As filed with the Securities and Exchange Commission on February 8, 2002

Registration No. 333-76366

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

Under

THE SECURITIES ACT OF 1933

Xcel Pharmaceuticals, Inc.

(Exact name of Registrant as specified in charter)

Delaware | | 2834 | | 33-0949894 |

(State or other jurisdiction of incorporation or organization) | | (Primary standard industrial classification code number) | | (IRS employer identification no.) |

6363 Greenwich Drive, Suite 100

San Diego, CA 92122

(858) 202-2700

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Michael T. Borer

President and Chief Executive Officer

6363 Greenwich Drive, Suite 100

San Diego, CA 92122

(858) 202-2700

(Name, address, including zip code, and telephone number, including area code, of agent for service)

David R. Snyder, Esq. T. Michael Hird, Esq. Christopher M. Forrester, Esq. Pillsbury Winthrop LLP 101 West Broadway, Suite 1800 San Diego, California 92101-4700 Phone: (619) 234-5000 Fax: (619) 236-1995 Counsel to the Registrant | | Faye H. Russell, Esq. Jeffrey C. Thacker, Esq. Brobeck, Phleger & Harrison LLP 12390 El Camino Real San Diego, California 92130 Phone: (858) 720-2500 Fax: (858) 720-2555 Counsel to the Underwriters |

| |

| |

| |

| |

| |

| |

| |

| |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. ¨

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered | | Proposed Maximum Aggregate Offering Price(1) | | Amount of Registration Fee |

|

|

|

|

|

| Common Stock | | $97,750,000 | | $8,993(2) |

|

|

|

|

|

| (1) | | Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933. |

| (2) | | The sum of $24,000 has been paid in connection with the Registrant’s initial filing; the total amount of the Registration Fee has been adjusted to reflect the decreased fees payable pursuant to SEC Fee Rate Advisory No. 8 published January 16, 2002. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED FEBRUARY 7, 2002.

PROSPECTUS

Shares

Common Stock

$ per share

We are selling shares of our common stock. We have granted the underwriters a 30-day option to purchase up to additional shares of our common stock to cover over-allotments.

This is the initial public offering of our common stock. We currently expect the initial public offering price to be between $ and $ per share. We have applied to have our common stock included for quotation on The Nasdaq National Market under the symbol “XCEL.”

Investing in our common stock involves risks. See “Risk Factors” beginning on page 5.

Concurrent with the closing of this offering, Elan Corporation, plc or one of its affiliates will purchase shares of our common stock at the initial public offering price. The underwriters will not receive any discount or commission on the sale of these shares. Elan has agreed not to sell any shares of our common stock, including the shares being purchased concurrent with this offering, for a period of at least 180 days following the date of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | | Per Share

| | Total

|

| Public offering price | | $ | | $ | |

| Underwriting discount | | $ | | $ | |

| Proceeds to Xcel (before expenses) | | $ | | $ | |

The underwriters expect to deliver the shares to purchasers on or about , 2002.

Salomon Smith Barney | | Merrill Lynch & Co. |

ABN AMRO Rothschild LLC | | Thomas Weisel Partners LLC |

, 2002

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any state where the offer is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this prospectus.

| | | Page

|

| | 1 |

| | 5 |

| | 14 |

| | 14 |

| | 15 |

| | 15 |

| | 16 |

| | 17 |

| | 18 |

| | 20 |

| | 26 |

| | 36 |

| | 43 |

| | 44 |

| | 46 |

| | 49 |

| | 51 |

| | 53 |

| | 53 |

| | 55 |

| | F-1 |

Until and including , 2002 (25 days after the date of this prospectus), all dealers that buy, sell or trade our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

This summary highlights information contained elsewhere in this prospectus. Because this is only a summary, it does not contain all of the information that may be important to you. You should read the entire prospectus carefully. You should consider the information under “Risk Factors” and in the financial statements and the notes relating to these financial statements, together with the information included elsewhere in this prospectus, before deciding to invest in our common stock. In this prospectus, unless the context indicates otherwise, the terms Xcel, we, our and us refer to Xcel Pharmaceuticals, Inc.

Overview

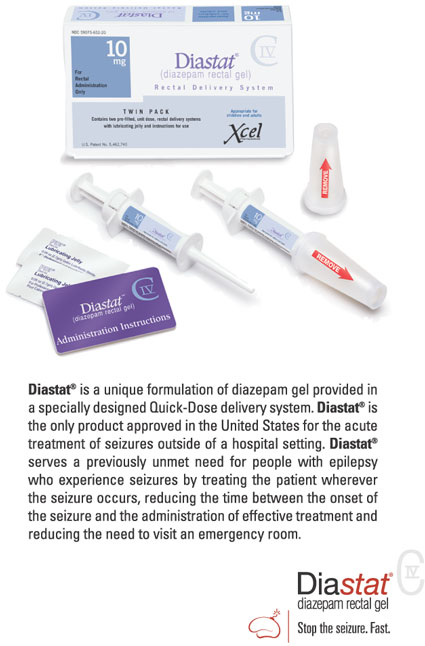

We are a specialty pharmaceutical company that acquires and markets prescription products in focused therapeutic markets in the United States. Our initial market is neurology, which we consider to be a focused market because a limited number of high-prescribing physicians write a significant number of prescriptions for neurology products. High-prescribing physicians write a significantly greater number of prescriptions for the products in a particular market than their peers. Our products, Diastat and Mysoline, are used in the treatment of seizures principally associated with epilepsy. Our strategy is to increase sales of our current products through targeted sales and marketing efforts, to acquire additional products in neurology that leverage our existing sales organization, to acquire additional products in other focused markets and to develop product enhancements.

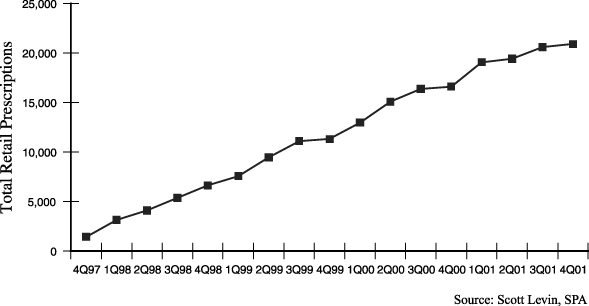

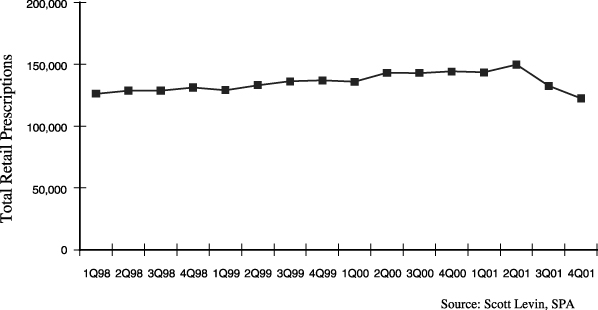

The neurology market is attractive to us because it is a large and rapidly growing focused market. Sales of neurology products in the United States totaled $6.7 billion in 2001, and grew at an average annual rate of 23% from 1997 to 2001. Sales of products used to treat epileptic seizures in the United States totaled $4.6 billion in 2001, and grew at an average annual rate of 26% from 1997 to 2001. Diastat is the only drug approved in the United States for the acute treatment of seizures outside of a hospital setting. Despite limited historical promotion, total retail prescriptions for Diastat, which was launched in October 1997, grew from 3,100 in the first quarter of 1998 to 20,900 in the fourth quarter of 2001. Diastat has orphan drug exclusivity, which can be granted by the Food and Drug Administration to the first drug approved to treat a condition that affects a limited patient population, through July 2004. Mysoline has been used since the early 1950s for the chronic treatment of seizures associated with epilepsy and has maintained stable prescription levels for many years. All of our revenues come from sales of Diastat and Mysoline.

