January 2018 NASDAQ: MBFI Investor Presentation EXHIBIT 99.2

Forward-Looking Statements 1 When used in this presentation and in reports filed with or furnished to the Securities and Exchange Commission (the "SEC"), in press releases or other public stockholder communications, or in oral statements made with the approval of an authorized executive officer, the words or phrases “believe,” “will,” “should,” “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” “project,” “plans,” or similar expressions are intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date made. These statements may relate to our future financial performance, strategic plans or objectives, revenues or earnings projections, or other financial items. By their nature, these statements are subject to numerous uncertainties that could cause actual results to differ materially from those anticipated in the statements. Important factors that could cause actual results to differ materially from the results anticipated or projected include, but are not limited to, the following: (1) the possibility that the actual reduction in our effective tax rate expected to result from Tax Cut and Jobs Act of 2017 might be different from the estimated reduction set forth in this presentation; (2) the risk that funds obtained from capital raising activities will not be utilized efficiently or effectively; (3) expected revenues, cost savings, synergies and other benefits from our merger and acquisition activities (including our merger with American Chartered Bancorp, Inc. in 2016) might not be realized within the expected time frames or at all and costs or difficulties relating to integration matters, including but not limited to customer and employee retention, might be greater than expected; (4) the credit risks of lending activities, including changes in the level and direction of loan delinquencies and write-offs and changes in estimates of the adequacy of the allowance for loan losses, which could necessitate additional provisions for loan losses, resulting both from originated loans and loans acquired from other financial institutions; (5) the quality and composition of our securities portfolio; (6) competitive pressures among depository institutions; (7) interest rate movements and their impact on customer behavior, net interest margin and the value of our mortgage servicing rights; (8) the possibility that our mortgage banking business may experience increased volatility in its revenues and earnings and the possibility that the profitability of our mortgage banking business could be significantly reduced if we are unable to originate and sell mortgage loans at profitable margins or if changes in interest rates negatively impact the value of our mortgage servicing rights; (9) the impact of repricing and competitors’ pricing initiatives on loan and deposit products; (10) fluctuations in real estate values; (11) results of examinations of us and our bank subsidiary by regulatory authorities and the possibility that any such regulatory authority may, among other things, limit our business activities, require us to change our business mix, increase our allowance for loan and lease losses, write-down asset values or increase our capital levels, or affect our ability to borrow funds or maintain or increase deposits, which could adversely affect our liquidity and earnings; (12) our ability to adapt successfully to technological changes to meet customers’ needs and developments in the market place; (13) the possibility that security measures implemented might not be sufficient to mitigate the risk of a cyber attack or cyber theft, and that such security measures might not protect against systems failures or interruptions; (14) our ability to realize the residual values of our direct finance, leveraged and operating leases; (15) our ability to access cost-effective funding; (16) changes in financial markets; (17) changes in economic conditions in general and in the Chicago metropolitan area in particular; (18) the costs, effects and outcomes of litigation;

Forward-Looking Statements – continued 2 (19) new legislation or regulatory changes, including but not limited to the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) and regulations adopted thereunder, changes in capital requirements pursuant to the Dodd-Frank Act, changes in the interpretation and/or application of laws and regulations by regulatory authorities, other governmental initiatives affecting the financial services industry and changes in federal and/or state tax laws, including but not limited to the Tax Cut and Jobs Act of 2017, or interpretations thereof by taxing authorities; (20) changes in accounting principles, policies or guidelines; (21) our future acquisitions of other depository institutions or lines of business; and (22) future goodwill impairment due to changes in our business, changes in market conditions, or other factors. We do not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date on which the forward-looking statement is made.

Table of Contents 3 1. Full year highlights; impact of 2017 Tax Cuts and Jobs Act 2. Company overview 3. Overview of core business segments 4. Company strategic priorities ― Build a diversified bank with lower risk and consistently better returns than peers ― Build a low-cost and stable funding base ― Focus intensely on fee income ― Invest in human talent ― Proactively acquire companies that fit strategic objectives ― Rapidly building technology environment to gain a competitive advantage in targeted areas 5. Non-GAAP disclosure reconciliations and footnotes

4 Full Year Highlights and Impact of 2017 Tax Cuts and Jobs Act

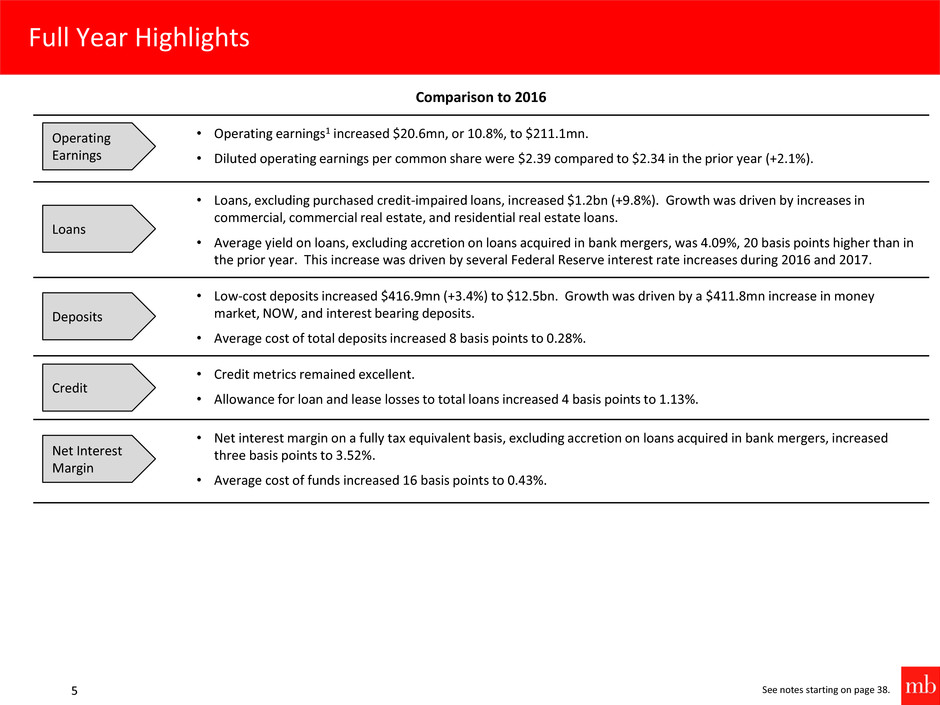

Full Year Highlights 5 See notes starting on page 38. Comparison to 2016 • Operating earnings1 increased $20.6mn, or 10.8%, to $211.1mn. • Diluted operating earnings per common share were $2.39 compared to $2.34 in the prior year (+2.1%). • Loans, excluding purchased credit-impaired loans, increased $1.2bn (+9.8%). Growth was driven by increases in commercial, commercial real estate, and residential real estate loans. • Average yield on loans, excluding accretion on loans acquired in bank mergers, was 4.09%, 20 basis points higher than in the prior year. This increase was driven by several Federal Reserve interest rate increases during 2016 and 2017. • Low-cost deposits increased $416.9mn (+3.4%) to $12.5bn. Growth was driven by a $411.8mn increase in money market, NOW, and interest bearing deposits. • Average cost of total deposits increased 8 basis points to 0.28%. • Credit metrics remained excellent. • Allowance for loan and lease losses to total loans increased 4 basis points to 1.13%. • Net interest margin on a fully tax equivalent basis, excluding accretion on loans acquired in bank mergers, increased three basis points to 3.52%. • Average cost of funds increased 16 basis points to 0.43%. Operating Earnings Loans Deposits Credit Net Interest Margin

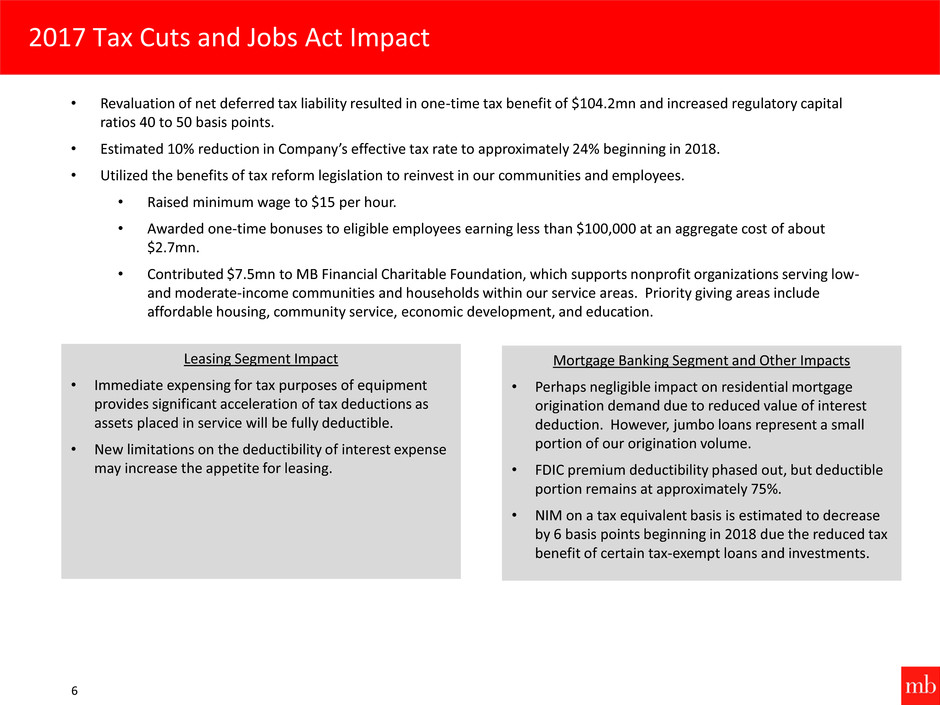

2017 Tax Cuts and Jobs Act Impact 6 • Revaluation of net deferred tax liability resulted in one-time tax benefit of $104.2mn and increased regulatory capital ratios 40 to 50 basis points. • Estimated 10% reduction in Company’s effective tax rate to approximately 24% beginning in 2018. • Utilized the benefits of tax reform legislation to reinvest in our communities and employees. • Raised minimum wage to $15 per hour. • Awarded one-time bonuses to eligible employees earning less than $100,000 at an aggregate cost of about $2.7mn. • Contributed $7.5mn to MB Financial Charitable Foundation, which supports nonprofit organizations serving low- and moderate-income communities and households within our service areas. Priority giving areas include affordable housing, community service, economic development, and education. Leasing Segment Impact • Immediate expensing for tax purposes of equipment provides significant acceleration of tax deductions as assets placed in service will be fully deductible. • New limitations on the deductibility of interest expense may increase the appetite for leasing. Mortgage Banking Segment and Other Impacts • Perhaps negligible impact on residential mortgage origination demand due to reduced value of interest deduction. However, jumbo loans represent a small portion of our origination volume. • FDIC premium deductibility phased out, but deductible portion remains at approximately 75%. • NIM on a tax equivalent basis is estimated to decrease by 6 basis points beginning in 2018 due the reduced tax benefit of certain tax-exempt loans and investments.

7 Company Overview

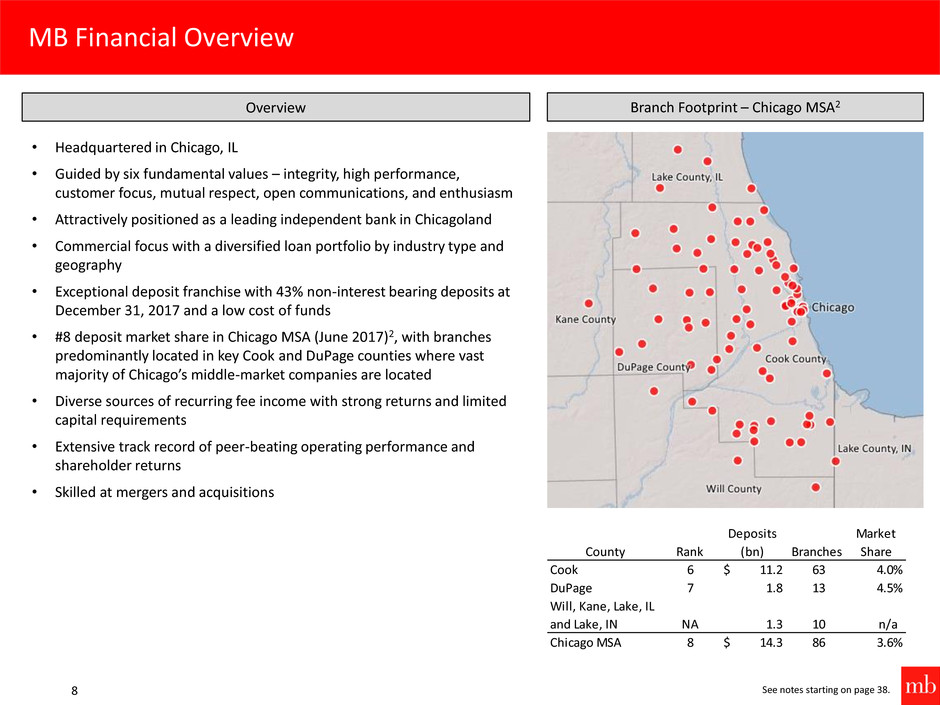

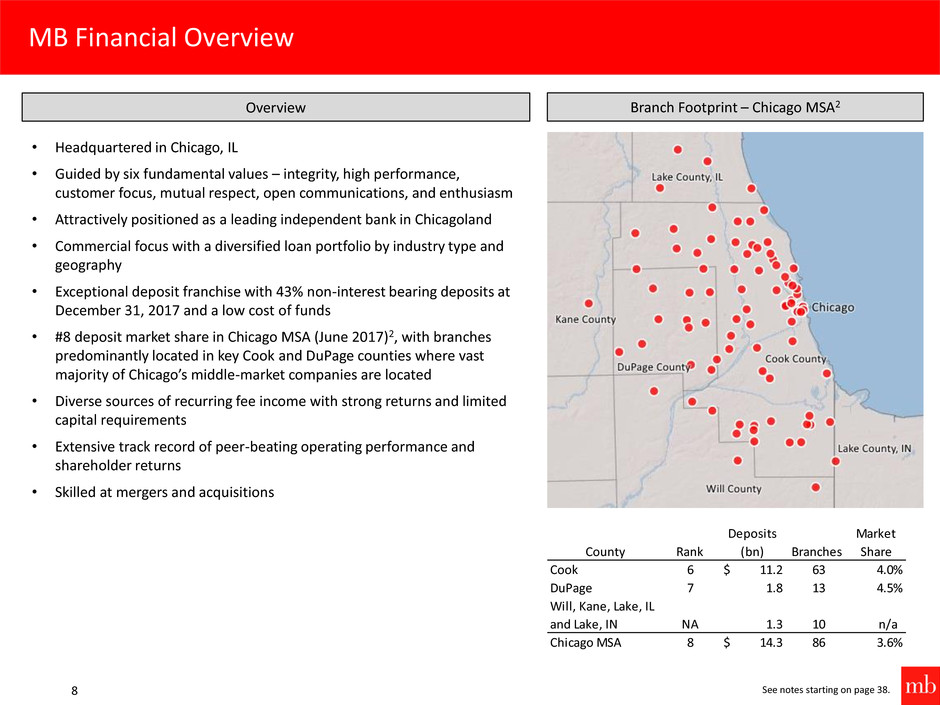

MB Financial Overview 8 See notes starting on page 38. • Headquartered in Chicago, IL • Guided by six fundamental values – integrity, high performance, customer focus, mutual respect, open communications, and enthusiasm • Attractively positioned as a leading independent bank in Chicagoland • Commercial focus with a diversified loan portfolio by industry type and geography • Exceptional deposit franchise with 43% non-interest bearing deposits at December 31, 2017 and a low cost of funds • #8 deposit market share in Chicago MSA (June 2017)2, with branches predominantly located in key Cook and DuPage counties where vast majority of Chicago’s middle-market companies are located • Diverse sources of recurring fee income with strong returns and limited capital requirements • Extensive track record of peer-beating operating performance and shareholder returns • Skilled at mergers and acquisitions Overview Branch Footprint – Chicago MSA2 County Rank Deposits (bn) Branches Market Share Cook 6 11.2$ 63 4.0% DuPage 7 1.8 13 4.5% Will, Kane, Lake, IL and Lake, IN NA 1.3 10 n/a Chicago MSA 8 14.3$ 86 3.6%

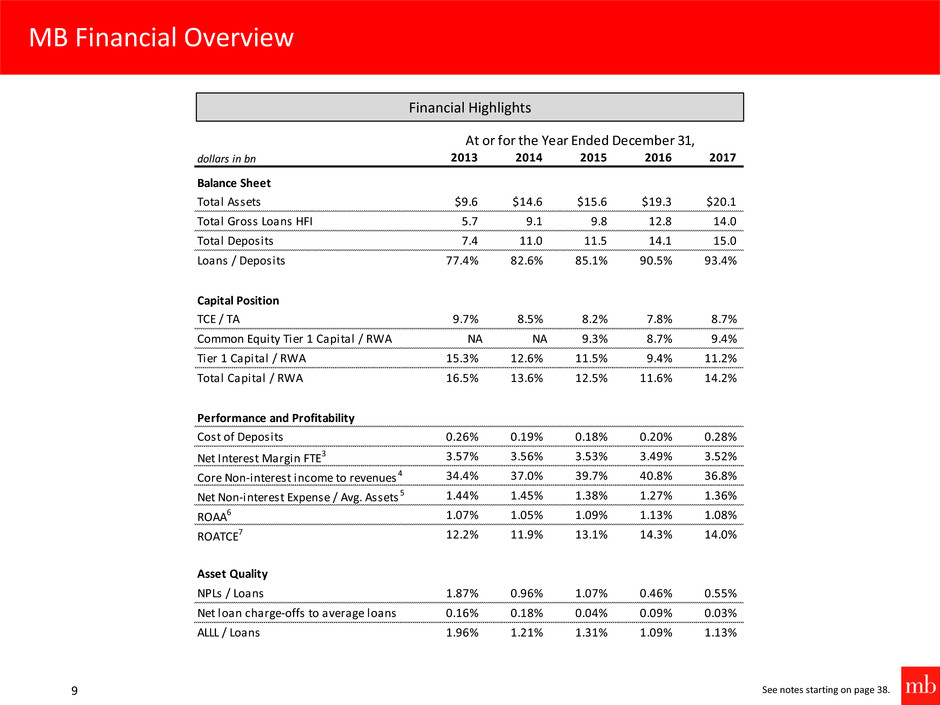

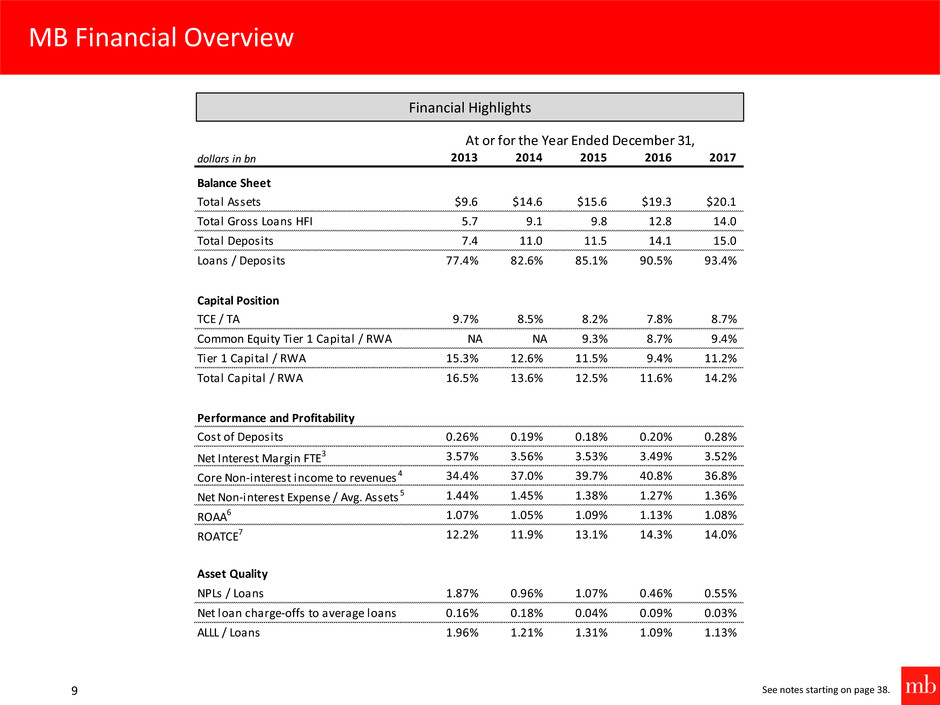

MB Financial Overview 9 See notes starting on page 38. Financial Highlights dollars in bn 2013 2014 2015 2016 2017 Balance Sheet Total Assets $9.6 $14.6 $15.6 $19.3 $20.1 Total Gross Loans HFI 5.7 9.1 9.8 12.8 14.0 Total Deposits 7.4 11.0 11.5 14.1 15.0 Loans / Deposits 77.4% 82.6% 85.1% 90.5% 93.4% Capital Position TCE / TA 9.7% 8.5% 8.2% 7.8% 8.7% Common Equity Tier 1 Capital / RWA NA NA 9.3% 8.7% 9.4% Tier 1 Capital / RWA 15.3% 12.6% 11.5% 9.4% 11.2% Total Capital / RWA 16.5% 13.6% 12.5% 11.6% 14.2% Performance and Profitability Cost of Deposits 0.26% 0.19% 0.18% 0.20% 0.28% Net Interest Margin FTE3 3.57% 3.56% 3.53% 3.49% 3.52% Core Non-interest income to revenues 4 34.4% 37.0% 39.7% 40.8% 36.8% Net Non-interest Expense / Avg. Assets 5 1.44% 1.45% 1.38% 1.27% 1.36% ROAA6 1.07% 1.05% 1.09% 1.13% 1.08% ROATCE7 12.2% 11.9% 13.1% 14.3% 14.0% Asset Quality NPLs / Loans 1.87% 0.96% 1.07% 0.46% 0.55% Net loan charge-offs to average loans 0.16% 0.18% 0.04% 0.09% 0.03% ALLL / Loans 1.96% 1.21% 1.31% 1.09% 1.13% At or for the Year Ended December 31,

