UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

(Exact name of registrant as specified in charter)

60 State Street, Boston, MA 02109

(Address of principal executive offices) (ZIP code)

Christopher J. Kelley, Amundi Asset Management, Inc.,

60 State Street, Boston, MA 02109

(Name and address of agent for service)

Registrant's telephone number, including area code:

Date of reporting period:

Item 1. Report to Stockholders.

(a) The registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

Pioneer CAT Bond Fund

Class A / ACBAX

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about Pioneer CAT Bond Fund (“Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.amundi.com/usinvestors/Resources/Shareholder-Reports. You can also request this information by contacting us at 1-800-225-6292. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class A | $182 | 1.70% |

How did the Fund perform last year and what affected the Fund performance?

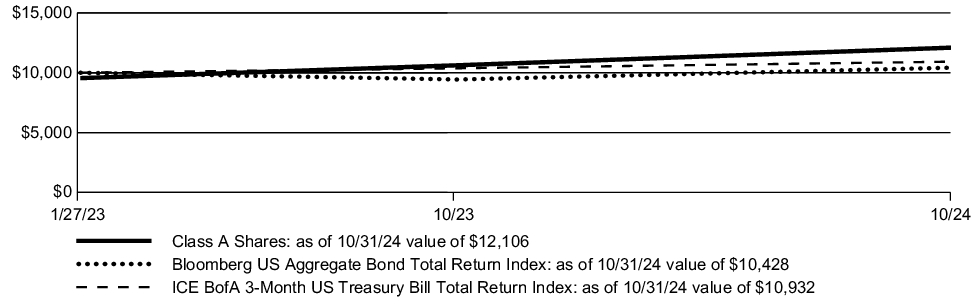

For the fiscal year ended October 31, 2024, the Fund’s Class A shares at NAV returned 13.98%. For the same period, the Fund’s broad-based benchmark, the Bloomberg US Aggregate Bond Total Return Index, returned 10.55%. The performance benchmark, the ICE BofA 3-Month US Treasury Bill Total Return Index, returned 5.39% during the period.

The continued elevated pricing trends associated with underwriting catastrophe risk, along with increased loss retention levels by insurance companies, helped drive the Fund’s positive performance during the period, but there were a few catastrophic events to which the Fund had exposure over the course of the reporting period.

Hurricane Helene made landfall on September 26 in the “Big Bend” area of Florida, as a Category 4 event. Expected insured losses, including the National Flood Insurance Program (NFIP), are estimated to be below $15 billion. Primary insurers will retain most of the losses and impact on the event-linked bonds in which the Fund invests is expected to be very limited.

Hurricane Milton made landfall on October 9 south of Tampa, Florida, as a Category 3 hurricane. Preliminary insured loss estimates, excluding NFIP, are between $25 billion and $40 billion. NFIP losses are anticipated to range from the low to mid-single billions, which means the NFIP CAT bonds will not be activated. A significant share of the insured losses is likely to be absorbed by the primary insurance companies. The catastrophe bonds held by the Fund tend to remain above these loss levels, which we believe will have a negligible impact on the Fund.

As of October 31, 2024, the North Atlantic hurricane season resulted in 15 named storms 10 hurricanes and 4 major hurricanes. Many of these events did not make landfall in the U.S. For those making U.S. landfall, most of the insured losses were retained by insurance companies with de minimis impact on the reinsurance industry. As a result, the Fund's catastrophe bond investments generally were not significantly negatively affected by the North Atlantic hurricane season.

Fund Performance

The line graph below shows the change in value of a $10,000 investment made in Class A shares of the Fund at public offering price during the periods shown, compared to that of the Bloomberg US Aggregate Bond Total Return Index and the ICE BofA 3-Month US Treasury Bill Total Return Index.

| AVERAGE ANNUAL TOTAL RETURN | 1 Year | Since Inception* |

| Class A (with sales charge) | 8.89% | 11.48% |

| Class A (without sales charge) | 13.98% | 14.43% |

| Bloomberg US Aggregate Bond Total Return Index | 10.55% | 2.46% |

| ICE BofA 3-Month US Treasury Bill Total Return Index | 5.39% | 5.28% |

| * | Performance of Class A shares of the Fund shown in the graph above is from the inception of Class A shares on 1/27/23 through 10/31/24. Index information shown in the graph above is from 1/31/23 through 10/31/24. |

Call 1-800-225-6292 or visit https://www.amundi.com/usinvestors/Resources/Shareholder-Reports for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

KEY FUND STATISTICS

(as of October 31, 2024)

| Fund net assets | $439,152,721% |

| Total number of portfolio holdings | 151^^ |

| Total advisory fee paid | $3,235,416 |

| Portfolio turnover rate | 25% |

| ^^ | Excluding short-term investments and all derivative contracts except for options purchased. |

SECTOR DIVERSIFICATION BY RISK

(as of October 31, 2024)*

| Event Linked Bonds | 92.1 |

| Collateralized Reinsurance | 7.9 |

| * | As a percentage of total investments excluding short-term investments and all derivative contracts except for options purchased. |

Amundi Asset Management US, Inc. (the “Adviser”), the Fund’s investment adviser, is currently an indirect, wholly-owned subsidiary of Amundi. On July 9, 2024, Amundi announced that it had entered into a definitive agreement with Victory Capital Holdings, Inc. (“Victory Capital”) to combine the Adviser with Victory Capital, and for Amundi to become a strategic shareholder of Victory Capital (the “Transaction”). Victory Capital is headquartered in San Antonio, Texas. The closing of the Transaction is subject to certain regulatory approvals and other conditions. There is no assurance that the Transaction will close.

The closing of the Transaction would cause the Fund’s current investment advisory agreement with the Adviser to terminate. Under the terms of the Transaction, the Fund’s Board of Trustees will be asked to approve a reorganization of the Fund into a corresponding, newly established Victory Fund advised by Victory Capital Management Inc., an affiliate of Victory Capital. The proposed reorganization of the Fund would be sought in connection with the closing of the Transaction. If approved by the Board, the proposal to reorganize the Fund will be submitted to the shareholders of the Fund for their approval. There is no assurance that the Board or the shareholders of the Fund will approve the proposal to reorganize the Fund.

For more complete information, you may review the Fund's next prospectus, which we expect to be available by March 3, 2025 at https://www.amundi.com/usinvestors/Products/Mutual-Funds or upon request at 1-800-225-6292.

Availability of Additional Information

You can find additional information about the Fund, including the Fund's prospectus, financial information, holdings and proxy voting information, at https://www.amundi.com/usinvestors/Resources/Shareholder-Reports. You can also request this information by contacting us at 1‑800‑225‑6292.

Important notice to shareholders

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communications to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 1-800-225-6292 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

Pioneer CAT Bond Fund

Class K / ACBKX

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about Pioneer CAT Bond Fund (“Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.amundi.com/usinvestors/Resources/Shareholder-Reports. You can also request this information by contacting us at 1-800-225-6292. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class K | $143 | 1.33% |

How did the Fund perform last year and what affected the Fund performance?

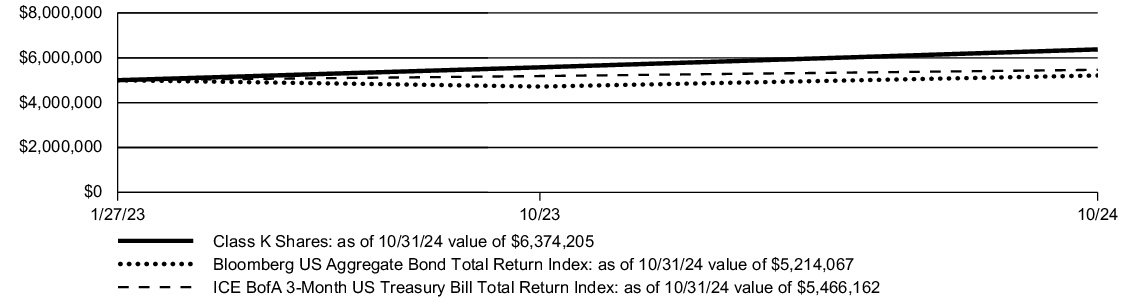

For the fiscal year ended October 31, 2024, the Fund’s Class K shares at NAV returned 14.43%. For the same period, the Fund’s broad-based benchmark, the Bloomberg US Aggregate Bond Total Return Index, returned 10.55%. The performance benchmark, the ICE BofA 3-Month US Treasury Bill Total Return Index, returned 5.39% during the period.

The continued elevated pricing trends associated with underwriting catastrophe risk, along with increased loss retention levels by insurance companies, helped drive the Fund’s positive performance during the period, but there were a few catastrophic events to which the Fund had exposure over the course of the reporting period.

Hurricane Helene made landfall on September 26 in the “Big Bend” area of Florida, as a Category 4 event. Expected insured losses, including the National Flood Insurance Program (NFIP), are estimated to be below $15 billion. Primary insurers will retain most of the losses and impact on the event-linked bonds in which the Fund invests is expected to be very limited.

Hurricane Milton made landfall on October 9 south of Tampa, Florida, as a Category 3 hurricane. Preliminary insured loss estimates, excluding NFIP, are between $25 billion and $40 billion. NFIP losses are anticipated to range from the low to mid-single billions, which means the NFIP CAT bonds will not be activated. A significant share of the insured losses is likely to be absorbed by the primary insurance companies. The catastrophe bonds held by the Fund tend to remain above these loss levels, which we believe will have a negligible impact on the Fund.

As of October 31, 2024, the North Atlantic hurricane season resulted in 15 named storms 10 hurricanes and 4 major hurricanes. Many of these events did not make landfall in the U.S. For those making U.S. landfall, most of the insured losses were retained by insurance companies with de minimis impact on the reinsurance industry. As a result, the Fund's catastrophe bond investments generally were not significantly negatively affected by the North Atlantic hurricane season.

