N93 W14475 Whittaker Way

Menomonee Falls, Wisconsin 53051

Dear Shareholder:

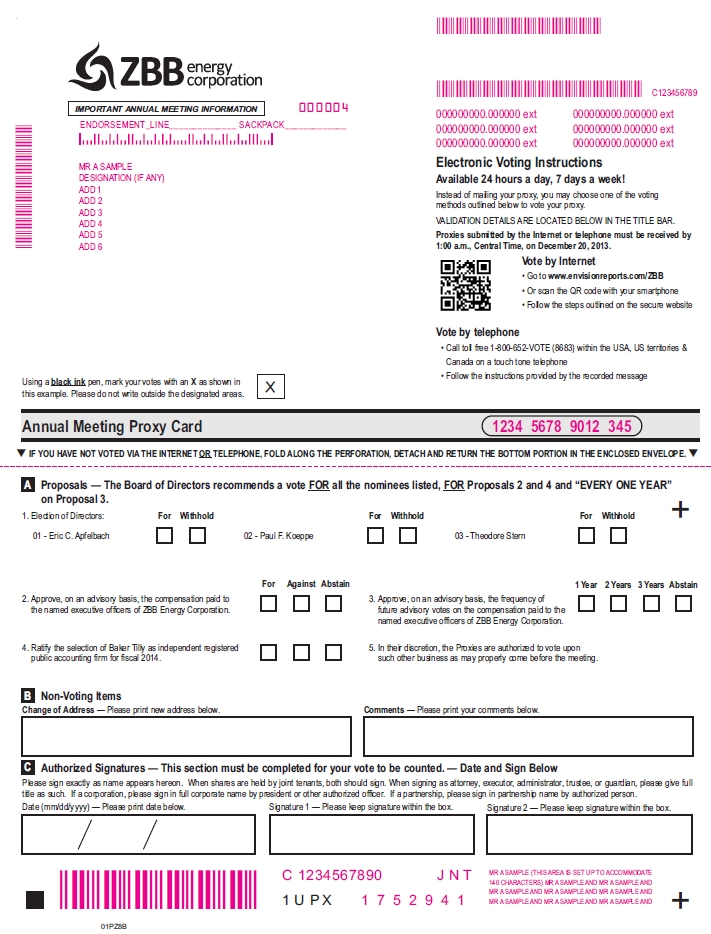

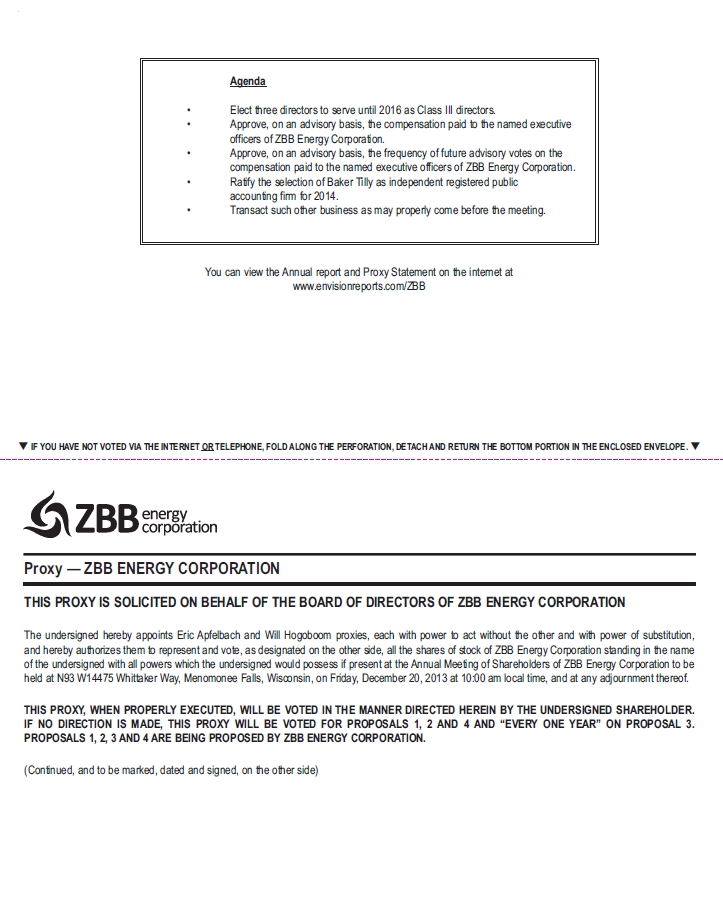

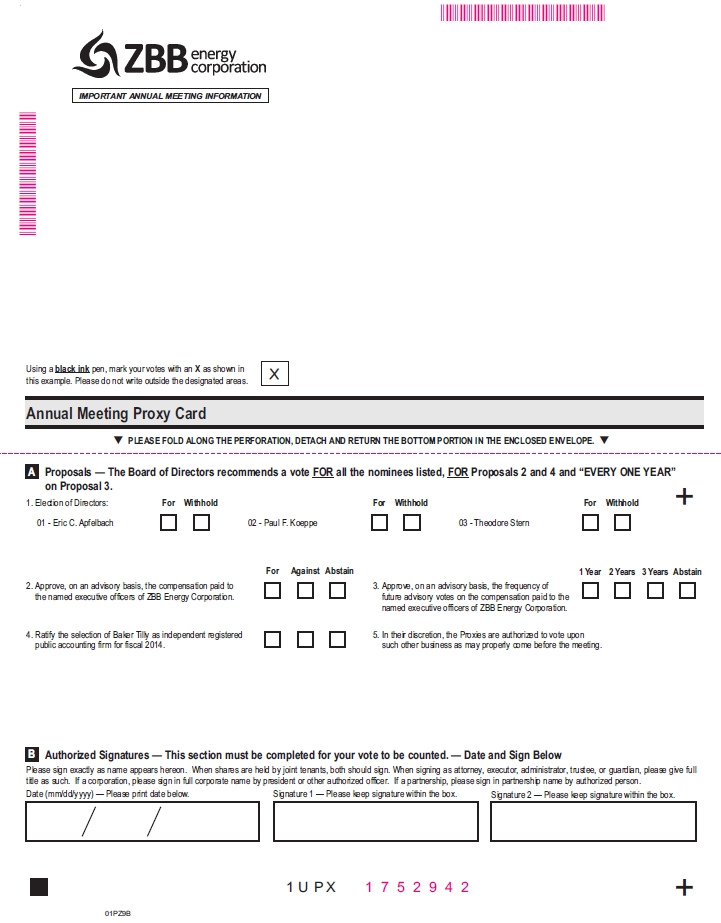

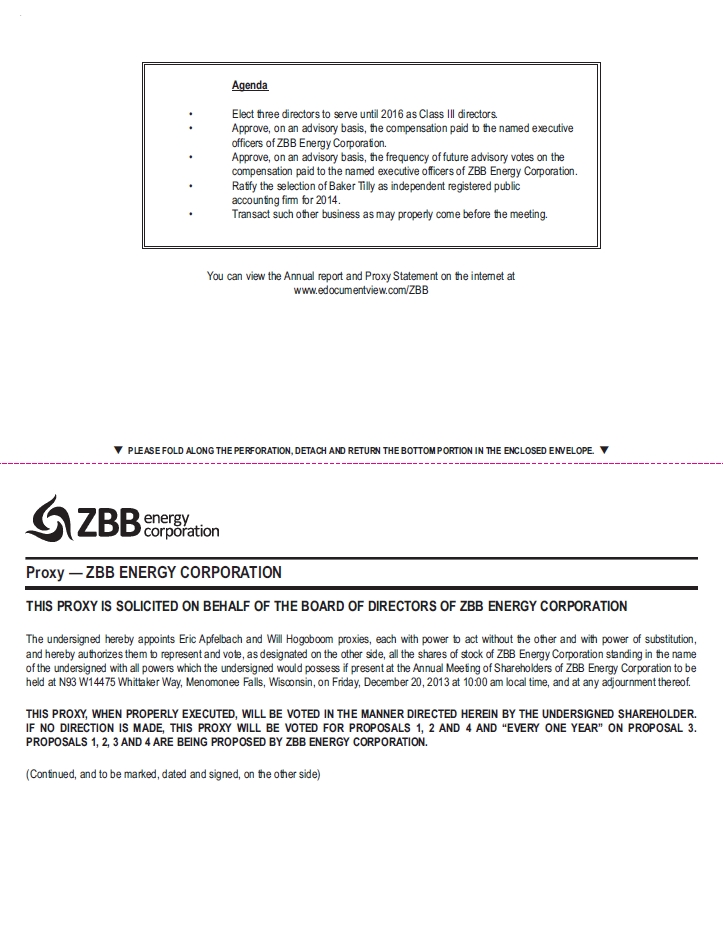

You are cordially invited to attend the annual meeting of shareholders of ZBB Energy Corporation to be held at our offices located at N93 W14475 Whittaker Way, Menomonee Falls, Wisconsin 53051, on Friday, December 20, 2013 at 10:00 a.m., local time. At the 2013 Annual Meeting, shareholders will be asked to:

| · | elect the three Class III directors nominated by the Board of Directors for three year terms; |

| · | vote, on a non-binding advisory basis, on the compensation paid to our named executive officers; |

| · | vote, on a non-binding advisory basis, on the frequency of future advisory votes on the compensation paid to our named executive officers; and |

| · | ratify the appointment of Baker Tilly Virchow Krause, LLP as our independent registered public accounting firm. |

We will be using the “Notice and Access” method of providing proxy materials to you via the Internet. We believe that this process should provide you with a convenient and quick way to access your proxy materials and vote your shares, while allowing us to conserve natural resources and reduce the costs of printing and distributing the proxy materials. On or about November 7, 2013, we will mail to our shareholders a Notice of Internet Availability of Proxy Materials (“Meeting Notice”) containing instructions on how to access our proxy statement and vote electronically via the Internet or by telephone. This notice also contains instructions on how to receive a paper copy of your proxy materials.

