2.1Strategy and market overview |

Gina Krog, NCS

Equinor’s business environment

Market overview

While the global economy grew largely above the historical trend in 2017, last year turned out more modest, driven by trade frictions and uneven performance in emerging markets. Estimated economic growth for 2018 by the OECD1 was 3.6%.

The US achieved a significant growth rate above historical average at 2.9% for 2018, owing to the effects of tax cuts, increased fiscal spending and accommodative monetary policies. Eurozone growth showed weakness through 2018, achieving an expected growth rate of a modest 1.8%, with the German economy close to recession and Italy contracting in the fourth quarter of 2018.

Due to prolonged uncertainty around Brexit, the UK realised an annualised growth rate of 0.8% in the fourth quarter of 2018. The full-year 2018 GDP growth projection is revised down to 1.4%.

The Chinese GDP growth rate abated from the 6.8% experienced in 2017 to 6.6% as domestic consumption weakened and uncertainty concerning trade issues took its toll. In line with the global trend, Japanese economic growth came off from 2017 to an expected annual GDP growth of a meagre 0.7% for 2018 as energy costs rose, and exports slowed.

India, on the other hand, is expected to deliver a GDP growth rate of 7.2% for 2018, benefitting from structural reforms implemented in 2017.

Following the presidential election in 2018 and consistent economic growth since the 2015-2016 recession, Brazil showed positive signs through 2018. In contrast, Russia developed less favourably due to a mix of fiscal and monetary policy decisions.

Looking ahead, it appears that the global economic expansion has lost momentum as uncertainty now poses a dominant theme. Trade tensions between the US and China as well as the monetary policy of key central banks and the development in key emerging economies will be important for the unfolding of the world economy in 2019.

.

1 All GDP numbers based on OECD information

Equinor, Annual Report on Form 20-F 2018 13

Oil prices and refining margins

2018 was characterised by high volatility both in crude prices and refinery margins. The average price for Dated Brent was 71.1 USD/bbl, 31% higher than the 54.2 USD/bbl average in 2017.

Oil prices opened 2018 at USD 66 USD/bbl, the strongest start to a calendar year since 2014. Because of decisions by the Organization of the Petroleum Exporting Counties (OPEC) and their non-OPEC allies to extend the production cut agreement in 2018, storage levels were significantly reduced, reaching the target 5-year average benchmark before the summer. Despite elevated oil price levels incentivising a rapid surge in US production, unplanned additional declines in supply from Venezuela, Mexico and Angola resulted in a tighter market during the first quarter, with prices rising steadily until May.

In June, OPEC and non-OPEC allies, concerned by tight market conditions and the forthcoming disruptions to Iran’s supply due to US sanctions, decided to collectively ramp up production to offset any potential losses and maintain prices on a healthy level. Prices remained relatively steady around 74 USD/bbl throughout the summer, but already in September another price rally started on fears that production might not be sufficient to offset supply losses from Iran when sanctions were to take effect in November. Brent peaked at USD 86.1 per barrel in October.

During November the market sentiment started shifting from fears of undersupply and low spare capacity towards the potential disruptive effect on demand from the trade disputes between the US and China and the effect of high oil prices. This, coupled with the unexpected softening of Iranian sanctions and record US production, led to serious worries about oversupply. Faced again with potential oversupply, OPEC and non-OPEC allies decided at the December meeting in Vienna to reintroduce a production cut agreement starting January 2019. By the end of the year, prices had dropped by more than 40% since the peak in October, closing the year at USD 50.2 per barrel on 28th December 2018. In essence, the new year started in the same fashion as in 2018 – albeit with significantly lower stock levels this second round.

Refining margins

Refinery margins in Europe in 2018 were weaker than in 2017, and volatile throughout the year. Demand in Europe was strong, with a normal seasonal summer peak. Diesel demand was the strongest ever, and gasoline demand the highest since 2012. In the US the peak demand occurred during the summer months, with the strongest refinery margin in August. Overall, the gasoline prices averaged USD 2.72 per gallon in 2018, 13% higher than in 2017. Between May and November, prices were affected negatively by low water

14 Equinor, Annual Report on Form 20-F 2018

levels on the Rhine, restricting normal barge traffic in and out of the Rotterdam pricing hub. This also restricted supply of naphtha to inland petrochemical plants. From September, margins for gasoline and naphtha collapsed. The wholesale gasoline prices in the US dropped about 20%. Export opportunities into the US fell due to high stock levels there. Import requirements into Asia fell on higher local supply and weak demand due to concerns over the effect of the US - China trade conflict. Diesel and fuel oil margins rose to compensate, though. Through most of the year, margins were supported by weak physical crude vs. the paper market at the International Currency Exchange (ICE).

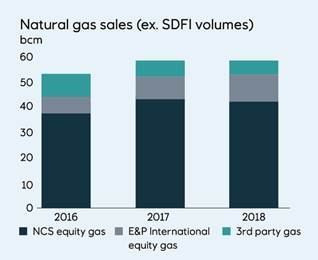

Natural gas prices

Gas prices – Europe

The National Balancing Point (NBP) fell in the beginning of 2018 from the December 2017 monthly average of 7.8 USD/MMBtu due to abnormally warm and windy weather and nuclear plants returning to full capacity. During a significant cold period in March, NBP day-ahead rocketed to 15 USD/MMBtu before settling down to pre-event levels of 7 USD/MMBtu. In the second and third quarter of 2018 the supply/demand balance was tight and there was a consistent growth in European gas prices, and the NBP monthly average in September was 9.6 USD/MMBtu. This was caused by an overall rallying energy complex (oil, CO2, coal and Asian LNG prices), call for gas to fill storage, strong Asian demand drawing LNG out of Europe, high level of maintenance and the extraordinarily warm summer in Northwest Europe. The fourth quarter of 2018 continued with warmer than normal seasonal weather, reducing gas demand. There was also an influx of LNG spot cargoes arriving in Europe rather than Asia as shipping rates were high. In addition, the storage inventory levels were comfortable, thus putting downward pressure on prices. Average annual price in 2018 was 8.0 USD/MMBtu compared to 5.8 USD/MMBtu in 2017.

Gas prices – North America

The Henry Hub price remained quite stable throughout 2018, averaging 3.15 USD/MMBtu for the year, 6% higher than in 2017. Dry gas production set record highs in 2018, but storage levels ended the year 17% below the five-year average as strong demand and a lack of price incentive depressed storage build during injection season. Winter periods continued to drive upside price risks. In November, prices reached 7 USD/MMBtu levels that had not been seen since the winter of 2014.

Global LNG prices

The Asian LNG average price for December 2017 was 10.6 USD/MMBtu, while the average price for 2017 was 7.1 USD/MMBtu. 2018 started with a tight LNG market and comparatively high prices due to strong Asian demand. From here, monthly prices fell throughout first quarter until April. With warm summer weather driving gas demand for cooling and planned maintenance, prices increased to 10.4 USD/MMBtu over the summer. September saw continued strong LNG demand with average price of 11.5 USD/MMBtu, before the market started softening with ramp up of new LNG supplies, fall in crude prices and a comparatively mild start of winter in Asia. At the end of the year, the Asian LNG price dropped below 9 USD/MMBtu, well below the average price for 2018 of 9.7 USD/MMBtu.

Equinor’s corporate strategy

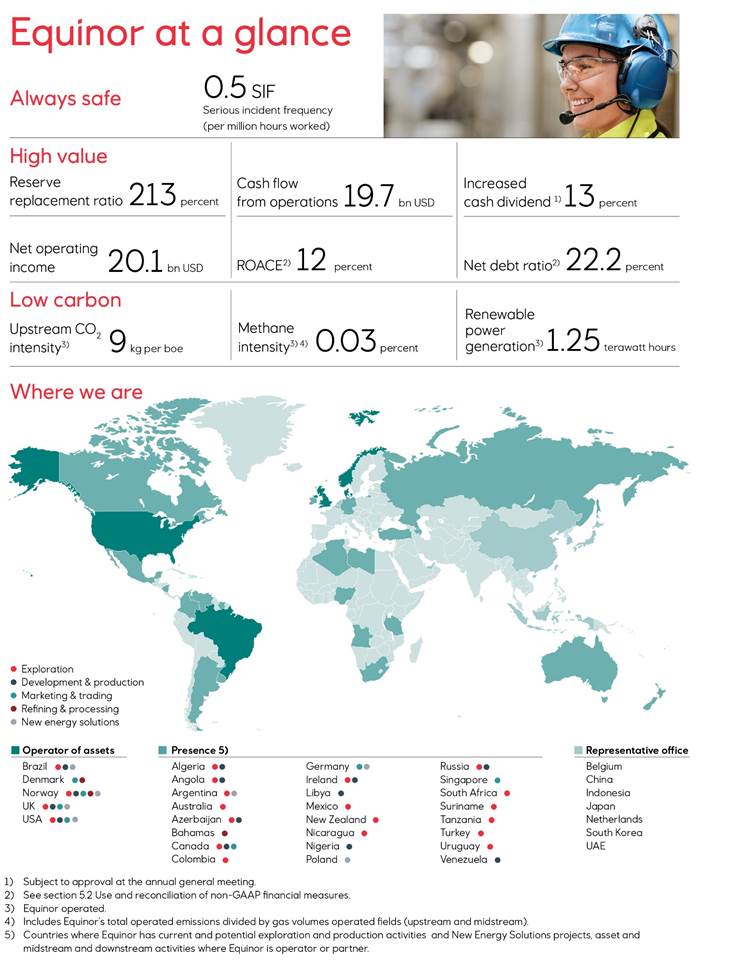

Equinor is an international energy company committed to long-term value creation in a low carbon future inspired by its vision of shaping the future of energy.