Fund Performance

The line graph below shows the change in value of a $5 million investment made in Class K shares of the Fund during the periods shown, compared to that of the Bloomberg US Aggregate Bond Total Return Index and the ICE BofA 3-Month US Treasury Bill Total Return Index.

| AVERAGE ANNUAL TOTAL RETURN | 1 Year | Since Inception* |

| Class K | 14.43% | 14.86% |

| Bloomberg US Aggregate Bond Total Return Index | 10.55% | 2.46% |

| ICE BofA 3-Month US Treasury Bill Total Return Index | 5.39% | 5.28% |

| * | Performance of Class K shares of the Fund shown in the graph above is from the inception of Class K shares on 1/27/23 through 10/31/24. Index information shown in the graph above is from 1/31/23 through 10/31/24. |

Call 1-800-225-6292 or visit https://www.amundi.com/usinvestors/Resources/Shareholder-Reports for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

KEY FUND STATISTICS

(as of October 31, 2024)

| Fund net assets | $439,152,721% |

| Total number of portfolio holdings | 151^^ |

| Total advisory fee paid | $3,235,416 |

| Portfolio turnover rate | 25% |

| ^^ | Excluding short-term investments and all derivative contracts except for options purchased. |

SECTOR DIVERSIFICATION BY RISK

(as of October 31, 2024)*

| Event Linked Bonds | 92.1 |

| Collateralized Reinsurance | 7.9 |

| * | As a percentage of total investments excluding short-term investments and all derivative contracts except for options purchased. |

Amundi Asset Management US, Inc. (the “Adviser”), the Fund’s investment adviser, is currently an indirect, wholly-owned subsidiary of Amundi. On July 9, 2024, Amundi announced that it had entered into a definitive agreement with Victory Capital Holdings, Inc. (“Victory Capital”) to combine the Adviser with Victory Capital, and for Amundi to become a strategic shareholder of Victory Capital (the “Transaction”). Victory Capital is headquartered in San Antonio, Texas. The closing of the Transaction is subject to certain regulatory approvals and other conditions. There is no assurance that the Transaction will close.

The closing of the Transaction would cause the Fund’s current investment advisory agreement with the Adviser to terminate. Under the terms of the Transaction, the Fund’s Board of Trustees will be asked to approve a reorganization of the Fund into a corresponding, newly established Victory Fund advised by Victory Capital Management Inc., an affiliate of Victory Capital. The proposed reorganization of the Fund would be sought in connection with the closing of the Transaction. If approved by the Board, the proposal to reorganize the Fund will be submitted to the shareholders of the Fund for their approval. There is no assurance that the Board or the shareholders of the Fund will approve the proposal to reorganize the Fund.

For more complete information, you may review the Fund's next prospectus, which we expect to be available by March 3, 2025 at https://www.amundi.com/usinvestors/Products/Mutual-Funds or upon request at 1-800-225-6292.

Availability of Additional Information

You can find additional information about the Fund, including the Fund's prospectus, financial information, holdings and proxy voting information, at https://www.amundi.com/usinvestors/Resources/Shareholder-Reports. You can also request this information by contacting us at 1‑800‑225‑6292.

Important notice to shareholders

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communications to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 1-800-225-6292 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

Pioneer CAT Bond Fund

Class Y / CBYYX

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about Pioneer CAT Bond Fund (“Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.amundi.com/usinvestors/Resources/Shareholder-Reports. You can also request this information by contacting us at 1-800-225-6292. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class Y | $156 | 1.46% |

How did the Fund perform last year and what affected the Fund performance?

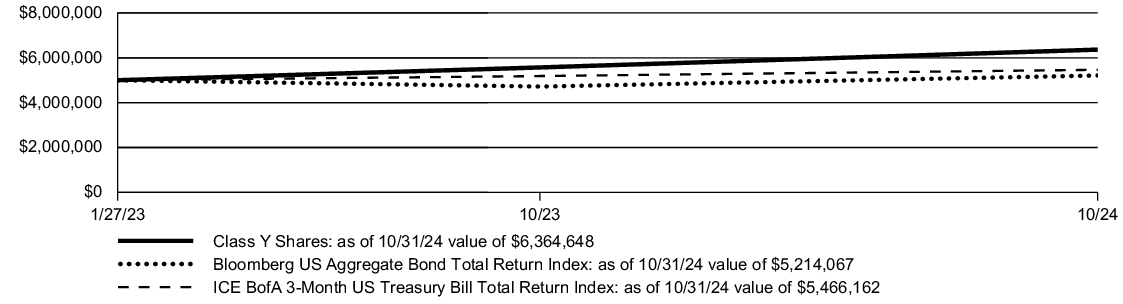

For the fiscal year ended October 31, 2024, the Fund’s Class Y shares at NAV returned 14.27%. For the same period, the Fund’s broad-based benchmark, the Bloomberg US Aggregate Bond Total Return Index, returned 10.55%. The performance benchmark, the ICE BofA 3-Month US Treasury Bill Total Return Index, returned 5.39% during the period.

The continued elevated pricing trends associated with underwriting catastrophe risk, along with increased loss retention levels by insurance companies, helped drive the Fund’s positive performance during the period, but there were a few catastrophic events to which the Fund had exposure over the course of the reporting period.

Hurricane Helene made landfall on September 26 in the “Big Bend” area of Florida, as a Category 4 event. Expected insured losses, including the National Flood Insurance Program (NFIP), are estimated to be below $15 billion. Primary insurers will retain most of the losses and impact on the event-linked bonds in which the Fund invests is expected to be very limited.

Hurricane Milton made landfall on October 9 south of Tampa, Florida, as a Category 3 hurricane. Preliminary insured loss estimates, excluding NFIP, are between $25 billion and $40 billion. NFIP losses are anticipated to range from the low to mid-single billions, which means the NFIP CAT bonds will not be activated. A significant share of the insured losses is likely to be absorbed by the primary insurance companies. The catastrophe bonds held by the Fund tend to remain above these loss levels, which we believe will have a negligible impact on the Fund.

As of October 31, 2024, the North Atlantic hurricane season resulted in 15 named storms 10 hurricanes and 4 major hurricanes. Many of these events did not make landfall in the U.S. For those making U.S. landfall, most of the insured losses were retained by insurance companies with de minimis impact on the reinsurance industry. As a result, the Fund's catastrophe bond investments generally were not significantly negatively affected by the North Atlantic hurricane season.

Fund Performance

The line graph below shows the change in value of a $5 million investment made in Class Y shares of the Fund during the periods shown, compared to that of the Bloomberg US Aggregate Bond Total Return Index and the ICE BofA 3-Month US Treasury Bill Total Return Index.

| AVERAGE ANNUAL TOTAL RETURN | 1 Year | Since Inception* |

| Class Y | 14.27% | 14.71% |

| Bloomberg US Aggregate Bond Total Return Index | 10.55% | 2.46% |

| ICE BofA 3-Month US Treasury Bill Total Return Index | 5.39% | 5.28% |

| * | Performance of Class Y shares of the Fund shown in the graph above is from the inception of Class Y shares on 1/27/23 through 10/31/24. Index information shown in the graph above is from 1/31/23 through 10/31/24. |

Call 1-800-225-6292 or visit https://www.amundi.com/usinvestors/Resources/Shareholder-Reports for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

KEY FUND STATISTICS

(as of October 31, 2024)

| Fund net assets | $439,152,721% |

| Total number of portfolio holdings | 151^^ |

| Total advisory fee paid | $3,235,416 |

| Portfolio turnover rate | 25% |

| ^^ | Excluding short-term investments and all derivative contracts except for options purchased. |

SECTOR DIVERSIFICATION BY RISK

(as of October 31, 2024)*

| Event Linked Bonds | 92.1 |

| Collateralized Reinsurance | 7.9 |

| * | As a percentage of total investments excluding short-term investments and all derivative contracts except for options purchased. |

Amundi Asset Management US, Inc. (the “Adviser”), the Fund’s investment adviser, is currently an indirect, wholly-owned subsidiary of Amundi. On July 9, 2024, Amundi announced that it had entered into a definitive agreement with Victory Capital Holdings, Inc. (“Victory Capital”) to combine the Adviser with Victory Capital, and for Amundi to become a strategic shareholder of Victory Capital (the “Transaction”). Victory Capital is headquartered in San Antonio, Texas. The closing of the Transaction is subject to certain regulatory approvals and other conditions. There is no assurance that the Transaction will close.

The closing of the Transaction would cause the Fund’s current investment advisory agreement with the Adviser to terminate. Under the terms of the Transaction, the Fund’s Board of Trustees will be asked to approve a reorganization of the Fund into a corresponding, newly established Victory Fund advised by Victory Capital Management Inc., an affiliate of Victory Capital. The proposed reorganization of the Fund would be sought in connection with the closing of the Transaction. If approved by the Board, the proposal to reorganize the Fund will be submitted to the shareholders of the Fund for their approval. There is no assurance that the Board or the shareholders of the Fund will approve the proposal to reorganize the Fund.

For more complete information, you may review the Fund's next prospectus, which we expect to be available by March 3, 2025 at https://www.amundi.com/usinvestors/Products/Mutual-Funds or upon request at 1-800-225-6292.

Availability of Additional Information

You can find additional information about the Fund, including the Fund's prospectus, financial information, holdings and proxy voting information, at https://www.amundi.com/usinvestors/Resources/Shareholder-Reports. You can also request this information by contacting us at 1‑800‑225‑6292.

Important notice to shareholders

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communications to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 1-800-225-6292 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

ITEM 2. CODE OF ETHICS.

(a) Disclose whether, as of the end of the period covered by the report, the registrant has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party. If the registrant has not adopted such a code of ethics, explain why it has not done so.

The registrant has adopted, as of the end of the period covered by this report, a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer and controller.

(b) For purposes of this Item, the term “code of ethics” means written standards that are reasonably designed to deter wrongdoing and to promote:

(1) Honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships;

(2) Full, fair, accurate, timely, and understandable disclosure in reports and documents that a registrant files with, or submits to, the Commission and in other public communications made by the registrant;

(3) Compliance with applicable governmental laws, rules, and regulations;

(4) The prompt internal reporting of violations of the code to an appropriate person or persons identified in the code; and

(5) Accountability for adherence to the code.

