UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 16, 2006

Hana Biosciences, Inc.

(Exact name of registrant as specified in its charter)

Delaware | 000-50782 | 32-0064979 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | |

| | | |

400 Oyster Point Blvd., Suite 215, South San Francisco, CA | 94080 |

| (Address of principal executive offices) | (Zip Code) |

| | (650) 588-6404 | |

| | (Registrant's telephone number, including area code) | |

| | | |

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01. Other Information

The following description of the business of Hana Biosciences, inc. (the “Company”) has been updated from the description set forth in the Company's Annual Report on Form 10-K for the year ended December 31, 2006 in order to reflect the completion of the Company’s licensing transaction with Inex Pharmaceuticals Corporation in May 2006, which was previously disclosed in the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on May 11, 2006. The description set forth below is subject to and should be read in conjunction with all of the risks and uncertainties identified under Item 1A of Part II of the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2006. References to “we,” “us,” and “our” refer to the Company.

Business Overview

We are a South San Francisco, California-based biopharmaceutical company focused on acquiring, developing, and commercializing innovative products to advance cancer care. We seek to license novel, late preclinical and early clinical oncology product candidates, primarily from academia and research institutes, in order to accelerate clinical development and time to commercialization. <?xml:namespace prefix = o ns = "urn:schemas-microsoft-com:office:office" />

We currently have four product candidates in clinical development:

Zensana (ondansetron HCI) Oral Spray, or Zensana, being developed to alleviate chemotherapy- and radiation-induced and post-operative nausea and vomiting;

Marqibo (vincristine sulfate) Liposomes Injection, or Marqibo, a liposomal formulation of the FDA-approved cancer drug vincristine, being developed for the treatment of non-Hodgkin’s lymphoma and acute lymphocytic leukemia, or ALL;

Talotrexin (PT-523), which is being evaluated as a chemotherapy agent in the treatment of a variety of solid tumors and hematological malignancies, including non-small cell lung cancer, or NSCLC, ALL, and cervical and ovarian cancers; and

Ropidoxuridine (IPdR), a radiation sensitizer being evaluated primarily for the treatment of colorectal, gastric, pancreatic, liver and brain cancr.

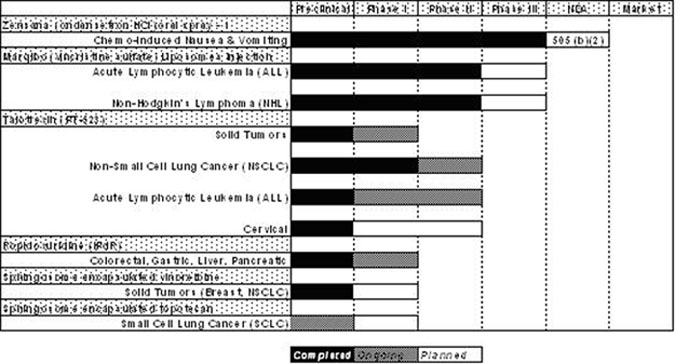

The following table describes the status of the product candidates in our development pipeline:

1- Zensana is being developed under a 505(b)(2) registrational pathway based on a demonstration of bioequivalence to 8mg oral Zofran tablets. As a result, efficacy and safety trials in patients (Phase II and III) are not required. However bioequivalence and bioavailability trials have been completed and Hana Biosciences plans to submit an NDA in the second quarter of 2006.

| | · | Zensana (ondansetron HCI) Oral Spray - Bioequivalent to 8mg Oral Zofran Tablet with Multidose Convenience and Desirable Route of Administration. We believe that Zensana, which we licensed from NovaDel Pharma, Inc. in October 2004, is the only multidose oral spray product candidate currently in development which utilizes a micro mist spray technology to deliver full doses of ondansetron to patients experiencing chemo- and radiotherapy-induced nausea and vomiting. Ondansetron, a selective blocking agent of the hormone serotonin, is an FDA-approved drug that is commonly used in tablet form to prevent chemotherapy- and radiation-induced and post-operative nausea and vomiting. Many patients receiving chemo and radiation therapy have difficulty swallowing and are potentially unable to tolerate other forms of ondansetron and other therapies intended to prevent nausea and vomiting, known as antiemetics. We believe that the convenience of drug delivery via a spray may offer a desirable alternative to tablets and other forms of ondansetron. In addition, we believe that drug delivery via a spray to the oral mucosa may avoid degradation of the drug in the gastrointestinal tract and metabolism by liver enzymes. All spray pump components used in our clinical trials for Zensana are standard components, and with the exception of the oral applicator, are currently being used for DDAVP® Nasal Spray manufactured for Aventis Pharmaceuticals Inc. by Ferring AB. The oral applicator is currently being used for Lamisil® Spray marketed by Novartis AG. We completed certain limited clinical trials of Zensana related to bioequivalence and bioavailability in early 2006, and hope to file an NDA under Section 505(b)(2) of the Food, Drug and Cosmetic Act, or FDCA, in the second quarter of 2006. If approved by the FDA, we intend to commercially launch Zensana in the United States in the first half of 2007. |

| | · | Marqibo (vincristine sulfate) Liposomes Injection - A Novel Targeted Anti-Cancer Compound for Non-Hodgkin’s Lymphoma and Acute Lymphocytic Leukemia. Marqibo, which we licensed from Inex Pharmaceuticals Corporation, or Inex, in May 2006, is a novel, targeted sphingosome encapsulated formulation of the FDA-approved cancer drug vincristine. Sphingosomal drug delivery consists of using an FDA-approved cancer agent (such as vincristine) encapsulated in a lipid envelope. The encapsulated agent is carried through the bloodstream and delivered to disease sites where it is released to carry out its therapeutic action. We believe sphingosomal encapsulation of vincristine significantly increases drug delivery to tumors and provides prolonged drug exposure for cell-cycle specific agents. Targeted sphingosomal drugs are designed to spare healthy tissues, selectively accumulate inside the tumor, and sustain cytotoxic drug levels for a longer period of time at the tumor site. Therefore, we believe that Marqibo possesses a potential pharmacologic advantage over vincristine in terms of dose intensity and toxicity. Based on clinical trials in over 500 patients to date, we intend to request regulatory authorization to commence a Phase III clinical trial of Marqibo in hematological malignancies in the second half of 2006. |

| | · | Talotrexin (PT-523) - A Novel Antifolate for Solid and Hematological Malignancies. Talotrexin, which we licensed from Dana-Farber Cancer Institute, Inc., or DFCI, and Ash Stevens, Inc. in December 2002, is a novel antifolate drug candidate under development for treatment of various types of tumors. Antifolates, also known as folic acid analogs, are a class of cytotoxic or antineoplastic agents which inhibit or prevent the maturation and proliferation of malignant cells. Antifolates have been used for more than 30 years to treat both solid and hematological cancers such as breast cancer and ALL, as well as inflammatory diseases such as rheumatoid arthritis. Talotrexin has demonstrated enhanced antitumor activity in a broad spectrum of cancer models by targeting the enzyme DHFR to prevent DNA synthesis in tumor cells and inhibit tumor growth. Preclinical studies performed by the DFCI and the National Cancer Institute, or NCI, suggest that Talotrexin, as compared to methotrexate, the most widely used antifolate, enters into cells up to 10 times more efficiently and demonstrates 10- to 100-fold more potency in overcoming polyglutamation, a well-established mechanism of antifolate resistance. Talotrexin also binds more tightly to its anti-tumor target DHFR, which we believe may further inhibit tumor growth. We commenced a Phase I clinical trial in solid tumors in February 2005, a Phase I/II clinical trial in NSCLC in March 2004, and a Phase I/II clinical trial in ALL in May 2005. |

