Filed by Corgentech Inc. Pursuant to Rule 425

Under the Securities Act of 1933

And Deemed Filed Pursuant to Rule 14a-12

Under the Securities Exchange Act of 1934

Subject Company: AlgoRx Pharmaceuticals, Inc.

Commission File No. of Subject Company: 000-51146

*** *** ***

The following presentation was made available by webcast on September 26, 2005 via Corgentech Inc. Internet site.

Corgentech and AlgoRx Announce Merger Agreement

September 26, 2005

FORWARD LOOKING STATEMENTS

This presentation includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. Forward-looking statements in this presentation include, without limitation, forecasts of product development, FDA filings, benefits of the proposed merger, and other matters that involve known and unknown risks, uncertainties and other factors that may cause actual results, levels of activity, performance or achievements to differ materially from results expressed or implied in this presentation. Such risk factors include, among others: difficulties encountered in integrating merged businesses; uncertainties as to the timing of the merger; approval of the transaction by the stockholders of the companies; the satisfaction of closing conditions to the transaction, including the receipt of regulatory approvals; whether certain market segments grow as anticipated; the competitive environment in the biotechnology industry; and whether the companies can successfully develop new products and the degree to which these gain market acceptance. Actual results may differ materially from those contained in the forward-looking statements in this presentation. Additional information concerning these and other risk factors is contained in Corgentech’s Form 10-K/A for the year ended December 31, 2004 and most recently filed Form10-Q.

Corgentech and AlgoRx undertake no obligation and do not intend to update these forward-looking statements to reflect events or circumstances occurring after this press release. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. All forward-looking statements are qualified in their entirety by this cautionary statement.

FORWARD LOOKING STATEMENTS (2)

Additional Information and Where to Find It

Corgentech Inc. intends to file a registration statement on Form S-4, and Corgentech and AlgoRx Pharmaceuticals, Inc. intend to file a related joint proxy statement/prospectus, in connection with the merger transaction involving Corgentech and AlgoRx. Investors and security holders are urged to read the registration statement on Form S-4 and the related joint proxy/prospectus when they become available because they will contain important information about the merger transaction. Investors and security holders may obtain free copies of these documents (when they are available) and other documents filed with the SEC at the SEC’s web site at www.sec.gov. In addition, investors and security holders may obtain free copies of the documents filed with the SEC by contacting Corgentech Investor Relations at the email address: investors@corgentech.com.

Corgentech, AlgoRx and their directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Corgentech and AlgoRx in connection with the merger transaction. Information regarding the special interests of these directors and executive officers in the merger transaction will be included in the joint proxy statement/prospectus of AlgoRx and Corgentech described above. Additional information regarding the directors and executive officers of Corgentech is also included in Corgentech’s proxy statement for its 2005 Annual Meeting of Stockholders, which was filed with the SEC on April 27, 2005. This document is available free of charge at the SEC’s web site at www.sec.gov and from Investor Relations at Corgentech as described above.

CREATING LATE-STAGE COMPANY

Multiple late-stage product development programs focused on significant clinical problems

– Pain management

– Inflammatory diseases

Brings together development and commercial expertise in critical areas

– Marketing, commercialization, regulatory affairs and clinical trials management

Financial strength and flexibility

All discovery & development programs 100% owned

AGENDA

Terms of merger agreement Product pipeline of combined company Commercial potential of products Deal timeline Why this merger makes sense

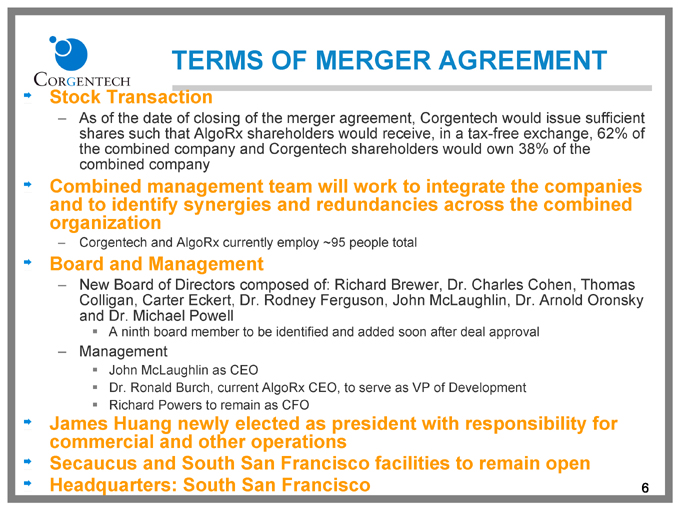

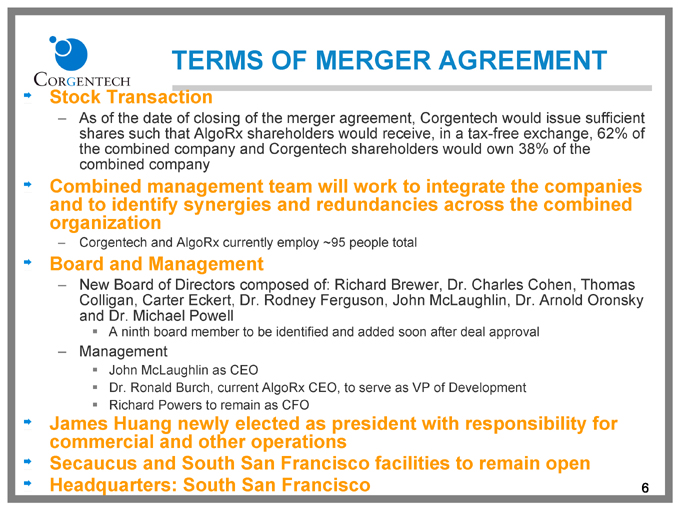

TERMS OF MERGER AGREEMENT

Stock Transaction

– As of the date of closing of the merger agreement, Corgentech would issue sufficient shares such that AlgoRx shareholders would receive, in a tax-free exchange, 62% of the combined company and Corgentech shareholders would own 38% of the combined company

Combined management team will work to integrate the companies and to identify synergies and redundancies across the combined organization

– Corgentech and AlgoRx currently employ ~95 people total

Board and Management

– New Board of Directors composed of: Richard Brewer, Dr. Charles Cohen, Thomas Colligan, Carter Eckert, Dr. Rodney Ferguson, John McLaughlin, Dr. Arnold Oronsky and Dr. Michael Powell

A ninth board member to be identified and added soon after deal approval

– Management

John McLaughlin as CEO

Dr. Ronald Burch, current AlgoRx CEO, to serve as VP of Development Richard Powers to remain as CFO

James Huang newly elected as president with responsibility for commercial and other operations Secaucus and South San Francisco facilities to remain open Headquarters: South San Francisco 6

AGENDA

Terms of merger agreement Product pipeline of combined company Commercial potential of products Deal timeline Why this merger makes sense

