Searchable text section of graphics shown above

[GRAPHIC]

BALANCE

Kerr-McGee Corporation

Annual Stockholders’

Meeting

May 10, 2005

Kerr-McGee Corporation

[GRAPHIC]

Luke R. Corbett

Chairman and Chief Executive Officer

Forward-Looking Statement

Statements in this presentation regarding the company’s or management’s intentions, beliefs or expectations, or that otherwise speak to future events, are “forward-looking statements.” These forward-looking statements include those statements preceded by, followed by or that otherwise include the words “expects,” “believe,” “projected” or similar words. In addition, any statements regarding possible commerciality, development plans, capacity expansions, drilling of new wells, ultimate recoverability of reserves, future production rates, cash flows and changes in any of the foregoing are forward-looking statements. Future results and developments discussed in these statements may be affected by numerous factors and risks, such as the accuracy of the assumptions that underlie the statements, the timing, manner and success of the planned separation of Kerr-McGee’s chemical business and the divestiture of certain oil and gas properties, the success of the oil and gas exploration and production program, drilling risks, the market value of Kerr-McGee’s products, uncertainties in interpreting engineering data, demand for consumer products for which Kerr-McGee’s businesses supply raw materials, the financial resources of competitors, changes in laws and regulations, the ability to respond to challenges in international markets (including changes in currency exchange rates), political or economic conditions in areas where Kerr-McGee operates, trade and regulatory matters, general economic conditions, and other factors and risks identified in the Risk Factors section of the company’s recent Annual Report on Form 10-K and other SEC filings. Actual results and developments may differ materially from those expressed or implied in this presentation.

Legal Information

This presentation is for informational purposes only and does not constitute an offer to buy or the solicitation of an offer to sell shares of the company’s common stock. The Tender Offer is being made only pursuant to the Offer to Purchase, the Supplement, the amended Letter of Transmittal and related documents, as may be amended or supplemented from time to time. Stockholders should read the Offer to Purchase, the Supplement, the amended Letter of Transmittal and the related materials carefully because they contain important information. Stockholders will be able to obtain a free copy of the Tender Offer Statement on Schedule TO, the Offer to Purchase, the Supplement, the amended Letter of Transmittal and other documents that the company has filed or is filing with the U.S. Securities and Exchange Commission at the commission’s website at www.sec.gov. Stockholders also may obtain a copy of these documents, without charge, from Georgeson Shareholder Communications Inc., the information agent for the Tender Offer, toll free at 877-278-6310.

2004 Accomplishments

As promised. . .

• Delivered consistent operating performance successfully

• Acquired and integrated Westport Resources’ production, prospects, people & systems

