QuickLinks -- Click here to rapidly navigate through this document| | Filed by MB-MidCity, Inc.

Pursuant to Rule 425 under the Securities Act of 1933

Commission File No. 333-64584 |

|

Subject Companies: |

|

MB Financial, Inc. (File No. 0-24566)

MidCity Financial Corporation |

Forward-Looking Statements

When used in this filing and in other filings with the Securities and Exchange Commission, in press releases or other public shareholder communications, or in oral statements made with the approval of an authorized executive officer, the words or phrases "believe," "will likely result," "are expected to," "will continue," "is anticipated," "estimate," "project," "plans," or similar expressions are intended to identify "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date made. Various factors could cause actual results to differ materially from the results anticipated or projected. These factors include, but are not limited to, the following: (1) expected cost savings and synergies from the planned merger of MB Financial, Inc. and MidCity Financial Corporation might not be realized within the expected time frame; (2) revenues following the merger could be lower than expected; (3) costs or difficulties related to the integration of the businesses of MB Financial and MidCity Financial might be greater than expected; (4) the requisite shareholder approvals of the transaction might not be obtained; (5) deposit attrition, operating costs, customer loss and business disruption following the merger may be greater than expected (6) competitive pressures among depository institutions; (7) the credit risks of lending activities; (8) changes in the interest rate environment and in the demand for loans; (9) general economic conditions, either nationally or in the states in which the combined company will be doing business, might be less favorable than expected; (10) new legislation or regulatory changes; and (11) changes in accounting principles, policies or guidelines.

We do not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking statement is made.

Additional Information

An amended registration statement on Form S-4 has been filed with the Securities and Exchange Commission in connection with the proposed transaction. The amended registration statement includes a joint proxy statement/prospectus which will be sent to the shareholders of both MB Financial and MidCity Financial seeking their approval of the proposed transaction. Investors and security holders are advised to read the amended registration statement and the joint proxy statement/prospectus because they will contain important information. These documents can be obtained free of charge from the web site maintained by the SEC at "www.sec.gov." These documents also can be obtained free of charge upon written request to MB Financial, Inc., Investor Relations, 1200 N. Ashland Avenue, Chicago, Illinois 60622 or by calling (773) 645-7868.

MB Financial and its directors and executive officers may be deemed to be participants in the solicitation of proxies from MB Financial shareholders to approve the merger. Information about these participants may be obtained through the SEC's web site from the definitive proxy statement filed with the SEC by MB Financial on March 21, 2001. Additional information regarding the interests of these participants, as well as information regarding the directors and executive officers of MidCity Financial, may be obtained by reading the joint proxy statement/prospectus regarding the proposed transaction.

Set forth below is the transcript of a conference call/webcast held by MB Financial, Inc. and MidCity Financial Corporation on April 20, 2001. Following the transcript are materials presented during the conference call/webcast, which were filed by MB Financial, Inc. with the Securities and Exchange Commission on April 20, 2001.

MB Financial, Inc. / MidCity Financial Corporation

Company Announcement Conference Call

April 20, 2001

11:00 a.m. CT

The conference host is Mitchell Feiger and the company is MB Financial, Inc. Caller ID is 583315. The date of the call is April 20, 2001. Post time is 11:00 a.m. central time.

Tina: |

|

AT&T Executive Conference Liaison. Thank you for standing by and welcome to the Company Announcement Conference Call. At this time all participant lines are in a listen only mode. However, later, there will be an opportunity for your questions. If you should need any assistance during the call, please press zero, followed by star on your touchtone phone. And as a reminder, this conference is being recorded. I would now like to turn the conference over to CEO and President of MB Financial, Inc., Mitchell Feiger. Please go ahead, sir. |

Feiger: |

|

Thank you, Tina. Good morning, everyone. I am Mitch Feiger, President and CEO of MB Financial, Inc., and I want to thank you very much for joining us today. Joining me today also is Ken Skopec, President of MidCity Financial Corporation, and then for the harder financial questions, Jill York, our Chief Financial Officer. As you know, the purpose of this morning's call is to announce the planned merger of equals between MidCity Financial Corporation and MB Financial, Inc., two great Chicago-based banks. |

|

|

In our call this morning, Ken and I will provide you with a brief presentation that explains our transaction and then we will open it up to your questions. Please remember that the call is being recorded for future playback, and please hold your questions until the end of the presentation. And, when you ask a question, please identify yourself and your company. If you have access to a computer, you can find supporting slides for this presentation on our website, which is at www.mbfinancial.com under the Electronic Literature section in Investor Relations. The presentation can also be found in an SEC filing we made this morning. |

|

|

Before we begin, I need to give you some legal language, so I need to remind you that our presentation today will contain forward looking statements. These are statements about things we expect will happen or believe may happen in the future; these statements are subject to risks and uncertainty, and there are a number of factors that could cause actual results to differ materially from the results we anticipate or project. Many of these factors are set forth in the press release that we just issued announcing the merger, as well as our current report on Form 8-K filed today with the SEC. Okay, that completes my introduction. |

|

|

Now those of you that have followed MB Financial know, I think, that we've built an excellent asset-generating bank. Our commercial bankers are very experienced, and we believe that our business development and credit processes are best in class. As part of our business development efforts, we regularly review competition focusing on their weaknesses. These weaknesses might be officer turnover or credit policy changes, or even operational problems. But one way or another, they lead to new business for us. The one bank that we've never had much success in gaining business from is MidCity. And if you ask our best business-developing commercial bankers, and I have, what bank is the most difficult bank to gain a customer from, they'll tell you without a question it's MidCity. And so, we jumped when we had the opportunity to discuss a merger with MidCity. What we have here, I think, are two excellent commercial banks with very similar cultures, similar business plans, complementary office locations and—and this is a true plus—complementary balance sheets. MidCity brings capital and funding, and MB Financial brings asset generation. We have a fantastic combination of two mid- market focused commercial banks, one with the best-in-class commercial development process, and both with best-in-class credit underwriting skills and customer relations. MidCity has been managed by Ken Skopec who's with us today, and Pete Bakwin, who is the current MidCity CEO and Chairman of the Board. I've spent a considerable amount of time studying banking and studying our competitors, and I've always been impressed by MidCity and I think that Pete and Ken have done a fantastic job there. They are tremendous bankers with outstanding reputations and, in addition, they are fantastic businessmen. Pete is going to continue as Chairman of the Board and Ken is going to continue as a member of our Board of Directors, and I very much look forward to working with them. |

|

|

Now I want to turn the call over to Ken, who will provide you with his perspective on the transaction, and then lead you through the beginning part of our presentation. |

Skopec: |

|

Good morning. This is Ken Skopec speaking. Thank you, Tina and Mitchell, and all of you for joining us this morning. This is an historic day for us at MidCity, which was founded in 1911 and has been privately-owned through various generations of the founding family. This opportunity to combine forces with MB Financial is a unique opportunity for our shareholders, for our employees and, certainly, for our customers. We serve a very similar geographic area and a very similar market, so I think everything that Mitchell has said has been outstanding. To backtrack just a little bit on MidCity Financial, approximately a year and a half ago, we employed investment bankers at the direction of the Board of Directors to look at our strategic options. That included and was not limited to the possible sale, the possible merger, and all sorts of things, such as going public, and a stock split. We came to the conclusion, after reviewing a lot of various opportunities, that a merger with MB Financial made great sense in the Chicago market, which is a dynamic market, and is changing dramatically in terms of locally-owned financial institutions. So, I am excited, enthusiastic, and prepared after 49 years of my life being with MidCity Financial, to work very hard to make this a very successful merger for shareholders, customers and employees. |

|

|

For those of you who do not have benefit of the slides, I will quickly go through some of the basics of the transaction, and I will try not to be redundant, realizing that your time is valuable. |

|

|

The transaction structure would be MB Financial, Inc. and MidCity Financial Corporation will form a new company, into which both will merge. The name of the new company will be MB Financial, Inc. The fixed exchange ratio is approximately 230 shares of MBFI for each MidCity share, and one MBFI share for each current MBFI share. |