We look forward to your attending either in person or by proxy. Your vote is important and I hope that you will vote as soon as possible by following the voting instructions set forth in the Meeting Notice.

| | Very truly yours, |

| |  |

| | Eric C. Apfelbach |

| | President and Chief Executive Officer |

November 7, 2013

N93 W14475 Whittaker Way

Menomonee Falls, Wisconsin 53051

PROXY STATEMENT

Unless the context requires otherwise, all references to “we”, “us” or “our” refer to ZBB Energy Corporation and its subsidiaries. Our fiscal year ends on June 30 of each year. In this proxy statement, we refer to fiscal years by reference to the calendar year in which they end (e.g., the fiscal year ended June 30, 2013 is referred to as “fiscal 2013”).

The enclosed proxy is solicited by the Board of Directors of ZBB Energy Corporation for use at the Annual Meeting of Shareholders to be held at 10:00 a.m., local time, on December 20, 2013, 2013, or at any postponement or adjournment of the annual meeting, for the purposes set forth in this proxy statement and in the accompanying notice of annual meeting of shareholders. The annual meeting will be held at our offices located at N93 W14475 Whitaker Way, Menomonee Falls, Wisconsin 53051.

The expenses of printing and mailing proxy materials, including expenses involved in forwarding materials to beneficial owners of stock, will be paid by us. No solicitation other than by mail is contemplated, except that our officers or employees may solicit the return of proxies from certain shareholders by telephone.

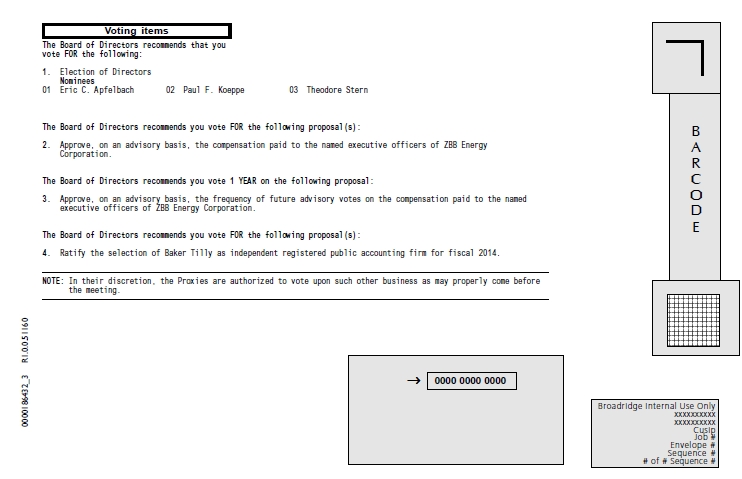

Our Board of Directors recommends that our shareholders vote their shares:

“FOR” the three Class III directors nominated by the Board of Directors to serve until the 2016 annual meeting of shareholders; |

| |

“FOR” the approval of the proposal regarding the compensation paid to our named executive officers; |

| |

“Every One Year” for the proposal regarding the frequency of future advisory votes on the compensation paid to our named executive officers; and |

| |

“FOR” the ratification of the appointment of Baker Tilly Virchow Krause, LLP as our independent registered public accounting firm. |

Only shareholders of record at the close of business on October 25, 2013 are entitled to notice of and to vote at the annual meeting. As of the record date, there were 88,538,801 shares of common stock, $0.01 par value per share, and 3,000 shares of series B convertible preferred stock, $0.01 par value per share, issued and outstanding and entitled to vote at the annual meeting. Each holder of our common stock is entitled to one vote for each share of our common stock held as of the close of business on the record date, and each holder of our series B convertible preferred stock is entitled to one vote for each share of our common stock issuable upon conversion of our series B convertible preferred stock held as of the close of business on the record date. As of the record date, each share of our series B convertible preferred stock was convertible into 5,304 shares of common stock. Accordingly, each share of our series B convertible preferred stock is entitled to 5,304 votes on each matter presented at the annual meeting.

Effective on October 31, 2013 we effected a one-for-five reverse stock split of our common stock as a result of which each five shares of common stock outstanding on the effective date become one share of common stock. Since the reverse stock split occurred after the record date it has no effect on the voting of shares at the annual meeting.

The presence, in person or by proxy, of one-third of the total votes entitled to be cast on each matter at the annual meeting will constitute a quorum at the annual meeting. Abstentions and broker non-votes, which are proxies from brokers or nominees indicating that such persons have not received instructions from the beneficial owners or other persons entitled to vote shares as to a matter with respect to which brokers or nominees do not have discretionary power to vote, will be treated as present for purposes of determining the quorum.

Directors are elected by a plurality of the votes cast by shareholders entitled to vote at the annual meeting which means the three nominees receiving the most affirmative votes will be elected. On all other matters, an affirmative vote of at least a majority of the votes cast is required for approval. The holders of the shares of our common stock and class B common stock issued and outstanding as of the record date will vote together, on a combined basis, on each matter to be presented at the annual meeting.

Banks, brokers and other holders of record do not have discretionary authority to vote shares held in street name in connection with non-routine proposals, which include all the proposals other than ratification of the appointment of Baker Tilly Virchow Krause, LLP as our independent registered public accounting firm. As a result, broker non-votes will occur at the 2013 Annual Meeting with respect to these non-routine proposals. However, since broker non-votes are not counted as votes cast they will have no effect on the outcome of these proposals.

Banks, brokers and other holders of record have discretionary authority to vote shares held in street name, even if they do not receive instructions from the beneficial owner, on routine proposals, which includes the ratification of the appointment of an independent registered public accounting firm. Accordingly, if you do not provide your bank, broker or other holder of record with voting instructions with respect to this proposal, such holder will have discretionary authority to vote your shares held in street name on this proposal at the 2013 annual meeting. As a result of this discretionary authority, broker non-votes are not expected to occur in connection with Proposal 4 at the annual meeting.

We are making this proxy statement and our Annual Report to Shareholders available on the Internet instead of mailing a printed copy of these materials to shareholders. Shareholders will not receive a printed copy of these materials other than as described below. Instead, the Shareholder Meeting Notice for the 2013 Annual Meeting (the “Notice”) contains instructions as to how shareholders may access and review all of the important information contained in the materials on the Internet, including how shareholders may submit proxies by telephone or over the Internet. If you would prefer to receive a printed copy of our proxy materials, please follow the instructions for requesting printed copies included in the Notice. The Notice will be mailed to shareholders on or about November 7, 2013.

If a proxy is granted properly by using the Internet or telephone procedures specified in the Notice or a proxy card is properly signed and returned to us and not revoked, it will be voted in accordance with the instructions given. Each shareholder may revoke a previously granted proxy at any time before it is exercised by using the Internet or telephone procedures specified in the Notice or by submitting written notice of revocation or a duly executed proxy bearing a later date to us. Attendance at the annual meeting will not, in itself, constitute revocation of a proxy but a shareholder in attendance may request a ballot and vote in person, which revokes a prior granted proxy. Where a proxy is properly signed and returned without indicating any voting instructions regarding a proposal, the shares represented by the proxy will be voted in the manner recommended by the Board of Directors on all matters presented in this proxy statement.

The Board of Directors knows of no other matters to be presented at the annual meeting. If any other matter should be presented at the annual meeting, the proxy holders may vote any shares represented by proxy in their discretion.

SECURITIES OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding beneficial ownership of our common stock as of October 25, 2013 by:

| · | each person or group of affiliated persons known by us to be the beneficial owner of more than 5% of our common stock; |

| · | each executive officer included in the Summary Compensation Table below; |

| · | each person nominated to become director; and |

| · | all executive officers, directors and nominees as a group. |

Unless otherwise noted below, the address of each person listed on the table is c/o ZBB Energy Corporation at N93 W14475 Whittaker Way, Menomonee Falls, Wisconsin 53051. To our knowledge, and subject to applicable community property laws, each person listed below has sole voting and investment power over the shares shown as beneficially owned except to the extent jointly owned with spouses or otherwise noted below.

Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission (the “SEC”). The information does not necessarily indicate ownership for any other purpose. Under these rules, a person is deemed the beneficial owner of a security if that person has the right to acquire beneficial ownership of such security within 60 days after October 25, 2013, including the right to acquire shares of common stock subject to options, warrants or convertible preferred stock. Shares of common stock subject to options and warrants that may be exercised within 60 days after October 25, 2013 are deemed to be beneficially owned and outstanding for purposes of calculating the number of shares and the percentage of common stock beneficially owned by the shareholder holding the options or warrants, but are not deemed to be beneficially owned and outstanding for purposes of computing the percentage beneficially owned by any other person. The applicable percentage of common stock outstanding as of October 25, 2013 is based upon 88,538,801 shares outstanding on that date.

| | | Amount and Nature of Beneficial Ownership | |

| Name of Beneficial Owner | | Common Stock | | | Shares Underlying Convertible Preferred Stock, Options and Warrants (1) | | | Total | | | Percentage of Class | |

| Directors, Nominees and Executive Officers | | | | | | | | | | | | | | | | | | |

| Richard A. Abdoo | | | 989,851 | | | | | | | 2,758,466 | | | | | | | 3,748,317 | | | | 4.1 | % |

| Eric C. Apfelbach | | | 100,812 | | | | | | | 670,755 | | | | | | | 771,567 | | | | * | |

| Manfred E. Birnbaum | | | 138,828 | | | | | | | 150,000 | | | | | | | 288,828 | | | | * | |

| Kevin A. Dennis | | | 36,312 | | | | | | | 218,458 | | | | | | | 254,770 | | | | * | |

| William C. Hogoboom | | | 90,734 | | | | | | | 173,710 | | | | | | | 264,444 | | | | * | |

| Paul F. Koeppe | | | 2,558,927 | | | | | | | 1,871,161 | (2) | | | | | | | 4,430,088 | | | | 4.9 | % |

| Daniel A. Nordloh | | | 16,000 | | | | | | | 136,667 | | | | | | | | 152,667 | | | | * | |

| James H. Ozanne | | | 259,313 | | | | | | | - | | | | | | | | 259,313 | | | | * | |

| Richard A. Payne | | | 174,988 | | | | | | | | 150,000 | | | | | | | | 324,988 | | | | * | |

| Jeffrey A. Reichard | | | 815,652 | (4) | | | | | | | 293,333 | | | | | | | | 1,108,985 | | | | 1.2 | % |

| Anthony J. Siebert | | | - | | | | | | | | 62,500 | | | | | | | | 62,500 | | | | * | |

| Charles W. Stankiewicz | | | 103,102 | | | | | | | | 361,111 | | | | | | | | 464,213 | | | | * | |

| Theodore Stern | | | 377,700 | | | | | | | | 4,164,775 | (5) | | | | | | | 4,542,475 | | | | 4.9 | % |

| Directors, Nominees and Executive Officers as a group (13 persons) | | | 5,662,219 | | | | | | | | 11,010,937 | | | | | | | | 16,673,157 | | | | 16.7 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Five Percent Stockholders | | | | | | | | | | | | | | | | | | | | | | | | |

| Marathon Capital Management (6) | | | 9,630,651 | | | | | | | | - | | | | | | | | 9,630,651 | | | | 10.9 | % |

| (1) | Includes shares of stock issuable upon the exercise of warrants and stock options exercisable within 60 days of October 25, 2013 and shares underlying shares of Series B convertible preferred stock convertible within 60 days of October 25, 2013. Does not include shares of stock issuable upon the exercise of stock options not exercisable within 60 days of October 25, 2013 or shares of common stock underlying restricted stock unit awards that are not issuable within 60 days of October 25, 2013. |

| (2) | Certain shares of Series B convertible preferred stock and warrants held by Mr. Koeppe are subject to a blocker provision that does not permit conversion or exercise to the extent it would cause the holder to hold more than 4.9% of our outstanding common stock. The amount of shares underlying convertible preferred stock, options and warrants indicated does not include shares of common stock underlying shares of Series B convertible preferred stock and warrants that exceed this ownership limitation. Assuming there were no such blocker provision and assuming conversion and exercise of all such shares of Series B convertible preferred stock and warrants held by Mr. Koeppe, Mr. Koeppe would beneficially own a total of 3,114,125 shares of our common stock representing 6.2% of the class. |

| (3) | Includes (i) 75,043 shares held by an affiliate of Mr. Payne, Geizo Pty. Ltd, as trustee for the RA Payne Family Trust, (ii) 17,206 shares held by Geizo Pty. Ltd as trustee for the RA Payne Super Fund and (iii) 1,412 shares held by the Emery Family Trust. |

| (4) | Includes 800,000 shares held by an affiliate of Mr. Reichard, TE Holdings LLC. |

| (5) | Certain shares of Series B convertible preferred stock and warrants held by Mr. Stern are subject to a blocker provision that does not permit conversion or exercise to the extent it would cause the holder to hold more than 4.9% of our outstanding common stock. The amount of shares underlying convertible preferred stock, options and warrants indicated does not include shares of common stock underlying shares of Series B convertible preferred stock and warrants that exceed this ownership limitation. Assuming there were no such blocker provision and assuming conversion and exercise of all such shares of Series B convertible preferred stock and warrants held by Mr. Stern, Mr. Stern would beneficially own a total of 10,837,637 shares of our common stock representing 11.3% of the class. |

| (6) | Shares are beneficially owned by Marathon Capital Management, LLC, a Maryland limited liability company. Marathon Capital Management, LLC has sole voting power with respect to 1,754,500 shares and sole dispositive power with respect to 9,630,651 shares. The principal business address of the above-named entity is 4 North Park Drive, Suite 106, Hunt Valley, MD 21030. This information has been obtained from a Schedule 13G/A filed by the above-named entities and persons with the SEC on January 1, 2013. |

PROPOSAL 1—ELECTION OF DIRECTORS

The Company’s Board of Directors currently consists of eight members and is divided into three classes serving terms of three years. Shareholders elect one class of directors at each annual meeting. Three directors are to be elected at this annual meeting to hold office until the 2016 annual meeting of shareholders or until a successor has been duly elected and qualified. Upon the recommendation of the Nominating/Governance Committee of our Board of Directors, the Board of Directors has nominated and recommended Eric C. Apfelbach and Paul F. Koeppe for re-election and Theodore Stern to fill a vacancy on the Board of Directors, each as a Class III director. Accordingly, if all three nominees are elected at the annual meeting, the Company’s Board of Directors will consist of nine members.

Shares represented by all proxies received by the Board of Directors and not marked so as to withhold authority to vote for any individual nominee will be voted FOR the election of all the nominees named below. The Board of Directors knows of no reason why any such nominee would be unable or unwilling to serve, but if such should be the case, proxies may be voted for the election of some other person nominated by the Board of Directors.

Election of the directors requires the affirmative vote of a plurality of the votes cast by the holders of our common stock and series B convertible preferred stock, voting together on a combined basis. Accordingly, the three director nominees receiving the most affirmative votes will be elected. An abstention or broker non-vote will have no effect on the outcome of the election of directors.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

A VOTE “FOR” THE NOMINEES LISTED BELOW

Information Concerning Directors and Nominees For Director

The following table sets forth the nominees to be elected at the annual meeting and continuing directors and, for each nominee and director whose term of office will extend beyond the annual meeting, the year such director was first elected as a director, the positions currently held by each director with us, the year each director’s current term will expire and the current class of each director.

| Nominee’s or Director’s Name and Year First Became Director | | Age | | Position with the Company | | Year Current Term Will Expire |

| | | | | | | |

| Nominees for Class III Directors: | | | | | | |

| | | | | | | |

| Eric C. Apfelbach | | 52 | | President, Chief Executive | 2016 |

| 2010 | | | | Officer and Director | | |

| | | | | | | |

| Paul F. Koeppe | | 64 | | Chairman and Director | | 2016 |

| 2009 | | | | | | |

| | | | | | | |

| Theodore Stern | | 84 | | Director | | 2016 |

| N/A | | | | | | |

| | | | | | | |

| Continuing Directors: | | | | | | |

| | | | | | | |

| James H. Ozanne | | 70 | | Director | | 2014 |

| 2011 | | | | | | |

| | | | | | | |

| Richard A. Payne | | 58 | | Director | | 2014 |

| 1998 | | | | | | |

| | | | | | | |

| Jeffrey A. Reichard | | 55 | | Chief Technology | | 2014 |

| 2011 | | | | Officer and Director | | |

| | | | | | | |

| Richard A. Abdoo | | 69 | | Director | | 2015 |

| 2009 | | | | | | |

| | | | | | | |

| Manfred E. Birnbaum | | 80 | | Director | | 2015 |

| 2007 | | | | | | |

| | | | | | | |

| Charles W. Stankiewicz | | 54 | | Chief Operating | | 2015 |

| 2011 | | | | Officer and Director | | |

Set forth below is background information for each current director and nominee for director, as well as information regarding additional experience, qualifications, attributes or skills that led the Board of Directors to conclude that such director or nominee should serve on the Board of Directors.

Eric C. Apfelbach has served as our President and Chief Executive Officer since January 2010. From December 2008 until September 2009, Mr. Apfelbach served as President and CEO of M2E Power, Inc., a start-up technology company. From August 2003 until November 2008, Mr. Apfelbach served as President, CEO and a member of the board of directors, including Chairman from 2004 to 2008, of Virent Energy Systems, Inc., a catalytic biofuel company. Before Virent, Mr. Apfelbach co-founded Alfalight, Inc. where, as President and CEO, he helped grow the high power diode laser company to 85 employees in two years and led the company through multiple financings. Prior to Alfalight, Mr. Apfelbach was Vice President of Global Sales and Marketing at Planar Systems, Inc. (Nasdaq: PLNR), a flat-panel display designer and manufacturer, and held operating responsibility for the LCD division. He began his career working as an engineer in the semiconductor industry, rising to senior management at Applied Materials, one of the world’s largest semiconductor equipment companies. He is a director of Xolve, Inc. and National Electrostatics Corporation (NEC). In 2006, he was elected to the Board of the Wisconsin Technology Council. Mr. Apfelbach received a Bachelor of Science degree in Chemical Engineering from the University of Wisconsin-Madison in 1984.