• Balanced E&P portfolio

• Increased returns - equity & capital

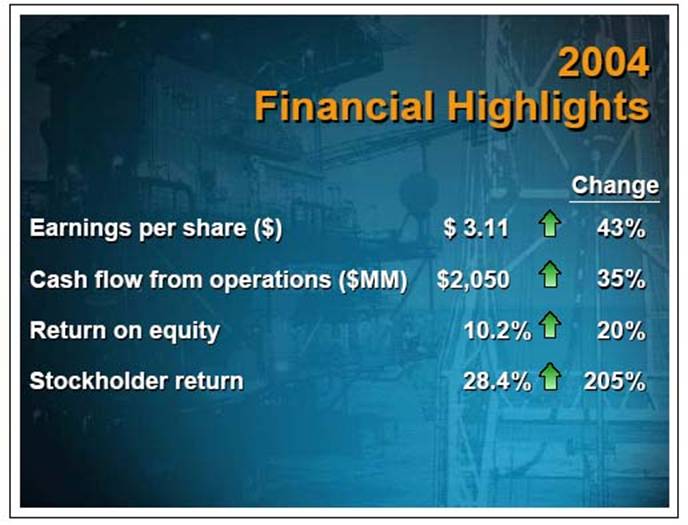

2004 Financial Highlights

| | | | | | Change | |

Earnings per share ($) | | $ | 3.11 | |

| | 43 | % |

| | | | | | | |

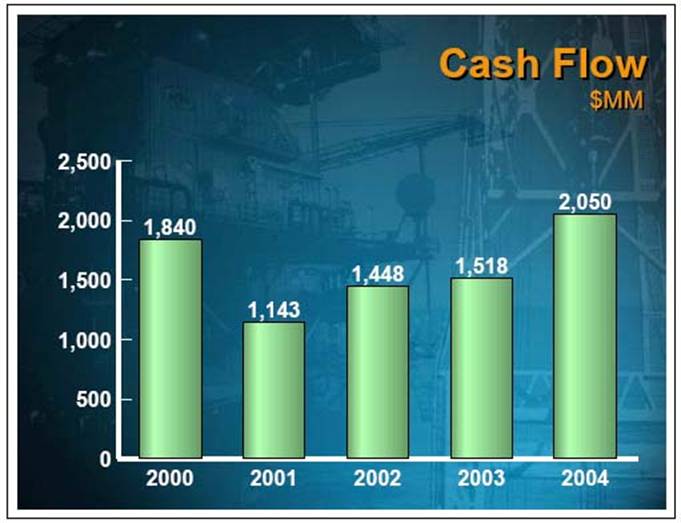

Cash flow from operations ($MM) | | $ | 2,050 | |

| | 35 | % |

| | | | | | | |

Return on equity | | 10.2 | % |

| | 20 | % |

| | | | | | | |

Stockholder return | | 28.4 | % |

| | 205 | % |

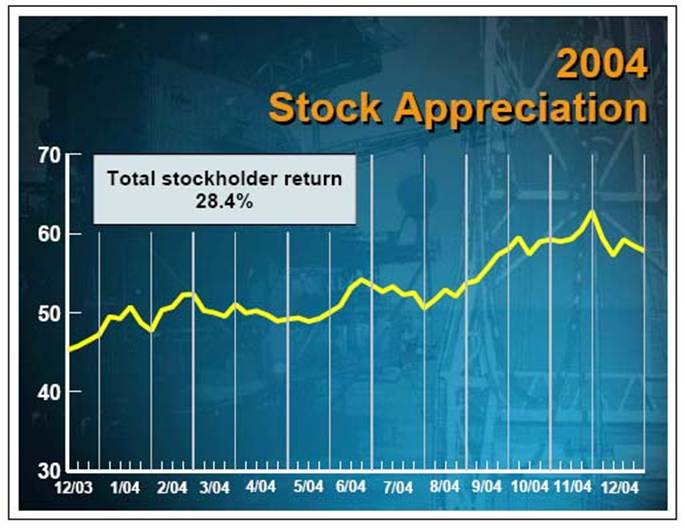

2004 Stock Appreciation

[CHART]

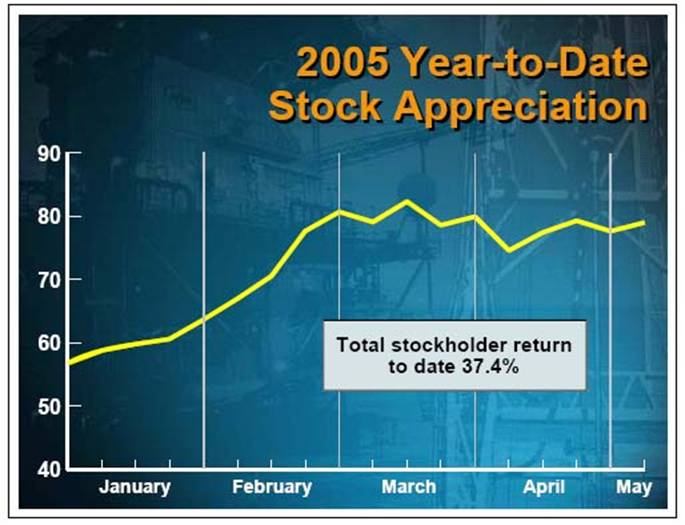

2005 Year-to-Date Stock Appreciation

[CHART]