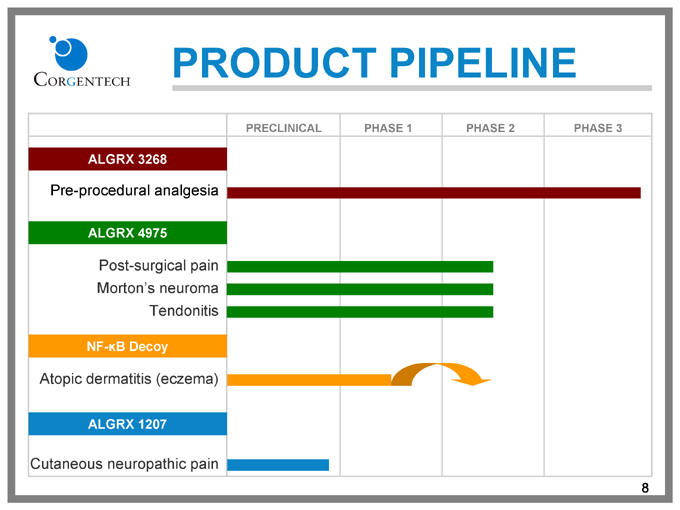

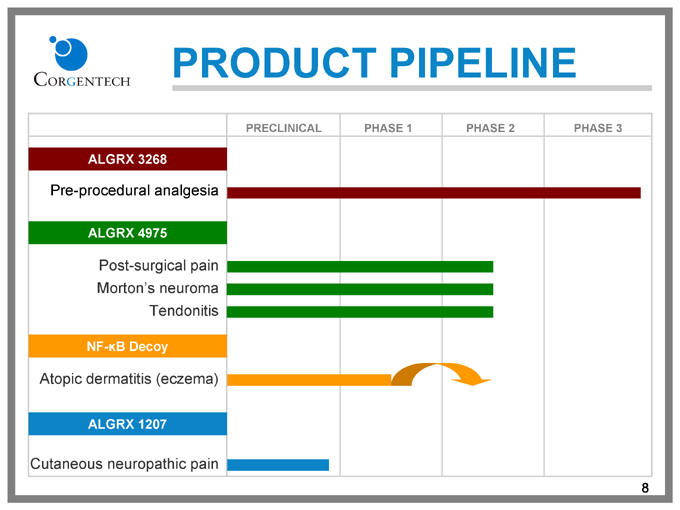

PRODUCT PIPELINE

PRECLINICAL PHASE 1 PHASE 2 PHASE 3

ALGRX 3268

Pre-procedural analgesia

ALGRX 4975

Post-surgical pain Morton’s neuroma Tendonitis

NF-KB Decoy

Atopic dermatitis (eczema)

ALGRX 1207

Cutaneous neuropathic pain

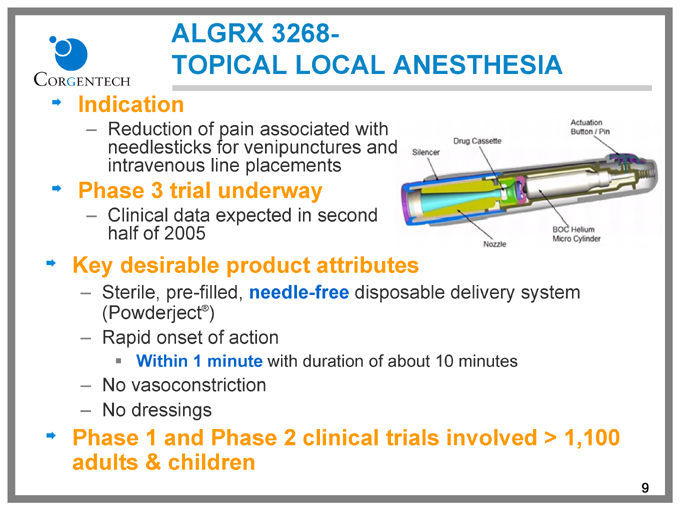

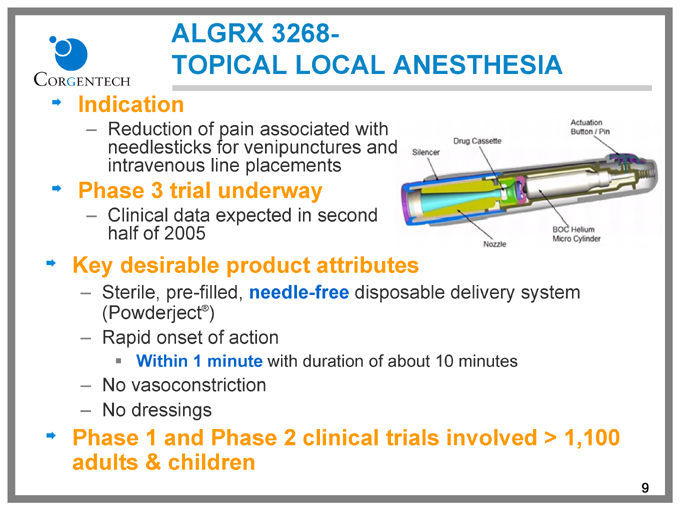

ALGRX 3268-

TOPICAL LOCAL ANESTHESIA

Indication

– Reduction of pain associated with needlesticks for venipunctures and intravenous line placements

Phase 3 trial underway

– Clinical data expected in second half of 2005

Key desirable product attributes

– Sterile, pre-filled, needle-free disposable delivery system (Powderject®)

– Rapid onset of action

Within 1 minute with duration of about 10 minutes

– No vasoconstriction

– No dressings

Phase 1 and Phase 2 clinical trials involved > 1,100 adults & children

9

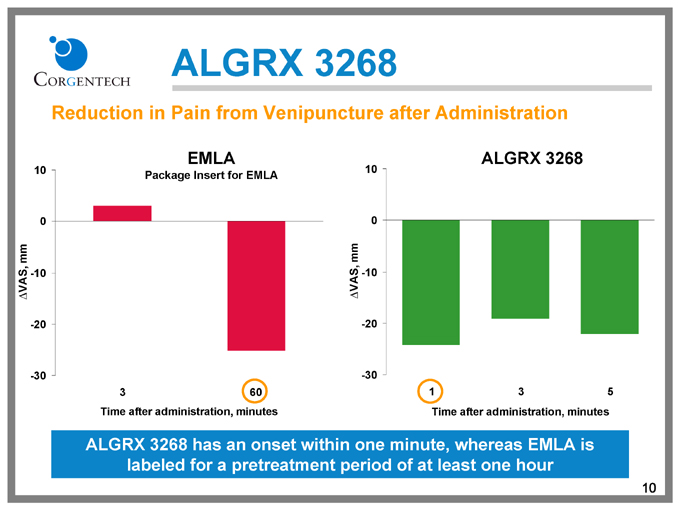

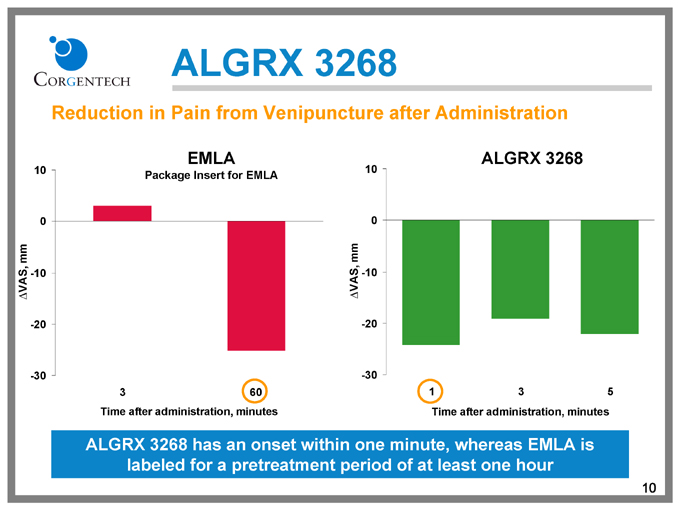

ALGRX 3268

Reduction in Pain from Venipuncture after Administration

EMLA

Package Insert for EMLA

VAS, mm

10 0 -10 -20 -30

60

Time after administration, minutes

ALGRX 3268

VAS, mm

10 0 -10 -20 -30

Time after administration, minutes

ALGRX 3268 has an onset within one minute, whereas EMLA is labeled for a pretreatment period of at least one hour

