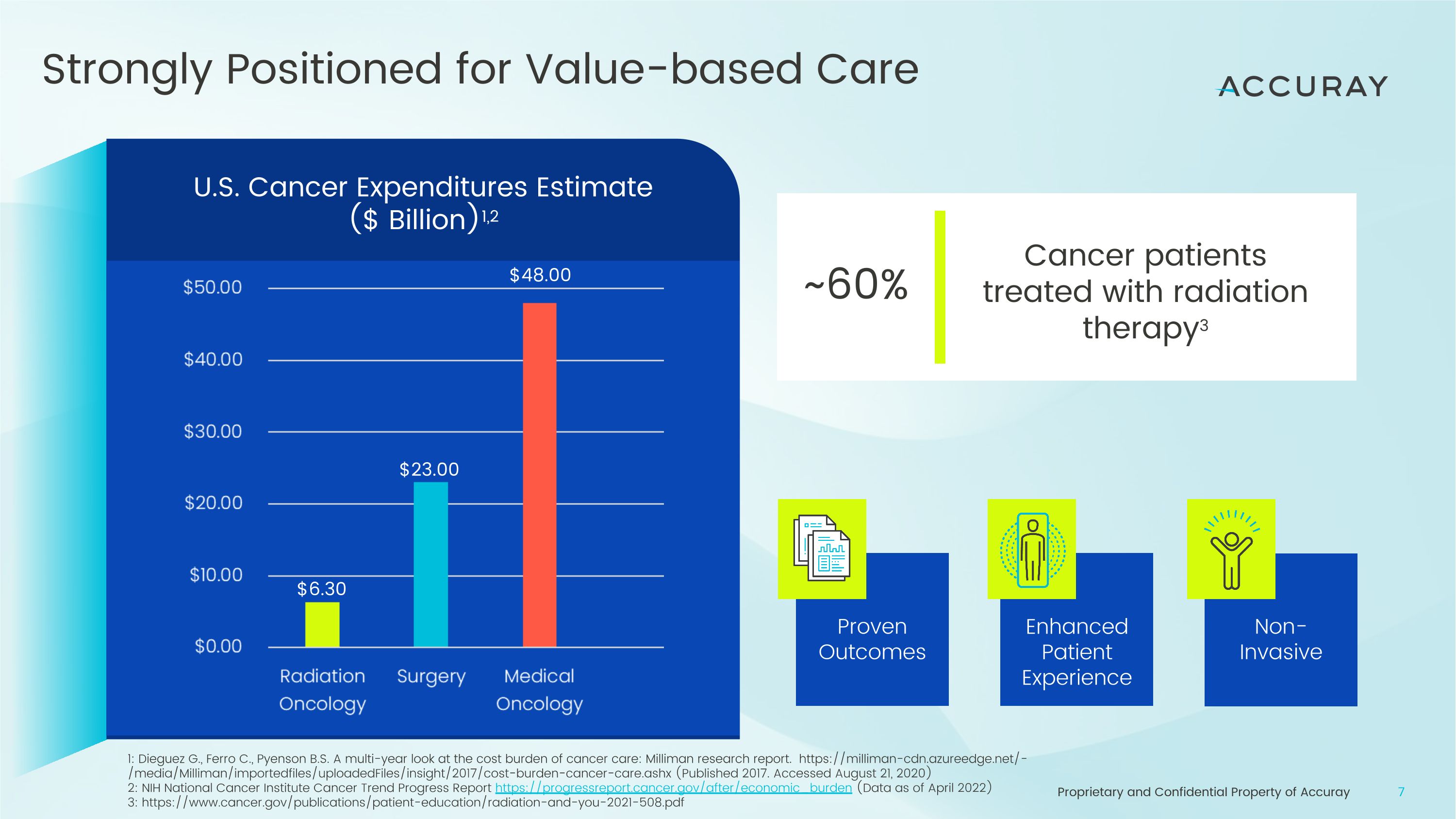

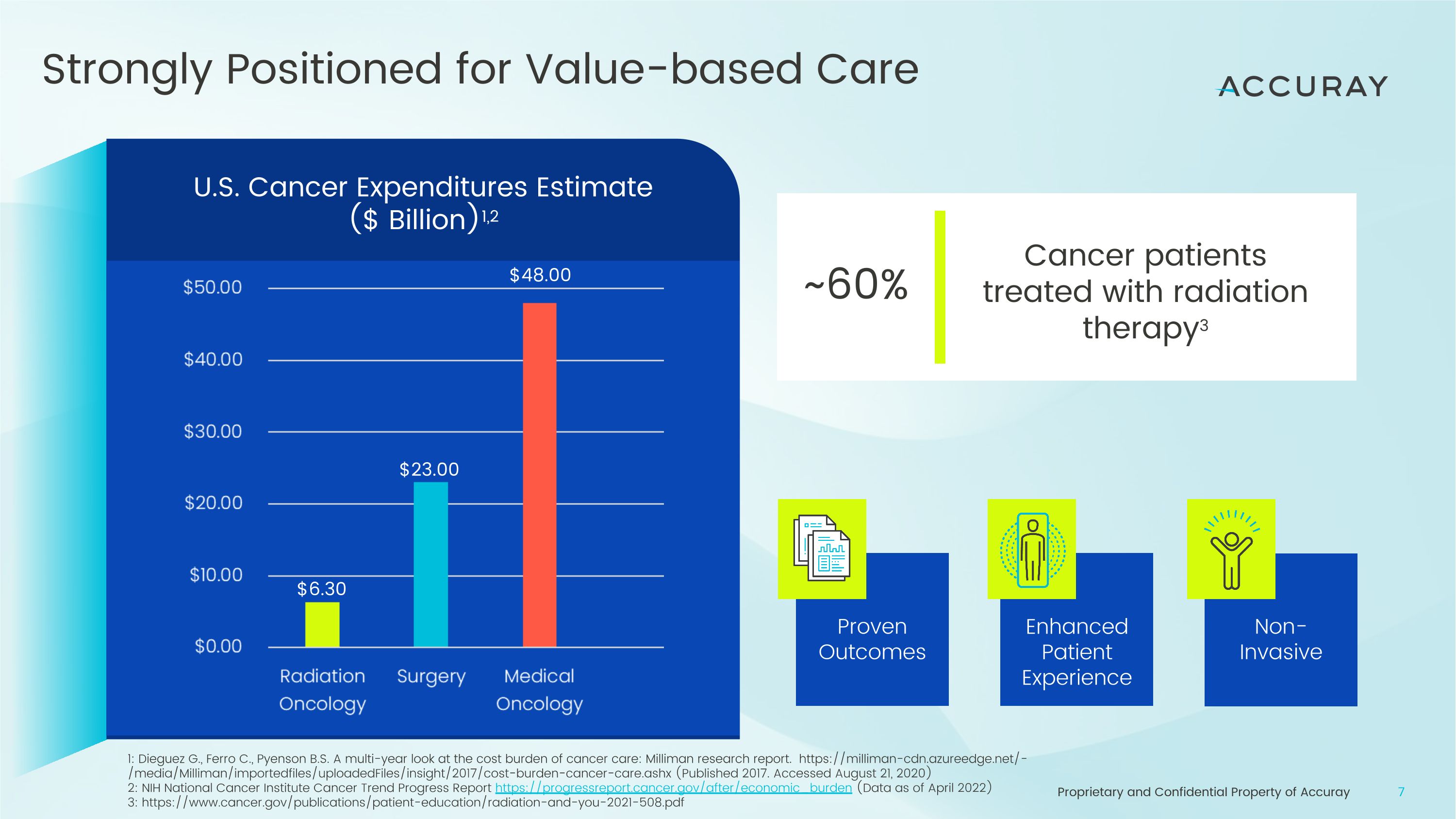

Strongly Positioned for Value-based Care U.S. Cancer Expenditures Estimate�($ Billion)1,2 1: Dieguez G., Ferro C., Pyenson B.S. A multi-year look at the cost burden of cancer care: Milliman research report. https://milliman-cdn.azureedge.net/-/media/Milliman/importedfiles/uploadedFiles/insight/2017/cost-burden-cancer-care.ashx (Published 2017. Accessed August 21, 2020) 2: NIH National Cancer Institute Cancer Trend Progress Report https://progressreport.cancer.gov/after/economic_burden (Data as of April 2022) 3: https://www.cancer.gov/publications/patient-education/radiation-and-you-2021-508.pdf Proven Outcomes Enhanced Patient Experience Non-Invasive Cancer patients treated with radiation therapy3 ~60% $6.30 $23.00 $48.00 7