(c) The registrant must briefly describe the nature of any amendment, during the period covered by the report, to a provision of its code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party, and that relates to any element of the code of ethics definition enumerated in paragraph (b) of this Item. The registrant must file a copy of any such amendment as an exhibit pursuant to Item 19(a), unless the registrant has elected to satisfy paragraph (f) of this Item by posting its code of ethics on its website pursuant to paragraph (f)(2) of this Item, or by undertaking to provide its code of ethics to any person without charge, upon request, pursuant to paragraph (f)(3) of this Item.

The registrant has made no amendments to the code of ethics during the period covered by this report.

(d) If the registrant has, during the period covered by the report, granted a waiver, including an implicit waiver, from a provision of the code of ethics to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party, that relates to one or more of the items set forth in paragraph (b) of this Item, the registrant must briefly describe the nature of the waiver, the name of the person to whom the waiver was granted, and the date of the waiver.

Not applicable.

(e) If the registrant intends to satisfy the disclosure requirement under paragraph (c) or (d) of this Item regarding an amendment to, or a waiver from, a provision of its code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions and that relates to any element of the code of ethics definition enumerated in paragraph (b) of this Item by posting such information on its Internet website, disclose the registrant’s Internet address and such intention.

Not applicable.

(f) The registrant must:

(1) File with the Commission, pursuant to Item 19(a)(1), a copy of its code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, as an exhibit to its annual report on this Form N-CSR (see attachment);

(2) Post the text of such code of ethics on its Internet website and disclose, in its most recent report on this Form N-CSR, its Internet address and the fact that it has posted such code of ethics on its Internet website; or

(3) Undertake in its most recent report on this Form N-CSR to provide to any person without charge, upon request, a copy of such code of ethics and explain the manner in which such request may be made. See Item 19(2)

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

(a) (1) Disclose that the registrant’s Board of Trustees has determined that the registrant either:

(i) Has at least one audit committee financial expert serving on its audit committee; or

(ii) Does not have an audit committee financial expert serving on its audit committee.

The registrant’s Board of Trustees has determined that the registrant has at least one audit committee financial expert.

(2) If the registrant provides the disclosure required by paragraph (a)(1)(i) of this Item, it must disclose the name of the audit committee financial expert and whether that person is “independent.” In order to be considered “independent” for purposes of this Item, a member of an audit committee may not, other than in his or her capacity as a member of the audit committee, the Board of Trustees, or any other board committee:

(i) Accept directly or indirectly any consulting, advisory, or other compensatory fee from the issuer; or

(ii) Be an “interested person” of the investment company as defined in Section 2(a)(19) of the Act (15 U.S.C. 80a-2(a)(19)).

Mr. Fred J. Ricciardi, an independent Trustee, is such an audit committee financial expert.

(3) If the registrant provides the disclosure required by paragraph (a)(1) (ii) of this Item, it must explain why it does not have an audit committee financial expert.

Not applicable.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

(a) Disclose, under the caption AUDIT FEES, the aggregate fees billed for each of the last two fiscal years for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years.

The audit fees for the Trust were $45,000 billed by Deloitte & Touche LLP for the year ended October 31, 2024 and $87,149 billed by Ernst & Young LLP for the year ended October 31, 2023.

(b) Disclose, under the caption AUDIT-RELATED FEES, the aggregate fees billed in each of the last two fiscal years for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this Item. Registrants shall describe the nature of the services comprising the fees disclosed under this category.

The audit-related services fees for the Trust were $0 billed by Deloitte & Touche LLP and $101 billed by Ernst & Young for the year ended October 31, 2024 and $781 billed by Ernst & Young LLP for the year ended October 31, 2023.

(c) Disclose, under the caption TAX FEES, the aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. Registrants shall describe the nature of the services comprising the fees disclosed under this category.

The aggregate non-audit fees for the Trust were billed by Deloitte & Touche LLP for tax services of $15,000 and $30,557 by Ernst & Young LLP for during the fiscal years ended October 31, 2024 and 2023, respectively.

(d) Disclose, under the caption ALL OTHER FEES, the aggregate fees billed in each of the last two fiscal years for products and services provided by the principal accountant, other than the services reported in paragraphs (a) through (c) of this Item. Registrants shall describe the nature of the services comprising the fees disclosed under this category.

There were no other fees in 2024 or 2023.

(e) (1) Disclose the audit committee’s pre-approval policies and procedures described in paragraph (c)(7) of Rule 2-01 of Regulation S-X.

PIONEER FUNDS

APPROVAL OF AUDIT, AUDIT-RELATED, TAX AND OTHER SERVICES

PROVIDED BY THE INDEPENDENT AUDITOR

SECTION I - POLICY PURPOSE AND APPLICABILITY

The Pioneer Funds recognize the importance of maintaining the independence of their outside auditors. Maintaining independence is a shared responsibility involving Amundi Asset Management US, Inc., the audit committee and the independent auditors.

The Funds recognize that a Fund’s independent auditors: 1) possess knowledge of the Funds, 2) are able to incorporate certain services into the scope of the audit, thereby avoiding redundant work, cost and disruption of Fund personnel and processes, and 3) have expertise that has value to the Funds. As a result, there are situations where it is desirable to use the Fund’s independent auditors for services in

addition to the annual audit and where the potential for conflicts of interests are minimal. Consequently, this policy, which is intended to comply with Rule 210.2-01(C)(7), sets forth guidelines and procedures to be followed by the Funds when retaining the independent audit firm to perform audit, audit-related tax and other services under those circumstances, while also maintaining independence.

Approval of a service in accordance with this policy for a Fund shall also constitute approval for any other Fund whose pre-approval is required pursuant to Rule 210.2-01(c)(7)(ii).

In addition to the procedures set forth in this policy, any non-audit services that may be provided consistently with Rule 210.2-01 may be approved by the Audit Committee itself and any pre-approval that may be waived in accordance with Rule 210.2-01(c)(7)(i)(C) is hereby waived.

Selection of a Fund’s independent auditors and their compensation shall be determined by the Audit Committee and shall not be subject to this policy.

SECTION II - POLICY

| | | | |

SERVICE CATEGORY | | SERVICE CATEGORY DESCRIPTION | | SPECIFIC PRE-APPROVED SERVICE SUBCATEGORIES |

| I. AUDIT SERVICES | | Services that are directly related to performing the independent audit of the Funds | | • Accounting research assistance • SEC consultation, registration statements, and reporting • Tax accrual related matters • Implementation of new accounting standards • Compliance letters (e.g. rating agency letters) • Regulatory reviews and assistance regarding financial matters • Semi-annual reviews (if requested) • Comfort letters for closed end offerings |

| | |

| II. AUDIT-RELATED SERVICES | | Services which are not prohibited under Rule 210.2-01(C)(4) (the “Rule”) and are related extensions of the audit services support the audit, or use the knowledge/expertise gained from the audit procedures as a foundation to complete the project. In most cases, if the Audit-Related Services are not performed by the Audit firm, the scope of the Audit Services would likely increase. The Services are typically well-defined and governed by accounting professional standards (AICPA, SEC, etc.) | | • AICPA attest and agreed-upon procedures • Technology control assessments • Financial reporting control assessments • Enterprise security architecture assessment |

| | |

AUDIT COMMITTEE APPROVAL POLICY | | AUDIT COMMITTEE REPORTING POLICY |

• “One-time” pre-approval for the audit period for all pre-approved specific service subcategories. Approval of the independent auditors as auditors for a Fund shall constitute pre approval for these services. | | • A summary of all such services and related fees reported at each regularly scheduled Audit Committee meeting. • A summary of all such services and related fees (including comparison to specified dollar limits) reported quarterly. |

• “One-time” pre-approval for the fund fiscal year within a specified dollar limit for all pre-approved specific service subcategories |

| | |

• Specific approval is needed to exceed the pre-approved dollar limit for these services (see general Audit Committee approval policy below for details on obtaining specific approvals) • Specific approval is needed to use the Fund’s auditors for Audit-Related Services not denoted as “pre-approved”, or to add a specific service subcategory as “pre-approved” | | |

SECTION III - POLICY DETAIL, CONTINUED

| | | | |

SERVICE CATEGORY | | SERVICE CATEGORY DESCRIPTION | | SPECIFIC PRE-APPROVED SERVICE SUBCATEGORIES |

| III. TAX SERVICES | | Services which are not prohibited by the Rule, if an officer of the Fund determines that using the Fund’s auditor to provide these services creates significant synergy in the form of efficiency, minimized disruption, or the ability to maintain a desired level of confidentiality. | | • Tax planning and support • Tax controversy assistance • Tax compliance, tax returns, excise tax returns and support • Tax opinions |

| | |

AUDIT COMMITTEE APPROVAL POLICY | | AUDIT COMMITTEE REPORTING POLICY |

• “One-time” pre-approval for the fund fiscal year within a specified dollar limit | | • A summary of all such services and related fees (including comparison to specified dollar limits) reported quarterly. |

| |

• Specific approval is needed to exceed the pre-approved dollar limits for these services (see general Audit Committee approval policy below for details on obtaining specific approvals) | | |

| |

• Specific approval is needed to use the Fund’s auditors for tax services not denoted as pre-approved, or to add a specific service subcategory as “pre-approved” | | |

SECTION III - POLICY DETAIL, CONTINUED

| | | | |

SERVICE CATEGORY | | SERVICE CATEGORY DESCRIPTION | | SPECIFIC PRE-APPROVED SERVICE SUBCATEGORIES |

IV. OTHER SERVICES A. SYNERGISTIC, UNIQUE QUALIFICATIONS | | Services which are not prohibited by the Rule, if an officer of the Fund determines that using the Fund’s auditor to provide these services creates significant synergy in the form of efficiency, minimized disruption, the ability to maintain a desired level of confidentiality, or where the Fund’s auditors posses unique or superior qualifications to provide these services, resulting in superior value and results for the Fund. | | • Business Risk Management support • Other control and regulatory compliance projects |

| | |

AUDIT COMMITTEE APPROVAL POLICY | | AUDIT COMMITTEE REPORTING POLICY |

• “One-time” pre-approval for the fund fiscal year within a specified dollar limit | | • A summary of all such services and related fees (including comparison to specified dollar limits) reported quarterly. |

| |

• Specific approval is needed to exceed the pre-approved dollar limits for these services (see general Audit Committee approval policy below for details on obtaining specific approvals) | | |

| |

• Specific approval is needed to use the Fund’s auditors for “Synergistic” or “Unique Qualifications” Other Services not denoted as pre-approved to the left, or to add a specific service subcategory as “pre-approved” | | |