Enhancing Stockholder Value

• $4 billion share repurchase via modified “Dutch auction” - $85-$92 per share

• Repurchasing approximately 27%-29% of shares outstanding

• Initially funded through debt; repaid from

• Proceeds from Chemical separation

• Proceeds from E&P divestments

• Cash flow

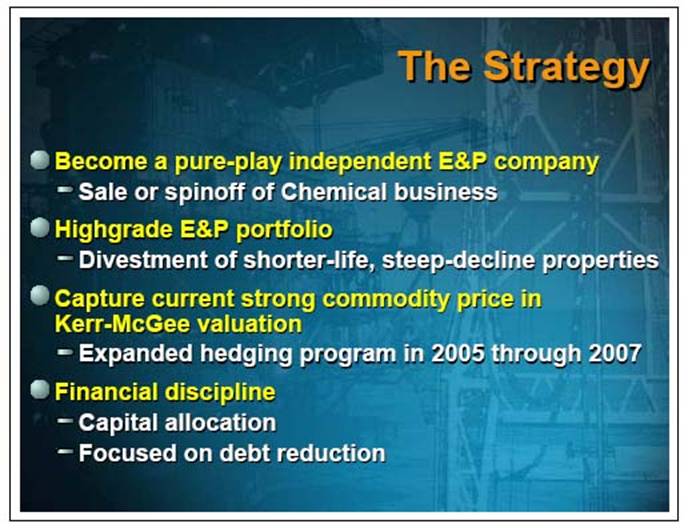

The Strategy

• Become a pure-play independent E&P company

• Sale or spinoff of Chemical business

• Highgrade E&P portfolio

• Divestment of shorter-life, steep-decline properties

• Capture current strong commodity price in Kerr-McGee valuation

• Expanded hedging program in 2005 through 2007

• Financial discipline

• Capital allocation

• Focused on debt reduction

The Pure-Play Kerr-McGee

• Strong free cash generator

• Longer reserve life

• Lower production decline rate

• Identified production growth

• High-impact exploration opportunities

• Reduced capital-intensive projects

Oil & Gas

Exploration & Production

[GRAPHIC]

David A. Hager

Senior Vice President

Kerr-McGee Oil & Gas

• Balanced portfolio

• High-quality assets

• Large inventory of repeatable, low-risk exploitation projects

• Balanced exploration program focused in proven hydrocarbon basins

• Capitalizing on operational and development expertise

• Proven record of value-enhancing transactions

Grow production and reserves per share

Per-Share Growth

Production and Reserves

• Foundational growth

• US onshore

• Infield drilling

• Satellite drilling

• High-impact exploration

• Gulf of Mexico

• China

• Alaska

• Brazil

• Tactical transactions

[GRAPHIC]

5-Year Change in Reserves

MM BOE

[CHART]

Recent Results

• 1Q 2005 E&P segment operating profit: $655 MM

• 98% increase versus 4Q 2004

• 99% increase versus 1Q 2004

• Operational excellence & more favorable hedging positions

• Focused on execution

• Already completed 250 wells

• 900 wells planned in 2005

• >98% facilities uptime (deepwater Gulf of Mexico)

• Major projects on schedule and on budget

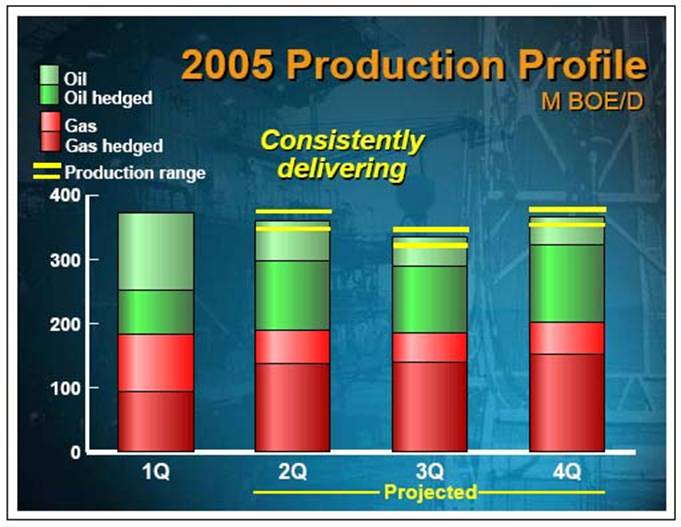

2005 Production Profile

M BOE/D

Consistently delivering

[CHART]