| | · | Ropidoxuridine (IPdR) - Oral Prodrug to Enhance Radiation Therapy for Brain and Other Cancers. Ropidoxuridine, which we licensed from Yale University and the Research Foundation of State University of New York in February 2004, is a novel oral prodrug of the radiation sensitizer IUdR. Data from Phase II clinical trials performed by the NCI on IUdR suggested a potential survival advantage in patients with anaplastic astrocytoma, a type of brain tumor. Due to its toxicity profile, however, IUdR was never developed beyond Phase II. In preclinical studies conducted at Yale University and the NCI, ropidoxuridine suggested improved activity with a significantly lower toxicity profile, including lower gastrointestinal and hematological side effects. Preclinical studies have also demonstrated that ropidoxuridine has a dose responsive and synergistic effect when combined with radiation in human glioblastoma models. We have commenced a Phase I clinical trial assessing the safety, toxicity and pharmacokinetics of ropidoxuridine in patients with solid tumors undergoing radiation therapy. |

| | · | Sphingosome Encapsulated Vinorelbine - A Novel Targeted Anti-Cancer Compound for Breast and Lung Cancer. Sphingosome encapsulated vinorelbine is our proprietary formulation of vinorelbine, a microtubule inhibitor that is FDA-approved for use as a single agent or in combination with cisplatin for the first-line treatment of unresectable, advanced NSCLC. We obtained the rights to develop and commercialize sphingosome encapsulated vinorelbine from Inex in May 2006. Sphingosome encapsulated vinorelbine is in preclinical development and we plan to request regulatory authorization to commence Phase I clinical trials in the second half of 2006. |

| | · | Sphingosome Encapsulated Topotecan - A Novel Targeted Anti-Cancer Compound for Small-Cell Lung Cancer and Ovarian Cancer. Sphingosome encapsulated topotecan is our proprietary formulation of topotecan, a topoisomerase I inhibitor that is FDA-approved for use in relapsed small-cell lung cancer and in relapsed ovarian cancer. We obtained the rights to develop and commercialize sphingosome encapsulated topotecan from Inex in May 2006. Sphingosome encapsulated topotecan is in preclinical development and we plan to we expect to file an IND in the second half of 2006 and to initiate clinical trials in 2007. |

Industry Background and Market Opportunity

Cancer is a group of diseases characterized by either the uncontrolled growth of cells or the failure of cells to die normally. Cancer is caused by a series of mutations, or alterations, in genes that control cells’ ability to grow and divide. These mutations cause cells to rapidly and continuously divide or lose their normal ability to die. There are more than 100 different varieties of cancer, which can be divided into six major categories. Carcinomas, the most common category, include breast, lung, colorectal and prostate cancer. Sarcomas begin in tissue that connects, supports or surrounds other tissues and organs. Lymphomas are cancers of the lymphatic system, a part of the body’s immune system. Leukemias are cancers of blood cells, which originate in the bone marrow. Brain tumors are cancers that begin in the brain, and skin cancers, including melanomas, originate in the skin. Cancers are considered metastatic if they spread via the blood or lymphatic system to other parts of the body to form secondary tumors.

According to the American Cancer Society, nearly 1.4 million new cases of cancer are expected to be diagnosed in 2006 in the United States alone. Cancer is the second leading cause of death, after heart disease, in the United States, and is expected to account for more than 550,000 deaths in 2006. Major cancer treatments include surgery, radiotherapy and chemotherapy. Supportive care, such as anti-nausea drugs, represents another major segment of the cancer treatment market. There are many different drugs that are used to treat cancer, including cytotoxics or antineoplastics, hormones and biologics. Major categories include:

| | · | Chemotherapy. Cytotoxic chemotherapy refers to anticancer drugs that destroy cancer cells by stopping them from multiplying. Healthy cells can also be harmed with the use of cytotoxic chemotherapy, especially those that divide quickly. Cytotoxic agents act primarily on macromolecular synthesis, repair or activity, which affects the production or function of DNA, RNA or proteins. Our product candidates Marqibo and Talotrexin are both cytotoxic agents we plan to evaluate for the treatment of solid and hematological tumors. According to Business Insights, cytotoxics or antineoplastic agents accounted for 44% or $16.2 billion of the total global cancer drug market in 2004. |

| | · | Radiotherapy. Radiation therapy, or radiotherapy, is the treatment of cancer and other diseases with ionizing radiation. Ionizing radiation deposits energy that injures or destroys cells in the area being treated by damaging their genetic material, making it impossible for those cells to continue growing. Although radiation damages both cancer cells and normal cells, the latter are able to repair themselves and regain proper function. Radiotherapy is used to treat localized solid tumors, such as cancers of the skin, tongue, larynx, brain, breast or uterine cervix and it can also be used to treat leukemia and lymphoma. In looking for ways to increase the effectiveness of radiation therapy, scientists are studying investigational drugs for their effect on cells exposed to radiation. Radiosensitizer drugs are designed to increase the damage done to tumor cells by radiation. Our product candidate ropidoxuridine is a radiosensitizer. According to the NCI, over 50% of all cancer patients undergo radiation therapy, either alone or in combination with other treatments. |

| | | Supportive care. Cancer treatment can include the use of chemotherapy, radiation therapy, biologic response modifiers, surgery or some combination of these or other therapeutic options. All of these treatment options are directed at killing or eradicating the cancer that exists in the patient’s body. Unfortunately, the delivery of many cancer therapies adversely affects the body’s normal organs. These complications of treatment or side effects not only cause discomfort, but may also prevent the optimal delivery of therapy to a patient at its optimal dose and time. The most common side effects of chemotherapy are nausea and vomiting. Nausea and vomiting induced by chemotherapy and radiation therapy are generally treated by antiemetic drugs such as ondansetron. According to the NCI, over 500,000 Americans received chemotherapy in 2004, and the majority of these patients received an antiemetic such as ondansetron. Our leading product candidate, Zensana, is ondansetron delivered via an oral spray. According to Business Insights, supportive care accounted for approximately 37% or $15.0 billion of the total U.S. cancer drug market in 2004. |

Our Strengths

| | · | Significant clinical development and commercialization expertise. Our senior management team has over 39 years of combined experience in the development and commercialization of innovative cancer therapies. Prior to joining Hana, our Chief Executive Officer, Dr. Ahn, served as Vice President, Hematology at Genentech, Inc. At Genentech, Dr. Ahn played a key role in the successful commercialization of Rituxan®. Our Chief Business Officer, Mr. Vitale, also served at Genentech as head of commercial development for Rituxan and head of pre-launch medical education for Avastin®. Prior to Genentech, both Dr. Ahn and Mr. Vitale worked together for over a decade in roles of increasing responsibility at Amgen, Inc. and Bristol-Myers Squibb Company. Our Chief Medical Officer, Dr. Berk, has served as an investigator in numerous clinical oncology trials, including the Gleevec® pivotal trials and the Avastin colorectal and breast trials. We believe the combined experience of our executive team has been and will continue to be a critical component of Hana’s success in developing and commercializing our product candidates. |

| | · | Multiple product candidates with a number of potential pathways for market expansion. We currently have four product candidates in various stages of clinical development. We believe that our product candidates have potential therapeutic utility in multiple indications. We are currently conducting clinical trials for Talotrexin in NSCLC and ALL and intend to conduct clinical trials for Talotrexin in cervical cancer and other solid tumors. We also plan to pursue multiple indications for Marqibo and our other product candidates to expand their potential markets. |

| | · | Cost effective clinical development process. We have been successful in acquiring promising product candidates for what we believe are reasonable upfront costs by partnering with leading academic and research organizations. We believe that academic and research organizations are particularly well suited to engage in early stage drug discovery and preclinical development. By partnering with these organizations, we seek to bring our senior management’s clinical development and commercialization expertise to bear on early stage research and preclinical development conducted by others. We believe that by focusing our activities on clinical development, we can accelerate the potential commercialization of our product candidates. |