SECTION III - POLICY DETAIL, CONTINUED

| | | | |

SERVICE CATEGORY | | SERVICE CATEGORY DESCRIPTION | | SPECIFIC PROHIBITED SERVICE SUBCATEGORIES |

| PROHIBITED SERVICES | | Services which result in the auditors losing independence status under the Rule. | | 1. Bookkeeping or other services related to the accounting records or financial statements of the audit client* 2. Financial information systems design and implementation* 3. Appraisal or valuation services, fairness* opinions, or contribution-in-kind reports 4. Actuarial services (i.e., setting actuarial reserves versus actuarial audit work)* 5. Internal audit outsourcing services* 6. Management functions or human resources 7. Broker or dealer, investment advisor, or investment banking services 8. Legal services and expert services unrelated to the audit 9. Any other service that the Public Company Accounting Oversight Board determines, by regulation, is impermissible |

| | |

AUDIT COMMITTEE APPROVAL POLICY | | AUDIT COMMITTEE REPORTING POLICY |

• These services are not to be performed with the exception of the(*) services that may be permitted if they would not be subject to audit procedures at the audit client (as defined in rule 2-01(f)(4)) level the firm providing the service. | | • A summary of all services and related fees reported at each regularly scheduled Audit Committee meeting will serve as continual confirmation that has not provided any restricted services. |

GENERAL AUDIT COMMITTEE APPROVAL POLICY:

| | • | | For all projects, the officers of the Funds and the Fund’s auditors will each make an assessment to determine that any proposed projects will not impair independence. |

| | • | | Potential services will be classified into the four non-restricted service categories and the “Approval of Audit, Audit-Related, Tax and Other Services” Policy above will be applied. Any services outside the specific pre-approved service subcategories set forth above must be specifically approved by the Audit Committee. |

| | • | | At least quarterly, the Audit Committee shall review a report summarizing the services by service category, including fees, provided by the Audit firm as set forth in the above policy. |

(2) Disclose the percentage of services described in each of paragraphs (b) through (d) of this Item that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

Non-Audit Services

Beginning with non-audit service contracts entered into on or after May 6, 2003, the effective date of the new SEC pre-approval rules, the Trust’s audit committee is required to pre-approve services to affiliates defined by SEC rules to the extent that the services are determined to have a direct impact on the operations or financial reporting of the Trust. For the years ended October 31, 2024 and 2023, there were no services provided to an affiliate that required the Trust’s audit committee pre-approval.

(f) If greater than 50 percent, disclose the percentage of hours expended on the principal accountants engagement to audit the registrant’s financial statements for the most recent fiscal year that were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

N/A

(g) Disclose the aggregate non-audit fees billed by the registrants accountant for services rendered to the registrant, and rendered to the registrants investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant for each of the last two fiscal years of the registrant.

The aggregate non-audit fees for the Trust were billed by Deloitte & Touche LLP for tax services of $15,000 and $30,557 by Ernst & Young LLP for during the fiscal years ended October 31, 2024 and 2023, respectively.

(h) Disclose whether the registrants audit committee of the Board of Trustees has considered whether the provision of non-audit services that were rendered to the registrants investment adviser (not including any subadviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal accountant’s independence.

The Fund’s audit committee of the Board of Trustees has considered whether the provision of non-audit services that were rendered to the Affiliates (as defined) that were not pre- approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal accountant’s independence.

(i) A registrant identified by the Commission pursuant to Section 104(i)(2)(A) of the Sarbanes-Oxley Act of 2002 (15 U.S.C. 7214(i)(2)(A)), as having retained, for the preparation of the audit report on its financial statements included in the Form NCSR, a registered public accounting firm that has a branch or office that is located in a foreign jurisdiction and that the Public Company Accounting Oversight Board has determined it is unable to inspect or investigate completely because of a position taken by an authority in the foreign jurisdiction must electronically submit to the Commission on a supplemental basis documentation that establishes that the registrant is not owned or controlled by a governmental entity in the foreign jurisdiction. The registrant must submit this documentation on or before the due date for this form. A registrant that is owned or controlled by a foreign governmental entity is not required to submit such documentation.

N/A

(j) A registrant that is a foreign issuer, as defined in 17 CFR 240.3b-4, identified by the Commission pursuant to Section 104(i)(2)(A) of the Sarbanes-Oxley Act of 2002 (15 U.S.C. 7214(i)(2)(A)), as having retained, for the preparation of the audit report on its financial statements included in the Form N-CSR, a registered public accounting firm that has a branch or office that is located in a foreign jurisdiction and that the Public Company Accounting Oversight Board has determined it is unable to inspect or investigate completely because of a position taken by an authority in the foreign jurisdiction, for each year in which the registrant is so identified, must provide the below disclosures. Also, any such identified foreign issuer that uses a variable-interest entity or any similar structure that results in additional foreign entities being consolidated in the financial statements of the registrant is required to provide the below disclosures for itself and its consolidated foreign operating entity or entities. A registrant must disclose:

(1) That, for the immediately preceding annual financial statement period, a registered public accounting firm that the PCAOB was unable to inspect or investigate completely, because of a position taken by an authority in the foreign jurisdiction, issued an audit report for the registrant;

N/A

(2) The percentage of shares of the registrant owned by governmental entities in the foreign jurisdiction in which the registrant is incorporated or otherwise organized;

N/A

(3) Whether governmental entities in the applicable foreign jurisdiction with respect to that registered public accounting firm have a controlling financial interest with respect to the registrant; N/A

(4) The name of each official of the Chinese Communist Party who is a member of the board of directors of the registrant or the operating entity with respect to the registrant;

N/A

(5) Whether the articles of incorporation of the registrant (or equivalent organizing document) contains any charter of the Chinese Communist Party, including the text of any such charter.

N/A

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS

(a) If the registrant is a listed issuer as defined in Rule 10A-3 under the Exchange Act (17 CFR 240.10A-3), state whether or not the registrant has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Exchange Act (15 U.S.C. 78c(a)(58)(A)). If the registrant has such a committee, however designated, identify each committee member. If the entire board of directors is acting as the registrant’s audit committee as specified in Section 3(a)(58)(B) of the Exchange Act (15 U.S.C. 78c(a)(58)(B)), so state.

N/A

(b) If applicable, provide the disclosure required by Rule 10A-3(d) under the Exchange Act (17 CFR 240.10A-3(d)) regarding an exemption from the listing standards for audit committees.

N/A

ITEM 6. SCHEDULE OF INVESTMENTS.

File Schedule of Investments in securities of unaffiliated issuers as of the close of the reporting period as set forth in 210.1212 of Regulation S-X [17 CFR 210.12-12], unless the schedule is included as part of the report to shareholders filed under Item 1 of this Form.

Included in Item 7

ITEM 7. FINANCIAL STATEMENTS AND FINANCIAL HIGHLIGHTS FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES.

Pioneer CAT Bond Fund

Annual Report | October 31, 2024

visit us: www.amundi.com/us

Pioneer CAT Bond Fund | Annual Report | 10/31/241

Schedule of Investments | 10/31/24

Principal

Amount

USD ($) | | | | | | Value |

| | Insurance-Linked Securities — 91.4% of

Net Assets# | |

| | Event Linked Bonds — 84.2% | |

| | Earthquakes – California — 3.6% | |

| 1,510,000(a) | Sutter Re, 11.313%, (3 Month U.S. Treasury Bill + 675 bps), 6/19/26 (144A) | $ 1,563,001 |

| 7,000,000(a) | Sutter Re, 14.313%, (3 Month U.S. Treasury Bill + 975 bps), 6/19/26 (144A) | 7,339,500 |

| 2,100,000(a) | Torrey Pines Re, 9.758%, (3 Month U.S. Treasury Bill + 522 bps), 6/5/26 (144A) | 2,164,470 |

| 500,000(a) | Torrey Pines Re, 10.553%, (1 Month U.S. Treasury Bill + 600 bps), 6/7/27 (144A) | 520,800 |

| 1,750,000(a) | Ursa Re, 10.042%, (3 Month U.S. Treasury Bill + 550 bps), 12/7/26 (144A) | 1,824,550 |

| 2,250,000(a) | Ursa Re, 13.803%, (3 Month U.S. Treasury Bill + 925 bps), 12/7/26 (144A) | 2,366,325 |

| | | | | | | $15,778,646 |

|

|

| | Earthquakes – Chile — 0.1% | |

| 250,000(a) | International Bank for Reconstruction & Development, 9.613%, (SOFR + 479 bps), 3/31/26 (144A) | $ 253,675 |

| | Earthquakes - Europe — 0.2% | |

| EUR1,000,000(a) | Azzurro Re II, 9.719%, (3 Month EURIBOR + 650 bps), 4/20/28 (144A) | $ 1,088,729 |

| | Earthquakes - Japan — 1.8% | |

| 8,000,000(a) | Nakama Re, 6.869%, (3 Month U.S. Treasury Bill + 235 bps), 4/4/29 (144A) | $ 7,996,800 |

| | Earthquakes – Mexico — 0.5% | |

| 1,500,000(a) | International Bank for Reconstruction & Development, 9.043%, (SOFR + 422 bps), 4/24/28 (144A) | $ 1,522,500 |

| 500,000(a) | International Bank for Reconstruction & Development, 16.043%, (SOFR + 1,122 bps), 4/24/28 (144A) | 502,650 |

| | | | | | | $2,025,150 |

|

|

| | Earthquakes – U.S. — 5.0% | |

| 5,750,000(a) | Acorn Re, 7.663%, (1 Month U.S. Treasury Bill + 310 bps), 11/5/27 (144A) | $ 5,750,000 |

| 5,750,000(a) | Acorn Re, 7.666%, (1 Month U.S. Treasury Bill + 310 bps), 11/7/25 (144A) | 5,750,000 |

| 5,500,000(a) | Logistics Re, 10.566%, (1 Month U.S. Treasury Bill + 600 bps), 12/21/27 (144A) | 5,499,453 |

The accompanying notes are an integral part of these financial statements.

