Exhibit 99.2

PEDEVCO CORP. (PACIFIC ENERGY DEVELOPMENT) NYSE MKT: PED Investor Presentation February 24, 2015

CAUTIONARY STATEMENT This presentation contains forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward looking statements are based on our current expectations about our company, our properties, our estimates of required capital expenditures and our industry. You can identify these forward looking statements when you see us using words such as "expect”, "will", "anticipate," "indicate," "estimate," "believes," "plans" and other similar expressions. It is important to note that any such forward looking statements are not guarantees of future performance and involve a number of risks and uncertainties. Actual results could differ materially from those projected in such forward-looking statements. Factors that could cause actual results to differ materially from those projected in such forward-looking statement include: the preliminary nature of well data, including permeability and gas content, and commercial viability of the wells; risk and uncertainties associated with exploration, development and production of oil and gas; drilling and production risks; our lack of operating history; limited and potentially inadequate cash resources; matters affecting the oil and gas industry generally; lack of oil and gas field goods and services; environmental risks; changes in laws or regulations affecting our operations; our satisfactory completion of due diligence of Dome Energy; our ability to negotiate and enter into a definitive combination agreement with Dome Energy and, if such an agreement is entered into, the satisfaction of the conditions contained in the definitive combination agreement; any delay or inability to obtain necessary approvals or consents from third parties; our and Dome Energy’s ability to obtain financing for funding obligations, our inability to maintain our listing on the NYSE MKT, our the ability to realize the anticipated benefits from the proposed business transaction with Dome Energy; as well as other risks described in PEDEVCO Corp.’s public filings with the U.S. Securities and Exchange Commission (the “SEC”) and Dome Energy’s regulatory filings. We undertake no obligation to publicly update any forward looking statements for any reason, even if new information becomes available or other events occur in the future. We caution you not to place undue reliance on those statements. Definition of Technical Terms: Certain technical terms used in this presentation associated with descriptions of the potential for oil and gas properties are not consistent with “Proved Reserves” as defined by the SEC. Note to Investors: This presentation contains information about adjacent properties on which we have no right to explore. Investors are cautioned that petroleum deposits on adjacent properties are not necessarily indicative of such deposits on our properties. This document is not an offer to sell securities and is not soliciting an offer to buy securities in any jurisdiction where the offer or sale is not permitted.

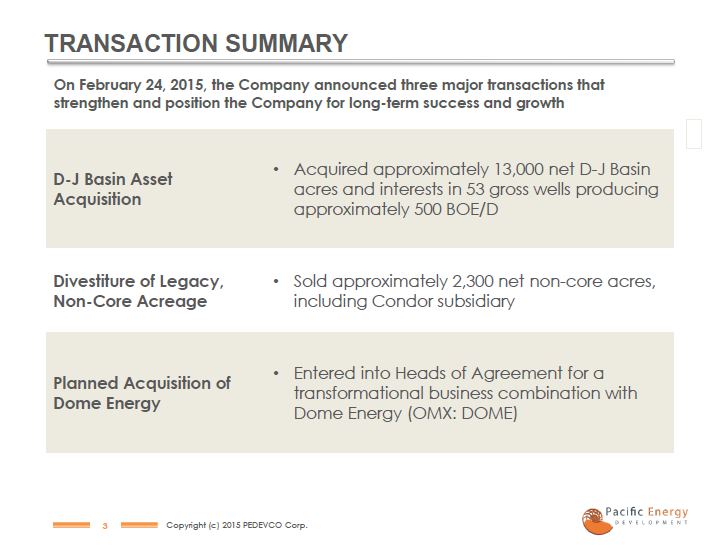

TRANSACTION SUMMARY In February 24, 2015, the Company announced three major transactions that strengthen and position the Company for long-term success and growth D-J Basin Asset Acquisition Acquired approximately 13,000 net D-J Basin acres and interests in 53 gross wells producing approximately 500 BOE/D Divestiture of Legacy, Non-Core Acreage Sold approximately 2,300 net non-core acres, including Condor subsidiary Planned Acquisition of Dome Energy Entered into Heads of Agreement for a transformational business combination with Dome Energy (OMX: DOME)

SUMMARY Overview, A dynamic energy company focusing on high-growth, early cash flow energy projects Focus, Shale and conventional oil and gas in the U.S. Ticker, NYSE MKT: PED Capital Structure (as of 02/19/15), $35.3mm in Secured Promissory Notes @ 15% due March 2017 $4.9mm in Secured Subordinated Promissory Notes @ 10% $8.4mm in Secured Subordinated Promissory Notes @ 12% Total Debt: $48.5mm Preferred Equity: 66,625 shares Series A Convertible Preferred Common Equity: 37.8mm shares (47.5mm fully diluted) Company Reserve Engineers, Ryder Scott Co. LP / South Texas Reservoir Alliance LLC Headquarters, Danville, CA (Corporate) / Houston, TX (Technical Operations)