“ | Equinor continues to pursue its strategy of always safe, high value and low carbon through developing and maximising the value of its unique Norwegian continental shelf position, its international oil and gas business, its manufacturing and trading activities and its growing new energy business. |

The energy context is expected to remain volatile characterised by geopolitical shifts, challenges in liquids resource replenishments, market cyclicality, structural changes to costs and increasing momentum towards low carbon. The company expects volatility in prices both upwards and downwards. Equinor’s strategic response is focused on creating value by building a more resilient, diverse and option-rich portfolio, delivered by an empowered organisation. To do so, Equinor will continue to concentrate its strategy realisation and development around the following areas:

· Norwegian continental shelf – transforming the NCS for continued high value creation and low carbon emissions for the coming decades

· International oil and gas – deepen core areas and develop growth options

· New energy solutions – create a material new industrial position

· Midstream and marketing – secure premium market access and grow value creation through cycles

Equinor’s unique position at the Norwegian continental shelf has enabled the company to develop new technologies and scale them industrially. Equinor has today a strong set of industrial value drivers:

Equinor, Annual Report on Form 20-F 2018 15

· Operational excellence

· World-class recovery

· Leading project deliveries

· Premium market access

· Digital leadership

In sum, these drivers strengthen the company’s competitiveness. Internationally, Equinor is increasingly taking the role as operator, allowing the company to leverage its industrial value drivers even more. Across its business, Equinor is targeting opportunities that play to its strength.

Melkøya in Hammerfest, Norway

Equinor is actively shaping its future portfolio guided by the following strategic principles:

· Cash generation capacity – generating positive cash flows from operations, even at low oil and gas prices, in order to sustain dividend and investment capacity through the economic cycles

· Capex flexibility – having sufficient flexibility in organic capital expenditure to be able to respond to market downturns and avoid value destructive measures as well as ability to always prioritise

· Capture value from cycles – ensuring the ability and capacity to act counter-cyclically to capture value through the cycles

· Low-carbon advantage – maintaining competitive advantage as a leading company in carbon-efficient oil and gas production, while building a low-carbon business to capture new opportunities in the energy transition

To deliver on the strategy, Equinor has identified four key strategic enablers that will continue to support the business’s needs:

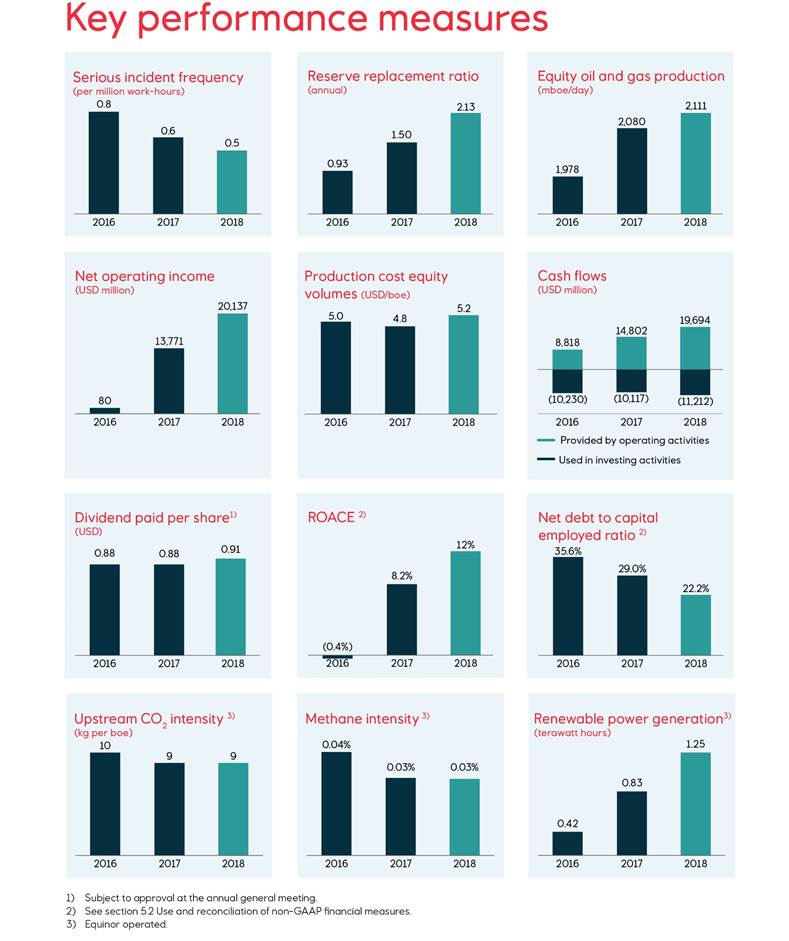

· Safe and secure operations: Safety and security is Equinor’s top priority. In 2018, measures to reinforce safety in all areas including continued collaboration with partners and suppliers, were initiated. The corporate wide activities focus on safety (I am safety), security (2020 Security roadmap), and IT security (New information technology strategy). In 2018, Equinor achieved an all-time low serious incident frequency.

· Technology and innovation: Equinor's technology strategy provides long-term guidance for technology development and implementation. In 2018, Equinor continued delivering on its digital roadmap. A key activity is building a cloud-based data platform designed to make data available anytime, anywhere. Safeguarding the company from cyber threats remains a key focus area for the company. In 2018, integrated operation centers were opened in Austin and Bergen as well as the Geo operations centre and automated drilling control is increasingly being used to reduce drilling cost.

16 Equinor, Annual Report on Form 20-F 2018

· Empowered people: Equinor promotes a culture of collaboration, innovation and safety, guided by its values. A diverse and inclusive Equinor continues to develop its employees and attract talents to deliver on the future-fit portfolio ambition.

· Stakeholder engagement: Equinor engages with stakeholders to secure industrial legitimacy, its social contract, trust and strategic support from stakeholders. This engagement extends to internal and external collaboration, partnerships, and other co-operation with suppliers, partners, governments, NGOs and communities in which Equinor operates.

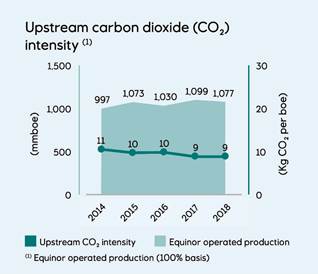

Equinor maintains its advantage as a leading company in carbon- efficient oil and gas production while building a low-carbon business to capture new opportunities in the energy transition. The company believes a lower carbon footprint will make it more competitive in the future and climate-related principles are embedded in the corporate strategy and performance and risk management. Further information can be found in section 2.12 Safety, security and sustainability.

Norwegian continental shelf – Transforming the NCS for continued high value creation and low carbon emissions for the coming decades

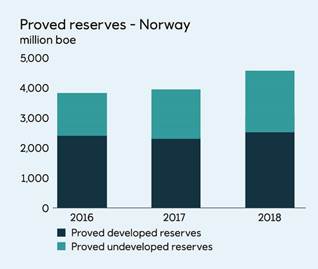

For more than 40 years, Equinor has explored, developed and produced oil and gas from the NCS. It represents approximately 60% of Equinor’s equity production at 1,288 mboe per day in 2018. Equinor aims to deepen and prolong its position by accessing and maturing opportunities into valuable production. At the same time, Equinor aims to continue to improve the efficiency, reliability, carbon emissions and lifespan of fields already in production. Strong volume growth is expected towards historically high production levels in 2025, representing significant value creation.

Equinor believes that the NCS holds substantial future potential and demonstrates its strategic commitment to the NCS through new development projects, new ways of working and asset optimisation, and continued exploration efforts for near infrastructure explorations as well as testing new plays. An extensive project portfolio holds large field developments, life-time extensions, subsea tie-back projects, and CO2-reducing measures. In the next few years, Equinor will bring several large projects on stream including Johan Sverdrup, Martin Linge, and Johan Castberg.

More information on assets in operations and projects under development is provided in section 2.3 E&P Norway – Exploration & Production Norway.

International oil and gas – Deepen core areas and develop growth options

Equinor has been growing its international portfolio for over 25 years. International oil and gas production represented approximately 40% of Equinor’s equity production at 823 mboe per day in 2018, a record-high year for production. During the year Equinor acquired and won attractive exploration licences in Brazil, Canada, the UK and the Gulf of Mexico to strengthen the exploration portfolio further.

As Equinor deepens in its international core areas in Brazil and the US, it will also develop future growth options across a broad portfolio. The share of operated equity production is expected to double over the next few years, allowing Equinor to add even more value as an operator. Equinor is drawing on more than 40 years of experience from the NCS in the future development of Bay du Nord and Rosebank. Other major assets in Equinor’s project portfolio include Mariner, Vito, Peregrino phase 2, Carcará, BM-C-33, North Komsomolskoye, North Platte and Block 17 satellites in Angola.

As well as pursuing growth options, Equinor is focused on continuing to deliver on cost improvements across its international portfolio, reducing carbon emissions and implementing digital solutions to maximise value.

In the United States, Equinor continued to focus on increasing and sustaining the profitability of existing assets in the portfolio, achieving a portfolio net operating income break-even below the target of USD 50 per barrel and contributing substantial positive cash flow. In Brazil, Equinor is sustaining and growing a competitive portfolio of high-quality assets in all development phases, including a strong exploration portfolio.

More information on assets in operations and projects under development internationally is provided in section 2.4 E&P International – Exploration & Production International.

New energy solutions – Create a material new industrial position

Equinor continues to explore new business opportunities in offshore wind, solar, hydrogen and carbon capture and storage (CCS). Equinor is building a new energy portfolio and expects 15-20% of its investments to be directed towards new energy solutions by 2030.

