Fourth Quarter 2005

Investor Presentation

February, 2006

Forward-Looking Statements

This presentation contains forward-looking statements, as defined by Federal securities laws, relating to present or future trends or factors affecting the operations, markets and products of First Security Group, Inc. These statements are provided to assist in the understanding of future financial performance. Any such statements are based on current expectations and involve a number of risks and uncertainties. For a discussion of factors that may cause such forward-looking statements to differ materially from actual results, please refer to First Security's most recent documents filed with the Securities and Exchange Commission.

First Security undertakes no obligation to release revisions to these forward-looking statements or reflect events or circumstances after the date of this presentation.

FSGI Corporate Profile

- Headquarters in Chattanooga, Tennessee

- Six years in operation as First Security; founded in Sept,1999 by current management team

- Assets of $1.0 billion

- 37 banking offices and 4 leasing offices in Tennessee and north Georgia

- Strategic focus on small to medium-sized owner-managed businesses and consumers

FSGI Market Statistics

- IPO completed on Aug. 15, 2005

- Net proceeds of $44.7 million

- 17.6 million shares outstanding

- Listed on Nasdaq NM under FSGI

- Market capitalization of $189 million*

- Institutions hold 20.6% of shares

- Average daily trading volume (3-months) is 23,400 shares

|  |

* As of February 17, 2006

Investment Appeals

- Earnings momentum from organic growth and acquisitions

- Sound asset quality

- Excellent core deposit base

- Infrastructure in place to support additional growth

- Experienced management team in all First Security markets

Management Team with Extensive In-Market Experience

Directors and senior management own 12.2% of FSGI*

* Includes FSGI directors, advisory board directors, senior management and regional bank presidents.

Capitalizing on Recent Bank Consolidations within Footprint

Target Dislocated Customers and Hire Their Bankers

Organic Growth Opportunities

Share of deposits for top 10 banks within footprint of FSGI*

*Source: SNL based on June 2005 FDIC call reports

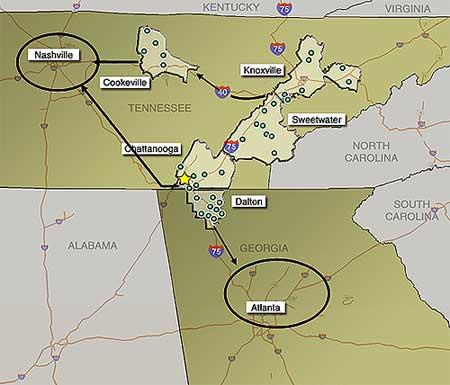

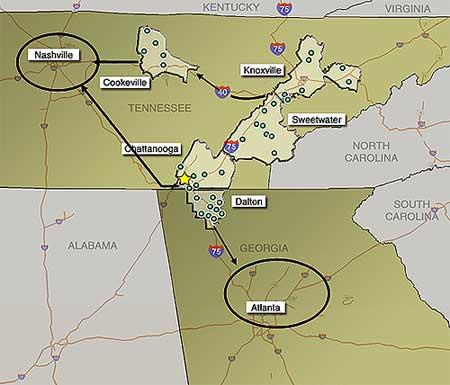

Expansion Along Interstates 75 & 40

| - Focus on Mid- & Eastern Tennessee and Northern Georgia

- Opened 2 new branches in 4Q’05 to fill in markets

- Varnell, Georgia

- Cleveland, Tennessee

- Acquire where price and culture fit

- Jackson Bank &Trust (JB&T)

|

Organized into Five Regional Community Banks

A Focus on Personalized Sales and Service

| - Regional bank presidents

- Local decision-making

- Local advisory boards

- Local strategies and identities

- Knowledge of local markets

- Serve small and medium-sized businesses within each market

- Customers get to know their bankers

|

Future Directions for Expansion

| Target Markets- I-75 corridor to Atlanta MSA

- I-40 corridor to Nashville MSA

- I-24 corridor to Nashville MSA

|

More Offices Make Banking More Convenient

Improving Efficiencies* As We Expand

* Excludes extraordinary, non-recurring and non-cash items.