2

|

|

The pro forma ownership, MBFI, would end with owning 40% and MidCity with 60%. The form of consideration would be 100% of MBFI common stock. The value per MidCity share currently is approximately $3,800.44, and that is based on the MBFI share price as of the close of business of April 19, 2001, giving an imputed transaction value of $292 million in total, with $175 million for MidCity Financial, and $117 million for MB Financial. The accounting would be a pooling of interest and it would be a tax-free exchange. A break-up fee of $5 million, approximately 3% of the aggregate transaction value for each company. The expected closing date would be the third quarter of 2001. Expected integration completion, not later than the first quarter of 2002. Transaction costs, pre-tax, would be approximately $19.6 million. Operating expense savings, $8.2 million pre-tax, or 9.7% of the combined, 100% realized in 2002. Required approvals, of course, the MidCity and MBFI shareholders would have to approve, as well as the regulatory approvals. The initial cash dividend is targeted at $0.15 per quarter. |

|

|

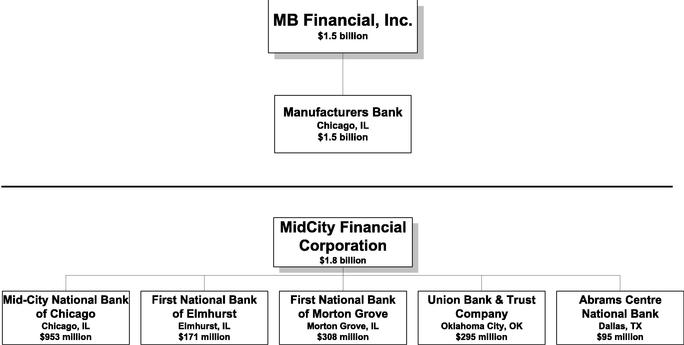

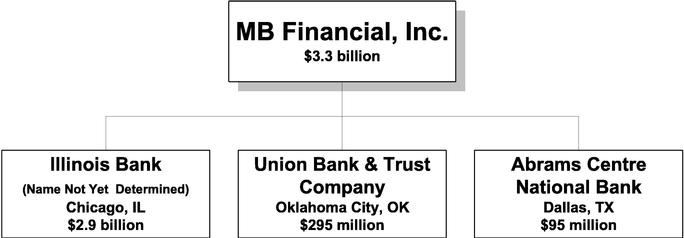

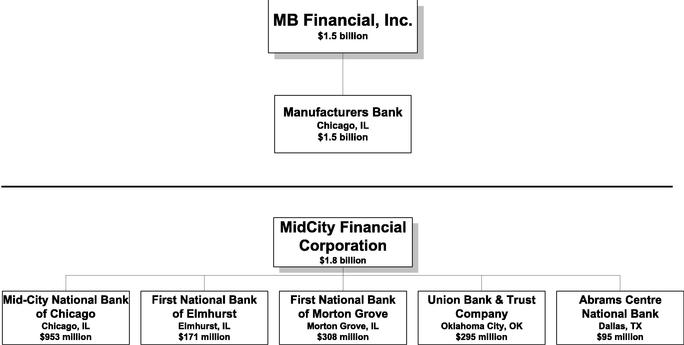

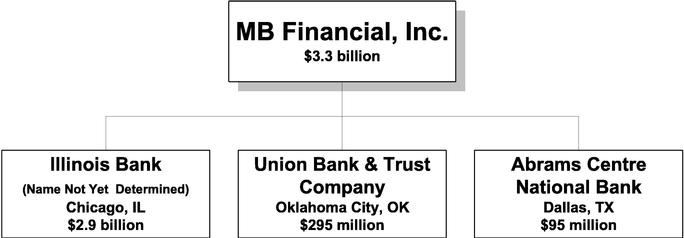

The current subsidiary structure, MB Financial, Inc., is the parent of Manufacturers Bank. MidCity Financial Corporation is the parent of the Mid-City National Bank of Chicago, which is the lead bank, the First National Bank of Elmhurst, the First National Bank of Morton Grove, the Union Bank and Trust Company of Oklahoma City, and Abrams Centre National Bank of Dallas, Texas. The pro forma subsidiary bank structure would be MB Financial, Inc., with $3.3 billion in assets as the parent, an Illinois bank yet not named would be approximately $2.9 billion in assets, and the charters of Union Bank and Trust Company of Oklahoma City and Abrams Centre National Bank of Dallas, Texas would remain intact. |

|

|

The new management structure—as mentioned earlier, Mitch Feiger will serve as the President and CEO. Pete Bakwin will serve as the Chairman of the Board, and Jill York, the Chief Financial Officer. The Commercial Banking Chairman of the Illinois Bank Group—Ron Santo, Commercial Banking Executive Vice President—Tom Panos (of MBFI), Commercial Banking and Lease Banking, Illinois Bank CEO and President—Burt Field, Wealth Management Operations—Executive Vice President—William McCarty (MidCity Financial), Retail Banking Senior Vice President—Tom FitzGibbon (of MBFI), and Human Resources Senior Vice President—Jeffrey Husserl (of MBFI). |

|

|

That is the summary of the transaction, and at this time I will turn the meeting back to Mitchell. |

Feiger: |

|

Thank you, Ken. Let me walk everybody through the rationale for this transaction, and why we think it makes tremendous sense for both companies. Strategically, what we end up with here is a company with very strong internal funding and strong asset generation. If you've been following MB Financial in the past, we've discussed in our 10-Ks and in our 10-Qs the steps we've been going through to increase our sources of funding. This combination with MidCity really makes that happen. MidCity has an approximately $750 million investment portfolio and a loan-to-deposit ratio that's a little bit less than 65% now. That said, MidCity has done an excellent job itself generating assets over the last few years. They've gained many of their deposits through a series of acquisitions that I'll explain later, and those acquisitions were really deposit acquisitions, more than asset acquisitions. |

3

|

|

Secondly, from a strategic perspective, we think that the company is extraordinarily well positioned to be the premier business bank in the Chicago market. As you know, the market has been consolidating, in particular the business banking market. We think that with in excess of $3 billion in assets in 30-plus locations in Cook County and tremendous asset-generating skills, we will be the premier business bank in the market. We also think that by combining we're going to be able to accelerate our growth in a couple of businesses that we have size matters, we think. Commercial banking is one of them; lease banking is another. And, if you look at MB Financial's track record, what you'll see is that we've grown, particularly from 1992 to now, 2001. As we've gotten bigger, our growth rate has accelerated, and I think that that's going to continue. The last strategic thing that we've listed here is that we now have a wealth management and asset management business segment. MidCity's been in the wealth management business for many, many years and is very, very good at it, and now we'll be able to take those skills and spread them over to MB Financial. MB Financial currently has no wealth management products at all. |

|

|

Let me just walk you through some of the financial and operational rationale. The transaction is accretive, in fact, significantly accretive, to both sets of shareholders and we'll go over that a little later. It's also significantly accretive to MBFI's book value per share. We think there are significant other opportunities to restructure and redeploy assets into higher yielding loans without adding a significant amount of incremental credit risk. We've identified cost savings, and I'll show you what those are. We think that the cost savings we've identified are conservative and very achievable, and our track record in this area is exceptionally good. Lastly, both companies are very experienced integrators. So, while mergers of equals tend to have high execution risks, we think this transaction actually has low execution risk. Just to remind you, MB Financial has done a merger of equals in 1999 with Avondale Financial, and that went off without a hitch. In fact, we exceeded our cost savings targets, we completed our integration more rapidly than we planned, and our results were better than we forecasted. I think the same thing's going to happen here. |

|

|

Let me give you a fast overview of our company for those who aren't familiar. Our company (being MB Financial) as it stands today, was created through a merger of equals with Avondale Financial Corp. in 1999. That's when we began trading under the ticker, MBFI. Really, particularly, the asset-generating part of our company began in 1992 when a group of investors bought control of Manufacturers Bank and has been working since 1992 to build the company. As of year-end 2000, we have $1.5 billion in assets and about $1.1 billion in deposits. |

|

|

Recently, a couple of months ago, we announced the acquisition of a company called FSL Holdings. FSL Holdings is the parent company of First Savings and Loan of South Holland. It has $211 million in assets. That transaction is currently pending, and we are waiting for regulatory approval, but we do expect it to close as scheduled before the end of the second quarter. |

4

|

|

Our focus, our business to date, is business banking and mid-market business banking. Our strengths are commercial and industrial lending, equipment leasing and commercial real estate lending. That's what we do well; we think we do it as well as anybody in the market. As I said before, we have very strong asset growth and excellent credit quality. If you look at our history, particularly as we have merged and combined with other institutions who have lesser credit quality, you can see how we're able to manage that down. In this case, fortunately, MidCity also has excellent credit quality, so credit quality is not an issue. We have a history of acquiring other institutions and merging with other institutions. We have done four acquisitions and mergers in the 1990s and we've got one pending now. Each one, we feel, we've done quite well with. And lastly, from an overview perspective, we have significant insider ownership. We feel that that's important; it aligns our company interests with our shareholders' interests. Our directors and our owners are 100% behind this transaction, so we feel very good about that. |

|

|

Let me turn it back to you, Ken—if you would provide an overview of MidCity for everyone. |