Efficient Developer and Producer

• Recognized as top-tier performer in development efficiency and cycle-time

• Supply-chain culture

• Contracts in place to minimize increases in service costs

• Further reduction of unit costs as divestiture program is completed

[GRAPHIC]

Industry Award

• 2005 recipient of the Distinguished Achievement Award at Offshore Technology Conference

• Pioneering the development of spar technology

• Second OTC award since 2000

[GRAPHIC]

The Environment

The safety of our employees and caring for the environment is a top priority

• Strive to provide a safe workplace

• Committed to caring for the environment

• Strong corporate citizen

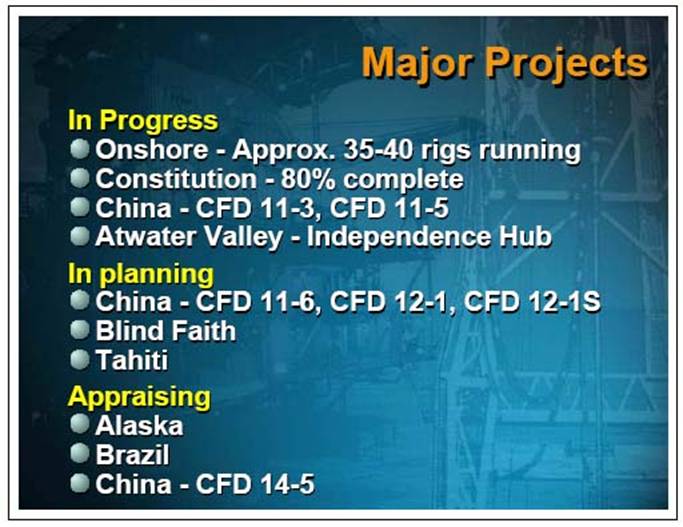

Major Projects

In Progress

• Onshore - Approx. 35-40 rigs running

• Constitution - 80% complete

• China - CFD 11-3, CFD 11-5

• Atwater Valley - Independence Hub

In planning

• China - CFD 11-6, CFD 12-1, CFD 12-1S

• Blind Faith

• Tahiti

Appraising

• Alaska

• Brazil

• China - CFD 14-5

What’s Ahead

World-class assets

• Execution of divestiture package

• Onshore assets grow as a percentage of portfolio

• Actively drilling in deepwater Gulf of Mexico

• On equal footing with peer group

Chemical

[GRAPHIC]

Thomas W. Adams

Vice President

Chemical Strategy

• Global market leader

• Diversified portfolio of products

• Execution of value strategy

• Focus on cash flow, profit & returns

• Driven from customers’ perspective

• Operational excellence

• Supply chain

• Technology

[CHART]

2004 Global TiO2 Market

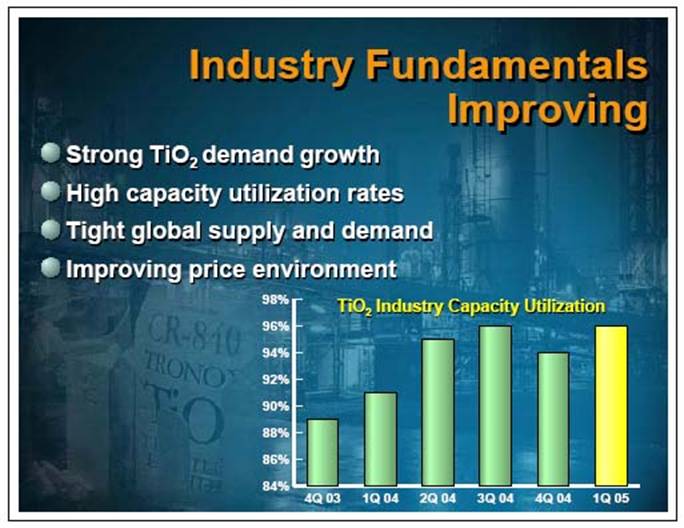

Industry Fundamentals Improving

• Strong TiO2 demand growth

• High capacity utilization rates

• Tight global supply and demand

• Improving price environment

TiO2 Industry Capacity Utilization

[CHART]