2Pioneer CAT Bond Fund | Annual Report | 10/31/24

Principal

Amount

USD ($) | | | | | | Value |

| | Earthquakes – U.S. — (continued) | |

| 250,000(a) | Nakama Re, 6.92%, (3 Month Term SOFR + 250 bps), 5/9/28 (144A) | $ 250,075 |

| 1,000,000(a) | Ursa Re, 10.061%, (3 Month U.S. Treasury Bill + 550 bps), 12/6/25 (144A) | 1,023,200 |

| 1,500,000(a) | Ursa Re II, 9.542%, (3 Month U.S. Treasury Bill + 500 bps), 6/16/25 (144A) | 1,512,000 |

| 2,000,000(a) | Veraison Re, 9.313%, (3 Month U.S. Treasury Bill + 475 bps), 3/8/27 (144A) | 2,061,600 |

| | | | | | | $21,846,328 |

|

|

| | Earthquakes – U.S. & Canada — 1.5% | |

| 6,500,000(a) | Acorn Re, 7.042%, (3 Month U.S. Treasury Bill + 250 bps), 11/7/24 (144A) | $ 6,480,500 |

| | Flood – U.S. — 3.4% | |

| 3,500,000(a) | FloodSmart Re, 16.383%, (3 Month U.S. Treasury Bill + 1,183 bps), 2/25/25 (144A) | $ 3,583,650 |

| 7,750,000(a) | FloodSmart Re, 18.553%, (3 Month U.S. Treasury Bill + 1,400 bps), 3/12/27 (144A) | 8,157,650 |

| 1,000,000(a) | FloodSmart Re, 21.70%, (1 Month U.S. Treasury Bill + 1,715 bps), 3/11/26 (144A) | 1,055,800 |

| 2,000,000(a) | FloodSmart Re, 21.792%, (3 Month U.S. Treasury Bill + 1,725 bps), 3/12/27 (144A) | 2,058,600 |

| 250,000(a) | FloodSmart Re, 26.95%, (1 Month U.S. Treasury Bill + 2,240 bps), 3/11/26 (144A) | 225,000 |

| | | | | | | $15,080,700 |

|

|

| | Health – U.S. — 0.5% | |

| 500,000(a) | Vitality Re XIII, 6.553%, (3 Month U.S. Treasury Bill + 200 bps), 1/6/26 (144A) | $ 497,300 |

| 1,000,000(a) | Vitality Re XV, 7.061%, (3 Month U.S. Treasury Bill + 250 bps), 1/7/28 (144A) | 998,800 |

| 500,000(a) | Vitality Re XV, 8.063%, (3 Month U.S. Treasury Bill + 350 bps), 1/7/28 (144A) | 500,200 |

| | | | | | | $1,996,300 |

|

|

| | Multiperil – Florida — 0.2% | |

| 1,000,000(a) | Sanders Re, 12.701%, (3 Month U.S. Treasury Bill + 814 bps), 6/5/26 (144A) | $ 1,065,000 |

| | Multiperil – Puerto Rico — 0.1% | |

| 500,000(a) | Puerto Rico Parametric Re, 13.542%, (1 Month U.S. Treasury Bill + 900 bps), 6/7/27 (144A) | $ 525,250 |

| | Multiperil – U.S. — 19.3% | |

| 2,250,000(a) | Aquila Re, 10.042%, (3 Month U.S. Treasury Bill + 550 bps), 6/7/27 (144A) | $ 2,306,025 |

The accompanying notes are an integral part of these financial statements.

Pioneer CAT Bond Fund | Annual Report | 10/31/243

Schedule of Investments | 10/31/24 (continued)

Principal

Amount

USD ($) | | | | | | Value |

| | Multiperil – U.S. — (continued) | |

| 3,750,000(a) | Aquila Re, 13.542%, (3 Month U.S. Treasury Bill + 900 bps), 6/7/27 (144A) | $ 3,973,125 |

| 3,000,000(a) | Atela Re, Ltd., 18.813%, (3 Month U.S. Treasury Bill + 1,425 bps), 5/9/27 (144A) | 3,142,800 |

| 750,000(a) | Baldwin Re, 9.05%, (3 Month U.S. Treasury Bill + 450 bps), 7/7/27 (144A) | 769,725 |

| 1,000,000(a) | Blue Halo Re, 19.792%, (3 Month U.S. Treasury Bill + 1,525 bps), 2/24/25 (144A) | 950,000 |

| 5,250,000(a) | Foundation Re, 10.80%, (3 Month U.S. Treasury Bill + 625 bps), 1/8/27 (144A) | 5,402,250 |

| 3,250,000(a) | Four Lakes Re, 10.303%, (3 Month U.S. Treasury Bill + 575 bps), 1/7/27 (144A) | 3,334,825 |

| 250,000(a) | Four Lakes Re, 11.021%, (3 Month U.S. Treasury Bill + 646 bps), 1/7/26 (144A) | 257,400 |

| 2,750,000(a) | Four Lakes Re, 14.042%, (3 Month U.S. Treasury Bill + 950 bps), 1/7/27 (144A) | 2,885,575 |

| 6,000,000(a) | Herbie Re, 10.542%, (3 Month U.S. Treasury Bill + 600 bps), 1/7/28 (144A) | 5,638,200 |

| 1,500,000(a) | Herbie Re, 13.553%, (3 Month U.S. Treasury Bill + 900 bps), 1/7/28 (144A) | 1,399,200 |

| 1,500,000(a) | High Point Re, 10.30%, (3 Month U.S. Treasury Bill + 575 bps), 1/6/27 (144A) | 1,536,300 |

| 1,100,000(a) | Hypatia Re, 15.042%, (3 Month U.S. Treasury Bill + 1,050 bps), 4/8/26 (144A) | 1,149,830 |

| 7,500,000(a) | Matterhorn Re, 10.103%, (SOFR + 525 bps), 3/24/25 (144A) | 7,507,500 |

| 750,000(a) | Merna Re II, 11.816%, (3 Month U.S. Treasury Bill + 725 bps), 7/7/27 (144A) | 772,984 |

| 5,625,000(a) | Merna Re II, 12.072%, (3 Month U.S. Treasury Bill + 753 bps), 7/7/25 (144A) | 5,870,250 |

| 350,000(a) | Merna Re II, 12.311%, (3 Month U.S. Treasury Bill + 775 bps), 7/7/26 (144A) | 367,500 |

| 5,000,000(a) | Merna Re II, 13.066%, (3 Month U.S. Treasury Bill + 850 bps), 7/7/27 (144A) | 5,258,880 |

| 11,250,000(a) | Mystic Re, 16.553%, (3 Month U.S. Treasury Bill + 1,200 bps), 1/8/27 (144A) | 11,526,750 |

| 500,000(a) | Residential Re, 4.553%, (3 Month U.S. Treasury Bill + 0 bps), 12/6/24 (144A) | 498,450 |

| 500,000(a) | Residential Re, 10.592%, (3 Month U.S. Treasury Bill + 605 bps), 12/6/25 (144A) | 492,600 |

| 500,000(a) | Residential Re, 10.843%, (3 Month U.S. Treasury Bill + 629 bps), 12/6/24 (144A) | 498,500 |

| 2,500,000(a) | Residential Re, 16.562%, (3 Month U.S. Treasury Bill + 1,202 bps), 12/6/25 (144A) | 2,482,500 |

The accompanying notes are an integral part of these financial statements.

4Pioneer CAT Bond Fund | Annual Report | 10/31/24

Principal

Amount

USD ($) | | | | | | Value |

| | Multiperil – U.S. — (continued) | |

| 4,750,000(a) | Sanders Re, 10.313%, (3 Month U.S. Treasury Bill + 575 bps), 4/7/28 (144A) | $ 4,930,500 |

| 250,000(a) | Sanders Re II, 7.542%, (3 Month U.S. Treasury Bill + 300 bps), 4/7/25 (144A) | 250,750 |

| 1,500,000(a) | Sanders Re III, 7.973%, (3 Month U.S. Treasury Bill + 341 bps), 4/7/26 (144A) | 1,499,250 |

| 700,000(a) | Sanders Re III, 10.116%, (3 Month U.S. Treasury Bill + 555 bps), 4/7/27 (144A) | 727,020 |

| 2,550,000(a) | Solomon Re, 10.062%, (3 Month U.S. Treasury Bill + 552 bps), 6/8/26 (144A) | 2,620,380 |

| 3,900,000(a) | Stabilitas Re, 13.056%, (3 Month U.S. Treasury Bill + 849 bps), 6/5/26 (144A) | 4,020,120 |

| 1,250,000(a) | Sussex Re, 12.923%, (3 Month U.S. Treasury Bill + 836 bps), 1/8/25 (144A) | 1,256,250 |

| 1,650,000(a) | Topanga Re, 9.611%, (3 Month U.S. Treasury Bill + 505 bps), 1/8/26 (144A) | 1,640,925 |

| | | | | | | $84,966,364 |

|

|

| | Multiperil – U.S. & Canada — 10.0% | |

| 5,750,000(a) | Ashera Re, 9.561%, (3 Month U.S. Treasury Bill + 500 bps), 4/7/27 (144A) | $ 5,852,925 |

| 3,000,000(a) | Atlas Re, 17.475%, (SOFR + 1,250 bps), 6/8/27 (144A) | 3,343,500 |

| 3,050,000(a) | Galileo Re, 11.542%, (3 Month U.S. Treasury Bill + 700 bps), 1/7/28 (144A) | 3,147,905 |

| 3,200,000(a) | Galileo Re, 11.55%, (3 Month U.S. Treasury Bill + 700 bps), 1/8/26 (144A) | 3,265,920 |

| 2,250,000(a) | Kilimanjaro II Re, 10.792%, (3 Month U.S. Treasury Bill + 625 bps), 6/30/28 (144A) | 2,313,450 |

| 4,500,000(a) | Kilimanjaro II Re, 11.792%, (3 Month U.S. Treasury Bill + 725 bps), 6/30/28 (144A) | 4,688,100 |

| 1,625,000(a) | Kilimanjaro III Re, 16.91%, (3 Month U.S. Treasury Bill + 1,236 bps), 4/21/25 (144A) | 1,685,125 |

| 3,000,000(a) | Kilimanjaro III Re, 16.91%, (3 Month U.S. Treasury Bill + 1,236 bps), 4/20/26 (144A) | 3,016,200 |

| 3,250,000(a) | Mona Lisa Re, 11.561%, (3 Month U.S. Treasury Bill + 700 bps), 7/8/25 (144A) | 3,314,025 |

| 500,000(a) | Mona Lisa Re, 14.303%, (3 Month U.S. Treasury Bill + 975 bps), 6/25/27 (144A) | 547,650 |

| 3,350,000(a) | Mystic Re IV, 10.642%, (3 Month U.S. Treasury Bill + 610 bps), 1/8/25 (144A) | 3,363,400 |

| 250,000(a) | Mystic Re IV, 16.253%, (3 Month U.S. Treasury Bill + 1,169 bps), 1/8/25 (144A) | 252,625 |

| 3,000,000(a) | Northshore Re II, 12.542%, (3 Month U.S. Treasury Bill + 800 bps), 7/8/25 (144A) | 3,111,600 |