The development of the Arkona offshore wind farm (operated by E.ON) is progressing and is expected to be in full operation in 2019. Equinor has also acquired three early phase offshore wind projects in Poland during 2018: MFW Bałtyk I, II and III. In the US, Equinor continues to mature the New York Wind energy area and will bid for offtake contracts both in New York and New Jersey. In 2018, Equinor acquired one of three offshore wind leases offered outside Massachusetts and a minority stake in Scatec Solar.

Equinor is operating three offshore windfarms in the UK: Sheringham Shoal, Dudgeon and Hywind Scotland. The Apodi solar plant in Brazil (operated by Scatec Solar) started commercial operations in November 2018. In 2018, Equinor Energy Ventures continued its investments in potential high-impact technologies supporting the company’s strategy of growth in new energy solutions.

More information on new energy assets in operation and projects under development is provided in section 2.6 Other group.

Equinor, Annual Report on Form 20-F 2018 17

Midstream and marketing – Secure premium market access and grow value creation through cycles

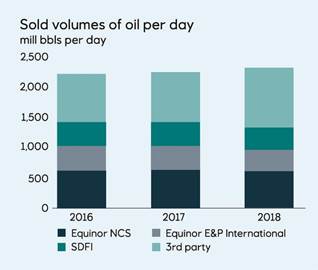

The main objective for Equinor’s Midstream, Marketing & Processing unit’s (MMP) mid- and downstream activities is to process and transport its oil and gas production (including the Norwegian State’s petroleum) competitively to premium markets, securing maximum value realisation. In addition, MMP is expanding its marketing of a small, but growing electricity portfolio. Focus in 2018 has been on:

· Safe, secure and efficient operations

· Securing flow assurance and premium market access for Equinor’s equity production and the Norwegian State’s direct financial interest volumes

· Building and maintaining resilience through asset backed trading, value chain positioning and counter-cyclical actions

· Reducing carbon emissions and intensity

· Focus on regional piped gas value chains and pursue selective trading positions in liquefied natural gas (LNG)

In 2018, Equinor announced the acquisition of Danske Commodities and closed the transaction in the beginning of 2019. This is strengthening the company’s ability to capture value from its current and future equity production of renewable energy and supports Equinor’s aim to grow in new energy solutions. Equinor has continued to take positions to strengthen its asset backed trading business and focused on renewing its contracted shipping portfolio. More information on mid- and downstream activities is provided in section 2.5 MMP – Marketing, Midstream & Processing.

Group outlook

Equinor’s plans address the current business environment while continuing to invest in high-quality projects. Equinor continues to reiterate its efforts and commitment to deliver on its strategy.

· Organic capital expenditures1 for 2019 are estimated at around USD 11 billion

· Equinor intends to continue to mature its large portfolio of exploration assets and estimates a total exploration activity level of around USD 1.7 billion for 2019, excluding signature bonuses

· Equinor’s ambition is to keep the unit of production cost in the top quartile of its peer group

· For the period 2019 – 2025, production growth2 is expected to come from new projects resulting in around 3% CAGR (Compound annual growth rate)

· Production for 2019 is estimated to be around the 2018 level

· Scheduled maintenance activity is estimated to reduce quarterly production by approximately 15 mboe per day in the first quarter of 2019. In total, maintenance is estimated to reduce equity production by around 40 mboe per day for the full year of 2019

These forward-looking statements reflect current views about future events and are, by their nature, subject to significant risks and uncertainties because they relate to events and depend on circumstances that will occur in the future. Deferral of production to create future value, gas off-take, timing of new capacity coming on stream, operational regularity, activity level in the US onshore, as well as uncertainty around the closing of the announced transactions represent the most significant risks related to the foregoing production guidance. For further information, see section 5.7 Forward-looking statements.

1 See section 5.2 for non-GAAP measures.

2 The production guidance reflects our estimates of proved reserves calculated in accordance with US Securities and Exchange Commission (SEC) guidelines and additional production from other reserves not included in proved reserves estimates. The growth percentage is based on historical production numbers, adjusted for portfolio measures.

18 Equinor, Annual Report on Form 20-F 2018

History in brief

“ | Equinor has grown along with the emergence of the Norwegian oil and gas industry, dating back to the late 1960s. Today, Equinor are evolving into a broad energy company, with a significant and growing renewables business. |

On 18 September 1972, Equinor, formerly Statoil, was formed by a decision of the Norwegian parliament and incorporated as a limited liability company under the name Den norske stats oljeselskap AS. Owned 100% by the Norwegian State, Equinor's initial role was to be the government's commercial instrument in the development of the oil and gas industry in Norway. Growing in parallel with the Norwegian oil and gas industry, Equinor’s operations were primarily focused on exploration, development and production of oil and gas on the Norwegian continental shelf (NCS).

Two years later the Statfjord field was discovered in the North Sea. In 1979, the Statfjord field commenced production, and in 1981 Equinor was the first Norwegian company to be given operatorship for a field, at Gullfaks in the North Sea.

During the 1980s and 1990s, Equinor grew substantially through the development of the NCS (Statfjord, Gullfaks, Oseberg, Troll and others). Equinor also became a major player in the European gas market by entering into large sales contracts for the development and operation of gas transport systems and terminals. During the same decade, Equinor was involved in manufacturing and marketing in Scandinavia and established a comprehensive network of service stations. This line of business was fully divested in 2012.

In 2001, Equinor was listed on the Oslo and New York stock exchanges and became a public limited company under the name Statoil ASA, now Equinor ASA, 67% majority owned by the Norwegian State. Equinor’s ability to fully realise the potential of the NCS and grow internationally was strengthened through the merger with Hydro's oil and gas division on 1 October 2007.

Equinor’s business has grown as a result of substantial investments on the NCS and internationally. Equinor has delivered the world’s longest multiphase pipelines on the Ormen Lange and Snøhvit gas fields, and the giant Ormen Lange development project was completed in 2007. Equinor has also expanded into Algeria, Angola, Azerbaijan, Brazil, Nigeria, UK, the US Gulf of Mexico, among others. The US onshore operations are the largest international production outside Norway, and with the Peregrino field, we are the largest international operator in Brazil.

In addition, our access to crude oil in the form of equity, governmental and third-party volumes make Equinor a large seller of crude oil, and Equinor is the second-largest supplier of natural gas to the European market. Processing, refining, offshore wind and carbon capture and storage are also part of our operations.

In recent years, Equinor has utilised its expertise to design and manage operations in various environments to grow upstream activities outside the traditional area of offshore production. This includes the development of shale oil and gas projects.

As part of Equinor’s strategy, the company is investing actively in new energy, such as offshore wind, and solar energy, in order to expand energy production, strengthen energy security and combat climate change.

In 2018, Statoil ASA changed its name to Equinor ASA following approval of the name change by the company’s annual general meeting on 15 May 2018. The new name supports the company’s strategy and development as a broad energy company in addition to reflecting Equinor’s evolution and identity as a company for the generations to come.

Equinor, Annual Report on Form 20-F 2018 19

“ | Equinor is among the world’s largest offshore operators, the second-largest gas exporter to Europe, and a growing force in renewables. Equinor is the world leader in carbon capture, storage and carbon efficiency in oil and gas production. While seeking to satisfy growing energy demand, Equinor recognises the need to minimise impact on the environment. |

Equinor operates in more than 30 countries and employs 20,525 people worldwide.

Equinor’s registered office is at Forusbeen 50, 4035 Stavanger, Norway. The telephone number of its registered office is +47 51 99 00 00.

Equinor’s competitive position

Key factors affecting competition in the oil and gas industry are oil and gas supply and demand, exploration and production costs, global production levels, alternative fuels, and environmental and governmental regulations. When acquiring assets and licences for exploration, development and production and in refining, marketing and trading of crude oil, natural gas and related products, Equinor competes with other integrated oil and gas companies.

Equinor continues to explore new business opportunities in offshore wind, solar, hydrogen and carbon capture and storage (CCS). Improvements in cost and technology for renewables have rapidly changed the landscape. Equinor competes with other companies within the renewable business.

Equinor's ability to remain competitive will depend, among other things, on continuous focus on reducing costs and improving efficiency. It will also depend on technological innovation to maintain long-term growth in reserves and production, the ability to seize opportunities in new areas and utilise new opportunities for digitalisation.

The information about Equinor's competitive position in the strategic report is based on a number of sources; e.g. investment analyst reports, independent market studies, and internal assessments of market share based on publicly available information about the financial results and performance of market players.

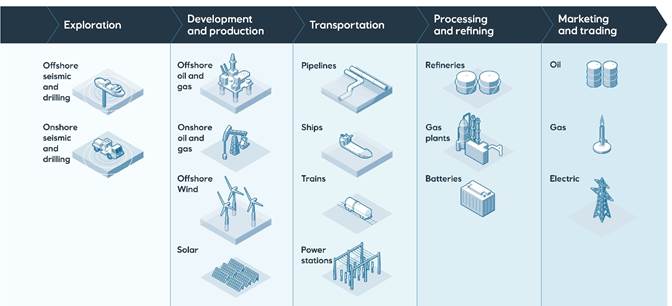

Corporate structure

Equinor is a broad international energy company, its value chain includes all phases from exploration of hydrocarbons through developing, production and manufacturing marketing and trading, while growing the renewables business. Equinor consists of eight business areas, staffs and support divisions.

Equinor’s value chain

Equinor’s operations are managed through eight business areas: Development & Production Norway (DPN), Development & Production International (DPI), Development & Production Brazil (DPB), Marketing, Midstream & Processing (MMP), New Energy Solutions (NES), Technology, Projects & Drilling (TPD), Exploration (EXP) and Global Strategy & Business Development (GSB). With

20 Equinor, Annual Report on Form 20-F 2018

effect from the third quarter 2018, DPB is a new business area, and former Development & Production USA (DPUSA) is included in DPI.