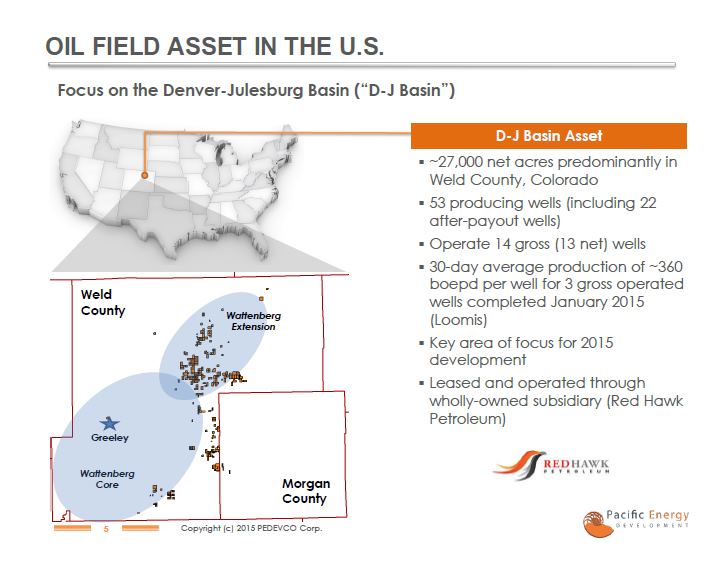

OIL FIELD ASSET IN THE U.S. Focus on the Denver-Julesburg Basin (“D-J Basin”) D-J Basin Asset ~27,000 net acres predominantly in Weld County, Colorado 53 producing wells (including 22 after-payout wells) Operate 14 gross (13 net) wells 30-day average production of ~360 boepd per well for 3 gross operated wells completed January 2015 (Loomis) Key area of focus for 2015 development Leased and operated through wholly-owned subsidiary (Red Hawk Petroleum) Weld County Wattenberg Extension Morgan County Greeley Wattenberg Core

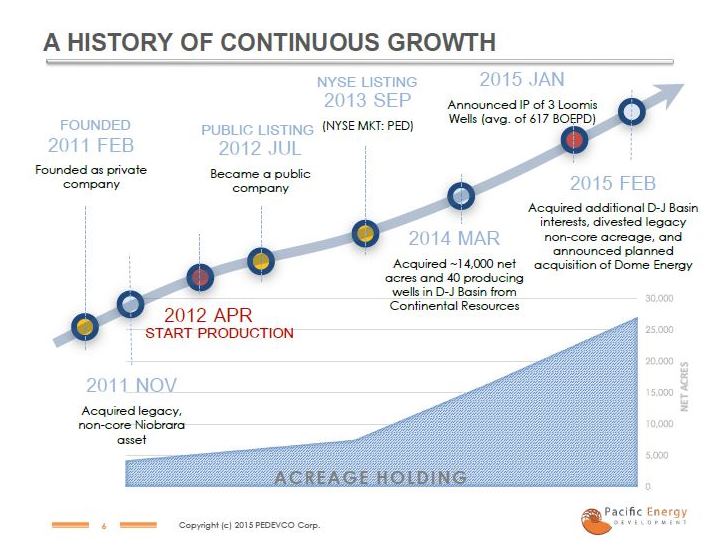

A HISTORY OF CONTINUOUS GROWTH FOUNDED 2011 FEB Founded as private company 2011 NOV Acquired legacy, non-core Niobrara asset PUBLIC LISTING 2012 APR START PRODUCTION 2012 JUL Became a public company NYSE LISTING 2013 SEP (NYSE MKT: PED) 2014 MAR Acquired ~14,000 net acres and 40 producing wells in D-J Basin from Continental Resources 2015 JAN Announced IP of 3 Loomis Wells (avg. of 617 BOEPD) 2015 FEB Acquired additional D-J Basin interests, divested legacy non-core acreage, and announced planned acquisition of Dome Energy Acreage HOLDING

MANAGEMENT TEAM Frank Ingriselli Chairman, CEO, Past President of Texaco International Operations Past President of Texaco Technology Ventures Past founder and CEO of CAMAC Energy Past CEO of Timan Pechora Company Led team that established the first successful Chinese oil contract by a foreign entity, Y.M. Shum Chief Technology Officer, Held senior management positions in E&P at Texaco Lead first foreign offshore oil discovery in China Led largest enhanced oil recovery in history for Texaco Head of Texaco in Beijing for almost a decade PhD, Brown University Michael Peterson President, CFO, Past Chairman and CEO of Solargen Energy, Inc. Past Interim CEO and Director of Blast Energy Services Founder and Managing Partner - Pascal Management Past Managing Partner, Co-founder and Director of Venture Investing - American International Partners First Vice President, Merrill Lynch Vice President, Goldman Sachs, Gregory Rozenfeld Development & Operations Officer, Division Manager, Project Evaluation, M&A – Lukoil-Overseas, Moscow, Russia VP Upstream & Special Projects – Sidan, Moscow Project Manager, International Asset Management, Texaco Power and Gasification Division, U.S. VP, Texaco International Operations, Inc. Clark Moore EVP & General Counsel, Past Lead in-house Corporate Counsel and Secretary of CAMAC Energy Former attorney at the law firms of Venture Law Group and Heller Ehrman LLP J. D. degree with distinction from Stanford Law School, Dan Mason VP of Corporate Development, Formerly with Triangle Petroleum in finance and corporate development for parent co and midstream JV (Caliber Midstream) Past Associate at Alinda Capital Partners on Sourcing & Execution Team Former Analyst in J.P. Morgan’s Natural Resources Investment Banking Team MBA from The Wharton School of the University of Pennsylvania

