Filed by MCG Capital Corporation Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934 Subject Company: MCG Capital Corporation (Registration Statement No. 333-204272)

June 1, 2015 Selected Reasons Why the HC2 Offer Is Not Reasonably Likely to Lead to a Superior Proposal

2 Forward-Looking Statements Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that relate to future events, performance or financial condition of PFLT, MCGC and the combined company, management’s future expectations, beliefs, intentions, goals, strategies, plans or prospects. Statements other than statements of historical facts included in this presentation may constitute forward-looking statements and are not guarantees of future performance or results and involve a number of known and unknown risks and uncertainties. Actual results may differ materially from those in the forward-looking statements as a result of a number of factors, including the ability of the parties to consummate the transaction described in this presentation on the expected timeline (or at all), the failure of PFLT or MCGC stockholders to approve the proposed merger, the ability to realize the anticipated benefits of the transaction, the effects of disruption on the companies’ business from the proposed merger, the effect that the announcement or consummation of the merger may have on the trading price of the common stock of PFLT or MCGC, the combined company’s plans, expectations, objectives and intentions, the proposal made by HC2 Holdings, Inc. or any other alternative proposed transactions and any potential termination of the merger agreement, the actions of MCG stockholders with respect to any proposed transactions, and the other factors described from time to time in the companies’ filings with the Securities and Exchange Commission. MCGC undertakes no duty to update any forward-looking statement made herein. All forward-looking statements speak only as of the date of this presentation. Important Additional Information and Where to Find It This communication is being made in respect of the proposed business combination involving PFLT and MCGC. In connection with the proposed transaction, PFLT has filed with the SEC a Registration Statement on Form N-14 that includes a joint proxy statement of PFLT and MCGC and that also constitutes a prospectus of PFLT. The definitive Joint Proxy Statement/Prospectus will be mailed to stockholders of PFLT and MCGC. INVESTORS AND SECURITY HOLDERS OF PFLT AND MCGC ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Proxy Solicitation Investors and security holders will be able to obtain free copies of the Registration Statement and Joint Proxy Statement/Prospectus (when available) and other documents filed with the SEC by each of PFLT and MCGC through the web site maintained by the SEC at www.sec.gov. Free copies of the Registration Statement and Joint Proxy Statement/Prospectus (when available) and other documents filed with the SEC can also be obtained on PFLT’s website at www.pennantpark.com or on MCGC’s website at www.mcgcapital.com. PFLT and MCGC and their respective directors, executive officers and certain other members of management and employees may be deemed to be participants in the solicitation of proxies from stockholders of PFLT and MCGC in respect of the proposed transaction. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of the PFLT and MCGC stockholders in connection with the proposed acquisition, PFLT’s executive officers and directors and MCGC’s executive officers and directors is set forth in the Registration Statement on Form N-14, filed with the SEC on May 18, 2015. You can obtain free copies of these documents from PFLT and MCGC in the manner set forth above. This presentation does not constitute an offer to sell or the solicitation of an offer to buy nor will there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of such jurisdiction. A registration statement relating to these securities will be filed with the Securities and Exchange Commission, and the securities may not be sold until the registration statement becomes effective. Investors are advised to carefully consider the investment objectives, risks and charges and expenses of PFLT before investing in its securities.

3 Executive Summary MCG has entered into a merger agreement with PFLT, offering merger consideration of $4.75/share in PFLT common stock and cash Subsequently, HC2 Holdings, Inc. offered HC2 common stock and cash in an amount that they believe is valued at $5.25/share The MCG board of directors has, with advisors, evaluated HC2’s proposal and has concluded that the HC2 proposal is not, and is not likely to lead to, a proposal that is superior to the merger with PFLT MCG’s Board believes there is significant risk of non-consummation of an HC2 transaction: — HC2’s proposal requires SEC clearance — Philip Falcone has admitted to violating SEC rules and is barred from acting as an investment advisor — HC2’s proposal also requires MCG shareholder approval To enter into a transaction with HC2, MCG would have to pay $7MM to PFLT with no guarantee of receiving it back If MCG entered into a transaction with HC2 which did not close for SEC or other reasons, MCG would incur significant expenses and experience significant diminution in value, which would be borne entirely by MCG shareholders if the transaction is not consummated The PFLT transaction agreement offers MCG shareholders consideration with a higher intrinsic value, taking into account HC2’s trading price volatility, HC2’s significant leverage and outstanding preferred stock, HC2’s compensation practices, the anticipated dilution that would be borne by MCG’s shareholders due to existing HC2 compensation and preferred stock arrangements, and PFLT’s dividend history