Skopec: |

|

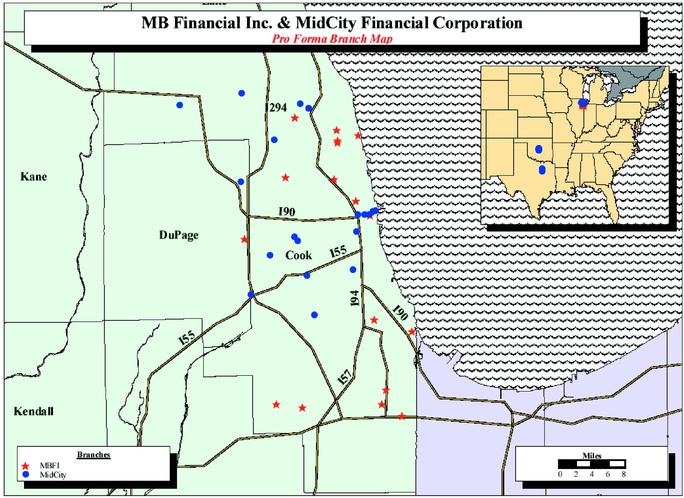

Thank you very much Mitchell. As I'd mentioned earlier, MidCity National Bank, which started out as MidCity Trust and Savings Bank in 1911, formed its holding company in 1982. We have 26 branch offices, 19 in Cook and DuPage Counties in Illinois in the greater metropolitan area, 5 branches in Oklahoma City and 2 branches in Dallas, Texas. One of the ideal parts, if you were to take the maps of the locations between the respective merger partners, there is virtually no overlap of locations as they are put together, which makes it a very attractive delivery system in the branching structure. As of December 31, 2000, our assets totaled $1.8 billion, with total deposits at $1.6 billion and equity slightly more than $185 million. We have prided ourselves in being relationship bankers throughout the years. All of my business life has been spent with MidCity, which started out as approximately a $50 million single-location bank at Madison and Halsted. We have prided ourselves in the retention that we've had of key commercial depositors and borrowers and customers, and I think that is where banking needs to be. Technology is a very important part of our future, but relationship banking seems to me to outweigh almost any consideration many people are looking for. We have been blessed with very, very key people whose average tenure in the senior management level exceeds 35 years. So, we do not have a lot of faces and names changing, which has been very helpful in retaining our relationships. We, too, have been active in the acquisition market. During the '90s we acquired Clyde Federal Savings. That was from the Federal Deposit Insurance Corporation. We acquired First Western in Oklahoma City in 1992, Peoples Federal Savings and Loan Association in 1995, Abrams Centre National Bank in 1997, Republic Bank, Waukegan Branch, in 1998 and Damen Financial Corporation in 1999. Prior to that, in the '80s we acquired the First National Bank of Elmhurst, the First National Bank of Morton Grove and the Union Bank and Trust Company in Oklahoma City. So, I think, collectively, both organizations have had a great deal of experience in merging and integrating acquisitions. Mitch, that is my comment on MidCity Financial, and I'll turn it back to you. |

5

Feiger: |

|

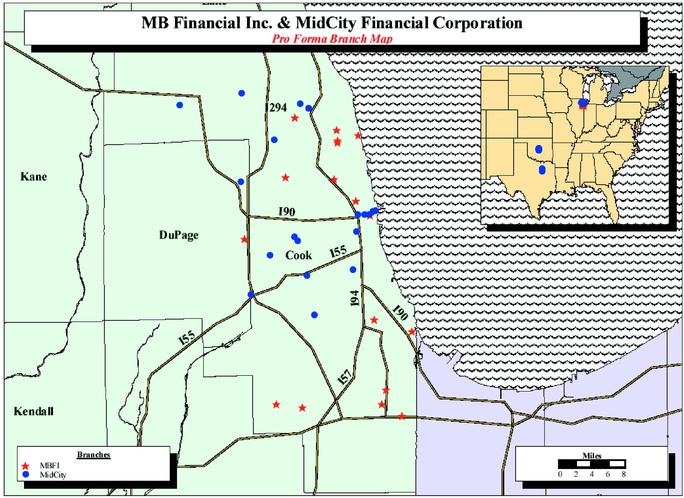

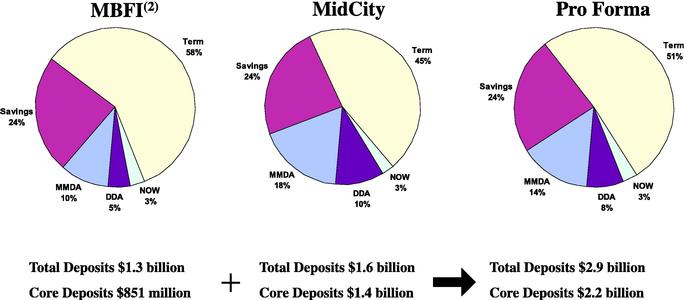

Thanks, Ken, that was great. Alright, let me run you through some of the other points that talk about our company. If you have your presentation, in the presentation is a map that shows our office locations in the Chicago area and then there's a small map of the United States that shows our offices in Oklahoma and in Texas. To me, there's several interesting things about this map. First, as Ken said, we have no branch overlap anywhere. When you look at the map, our branches are extremely complementary, and what that will allow us to do is do much, much better on the retail side of the bank. As you know, the Chicago market is a huge market. The marketing and advertising expenses are very high, and distribution is a problem without having a lot of offices. Now we will have 31 offices in the Chicago area, which should put us at number 7 in Cook County in terms of the number of branches. We think that that's going to give us a big boost on the retail side of the bank, which will help in particular with our funding sources. Inside Cook County we will have $2.2 billion in deposits, in which case we will rank number 9. That does not count $147 million of deposits that we have in neighboring DuPage County. Prior to this, we were number 17 and 18 in Cook County. |

|

|

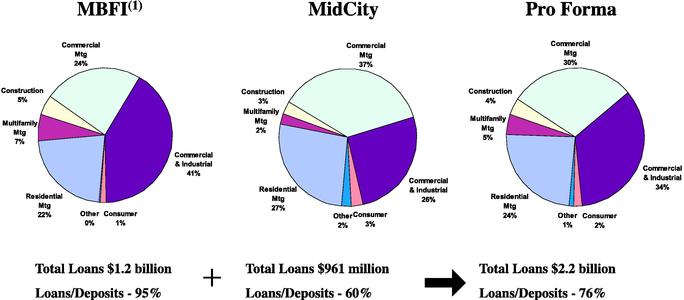

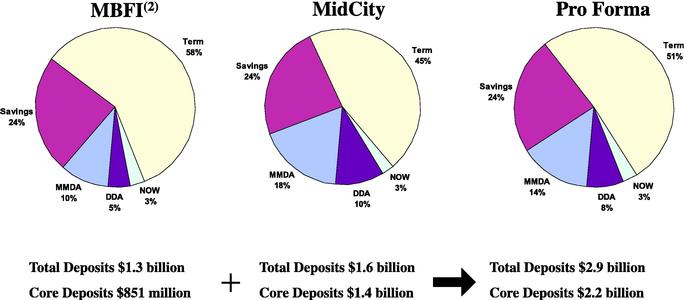

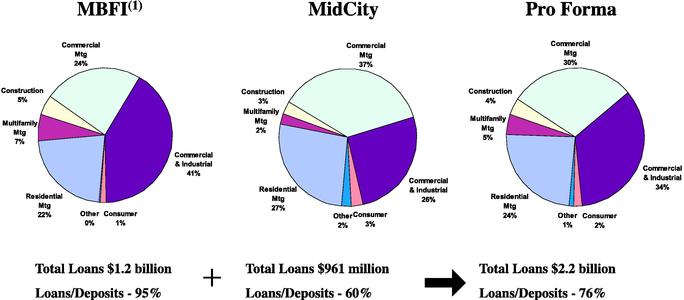

Our core deposits are going to more than double. We think that we end up with an extremely stable deposit base. And one thing you might be interested in is that the deposit figures that are in this presentation and that I've been giving you do not include about $80 million in deposits that we sweep outside of the bank. That is a source of funds and has been growing. On the loan side, it's pretty amazing when you look at the distribution of the loans. The loan portfolio between commercial loans, commercial real estate loans, and residential loans are very similar from company to company. Both companies are primarily commercial lenders, but each have some residential loans left over from previous thrift acquisitions. I think that on a combined basis the percentage of the residential loans in our portfolio is likely to decline, and it has been when you look historically. On the MBFI side we have about 70 or 75% of our loans are commercial in nature and those include about $250 million of what we call lease loans. These are discounted lease loans. In MidCity's case, it's a pretty similar percentage, and when we combine the two companies, pro forma is 68% commercial. If you included multi-family loans, it's a 73% commercial loan base. That's exactly where our expertise lies, and that's exactly where we're the best credit quality managers, and that's exactly where we think the best part of the market is for profitability and growth. |

|

|

From a shareholder perspective we think the economics are extremely compelling. We're doing this as a merger of equals and so, as a result, shareholders of both organizations are going to participate in the upside. We have laid out certain cost savings, targets, but we think there might be even more cost saves. We firmly believe there are significant revenue enhancements, and I'll walk you through just one of those, but there are many, many others. |

