Q2’FY25 Earnings Call�Supplemental Presentation February 5, 2025

Forward-looking Statements This presentation is intended exclusively for investors. It is not intended for use in Sales or Marketing. 2 Proprietary and Confidential Property of Accuray Safe Harbor Statement Statements in this presentation (including the oral commentary that accompanies it) that are not statements of historical fact are forward-looking statements and are subject to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements in this presentation relate, but are not limited, to: expectations regarding adjusted EBITDA and revenue; expectations regarding China deferred margin release; our ability to deliver on our goals, priorities, and strategic growth plans; our expectations related to the markets and regions in which we operate; expectations related to our China joint venture, including related to the Tomo-C System and margin deferral from the China joint venture; and expectations related to new product innovations and offerings as well as revenue growth and market share going forward. Forward-looking statements generally can be identified by words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “projects,” “may,” “will be,” “will continue,” and similar expressions. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from expectations. These risks and uncertainties include, but are not limited to: risks related to the effect of the global macroeconomic environment on the operations of the company and those of its customers and suppliers; disruptions to our supply chain, including increased logistics costs; the company's ability to achieve widespread market acceptance of its products; the company’s ability to realize the expected benefits of the China joint venture and other partnerships; risks inherent in international operations; the company's ability to maintain or increase its gross margins on product sales and services; delays in regulatory approvals or the development or release of new offerings; the company's ability to meet the covenants under its credit facilities; the company's ability to convert backlog to revenue and other risks identified under the heading “Risk Factors” in our annual report on Form 10-K, filed with the Securities and Exchange Commission (the “SEC”) on September 19, 2024, and as updated periodically with our other filings with the SEC. Forward-looking statements speak only as of the date the statements are made and are based on information available to Accuray at the time those statements are made and/or management’s good faith belief as of that time with respect to future events. Accuray assumes no obligation to update forward-looking statements to reflect actual performance or results, changes in assumptions or changes in other factors affecting forward-looking information, except to the extent required by applicable securities laws. Accordingly, investors should not place undue reliance on any forward-looking statements. Non-GAAP Financial Measures This presentation also contains non-GAAP financial measures. Management believes that non-GAAP financial measures provide useful supplemental information to management and investors regarding the performance of the company and facilitates a more meaningful comparison of results for current periods with previous operating results. Additionally, these non-GAAP financial measures assist management in analyzing future trends, making strategic and business decisions, and establishing internal budgets and forecasts. A reconciliation of these non-GAAP financial measures to the most directly comparable GAAP measure is provided in the Appendix. Accuray has also reported certain operating results on a constant currency basis in order to facilitate period-to-period comparisons of its results without regard to the impact of foreign currency exchange rate fluctuations. Management believes disclosure of non-GAAP constant currency results is helpful to investors because it facilitates period-to-period comparisons of the company's results by increasing the transparency of the underlying performance by excluding the impact of foreign currency exchange rate fluctuations. Accuray calculates the constant currency amounts by translating local currency amounts in the current period using the same foreign translation rate used in the prior period being compared against rather than the actual exchange rate in effect during the current period. There are limitations in using these non-GAAP financial measures because they are not prepared in accordance with GAAP and may be different from non-GAAP financial measures used by other companies. These non-GAAP financial measures should not be considered in isolation or as a substitute for GAAP financial measures. Investors and potential investors should consider non-GAAP financial measures only in conjunction with the company’s consolidated financial statements prepared in accordance with GAAP. Medical Advice Disclaimer Accuray Incorporated as a medical device manufacturer cannot and does not recommend specific treatment approaches. Individual results may vary.