10 Overview of Core Business Segments

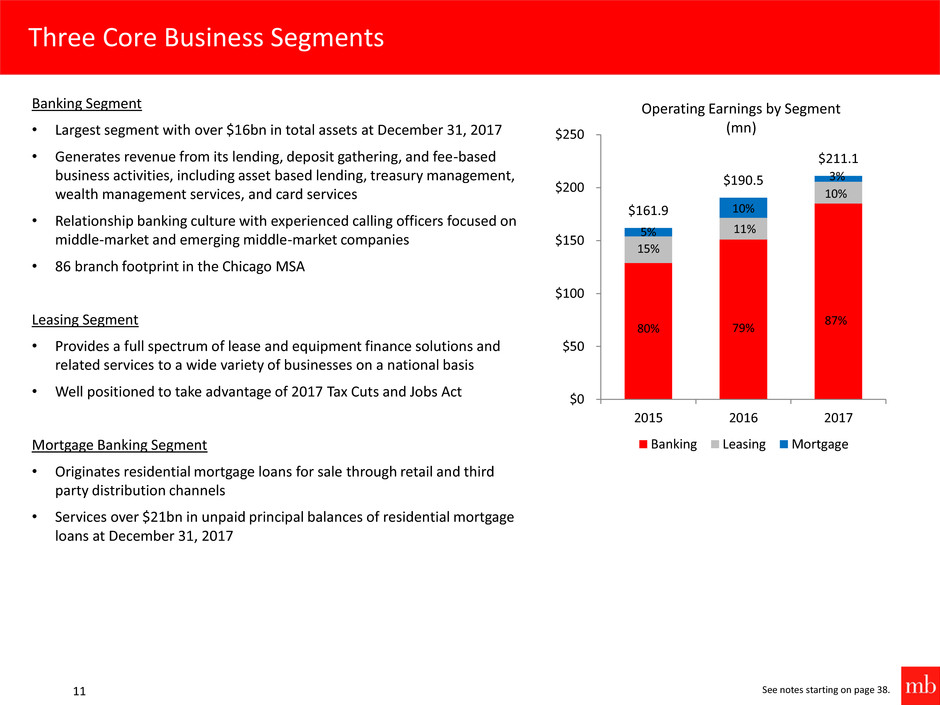

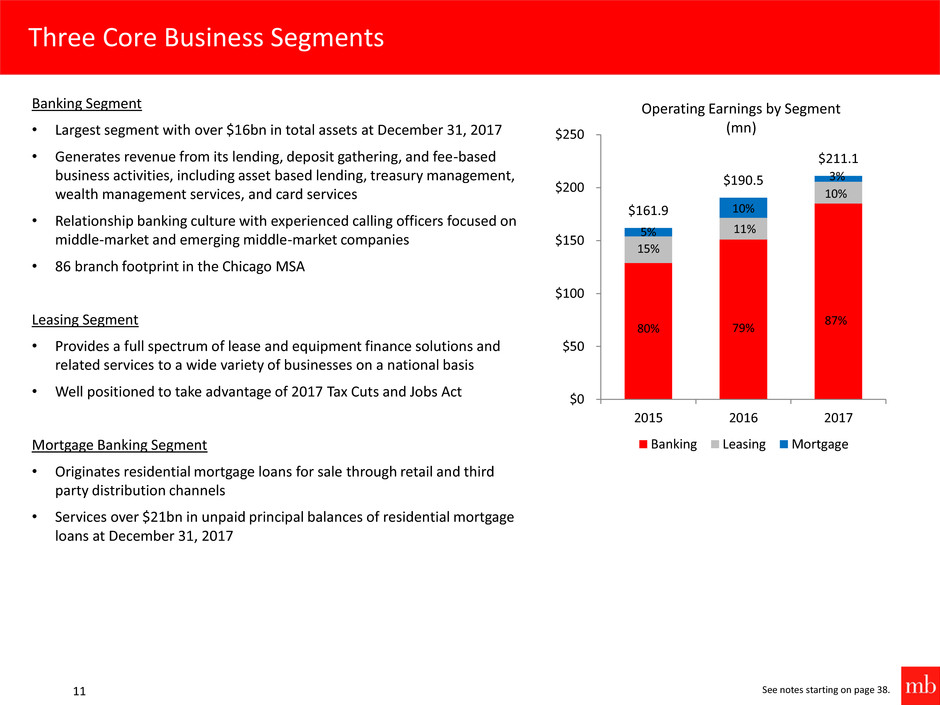

Three Core Business Segments 11 Banking Segment • Largest segment with over $16bn in total assets at December 31, 2017 • Generates revenue from its lending, deposit gathering, and fee-based business activities, including asset based lending, treasury management, wealth management services, and card services • Relationship banking culture with experienced calling officers focused on middle-market and emerging middle-market companies • 86 branch footprint in the Chicago MSA Leasing Segment • Provides a full spectrum of lease and equipment finance solutions and related services to a wide variety of businesses on a national basis • Well positioned to take advantage of 2017 Tax Cuts and Jobs Act Mortgage Banking Segment • Originates residential mortgage loans for sale through retail and third party distribution channels • Services over $21bn in unpaid principal balances of residential mortgage loans at December 31, 2017 See notes starting on page 38. $161.9 $190.5 $211.1 80% 79% 87% 15% 11% 10% 5% 10% 3% 0% 20% 40% 60% 80% 100%$0 $50 $100 $150 $200 $250 2015 2016 2017 Operating Earnings by Segment (mn) Banking Leasing Mortgage

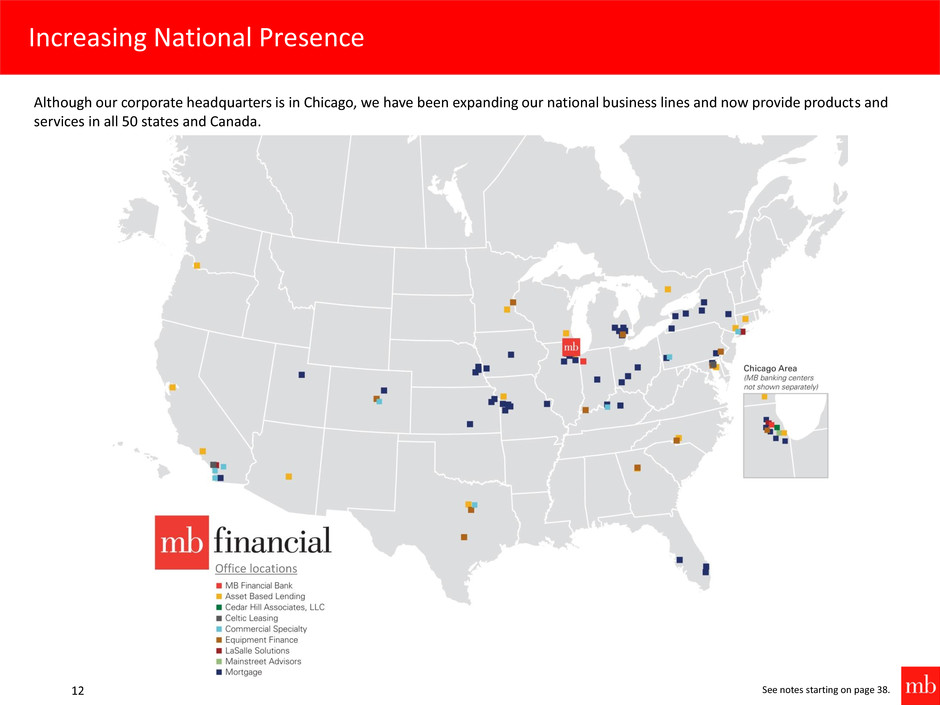

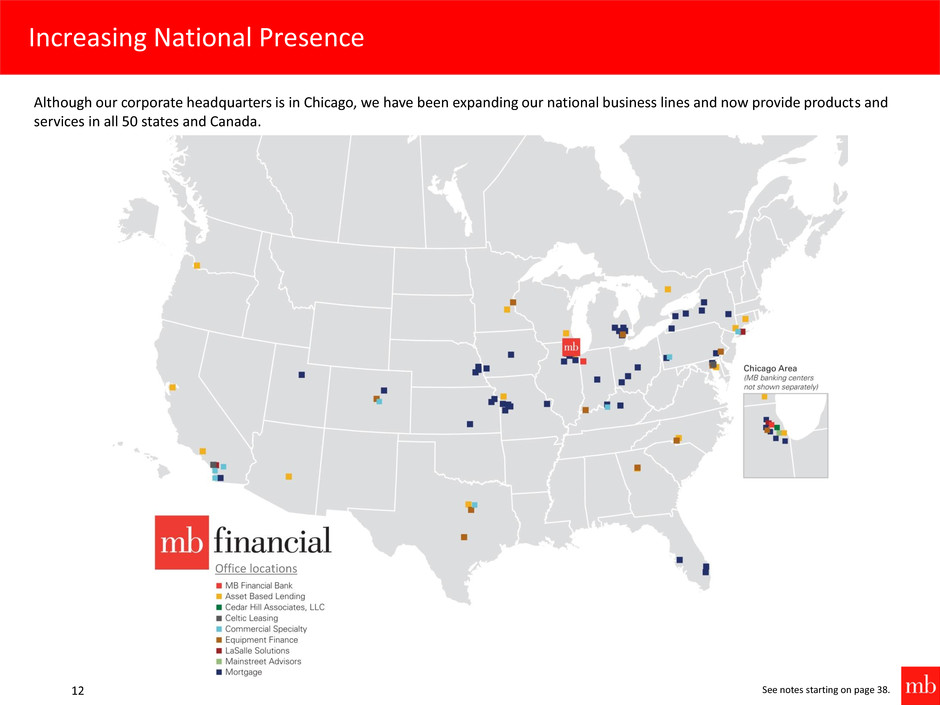

Increasing National Presence 12 See notes starting on page 38. Although our corporate headquarters is in Chicago, we have been expanding our national business lines and now provide products and services in all 50 states and Canada. Office locations

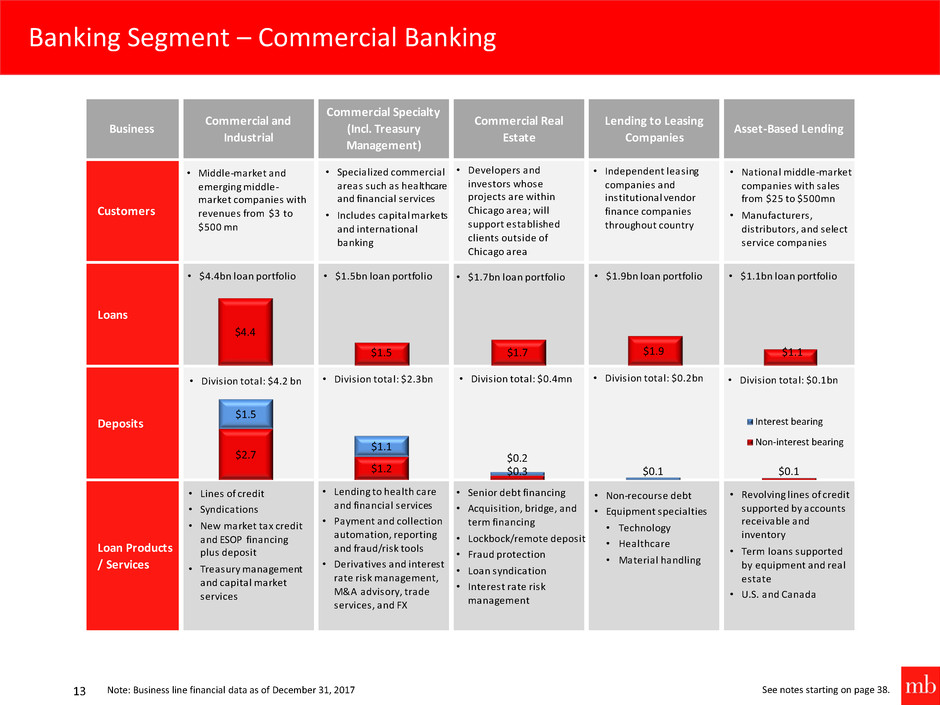

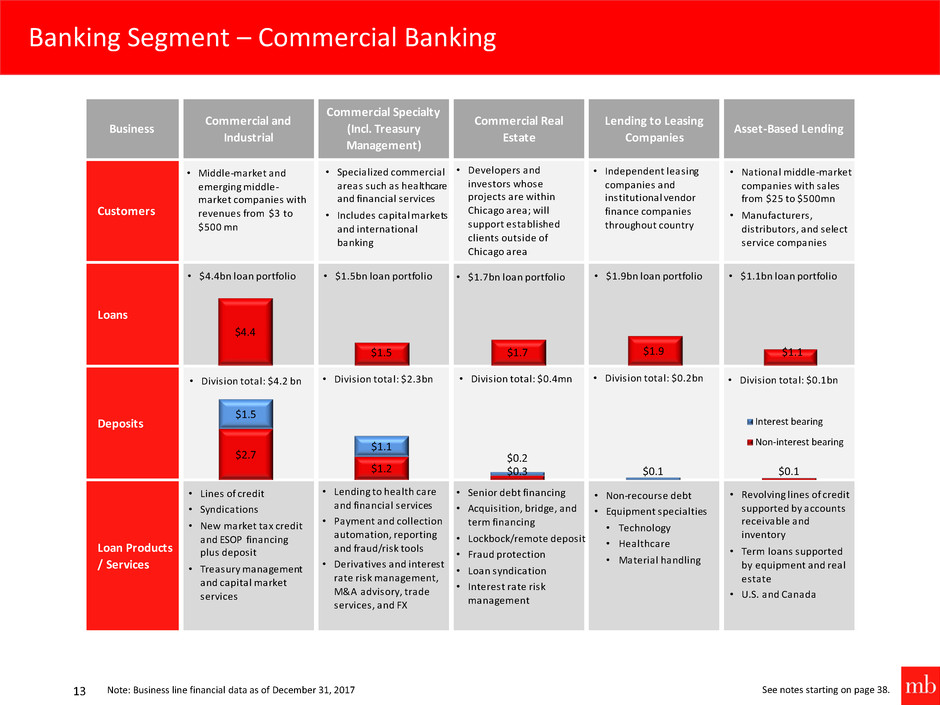

Banking Segment – Commercial Banking 13 See notes starting on page 38. Note: Business line financial data as of December 31, 2017 Business Commercial and Industrial Commercial Specialty (Incl. Treasury Management) Commercial Real Estate Lending to Leasing Companies Asset-Based Lending Customers Loans Deposits Loan Products / Services • $4.4bn loan portfolio • Lines of credit • Syndications • New market tax credit and ESOP financing plus deposit • Treasury management and capital market services • Division total: $4.2 bn • Middle-market and emerging middle- market companies with revenues from $3 to $500 mn • Developers and investors whose projects are within Chicago area; will support established clients outside of Chicago area • Senior debt financing • Acquisition, bridge, and term financing • Lockbock/remote deposit • Fraud protection • Loan syndication • Interest rate risk management • Division total: $0.4mn • $1.7bn loan portfolio • Division total: $0.1bn • Revolving lines of credit supported by accounts receivable and inventory • Term loans supported by equipment and real estate • U.S. and Canada • Lending to health care and financial services • Payment and collection automation, reporting and fraud/risk tools • Derivatives and interest rate risk management, M&A advisory, trade services, and FX • Division total: $2.3bn • $1.5bn loan portfolio • $1.1bn loan portfolio • Specialized commercial areas such as healthcare and financial services • Includes capital markets and international banking • National middle-market companies with sales from $25 to $500mn • Manufacturers, distributors, and select service companies • Independent leasing companies and institutional vendor finance companies throughout country • $1.9bn loan portfolio • Division total: $0.2bn • Non-recourse debt • Equipment specialties • Technology • Healthcare • Material handling $4.4 $1.5 $1.7 $1.9 $1.1 $2.7 $1.2 $0.3 $0.1 $1.5 $1.1 $0.2 $0.1 Interest bearing Non-interest bearing

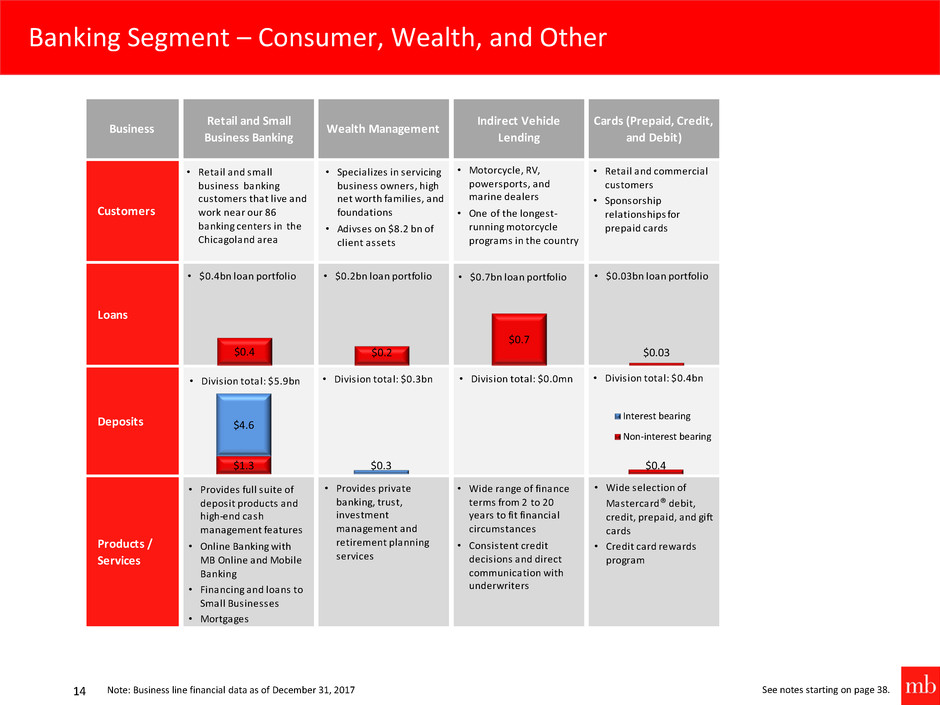

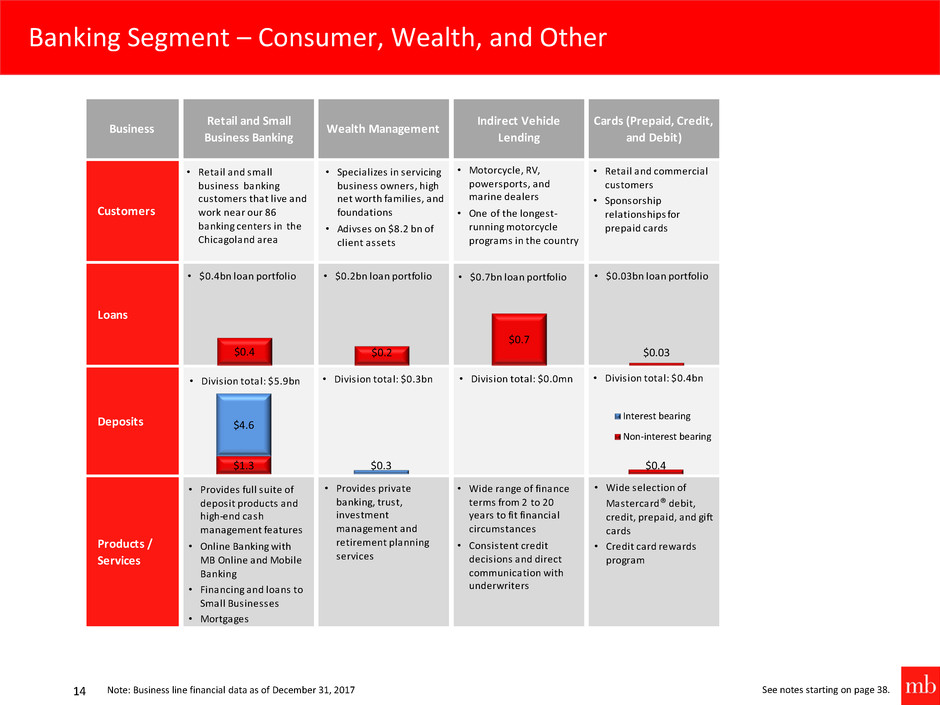

Banking Segment – Consumer, Wealth, and Other 14 See notes starting on page 38. Note: Business line financial data as of December 31, 2017 Business Retail and Small Business Banking Wealth Management Indirect Vehicle Lending Cards (Prepaid, Credit, and Debit) Customers Loans Deposits Products / Services • $0.4bn loan portfolio • Provides full suite of deposit products and high-end cash management features • Online Banking with MB Online and Mobile Banking • Financing and loans to Small Businesses • Mortgages • Division total: $5.9bn • Retail and small business banking customers that live and work near our 86 banking centers in the Chicagoland area • Motorcycle, RV, powersports, and marine dealers • One of the longest- running motorcycle programs in the country • Wide range of finance terms from 2 to 20 years to fit financial circumstances • Consistent credit decisions and direct communication with underwriters • Division total: $0.0mn • $0.7bn loan portfolio • Division total: $0.3bn • $0.2bn loan portfolio • Specializes in servicing business owners, high net worth families, and foundations • Adivses on $8.2 bn of client assets • Retail and commercial customers • Sponsorship relationships for prepaid cards • $0.03bn loan portfolio • Division total: $0.4bn • Wide selection of Mastercard® debit, credit, prepaid, and gift cards • Credit card rewards program • Provides private banking, trust, investment management and retirement planning services $0.4 $0.2 $0.7 $0.03 $1.3 $0.4 $4.6 $0.3 Interest bearing Non-interest bearing

