U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

INFORMATION REQUIRED IN PROXY STATEMENT

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ý

Filed by a Party other than the Registrant o

Check the Appropriate Box:

| | |

| ¨ | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Under Rule 14a-12 |

HANA BIOSCIENCES, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ý | No fee required |

| | |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

| o | Fee paid previously with preliminary materials: |

| | |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

HANA BIOSCIENCES, INC.

400 Oyster Point Boulevard, Suite 215

South San Francisco, California 94080

________________________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

MAY 9, 2006

________________________

To Our Stockholders:

You are cordially invited to attend the Annual Meeting of Stockholders of Hana Biosciences, Inc., a Delaware corporation (the “Company”). The Annual Meeting will be held at the Embassy Suites Hotel, 250 Gateway Boulevard, South San Francisco, California 94080, on May 9, 2006, at 9:00 a.m. (PDT), or at any adjournment or postponement thereof, for the purpose of considering and taking appropriate action with respect to the following:

1. To elect five directors;

2. To ratify and approve the Company’s 2003 Stock Option Plan;

3. To ratify and approve the Company’s 2004 Stock Incentive Plan;

4. To ratify and approve the Company’s 2006 Employee Stock Purchase Plan; and

5. To transact any other business as may properly come before the meeting or any adjournments thereof.

Our Board of Directors has fixed the close of business on March 22, 2006, as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting and at any adjournments or postponement thereof.

All stockholders are invited to attend the Annual Meeting in person. Whether or not you plan to attend the meeting, please complete, date and sign the enclosed proxy and return it in the enclosed envelope, as promptly as possible. If you attend the meeting, you may withdraw the proxy and vote in person.

| | By Order of the Board of Directors, |

| | | |

| | | |

| | HANA BIOSCIENCES, INC. |

|

|

|

| | By: | /s/ John P. Iparraguirre |

| |

John P. Iparraguirre |

| | Vice President, Chief Financial Officer and Secretary |

South San Francisco, California

April 7, 2006

PROXY STATEMENT

OF

HANA BIOSCIENCES, INC.

___________________

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD

MAY 9, 2006

___________________

The enclosed proxy is solicited on behalf of the Board of Directors (the “Board”) of Hana Biosciences, Inc., a Delaware corporation, for use at the Annual Meeting of Stockholders to be held on May 9, 2006, at 9:00 a.m. PDT (the “Annual Meeting”), or at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting. The Annual Meeting will be held at the Embassy Suites Hotel, 250 Gateway Boulevard, South San Francisco, California 94080. We intend to mail this proxy statement and accompanying proxy card on or about April 7, 2006, to all stockholders entitled to vote at the Annual Meeting.

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING

Why am I receiving these materials?

We sent you this proxy statement and the enclosed proxy card because the Board of Directors of Hana Biosciences, Inc., a Delaware corporation (sometimes referred to as “Hana,” the “Company,” “we,” “us,” or “our”), is soliciting your proxy to vote at the 2006 Annual Meeting of Stockholders. You are invited to attend the Annual Meeting to vote on the proposals described in this proxy statement. The Annual Meeting will be held on Tuesday, May 9, 2006 at 9:00 a.m. (PDT) at the Embassy Suites Hotel, 250 Gateway Boulevard, South San Francisco, California 94080. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card.

We intend to mail this proxy statement and accompanying proxy card on or about March 22, 2006 to all stockholders of record entitled to vote at the Annual Meeting.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on March 22, 2006, will be entitled to vote at the Annual Meeting. On this record date, there were 22,527,734 shares of our common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If on March 22, 2006, your shares were registered directly in your name with our transfer agent, Corporate Stock Transfer, then you are a stockholder of record. As a stockholder of record, you may vote in person at the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to fill out and return the enclosed proxy card to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on March 22, 2006, your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy from your broker or other agent.

What am I voting on?

There are four matters scheduled for a vote:

| · | Election of five directors to hold office until the 2007 Annual Meeting of Stockholders; |

| · | Ratification and approval of our 2003 Stock Option Plan; |

| · | Ratification and approval of our 2004 Stock Incentive Plan; and |

| · | Ratification and approval of our 2006 Employee Stock Purchase Plan. |

How do I vote?

You may either vote “For” all the nominees to the Board of Directors or you may “Withhold” your vote for any nominee you specify. For the other matters to be voted on, you may vote “For” or “Against” or abstain from voting. The procedures for voting are as follows:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the Annual Meeting, or vote by proxy using the enclosed proxy card. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote in person if you have already voted by proxy.

| · | To vote in person, come to the Annual Meeting, where a ballot will be made available to you. |

| · | To vote using the proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct. |

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than from Hana. Simply complete and mail the proxy card to ensure that your vote is counted. Alternatively, you may vote by telephone or over the Internet as instructed by your broker or bank, if your broker or bank makes telephone or Internet voting available. To vote in person at the Annual Meeting, you must obtain a valid proxy from your broker, bank, or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of the close of business on March 22, 2006.

What if I return a proxy card but do not make specific choices?

If you return a signed and dated proxy card without marking any voting selections, your shares will be voted “For” the election of all five nominees for director, and “For” ratification of the ratification and approval of the 2003 Stock Option Plan, the 2004 Stock Incentive Plan and the 2006 Employee Stock Purchase Plan. If any other matter is properly presented at the meeting, your proxy (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these mailed proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. Please complete, sign and return each proxy card to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the meeting. If you are the record holder of your shares, you may revoke your proxy in any one of three ways:

| · | You may submit another properly completed proxy card with a later date. |

| · | You may send a written notice that you are revoking your proxy to our Secretary at 400 Oyster Point Boulevard, Suite 215, South San Francisco, California 94080. |

| · | You may attend the meeting and vote in person. Simply attending the Annual Meeting will not, by itself, revoke your proxy. |

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

When are stockholder proposals due for next year’s Annual Meeting?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by the close of business on December 8, 2006 to our Secretary at 400 Oyster Point Boulevard, Suite 215, South San Francisco, California 94080. If you wish to bring a matter before the stockholders at next year’s annual meeting and you do not notify us by February 21, 2007, our management will have discretionary authority to vote all shares for which it has proxies in opposition to the matter.

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count “For” and “Withhold” and, with respect to proposals other than the election of directors, “Against” votes, abstentions and broker non-votes. Abstentions will be counted towards the vote total for each proposal and will have the same effect as “Against” votes. Broker non-votes have no effect and will not be counted towards the vote total for any proposal.

If your shares are held by your broker as your nominee (that is, in “street name”), you will need to obtain a proxy form from the institution that holds your shares and follow the instructions included on that form regarding how to instruct your broker to vote your shares. If you do not give instructions to your broker, your broker can vote your shares with respect to “discretionary” items, but not with respect to “non-discretionary” items. Discretionary items are proposals considered routine under the rules of the New York Stock Exchange (“NYSE”) on which your broker may vote shares held in street name in the absence of your voting instructions. On non-discretionary items for which you do not give your broker instructions, the shares will be treated as broker non-votes.

How many votes are needed to approve each proposal?

For the election of directors to hold office until the 2007 Annual Meeting of Stockholders, the five nominees receiving the most “For” votes (among votes properly cast in person or by proxy) will be elected. Only votes “For” or “Withheld” will affect the outcome.