6

|

|

Additionally, our current stock price—let's say yesterday—I'm not sure what it is right now, we were trading two earnings multiples below our regional peer group. In other words, we think we were cheap. And so we think that there's significant upside in that, particularly as the market views our company as a breakout company in the Chicago market. With regard to dividends, we're targeting a dividend payout ratio of at least 25%. This will be a new dividend for MB Financial stockholders who have never received a dividend in the past. We have very strong pro forma capital ratios and so we think that that will provide for good continued growth. From an earnings-per-share perspective, the transaction is around 25% accretive to MidCity shareholders. That's right, 25%. To MBFI shareholders it's, we think, between 6 and 10% accretive, and that's on a GAAP EPS. We're forecasting about $8 million in pre-tax expense savings and we think, as I said before, that these are conservative and very attainable. We both have an excellent track record of hitting our savings targets on mergers. One comment, the $8.2 million cost saving targets does not include savings from our pending FSL transaction, which would add another $2 million or so, or $2.1 million, in expense savings that we've already included when we've spoken with you in the past, so we don't want to double count that. Pro forma, we think we're going to make about $41 - 42 million. If you just look at cost saves, our pro forma 2002 numbers are about $40 million. Now, that's based on a $15.3 million IBES earnings estimate for Manufacturers, and an internal estimate for MidCity of $19.4 million. When you add those together with the cost saves, you get about $40 million pro forma net income. We feel that there's one revenue enhancement that is extremely simple for us to achieve, and we anticipate having it in place right around the time we close the transaction. And that is, in our lease banking business on the MB Financial side. We have an ability to generate a significant amount of lease loans, very high quality lease loans, in a short period of time. This is a product that we have historically managed the deal flow, so we maintain proper liquidity inside the bank and appropriate capital levels. And so, now we have an opportunity to do more of this, and we're estimating we're going to have $250 million in lease loans between now and the time we close the transaction or shortly thereafter. And at a simple 1% spread over investment yields, we're going to pick up $2.5 million pre-tax, we think. Now, the rest of the presentation doesn't include that revenue enhancement; it's only based on cost saves, but we feel very comfortable that that one's going to be there. From an accretion standpoint, for the combined company in 2002 we're forecasting earnings per share, pro forma diluted earnings per share, at $2.25. That's a $0.13 accretion for MBFI shareholders and a $0.42 per share increase for MidCity shareholders. And, interestingly, it provides an efficiency ratio that's in the low '50s. We think it will be in the 52-53-54% range, which is getting to be very good, particularly in this market. If you were to include that one revenue enhancement that I spoke about, our pro forma diluted earnings per share in 2002 will be about $2.34. Both those numbers produce a 131/2% or 14% ROE. Okay, we've got slides in here on cost saves and revenue enhancements. I think you can look at those, so I won't read you those. We also have some slides in here that show how each company is doing relative to our peers, and also how we compare to our peers on a pro forma basis for 2002. You can take a look at those. Suffice it to say that we compare very, very favorably to our peers, I think, both before and after. We've spoken about the integration risks and we feel very comfortable with that. I think that from my perspective, the integration risk is truly minimized because we have very similar conservative cultures. Our credit cultures are very, very compatible; our lenders have been speaking to each other for several weeks now through the due diligence process, and I think what we have found is—we think alike and we work alike, and that's very, very encouraging to me. And, again, we think our integration will be completed by the first quarter of 2002 and possibly earlier. Let me say one comment, when MB Financial merged with Avondale Financial Corp. in 1999, we began working on our integration the day after we signed the deal, and we're going to go through that same process here. In the Avondale case, we actually completed the integration less than a month after the deal closed. Now these companies are much larger than Avondale was, so it's going to take a little longer than that. But, we plan to be working on this immediately. By the way, we also plan to begin working on the revenue enhancements immediately as well. |

7

|

|

Just to summarize and after this we'll open it up to Q&A. We have a transaction here that's, we think, quite accretive to GAAP earnings in the first full year of operations. We're going to create a $3.3 billion bank that's exceptionally well-positioned in metropolitan Chicago. We have two great banks, one in Dallas and one in Texas, as well. We feel the transaction expands the depth of management in both companies. Our franchises, particularly our branch locations, are highly complementary. We end up pro forma with very strong capital ratios to support very good growth. Cost savings are significant and achievable. There is great potential, we believe, for revenue enhancements and we think, low execution risk. And, lastly, we see significant improvement and liquidity for all of our shareholders. We think all those combined will create increased earnings growth. So that's why we think this is such an excellent transaction. There are several other slides in the presentation that you can look at at your leisure. I think we've talked to most of them already. And at this point, I'd like to open it up for questions and answers. |

Tina: |

|

Ladies and Gentlemen, if you would like to ask a question, please press the "1" on your touchtone phone. You will hear a tone indicating that you've been placed in "queue" and you may remove yourself from that queue at any time by pressing the pound key. Also, if you're using a speaker phone, please lift up your handset before pressing the number 1. One moment for our first question. |

Haberman: |

|

Ross Haberman of Haberman Brothers. How are you, Mitch? Looks like an interesting deal. I have a couple of questions. One, are the MidCity investors locked up from selling any shares for any periods of time once the deal closes? That was my first question, and two, you didn't make any reference of if there were any overlapping branches and if you'll be consolidating them as part of the $8 million of cost savings? Could that be additional on top of the $8 million? And once you do merge, how important—I think you said MidCity had some Oklahoma City branches and some Dallas ones—how profitable are those, and are they part of the long-term picture? |

Feiger: |

|

Let me take them in reverse order—first, second. Ken, you can speak to the Oklahoma and Texas banks certainly better than I can at this point, but from my perspective, those markets are excellent banking markets. I think they're growing faster than the City of Chicago, Cook County market is growing. They're very well run and we have an excellent management team and those banks are going to remain. Ken, do you have any comments? |

Skopec |

|

Yes, I would add that they have been extraordinarily profitable, certainly Union Bank, which we've owned now for about 12 or 13 years. It was a purchase after the bank had failed, and we have realized a significant rate of return on our invested capital. It is in a very dynamic market, some of the major regional players, Bank One, Bank of America, to name a couple of them, who are having an active presence. So I think it's a good growth area, and I look forward to them being able to not only do well currently, but to expand the growth in the future. The same for the Dallas area that is not any longer an energy economy, but it is a very diversified, high-tech kind of economy. I believe that will continue to do well, and I believe there might be other opportunities there if we wish to grow the southwest presence in the future. So, I think they will add significantly to the income stream. |

Feiger: |

|

Ross, let's take your second question, which was? Can you repeat it? |

8

Haberman: |

|

Sorry. Any overlap of branches, and will there be closings, and are they included in that $8 million pre-tax of cost savings? |

Feiger: |

|

No, there are no branch overlaps, and we do not anticipate closing any branches as a result of the transaction. But you do know, let me say a couple of things. In our FSL transaction, we are combining three offices into one. But that's not built into these cost saves numbers, that's in that other $2 million cost saves number that I spoke about earlier. |

Haberman: |

|

I'm sorry, that was in the projection of the $15.3 million for next year? |

Feiger: |

|

Well, that $15.3 million is an IBES estimate. |

Haberman: |

|

Right. |

Feiger: |

|

How the analysts come up with those numbers, I can't tell you. You're better off asking them. |

Haberman: |

|

Okay. |

Feiger: |

|

We feel good about that number. |

Haberman: |

|

Okay, I was just curious if that's built into the savings from the FSL deal or will that be in addition? |

Feiger: |

|

I think, Ross, at this point consider it built-in. |

Haberman: |

|

Okay, Okay. And the final question was the lock-up on the MidCity. Do they have any sort of lock-ups for any period of time, or once the deal closes, can they sell any and all of their shares if they so chose to immediately? |

Feiger: |

|

What I would like to do, so I don't give you the wrong answer, there are restrictions on when either of us can sell stock. But what I'd like to do, let's go to other questions and answers, and I'll loop back to you with the right answer. |

Haberman: |

|

Okay, thank you. |

Feiger: |

|

Okay, thanks, Ross. |

Peterson: |

|

Ron Peterson of Sandler O'Neill & Partners. Good morning, Mitch, Ken. Congratulations. Mitch, perhaps you can expand on this. I note that the acquisition of Avondale in 1999 you acquired, obviously, some assets that are maybe a little higher risk in nature, such as the nationwide portfolio of credit-scored home equity loans and some other assets that I think may have been holding back your multiple. I was wondering if you could expand on how much of MB Financial's assets are the ones acquired from Avondale and also what will happen to that percentage following the merger with MidCity. |

9

Feiger: |

|

Ron, excellent question. On our balance sheet, the total high-risk Avondale assets that are left are about $60 million, and it's declining very rapidly in excess of 35% a year. We also, as you know, we service three home equity lines of credit pools. Those total about $75 or $80 million in assets as well. We consider the amount outstanding at this point fairly nominal. All those assets are performing better than expected. One of the things that we didn't talk about earlier in the conference calls—one of our best in class strengths, we think, is our collection activity. We have a world-class collection department, and for that reason these assets are performing much better than forecasted. We feel very comfortable with these assets, and they're going to run off shortly. |

Peterson: |

|

Thank you. |

Feiger: |

|

Thank you, Ron. |

Tina: |

|

If there are any additional questions, please press 1. |

Engelman: |

|

Robert Engelman of MB Financial. Mitchell, would you talk a little bit about the combined middle-market market share of the two companies put together and prospects for continued growth in that area as a larger organization. |

Feiger: |

|

Okay, good question. The market share data that we have is from the Chicago area market. Individually, each of us are running a market share between two and four percent right now, and we estimate a combined mid-market market share of between—it's in the 6% range, 5-6-7%. By mid-market, we define that as companies with sales between $5 and $50 million, manufacturers, wholesalers, distribu- tors, health care companies, folks like that—bread-and-butter middle Chicago. Our market share at MB has been growing quite rapidly and actually it's accelerated. Growth has accelerated over the last year and continued to accelerate in the first quarter here. I think MidCity's has been increasing as well, not quite as fast, but I think combined our market shares will grow even faster. If you look at our market share report on who the major competitors are in the Chicago area, you'll find that we we're getting close to ranking in the top 5 and we might rank there already. Thanks, Bob. |