The concentration of high-prescribing physicians in the neurology market enables us to promote our products effectively with a small, dedicated sales and marketing organization and a limited corporate infrastructure. During 2001, the 14,000 neurologists and pediatric neurologists in the United States collectively wrote prescriptions for 29%, or $1.3 billion, of the products used to treat epileptic seizures. Our nationwide field sales organization of 80 experienced professionals promotes our products to 8,000 of the highest-prescribing physicians in this group. We maintain a limited corporate infrastructure to support our field sales organization and to identify and acquire additional products. We rely on third parties to manufacture and distribute our products and to support our development of product enhancements.

We believe that the changing pharmaceutical industry landscape will present significant opportunities for us to acquire additional products. Larger pharmaceutical companies are shifting their sales and marketing efforts away from smaller products toward products with higher revenue potential and new product launches. As a result, an increasing number of smaller products that may have growth potential are receiving little or no promotional effort and present potentially attractive acquisition opportunities for us. We continually evaluate opportunities to acquire these types of products, although currently we have no specific agreements or commitments with respect to any product acquisitions. We currently are analyzing the results from two post-approval clinical studies for Diastat and we also are evaluating other potential product enhancements for both Diastat and Mysoline.

1

We were founded in January 2001 and began selling Diastat and Mysoline in April 2001. Our senior management has over 30 years of collective experience acquiring and marketing branded products in the specialty pharmaceutical industry.

Strategy

Our objective is to capitalize on our management team’s experience acquiring and marketing pharmaceutical products. We intend to become a leading specialty pharmaceutical company marketing products in focused therapeutic markets in the United States. Specifically, our strategy is to:

| | • | | Expand Sales of Diastat. We believe there are significant opportunities to expand sales of Diastat. Diastat is the only product approved in the United States for the acute treatment of seizures associated with epilepsy outside of a hospital setting. Diastat is safe and effective and has significant quality-of-life and cost advantages. We intend to expand sales of Diastat by promoting to our targeted physicians the benefits of including Diastat as part of the standard treatment regimen for their epilepsy patients. |

| | • | | Leverage Our Existing Neurology Sales Organization. We intend to leverage our 80-person field sales organization by acquiring additional products that can be marketed to our targeted neurologist audience. |

| | • | | Acquire Products in Other Focused Markets. We seek to acquire products that can be marketed to concentrated groups of high-prescribing physicians in focused therapeutic markets in addition to neurology. |

| | • | | Maximize Value of Products by Developing Product Enhancements. We intend to expand our sales by developing product enhancements, such as new delivery systems, new formulations and new dosage strengths, and by conducting targeted post-approval clinical studies. We currently are analyzing the results from two post-approval clinical studies for Diastat to obtain additional clinical data about the product and its usefulness in treating epileptic seizures among adults and seizures among children caused by high fever. |

Our headquarters are located at 6363 Greenwich Drive, Suite 100, San Diego, California 92122 and our telephone number is (858) 202–2700. Our web site address iswww.xcelpharmaceuticals.com. The information on our web site is not a part of this prospectus.

We have pending a U.S. trademark application for Xcel Pharmaceuticals™. We also own the registered trademarks Diastat® and Mysoline®. All other trademarks and trade names referred to in this prospectus are the property of their respective owners.

2

The Offering

|

| Common stock offered | | shares |

|

| Common stock to be sold to Elan concurrent with the closing of this offering | | shares |

|

| Common stock outstanding after this offering | | shares |

|

| Use of proceeds | | For general corporate purposes, including product acquisitions and working capital. |

|

| Proposed Nasdaq National Market symbol | | “XCEL” |

The common stock to be outstanding after this offering is based on 18,728,975 shares of common stock outstanding as of December 31, 2001, assuming conversion of all outstanding shares of our convertible preferred stock. This table excludes:

| | • | | 345,500 shares of our common stock issuable upon exercise of options outstanding under our stock option plan as of December 31, 2001 at a weighted average exercise price of $0.68 per share; and |

| | • | | 925,525 additional shares of our common stock reserved for grant as of December 31, 2001 under our stock option plan. |

Except as otherwise indicated, information in this prospectus is based on the following assumptions:

| | • | | the conversion of all outstanding shares of our convertible preferred stock into 14,000,000 shares of common stock upon the closing of this offering; |

| | • | | the filing of an amended and restated certificate of incorporation upon the closing of this offering; |

| | • | | the purchase by Elan Corporation, plc or one of its affiliates concurrent with the closing of this offering of shares of our common stock (we refer to Elan and its affiliates in this prospectus as Elan); and |

| | • | | no exercise of the underwriters’ over-allotment option. |

Prior to this offering, our relationship with Elan consisted of the following:

| | • | | Elan sold us our two products, Diastat and Mysoline; |

| | • | | Elan provided $99 million of financing for the purchase of our products, a $10 million line of credit and product financing whereby Elan makes payments to us based on a percentage of net sales of its product Zanaflex and we make payments to Elan based on a percentage of net sales of Mysoline; |

| | • | | Elan purchased 3,000,000 shares of our preferred stock at the same price and on the same terms as all other investors. These shares, together with 30,000 shares subject to an option that we have issued to Elan in connection with the election of its nominee to our board of directors, are all of the shares of our capital stock beneficially owned by Elan and represent 16.2% of our outstanding capital stock on a fully-diluted basis; |

| | • | | Elan has the right to nominate one of our seven directors, and we and our principal stockholders have agreed to use our best efforts to elect Elan’s nominee to our board of directors for so long as we continue to have outstanding indebtedness to Elan; and |

| | • | | Elan agreed to purchase shares of our stock concurrent with the closing of this offering. |

After this offering, Elan will beneficially own shares of our common stock, or % of our outstanding capital stock on a fully-diluted basis.

3

Summary Financial Data

The following table sets forth our summary financial data. You should read this information together with the financial statements and related notes appearing elsewhere in this prospectus and the information under “Selected Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

| | | Period from January 24, 2001 (inception) through December 31, 2001(1)

| |

| | | (in thousands, except per share data) | |

Statement of Operations Data: | | | | |

| Net sales | | $ | 14,124 | |

| Total operating costs and expenses | | | 20,317 | |

| | |

|

|

|

| Operating loss | | | (6,193 | ) |

| Net interest expense | | | (3,323 | ) |

| | |

|

|

|

| Net loss | | $ | (9,516 | ) |

| | |

|

|

|

| Pro forma net loss per common share—basic and diluted(2) | | $ | (2.12 | ) |

| | |

|

|

|

| Pro forma weighted average common shares outstanding(2) | | | 4,487 | |

| | |

|

|

|

Unaudited adjusted pro forma net loss per common share assuming conversion of preferred stock—basic and diluted(3) | | $ | (0.60 | ) |

| | |

|

|

|

Unaudited adjusted pro forma weighted average common shares outstanding assuming conversion of preferred stock(3) | | | 15,777 | |