** 2 branches were acquired from Colonial BancGroup in 1999

+Does not include 4 leasing offices acquired in 2004

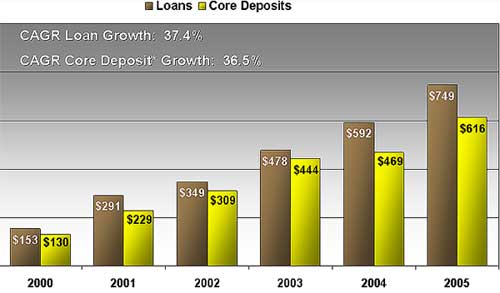

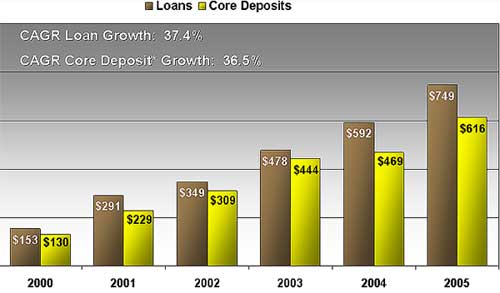

Strong Deposit and Loan Growth

* Core deposits = Transaction accounts + Retail CDs

Portfolio Mix Reflects Market Opportunities

Total loans = $748.7 million at December 31, 2005

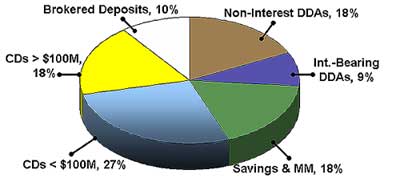

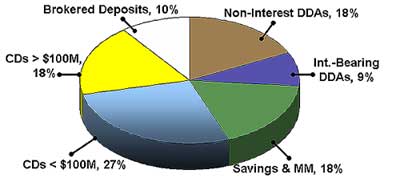

Deposits are Low-Cost & Stable

Total Deposits = $861.5 million at Dec. 31, 2005

- 72% core deposits

- Avg. cost of deposits is 2.37%

- Brokered CDs fund leasing company

Product and Service Expansion

- Equipment leasing through J&S Leasing, Inc. and Kenesaw Leasing, Inc.

- Acquired in October 2004

- 4 offices across Tennessee

- Wealth Management Group – 6 professionals offer private banking, financial planning and trust services

- Recently hired experienced mortgage banker to expand mortgage banking operations

Infrastructure in Place

~Decentralized Sales & Service with Centralized Operations~

- Back office activities centralized at holding company level:

- Accounting

- Credit Administration/Collection & Recoveries

- Human Resources/Training

- Risk Management/Audit, Compliance & Loan Review

- Treasury/ALCO Management

- Data processing & check clearing – Outsourced to Fidelity/ BancLine product

- Investment in technology includes Baker Hill, Intelligent Banking Solutions and SENDERO software

- New headquarters building to be completed 3Q 2006

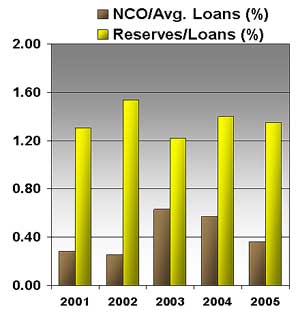

Strong Controls Ensure Sound Asset Quality

~ We do not sacrifice credit quality for growth ~

- Loan review is centralized at the holding company

- Hired ten experienced staff to oversee credit administration, loan review & risk management

- Implemented commercial and retail underwriting standards, enhanced loan policies and adopted early detection procedures