Technical/Operating Experts Pacific Energy Technical Services Sean Fitzgerald VP of Business Development, Former Lead Business Development Engineer at Rosetta Resources & Lead Reservoir Engineer at Shell Led over $350M in completed acquisition including the Mid-Continental, Gulf Coast, Gulf Coast Shelf, West Coast, and Rockies BS Petroleum Engineering from the University of Texas at Austin; licensed petroleum engineer in Texas, Michael Rozenfeld VP of Geosciences, Former Lead Reservoir Engineer and Petrophysicist at Rosetta Resources and Shell Proven record of success in leasing, planning, and drilling vertical and horizontal wells in conventional, tight gas, and shale plays BS Petroleum Engineering from the University of Texas at Austin; licensed petroleum engineer in Texas Kristopher Johnson VP -Operations, Former Asset & Operations Engineer at Citation Oil &d Gas Led the development of various multi-well exploration drilling programs at Citation Proven record in large oil and gas properties management, capital projects implementation and acquisition opportunity development BS Petroleum Engineering from the University of Texas at Austin; licensed petroleum engineer in Texas, Cindy Welch Manager, Geosciences, Geoscientist with over 10 years of experience at Chevron and other majors Expertise in carbonate depositional systems, sequence stratigraphy, petrophysics & waterflood analysis. Drilled over 100 horizontal and vertical wells in multiple reservoirs in the Permian Basin, Oklahoma & Monterey shale MS in Geology and a BS in Geophysics from Texas Tech University Hakim Benhammou Manager, Exploration & Production, Reservoir production specialist. Has optimized & improved thousands of producing oil & gas wells Instrumental in drilling and completing Bone Springs horizontals and recompletions years before the play was on the map International experience in Morocco and Spain, drilling company’s first international wells in logistically challenging desert environments BS Petroleum Engineering from the University of Texas at Austin, Richard Wilde Manager, Operations, Lead operator; has overseen the drilling of over 400 horizontal wells (4.4 million FT) Managed drilling rig scheduling of up to 25 rigs in his previous career at XTO in partnership with Exxon Optimized 175 wells resulting in a 300% increase in production while reducing drilling costs by 50% Reduced drill times from 25 days to 10 days while increasing laterals lengths by thousands of feet BS Petroleum Engineering from the University of Texas at Austin

BOARD OF DIRECTORS Frank Ingriselli Chairman, CEO, Chairman and CEO of Pacific Energy Development (NYSE: PED) Founder and former President and CEO of CAMAC Energy President of Texaco International President of Texaco Technology Ventures CEO of Timan Pechora Company Led team that established the first successful Chinese oil contract by a foreign entity David C. Crikelair Director, Over 40 years experience in corporate finance, banking, capital markets and financial reporting in the energy industry Managing Partner, FrontStreet Partners, LLC Vice President, Treasurer, and Head of Alternate Energy, Texaco Inc. CFO, Equilon Enterprises, LLC – largest downstream company in the United States Director, Caltex Petroleum Corporation MBA, Corporate Finance from NYU Elizabeth P. Smith Director, Over 30 years experience in corporate compliance, investor relations, and law in the energy industry Vice President-Investor Relations and Shareholder Services, Texaco Inc. Corporate Compliance Officer, Texaco Inc. Former member and past President of Investor Relations Association and the Petroleum Investor Relations Institute JD from Georgetown University Law Center

COMPANY STRATEGY Acquire assets in prime locations March 2014 acquired ~14,000 net acres and 40 producing wells in Colorado’s Wattenberg and Wattenberg Extension from Continental Resources February 2015 acquired additional ~13,000 net acres and working interests in 53 producing wells in existing footprint Optimize operated development of core acreage Reduce drilling & construction costs while increasing production results Operate 14 gross (13 net) operated wells in D-J Basin (drilled 3 of the 14) Tested three different completion methods on three newly drilled HZ wells in Wattenberg Extension (Loomis pad); implementing findings on future locations Hold acreage by production and/or opportunistically monetize acreage position February 2015 announced sale of ~2,300 net non-core acres, including Condor subsidiary at a premium valuation Focused on reducing costs and developing highest return assets in low price environment Recently reduced workforce by 25% and cut SG&A by 33% 2015 drilling program focuses on core Wattenberg locations