4 Philip Falcone: History of SEC and Legal Violations In 2012, Philip Falcone and Harbinger Capital Partners LLC were charged with, and in 2013 subsequently admitted to, multiple counts of securities fraud stemming from activities beginning in 2006 As outlined in SEC Public Release 2013-159, among the set of facts that Mr. Falcone and Harbinger admitted to in the settlement papers filed with the court were the following: — “Mr. Falcone improperly borrowed $113.2 million from the Harbinger Capital Partners Special Situations Fund (SSF) at an interest rate less than SSF was paying to borrow money, to pay his personal tax obligation, at a time when Mr. Falcone had barred other SSF investors from making redemptions, and did not disclose the loan to investors for approximately five months — Mr. Falcone and Harbinger granted favorable redemption and liquidity terms to certain large investors in HCP Fund I, and did not disclose certain of these arrangements to the fund’s board of directors and the other fund investors — During the summer of 2006, Mr. Falcone heard rumors that a Financial Services Firm was shorting the bonds of the Canadian manufacturer, and encouraging its customers to do the same — In September and October 2006, Mr. Falcone retaliated against the Financial Services Firm for shorting the bonds by causing the Harbinger funds to purchase all of the remaining outstanding bonds in the open market — Mr. Falcone and the other Harbinger funds then demanded that the Financial Services Firm settle its outstanding transactions in the bonds and deliver the bonds that it owed. Mr. Falcone and the Harbinger funds did not disclose at the time that it would be virtually impossible for the Financial Services Firm to acquire any bonds to deliver, as nearly the entire supply was locked up in the Harbinger funds’ custodial account and the Harbinger funds were not offering them for sale — Due to Mr. Falcone’s and the other Harbinger funds’ improper interference with the normal interplay of supply and demand in the bonds, the bonds more than doubled in price during this period.” In order to settle the charges, Falcone and Harbinger admitted to their guilt with respect to the charges and agreed to the following restrictions and penalties: — A payment of $11.5 million from Falcone out of his personal assets and the payment of a $6.5 million penalty by Harbinger — A ban on Falcone’s “acting as or associating with any broker, dealer, investment adviser, municipal securities dealer, municipal advisor, transfer agent, or nationally recognized statistical rating organization,” with no right to petition to lift the ban until 2018 — The appointment of an independent monitor to oversee certain actions by Harbinger and Mr. Falcone

5 Philip Falcone: History of SEC and Legal Violations (Cont’d) As a result of the ban, Philip Falcone is an “ineligible person” who is prohibited from serving as an employee, officer, director, member of an advisory board, investment adviser, or depositor of any registered investment company. HC2 Holdings is also an “ineligible person” by virtue of its affiliation with Mr. Falcone, who serves as HC2’s Chairman, President and Chief Executive Officer (Section 9 of the 1940 Act) In 2009, Harbinger faced allegations of fraud in connection with a topping bid for Applica Incorporated after it entered into a merger agreement with another buyer — Harbinger continued building a stake in Applica following Applica’s agreement to be acquired by NACCO Industries, and subsequently announced an offer to acquire Applica — Harbinger had continued to state in its 13D filings that it was acquiring Applica stock “for investment purposes” with “no plan or proposal” to engage in a merger or other transaction with Applica, at a time when internal communications showed that Harbinger was preparing to bid for Applica — NACCO also alleged that Harbinger was guilty of tortious interference with the merger agreement and that Applica breached its obligations under the no-shop provisions of the merger agreement — The matter was ultimately settled for $60 million without an admission of guilt In 2012, it was alleged that Mr. Falcone and his affiliates engaged in improper behavior in connection with securing governmental approvals for LightSquared — Harbinger was the owner of a significant controlling majority of LightSquared, a provider of communications and broadband services — The Senate Judiciary Committee initiated an investigation into the methods employed by LightSquared to receive certain governmental approvals — Senator Charles Grassley, the head of the Judiciary Committee, alleged that affiliates of Mr. Falcone and LightSquared contacted Senator Grassley’s office to offer quid pro quo arrangements, such as establishing a call center to provide jobs in Iowa (Mr. Grassley’s home state), in exchange for assistance in securing the required regulatory approvals