- Established procedures and developed a comprehensive analysis for loan losses

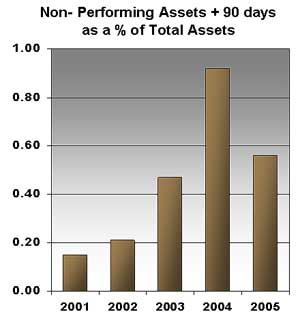

Asset Quality is Sound & Improving

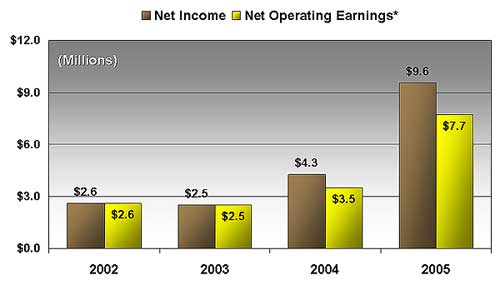

2005 Results: A Balanced Performance

* Before extraordinary and non-recurring items

** Before extraordinary, non-recurring and non-cash items

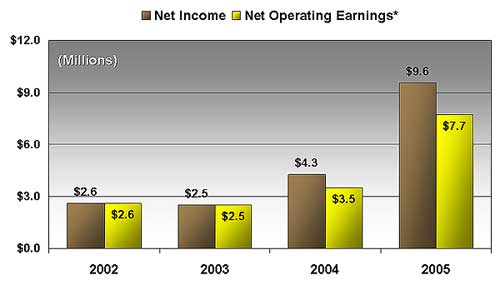

Net Income

* Excludes extraordinary and non-recurring items

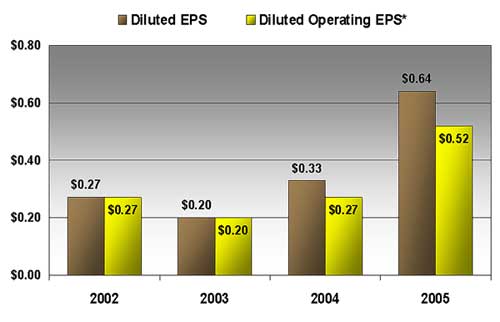

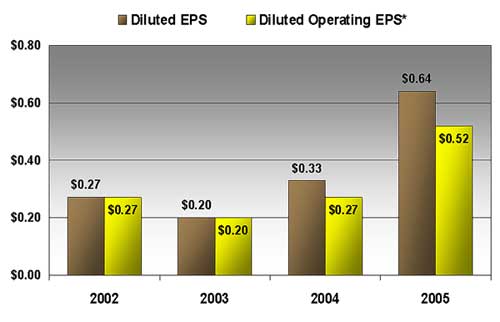

Earnings Per Share

* Excludes extraordinary and non-recurring items.

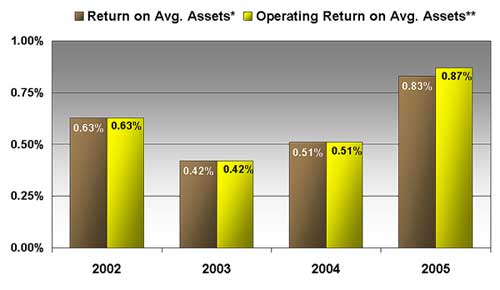

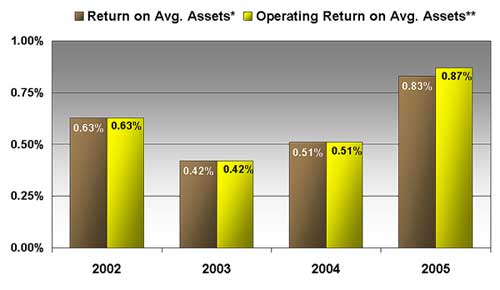

Return on Average Assets

* Excludes extraordinary items

** Excludes extraordinary and non-recurring items.

Return on Average Equity

* Excludes extraordinary and non-recurring items.