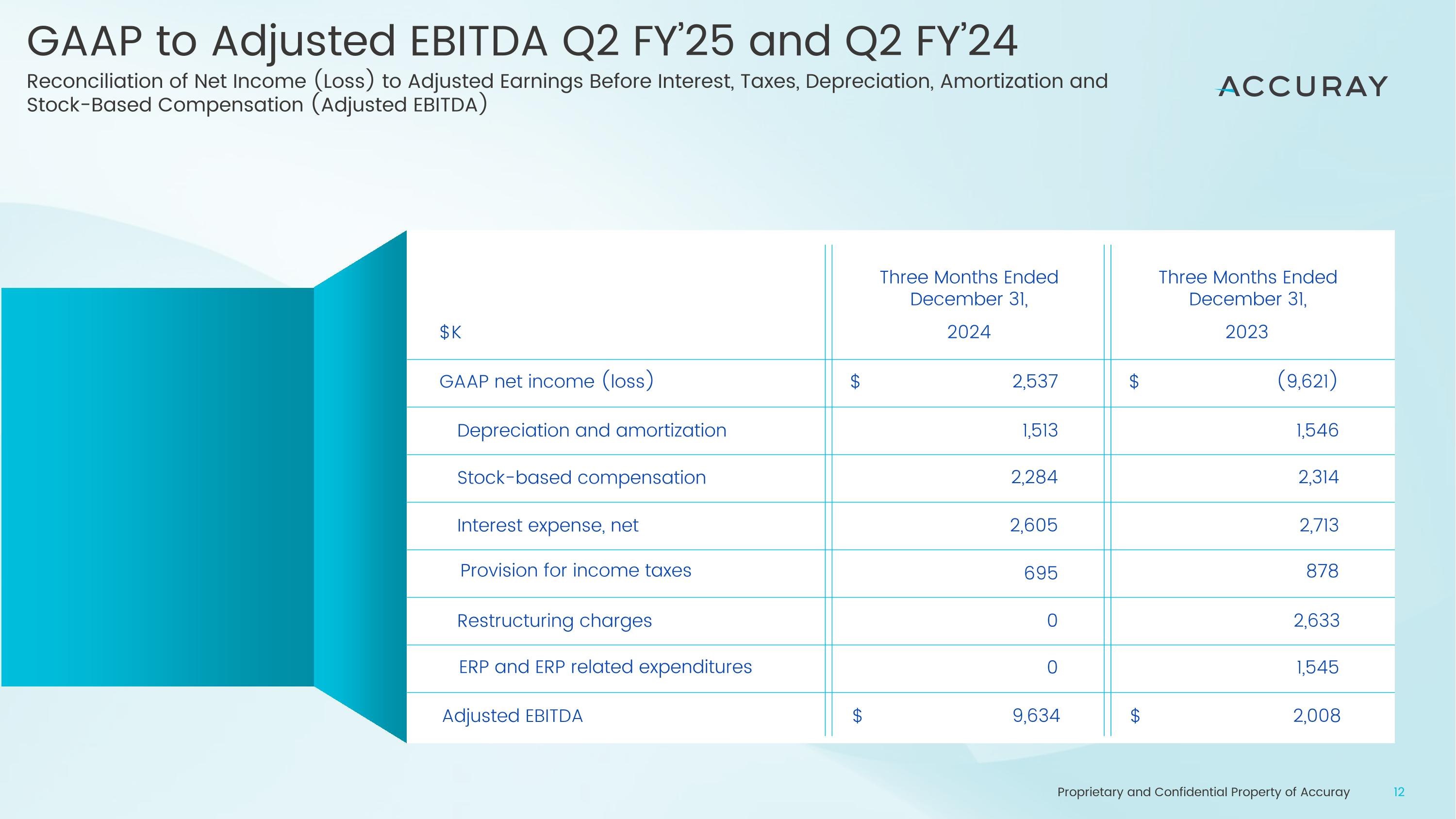

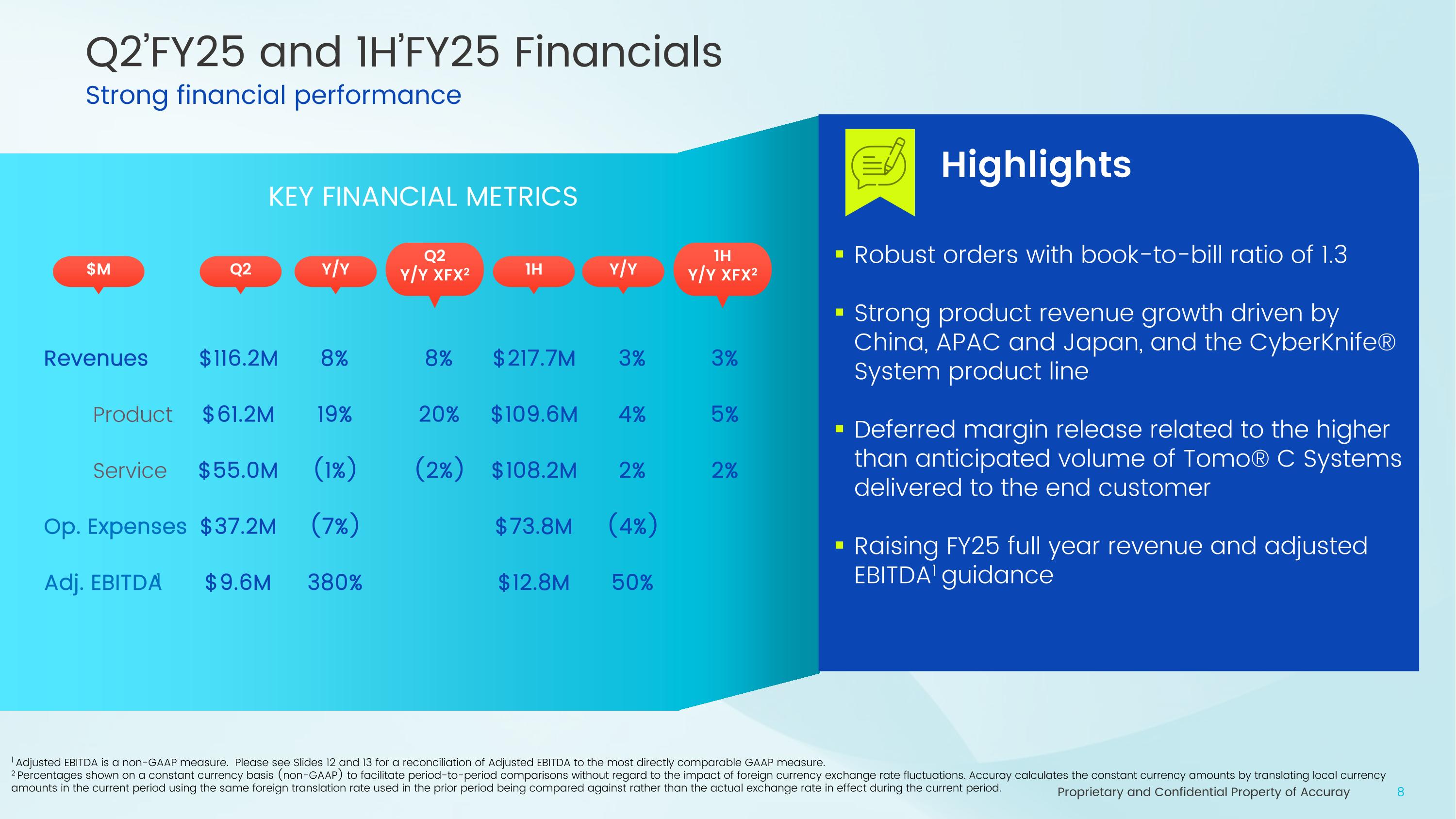

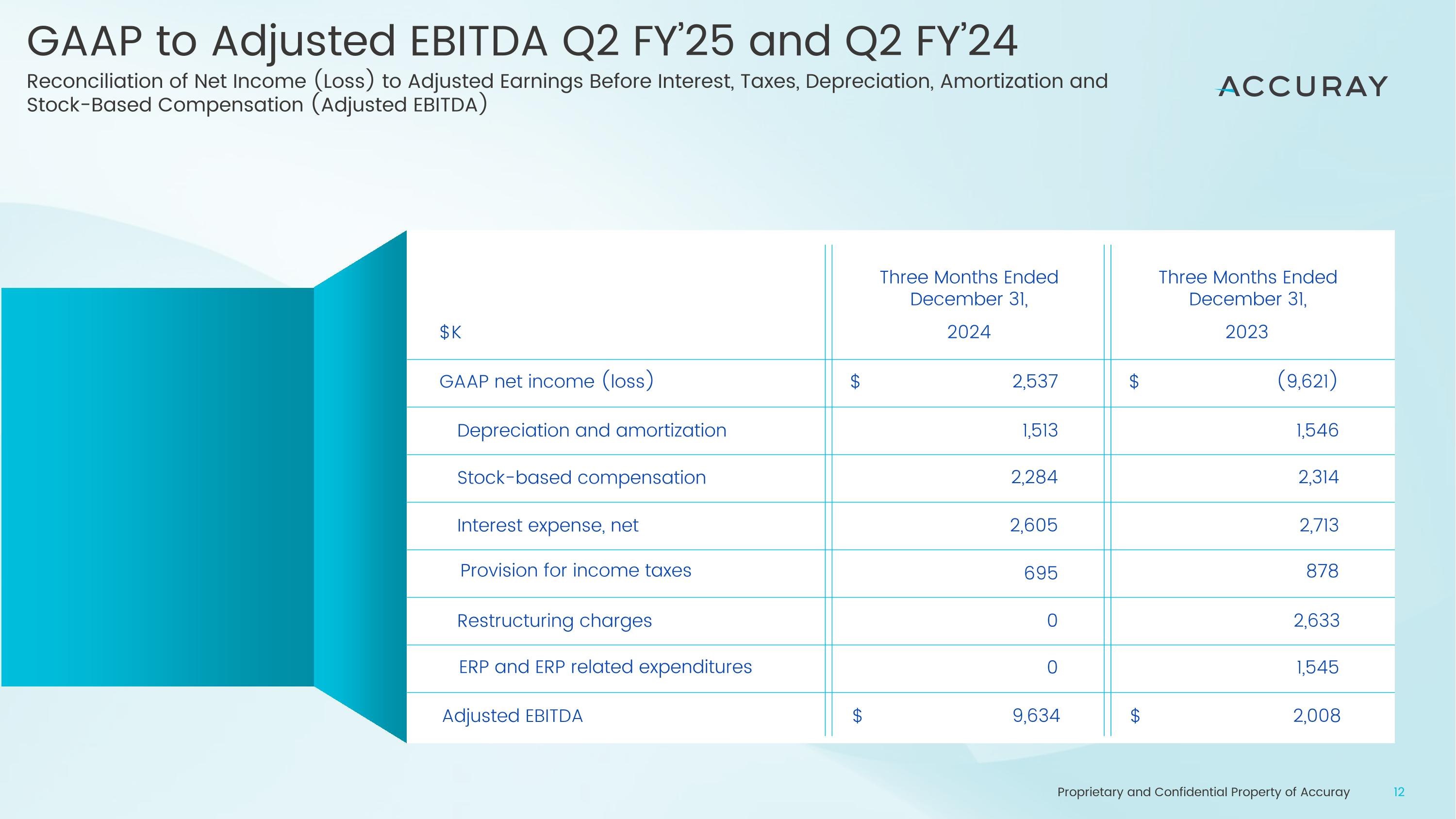

Highlights Strong second quarter and first half results; raising fiscal year 2025 guidance Total net revenue was $116.2 million, an increase of 8 percent year-over-year Net income was $2.5 million compared to a net loss of $9.6 million in the prior year period Adjusted EBITDA1 was $9.6 million compared to $2.0 million in the prior year period 1 Adjusted EBITDA is a non-GAAP measure. Please see Slide 12 for a reconciliation of Adjusted EBITDA to the most directly comparable GAAP measure.

Vision To expand the curative power of radiation therapy to improve as many lives as possible Mission To think, act, and execute beyond expectations every day to deliver better, safer radiation therapy solutions and help patients get back to living their lives, faster

Customer and Patient Focused Priorities Advance Care �by providing solutions that address�the biggest pain points in RT Drive Patient Access�to radiotherapy treatments in developed and high potential underserved markets Delight Customers�by ensuring high operational performance so no patient�is rescheduled Hope Confidence Conquer Cancer by Closing the Gaps to Care

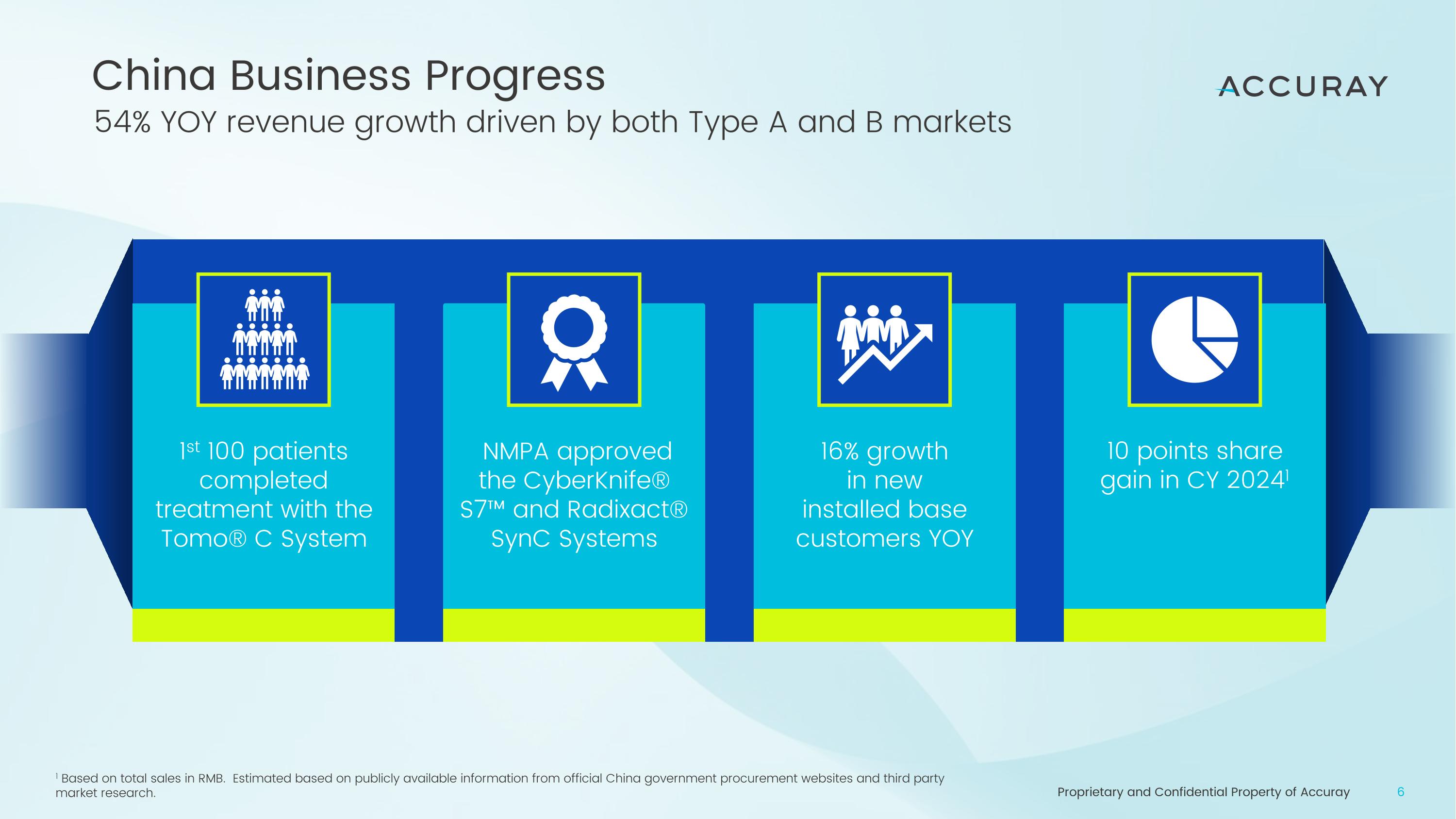

China Business Progress 54% YOY revenue growth driven by both Type A and B markets 16% growth�in new�installed base customers YOY NMPA approved the CyberKnife® S7™ and Radixact® SynC Systems 10 points share gain in CY 20241 1st 100 patients completed treatment with the Tomo® C System 1 Based on total sales in RMB. Estimated based on publicly available information from official China government procurement websites and third party market research.