To be approved, Proposals 2, 3 and 4, the ratification and approval of our 2003 Stock Option Plan, our 2004 Stock Incentive Plan and our 2006 Employee Stock Purchase Plan, each must receive a “For” vote from the majority of shares present either in person or by proxy and entitled to vote. If you “Abstain” from voting, it will have the same effect as an “Against” vote. “Broker non-votes,” which occur when brokers are prohibited from exercising discretionary voting authority for beneficial owners who have not provided voting instructions, will not be counted for the purpose of determining the number of shares present in person or by proxy on a voting matter and will have no effect on the outcome of the vote.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if at least a majority of the outstanding shares are represented by stockholders present at the meeting or by proxy. On the record date, there were 22,527,734 shares of common stock outstanding and entitled to vote. Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, either the chairman of the meeting or a majority of the votes present may adjourn the meeting to another date.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be published in our quarterly report on Form 10-Q for the second quarter of 2006.

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the ownership of our common stock as of March 22, 2006 by: (i) each director and nominee for director; (ii) each of our current executive officers; (iii) all of our directors and executive officers as a group; and (iv) all those known by us to be beneficial owners of at least five percent of our common stock. Beneficial ownership is determined under rules promulgated by the SEC. Under those rules, beneficial ownership includes any shares as to which the individual has sole or shared voting power or investment power and also any shares which the individual has the right to acquire within 60 days of the date hereof, through the exercise or conversion of any stock option, convertible security, warrant or other right. Inclusion of shares in the table does not, however, constitute an admission that the named stockholder is a direct or indirect beneficial owner of those shares. Unless otherwise indicated, each person or entity named in the table has sole voting power and investment power (or shares that power with that person’s spouse) with respect to all shares of capital stock listed as owned by that person or entity. Unless otherwise indicated, the address of each of the following persons is 400 Oyster Point Boulevard, Suite 215, South San Francisco, California 94080.

Name | | Shares Beneficially Owned | | Percent of Class | |

Mark J. Ahn (1) | | | 738,156 | | | 3.2 | |

Gregory I. Berk (2) | | | 50,000 | | | * | |

John P. Iparraguirre (3) | | | 51,905 | | | * | |

Fred L. Vitale (4) | | | 259,995 | | | 1.1 | |

Arie S. Belldegrun (2) UCLA School of Medicine 10833 Le Conte 66-118 CHS BOX 951738 Los Angeles, CA 9095-1738 | | | 72,134 | | | * | |

Isaac Kier (5) 1775 Broadway, Suite 604 New York, NY 10019 | | | 1,118,774 | | | 4.9 | |

Leon E. Rosenberg (2) Room 253, Lewis Thomas Lab Princeton University Princeton, NY 08554 | | | 72,134 | | | * | |

Michael Weiser (6) 787 7th Avenue, 48th Floor New York, NY 10019 | | | 633,297 | | | 2.8 | |

All directors and officers as a group (8 persons) | | | | | | | |

Lester E. Lipschutz (7) 1650 Arch Street - 22nd Floor Philadelphia, PA 19103 | | | 2,063,662 | | | 9.2 | |

Balyasny Asset Management L.P. (8) dd 181 West Madison, Suite 3600 Chicago, IL 60602 | | | 1,573,344 | | | 7.0 | |

_________________________

* represents less than 1 percent.

(1) Includes 677,802 shares issuable upon the exercise of stock options and 13,896 shares issuable upon the exercise of warrants.

(2) Represents shares issuable upon the exercise of stock options.

(3) Includes 41,535 shares issuable upon the exercise of stock options.

(4) Includes 169,341 shares issuable upon the exercise of stock options and 15,745 shares issuable upon the exercise of warrants.

(5) Includes (i) 144,885 shares held by Kier Family Partners, LP, of which 4,357 are issuable upon the exercise of warrants, (ii) 719,369 shares held by Coqui Capital Partners, LP, of which 57,768 shares are issuable upon the exercise of warrants, (iii) 143,779 shares held by JIJ Investments, of which 23,437 shares are issuable upon the exercise of warrants, (iv) 5,859 shares issuable upon the exercise of a warrant held by Mr. Kier, and (v) 32,134 shares issuable upon the exercise of stock options held by Mr. Kier. Mr. Kier is a general partner of Kier Family Partners, LP and Coqui Capital Partners, LP, and he is a partner of JIJ Investments.

(6) Includes 82,630 shares issuable upon the exercise of stock options and warrants.

(7) Based on Schedule 13G/A filed by Mr. Lipschutz on December 17, 2004.

(8) The number of shares beneficially owned by Balyasny Asset Management L.P is based on a Schedule 13G/A filed on February 14, 2006.

PROPOSAL 1:

ELECTION OF DIRECTORS

The number of directors comprising our Board of Directors is currently set at five and our Board is presently composed of five members. Vacancies on our Board of Directors may be filled by persons elected by a majority of our remaining directors. A director elected by our Board of Directors to fill a vacancy (including any vacancy created by an increase in the number of directors) shall serve until the next meeting of stockholders at which the election of directors is considered and until such director’s successor is elected and qualified.

None of our directors has previously been elected as such by our stockholders. Each nominee is currently a director of the Company who was recommended for election as a director by our Board’s Nominating and Corporate Governance Committee. If elected at the Annual Meeting, each of the nominees below would serve until our 2007 Annual Meeting of Stockholders, and until his successor is elected and has qualified, or until such director’s earlier death, resignation or removal. It is our policy to invite directors to attend the Annual Meeting.

The name and age of each of the five nominees, his position with the Company, his principal occupation, and the period during which such person has served as a director of the Company are set forth below.

Biographical Summaries of Nominees for the Board of Directors

Name | | Age | | Position(s) Held | | Director Since |

| Mark J. Ahn, Ph.D. | | 43 | | President, Chief Executive Officer and Director | | 2003 |

| Arie S. Belldegrun, M.D. | | 56 | | Director | | 2004 |

| Isaac Kier | | 53 | | Director | | 2004 |

| Leon E. Rosenberg, M.D. | | 73 | | Director | | 2004 |

| Michael Weiser, M.D. | | 43 | | Director | | 2003 |

Mark J. Ahn, Ph.D. has been our President and Chief Executive Officer and a member of our board of directors since November 2003. Prior to joining Hana, from December 2001 to November 2003, he served as Vice President, Hematology and corporate officer at Genentech, Inc. where he was responsible for commercial and clinical development of the Hematology franchise, which surpassed $1 billion in annual revenues. From February 1991 to February 1997 and from February 1997 to December 2001, Dr. Ahn was employed by Amgen and Bristol-Myers Squibb Company, respectively, holding a series of positions of increasing responsibility in strategy, general management, sales & marketing, business development, and finance. He has also served as an officer in the U.S. Army. Dr. Ahn is a Henry Crown Fellow at the Aspen Institute, founder of the Center for Non-Profit Leadership, a director of Transmolecular, Inc., a privately held biotechnology company focused on neuroncology, and a member of the Board of Trustees for the MEDUNSA (Medical University of South Africa) Trust. Dr. Ahn received a BA in History and an MBA in Finance from Chaminade University. He was a graduate fellow in Economics at Essex University, and has a Ph.D. in Business Administration from the University of South Australia.

Arie Belldegrun, M.D., FACS has served on Hana’s Board of Directors since April 2004. He has served as Professor of Urology since 1994, Chief of the Division of Urologic Oncology since 1996 at the David Geffen School of Medicine at the University of California, Los Angeles (UCLA). He has also held the Roy and Carol Doumani Chair in Urologic Oncology at UCLA since 2000. Dr. Belldegrun completed his medical degree at the Hebrew University Hadassah Medical School in Jerusalem, his post at the Weizmann Institute of Science and his residency in Urology at Harvard Medical School. Prior to UCLA, Dr. Belldegrun served as a research fellow in surgical oncology at the National Cancer Institute/NIH under Steven A. Rosenberg, MD, Ph.D. from 1985 to 1988. He is certified by the American Board of Urology and is a Fellow of the American College of Surgeons. Dr. Belldegrun is on the scientific boards of several biotechnology and pharmaceutical companies and serves as a reviewer for many medical journals and granting organizations. In addition to holding several patents, Dr. Belldegrun is the author of several books on prostate and kidney cancers, and has written over 350 scientific publications with an emphasis on urologic oncology, particularly kidney, prostate and bladder cancers. He is the founder of Agensys, Inc., a company focused on the development of fully human monoclonal antibodies to treat solid tumor cancers based on Agensys’ propriety targets. Dr. Belldegrun served as founding Chairman of Agensys from 1997-2002 and currently serves on the Board of Directors and as a consultant. Dr. Belldegrun is also Vice Chairman of the Board of Directors and Chairman of the Scientific Advisory Board of Cougar Biotechnology, Inc., established to in-license and develop early clinical stage drugs, with a specific focus on the field of oncology.