Tina: |

|

Next question comes from Howard Ludwig of Daily Southtown News. |

Ludwig: |

|

Hi, fellows. I was just wondering if you guys planned any name changes at your branches? What will be the name of the combined company? |

Skopec: |

|

As mentioned earlier, the parent will remain as MB Financial. The Illinois charters will be folded into one and the name of that bank is being researched right now. We will use internal recommendations from employees and directors, and even our customers. And if necessary, we will employ the services of a consultant to help us develop a name that will be the most meaningful. Both names are distinguished in the marketplace; Manufacturers certainly, and MidCity is a little older, but both names have been highly respected. There has been no decision made yet. Mitch, correct me if there is anything you'd like to add. |

Feiger: |

|

That's exactly right. We have four banks in the Chicago market and they all have excellent names. Our problem is we have too many good names to choose from, so we wanted to talk with some of our customers—we want to have an ability to talk openly with our employees about it and see what they think. You know, before this transaction was announced, it was too hard to do that. I think we'll come up with a name in the next month. |

Ludwig: |

|

Okay. I was also wondering if you would expect any employment changes as a result of the merger. |

10

Feiger: |

|

Well, I think that in any transaction like this, there's some overlap in jobs and so, yes, I think there will be some reductions in certain positions. But the way our company is growing and given the tight labor market and some of the vacancies that it's created, I don't think the personnel dislocation is going to be that great. But, we're working through that now. |

Skopec: |

|

Mitch, if I may add, part of the problem with managing in the last several years, certainly all over the country, but certainly in Chicago, is obtaining and recruiting good people for jobs. We have positions on board right now that are unfilled and I'm sure you have a similar situation at MB Financial, where we literally have open positions. Attrition has a way of taking care of a number of these things, and I think it's important to note that if there are any jobs that are phased out, both organizations are committed to working with the people involved in out-placement counseling and in any area that we can be of assistance if a job is eliminated. |

Ludwig: |

|

Okay, thank you, gentlemen. |

Tina: |

|

Thank you. Next we have Lance Gad with Greenfeld Hill Capital. |

Gad: |

|

Yes. Hi, gentlemen. I was curious—I don't have the slides or the faxed copy of them. Pro forma—what does tangible book do? What does it look like at MBFI? |

Feiger: |

|

Tangible book value per share? |

Gad: |

|

Yes, today versus pro forma? |

Feiger: |

|

We're looking that up for you right now. |

Skopec: |

|

I believe currently it's $10.94 versus $13.12. Is that correct? |

Feiger: |

|

For MBFI it's going from $10.94 to $13.12. |

Gad: |

|

Right, so it's accretive from a tangible book value. |

Feiger: |

|

Right. For MBFI shareholders it's accretive from a book perspective. For MidCity shareholders it is not. |

Gad: |

|

But the other way on earnings, it's correct. |

Feiger: |

|

That's right; that's the trade. |

Gad: |

|

So, it was looked at as a real merger of equals. |

Feiger: |

|

Oh, yes, absolutely. That's what this is. I wouldn't be mistaken about that. This is a true merger of equals. |

Gad: |

|

Okay, great. Thank you. |

Tina: |

|

I have a follow-up from Ross Haberman of Haberman Brothers. |

Haberman: |

|

Hi, Mitch. Just a couple of follow-up questions. Based on the new, if they pass these new accounting rules, what is going to be, uh, how would the $2.25 or the $2.34, I wasn't quite sure the difference there, which you had mentioned. What will those numbers be based on for the new accounting rules if you didn't have to amortize the goodwill? |

Feiger: |

|

Okay, Jill York can answer that question. But let me just clarify the $2.34 and the $2.25. The $2.25 number, earnings per share for 2002, was just combining the companies and implementing the $8 million in cost saves. The $2.34 was with the single revenue enhancement that I spoke about, adding the lease loans. Jill, do you have the answer for Ross? |

11

York: |

|

The final rules, of course, haven't been published on how these rules are going to work. My understanding is that under the new rules—of course, for purposes of this deal and it wouldn't be a change. However, my understanding is that you would no longer have to amortize goodwill acquired in previous acquisitions. That's my present understanding. |

Haberman: |

|

And that would gross up the numbers to what? |

York: |

|

Okay, I can calculate that for you in a couple of minutes and then come back on the line with it. |

Feiger: |

|

We'll come back on that. |

Haberman: |

|

Alright. Mitch, could you elaborate if there are other avenues of revenue enhancements which you might find, and how sensitive will the combined company be as rates are coming down, to margin compression as rates are coming down recently? And, will that throw off or make your projections here a little optimistic? |

Feiger: |

|

Okay, let me address the revenue enhancements first. Some additional ones that we've identified is additional bank owned life insurance, more BOLI. MBFI has a BOLI right now. MidCity does not; that's one. Secondly, further reallocation of MidCity's liquidity into loans. Now, the revenue enhancement that we spoke about, this $250 million of lease loans, is our lowest margin, our lowest yielding, non-investment asset. To the extent that we can deploy funds into true direct commercial loans, the spreads increase from 1% - 2% or 3% over the investment yields, and will provide considerably more revenue. And one thing to keep in mind—and this is one of the reasons why as we've gotten bigger our growth rate has accelerated. As we've gotten bigger we've been able to do bigger deals, bigger commercial banking deals, and do them safely. Today we are active sellers, for risk control reasons, of commercial loans that together, we will totally safely be able to hold. So without doing any more work we're just going to have more higher yielding, high quality assets. Frankly, I think that that's the big payoff on the revenue side. We also can more rapidly expand our wealth management business, and I see this as a very important business segment for us. As you know, MidCity has the wealth management product, and MB Financial has none. And we have a customer base here that we think is extremely wealthy and extremely ripe for these kinds of services. And whenever we talk with our customers about their needs or wants here, they tell us they want the product, they need the product, and they would be more than willing to do their business with us. It's just that we have not been able up until now to find a way to provide this product in a high-quality fashion without losing a lot of money. And now comes along the MidCity component and they already have the critical mass, and the product's already built. So I see that as having significant upside and significant growth. |

|

|

Ken, do you have any others? |

Skopec: |

|

No, I think you've covered it very adequately. I think it's important to point out that lending has almost become a commodity sale anymore and net interest margins have been declining significantly over the past several years. I think it makes it very, very clear to management that in order to do well in this business it is exceedingly important to increase non-interest income. And, that comes from wealth management or any other source, the sale of mutual funds or other things that consumers are using. And if we do not provide the service, they will go to other vendors to get the service done. So, my own view is that non-interest income is a key component of doing well in the future, and a great deal of emphasis will be placed on that area. |

12

Feiger: |

|

Okay Lance, your other question had to do with margin compression from the rate reductions? |

Haberman: |

|

Right, Ross. |

Feiger: |

|

Okay, I'm sorry, Ross. As commercial banks, we tend to have a lot of floating rate commercial loans that can be funded by three or six- month kinds of deposits. So, what you see is an early compression and then as the rest of that six-month period or year unwinds, the margin comes right back, and I think that's what going to happen here. That is not going to have any kind of material effect on our forecasts. |

Haberman: |

|

Okay, thank you. |

Feiger: |

|

We have an answer on the cash earnings per share question. Jill? |

York: |

|

Okay, I took a look at it, and it adds basically $.13 a share. So, under the cost savings only analysis it would go to $2.38 and the analysis including the revenue enhancement would go to $2.47. |

Haberman: |

|

Mitch, can we get back on the restrictions? |

Feiger: |

|

Right. Do we have an answer on the restrictions? |

York: |

|

Yes. I spoke briefly with our attorneys and if you are a non-affiliated shareholder, so if you're not a director or officer, there does not appear to be any significant restrictions in their initial answer. There are some rules regarding the affiliate letter agreements that would pertain to directors and officers. My understanding is that in the 30-day period prior to merger, those individuals could not sell their shares, as well as subsequent to merger there is a period of time where the two entities need to be together for 30 days and prior to selling the shares. Also, it's my understanding that to the extent the directors have signed voting agreements, there would be some restriction to them selling their shares prior to merger. |

Haberman: |

|

Just as a follow-up to that, Mitch, how big—or maybe this is better aimed at MidCity, how big an issue was it in your strategic planning to get a liquid currency essentially, as opposed to your totally illiquid stock? |

Skopec: |

|

That was one of the key considerations because we were so closely held and so tightly traded, one of the major goals was to provide a more liquid currency and that was a key element to looking at our initiative. |

Haberman: |

|

Could you just give us a little background on your shareholder base—is it all controlled by the insiders or how much do the insider's control, vis-a-vis, some institutions or a founding family, and so on and so forth? |

Skopec: |

|

The insiders, which would include officers and directors, and just offhand would approximate in excess of 60%. |

Haberman: |

|

And the other 40 is? |

Skopec: |

|

Pretty broadly held. |

Haberman: |

|

Individuals or institutions? |

13

Skopec: |

|

By individuals as opposed to not a lot of institutional investors. There are some, but not a very large percentage. |

Haberman: |

|

And just a final thought—do you have any expectation that a large amount of your shares will be coming on the market once people have a more liquid currency? |