6 Philip Falcone: History of SEC and Legal Violations (Cont’d) In 2013, New York’s Department of Financial Services banned Mr. Falcone and other Harbinger employees from controlling New York licensed insurers — The ban prohibits the exercise of direct or indirect control over the management, policies, operations and investment funds of any New York-licensed insurer for a period of seven years — New York DFS found that Mr. Falcone and Harbinger’s admissions of guilt in relation to the SEC allegations “demonstrate[d] serious issues related to Mr. Falcone’s fitness to control the management, operations, and policyholder funds of a New York insurance company.”

7 Uncertainty of Transaction Closing: Need for SEC Clearance SEC no-action relief may be required in order for HC2 to acquire MCG — As “ineligible persons” under the ’40 Act due to Mr. Falcone’s ban from the securities industry, Mr. Falcone and HC2 cannot be affiliated with an investment company — MCG is currently a registered BDC subject to the ’40 Act investment company rules, and consequently Mr. Falcone and HC2 would not be permitted to be an officer, director, or investment adviser of MCG — HC2 has proposed that MCG withdraw its BDC election prior to the closing of the merger — The SEC may view this as a fiction designed to circumvent the prohibition on Mr. Falcone’s association with an investment company and to deprive MCG’s investors of the protections of the ’40 Act — As a result, no-action relief may be required. Even if available, this would likely cause significant delay in closing the transaction — Requests for no-action relief involving investment companies frequently require multiple years of evaluation and review — The SEC may also question whether HC2 should be required to register as an investment company Under the ’40 Act, a company that holds itself out as being engaged primarily in the business of investing or trading in securities is an investment company HC2’s public disclosures and business model are consistent with that of an investment company Failure to register as an investment company if required to do so would prohibit HC2 from issuing securities HC2’s failure to register as an investment company if required to do so also means that HC2 investors do not benefit from the protections of the ’40 Act, including: – Requirements with respect to HC2’s approval of affiliate transactions – Asset coverage requirements – Shareholder approval requirement for below-NAV issuances

8 Uncertainty of Transaction Closing: Settlement Restrictions Mr. Falcone’s actions are subject to review by an independent monitor to ensure compliance with the terms of the settlement with the SEC — Under the terms of the settlement, the independent monitor is required to oversee Mr. Falcone and the Harbinger funds’ actions — The independent monitor may scrutinize the proposed transaction and Mr. Falcone’s actions, including whether the acquisition of an investment company in a stock transaction by an entity of which Mr. Falcone is CEO, or Mr. Falcone’s involvement with HC2, complies with the settlement terms — If the independent monitor believes there has been any non-compliance, he is required to make a judicial filing — In addition, if the SEC makes a determination that there been any non-compliance and the independent monitor has failed to provide sufficient oversight, the SEC could independently petition for relief — This requested relief could include replacing the independent monitor and/or the imposition of further prohibitions on Mr. Falcone or his affiliated entities — Any action of this type could cause significant disruption or delay of any potential transaction, and there is no way to know in advance what the outcome would be — The SEC or a court could ultimately prohibit the proposed transaction or impose significant restrictions on the transaction, HC2 or Mr. Falcone