Isaac Kier has served on Board of Directors of Hana since February 2004. Since March 2006, he has been a principal of Kier Global, LLC, an investment partnership focusing on merger, acquisition and real estate opportunities globally. From February 2000 to February 2006, Mr. Kier was a member of the general partner of Coqui Capital Partners, a venture capital firm licensed by the Small Business Administration. Mr. Kier has served since 2004 as treasurer and director of Tremisis Energy Acquisition Corporation (TEGYU.OB), as a director of Rand Acquisition Corp (RAQCU.OB), and since 2005 as a director of Paramount Acquisition Corp (PMQCU.OB) and as CEO and Director of MPLC, Inc. (MILB.PK), all special purpose acquisition companies. He served as President, Chief Executive Officer and Chairman of the Board of Lida, Inc (formerly NASDAQ: LIDA) from 1981 until 1995. He was a lead investor in eDiets.com (NASDAQ: DIET) in 1999 and served on its board until 2004. Mr. Kier received a BA in Economics from Cornell University and a JD from George Washington University Law School.

Leon E. Rosenberg, M.D., a director of Hana since February 2004, has been a Professor in the Princeton University Department of Molecular Biology and the Woodrow Wilson School of Public and International Public Affairs since September 1997. Since July 1999, he has also been Professor Adjunct of Genetics at Yale University School of Medicine. From January 1997 to March 1998, Dr. Rosenberg served as Senior Vice President, Scientific Affairs of Bristol-Myers Squibb Company, and from September 1991 to January 1997, Dr. Rosenberg served as President of the Bristol-Myers Squibb Pharmaceutical Research Institute, where he was responsible for the company’s worldwide pharmaceutical research and development. Prior to Bristol-Myers Squibb, Dr. Rosenberg was Dean of the Yale University School of Medicine from July 1984 to September 1991. Dr. Rosenberg also serves on the Boards of Directors of Lovelace Respiratory Research Institute (since 1997), Karo Bio AB (since 2000), and Medicines for Malaria Venture (since 2000).

Michael Weiser, M.D., Ph.D., has been a director of the Hana since its inception. Dr. Weiser is Director of Research of Paramount BioCapital, Inc. Dr. Weiser completed his Ph.D. in Molecular Neurobiology at Cornell University medical College and received his M.D. from New York University School of Medicine, where he also completed a Postdoctoral Fellowship in the Department of Physiology and Neuroscience. Dr. Weiser currently serves on the boards of directors of Manhattan Pharmaceuticals, Inc. (AMEX: MHA), Chelsea Therapeutics International Ltd. (OTCBB: CHTP), Emisphere Technologies Inc. (Nasdaq: EMIS), ZIOPHARM Oncology Inc. (OTCBB: ZIOP) and VioQuest Pharmaceuticals Inc. (OTCBB: VQPH), as well as several other privately held biotechnology companies.

Vote Required

All shares represented by proxies will be voted “FOR” the election of the foregoing nominees unless a contrary choice is specified. If any nominee should withdraw or otherwise become unavailable for reasons not presently known, the proxies which would have otherwise been voted for such nominee will be voted for such substitute nominee as may be selected by the Board of Directors. In order to be elected as a director, each nominee must receive the affirmative vote of a plurality of the votes present in person or represented by proxy at the meeting.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” ALL OF THE NOMINEES LISTED ABOVE.

INFORMATION CONCERNING THE BOARD OF DIRECTORS AND ITS COMMITTEES

Independence of the Board of Directors

As required under the listing standards of the American Stock Exchange, a majority of the members of a listed company’s board of directors must qualify as “independent,” as determined by the board. Our Board of Directors consults with our legal counsel to ensure that the Board’s determinations are consistent with all relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in the applicable listing standards of the American Stock Exchange. Consistent with these considerations, and after review of all relevant transactions or relationships between each director, or any of his family members, and Hana, its senior management and its independent registered public accounting firm, the Board has determined that all of our directors are independent directors within the meaning of the applicable American Stock Exchange listing standard, except for Dr. Ahn, our President and Chief Executive Officer.

Board Committees and Meetings

The Board held 5 meetings (either in person or by conference call) in 2005 and took action by written consent twice. All directors attended at least 75 percent of the aggregate meetings of the Board and of the committees on which they served.

The Board of Directors has four standing committees: an Audit Committee, a Compensation Committee, an Executive Committee and a Nominating and Corporate Governance Committee. The following table provides membership for each of the Board committees:

Name of Committee | Membership |

| Audit | Arie S. Belldegrun, Isaac Kier (Chair) and Leon E. Rosenberg |

| | |

| Compensation | Arie S. Belldegrun (Chair), Isaac Kier and Michael Weiser |

| | |

| Executive | Mark J. Ahn (Chair), Isaac Kier and Michael Weiser |

| | |

| Nominating and Governance | Arie S. Belldegrun, Leon Rosenberg (Chair) and Michael Weiser |

Audit Committee

The Audit Committee oversees the Company’s accounting and financial reporting process. For these purposes, the Audit Committee performs several functions. For example, the Committee evaluates and assesses the qualifications of the independent registered public accounting firm; determines the engagement of the independent registered public accounting firm; determines whether to retain or terminate the existing independent registered public accounting firm; reviews and approves the retention of the independent registered public accounting firm to perform any non-audit services; reviews the financial statements to be included in the Company’s Annual Report on Form 10-K; and discusses with management and the independent registered public accounting firm the results of the annual audit and the results of the Company’s quarterly financial statements. The Board of Directors adopted a written Audit Committee Charter, a copy of which is attached to this Proxy Statement as Appendix A and can also be found on our company website at www.hanabiosciences.com. The Audit Committee met four times in 2005.

Our Board of Directors has reviewed the definition of independence for Audit Committee members and has determined that each of member of our Audit Committee is independent (as independence for audit committee members is currently defined by Section 121 of the Listing Standards of the American Stock Exchange). The Board has further determined that Mr. Kier qualifies as an “audit committee financial expert,” as defined by applicable rules of the Securities and Exchange Commission.

Compensation Committee

The Compensation Committee of the Board of Directors oversees our compensation policies, plans and programs. The Compensation Committee reviews and approves corporate performance goals and objectives relevant to the compensation of our executive officers and other senior management; reviews and recommends to the Board the compensation and other terms of employment of our Chief Executive Officer and our other executive officers; administers our equity incentive and stock option plans; and makes recommendations to the Board concerning the issuance of awards pursuant to those plans. All current members of the Compensation Committee are independent (as independence is currently defined under Section 121 of the American Stock Exchange listing standards). The Compensation Committee met three times in 2005. The Board of Directors has adopted a written charter of the Compensation Committee, a copy of which can be found on our company website at www.hanabiosceinces.com.