On 28 April 2018, Equinor announced changes of its business area structure to strengthen its ability to deliver on Equinor’s always safe, high value and low carbon strategy as it develops as a broad energy company. Brazil was established as a separate business area representing a new core area, holding promising offshore oil and gas basins with a significant resource base. Equinor’s US operations were integrated in DPI as US operations have been maturing over the last few years. Equinor is pursuing unconventional onshore business opportunities globally and sees synergies in having US onshore operations which are organised within DPI.

Development & Production Norway (DPN)

Managing Equinor’s upstream activities on the NCS, DPN explores for and extracts crude oil, natural gas and natural gas liquids in the North Sea, the Norwegian Sea and the Barents Sea. DPN aims to ensure safe and efficient operations and transform the NCS to deliver sustainable value for many decades. DPN is shaping the future of the NCS with a digital transformation and solutions to achieve a lower carbon footprint and high recovery rates.

Development & Production International (DPI)

DPI manages Equinor’s worldwide upstream activities in all countries outside Norway and Brazil. DPI operates across six continents covering offshore and onshore exploration and extraction of crude oil, natural gas and natural gas liquids; and implementing rigorous safety standards, technological innovations and environmental awareness. DPI's intent is to build and grow a competitive international portfolio - always safe, high value and low carbon.

Development & Production Brazil (DPB)

DPB manages the development and production of oil and gas resources in Brazil, which has been defined as a core area for long-term growth. Equinor has a diverse portfolio with activities in all development stages from exploration to production. Most of Brazil licences are in deep-water areas, some of them more than 2,900 metres deep. Equinor has been producing in Brazil since 2011 with the Peregrino field, in the Campos Basin. DPB's intent is to grow a competitive portfolio creating value by increasing capacity and increasing recovery from mature fields; reducing emissions and safety as priority.

Marketing, Midstream & Processing (MMP)

MMP works to maximise the value creation in Equinor’s global mid- and downstream positions. MMP is responsible for global marketing and trading of crude, petroleum products, natural gas and electricity, including marketing of the Norwegian State’s natural gas and crude on the Norwegian continental shelf. MMP is also responsible for onshore plants, transportation and for the development of value chains to ensure flow assurance for Equinor’s upstream production and to maximise value creation.

Technology, Projects & Drilling (TPD)

TPD is responsible for field development, well deliveries, technology development and procurement in Equinor. TPD delivers safe, secure and efficient field development, including well construction, founded on world-class project execution and technology excellence. TPD utilises innovative technologies, digital solutions and carbon-efficient concepts to shape a competitive project portfolio at the forefront of the energy industry transformation. Sustainable value is being created together with suppliers through a simplified and standardised fit-for-purpose approach.

Exploration (EXP)

EXP manages Equinor’s worldwide exploration activities with the aim of positioning Equinor as one of the leading global exploration companies. This is achieved through accessing high potential new acreage in priority basins, globally prioritising and drilling more significant wells in growth and frontier basins, delivering near-field exploration on the NCS and other select areas, and achieving step-change improvements in performance.

New Energy Solutions (NES)

NES reflects Equinor’s long-term goal to complement Equinor’s oil and gas portfolio with profitable renewable energy and other low-carbon energy solutions. NES is responsible for wind farms and carbon capture and storage as well as other renewable energy and low-carbon energy solutions. NES aims to do this by combining Equinor’s oil and gas competence, project delivery capacities and ability to integrate technological solutions.

Global Strategy & Business Development (GSB)

GSB develops the corporate strategy and manages business development and merger and acquisition activities for Equinor. The ambition of the GSB business area is to closely link corporate strategy, business development and merger and acquisition activities to actively drive Equinor's corporate development.

Equinor, Annual Report on Form 20-F 2018 21

Segment reporting

The business areas DPI and DPB are aggregated into the reporting segment Exploration & Production International (E&P International). The aggregation has its basis in similar economic characteristics, such as the assets’ long term and capital-intensive nature and exposure to volatile oil and gas commodity prices, the nature of products, service and production processes, the type and class of customers, the methods of distribution and regulatory environment. The reporting segments Exploration & Production Norway (E&P Norway) and MMP consists of the business areas DPN and MMP respectively. The business areas NES, GSB, TPD, EXP and corporate staffs and support functions are aggregated into the reporting segment “Other” due to the immateriality of these areas. The changes in the business area structure had no effect on the reporting segments.

Most of costs within the business areas GSB, TPD and EXP are allocated to the E&P International, E&P Norway and MMP reporting segments. Activities relating to the EXP business area are fully allocated to the relevant exploration and production reporting segments. Activities relating to the TPD, GSB business areas and corporate staffs and support functions are partly allocated to the relevant exploration and production and MMP reporting segments.

Internal transactions in oil and gas volumes occur between reporting segments before being sold in the market. The pricing policy for internal transfers is based on estimated market prices. For further information, see section 2.8 Operational performance under Production volumes and prices.

Equinor eliminates intercompany sales when combining the results of reporting segments. Intercompany sales include transactions recorded in connection with oil and natural gas production in the E&P Norway and the E&P International reporting segments, and in connection with the sale, transportation or refining of oil and natural gas production in the MMP reporting segment. Certain types of transportation costs are reported in both the MMP and the E&P International segments.

The E&P Norway segment produces oil and natural gas which is sold internally to the MMP segment. A large share of the oil produced by the E&P International segment is also sold through the MMP segment. The remaining oil and gas from the E&P International segment is sold directly in the market. For intercompany sales and purchases, Equinor has established a market-based transfer pricing methodology for the oil and natural gas that meets the requirements for applicable laws and regulations.

In 2018, the average transfer price for natural gas was USD 5.65 per mmbtu. The average transfer price was USD 4.33 per mmbtu in 2017 and USD 3.42 in 2016. For the oil sold from the E&P Norway segment to the MMP segment, the transfer price is the applicable market-reflective price minus a cost recovery rate.

22 Equinor, Annual Report on Form 20-F 2018

The following table shows certain financial information for the four reporting segments, including intercompany eliminations for each of the years in the three-year period ending 31 December 2018.

For additional information, see note 3 Segments to the Consolidated financial statements.

Presentation

In the following sections of this report, the description of the operations and financial review are discussed following the reporting segments presentation.

As required by the SEC, Equinor prepares its disclosures about oil and gas reserves and certain other supplementary oil and gas disclosures based on geographic areas. Equinor’s geographical areas are defined by country and continent and consist of Norway, Eurasia excluding Norway, Africa, US and Americas excluding US.

Segment performance | | | |

| | | | |

| For the year ended 31 December |

(in USD million) | 2018 | 2017 | 2016 |

| | | | |

Exploration & Production Norway | | | |

Total revenues and other income | 22,475 | 17,692 | 13,077 |

Net operating income/(loss) | 14,406 | 10,485 | 4,451 |

Non-current segment assets1) | 30,762 | 30,278 | 27,816 |

| | | | |

Exploration & Production International | | | |

Total revenues and other income | 12,399 | 9,256 | 6,657 |

Net operating income/(loss) | 3,802 | 1,341 | (4,352) |

Non-current segment assets1) | 38,672 | 36,453 | 36,181 |

| | | | |

Marketing, Midstream & Processing | | | |

Total revenues and other income | 75,794 | 59,071 | 44,979 |

Net operating income/(loss) | 1,906 | 2,243 | 623 |

Non-current segment assets1) | 5,148 | 5,137 | 4,450 |

| | | | |

Other | | | |

Total revenues and other income | 280 | 87 | 39 |

Net operating income/(loss) | (79) | (239) | (423) |

Non-current segment assets1) | 353 | 390 | 352 |

| | | | |

Eliminations2) | | | |

Total revenues and other income | (31,355) | (24,919) | (18,880) |

Net operating income/(loss) | 103 | (59) | (219) |

Non-current segment assets1) | - | - | - |

| | | | |

Equinor group | | | |

Total revenues and other income | 79,593 | 61,187 | 45,873 |

Net operating income/(loss) | 20,137 | 13,771 | 80 |

Non-current segment assets1) | 74,934 | 72,258 | 68,799 |

| | | | |

1) | Equity accounted investments, deferred tax assets, pension assets and non-current financial assets are not allocated to segments. |

2) | Includes elimination of inter-segment sales and related unrealised profits, mainly from the sale of crude oil and products. Inter-segment revenues are based upon estimated market prices. |

| |

Equinor, Annual Report on Form 20-F 2018 23

The following tables show total revenues and other income by country.

2018 Total revenues and other income by country | Crude oil | Natural gas | Natural gas liquids | Refined products | Other | Total sales |

(in USD million) |

| | | | | | |

Norway | 30,221 | 12,441 | 5,969 | 8,299 | 1,483 | 58,412 |

US | 9,113 | 1,575 | 1,198 | 1,790 | 444 | 14,120 |

Denmark | 0 | 0 | 0 | 2,533 | 22 | 2,556 |

United Kingdom | 653 | 0 | 0 | 0 | 124 | 777 |

Other | 962 | 543 | 0 | 502 | 1,430 | 3,436 |

| | | | | | |

Total revenues and other income1) | 40,948 | 14,559 | 7,167 | 13,124 | 3,503 | 79,301 |

| | | | | | |

2017 Total revenues and other income by country | Crude oil | Natural gas | Natural gas liquids | Refined products | Other | Total sales |

(in USD million) |

| | | | | | |

Norway | 23,087 | 9,741 | 4,948 | 6,463 | 1,026 | 45,264 |

US | 5,726 | 1,237 | 668 | 1,497 | 1,237 | 10,365 |

Sweden | 0 | 0 | 0 | 1,268 | 10 | 1,277 |

Denmark | 0 | 0 | 0 | 2,195 | 12 | 2,208 |

Other | 706 | 442 | 31 | 0 | 705 | 1,884 |

| | | | | | |

Total revenues and other income1) | 29,519 | 11,420 | 5,647 | 11,423 | 2,990 | 60,999 |

| | | | | | |

| | | | | | |

2016 Total revenues and other income by country | Crude oil | Natural gas | Natural gas liquids | Refined products | Other | Total sales |

(in USD million) |

| | | | | | |

Norway | 20,544 | 7,973 | 3,580 | 4,135 | (497) | 35,735 |

US | 3,073 | 957 | 455 | 1,110 | 867 | 6,463 |

Sweden | 0 | 0 | 0 | 1,379 | (53) | 1,326 |

Denmark | 0 | 0 | 0 | 1,518 | 14 | 1,532 |

Other | 690 | 272 | 1 | 0 | (26) | 936 |

| | | | | | |

Total revenues and other income1) | 24,307 | 9,202 | 4,036 | 8,142 | 305 | 45,993 |

|

1) Excluding net income (loss) from equity accounted investments |

| | | | | | |

| | | | | | |

Research and development

Equinor is a technology-intensive company and research and development is an integral part of our strategy. The technology strategy is about prioritising technology for value creation that enables growth and access, and sets the direction for technology development and implementation for the future. The focus is on low cost, low carbon solutions and re-using standardised technologies.

