System Solutions

NS Solutions Corporation (renamed Nippon Steel Solutions Co., Ltd. as of April 1, 2019) provides advanced solution services and other comprehensive solutions in the planning, configuration, operation, and maintenance of IT systems for clients in a wide range of business fields. During fiscal 2018, against the backdrop of robust system investments stemming mainly from customers’ advanced operational needs, the company’s business environment continued to be favorable. In addition to developing safe, protective solutions at factories and other work sites that make use of IoT technology and developing platforms to analyze data based on AI technology, NS Solutions proceeded proactively in making changings to the company’s systems following the corporate name change to Nippon Steel Corporation and the reorganization of the group. The System Solutions segment recorded revenue of ¥267.5 billion and business profit of ¥26.5 billion.

Revenue and Profit

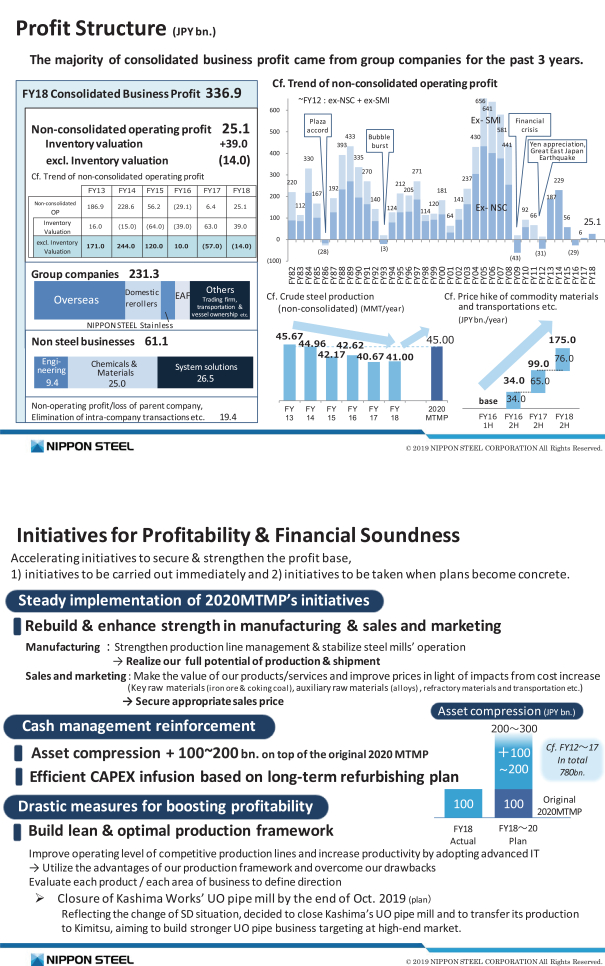

Consolidated results for fiscal 2018 were mainly affected by natural disasters such as heavy rains and typhoons, an overall cost increase, stemming from a surge in prices of primary raw materials, rises in costs of commodity materials, other material procurement costs, and distribution costs, and by the negative impact of differences in inventory evaluations by NSSMC and its group companies. Meanwhile, in addition to corporate-wide efforts to implement measures to stabilize facilities and operations and the steady execution of cost reduction measures, positive factors included an improvement in steel product prices, driven mainly by a rise in overseas markets, especially in the first half of fiscal 2018, and profit improvement in business segments other than Steelmaking and Steel Fabrication. As a result, NSSMC posted revenue of ¥6,177.9 billion, business profit of ¥336.9 billion and profit for the year attributable to owners of the parent of ¥251.1 billion.

Assets, Liabilities, Equity, and Cash Flows

Consolidated total assets as of March 31, 2019 were ¥8,049.5 billion, an increase of ¥293.3 billion as compared to as of March 31, 2018. This increase was primarily due to a rise in trade and other receivables of ¥136.2 billion, the inventories of ¥167.2 billion and property, plant and equipment of ¥122.8 billion mainly resulting from acquisition of Sanyo Special Steel Co., Ltd. and Ovako AB, which offset a decrease in other financial assets(non-current) of ¥194.9 billion caused by a fair value decrease and sales of investment securities.

Consolidated total liabilities as of March 31, 2019 were ¥4,442.1 billion, an increase of ¥210.9 billion as compared to as of March 31, 2018. This increase was primarily due to a rise in interest-bearing liabilities of ¥211.4 billion, from ¥2,157.7 billion as of March 31, 2018 to ¥2,369.2 billion as of March 31, 2019.

5