Executive Committee

The purpose of the Executive Committee is to exercise certain powers of the full Board of Directors when it is not feasible for the entire board to meet and only when reasonably necessary to expedite the interests of the Company between regular board meetings, or when the entire Board of Directors has specifically authorized the committee to consider and take action with respect to a matter. The Executive Committee is comprised of three members, at least two of which must be independent (as is currently defined under Section 121 of the American Stock Exchange listing standards). Notwithstanding the foregoing, the Executive Committee is not authorized to act for the full board (unless otherwise specifically authorized to do so) with respect to various significant corporate matters, including, without limitation, amending our charter documents, approving a merger, consolidation or sale of substantially all of our assets, fill a vacancy on the Board of Directors or any committee thereof, remove from office any officer, fix compensation for directors, create or amend any stock option or compensation plan, declare dividends, or authorize the issuance of any securities, borrowing transaction or acquisition of a business or assets in excess of $500,000. The Executive Committee did not meet in 2005.

Nominating and Governance Committee

The Nominating and Governance Committee considers and recommends to the Board persons to be nominated for election by the stockholders as directors. In addition to nominees recommended by directors, the Nominating and Governance Committee will consider nominees recommended by stockholders if submitted in writing to the Secretary of the Company at the address of Company’s principal offices. The Board believes that any candidate for director, whether recommended by stockholders or by the Board, should be considered on the basis of all factors relevant to the needs of the Company and the credentials of the candidate at the time the candidate is proposed. Such factors include relevant business and industry experience and demonstrated character and judgment. The Board of Directors adopted a written charter of the Nominating and Governance Committee, a copy of which can be found on our company website at www.hanabiosceinces.com. The Nominating Committee met once in 2005.

Communication with the Board of Directors

Although we have not adopted a formal process for stockholder communications with our Board of Directors, we believe stockholders should have the ability to communicate directly with the Board so that their views can be heard by the Board or individual directors, as applicable, and that appropriate and timely responses be provided to stockholders. All communications regarding general matters should be directed to the Secretary of the Company at the address below and should prominently indicate on the outside of the envelope that it is intended for the complete Board of Directors or for any particular director(s). If no designation is made, the communication will be forwarded to the entire board. Stockholder communications to the Board should be sent to

Corporate Secretary

Attention: Board of Directors [or name(s) of particular directors]

Hana Biosciences, Inc.

400 Oyster Point Boulevard, Suite 215

South San Francisco, CA 94080

Code of Ethics

We have adopted a Code of Business Conduct and Ethics that applies to all officers, directors and employees of our company. A copy of our Code of Business Conduct and Ethics is available on our company’s website at www.hanabiosciences.com. If we make any substantive amendments to the Code of Business Conduct and Ethics or grant any waiver from a provision of the code to an executive officer or director, we will promptly disclose the nature of the amendment or waiver by filing with the SEC a current report on Form 8-K.

REPORT OF THE AUDIT COMMITTEE*

The following is the report of our Audit Committee with respect to our audited financial statements for the fiscal year ended December 31, 2005.

The purpose of the Audit Committee is to assist the Board in its general oversight of our financial reporting, internal controls and audit functions. The Audit Committee Charter describes in greater detail the full responsibilities of the Committee. The Audit Committee is comprised solely of independent directors as defined by the listing standards of American Stock Exchange.

The Audit Committee has reviewed and discussed the financial statements with management and J.H. Cohn LLP, our independent registered public accounting firm. Management is responsible for the preparation, presentation and integrity of our financial statements; accounting and financial reporting principles; establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rule 13a-15(e)); establishing and maintaining internal control over financial reporting (as defined in Exchange Act Rule 13a-15(f)); evaluating the effectiveness of disclosure controls and procedures; evaluating the effectiveness of internal control over financial reporting; and evaluating any change in internal control over financial reporting that has materially affected, or is reasonably likely to materially affect, internal control over financial reporting. J.H. Cohn LLP is responsible for performing an independent audit of the financial statements and expressing an opinion on the conformity of those financial statements with U.S. generally accepted accounting principles.

Because the Company is not yet an “accelerated filer,” as that term is defined under applicable SEC rule, the Company is not yet required to have completed the documentation, testing and evaluation of our system of internal control over financial reporting in response to the requirements set forth in Section 404 of the Sarbanes-Oxley Act of 2002 and related regulations. Management has been taking steps in order to prepare the Company for compliance with Section 404 and its related regulations and the Audit Committee was kept apprised of this progress throughout 2005. The Company expects that it will become an accelerated filer for fiscal year 2006, which will require the Company to become fully subject to Section 404 by the end of the 2006 fiscal year. The Committee continues to oversee the Company’s efforts related to its internal control over financial reporting and management’s preparations for the evaluation in fiscal 2006. The Audit Committee believes that management maintains an effective system of internal controls that results in fairly presented financial statements.

The Audit Committee has reviewed and discussed our audited financial statements with management and J.H. Cohn LLP, our independent registered public accounting firm. Our Audit Committee has also discussed with J.H. Cohn LLP the matters required to be discussed by Statement of Auditing Standards No. 61, Communication with Audit Committees, which includes, among other items, matters related to the conduct of the audit of our financial statements. The Audit Committee has also received written disclosures and the letter from J.H. Cohn LLP required by Independence Standards Board Standard No. 1, which relates to the auditor’s independence from us and our related entities, and has discussed with J.H. Cohn LLP their independence from us.

__________________________________

*This report is not “solicited material,” is not deemed filed with the SEC and is not to be incorporated by reference in any of our filings under the Securities Exchange Act of 1934, as amended, whether before or after the date hereof and irrespective of any general incorporation language in any such filing.

Based on the review and discussions referred to above, the Audit Committee recommended to our Board of Directors that our audited financial statements be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2005.

Isaac Kier (Chair)

Dr. Arie S. Belldegrun

Dr. Leon E. Rosenberg

Fees Billed to the Company by Its Independent Registered Public Accounting Firm

The following is a summary of the fees billed to us by J.H. Cohn LLP, our independent registered public accounting firm for professional services rendered for fiscal years ended December 31, 2005 and 2004:

Fee Category | | 2005 Fees | | 2004 Fees | |

Audit Fees | | $ | 93,374 | | $ | 73,146 | |

Audit-Related Fees (1) | | | 24,990 | | | 40,627 | |

Tax Fees (2) | | | 9,847 | | | 17,832 | |

All Other Fees (3) | | | 0 | | | 683 | |

| | | | | | | | |

Total Fees | | $ | 128,211 | | $ | 132,288 | |

______________

| (1) | Audit-Related Fees consist principally of assurance and related services that are reasonably related to the performance of the audit or review of the Company’s financial statements but not reported under the caption “Audit Fees.” These fees include review of registration statements and other filings made with the SEC. |

| (2) | Tax Fees consist of fees for tax compliance, tax advice and tax planning. |

| (3) | All Other Fees consist of aggregate fees billed for products and services provided by the independent registered public accounting firm, other than those disclosed above. |

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditors

At present, the Audit Committee approves each engagement for audit or non-audit services before the Company engages its independent public accountants to provide those services. The Audit Committee has not established any pre-approval policies or procedures that would allow the Company’s management to engage its independent auditor to provide any specified services with only an obligation to notify the audit committee of the engagement for those services. None of the services provided by the Company’s independent auditors for fiscal 2005 was obtained in reliance on the waiver of the pre-approval requirement afforded in SEC regulations.

COMPENSATION OF EXECUTIVE OFFICERS AND DIRECTORS

Compensation of Directors

Prior to 2006, our non-employee directors received a cash fee of $2,500 for each meeting they attend, as well reimbursement for their out-of-pocket expenses. Non-employee directors also received, from time to time at the discretion of the Board, options to purchase shares of our common stock. Under this arrangement, our Board approved two option grants to our non-employee directors in April and July 2005 under our 2004 Stock Incentive Plan of 20,000 shares each. The right to purchase the shares underlying each option award vest in three equal annual installments commencing on the first anniversary of the grant. The exercise prices applicable to the April and July option grants were $1.33 and $1.65 per share, respectively. In November 2005, the Board granted to each non-employee director an option pursuant to the 2004 Stock Incentive Plan to purchase an additional 40,000 shares at an exercise price of $4.75 per share. These options vest in November 2006, but can be exercised only if our stockholders approve our 2004 Stock Incentive Plan, which approval is being sought at the Annual Meeting.