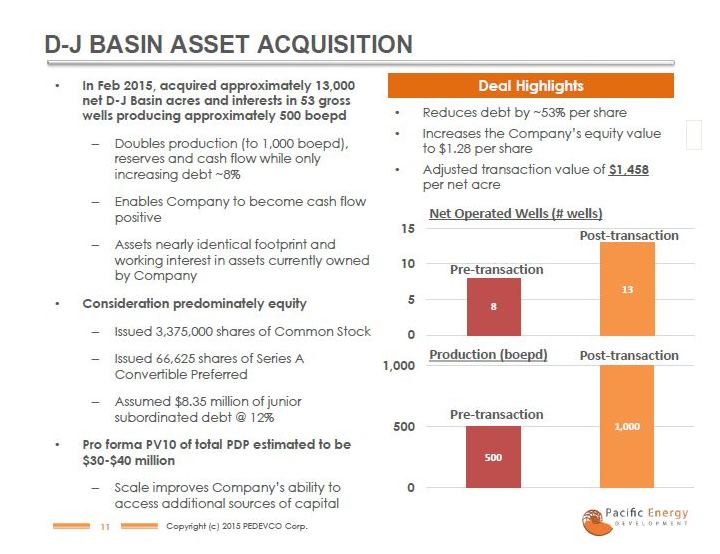

D-J BASIN ASSET ACQUISITION In Feb 2015, acquired approximately 13,000 net D-J Basin acres and interests in 53 gross wells producing approximately 500 boepd Doubles production (to 1,000 boepd), reserves and cash flow while only increasing debt ~8% Enables Company to become cash flow positive Assets nearly identical footprint and working interest in assets currently owned by Company Consideration predominately equity Issued 3,375,000 shares of Common Stock Issued 66,625 shares of Series A Convertible Preferred Assumed $8.35 million of junior subordinated debt @ 12% Pro forma PV10 of total PDP estimated to be $30-$40 million Scale improves Company’s ability to access additional sources of capital Deal Highlights Reduces debt by ~53% per share Increases the Company’s equity value to $1.28 per share Adjusted transaction value of $1,458 per net acre

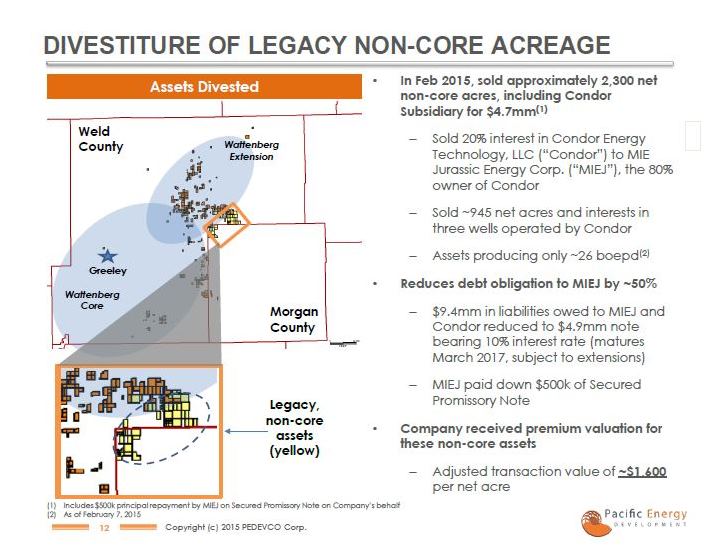

DIVESTITURE OF LEGACY NON-CORE ACREAGE In Feb 2015, sold approximately 2,300 net non-core acres, including Condor Subsidiary for $4.7mm(1) Sold 20% interest in Condor Energy Technology, LLC (“Condor”) to MIE Jurassic Energy Corp. (“MIEJ”), the 80% owner of Condor Sold ~945 net acres and interests in three wells operated by Condor Assets producing only ~26 boepd(2) Reduces debt obligation to MIEJ by ~50% $9.4mm in liabilities owed to MIEJ and Condor reduced to $4.9mm note bearing 10% interest rate (matures March 2017, subject to extensions) MIEJ paid down $500k of Secured Promissory Note Company received premium valuation for these non-core assets Adjusted transaction value of ~$1,600 per net acre

PRE- / POST-TRANSACTION HIGHLIGHTS Comparison of Company before and after the D-J Basin Asset Acquisition and Divestiture of Legacy Non-Core Acreage Pre-transactions, Post-transactions Net Acres, ~16,500, ~27,000 Producing Wells (Gross / Net), 58 / 10, 53 / 17 Operated Wells (Gross / Net), 19 / 8, 14 / 13 Daily Production (Boepd), ~500, ~1,000 Total Debt & Accrued Interest, $45.1 million, $48.5 million(1) Total Shares, 34.4 million Common Stock, 37.8 million Common Stock / 66,625 Preferred Stock PV-10 of PDP, $15-$20 million, $30-$40 million PV-10 of 1P, ~$75 million, ~$150 million (1) Assumes $500k of Secured Promissory Note repaid, $9.4mm of debt owed to MIEJ and Condor reduced to $4.9mm and assumption of $8.35mm of Subordinated Secured Promissory Notes