Strategic Areas of Focus Proprietary and Confidential Property of Accuray Drive market share through disruptive innovation Expand service business Transform through strategic partnerships Drive margin and profitability initiatives 8

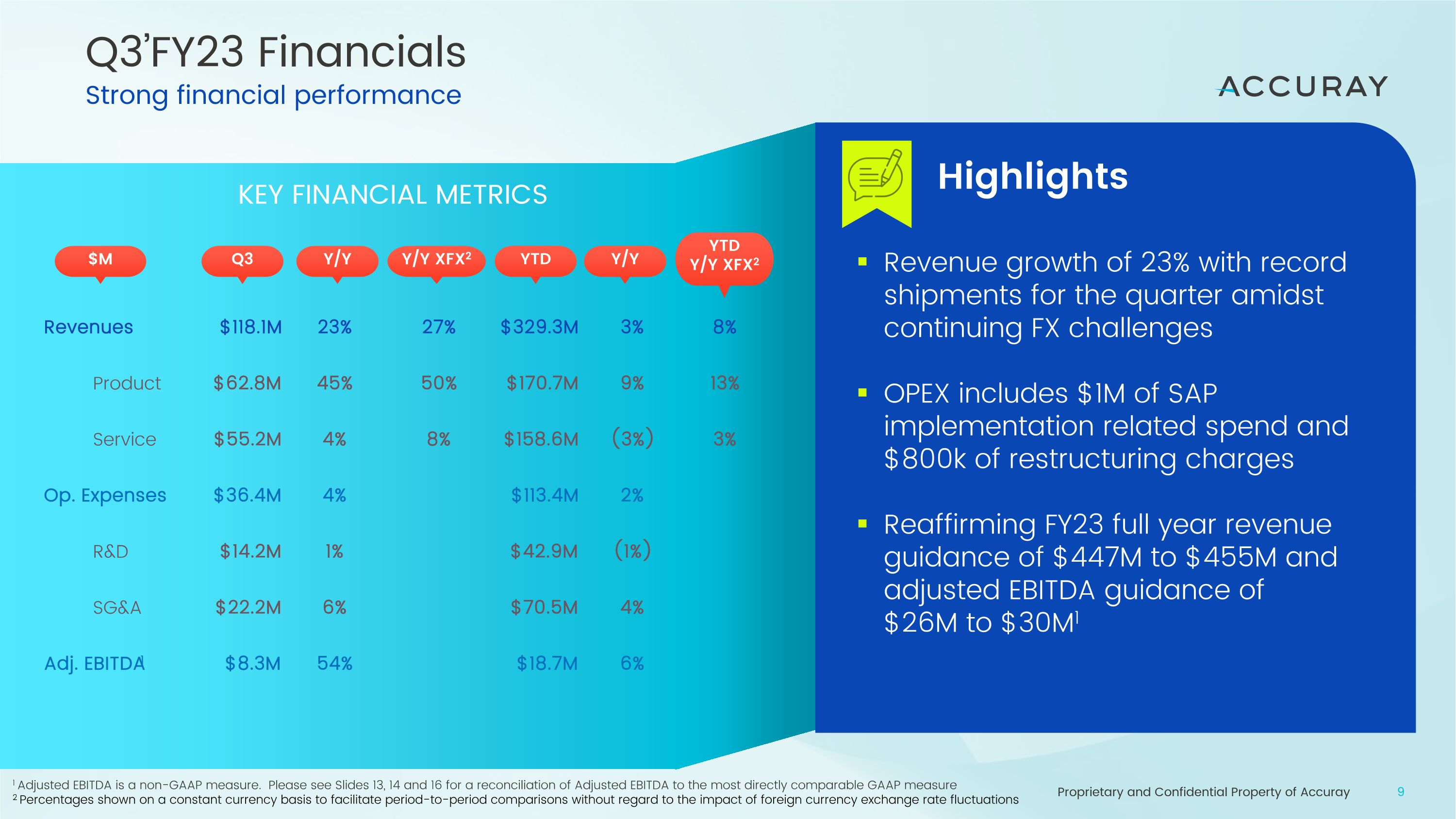

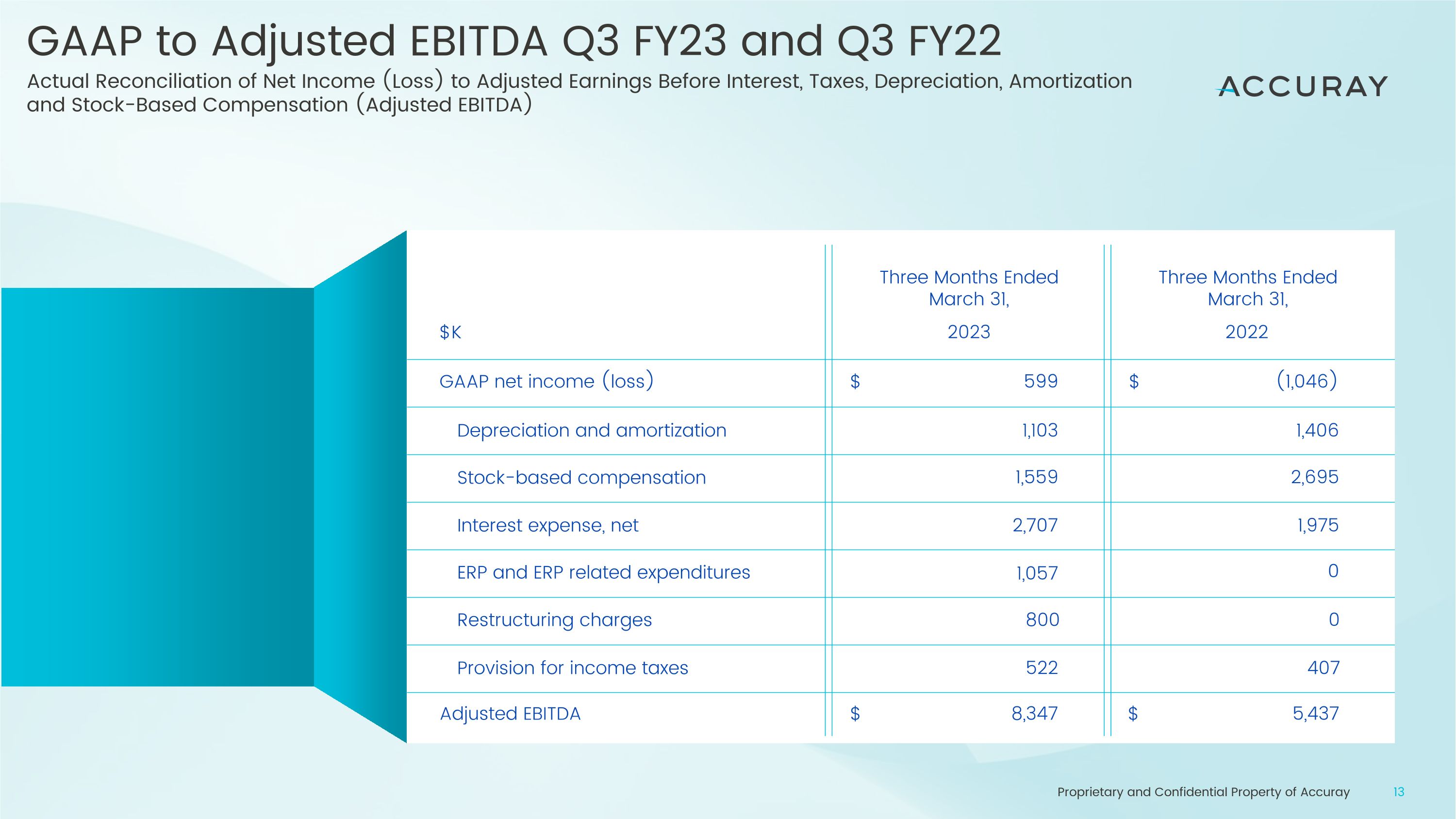

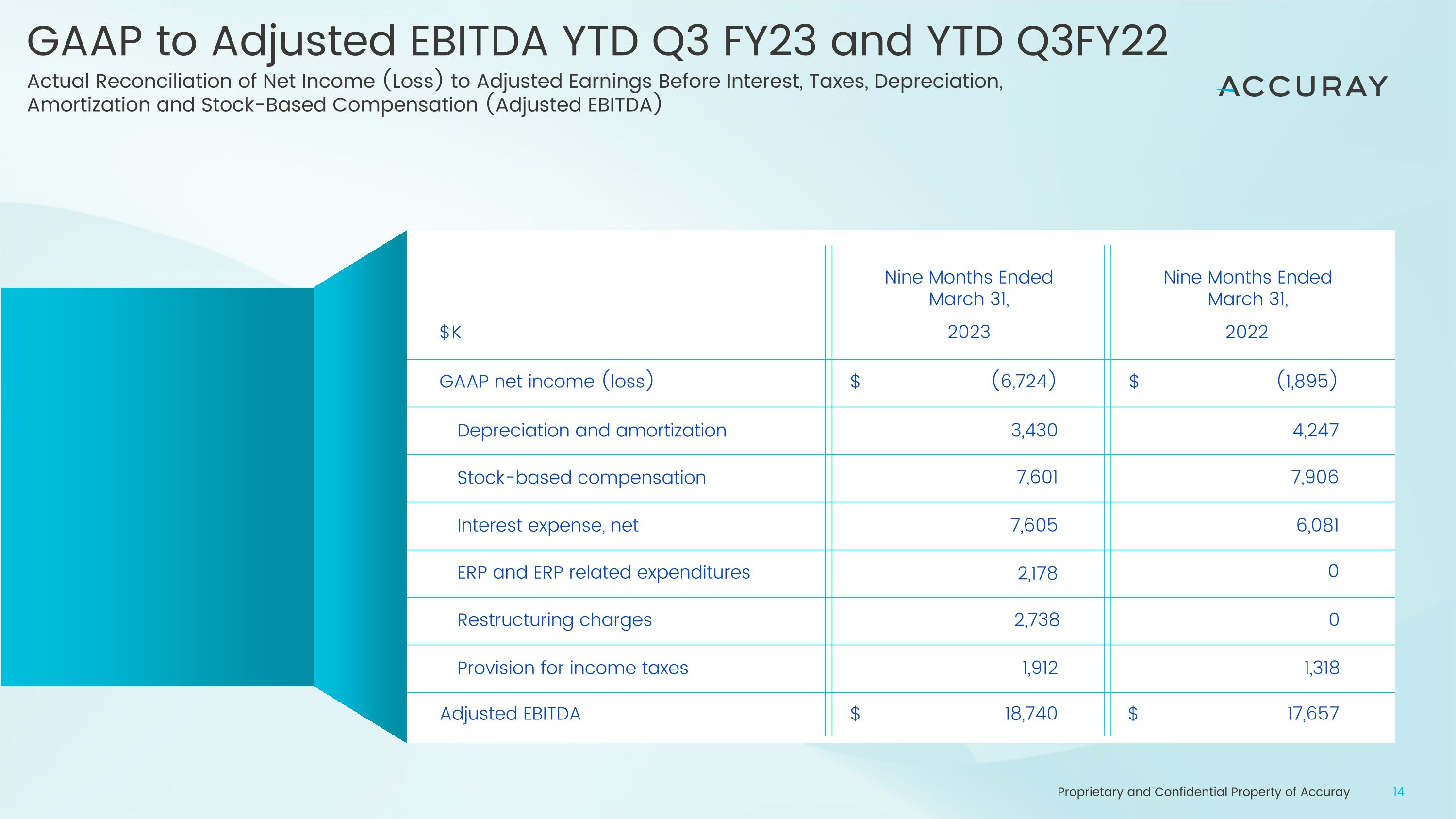

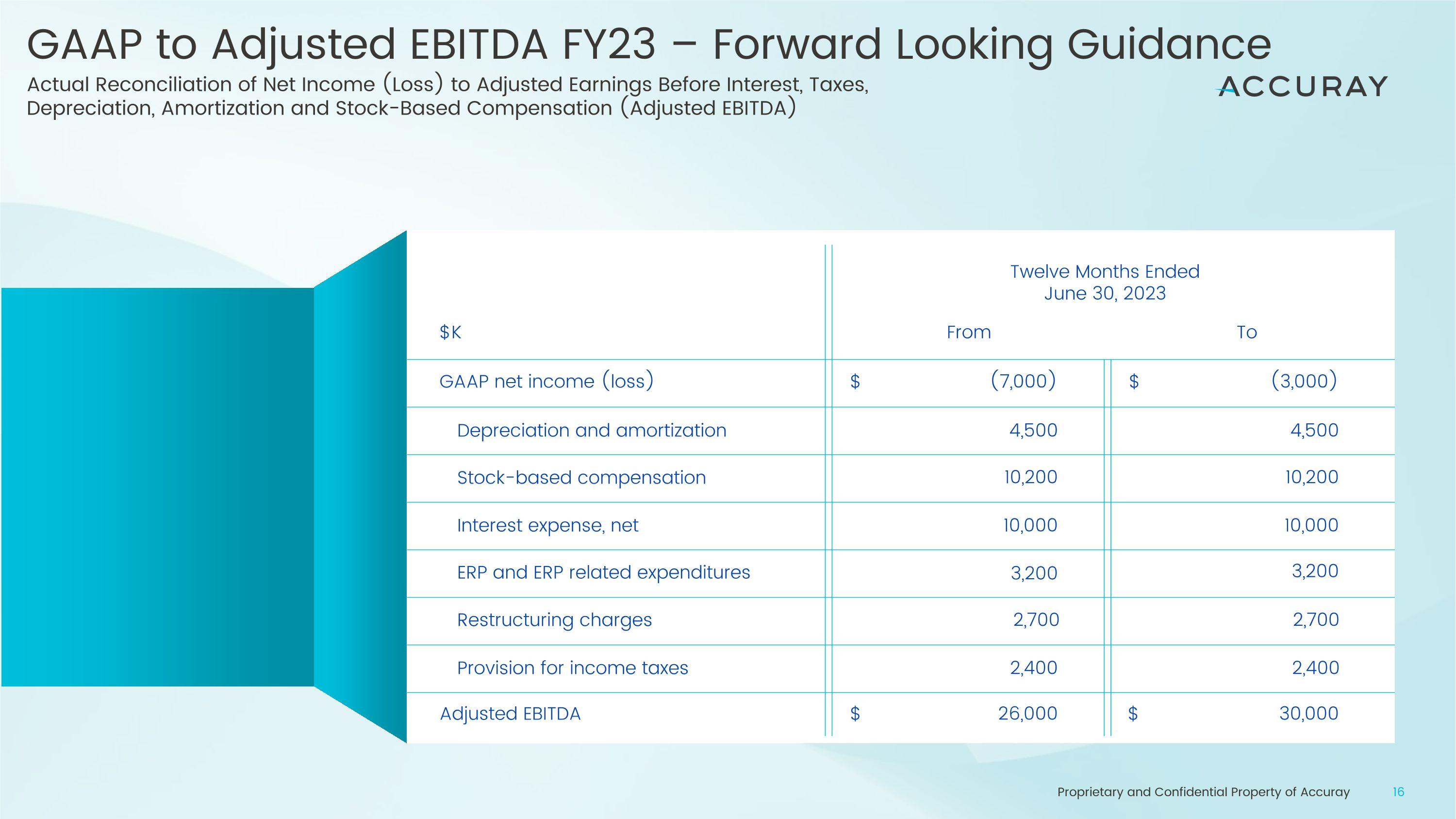