In 2005, the Board of Directors approved and adopted a new compensation arrangement for non-employee directors of the Company. Effective January 1, 2006, non-employee directors serving on the Board will be entitled to receive the following in consideration for their service on the Board: (1) a cash fee of $2,500 for attendance at each regular quarterly meeting of the Board; (2) an annual fee of $15,000, as compensation for special Board and other meetings; and (3) an annual stock option grant relating to 40,000 shares of common stock, which option would vest upon the first anniversary of the grant and would accelerate upon a “change of control” of the Company. The stock option grants made to each non-employee director in November 2005, as described above, will satisfy the 2006 annual stock option grant. The November 2005 option grants, which were made pursuant to the Company’s 2004 Stock Incentive Plan, provide that they are not exercisable unless and until the Company’s stockholders ratify and approve such plan, which is being considered at the Annual Meeting. See “Proposal 3 - Approval of 2004 Stock Incentive Plan.”

In addition to the compensation described above, the chair of the Audit Committee is also entitled to receive an annual grant of 10,000 shares of our common stock, which grant is made pursuant to our 2004 Stock Incentive Plan, the approval of which will be considered at the Annual Meeting. See “Proposal 3 - Approval of 2004 Stock Incentive Plan.”

Biographical Summaries of our Executive Officers

Name | Age | Position |

| Mark J. Ahn, Ph.D. | 43 | President and Chief Executive Officer and Director |

| Gregory I. Berk, M.D. | 47 | Senior Vice President, Chief Medical Officer |

| John P. Iparraguirre | 30 | Vice President, Chief Financial Officer and Secretary |

| Fred L. Vitale | 49 | Vice President, Chief Business Officer |

Mark J. Ahn has been President and Chief Executive Officer and a director of our company since October 2003. His complete biography is set forth above under the caption “Proposal 1: Election of Directors - Biographical Summaries.”

Gregory I. Berk, M.D., was appointed as our Vice President, Chief Medical Officer in October 2005, and in December 2005 was named Senior Vice President, Chief Medical Officer. From January 2003 until he joined Hana, Dr. Berk was Medical Director for Network of Medical Communications and Research where he provided clinical development strategy consulting for leading global oncology companies. From July 1990 to December 2002, Dr. Berk practiced oncology in New York as a partner in Richard T. Silver, M.D. and Gregory I. Berk, M.D., P.C. and was Attending Physician, Department of Medicine at New York Presbyterian Hospital (Cornell Campus) from June 1989 to December 2002. From July 1995 to December 2002, Dr. Berk was Assistant Professor of Medicine, Weill Medical College, Cornell University, New York, where he also served an investigator in numerous clinical trials for oncology product candidates, including the Gleevec pivotal trials, Avastin colorectal and breast trials, and several CALGB studies. Dr. Berk received an M.D. in 1984 from Case Western Reserve University School of Medicine in Cleveland, Ohio.

John P. Iparraguirre has been Vice President, Chief Financial Officer and Secretary of Hana since January 2006. Prior to that, Mr. Iparraguirre served as our Controller and Assistant Secretary since May 2004, as well as interim Chief Financial Officer and Secretary from August 2004 to November 2004. Prior to joining Hana, Mr. Iparraguirre was the Accounting Manager at Discovery Toys, Inc. from April 2002 until May 2004 where he held several roles of responsibility in Finance Management. Mr. Iparraguirre was primarily responsible for maintaining the integrity of the company’s financial reporting as well as coordinating all aspects of its SEC regulatory filings. Prior to Discovery Toys, Mr. Iparraguirre was a Senior Audit Associate at BDO Seidman, LLP, an international accounting firm, from September 1998 until April 2002, focusing on publicly traded companies and their related SEC compliance. In addition, he was appointed the West Coast administrator for BDO’s Computer Assisted Auditing Tools. Mr. Iparraguirre received a Bachelor of Science degree in Business Economics with an Emphasis in Accounting from the University of California, Santa Barbara.

Fred Vitale has been an executive officer with Hana since January 2003, serving first as Vice President, Business Development until December 2005. In December 2005, he was appointed Vice President, Chief Business Officer. From April 2001 to January 2004, Mr. Vitale was employed by Genentech, where he served as head of commercial Rituxan (rituximab) and pre-launch medical education for Avastin (bevacizumab). From December 1998 to April 2001, Mr. Vitale was Director, Global Oncology Marketing at Bristol-Myers Squibb where he was responsible for pipeline development, licensing, and life cycle management for cancer products including Taxol (paclitaxel); as well as Director of Operations and Planning for Japan and China. Prior to that, Mr. Vitale held several roles of increasing responsibility in sales, marketing and general management at Amgen from January 1990 to December 1998. Mr. Vitale received a Bachelor of Science in Biology from The Citadel in Charleston, South Carolina and a Physician Assistant degree from the Medical University of South Carolina.

Compensation of Executive Officers

Summary of Compensation

The following table sets forth, for the last three fiscal years, the compensation earned for services rendered in all capacities by our chief executive officer and the other highest-paid executive officers serving as such at the end of 2005 whose compensation for that fiscal year was in excess of $100,000. The individuals named in the table will be hereinafter referred to as the “Named Executive Officers.”

Summary Compensation Table

| | | | | | | | | | | | | | | | |

| | | | | Annual Compensation | | Long-Term Compensation Awards | | | |

Name & Position | | Fiscal Year | | Salary ($) | | Bonus ($) | | Other ($) | | Restricted Stock Awards ($) | | Shares Underlying Options (#) | | All Other Compensation ($) | |

Mark J. Ahn (1) | | | 2005 | | | 250,000 | | | 187,500 | | | 0 | | | 0 | | | 281,680 | | | 12,500 (2 | ) |

President & CEO | | | 2004 | | | 250,000 | | | 237,500 | | | 0 | | | 12,000 | | | 458,781 | | | 12,500 (2 | ) |

| | | | 2003 | | | 41,667 | | | 80,000 | | | 0 | | | 0 | | | 493,524 | | | 0 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Gregory I. Berk (3) | | | 2005 | | | 150,000 | | | 85,000 | | | 0 | | | 0 | | | 200,000 | | | 7,500 (2 | ) |

Sr. VP, Chief Medical | | | 2004 | | | 25,000 | | | 25,000 | | | 0 | | | 0 | | | 150,000 | | | 1,250 (2 | ) |

Officer | | | 2003 | | | - | | | - | | | - | | | - | | | - | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | |

Russell L. Skibsted (4) | | | 2005 | | | 175,000 | | | 0 | | | 0 | | | 0 | | | 150,000 | | | 25,000 (5 | ) |

VP, Chief Financial | | | 2004 | | | 25,521 | | | 40,000 | | | 0 | | | 0 | | | 0 | | | 0 | |

Officer | | | 2003 | | | - | | | - | | | - | | | - | | | - | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | |

Fred L. Vitale (6) | | | 2005 | | | 175,000 | | | 70,000 | | | 0 | | | 0 | | | 235,000 | | | 8,750 (2 | ) |

VP, Chief Business | | | 2004 | | | 163,731 | | | 128,904 | | | 0 | | | 24,000 | | | 141,007 | | | 8,750 (2 | ) |