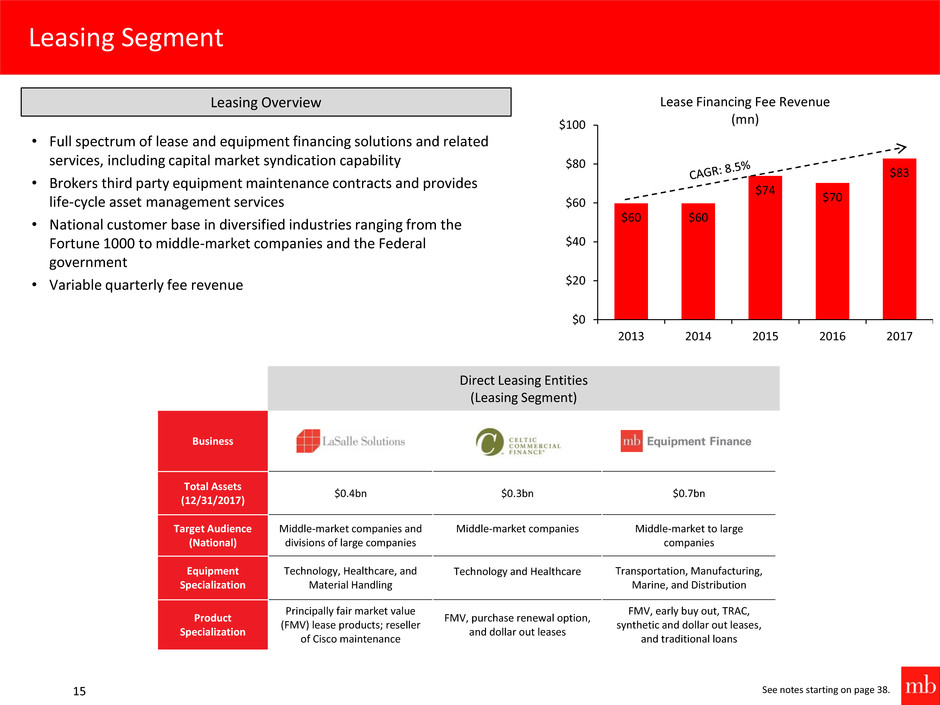

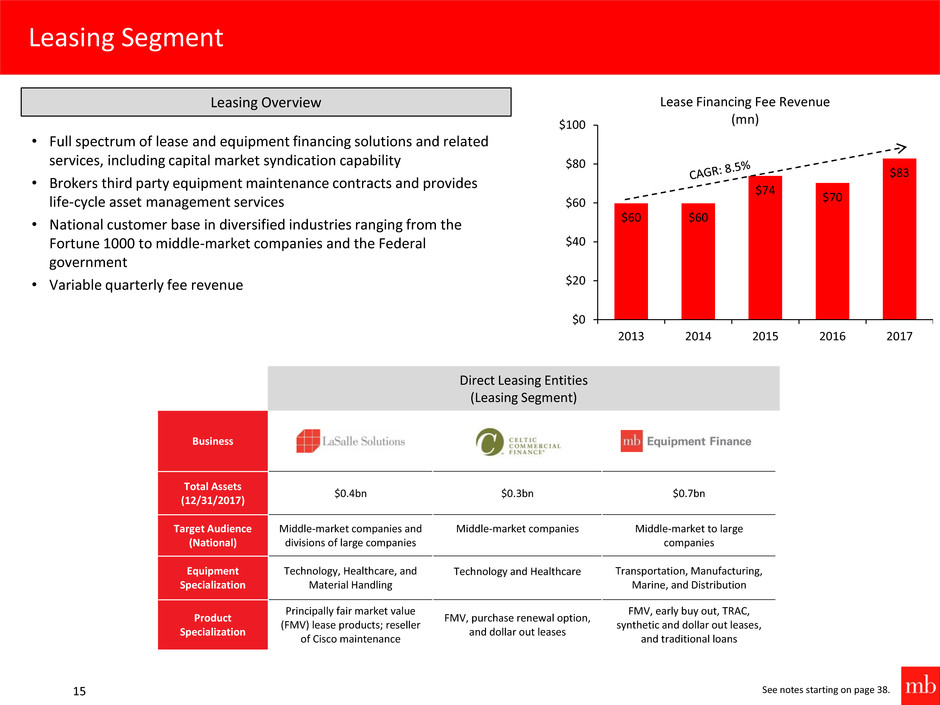

Leasing Segment 15 Business Total Assets (12/31/2017) $0.4bn $0.3bn $0.7bn Target Audience (National) Middle-market companies and divisions of large companies Middle-market companies Middle-market to large companies Equipment Specialization Technology, Healthcare, and Material Handling Technology and Healthcare Transportation, Manufacturing, Marine, and Distribution Product Specialization Principally fair market value (FMV) lease products; reseller of Cisco maintenance FMV, purchase renewal option, and dollar out leases FMV, early buy out, TRAC, synthetic and dollar out leases, and traditional loans Direct Leasing Entities (Leasing Segment) See notes starting on page 38. $60 $60 $74 $70 $83 $0 $20 $40 $60 $80 $100 2013 2014 2015 2016 2017 Lease Financing Fee Revenue (mn) Leasing Overview • Full spectrum of lease and equipment financing solutions and related services, including capital market syndication capability • Brokers third party equipment maintenance contracts and provides life-cycle asset management services • National customer base in diversified industries ranging from the Fortune 1000 to middle-market companies and the Federal government • Variable quarterly fee revenue

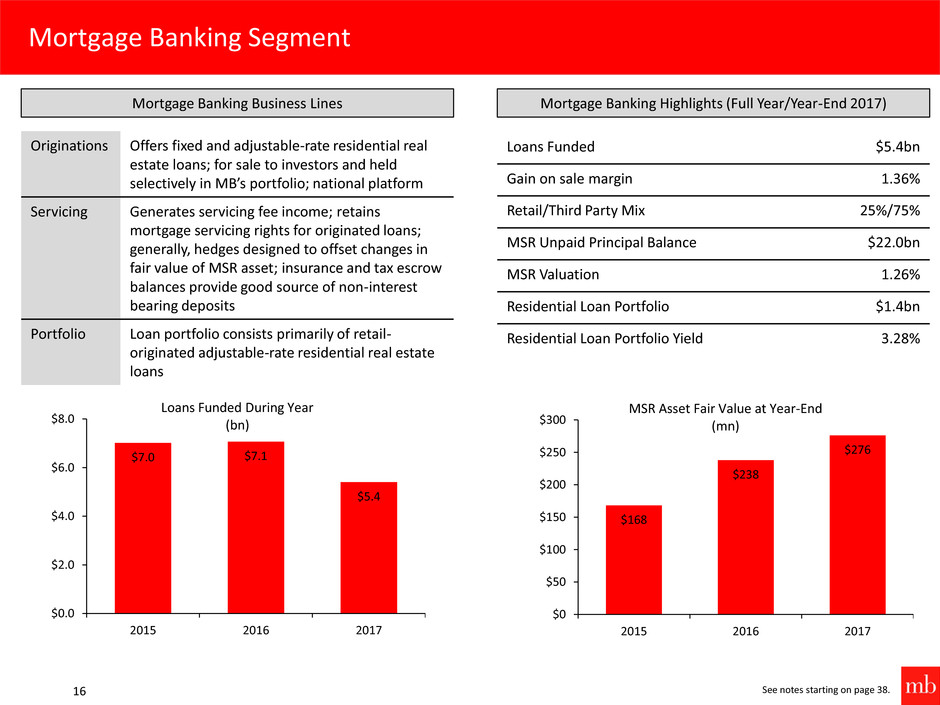

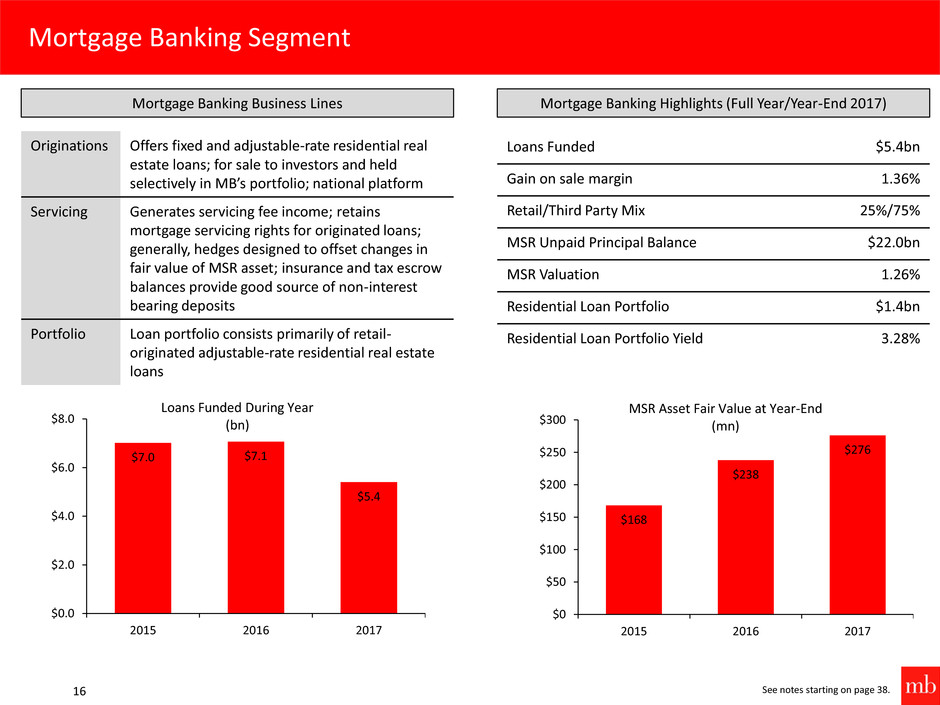

Mortgage Banking Segment 16 See notes starting on page 38. Loans Funded $5.4bn Gain on sale margin 1.36% Retail/Third Party Mix 25%/75% MSR Unpaid Principal Balance $22.0bn MSR Valuation 1.26% Residential Loan Portfolio $1.4bn Residential Loan Portfolio Yield 3.28% Mortgage Banking Highlights (Full Year/Year-End 2017) Mortgage Banking Business Lines Originations Offers fixed and adjustable-rate residential real estate loans; for sale to investors and held selectively in MB’s portfolio; national platform Servicing Generates servicing fee income; retains mortgage servicing rights for originated loans; generally, hedges designed to offset changes in fair value of MSR asset; insurance and tax escrow balances provide good source of non-interest bearing deposits Portfolio Loan portfolio consists primarily of retail- originated adjustable-rate residential real estate loans $7.0 $7.1 $5.4 $0.0 $2.0 $4.0 $6.0 $8.0 2015 2016 2017 Th o u sa n d s Loans Funded During Year (bn) $168 $238 $276 $0 $50 $100 $150 $200 $250 $300 2015 2016 2017 MSR Asset Fair Value at Year-End (mn)

17 Company Strategic Priorities

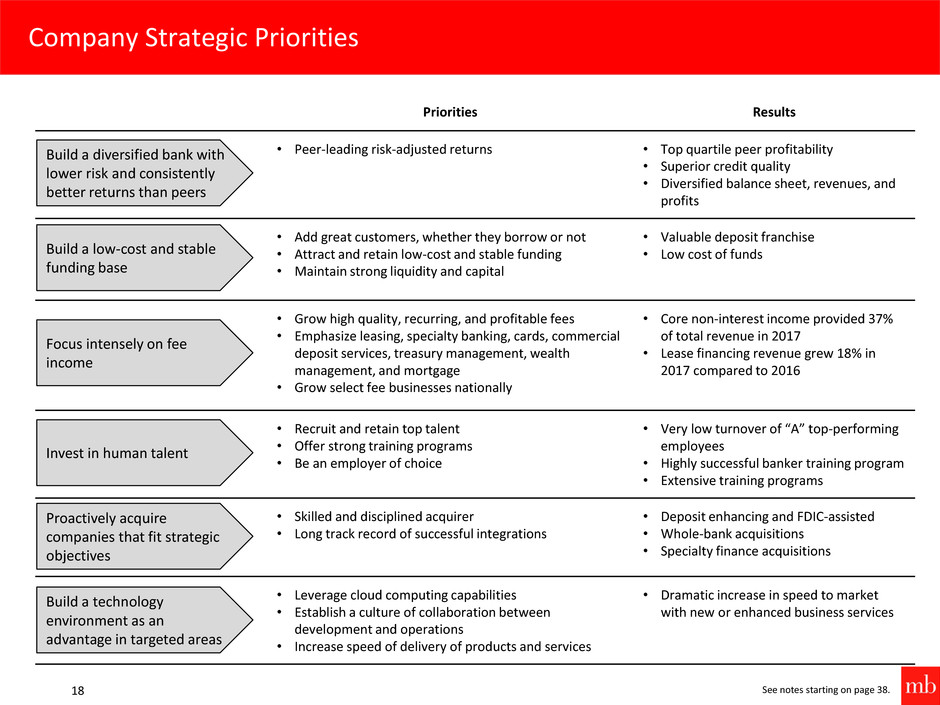

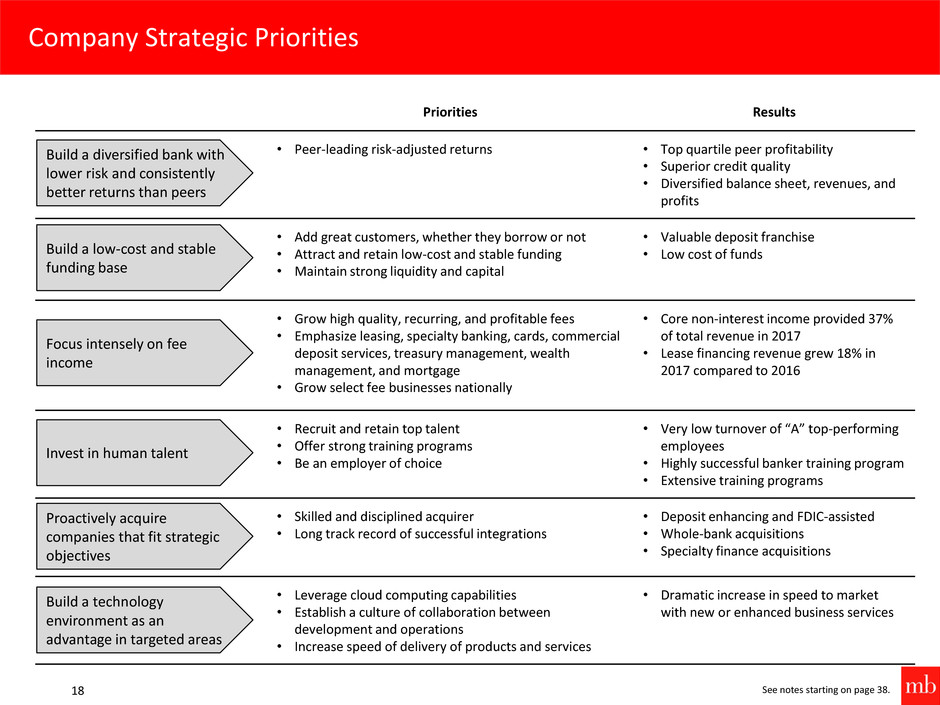

Company Strategic Priorities 18 See notes starting on page 38. Priorities Results • Peer-leading risk-adjusted returns • Top quartile peer profitability • Superior credit quality • Diversified balance sheet, revenues, and profits • Add great customers, whether they borrow or not • Attract and retain low-cost and stable funding • Maintain strong liquidity and capital • Valuable deposit franchise • Low cost of funds • Grow high quality, recurring, and profitable fees • Emphasize leasing, specialty banking, cards, commercial deposit services, treasury management, wealth management, and mortgage • Grow select fee businesses nationally • Core non-interest income provided 37% of total revenue in 2017 • Lease financing revenue grew 18% in 2017 compared to 2016 • Recruit and retain top talent • Offer strong training programs • Be an employer of choice • Very low turnover of “A” top-performing employees • Highly successful banker training program • Extensive training programs • Skilled and disciplined acquirer • Long track record of successful integrations • Deposit enhancing and FDIC-assisted • Whole-bank acquisitions • Specialty finance acquisitions • Leverage cloud computing capabilities • Establish a culture of collaboration between development and operations • Increase speed of delivery of products and services • Dramatic increase in speed to market with new or enhanced business services Build a diversified bank with lower risk and consistently better returns than peers Build a low-cost and stable funding base Focus intensely on fee income Invest in human talent Proactively acquire companies that fit strategic objectives Build a technology environment as an advantage in targeted areas