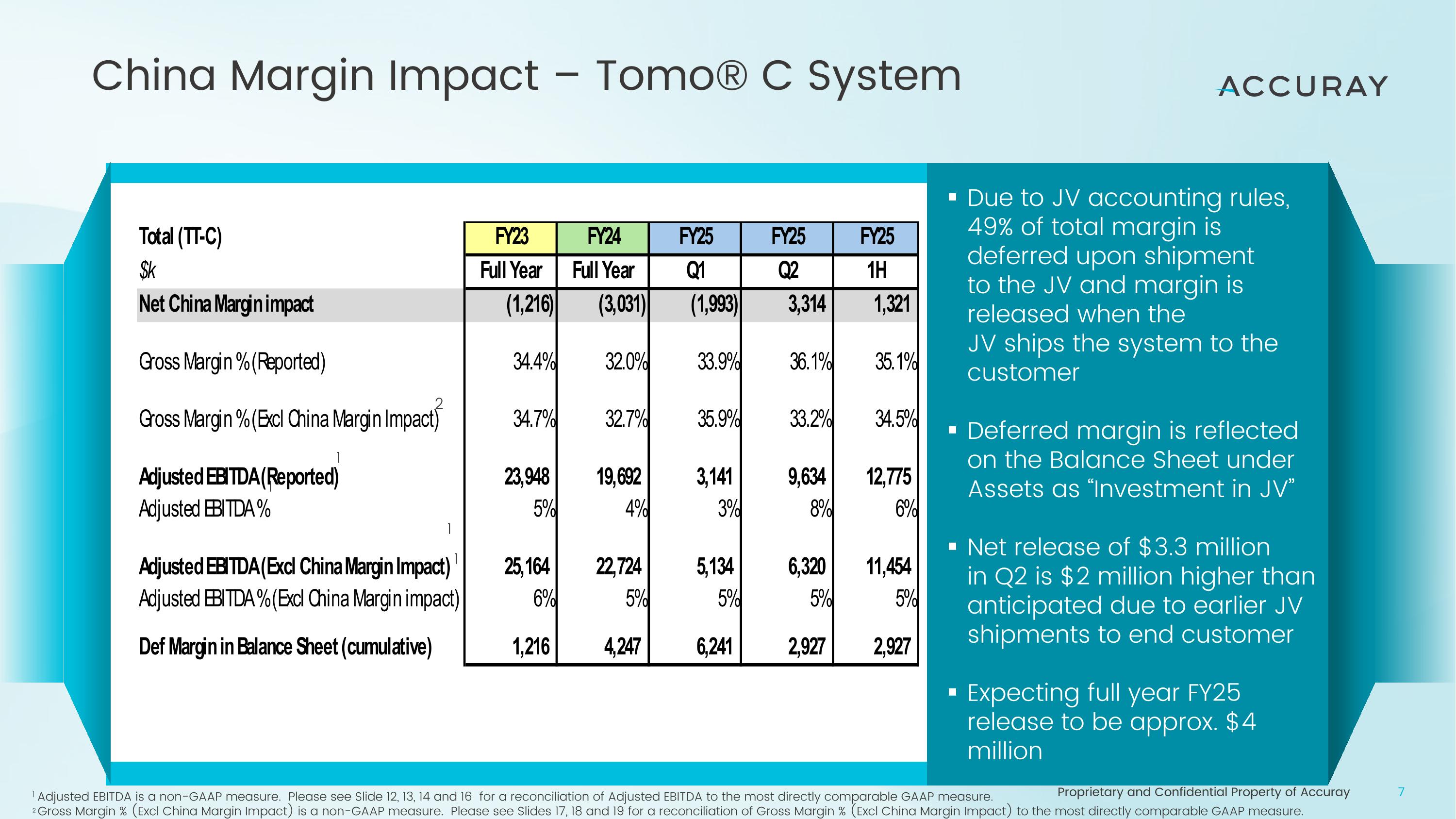

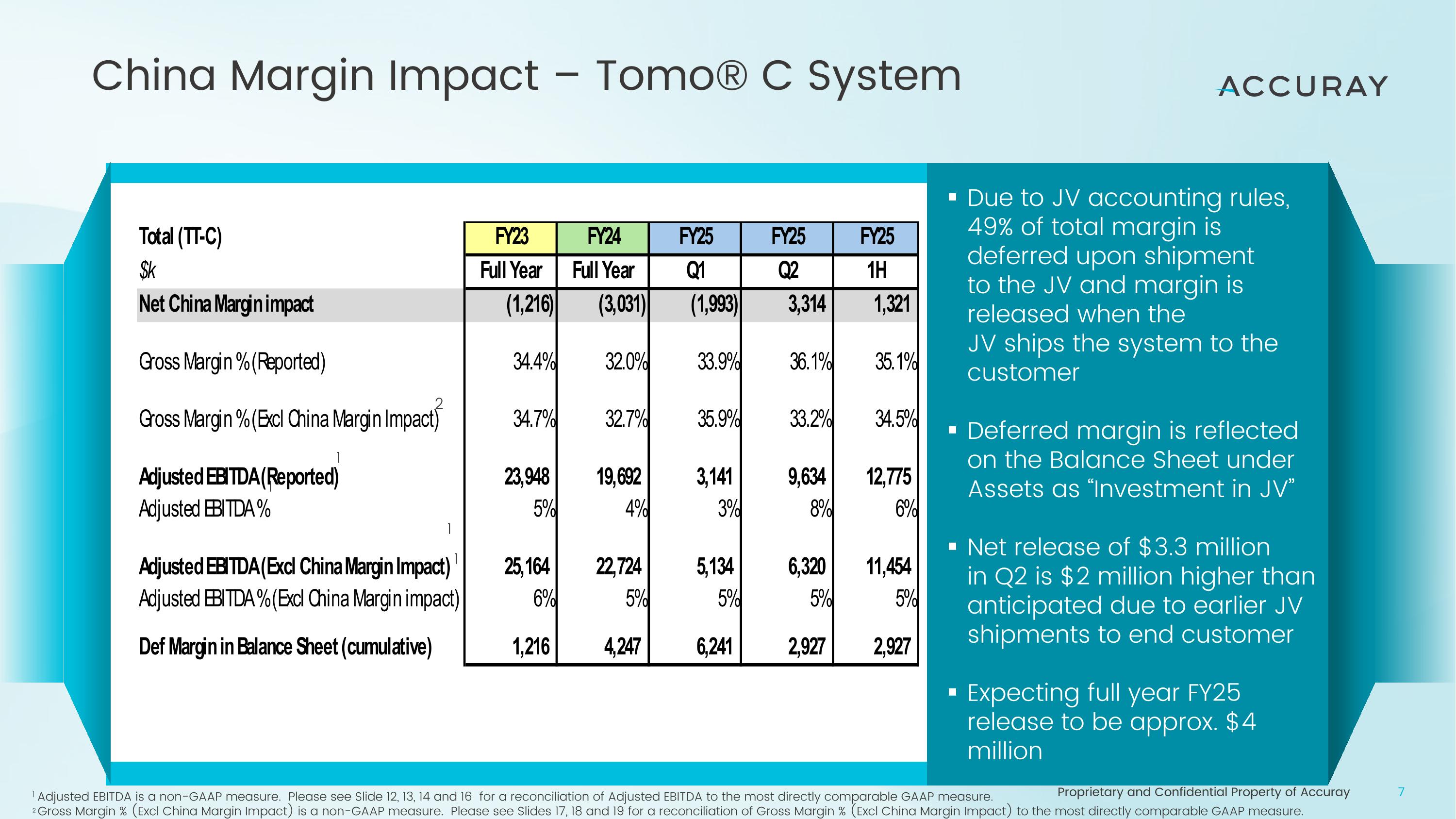

China Margin Impact – Tomo® C System Due to JV accounting rules, 49% of total margin is deferred upon shipment�to the JV and margin is released when the�JV ships the system to the customer Deferred margin is reflected�on the Balance Sheet under Assets as “Investment in JV” Net release of $3.3 million�in Q2 is $2 million higher than anticipated due to earlier JV shipments to end customer Expecting full year FY25 release to be approx. $4 million 1 Adjusted EBITDA is a non-GAAP measure. Please see Slide 12, 13, 14 and 16 for a reconciliation of Adjusted EBITDA to the most directly comparable GAAP measure. 2 Gross Margin % (Excl China Margin Impact) is a non-GAAP measure. Please see Slides 17, 18 and 19 for a reconciliation of Gross Margin % (Excl China Margin Impact) to the most directly comparable GAAP measure. 1 1 1 1 2