The accompanying notes are an integral part of these financial statements.

Pioneer CAT Bond Fund | Annual Report | 10/31/245

Schedule of Investments | 10/31/24 (continued)

Principal

Amount

USD ($) | | | | | | Value |

| | Multiperil – U.S. & Canada — (continued) | |

| 5,000,000(a) | Ramble Re, 10.803%, (3 Month U.S. Treasury Bill + 625 bps), 3/5/27 (144A) | $ 4,875,000 |

| 1,000,000(a) | Titania Re, 17.083%, (1 Month U.S. Treasury Bill + 1,253 bps), 2/27/26 (144A) | 1,064,700 |

| | | | | | | $43,842,125 |

|

|

| | Multiperil – U.S. Regional — 1.7% | |

| 250,000(a) | Aquila Re, 10.213%, (3 Month U.S. Treasury Bill + 565 bps), 6/8/26 (144A) | $ 259,450 |

| 400,000(a) | Aquila Re, 12.833%, (3 Month U.S. Treasury Bill + 827 bps), 6/8/26 (144A) | 422,720 |

| 1,400,000(a) | Aquila Re, 13.748%, (3 Month U.S. Treasury Bill + 918 bps), 6/8/26 (144A) | 1,492,400 |

| 1,150,000(a) | Locke Tavern Re, 9.345%, (3 Month U.S. Treasury Bill + 478 bps), 4/9/26 (144A) | 1,185,190 |

| 4,000,000(a) | Long Point Re IV, 8.80%, (3 Month U.S. Treasury Bill + 425 bps), 6/1/26 (144A) | 4,079,600 |

| | | | | | | $7,439,360 |

|

|

| | Multiperil – Worldwide — 6.7% | |

| 2,150,000(a) | Atlas Capital, 12.67%, (SOFR + 772 bps), 6/5/26 (144A) | $ 2,198,805 |

| 9,250,000(a) | Cat Re 2001, 17.053%, (3 Month U.S. Treasury Bill + 1,250 bps), 1/8/27 (144A) | 9,436,850 |

| 2,500,000(a) | Kendall Re, 10.803%, (3 Month U.S. Treasury Bill + 625 bps), 4/30/27 (144A) | 2,594,750 |

| 10,000,000(a) | Kendall Re, 12.303%, (3 Month U.S. Treasury Bill + 775 bps), 4/30/27 (144A) | 10,160,000 |

| 5,000,000(a) | Montoya Re, 11.653%, (1 Month U.S. Treasury Bill + 710 bps), 4/7/25 (144A) | 5,058,000 |

| | | | | | | $29,448,405 |

|

|

| | Windstorm – Europe — 0.7% | |

| EUR2,000,000(a) | Blue Sky Re, 8.822%, (3 Month EURIBOR + 575 bps), 1/26/27 (144A) | $ 2,251,425 |

| EUR750,000(a) | Windmill III Re DAC, 8.488%, (3 Month EURIBOR + 525 bps), 7/5/28 (144A) | 810,509 |

| | | | | | | $3,061,934 |

|

|

| | Windstorm – Florida — 5.1% | |

| 2,000,000(a) | Armor Re, 14.803%, (3 Month U.S. Treasury Bill + 1,025 bps), 5/7/27 (144A) | $ 2,096,000 |

| 600,000(a) | First Coast Re, 9.52%, (3 Month U.S. Treasury Bill + 952 bps), 4/7/26 (144A) | 627,060 |

| 3,000,000(a) | Integrity Re, 17.813%, (1 Month U.S. Treasury Bill + 1,325 bps), 6/6/26 (144A) | 2,250,000 |

The accompanying notes are an integral part of these financial statements.

6Pioneer CAT Bond Fund | Annual Report | 10/31/24

Principal

Amount

USD ($) | | | | | | Value |

| | Windstorm – Florida — (continued) | |

| 1,500,000(a) | Integrity Re, 27.563%, (1 Month U.S. Treasury Bill + 2,300 bps), 6/6/26 (144A) | $ 967,500 |

| 500,000(a) | Marlon Re, 11.566%, (3 Month U.S. Treasury Bill + 700 bps), 6/7/27 (144A) | 503,250 |

| 2,000,000(a) | Merna Re II, 13.316%, (3 Month U.S. Treasury Bill + 875 bps), 7/7/27 (144A) | 1,995,000 |

| 7,000,000(a) | Palm Re, 14.061%, (1 Month U.S. Treasury Bill + 950 bps), 6/7/27 (144A) | 7,320,600 |

| 3,600,000(a) | Purple Re, 13.561%, (1 Month U.S. Treasury Bill + 900 bps), 6/7/27 (144A) | 3,726,720 |

| 2,250,000(a) | Winston Re, 14.818%, (3 Month U.S. Treasury Bill + 1,025 bps), 2/26/27 (144A) | 2,361,375 |

| 500,000(a) | Winston Re, 16.318%, (3 Month U.S. Treasury Bill + 1,175 bps), 2/26/27 (144A) | 377,500 |

| | | | | | | $22,225,005 |

|

|

| | Windstorm – Florida & Louisana — 0.5% | |

| 2,250,000(a) | Nature Coast Re, 14.568%, (3 Month U.S. Treasury Bill + 1,000 bps), 12/7/26 (144A) | $ 2,300,625 |

| | Windstorm – Jamaica — 0.7% | |

| 3,000,000(a) | International Bank for Reconstruction & Development, 12.01%, (SOFR + 719 bps), 12/29/27 (144A) | $ 3,060,900 |

| | Windstorm – Japan — 1.2% | |

| 2,050,000(a) | Black Kite Re, 11.362%, (3 Month U.S. Treasury Bill + 682 bps), 6/9/25 (144A) | $ 2,106,170 |

| 1,000,000(a) | Sakura Re, 6.963%, (3 Month U.S. Treasury Bill + 241 bps), 4/7/25 (144A) | 1,006,300 |

| 1,500,000(a) | Tomoni Re, 7.311%, (3 Month U.S. Treasury Bill + 275 bps), 4/7/26 (144A) | 1,495,950 |

| 750,000(a) | Tomoni Re, 7.792%, (3 Month U.S. Treasury Bill + 325 bps), 4/5/28 (144A) | 742,725 |

| | | | | | | $5,351,145 |

|

|

| | Windstorm – Massachusetts — 0.5% | |

| 2,000,000(a) | Mayflower Re, 4.50%, (1 Month U.S. Treasury Bill + 450 bps), 7/8/27 (144A) | $ 2,066,600 |

The accompanying notes are an integral part of these financial statements.

Pioneer CAT Bond Fund | Annual Report | 10/31/247

Schedule of Investments | 10/31/24 (continued)

Principal

Amount

USD ($) | | | | | | Value |

| | Windstorm – Mexico — 0.8% | |

| 1,500,000(a) | International Bank for Reconstruction & Development, 17.048%, (SOFR + 1,222 bps), 4/24/28 (144A) | $ 1,551,000 |

| 2,000,000(a) | International Bank for Reconstruction & Development, 18.548%, (SOFR + 1,372 bps), 4/24/28 (144A) | 2,105,800 |

| | | | | | | $3,656,800 |

|

|

| | Windstorm - New York — 0.5% | |

| 2,000,000(a) | MetroCat Re, 5.75%, (3 Month U.S. Treasury Bill + 575 bps), 5/8/26 (144A) | $ 2,050,600 |

| | Windstorm – North Carolina — 1.1% | |

| 500,000(a) | Blue Ridge Re, 12.553%, (1 Month U.S. Treasury Bill + 800 bps), 1/8/27 (144A) | $ 519,500 |

| 4,000,000(a) | Longleaf Pine Re, 22.053%, (1 Month U.S. Treasury Bill + 1,750 bps), 5/25/27 (144A) | 4,406,000 |

| | | | | | | $4,925,500 |

|

|

| | Windstorm – Texas — 1.6% | |

| 1,500,000(a) | Alamo Re, 6.00%, (1 Month U.S. Treasury Bill + 600 bps), 6/7/27 (144A) | $ 1,566,750 |

| 500,000(a) | Alamo Re, 12.064%, (1 Month U.S. Treasury Bill + 752 bps), 6/7/25 (144A) | 519,250 |

| 1,500,000(a) | Alamo Re, 12.311%, (1 Month U.S. Treasury Bill + 775 bps), 6/7/27 (144A) | 1,562,550 |

| 3,000,000(a) | Alamo Re, 15.813%, (1 Month U.S. Treasury Bill + 1,125 bps), 6/7/26 (144A) | 3,182,100 |

| | | | | | | $6,830,650 |

|

|

| | Windstorm – U.S. — 5.9% | |

| 5,000,000(a) | Alamo Re, 12.945%, (1 Month U.S. Treasury Bill + 839 bps), 6/7/26 (144A) | $ 5,244,500 |

| 750,000(a) | Bonanza Re, 10.173%, (3 Month U.S. Treasury Bill + 562 bps), 3/16/25 (144A) | 747,750 |

| 1,500,000(a) | Cape Lookout Re, 12.981%, (1 Month U.S. Treasury Bill + 842 bps), 4/28/26 (144A) | 1,569,450 |

| 500,000(a) | Gateway Re, 18.502%, (1 Month U.S. Treasury Bill + 1,396 bps), 2/24/26 (144A) | 542,450 |

| 2,500,000(a) | Lower Ferry Re, 8.98%, (1 Month U.S. Treasury Bill + 443 bps), 7/8/26 (144A) | 2,579,250 |

| 1,900,000(a) | Lower Ferry Re, 9.82%, (1 Month U.S. Treasury Bill + 527 bps), 7/8/26 (144A) | 1,962,510 |

| 1,750,000(a) | Mayflower Re, 4.691%, (1 Month U.S. Treasury Bill + 469 bps), 7/8/26 (144A) | 1,810,725 |

| 3,250,000(a) | Mayflower Re, 10.557%, (1 Month U.S. Treasury Bill + 602 bps), 7/8/26 (144A) | 3,388,775 |

The accompanying notes are an integral part of these financial statements.