Our Strategy

We are committed to creating value by building a strong, experienced team, accelerating the development of our lead product candidates, expanding our pipeline by being the alliance partner of choice for academic and research organizations, and nurturing a unique company culture. Key aspects of our strategy include:

| | · | Pursue commercialization of Zensana. We expect to file an NDA for Zensana in the second quarter of 2006. If we receive FDA approval, we expect to commercially launch Zensana in the United States in the first half of 2007. We anticipate that revenues from Zensana will help offset a portion of the development costs for our other product candidates and reduce our dependence on external financing. Additionally, we intend to develop a specialized oncology salesforce of approximately 30 people that can educate oncologists and oncology nurses regarding Zensana. We believe that that nurses are the key providers of supportive care and are often the main decision makers regarding treatment. We intend to leverage this salesforce in commercializing future products, if developed successfully and approved by the FDA. |

| | · | Focus on developing innovative cancer therapies. We focus on oncology product candidates in order to capture efficiencies and economies of scale. We believe that drug development for cancer markets is particularly attractive because relatively small clinical trials can provide meaningful information regarding patient response and safety. The oncology market is concentrated, meaning that a small number of doctors write a large percentage of prescriptions, and we believe that the market can be addressed by a relatively small, focused salesforce. Furthermore, we believe that our capabilities are well suited to the oncology market and represent distinct competitive advantages. |

| | · | Build a sustainable pipeline by employing multiple therapeutic approaches and disciplined decision criteria based on clearly defined proof of principle goals. We seek to build a sustainable product pipeline by employing multiple therapeutic approaches and by acquiring product candidates belonging to known drug classes. In addition, we employ disciplined decision criteria to assess product candidates. By pursuing this strategy, we seek to minimize our clinical development risk and accelerate the potential commercialization of current and future product candidates. We intend to pursue regulatory approval for a majority of our product candidates in multiple indications. |

Our Product Pipeline

Zensana (ondansetron HCI) Oral Spray

Background

According to an independent study, nausea and vomiting are the leading concerns of patients undergoing chemotherapy. The management of nausea and vomiting induced by chemo and radiation therapy and/or following surgery is a critical aspect of cancer patient care. The NCI estimates that a majority of the approximately 500,000 patients receiving chemotherapy treatment per year experience nausea and vomiting, and could benefit from nausea-reducing, or antiemetic, therapies. Ondansetron is a selective blocking agent of the serotonin 5-HT3 receptor type and is widely accepted as the standard of care for antiemesis. Ondansetron is currently FDA-approved for the prevention of nausea and vomiting associated with:

| | · | Moderate to highly emetogenic cancer chemotherapy-induced nausea and vomiting, or CINV; |

| | · | Radiotherapy-induced nausea and vomiting in patients receiving total body irradiation, single high-dose fraction to the abdomen, or daily fractions to the abdomen; and |

| | · | Post-operative induced nausea and vomiting. |

Ondansetron is currently commonly used in tablet form to prevent chemotherapy- and radiation-induced, and post-operative nausea and vomiting. However, many patients receiving chemo and radiation therapy have difficulty swallowing and holding down pills, and are potentially unable to tolerate other forms of ondansetron and other antiemetic therapies.

We believe Zensana would represent the first commercialized multidose oral spray 5-HT3 antagonist. Zensana utilizes a novel micro mist spray technology to deliver full doses of ondansetron to patients receiving emetogenic, or vomit- and/or nausea-inducing, chemotherapy. We believe the convenience of spray delivery will offer patients a desirable alternative to tablets and other currently available forms of ondansetron.

Marketing Survey

We commissioned the Winokur Consulting Group to conduct market research to determine physician and payor utilization and perceptions of current and emerging antiemetics for CINV. This survey, completed in August 2005, was intended to determine current trends and market potential for the introduction of Zensana for the prevention of CINV. The study consisted of a statistically significant and representative survey of 162 hematologists-oncologists in academia and community practices, out of 800 surveyed (20.3% response rate, 95% confidence interval, plus-or-minus 5% margin of error). Major conclusions of this study include:

| | · | 90% of surveyed oncologists believed that Zensana would be more convenient for their patients than a tablet for the prevention of CINV. 48% of these oncologists indicated that the most important product attribute for oral 5-HT3 antagonists is: “can be used easily by patients who are experiencing nausea and vomiting, in contrast to swallowing a tablet.” |

| | · | Surveyed oncologists indicated that they would use Zensana prior to chemotherapy in at least 25% of their patients. In addition, 66% of the oncologists surveyed indicated that they would prescribe Zensana after chemotherapy to more than 50% of their patients treated with moderate-to-highly emetogenic chemotherapy. Thus, while we believe the primary use of Zensana will be in the post-chemotherapy setting, we believe there is also a significant opportunity to use Zensana for the entire treatment cycle. |

Winokur also conducted in-depth interviews with oncologists and pharmacy directors from major public and private insurers who indicated that they believed Zensana could support a price level of approximately 15% below or above the current price of branded ondansetron products, even after the launch of generics. We believe this supports proprietary pricing of Zensana, based on projected patient benefits of convenience and faster time to drug delivery.

Clinical Development Program

In the first quarter of 2006, we completed our bioequivalence and bioavailability trials for Zensana for the prevention of CINV. Our clinical development program consisted of four clinical trials including single and multiple dose pharmacokinetic studies, and an evaluation of the effects of food and water on Zensana. While not yet reviewed or approved by the FDA, we believe data from the four studies demonstrated that the standard 8 milligram dose of Zensana is statistically bioequivalent to the current commercially available 8 milligram ondansetron (Zofran) tablet. Zensana showed statistically faster absorption, as defined by median time to detectible drug levels of ondansetron, of 15 minutes for Zensana compared to 30 minutes for the tablet. In the four studies, Zensana was well tolerated by both men and women and had a side effect profile similar to ondansetron tablets, which included mild headache and constipation.

We met with the FDA in May 2006, and plan to submit our NDA for Zensana for the prevention of CINV in the second quarter of 2006. We intend to file the application under Section 505(b)(2) of the FDCA, a form of registration that relies, at least in part, on data in previously approved NDAs or published literature for which we do not have a right of reference or both. If our NDA is approved, we anticipate commercially launching Zensana in the United States in the first half of 2007.

Marqibo (vincristine sulfate) Sphingosomal Injection

Background of Sphingosomal Targeted Drug Delivery

Sphingosomal encapsulation is a novel method of liposomal drug delivery, which is designed to significantly increase tumor targeting and duration of exposure for cell-cycle specific anticancer agents. Sphingosomal drug delivery consists of using a generic FDA-approved cancer agent, vincristine, encapsulated in a lipid envelope. The encapsulated agent is carried through the bloodstream and delivered to disease sites where it is released to carry out its therapeutic action. When used in unencapsulated form, chemotherapeutic drugs diffuse indiscriminately throughout the body, diluting drug effectiveness and causing toxic side effects in the patient’s healthy tissues. Our proprietary sphingosomal formulation technology is designed to permit loading high concentrations of therapeutic agent inside the lipid envelope, which promotes accumulation of the drug in tumors and prolongs the drug’s release at disease sites. Clinical trials have demonstrated the sphingosomal formulation technology’s ability to deliver dose intensification to the tumor, which we believe has the potential to increase the therapeutic benefit of the drug.

| | · | Longer circulation time in the bloodstream is designed to deliver more of the therapeutic agent to targeted tumor sites over a longer period of time. To stabilize the lipid bilayer walls and retain active drug within its interior, liposomal technology uses sphingomyelin, a biologically inert macromolecule that renders liposomes resistant to hydrolysis and enzymatic degradation. The increased rigidity of the liposomal walls prolongs the circulating life of liposomes and is designed to extend the duration of drug release. |

| | · | Sphingosomal drugs like Marqibo accumulate in the pores of leaky tumor vessels created during angiogenesis. In normal tissues, a continuous endothelial lining constrains liposomes within capillaries, preventing accumulation of the drug in the healthy tissues. In contrast, the immature blood vessel system within tumors is created during tumor growth and has numerous holes up to 800 nanometers in size. With an average diameter of approximately 100 nanometers, liposomes accumulate in these pores. Once lodged within the interstitial space, these resilient liposomes slowly release the encapsulated drug. We believe that slow release of the drug from liposomes increases drug levels within the tumor, extends drug exposure through multiple cell cycles, and significantly increases tumor cell killing. Fewer than 5% of a patient’s tumor cells are in a drug-sensitive phase at any point in time, which we believe indicates that duration of drug exposure is critical to increased drug efficacy. |

| | · | Increased drug concentration at the tumor site is associated with increased efficacy. The link between drug exposure and anti-tumor efficacy is especially pronounced for cell cycle-specific agents such as vincristine, vinorelbine and topotecan, which kill tumor cells by interfering in the G2/M phase in mitosis, or cell division. |