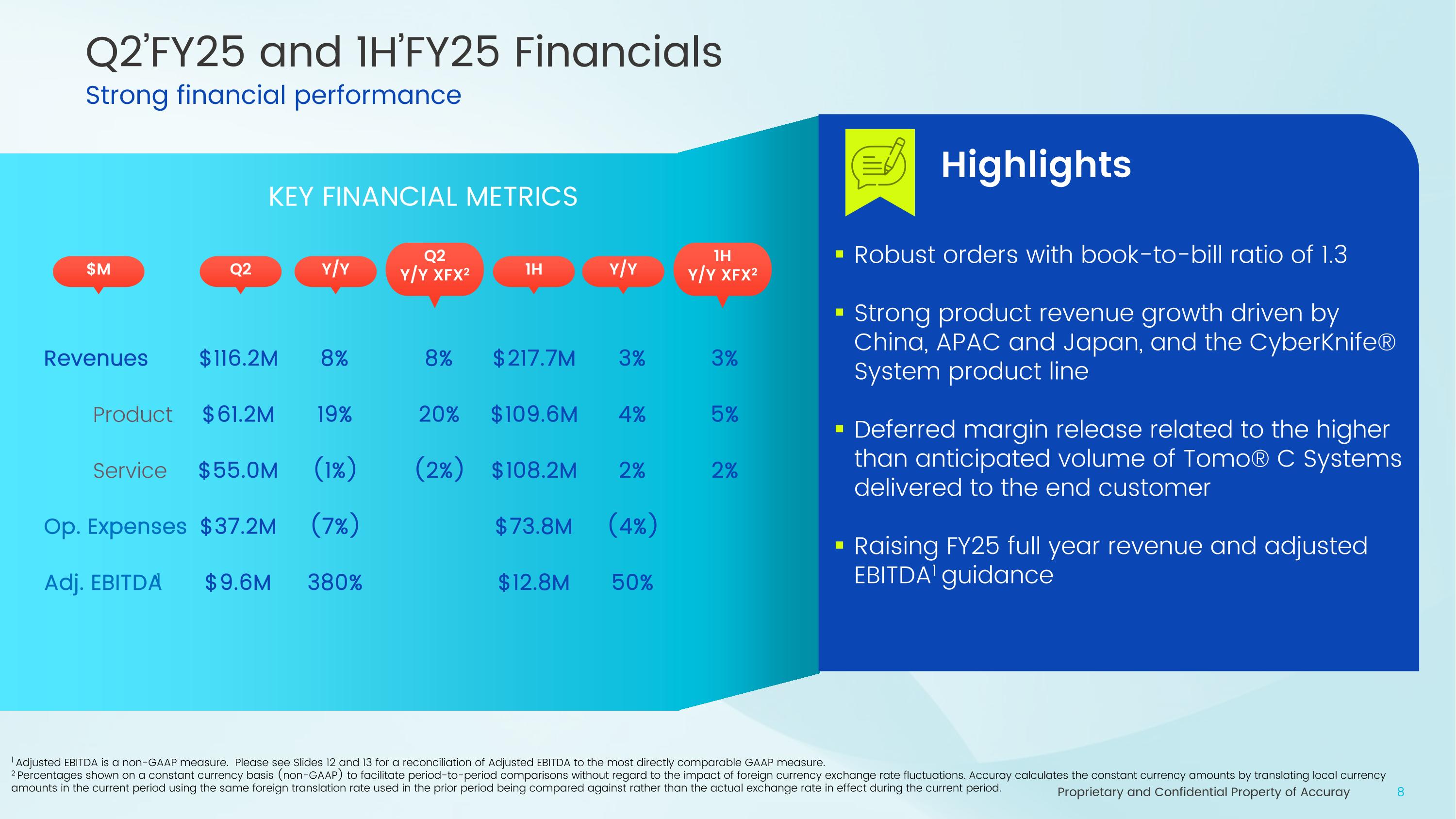

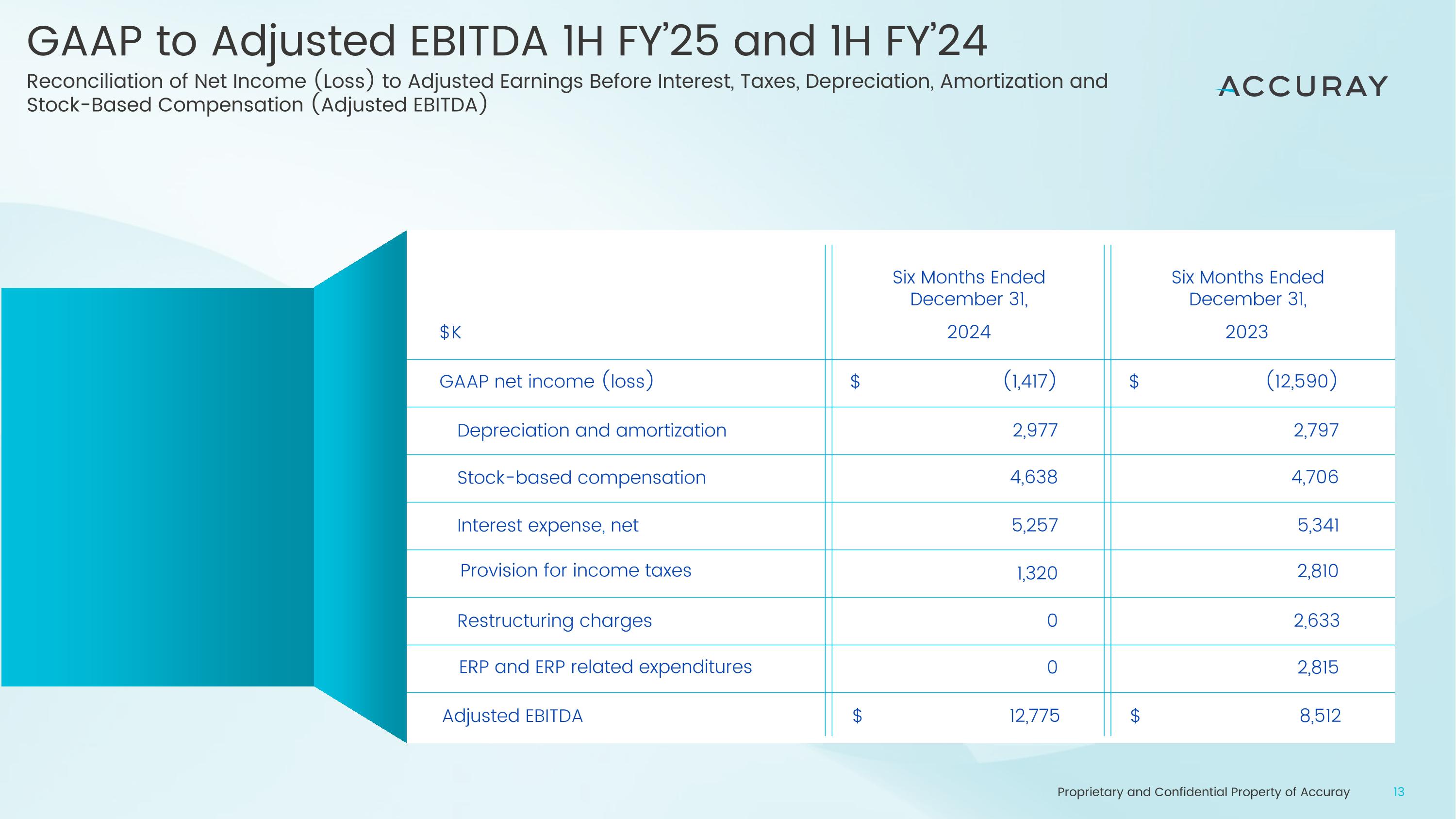

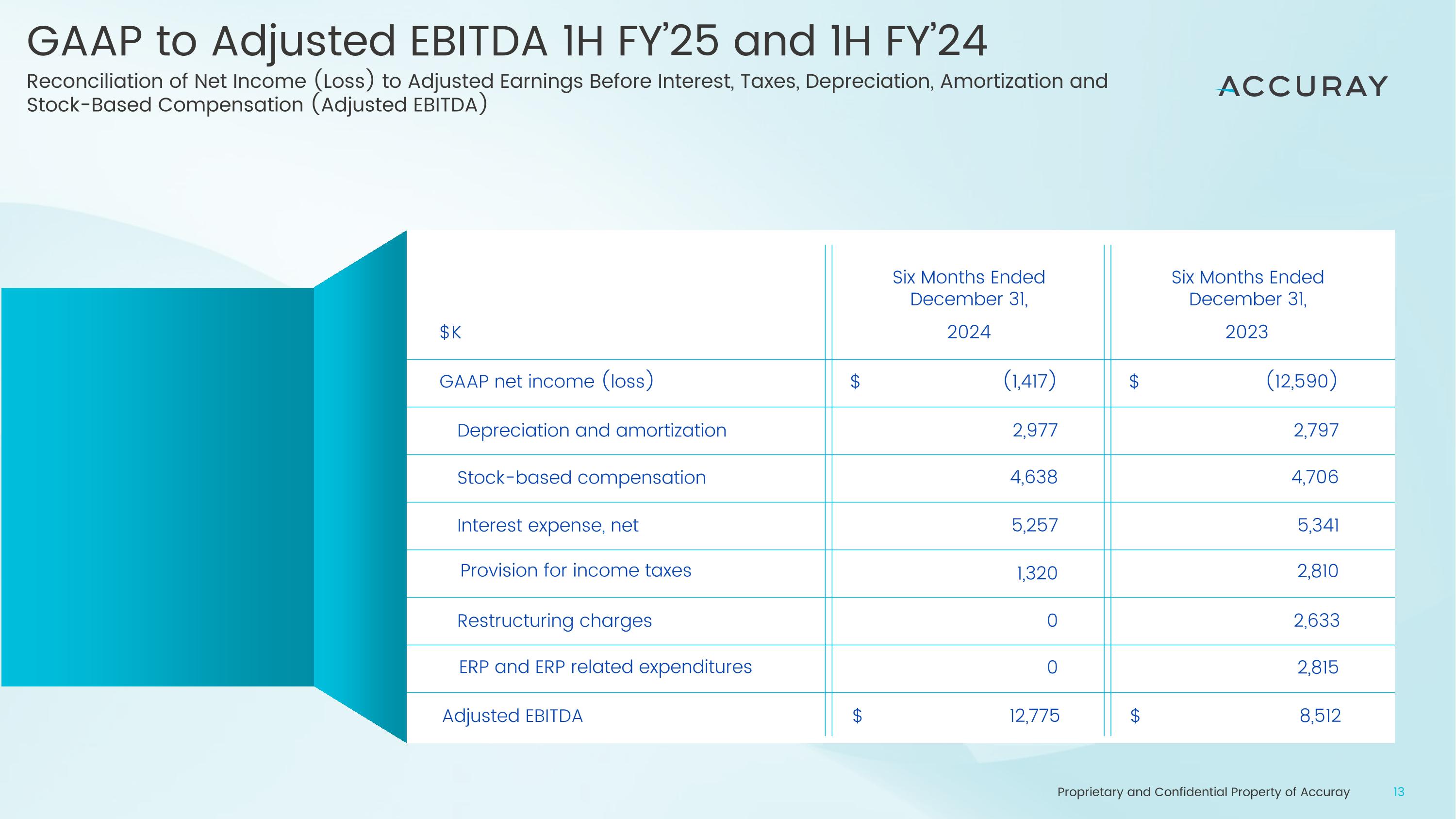

Q2’FY25 and 1H’FY25 Financials Strong financial performance KEY FINANCIAL METRICS Highlights Robust orders with book-to-bill ratio of 1.3 Strong product revenue growth driven by China, APAC and Japan, and the CyberKnife® System product line Deferred margin release related to the higher than anticipated volume of Tomo® C Systems delivered to the end customer Raising FY25 full year revenue and adjusted EBITDA1 guidance $M Q2 Y/Y 1H Y/Y Q2�Y/Y XFX2 1H�Y/Y XFX2 Revenues $116.2M 8% 8% $217.7M 3% 3% Product $61.2M 19% 20% $109.6M 4% 5% Service $55.0M (1%) (2%) $108.2M 2% 2% Op. Expenses $37.2M (7%) $73.8M (4%) Adj. EBITDA1 $9.6M 380% $12.8M 50% 1 Adjusted EBITDA is a non-GAAP measure. Please see Slides 12 and 13 for a reconciliation of Adjusted EBITDA to the most directly comparable GAAP measure. 2 Percentages shown on a constant currency basis (non-GAAP) to facilitate period-to-period comparisons without regard to the impact of foreign currency exchange rate fluctuations. Accuray calculates the constant currency amounts by translating local currency amounts in the current period using the same foreign translation rate used in the prior period being compared against rather than the actual exchange rate in effect during the current period.