Mr. Apfelbach brings extensive business and leadership experience to the Board of Directors. With his significant knowledge of and breadth of experience in the high technology industry in general and the alternative energy industry in particular, he provides the Board of Directors with a vital understanding of our business.

Paul F. Koeppe has served as our Chairman since September 2010. Mr. Koeppe was President, CEO and founder of Superconductivity, Inc., a manufacturer of superconducting magnetic energy storage systems, from 1988 to 1997 when it was acquired by American Superconductor Corp. (Nasdaq: AMSC), an electricity solutions company. He then served as Executive Vice President of Strategic Planning for American Superconductor until his retirement in 2001. From 1993 to 1995, Mr. Koeppe was acting CEO and chairman of the executive committee of the board of directors of Best Power, Inc., a supplier of uninterruptible power supply equipment. Mr. Koeppe also serves as a director of Incontact (Nasdaq: SAAS), a developer of contact center software. Mr. Koeppe also served as a a director of Distributed Energy Systems Corp., from 2003 to 2010 and also as a member of the Board of Directors at Northern Power Systems from 1998 to until 2003 when Northern was acquired by Distributed Energy Systems Corp. Prior to founding Superconductivity, Inc. Mr. Koeppe worked for Wisconsin Power and Light Company for 15 years in a variety of functions. He has earned a Bachelor’s Degree in Business Administration from Lakeland College and Associate Degrees in Materials Management and Electrical Power Technology.

Mr. Koeppe’s extensive executive, managerial and leadership experience, including many years in the energy services industry, positions him well to serve as a member of our Board of Directors. His business acumen and experience on the boards of directors of numerous companies make him a valuable addition to our Board of Directors.

Theodore Stern served as a director of inContact, beginning in June 1999, and subsequently as the Chairman of the Board of Directors and Chief Executive Officer beginning in September 2000, until January 1, 2005, when the two positions were separated. He served on the board of directors of Distributed Energy Systems Corporation, a manufacturer of renewable generation systems located in Wallingford, CT from November 2003 to May 2010. Mr. Stern holds a Bachelor of Mechanical Engineering from the Pratt Institute and a Master of Science degree in Theoretical Mathematics from New York University. Mr. Stern is a member of the National Academy of Engineering.

Mr. Stern would bring his over 20-years of experience serving as a director with public companies to our Board of Directors. This experience, which includes service as chairman and as a member of audit, compensation and governance committees, will provide our Board of Directors with a valuable perspective regarding public company governance, corporate management and strategy, and board practices.

James H. Ozanne has served in executive and director positions in the financial services industries since 1972. During this time he has held the positions of Chief Financial Officer, President, Chief Executive Officer and Chairman of several leasing, rental, and consumer finance businesses ranging from full service railcar leasing to general equipment finance and grocery pallet rental. He was President and Chief Executive Officer of Nation Financial Holdings and its predecessor, US WEST Capital. Prior to that, he served as Executive Vice President of GE Capital responsible for the Consumer Finance and Operating Lease/Asset Management business units. Mr. Ozanne is a director of United Rentals, Inc. (NYSE: URI), the largest equipment rental company in the world, and a director of the Bank of Maine. Previously, Mr. Ozanne was Lead Independent Director of RSC Holdings Inc., a director of Financial Security Assurance Holdings Ltd. and Distributed Energy Systems Corp., Vice Chairman and director of Fairbanks Capital Corp. and Chairman of Source One Mortgage Corporation. Mr. Ozanne received a Bachelors of Science degree from DePaul University.

Mr. Ozanne brings financial and management expertise to our Board of Directors acquired through his experience as a chief financial officer and as an operating executive. He also possesses valuable director experience from having served on the boards of directors of numerous companies, including in the roles of chairman and lead independent director.

Richard A. Payne served as our Chairman from 2004 to 2008. In addition to serving as a member of our Board of Directors, Mr. Payne also serves as a director and chairman of the board of ZBB PowerSav Holdings Limited, the entity through which we are executing our China joint venture (our “Hong Kong Holding Company”). Mr. Payne is the principal of Richard Payne & Associates and is a commercial lawyer who has practiced as a corporate and commercial attorney in Australia since 1982. Mr. Payne has been a director of the Broome International Airport Group of companies since 2001. Richard Payne & Associates acted as a legal adviser to the Company and its predecessor in Australia between 1993 and 2005. Mr. Payne received a Bachelor of Jurisprudence (Hons) and a Bachelor of Law degrees from the University of Western Australia.

Mr. Payne’s longstanding quality service as a member of our Board of Directors, as well as his significant experience serving on the boards of directors of other companies and legal expertise, make him a valuable member of our Board of Directors. In addition, his residence in Australia and experience with transactions in Asia uniquely qualify him to serve as chairman of our Hong Kong Holding Company.

Jeffrey A. Reichard joined the Company in January 2011 as Vice President of Electronics Development and was promoted to Chief Technology Officer in September 2012. Mr. Reichard founded Tier Electronics, LLC in June 2003 and currently serves as its President. Tier Electronics specializes in power converters and conversion systems for alternative energy and power quality applications and operates as a wholly-owned subsidiary of the Company. From June 2000 to June 2002, Mr. Reichard served as Vice President of R&D at American Superconductor Corp. (Nasdaq: AMSC), an electricity solutions company. Mr. Reichard founded Integrated Electronics in March 1996, and rapidly grew the company by developing products at the leading edge of innovation, and offered significant price and performance advantages. Acquired by American Superconductor in 2000, Integrated Electronics developed the converter that became the standard for AMSC’s power quality products. Mr. Reichard earned a Bachelors of Science degree in Electrical Engineering from Marquette University.

Mr. Reichard is a well-known expert and visionary in the area of power electronics design. With his significant knowledge and experience in the power electronics industry, he provides the Board of Directors with keen insight into the business and product opportunities afforded by this important market.

Richard A. Abdoo is president of R.A. Abdoo & Co. LLC, an environmental and energy consulting firm. Prior to starting this business, he was chairman and chief executive officer of Wisconsin Energy Corporation (NYSE: WEC) from 1991 until his retirement in 2004. He also served as President from 1991 to 2003 and joined the company in 1975 as Director of Strategic Planning. During his administration, Wisconsin Energy Corporation grew to become a Fortune 500 company through a series of mergers and acquisitions. Mr. Abdoo currently serves as a director of AK Steel (NYSE: AKS), a steel products producer, and NiSource Inc. (NYSE: NI), a natural gas and electric generation and distribution company. Mr. Abdoo previously served as a director of Renegy Holdings, Inc. and M&I Marshall & Ilsley Corporation. He is currently a member of St. Jude’s Children’s Research Hospital’s Professional Advisory Board. A registered professional engineer in Michigan, Ohio, Pennsylvania and Wisconsin, he is also a longtime member of the American Economic Association. In 2000, Mr. Abdoo was awarded the Ellis Island Medal of Honor, presented to Americans of diverse origins for their outstanding contributions to their own ethnic groups and to American society. Honorees typically include U.S. presidents, Nobel Prize winners and leaders of industry. Mr. Abdoo received a master’s degree in economics from University of Detroit and a bachelor’s degree in electrical engineering from University of Dayton.

Mr. Abdoo’s extensive knowledge of the energy and energy services industries, and his extensive experience serving on the boards of directors of other companies qualify him to serve as a member of our Board of Directors.

Manfred E. Birnbaum has been an independent management consultant in the energy and power industries since 1994. Mr. Birnbaum’s consulting services include assistance on divestitures, contract dispute resolution, technology licensing, and developing marketing strategies. From 1982 to 1985, Mr. Birnbaum was chief executive officer of English Electric Corp., a wholly owned subsidiary of General Electric Company of England. Prior to that, Mr. Birnbaum held various senior management positions at Westinghouse Electric Corporation between 1958 and 1982. Mr. Birnbaum serves as a director of STW Resources Holding Corp. (OTC: STWS), a water reclamation services company. Mr. Birnbaum earned a B.A. in mechanical engineering from Polytechnic Institute of the City University of New York and a Masters Degree in electrical engineering from the University of Pennsylvania.

Mr. Birnbaum’s longstanding quality service as a member of our Board of Directors, as well as his significant experience serving as chief executive officer of English Electric Corp., gives him an understanding of the role of the board of directors and management. He also brings to the Board of Directors expertise and leadership skills he has acquired as an executive and consultant in the energy and power industries.

Charles W. Stankiewicz joined the Company in November 2011 as Executive Vice President of Operations and as a director and was promoted to Chief Operating Officer in July 2012. Prior to joining the Company, Mr. Stankiewicz held a number of executive level positions at American Superconductor Corporation, an electricity solutions company, including from June 2007 through August 2011, Executive Vice President of AMSC Power Systems, a division of American Superconductor Corp., based in Wisconsin with operations in Europe and China. During his tenure at American Superconductor, he grew the Power Systems group from virtually no revenue to several hundred million in revenues. Prior to joining AMSC Power Systems in 1998, Mr. Stankiewicz worked in a variety of technical and business management positions at Westinghouse Electric Corporation and Asea Brown Boveri (ABB) where he served as the Vice President of Power Development.

Mr. Stankiewicz brings important management and industry experience to the Board of Directors, including experience doing business in China.