Unmet Medical Needs in Acute Lymphocytic Leukemia and Non-Hodgkin’s Lymphoma

Acute lymphocytic leukemia, or ALL, is a type of cancer of the blood and bone marrow, the spongy tissue inside bones where blood cells are made. Acute leukemias progress rapidly and affect immature blood cells. ALL affects a group of white blood cells, called lymphocytes, which fight infection. Normally, bone marrow produces immature cells or stem cells, in a controlled way, and they mature and specialize into the various types of blood cells, as needed. In people with ALL, this production process breaks down. Large numbers of immature, abnormal lymphocytes called lymphoblasts are produced and released into the bloodstream. These abnormal cells are not able to mature and perform their usual functions. Furthermore, they multiply rapidly and can crowd out healthy blood cells, leaving an adult or child with ALL vulnerable to infection or bleeding. Leukemic cells can also collect in certain areas of the body, including the central nervous system and spinal cord, which can cause serious problems. According to the American Cancer Society, almost 4,000 people in the United States are expected to be diagnosed with ALL in 2006. Multiple clinical trials have suggested the overall survival rate for adults diagnosed with ALL is approximately 20% to 50%, underscoring the need for new therapeutic options.

Non-Hodgkin’s lymphoma, or NHL, is a heterogeneous disease which is estimated to result in more than 58,000 new cases and nearly 19,000 deaths in 2006 in the United States, according to the American Cancer Society. NHL can be divided into two prognostic groups: indolent lymphomas and aggressive lymphomas. Patients with indolent NHL types have a relatively good prognosis, with median survival as long as 10 years after diagnosis, but they usually are not curable in advanced clinical stages. The aggressive type of NHL is more rapidly progressive, but a significant number of these patients can be cured with intensive combination chemotherapy regimens which include agents such as vincristine. Multiple clinical trials have suggested that, with current treatment, overall five-year survival of NHL patients is approximately 50% to 60%. Of patients with aggressive NHL, 30% to 60% can achieve durable remission. The vast majority of relapses occur in the first two years after therapy and new therapeutic options within this time frame are needed.

Product Description

Marqibo is our proprietary product candidate comprised of the widely used off-patent anticancer drug vincristine encapsulated in sphingosomes. This encapsulation is designed to provide prolonged circulation of the drug in the blood and accumulation at the tumor site. These characteristics are intended to increase the effectiveness and reduce the side effects of the encapsulated drug. Vincristine, a microtubule inhibitor, is FDA-approved for ALL and is widely used as a single agent and in combination regimens for treatment for hematologic malignancies such as lymphomas and leukemias.

Clinical Development Program

We acquired our rights to Marqibo from Inex Pharmaceuticals Corporation in May 2006. Inex submitted an NDA for accelerated marketing approval of Marqibo based upon a single arm, Phase II clinical trial in relapsed refractory NHL, which was reviewed by the FDA in 2004. This clinical trial was conducted with 119 patients and demonstrated an overall response rate of 25%. The FDA determined that the Phase II clinical trial was insufficient to support an accelerated marketing approval, issued a “not approvable” letter in January 2005 and advised Inex to conduct a Phase III randomized clinical trial. The FDA’s not approvable letter states that the FDA determined the response rate to be 21%. The not approvable letter was issued after the FDA’s oncological drugs advisory committee unanimously voted that the results of the trial were not predictive of clinical benefit and that there was no improvement over available therapy.

Marqibo has been evaluated in 13 clinical trials with over 540 patients, including Phase II clinical trials in patients with NHL and ALL. Based on the results from these studies, we intend to request regulatory approvals to initiate a randomized Phase III clinical trial in 2006 in relapsed ALL. We intend to pursue a special protocol assessment from the FDA prior to the initiation of this clinical trial.

Inex previously sponsored multiple Marqibo clinical trials, two of which provide the basis for our clinical development plan. The first is an ongoing Phase I/II clinical trial using 2.0 milligrams per meter squared combined with a fixed dose of oral dexamethasone in ALL. As of March 31, 2006, 22 patients have been treated on the Phase I portion of this clinical trial with dosing ranging from 1.5 to 2.4 milligrams per meter squared weekly. Complete response, or CR, defined as complete reduction in detectable disease and/or blast counts of 5%, was 27%, and the toxicity profile was consistent with vincristine at the normal dose.

An additional Phase II clinical trial was completed by the University of Texas M.D. Anderson Cancer Center, or MDACC, in January 2005. This trial employed the use of R-CHOP, a common treatment regimen for NHL consisting of rituximab, cyclophosphamide, doxorubicim, vincristine and prednisone. This clinical trial involved patients with previously untreated aggressive NHL in which Marqibo was substituted for free vincristine. Of the 73 patients treated, 80% of patients achieved a CR. These results compare favorably with the 65% to 75% CR rates historically achieved in patients receiving R-CHOP.

Based on these results, we plan to request regulatory authorization to further study Marqibo in the treatment of hematologic malignancies, including ALL and NHL. Specifically, we plan to conduct Phase III clinical trials in ALL, one of which we expect to be in the front-line, elderly ALL setting, and another in the relapsed/refractory ALL setting. The primary endpoints in both of these clinical trials will be CR rates. We plan to seek regulatory approval to initiate at least one of these clinical trials by the end of 2006. We also intend to seek regulatory approval to commence a Phase III clinical trial of Marqibo in front-line aggressive lymphoma, with Marqibo substituted for vincristine in the R-CHOP regimen.

Talotrexin (PT-523)

Product Candidate Background and Preclinical Data

Antifolates, also known as folic acid analogs, are a class of cytotoxic or antineoplastic agents, which are structural analogs of naturally occurring compounds that that interfere with the production of nucleic acids known as antimetabolites. Antifolates have been used clinically for more than 30 years to treat both solid and hematological cancers such as breast cancer and ALL, as well as inflammatory diseases such as rheumatoid arthritis. Antimetabolites are the most widely used antifolates. One such antimetabolite, methotrexate, is structurally related to folic acid and acts as an antagonist to this vitamin by inhibiting DHFR, the enzyme that converts folic acid to its active form. Rapidly dividing cells, such as cancer cells, need folic acid to multiply. The decreased level of folic acid leads to depressed DNA, RNA, and protein synthesis which in turn lead to cell death.