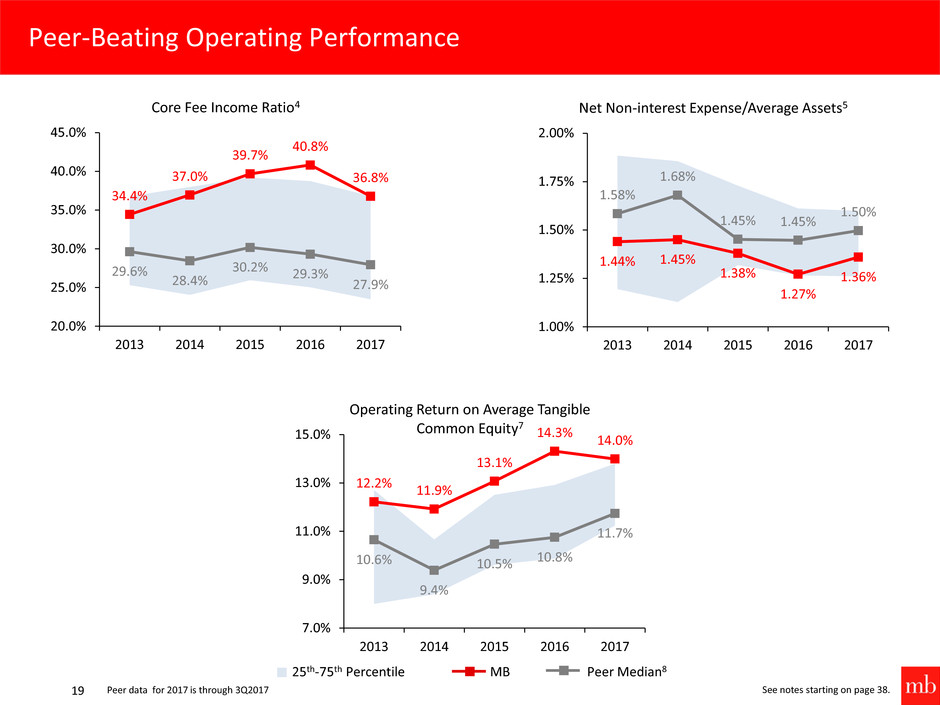

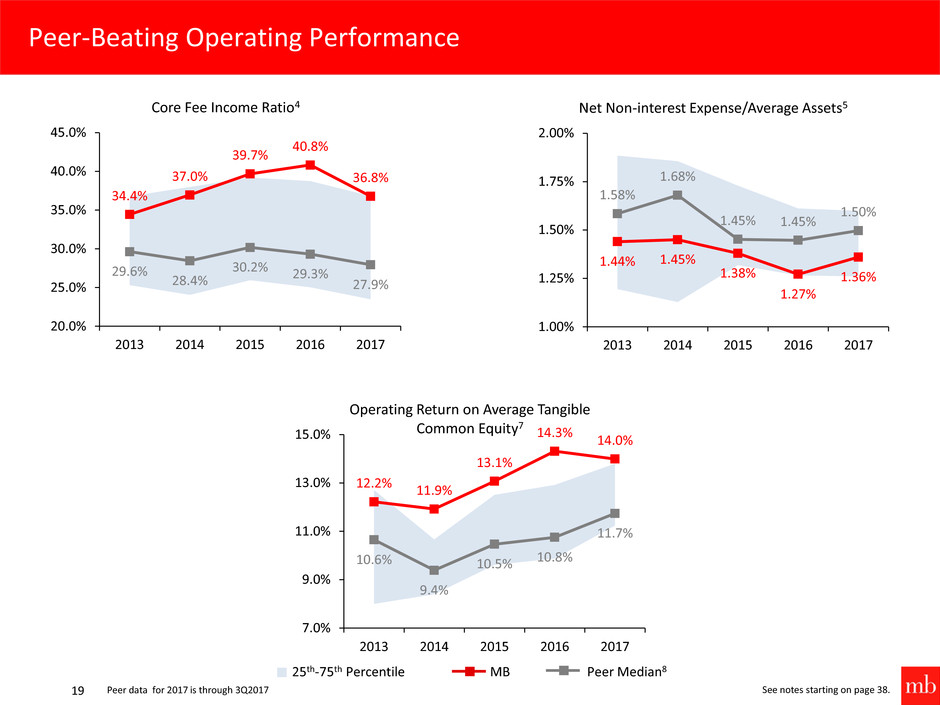

25th-75th Percentile MB Peer Median8 Peer-Beating Operating Performance 19 See notes starting on page 38. 34.4% 37.0% 39.7% 40.8% 36.8% 29.6% 28.4% 30.2% 29.3% 27.9% 20.0% 25.0% 30.0% 35.0% 40.0% 45.0% 2013 2014 2015 2016 2017 Core Fee Income Ratio4 12.2% 11.9% 13.1% 14.3% 14.0% 10.6% 9.4% 10.5% 10.8% 11.7% 7.0% 9.0% 11.0% 13.0% 15.0% 2013 2014 2015 2016 2017 Operating Return on Average Tangible Common Equity7 1.44% 1.45% 1.38% 1.27% 1.36% 1.58% 1.68% 1.45% 1.45% 1.50% 1.00% 1.25% 1.50% 1.75% 2.00% 2013 2014 2015 2016 2017 Net Non-interest Expense/Average Assets5 Peer data for 2017 is through 3Q2017

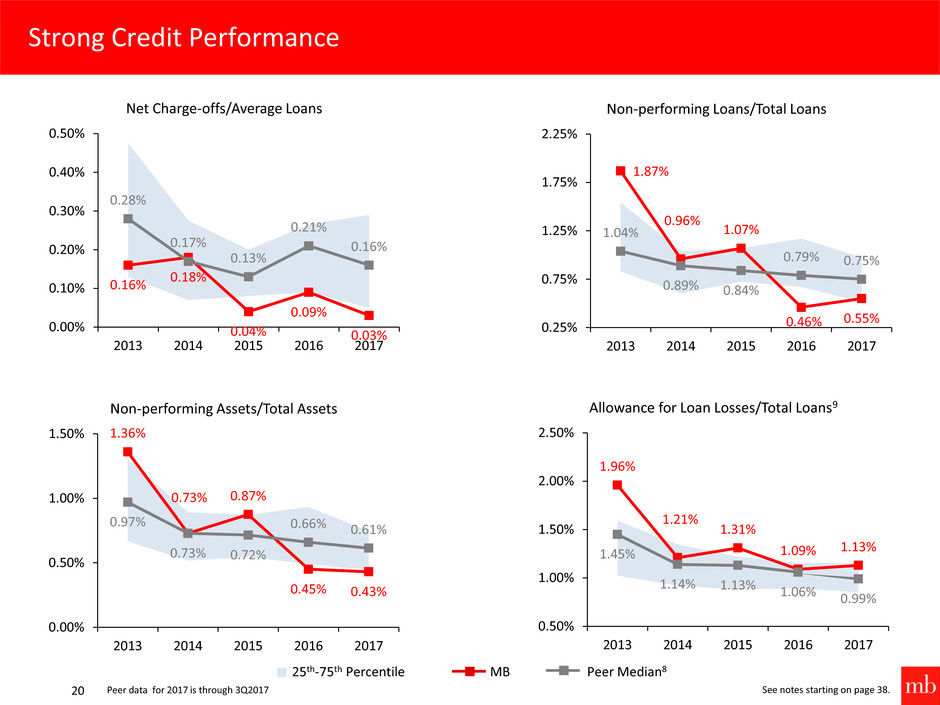

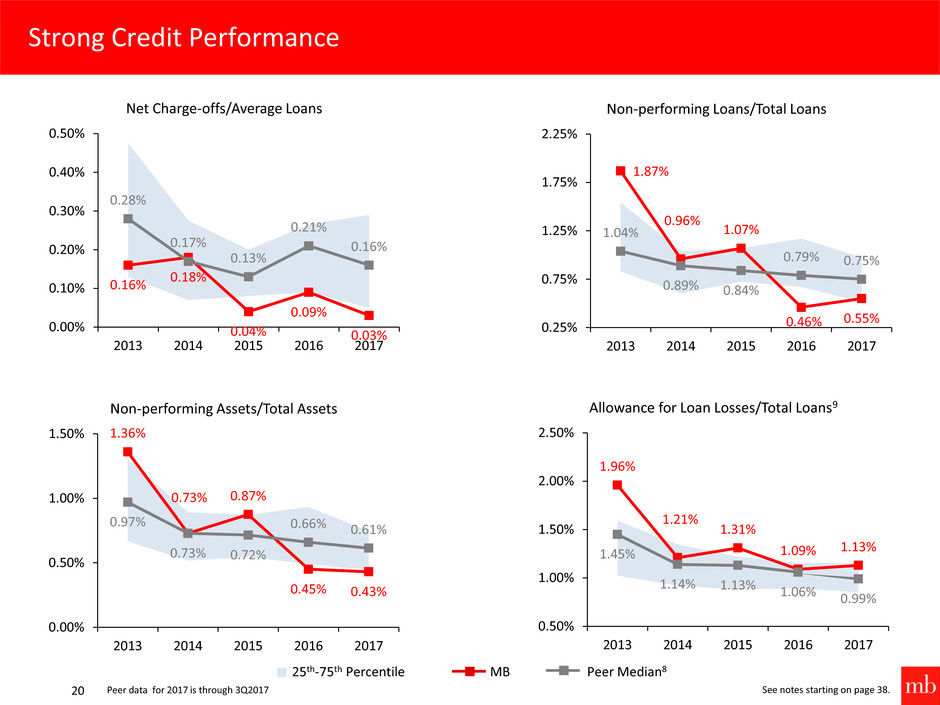

25th-75th Percentile MB Peer Median8 Strong Credit Performance 20 See notes starting on page 38. 1.36% 0.73% 0.87% 0.45% 0.43% 0.97% 0.73% 0.72% 0.66% 0.61% 0.00% 0.50% 1.00% 1.50% 2013 2014 2015 2016 2017 Non-performing Assets/Total Assets 1.87% 0.96% 1.07% 0.46% 0.55% 1.04% 0.89% 0.84% 0.79% 0.75% 0.25% 0.75% 1.25% 1.75% 2.25% 2013 2014 2015 2016 2017 Non-performing Loans/Total Loans 1.96% 1.21% 1.31% 1.09% 1.13% 1.45% 1.14% 1.13% 1.06% 0.99% 0.50% 1.00% 1.50% 2.00% 2.50% 2013 2014 2015 2016 2017 Allowance for Loan Losses/Total Loans9 0.16% 0.18% 0.04% 0.09% 0.03% 0.28% 0.17% 0.13% 0.21% 0.16% 0.00% 0.10% 0.20% 0.30% 0.40% 0.50% 2013 2014 2015 2016 2017 Net Charge-offs/Average Loans Peer data for 2017 is through 3Q2017

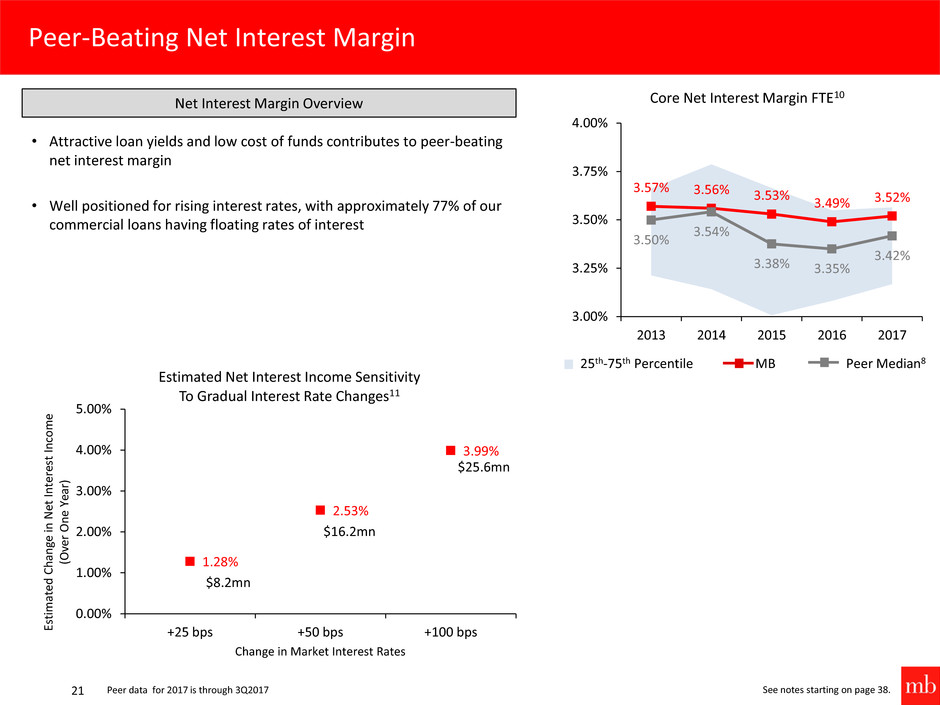

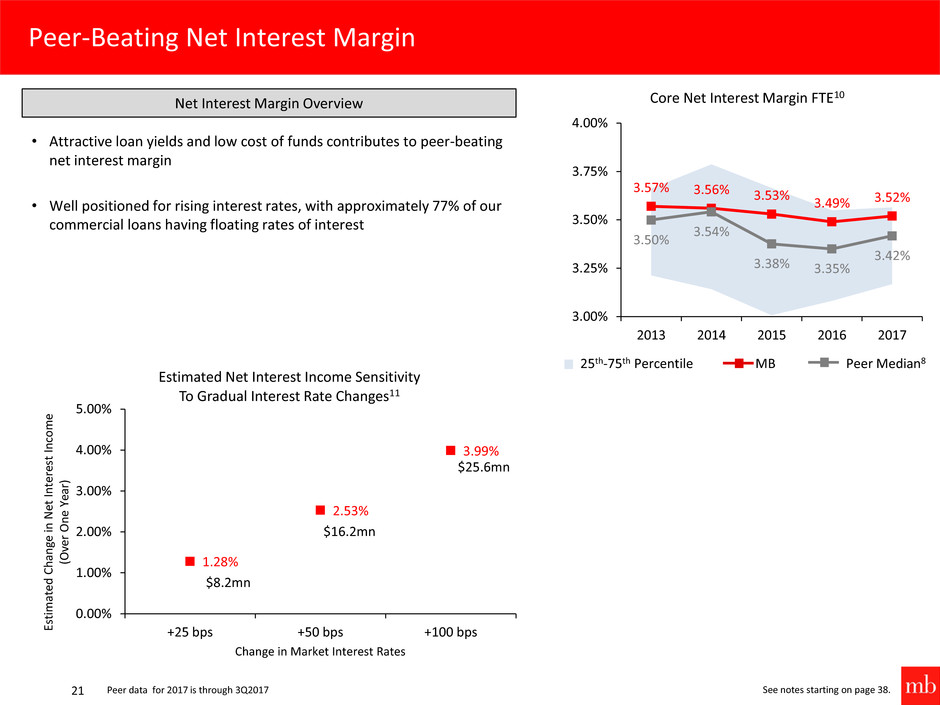

Peer-Beating Net Interest Margin 21 • Attractive loan yields and low cost of funds contributes to peer-beating net interest margin • Well positioned for rising interest rates, with approximately 77% of our commercial loans having floating rates of interest See notes starting on page 38. Net Interest Margin Overview 1.28% 2.53% 3.99% $8.2mn $16.2mn $25.6mn 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% +25 bps +50 bps +100 bpsE stimate d Ch an ge in N et In ter es t In com e (O ve r O n e Ye ar ) Change in Market Interest Rates Estimated Net Interest Income Sensitivity To Gradual Interest Rate Changes11 3.57% 3.56% 3.53% 3.49% 3.52% 3.50% 3.54% 3.38% 3.35% 3.42% 3.00% 3.25% 3.50% 3.75% 4.00% 2013 2014 2015 2016 2017 Core Net Interest Margin FTE10 25th-75th Percentile MB Peer Median8 Peer data for 2017 is through 3Q2017

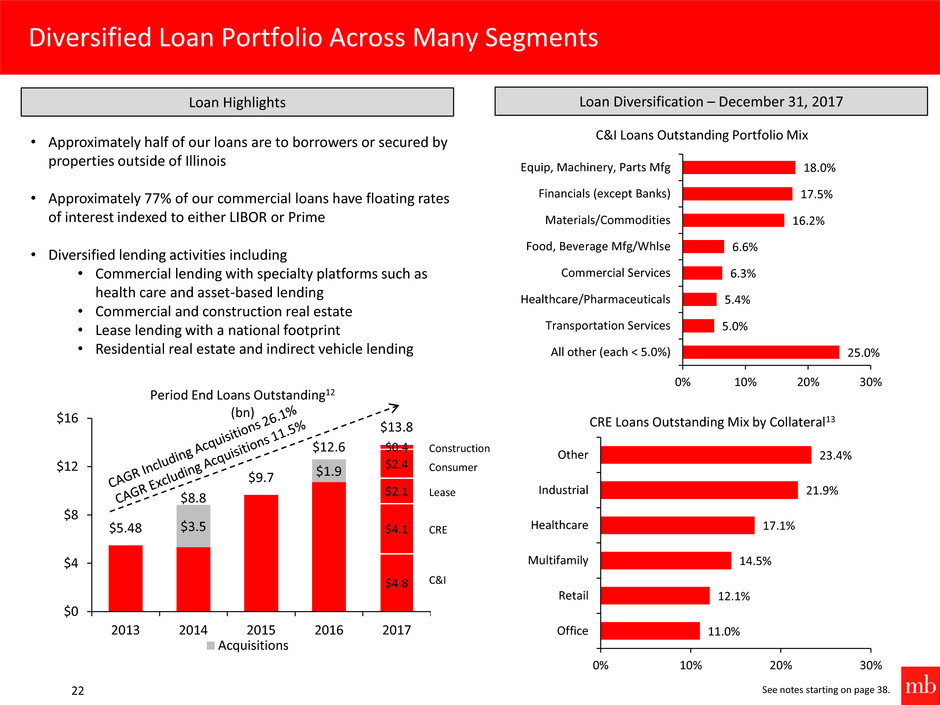

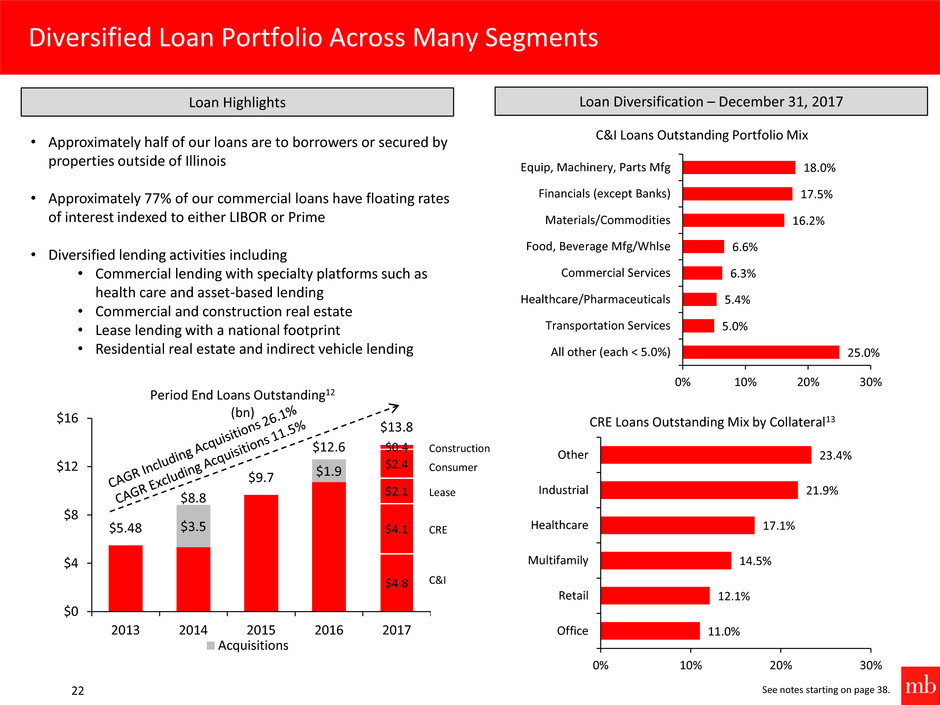

$3.5 $1.9 $4.8 $4.1 $2.1 $2.4 $0.4 $5.48 $8.8 $9.7 $12.6 $13.8 $0 $4 $8 $12 $16 2013 2014 2015 2016 2017 Period End Loans Outstanding12 (bn) Acquisitions Diversified Loan Portfolio Across Many Segments 22 See notes starting on page 38. Loan Highlights Loan Diversification – December 31, 2017 • Approximately half of our loans are to borrowers or secured by properties outside of Illinois • Approximately 77% of our commercial loans have floating rates of interest indexed to either LIBOR or Prime • Diversified lending activities including • Commercial lending with specialty platforms such as health care and asset-based lending • Commercial and construction real estate • Lease lending with a national footprint • Residential real estate and indirect vehicle lending Construction Consumer Lease CRE C&I 25.0% 5.0% 5.4% 6.3% 6.6% 16.2% 17.5% 18.0% 0% 10% 20% 30% All other (each < 5.0%) Transportation Services Healthcare/Pharmaceuticals Commercial Services Food, Beverage Mfg/Whlse Materials/Commodities Financials (except Banks) Equip, Machinery, Parts Mfg C&I Loans Outstanding Portfolio Mix 11.0% 12.1% 14.5% 17.1% 21.9% 23.4% 0% 10% 20% 30% Office Retail Multifamily Healthcare Industrial Other CRE Loans Outstanding Mix by Collateral13