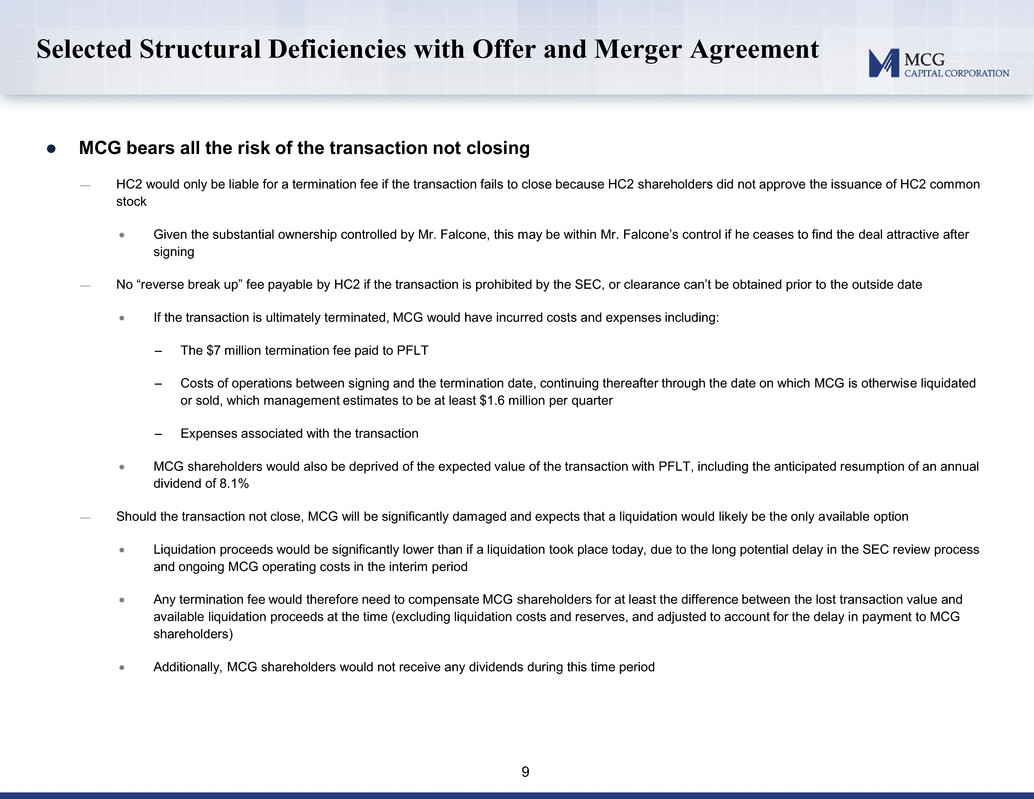

9 Selected Structural Deficiencies with Offer and Merger Agreement MCG bears all the risk of the transaction not closing — HC2 would only be liable for a termination fee if the transaction fails to close because HC2 shareholders did not approve the issuance of HC2 common stock Given the substantial ownership controlled by Mr. Falcone, this may be within Mr. Falcone’s control if he ceases to find the deal attractive after signing — No “reverse break up” fee payable by HC2 if the transaction is prohibited by the SEC, or clearance can’t be obtained prior to the outside date If the transaction is ultimately terminated, MCG would have incurred costs and expenses including: – The $7 million termination fee paid to PFLT – Costs of operations between signing and the termination date, continuing thereafter through the date on which MCG is otherwise liquidated or sold, which management estimates to be at least $1.6 million per quarter – Expenses associated with the transaction MCG shareholders would also be deprived of the expected value of the transaction with PFLT, including the anticipated resumption of an annual dividend of 8.1% — Should the transaction not close, MCG will be significantly damaged and expects that a liquidation would likely be the only available option Liquidation proceeds would be significantly lower than if a liquidation took place today, due to the long potential delay in the SEC review process and ongoing MCG operating costs in the interim period Any termination fee would therefore need to compensate MCG shareholders for at least the difference between the lost transaction value and available liquidation proceeds at the time (excluding liquidation costs and reserves, and adjusted to account for the delay in payment to MCG shareholders) Additionally, MCG shareholders would not receive any dividends during this time period