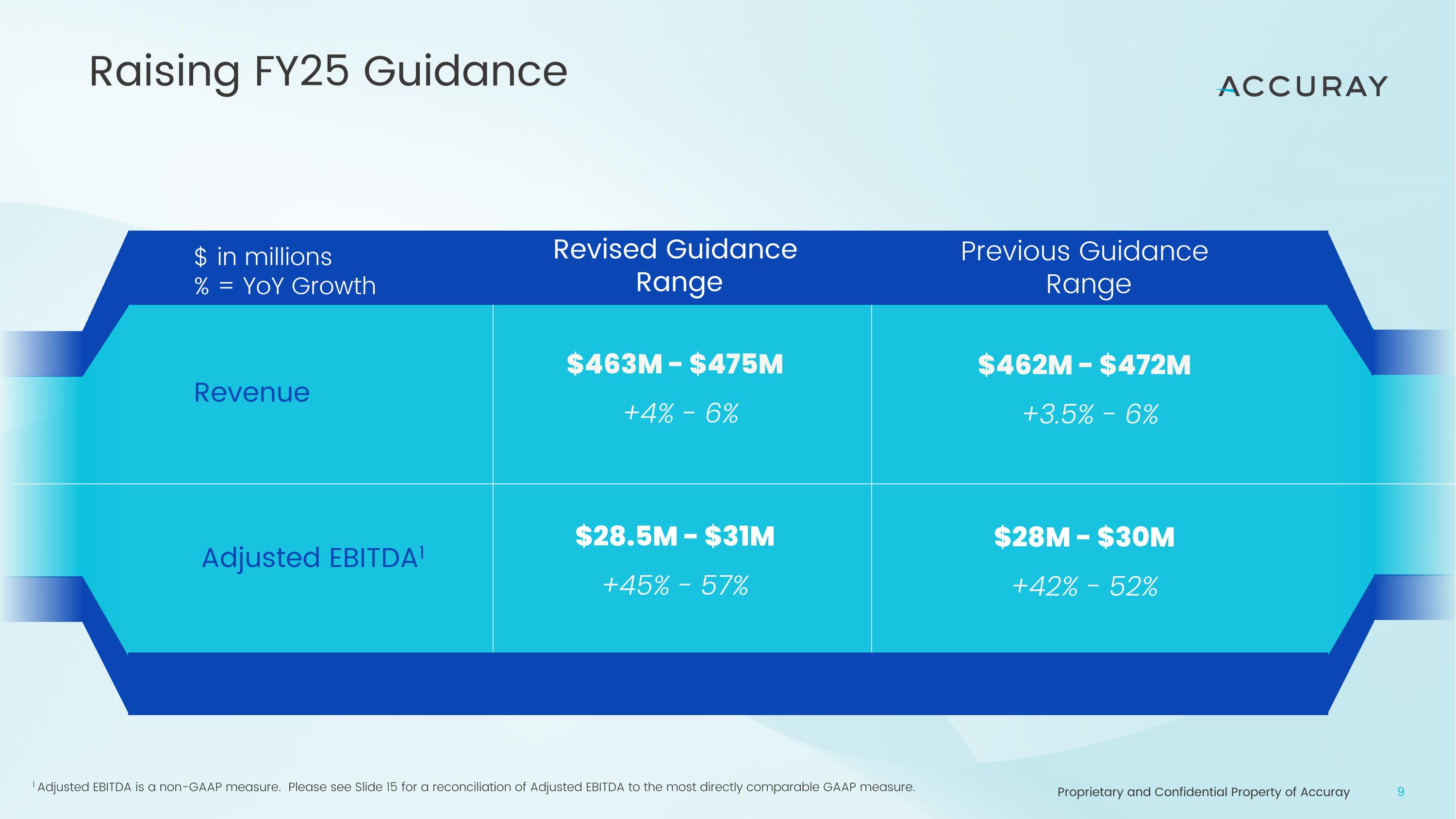

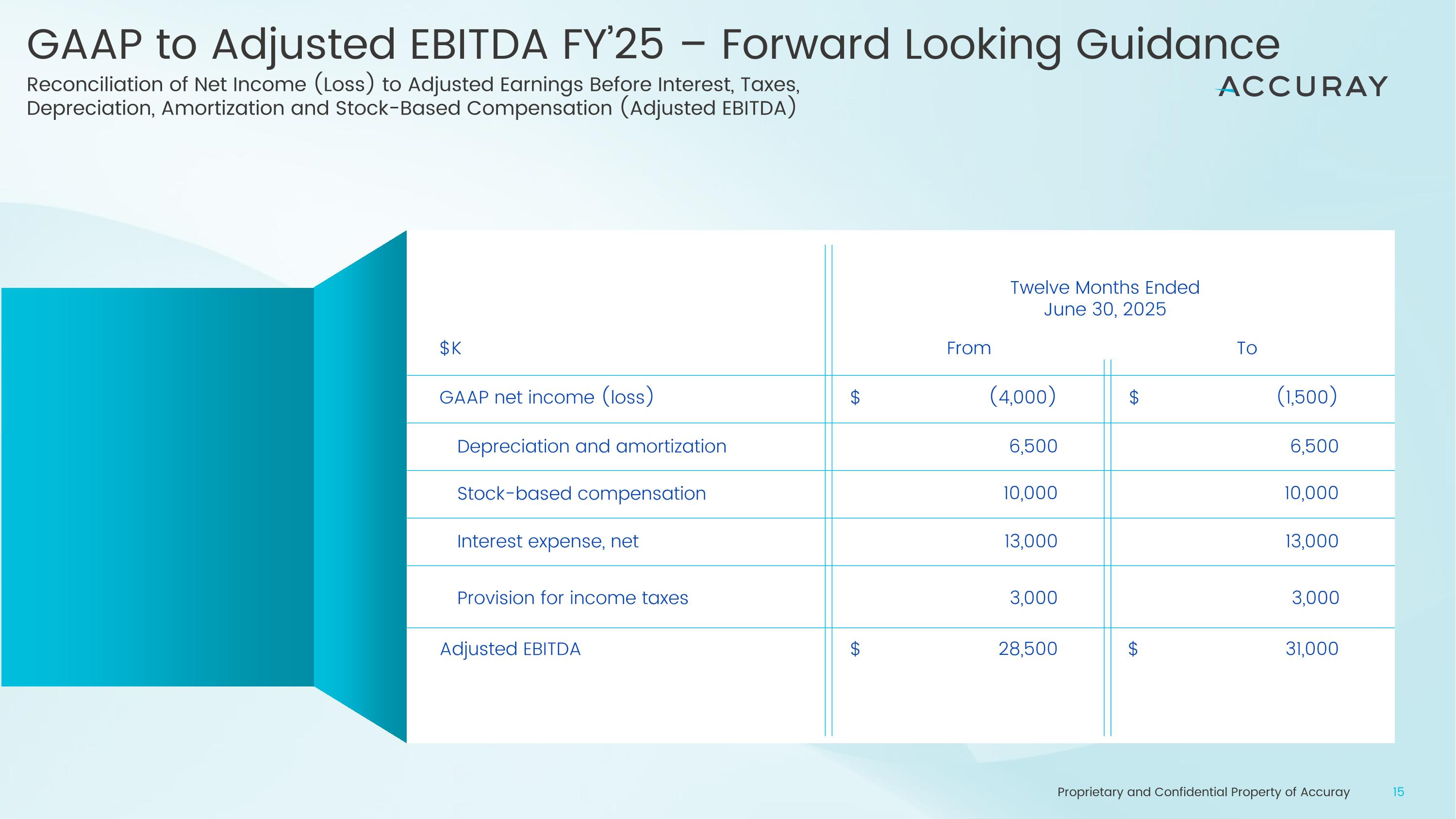

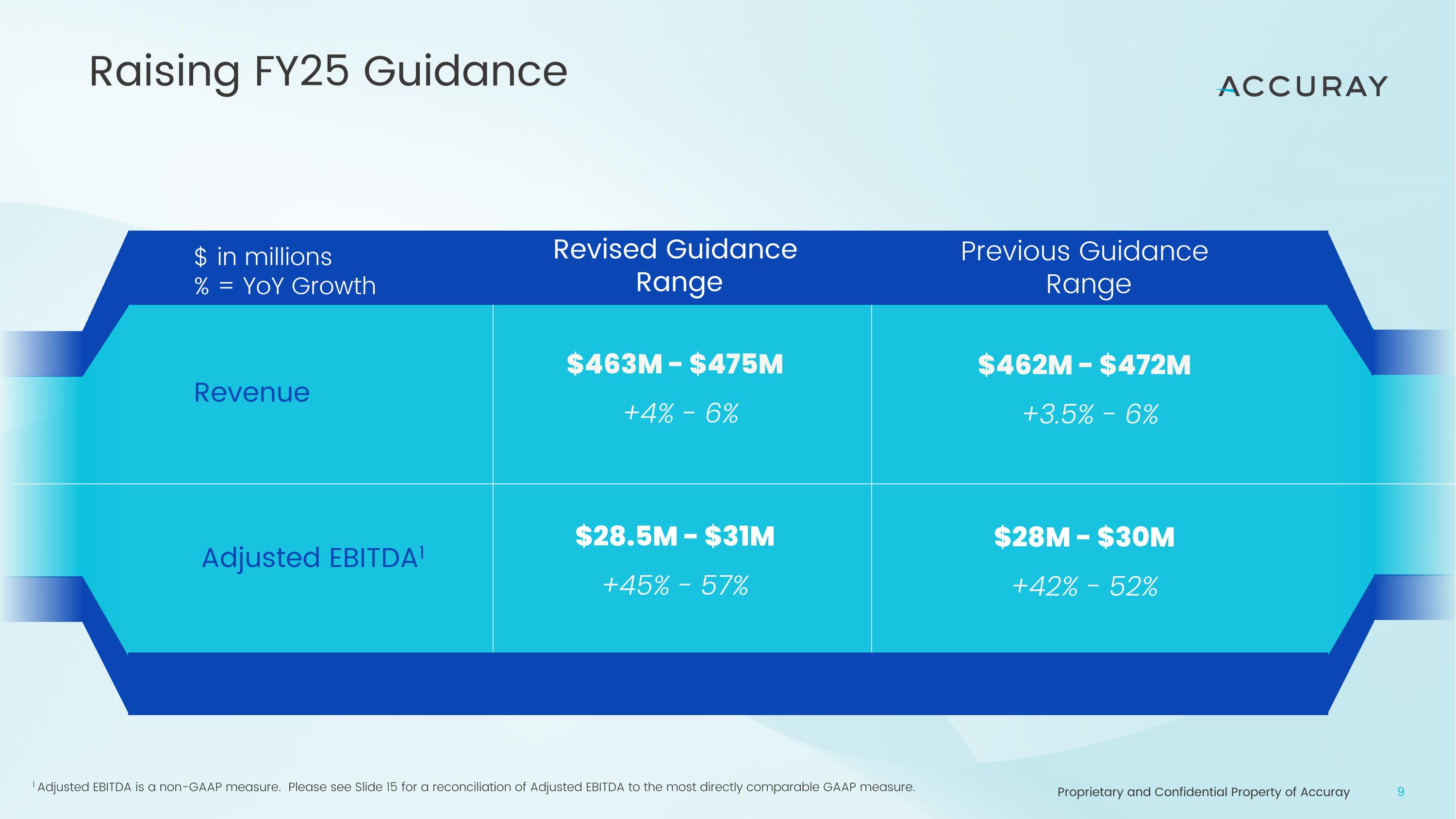

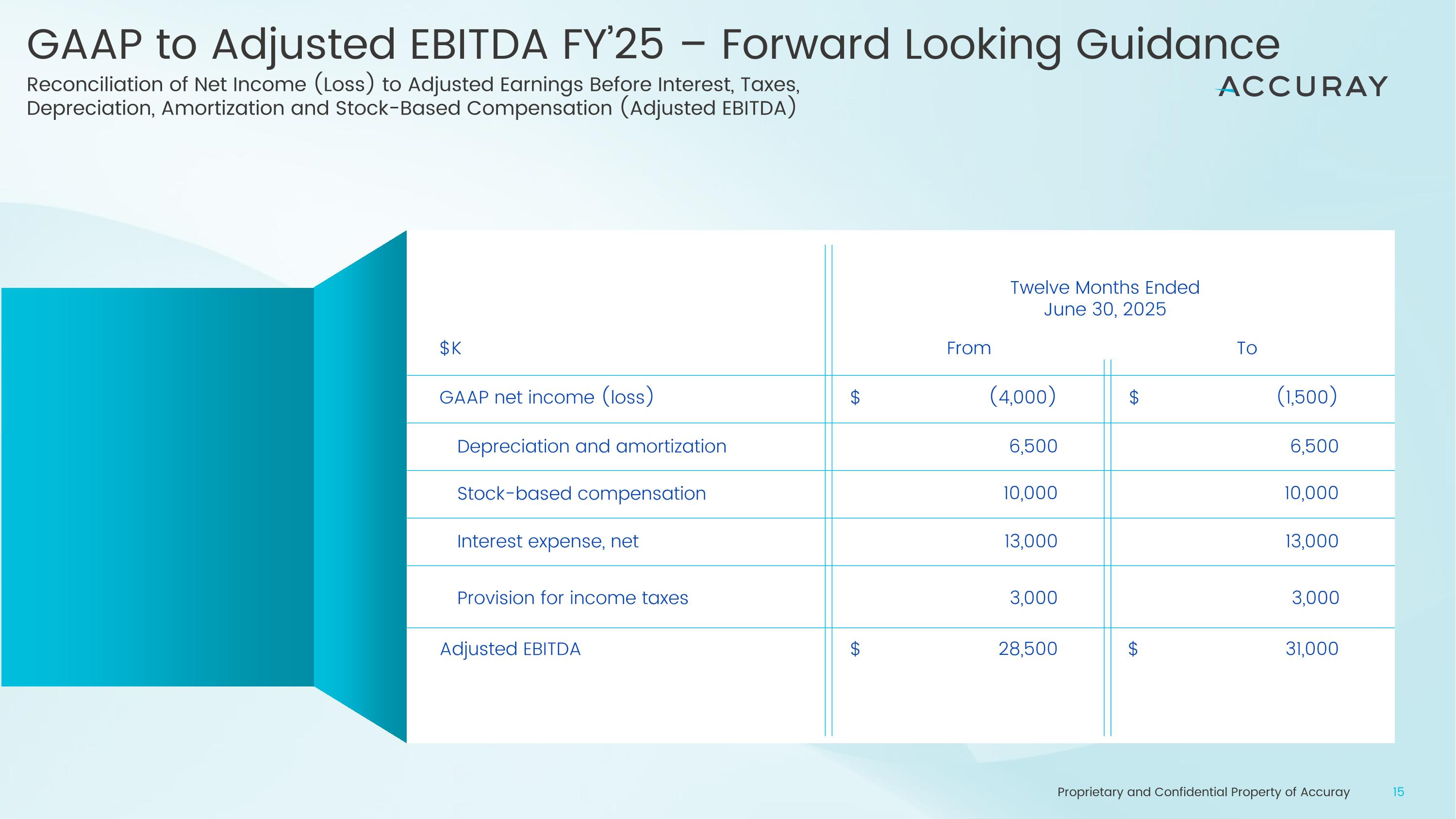

Raising FY25 Guidance Revenue Adjusted EBITDA1 Previous Guidance Range $28M - $30M +42% - 52% 1 Adjusted EBITDA is a non-GAAP measure. Please see Slide 15 for a reconciliation of Adjusted EBITDA to the most directly comparable GAAP measure. $ in millions % = YoY Growth $462M - $472M +3.5% - 6% Revised Guidance Range $28.5M - $31M +45% - 57% $463M - $475M +4% - 6%

FY2025 Fiscal Focused Priorities Outpace the Market and Grow Customer Base Expand Service and Solutions Recurring Revenue Improve Profitability and Operational Excellence Strengthen Balance Sheet and Cash Flow

Thank you

$K GAAP net income (loss) Stock-based compensation Interest expense, net Restructuring charges Depreciation and amortization Three Months Ended December 31, Three Months Ended December 31, 2023 2024 $ $ 2,537 1,513 2,284 2,605 0 0 (9,621) 1,546 2,314 2,713 2,633 1,545 ERP and ERP related expenditures 695 878 GAAP to Adjusted EBITDA Q2 FY’25 and Q2 FY’24 Reconciliation of Net Income (Loss) to Adjusted Earnings Before Interest, Taxes, Depreciation, Amortization and Stock-Based Compensation (Adjusted EBITDA) Adjusted EBITDA $ $ 9,634 2,008 Provision for income taxes