10

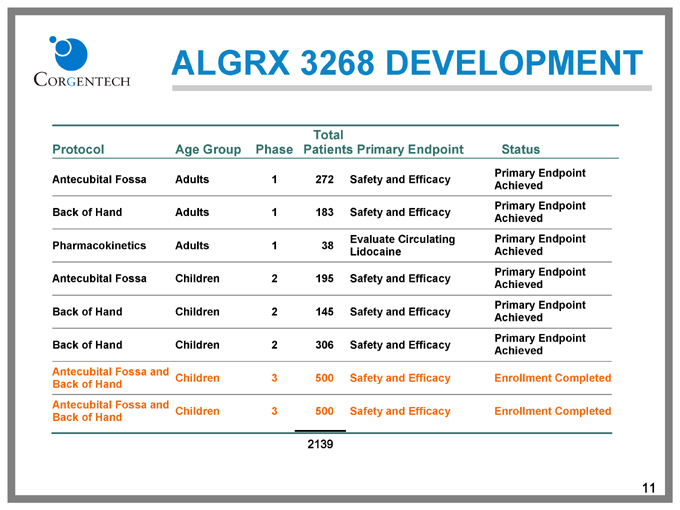

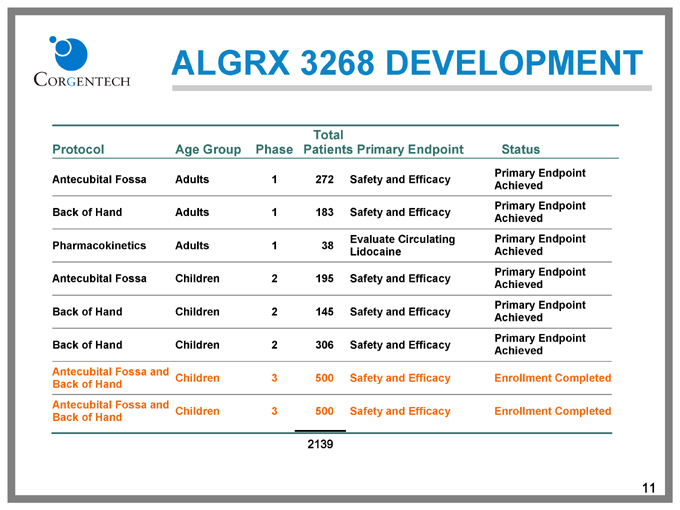

ALGRX 3268 DEVELOPMENT

Protocol Age Group Phase Total Patients Primary Endpoint Status

Primary Endpoint

Antecubital Fossa Adults 1 272 Safety and Efficacy

Achieved

Primary Endpoint

Back of Hand Adults 1 183 Safety and Efficacy

Achieved

Evaluate Circulating Primary Endpoint

Pharmacokinetics Adults 1 38

Lidocaine Achieved

Primary Endpoint

Antecubital Fossa Children 2 195 Safety and Efficacy

Achieved

Primary Endpoint

Back of Hand Children 2 145 Safety and Efficacy

Achieved

Primary Endpoint

Back of Hand Children 2 306 Safety and Efficacy

Achieved

Antecubital Fossa and

Children 3 500 Safety and Efficacy Enrollment Completed

Back of Hand

Antecubital Fossa and

Children 3 500 Safety and Efficacy Enrollment Completed

Back of Hand

2139

11

ALGRX 4975 – VR1 ANESTHETIC

Activates the VR1 channel; expressed by pain receptor C-fibers

Capsaicin Overview Administered locally at the site of pain Single administration may provide analgesia for weeks to months Non-opioid based Only reduces long-term noxious pain associated with C-neurons Does not affect other nerve fibers important for motor skills

Blocks noxious pain with long duration

12

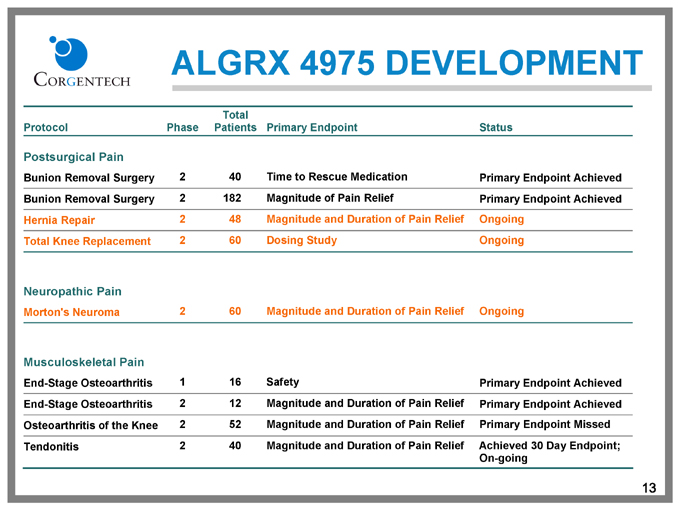

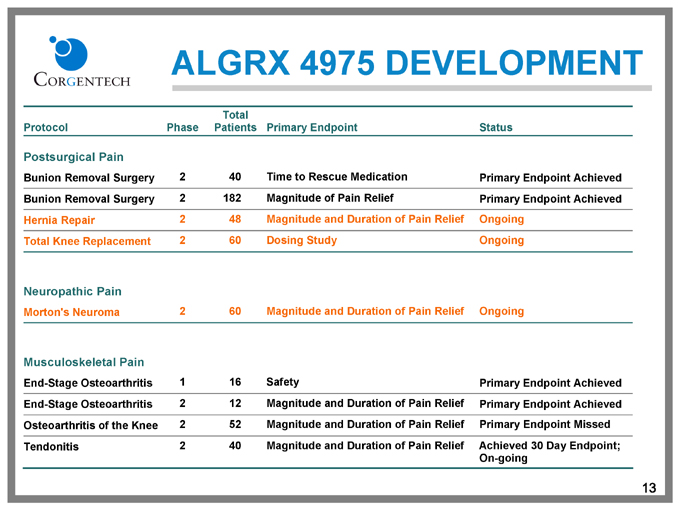

ALGRX 4975 DEVELOPMENT

Protocol Phase Total Patients Primary Endpoint Status

Postsurgical Pain

Bunion Removal Surgery 2 40 Time to Rescue Medication Primary Endpoint Achieved

Bunion Removal Surgery 2 182 Magnitude of Pain Relief Primary Endpoint Achieved

Hernia Repair 2 48 Magnitude and Duration of Pain Relief Ongoing

Total Knee Replacement 2 60 Dosing Study Ongoing

Neuropathic Pain

Morton’s Neuroma 2 60 Magnitude and Duration of Pain Relief Ongoing

Musculoskeletal Pain

End-Stage Osteoarthritis 1 16 Safety Primary Endpoint Achieved

End-Stage Osteoarthritis 2 12 Magnitude and Duration of Pain Relief Primary Endpoint Achieved

Osteoarthritis of the Knee 2 52 Magnitude and Duration of Pain Relief Primary Endpoint Missed

Tendonitis 2 40 Magnitude and Duration of Pain Relief Achieved 30 Day Endpoint;

On-going

13

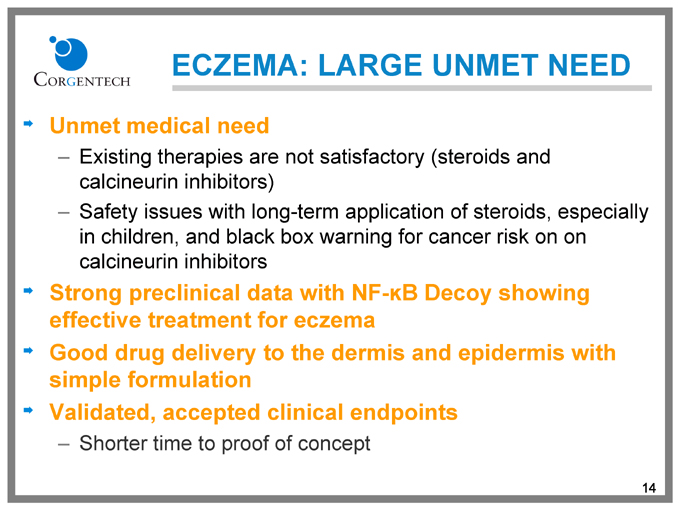

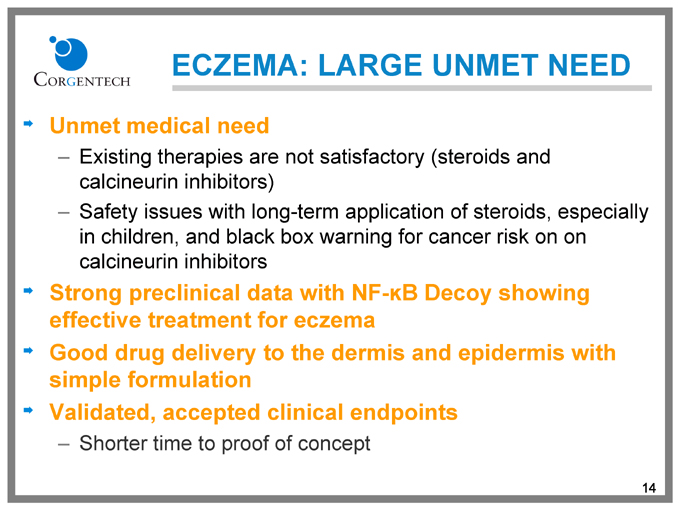

ECZEMA: LARGE UNMET NEED

Unmet medical need

– Existing therapies are not satisfactory (steroids and calcineurin inhibitors)

