Exhibit 99.1

Exhibit 99.1

ARRIS

Second Quarter 2013

Update Conference Call

May 15, 2013

Safe Harbor

Statements in this presentation or made in this meeting, including those related to the outlook for 2013 and beyond, the integration of Motorola Home and expected synergies, expected revenues and net income, gross margins, operating expenses, income taxes, acceptance of certain ARRIS products, the general market outlook, and industry trends, are forward-looking statements. These statements involve risks and uncertainties that may cause actual results to differ materially from those set forth in these statements. Among other things, projected results are based on preliminary estimates, assumptions and projections that management believes to be reasonable at this time, but are beyond management’s control; ARRIS is dependent upon customer decisions to purchase the Company’s products—these decisions can be deferred and customers also may select competitor products; and because the market in which ARRIS operates is volatile and actions taken and contemplated may not achieve the desired impact. Other factors that could cause results to differ from current expectations include: the uncertain current economic climate and financial markets, and their impact on our customers’ plans and access to capital; ARRIS’ ability to successfully integrate Motorola Home’s opportunities, technology, personnel, and operations, the impact of rapidly changing technologies; the impact of competition on product development and pricing; the ability of ARRIS to react to changes in general industry and market conditions; rights to intellectual property and the current trend toward increasing patent litigation, market trends and the adoption of industry standards; possible acquisitions and dispositions; and consolidations within the telecommunications industry of both the customer and supplier base. These factors are not intended to be an all-encompassing list of risks and uncertainties that may affect the Company’s business. Additional information regarding these and other factors can be found in ARRIS’ reports filed with the Securities and Exchange Commission, including its Form 10-Q for the quarter ended March 31, 2013. In providing forward-looking statements, the Company expressly disclaims any obligation to update publicly or otherwise these statements, whether as a result of new information, future events or otherwise.

ARRIS Q2 2013 Update

May 15, 2013

Second Quarter

2013

Update

Bob Stanzione

CEO & Chairman

ARRIS Q2 2013 Update 3 May 15, 2013

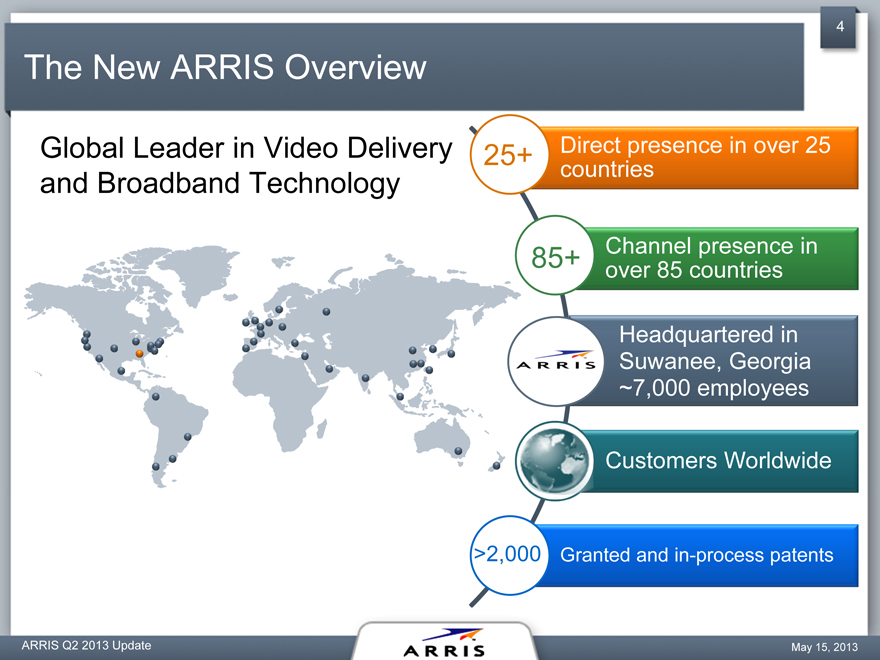

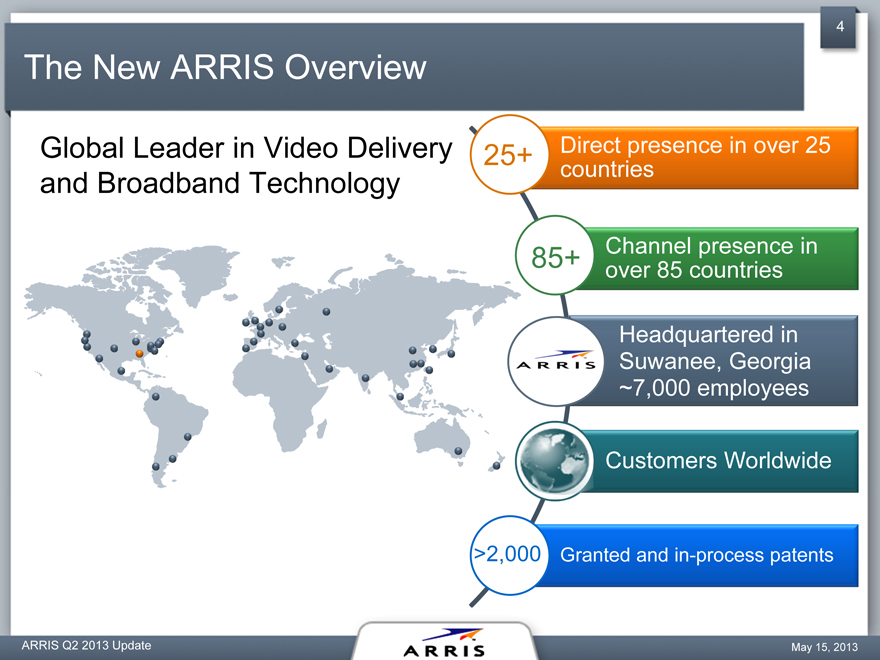

The New ARRIS Overview

Global Leader in Video Delivery

25+

Direct presence in over 25

and Broadband Technology

countries

85+

Channel presence in

over 85 countries

Headquartered in

Suwanee, Georgia

~7,000 employees

Customers Worldwide

>2,000 Granted and in-process patents

ARRIS Q2 2013 Update

May 15, 2013

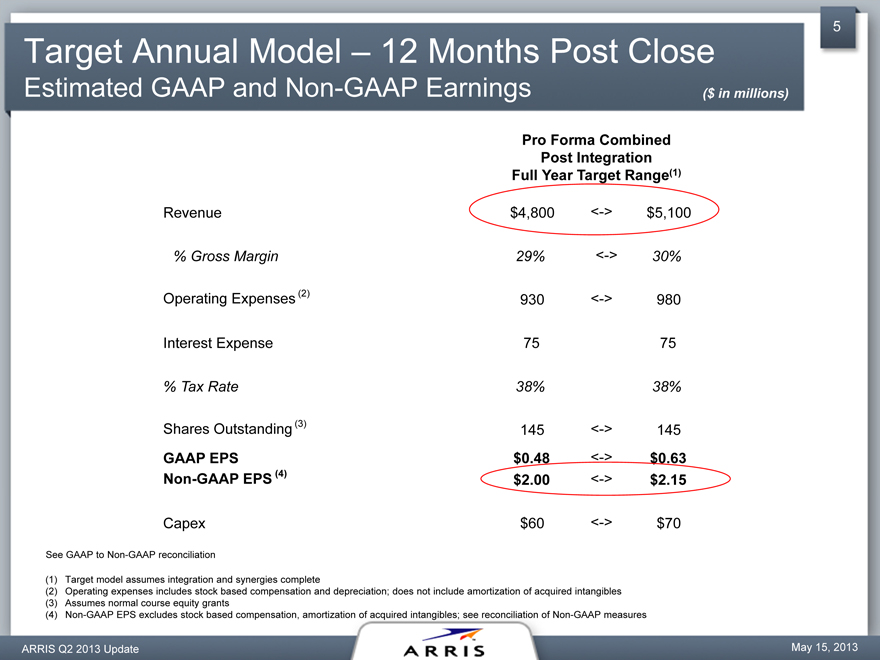

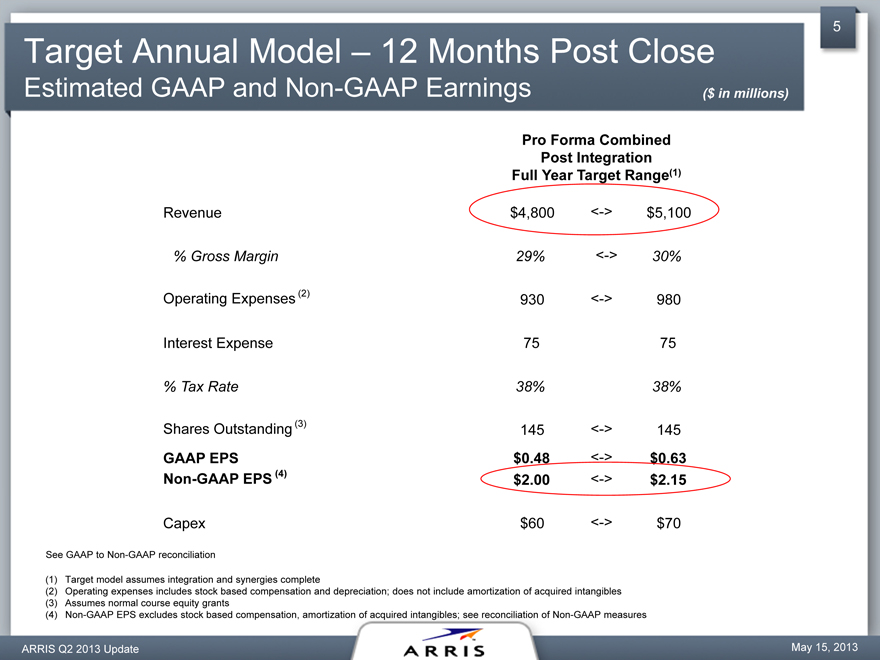

Target Annual Model – 12 Months Post Close

Estimated GAAP and Non-GAAP Earnings

($ in millions)