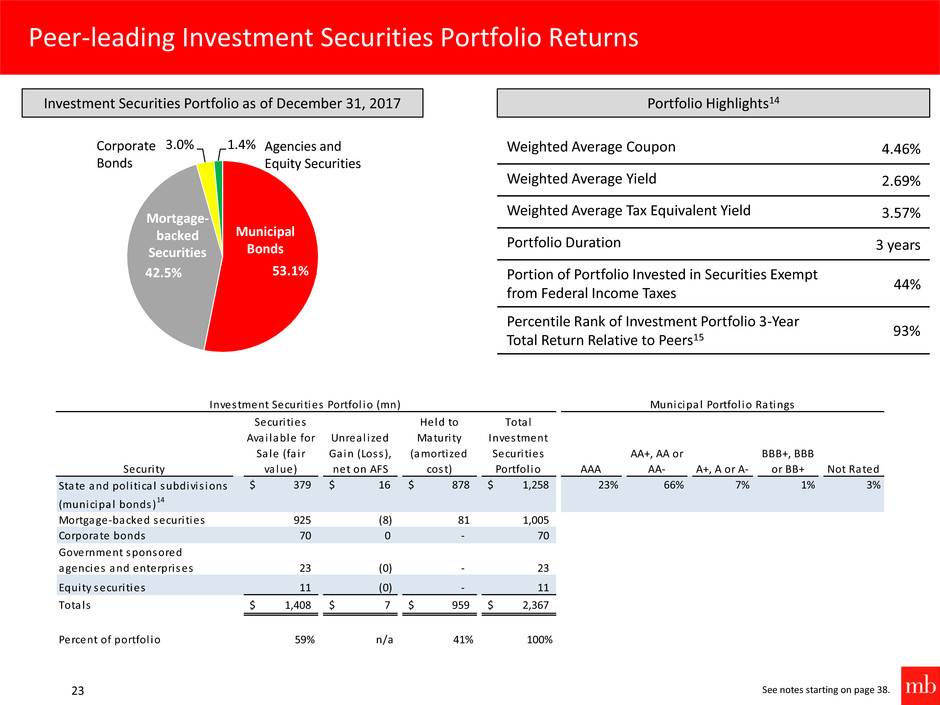

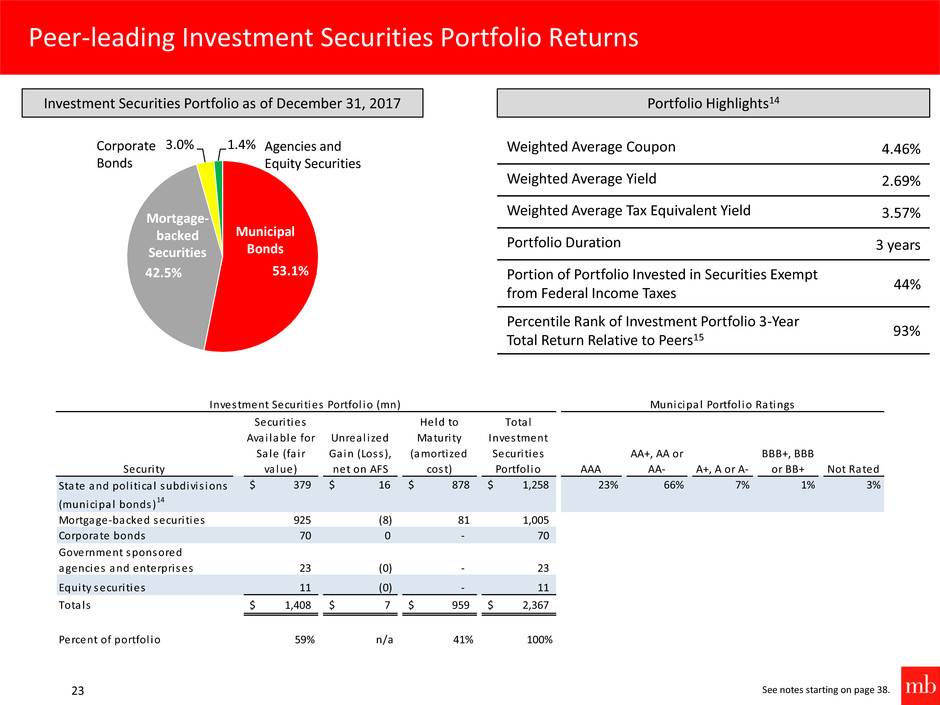

Peer-leading Investment Securities Portfolio Returns 23 See notes starting on page 38. Investment Securities Portfolio as of December 31, 2017 53.1% 42.5% 3.0% 1.4% Mortgage- backed Securities Municipal Bonds Corporate Bonds Agencies and Equity Securities Weighted Average Coupon 4.46% Weighted Average Yield 2.69% Weighted Average Tax Equivalent Yield 3.57% Portfolio Duration 3 years Portion of Portfolio Invested in Securities Exempt from Federal Income Taxes 44% Percentile Rank of Investment Portfolio 3-Year Total Return Relative to Peers15 93% Portfolio Highlights14 Securi ty Securi ties Avai lable for Sa le (fa i r va lue) Unreal ized Gain (Loss ), net on AFS Securi ties Held to Maturi ty (amortized cost) Total Investment Securi ties Portfol io AAA AA+, AA or AA- A+, A or A- BBB+, BBB or BB+ Not Rated St te and pol i tica l subdivis ions (mu icipal bonds) 14 $ 379 $ 16 $ 878 $ 1,258 23% 66% 7% 1% 3% Mortgage-back d securi ties 925 (8) 81 1,005 Corporate bonds 70 0 - 70 Government sponsored agencies and enterprises 23 (0) - 23 Equity securi ties 11 (0) - 11 Totals $ 1,408 $ 7 $ 959 $ 2,367 Percent of portfol io 59% n/a 41% 100% Municipal Portfol io RatingsInvestment Securi ties Portfol io (mn)

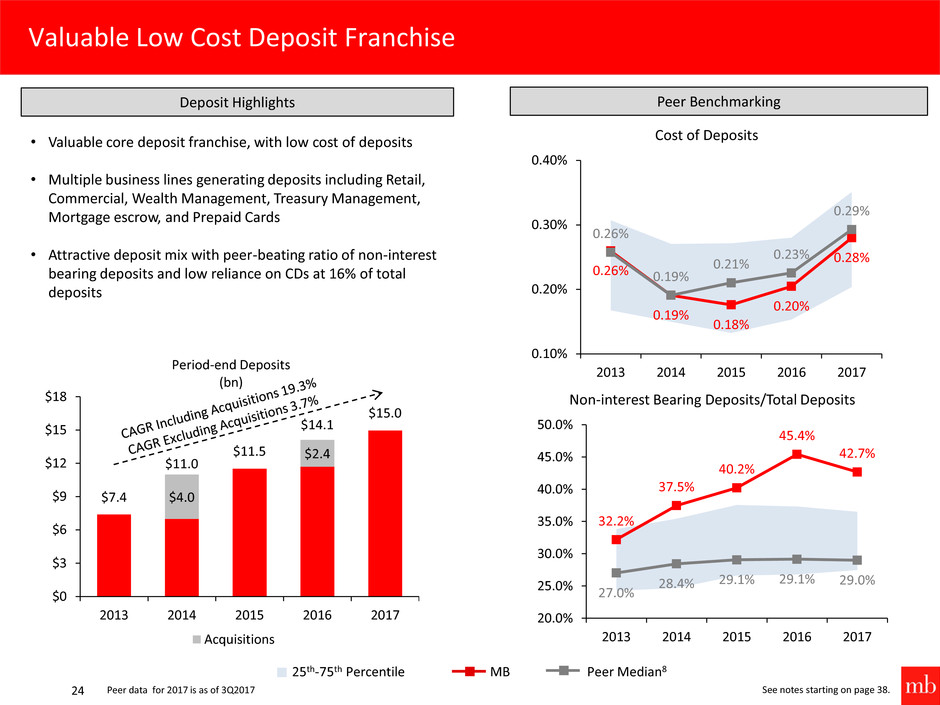

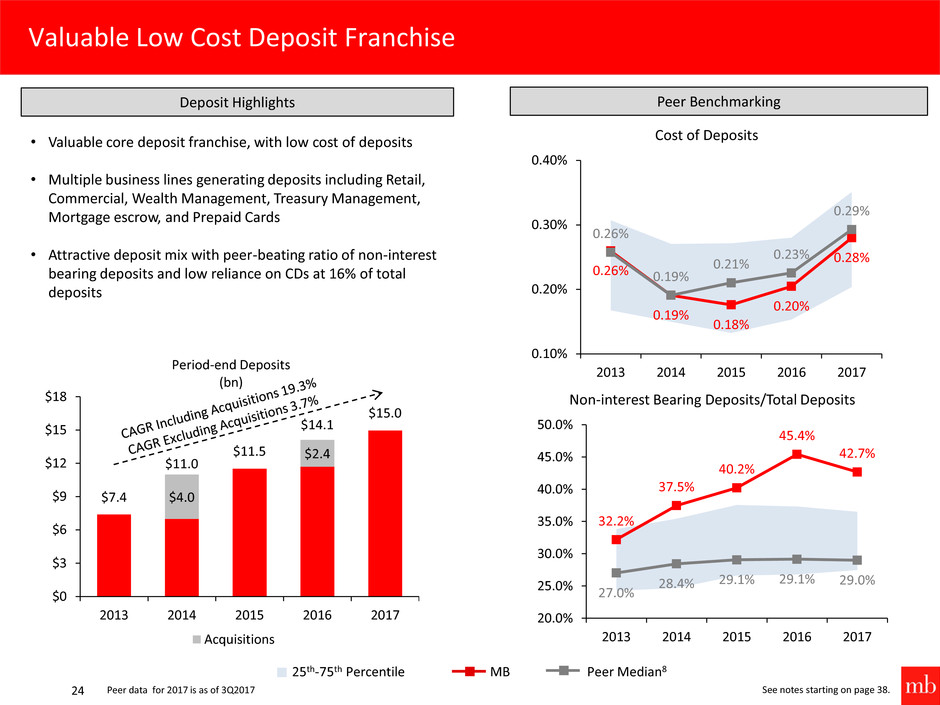

Valuable Low Cost Deposit Franchise 24 See notes starting on page 38. $4.0 $2.4 $7.4 $11.0 $11.5 $14.1 $15.0 $0 $3 $6 $9 $12 $15 $18 2013 2014 2015 2016 2017 Period-end Deposits (bn) Acquisitions Deposit Highlights Peer Benchmarking • Valuable core deposit franchise, with low cost of deposits • Multiple business lines generating deposits including Retail, Commercial, Wealth Management, Treasury Management, Mortgage escrow, and Prepaid Cards • Attractive deposit mix with peer-beating ratio of non-interest bearing deposits and low reliance on CDs at 16% of total deposits 0.26% 0.19% 0.18% 0.20% 0.28% 0.26% 0.19% 0.21% 0.23% 0.29% 0.10% 0.20% 0.30% 0.40% 2013 2014 2015 2016 2017 Cost of Deposits 32.2% 37.5% 40.2% 45.4% 42.7% 27.0% 28.4% 29.1% 29.1% 29.0% 20.0% 25.0% 30.0% 35.0% 40.0% 45.0% 50.0% 2013 2014 2015 2016 2017 Non-interest Bearing Deposits/Total Deposits 25th-75th Percentile MB Peer Median8 Peer data for 2017 is as of 3Q2017

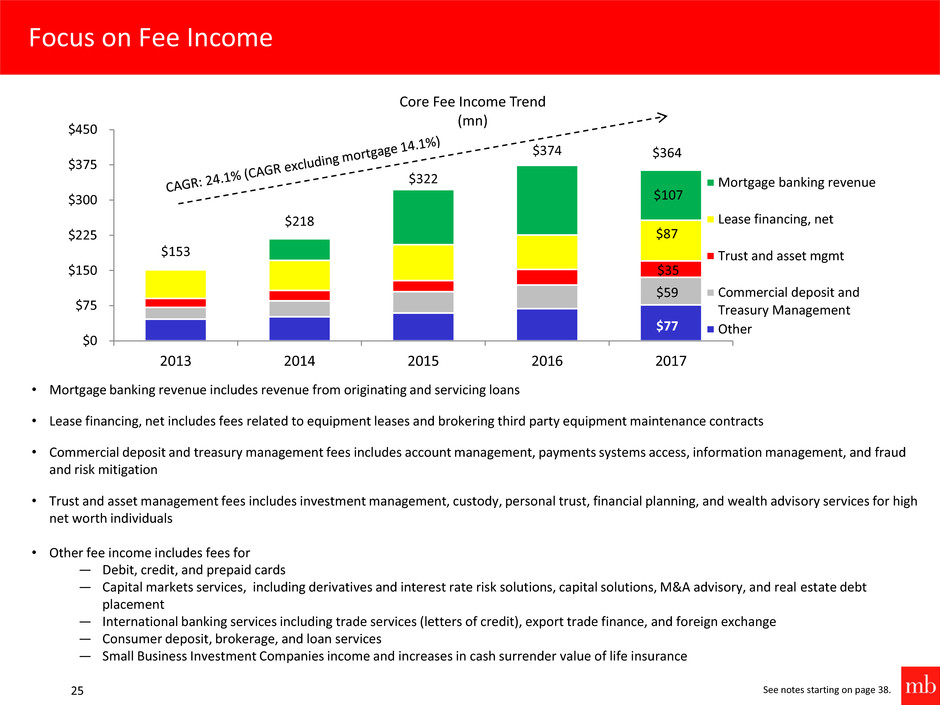

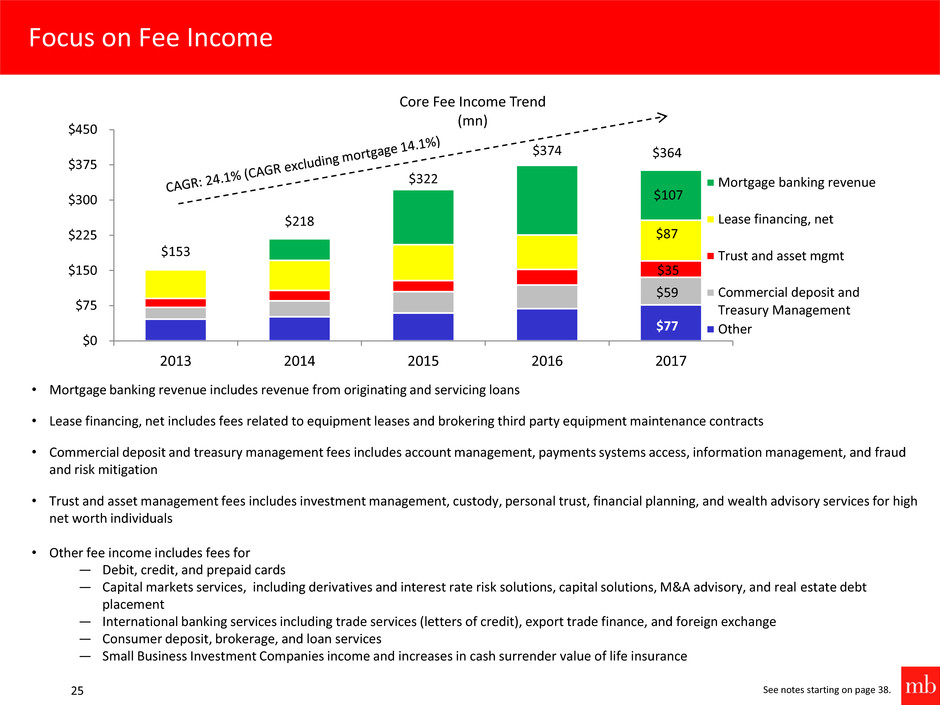

Focus on Fee Income 25 • Mortgage banking revenue includes revenue from originating and servicing loans • Lease financing, net includes fees related to equipment leases and brokering third party equipment maintenance contracts • Commercial deposit and treasury management fees includes account management, payments systems access, information management, and fraud and risk mitigation • Trust and asset management fees includes investment management, custody, personal trust, financial planning, and wealth advisory services for high net worth individuals • Other fee income includes fees for ― Debit, credit, and prepaid cards ― Capital markets services, including derivatives and interest rate risk solutions, capital solutions, M&A advisory, and real estate debt placement ― International banking services including trade services (letters of credit), export trade finance, and foreign exchange ― Consumer deposit, brokerage, and loan services ― Small Business Investment Companies income and increases in cash surrender value of life insurance See notes starting on page 38. $153 $218 $322 $374 $364 $77 $59 $35 $87 $107 $0 $75 $150 $225 $300 $375 $450 2013 2014 2015 2016 2017 Core Fee Income Trend (mn) Mortgage banking revenue Lease financing, net Trust and asset mgmt Commercial deposit and Treasury Management Other

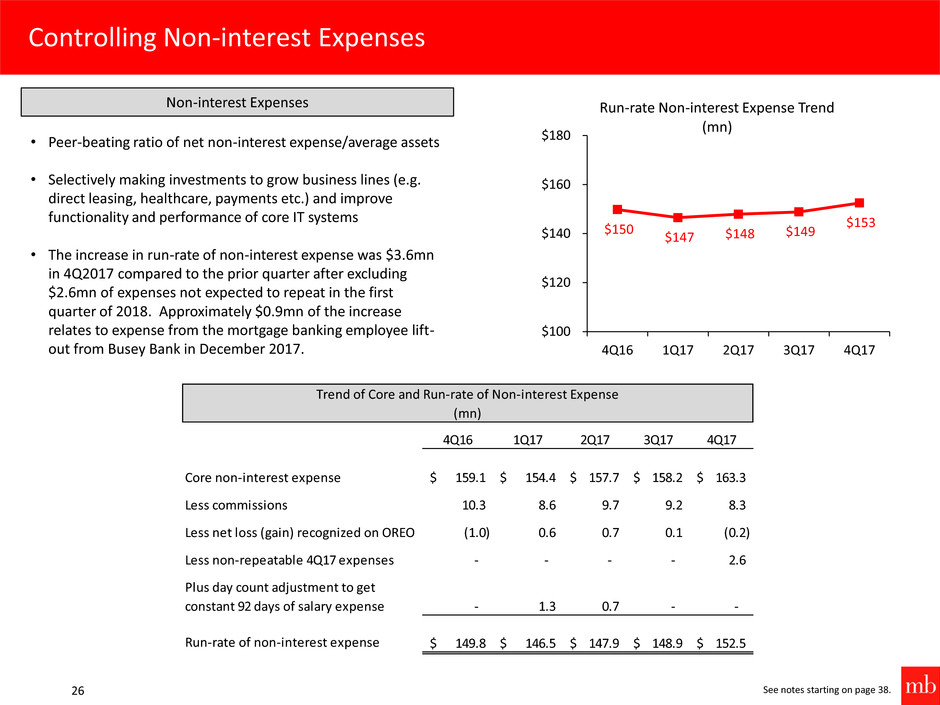

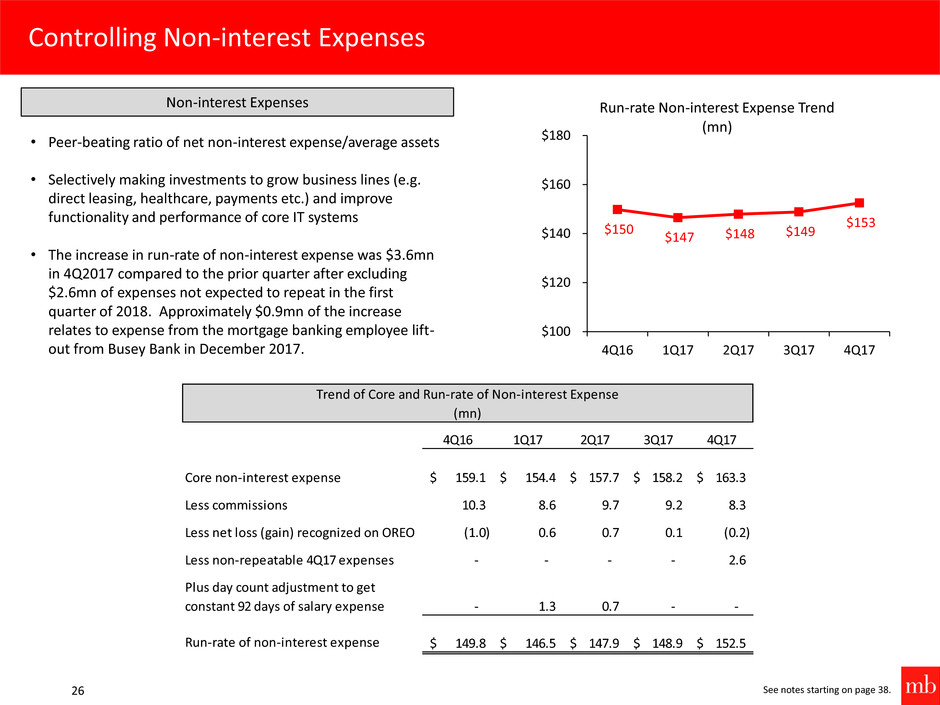

Controlling Non-interest Expenses 26 See notes starting on page 38. 4Q16 1Q17 2Q17 3Q17 4Q17 Core non-interest expense 159.1$ 154.4$ 157.7$ 158.2$ 163.3$ Less commissions 10.3 8.6 9.7 9.2 8.3 Less net loss (gain) recognized on OREO (1.0) 0.6 0.7 0.1 (0.2) Less non-repeatable 4Q17 expenses - - - - 2.6 Plus day count adjustment to get constant 92 days of salary expense - 1.3 0.7 - - Run-rate of non-interest expense 149.8$ 146.5$ 147.9$ 148.9$ 152.5$ Trend of Core and Run-rate of Non-interest Expense (mn) $150 $147 $148 $149 $153 $100 $120 $140 $160 $180 4Q16 1Q17 2Q17 3Q17 4Q17 Run-rate Non-interest Expense Trend (mn) Non-interest Expenses • Peer-beating ratio of net non-interest expense/average assets • Selectively making investments to grow business lines (e.g. direct leasing, healthcare, payments etc.) and improve functionality and performance of core IT systems • The increase in run-rate of non-interest expense was $3.6mn in 4Q2017 compared to the prior quarter after excluding $2.6mn of expenses not expected to repeat in the first quarter of 2018. Approximately $0.9mn of the increase relates to expense from the mortgage banking employee lift- out from Busey Bank in December 2017.