– Safety issues with long-term application of steroids, especially in children, and black box warning for cancer risk on on calcineurin inhibitors

Strong preclinical data with NF-KB Decoy showing effective treatment for eczema Good drug delivery to the dermis and epidermis with simple formulation Validated, accepted clinical endpoints

– Shorter time to proof of concept

14

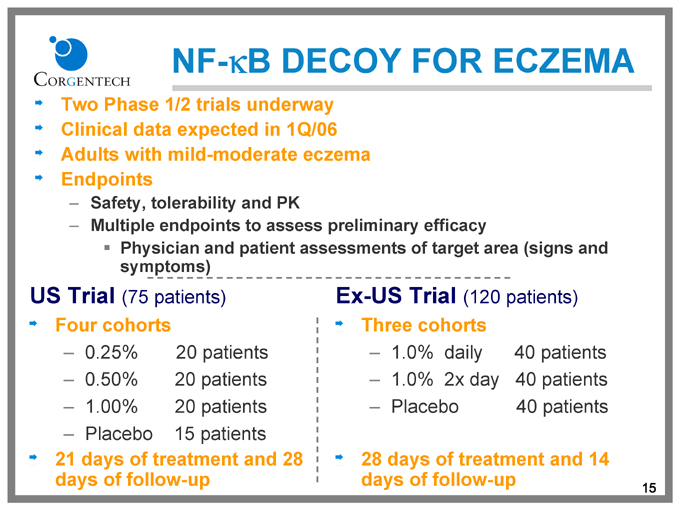

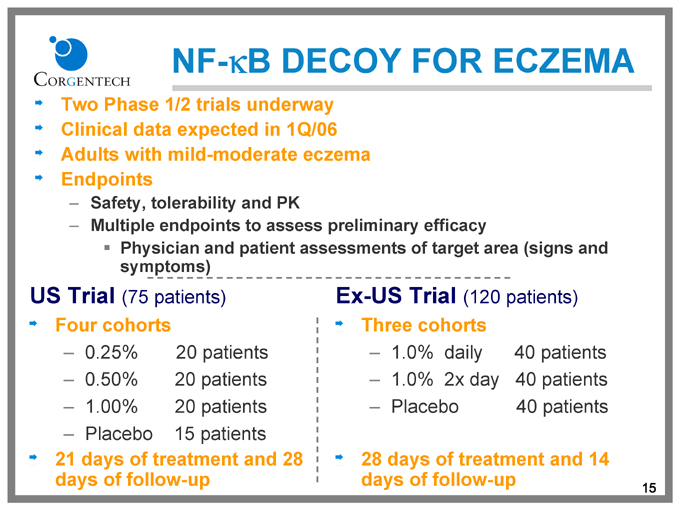

NF-KB DECOY FOR ECZEMA

Two Phase 1/2 trials underway Clinical data expected in 1Q/06 Adults with mild-moderate eczema Endpoints

– Safety, tolerability and PK

– Multiple endpoints to assess preliminary efficacy

Physician and patient assessments of target area (signs and symptoms)

US Trial (75 patients)

Four cohorts

– 0.25% 20 patients

– 0.50% 20 patients

– 1.00% 20 patients

– Placebo 15 patients

21 days of treatment and 28 days of follow-up

Ex-US Trial (120 patients)

Three cohorts

– 1.0% daily 40 patients

– 1.0% 2x day 40 patients

– Placebo 40 patients

28 days of treatment and 14 days of follow-up

15

ALGRX 1207

IND-enabling studies underway

New chemical class of local anesthetic for topical analgesia

Deep, rapid penetration of the skin and long duration of action Addresses a wide variety of procedures including:

– Neuropathic pain

– Dermatological surgery

– Surgical incisions

16

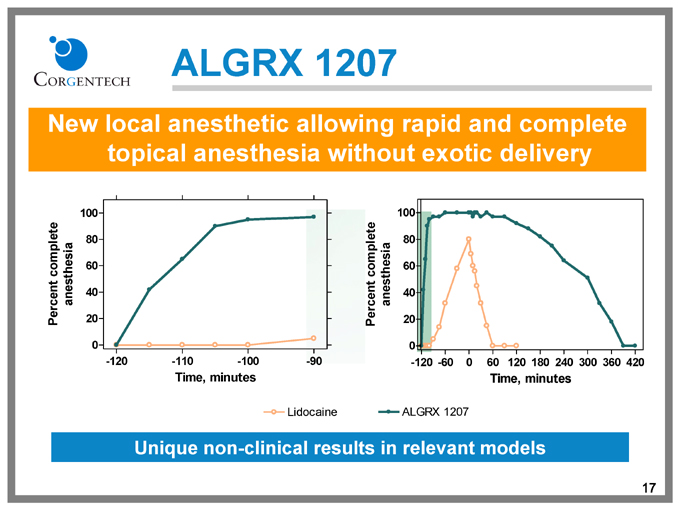

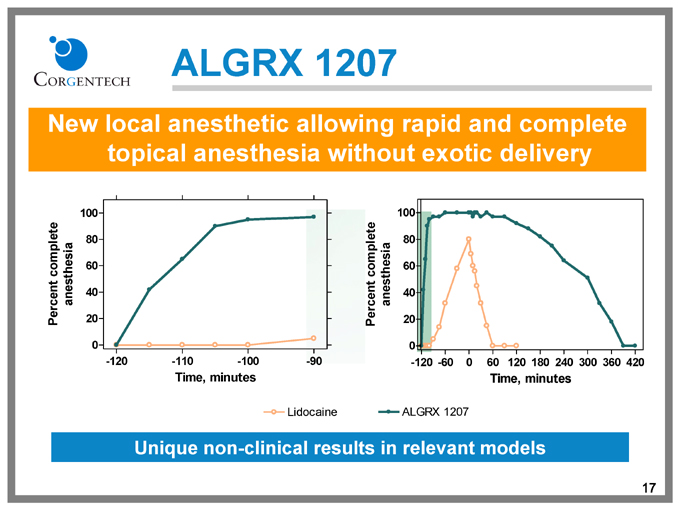

ALGRX 1207

New local anesthetic allowing rapid and complete topical anesthesia without exotic delivery

Percent complete anesthesia

100 80 60 40 20 0

-120 -110 -100 -90

Time, minutes

Percent complete anesthesia

100 80 60 40 20 0

-120 -60 0 60 120 180 240 300 360 420

Time, minutes

Lidocaine

ALGRX 1207

Unique non-clinical results in relevant models

17

AGENDA

Terms of merger agreement Product pipeline of combined company Commercial potential of products Deal timeline Why this merger makes sense