| | |

|

|

|

| | | As of December 31, 2001

|

| | | Actual

| | | Pro Forma As Adjusted(4)

|

| | | (in thousands, except per share data) |

Balance Sheet Data: | | | | | | | |

| Cash and cash equivalents | | $ | 19,487 | | | $ | |

| Working capital | | | 16,093 | | | | |

| Total assets | | | 171,906 | | | | |

| Long-term debt | | | 99,000 | | | | |

| Accumulated deficit | | | (9,516 | ) | | | |

| Total stockholders’ equity | | | 60,382 | | | | |

| (1) | | We acquired Diastat on March 31, 2001 and Mysoline on April 1, 2001 and the related operations are included in our results since April 1, 2001. |

| (2) | | See note 1 to our financial statements for an explanation of the number of shares used in computing pro forma net loss per common share. |

| (3) | | The unaudited adjusted pro forma net loss per common share assuming conversion of preferred stock and the related weighted average common shares outstanding reflect the conversion of all outstanding shares of our convertible preferred stock into 14,000,000 shares of common stock upon the closing of this offering. |

| (4) | | The pro forma as adjusted balance sheet data gives effect to: |

| | • | | the conversion of all outstanding shares of our convertible preferred stock into 14,000,000 shares of common stock upon the closing of this offering; |

| | • | | the sale of shares of common stock in this offering at the initial offering price of $ per share, which is the midpoint of our expected public offering range, after deducting the underwriting discounts and commissions and estimated offering expenses; and |

| | • | | the sale of shares of common stock to Elan concurrent with the closing of this offering at the initial public offering price. |

4

An investment in our common stock involves significant risks. You should carefully consider the following risks described below, and the other information included in this prospectus, including our financial statements and related notes, before you decide to buy our common stock. Our business, operating results and financial condition could be harmed by any of the following risks. The trading price of our common stock could decline due to any of these risks, and you could lose all or part of your investment.

Risks Related to Our Business

Our short operating history makes it difficult to evaluate our business and prospects

Our ability to generate revenues and income is unproven as a result of our short operating history. We were formed in January 2001 and focused during 2001 primarily on acquiring our initial products, hiring and training our sales force and identifying and seeking to acquire additional products. We recorded net sales of $14.1 million and a net loss of $9.5 million during the period from our inception through December 31, 2001. We may continue to incur significant losses if our revenues do not increase to keep pace with our current expenses and any future increase in our expenses. As a result of this limited operating history, our brief operating results are not indicative of our future results or prospects.

We rely on sales from our only two products, Diastat and Mysoline, for all of our revenues

Since our inception all of our revenues have come from sales of our only two products, Diastat and Mysoline. We expect that, for the foreseeable future, we will continue to rely on these products for substantially all of our revenues. Accordingly, our success depends on our ability to maintain and increase sales of Diastat and Mysoline. We acquired these products only recently and our sales force has only limited experience with these products. Our sales and marketing efforts may not be successful in maintaining and increasing the prescriptions for our products. Our sales of Diastat and Mysoline are also subject to the following risks:

| | • | | the ability of some of our competitors to price products below a price at which we can competitively sell these products; |

| | • | | physician or public perception that these products are not safe or effective; |

| | • | | the introduction of new competitive products; and |

| | • | | a suspension or reduction in sales of these products as a result of an adverse event experienced by a patient. |

Furthermore, our success depends on our ability to increase physician awareness of the benefits of including Diastat as part of the standard treatment regimen for their epilepsy patients. As a new company, we may have difficulty raising the awareness necessary to increase physician use of Diastat. If Diastat fails to gain market share, our business may be harmed.

We have derived 84% of our revenues from three customers

Since our inception, we have received 38% of our revenues from McKesson HBOC, Inc., 27% of our revenues from AmerisourceBergen Corporation and 19% of our revenues from Cardinal Health, Inc. Our business would be harmed if we were to lose any of these customers and we were unable to replace the revenues lost, or if any of these customers were unable or unwilling to pay us for our products and we were unable to collect the amounts owing to us.

5

We rely on single third-party manufacturers and a single third-party distributor for our products

Diastat is manufactured by DPT Laboratories, Inc. and Mysoline is manufactured by Wyeth-Ayerst Pharmaceuticals, Inc. In addition, both of our products are distributed by Integrated Commercialization Solutions, Inc. If we were to experience any interruption in the manufacturing or distribution of our products, we might not be able to locate an alternative manufacturer or distributor in a timely fashion or on commercially reasonable terms. In addition, in the event of any interruption of the manufacturing or distribution of our products, we likely would experience reduced sales and increased expenses associated with identifying and qualifying alternate manufacturers or distributors.Any of the following factors could impact the supply of our products from third-party manufacturers and distributors:

| | • | | an interruption in the supply of products from a third party as a result of the lack of required governmental or regulatory approvals, including as a result of deficiencies in the current Good Manufacturing Practices, or cGMP, identified by a governmental or regulatory agency following an inspection of a manufacturer’s or distributor’s facilities; |

| | • | | an interruption in the supply of products from a third-party manufacturer as a result of the unavailability of raw materials or component parts; or |

| | • | | an interruption in the supply of products from third-party manufacturers or distributors as a result of the occurrence of a labor interruption or natural disaster. |

The manufacturer of Mysoline has indicated that it does not intend to renew our current manufacturing agreement upon its expiration in March 2003. As a result, we will be required to identify a new manufacturer for Mysoline and negotiate a new manufacturing agreement. We will also be required to work with the new manufacturer to obtain all government approvals required for the manufacturer to supply the product. We may not be successful in identifying a new manufacturer for Mysoline on a timely basis, or at all. Further, even if we do identify a new manufacturer, we may not be successful in negotiating an agreement with the manufacturer and any agreement we may negotiate may not be favorable to us. If we are unsuccessful in identifying a new manufacturer, negotiating a favorable agreement with the manufacturer and working with the manufacturer to obtain all required governmental approvals prior to the time that our inventory of Mysoline is exhausted, we will not be able to fill orders for Mysoline.

Failure to comply with government regulations could impair our ability to operate our business

Our business and products are subject to extensive and rigorous regulation at both the federal and state levels. We and our contract manufacturers are principally regulated by the Food and Drug Administration, or FDA, as well as by various other governmental agencies including, in the case of Diastat, the Drug Enforcement Agency, or DEA. These regulatory authorities govern the development, testing, manufacture, safety, effectiveness, labeling, storage, record keeping, approval, advertising and promotion of our products.

The FDA has approved Diastat and Mysoline for marketing. Some changes to an approved product, for example, adding a new indication, require additional FDA approval before the change can be implemented. Our products are sometimes used by physicians for indications other than those approved by the FDA, and we cannot be sure that the FDA will not object to this off-label use. Failure to obtain any necessary additional approvals or maintain existing approvals may result in a default under our loan and security agreements with Elan or cause the FDA to object to the continued marketing of our products.

We and our contract manufacturers and distributors, our products, the facilities at which the products are manufactured and stored and other aspects of our business such as our promotional activities, must continue to comply with the FDA’s regulatory requirements, including compliance with cGMP. In addition, because Diastat is regulated as a controlled substance, our third-party manufacturer and distributor must have security, control and accounting mechanisms in order to prevent loss and diversion of controlled substances. The FDA and the DEA regularly inspect manufacturing and other pharmaceutical facilities to evaluate compliance with these

6

requirements. Violation of regulatory requirements may result in various adverse consequences, including the regulatory agency’s delay in approving, or refusing to approve, a product, suspension or withdrawal of an approved product from the market, recalls, operating restrictions, seizures, injunctions or criminal prosecution, which could harm our business.