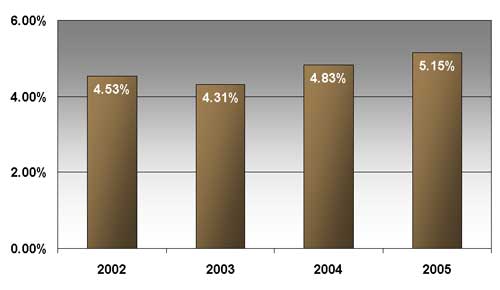

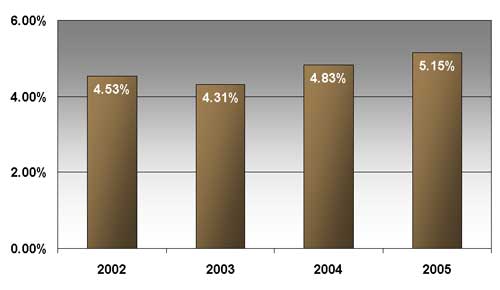

Net Interest Margin*

* Tax equivalent

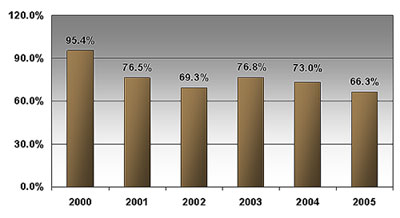

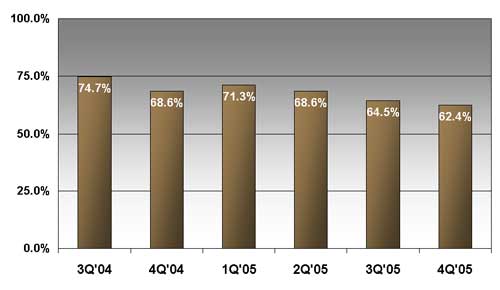

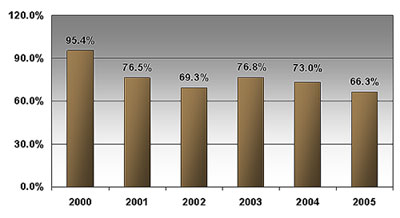

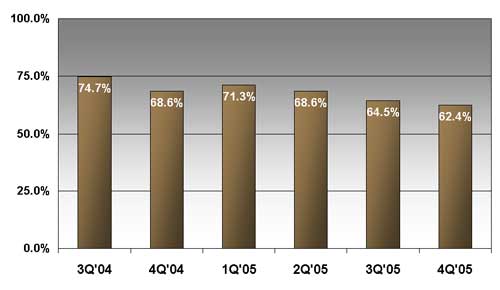

Core Efficiency Ratio *

620 Basis Point Improvement Over Past 12 Months

* Excludes extraordinary, non-recurring and non-cash items.

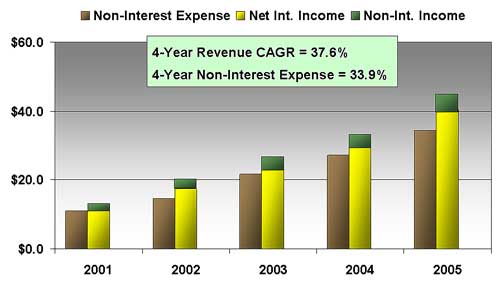

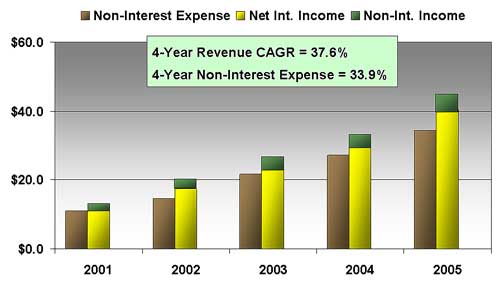

Improved Operating Leverage

How We Compare With Our Peers: Superior Growth

* Median of 10 SE banks closest in asset size to FSGI: SCMF, BTFG, FMFC, GRAN, CBAN, TIBB, SMMF, FNBF, LXBX, YAVY. Most recent 12-months for which data is available.

**Excludes extraordinary and non-recurring items

***Excludes extraordinary, non-recurring and non-cash items

How We Compare With Our Peers: Attractive Valuation

* Median of 10 SE banks closest in asset size to FSGI: SCMF, BTFG, FMFC, GRAN, CBAN, TIBB, SMMF, FNBF, LXBK, YAVY. Most recent 12-months for which data is available.

** Based on closing price on 2/21/06

*** Based on consensus forecast by all covering analysts

Where Are We Going?

- Leverage the existing franchise

- Maintain strong asset quality

- Maintain balance between growth and profitability

- Goals over the next three years include:

- Annual earnings per share growth > 15%

- Efficiency ratio < 60%

- Annual balance sheet growth: 8% -12%

- Align incentives to achieve performance goals

- Position FSGI as one of the preeminent Tennessee franchises

Nasdaq: FSGI