18

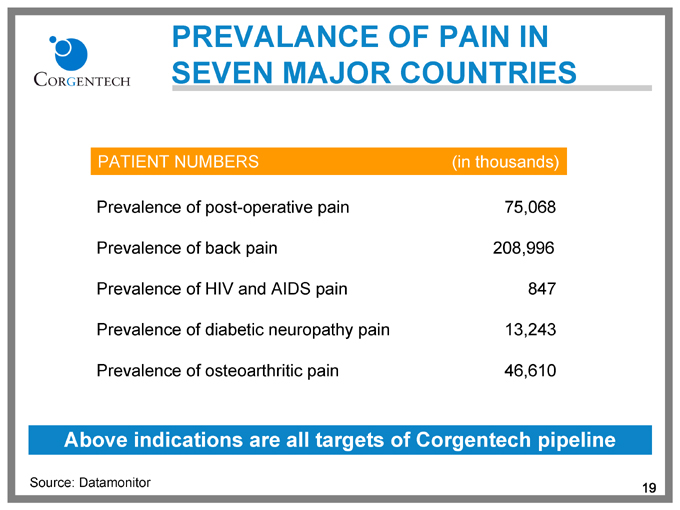

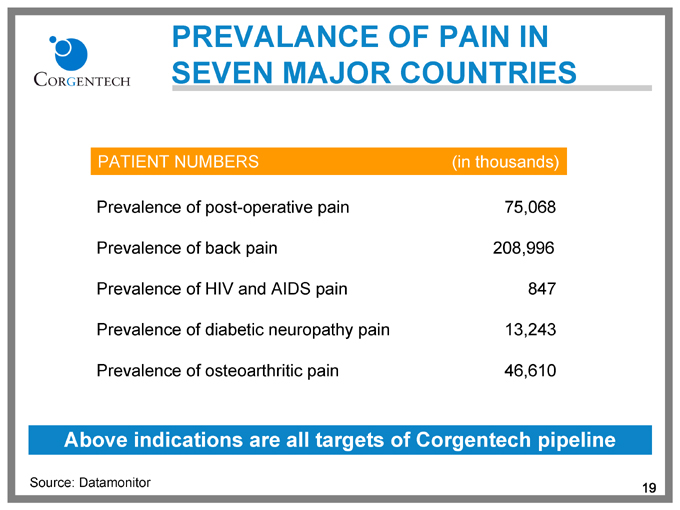

PREVALANCE OF PAIN IN SEVEN MAJOR COUNTRIES

PATIENT NUMBERS (in thousands)

Prevalence of post-operative pain 75,068

Prevalence of back pain 208,996

Prevalence of HIV and AIDS pain 847

Prevalence of diabetic neuropathy pain 13,243

Prevalence of osteoarthritic pain 46,610

Above indications are all targets of Corgentech pipeline

Source: Datamonitor

19

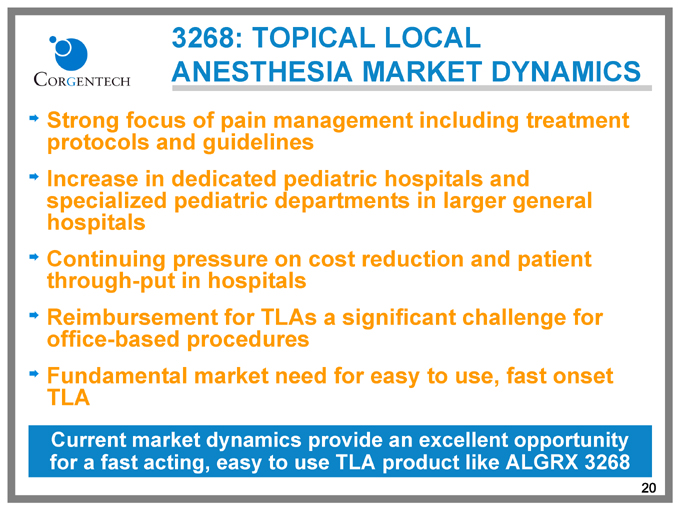

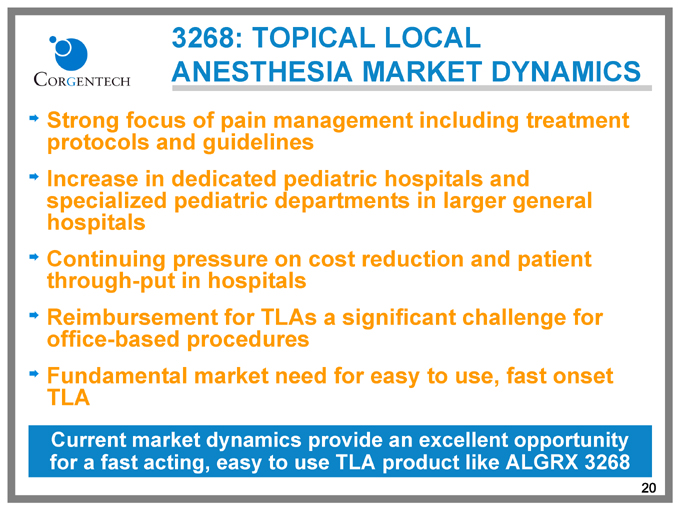

3268: TOPICAL LOCAL

ANESTHESIA MARKET DYNAMICS

Strong focus of pain management including treatment protocols and guidelines Increase in dedicated pediatric hospitals and specialized pediatric departments in larger general hospitals Continuing pressure on cost reduction and patient through-put in hospitals Reimbursement for TLAs a significant challenge for office-based procedures Fundamental market need for easy to use, fast onset TLA

Current market dynamics provide an excellent opportunity for a fast acting, easy to use TLA product like ALGRX 3268

20

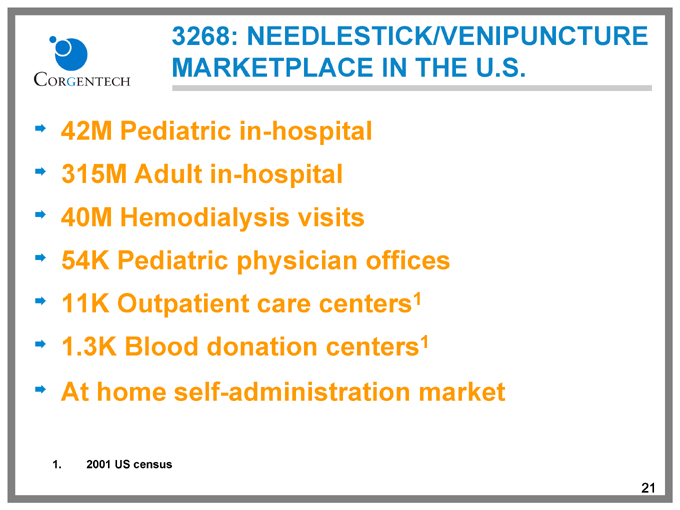

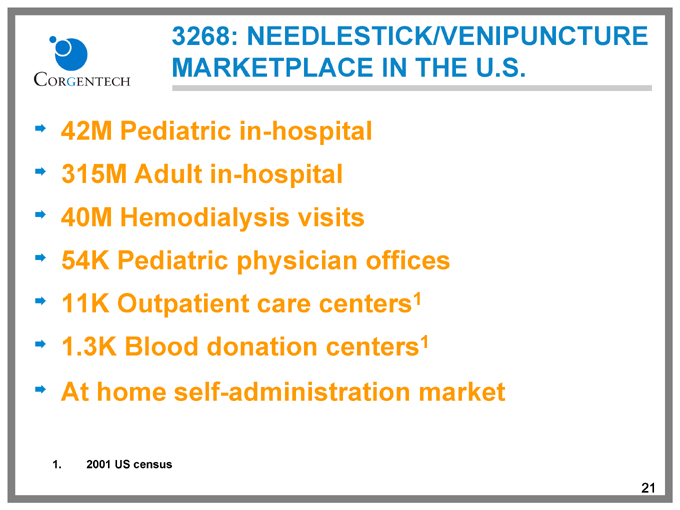

3268: NEEDLESTICK/VENIPUNCTURE MARKETPLACE IN THE U.S.