Pro Forma Combined

Post Integration

Full Year Target Range(1)

Revenue

$4,800

<->

$5,100

% Gross Margin

29%

<->

30%

Operating Expenses (2)

930

<->

980

Interest Expense

75

75

% Tax Rate

38%

38%

Shares Outstanding (3)

145

<->

145

GAAP EPS

$0.48

<->

$0.63

Non-GAAP EPS (4)

$2.00

<->

$2.15

Capex

$60

<->

$70

See GAAP to Non-GAAP reconciliation

Target model assumes integration and synergies complete

Operating expenses includes stock based compensation and depreciation; does not include amortization of acquired intangibles

Assumes normal course equity grants

Non-GAAP EPS excludes stock based compensation, amortization of acquired intangibles; see reconciliation of Non-GAAP measures

ARRIS Q2 2013 Update

May 15, 2013

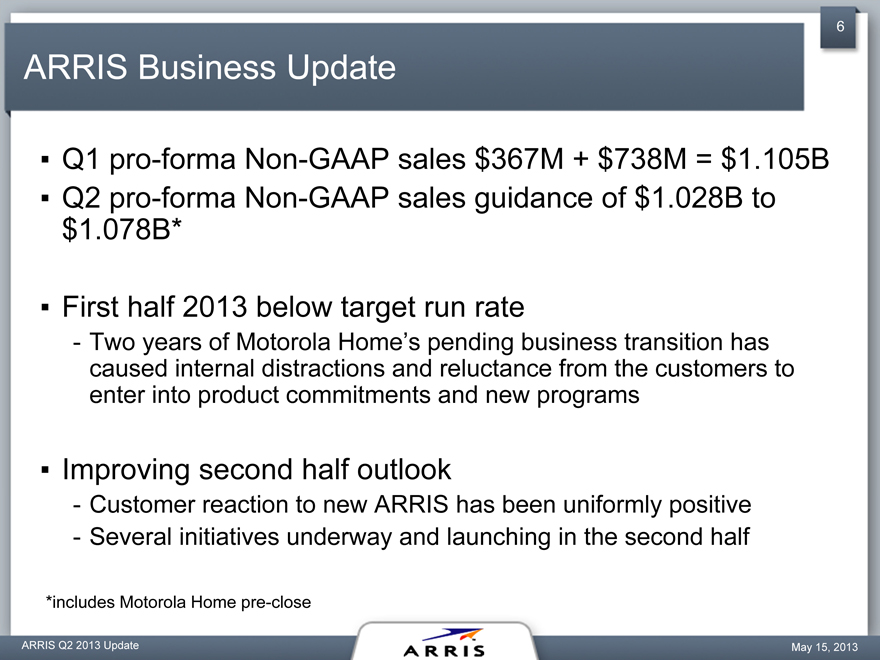

ARRIS Business Update

Q1 pro-forma Non-GAAP sales $367M + $738M = $1.105B

Q2 pro-forma Non-GAAP sales guidance of $1.028B to $1.078B*

First half 2013 below target run rate

Two years of Motorola Home’s pending business transition has caused internal distractions and reluctance from the customers to enter into product commitments and new programs

Improving second half outlook

Customer reaction to new ARRIS has been uniformly positive

Several initiatives underway and launching in the second half

*includes Motorola Home pre-close

ARRIS Q2 2013 Update

May 15, 2013

Second

Half

Outlook

An improving environment

Service provider capex increasing

Expanding market size

Healthy product pipeline

Whole Home Gateway projects

Wireless HSD devices

CCAP (E6000, APEX 3000 QAM)

Multi Screen software and service

Etc…

ARRIS Q2 2013 Update

May 15, 2013

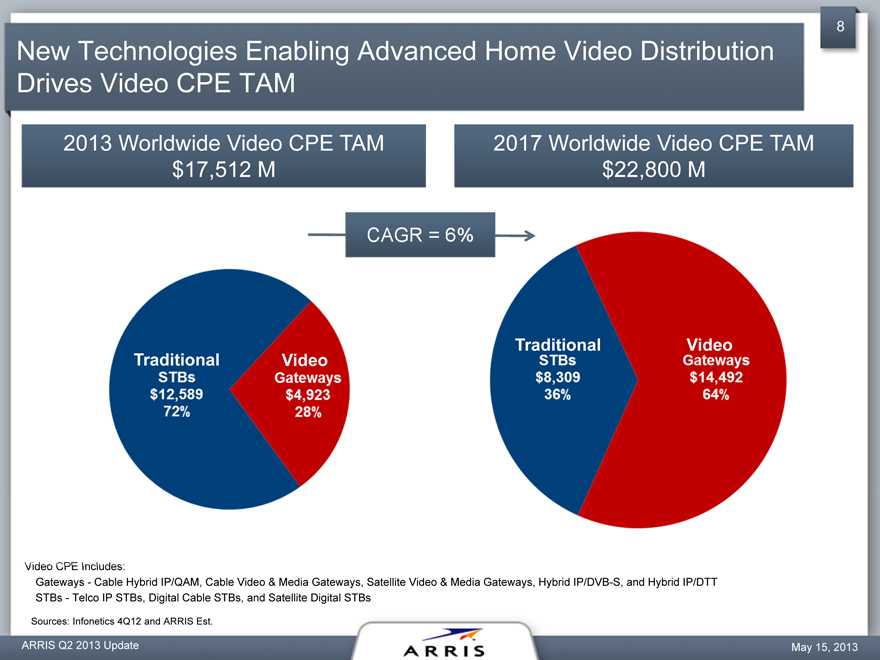

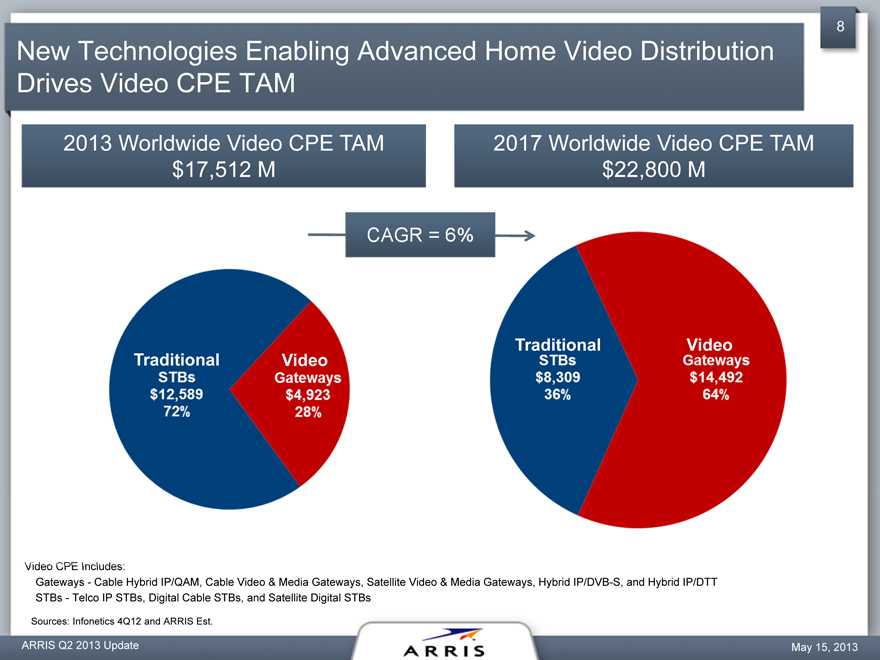

New Technologies Enabling Advanced

Home Video

Distribution

Drives Video CPE TAM

2013 Worldwide Video CPE TAM

2017 Worldwide Video CPE TAM

$17,512 M

$22,800 M

Traditional

Video

Traditional

Video

Gateways—Cable Hybrid IP/QAM, Cable Video & Media Gateways, Satellite Video & Media Gateways, Hybrid IP/DVB-S, and Hybrid IP/DTT STBs—Telco IP STBs, Digital Cable STBs, and Satellite Digital STBs

Sources: Infonetics 4Q12 and ARRIS Est.