Officer | | | 2003 | | | - | | | - | | | - | | | - | | | - | | | - | |

| (1) | Dr. Ahn’s compensation for 2003 represents amounts received from his hiring on November 1, 2003, which included an $80,000 signing bonus and the prorated amount of his $250,000 annual base salary. The number of securities underlying options granted to Dr. Ahn reflect an original option grant relating to 350,000, which as a result of the July 2004 merger with EMLR, Inc. and September 2004 stock combination, converted into the right to purchase 493,524 shares of common stock. |

| (2) | Represents contributions made by us under our 401(k) plan. |

| (3) | Dr. Berk’s compensation for 2004 represents amount from his hiring on October 13, 2004, which included a $25,000 signing bonus. |

| (4) | Mr. Skibsted’s compensation for 2004 represents amount from his hiring on November 8, 2004, which included a $40,000 signing bonus. Mr. Skibsted’s employment with us terminated on December 31, 2005. |

| (5) | Represents aggregate cash amounts payable to Mr. Skibsted upon his separation from the Company. |

| (6) | Mr. Vitale’s compensation for 2004 represents amounts received from his hiring on January 25, 2004, which included a $40,000 signing bonus and the prorated amount of his $175,000 annual base salary. Prior to December 2005, Mr. Vitale’s title was Vice President, Business Development. |

Stock Option Grants in Last Fiscal Year

We grant options to our executive officers under our 2004 Stock Incentive Plan (the “2004 Plan”), and we formerly granted options to our executive officers under our 2003 Stock Option Plan (the “2003 Plan”), which we no longer use. As of December 31, 2005, options to purchase a total of 2,127,183 shares were outstanding under the 2004 Plan and options to purchase 372,817 shares remained available for grant under the 2004 Plan. As of December 31, 2005, options to purchase a total of 704,296 shares were outstanding under the 2003 Plan and options to purchase 295,704 shares remained available for grant under the 2003 Plan.

The following table sets forth certain information regarding options granted to the Named Executive Officers during the fiscal year ended December 31, 2005:

| | | | | | | | | | |

| | | | | % of Total | | | | | | Potential Realizable | |

| | | | | Options | | | | | | Value at Assumed | |

| | | | | Granted to | | | | | | Annual Rates of Stock | |

| | | | | Employees | | Exercise | | | | Price Appreciation for | |

| | | Options | | in Fiscal | | Price | | Expiration | | Option Term(2) | |

| Name | | Granted (#) | | Year(%)(1) | | | | | | 5% ($) | | 10% ($) | |

| Dr. Ahn | | | 126,501 (3 | ) | | 9.1 | | | 1.33 | | | 4/11/2015 | | | 105,809 | | | 268,141 | |

| | | | 155,179 (4 | ) | | 11.2 | | | 4.75 | | | 11/10/2015 | | | 463,558 | | | 1,174,748 | |

| | | | | | | | | | | | | | | | | | | | |

| Dr. Berk | | | 200,000 (4 | ) | | 14.5 | | | 4.75 | | | 11/10/2015 | | | 597,450 | | | 1,514,055 | |

| | | | | | | | | | | | | | | | | | | | |

| Dr. Skibsted | | | 150,000 (5 | ) | | 10.9 | | | 2.39 | | | 7/25/2015 | | | 225,459 | | | 571,357 | |

| | | | | | | | | | | | | | | | | | | | |

| Mr. Vitale | | | 85,000 (3 | ) | | 6.2 | | | 1.33 | | | 4/11/2015 | | | 71,097 | | | 180,173 | |

| | | | 150,000 (4 | ) | | 10.9 | | | 4.75 | | | 11/10/2015 | | | 448,087 | | | 1,135,542 | |

| (1) | Based upon options to purchase a total of 1,380,679 shares of our common stock granted to employees in 2005. |

| (2) | The potential realizable value is based upon the assumption that the fair market value of our common stock appreciates at the rate shown (compounded annually) from the date of the grant until the end of the option term. Actual realizable value, if any, on stock option exercises is dependent on the future performance of our common stock and overall market conditions, as well as the option holder’s continued employment through the vesting period. |

| (3) | Options vest in three annual installments commencing April 11, 2006. |

| (4) | Options vest in three annual installments commencing November 10, 2006. |

| (5) | Represents option grant required to be issued pursuant to the terms of Mr. Skibsted’s employment agreement with us dated November 15, 2004. As of December 31, 2005, the date of Mr. Skibsted’s separation from our company, the right to purchase 100,000 shares subject to this option had vested. The terms of the agreement evidencing this option provided that the vested portion of such option was exercisable only through March 31, 2006 as a result of separation from our company. |

Aggregated Option Exercises in Last Fiscal year and Fiscal Year-End Option Values

The following table provides information concerning option exercises by the Named Executive Officers during the year ended December 31, 2005 and the number and value of unexercised options held by the Named Executive Officers at December 31, 2005. The value realized on option exercises is calculated based on the fair market value per share of common stock on the date of exercise less the applicable exercise price.

The value of unexercised in-the-money options held at December 31, 2005 represents the total gain which the option holder would realize if he exercised all of the in-the-money options held at December 31, 2005, and is determined by multiplying the number of shares of common stock underlying the options by the difference between $5.87, which was the closing price per share of our common stock on the American Stock Exchange on December 30, 2005 (the last trading day of 2005), and the applicable per share option exercise price. An option is “in-the-money” if the fair market value of the underlying shares exceeds the exercise price of the option.

| | | | | | | Number of Shares | | Value of Unexercised | |

| | | | | | | Underlying Unexercised | | In-the-Money Options | |

| | | | | | | Options at Fiscal Year End (#) | | at Fiscal Year End ($) | |

| | | | | | | | | | | | | | |

| Name | | Shares Acquired on Exercise | | Value Realized ($) | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable | |

| Dr. Ahn | | | 0 | | | – | | | 481,942 | | | 752,043 | | | 2,732,975 | | | 3,399,515 | |

| | | | | | | | | | | | | | | | | | | | |

| Dr. Berk | | | 0 | | | – | | | 50,000 | | | 300,000 | | | 174,000 | | | 1,044,000 | |

| | | | | | | | | | | | | | | | | | | | |

| Mr. Skibsted | | | 0 | | | – | | | 100,000 | | | 50,000 | | | 348,000 | | | 174,000 | |

| | | | | | | | | | | | | | | | | | | | |

| Mr. Vitale | | | 0 | | | – | | | 70,504 | | | 305,503 | | | 390,169 | | | 944,064 | |

Long Term Incentive Plan Awards

No long term incentive plan awards were made to any Named Executive Officer during the last fiscal year.

Equity Compensation Plan Information

The following table summarizes outstanding options under our 2003 Stock Option Plan and our 2004 Stock Incentive Plan, as well as outstanding options that we have issued to certain officers, directors and employees of our company outside of any plan.