Information Concerning Executive Officers

Set forth below is background information relating to our executive officers:

| Name | | Age | | Position |

| Eric C. Apfelbach | | 52 | | President and Chief Executive Officer |

| Charles W. Stankiewicz | | 54 | | Chief Operating Officer |

| William C. Hogoboom | | 60 | | Chief Financial Officer and Secretary |

| Daniel A. Nordloh | | 47 | | Executive Vice President of Global Business Development |

| Jeffrey A. Reichard | | 55 | | Chief Technology Officer |

| Kevin A. Dennis | | 51 | | Vice President of Engineering and Product Development |

| Anthony J. Siebert | | 44 | | Vice President of Sales and Product Marketing |

Eric C. Apfelbach is discussed above under Information Concerning Directors and Nominees for Director.

Charles W. Stankiewicz is discussed above under Information Concerning Directors and Nominees for Director.

William C. Hogoboom joined the Company in September 2009 and was appointed Secretary, Controller, and Director of Finance in March 2010 before being appointed Chief Financial Officer in November 2010. From 1996 to 2001, he was CFO of Superconductivity, Inc. and the Wisconsin division of American Superconductor Corp., and from 2001 to 2010 he was the CFO for several privately held high-technology companies including Imago Scientific Instruments Corp. and Spectrocon International LLC. Mr. Hogoboom was formerly audit partner at Smith & Gesteland, LLP and audit manager at Ernst & Young. Mr. Hogoboom holds a Bachelors Degree in Accounting from the University of Wisconsin-Madison and is a Certified Public Accountant. He is a member of the American Institute of Certified Public Accountants (AICPA) and the Wisconsin Institute of Certified Public Accountants (WICPA).

Daniel A. Nordloh joined the Company as Vice President of Sales, Marketing and Business Development in April 2010 and was appointed Executive Vice President of Global Business Development in November 2011. From August 2007 to April 2010 Mr. Nordloh served as Principle of Synapse Junction, LLC a boutique advisory practice foundedto assist early stage and established companies with effective growth planning and execution initiatives. In his role at Synapse, Mr. Nordloh served in numerous leadership roles, including interim President and CEO of a technology company on behalf of a private equity group. From August 2005 to August 2007 Mr. Nordloh served as President and CEO of Naviant, Inc. (formerly MTM International), a consulting and technology firm. Mr. Nordloh presently serves on the Board of Directors of Meineng Energy China and the Board of Directors of Standard Imaging Inc.Mr. Nordloh previously served a President of the Board of the not-for-profit Family Support & Resource Center of Dane County, WI. He earned an MBA from the University of Wisconsin-Milwaukee and a BS degree in Behavioral Sciences from Eastern Kentucky University.

Jeffrey A. Reichard is discussed above under Information Concerning Directors and Nominees for Director.

Kevin A. Dennis joined the Company as Vice President of Marketing and Sales in January 2008 and was appointed Vice President of Engineering and Product Development in 2010. Mr. Dennis has extensive expertise in the utility and renewable energy markets having held various engineering, sales and senior management roles with ABB (NYSE:ABB), a power and automation technologies company, most recently as Director, Advanced Power Electronics – North America. He also spent four years as both the sales and engineering manager for Omnion Power Engineering Corporation, a manufacturer of power electronics systems for advanced energy systems. His early career also includes five years as a design engineer with American Electric Power Service Corporation (AEP). He holds a Bachelors of Science degree in Electrical Engineering from Michigan Technological University, is a registered professional engineer in the States of Wisconsin and California and is a member of the IEEE (Power Electronics Group). He participated as an industry representative in the working group for the development of Underwriters Laboratory standard, UL 741, for utility grid connected power converters. He also participates in various renewable energy and energy storage organizations.

Anthony J. Siebert joined the Company as Vice President of Sales and Product Marketing in August 2012. Mr. Siebert has more than 20 years of experience in sales and engineering in the utility and industrial industries. Prior to joining the Company, Mr. Siebert held several position at American Superconductor Corporation (Nasdaq: AMSC), an electricity solutions company, including from 2004 through August 2012, Managing Director of Grid Sales. From 1990 to 2004, Mr. Siebert held several engineering and sales positions with ABB (NYSE:ABB), a power and automation technologies company. He holds a Bachelors of Science degree in Electrical Engineering Technology from Milwaukee School of Engineering and is a member of the IEEE (Power Electronics Group) and CIGRE.

Corporate Governance Principles and Board Matters

The Board of Directors has determined that each of Paul F. Koeppe, James H. Ozanne, Richard A. Payne, Richard A. Abdoo, Manfred E. Birnbaum and Theodore Stern is an independent director within the meaning of the director independence standards of the NYSE MKT (“NYSE MKT”). Furthermore, the Board of Directors has determined that all of the members of the Audit Committee, Compensation Committee and Nominating/Governance Committee are independent within the meaning of the director independence standards of NYSE MKT and the rules of the SEC applicable to each such committee.

| | Executive Sessions of Independent Directors |

Executive sessions of our independent directors are generally held following each regularly scheduled in-person meeting of the Board of Directors. Executive sessions do not include any non-independent directors and are led by the chairman of the Board of Directors, who is independent. The independent directors of the Board of Directors met in executive session three times in fiscal 2013.

| | Board Leadership Structure |

The Board of Directors has an independent chairman, meaning that the positions of chairman of the Board of Directors and Chief Executive Officer are not held by a single individual. The Board of Directors believes that having an independent chairman ensures that management is subject to independent and objective oversight and the independent directors have an active voice in the governance of the Company.

| | Policies Regarding Director Nominations |

The Nominating/Governance Committee is responsible for identifying the appropriate qualifications, skills and characteristics desired of members of the Board of Directors in the context of the needs of the business and the current composition and needs of the Board of Directors.

Director candidates are considered based upon a variety of criteria, including demonstrated business and professional skills and experiences relevant to our business and strategic direction, concern for long-term shareholder interests, personal integrity and sound business judgment. The Board of Directors seeks men and women from diverse professional backgrounds who combine a broad spectrum of relevant industry and strategic experience and expertise that, in concert, offer us and our shareholders diversity of opinion and insight in the areas most important to us and our corporate mission. In addition, nominees for director are selected to have complementary, rather than overlapping, skill sets. However, the Nominating/Governance Committee does not have a formal policy concerning the diversity of the Board of Directors. All candidates for director nominee must have time available to devote to the activities of the Board of Directors. The Nominating/Governance Committee also considers the independence of candidates for director nominee, including the appearance of any conflict in serving as a director. Candidates for director nominees who do not meet all of these criteria may still be considered for nomination to the Board of Directors, if the Nominating/Governance Committee believes that the candidate will make an exceptional contribution to us and our shareholders.

| | Process for Identifying and Evaluating Director Nominees |

The Board of Directors is responsible for selecting its own members. The Board of Directors delegates the selection process to the Nominating/Governance Committee, with the expectation that other members of the Board of Directors, and of management, may be requested to take part in the process as appropriate. Generally, the Nominating/Governance Committee identifies candidates for director nominees in consultation with management, through the recommendations submitted by other directors or shareholders or through such other methods as the Nominating/Governance Committee deems appropriate. Once candidates have been identified, the Nominating/Governance Committee confirms that the candidates meet the qualifications for director nominees established by the Nominating/Governance Committee. The Nominating/Governance Committee may gather information about the candidates through interviews, detailed questionnaires, comprehensive background checks, or any other means that the Nominating/Governance Committee deems to be helpful in the evaluation process. The Nominating/Governance Committee then meets as a group to discuss and evaluate the qualities and skills of each candidate, both on an individual basis and taking into account the overall composition and needs of the Board of Directors. Based on the results of the evaluation process, the Nominating/Governance Committee recommends candidates for the Board of Directors’ approval as director nominees for election to the Board of Directors.

| | Policy for Recommendation of Director Nominees by Shareholders |

The policy of the Nominating/Governance Committee is to consider properly submitted shareholder recommendations for director candidates in accordance with our Policies Regarding Recommendation of Director Candidates. Under our policy, recommendations for director candidates other than those made by the Board of Directors or the Nominating/Governance Committee must be made pursuant to timely notice in proper written form to the secretary of ZBB Energy. To be timely, a shareholder’s recommendation of a candidate for election to the board at an annual meeting of shareholders, together with the written consent of such person to serve as a director, must be received by the secretary of ZBB Energy not more than 120 days before the date our proxy statement was released to shareholders in connection with the previous year’s annual meeting. To be in proper written form, the notice must contain certain information concerning the nominee and the shareholder submitting the nomination and include:

| · | the name and address of the shareholder submitting the recommendation, the beneficial owner, if any, on whose behalf the recommendation is made and the director candidate; |

| · | the class and number of shares of our stock that are owned beneficially and of record by the shareholder and, if applicable, the beneficial owner, including the holding period for such shares as of the date of the recommendation; |

| · | full biographical information concerning the director candidate, including a statement about the director’s qualifications; |

| · | all other information regarding each director candidate proposed by such shareholder as would be required to be included in a proxy statement filed pursuant to the proxy rules of the Securities and Exchange Commission; |

| · | description of all arrangements or understandings among the shareholder and the candidate and any other person or persons pursuant to which the recommendation is being made; |

| · | description of all relationships between the candidate and any of our competitors, customers, suppliers, labor unions or other persons with special interests regarding us; and |

| · | a written consent of the candidate to be named in our proxy statement and stand for election if nominated by the Board of Directors and to serve if elected by the shareholders. |

Recommendations must be sent to the Chairman of the Nominating/Governance Committee c/o the Secretary, ZBB Energy Corporation, N93 W14475 Whittaker Way, Menomonee Falls, Wisconsin 53051. Once the Nominating/Governance Committee receives a recommendation for a director candidate, such candidate will be evaluated in the same manner as other candidates and a recommendation with respect to such candidate will be delivered to the Board of Directors. The submission of a recommendation by a shareholder in compliance with these procedures will not guarantee the selection of the shareholder’s candidate or the inclusion of the candidate in the proxy statement for the annual meeting. A shareholder wishing to formally nominate a candidate (as opposed to recommending a candidate for nomination by the Board as described above) must do so by following the procedures set forth in our Amended and Restated By-laws (“Bylaws”).

| | Policy Governing Director Attendance at Annual Meetings of Shareholders |

Our policy is to schedule a regular meeting of the Board of Directors on the same date as our annual meeting of shareholders and, accordingly, directors are encouraged to be present at such shareholder meetings. All of our then-current board members attended the 2012 annual meeting of shareholders, other than Richard Payne who resides in Australia.