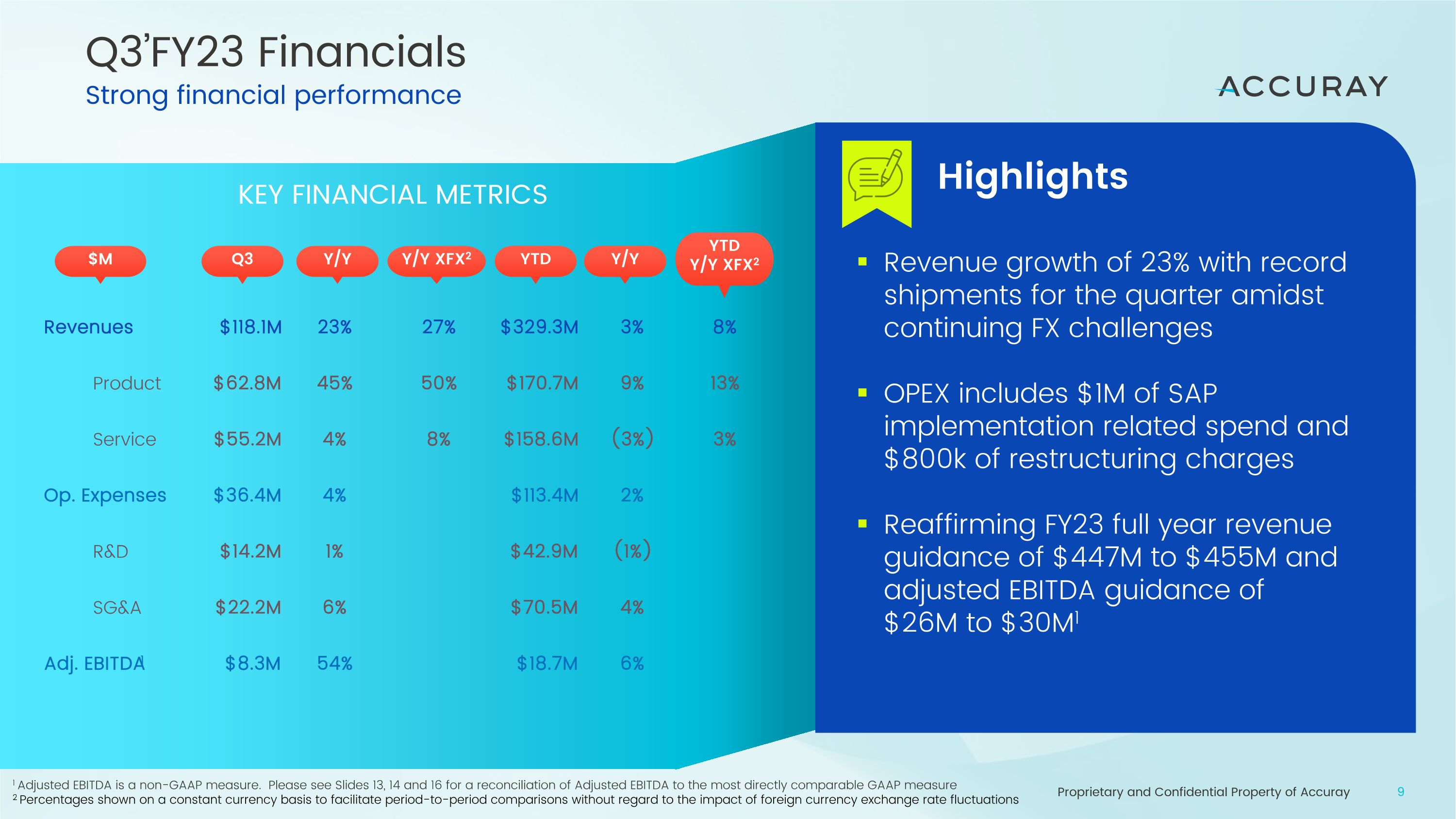

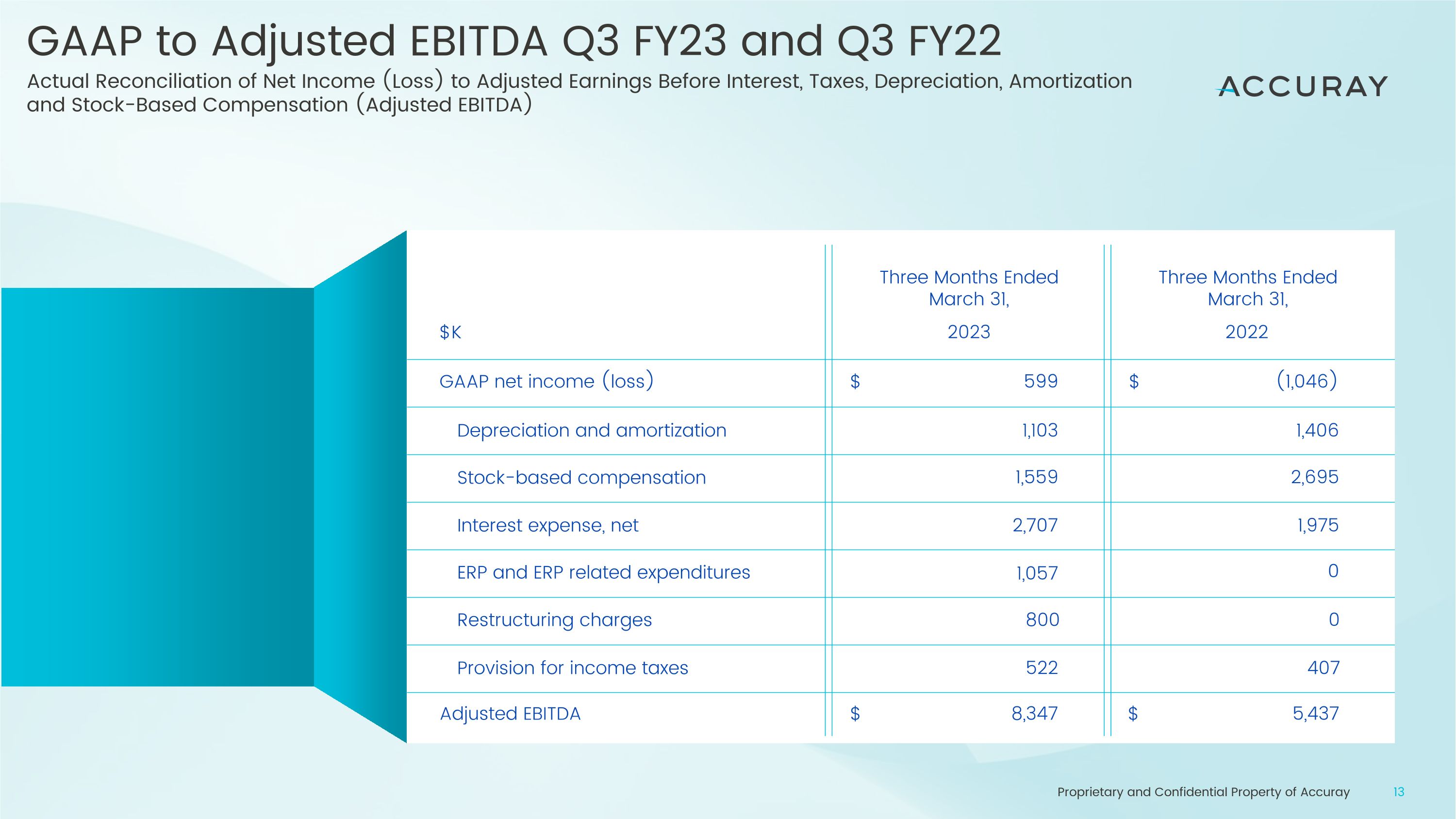

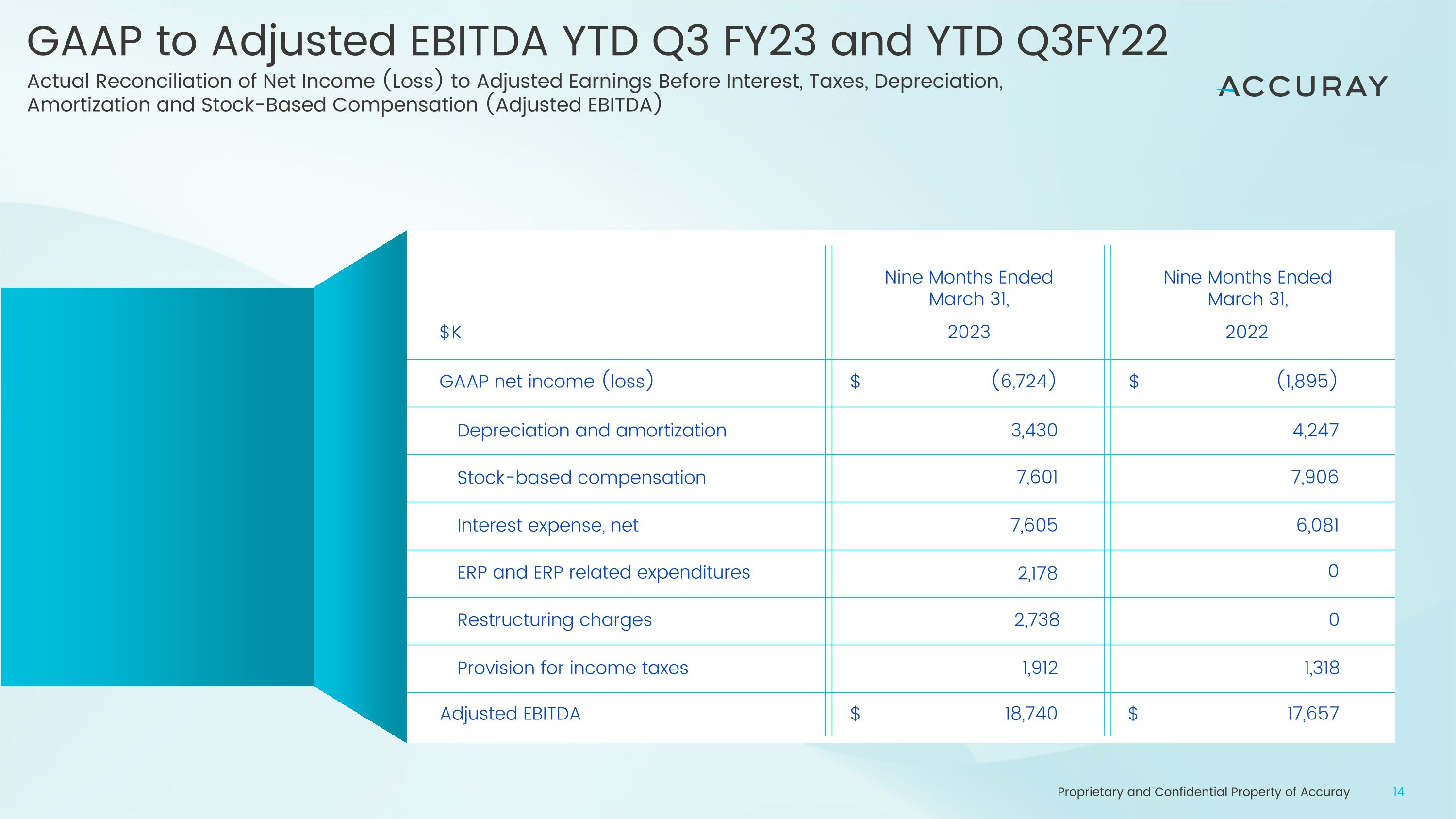

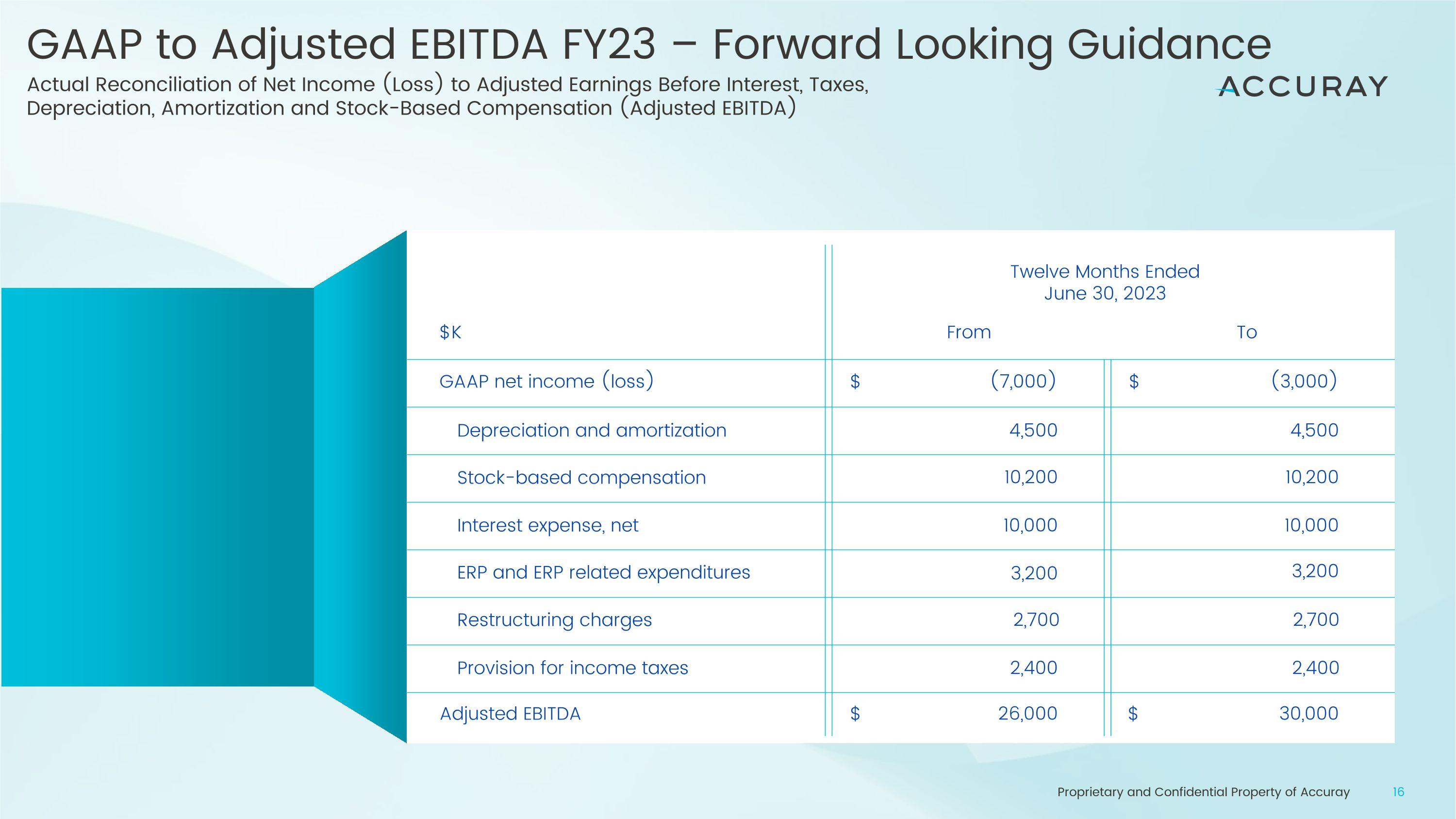

Q3’FY23 Financials Strong financial performance Highlights Revenue growth of 23% with record shipments for the quarter amidst continuing FX challenges OPEX includes $1M of SAP implementation related spend and $800k of restructuring charges Reaffirming FY23 full year revenue guidance of $447M to $455M and adjusted EBITDA guidance of�$26M to $30M1 $M Q3 Y/Y YTD Y/Y Y/Y XFX2 YTD�Y/Y XFX2 Revenues $118.1M 23% 27% $329.3M 3% 8% Product $62.8M 45% 50% $170.7M 9% 13% Service $55.2M 4% 8% $158.6M (3%) 3% Op. Expenses $36.4M 4% $113.4M 2% R&D $14.2M 1% $42.9M (1%) SG&A $22.2M 6% $70.5M 4% Adj. EBITDA1 $8.3M 54% $18.7M 6% KEY FINANCIAL METRICS 1 Adjusted EBITDA is a non-GAAP measure. Please see Slides 13, 14 and 16 for a reconciliation of Adjusted EBITDA to the most directly comparable GAAP measure 2 Percentages shown on a constant currency basis to facilitate period-to-period comparisons without regard to the impact of foreign currency exchange rate fluctuations