8Pioneer CAT Bond Fund | Annual Report | 10/31/24

Principal

Amount

USD ($) | | | | | | Value |

| | Windstorm – U.S. — (continued) | |

| 700,000(a) | Merna Re II, 14.811%, (3 Month U.S. Treasury Bill + 1,025 bps), 7/7/26 (144A) | $ 741,930 |

| 3,250,000(a) | Purple Re, 17.548%, (1 Month Term SOFR + 1,281 bps), 4/24/26 (144A) | 3,185,000 |

| 3,950,000(a) | Queen Street Re, 12.076%, (3 Month U.S. Treasury Bill + 750 bps), 12/8/25 (144A) | 4,062,575 |

| | | | | | | $25,834,915 |

|

|

| | Windstorm – U.S. & Canada — 1.1% | |

| 4,750,000(a) | Titania Re, 17.716%, (1 Month U.S. Treasury Bill + 1,315 bps), 2/27/26 (144A) | $ 5,052,575 |

| | Windstorm – U.S. Gulf — 0.1% | |

| 500,000(a) | 3264 Re, 22.542%, (3 Month U.S. Treasury Bill + 1,800 bps), 7/8/27 (144A) | $ 544,400 |

| | Windstorm – U.S. Multistate — 3.2% | |

| 1,000,000(a) | Charles River Re, 11.311%, (1 Month U.S. Treasury Bill + 675 bps), 5/10/27 (144A) | $ 1,025,600 |

| 4,250,000(a) | Gateway Re, 4.542%, (1 Month U.S. Treasury Bill + 0 bps), 12/23/24 (144A) | 4,236,825 |

| 1,000,000(a) | Gateway Re, 4.542%, (1 Month U.S. Treasury Bill + 0 bps), 1/8/25 (144A) | 996,900 |

| 750,000(a) | Gateway Re, 10.061%, (1 Month U.S. Treasury Bill + 550 bps), 7/8/27 (144A) | 766,725 |

| 5,250,000(a) | Gateway Re, 14.55%, (1 Month U.S. Treasury Bill + 1,000 bps), 7/8/26 (144A) | 5,493,075 |

| 1,500,000(a) | Purple Re, 15.042%, (1 Month U.S. Treasury Bill + 1,050 bps), 6/5/26 (144A) | 1,585,500 |

| | | | | | | $14,104,625 |

|

|

| | Windstorm – U.S. Northeast — 0.3% | |

| 1,250,000(a) | 3264 Re, 11.542%, (3 Month U.S. Treasury Bill + 700 bps), 7/8/27 (144A) | $ 1,316,500 |

| | Windstorm – U.S. Regional — 2.8% | |

| 2,450,000(a) | Citrus Re, 11.143%, (3 Month U.S. Treasury Bill + 659 bps), 6/7/26 (144A) | $ 2,557,065 |

| 750,000(a) | Citrus Re, 13.323%, (3 Month U.S. Treasury Bill + 877 bps), 6/7/26 (144A) | 783,525 |

| 4,250,000(a) | Citrus Re, 13.811%, (3 Month U.S. Treasury Bill + 925 bps), 6/7/27 (144A) | 4,410,225 |

| 4,500,000(a) | Citrus Re, 15.061%, (3 Month U.S. Treasury Bill + 1,050 bps), 6/7/27 (144A) | 4,717,350 |

| | | | | | | $12,468,165 |

|

|

The accompanying notes are an integral part of these financial statements.

Pioneer CAT Bond Fund | Annual Report | 10/31/249

Schedule of Investments | 10/31/24 (continued)

Principal

Amount

USD ($) | | | | | | Value | |

| | Winterstorm – Florida — 3.5% | | |

| 5,700,000(a) | Integrity Re, 17.426%, (1 Month U.S. Treasury Bill + 1,286 bps), 6/6/25 (144A) | $ 5,700,000 | |

| 8,900,000(a) | Lightning Re, 15.561%, (3 Month U.S. Treasury Bill + 1,100 bps), 3/31/26 (144A) | 9,478,500 | |

| | | | | | | $15,178,500 | |

| |

| |

| | Total Event Linked Bonds | $369,862,771 | |

| |

| |

Face

Amount

USD ($) | | | | | | |

| | Collateralized Reinsurance — 7.2% | |

| | Multiperil – U.S. — 0.6% | |

| 2,500,000(b)(c)+ | Cheltenham-PI0051 Re 2024, 5/31/30 | $ 2,283,898 |

| 500,000(b)(c)+ | Mangrove Risk Solutions, 5/10/25 (144A) | 474,079 |

| | | | | | | $2,757,977 |

|

|

| | Multiperil – U.S. Regional — 1.1% | |

| 4,992,000(b)(c)+ | Ailsa Re 2024, 5/31/29 | $ 4,913,716 |

| | Multiperil – Worldwide — 1.1% | |

| 5,000,000(b)(c)+ | Merion Re 2024-2, 12/31/29 | $ 4,925,971 |

| | Windstorm – Florida — 0.6% | |

| 2,811,750(b)(c)+ | Mangrove Risk Solutions, 5/31/30 | $ 2,806,574 |

| | Windstorm – North Carolina — 0.7% | |

| 2,000,000(b)(c)+ | Mangrove Risk Solutions, 4/30/30 | $ 2,010,400 |

| 700,000(b)(c)+ | Mangrove Risk Solutions, 4/30/30 | 702,940 |

| 500,000(b)(c)+ | Mangrove Risk Solutions, 4/30/30 | 501,700 |

| | | | | | | $3,215,040 |

|

|

| | Windstorm – U.S. — 1.4% | |

| 3,000,000(b)(c)+ | Aberystwyth-PI0049, 11/30/27 | $ 2,946,902 |

| 3,000,000(b)(c)+ | PI0048 Re 2024, 11/30/27 | 2,948,705 |

| | | | | | | $5,895,607 |

|

|

| | Windstorm – U.S. Multistate — 1.3% | |

| 5,500,000(b)(c)+ | White Heron Re, 5/31/30 | $ 5,588,689 |

The accompanying notes are an integral part of these financial statements.

10Pioneer CAT Bond Fund | Annual Report | 10/31/24

Face

Amount

USD ($) | | | | | | Value |

| | Windstorm – U.S. Regional — 0.4% | |

| 1,500,000(b)(c)+ | Oakmont Re 2024, 4/1/30 | $ 1,501,656 |

| | Total Collateralized Reinsurance | $31,605,230 |

|

|

| | Total Insurance-Linked Securities

(Cost $391,275,742) | $401,468,001 |

|

|

| | TOTAL INVESTMENTS IN UNAFFILIATED ISSUERS — 91.4%

(Cost $391,275,742) | $401,468,001 |

| | OTHER ASSETS AND LIABILITIES — 8.6% | $37,684,720 |

| | net assets — 100.0% | $439,152,721 |

| | | | | | | |

| bps | Basis Points. |

| EURIBOR | Euro Interbank Offered Rate. |

| SOFR | Secured Overnight Financing Rate. |

| (144A) | The resale of such security is exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be resold normally to qualified institutional buyers. At October 31, 2024, the value of these securities amounted to $370,336,850, or 84.3% of net assets. |

| (a) | Floating rate note. Coupon rate, reference index and spread shown at October 31, 2024. |

| (b) | Non-income producing security. |

| (c) | Issued as participation notes. |

| + | Security is valued using significant unobservable inputs (Level 3). |

| # | Securities are restricted as to resale. |

| Restricted Securities | Acquisition date | Cost | Value |

| 3264 Re | 6/24/2024 | $1,250,000 | $1,316,500 |

| 3264 Re | 6/24/2024 | 500,000 | 544,400 |

| Aberystwyth-PI0049 | 7/1/2024 | 2,624,250 | 2,946,902 |

| Acorn Re | 1/10/2024 | 6,499,752 | 6,480,500 |

| Acorn Re | 10/25/2024 | 5,750,000 | 5,750,000 |

| Acorn Re | 10/25/2024 | 5,750,000 | 5,750,000 |

| Ailsa Re 2024 | 8/27/2024 | 4,737,656 | 4,913,716 |

| Alamo Re | 4/12/2023 | 5,079,061 | 5,244,500 |

| Alamo Re | 9/25/2023 | 501,190 | 519,250 |

| Alamo Re | 4/4/2024 | 1,500,000 | 1,566,750 |

| Alamo Re | 4/4/2024 | 1,500,000 | 1,562,550 |

| Alamo Re | 4/4/2024 | 3,000,000 | 3,182,100 |

| Aquila Re | 5/10/2023 | 400,000 | 422,720 |

| Aquila Re | 5/10/2023 | 250,000 | 259,450 |

| Aquila Re | 5/10/2023 | 1,400,000 | 1,492,400 |

| Aquila Re | 4/26/2024 | 2,250,000 | 2,306,025 |

| Aquila Re | 4/26/2024 | 3,750,000 | 3,973,125 |

The accompanying notes are an integral part of these financial statements.