Strong First-Quarter Performance

• Operating profit improving

• Record sales volumes & improving prices

• Successful execution of manufacturing strategies

Kerr-McGee Chemical Segment Operating Profit*

[CHART]

* From continuing operations

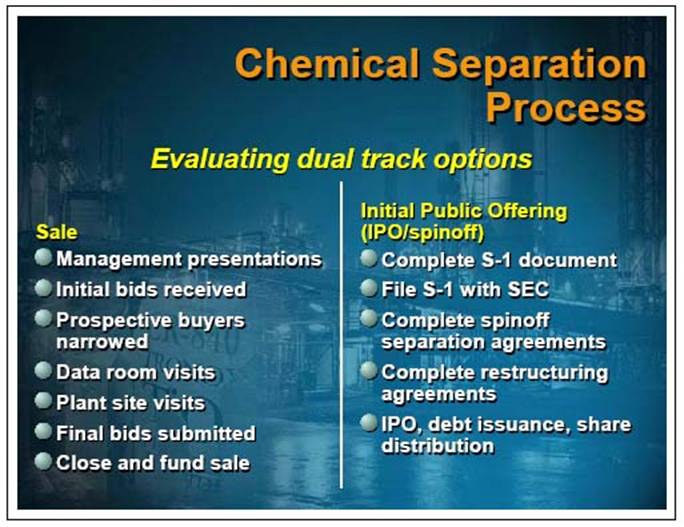

Chemical Separation Process

Evaluating dual track options

Sale

• Management presentations

• Initial bids received

• Prospective buyers narrowed

• Data room visits

• Plant site visits

• Final bids submitted

• Close and fund sale

Initial Public Offering (IPO/spinoff)

• Complete S-1 document

• File S-1 with SEC

• Complete spinoff separation agreements

• Complete restructuring agreements

• IPO, debt issuance, share distribution

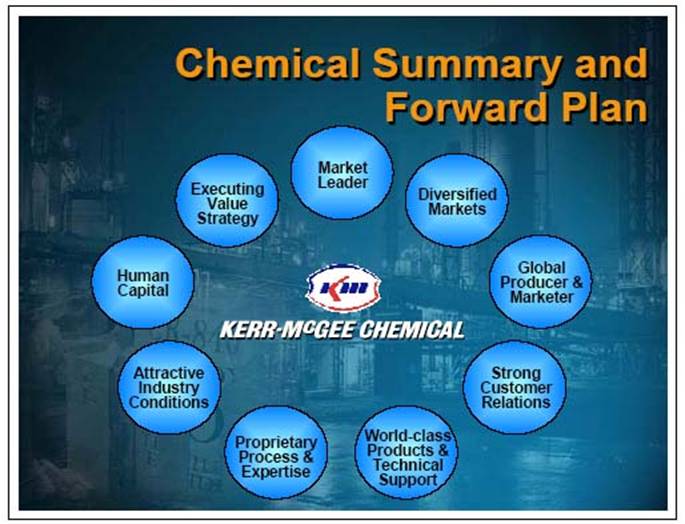

Chemical Summary and Forward Plan

| | Market | | |

| | Leader | | |

| Executing | | Diversified | |

| Value | | Markets | |

| Strategy | | | Global |

Human | | | | Producer & |

Capital | | [LOGO] | | Marketer |

| KERR-McGEE CHEMICAL | |

Attractive | | | | Strong |

Industry | | | | Customer |

Conditions | | | �� | Relations |

| Proprietary | | World-class | |

| Process & | | Products & | |

| Expertise | | Technical | |

| | | Support | |

Financial Issues

[GRAPHIC]