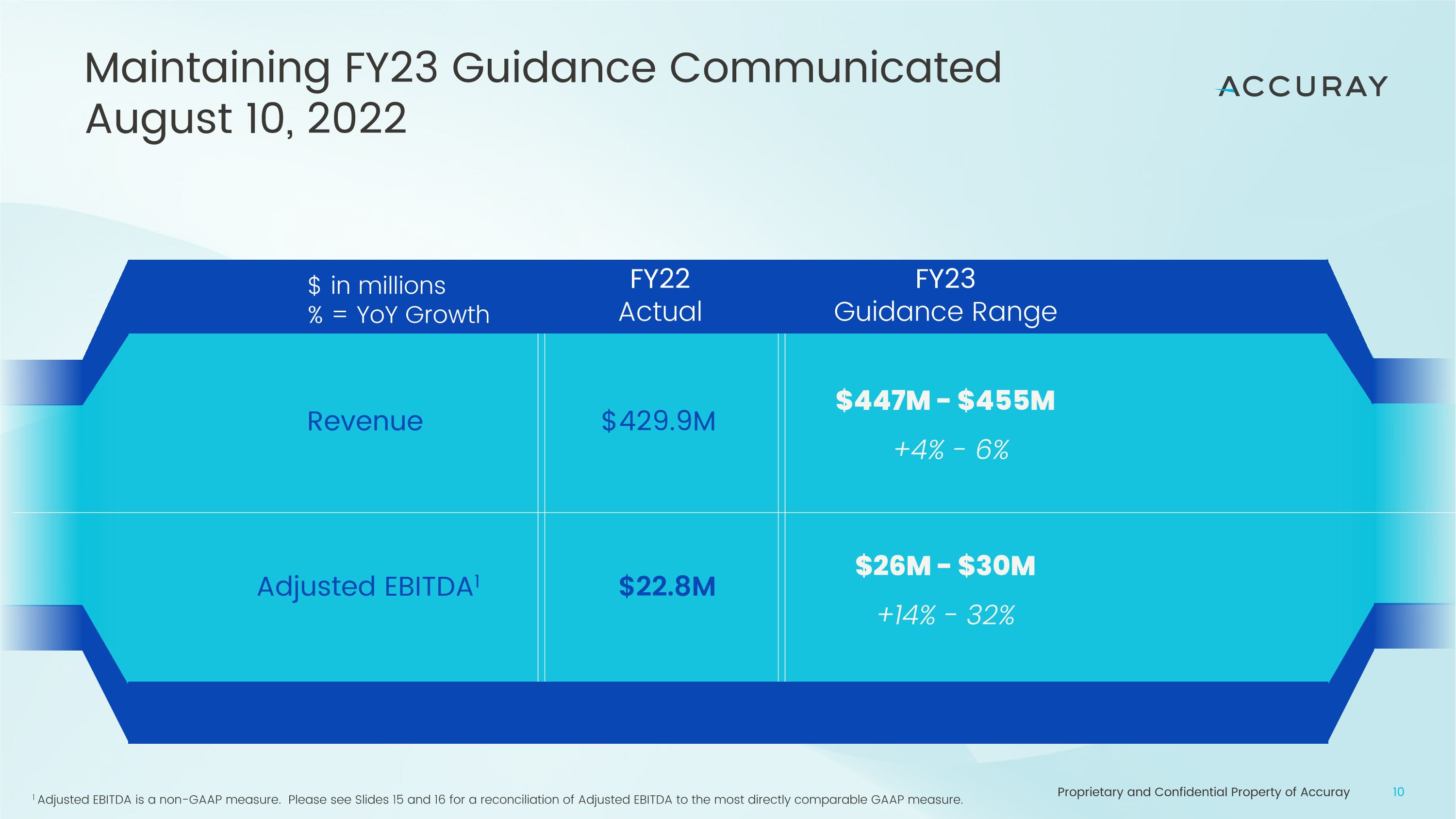

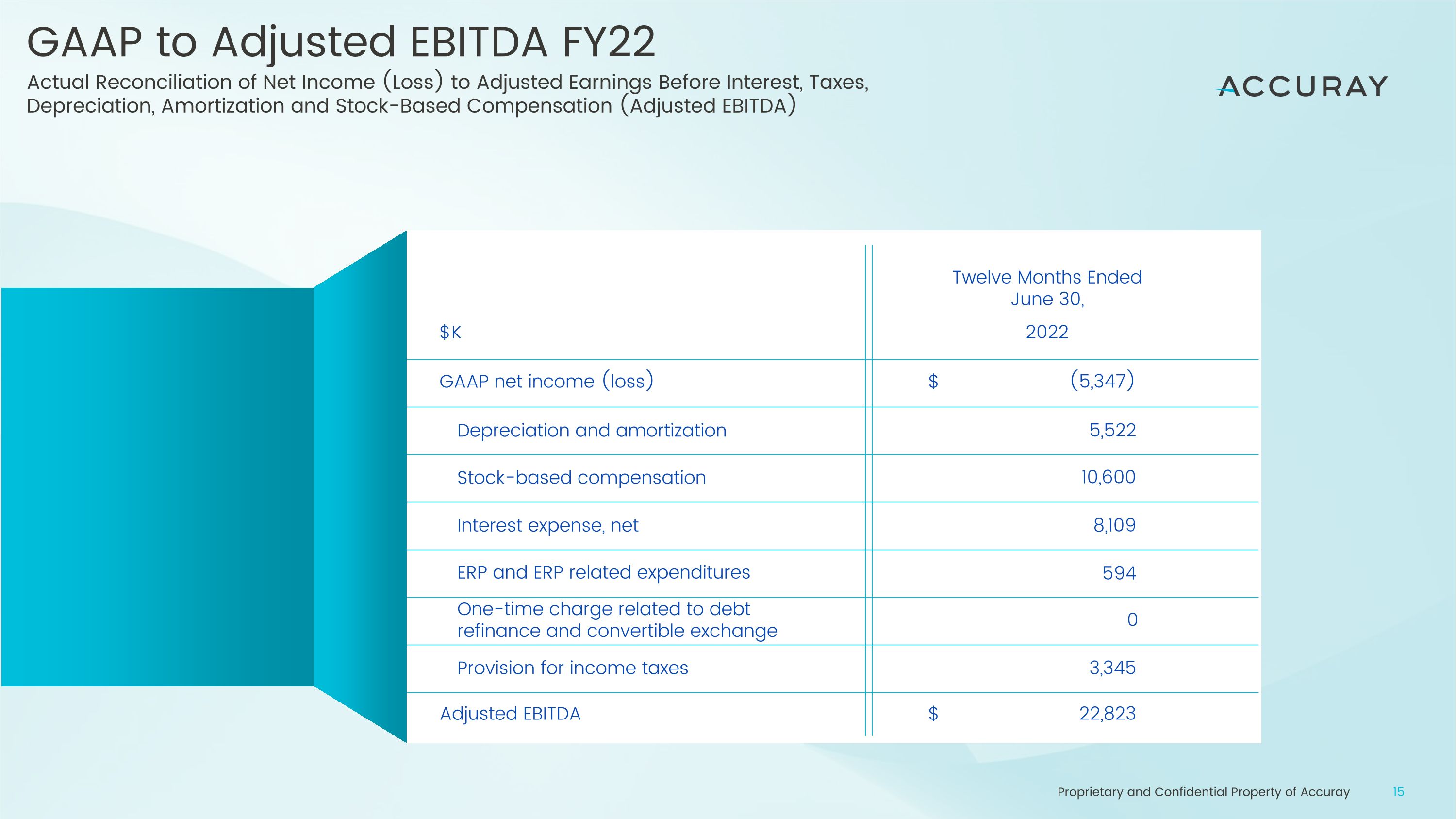

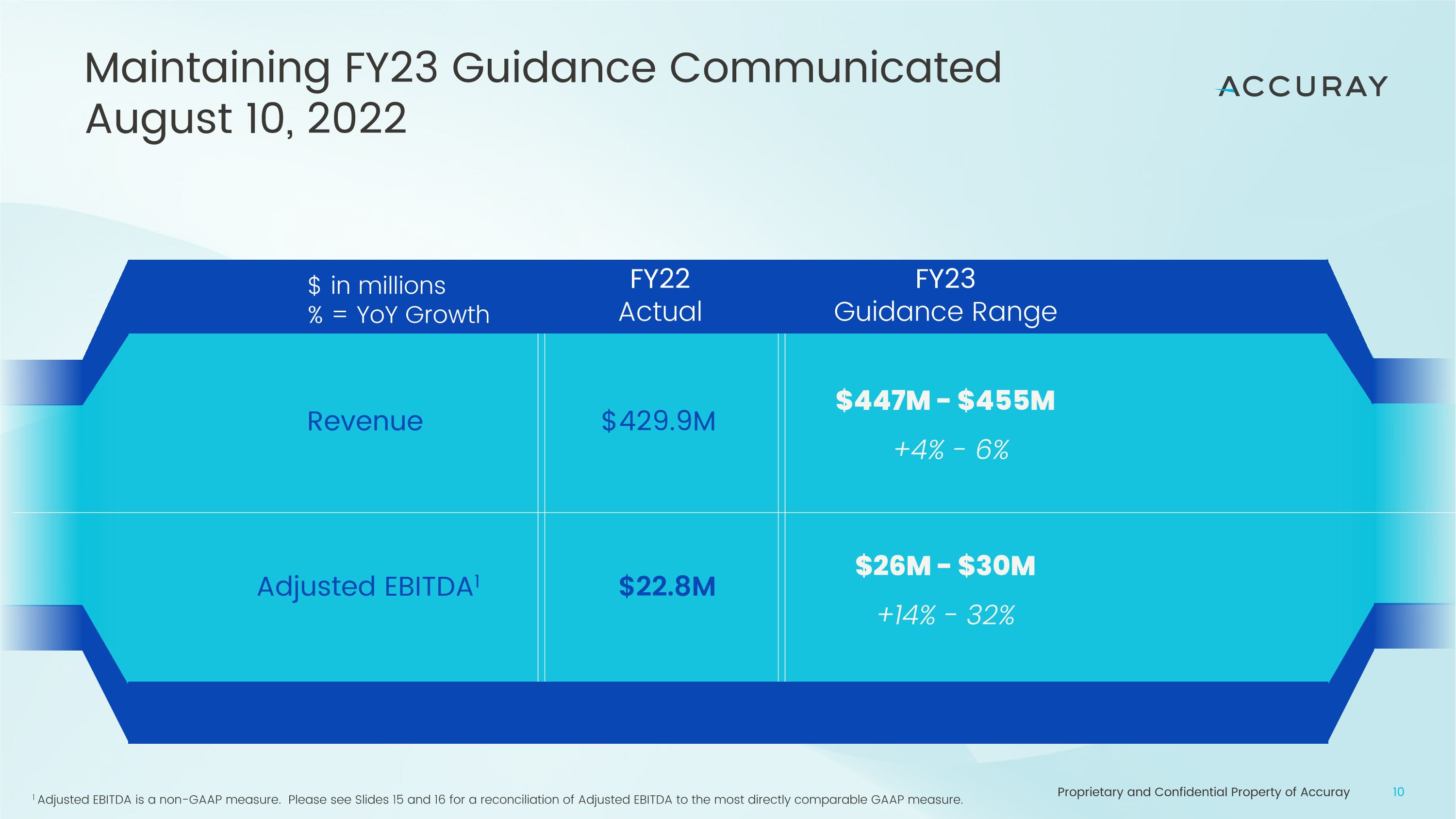

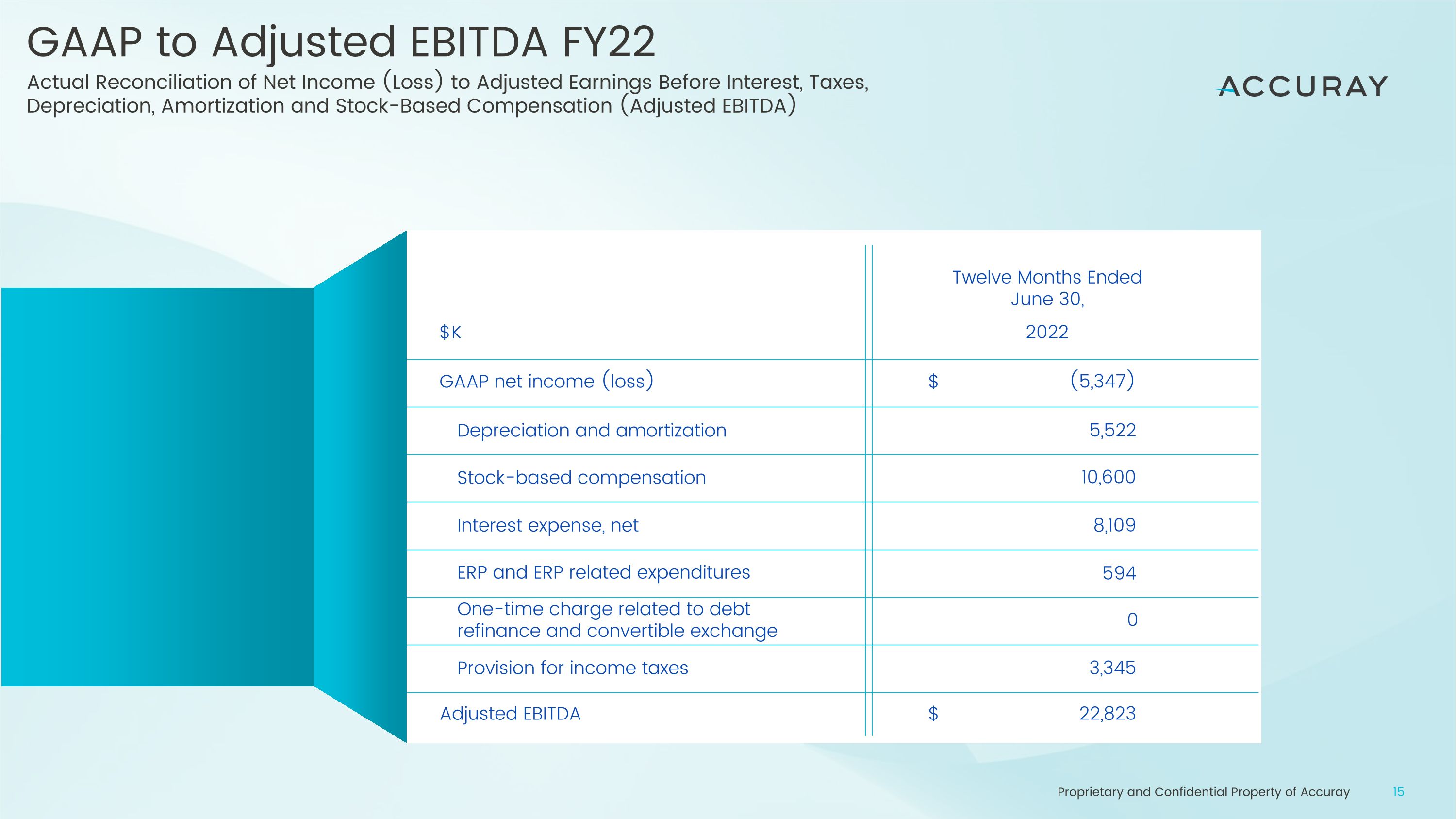

Maintaining FY23 Guidance Communicated�August 10, 2022 Revenue Adjusted EBITDA1 $429.9M $22.8M FY23 Guidance Range FY22 Actual $ in millions % = YoY Growth $447M - $455M +4% - 6% $26M - $30M +14% - 32% 1 Adjusted EBITDA is a non-GAAP measure. Please see Slides 15 and 16 for a reconciliation of Adjusted EBITDA to the most directly comparable GAAP measure.