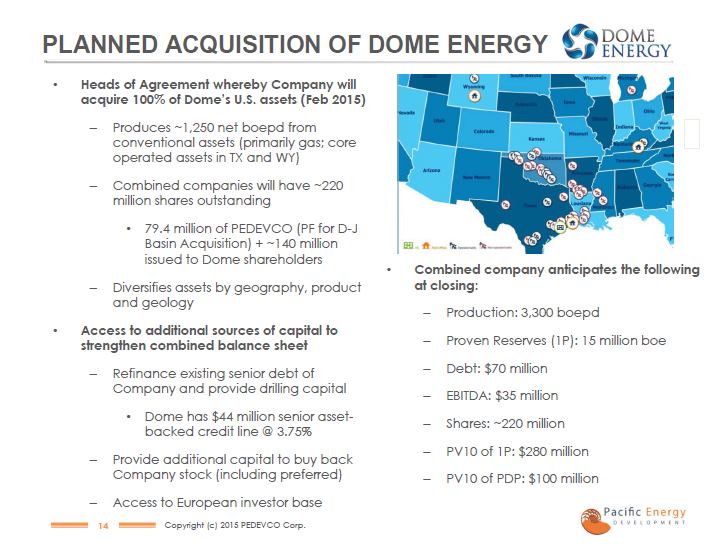

PLANNED ACQUISITION OF DOME ENERGY Heads of Agreement whereby Company will acquire 100% of Dome’s U.S. assets (Feb 2015) Produces ~1,250 net boepd from conventional assets (primarily gas; core operated assets in TX and WY) Combined companies will have ~220 million shares outstanding 79.4 million of PEDEVCO (PF for D-J Basin Acquisition) + ~140 million issued to Dome shareholders Diversifies assets by geography, product and geology Access to additional sources of capital to strengthen combined balance sheet Refinance existing senior debt of Company and provide drilling capital Dome has $44 million senior asset-backed credit line @ 3.75% Provide additional capital to buy back Company stock (including preferred) Access to European investor base Combined company anticipates the following at closing: Production: 3,300 boepd Proven Reserves (1P): 15 million boe Debt: $70 million EBITDA: $35 million Shares: ~220 million PV10 of 1P: $280 million PV10 of PDP: $100 million

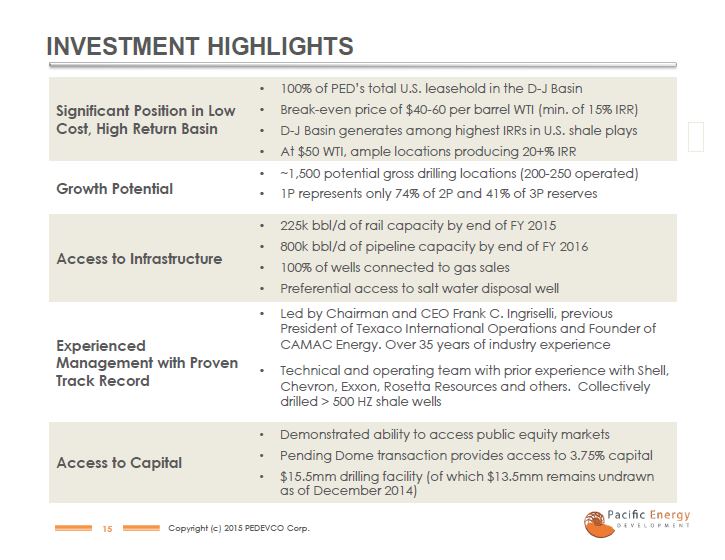

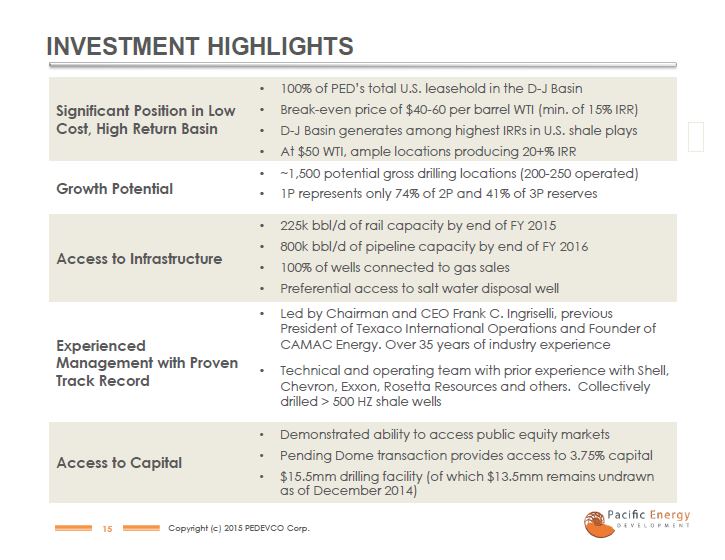

INVESTMENT HIGHLIGHTS Significant Position in Low Cost, High Return Basin, 100% of PED’s total U.S. leasehold in the D-J Basin Break-even price of $40-60 per barrel WTI (min. of 15% IRR) D-J Basin generates among highest IRRs in U.S. shale plays At $50 WTI, ample locations producing 20+% IRR Growth Potential, ~1,500 potential gross drilling locations (200-250 operated) 1P represents only 74% of 2P and 41% of 3P reserves Access to Infrastructure, 225k bbl/d of rail capacity by end of FY 2015 800k bbl/d of pipeline capacity by end of FY 2016 100% of wells connected to gas sales Preferential access to salt water disposal well Experienced Management with Proven Track Record, Led by Chairman and CEO Frank C. Ingriselli, previous President of Texaco International Operations and Founder of CAMAC Energy. Over 35 years of industry experience Technical and operating team with prior experience with Shell, Chevron, Exxon, Rosetta Resources and others. Collectively drilled > 500 HZ shale wells Access to Capital, Demonstrated ability to access public equity markets Pending Dome transaction provides access to 3.75% capital $15.5mm drilling facility (of which $13.5mm remains undrawn as of December 2014)