Talotrexin is a novel antifolate that is a water-soluble, non-polyglutamatable analogue of aminopterin. Talotrexin was developed at the Dana-Farber Cancer Institute, Inc. and the NCI as part of a program to develop oncology product candidates with improved efficacy, tolerability and resistance. We believe that potential advantages of Talotrexin over existing therapies include:

| | · | Increased Targeting of Tumor Cells: Talotrexin produces cytotoxicity by inhibiting DHFR. It binds to DHFR more tightly than other antifolates, allowing Talotrexin to inhibit DNA synthesis more potently than other antifolates, including methotrexate. In preclinical in vitro and in vivo studies at the Dana-Farber Cancer Institute, Inc. and the NCI, Talotrexin demonstrated that it is 10-fold more tightly bound to DHFR, than methotrexate, has 10-fold higher affinity to the membrane-bound transporter utilized by methotrexate, and demonstrated 10- to 100-fold more potency than methotrexate. We believe that these characteristics may allow for potent, targeted delivery of Talotrexin. |

| | · | Better Tolerability: We believe that Talotrexin may be more tolerable than other existing cancer drugs. Classical compounds such as methotrexate are polyglutamated once they enter the cells. Polyglutamation is an enzymatic process which allows the drug to stay in the cell and act on its target more effectively. However, while healthy cells maintain their ability to make polyglutamates, cancer cells lose their ability to form polyglutamates. Consequently, the drug stays in the healthy cells, causing toxicity and preventing the drug from exerting its effect on the cancer cell to kill it. Talotrexin blocks and alters the side chain of the compound, which allows the drug to stay in the cancer cell and act on its target. |

| | · | Superior Resistance Profile: In preclinical studies, Talotrexin has demonstrated activity against tumor cells that were resistant to other antifolates. Human head-and-neck squamous carcinoma cells that were resistant to methotrexate were shown to be highly sensitive to the effects of Talotrexin. |

| | · | Distinct Dose-Dependent Activity: In preclinical studies, Talotrexin showed significant dose responsiveness which may suggest a wide therapeutic index (the difference between the minimum effective dose and maximum tolerated dose of a drug), as well as enhanced clinical utility. |

Clinical Development Program

In April 2004, we commenced an NCI-sponsored Phase I clinical trial to evaluate the safety of Talotrexin when administering it intravenously on days 1, 8 and 15 of a 28-day cycle to patients with solid tumors. The patients selected for the clinical trial had failed curative or survival-prolonging therapy, or no such therapies existed for them. This clinical trial, which is being conducted at the Dana-Farber Cancer Institute, Inc., Massachusetts General Hospital and Beth-Israel Deaconess Hospital, is expected to involve 25 to 40 patients, with 26 subjects having received doses of Talotrexin through April 2006.

In February 2005, we commenced an open-label multicenter, multinational Phase I/II clinical trial of Talotrexin in the treatment of relapsed or refractory non-small cell lung cancer, or NSCLC. Increasing doses of Talotrexin were administered as a five-minute intravenous infusion on days 1 and 8 on a 21-day cycle to eligible patients in the Phase I portion of this clinical trial. Talotrexin was well tolerated over multiple cycles of therapy with myelosuppression and mucositis as the dose limiting toxicities. The Phase I portion of this clinical trial is now closed for enrollment with 25 patients receiving doses. The primary objectives of the Phase II portion of this ongoing clinical trial is to demonstrate an improvement in overall survival. Secondary objectives include evaluation of safety, overall response rate, time to progression and progression free survival. Relapsed or refractory NSCLC patients who have failed at least two lines of treatment including standard chemotherapy and/or epidermal growth factor receptor tyrosine kinase inhibitor are eligible to enroll in the study. One patient death has been reported in this study. The study investigator deemed the death unrelated to Talotrexin administration.

In May 2005, we commenced an open-label, multicenter Phase I/II clinical trial of Talotrexin in the treatment of refractory ALL. The primary objectives of the Phase I portion of this clinical trial are to evaluate the safety of Talotrexin when administered on days 1 through 5 on a 21-day cycle to ALL subjects who have failed curative or survival prolonging therapy or for whom no such therapies exist and to establish the maximum tolerated dose and identify the dose limiting toxicities of Talotrexin. The primary objective of the Phase II portion of this clinical trial is to evaluate the anti-tumor activity of Talotrexin as therapy in leukemia patients with relapsed or refractory to frontline and/or salvage therapy as measured by overall response. The secondary objective is to assess the impact of Talotrexin as measured by duration of remission and survival. A total of 75 patients are expected to enroll in the Phase I/II clinical trial. While some treatment options for ALL patients are currently available, we believe that a significant opportunity exists for Talotrexin to improve the therapeutic options for patients with the progressive form of leukemia. One patient death has been reported in this study. The patient expired due to thromboembolism of the pulmonary trunk after starting Talotrexin and after having been diagnosed with grade 3 mucositis (esophagitis and stomatitis). The study co-investigator deemed the mucositis possibly/probably related to Talotrexin, and the death unrelated to Talotrexin.

Subject to regulatory approval, we currently plan additional clinical trials for Talotrexin in other potential indications to maximize its therapeutic potential as follows:

| | · | A Phase II, open-label, multicenter clinical trial of single agent Talotrexin in the treatment of relapsed or refractory gastric cancer in 2006; |

| | · | A Phase II clinical trial of Talotrexin in the treatment of persistent or recurrent carcinoma of the cervix in 2006; and |

| | · | A Phase I pediatric solid tumor clinical trial being developed in conjunction with the NCI’s Children’s Oncology Group in 2006. |

In May 2006, the FDA granted our application for orphan drug designation for Talotrexin (PT-523) in patients with ALL.

Ropidoxuridine (IPdR)

Product Description and Preclinical Data

Ropidoxuridine (IPdR) is an oral prodrug of IUdR, a radiation sensitizer. Ropidoxuridine is referred to as a prodrug because after it is absorbed through the digestive tract, it is converted in the liver by an enzyme to the active agent IUdR. Because it is a nucleoside analog which mimics a normal building block of DNA, IUdR integrates into the cancer cell DNA, rendering it more sensitive to the killing effect of radiation. Because it increases the effects of radiation, ropidoxuridine is referred to as a radiation sensitizer.

Phase I and II clinical trials conducted by the NCI with IUdR established it as a radiation sensitizer. However, due to significant hematological and gastrointestinal toxicity resulting in mucositis and diarrhea, IUdR was not developed beyond Phase II. We believe ropidoxuridine may have the potential to deliver the activity of IUdR, but with significantly less toxicity. Preclinical studies conducted by the NCI and Case Western Reserve University with ropidoxuridine demonstrated conversion to IUdR, incorporation into tumor-cell DNA, and acceptable toxicity. IUdR has not been approved by the FDA for any indication.

In September 2005, we initiated a Phase I clinical trial of ropidoxuridine in patients with solid tumors undergoing radiation therapy. The objectives of this clinical trial are to establish the safety, dose, pharmacokinetics, and preliminary efficacy of ropidoxuridine in combination with radiation therapy. In June 2006, the FDA granted our application for orphan drug designation of ropidoxuridine for the treatment of gioblastoma, the most common type of brain cancer.

Sphingosome Encapsulated Vinorelbine

Sphingosome Encapsulated Vinorelbine is our proprietary product candidate, based on the widely used off-patent anticancer drug vinorelbine encapsulated in sphingosomes. Vinorelbine, a microtubule inhibitor, is FDA-approved for use as a single agent or in combination with cisplatin for the first-line treatment of unresectable, advanced NSCLC. We plan to commence Phase I clinical trials for sphingosome encapsulated vinorelbine in the second half of 2006. The regulatory strategy for sphingosomal vinorelbine may include NSCLC and breast cancer registration paths.

Sphingosome Encapsulated Topotecan

License Agreements

Zensana

Pursuant to the terms of an October 2004 license agreement with NovaDel Pharma, Inc., as amended in August 2005 and May 2006, we hold a royalty-bearing, exclusive right and license (with the right to sublicense with NovaDel’s prior written consent) to develop and commercialize NovaDel’s oral spray version of ondansetron in the United States and Canada, while NovaDel retained the rights to the development and commercialization of Zensana in other countries and all non-human uses of Zensana. In addition, NovaDel also retained the rights to conduct internal, non-commercial research and development activities with respect to Zensana in all countries, and the rights to use the oral spray technology with other drug products, either by itself or with a third party. Under the agreement, we and NovaDel collaborated on the initial development governed by a development plan and overseen by a joint development committee on the formulation, analytical method and manufacturing process development for Zensana. The joint development committee continues to discuss potential strategies for Zensana going forward, including regulatory strategies for Zensana.