Skopec: |

|

No, I do not believe that to be the case at all. |

Haberman: |

|

Okay, thank you. |

Skopec: |

|

You bet. |

Tina: |

|

Next question is from Ron Peterson of Sandler O'Neill & Partners. |

Pugliese: |

|

Mitch, actually it's Ken Pugliese. I had a question about the integration. You indicated that you tend to start the integration, you know, like the day after the deal's announced. I'm wondering if there are any opportunities for these revenue enhancements to occur perhaps even before the deal is closed, number one; and number two, I think you indicated the deal's going to close in the third quarter and you look to get all the costs out within 6 months. I'm wondering, you know, how much of that's going to come immediately; how much of the cost savings will come almost immediately. |

Feiger: |

|

That's a good question. On the revenue side we've already begun—we've got a package of $20 million of lease loans that we're getting ready on the MB side to sell to MidCity, Ken, that I spoke about earlier. |

Skopec: |

|

And, the bank owned life insurance. |

Feiger: |

|

Yes, and we have the bank owned life insurance which we think will be put in place before the closing as well. That's an excellent point, Ken. |

Pugliese: |

|

But, you hit the ground running on that stuff right out of the shoot. |

Feiger: |

|

Yes, that's going to go in before the closing, both of those. |

Skopec: |

|

As a matter of fact, we had already initiated and put together a plan for the acquisition of bank owned life insurance. We've got everything in place; we've done all of our research and have withheld doing anything while the negotiations of merger were going on so that the combined institution would not be overly invested in BOLI. We have all the groundwork done, we know exactly the direction we're moving in, and we are prepared to move on that momentarily. |

Pugliese: |

|

Okay, thank you gentlemen. Congratulations. |

Tina: |

|

Next we have Lance Gad of Greenfeld Hill Capital. |

Gad: |

|

Yes, just two more quick questions. Has there been any trading in Mid-City, and at what price level recently? |

Skopec: |

|

Most recently I believe there has been minimal trading, and I believe it was in the $4,000 - $4,100 range. That's just a guess now; I don't have access to those figures, but I do believe it was in that area. |

Gad: |

|

Okay, great. The other question is, Mid-City—they have a large investment portfolio, we've heard, investment securities. Is some of it held to maturity? |

Skopec: |

|

It is all available for sale. |

Gad: |

|

All available for sale, so the book is market. |

14

Skopec: |

|

Right. |

Gad: |

|

Okay, thank you. |

Tina: |

|

We have no further questions. Please continue, gentlemen. |

Feiger: |

|

Well, I guess that wraps it up. Thank you, everybody, for listening in. If you have any further questions, our phone numbers are on the press release. I'm happy to speak with anybody; I'm sure Ken is as well, or you can call Jill York, here at the Bank. Thank you. |

Skopec: |

|

I would add just one point. One of the ideal parts of this merger, as I look at it, is the fact that our cultures are very compatible, but very often in a merger of equals it's almost an oxymoron because the fight starts from the get-go as to who's going to become the CEO. That was never an issue here, because Mid-City Financial was looking for succession management, and we are very, very confident and very pleased that Mitchell Feiger is going to more than adequately fill that bill, and so I think that that helps right from the beginning. There has been great interplay between our senior people and Mitch and his senior staff, and we've seen this thing in process now for a couple of months, and I feel very, very encouraged that there is mutual respect and admiration for each other's ability. So, Mitchell, I know you'll do a fine job for MidCity Financial shareholders who will soon be MB Financial shareholders. |

Feiger: |

|

Thank you very much, Ken. Your support is greatly appreciated. Alright, that wraps it up, everybody. Thanks. |

Tina: |

|

Ladies and gentlemen, today's conference will be available for replay starting today at 2:30 p.m. central time, running through April 23rd at midnight. You may access the replay by dialing 1-800-475-6701 and entering the access code of 583315. The number again is 1-800-475-6701 with the access code of 583315. That concludes our conference. Thank you for your participation and thanks for using AT&T Executive Teleconference. You may now disconnect. |

15

Set forth below are materials presented during the conference call/webcast held by MB Financial, Inc. and MidCity Financial Corporation on April 20, 2001.

MB Financial, Inc.

and

MidCity Financial Corporation

are combining in a merger-of-equals

|

Conference Call Information |

MB Financial, Inc. and MidCity Financial Corporation will host a conference call at 11:00 am C.S.T. on April 20, 2001. The number to call in the United States is (888) 276-0007. If this time is inconvenient, a taped rebroadcast will be continuously played for 80 hours at (800) 475-6701 in the United States (access code 583315) starting at 2:30 pm C.S.T. A copy of this presentation, along with a web cast of this call, can be found atwww.mbfinancial.com underInvestor Relations. |

|

1

Forward Looking Statements

When used in this document or other public shareholder communications, in filings with the Securities and Exchange Commission, or in oral statements made with the approval of an authorized executive officer, the words or phrases "believe," "will likely result," "are expected to," "will continue," "is anticipated," "estimate," "project," "plans," or similar expressions are intended to identify "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date made. Various factors could cause actual results to differ materially from the results anticipated or projected. These factors include, but are not limited to, the following: (1) expected cost savings and synergies from the merger might not be realized within the expected time frame; (2) revenues following the merger could be lower than expected; (3) costs or difficulties related to the integration of the businesses of MB Financial and MidCity might be greater than expected; (4) the requisite shareholder and/or regulatory approvals of the transaction might not be obtained; (5) deposit attrition, operating costs, customer loss and business disruption following the merger may be greater than expected (6) competitive pressures among depository institutions; (7) the credit risks of lending activities; (8) changes in the interest rate environment and in the demand for loans; (9) general economic conditions, either nationally or in the states in which the combined company will be doing business, might be less favorable than expected; (10) new legislation or regulatory changes; and (11) changes in accounting principles, policies or guidelines.

We do not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking statement is made.

Additional Information

A registration statement on Form S- 4 will be filed with the Securities and Exchange Commission in connection with the proposed transaction. The registration statement will include a joint proxy statement/prospectus which will be sent to the shareholders of both MB Financial, Inc. and MidCity Financial Corporation seeking their approval of the proposed transaction. Investors and security holders are advised to read the registration statement and joint proxy statement/prospectus because they will contain important information. When filed, these documents can be obtained free of charge from the web site maintained by the SEC at "www.sec.gov." These documents also can be obtained free of charge upon written request to MB Financial, Inc., Investor Relations, 1200 North Ashland Avenue, Chicago, Illinois 60622 or by calling (773) 645-7868.

MB Financial, Inc. and its directors and executive officers may be deemed to be participants in the solicitation of proxies from MB Financial shareholders to approve the merger. Information about these participants may be obtained through the SEC's web site from the definitive proxy statement filed with the SEC by MB Financial on March 21, 2001. Additional information regarding the interests of these participants, as well as information regarding the directors and executive officers of MidCity Financial, may be obtained by reading the joint proxy statement/prospectus regarding the proposed transaction when it becomes available.

2

Transaction Summary

Transaction Structure: |

|

MB Financial, Inc. and MidCity Financial Corporation will form a new company into which both will merge. |

Name of New Company: |

|

MB Financial, Inc. |

Fixed Exchange Ratio: |

|

230.32955 MBFI shares per MidCity share;

one new MBFI share for each current MBFI share |

Pro forma Ownership: |

|

MBFI 40% / MidCity 60% |

Form of Consideration: |

|

100% MBFI common stock |

Value per MidCity share: |

|

$3,800.44(1) |

Transaction Value: |

|

$292 million in total—

175 million for MidCity Financial Corporation

117 million for MB Financial, Inc. |

Accounting and Tax Treatment: |

|

Pooling of interests

Tax-free exchange |

Breakup Fee: |

|

$5 million (approximately 3% of aggregate transaction value) for each company |

- (1)

- Based on MBFI share price as of close April 19, 2001

3

Transaction Summary

Expected Closing: |

|

3rd Quarter 2001 |

Expected Integration Completion: |

|

Not later than 1st quarter 2002 |

Transaction Costs: |

|

$19.6 million (pre-tax) |

Operating Expense Savings: |

|

$8.2 million (pre-tax) (9.7% of combined)

100% realized in 2002 |

Required Approvals: |

|

MidCity and MBFI shareholders and customary regulatory approvals |

Dividend: |

|

Initial dividend target $0.15 per quarter |

4

Current Subsidiary Bank Structures

Note: Figures are total assets as of December 31, 2000

5

Pro Forma Subsidiary Bank Structure

MidCity's and MB Financial's Illinois banks will be merged. The name has yet to be determined. The Oklahoma and Texas banks will retain separate charters and current names.