Pioneer CAT Bond Fund | Annual Report | 10/31/2411

Schedule of Investments | 10/31/24 (continued)

| Restricted Securities | Acquisition date | Cost | Value |

| Armor Re | 4/11/2024 | $2,000,000 | $2,096,000 |

| Ashera Re | 3/21/2024 | 5,750,000 | 5,852,925 |

| Atela Re, Ltd. | 4/29/2024 | 3,000,000 | 3,142,800 |

| Atlas Capital | 5/17/2023 | 2,150,000 | 2,198,805 |

| Atlas Re | 5/24/2024 | 3,000,000 | 3,343,500 |

| Azzurro Re II | 3/21/2024 | 1,085,650 | 1,088,729 |

| Baldwin Re | 6/21/2023 | 750,000 | 769,725 |

| Black Kite Re | 6/6/2023 | 2,064,479 | 2,106,170 |

| Blue Halo Re | 2/14/2024 | 1,005,191 | 950,000 |

| Blue Ridge Re | 11/14/2023 | 500,000 | 519,500 |

| Blue Sky Re | 12/11/2023 | 2,152,900 | 2,251,425 |

| Bonanza Re | 1/27/2023 | 716,880 | 747,750 |

| Cape Lookout Re | 4/14/2023 | 1,507,228 | 1,569,450 |

| Cat Re 2001 | 11/14/2023 | 9,183,458 | 9,436,850 |

| Charles River Re | 4/5/2024 | 1,000,000 | 1,025,600 |

| Cheltenham-PI0051 Re 2024 | 7/1/2024 | 1,966,257 | 2,283,898 |

| Citrus Re | 4/27/2023 | 750,000 | 783,525 |

| Citrus Re | 4/27/2023 | 2,478,618 | 2,557,065 |

| Citrus Re | 3/19/2024 | 4,250,000 | 4,410,225 |

| Citrus Re | 3/19/2024 | 4,500,000 | 4,717,350 |

| First Coast Re | 3/24/2023 | 600,000 | 627,060 |

| FloodSmart Re | 2/23/2023 | 1,000,000 | 1,055,800 |

| FloodSmart Re | 2/23/2023 | 250,000 | 225,000 |

| FloodSmart Re | 2/29/2024 | 7,750,000 | 8,157,650 |

| FloodSmart Re | 2/29/2024 | 2,000,000 | 2,058,600 |

| FloodSmart Re | 10/23/2024 | 3,582,056 | 3,583,650 |

| Foundation Re | 12/19/2023 | 5,250,000 | 5,402,250 |

| Four Lakes Re | 3/3/2023 | 250,000 | 257,400 |

| Four Lakes Re | 12/8/2023 | 3,261,255 | 3,334,825 |

| Four Lakes Re | 12/8/2023 | 2,750,388 | 2,885,575 |

| Galileo Re | 12/4/2023 | 3,050,000 | 3,147,905 |

| Galileo Re | 12/4/2023 | 3,232,186 | 3,265,920 |

| Gateway Re | 2/3/2023 | 500,000 | 542,450 |

| Gateway Re | 7/14/2023 | 5,336,971 | 5,493,075 |

| Gateway Re | 3/11/2024 | 750,000 | 766,725 |

| Gateway Re | 3/11/2024 | 4,186,908 | 4,236,825 |

| Gateway Re | 6/24/2024 | 941,152 | 996,900 |

| Herbie Re | 2/15/2024 | 6,000,000 | 5,638,200 |

| Herbie Re | 2/15/2024 | 1,500,000 | 1,399,200 |

| High Point Re | 12/1/2023 | 1,500,000 | 1,536,300 |

| Hypatia Re | 3/27/2023 | 1,100,000 | 1,149,830 |

| Integrity Re | 3/23/2023 | 5,783,625 | 5,700,000 |

| Integrity Re | 3/1/2024 | 3,000,000 | 2,250,000 |

| Integrity Re | 3/1/2024 | 1,500,000 | 967,500 |

| International Bank for Reconstruction & Development | 3/17/2023 | 250,000 | 253,675 |

| International Bank for Reconstruction & Development | 4/3/2024 | 1,500,000 | 1,522,500 |

| International Bank for Reconstruction & Development | 4/3/2024 | 2,000,000 | 2,105,800 |

The accompanying notes are an integral part of these financial statements.

12Pioneer CAT Bond Fund | Annual Report | 10/31/24

| Restricted Securities | Acquisition date | Cost | Value |

| International Bank for Reconstruction & Development | 4/3/2024 | $500,000 | $502,650 |

| International Bank for Reconstruction & Development | 4/25/2024 | 2,990,879 | 3,060,900 |

| International Bank for Reconstruction & Development | 5/1/2024 | 1,500,000 | 1,551,000 |

| Kendall Re | 4/22/2024 | 2,500,000 | 2,594,750 |

| Kendall Re | 4/22/2024 | 10,000,000 | 10,160,000 |

| Kilimanjaro II Re | 6/24/2024 | 2,250,000 | 2,313,450 |

| Kilimanjaro II Re | 6/24/2024 | 4,500,000 | 4,688,100 |

| Kilimanjaro III Re | 1/8/2024 | 1,618,561 | 1,685,125 |

| Kilimanjaro III Re | 1/12/2024 | 2,947,787 | 3,016,200 |

| Lightning Re | 3/20/2023 | 9,253,373 | 9,478,500 |

| Locke Tavern Re | 3/23/2023 | 1,150,000 | 1,185,190 |

| Logistics Re | 10/22/2024 | 5,500,000 | 5,499,453 |

| Long Point Re IV | 2/23/2023 | 3,979,703 | 4,079,600 |

| Longleaf Pine Re | 10/15/2024 | 4,309,587 | 4,406,000 |

| Lower Ferry Re | 6/23/2023 | 2,500,429 | 2,579,250 |

| Lower Ferry Re | 3/11/2024 | 1,924,936 | 1,962,510 |

| Mangrove Risk Solutions | 6/17/2024 | 449,306 | 474,079 |

| Mangrove Risk Solutions | 7/9/2024 | 1,854,123 | 2,010,400 |

| Mangrove Risk Solutions | 7/9/2024 | 657,665 | 702,940 |

| Mangrove Risk Solutions | 7/9/2024 | 474,211 | 501,700 |

| Mangrove Risk Solutions | 8/5/2024 | 2,556,990 | 2,806,574 |

| Marlon Re | 5/24/2024 | 500,000 | 503,250 |

| Matterhorn Re | 1/26/2024 | 7,514,423 | 7,507,500 |

| Mayflower Re | 6/26/2023 | 1,750,000 | 1,810,725 |

| Mayflower Re | 6/21/2024 | 2,000,000 | 2,066,600 |

| Mayflower Re | 7/19/2024 | 3,287,923 | 3,388,775 |

| Merion Re 2024-2 | 8/12/2024 | 4,253,750 | 4,925,971 |

| Merna Re II | 4/5/2023 | 350,000 | 367,500 |

| Merna Re II | 4/5/2023 | 700,000 | 741,930 |

| Merna Re II | 1/12/2024 | 5,692,563 | 5,870,250 |

| Merna Re II | 5/8/2024 | 750,000 | 772,984 |

| Merna Re II | 5/8/2024 | 2,000,000 | 1,995,000 |

| Merna Re II | 5/8/2024 | 5,014,842 | 5,258,880 |

| MetroCat Re | 5/12/2023 | 2,016,410 | 2,050,600 |

| Mona Lisa Re | 1/27/2023 | 3,230,505 | 3,314,025 |

| Mona Lisa Re | 6/13/2024 | 500,000 | 547,650 |

| Montoya Re | 2/28/2023 | 5,006,998 | 5,058,000 |

| Mystic Re | 12/12/2023 | 11,280,961 | 11,526,750 |

| Mystic Re IV | 1/31/2023 | 243,495 | 252,625 |

| Mystic Re IV | 9/19/2023 | 3,338,401 | 3,363,400 |

| Nakama Re | 4/14/2023 | 250,000 | 250,075 |

| Nakama Re | 4/16/2024 | 8,001,438 | 7,996,800 |

| Nature Coast Re | 11/16/2023 | 2,259,988 | 2,300,625 |

| Northshore Re II | 10/5/2023 | 3,053,464 | 3,111,600 |

| Oakmont Re 2024 | 5/23/2024 | 1,331,036 | 1,501,656 |

| Palm Re | 4/4/2024 | 7,000,000 | 7,320,600 |

| PI0048 Re 2024 | 6/12/2024 | 2,527,350 | 2,948,705 |

| Puerto Rico Parametric Re | 6/14/2024 | 500,000 | 525,250 |

The accompanying notes are an integral part of these financial statements.

Pioneer CAT Bond Fund | Annual Report | 10/31/2413

Schedule of Investments | 10/31/24 (continued)

| Restricted Securities | Acquisition date | Cost | Value |

| Purple Re | 4/6/2023 | $3,283,928 | $3,185,000 |

| Purple Re | 6/27/2023 | 1,500,000 | 1,585,500 |

| Purple Re | 4/2/2024 | 3,600,000 | 3,726,720 |

| Queen Street Re | 5/12/2023 | 3,956,963 | 4,062,575 |

| Ramble Re | 2/26/2024 | 5,000,000 | 4,875,000 |

| Residential Re | 1/30/2023 | 499,159 | 498,500 |

| Residential Re | 9/19/2023 | 491,002 | 492,600 |

| Residential Re | 11/7/2023 | 493,358 | 498,450 |

| Residential Re | 7/10/2024 | 2,369,318 | 2,482,500 |

| Sakura Re | 5/24/2023 | 995,298 | 1,006,300 |

| Sanders Re | 5/24/2023 | 1,000,000 | 1,065,000 |

| Sanders Re | 1/16/2024 | 4,776,720 | 4,930,500 |