Under the license agreement, we are responsible for the regulatory filings for Zensana and associated costs and all such filings will be made in our name and have us as the primary contact. We consult with NovaDel on such filings and keep NovaDel informed as to our communications with the regulatory authorities, although we have the right to determine the regulatory pathways we feel best meet our objectives. NovaDel does have the non-exclusive right to use and reference all our regulatory filings and data contained therein for all purposes.

We will be responsible for the clinical and commercial supply of Zensana. We may engage a third party for the manufacture of Zensana, provided that NovaDel will have the right to review all agreements with such third party manufacturer and to purchase Zensana from such third party at essentially the same costs as we do, and provided that such third party agreements contains sufficient confidentiality and non-use obligations. Subsequently, we have agreed that Ferring AB, a Swedish company, will take over NovaDel’s supply obligations to us. Currently, Ferring AB is the supplier for our clinical supply under a purchase order which has been reviewed by NovaDel. The confidentiality and non-use obligations of Ferring AB are governed under a separate confidentiality agreement between us and Ferring AB entered into in June 2005. We plan to enter into a manufacturing agreement with them for the commercial supply of Zensana. To date, Ferring AB has also supplied us with the spray pump components and oral applicator for Zensana, and we anticipate that the manufacturing agreement that we enter into for Zensana will also include all components of the delivery device.

In consideration for the license, the agreement provides that we will make double-digit royalty payments to NovaDel based on a percentage of net sales (as defined in the agreement). In addition, we issued NovaDel 73,121 shares of our common stock (determined by dividing $500,000 by the average selling price of our common stock during the 10 business days preceding the date of the license agreement) and we purchased 400,000 shares of NovaDel’s common stock at a price of $2.50 per share. Neither party may sell such shares for a two-year period following the effective date of the license agreement. Pursuant to the license agreement, we are also obligated to pay NovaDel up to an additional $10.0 million upon achievement of certain milestones.

NovaDel will own all information and inventions that are made by or on behalf of us, our affiliates and sublicensees relating to the oral spray process or the Zensana product, and all licensed trademarks. NovaDel has the right to file, prosecute and maintain all licensed patent applications, patents and trademarks, and we have the right to comment on the filings, but NovaDel will not be obligated to incorporate our comments. If NovaDel decides to discontinue the filing, prosecution or maintenance of any such patent or patent application in a particular country, then we have the right to do so. NovaDel also has the first right to enforce the licensed patents and we need to reimburse NovaDel for 100% of its out-of-pocket costs with respect to the removal of any such infringement to the extent such infringement adversely affects the exploitation of Zensana in the United States and Canada, and we have the right to enforce such patents only if NovaDel fails to do so. NovaDel is also in control of any defense of third party infringement, invalidity or unenforceability suit, and we are required to reimburse NovaDel for 100% of the costs and expenses associated with such suit to the extent it relates to the exploitation of Zensana. We do not have a clear contractual right to defend against such third-party lawsuits even if NovaDel fails to do so. We have also covenanted not to institute or prosecute any action seeking to have any claim in the licensed patents declared invalid or unenforceable.

NovaDel may terminate our license, after giving us notice and an opportunity to cure, for our material breach (30 day cure period) or payment default (10 day cure period). The license also terminates automatically if we are involved in a bankruptcy. In the event this license agreement is terminated, we will lose all of our rights to develop and commercialize Zensana. The license agreement expires on the later of the expiration date of the last to expire patent covered by the license, currently March 2022, or October 2024, 20 years from the effective date of the license agreement. We have the right to terminate this agreement by giving NovaDel a 90-day notice or by not making a milestone payment when due.

We are required to indemnify NovaDel for losses arising from the breach of this agreement by us, our affiliates or sublicensees or permitted assigns or transferees, the actual or asserted violations of law by us, our affiliates or sublicensees or permitted assigns or transferees, the use by us, our affiliates or sublicensees or permitted assigns or transferees of the oral spray technology with ondansetron, or the exploitation of Zensana by us, our affiliates, sublicensees or permitted assigns or transferees, to the extent NovaDel is not required to indemnify us for such losses. NovaDel agreed to indemnify us for losses arising from the breach of this agreement by NovaDel or its affiliates or the actual or asserted violation of law by NovaDel or its affiliates, to the extent we are not required to indemnify NovaDel for such losses. In either case, the indemnifying party will have control over the defense and settlement of any claim or action relating to such losses and the indemnified party will have the right to participate. The indemnifying party has the right to consent to monetary damages but will need the indemnified party’s consent before consenting to any damages that will result in the indemnified party’s becoming subject to injunctive or other relief or otherwise adversely affect the business of the indemnified party in any manner.

Marqibo, Sphingosomal Vinorelbine and Sphingosomal Topotecan

On May 6, 2006, we completed a transaction with Inex Pharmaceuticals Corporation pursuant to which we acquired exclusive, worldwide rights to develop and commercialize three product candidates known as Marqibo (vincristine sulfate) Liposomes Injection, sphingosome encapsulated vinorelbine and sphingosome encapsulated topotecan, collectively called the Licensed Products. In consideration for all of the intellectual property rights and assets acquired by us in the transaction, we paid to Inex aggregate consideration of $11.5 million, of which $1.5 million was paid in cash and the remaining $10 million was satisfied by issuing to Inex 1,118,568 shares of our common stock. The shares were valued at a price of $8.94 per share, which represented the average weighted volume price of our common stock over the 20 trading days preceding March 16, 2006, the date of the parties’ letter of intent regarding the transaction. The following is a summary of the various agreements entered into to consummate the transaction.

License Agreement

Pursuant to the terms of a license agreement dated May 6, 2006, between us and Inex, Inex granted us:

| | · | an exclusive license under certain patents held by Inex to commercialize the Licensed Products for all uses throughout the world; |

| | · | an exclusive license under certain patents held by Inex to commercialize the Licensed Products for all uses throughout the world under the terms of certain research agreements between Inex and the British Columbia Cancer Agency, or BCCA; |

| | · | an exclusive sublicense under certain patents relating to the Licensed Products that Inex licensed from MDACC, to commercialize the Licensed Products throughout the world under the terms of a license agreement between Inex and MDACC; and |

| | · | an exclusive license to all technical information and know-how relating to the technology claimed in the patents held exclusively by Inex and to all confidential information possessed by Inex relating to the Licensed Products, including all data, know-how, manufacturing information, specifications and trade secrets, collectively called the Inex Technology, to commercialize the Licensed Products for all uses throughout the world. |

We have the right to grant sublicenses to third parties and in such event we and Inex will share sublicensing revenue received by us at varying rates for each Licensed Product depending on such Licensed Product’s stage of clinical development. Under the license agreement, we also granted back to Inex a limited, royalty-free, non-exclusive license in certain patents and technology owned or licensed to us solely for use in developing and commercializing liposomes having an active agent encapsulated, intercalated or entrapped therein.

We agreed to pay to Inex up to an aggregate of $30.5 million upon the achievement of various clinical and regulatory milestones relating to all Licensed Products. At our option, the milestones may be paid in cash or additional shares of our common stock. However, the total number of shares of our common stock that may be issued to Inex in connection with the transaction may not exceed 19.99% of our outstanding shares of common stock as of May 6, 2006. In addition to the milestone payments, we agreed to pay royalties to Inex in the range of 5% to 10% based on net sales of the Licensed Products, against which we may offset a portion of the research and development expenses we incur. In addition to our obligations to make milestone payments and pay royalties to Inex, we also assumed all of Inex’s obligations to its licensors and collaborators relating to the Licensed Products, which include aggregate milestone payments of up to $2.5 million, annual license fees and additional royalties.

The license agreement provides that we will use our commercially reasonable efforts to develop each Licensed Product, including causing the necessary and appropriate clinical trials to be conducted in order to obtain and maintain regulatory approval for each Licensed Product and preparing and filing the necessary regulatory submissions for each Licensed Product. We also agreed to provide Inex with periodic reports concerning the status of each Licensed Product.