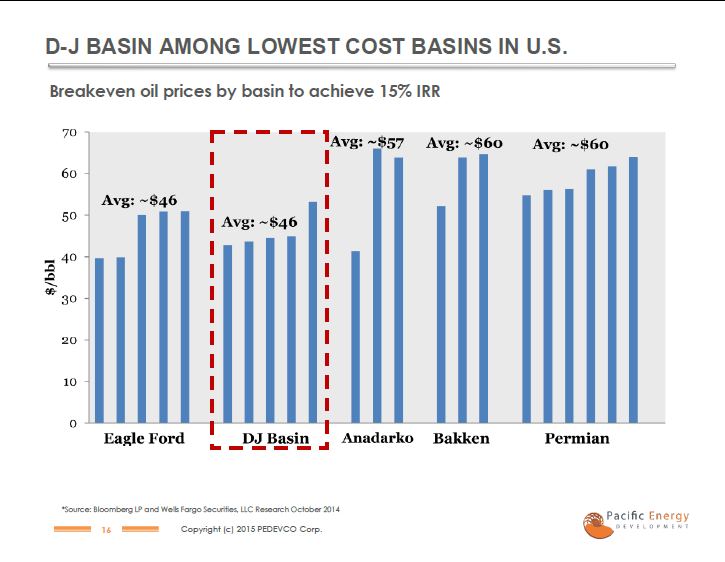

D-J BASIN AMONG LOWEST COST BASINS IN U.S. Breakeven oil prices by basin to achieve 15% IRR *Source: Bloomberg LP and Wells Fargo Securities, LLC Research October 2014

OIL-WEIGHTED BASIN WITH HIGH IRRs Assumes $55 oil / $3 gas *Source: Bloomberg LP and Wells Fargo Securities, LLC Research January 2015

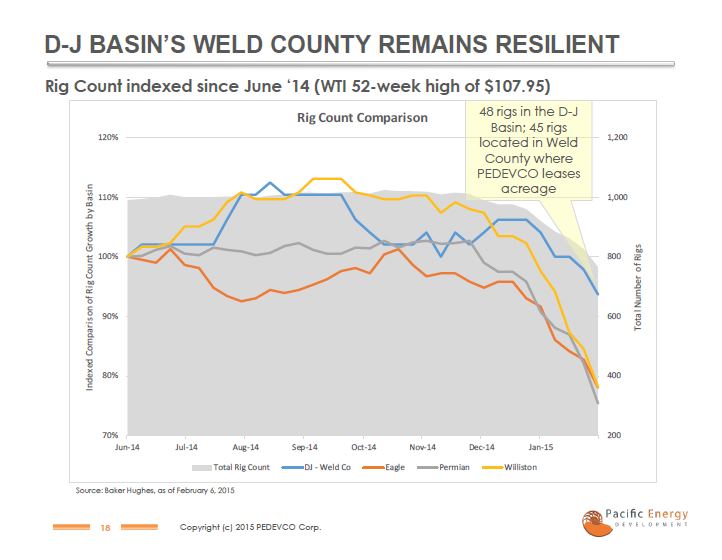

D-J BASIN’S WELD COUNTY REMAINS RESILIENT Rig Count indexed since June ‘14 (WTI 52-week high of $107.95) 48 rigs in the D-J Basin; 45 rigs located in Weld County where PEDEVCO leases acreage Source: Baker Hughes, as of February 6, 2015

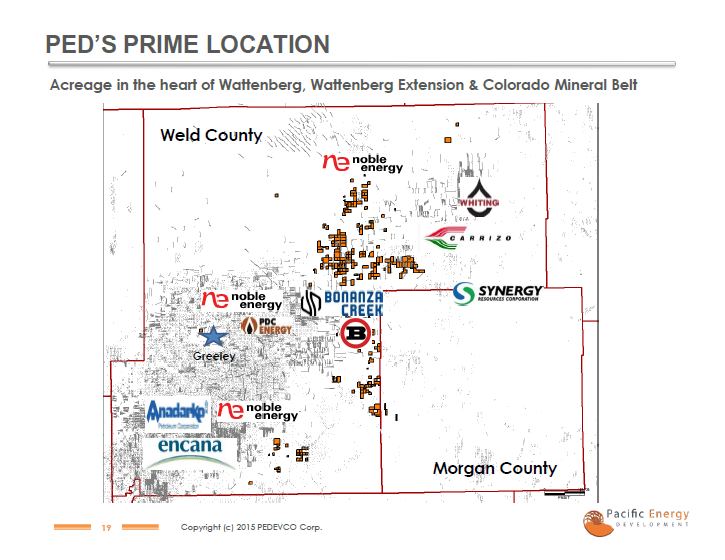

PED’S PRIME LOCATION Acreage in the heart of Wattenberg, Wattenberg Extension & Colorado Mineral Belt

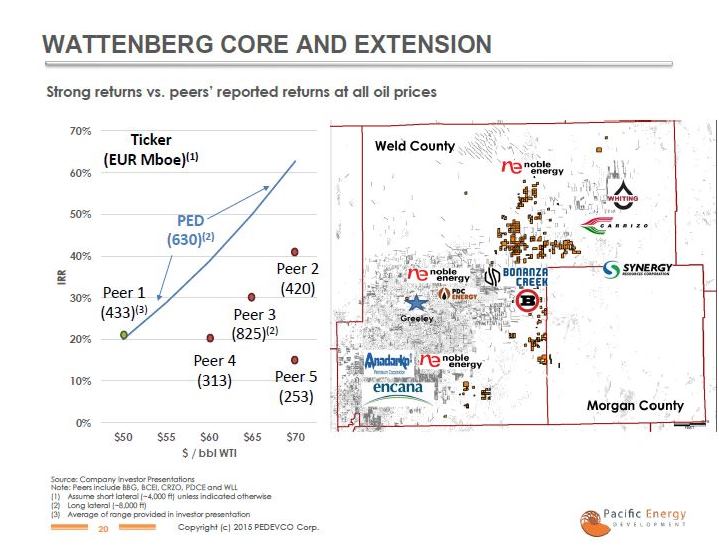

WATTENBERG CORE AND EXTENSION Strong returns vs. peers’ reported returns at all oil prices Ticker (EUR Mboe)(1) PED (630)(2) Peer 1 (433)(3 Peer 2 (420) Peer 3 (825)(2) Peer 4 (313) Peer 5 (253) Source: Company Investor Presentations Note: Peers include BBG, BCEI, CRZO, PDCE and WLL (1) Assume short lateral (~4,000 ft) unless indicated otherwise (2) Long lateral (~8,000 ft) (3) Average of range provided in investor presentation