ARRIS Q2 2013 Update

May 15, 2013

9

Q2 Status

Synergies…

On track to reaching annualized cost reductions of $100M to $125M

Sales and Marketing complete

Supply Chain in process

G&A and R&D planning in process

Business gaining momentum in second half

ARRIS Q2 2013 Update May 15, 2013

10

The New ARRIS

A stronger company with a broader portfolio

Serving a broader and more diversified customer base

Well positioned to capture significant share in a growing market

Materially enhanced shareholder value

ARRIS Q2 2013 Update May 15, 2013

11

Second Quarter 2013 Financial Update

David Potts

Chief Financial Officer

ARRIS Q2 2013 Update 11 May 15, 2013

12

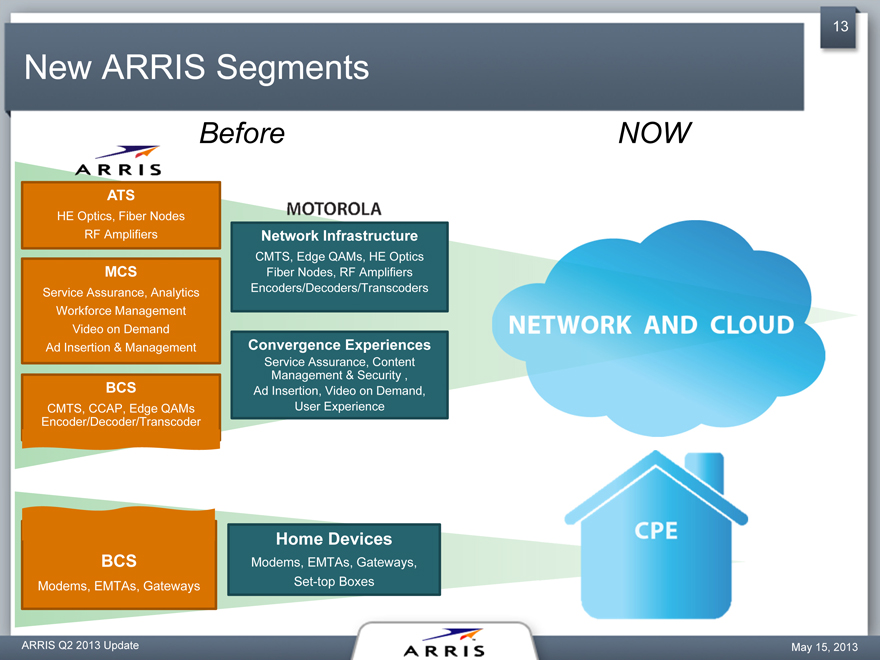

Our New Segments and Reporting

Will report two product segments

Network & Cloud

Customer Premises Equipment

Will report sales and operating income by segment

Operating income for the product segments will reflect direct contribution

Gross Margin less direct OPEX

Corporate/Other will include: Global M&S, Corporate G&A, Advanced Technology, all equity compensation, and annual bonuses

ARRIS Q2 2013 Update

May 15, 2013

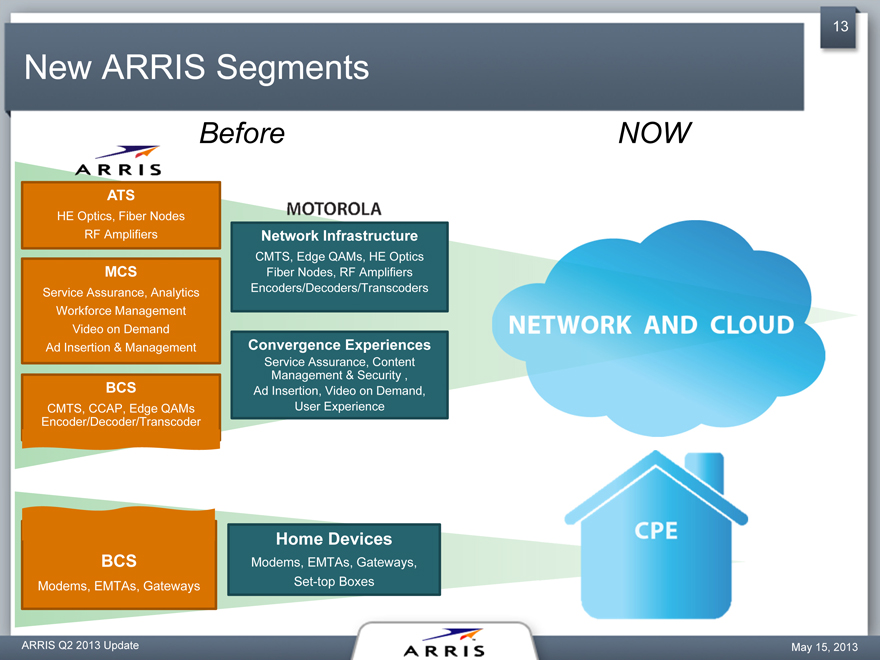

13

New ARRIS Segments

Before

NOW

ATS

HE Optics, Fiber Nodes

RF Amplifiers

Network Infrastructure

CMTS, Edge QAMs, HE Optics

MCS

Fiber Nodes, RF Amplifiers

Service Assurance, Analytics

Encoders/Decoders/Transcoders

Workforce Management

Video on Demand

Ad Insertion & Management

Convergence Experiences

Service Assurance, Content

Management & Security ,

BCS

Ad Insertion, Video on Demand,

CMTS, CCAP, Edge QAMs

User Experience

Encoder/Decoder/Transcoder

Home Devices

BCS

Modems, EMTAs, Gateways,

Modems, EMTAs, Gateways

Set-top Boxes

ARRIS Q2 2013 Update

May 15, 2013

14

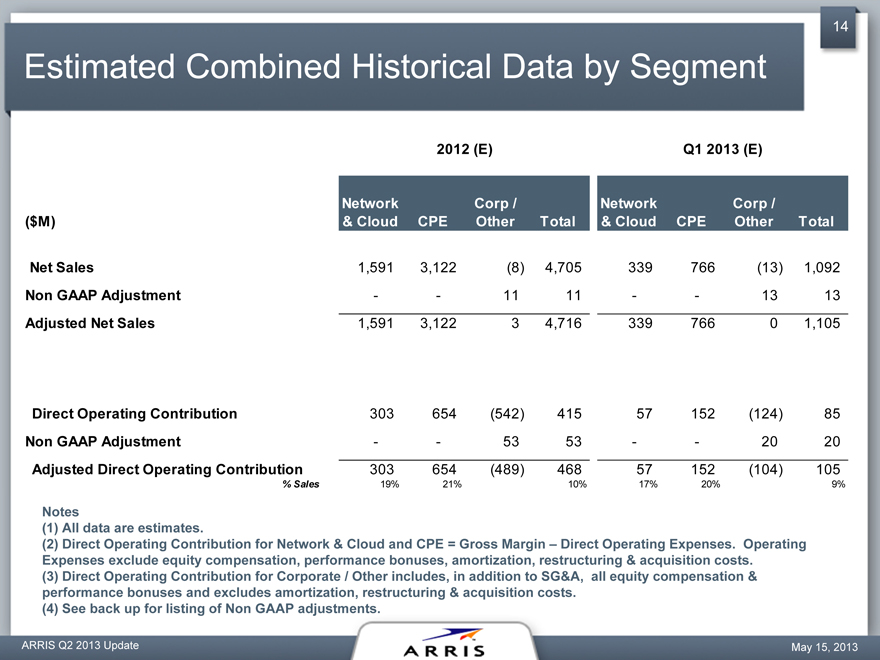

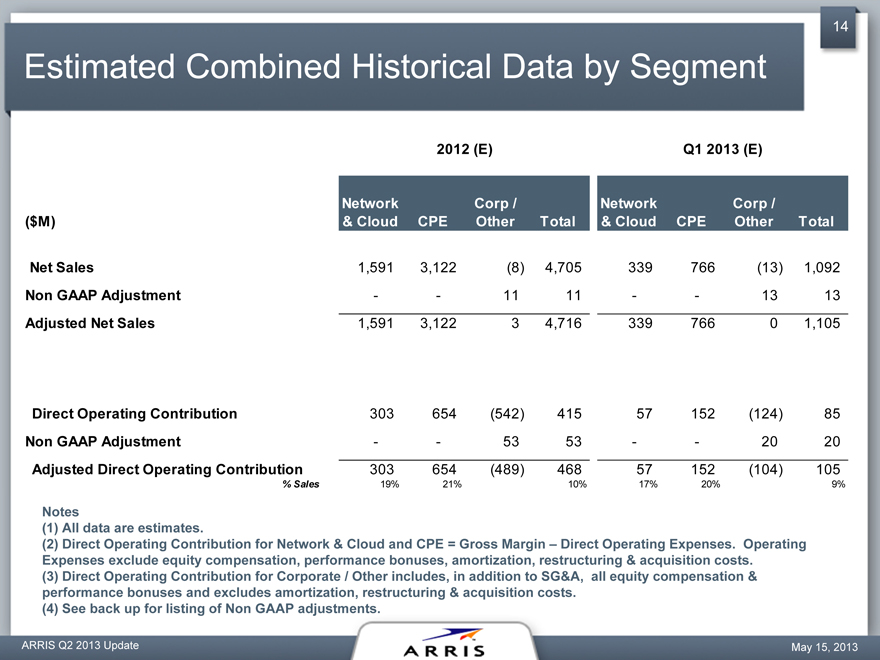

Estimated Combined Historical Data by Segment

2012 (E)

Q1 2013 (E)

Network

Corp /

Network

Corp /

($M)

& Cloud

CPE

Other

Total

& Cloud

CPE

Other

Total

Net Sales

1,591

3,122

4,705

339

766

1,092

Non GAAP Adjustment

-

-

11

11

-

-

13

13

Adjusted Net Sales

1,591

3,122

4,716

339

766

0

1,105

Direct Operating Contribution

303

654

(542)

415

57

152

(124)

85

Non GAAP Adjustment

-

-

53

53

-

-

20

20

Adjusted Direct Operating Contribution

303

654

(489)

468

57

152

(104)

105

% Sales

19%

21%

10%

17%

20%

9%

Notes

All data are estimates.

Direct Operating Contribution for Network & Cloud and CPE = Gross Margin – Direct Operating Expenses. Operating

Expenses exclude equity compensation, performance bonuses, amortization, restructuring & acquisition costs. (3) Direct Operating Contribution for Corporate / Other includes, in addition to SG&A, all equity compensation & performance bonuses and excludes amortization, restructuring & acquisition costs.