42M Pediatric in-hospital 315M Adult in-hospital 40M Hemodialysis visits 54K Pediatric physician offices 11K Outpatient care centers1 1.3K Blood donation centers1 At home self-administration market

1. 2001 US census

21

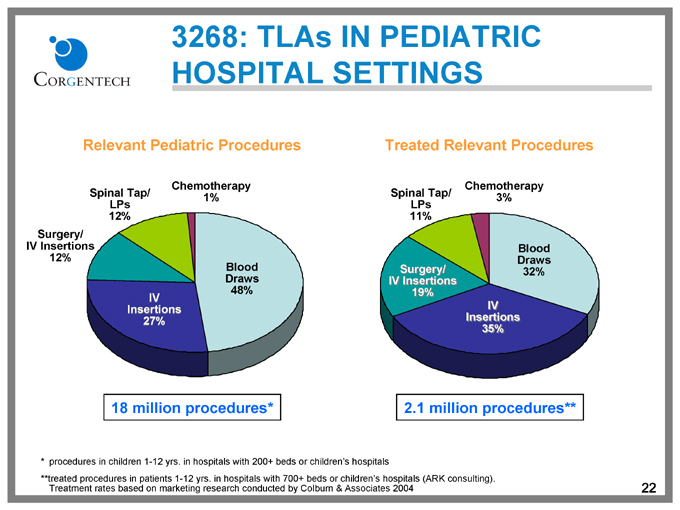

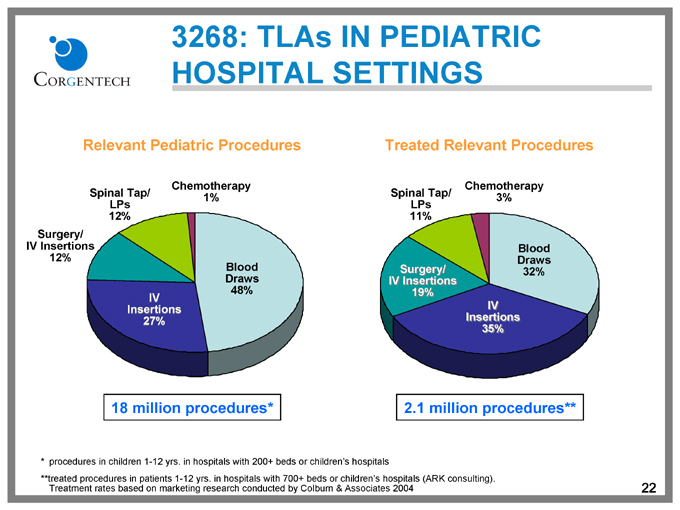

3268: TLAs IN PEDIATRIC HOSPITAL SETTINGS

Relevant Pediatric Procedures

Surgery/ IV Insertions 12%

Spinal Tap/ LPs 12%

Chemotherapy 1%

Blood Draws 48%

IV Insertions 27%

18 million procedures*

Treated Relevant Procedures

Spinal Tap/ LPs 11%

Chemotherapy 3%

Surgery/ IV Insertions 19%

IV Insertions 35%

Blood Draws 32%

2.1 million procedures**

* | | procedures in children 1-12 yrs. in hospitals with 200+ beds or children’s hospitals |

**treated procedures in patients 1-12 yrs. in hospitals with 700+ beds or children’s hospitals (ARK consulting).

Treatment rates based on marketing research conducted by Colburn & Associates 2004

22

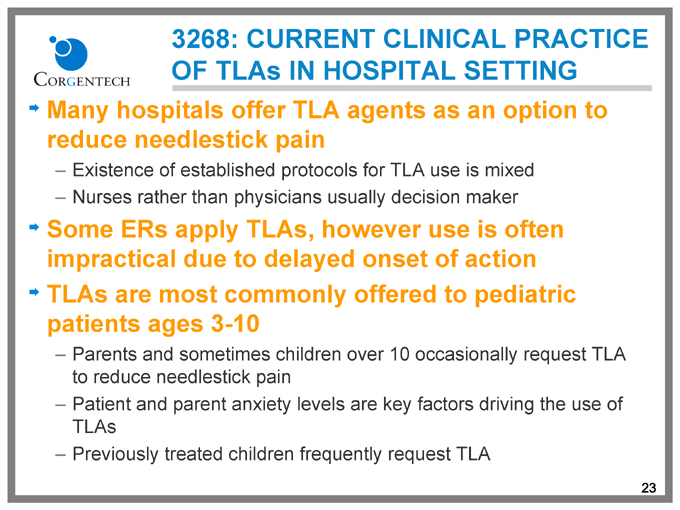

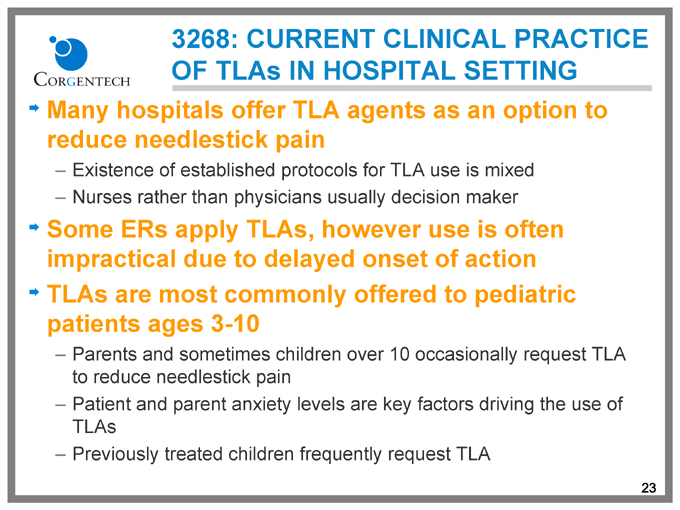

3268: CURRENT CLINICAL PRACTICE OF TLAs IN HOSPITAL SETTING

Many hospitals offer TLA agents as an option to reduce needlestick pain

– Existence of established protocols for TLA use is mixed

– Nurses rather than physicians usually decision maker

Some ERs apply TLAs, however use is often impractical due to delayed onset of action TLAs are most commonly offered to pediatric patients ages 3-10

– Parents and sometimes children over 10 occasionally request TLA to reduce needlestick pain

– Patient and parent anxiety levels are key factors driving the use of TLAs

– Previously treated children frequently request TLA

23

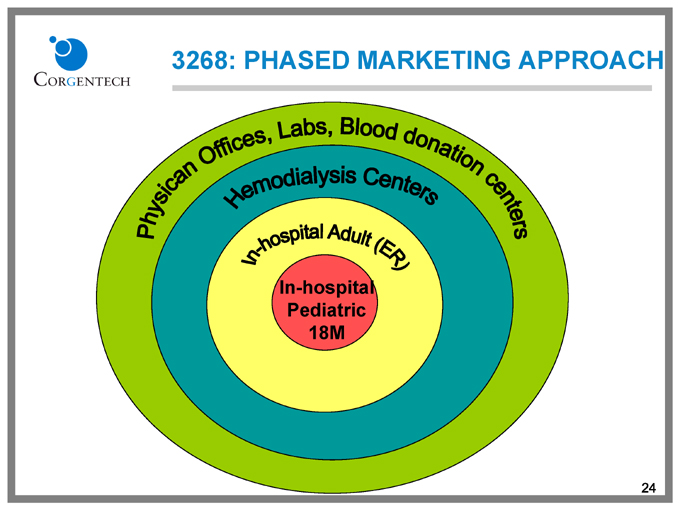

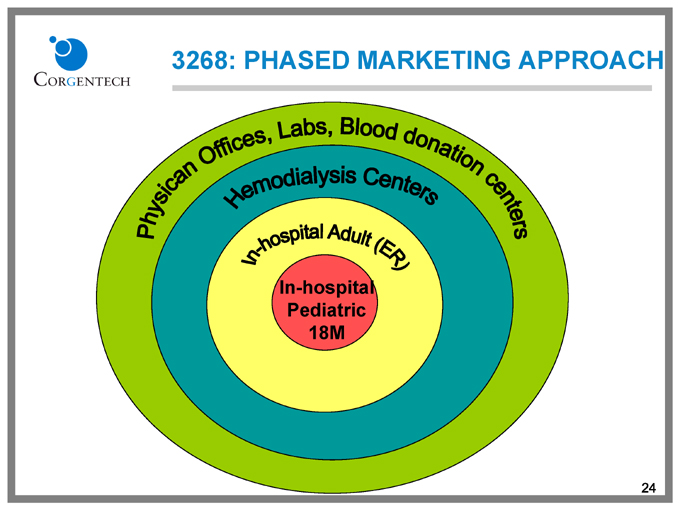

3268: PHASED MARKETING APPROACH

Physican Offices, Labs, Blood donation centers

Hemodialysis Centers

In-hospital Adult (ER)