We cannot predict what impact changes in regulations, enforcement positions, statutes or legal interpretations, when and if promulgated, adopted or enacted, may have on our business in the future.

If third-party reimbursement ceases to be available for our products, the market may no longer accept our products and we may not be able to maintain our current product price levels

Our ability to sell our products depends in part on the extent to which reimbursement for the costs of our products is available from government health administration authorities, private health insurers and others. Third-party insurance coverage may not be adequate for us to maintain price levels sufficient to realize an appropriate return on our investment in our products. Government authorities, private insurers and other third-party payors are increasingly attempting to contain health care costs by:

| | • | | generally limiting the coverage and level of reimbursement for prescription products; |

| | • | | refusing, in some cases, to provide any coverage for uses of approved products for indications for which the FDA has not granted marketing approval; |

| | • | | controlling the pharmaceutical products that are on their formulary lists; and |

| | • | | requiring or encouraging, through more favorable reimbursement levels or otherwise, the substitution of generic alternatives to branded products. |

In addition, many managed care organizations are considering formulary contracts primarily with pharmaceutical companies that can offer a full line of products for a given therapy sector or disease state. Our products may not be included on the formulary lists of managed care organizations. In this event, third-party reimbursement for our products would not likely be available and physicians may not prescribe our products.

The competition between pharmaceutical companies to get their products approved for reimbursement may also result in downward pricing pressure in the industry or in the markets where our products compete. We may not be successful in any efforts we take to mitigate the effect of a decline in average selling prices for our products. Any decline in our average selling prices would also reduce our gross margins.

New legislation or regulatory proposals may harm our ability to raise capital and increase our revenues

A number of legislative and regulatory proposals aimed at changing the health care system, including the cost of prescription products and changes in the levels at which consumers and healthcare providers are reimbursed for purchases of pharmaceutical products, have been proposed. While we cannot predict when or whether any of these proposals will be adopted or the effect these proposals may have on our business, the nature of these pending proposals, as well as the adoption of any proposal, may harm our ability to raise capital or exacerbate industry-wide pricing pressures and could harm our ability to generate revenues.

Our competitive position in our industry may suffer if we are not successful in growing our business through acquisitions of complementary products

We intend to increase our sales and enhance our competitive position by acquiring products that we can promote and sell through our existing sales and marketing organization or that enable us to expand into new focused markets. We engage in only limited efforts to develop product enhancements for our products and will rely primarily on acquisitions from other companies to obtain new products. These product acquisitions may be

7

carried out through the purchase of assets, joint ventures, licenses or by acquiring other companies. We may not be able to identify acquisition candidates and, even if we identify appropriate candidates, we may not be able to complete acquisitions on satisfactory terms.

Other companies, many of which have substantially greater financial, marketing and sales resources than our own, compete with us for the acquisition of products or companies. We may not be able to acquire rights to additional products on acceptable terms, or at all, and we may not be able to obtain future financing for acquisitions on acceptable terms, or at all. Our inability to acquire additional products could limit our growth. Furthermore, even if we are successful in acquiring additional products, we may not be able to generate sales sufficient to create a profit or otherwise avoid a loss. Future acquisitions could also result in large and immediate write-offs, incurrence of debt and contingent liabilities or amortization of expenses related to intangible assets, any of which could harm our business.

We anticipate that the integration of newly-acquired products or companies into our business will require significant management attention and may require expansion of our sales organization. To manage any acquisitions we complete, we must maintain adequate operational, financial and management information systems and motivate and manage our employees. Any failure by us to integrate successfully our acquisitions could harm our business.

We may need to raise additional funds to pursue our growth strategy or continue our operations

We do not have a sufficient operating history to know with certainty whether our existing financial resources and the proceeds of the sale of our common stock in this offering and to Elan will be sufficient to finance our anticipated growth. Depending on the acquisition opportunities available and our use of our financial resources to satisfy existing capital and operating needs, we may need to raise additional funds to finance these transactions or continue our operations, either through the public or private sale of our debt or equity securities or by borrowing funds. We may not be able to borrow money on commercially reasonable terms, or at all, and any sale of our debt or equity securities may result in dilution to our stockholders. In addition, our loan and security agreements with Elan limit our ability to incur debt without Elan’s consent in excess of certain limits. Further, the rights, preferences and privileges of the securities we may sell may be senior to those held by our current stockholders. If adequate funds are not available on commercially reasonable terms, our ability to expand our business through the acquisition of additional products or companies or to respond to competitive pressures would be significantly limited.

In connection with our purchase of Diastat and Mysoline, we have borrowed $99 million from Elan pursuant to loan and security agreements containing various operating covenants

In connection with these loans, we have granted to Elan a security interest in all of the assets we purchased from Elan. Elan is also protected by various loan covenants and other rights that, if breached by us, even in the absence of a payment default, will entitle Elan to foreclose on its security interest and reacquire the products without payment or refund to us. These covenants include not taking any of the following actions without Elan’s consent:

| | • | | engaging in a material line of business outside of the pharmaceutical business; |

| | • | | selling, leasing or disposing of substantially all of our assets or any of the collateral; |

| | • | | acquiring all or substantially all of the assets of others; |

| | • | | merging with or consolidating into other parties; and |

| | • | | making certain distributions to our stockholders. |

8

We have also agreed to limit our borrowings from third parties without Elan’s consent. Generally, except for specific exceptions set forth in the loan and security agreements, including an exception permitting us to incur debt without Elan’s consent in connection with our purchase of additional products, we cannot have debt outstanding, other than the debt owed to Elan, in excess of $3 million until we have paid for the Diastat and Mysoline inventory we purchased from Elan, at which time this amount will be increased to $6.5 million.

We will also be in default if we fail to cure a breach of our representations, warranties and covenants under the loan and security agreements within any applicable cure period. In such an event, Elan may exercise its rights and remedies under the loan and security agreements, including refusing to make any advances to us under the credit line, accelerating the due date of all our obligations to Elan and foreclosing on the products and other collateral without payment or refund to us. Any such foreclosure would severely harm us and the interests of our stockholders and could result in a complete loss of your investment.

We may face competition for Diastat once its orphan drug exclusivity expires in July 2004

Other drug companies may be able to obtain FDA approval to market generic versions of Diastat after July 2004 if they can design products that do not infringe our patent for Diastat and that meet the FDA’s approval requirements. Our patent on Diastat, which expires in 2012, is a formulation patent and does not protect against use of Diastat’s active pharmaceutical ingredient outside of the specific formulation described in our patent. If competing products are developed and marketed, we may experience downward price pressure and reduced sales of Diastat. Given that we currently rely on sales of Diastat for a substantial portion of our revenues, any decline in Diastat sales or downward price pressure on Diastat as a result of competing drugs could significantly harm our business.