(4) | | See back up for listing of Non GAAP adjustments. |

ARRIS Q2 2013 Update

May 15, 2013

15

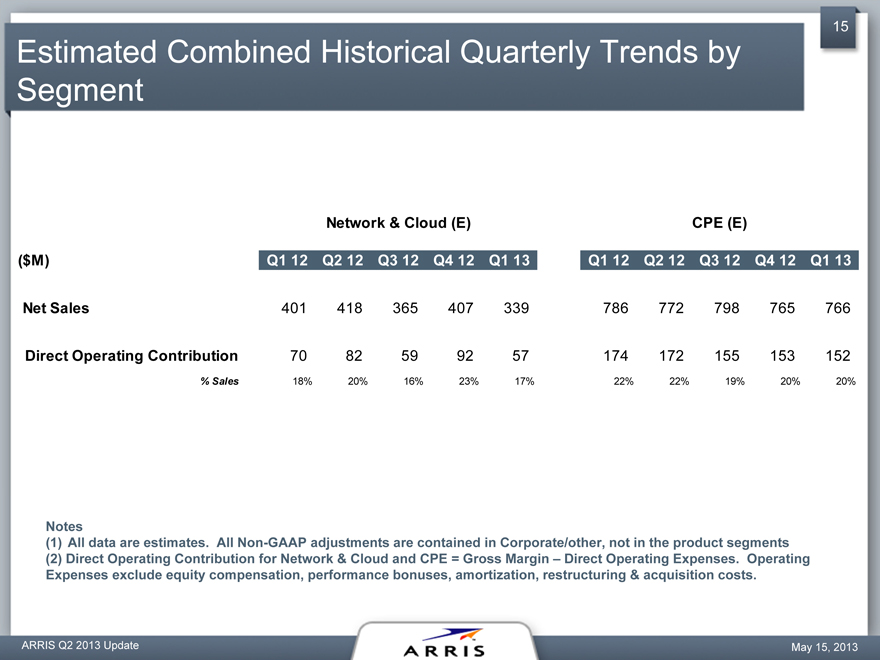

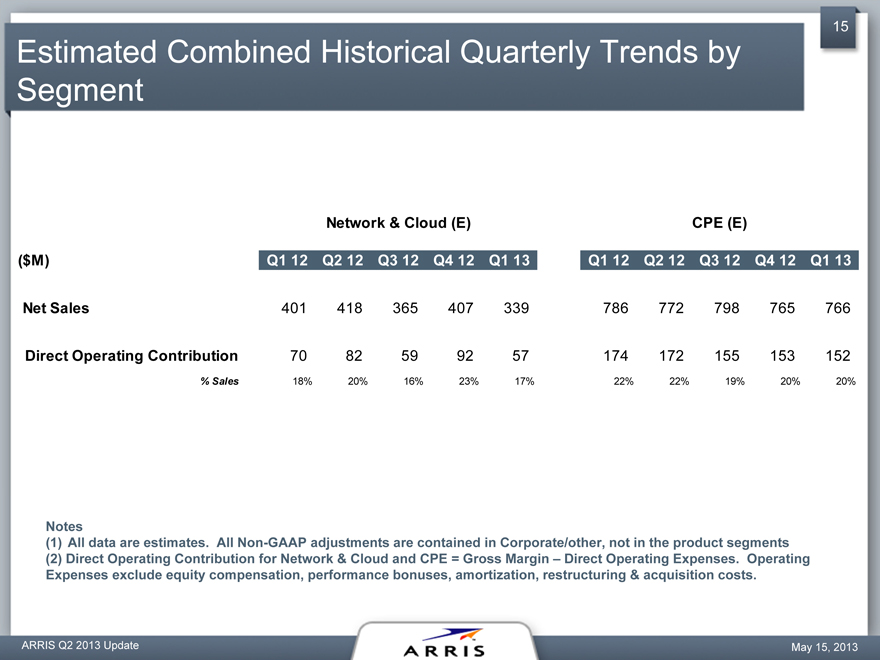

Estimated Combined Historical Quarterly Trends by Segment

Network & Cloud (E)

CPE (E)

($M)

Q1 12

Q2 12

Q3 12

Q4 12

Q1 13

Q1 12

Q2 12

Q3 12

Q4 12

Q1 13

Net Sales

401

418

365

407

339

786

772

798

765

766

Direct Operating Contribution

70

82

59

92

57

174

172

155

153

152

% Sales

18%

20%

16%

23%

17%

22%

22%

19%

20%

20%

Notes

All data are estimates. All Non-GAAP adjustments are contained in Corporate/other, not in the product segments

Direct Operating Contribution for Network & Cloud and CPE = Gross Margin – Direct Operating Expenses. Operating

Expenses exclude equity compensation, performance bonuses, amortization, restructuring & acquisition costs.

ARRIS Q2 2013 Update

May 15, 2013

16

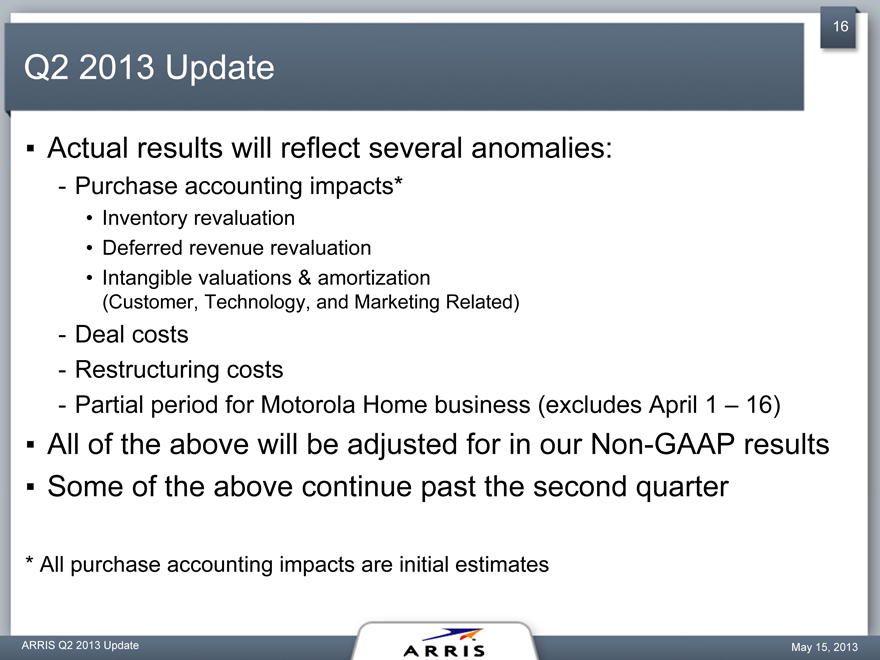

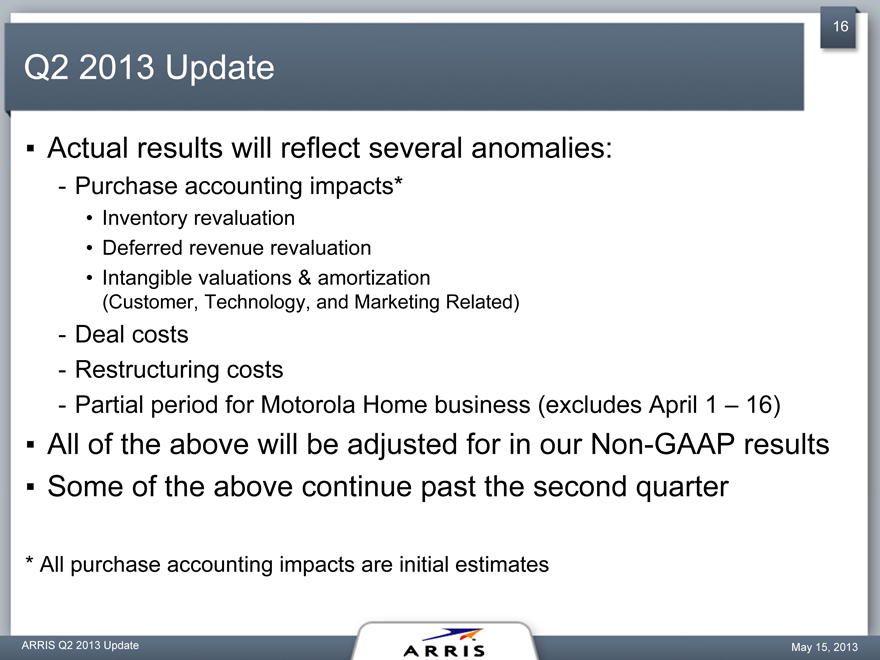

Q2 2013 Update

Actual results will reflect several anomalies:

Purchase accounting impacts*

Inventory revaluation

Deferred revenue revaluation

Intangible valuations & amortization

(Customer, Technology, and Marketing Related)

Deal costs

Restructuring costs

Partial period for Motorola Home business (excludes April 1 – 16)