$K GAAP net income (loss) Stock-based compensation Interest expense, net Restructuring charges Depreciation and amortization Six Months Ended December 31, Six Months Ended December 31, 2023 2024 $ $ (1,417) 2,977 4,638 5,257 0 0 (12,590) 2,797 4,706 5,341 2,633 2,815 ERP and ERP related expenditures 1,320 2,810 GAAP to Adjusted EBITDA 1H FY’25 and 1H FY’24 Reconciliation of Net Income (Loss) to Adjusted Earnings Before Interest, Taxes, Depreciation, Amortization and Stock-Based Compensation (Adjusted EBITDA) Adjusted EBITDA $ $ 12,775 8,512 Provision for income taxes

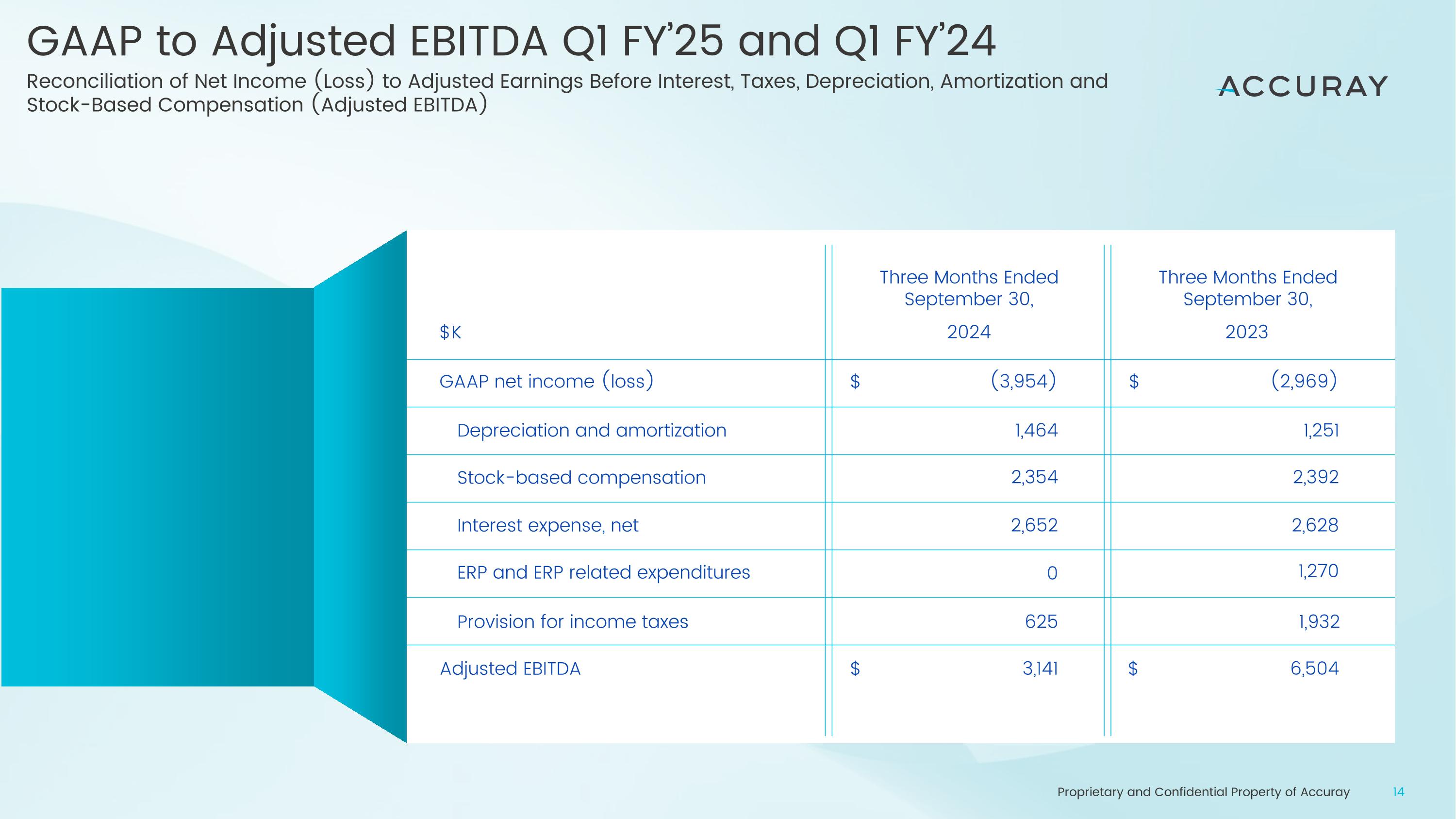

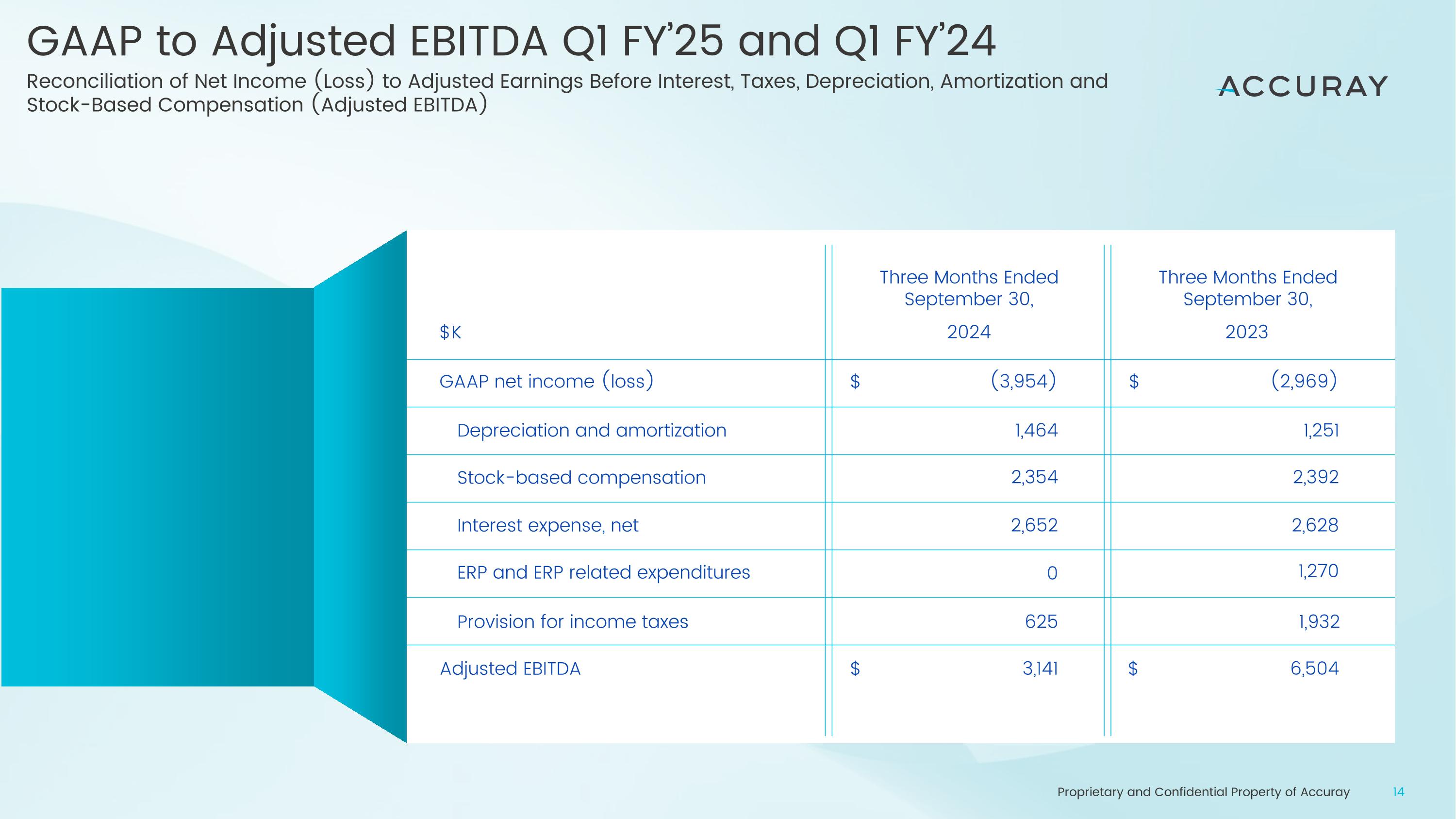

$K GAAP net income (loss) Stock-based compensation Interest expense, net Provision for income taxes Adjusted EBITDA Depreciation and amortization Three Months Ended September 30, Three Months Ended September 30, 2023 2024 $ $ $ $ (3,954) 1,464 2,354 2,652 625 3,141 (2,969) 1,251 2,392 2,628 1,932 6,504 ERP and ERP related expenditures 0 1,270 GAAP to Adjusted EBITDA Q1 FY’25 and Q1 FY’24 Reconciliation of Net Income (Loss) to Adjusted Earnings Before Interest, Taxes, Depreciation, Amortization and Stock-Based Compensation (Adjusted EBITDA)

$K GAAP net income (loss) Stock-based compensation Interest expense, net Provision for income taxes Adjusted EBITDA Depreciation and amortization To From $ $ $ $ (4,000) 6,500 10,000 13,000 3,000 28,500 (1,500) 6,500 10,000 13,000 3,000 31,000 GAAP to Adjusted EBITDA FY’25 – Forward Looking Guidance Reconciliation of Net Income (Loss) to Adjusted Earnings Before Interest, Taxes, Depreciation, Amortization and Stock-Based Compensation (Adjusted EBITDA) Twelve Months Ended June 30, 2025