We compete with generic substitutes for Mysoline

We have no patent protection on Mysoline and we compete with manufacturers of generic substitutes for Mysoline. These generic manufacturers include Watson Pharmaceuticals, Inc., Danbury Pharmaceuticals, Inc., Lannett Company, Inc. and Qualitest Pharmaceuticals, Inc. Generic substitutes for Mysoline currently sell at prices that are less than the price of Mysoline. Any significant decline in the prices for generic substitutes for Mysoline would result in downward price pressure on Mysoline, particularly if third-party payors refuse to reimburse patients or reduce the reimbursements patients receive, for branded products or if physicians begin to prescribe, or pharmacists begin to substitute, generic products more frequently than the branded counterparts. We rely on sales of Mysoline for a substantial portion of our revenues and any decline in Mysoline sales or downward price pressure on Mysoline could significantly harm our business.

Our revenues and operating results may fluctuate in future periods and we may fail to meet expectations, which may cause the price of our common stock to decline

Variations in our quarterly operating results are difficult to predict and may fluctuate significantly from period to period, particularly because we are a relatively new company and our sales prospects are uncertain. If our quarterly sales or operating results fall below the expectations of investors or securities analysts, the price of our common stock could decline substantially. In addition to the other factors discussed under these “Risk Factors,” specific factors that may cause fluctuations in our operating results include:

| | • | | demand and pricing for our products, including any change in wholesaler purchasing patterns for our products; |

| | • | | physician and patient acceptance of, and prescription rates for, our products; |

| | • | | government or private healthcare reimbursement policies; |

| | • | | any interruption in the manufacturing or distribution of our products; and |

| | • | | timing and size of any new product acquisitions we may complete. |

9

As a result of these factors, we believe that period-to-period comparisons of our operating results are not a good indication of our future performance.

Impairment of our significant intangible assets may reduce our profitability

The costs of our acquired product rights are recorded as intangible assets and amortized over the period that we expect to benefit from the assets. As of December 31, 2001, intangible assets comprised approximately 83% of our total assets and over two times our stockholders’ equity. We periodically evaluate the recoverability and the amortization period of our intangible assets. Any impairment of our intangible assets will harm our profitability.

We are recording stock-based compensation expense relating to stock option grants and the amortization of this compensation expense will result in a charge to our earnings over the next four years

Stock-based compensation represents an expense associated with the recognition of the difference between the deemed fair market value of common stock at the time of an option grant and the option exercise price. Stock-based compensation is amortized over the vesting period of the options. At December 31, 2001, deferred stock-based compensation related to option grants to our employees and members of our board of directors totaled $1,376,000, which will be amortized to selling, general and administrative expense on a straight-line basis as the options are earned, generally over a period of four years. Also, we have granted options to consultants which, for compensation purposes, must be re-measured at each reporting date during the vesting period. This requires us to record additional non-cash selling, general and administrative expenses. This re-measurement and the corresponding effect on the related expense may result in us incurring net losses or an increase in net losses for a given period.

Our product enhancements may not be approved by the FDA

We are evaluating potential product enhancements for both Diastat and Mysoline. We may not be successful in developing or making enhancements that will benefit patients or be accepted by physicians. We intend to rely on third parties to help develop, test and manufacture product enhancements. We may not be able to identify adequate development partners, and even if identified, we may not be able to enter into agreements with these entities on commercially reasonable terms, or at all. Further, the process of obtaining FDA and other regulatory approvals for product enhancements may be lengthy and expensive. If we select the wrong product enhancements or fail to develop or obtain regulatory approval for these product enhancements, our growth may be limited.

We depend on protection of our intellectual property rights

Diastat is protected by a U.S. formulation patent until 2012. Other drug companies may be able to develop generic versions of Diastat prior to 2012 if they can design products that do not infringe our patent. Our patent is a formulation patent and does not protect the use of Diastat’s active pharmaceutical ingredient outside of the formulation described in our patent. Mysoline is not covered by a patent. In addition, we have rights to several trademarks regarding Diastat and a trademark regarding Mysoline. We also have trade secrets and other proprietary information in connection with the manufacture of our products.

We may not be able to protect our intellectual property rights against third party infringement. We may not be successful in securing or maintaining proprietary or patent protection for our products. The validity of patents and other intellectual property rights can be subject to expensive litigation, and our patents and intellectual property rights may be challenged. In addition, our competitors may develop products similar to ours using methods and technologies that are beyond the scope of our intellectual property protection, which could reduce our sales. If we are unsuccessful in defending our intellectual property rights, third parties may be able to copy our products, which would impair our ability to meet our sales projections. A third party could claim that our intellectual property rights infringe its intellectual property rights. If our intellectual property rights ultimately were determined to infringe a third party’s rights, we could be liable for royalties on past sales, and could be

10

required to enter into licenses to continue to manufacture and sell our products. These licenses would require us to pay future royalty payments to the third party. If we become involved in any dispute regarding our intellectual property rights, regardless of whether we prevail, we could be required to engage in costly, distracting and time-consuming litigation that could harm our business.

We may face liability and indemnity claims that could result in unexpected costs and damage to our reputation

Our business exposes us to potential liability risks that arise from the testing, manufacture and sale of our products. Some plaintiffs have received substantial damage awards in some jurisdictions against pharmaceutical companies based upon claims for injuries allegedly caused by the use of their products. Although currently we maintain product liability insurance coverage of $10 million, there is no guarantee that any claims brought against us would be within our existing or future insurance policy coverage or limits. Any judgment against us that is in excess of our policy limits would have to be paid from our cash reserves, which would reduce our capital resources. Further, we may not have sufficient capital resources to pay a judgment, in which case our creditors could levy against our assets. Also, it may be necessary for us to recall products that do not meet approved specifications, which would result in adverse publicity, potentially significant costs in connection with the recall and a loss of revenues. Any product liability claim or series of claims brought against us could significantly harm our business, particularly if such claims resulted in adverse publicity or damage awards outside or in excess of our insurance policy limits.

We rely for our success on our ability to hire and retain key personnel

Our success depends on all of our executive officers. If we lose the services of one or more of these individuals, we may not be able to achieve our business objectives. We do not have employment contracts with any of our executive officers. We may not be able to recruit and retain qualified personnel in the future due to intense competition for personnel among pharmaceutical businesses. Recruiting and retaining experienced sales personnel is equally difficult but essential to the success of our operations. As of December 31, 2001, we had 99 full-time employees, of which 83 were in sales and marketing and 16 were in administration and support services.

Some of our charter and other contractual and statutory provisions may prevent a change of control that could be beneficial to our stockholders

Some provisions of our charter documents and our loan and security agreements with Elan could make it more difficult for a third party to acquire us without separate approval of our board of directors and Elan. As a result of these provisions, we or Elan could delay, deter or prevent a takeover attempt or third party acquisition that our stockholders consider to be in their best interests, including a takeover attempt that results in a premium over the market price for the shares held by our stockholders. These provisions include:

| | • | | a classified board of directors; |

| | • | | the ability of the board of directors to designate the terms, and issue new series, of preferred stock; |

| | • | | advance notice requirements for nominations for election to the board of directors; |

| | • | | special voting requirements for the amendment of our charter and bylaws; and |

| | • | | Elan’s right to approve transactions that would constitute a change of control. |

We are also subject to anti-takeover provisions of Delaware law which could delay or prevent a change of control. Together, these charter, contractual and statutory provisions may make the removal of management more difficult and may discourage transactions that otherwise could involve payment of a premium over prevailing market prices for our common stock.

11

Risks Related to this Offering

We have broad discretion to use the offering proceeds, and the manner in which we invest these proceeds may not yield a favorable return on your investment

The net proceeds of this offering are not allocated for specific uses other than general corporate purposes, including product acquisitions and working capital. Our management has broad discretion over how these proceeds are used and could spend the proceeds in ways with which you may not agree. The proceeds may not be invested ultimately in a manner that yields a favorable or any return on your investment.