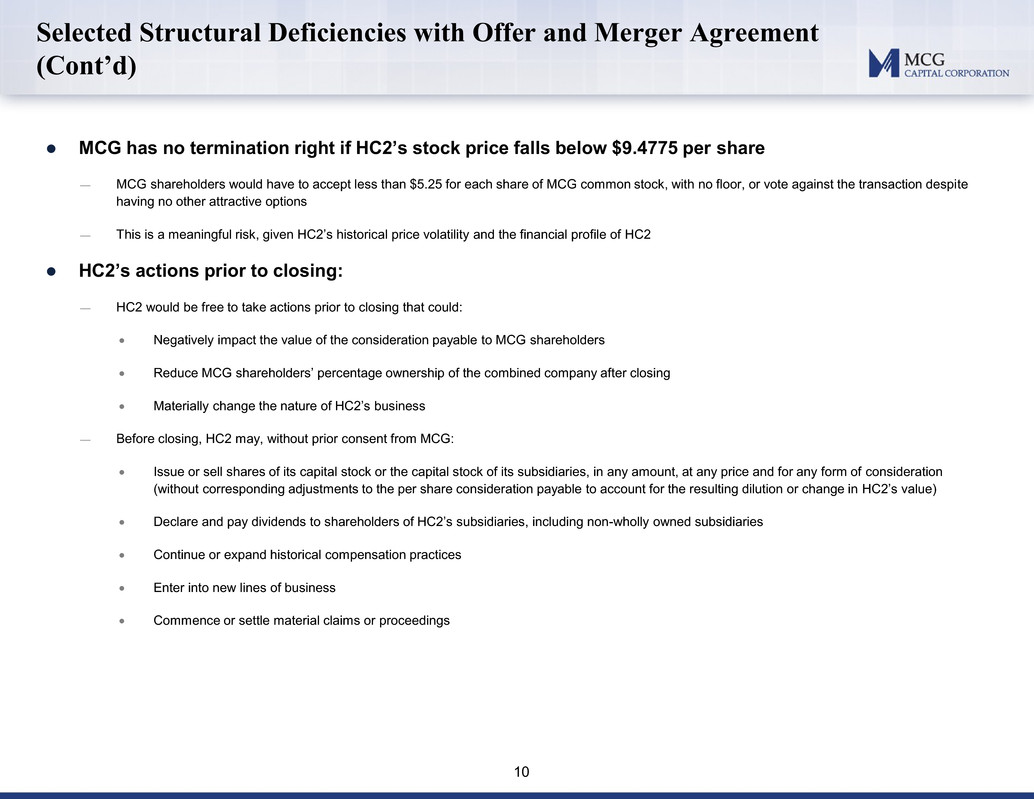

10 Selected Structural Deficiencies with Offer and Merger Agreement (Cont’d) MCG has no termination right if HC2’s stock price falls below $9.4775 per share — MCG shareholders would have to accept less than $5.25 for each share of MCG common stock, with no floor, or vote against the transaction despite having no other attractive options — This is a meaningful risk, given HC2’s historical price volatility and the financial profile of HC2 HC2’s actions prior to closing: — HC2 would be free to take actions prior to closing that could: Negatively impact the value of the consideration payable to MCG shareholders Reduce MCG shareholders’ percentage ownership of the combined company after closing Materially change the nature of HC2’s business — Before closing, HC2 may, without prior consent from MCG: Issue or sell shares of its capital stock or the capital stock of its subsidiaries, in any amount, at any price and for any form of consideration (without corresponding adjustments to the per share consideration payable to account for the resulting dilution or change in HC2’s value) Declare and pay dividends to shareholders of HC2’s subsidiaries, including non-wholly owned subsidiaries Continue or expand historical compensation practices Enter into new lines of business Commence or settle material claims or proceedings