We continuously research, develop and deploy innovative technologies to create opportunities and enhance the value of Equinor’s current and future assets. Equinor’s technology development activities aim to reduce field development, drilling and operating costs, and CO2 and other greenhouse gas emissions. We utilise a range of tools for the development of new technologies:

· In-house research and development

· Cooperation with academia and research institutes

· Collaborative development projects with major suppliers

· Project related development as part of field development activities

· Direct investment in technology start-up companies through Equinor Technology Invest venture activities

· Invitation to open innovation challenges as part of Equinor Innovate

24 Equinor, Annual Report on Form 20-F 2018

For additional information, see note 7 Other expenses to the Consolidated financial statements.

Equinor, Annual Report on Form 20-F 2018 25

Key figures | | | | | |

| | | | | | |

(in USD million, unless stated otherwise) | For the year ended 31 December |

2018 | 2017 | 2016 | 2015 | 2014 |

| | | | | | |

Financial information | | | | | |

Total revenues and other income | 79,593 | 61,187 | 45,873 | 59,642 | 99,264 |

Operating expenses | (9,528) | (8,763) | (9,025) | (10,512) | (11,657) |

Net operating income/(loss) | 20,137 | 13,771 | 80 | 1,366 | 17,878 |

Net income/(loss) | 7,538 | 4,598 | (2,902) | (5,169) | 3,887 |

Non-current finance debt | 23,264 | 24,183 | 27,999 | 29,965 | 27,593 |

Net interest-bearing debt before adjustments | 11,130 | 15,437 | 18,372 | 13,852 | 12,004 |

Total assets | 112,508 | 111,100 | 104,530 | 109,742 | 132,702 |

Total equity | 42,990 | 39,885 | 35,099 | 40,307 | 51,282 |

Net debt to capital employed ratio before adjustments1) | 20.6% | 27.9% | 34.4% | 25.6% | 19.0% |

Net debt to capital employed ratio adjusted1) | 22.2% | 29.0% | 35.6% | 26.8% | 20.0% |

ROACE2) | 12.0% | 8.2% | (0.4%) | 4.1% | 8.7% |

| | | | | | |

Operational data | | | | | |

Equity oil and gas production (mboe/day) | 2,111 | 2,080 | 1,978 | 1,971 | 1,927 |

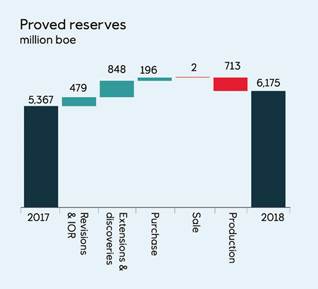

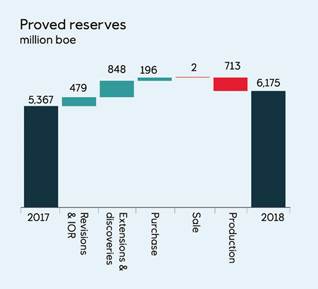

Proved oil and gas reserves (mmboe) | 6,175 | 5,367 | 5,013 | 5,060 | 5,359 |

Reserve replacement ratio (annual) | 2.13 | 1.50 | 0.93 | 0.55 | 0.62 |

Reserve replacement ratio (three-year average) | 1.53 | 1.00 | 0.70 | 0.81 | 0.97 |

Production cost equity volumes (USD/boe) | 5.2 | 4.8 | 5.0 | 5.9 | 7.6 |

Average Brent oil price (USD/bbl) | 71.1 | 54.2 | 43.7 | 52.4 | 98.9 |

| | | | | | |

Share information3) | | | | | |

Diluted earnings per share (in USD) | 2.27 | 1.40 | (0.91) | (1.63) | 1.21 |

Share price at OSE (Norway) on 31 December (in NOK) | 183.75 | 175.20 | 158.40 | 123.70 | 131.20 |

Share price at NYSE (USA) on 31 December (in USD) | 21.17 | 21.42 | 18.24 | 13.96 | 17.61 |

Dividend paid per share (in USD)4) | 0.91 | 0.88 | 0.88 | 0.90 | 1.73 |

Weighted average number of ordinary shares outstanding (in millions) | 3,326 | 3,268 | 3,195 | 3,179 | 3,180 |

| | | | | | |

1) | See section 5.2 Use and reconciliation of non-GAAP financial measures for net debt to capital employed ratio. |

2) | See section 5.2 Use and reconciliation of non-GAAP financial measures for return on average capital employee (ROACE). |

3) | See section 5.1 Shareholder information for a description of how dividends are determined and information on share repurchases. |

4) | Dividends for the third and fourth quarter 2017 and the first and second quarter 2018 were paid in 2018. Dividend paid in 2014 includes yearly dividend related to 2013 and two quarterly dividends related to 2014 due to change from yearly to quarterly dividend. From and including the third quarter of 2015, dividends were declared in USD. Dividends in previous periods were declared in NOK. Figures for 2015 and earlier periods are presented using the Central Bank of Norway year end rates for NOK. |

26 Equinor, Annual Report on Form 20-F 2018

2.3Exploration & Production Norway

(E&P Norway) |

Overview

The Exploration & Production Norway segment covers exploration, field development and operations on the NCS, which includes the North Sea, the Norwegian Sea and the Barents Sea. E&P Norway aims to ensure safe and efficient operations, maximising the value potential from the NCS.

For 2018, Equinor reports production on the NCS from 40 Equinor-operated fields, 10 partner-operated fields, as well as equity-accounted production from Lundin Petroleum AB.

Key events and portfolio developments in 2018 and early 2019:

· Equinor was on 16 January 2018 awarded 31 licences (17 as operator) on the NCS in the Awards for predefined areas round 2017 for mature areas

· Equinor acquired Total’s equity share of the Martin Linge oil and gas field development, effective as of 1 January, and assumed operatorship on 19 March

· A subsea development of the Askeladd gas /condensate discovery near the Snøhvit field in the Barents Sea was sanctioned on 7 March

· Two newbuild category J jack-up rigs were brought in operation: Askepott started drilling on 25 February, spudding the first well at the new field Oseberg Vestflanken 2. The second rig, Askeladden, started operations at Gullfaks on 26 March. These newbuilds increase the safety and efficiency of drilling operations

· In the 24th concession round for frontier areas Equinor was on 18 June awarded seven licences (five as operator) in the Norwegian Sea and the Barents Sea

· The Ministry of Petroleum and Energy approved the Plan for development and operation of the Johan Castberg oil field in the Barents Sea on 28 June

· The Ministry of Petroleum and Energy on 5 July approved the plan for development and operation of Snorre Expansion, expected to increase the oil recovery from the Snorre field and extend field life beyond 2040

· Visund Nord improved oil recovery came on stream on 2 September. This record fast-track development took 21 months from concept selection until production started and will provide additional oil barrels from Visund, 6% more than originally estimated

· A new gas treatment module Z at Troll B came on stream on 22 September, expected to boost production at Troll B by 4.7 million barrels of oil

· The power solution which will provide the Johan Sverdrup field with electric power from Kårstø through an 80 kV submarine cable, was officially opened on 9 October

“ | Oseberg Vestflanken 2 achieved first oil on 14 October. The new Oseberg H platform is Norway’s first unmanned platform and will be remotely controlled from the Oseberg field centre |

Equinor, Annual Report on Form 20-F 2018 27

· Equinor announced on 15 October the sales of its equity share in two gas and condensate discoveries in the Ekofisk area of the NCS. An operated interest in King Lear was sold to Aker BP for USD 250 million, and a non-operated interest in Tommeliten to PGNiG for USD 220 million. The transactions were completed on 28 December

· Strengthening the position in the Norwegian Sea, Equinor on 5 December agreed with Faroe Petroleum on several swap transactions with no cash considerations, effective as of 1 January 2019. The transactions increase Equinor’s equity share of the prolific Njord area and reduce its share in non-core assets

· The Ministry of Petroleum and Energy approved on 7 December the plan for development and operation of Troll phase 3, expected to boost gas recovery from the Troll field and extend field life beyond 2050

· The power solution which will provide the Martin Linge field with electric power from Kollsnes through the 100 kV alternating current 163-km submarine cable, was connected on 12 December. This is the world’s longest high-voltage alternating current submarine cable

· The Government issued a white paper to the Norwegian parliament on 14 December, recommending approval of the plan for development and operation of the second phase of the Johan Sverdrup oil and gas field, Norway’s largest industrial project. The plan was submitted to the Ministry of Petroleum and Energy on 27 August

“ | First gas from the Aasta Hansteen field in the Norwegian Sea was achieved on 16 December. At 1,300 metres, the development is the deepest ever on the NCS. The gas is piped from three subsea templates to the floating platform and transported in the Polarled pipeline to the Nyhamna processing plant in Norway for further export through the Langeled pipeline to the UK. The subsea development of the adjacent Snefrid North discovery is underway and will be tied in to the Aasta Hansteen platform |

28 Equinor, Annual Report on Form 20-F 2018

· The plan for development and operation of Shetland/Lista phase 2 was submitted to the Ministry of Petroleum and Energy on 15 January 2019. Water injection and new horizontal wells are expected to boost production at Gullfaks by 17 million barrels of oil

· Equinor was on 15 January 2019 awarded 29 licences (13 as operator) on the NCS in the Awards for predefined areas round 2018 for mature areas

· Two new onshore digital support centres, expected to increase value creation, improve safety and lower emissions from Equinor’s installations on the NCS, were officially opened at Sandsli, Bergen, on 7 January 2019. Within a few years, all Equinor-operated fields on the NCS will be supported by onshore operational centres

· Equinor and its partners made nine commercial discoveries on the NCS in 2018

Demonstration of the digital twin of the Valemon platform, remotely controlled from Bergen, Norway.