Our stock price may be volatile and you may not be able to sell your shares at or above the offering price

Our common stock has not been publicly traded, and an active trading market may not develop or be sustained after this offering. The market prices for securities of specialty pharmaceutical companies in general have been highly volatile and may continue to be highly volatile in the future. You may not be able to sell your shares at or above the offering price. The price at which our common stock will trade after this offering may fluctuate substantially as a result of one or more of the following factors:

| | • | | actual or anticipated fluctuations in our operating results; |

| | • | | changes in or our failure to meet investors’ and securities analysts’ expectations; |

| | • | | announcements of technological innovations or new commercial products; |

| | • | | introduction of new products and services by us or our competitors; |

| | • | | developments concerning proprietary rights, including patents; |

| | • | | regulatory developments and related announcements in the United States and foreign countries; |

| | • | | general stock market conditions. |

Future sales of our common stock may depress our stock price

Sales of a substantial number of shares of our common stock in the public market after this offering or after the expiration of contractually or legally required holding periods could cause the market price of our common stock to decline. After this offering, we will have approximately shares of common stock outstanding. All of the shares sold in this offering will be freely tradable unless they are purchased by our affiliates, as defined under the Securities Act of 1933. The remaining shares of common stock outstanding immediately after this offering, including the shares to be purchased by Elan concurrent with the closing of this offering, will be subject to the restrictions on transfer contained in the lock-up agreements described under “Underwriting.” Immediately after the expiration of the 180-day period set forth in the lock-up agreements, shares, which will be outstanding immediately after this offering, will become available for sale.

Our executive officers and directors and their affiliates will exercise control over stockholder voting matters

After this offering, our executive officers and directors and their affiliates will together control approximately % of our outstanding common stock. As a result, these stockholders will collectively be able to control all matters requiring approval of a majority of our stockholders, including the election of directors and significant corporate transactions. We and our principal stockholders have also entered into an agreement under which we will use our best efforts to have a nominee of Elan elected to our board of directors. The concentration of ownership may delay, prevent or deter a change in control of our company, could deprive our stockholders of an opportunity to receive a premium for their common stock as part of a sale of our company or our assets and might affect the prevailing market price of our common stock.

12

We may become involved in securities class action litigation that could divert management’s attention and harm our business

The stock market has from time to time experienced significant price and volume fluctuations that have affected the market prices for the common stock of pharmaceutical companies. These broad market fluctuations may cause the market price of our common stock to decline. In the past, following periods of volatility in the market price of a particular company’s securities, securities class action litigation has often been brought against the company. We may become involved in this type of litigation in the future. Litigation often is expensive and diverts management’s attention and resources, which could harm our business.

13

INFORMATION REGARDING FORWARD-LOOKING STATEMENTS

This prospectus may contain forward-looking statements. You may find these forward-looking statements under “Prospectus Summary,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” as well as elsewhere in this prospectus. These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by any forward-looking statements. Forward-looking statements include, but are not limited to, statements about:

| | • | | our ability to successfully market and sell our products; |

| | • | | our ability to leverage our existing sales force; |

| | • | | our ability to acquire and assimilate new product acquisitions; |

| | • | | our ability to develop product enhancements; |

| | • | | our estimates regarding reimbursement rates or methods; and |

| | • | | our estimates regarding our capital requirements and our need for additional financing. |

In some cases, you can identify forward-looking statements by the following terms: intends, may, will, should, could, would, expects, plans, anticipates, believes, estimates, projects, predicts and potential, as well as similar expressions intended to identify forward-looking statements. These statements reflect our views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. We discuss many of these risks in this prospectus in greater detail under “Risk Factors.” These forward-looking statements represent our estimates and assumptions only as of the date of this prospectus.

You should read this prospectus and the documents that we reference in this prospectus completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

Concurrent with the closing of this offering, we are selling shares of our common stock to Elan in a separate private placement transaction at a price per share equal to the initial public offering price. The underwriters will not receive any discount or commission on the sale of these shares.

Elan has agreed not to sell any shares of our common stock, including the shares being purchased in the private placement, for a period of at least 180 days following the date of this prospectus. Prior to this offering, Elan beneficially owned 3,030,000 shares of our common stock. See “Business–Material Agreements,” “Management,” “Related-Party Transactions,” “Principal Stockholders” and “Description of Capital Stock–Registration Rights” for further discussion of our relationship with Elan.

14

The net proceeds we will receive from the sale of the shares of common stock offered by us in this offering and the sale of shares of common stock to Elan concurrent with the closing of this offering at the initial public offering price are estimated to be $ , or $ if the underwriters’ over-allotment option is exercised in full. This is based on an assumed initial public offering price of $ per share, which is the midpoint of our expected public offering range, and after deducting the underwriting discounts and commissions and the estimated offering expenses payable by us.

We intend to use the net proceeds of this offering for general corporate purposes, including product acquisitions and working capital. We have not yet determined the expected expenditures and thus cannot estimate the amounts to be used for each specified purpose. The actual amounts and timing of these expenditures will vary significantly depending on a number of factors including the amount of cash used in or generated by our operations. We continually evaluate opportunities to acquire products, although currently we have no specific agreements or commitments with respect to any product acquisitions. Accordingly, our management will retain broad discretion as to the allocation of the net proceeds of this offering. We intend to invest the net proceeds of this offering in short-term, interest-bearing investment grade securities until they are used.

We have never declared or paid dividends on our capital stock and do not anticipate paying dividends in the foreseeable future. We currently intend to retain our earnings, if any, for the development of our business. Furthermore, our loan and security agreements with Elan prohibit the payment of dividends without Elan’s consent.

15

The following table sets forth our capitalization as of December 31, 2001:

| | • | | on a pro forma basis after giving effect to the conversion of all outstanding shares of our convertible preferred stock into 14,000,000 shares of common stock upon the closing of this offering; and |

| | • | | on the same pro forma basis as adjusted to give effect to: |

| | • | | the sale of shares of common stock by us in the offering at an assumed initial public offering price of $ per share, which is the midpoint of our expected public offering range for our common stock in this offering; |

| | • | | deducting the underwriting discounts and commissions and estimated offering expenses; |

| | • | | the sale to Elan of shares of common stock to be purchased concurrent with the closing of this offering at the initial public offering price; and |

| | • | | the filing of our amended and restated certificate of incorporation upon the closing of this offering increasing our authorized shares of common stock to 100,000,000 and changing our authorized shares of preferred stock to 5,000,000. |

You should read this table together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” our financial statements and the related notes appearing elsewhere in this prospectus.