All of the above will be adjusted for in our Non-GAAP results

Some of the above continue past the second quarter

* | | All purchase accounting impacts are initial estimates |

ARRIS Q2 2013 Update

May 15, 2013

17

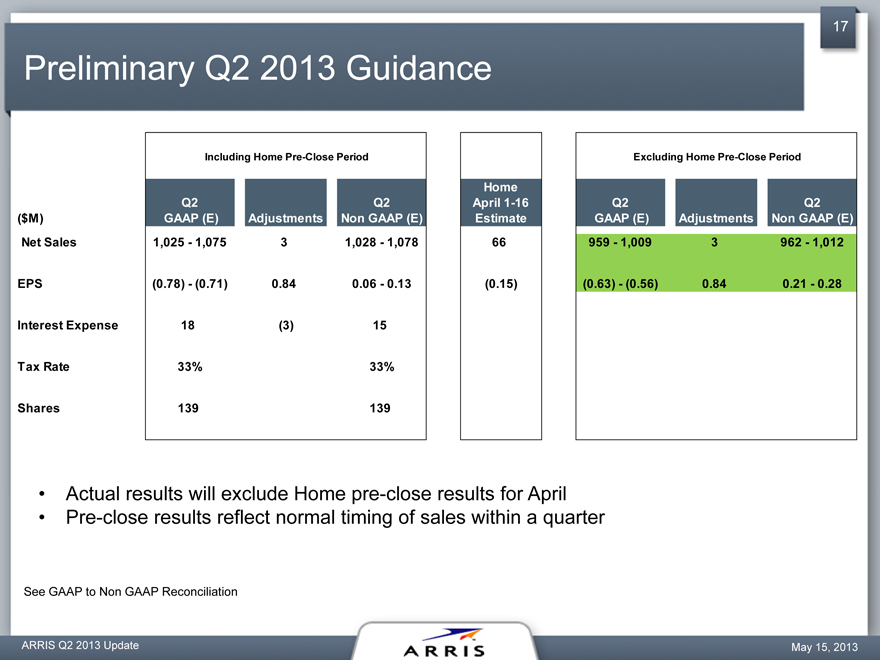

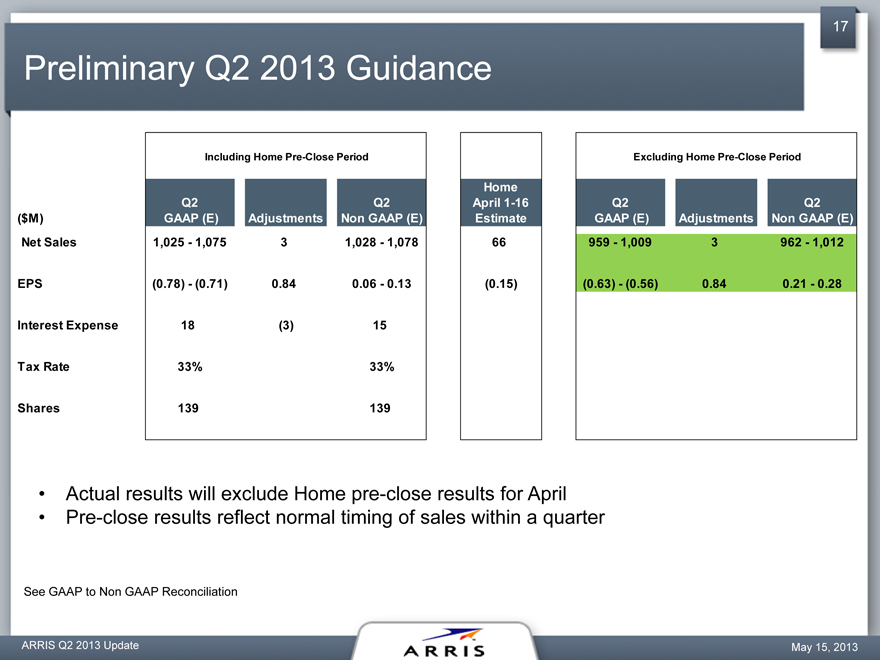

Preliminary Q2 2013 Guidance

Including Home Pre-Close Period

Excluding Home Pre-Close Period

Home

Q2

Q2

April 1-16

Q2

Q2

($M)

GAAP (E)

Adjustments

Non GAAP (E)

Estimate

GAAP (E)

Adjustments

Non GAAP (E)

Net Sales

1,025—1,075

1,028—1,078

66

959—1,009

962—1,012

EPS

(0.78)—(0.71)

0.84

0.06—0.13

(0.15)

(0.63)—(0.56)

0.84

0.21—0.28

Interest Expense

18

15

Tax Rate

33%

33%

Shares

139

139

Actual results will exclude Home pre-close results for April

Pre-close results reflect normal timing of sales within a quarter

See GAAP to Non GAAP Reconciliation

ARRIS Q2 2013 Update

May 15, 2013

18

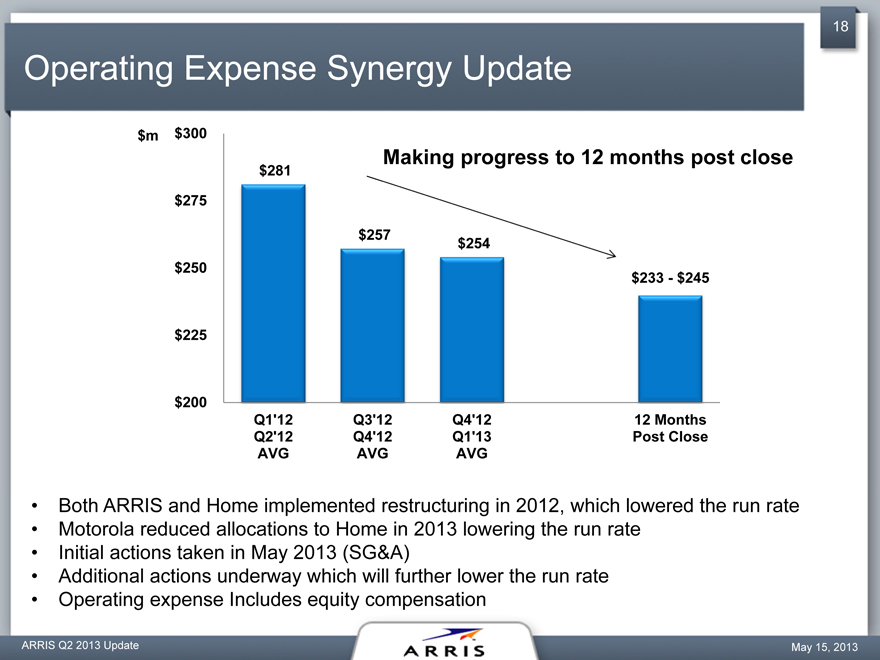

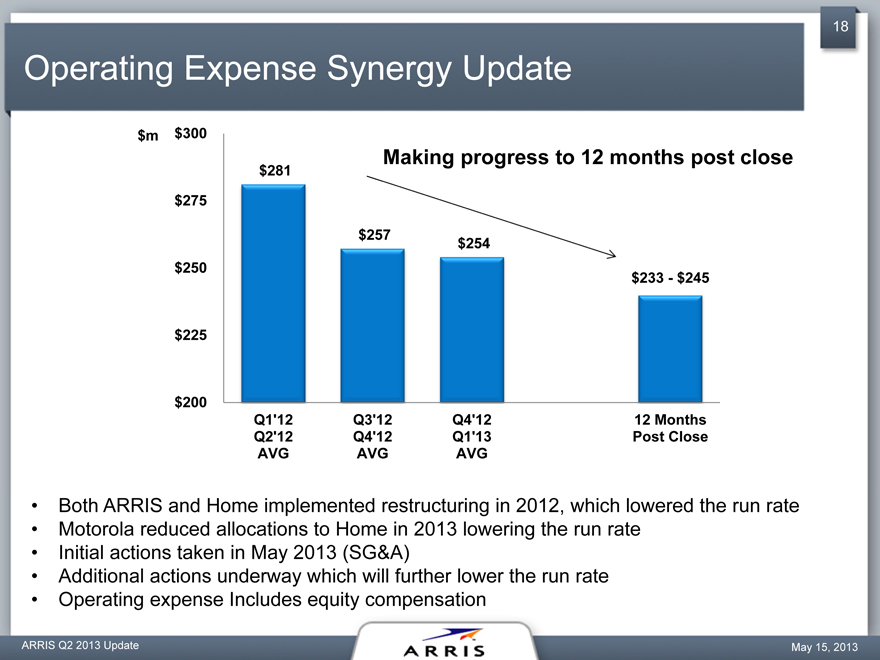

Operating Expense Synergy Update

$m

$

300

Making progress to 12 months post close

$

281

$

275

$

257

$254

$

250

$233—$245

$225

$200

Q1’12 Q3’12 Q4’12 12 Months

Q2’12 Q4’12 Q1’13 Post Close

AVG AVG AVG

Both ARRIS and Home implemented restructuring in 2012, which lowered the run rate

Motorola reduced allocations to Home in 2013 lowering the run rate

Initial actions taken in May 2013 (SG&A)