In-hospital Pediatric 18M

24

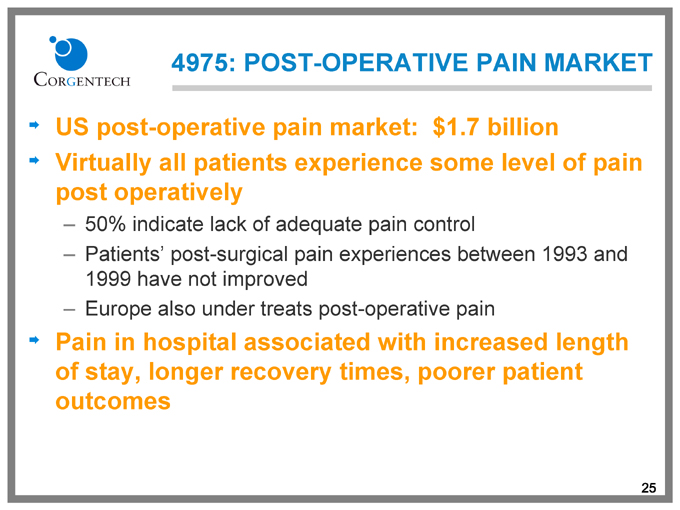

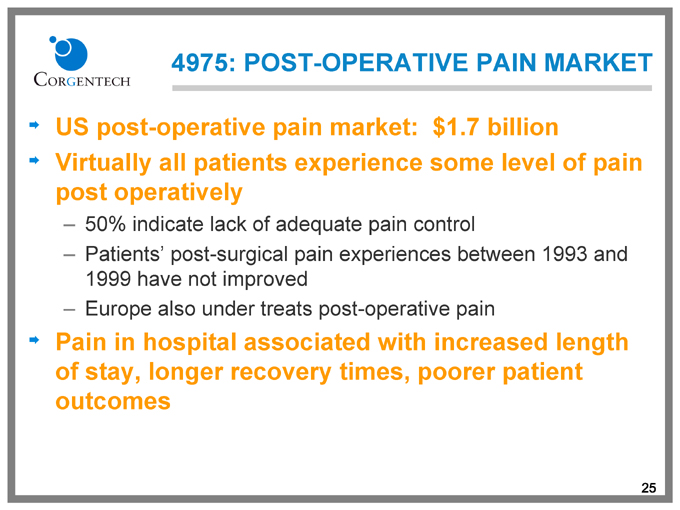

4975: POST-OPERATIVE PAIN MARKET

US post-operative pain market: $1.7 billion Virtually all patients experience some level of pain post operatively

– 50% indicate lack of adequate pain control

– Patients’ post-surgical pain experiences between 1993 and 1999 have not improved

– Europe also under treats post-operative pain

Pain in hospital associated with increased length of stay, longer recovery times, poorer patient outcomes

25

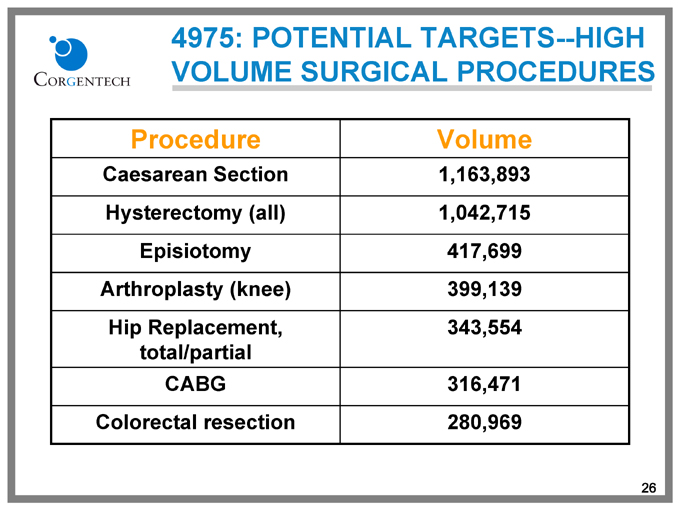

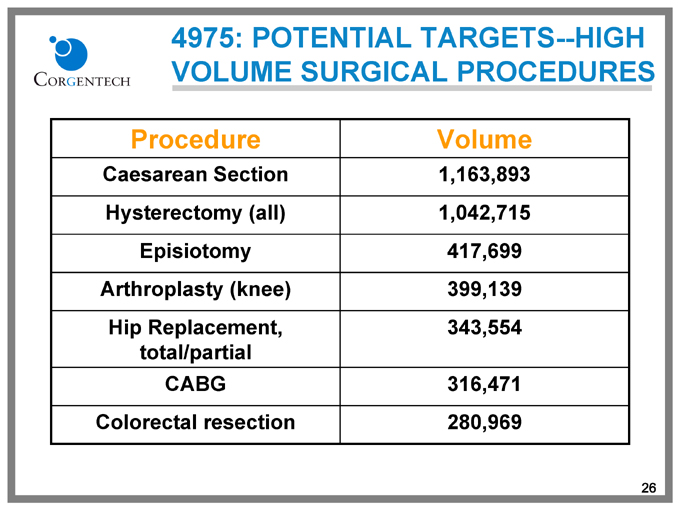

4975: POTENTIAL TARGETS—HIGH VOLUME SURGICAL PROCEDURES

Procedure Volume

Caesarean Section 1,163,893

Hysterectomy (all) 1,042,715

Episiotomy 417,699

Arthroplasty (knee) 399,139

Hip Replacement, 343,554

total/partial

CABG 316,471

Colorectal resection 280,969

26

CURRENT POST-OP PAIN MEDICATIONS VS. ALGRX 4975

Epidurals

– Use declining significantly due to contra-indication in combination use with anticoagulants

Opioids

– Nausea, vomiting, respiratory depression and constipation

– Sedation may limit the ability of the patient to ambulate and prolong time to discharge

– Decreased bowel function can lead to an ileus which causes morbidity and prolongs hospitalization

– Concern about addiction leads to insufficient pain relief which has physiologic consequences

Non-narcotics

– Unacceptable anesthesia for moderate to severe pain

ALGRX 4975

– Unlikely to be contra-indicated for use in conjunction with anticoagulants

– Site-specific with limited systemic exposure and unlikely to cause nausea, vomiting, respiratory depression or sedation