Equinor, Annual Report on Form 20-F 2018 29

Major producing fields and field developments operated by Equinor and Equinor’s licence partners

Fields in production on the NCS

The table below shows E&P Norway's average daily entitlement production for the years ending 31 December 2018, 2017 and 2016. Production in 2018 decreased owing to natural decline and higher losses associated with turnarounds.

Average daily entitlement production | | | | | | | | | | |

| | | | | | | | | | | |

| For the year ended 31 December |

| 2018 | | 2017 | | 2016 |

| Oil and NGL | Natural gas | | | Oil and NGL | Natural gas | | | Oil and NGL | Natural gas | |

Area production | mbbl/day | mmcm/day | mboe/day | | mbbl/day | mmcm/day | mboe/day | | mbbl/day | mmcm/day | mboe/day |

| | | | | | | | | | | |

Equinor operated fields | 470 | 99 | 1,090 | | 505 | 100 | 1,136 | | 511 | 86 | 1,049 |

Partner operated fields | 79 | 16 | 181 | | 70 | 17 | 179 | | 70 | 17 | 177 |

Equity accounted production | 16 | - | 16 | | 19 | - | 19 | | 8 | - | 8 |

| | | | | | | | | | | |

Total | 565 | 115 | 1,288 | | 594 | 118 | 1,334 | | 589 | 103 | 1,235 |

30 Equinor, Annual Report on Form 20-F 2018

The following tables show the NCS entitlement production by fields in which Equinor was participating during the year ended 31 December 2018.

Equinor operated fields, average daily entitlement production | | | | | |

| | | | | | | |

| Geographical area | Equinor's equity interest in % | | On stream | Licence expiry date | | Average production in 2018 mboe/day |

| |

Field | |

| | | | | | | |

Troll Phase 1 (Gas) | The North Sea | 30.58 | | 1996 | 2030 | | 207 |

Gullfaks | The North Sea | 51.00 | | 1986 | 2036 | | 99 |

Åsgard | The Norwegian Sea | 34.57 | | 1999 | 2030 | 7) | 85 |

Oseberg | The North Sea | 49.30 | | 1988 | 2031 | | 76 |

Visund | The North Sea | 53.20 | | 1999 | 2034 | | 76 |

Snøhvit | The Barents Sea | 36.79 | | 2007 | 2035 | | 50 |

Tyrihans | The Norwegian Sea | 58.84 | | 2009 | 2029 | | 49 |

Kvitebjørn | The North Sea | 39.55 | | 2004 | 2031 | | 47 |

Grane | The North Sea | 36.61 | | 2003 | 2030 | | 44 |

Sleipner Vest | The North Sea | 58.35 | | 1996 | 2028 | | 38 |

Troll Phase 2 (Oil) | The North Sea | 30.58 | | 1995 | 2030 | | 34 |

Snorre | The North Sea | 33.28 | | 1992 | 2040 | 1) | 31 |

Statfjord Unit | The North Sea | 44.34 | | 1979 | 2026 | | 31 |

Gina Krog | The North Sea | 58.70 | | 2017 | 2032 | | 30 |

Gudrun | The North Sea | 36.00 | | 2014 | 2028 | | 27 |

Valemon | The North Sea | 53.78 | | 2015 | 2031 | | 23 |

Mikkel | The Norwegian Sea | 43.97 | | 2003 | 2024 | | 22 |

Fram | The North Sea | 45.00 | | 2003 | 2024 | | 18 |

Kristin | The Norwegian Sea | 55.30 | | 2005 | 2027-2033 | 2) | 17 |

Alve | The Norwegian Sea | 53.00 | | 2009 | 2029 | 3) | 14 |

Vigdis area | The North Sea | 41.50 | | 1997 | 2040 | 1) | 11 |

Heidrun | The Norwegian Sea | 13.04 | | 1995 | 2024-2025 | | 9 |

Morvin | The Norwegian Sea | 64.00 | | 2010 | 2027 | | 9 |

Urd | The Norwegian Sea | 63.95 | | 2005 | 2026 | | 7 |

Tordis area | The North Sea | 41.50 | | 1994 | 2040 | 1) | 7 |

Sleipner Øst | The North Sea | 59.60 | | 1993 | 2028 | | 7 |

Norne | The Norwegian Sea | 60.00 | | 1997 | 2036 | 7) | 5 |

Gungne | The North Sea | 62.00 | | 1996 | 2028 | | 4 |

Byrding | The North Sea | 70.00 | | 2017 | 2024-2035 | | 3 |

Sigyn | The North Sea | 60.00 | | 2002 | 2022 | 1) | 2 |

Veslefrikk | The North Sea | 18.00 | | 1989 | 2020-2031 | | 2 |

Statfjord Nord | The North Sea | 21.88 | | 1995 | 2026 | | 2 |

Tune | The North Sea | 50.00 | | 2002 | 2020-2032 | | 1 |

Statfjord Øst | The North Sea | 31.69 | | 1994 | 2026-2040 | | 1 |

Heimdal | The North Sea | 29.44 | | 1985 | 2021 | | 1 |

Sygna | The North Sea | 30.71 | | 2000 | 2026-2040 | | 1 |

Aasta Hansteen | The Norwegian Sea | 51.00 | | 2018 | 2041 | 4) | 0 |

Fram H Nord | The North Sea | 49.20 | | 2014 | 2024-2035 | 4) | 0 |

Sindre | The North Sea | 52.34 | | 2017 | 2023-2034 | 4) | 0 |

Gimle | The North Sea | 65.13 | | 2006 | 2023-2034 | 4) | 0 |

| | | | | | | |

Total Equinor operated fields | | | | | 1,090 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Equinor, Annual Report on Form 20-F 2018 31

Partner operated fields, average daily entitlement production | | | | | |

| | | | | | | |

| Geographical area | Equinor's equity interest in % | Operator | On stream | Licence expiry date | | Average production in 2018 mboe/day |

| |

Field | |

| | | | | | | |

Ormen Lange | The Norwegian Sea | 25.35 | A/S Norske Shell | 2007 | 2040-2041 | | 72 |

Skarv | The Norwegian Sea | 36.17 | Aker BP ASA | 2013 | 2029-2033 | | 37 |

Ivar Aasen | The North Sea | 41.47 | Aker BP ASA | 2016 | 2029-2036 | | 27 |

Goliat | The Barents Sea | 35.00 | Vår Energi AS5) | 2016 | 2042 | 5) | 22 |

Ekofisk area | The North Sea | 7.60 | ConocoPhillips Skandinavia AS | 1971 | 2028 | | 13 |

Marulk | The Norwegian Sea | 33.00 | Vår Energi AS5) | 2012 | 2025 | 3) | 6 |

Vilje | The North Sea | 0.00 | Aker BP ASA | 2008 | 2021 | 3) | 2 |

Ringhorne Øst | The North Sea | 0.00 | Vår Energi AS6) | 2006 | 2030 | 3) | 1 |

Enoch | The North Sea | 11.78 | Repsol Sinopec North Sea Ltd. | 2007 | 2024 | 4) | 0 |

Flyndre | The North Sea | 0.00 | Maersk Oil UK Ltd. | 2017 | 2028 | 3) 4) | 0 |

| | | | | | | |

Total partner operated fields | | | | | 181 |

| | | | | | | |

Equity accounted production | | | | | | | |

Lundin Petroleum AB | | 20.10 | Lundin Petroleum AB | | | | 16 |

| | | | | | | |

Total E&P Norway including share of equity accounted production | | | 1,288 |

1) Licence extended in 2018.

2) The field has licences with different expiration dates.

3) A swap of interests was agreed with Faroe Petroleum in 2018, effective 1 January 2019. The transactions are subject to authority approval. The table reflects the new Equinor ownership share, effective 1 January 2019 for the fields Vilje, Ringhorne Øst, Marulk and Alve.

4) The production is less than 1 mboe/day.

5) Formerly Eni Norge AS.

6) Formerly Point Resources AS.

7) Licence extended in early 2019.

.

Main producing fields on the NCS

Equinor-operated fields

Troll (Equinor 30.58%) is the largest gas field on the NCS and a major oil field. The Troll field regions are connected to the Troll A, B and C platforms. Troll gas is produced mainly at Troll A, and oil mainly at Troll B and C. Fram, Fram H Nord and Byrding are tie-ins to Troll C. The third phase of the Troll field is under development.