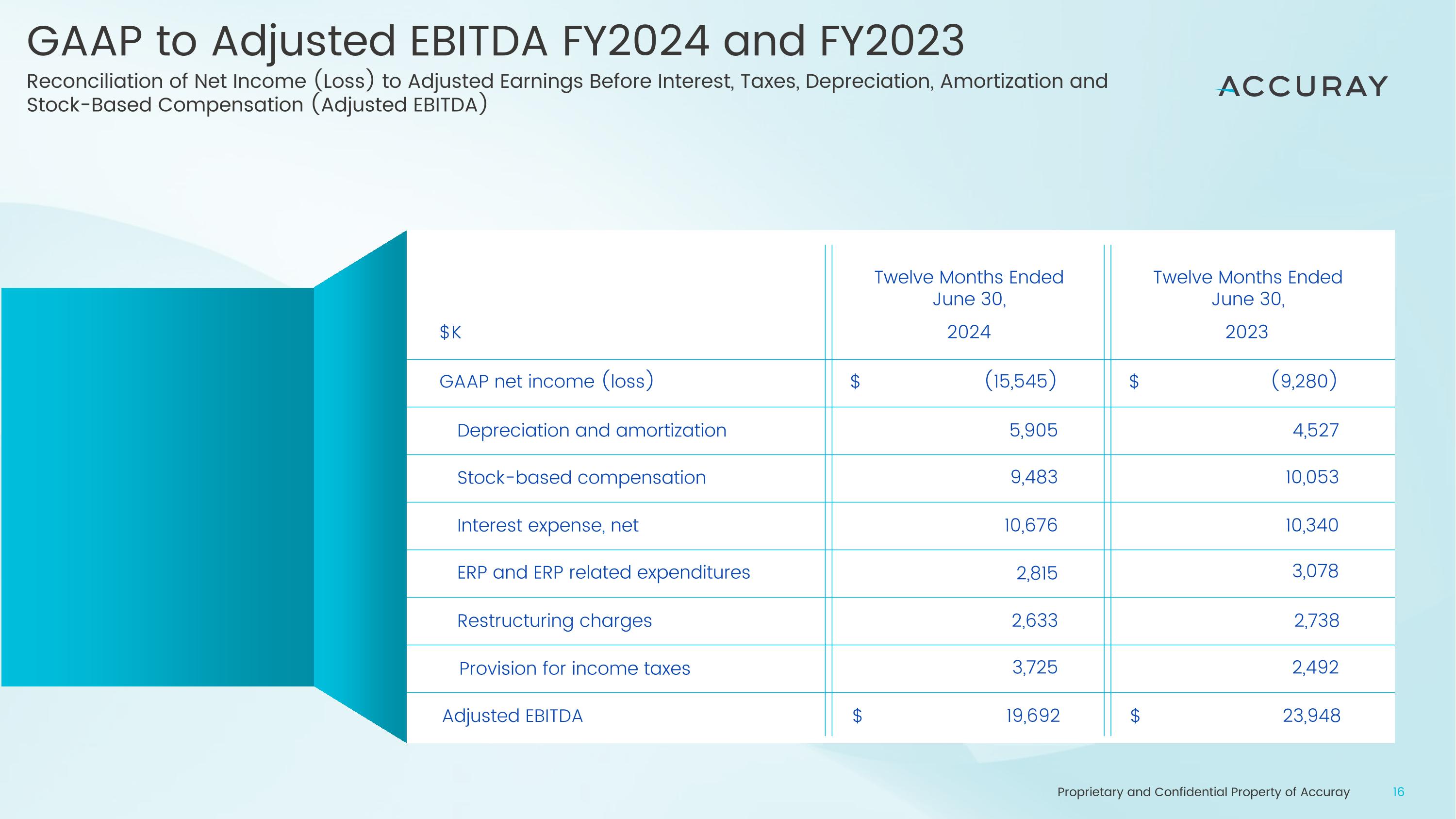

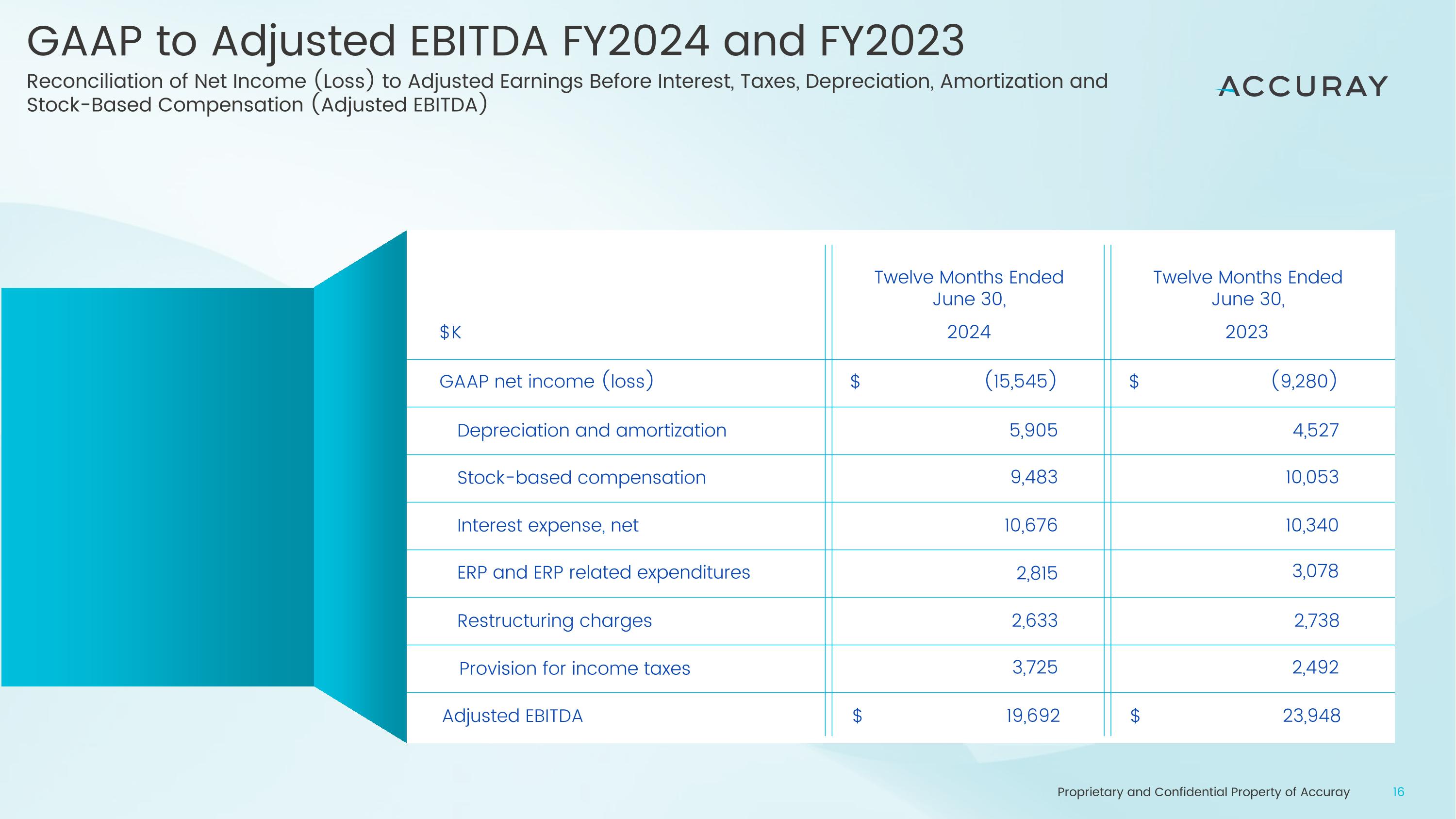

$K GAAP net income (loss) Stock-based compensation Interest expense, net Restructuring charges Depreciation and amortization Twelve Months Ended June 30, Twelve Months Ended June 30, 2023 2024 $ $ (15,545) 5,905 9,483 10,676 2,633 3,725 (9,280) 4,527 10,053 10,340 2,738 2,492 ERP and ERP related expenditures 2,815 3,078 GAAP to Adjusted EBITDA FY2024 and FY2023 Reconciliation of Net Income (Loss) to Adjusted Earnings Before Interest, Taxes, Depreciation, Amortization and Stock-Based Compensation (Adjusted EBITDA) Adjusted EBITDA $ $ 19,692 23,948 Provision for income taxes

$K Total Net Revenue Gross Profit TT-C China Margin Deferral Gross Margin % excl TT-C China Margin Impact Total Cost of Revenue Twelve Months Ended June 30, Twelve Months Ended June 30, 2023 2024 $ $ 446,551 (303,630) 142,921 (3,031) 32.68% 447,605 (293,645) 153,960 (1,216) 34.67% Gross Profit excl TT-C China Margin Impact 145,952 155,176 Gross Margin to Gross Margin Excluding China Margin Impact Reconciliation of Gross margin to Gross margin excluding China Margin Impact $ $

$K Total Net Revenue Gross Profit TT-C China Margin (Deferral)/Release Gross Margin % excl TT-C China Margin Impact Total Cost of Revenue Three Months Ended December 31, Six Months Ended December 31, 2024 2024 $ $ 116,174 (74,282) 41,892 3,314 33.21% 217,719 (141,358) 76,361 1,321 34.47% Gross Profit excl TT-C China Margin Impact 38,578 75,040 Gross Margin to Gross Margin Excluding China Margin Impact Reconciliation of Gross margin to Gross margin excluding China Margin Impact $ $

$K Total Net Revenue Gross Profit TT-C China Margin Deferral Gross Margin % excl TT-C China Margin Impact Total Cost of Revenue Three Months Ended September 30, 2024 $ 101,545 (67,076) 34,469 (1,993) 35.91% Gross Profit excl TT-C China Margin Impact 36,462 Gross Margin to Gross Margin Excluding China Margin Impact Reconciliation of Gross margin to Gross margin excluding China Margin Impact $