We are required to use commercially reasonable efforts to commercialize each Licensed Product in each jurisdiction where a Licensed Product has received regulatory approval. We will be deemed to have breached our commercialization obligations in the United States, or in Germany, the United Kingdom, France, Italy or Spain, if for a continuous period of 180 days at any time following commercial sales of a Licensed Product in any such country, no sales of a Licensed Product are made in the ordinary course of business in such country by us (or a sublicensee), unless the parties agree to such delay or unless we are prohibited from making sales by a reason beyond our control. If we breach this obligation, then Inex is entitled to terminate the license with respect to such Licensed Product and for such country.

Under the license agreement, Inex, either alone or jointly with MDACC, will be the owner of patents and patent applications claiming priority to certain patents licensed to us, and we have an obligation to assign to Inex our rights to inventions covered by such patents or patent applications, and, when negotiating any joint venture, collaborative research, development, commercialization or other agreement with a third party, to require such third party to do the same.

The prosecution and maintenance of the licensed patents will be overseen by an IP committee having equal representation from us and Inex. We will have the right and obligation to file, prosecute and maintain most of the licensed patents, although Inex maintained primary responsibility to prosecute certain of the licensed patents. The parties agreed to share the expenses of prosecution at varying rates. We also have the first right, but not the obligation, to enforce such licensed patents against third party infringers, or to defend against any infringement action brought by any third party.

We agreed to indemnify Inex for all losses resulting from our breach of our representations and warranties, or other default under the license agreement, our breach of any regulatory requirements, regulations and guidelines in connection with the Licensed Products, complaints alleging infringement against Inex with respect to the our manufacture, use or sale of a Licensed Product, and any injury or death to any person or damage to property caused by any Licensed Product provided by us or our sublicensee, except to the extent such losses are due to Inex’s breach of a representation or warranty, Inex’s default under the agreement, and the breach by Inex of any regulatory requirements, regulations and guidelines in connection with licensed patent and related know-how, including certain of Inex’s indemnification obligations to MDACC that will be passed through to us as a result. Inex has agreed to indemnify us for losses arising from Inex’s breach of representation or warranty, Inex’s default under the agreement, and the breach by Inex of any regulatory requirements, regulations and guidelines in connection with licensed patent and related know-how, except to the extent such losses are due to our breach of our representations and warranties, our default under the agreement, our breach of any regulatory requirements, regulations and guidelines in connection with the Licensed Products, complaints alleging infringement against Inex with respect to our manufacture, use or sale of a Licensed Product, and any injury or death to any person or damage to property caused by any Licensed Product provided by us or our sublicensee.

Unless terminated earlier, the license grants made under the license agreement expire on a country-by-country basis upon the later of (i) the expiration of the last to expire patents covering each Licensed Product in a particular country, (ii) the expiration of the last to expire period of product exclusivity covered by a Licensed Product under the laws of such country, or (iii) with respect to the Inex Technology, on the date that all of the Inex Technology ceases to be confidential information. The covered issued patents are scheduled to expire between 2014 and 2020.

Either we or Inex may terminate the license agreement in the event that the other has materially breached its obligations thereunder and fails to remedy such breach within 90 days following notice by the non-breaching party. If such breach is not cured, then the non-breaching party may, upon 6 months’ notice to the breaching party, terminate the license in respect of the Licensed Products or countries to which the breach relates. Inex may also terminate the license if we assert or intend to assert any invalidity challenge on any of the patents licensed to us. The license agreement also provides that either party may, upon written notice, terminate the agreement in the event of the other’s bankruptcy, insolvency, dissolution or similar proceeding. In the event Inex validly terminates the license agreement, all data, materials, regulatory filings and all other documentation reverts to Inex.

UBC Sublicense Agreement

Under the UBC sublicense agreement, Inex granted to us an exclusive, worldwide sublicense under several patents relating to the sphingosomal encapsulated vinorelbine and sphingosomal encapsulated topotecan Licensed Products, together with all knowledge, know-how, and techniques relating to such patents, called the UBC Technology. The UBC Technology is owned by the University of British Columbia, or UBC, and licensed to Inex pursuant to a license agreement dated July 1, 1998. The UBC sublicense agreement provides that we will undertake all of Inex’s obligations contained in Inex’s license agreement with UBC, which includes the payment of royalties (in addition to the royalties owing to Inex under the license agreement between Inex and us) and an annual license fee. The provisions of the UBC sublicense agreement relating to our obligation to develop and commercialize the UBC Technology, termination and other material obligations are substantially similar to the terms of license agreement between Inex and us, as discussed above.

Assignment of Agreement with Elan Pharmaceuticals, Inc.

Pursuant to an Amended and Restated License Agreement dated April 3, 2003, between Inex (including two of its wholly-owned subsidiaries) and Elan Pharmaceuticals, Inc., Inex held a paid up, exclusive, worldwide license to certain patents, know-how and other intellectual property relating to vincristine sulfate liposomes. In connection with our transaction with Inex, Inex assigned to us all of its rights under the Elan license agreement pursuant to an Assignment and Novation Agreement dated May 6, 2006 among us, Inex and Elan.

As assigned to us, the Elan license agreement provides that Elan will own all improvements to the licensed patents or licensed know-how made by us or our sublicensees, which will in turn be licensed to us as part of the technology we license from Elan. Elan has the first right to file, prosecute and maintain all licensed patents and we have the right to do so if Elan decides that it does not wish to do so only pertaining to certain portions of the technology. Elan also has the first right to enforce such licensed patents and we may do so only if Elan elects not to enforce such patents. In addition, Elan also has the right but not the obligation to control any infringement claim brought against Elan.

We have indemnification obligations to Elan for all losses arising from the research, testing, manufacture, transport, packaging, storage, handling, distribution, marketing, advertising, promotion or sale of the products by us, our affiliates or sublicensees, any personal injury suits brought against Elan, any infringement claim, certain third party agreements entered into by Elan, and any acts or omissions of any of our sublicensees.

The Elan license agreement, unless earlier terminated, will expire on a country by country basis, upon the expiration of the life of the last to expire licensed patent in that country. Elan may terminate the Elan license agreement earlier for our material breach upon 60 days’ written notice if we do not cure such breach within such 60 day period (we may extend such cure period for up to 90 days if we propose a course of action to cure the breach within the initial 60 day period and act in good faith to cure such breach), for our bankruptcy or going into liquidation upon 10 days’ written notice, or immediately if we, or our sublicense, directly or indirectly disputes the ownership, scope or validity of any of the licensed technology or support any such attack by a third party.

Service Agreement

We and Inex also entered into a Service Agreement dated May 6, 2006. Under the service agreement, we engaged Inex on a non-exclusive basis to perform various transition services relating to the transfer of technology, agreements and other matters useful to us in the period following the completion of the our transaction with Inex. The service agreement provides that we and Inex will jointly review a schedule each quarter that will describe the services requested of Inex for such period, together with a forecast of the estimated number of full-time employees of Inex required to perform such services and a schedule identifying the time by which the services are expected to be completed. Such services may include Inex’s assistance in transferring data and other materials relating to or useful in the development of the Licensed Products or its assistance assigning various testing and material supply agreements and relationships that Inex has established in connection with the Licensed Products. As consideration for Inex’s services, and in addition to the $11.5 million upfront payment paid in connection with the transaction, we will pay to Inex fees calculated on the number of actual time employees, contractors or consultants of Inex who perform such services based on a rate of $250,000 per full time employee equivalent.

The service agreement expires on June 30, 2007, unless terminated earlier. We may terminate the service agreement upon 60 days’ written notice for any reason. Upon 30-days’ notice and an opportunity to cure, either party may terminate the service agreement in the event the other party fails to comply with a material term of the agreement or the service schedule (including any change orders to the service schedule). Either party may also terminate the agreement in the event the other makes an assignment for the benefit of creditors, becomes insolvent, files a bankruptcy petition or similar proceeding, which proceeding remains undismissed or unstayed for at least 60 days.