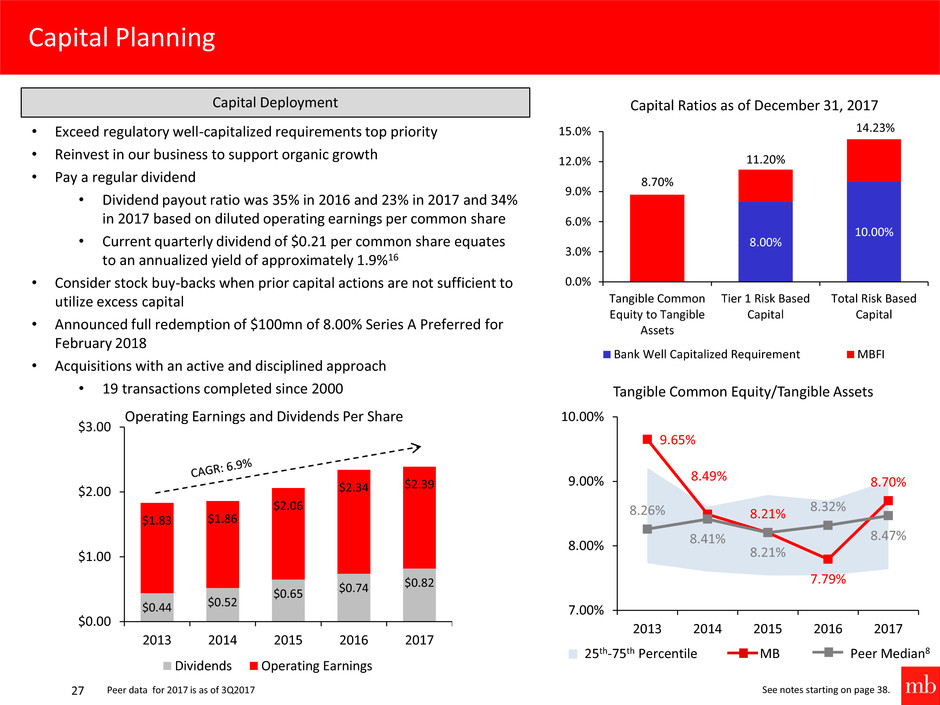

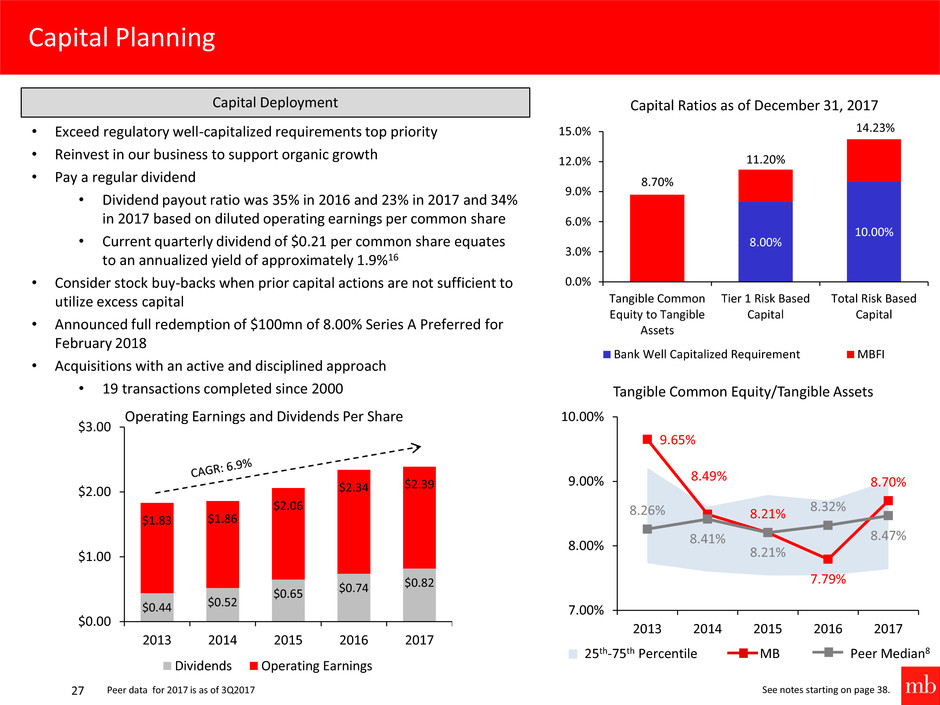

Capital Planning 27 8.00% 10.00% 8.70% 11.20% 14.23% 0.0% 3.0% 6.0% 9.0% 12.0% 15.0% Tangible Common Equity to Tangible Assets Tier 1 Risk Based Capital Total Risk Based Capital Capital Ratios as of December 31, 2017 Bank Well Capitalized Requirement MBFI • Exceed regulatory well-capitalized requirements top priority • Reinvest in our business to support organic growth • Pay a regular dividend • Dividend payout ratio was 35% in 2016 and 23% in 2017 and 34% in 2017 based on diluted operating earnings per common share • Current quarterly dividend of $0.21 per common share equates to an annualized yield of approximately 1.9%16 • Consider stock buy-backs when prior capital actions are not sufficient to utilize excess capital • Announced full redemption of $100mn of 8.00% Series A Preferred for February 2018 • Acquisitions with an active and disciplined approach • 19 transactions completed since 2000 See notes starting on page 38. $0.44 $0.52 $0.65 $0.74 $0.82 $1.83 $1.86 $2.06 $2.34 $2.39 $0.00 $1.00 $2.00 $3.00 2013 2014 2015 2016 2017 Operating Earnings and Dividends Per Share Dividends Operating Earnings Capital Deployment 9.65% 8.49% 8.21% 7.79% 8.70% 8.26% 8.41% 8.21% 8.32% 8.47% 7.00% 8.00% 9.00% 10.00% 2013 2014 2015 2016 2017 Tangible Common Equity/Tangible Assets 25th-75th Percentile MB Peer Median8 Peer data for 2017 is as of 3Q2017

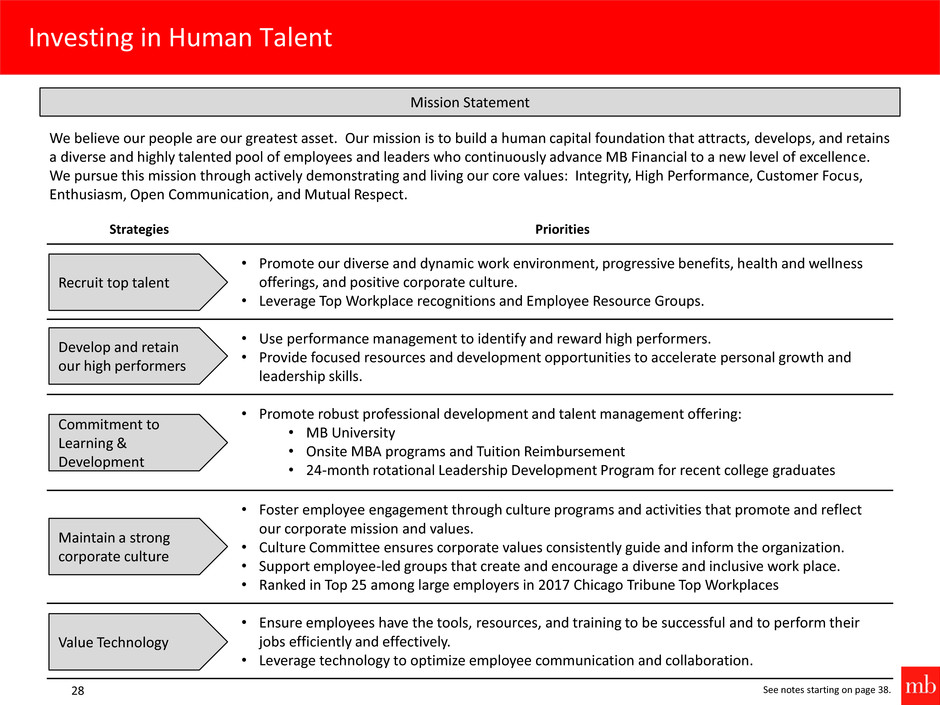

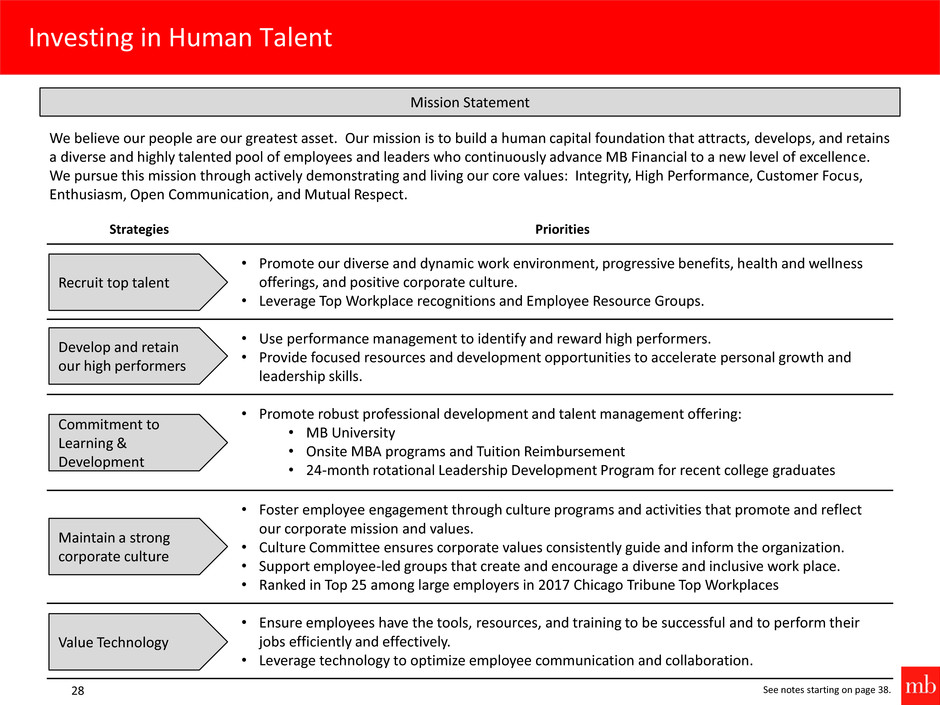

Investing in Human Talent 28 See notes starting on page 38. Strategies Priorities • Promote our diverse and dynamic work environment, progressive benefits, health and wellness offerings, and positive corporate culture. • Leverage Top Workplace recognitions and Employee Resource Groups. • Use performance management to identify and reward high performers. • Provide focused resources and development opportunities to accelerate personal growth and leadership skills. • Promote robust professional development and talent management offering: • MB University • Onsite MBA programs and Tuition Reimbursement • 24-month rotational Leadership Development Program for recent college graduates • Foster employee engagement through culture programs and activities that promote and reflect our corporate mission and values. • Culture Committee ensures corporate values consistently guide and inform the organization. • Support employee-led groups that create and encourage a diverse and inclusive work place. • Ranked in Top 25 among large employers in 2017 Chicago Tribune Top Workplaces • Ensure employees have the tools, resources, and training to be successful and to perform their jobs efficiently and effectively. • Leverage technology to optimize employee communication and collaboration. Recruit top talent Develop and retain our high performers Commitment to Learning & Development Maintain a strong corporate culture Value Technology Mission Statement We believe our people are our greatest asset. Our mission is to build a human capital foundation that attracts, develops, and retains a diverse and highly talented pool of employees and leaders who continuously advance MB Financial to a new level of excellence. We pursue this mission through actively demonstrating and living our core values: Integrity, High Performance, Customer Focus, Enthusiasm, Open Communication, and Mutual Respect.

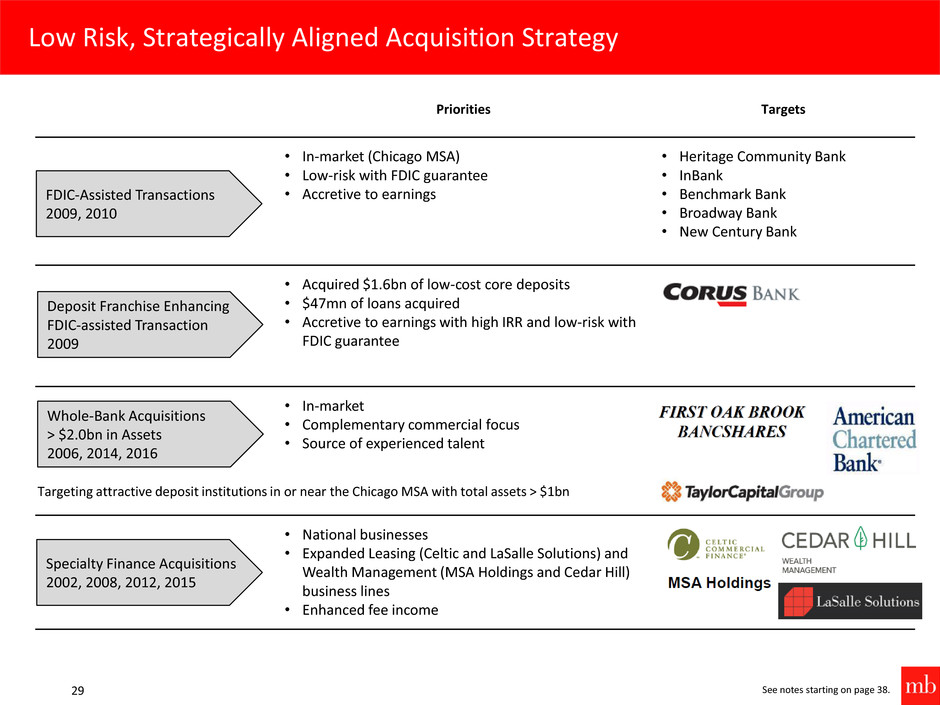

Low Risk, Strategically Aligned Acquisition Strategy 29 See notes starting on page 38. Priorities Targets • In-market (Chicago MSA) • Low-risk with FDIC guarantee • Accretive to earnings • Heritage Community Bank • InBank • Benchmark Bank • Broadway Bank • New Century Bank • Acquired $1.6bn of low-cost core deposits • $47mn of loans acquired • Accretive to earnings with high IRR and low-risk with FDIC guarantee • In-market • Complementary commercial focus • Source of experienced talent • National businesses • Expanded Leasing (Celtic and LaSalle Solutions) and Wealth Management (MSA Holdings and Cedar Hill) business lines • Enhanced fee income FDIC-Assisted Transactions 2009, 2010 Deposit Franchise Enhancing FDIC-assisted Transaction 2009 Whole-Bank Acquisitions > $2.0bn in Assets 2006, 2014, 2016 Specialty Finance Acquisitions 2002, 2008, 2012, 2015 Targeting attractive deposit institutions in or near the Chicago MSA with total assets > $1bn

30 Non-GAAP Disclosure Reconciliations and Footnotes

Non-GAAP Disclosure Reconciliations 31 This presentation contains certain financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (GAAP). These measures include operating earnings, core non-interest income, core non-interest income to revenues (with non-core items excluded from both core non-interest income and revenues), core non-interest expense, non-core non-interest income, and non-core non-interest expense, net interest margin on a fully tax equivalent basis excluding acquisition accounting discount accretion on bank merger loans, and the ratio of net non-interest expense to average assets with net gains and losses on investment securities, net gains and losses on disposal of other assets, recovery of low income housing investment, and increase in market value of assets held in trust for deferred compensation excluded from the non-interest income components of these ratios, prepayment fees on interest bearing liabilities, and branch exit and facilities impairment charges, merger related and repositioning expenses, restructuring severance charges, one-time bonuses, increase in market value of assets held in trust for deferred compensation, and contribution to MB Financial Charitable Foundation excluded from the non-interest expense components of this ratio, with tax equivalent adjustment for tax-exempt interest income and increase in cash surrender value of life insurance, as applicable; ratios of tangible common equity to tangible assets; operating return on average assets, and cash operating return on average tangible common equity. Our management uses these non-GAAP measures, together with the related GAAP measures, in its analysis of our performance and in making business decisions. Management also uses these measures for peer comparisons. Management believes that operating earnings, core and non-core non-interest income, and core and non-core non-interest expense are useful in assessing our core operating performance and in understanding the primary drivers of our non-interest income and non-interest expense when comparing periods. Management believes that operating earnings adjusted for merger related and repositioning expenses is a useful measure because it excludes expenses that can significantly fluctuate from acquisition to acquisition. In addition, management believes that excluding these expenses provides investors and analysts a measure to better understand the Company's primary operations when comparing the periods presented in the earnings release. The tax equivalent adjustment to net interest income, net interest margin, tax-exempt interest income, and increase in cash surrender value of life insurance recognizes the income tax savings when comparing taxable and tax-exempt assets and assumes a 35% tax rate. Management believes that it is a standard practice in the banking industry to present net interest income and net interest margin on a fully tax equivalent basis, and accordingly believes that providing these measures may be useful for peer comparison purposes. For the same reasons, management believes that the tax equivalent adjustments to tax-exempt interest income and increase in cash surrender value of life insurance are useful.

Non-GAAP Disclosure Reconciliations – continued 32 The other measures exclude the acquisition-related goodwill and other intangible assets, net of tax benefit, in determining tangible assets, tangible equity, tangible common equity, and average tangible common equity and exclude other intangible amortization expense, net of tax benefit, in determining net cash flow available to common stockholders. Management believes the presentation of these other financial measures, excluding the impact of such items, provides useful supplemental information that is helpful in understanding our financial results, as they provide a method to assess management’s success in utilizing our tangible capital, as well as our capital strength. Management also believes that providing measures that exclude balances of acquisition-related goodwill and other intangible assets, which are subjective components of valuation, facilitates the comparison of our performance with the performance of our peers. In addition, management believes that these are standard financial measures used in the banking industry to evaluate performance. The non-GAAP disclosures contained herein should not be viewed as substitutes for the results determined to be in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies.