| | | As of December 31, 2001

|

| | | Actual

| | | Pro Forma

| | | Pro Forma As Adjusted

|

| | | (in thousands, except share and per share data) |

| Cash and cash equivalents | | $ | 19,487 | | | $ | 19,487 | | | $ | |

| | |

|

|

| |

|

|

| |

|

|

| Long-term debt | | $ | 99,000 | | | $ | 99,000 | | | $ | |

| | |

|

|

| |

|

|

| |

|

|

| Stockholders’ equity: | | | | | | | | | | | |

| Convertible preferred stock; $0.0001 par value; 33,000,000 shares authorized actual and pro forma and no shares authorized pro forma as adjusted; 14,000,000 shares issued and outstanding actual and no shares issued and outstanding pro forma and pro forma as adjusted | | | 1 | | | | — | | | | |

| Preferred stock; $0.0001 par value; no shares authorized, issued or outstanding actual and pro forma; 5,000,000 shares authorized and no shares issued or outstanding pro forma as adjusted | | | — | | | | — | | | | |

| Common stock; $0.0001 par value; 43,000,000 shares authorized actual and pro forma; 100,000,000 shares authorized pro forma as adjusted; 4,728,975 shares issued and outstanding actual, 18,728,975 shares issued and outstanding pro forma and shares issued and outstanding pro forma as adjusted | | | 1 | | | | 2 | | | | |

| Additional paid-in capital | | | 71,272 | | | | 71,272 | | | | |

| Deferred stock-based compensation | | | (1,376 | ) | | | (1,376 | ) | | | |

| Accumulated deficit | | | (9,516 | ) | | | (9,516 | ) | | | |

| | |

|

|

| |

|

|

| |

|

|

| Total stockholders’ equity | | | 60,382 | | | | 60,382 | | | | |

| | |

|

|

| |

|

|

| |

|

|

| Total capitalization | | $ | 159,382 | | | $ | 159,382 | | | $ | |

| | |

|

|

| |

|

|

| |

|

|

The actual, pro forma and pro forma as adjusted information set forth in the table excludes:

| | • | | 345,500 shares of our common stock issuable upon exercise of options outstanding under our stock option plan as of December 31, 2001 at a weighted average exercise price of $0.68 per share; and |

| | • | | 925,525 additional shares of our common stock reserved for grant as of December 31, 2001 under our stock option plan. |

16

Our pro forma net tangible book value as of December 31, 2001 was $(81,991,000), or $(4.38) per share. Pro forma net tangible book value per share is determined by dividing the amount of our pro forma total assets less total liabilities and intangible assets by the number of shares of common stock outstanding, assuming conversion of all outstanding shares of convertible preferred stock into shares of common stock upon the closing of this offering.

Dilution in pro forma net tangible book value per share represents the difference between the amount per share paid by purchasers of common stock in this offering and the pro forma net tangible book value per share of common stock immediately after the closing of this offering. After giving effect to the sale of the shares of common stock offered by us in this offering, our pro forma net tangible book value at December 31, 2001 would have been $ or $ per share. This assumes an initial public offering price of $ per share, which is the midpoint of our expected public offering range, after deducting the underwriting discounts and commissions and our estimated offering expenses, and the sale of shares of our common stock to Elan concurrent with the closing of this offering at the initial public offering price. This represents an immediate increase in pro forma net tangible book value of $ per share to the existing stockholders and an immediate dilution of $ per share to Elan and to new investors purchasing shares in this offering. The following table illustrates this per share dilution:

| Assumed initial public offering price | | | | | | $ | |

| Pro forma net tangible book value per share at December 31, 2001 | | $ | (4.38 | ) | | | |

| Increase per share attributable to this offering | | | | | | | |

| | |

|

|

| | | |

| Pro forma net tangible book value per share after this offering | | | | | | | |

| Dilution per share to new investors | | | | | | | |

The following table summarizes, on a pro forma basis as of December 31, 2001, assuming the conversion of all outstanding shares of convertible preferred stock, the total number of shares of common stock purchased from us, the total consideration paid to us and the average price per share paid by existing stockholders, by Elan in the private placement occurring concurrent with the closing of this offering and by new investors purchasing shares in this offering. The information on the table assumes an initial public offering price of $ per share, which is the midpoint of our expected public offering range, after deducting the underwriting discounts and commissions and our estimated offering expenses.

| | | Shares Purchased

| | | Total Consideration

| | | Average Price Per Share

|

| | | Number

| | Percent

| | | Amount

| | Percent

| | |

| Existing stockholders | | 18,728,975 | | % | | | $ | 70,131,538 | | % | | | $ | 3.74 |

| Investor in the private placement | | | | | | | | | | | | | | |

| New investors | | | | | | | | | | | | | | |

| | |

| |

|

| |

|

| |

|

| |

|

|

| Total | | | | 100 | % | | $ | | | 100 | % | | $ | |

| | |

| |

|

| |

|

| |

|

| |

|

|

The preceding information excludes:

| | • | | 345,500 shares of our common stock issuable upon exercise of options outstanding under our stock option plan as of December 31, 2001 at a weighted average exercise price of $0.68 per share; and |

| | • | | 925,525 additional shares of our common stock reserved for grant as of December 31, 2001 under our stock option plan. |

17

We were formed on January 24, 2001. We acquired Diastat and Mysoline from Elan on March 31, 2001 and April 1, 2001, respectively. Prior to the acquisition of the products, we had no substantive operations. The selected financial data reflects our results since our inception and the contribution of the products to Elan’s results for the years ended December 31, 1997 through 2000 and the three months ended March 31, 2001. The selected financial data should be read in conjunction with the financial statements and related notes thereto and other financial information included elsewhere in this prospectus, as well as “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Historical results are not necessarily indicative of our future results.

Our balance sheet data as of December 31, 2001 and our operations data for the period from January 24, 2001 (inception) through December 31, 2001 were derived from our financial statements that have been audited by Deloitte & Touche LLP, independent public accountants, and are included elsewhere in this prospectus. The product contribution data represents the contribution of the products while they were owned by Elan and includes certain allocations of general costs to the products. The product contribution data for the years ended December 31, 1999 and 2000 and for the three months ended March 31, 2001 were derived from the statements of product contribution that have been audited by Deloitte & Touche LLP and are included elsewhere in this prospectus. The product contribution data for the years ended December 31, 1997 and 1998 were derived from unaudited statements of product contribution not included in this prospectus. The unaudited statements of product contribution were prepared on the same basis as the audited statements of product contribution and, in the opinion of management, include all adjustments, consisting only of normal recurring accruals, necessary for a fair presentation of the contribution of Diastat and Mysoline to Elan’s results.

Diastat was approved by the FDA in July 1997 and was launched by Elan in October 1997. Elan acquired Mysoline in February 1998. The contribution of Mysoline to Elan’s results is included since February 1998.

18

| | | Product Contribution Data of Diastat and Mysoline

| | Operations Data of Xcel

| |

| | | Year Ended December 31,

| | Three Months Ended March 31 2001

| | Period from January 24, 2001 (inception) through December 31, 2001(1)

| |

| | | 1997

| | | 1998

| | 1999

| | 2000

| | |

| | | (in thousands, except per share data) | |

Net sales | | $ | 4,021 | | | $ | 17,497 | | $ | 33,575 | | $ | 42,131 | | $ | 8,773 | | $ | 14,124 | |

| Operating costs and expenses: | | | | | | | | | | | | | | | | | | | | |

| Cost of sales | | | 755 | | | | 3,262 | | | 5,571 | | | 7,381 | | | 1,608 | | | 3,285 | |

| Selling, general and administrative | | | 6,155 | | | | 8,004 | | | 12,963 | | | 13,382 | | | 2,269 | | | 11,224 | |

| Research and development | | | 1,155 | | | | 444 | | | 1,651 | | | 2,072 | | | 354 | | | — | |

| Product rights amortization | | | — | | | | — | | | — | | | — | | | — | | | 5,808 | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

|

| Total operating costs and expenses | | | 8,065 | | | | 11,710 | | | 20,185 | | | 22,835 | | | 4,231 | | | 20,317 | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