6

New Management Structure

Board Representation: 9 MidCity / 8 MBFI Headquarters: Chicago, Illinois

Function

| | Title

| | Executive

|

|---|

| Chairman (non-executive) | | Chairman | | E.M. Bakwin (MidCity) |

CEO & President |

|

CEO & President |

|

Mitchell Feiger (MBFI) |

Finance |

|

Chief Financial Officer, Senior Vice President |

|

Jill York (MBFI) |

Commercial Banking |

|

Chairman of Illinois Bank, Group President |

|

Ronald Santo (MidCity) |

Commercial Banking |

|

Executive Vice President |

|

Thomas Panos (MBFI) |

Commerical Banking & Lease Banking |

|

Illinois Bank CEO & President |

|

Burton Field (MBFI) |

Wealth Management, Operations |

|

Executive Vice President |

|

William McCarty III (MidCity) |

Retail Banking |

|

Senior Vice President |

|

Thomas FitzGibbon (MBFI) |

Human Resources |

|

Senior Vice President |

|

Jeffrey Husserl (MBFI) |

7

Transaction Rationale—Strategic

- •

- Combines a company with strong internal funding sources and a company with strong asset generation.

- •

- Creates a company well positioned to become the premier business bank in the Chicago market.

- •

- New entity enhances the existing banking platform for continued growth both internal and external.

- •

- Creates a platform to aggressively pursue a wealth/asset management line of business.

8

Transaction Rationale—Financial/Operational

- •

- Accretive to both companies' GAAP earnings in first full year of operations (2002). Accretive to MBFI's book value.

- •

- There are additional opportunities to restructure and redeploy assets into higher yielding assets without significant incremental credit risk.

- •

- Identified cost savings are achievable within 6 months of closing.

- •

- Experienced integrators, low execution risk.

9

Overview of MB Financial, Inc.

- •

- Created in February 1999 through the merger of Avondale Financial Corp. and Coal City Corporation, the ticker is MBFI.

- •

- As of December 31, 2000, assets were $1.5 billion, deposits were $1.1 billion and equity was $91.7 million.

- •

- MBFI announced the acquisition of FSL Holdings, Inc., with $211 million in assets, in February 2001. The transaction is currently pending and expected to close before the end of second quarter 2001.

- •

- Mid-market business banking focus with strengths in commercial and industrial lending, equipment leasing and commercial real estate lending.

- •

- Strong asset growth and excellent asset quality.

- •

- MB Financial has a history of acquiring other depository institutions, consolidating operations, and recognizing cost saves within a short period of time after closing.

| — | | Manufacturers National Corporation | | 1992 |

| — | | Peterson Bank | | 1995 |

| — | | U.S. Bancorp, Inc. | | 1997 |

| — | | Avondale Financial Corp. | | 1999 |

- •

- Significant insider ownership.

10

Overview of MidCity Financial Corporation

- •

- Mid-City National Bank of Chicago was founded in 1911. The holding company was established in 1982.

- •

- 26 branch offices:

- —

- 19 branches in Cook and DuPage counties Illinois (metropolitan Chicago)

- —

- 5 branches in Oklahoma City, Oklahoma metropolitan area

- —

- 2 branches in Dallas, Texas metropolitan area

- •

- As of December 31, 2000, assets were $1.8 billion, deposits were $1.6 billion and equity was $185.6 million.

- •

- Commercial banking focus with strengths in commercial and industrial lending, wealth management services and deposit gathering.

- •

- Strong deposit franchise and commercial customer base.

11

Overview of MidCity Financial Corporation

- •

- MidCity also has a history of acquiring other depository institutions and successfully consolidating them.

| — | | Clyde Federal Savings | | 1991 |

| — | | First Western | | 1992 |

| — | | Peoples Federal Savings & Loan Association of Chicago | | 1995 |

| — | | Abrams Centre National Bank | | 1997 |

| — | | Republic Bank (Waukegan branch) | | 1998 |

| — | | Damen Financial Corporation | | 1999 |

- •

- Significant insider ownership.

12

Geographic Footprint

13

Deposit Market Share—Cook County, IL

| |

| |

| |

| |

| | June '00

|

|---|

County

| | Rank Institution

| | Inst

Type

| | Number of

Branches

| | Total

Deposits

| | Market

Share

|

|---|

| Cook, IL | | 1 | | Bank One Corp. (IL) | | Bank | | 146 | | | 25,870,710 | | 19.86 |

| | Total County Deposits =

$130,288,985 | | 2

3 | | ABN AMRO North America HC (IL)

Bank of Montreal | | Bank

Bank | | 128

86 | | | 25,263,885

11,859,791 | | 19.39

9.10 |

| | | 4 | | Northern Trust Corp. (IL) | | Bank | | 11 | | | 7,860,001 | | 6.03 |

| | | 5 | | Charter One Financial (OH) | | Bank | | 53 | | | 3,560,498 | | 2.73 |

| | | 6 | | Bank of America Corp. (NC) | | Bank | | 2 | | | 3,547,889 | | 2.72 |

| | | 7 | | Citigroup Inc. (NY) | | Bank | | 44 | | | 3,510,816 | | 2.69 |

| | | 8 | | Fifth Third Bancorp (OH) | | Bank | | 31 | | | 2,974,299 | | 2.28 |

| | | 9 | | Corus Bankshares Inc. (IL) | | Bank | | 14 | | | 2,052,074 | | 1.58 |

| | | 10 | | MAF Bancorp Inc. (IL) | | Thrift | | 16 | | | 1,857,979 | | 1.43 |

| | | 11 | | FBOP Corp. (IL) | | Bank | | 21 | | | 1,775,536 | | 1.36 |

| | | 12 | | TCF Financial Corp. (MN) | | Bank | | 106 | | | 1,729,965 | | 1.33 |

| | | 13 | | Taylor Capital Group, Inc. (IL) | | Bank | | 13 | | | 1,704,457 | | 1.31 |

| | | 14 | | U.S. Bancorp (MN) | | Bank | | 31 | | | 1,520,386 | | 1.17 |

| | | 15 | | Popular Inc. (PR) | | Bank | | 20 | | | 1,439,372 | | 1.10 |

| | | 16 | | Superior Holdings Inc. (NV) | | Thrift | | 12 | | | 1,434,968 | | 1.10 |

| | |

|

| | | 17 | | MB Financial, Inc. | | Bank | | 11 | | | 1,150,651 | (1) | 0.88 |

| | |

|

| | | 18 | | MidCity Financial Corp. | | Bank | | 19 | | | 1,074,382 | | 0.82 |

| | |

|

| | | 19 | | Metropolitan Bank Group, Inc. (IL) | | Bank | | 37 | | | 1,045,845 | | 0.80 |

| | | 20 | | Hershenhorn Bancorp., Inc. (IL) | | Bank | | 2 | | | 1,011,863 | | 0.78 |

| | | | |

|

| | | | | TOTAL | | | | 808 | | $ | 102,245,367 | | |

| | | | |

|

| | |

|

| | | 9 | | PRO FORMA | | Bank | | 31 | | | 2,225,033 | (2) | 1.70 |

| | |

|

- (1)

- Pro Forma for the pending acquisition of FSL Holdings, Inc.

- (2)

- In addition to these Cook County offices, the company also has three offices in DuPage County with $147 million of deposits.

Source: SNL Datasource 3.0 as of April 4, 2001.

14

Core Deposits(1) More Than Double

- (1)

- Core deposits exclude term deposits greater than $100,000 and brokered deposits.

- (2)

- Pro Forma including pending acquistion of FSL Holdings, Inc.

Source: SNL Datasource, figures as of 12/31/2000

15

Loan Structure

- (1)

- Pro Forma including the pending acquistions of FSL Holdings, Inc.

Source: SNL Datasource, figures as of 12/31/2000

16

Compelling Economics for Shareholders

- •

- Terms of this Merger-of-Equals enable shareholders of both organizations to participate in upside potential

- •

- Additional cost savings and revenue enhancements

- •

- Market valuation (currently 2 earnings multiples below regional peer group)

- •

- Dividend on common stock

- •

- Payout ratio of at least 25% expected

- •

- New for MB Financial shareholders

- •

- Strong pro forma capital ratios—platform for continued profitable incremental asset growth

- •

- 6% to 10% accretive to MBFI 2002 GAAP EPS. 23% to 28% accretive to MidCity 2002 GAAP EPS.