Additional actions underway which will further lower the run rate

Operating expense Includes equity compensation

ARRIS Q2 2013 Update

May 15, 2013

19

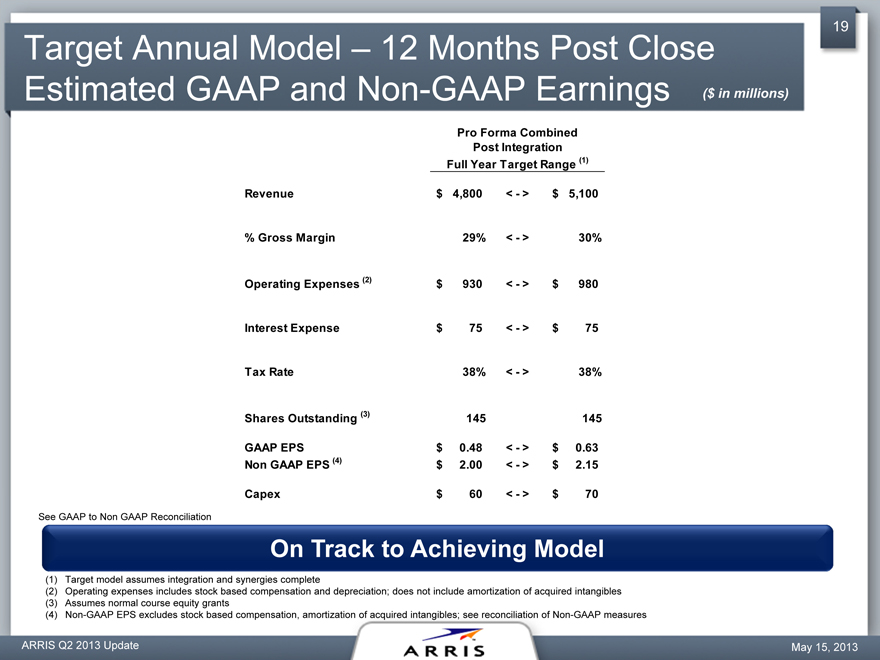

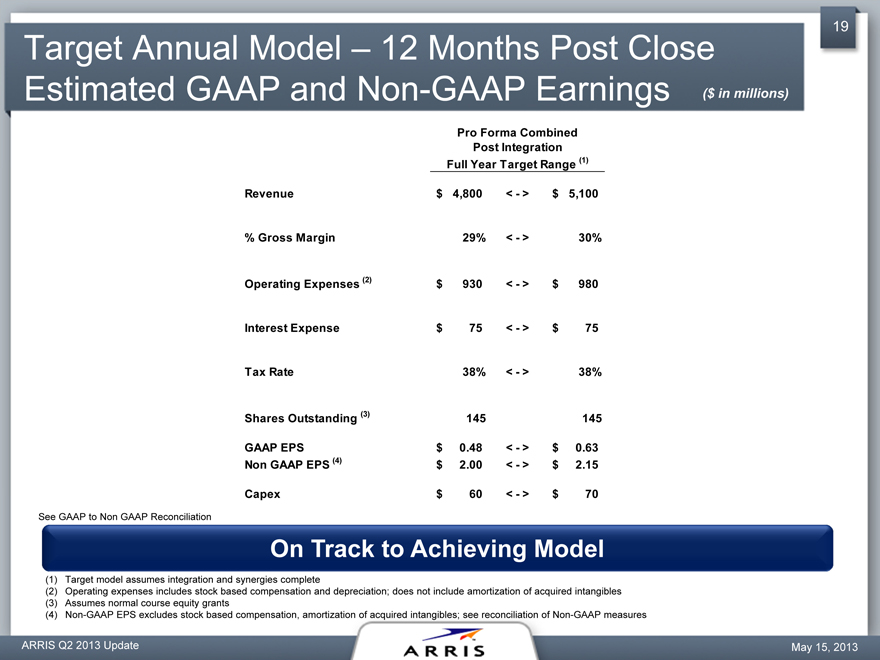

Target Annual Model – 12 Months Post Close

Estimated GAAP and Non-GAAP Earnings

($ in millions)

Pro Forma Combined

Post Integration

Full Year Target Range (1)

Revenue

$ 4,800

<—>

$

5,100

% Gross Margin

29%

<—>

30%

Operating Expenses (2)

$ 930

<—>

$

980

Interest Expense

$

75

<—>

$

75

Tax Rate

38%

<—>

38%

Shares Outstanding (3)

145

145

GAAP EPS

$ 0.48

<—>

$

0.63

Non GAAP EPS (4)

$ 2.00

<—>

$

2.15

Capex

$

60

<—>

$

70

See GAAP to Non GAAP Reconciliation

On Track to Achieving Model

Target model assumes integration and synergies complete

Operating expenses includes stock based compensation and depreciation; does not include amortization of acquired intangibles

Assumes normal course equity grants

Non-GAAP EPS excludes stock based compensation, amortization of acquired intangibles; see reconciliation of Non-GAAP measures

ARRIS Q2 2013 Update

May 15, 2013

20

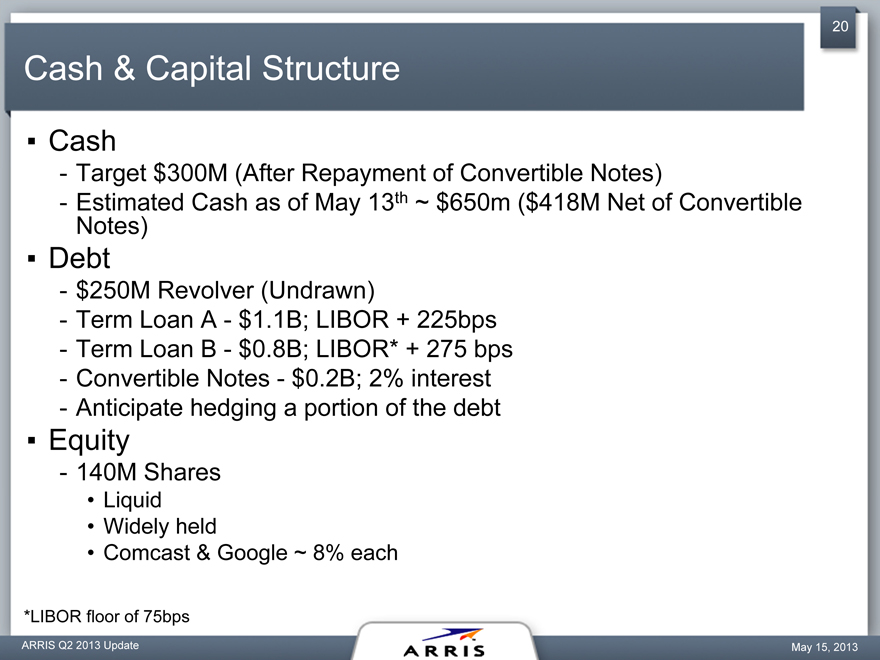

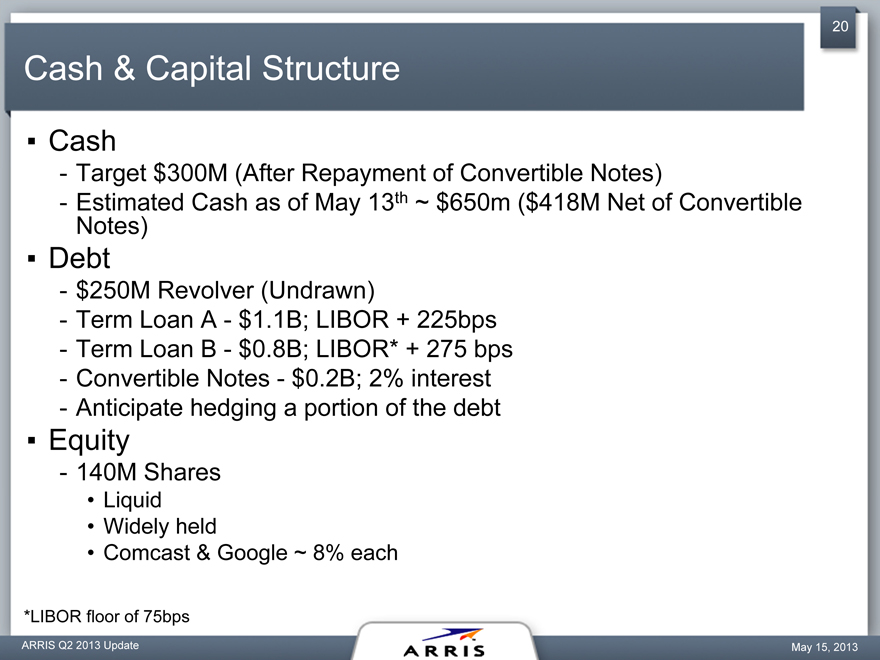

Cash & Capital Structure

Cash

Target $300M (After Repayment of Convertible Notes)

Estimated Cash as of May 13th ~ $650m ($418M Net of Convertible Notes)

Debt

$250M Revolver (Undrawn)