– No addiction potential

– Long-acting with single administration and ideal for moderate to severe pain

27

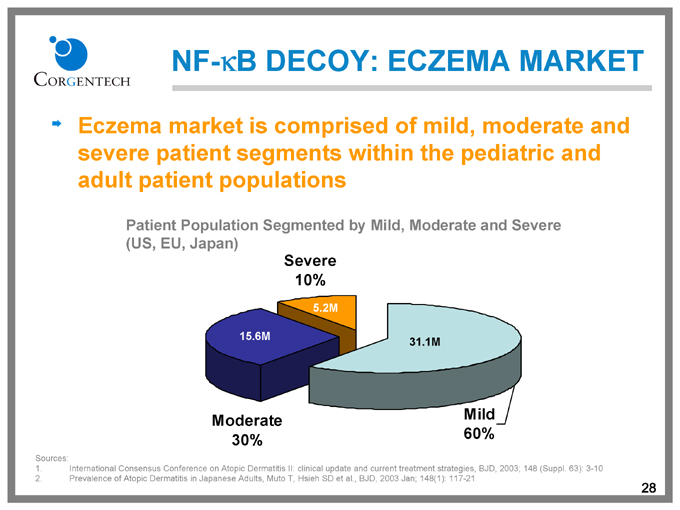

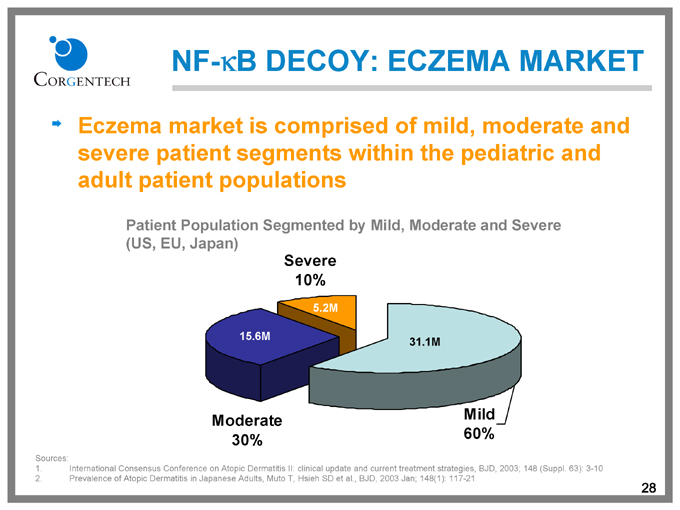

NF-KB DECOY: ECZEMA MARKET

Eczema market is comprised of mild, moderate and severe patient segments within the pediatric and adult patient populations

Patient Population Segmented by Mild, Moderate and Severe (US, EU, Japan)

Severe 10%

15.6M

5.2M

31.1M

Moderate 30%

Mild 60%

Sources:

1. International Consensus Conference on Atopic Dermatitis II: clinical update and current treatment strategies, BJD, 2003; 148 (Suppl. 63): 3-10

2. Prevalence of Atopic Dermatitis in Japanese Adults, Muto T, Hsieh SD et al., BJD, 2003 Jan; 148(1): 117-21

28

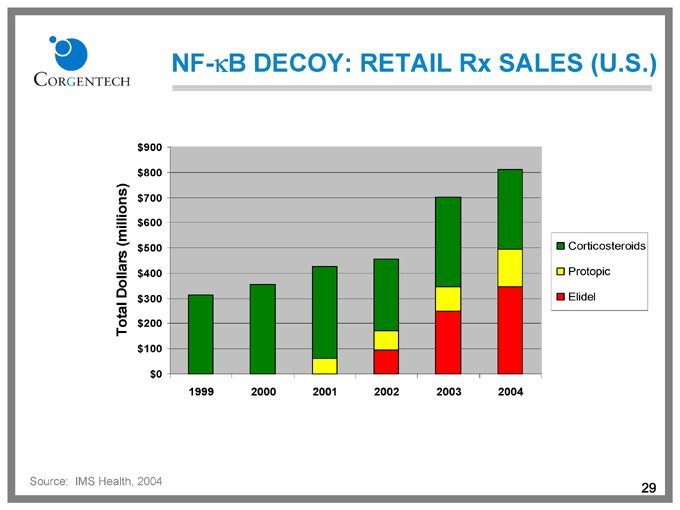

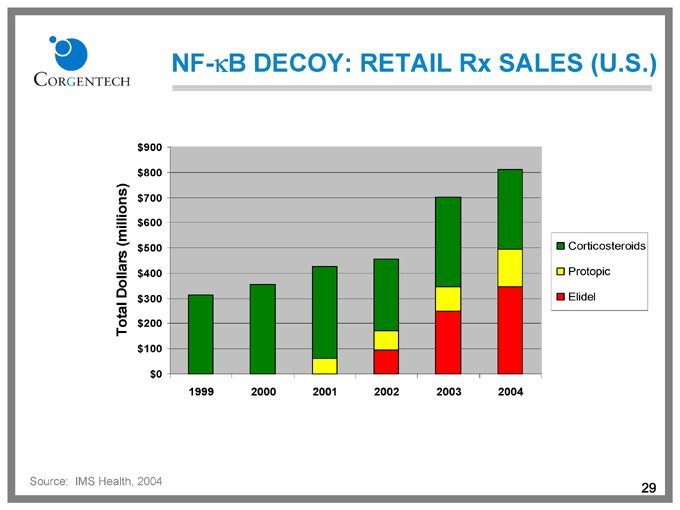

NF-KB DECOY: RETAIL Rx SALES (U.S.)

Total Dollars (millions) $900 $800 $700 $600 $500 $400 $300 $200 $100 $0

1999 2000 2001 2002 2003 2004

Corticosteroids Protopic Elidel

Source: IMS Health, 2004

29

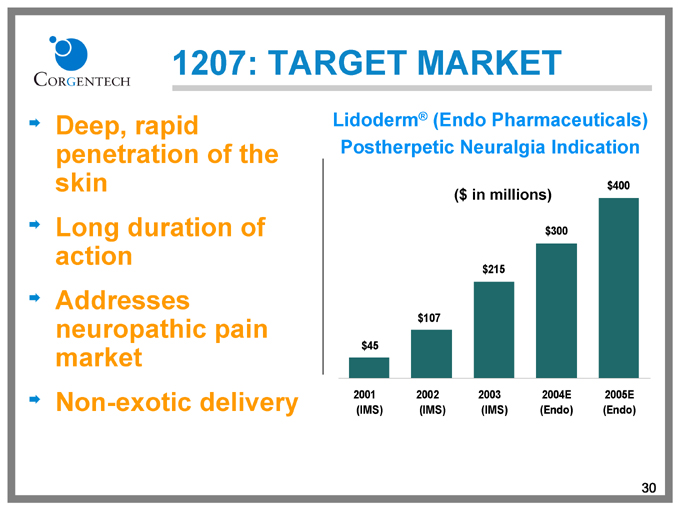

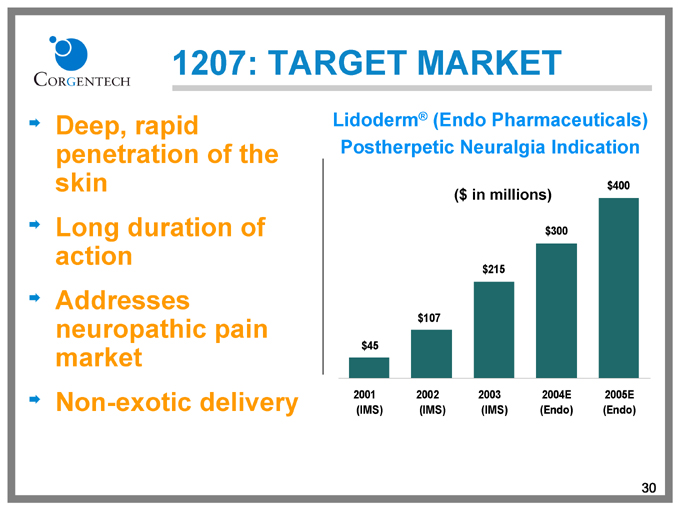

1207: TARGET MARKET

Deep, rapid penetration of the skin Long duration of action Addresses neuropathic pain market Non-exotic delivery

Lidoderm® (Endo Pharmaceuticals) Postherpetic Neuralgia Indication

($ in millions) $45 $107 $215 $300 $400

2001 2002 2003 2004E 2005E (IMS) (IMS) (IMS) (Endo) (Endo)

30

AGENDA

Terms of merger agreement Product pipeline of combined company Commercial potential of products Deal timeline Why this merger makes sense

31

DEAL TIMELINE

Merger requires stockholder approval

– Both boards have approved the merger

Merger documents to be filed in coming weeks

– S-4 and related joint Proxy Statement

Shareholder vote expected to occur in late 2005 / early 2006

32

AGENDA

Terms of merger agreement Product pipeline of combined company Commercial potential of products Deal timeline Why this merger makes sense

33

WHY THIS MERGER MAKES SENSE

Multiple late-stage product development programs focused on significant clinical problems

– Pain management

– Inflammatory diseases

Brings together development and commercial expertise in critical areas

– Marketing, commercialization, regulatory affairs and clinical trials management

Financial strength and flexibility

All discovery & development programs 100% owned

34