0.00% to 0.75%, in each case, based upon Parent’s guaranteed senior-unsecured long term debt rating. In addition, Trinity Acquisition plc will pay (a) a commitment fee equal to 0.10% to 0.25% of the committed amount of the Revolving Credit Facility that has not been borrowed and (b) a letter of credit fee for each outstanding letter of credit equal to (i) the daily amount available to be drawn under such letter of credit times (ii) 1.00% to 1.75%, in each case, based upon Parent’s guaranteed, senior-unsecured long term debt rating.

Voluntary prepayments are permitted under the Revolving Credit Facility without penalty or premium in amounts greater than $5,000,000 or a whole multiple of $1,000,000 in excess thereof or, in each case, if less, the entire principal amount thereof then outstanding. In addition, the Revolving Credit Facility requires mandatory prepayment in certain circumstances.

Guarantees

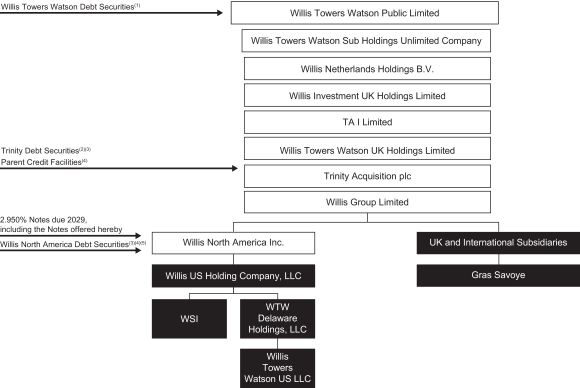

All of Trinity Acquisition plc’s obligations under the Revolving Credit Facility are unconditionally guaranteed on a senior basis by (A) Parent, and (B) Trinity Acquisition plc’s affiliates: (i) Willis Group Limited, (ii) Willis Investment UK Holdings Limited, (iii) TA I Limited, (iv) Willis North America Inc., (v) Willis Netherlands Holdings B.V., (vi) Willis Towers Watson UK Holdings Limited and (vii) Willis Towers Watson Sub Holdings Unlimited Company.

Further Incremental Facilities and Maturity Extensions

Subject to compliance with certain customary conditions precedent, Parent and Trinity Acquisition plc have the right under the Revolving Credit Facility, from time to time and on one or more occasions, to add one or more incremental revolving facilities in an aggregate principal amount not to exceed $500 million. Parent and Trinity Acquisition plc also have the right, on up to two occasions, to request a further extension of the maturity date of the Revolving Credit Facility by one year, subject to certain requirements.

Covenants

Parent and Trinity Acquisition plc are subject to various affirmative and negative covenants and reporting obligations under the Revolving Credit Facility. These include, among others, limitations on subsidiary indebtedness, liens, sale and leaseback transactions, certain investments, fundamental changes, assets sales, restricted payments, and maintenance of certain financial covenants.

Events of Default

Events of default under the Revolving Credit Facility includenon-payment of amounts due to the lenders, violation of covenants, incorrect representations, defaults under other material indebtedness, judgments and specified insolvency-related events, certain ERISA (as defined herein) events and invalidity of loan documents, subject to, in certain instances, specified thresholds, cure periods and exceptions.

Term Loan Facility

Amounts outstanding under the Term Loan Facility bear interest, at the option of the Issuer and Trinity Acquisition plc, at a rate equal to (a) for Eurocurrency Rate Loans, LIBOR plus 0.75% to 1.375% and (b) for Base Rate Loans, the highest of (i) the Federal Funds Rate plus 1/2 of 1%, (ii) the “prime rate” quoted by Bank of America, N.A., and (iii) LIBOR plus 1.00%, plus 0.00% to 0.375%, in each case, based upon Parent’s guaranteed senior-unsecured long term debt rating.

Voluntary prepayments are permitted under the Term Loan Facility without penalty or premium in amounts greater than $5,000,000 or a whole multiple of $1,000,000 in excess thereof or, in each case, if less, the entire principal amount thereof then outstanding. The Term Loan Facility will be repaid with the net proceeds of this offering.

S-25