Term Loan A—$1.1B; LIBOR + 225bps

Term Loan B—$0.8B; LIBOR* + 275 bps

Convertible Notes—$0.2B; 2% interest

Anticipate hedging a portion of the debt

Equity

140M Shares

Liquid

Widely held

Comcast & Google ~ 8% each

*LIBOR floor of 75bps

ARRIS Q2 2013 Update

May 15, 2013

Backup

ARRIS Q2 2013 Update

21

May 15, 2013

22

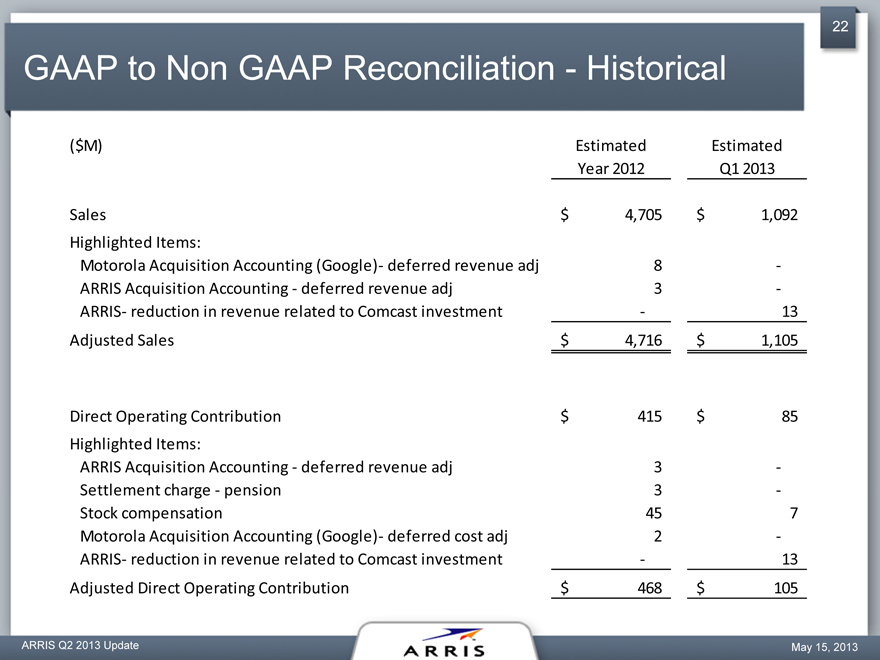

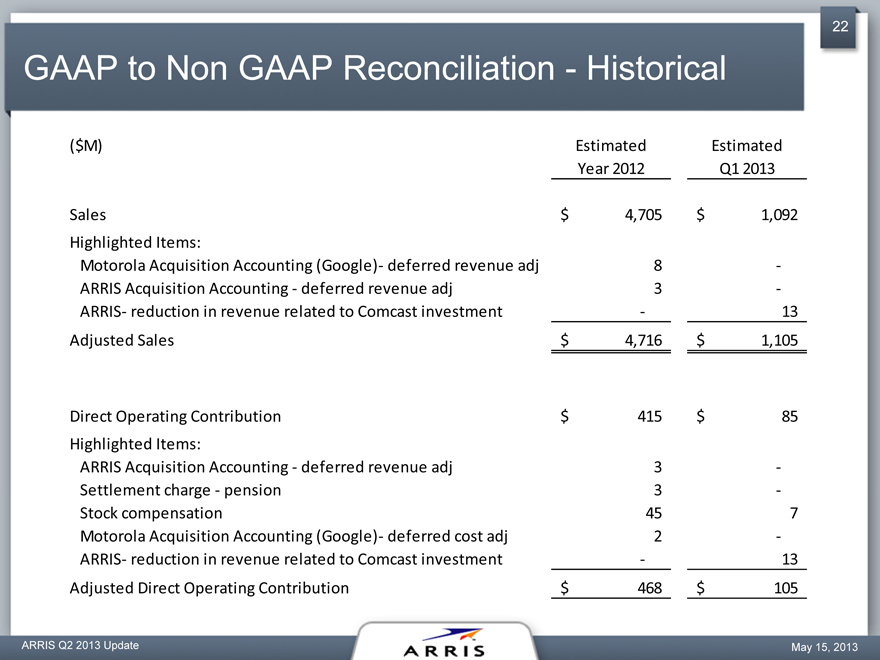

GAAP to Non GAAP Reconciliation—Historical

($M)

Estimated

Estimated

Year 2012

Q1 2013

Sales

$

4,705

$

1,092

Highlighted Items:

Motorola Acquisition Accounting (Google)- deferred revenue adj

-

ARRIS Acquisition Accounting—deferred revenue adj

-

ARRIS- reduction in revenue related to Comcast investment

-

13

Adjusted Sales

$

4,716

$

1,105

Direct Operating Contribution

$

415

$

85

Highlighted Items:

ARRIS Acquisition Accounting—deferred revenue adj

-

Settlement charge—pension

-

Stock compensation

45

Motorola Acquisition Accounting (Google)- deferred cost adj

-

ARRIS- reduction in revenue related to Comcast investment

-

13

Adjusted Direct Operating Contribution

$

468

$

105

ARRIS Q2 2013 Update

May 15, 2013

23

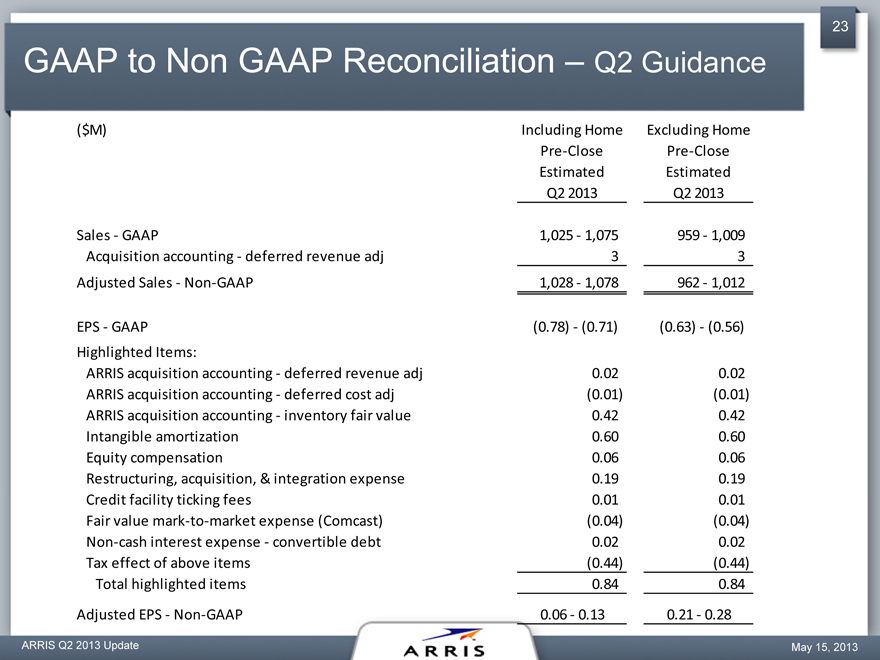

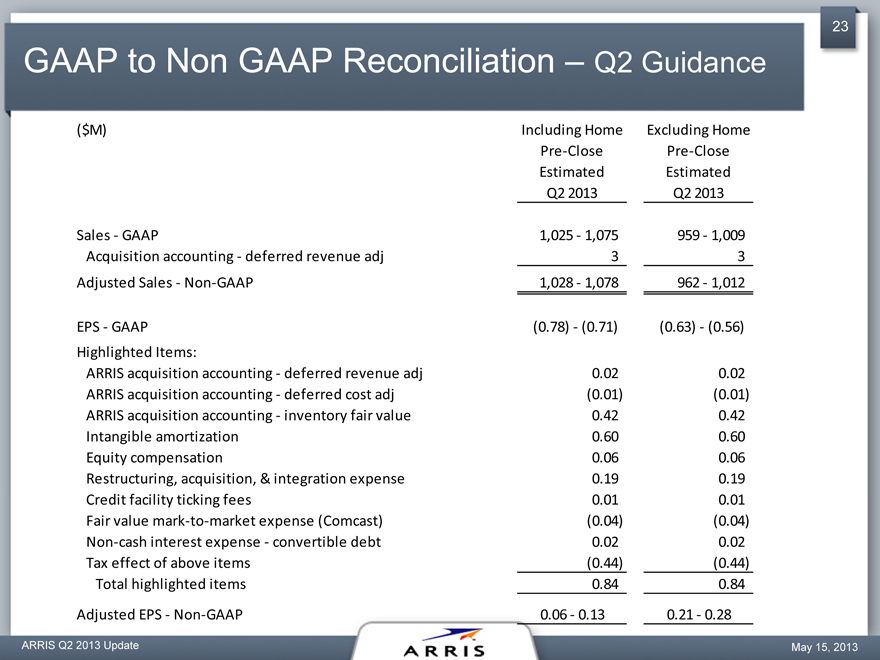

GAAP to Non GAAP Reconciliation – Q2 Guidance

($M)

Including Home

Excluding Home

Pre-Close

Pre-Close

Estimated

Estimated

Q2 2013

Q2 2013

Sales—GAAP

1,025—1,075

959—1,009

Acquisition accounting—deferred revenue adj

Adjusted Sales—Non-GAAP

1,028—1,078

962—1,012

EPS—GAAP

(0.78)—(0.71)

(0.63)—(0.56)

Highlighted Items:

ARRIS acquisition accounting—deferred revenue adj

0.02

0.02

ARRIS acquisition accounting—deferred cost adj

(0.01)

(0.01)

ARRIS acquisition accounting—inventory fair value

0.42

0.42

Intangible amortization

0.60

0.60

Equity compensation

0.06

0.06

Restructuring, acquisition, & integration expense

0.19

0.19

Credit facility ticking fees

0.01

0.01

Fair value mark-to-market expense (Comcast)

(0.04)

(0.04)

Non-cash interest expense—convertible debt

0.02

0.02

Tax effect of above items

(0.44)

(0.44)