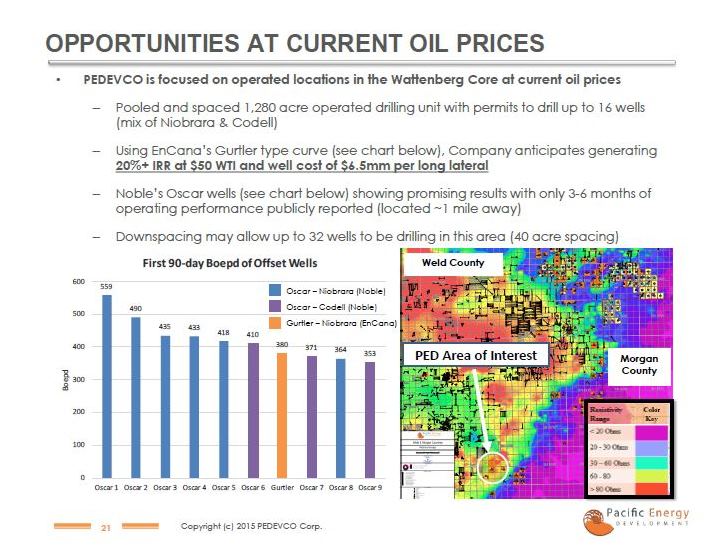

OPPORTUNITIES AT CURRENT OIL PRICES PEDEVCO is focused on operated locations in the Wattenberg Core at current oil prices Pooled and spaced 1,280 acre operated drilling unit with permits to drill up to 16 wells (mix of Niobrara & Codell) Using EnCana’s Gurtler type curve (see chart below), Company anticipates generating 20%+ IRR at $50 WTI and well cost of $6.5mm per long lateral Noble’s Oscar wells (see chart below) showing promising results with only 3-6 months of operating performance publicly reported (located ~1 mile away) Downspacing may allow up to 32 wells to be drilling in this area (40 acre spacing)

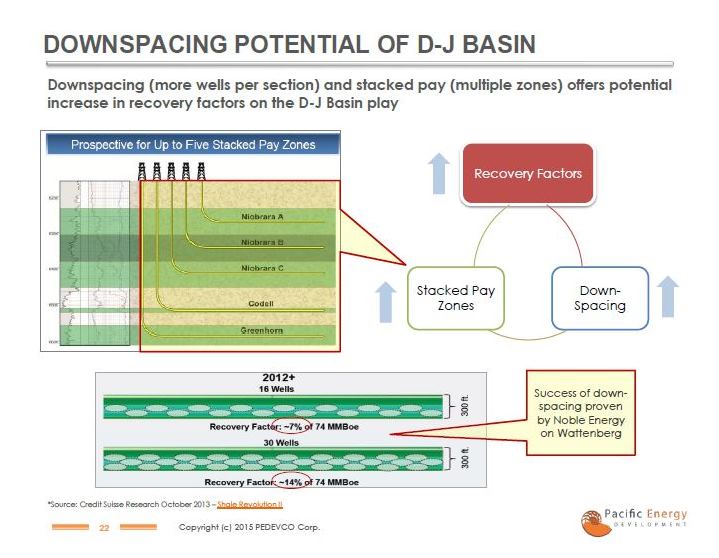

DOWNSPACING POTENTIAL OF D-J BASIN Downspacing (more wells per section) and stacked pay (multiple zones) offers potential increase in recovery factors on the D-J Basin play Recovery Factors Stacked Pay Zones Down-Spacing

Success of down-spacing proven by Noble Energy on Wattenberg *Source: Credit Suisse Research October 2013 – Shale Revolution II