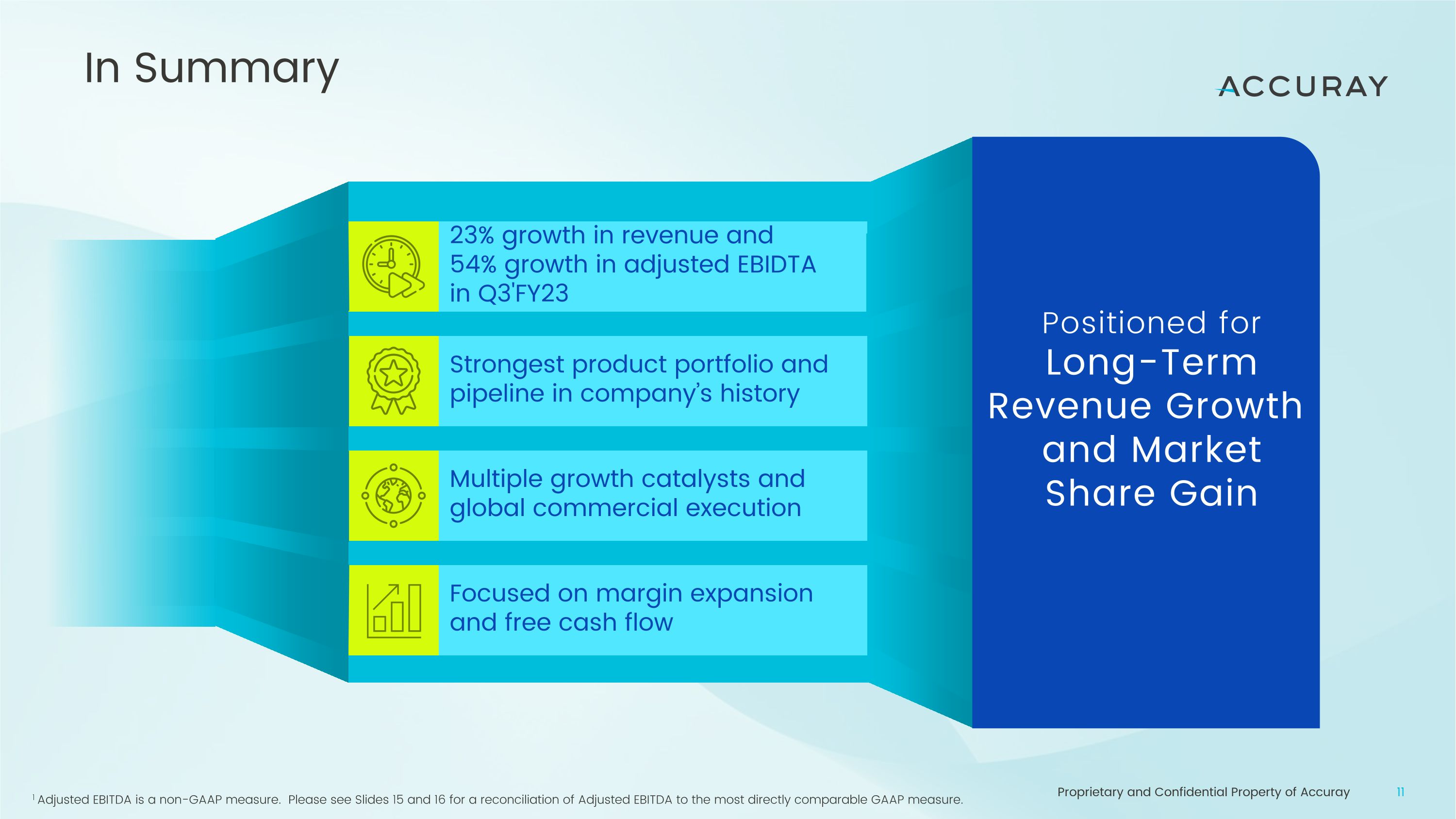

In Summary 23% growth in revenue and�54% growth in adjusted EBIDTA�in Q3'FY23 Strongest product portfolio and pipeline in company’s history Multiple growth catalysts and global commercial execution Focused on margin expansion and free cash flow Positioned for Long-Term Revenue Growth and Market Share Gain 1 Adjusted EBITDA is a non-GAAP measure. Please see Slides 15 and 16 for a reconciliation of Adjusted EBITDA to the most directly comparable GAAP measure.

Thank you

$K GAAP net income (loss) Stock-based compensation Interest expense, net Provision for income taxes Adjusted EBITDA Depreciation and amortization Three Months Ended March 31, Three Months Ended March 31, 2022 2023 $ $ $ $ 599 1,103 1,559 2,707 522 8,347 (1,046) 1,406 2,695 1,975 407 5,437 ERP and ERP related expenditures 1,057 Restructuring charges 800 0 0 GAAP to Adjusted EBITDA Q3 FY23 and Q3 FY22 Actual Reconciliation of Net Income (Loss) to Adjusted Earnings Before Interest, Taxes, Depreciation, Amortization and Stock-Based Compensation (Adjusted EBITDA)

$K GAAP net income (loss) Stock-based compensation Interest expense, net Provision for income taxes Adjusted EBITDA Depreciation and amortization Nine Months Ended March 31, Nine Months Ended March 31, 2022 2023 $ $ $ $ (6,724) 3,430 7,601 7,605 1,912 18,740 (1,895) 4,247 7,906 6,081 1,318 17,657 ERP and ERP related expenditures 2,178 Restructuring charges 2,738 0 0 GAAP to Adjusted EBITDA YTD Q3 FY23 and YTD Q3FY22 Actual Reconciliation of Net Income (Loss) to Adjusted Earnings Before Interest, Taxes, Depreciation,�Amortization and Stock-Based Compensation (Adjusted EBITDA)

GAAP to Adjusted EBITDA FY22 Actual Reconciliation of Net Income (Loss) to Adjusted Earnings Before Interest, Taxes,�Depreciation, Amortization and Stock-Based Compensation (Adjusted EBITDA) $K GAAP net income (loss) Stock-based compensation Interest expense, net Provision for income taxes Adjusted EBITDA Depreciation and amortization Twelve Months Ended June 30, 2022 $ $ (5,347) 5,522 10,600 8,109 3,345 22,823 ERP and ERP related expenditures 594 One-time charge related to debt refinance and convertible exchange 0

$K GAAP net income (loss) Stock-based compensation Interest expense, net Provision for income taxes Adjusted EBITDA Depreciation and amortization To From $ $ $ $ (7,000) 4,500 10,200 10,000 2,400 26,000 (3,000) 4,500 10,200 10,000 2,400 30,000 ERP and ERP related expenditures 3,200 Restructuring charges 2,700 3,200 2,700 GAAP to Adjusted EBITDA FY23 – Forward Looking Guidance Actual Reconciliation of Net Income (Loss) to Adjusted Earnings Before Interest, Taxes, Depreciation, Amortization and Stock-Based Compensation (Adjusted EBITDA) Twelve Months Ended June 30, 2023