Our Board of directors adopted a Code of Business Conduct. The Code of Business Conduct, in accordance with Section 406 of the Sarbanes Oxley Act of 2002 and Item 406 of Regulation S-K, constitutes our Code of Ethics. The Code of Business Conduct codifies the business and ethical principles that govern our business.

The Code of Business Conduct is designed, among other things, to deter wrongdoing and to promote:

| · | Honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; |

| · | Compliance with applicable governmental laws, rules and regulations; |

| · | The prompt internal reporting violations of the ethics code to an appropriate person or persons identified in the code of ethics; and |

| · | Accountability for adherence to the Code. |

Our Code of Business Conduct has historically been posted and is available on our website at www.zbbenergy.com. Additionally, this Code of Business Conduct provided to all directors, officers and all other personnel upon joining the Company, and thereafter from time-to-time to any person, upon request, and without charge. A copy may also be obtained, free of charge, from us upon a request directed to ZBB Energy Corporation, N93 W14475 Whittaker Way, Menomonee Falls, Wisconsin 53051, attention: Investor Relations. We intend to disclose any amendments to or waivers of a provision of the code of ethics by posting such information on our website available at www.zbbenergy.com or in our public filings with the SEC.

For more corporate governance information, you are invited to access the Corporate Governance section of our website available at www.zbbenergy.com.

The Board of Directors and Its Committees

Our Bylaws state that the number of directors constituting the entire Board of Directors shall be determined by resolution of the Board and that the Board has the authority to increase the number of directors, fill any vacancies on the Board and to decrease the number of directors to eliminate any vacancies. The number of directors currently fixed by our Board of Directors is eight.

The Board of Directors has standing audit, compensation, and nominating/governance committees. The Board of Directors held 18 regular and special meetings during fiscal 2013. Each director except for Mr. Payne who resides in Australia attended at least 75% of the full board meetings and meetings of committees on which each served in the same period. The Board of Directors and each standing committee retains the authority to engage its own advisors and consultants. Each standing committee has a charter that has been approved by the Board of Directors. A copy of each committee charter is available at www.zbbenergy.com. Each committee reviews the appropriateness of its charter annually or at such other intervals as each committee determines.

The following table sets forth the current members of each standing committee of the Board:

| | Audit: | James H. Ozanne (Chairman) |

| | | Richard A. Abdoo |

| | | Manfred E. Birnbaum |

| | | Paul F. Koeppe |

| | | |

| | Compensation: | Manfred E. Birnbaum (Chairman) |

| | | Richard A. Abdoo |

| | | Paul F. Koeppe |

| | | James H. Ozanne |

| | | |

| | Nominating/Governance: | Richard A. Abdoo (Chairman) |

| | | Manfred E. Birnbaum |

| | | Paul F. Koeppe |

| | | James H. Ozanne |

The Audit Committee (1) reviews, monitors and reports to the Board of Directors on the adequacy of the Company’s financial reporting process and system of internal controls over financial reporting, (2) has the ultimate authority to select, evaluate and replace the independent auditor and is the ultimate authority to which the independent auditors are accountable, (3) provides the audit committee report for inclusion in our proxy statement for our annual meeting of shareholders and (4) establishes procedures for the receipt, retention and treatment of complaints relating to accounting, internal accounting controls or auditing matters and the receipt of confidential, anonymous submissions by employees of concerns regarding questionable accounting or auditing matters. The Audit Committee is required at all times to be composed exclusively of directors who, in the opinion of our Board of Directors, are free from any relationship that would interfere with the exercise of independent judgment as a committee member and who possess an understanding of financial statements and generally accepted accounting principles. We believe that all the members of the Audit Committee are independent directors as required by the listing requirements for the NYSE MKT. Our Board of Directors has determined that Mr. Koeppe qualifies as an “audit committee financial expert” as defined under Item 407(d) of Regulation S-K. The Audit Committee met five times during fiscal 2013.

The Compensation Committee (1) discharges the responsibilities of the Board of Directors relating to the compensation of our directors and executive officers, including approving individual executive officer compensation, (2) review and recommend to the Board of Directors compensation plans, policies and programs, (3) administers and implements the Company’s incentive compensation plans and equity-based plans, and (4) provides the compensation committee report for inclusion in our proxy statement for our annual meeting of shareholders. The Compensation Committee met four times during fiscal 2013.

The Nominating/Governance Committee (1) recommends to the Board of Directors persons to serve as members of the Board of Directors and as members of and chairpersons for the committees of the Board of Directors, (2) considers the recommendation of candidates to serve as directors submitted from the shareholders of the Company, (3) assists the Board of Directors in evaluating the performance of the Board of Directors and the Board committees, (4) advises the Board of Directors regarding the appropriate board leadership structure for the Company, (5) reviews and makes recommendations to the Board of Directors on corporate governance and (6) reviews the size and composition of the Board of Directors and recommends to the Board of Directors any changes it deems advisable. The composition of the Board of Directors should encompass a broad range of skills, expertise, industry knowledge and diversity of opinion. The Nominating/Governance Committee met one time during fiscal 2013.

| | Shareholder Communications with the Board |

Shareholders wishing to communicate with members of the Board of Directors may direct correspondence to such individuals c/o Will Hogoboom, Secretary, N93 W14475 Whittaker Way, Menomonee Falls, Wisconsin 53051.

All communications received in accordance with these procedures will be reviewed by the Secretary of the Company and forwarded to the appropriate director or directors unless such communications are considered, in the reasonable judgment of the Secretary, to be improper for submission to the intended recipient. Examples of shareholder communications that would be considered improper for submission include, without limitation, communications that:

| · | do not relate to the business or affairs of the Corporation or the functioning or constitution of the Board of Directors or any of its committees; |

| · | relate to routine or insignificant matters that do not warrant the attention of the Board of Directors; |

| · | are advertisements or other commercial solicitations; |

| · | are frivolous or offensive; or |

| · | are otherwise not appropriate for delivery to directors. |

| | Role of the Board of Directors in Risk Oversight |

The Board of Directors administers its risk oversight function directly and through the Audit Committee. The Board of Directors and the Audit Committee regularly discuss with management the Company’s major risk exposures, their potential financial impact on the Company, and the steps taken to monitor and control those risks.

Audit Committee Report

The Audit Committee of the Company has:

| · | reviewed and discussed the audited financial statements for the fiscal year ended June 30, 2013 with management; |

| · | discussed with Baker Tilly, our independent auditors, the matters required to be discussed by PCAOB Auditing Standards AU 380, Communication with Audit Committees; |

| · | received the written disclosures and the letter from Baker Tilly required by Independent Standards Board Standard No. 1, Independence Discussions with Audit Committees; and |

| · | discussed with Baker Tilly the auditors’ independence. |

Based on these reviews and discussions, the Audit Committee recommended to the Board of Directors that that the audited financial statements be included in the annual report on Form 10-K for the fiscal year ended June 30, 2013.

Respectfully submitted by the Audit Committee.

THE AUDIT COMMITTEE:

James H. Ozanne, Chairman

Richard A. Abdoo

Manfred E. Birnbaum

Paul F. Koeppe

EXECUTIVE AND DIRECTOR COMPENSATION

Our compensation philosophy is to offer our executive officers compensation and benefits that are competitive and meet our goals of attracting, retaining and motivating highly skilled management, which is necessary to achieve our financial and strategic objectives and create long-term value for our shareholders. We believe the levels of compensation we provide should be competitive, reasonable and appropriate for our business needs and circumstances. The principal elements of our executive compensation program have to date included base salary, and long-term equity compensation in the form of restricted stock or stock options. We believe successful long term Company performance is more critical to enhancing shareholder value than short term results. For this reason and to conserve cash and better align the interests of management and our shareholders, we emphasize long-term performance-based equity compensation over base annual salaries.