Robert M. Wohleber

Senior Vice President and Chief Financial Officer

Financial Highlights

$MM

| | 2003 | | 2004 | | | | Change | |

Revenues | | $ | 4,080 | | $ | 5,157 | |

| | 26 | % |

Operating Profit | | 966 | | 1,168 | |

| | 21 | % |

Net Income | | 219 | | 404 | |

| | 84 | % |

Cash Flow from Ops | | 1,518 | | 2,050 | |

| | 35 | % |

Total Assets | | 10,250 | | 14,518 | |

| | 42 | % |

Stockholders’ Equity | | 2,636 | | 5,318 | |

| | 102 | % |

| | | | | | | | | | | |

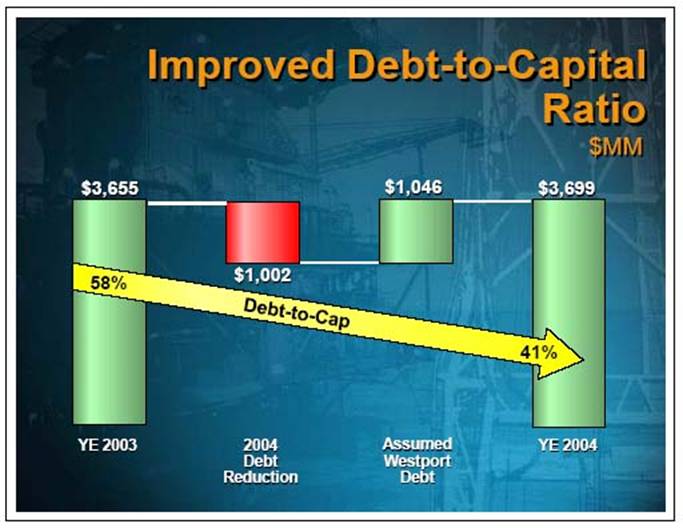

Improved Debt-to-Capital Ratio

$MM

[CHART]

First Quarter 2005

$MM

[CHART]

Financing for Tender Offer

• Tender offer funded with cash and net proceeds from new borrowings

• Company obtained commitments for financing of up to $6 B

• Near-term deleveraging planned

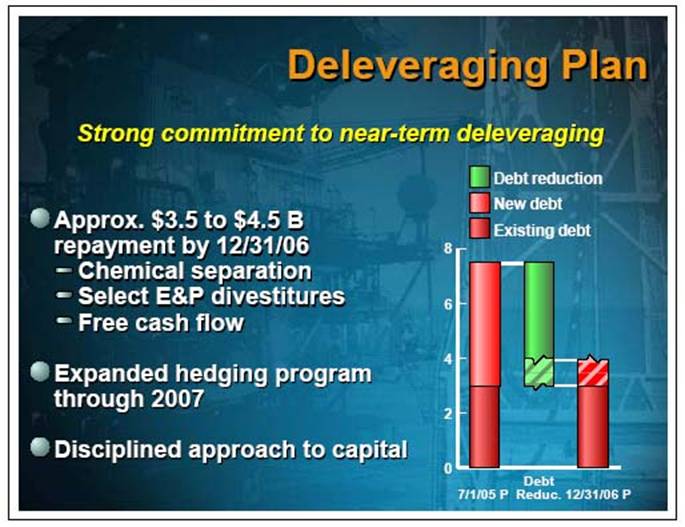

Deleveraging Plan

Strong commitment to near-term deleveraging

• Approx. $3.5 to $4.5 B repayment by 12/31/06

• Chemical separation

• Select E&P divestitures

• Free cash flow

• Expanded hedging program through 2007

• Disciplined approach to capital

[CHART]

Financial Outlook

• Unlocking value for stockholders

• Continued strong cash flow

• Capital discipline

• Per-share performance

[GRAPHIC]

BALANCE

Kerr-McGee Corporation

Annual Stockholders’

Meeting

May 10, 2005