Transaction Agreement

We entered into a Transaction Agreement on May 6, 2006 with Inex which generally provided for the mechanics of closing our transaction with them. The agreement contains several provisions relating to the assignment to us of various clinical trial and other agreements relating to the Licensed Products, as well as provisions obligating Inex to use its commercially reasonable efforts to cause the outright assignment to us of Inex’s license with MDACC and its rights to certain of the patents covered by our license agreement with Inex.

The transaction agreement also contains provisions relating to competition by the parties. More specifically, we agreed that, to the extent we develop, manufacture or commercialize a product candidate that incorporates the Licensed Products encapsulated in a liposome not proprietary to Inex in a particular country during the term of the license agreement, all licenses and sublicenses granted to us under the license agreement with respect to such country and such Licensed Product will revert to Inex. The transaction agreement further provides that Inex will not, directly or indirectly, engage in the business of developing, manufacturing or commercializing any of the Licensed Products, including any future generation products for formulations containing vincristine, vinorelbine or topotecan.

Asset Purchase Agreement

We also entered an Asset Purchase Agreement with Inex on May 6, 2006. Under this agreement, Inex assigned to us various equipment, inventory and other assets useful in the development of the Licensed Products. We did not pay any additional consideration for such assets beyond the $11.5 million payment, discussed above.

Registration Rights Agreement

Pursuant to a Registration Rights Agreement dated May 6, 2006, we agreed to file a registration statement covering the resale of the 1,118,568 shares of our common stock issued to Inex in connection with the transaction on or before July 5, 2006, and to use commercially reasonable efforts to have such registration statement declared effective by the Securities and Exchange Commission on or before November 2, 2006. In the event we do not file such registration statement by July 6, 2006, or in the event such registration statement is not declared effective by November 6, 2006, then we must issue to Inex an additional approximately 22,400 shares of our common stock. Inex agreed that it will not sell more than 25% of the shares issued in each three month period commencing on the effective date of the registration statement.

Talotrexin

Our rights to Talotrexin are governed by the terms of a December 2002 license agreement with Dana-Farber Cancer Institute, Inc., or DFCI, and Ash Stevens, Inc., or ASI. The agreement provides us with an exclusive worldwide royalty bearing license, including the right to grant sublicenses. We also acquired an option for any new inventions made by DFCI or ASI directly relating to the same subject matter for a reasonable license fee to be negotiated by the parties. DFCI reserved the rights under the licensed technology for its own non-commercial research, the rights to conduct pre-clinical and clinical trials of Talotrexin with our prior written consent, and the rights to supply know-how and grant non-exclusive, non-transferable licenses under the licensed technology to other academic, governmental or not-for-profit organizations for non-commercial research purposes but not in human subjects. In addition, DFCI or ASI may require us to grant a third party a sublicense under the licensed technology for the development and commercialization of products outside the oncology field, unless such products will be directly competitive with any licensed product then sold or under development by us or our sublicensee, included in our annual strategic development plan then in force, or if we provide DFCI and ASI with a plan for developing such non-competing new product.

The license agreement requires us to make upfront and future payments totaling up to $6.1 million upon the achievement of certain milestones should Talotrexin be granted approval by the FDA of an NDA. Additionally, we are obligated to pay royalties of 3.5% based on net sales (as defined in the license agreement) of Talotrexin.

We are required to use commercially reasonable efforts no less than efforts we expend on our other high priority projects to bring one or more licensed products to market and then continue active and diligent efforts to keep such products available to the public. We were required to fulfill specific diligence milestones, all of which we have met. We are also required to manufacture the licensed products substantially in the United States.

We have the rights and obligation to prepare, file, prosecute and maintain patent applications and patents licensed to us at our expense, and we are required to surrender our license under any patent application or patent that we elect not to prepare, file, prosecute or maintain. We have the right, but not the obligation, to enforce the licensed patents and to defend against alleged infringements, and we need DFCI’s consent prior to entering into any settlement agreement.

We agreed to indemnify DFCI and ASI against all losses arising from the design, production, manufacture, sale, use in commerce, lease or promotion of any product, process or service relating to or developed pursuant to the license agreement by us or our sublicensee, affiliate or agent, or arising from any other activities to be carried out under the agreement, to the extent not attributable to the negligent activities or intentional misconduct of the indemnitees.

DFCI and ASI may terminate the agreement, after giving us notice and an opportunity to cure, if we commit a material breach, including failing to make a scheduled milestone or other payment when due, failing to meet our diligence obligations, ceasing to carry on our business with respect to the licensed products, or being convicted of a felony relating to the manufacture, use, sale or importation of the licensed products. The agreement also provides that it may be terminated if we become involved in a bankruptcy, insolvency or similar proceeding. We can terminate this agreement by giving DFCI or ASI 90-day prior written notice. In the event this license agreement is terminated, we will lose all of our rights to develop and commercialize Talotrexin. The license agreement automatically expires on the date on which the last of the patent covered by the agreement expires.

Ropidoxuridine (IPdR)

In February 2004, we entered into an exclusive worldwide, royalty-bearing license agreement with Yale University and The Research Foundation of State University of New York, or SUNY for ropidoxuridine (IPdR), including the right to grant sublicenses. Yale and SUNY reserved the rights to make, use and practice the licensed patents for academic research purposes. We are under an obligation to manufacture any licensed products substantially in the United States.

Under the agreement, we are required to use all reasonable commercial efforts to conduct research and development, testing, government approval, manufacturing, marketing and selling of licensed products and/or licensed methods pursuant to a plan that we committed to upon signing of the agreement. We have also agreed on certain specific diligence milestones, and to date we have not breached any of them. Yale University and SUNY may terminate this agreement and our license for our failure to meet our diligence obligations if we also have not incurred direct expenditures towards the development and commercialization of a licensed product and/or licensed method up to a certain amount each year starting in 2005.

The license agreement requires us to make upfront and future payments of up to $600,000, in the aggregate, upon the achievement of certain milestones should ropidoxuridine be granted approval by the FDA of an NDA. In addition, upon execution of the agreement, we issued to our Yale University and SUNY 10-year options to purchase an aggregate of approximately 141,000 shares of our common stock at a price of $1.02 per share. We are also required to make an annual license payment of $25,000 on the anniversary of the agreement. Additionally, we are obligated to pay royalties of 3% on sales, if any, of ropidoxuridine.

Under the agreement, we have the rights and obligations to file, prosecute and maintain the licensed patents at our expenses. We also have the rights and obligations to enforce the licensed patents against third party infringers.

We are required to indemnify Yale University and SUNY for all losses resulting from the production, manufacture, sale, use, lease or other disposition or consumption or advertisement of the licensed products or licensed methods by us, our affiliates, sublicensees or any other transferees, or in connection with any statement, representation or warranty of the licensed products or licensed methods made by us and such related parties, to the extent such losses do not arise from the Yale University’s or SUNY’s gross negligence or willful misconduct.

Yale University and SUNY may terminate the agreement, after giving us notice and an opportunity to cure, if we commit a material breach, including failing to make scheduled payments, or terminate the agreement without giving us the opportunity to cure for our failure to obtain or maintain adequate insurance, or our involvement in a bankruptcy. We have the right to terminate this agreement with 90-day written notice or within 60 days for our licensors’ uncured material breach. In the event this license agreement is terminated, we will lose all of our rights to develop and commercialize ropidoxuridine. The license agreement automatically expires, on a country-by-country basis, on the date on which the last of the patent claims covered by the agreement expires, lapses or is declared invalid by a court of competent jurisdiction in such country. In the United States, a patent currently expired due to an unintentionally delayed payment of a maintenance fee with the U.S. Patent and Trademark Office would, if reinstated, be the latest U.S. patent to expire. A petition has been filed with the U.S. Patent and Trademark Office to accept an unintentionally delayed payment of maintenance fee. If reinstated, the U.S. patent will expire in May 2015.

Intellectual Property

General