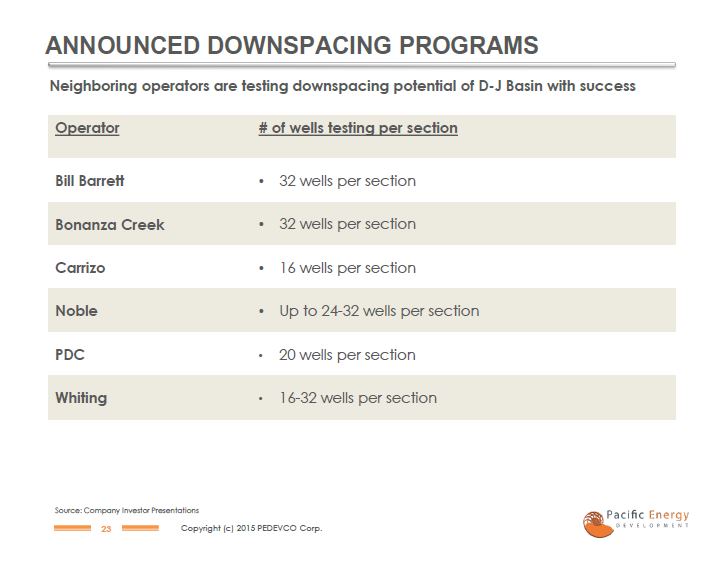

ANNOUNCED DOWNSPACING PROGRAMS Neighboring operators are testing downspacing potential of D-J Basin with success Operator, # of wells testing per section Bill Barrett, 32 wells per section Bonanza Creek, 32 wells per section Carrizo, 16 wells per section Noble, Up to 24-32 wells per section PDC, 20 wells per section Whiting, 16-32 wells per section Source: Company Investor Presentations

STRONG OPERATOR WITH RECENT SUCCESS Loomis Pad (7N60W section 2) (Initial Production Announced Jan ‘15) Wells, 2-1H, 2-3H, 2-6H Boepd IP, 681, 581, 590 30-day Boepd, 381, 301, 390 NRI, 80%, 80%, 80% Net 30-day Boepd, 305, 241, 312 Stages, 18, 18, 25 Design, New Enhanced Standard, Increased Proppant, Tighter Spacing Well Cost, $4.4mm, $4.0mm, $3.9mm The Loomis pad located in 7N60W section 2 was a test pad for new completion designs Initial results exceed expectations Gas lift decreasing LOE First pad for PEDEVCO showing significant cost reductions through shared facilities Decreased spacing showed no interference and indicates even potentially closer future spacing for wells (1) Includes Loomis Pad production and production from D-J Basin Asset Acquisition

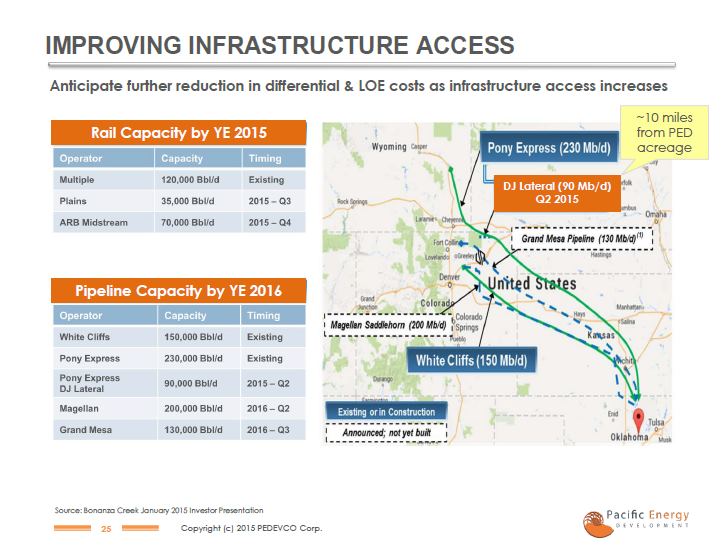

IMPROVING INFRASTRUCTURE ACCESS Anticipate further reduction in differential & LOE costs as infrastructure access increases Rail Capacity by YE 2015 Pipeline Capacity by YE 2016 ~10 miles from PED acreage Source: Bonanza Creek January 2015 Investor Presentation

RECENT TRANSACTIONS IN D-J BASIN PED consistently demonstrates ability to acquire and divest assets at attractive valuations Date, Oct 2014, May 2014, Mar 2014, Feb 2015, Feb 2015 Transaction Value ($mm), 125, 226, 35, 39, 5 Production (boepd), 1,240, 700, 200, 500, 26 $ per bbl/d, $60,000, $80,000, $60,000, $40,000, $40,000 PDP Value ($mm), 74, 56, 12, 20, 1 Adjusted Transaction Value ($mm)(1), 51, 170, 23, 19, 4 Net Acres, 5,792, 34,600, 14,000, 13,000, 2,300 $ per Adjusted Net Acre, $8,805, $4,913, $1,607, $1,458, $1,591 Wattenberg Core & Extension Non-core acreage (1) Transaction value less PDP value

CONCLUSION PED is uniquely positioned to develop its assets in the D-J Basin, one of the fastest growing, lowest cost shale plays in the U.S. Management acted decisively to significantly increase the size of the Company, monetize non-core assets and lay groundwork for a business combination Increases producing assets, cash flow and development opportunities Improves Company’s ability to secure access to lower cost capital Near-term growth drivers include: Drilling core Wattenberg locations that are pooled, spaced and permitted Down-spacing (80 to 40 acre spacing, implying 8 to 16+ wells per section) Stacked pay zones (Additional four zones not currently being developed, i.e. Niobrara A, C, Codell, Greenhorn) Improved drilling and completion techniques to increase well performance and reduce costs Opportunity to invest in early stage, high growth oil and gas company with experienced management and operational expertise

CONTACT INFORMATION CORPORATE HEADQUARTERS 4125 Blackhawk Plaza Circle, Suite 201 Danville, CA 94506 Tel: 855-PEDEVCO / 925-271-9314 contact@pacificenergydevelopment.com Corporate website: www.PacificEnergyDevelopment.com Investor Relations Contacts: Stonegate Securities scott@stonegateinc.com 214-987-4121