Total highlighted items

0.84

0.84

Adjusted EPS—Non-GAAP

0.06—0.13

0.21—0.28

ARRIS Q2 2013 Update

May 15, 2013

24

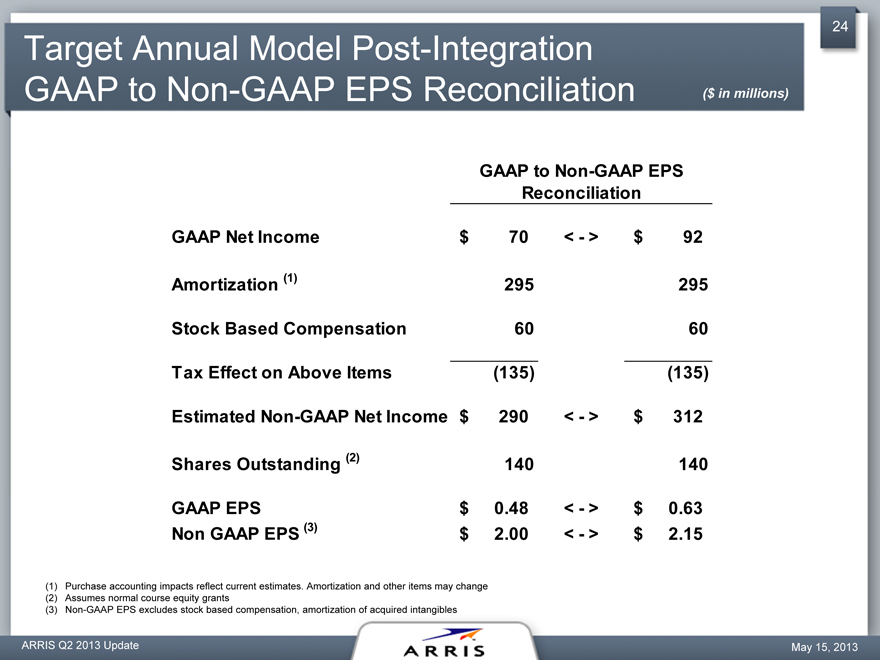

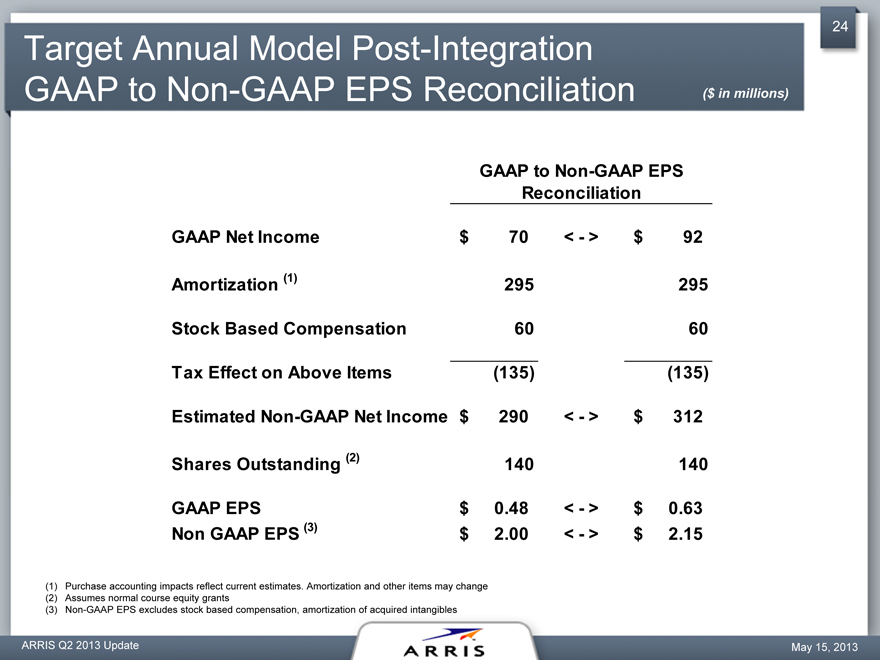

Target Annual Model Post-Integration

GAAP to Non-GAAP EPS Reconciliation ($ in millions)

GAAP to Non-GAAP EPS

Reconciliation

GAAP Net Income

$

70

<

-

>

$

92

Amortization (1)

295

295

Stock Based Compensation

60

60

Tax Effect on Above Items

(135)

(135)

Estimated Non-GAAP Net Income

$

290

<

-

>

$

312

Shares Outstanding (2)

140

140

GAAP EPS

$

0.48

<

-

>

$

0.63

Non GAAP EPS (3)

$

2.00

<

-

>

$

2.15

Purchase accounting impacts reflect current estimates. Amortization and other items may change

Assumes normal course equity grants

Non-GAAP EPS excludes stock based compensation, amortization of acquired intangibles

ARRIS Q2 2013 Update

May 15, 2013

25

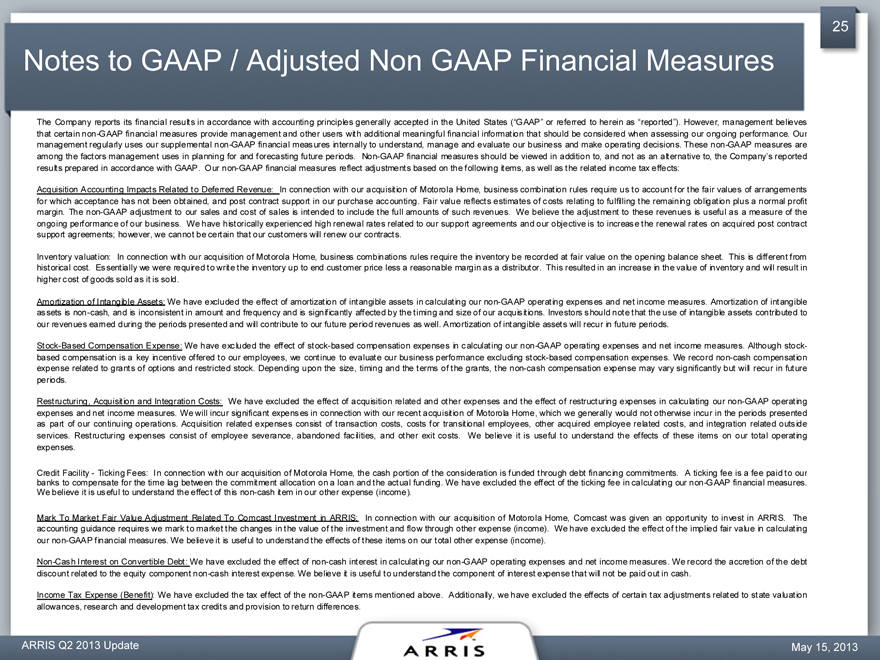

Notes to GAAP / Adjusted Non GAAP Financial Measures

The Company reports its financial results in accordance with accounting principles generally accepted in the United States (“GAAP” or referred to herein as “reported”). However, management believes that certain non-GAAP financial measures provide management and other users with additional meaningful financial information that should be considered when assessing our ongoing performance. Our management regularly uses our supplemental non-GAAP financial measures internally to understand, manage and evaluate our business and make operating decisions. These non-GAAP measures are among the factors management uses in planning for and forecasting future periods. Non-GAAP financial measures should be viewed in addition to, and not as an alternative to, the Company’s reported results prepared in accordance with GAAP. Our non-GAAP financial measures reflect adjustments based on the following items, as well as the related income tax effects:

Acquisition Accounting Impacts Related to Deferred Revenue: In connection with our acquisition of Motorola Home, business combination rules require us to account for the fair values of arrangements for which acceptance has not been obtained, and post contract support in our purchase accounting. Fair value reflects estimates of costs relating to fulfilling the remaining obligation plus a normal profit margin. The non-GAAP adjustment to our sales and cost of sales is intended to include the full amounts of such revenues. We believe the adjustment to these revenues is useful as a measure of the ongoing performance of our business. We have historically experienced high renewal rates related to our support agreements and our objective is to increase the renewal rates on acquired post contract support agreements; however, we cannot be certain that our customers will renew our contracts.

Inventory valuation: In connection with our acquisition of Motorola Home, business combinations rules require the inventory be recorded at fair value on the opening balance sheet. This is different from historical cost. Essentially we were required to write the inventory up to end customer price less a reasonable margin as a distributor. This resulted in an increase in the value of inventory and will result in higher cost of goods sold as it is sold.

Amortization of Intangible Assets: We have excluded the effect of amortization of intangible assets in calculating our non-GAAP operating expenses and net income measures. Amortization of intangible assets is non-cash, and is inconsistent in amount and frequency and is significantly affected by the timing and size of our acquisitions. Investors should note that the use of intangible assets contributed to our revenues earned during the periods presented and will contribute to our future period revenues as well. Amortization of intangible assets will recur in future periods.

Stock-Based Compensation Expense: We have excluded the effect of stock-based compensation expenses in calculating our non-GAAP operating expenses and net income measures. Although stock-based compensation is a key incentive offered to our employees, we continue to evaluate our business performance excluding stock-based compensation expenses. We record non-cash compensation expense related to grants of options and restricted stock. Depending upon the size, timing and the terms of the grants, the non-cash compensation expense may vary significantly but will recur in future periods.

Restructuring, Acquisition and Integration Costs: We have excluded the effect of acquisition related and other expenses and the effect of restructuring expenses in calculating our non-GAAP operating expenses and net income measures. We will incur significant expenses in connection with our recent acquisition of Motorola Home, which we generally would not otherwise incur in the periods presented as part of our continuing operations. Acquisition related expenses consist of transaction costs, costs for transitional employees, other acquired employee related costs, and integration related outside services. Restructuring expenses consist of employee severance, abandoned facilities, and other exit costs. We believe it is useful to understand the effects of these items on our total operating expenses.

Credit Facility—Ticking Fees: In connection with our acquisition of Motorola Home, the cash portion of the consideration is funded through debt financing commitments. A ticking fee is a fee paid to our banks to compensate for the time lag between the commitment allocation on a loan and the actual funding. We have excluded the effect of the ticking fee in calculating our non-GAAP financial measures. We believe it is useful to understand the effect of this non-cash item in our other expense (income).

Mark To Market Fair Value Adjustment Related To Comcast Investment in ARRIS: In connection with our acquisition of Motorola Home, Comcast was given an opportunity to invest in ARRIS. The accounting guidance requires we mark to market the changes in the value of the investment and flow through other expense (income). We have excluded the effect of the implied fair value in calculating our non-GAAP financial measures. We believe it is useful to understand the effects of these items on our total other expense (income).

Non-Cash Interest on Convertible Debt: We have excluded the effect of non-cash interest in calculating our non-GAAP operating expenses and net income measures. We record the accretion of the debt discount related to the equity component non-cash interest expense. We believe it is useful to understand the component of interest expense that will not be paid out in cash.

Income Tax Expense (Benefit): We have excluded the tax effect of the non-GAAP items mentioned above. Additionally, we have excluded the effects of certain tax adjustments related to state valuation allowances, research and development tax credits and provision to return differences.

ARRIS Q2 2013 Update May 15, 2013

Transforming how service providers deliver entertainment and communications without boundaries

ARRIS Q2 2013 Update

May 15, 2013