Plan category | | Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) | | Weighted average exercise price of outstanding options, warrants and rights (b) | | Number of securities remaining available for future issuance (excluding securities reflected in column (a) (c) | |

| Equity compensation plans approved by stockholders | | | - | | $ | - | | | - | |

| Equity compensation plans not approved by stockholders - Outside any Plan(1) | | | 960,094 | | $ | 0.23 | | | n/a | |

| Equity compensation plans not approved by stockholders - 2003 Plan (2) | | | 704,296 | | $ | 0.86 | | | 705,772 | |

| Equity compensation plans not approved by stockholders - 2004 Plan (2) | | | 2,252,183 | | $ | 3.59 | | | 1,747,817 | |

| | | | | | | | | | | |

__________________________________

| (1) | Represent shares of common stock issuable outside of any stock option plan. The numbers of shares and exercise price have been adjusted to give effect to the mergers and reincorporation effected in 2004. |

| (2) | Represent shares issued under the Company’s 2003 and 2004 Stock Option Plan. During 2004 the Company’s Board of Directors adopted the 2004 Plan and all future issuances of securities will be made under the 2004 Plan. See also Note 4 of the Company’s audited financial statements as of and for the year ended December 31, 2005 included in this Annual Report. |

Employment, Severance and Change of Control Agreements

Mark J. Ahn

Dr. Ahn’s employment with us is governed by an employment agreement dated November 1, 2003, as amended. As amended, the agreement provides for a term that expires in November 2008 and an initial annual base salary of $250,000. Dr. Ahn is also eligible to receive milestone bonus payments, as follows: (i) $50,000 upon the dosing of the first patient in a Phase II clinical trial of Talotrexin; (ii) $75,000 upon the dosing of the first patient in a Phase III clinical trial of Talotrexin; (iii) $75,000 upon the in-licensing of a Phase II clinical compound introduced to us by Dr. Ahn; (iv) $100,000 upon our licensing of a Phase III clinical compound introduced to us by Dr. Ahn; (v) $50,000 following the successful completion of an initial public offering; and (vi) $100,000 in the event that our market capitalization is at least $100 million for a period of 90 consecutive days. Dr. Ahn is further eligible to receive an annual bonus in an amount up to 75 percent of his base salary, as determined by our board of directors. Pursuant to his employment agreement, Dr. Ahn also received an option to purchase 493,524 shares of our common stock at a price of $0.167 per share.

In addition to Dr. Ahn’s initial option grant that he received upon joining Hana, his employment agreement also provides that he is entitled to receive additional option grants in the future in order to maintain his beneficial ownership of Hana’s common stock at specified levels. In particular, his agreement provides that until such time as we raise aggregate gross proceeds of $10 million through the sale of equity securities, we are required to issue Dr. Ahn an additional number of options sufficient to maintain his ownership percentage of our common stock at no less than 8 percent. Thereafter, and until we have raised an aggregate of $50 million through the sale of equity securities, Dr. Ahn is entitled to receive additional options to maintain his ownership at no less than 5 percent (assuming the exercise of all options held by Dr. Ahn, without regard to the vesting schedule). Once we have raised at least $50 million, then Dr. Ahn is no longer entitled to such additional options. Dr. Ahn’s employment agreement provides that such additional stock options will vest in 3 annual installments beginning on the first anniversary of the grant date and shall be exercisable at a price equal to the greater of 20 percent of the then-current market price of our common stock or $0.167 per share. Our obligation to issue any such additional stock options, if any, is triggered on the last day of each fiscal quarter in which we issued additional shares of common stock that resulted in Dr. Ahn’s ownership percentage decreasing below the 8 or 5 percent levels, unless we sell any shares of common stock as part of a financing transaction, in which case the additional options are to be issued as of the closing of such transaction. In accordance with the terms of his employment agreement, we made two additional stock option grants to Dr. Ahn in 2004, consisting of a grant of 79,658 shares in February 2004 and a grant of 194,568 shares in July 2004. As of July 15, 2005, we have raised an aggregate of approximately $17.7 million through the sale of our equity securities.

In the event we terminate Dr. Ahn’s employment for “cause” (as defined in the employment agreement), it is only obligated to pay his compensation through the date of termination and all unvested options then held by Dr. Ahn immediately terminate. In the event Dr. Ahn’s employment is terminated upon the occurrence of a “change of control” or for a reason other than for “cause,” we are obligated to continue paying to Dr. Ahn his base salary for a period of one year, as well as any accrued and unpaid bonus through the date of termination; provided, that our obligation to pay Dr. Ahn such amounts shall be reduced by amounts he otherwise earns during the 1-year period following termination. In the event his employment is terminated upon a change of control, all of Dr. Ahn’s stock options that have not yet vested will accelerate and be deemed to have vested upon such termination; otherwise, the unvested portion of such options will terminate and he will have 90 days to exercise the vested portions of any options.

Gregory I. Berk

We have entered into a written employment agreement with Dr. Berk in October 2004 providing for a 3-year term and an initial annual base salary of $150,000, as well as a $25,000 signing bonus, a housing allowance and other benefits generally made available to the Registrant’s other senior management. The employment agreement also provides that Dr. Berk is entitled to receive an option to purchase 150,000 shares of our common stock at a price of $2.39 per share. The option shall vest in three equal annual installments. In the event Dr. Berk’s employment is terminated by us upon a “change of control” (as defined in the employment agreement), Dr. Berk is entitled to receive his base salary for six months and all of his unvested stock options shall be deemed vested. If, prior to the end of the 3-year term, we terminate Dr. Berk’s employment without “cause” or other than as a result of a “disability” (as those terms are defined in the agreement) or death, or if Dr. Berk terminates his employment for “good reason,” then Dr. Berk is entitled to receive his base salary for a period of one year from the date of such termination.

Russell L. Skibsted

Mr. Skibsted’s employment with us was governed by a written employment agreement dated November 8, 2004. The agreement provided for a 3-year term and an initial annual base salary of $175,000, as well as a $40,000 bonus payable prior to January 15, 2005 and other benefits generally made available to our other senior management. The employment agreement also provided that Mr. Skibsted was entitled to receive an option to purchase 150,000 shares of our common stock at a price of $2.39 per share, vesting in three equal annual installments, commencing November 2005. In the event Mr. Skibsted’s employment was terminated by us upon a “change of control” (as defined in the employment agreement), he was to receive his base salary for six months thereafter or the remainder of the term, whichever is longer, and all unvested portions of his stock option grant shall be deemed vested. If, prior to the end of the 3-year term, we terminated Mr. Skibsted’s employment without “cause”, then Mr. Skibsted was to receive his base salary for a period of one year from the date of such termination, provided, however, that such amount shall be reduced by amounts Mr. Skibsted earns from other employment during such one-year period, and his stock options scheduled to vest in the contract year of such termination shall be accelerated and deemed vested. On December 28, 2005, we entered into a separation agreement with Mr. Skibsted, which provided that his employment with us would end as of December 31, 2005. In accordance with the terms of his employment agreement, the separation agreement provided that we would continue to pay to Mr. Skibsted his base salary for a period of six months and that 100,000 shares subject to his stock option would vest, with his rights to the remaining 50,000 unvested shares terminating. In addition, pursuant to the separation agreement, we agreed to pay Mr. Skibsted additional aggregate consideration of $25,000 and Mr. Skibsted agreed to release any possible legal claims against us.

Fred Vitale

Mr. Vitale’s employment with us is governed by an employment agreement dated January 25, 2004, which was amended in December 2005. As amended, the term of the agreement continues until November 2008. The agreement provided for an initial base salary of $175,000 and a signing bonus of $40,000. Mr. Vitale is also eligible to receive periodic incentive bonuses upon the achievement of milestones to be determined by the chief executive officer. In connection with his employment agreement, Mr. Vitale was also granted stock options that now represent the right to purchase 141,007 shares of common stock, which vest in two equal installments on February 1, 2005 and February 1, 2006. The options are exercisable at a price equal to $0.336 per share.

In the event Mr. Vitale’s employment is terminated for “cause” (as defined in the employment agreement), we are only obligated to pay his compensation through the date of termination and all stock options held by Mr. Vitale that have not yet vested immediately terminate. In the event we terminate Mr. Vitale’s employment upon a “change of control,” then Mr. Vitale is entitled to continue receiving his base salary for a period of six months. All stock options that have not yet vested as of such date will be accelerated and deemed to have vested. If we terminate Mr. Vitale’s employment agreement for a reason other than for cause or upon a change of control, he is entitled to receive his base salary for a period of one year, which amount may be reduced by any amounts earned by Mr. Vitale from other employment during such one-year period.