Gullfaks (Equinor 51%) was developed with three platforms. Since production started on Gullfaks in 1986, several satellite fields have been developed with subsea wells which are remotely controlled from the Gullfaks A and C platforms. Gullfaks Shetland Lista is being developed, with drilling of seven new horizontal wells.

The Åsgard field (Equinor 34.57%) includes the Åsgard A production and storage ship for oil, the Åsgard B semi-submersible floating production platform for gas and condensate, and the Åsgard C storage vessel for oil and condensate. Åsgard C is also storage for oil produced at Kristin and Tyrihans. In 2015 Equinor started the world’s first subsea gas compression train on Åsgard. The Trestakk development will be a tie-in to Åsgard A.

The Oseberg area (Equinor 49.30%) includes the Oseberg field centre, Oseberg C, Oseberg East and Oseberg South production platforms. Oil and gas from the satellites are transported to the Oseberg field centre for processing and transportation. The new Oseberg H unmanned platform came on stream in mid-October.

32 Equinor, Annual Report on Form 20-F 2018

Partner-operated fields

Ormen Lange (Equinor 25.35%, operated by A/S Norske Shell) is a deepwater gas field in the Norwegian Sea. The well stream is transported to an onshore processing and export plant at Nyhamna. Gassco became operator of Nyhamna from 1 October 2017, with Shell as technical service provider.

Skarv (Equinor 36.17%, operated by Aker BP ASA) is an oil and gas field in the Norwegian Sea. The field development includes a floating production, storage and offloading vessel and five subsea multi-well installations.

Ivar Aasen (Equinor 41.47%, operated by Aker BP ASA) is an oil and gas field in the North Sea. The development includes a fixed steel jacket with partial processing and living quarters tied in as a satellite to Edvard Grieg for further processing and export.

Goliat (Equinor 35%, operated by Vår Energi AS, formerly Eni Norge AS) is the first oil field developed in the Barents Sea. The field consists of subsea wells tied back to a circular floating production, storage and offloading vessel. The oil is offloaded to shuttle tankers.

Ekofisk area (Equinor 7.60%, operated by ConocoPhillips Skandinavia AS) consists of the Ekofisk, Tor, Eldfisk and Embla fields.

Marulk (Equinor 33%, operated by Vår Energi AS, formerly Eni Norge AS) is a gas and condensate field developed as a tie-back to the Norne FPSO.

Exploration on the NCS

Equinor holds exploration acreage and actively explores for new resources in all three regions on the NCS, the Norwegian Sea, the North Sea and the Barents Sea.

Equinor was awarded seven licences (five as operator) in the 24th concession round for frontier areas and 29 licences (13 as operator) in the Awards for predefined areas (APA) round 2018 for mature areas and completed several farm-in transactions with other companies.

Throughout 2018, as part of the industry initiative Barents Sea exploration collaboration (BaSEC), Equinor and its partners have continued drilling wells in the Barents Sea and are planning to continue drilling in 2019.

In 2018 Equinor and its partners completed 18 exploratory wells and made nine commercial and three non-commercial discoveries in Norway.

Exploratory wells drilled1) | | | |

| | | |

| For the year ended 31 December |

| 2018 | 2017 | 2016 |

| | | |

North Sea | | | |

Equinor operated | 5 | 7 | 9 |

Partner operated | 2 | 0 | 2 |

Norwegian Sea | | | |

Equinor operated | 4 | 4 | 2 |

Partner operated | 4 | 0 | 0 |

Barents Sea | | | |

Equinor operated | 2 | 5 | 0 |

Partner operated | 1 | 1 | 1 |

Total (gross) | 18 | 17 | 14 |

|

1) Wells completed during the year, including appraisals of earlier discoveries. |

Fields under development on the NCS

Equinor’s major development projects on the NCS as of 31 December 2018:

Equinor, Annual Report on Form 20-F 2018 33

Johan Sverdrup (Equinor 40.03%, operator, with additional 4.54% indirect interest held through Lundin) is an oil and gas discovery in the North Sea. The first phase of the development will consist of 18 producers, 16 water injectors, one observation well and a field centre with four platforms: A living quarter platform, a wellhead platform with permanent drilling facility, a processing platform and a riser and utility platform. Crude oil will be exported to Mongstad through a 283-km designated pipeline, and gas will be exported to the gas processing facility at Kårstø through a 156-km pipeline via a subsea connection to the Statpipe pipeline. The laying of the 36-inch oil pipe and the 18-inch gas pipe was completed in autumn 2018. The power-from-shore solution was officially opened on 9 October 2018. As at the end of 2018, eight production wells and twelve water injection wells have been drilled. First oil is expected in late 2019.

The plan for development and operation for the second phase of the Johan Sverdrup field was submitted to the Ministry of Petroleum and Energy on 27 August. The development includes a new processing platform linked to the field centre, five new subsea templates and 28 wells. Around one fourth of the oil from the Johan Sverdrup full field will be produced in the second phase. First oil is expected in late 2022

Johan Castberg (Equinor 50%, operator) is the development of the three oil discoveries Skrugard, Havis and Drivis, located some 240 kilometres northwest of Hammerfest in the Barents Sea. The development includes a production vessel and a subsea development with 30 wells, ten subsea templates and two satellite structures. On 28 June 2018, the Norwegian authorities approved the Plan for development and operation of the field. The first steel cut for the topside of the Johan Castberg floating production, storage and offloading unit was made at Kværner’s yard at Stord in November 2018. First oil is expected in late 2022.

Martin Linge (Equinor 70%, operator from 19 March 2018) is an oil and gas field near the British sector of the North Sea. The reservoir is complex with gas under high pressure and high temperatures. Effective as of January 1, 2018, Equinor acquired Total’s interest and assumed the operatorship. The development includes a fixed steel jacket platform with processing and export facilities, with electric power to be supplied from Kollsnes. The two process modules, living quarter and flare modules were successfully installed offshore in July 2018. The power-from-shore solution was energised on 12 December 2018. First oil is expected in 2020.

Snorre expansion (Equinor 33.28%, operator) is expected to increase oil recovery from the Snorre field and extend field life beyond 2040. The Ministry of Petroleum and Energy approved the plan for development and operation on 5 July 2018. The concept consists of six subsea templates, with four well slots each. Each slot will have the possibility for either production or injection. 24 wells will be drilled, twelve production wells and twelve injection wells. First oil is expected in 2021.

Njord future (Equinor 20%, operator) is a development to enable safe, reliable and efficient exploitation of the Njord and Hyme oil discoveries through to 2040. The development includes an upgrade of the Njord A floating platform, an optimal oil export solution and drilling of ten new wells. As part of the upgrade, the platform will be prepared to bring the nearby fields Bauge and Fenja on stream. The Plan for development and operation was approved on 20 June 2017. First oil is expected in late 2020.

Ærfugl (Equinor 36.17%, operated by Aker BP) is the development of the gas and condensate discoveries Ærfugl and Snadd Outer fields in the Norwegian Sea, near the Skarv field, some 200 km west of Sandnessjøen. The field is being developed in two phases and includes six new production wells which will be tied into the Skarv floating production, storage and offloading vessel for processing and storage. The Ministry of Petroleum and Energy approved the plan for development and operation on 6 April 2018. The operator plans for first gas in late 2020.

Troll phase 3 (Equinor 30.58%, operator) is expected to increase gas recovery from the Troll field and extend field life beyond 2050. The Ministry of Petroleum and Energy approved the plan for development and operation on 7 December 2018. The subsea development includes two subsea templates, eight production wells, a 36-inch export pipeline and a new process module on the Troll A platform. First gas is expected in 2021.

Askeladd (Equinor 36.79%, operator) is the next plateau extender of the Snøhvit gas field in the Barents Sea. The development includes two subsea templates, a 42-km tie-back to Snøhvit and drilling of three gas producers. The project was sanctioned in March 2018. First gas is expected in late 2020.

Trestakk (Equinor 59.1%, operator) is an oil discovery with associated gas on Haltenbanken in the Norwegian Sea. It will be developed as a subsea tie-back to Åsgard A, comprising one subsea template and one satellite with three producers and two injectors. In March 2017, the Plan for development and operation was approved by the Norwegian authorities. During summer 2018, subsea production systems and pipelines were installed at the field. The first well of the Trestakk field development was spudded in November 2018. First oil is expected in 2019.

Utgard (Equinor 38.44% interest in the Norwegian and 38% in the UK sector, operator) is a gas and condensate discovery. The development includes two wells in a standard subsea concept, with one drilling target on each side of the UK-Norwegian maritime border in the North Sea. Gas and condensate will be piped through a new 21-km pipeline to the Sleipner field for processing and further transportation to market. In January 2017, the Plan for development and operation and the field development plan were approved by the Norwegian and UK authorities. The first well of the Utgard field development was spudded in September 2018. First gas is expected in second half of 2019.

34 Equinor, Annual Report on Form 20-F 2018

Decommissioning on the NCS

Under the Petroleum Act, the Norwegian government has imposed strict procedures for removal and disposal of offshore oil and gas installations. The convention for the protection of the marine environment of the Northeast Atlantic (OSPAR) stipulates similar procedures.

Volve (Equinor formerly 59.6%, operator) ceased production in September 2016, after more than eight years in production. The permanent plugging of wells was finalised during 2016, and the removal of the subsea facilities was completed in 2018. On 14 June 2018,

“ | Equinor and its partners announced the disclosure of all subsurface and operating data from Volve, to foster research, study, development and innovation. This is the most comprehensive NCS data release ever made. |

Huldra (Equinor 70%, operator) ceased production in September 2014, after 13 years in production. The permanent plugging and abandonment of wells was finalised in 2017, and the platform removal will take place in 2019.

Ekofisk (Equinor 7.6%, operated by ConocoPhillips Skandinavia AS): In the third removal campaign, some installations will be removed in 2019.