In fiscal 2013, the named executive officers received restricted stock units (“RSUs”) as follows: Mr. Apfelbach, 1,500,000 RSUs; Mr. Stankiewicz, 1,500,000 RSUs; and Mr. Reichard, 250,000 RSUs. Other than 200,000 of the RSUs granted to Mr. Reichard, all of these RSUs were made subject to performance-based vesting requirements. Based on the Company’s not satisfying certain performance-based vesting conditions, as of June 30, 2013 the named executive officers had forfeited a portion of these RSUs as follows: Mr. Apfelbach, 500,000 RSUs; Mr. Stankiewicz, 500,000 RSUs; and Mr. Reichard, 50,000 RSUs. Mr. Apfelbach’s and Mr. Stankiewicz’s remaining 1,000,000 RSUs are subject to achievement of additional performance-based vesting requirements to be measured as of December 31, 2013. Mr. Reichard’s remaining 200,000 RSUs vest in three equal annual installments beginning January 15, 2014.

Summary Compensation Table For 2013

The following table represents summary information regarding the compensation of each of Eric C. Apfelbach, our President and Chief Executive Officer, Charles Stankiewicz, our Chief Operating Officer, and Jeffrey A. Reichard, our Chief Technology Officer (the “named executive officers”), for fiscal 2013 and fiscal 2012.

| Name and Principal Position | Year | | Salary ($) | | | Stock Awards ($)(1) | | | Option Awards ($)(2) | | | All Other Compensation ($)(3) | | | Total ($) | |

| Eric C. Apfelbach | 2013 | | | 250,000 | | | | 400,000 | | | | - | | | | 29,185 | | | | 679,185 | |

| Chief Executive Officer | 2012 | | | 262,860 | | | | 350,000 | | | | 157,034 | | | | 35,919 | | | | 805,813 | |

| | | | | | | | | | | | | | | | | | | | | | |

Charles W. Stankiewicz (4) | 2013 | | | 239,942 | | | | 400,000 | | | | 26,801 | | | | 9,598 | | | | 676,341 | |

| Chief Operating Officer | 2012 | | | 145,385 | | | | - | | | | 234,838 | | | | - | | | | 380,223 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Jeffrey A. Reichard | 2013 | | | 200,000 | | | | 85,000 | | | | - | | | | 7,923 | | | | 292,923 | |

| Chief Technology Officer | 2012 | | | 200,000 | | | | - | | | | - | | | | 8,000 | | | | 208,000 | |

| | | | | | | | | | | | | | | | | | | | | | |

| (1) | Represents restricted stock unit awards (“RSUs”). As described above, all of Mr. Apfelbach’s and Mr. Stankiewicz’s and 20% of Mr. Reichard’s fiscal 2013 RSUs were made subject to performance-based vesting conditions. The amounts shown in this column indicate the full grant date fair value of RSUs computed in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 718 (“FASB ASC Topic 718”). For additional information regarding the assumptions made in calculating these amounts, see the Notes to our consolidated financial statements included in our Annual Report on Form 10-K. These amounts reflect our accounting expense for these awards and do not correspond to the actual value that will be recognized by the named executive officers. |

| (2) | The amounts shown in this column indicate the full grant date fair value of option awards computed in accordance with FASB ASC Topic 718. Generally, the full grant date fair value is the amount that we would expense in our financial statements over the award’s vesting schedule. For additional information regarding the assumptions made in calculating these amounts, see the Notes to our consolidated financial statements included in our Annual Report on Form 10-K. These amounts reflect our accounting expense for these awards and do not correspond to the actual value that will be recognized by the named executive officers. |

| (3) | The amounts set forth in this column consisted of (i) disability insurance reimbursement, (ii) health insurance payments, (iii) matching contributions to our 401(k) Plan, and (iv) car allowance and commuting expense reimbursement as follows: |

| | Year | | Disability Insurance ($) | | | Health Insurance ($) | | | Matching Contribution to 401(k) Plan ($) | | | Commuting Expense Reimbursement ($) | | | Total ($) | |

| Eric C. Apfelbach | 2013 | | | 6,768 | | | | 2,894 | | | | 10,000 | | | | 9,523 | | | | 29,184 | |

| | 2012 | | | 11,843 | | | | 5,400 | | | | 10,452 | | | | 8,224 | | | | 35,919 | |

| Charles W. Stankiewicz | 2013 | | | - | | | | - | | | | 9,598 | | | | - | | | | 9,598 | |

| | 2012 | | | - | | | | - | | | | - | | | | - | | | | - | |

| Jeffrey A. Reichard | 2013 | | | - | | | | - | | | | 7,923 | | | | - | | | | 7,923 | |

| | 2012 | | | - | | | | - | | | | 8,000 | | | | - | | | | 8,000 | |

| (4) | Mr. Stankiewicz joined the Company in November 2011. |

Outstanding Equity Awards at June 30, 2013

The following table presents information about unexercised options that were held by the named executive officers as of June 30, 2013.

| | | Options Awards | | Stock Awards | | | | | | | |

| Name | | Number of Securities Underlying Unexercised Options (#) Exercisable | | | Number of Securities Underlying Unexercised Options (#) Unexercisable | | | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) | | Option Exercise Price ($) | | Option Expiration Date | | Number of Shares or Units of Stock that Have Not Vested (#)(1) | | | Market Value of Shares or Units of Stock That Have Not Vested ($)(1) | | | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights that Have Not Vested (#)(1) | | | Equity Incentive Plan Awards: Market Value of Unearned Shares, Units or Other Rights That Have Not Vested ($)(1) | |

| Eric C. | | | 100,000 | | | | - | | | | - | | | 0.87 | | 08/09/19 | | | 91,667 | (2) | | | 23,833 | | | | 1,000,000 | (3) | | | 260,000 | |

| Apfelbach | | | 50,000 | | | | - | | | | - | | | 0.49 | | 06/30/18 | | | | | | | | | | | | | | | | |

| | | | 400,000 | | | | - | | | | - | | | 1.33 | | 01/07/18 | | | | | | | | | | | | | | | | |

| | | | 50,000 | | | | - | | | | - | | | 1.33 | | 06/30/15 | | | | | | | | | | | | | | | | |

| | | | 50,000 | | | | - | | | | - | | | 1.33 | | 12/31/15 | | | | | | | | | | | | | | | | |

| Charles A. | | | - | | | | 100,000 | (4) | | | - | | | 0.38 | | 09/06/20 | | | | | | | | | | | 1,000,000 | (3) | | | 260,000 | |

Stankiewicz | | | 211,111 | | | | 188,889 | (5) | | | - | | | 0.79 | | 11/09/19 | | | - | | | | - | | | | - | | | | - | |

| | | | 25,000 | | | | - | | | | - | | | 0.79 | | 11/09/19 | | | | | | | | | | | | | | | | |

| Jeffrey A. | | | 153,333 | | | | 76,667 | (6) | | | - | | | 1.15 | | 01/21/19 | | | 200,000 | (8) | | | 52,000 | | | | - | | | | - | |

| Reichard | | | 140,000 | | | | - | | | | 140,000 | (7) | | 1.15 | | 01/21/19 | | | | | | | | | | | | | | | | |

__________

| (1) | Represents shares underlying restricted stock unit awards. Market value is based on the closing price of our common stock on June 28, 2013 ($0.26). |

| (2) | 25,000 of these shares vest on November 10, 2013 and 66,667 of these shares vest on May 6, 2013. |

| (3) | Reflects the unvested portion of a restricted stock unit grant which vests in full on December 31, 2013 subject to the achievement of certain performance vesting conditions. |

| (4) | Reflects the unvested portion of an option grant which vests in three equal annual installments beginning July 3, 2013. |

| (5) | Reflects the unvested portion of an option grant which vests in equal monthly installments through November 2014. |

| (6) | Reflects the unvested portion of an option grant which vests in full on January 21, 2014. |

| (7) | Reflects the unvested portion of an option grant which, subject to the achievement of certain performance vesting conditions, will vest on December 31, 2013. |

| (8) | Reflects the unvested portion of a restricted stock unit grant which vests in three equal annual installments beginning January 15, 2014. |

Employment Agreements

On January 7, 2010, Eric C. Apfelbach entered into an employment agreement with us to act as our President and Chief Executive Officer which provides for a minimum base salary of $250,000. Pursuant to the employment agreement, in January 2010 Mr. Apfelbach was awarded two inducement option grants to purchase a total of 500,000 shares of common stock. The first covered 400,000 shares and provided for vesting as follows: one-third on grant and the balance in 24 monthly installments beginning on January 31, 2011 and ending on December 31, 2012. The second grant covered 100,000 shares and vested in two equal installments on June 30, 2010 and December 31, 2010 based on the achievement of certain performance vesting conditions for the six month periods then ended. The per share exercise price of the inducement options is $1.33 which was the closing price of our common stock on the NYSE MKT on January 7, 2010.

If we terminate Mr. Apfelbach’s employment agreement for any reason other than for cause, Mr. Apfelbach terminates his employment for Good Reason (as defined in the employment agreement), or he dies, we must pay him a severance payment in an amount equal to six months of his annual base salary as then in effect, and he is entitled to certain benefits under COBRA. Furthermore, Mr. Apfelbach will forfeit any options that have not vested at the time of termination for any reason, except that upon a change of control, his death, or his Disability (as defined in the employment agreement), the options shall become immediately exercisable and fully vested.

On October 24, 2011, Charles W. Stankiewicz entered into an employment agreement with us as Executive Vice President of Operations and as a member of our Board of Directors which provides for a minimum base salary of $225,000. Pursuant to the employment agreement, in November 2011 Mr. Stankiewicz was awarded two inducement option grants to purchase a total of 500,000 shares of common stock. The first covered 400,000 shares and provided for vesting as follows: one-third on each of the first, second and third anniversaries of November 9, 2011. The second grant covered 100,000 shares and vests in two equal installments on September 30, 2012 and June 30, 2013 based on the achievement of certain performance vesting conditions. The per share exercise price of the options is $0.79 which was the closing price of our common stock on the NYSE MKT on November 9, 2011.