- •

- $8.2 million in pre-tax expense savings are conservative and attainable

17

Financially Compelling

($ in 000's, except per share data)

| |

| |

|---|

Earnings Projections

| | Year Ended

December 31, 2002

| |

|---|

| MBFI Earnings(1) | | $ | 15,300 | |

| MidCity Financial Earnings(2) | | | 19,400 | |

| Expected Cost Savings (tax effected)(3) | | | 5,324 | |

| | |

| |

| Pro Forma Net Income | | $ | 40,024 | |

Immediate Revenue Enhancements (tax effected)(4) |

|

|

1,625 |

|

| | |

| |

| Pro Forma Net Income With Immediate Enhancements | | $ | 41,649 | |

Analysis Including Cost Savings Only: |

|

|

|

|

| MBFI Stand Alone Diluted EPS(5) | | $ | 2.12 | |

| MidCity Financial Stand Alone Diluted EPS(6) | | $ | 1.83 | |

| Pro Forma Diluted EPS(7) | | $ | 2.25 | |

| EPS Accretion/Dilution to MBFI | | | 6.13 | % |

| EPS Accretion/Dilution to MidCity Financial | | | 22.95 | % |

| ROAA | | | 1.08 | % |

| ROE | | | 13.42 | % |

| Efficiency Ratio | | | 53.68 | % |

Analysis Including Revenue Enhancements: |

|

|

|

|

| Pro Forma Diluted EPS with Immediate Revenue Enhancements(7) | | $ | 2.34 | |

| EPS Accretion to MBFI | | | 10.38 | % |

| EPS Accretion/Dilution to MidCity Financial | | | 27.87 | % |

| ROAA | | | 1.12 | % |

| ROE | | | 13.96 | % |

| Efficiency Ratio | | | 52.75 | % |

- (1)

- Based on IBES estimates

- (2)

- Estimated earnings

- (3)

- Cost savings of $8.19 million are assumed, tax effected at 35% tax rate

- (4)

- Revenue enhancements assume reinvestment of $250 million in securities into commercial lease loans at a 100bp spread over the current securities spread

- (5)

- Calculated using 7,204,515 fully diluted shares

- (6)

- Calculated 10,596,773 fully diluted shares

- (7)

- Calculated using 17,801,288 fully diluted shares

18

Transaction Synergies

($ in 000's)

Sources of Cost Savings

| | Pre-Tax

Amount

| |

| |

|

|---|

| Compensation and Benefits | | $ | 4,865 | | | | |

| Backoffice and Administrative | | | 2,661 | | | | |

| Systems and Facilities | | | 564 | | | | |

| Other | | | 100 | | | | |

| | |

| | | | |

| | Total Cost Savings (pre-tax) | | $ | 8,190 | | | | |

| | | | | | --> | | 9.7% of combined overhead |

| Immediate Revenue Enhancements | | | | | | | |

| | |

| | | | |

| Reinvest Securities Into Lease Loans(1) | | $ | 2,500 | | | | |

| | |

| | | | |

| | Total Cost Savings & Revenue Enhancements (pre-tax) | | $ | 10,690 | | | | |

Additional Revenue Enhancement Opportunities:

- •

- BOLI

- •

- Additional securities portfolio reallocation (MidCity currently has a loan to deposit ratio of less than 65%)

- •

- Expand trust services/wealth management

- •

- Balance sheet restructuring

- (1)

- Revenue enhancements assume reinvestment of $250 million in securities into commercial lease loans at a 100bp spread over the current securities spread

19

Comparative Performance

| | For the Year Ended

Dec 31, 2000

| | Proforma

Year Ended(2)

| |

|---|

Performance Measures

| |

|---|

| | MBFI

| | MidCity

| | Peers*

| | 2002

| |

|---|

| ROAA | | 0.84 | % | 0.85 | % | 1.12 | % | 1.08 | % |

| ROAE | | 13.86 | | 8.55 | | 13.86 | | 13.42 | |

| Net Interest Margin | | 3.62 | | 3.69 | | 3.82 | | 3.58 | |

| Efficiency Ratio(1) | | 61.14 | | 65.03 | | 56.30 | | 53.68 | |

| Leverage Ratio | | 7.38 | | 9.10 | | 8.13 | | 8.00 | |

| NCOs/Loans | | 0.14 | | 0.18 | | 0.16 | | | |

- *

- Median peer group value. Peer group includes CBCL, CHFC, BUSE, THFF, FRME, HTLF, IBCP, MBFI, MBTF, MAB, MBHI, MVBI and RBCAA.

- (1)

- (Noninterest expense—intangible amortization)/(net interest income + noninterest income)

- (2)

- Including cost savings only

20

Integration Risk is Low

- •

- Management team has extensive commercial banking experience

- •

- Proven integrators with positive results

- •

- MBFI: 4 acquisitions and 1 in progress

- •

- MidCity: 6 acquisitions

- •

- Similar, conservative credit cultures

- •

- Similar focus on exceptional customer service

- •

- Conservative cost savings assumptions

- •

- Integration expected to be completed by the first quarter of 2002, possibly earlier

21

Summary

- •

- Accretive to GAAP earnings in the first full year of operations (2002)

- •

- $3.3 billion asset bank is exceptionally well positioned in metropolitan Chicago

- •

- Expands the depth of management

- •

- Franchises are complementary

- •

- Enhances capital ratios

- •

- Cost savings are significant and achievable

- •

- Great potential for revenue enhancements

- •

- Low execution risk

- •

- Improves liquidity for shareholders

22

Contribution Analysis

($ in millions)

| |

| |

| | Contribution

| |

|---|

| | MBFI(1)

| | MidCity

| | MBFI

| | MidCity

| |

|---|

| Selected Balance Sheet Items:(2) | | | | | | | | | | | |

| Securities | | $ | 240.4 | | $ | 710.1 | | 25.3 | % | 74.7 | % |

| Net Loans | | | 1,088.7 | | | 947.2 | | 53.5 | % | 46.5 | % |

| Goodwill and Other Intangibles | | | 14.5 | | | 16.7 | | 46.5 | % | 53.5 | % |

| Total Assets | | | 1,458.2 | | | 1,829.2 | | 44.4 | % | 55.6 | % |

Deposits |

|

|

1,069.3 |

|

|

1,570.1 |

|

40.5 |

% |

59.5 |

% |

| Total Equity | | | 91.7 | | | 185.6 | | 33.1 | % | 66.9 | % |

Tangible Equity |

|

|

77.2 |

|

|

168.9 |

|

31.4 |

% |

68.6 |

% |

Selected Income Statement Items: |

|

|

|

|

|

|

|

|

|

|

|

| LTM 12/31/00 Net Income | | $ | 11,605 | | $ | 15,356 | | 43.0 | % | 57.0 | % |

| 2001 Net Income | | | 12,900 | (3) | | 18,000 | (4) | 41.7 | % | 58.3 | % |

| 2002 Net Income | | | 15,300 | (3) | | 19,400 | (4) | 44.1 | % | 55.9 | % |

- (1)

- Pro forma for pending acquisition of FSL Holdings, Inc.

- (2)

- As of December 31, 2000

- (3)

- IBES estimates as of 4/11/01

- (4)

- Estimated Net Income

23

Pro Forma Balance Sheet

($ in 000's except per share amounts)

| | MBFI

12/31/00

| | MidCity

12/31/00

| | Pro Forma(1)

| |

|---|

| Cash & Equivalents | | $ | 34,289 | | $ | 97,310 | | $ | 117,199 | |

| Securities | | $ | 250,891 | | $ | 710,093 | | $ | 960,984 | |

| Net Loans & Leases | | $ | 1,088,670 | | $ | 947,188 | | $ | 2,035,858 | |

| Goodwill and other intangibles | | $ | 14,466 | | $ | 16,659 | | $ | 31,125 | |

| Other assets | | $ | 69,932 | | $ | 57,853 | | $ | 127,785 | |

| | |

| |

| |

| |

| Total Assets | | $ | 1,458,248 | | $ | 1,829,103 | | $ | 3,272,951 | |

| | |

| |

| |

| |

| Noninterest-bearing Deposits | | $ | 157,237 | | $ | 277,339 | | $ | 434,576 | |

| Interest-bearing Deposits | | $ | 912,027 | | $ | 1,292,792 | | $ | 2,204,819 | |

| | |

| |

| |

| |

| Total Deposits | | $ | 1,069,264 | | $ | 1,570,131 | | $ | 2,639,395 | |

Borrowed funds |

|

$ |

256,210 |

|

$ |

57,187 |

|

$ |

313,397 |

|

| Trust Preferred Securities | | $ | 25,000 | | $ | 0 | | $ | 25,000 | |

| Other Liabilities | | $ | 16,033 | | $ | 16,220 | | $ | 32,253 | |

| | |

| |

| |

| |

| Total Liabilities | | $ | 1,366,507 | | $ | 1,643,538 | | $ | 3,010,045 | |

| | |

| |

| |

| |

| Common Equity | | $ | 91,741 | | $ | 185,565 | | $ | 262,906 | |

| | |

| |

| |

| |

| Total Equity | | $ | 91,741 | | $ | 185,565 | | $ | 262,906 | |

| | |

| |

| |

| |

| Total Liabilities and Equity | | $ | 1,458,248 | | $ | 1,829,103 | | $ | 3,272,951 | |

| | |

| |

| |

| |

| Book Value per share | | $ | 12.99 | | $ | 4,033 | | $ | 14.89 | |

| Tangible Book Value per share | | $ | 10.94 | | $ | 3,671 | | $ | 13.12 | |

Equity/Assets |

|

|

6.29 |

% |

|

10.15 |

% |

|

7.12 |

% |

| Leverage Ratio | | | 7.38 | % | | 9.26 | % | | 7.84 | % |

| Total Risk Based Ratio | | | 9.60 | % | | 16.90 | % | | 11.68 | % |

- (1)

- Doesn't include MBFI's pending acquisition of FSL Holdings, Inc.

24

Credit Quality

| | MBFI

| | MidCity

| | Combined

| |

|---|

| Reserves/NPAs (a) | | 241.86 | % | 84.48 | % | 127.14 | % |

| NPAs/Loans & OREO | | 0.54 | % | 1.60 | % | 1.05 | % |

| Provision/NCOs | | 213.10 | % | 294.77 | % | 257.43 | % |

| NCOs/Loans | | 0.14 | % | 0.18 | % | 0.16 | % |

- (a)