Compensation Committee Interlocks and Insider Participation

There were no interlocks or other relationships with other entities among our executive officers and directors that are required to be disclosed under applicable SEC regulations relating to compensation committee interlocks and insider participation.

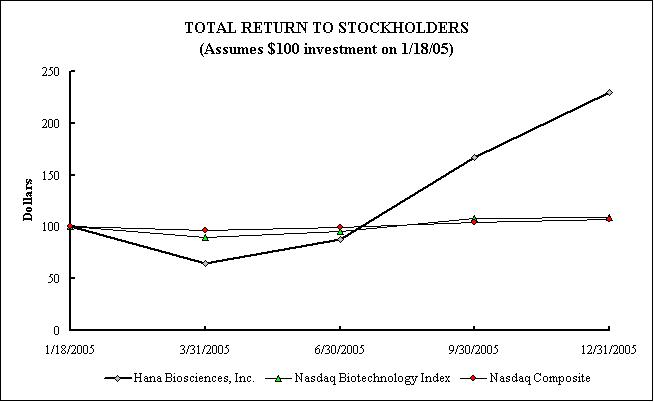

Stock Performance Graph*

The SEC requires that we include in following this Proxy Statement a line-graph presentation compares the cumulative return to our stockholders (based on appreciation in the market price of our common stock) on an indexed basis with (i) a broad equity market index and (ii) an appropriate published industry or line-of-business index, or peer group index constructed by us. The following presentation compares our common stock price from January 18, 2005, the effective date of our registration statement on Form SB-2 covering the resale of an aggregate of 7,904,114 shares of our common stock held by the selling stockholders identified therein, and for each quarterly period through December 31, 2005, to the Nasdaq Composite Index and the Nasdaq Biotechnology Index. Prior to the effective date of this registration statement, there was no active market for our common stock. The presentation assumes that the value of an investment in each of our common stock, the Nasdaq Composite Index and the Nasdaq Biotechnology Index was $100 on January 18, 2005, and that any dividends paid were reinvested in the same security. We have not declared or paid any dividends on our common stock in such period.

Our Board of Directors and the Compensation Committee recognize that the market price of our common stock is influenced by many factors, only one of which is our performance. The historical stock price performance shown on the graph below is not necessarily indicative of our future stock price performance.

_________________________

* The material in this section is not “soliciting material,” is not deemed filed with the SEC and is not to be incorporated by reference in any of our filings under the Securities Act or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

Total Return Analysis | | | | | | | | | | | |

| | | Jan. 18, 2005 | | Mar. 31, 2005 | | Jun. 30, 2005 | | Sep. 30, 2005 | | Dec. 31, 2005 | |

Hana Biosciences, Inc. | | $ | 100.00 | | $ | 64.71 | | $ | 88.24 | | $ | 166.67 | | $ | 230.20 | |

Nasdaq Biotechnology Index | | $ | 100.00 | | $ | 89.70 | | $ | 95.19 | | $ | 108.22 | | $ | 108.97 | |

Nasdaq Composite | | $ | 100.00 | | $ | 96.94 | | $ | 99.74 | | $ | 104.33 | | $ | 106.93 | |

| Source: CTA Public Relations. Data from BRIDGE Information Systems, Inc. | | | | | | |

REPORT OF THE COMPENSATION COMMITTEE OF THE BOARD OR DIRECTORS*

The Compensation Committee of our Board of Directors is currently composed of Dr. Belldegrun (Chair), Mr. Kier and Dr. Weiser, directors who are not our employees. The Compensation Committee is responsible for establishing and administering our executive compensation arrangements.

Compensation Philosophy

We believe that a competitive, goal-oriented compensation policy is critically important to the creation of value for stockholders. To that end, we have created an incentive compensation program intended to reward outstanding individual performance. The goals of the compensation program are to align compensation with business objectives and performance to enable us to attract and retain the highest quality executive officers and other key employees, reward them for our progress and motivate them to enhance long-term stockholder value. Our compensation program is intended to implement the following principles:

_________________________________

* This material in this report is not “soliciting material,” is not deemed filed with the SEC and is not to be incorporated by reference in any of our filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether before or after the date hereof and irrespective of any general incorporation language in any such filing.

| · | Compensation should be related to the value created for stockholders; |

| · | Compensation programs should support the short-term and long-term strategic goals and our objectives; |

| · | Compensation programs should reflect and promote our values and reward individuals for outstanding contributions to our success; and |

| · | Short-term and long-term compensation programs play a critical role in attracting and retaining well-qualified executives. |

While compensation opportunities are based in part upon individual contribution, the actual amounts earned by executives in variable compensation programs are also based upon how we perform. The executive compensation for the Chief Executive Officer and all other executives is based upon three components, each of which is intended to serve our compensation principles.

Base Salary

Base salary is targeted at the competitive median for similar companies in the biotechnology industry. For the purpose of establishing these levels, the Compensation Committee compares our compensation structure from time to time with biotechnology companies of similar size and with product candidates at similar stages of development. Based upon its reviews of such data, the Compensation Committee determined that the base salaries of the Chief Executive Officer and all other executive officers were appropriate and necessary to attract individuals of such high caliber within the biotechnology industry. The Compensation Committee reviews the salaries of the Chief Executive Officer and other executive officers each year and such salaries may be increased based upon (i) the individual’s performance and contribution, (ii) our performance and (iii) increases in median competitive pay levels.

Discretionary Bonus and Equity Based Awards

Our Chief Executive Officer and other executive officers are also eligible for annual discretionary bonuses. In accordance with the terms of his employment agreement, our Chief Executive Officer is eligible for a discretionary bonus of up to 75 percent of his annual base salary. The determination of the bonuses paid to our Chief Executive Officer and other executive officers is based upon a set of criteria established by the Compensation Committee at the beginning of each fiscal year. Such criteria include, among other things, the Company’s achievement of certain corporate goals related to clinical development of the Company’s current product candidates, certain financial performance measurements, and goals related to investor relations initiatives.

In addition to annual discretionary bonuses, the Company also makes annual stock option or other equity compensation based awards to its executive officers, including its Chief Executive Officer. Like discretionary cash bonuses, these awards are determined based on the achievement by such executive and the Company of certain pre-determined goals.

Compensation of the Chief Executive Officer

Based on the terms of his employment agreement with the Company, Dr. Ahn received an annualized base salary of $250,000 during fiscal 2005, which the Compensation Committee believes is competitive with executives in other industry-related companies. The Company granted Dr. Ahn a bonus of $187,500 for his performance during fiscal 2005, which represents the maximum 75 percent of his target bonus. Dr. Ahn was awarded the maximum discretionary bonus because he successfully achieved each of the objectives established by the Compensation Committee at the beginning of fiscal 2005. Dr. Ahn also received two stock option grants in fiscal 2005 - one in April 2005 relating to 126,501 shares and another in November 2005 relating to 155,179 shares. The April stock option grant was awarded to Dr. Ahn in connection with his performance for fiscal 2004, and the November 2005 award related to his performance in fiscal 2005.

Arie S. Belldegrun (Chair)

Isaac Kier

Michael Weiser

PROPOSAL 2:

APPROVAL OF 2003 STOCK OPTION PLAN

Stockholders are requested in this Proposal 2 to ratify and approve the Company’s 2003 Stock Option Plan (the “2003 Plan”) and all stock option grants made pursuant to the 2003 Plan. The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the meeting will be required to ratify and approve the 2003 Plan. Abstentions will be counted toward the tabulation of votes cast on proposals presented to the stockholders and will have the same effect as negative votes. Broker non-votes are counted towards a quorum, but are not counted for any purpose in determining whether this matter has been approved.

The brief summary of the 2003 Plan which follows is qualified in its entirety by reference to the complete text, a copy of which is attached to this Proxy Statement as Appendix B.

General