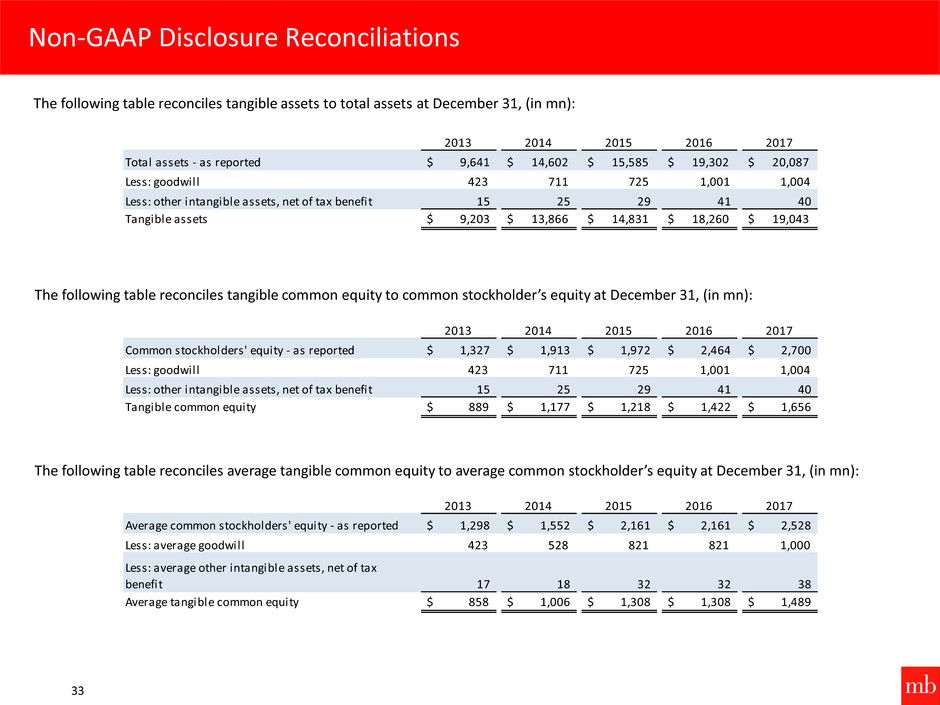

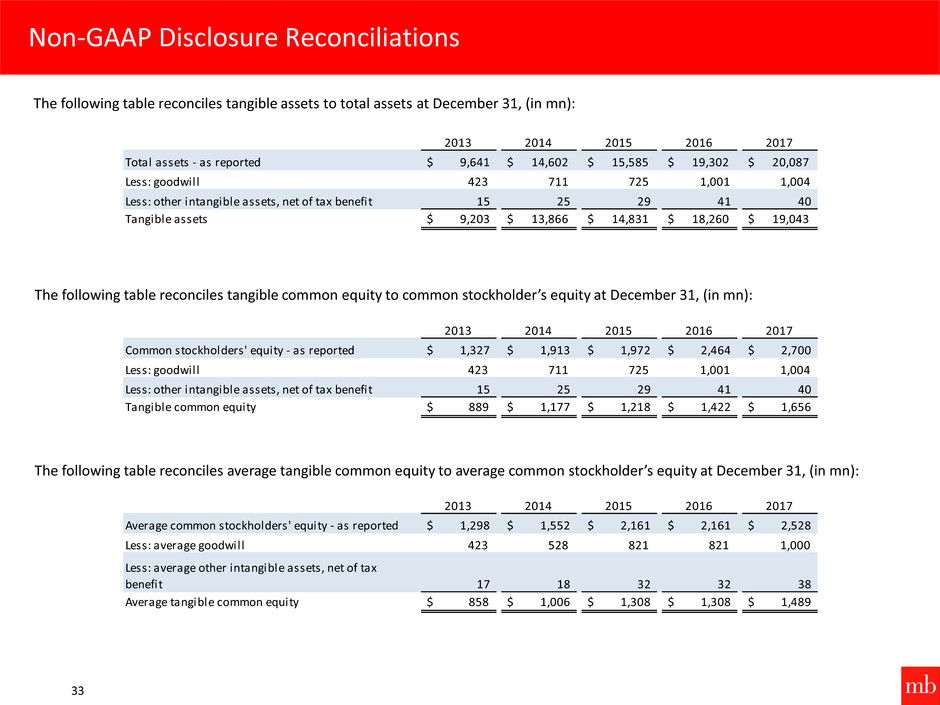

Non-GAAP Disclosure Reconciliations 33 2013 2014 2015 2016 2017 Total assets - as reported $ 9,641 $ 14,602 $ 15,585 $ 19,302 $ 20,087 Less: goodwill 423 711 725 1,001 1,004 Less: other intangible assets, net of tax benefit 15 25 29 41 40 Tangible assets $ 9,203 $ 13,866 $ 14,831 $ 18,260 $ 19,043 The following table reconciles tangible assets to total assets at December 31, (in mn): 2013 2014 2015 2016 2017 Common stockholders' equity - as reported $ 1,327 $ 1,913 $ 1,972 $ 2,464 $ 2,700 Less: goodwill 423 711 725 1,001 1,004 Less: other intangible assets, net of tax benefit 15 25 29 41 40 Tangible common equity $ 889 $ 1,177 $ 1,218 $ 1,422 $ 1,656 The following table reconciles tangible common equity to common stockholder’s equity at December 31, (in mn): 2013 2014 2015 2016 2017 Average common stockholders' equity - as reported $ 1,298 $ 1,552 $ 2,161 $ 2,161 $ 2,528 Less: average goodwill 423 528 821 821 1,000 Less: average other intangible assets, net of tax benefit 17 18 32 32 38 Average tangible common equity $ 858 $ 1,006 $ 1,308 $ 1,308 $ 1,489 The following table reconciles average tangible common equity to average common stockholder’s equity at December 31, (in mn):

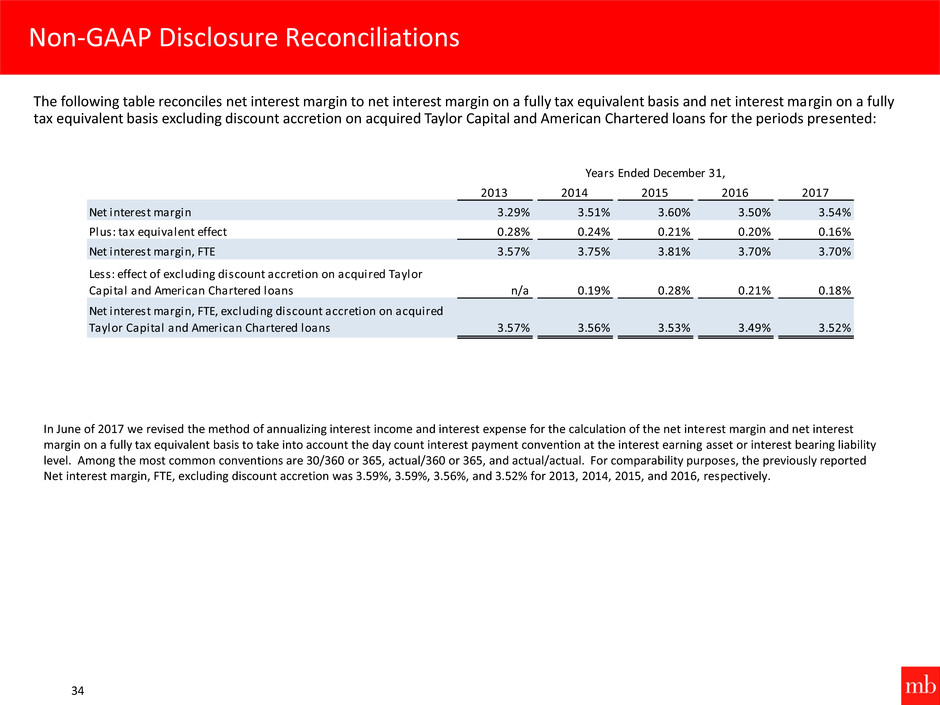

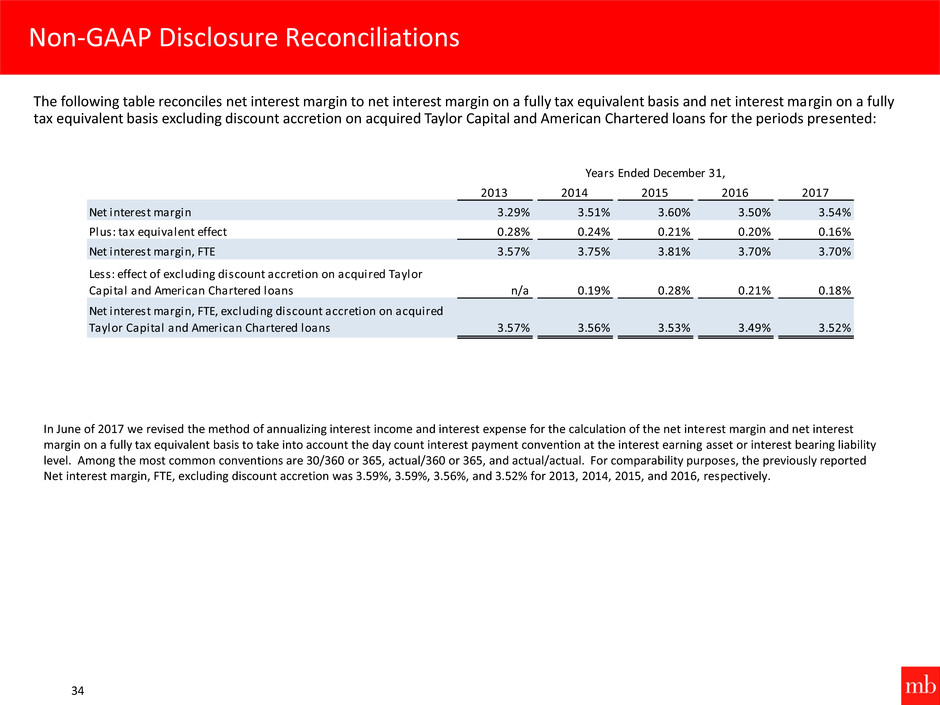

Non-GAAP Disclosure Reconciliations 34 2013 2014 2015 2016 2017 Net interest margin 3.29% 3.51% 3.60% 3.50% 3.54% Plus: tax equivalent effect 0.28% 0.24% 0.21% 0.20% 0.16% Net interest margin, FTE 3.57% 3.75% 3.81% 3.70% 3.70% Less: effect of excluding discount accretion on acquired Taylor Capital and American Chartered loans n/a 0.19% 0.28% 0.21% 0.18% Net interest margin, FTE, excluding discount accretion on acquired Taylor Capital and American Chartered loans 3.57% 3.56% 3.53% 3.49% 3.52% Years Ended December 31, The following table reconciles net interest margin to net interest margin on a fully tax equivalent basis and net interest mar in on a fully tax equivalent basis excluding discount accretion on acquired Taylor Capital and American Chartered loans for the periods presented: In June of 2017 we revised the method of annualizing interest income and interest expense for the calculation of the net interest margin and net interest margin on a fully tax equivalent basis to take into account the day count interest payment convention at the interest earning asset or interest bearing liability level. Among the most common conventions are 30/360 or 365, actual/360 or 365, and actual/actual. For comparability purposes, the previously reported Net interest margin, FTE, excluding discount accretion was 3.59%, 3.59%, 3.56%, and 3.52% for 2013, 2014, 2015, and 2016, respectively.

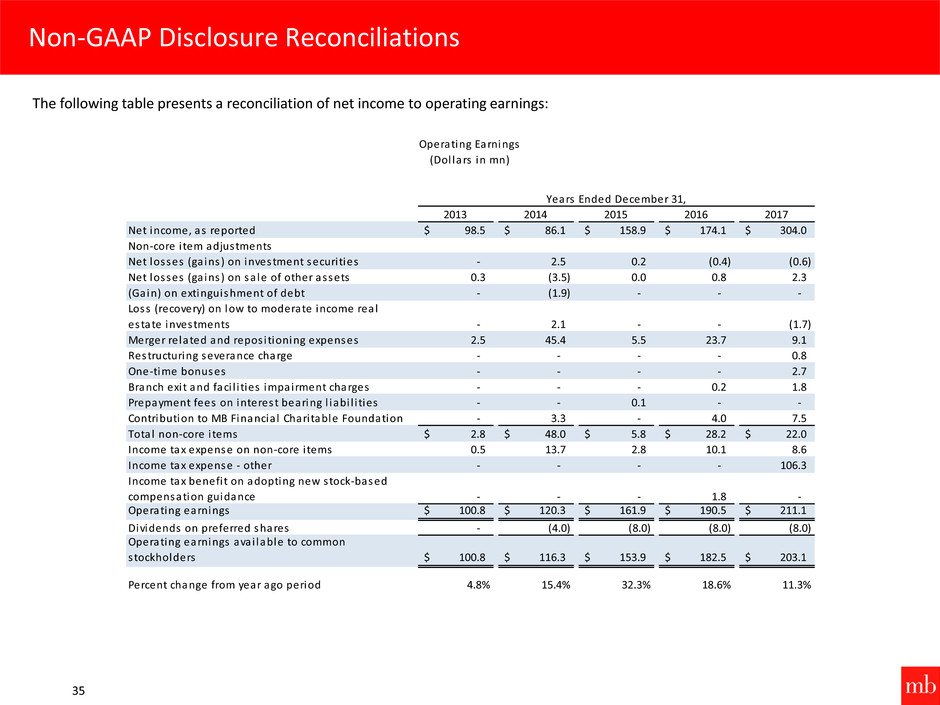

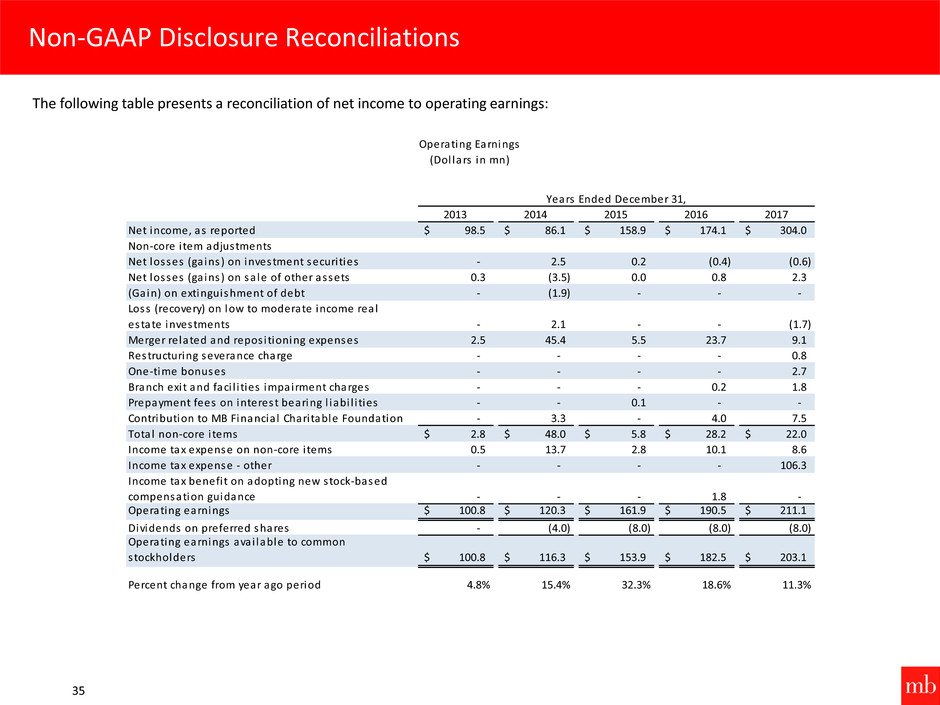

Non-GAAP Disclosure Reconciliations 35 2013 2014 2015 2016 2017 Net income, as reported $ 98.5 $ 86.1 $ 158.9 $ 174.1 $ 304.0 Non-core i tem adjustments Net losses (ga ins ) on investment securi ties - 2.5 0.2 (0.4) (0.6) Net losses (ga ins ) on sa le of other assets 0.3 (3.5) 0.0 0.8 2.3 (Gain) on extinguishment of debt - (1.9) - - - Loss (recovery) on low to moderate income real estate investments - 2.1 - - (1.7) Merger related and repos i tioning expenses 2.5 45.4 5.5 23.7 9.1 Restructuring severance charge - - - - 0.8 One-time bonuses - - - - 2.7 Branch exi t and faci l i ties impairment charges - - - 0.2 1.8 Prepayment fees on interest bearing l iabi l i ties - - 0.1 - - Contribution to MB Financia l Chari table Foundation - 3.3 - 4.0 7.5 Total non-core i tems $ 2.8 $ 48.0 $ 5.8 $ 28.2 $ 22.0 Income tax expense on non-core i tems 0.5 13.7 2.8 10.1 8.6 Income tax expense - other - - - - 106.3 Income tax benefi t on adopting new stock-based compensation guidance - - - 1.8 - Operating earnings $ 100.8 $ 120.3 $ 161.9 $ 190.5 $ 211.1 Dividends on preferred shares - (4.0) (8.0) (8.0) (8.0) Operating earnings avai lable to common stockholders $ 100.8 $ 116.3 $ 153.9 $ 182.5 $ 203.1 Percent change from year ago period 4.8% 15.4% 32.3% 18.6% 11.3% Years Ended December 31, Operating Earnings (Dol lars in mn) The following table presents a reconciliation of net income to operating earnings:

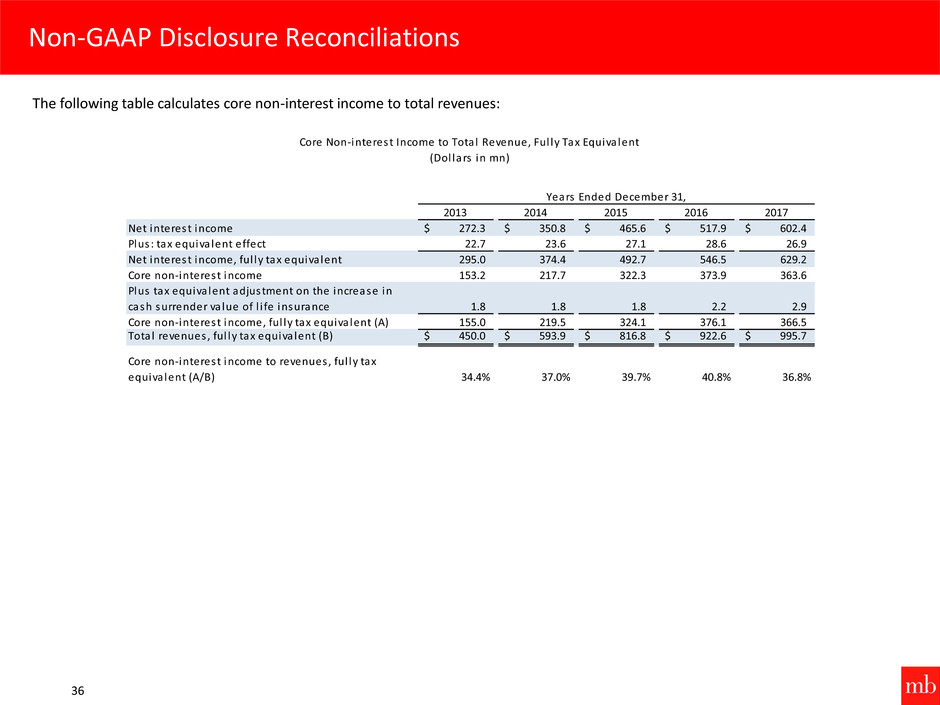

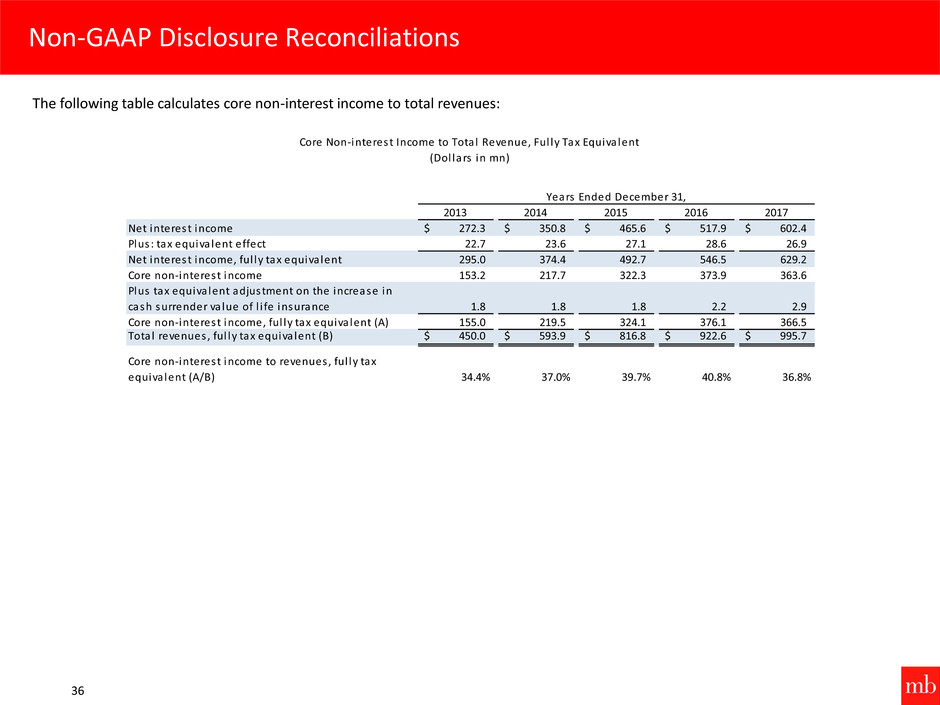

Non-GAAP Disclosure Reconciliations 36 2013 2014 2015 2016 2017 Net interest income $ 272.3 $ 350.8 $ 465.6 $ 517.9 $ 602.4 Plus : tax equiva lent effect 22.7 23.6 27.1 28.6 26.9 Net interest income, ful ly tax equiva lent 295.0 374.4 492.7 546.5 629.2 Core non-interest income 153.2 217.7 322.3 373.9 363.6 Plus tax equiva lent adjustment on the increase in cash surrender va lue of l i fe insurance 1.8 1.8 1.8 2.2 2.9 Core non-interest income, ful ly tax equiva lent (A) 155.0 219.5 324.1 376.1 366.5 Total revenues , ful ly tax equiva lent (B) $ 450.0 $ 593.9 $ 816.8 $ 922.6 $ 995.7 Core non-interest income to revenues , ful ly tax equiva lent (A/B) 34.4% 37.0% 39.7% 40.8% 36.8% Years Ended December 31, Core Non-interest Income to Total Revenue, Ful ly Tax Equiva lent (Dol lars in mn) The following table calculates core non-interest income to total revenues:

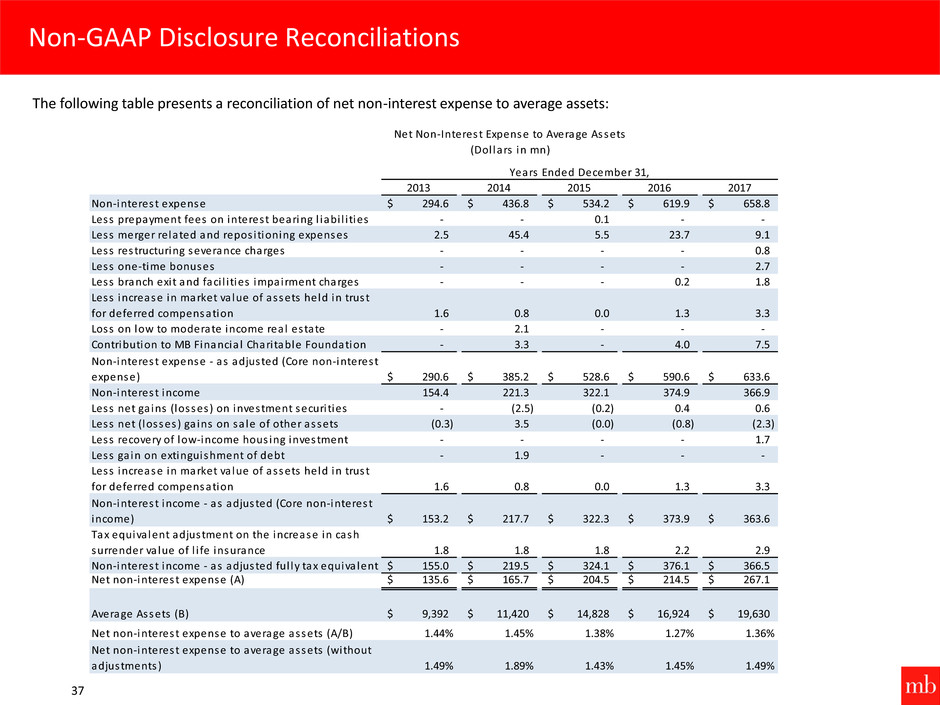

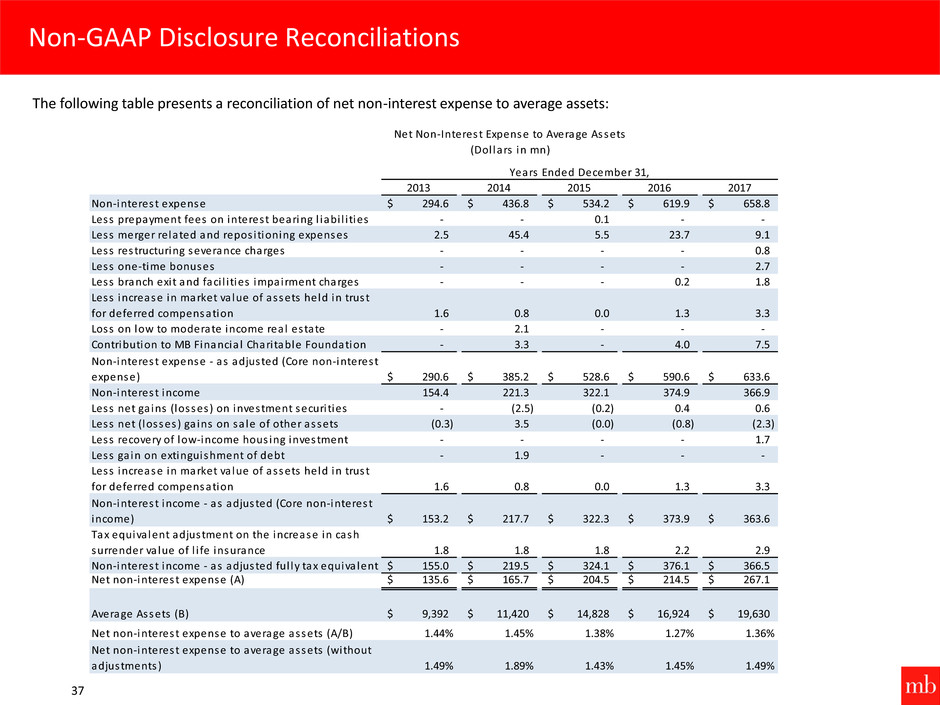

Non-GAAP Disclosure Reconciliations 37 2013 2014 2015 2016 2017 Non-interest expense $ 294.6 $ 436.8 $ 534.2 $ 619.9 $ 658.8 Less prepayment fees on interest bearing l iabi l i ties - - 0.1 - - Less merger related and repos i tioning expenses 2.5 45.4 5.5 23.7 9.1 Less restructuring severance charges - - - - 0.8 Less one-time bonuses - - - - 2.7 Less branch exi t and faci l i ties impairment charges - - - 0.2 1.8 Less increase in market va lue of assets held in trust for deferred compensation 1.6 0.8 0.0 1.3 3.3 Loss on low to moderate income real estate - 2.1 - - - Contribution to MB Financia l Chari table Foundation - 3.3 - 4.0 7.5 Non-interest expense - as adjusted (Core non-interest expense) $ 290.6 $ 385.2 $ 528.6 $ 590.6 $ 633.6 Non-interest income 154.4 221.3 322.1 374.9 366.9 Less net ga ins (losses) on investment securi ties - (2.5) (0.2) 0.4 0.6 Less net (losses) ga ins on sa le of other assets (0.3) 3.5 (0.0) (0.8) (2.3) Less recovery of low-income hous ing investment - - - - 1.7 Less ga in on extinguishment of debt - 1.9 - - - Less increase in market va lue of assets held in trust for deferred compensation 1.6 0.8 0.0 1.3 3.3 Non-interest income - as adjusted (Core non-interest income) $ 153.2 $ 217.7 $ 322.3 $ 373.9 $ 363.6 Tax equiva lent adjustment on the increase in cash surrender va lue of l i fe insurance 1.8 1.8 1.8 2.2 2.9 Non-interest income - as adjusted ful ly tax equiva lent $ 155.0 $ 219.5 $ 324.1 $ 376.1 $ 366.5 Net non-interest expense (A) $ 135.6 $ 165.7 $ 204.5 $ 214.5 $ 267.1 Average Assets (B) $ 9,392 $ 11,420 $ 14,828 $ 16,924 $ 19,630 Net non-interest expense to average assets (A/B) 1.44% 1.45% 1.38% 1.27% 1.36% Net non-interest expense to average assets (without adjustments) 1.49% 1.89% 1.43% 1.45% 1.49% Net Non-Interest Expense to Average Assets (Dol lars in mn) Years Ended December 31, The following table presents a reconciliation of net non-interest expense to average assets:

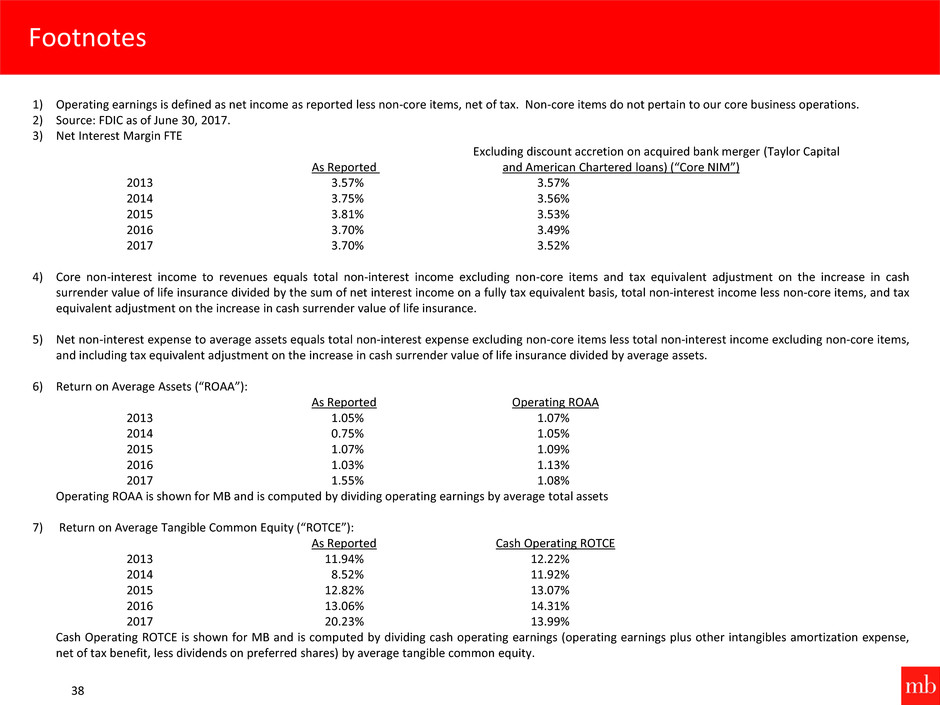

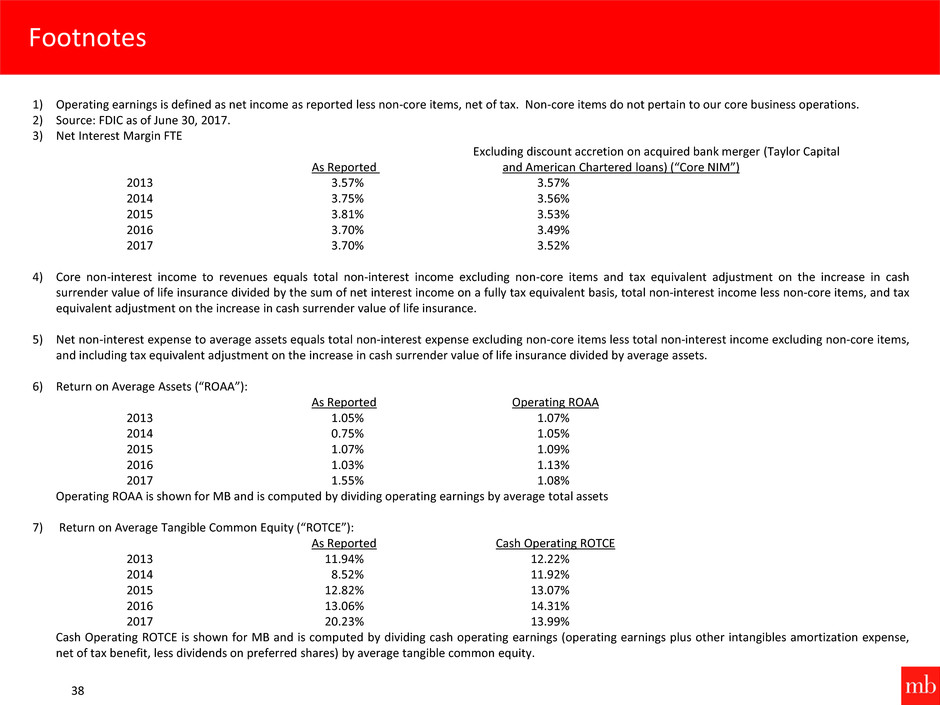

Footnotes 38 1) Operating earnings is defined as net income as reported less non-core items, net of tax. Non-core items do not pertain to our core business operations. 2) Source: FDIC as of June 30, 2017. 3) Net Interest Margin FTE Excluding discount accretion on acquired bank merger (Taylor Capital As Reported and American Chartered loans) (“Core NIM”) 2013 3.57% 3.57% 2014 3.75% 3.56% 2015 3.81% 3.53% 2016 3.70% 3.49% 2017 3.70% 3.52% 4) Core non-interest income to revenues equals total non-interest income excluding non-core items and tax equivalent adjustment on the increase in cash surrender value of life insurance divided by the sum of net interest income on a fully tax equivalent basis, total non-interest income less non-core items, and tax equivalent adjustment on the increase in cash surrender value of life insurance. 5) Net non-interest expense to average assets equals total non-interest expense excluding non-core items less total non-interest income excluding non-core items, and including tax equivalent adjustment on the increase in cash surrender value of life insurance divided by average assets. 6) Return on Average Assets (“ROAA”): As Reported Operating ROAA 2013 1.05% 1.07% 2014 0.75% 1.05% 2015 1.07% 1.09% 2016 1.03% 1.13% 2017 1.55% 1.08% Operating ROAA is shown for MB and is computed by dividing operating earnings by average total assets 7) Return on Average Tangible Common Equity (“ROTCE”): As Reported Cash Operating ROTCE 2013 11.94% 12.22% 2014 8.52% 11.92% 2015 12.82% 13.07% 2016 13.06% 14.31% 2017 20.23% 13.99% Cash Operating ROTCE is shown for MB and is computed by dividing cash operating earnings (operating earnings plus other intangibles amortization expense, net of tax benefit, less dividends on preferred shares) by average tangible common equity.

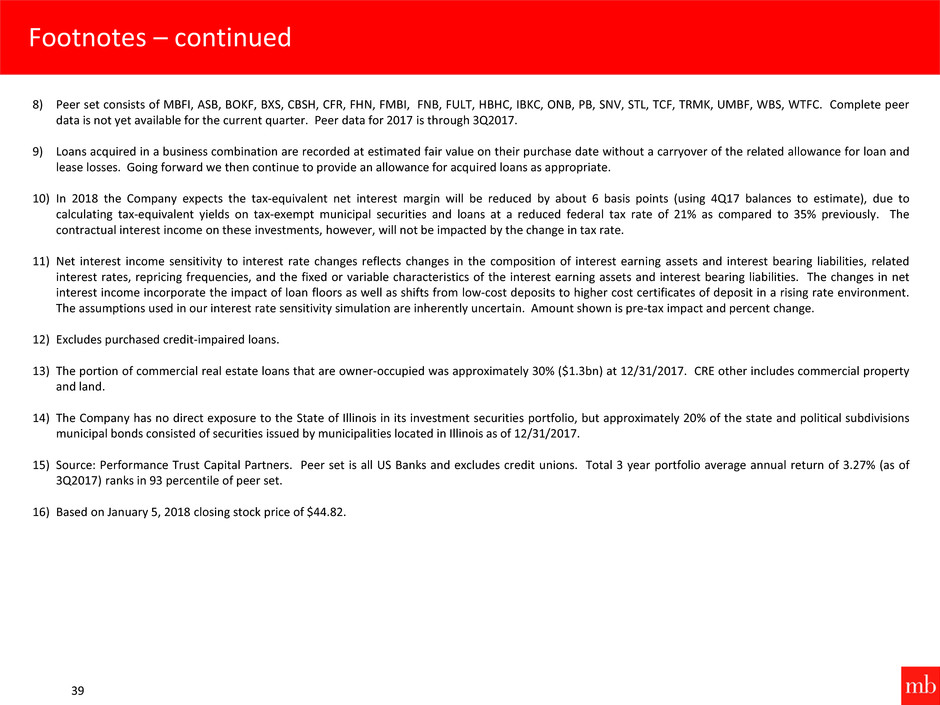

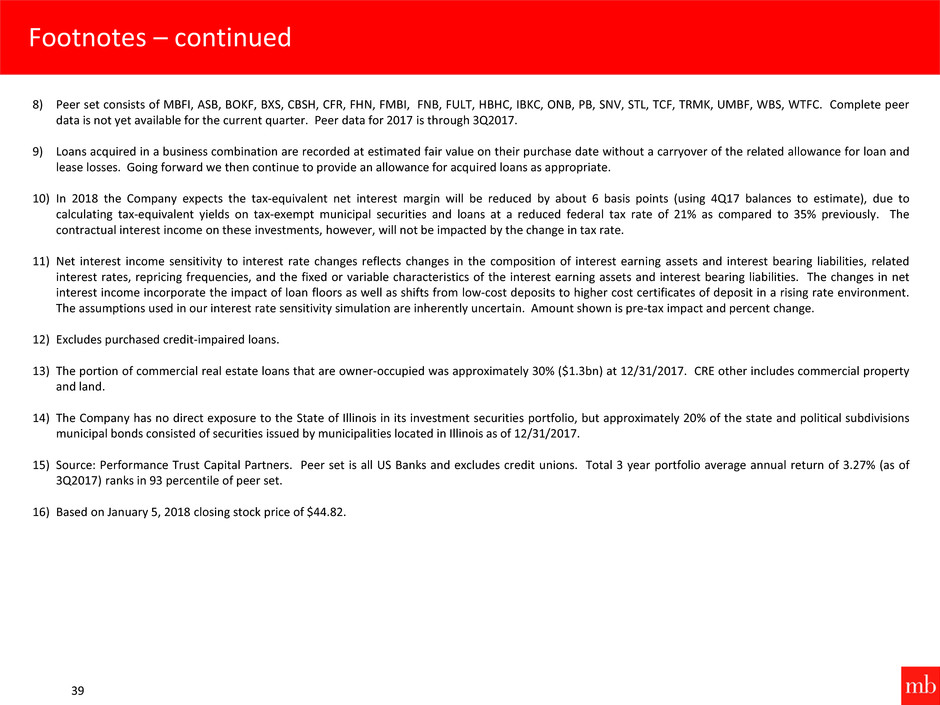

Footnotes – continued 39 8) Peer set consists of MBFI, ASB, BOKF, BXS, CBSH, CFR, FHN, FMBI, FNB, FULT, HBHC, IBKC, ONB, PB, SNV, STL, TCF, TRMK, UMBF, WBS, WTFC. Complete peer data is not yet available for the current quarter. Peer data for 2017 is through 3Q2017. 9) Loans acquired in a business combination are recorded at estimated fair value on their purchase date without a carryover of the related allowance for loan and lease losses. Going forward we then continue to provide an allowance for acquired loans as appropriate. 10) In 2018 the Company expects the tax-equivalent net interest margin will be reduced by about 6 basis points (using 4Q17 balances to estimate), due to calculating tax-equivalent yields on tax-exempt municipal securities and loans at a reduced federal tax rate of 21% as compared to 35% previously. The contractual interest income on these investments, however, will not be impacted by the change in tax rate. 11) Net interest income sensitivity to interest rate changes reflects changes in the composition of interest earning assets and interest bearing liabilities, related interest rates, repricing frequencies, and the fixed or variable characteristics of the interest earning assets and interest bearing liabilities. The changes in net interest income incorporate the impact of loan floors as well as shifts from low-cost deposits to higher cost certificates of deposit in a rising rate environment. The assumptions used in our interest rate sensitivity simulation are inherently uncertain. Amount shown is pre-tax impact and percent change. 12) Excludes purchased credit-impaired loans. 13) The portion of commercial real estate loans that are owner-occupied was approximately 30% ($1.3bn) at 12/31/2017. CRE other includes commercial property and land. 14) The Company has no direct exposure to the State of Illinois in its investment securities portfolio, but approximately 20% of the state and political subdivisions municipal bonds consisted of securities issued by municipalities located in Illinois as of 12/31/2017. 15) Source: Performance Trust Capital Partners. Peer set is all US Banks and excludes credit unions. Total 3 year portfolio average annual return of 3.27% (as of 3Q2017) ranks in 93 percentile of peer set. 16) Based on January 5, 2018 closing stock price of $44.82.