For further information about decommissioning, see note 2 Significant accounting policies to the Consolidated financial statements.

Equinor, Annual Report on Form 20-F 2018 35

2.4Exploration & Production International(E&P International) |

Overview

Equinor is present in several of the most important oil and gas provinces in the world. The E&P International segment covers development and production of oil and gas outside the Norwegian continental shelf (NCS).

E&P International is present in nearly 30 countries and had production in 12 countries in 2018. E&P International produced 39% of Equinor’s total equity production of oil and gas in 2018, compared to 36% in 2017. For information about proved reserves development see section 2.8 Operational Performance under Proved oil and gas reserves.

Bakken in North Dakota, US

Key events and portfolio developments in 2018 and early 2019:

· On 31 January, Equinor finalised the farm-in transaction for a 50% share in the Deepwater Durban licence in South Africa

· On 21 March, Equinor was awarded five leases in the US Gulf of Mexico

· On 29 March, Equinor in a consortium comprising other partners was awarded four blocks offshore Brazil in the Campos basin in the 15th licensing round

· On 29 March, the extension of In Amenas licence in Algeria from 2022 to 2027 with a restated production sharing agreement (PSA) was formally approved by authorities

· On 10 April, Equinor completed the acquisition of 40% non-operated interest in the North Platte deep water discovery in the US Gulf of Mexico from Cobalt International Energy, with an effective date of 1 January 2018. Total is the operator

· On 23 May, Equinor was awarded nine new licences in the 30th offshore licensing round on the UK continental shelf, eight as operator and one as partner

· On 30 May, Equinor and Azerbaijan’s state oil company SOCAR signed a risk service agreement related to the appraisal and development of the Karabagh oil field and a PSA for the Ashrafi, Dan Ulduzu, Aypara area

· On 5 June, the transactions for Equinor’s sales of equity shares to ExxonMobil and Galp in the BM-S-8 block in the Santos basin, Brazil, were closed. Equinor agreed on 4 July additional equity share transactions with its partners in the BM-S-8 block, pending approval. Equinor will own a 40% operated interest in the neighbouring BM-S-8 and Carcará North blocks following the approval

· On 7 June, Equinor in a consortium comprising other partners won 28% interest in the Uirapuru block in the Santos basin and 25% in Dois Irmãos block in the Campos basin in the 4th production sharing bidding round in Brazil. Petrobras is the operator of both blocks

· On 14 June, Equinor and Petrobras completed their transaction, whereby Equinor acquired a 25% non-operated interest in the Roncador oil field in Brazil’s Campos basin. Petrobras retains operatorship and a 75% interest. The effective date for the Roncador transaction is 1 January 2018

· On 15 August, Equinor was awarded 16 leases in US Gulf of Mexico

36 Equinor, Annual Report on Form 20-F 2018

“ | Equinor acquired 40% interest and assumed operatorship of Rosebank, one of the largest undeveloped fields on the UK continental shelf. The transaction was closed on 10 January 2019. |

· On 7 November, Equinor was awarded three new licences in the Jeanne d’Arc basin, offshore Newfoundland, two as operator and one as partner

· On 23 November, Equinor completed the sale of its 17% non-operated interest in the Alba oil field on the UK continental shelf to Verus Petroleum

For more information about the transactions see note 4 Acquisitions and divestments to the Consolidated financial statements.

International production

Entitlement production volumes are Equinor’s share of the volumes distributed to the partners according to production sharing agreement (PSA) (see section 5.6 Terms and abbreviations). For US assets entitlement production is expressed net of royalty interests. For all other countries royalties paid in-cash are included in entitlement production and royalties payable in-kind are excluded. Equity production represents volumes that correspond to Equinor’s percentage ownership in a particular field and is larger than Equinor’s entitlement production if the field is governed by a PSA.

Equinor's equity production outside Norway was 39% of Equinor's total equity production of oil and gas in 2018. Equinor's entitlement production outside Norway was 34% of Equinor's total entitlement production in 2018.

The following table shows E&P International's average daily entitlement production of liquids and natural gas for the years ending 31 December 2018, 2017 and 2016.

Average daily entitlement production | | | | | | | | | |

| | | | | | | | | | | |

| For the year ended 31 December |

| 2018 | | 2017 | | 2016 |

| Oil and NGL | Natural gas | | | Oil and NGL | Natural gas | | | Oil and NGL | Natural gas | |

Production area | mboe/day | mmcm/day | mboe/day | | mboe/day | mmcm/day | mboe/day | | mboe/day | mmcm/day | mboe/day |

| | | | | | | | | | | |

Americas | 245 | 25 | 403 | | 186 | 19 | 304 | | 189 | 18 | 299 |

Africa | 168 | 6 | 209 | | 197 | 6 | 233 | | 203 | 5 | 232 |

Eurasia | 21 | 3 | 40 | | 26 | 3 | 46 | | 32 | 3 | 50 |

Equity accounted production | 0 | - | 0 | | 5 | - | 5 | | 10 | - | 10 |

Total | 434 | 35 | 652 | | 415 | 27 | 588 | | 435 | 25 | 592 |

The table below provides information about the fields that contributed to production in 2018. Equity production per field is included in this table.

Average daily equity production | | | | | |

| | | | | | | | |

Field | Country | Equinor's equity interest in % | Operator | On stream | | Licence expiry date | Average daily equity production in 2018 mboe/day |

|

|

| | | | | | | | |

Americas | | | | | | | 462 |

Appalachian1) 2) | US | Varies | Equinor/others3) | 2008 | | HBP6) | 174 |

Bakken 1) | US | Varies | Equinor/others4) | 2011 | | HBP6) | 63 |

Eagle Ford 1) | US | Varies | Equinor/others5) | 2010 | | HBP6) | 43 |

Peregrino | Brazil | 60.00 | Equinor Brasil Energia Ltda. | 2011 | | 20347) | 37 |

Tahiti | US | 25.00 | Chevron USA Inc. | 2009 | | HBP6) | 28 |

Roncador | Brazil | 25.00 | Petróleo Brasileiro S.A. | 2018 | | 2025 | 28 |

St. Malo | US | 21.50 | Chevron USA Inc. | 2014 | | HBP6) | 23 |

Caesar Tonga | US | 23.55 | Anadarko U.S. Offshore LLC | 2012 | | HBP6) | 16 |

Julia | US | 50.00 | ExxonMobil Corporation | 2016 | | HBP6) | 13 |

Jack | US | 25.00 | Chevron USA Inc. | 2014 | | HBP6) | 9 |

Hibernia/Hibernia Southern Extension8) | Canada | Varies | Hibernia Management and Development Corporation Ltd. | 1997 | | HBP6) | 8 |

Hebron | Canada | 9.01 | ExxonMobil Canada Properties | 2017 | | HBP6) | 6 |

Terra Nova | Canada | 15.00 | Suncor Energy Inc. | 2002 | | HBP6) | 5 |

Stampede | US | 25.00 | Hess Corporation | 2018 | | HBP6) | 4 |

Heidelberg | US | 12.00 | Anadarko U.S. Offshore LLC | 2016 | | HBP6) | 4 |

Titan | US | 100.00 | Equinor USA E&P Inc. | 2018 | | HBP6) | 2 |

Big Foot9) | US | 27.50 | Chevron USA Inc. | 2018 | | HBP6) | 0 |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Field | Country | Equinor's equity interest in % | Operator | On stream | | Licence expiry date | Average daily equity production in 2018 mboe/day |

|

|

Africa | | | | | | | 287 |

Block 17 | Angola | 23.33 | Total E&P Angola Block 17 | 2001 | | 2022-3410) | 124 |

In Salah | Algeria | 31.85 | Sonatrach11) | 2004 | | 2027 | 46 |

| | | | BP Exploration (El Djazair) Limited | | | | |

| | | | Equinor In Salah AS | | | | |

Agbami | Nigeria | 20.21 | Star Deep Water Petroleum Limited (an affiliate of Chevron in Nigeria) | 2008 | | 2024 | 43 |

Block 15 | Angola | 13.33 | Esso Exploration Angola Block 15 | 2004 | | 2026-3210) | 31 |

In Amenas | Algeria | 45.90 | Sonatrach11) | 2006 | | 2027 | 21 |

| | | | BP Amoco Exploration (In Amenas) Limited | | | | |

| | | | Equinor In Amenas AS | | | | |

Block 31 | Angola | 13.33 | BP Exploration Angola | 2012 | | 2031 | 15 |

Murzuq | Libya | 10.00 | Akakus Oil Operations | 2003 | | 2035 | 8 |

| | | | | | | | |

Eurasia | | | | | | | 73 |

ACG | Azerbaijan | 7.27 | BP Exploration (Caspian Sea)Limited | 1997 | | 2049 | 42 |

Corrib | Ireland | 36.50 | Vermilion Exploration and Production Ireland Limited | 2015 | | 2031 | 19 |

Kharyaga | Russia | 30.00 | Zarubezhneft-Production Kharyaga LLC | 1999 | | 2031 | 9 |

Alba12) | UK | 17.00 | Chevron North Sea Limited | 1994 | | HBP6) | 2 |

| | | | | | | | |

Total E&P International | | | | 823 |

| | | | | | | | |

Equity accounted production | | | | | | | |

North Komsomolskoye 13) | Russia | 33.33 | LLC SevKomNeftegaz | 2018 | | 2112 | 0 |

| | | | | | | | |

Total E&P International including share of equity accounted production | | | 823 |

| | | | | | | | |

1) | Equinor’s actual equity interest can vary depending on wells and area. |

2) | Appalachian basin contains Marcellus and Utica formations. |

3) | Operators are Equinor USA Onshore Properties Inc, Chesapeake Operating INC., Southwestern Energy, Alta Resources Development LLC, Chief Oil & Gas LLC and several other operators. |