|

| Operating income (loss) | | $ | (4,044 | ) | | $ | 5,787 | | $ | 13,390 | | $ | 19,296 | | $ | 4,542 | | | (6,193 | ) |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

|

| Other income (expense): | | | | | | | | | | | | | | | | | | | | |

| Interest expense | | | | | | | | | | | | | | | | | | | (3,996 | ) |

| Interest income | | | | | | | | | | | | | | | | | | | 673 | |

| | | | | | | | | | | | | | | | | | |

|

|

|

| Total other income (expense) | | | | | | | | | | | | | | | | | | | (3,323 | ) |

| | | | | | | | | | | | | | | | | | |

|

|

|

| Net loss | | | | | | | | | | | | | | | | | | $ | (9,516 | ) |

| | | | | | | | | | | | | | | | | | |

|

|

|

Pro forma net loss per common share—basic and

diluted(2) | | | | | | | | | | | | | | | | | | $ | (2.12 | ) |

| | | | | | | | | | | | | | | | | | |

|

|

|

Pro forma weighted average common shares

outstanding(2) | | | | | | | | | | | | | | | | | | | 4,487 | |

| | | | | | | | | | | | | | | | | | |

|

|

|

| Unaudited adjusted pro forma net loss per common share assuming conversion of preferred stock—basic and diluted(3) | | | | | | | | | | | | | | | | | | $ | (0.60 | ) |

| | | | | | | | | | | | | | | | | | |

|

|

|

Unaudited adjusted pro forma weighted average

common shares outstanding assuming conversion of preferred stock(3) | | | | | | | | | | | | | | | | | | | 15,777 | |

| | | | | | | | | | | | | | | | | | |

|

|

|

| | | As of December 31, 2001

| | | Pro Forma As Adjusted(4)

|

| | | (in thousands) |

Balance Sheet Data: | | | | | | | |

| Cash and cash equivalents | | $ | 19,487 | | | $ | |

| Working capital | | | 16,093 | | | | |

| Total assets | | | 171,906 | | | | |

| Long-term debt | | | 99,000 | | | | |

| Accumulated deficit | | | (9,516 | ) | | | |

| Total stockholders’ equity | | | 60,382 | | | | |

| (1) | | We acquired Diastat on March 31, 2001 and Mysoline on April 1, 2001, and the related operations are included in our results since April 1, 2001. |

| (2) | | See note 1 to our financial statements for an explanation of the number of shares used in computing pro forma net loss per common share. |

| (3) | | The unaudited adjusted pro forma net loss per common share assuming conversion of preferred stock and the related weighted average common shares outstanding reflects the conversion of all outstanding shares of our convertible preferred stock into 14,000,000 shares of common stock upon the closing of this offering. |

| (4) | | The pro forma as adjusted balance sheet data gives effect to: |

| | • | | the conversion of all outstanding shares of our convertible preferred stock into 14,000,000 shares of common stock upon the closing of this offering; |

| | • | | the sale of shares of common stock in this offering at the initial offering price of $ per share, which is the midpoint of our expected public offering range, after deducting the underwriting discounts and commissions and estimated offering expenses; and |

| | • | | the sale of shares of common stock to Elan concurrent with the closing of this offering at the initial public offering price. |

19

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion may contain predictions, estimates and other forward-looking statements that involve a number of risks and uncertainties, including those discussed under “Risk Factors” and elsewhere in this prospectus. These risks could cause our actual results to differ materially from any future performance suggested below. We undertake no obligation to update these forward-looking statements to reflect events or circumstances arising after the date of this prospectus. You should read this discussion together with the financial statements, related notes and other financial information included elsewhere in this prospectus.

Overview

We are a specialty pharmaceutical company that acquires and markets prescription products in focused therapeutic markets in the United States. Our strategy is to increase sales of our current products through targeted marketing efforts, to acquire additional products in neurology that leverage our existing sales organization, to acquire additional products in other focused markets and to develop product enhancements. Third parties manufacture our products and provide our distribution services.

We were formed in January 2001. On March 30, 2001, we raised net proceeds of $69.6 million from the issuance of 14,000,000 shares of convertible preferred stock. We then acquired Diastat and Mysoline from Elan and began selling our products in April 2001. We had no substantive operations prior to these activities. From April 1, 2001 through December 31, 2001, we focused on hiring and training our field sales force, hiring our corporate administrative employees, building our corporate infrastructure, promoting our products and pursuing new product opportunities.

This management’s discussion and analysis of financial condition and results of operations includes an analysis of our results of operations and our liquidity and capital resources for the period from our inception through December 31, 2001. In addition, the discussion includes a separate analysis of the contribution of Diastat and Mysoline to the results of their prior owner, Elan, for the years ended December 31, 1999 and 2000 and the three months ended March 31, 2001. During this period, the operations of Diastat and Mysoline were included in Elan’s consolidated results and had not been reported on separately. The analysis of the contribution to Elan’s results should be read together with the audited statements of product contribution for the years ended December 31, 1999 and 2000 and the three months ended March 31, 2001 included elsewhere in this prospectus.

Comparing the products’ results while owned by Elan to our results since we acquired the products would not be meaningful. This is due to the significant differences in our organizational structure, marketing and promotional strategies and corporate resources compared to those of Elan. Elan is a multi-national organization with a portfolio of products. Diastat and Mysoline received varying levels of sales and marketing attention by Elan based on the promotional priorities of Elan’s corporate strategy. In addition, Elan has significant internal resources for performing other administrative activities to support its products. We are a specialty pharmaceutical company with only two products and fewer internal resources and we seek to promote our products through targeted marketing efforts. We also seek to leverage our resources by adding new products to our portfolio without materially increasing our marketing and support infrastructure. Our emphasis in 2001 was on transitioning responsibilities for the products from Elan and building our corporate infrastructure, while allowing our wholesaler customers to fulfill demand for Diastat and Mysoline primarily from the wholesalers’ existing product inventories. This further contributes to the lack of comparability of our results to the historical net sales and related costs of the products while owned by Elan. For the same reasons, we expect that our results for 2001 will not be indicative of our future results.

20

Xcel Pharmaceuticals, Inc.

Revenue Recognition

We sell our products to wholesale drug distributors who generally sell our products to retail pharmacies, hospitals and other institutional customers. Revenues are recognized when the products are received by the wholesaler, which represents the point when the risks and rewards of ownership are transferred to the customer. We invoice wholesalers at our wholesale list price. Sales are shown net of discounts, rebates, chargebacks and returns, which are estimated based on Elan’s historical experience with the products. Chargebacks represent the difference between the wholesale list price and the estimated contractual sales price.

Operating Costs and Expenses

Cost of sales includes primarily third-party product manufacturing and distribution costs and royalties due to third parties under separate royalty arrangements ranging from 5% to 10% of net sales.

Selling, general, and administrative expenses include the costs of selling, marketing and promoting our products, administrative services such as finance, human resources, information systems and other corporate affairs and non-cash stock-based compensation. Stock-based compensation represents the amortization of the difference between the exercise price of stock options granted and the deemed fair value of our common stock on the grant date. See note 1 to financial statements for a detailed description of our policy for accounting for stock-based compensation.

The net cost of our products was capitalized and is being amortized over the 20-year period we expect to benefit from the products.

Results of Operations

Period from January 24, 2001 (inception) through December 31, 2001