If we terminate Mr. Stankiewicz’s employment agreement for any reason other than for Cause or Disability (each as defined in the employment agreement), Mr. Apfelbach terminates his employment for Good Reason (as defined in the employment agreement), or he dies, we must pay him a severance payment in an amount equal to four months of his annual base salary as then in effect, and he is entitled to certain benefits under COBRA. If his employment agreement is terminated for Disability, Mr. Stankiewicz will be entitled to a severance payment in an amount equal to his annual base salary as then in effect from the date of termination through the date on which his benefits under the long-term disability policy begin, but in no event longer than 90 days. Furthermore, Mr. Stankiewicz will forfeit any options that have not vested at the time of termination for any reason, except that upon a change of control, his death, or his Disability, the options shall become immediately exercisable and fully vested.

On January 21, 2011, Jeffrey Reichard entered into an employment agreement with us as our Vice President of Electronics Development and Tier’s President and as a member of our Board of Directors and a member of the Board of Directors of Tier which provides for a minimum base salary of $200,000. Pursuant to the employment agreement, in January 2011 Mr. Reichard was awarded an option to purchase 230,000 shares of common stock. The per share exercise price of the options is $1.26 which was the closing price of our common stock on the NYSE MKT on January 21, 2011.

If we terminate Mr. Reichard’s employment agreement for any reason other than for Cause or Disability (each as defined in the employment agreement) or Mr. Reichard terminates his employment for Good Reason (as defined in the employment agreement), we must pay him a severance payment in an amount equal to the greater of (i) 12 months of his annual base salary as then in effect, or (ii) the remaining number of complete months in the scheduled term of his employment agreement (which terminates on January 21, 2014) of his annual base salary as then in effect, and he is entitled to certain benefits under COBRA. If his employment agreement is terminated for Disability, Mr. Reichard will be entitled to a severance payment in an amount equal to his annual base salary as then in effect from the date of termination through the date on which his benefits under the long-term disability policy begin, but in no event longer than 90 days.

As a condition of these employment agreements, Mr. Apfelbach, Mr. Stankiewicz and Mr. Reichard each entered into a restrictive covenant agreement with the Company. The restrictive covenant agreement contains, among other terms, covenants prohibiting him from competing with the Company during his employment and at any time during the 24 months (or 12 months in the case of Mr. Reichard) following termination for any reason and a requirement for him to keep all confidential information of the Company strictly confidential during his employment and for a period of 24 months after termination of employment.

Director Compensation

| | 2012 Compensation Policy for Non-Employee Directors |

On November 7, 2012 the Board of Directors adopted the following compensation policy for members of the Board of Directors who are not officers or employees of the Company (“non-employee directors”):

| · | An annual retainer in the amount of $72,000, to be awarded as described below. |

| · | In addition, an annual Chairman’s retainer in the following amounts, to be awarded as described below: $30,000 for the Chairman of the Board; $12,000 for the Chairman of the Audit Committee and for the Chairman of the Compensation Committee; and $8,000 for the Chairman of the Nominating/Governance Committee. |

| · | The total amounts determined above for a non-employee director for a year will is awarded as of the date of the annual meeting of shareholders of the Company (the “Annual Meeting”) in the form of restricted stock units (“RSUs”) under the 2012 Non-Employee Director Equity Compensation Plan (or any successor plan thereto) (the “Stock Plan”). The RSUs have the following terms and conditions: (A) the number of RSUs is be determined by dividing the dollar amount of the award by the closing price of the Company’s common stock on the first business day preceding the Annual Meeting, rounded up to the next whole share (provided that notwithstanding the foregoing the price to be used to determine the number of RSUs to be issued on the date of the 2012 Annual Meeting shall be $0.38); (B) 25% of the RSUs vest on the date of grant, and the remaining RSUs vest 25% each on March 31, June 30 and September 30 following the Annual Meeting, provided the non-employee director remains in continuous service with the Board of Directors through the applicable vesting date; (C) the RSUs vest earlier in the event of a “Change in Control” of the Company (as defined in the Stock Plan); (D) vested RSUs are payable upon the earlier of (x) the date that is six months after the non-employee director “separates from service” with the Board of Directors (within the meaning of Section 409A of the Internal Revenue Code) or (y) the date of a Change in Control; and (E) vested RSUs are payable in the form of one share of common stock of the Company for each vested RSU then payable; and (F) the RSUs are otherwise subject to the terms of the Stock Plan and will be evidenced by an appropriate RSU award agreement.. |

| · | In addition, an annual committee membership fee in the amount of $6,000 for each board committee on which the non-employee director serves (treating Richard Payne’s service as a member of the Board of the Company’s China joint venture entity as service on a committee of the Board of Directors), payable in cash quarterly in arrears, provided the non-employee director remains in continuous service with the Board of Directors through each applicable payment date. |

An employee of the Company who serves as a director receives no additional compensation for such service.

Non-Employee Director Compensation in 2013

The following table provides compensation information for the one-year period ended June 30, 2013 for each non-employee member of our Board of Directors.

| Name | | Fees Earned or Paid in Cash ($) | | | Stock Awards ($)(1)(2) | | | Total ($) | |

| Richard A. Abdoo | | | 18,000 | | | | 46,316 | | | | 64,316 | |

| Manfred E. Birnbaum | | | 18,000 | | | | 46,316 | | | | 64,316 | |

| Paul F. Koeppe | | | 18,000 | | | | 59,053 | | | | 77,053 | |

| James H. Ozanne | | | 18,000 | | | | 48,632 | | | | 66,632 | |

| Richard A. Payne | | | 6,111 | | | | 41,684 | | | | 47,796 | |

| (1) | The amounts shown in this column indicate the full grant date fair value of restricted stock unit awards computed in accordance with FASB ASC Topic 718. Generally, the full grant date fair value is the amount that we would expense in our financial statements over the award’s vesting schedule. For additional information regarding the assumptions made in calculating these amounts, see the Notes to our consolidated financial statements included in our Annual Report on Form 10-K. These amounts reflect our accounting expense for these awards and do not correspond to the actual value that will be recognized by the directors. |

| (2) | The aggregate number of restricted stock unit awards and option awards outstanding on June 30, 2013 and held by each non-employee director was as follows: |

| Name | | Number of Securities Underlying Unexercised Options | | | Number of Securities Underlying Restricted Stock Unit Awards | |

| Richard A. Abdoo | | | 75,000 | | | | 580,223 | |

| Manfred E. Birnbaum | | | 150,000 | | | | 580,526 | |

| Paul F. Koeppe | | | 275,000 | | | | 772,291 | |

| James H. Ozanne | | | 75,000 | | | | 314,559 | |

| Richard A. Payne | | | 150,000 | | | | 485,837 | |

EQUITY COMPENSATION PLAN INFORMATION

We maintain the following equity compensation plan under which our equity securities are authorized for issuance to our employees and/or directors: the 2012 Non-Employee Director Equity Compensation Plan. We also maintain the following four equity compensation plans, which are frozen and under which no new grants will be made: the 2002 Stock Option Plan, the Employee Stock Option Scheme, the 2007 Equity Incentive Plan and the 2010 Omnibus Long-Term Incentive Plan. Each of the foregoing equity compensation plans was approved by our shareholders. The following table presents information about these plans as of June 30, 2013.

| Equity Compensation Plan Information | |

| Plan Category | | Number of securities to be issued upon exercise of outstanding options, warrants and rights | | | Weighted average exercise price of outstanding options, warrants and rights | | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities outstanding) | |

Equity compensation plans approved by security holders | | 7,849,849 | (1) | | $ | 0.68 | (2) | | 5,901,454 | (3) |

Equity compensation plans not approved by security holders | | 1,685,000 | (4)(5) | | $ | 1.04 | | | None | |

| Total | | 9,534,849 | | | $ | 0.74 | | | 5,901,454 | |

| (1) | Includes 4,558,436 outstanding restricted stock units under plans approved by our security holders. |

| (2) | Does not reflect restricted stock units included in the first column that do not have an exercise price. |

| (3) | Represents shares available for issuance under our 2010 Omnibus Long-term Incentive Plan. |

| (4) | Consists of inducement option grants awarded to Mr. Apfelbach in connection with his hiring in January 2010, members of management of Tier Electronics LLC in connection with its acquisition in January 2011, Mr. Stankiewicz in connection with his hiring in November 2011 and Mr. Siebert in connection with his hiring in August 2012. The material terms of Mr. Apfelbach’s inducement option grants are described above under EXECUTIVE AND DIRECTOR COMPENSATION – EMPLOYMENT AGREEMENTS. The material terms of the inducement option grants made in connection with the Tier acquisition are described in footnote 5 below. The material terms of Mr. Stankiewicz’s inducement option grants are described above under EXECUTIVE AND DIRECTOR COMPENSATION – EMPLOYMENT AGREEMENTS. In connection with his hiring, we awarded Mr. Siebert an inducement option grant to purchase 150,000 shares of common stock that provided for vesting as follows: one-third on August 24, 2013 and the balance in 24 monthly installments beginning on September 24, 2013 and ending on August 24, 2015. The per share exercise price of the inducement options is $0.38. |