11 Selected Structural Deficiencies with Offer and Merger Agreement (Cont’d) MCG shareholders would not have the option to elect to receive cash consideration — HC2’s offer would require MCG shareholders to accept consideration primarily in the form of HC2 common stock — It is not clear that significant liquidity would be available to any MCG shareholder who wanted to monetize their shares post-closing, due to the trading characteristics of HC2 and the significant percentage of stock controlled by Mr. Falcone Anticipated significant sales by former MCG shareholders post-closing, due to the fundamental differences in HC2’s investment philosophy compared to MCG’s and the consequent differences in the nature of the investor base, would be expected to exert significant downward pressure on HC2’s trading price — MCG shareholders would be subject to the significant volatility of HC2 common stock, both prior to and after closing, and may not be able to mitigate this risk by selling a portion of their shares if attractive trading prices are not available — MCG shareholders are also subject to potential dilution, due to HC2’s proposed freedom to issue additional shares both before and after closing, together with potential dilution to the extent that HC2 continues historical compensation practices

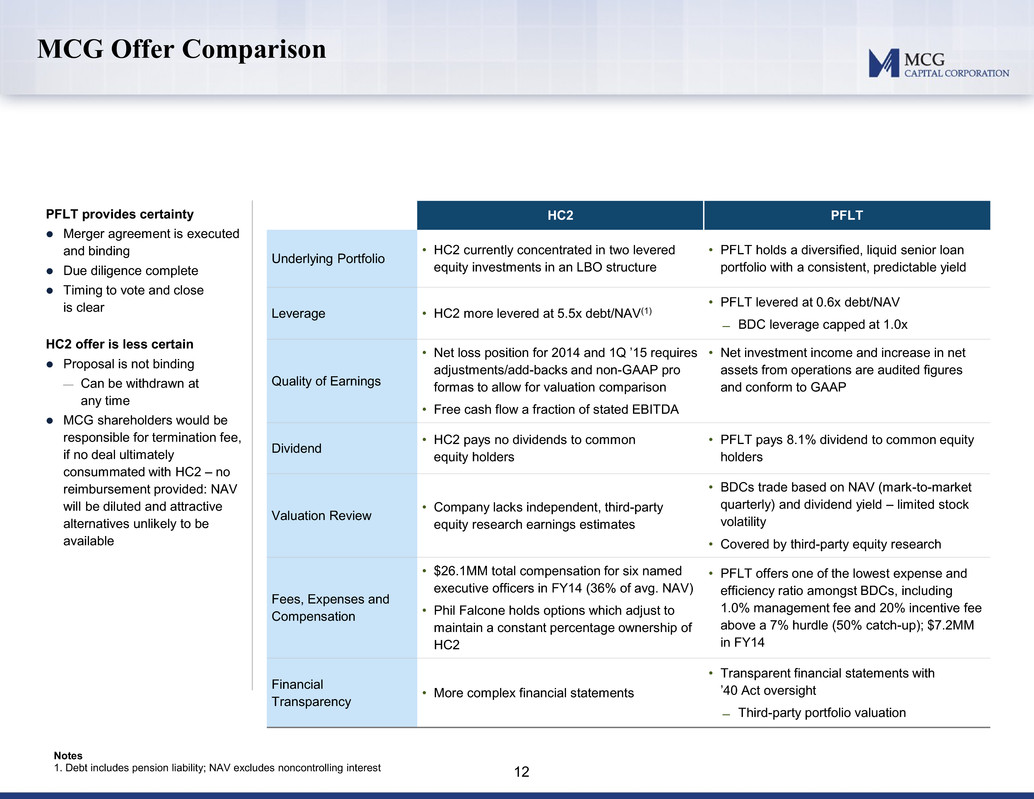

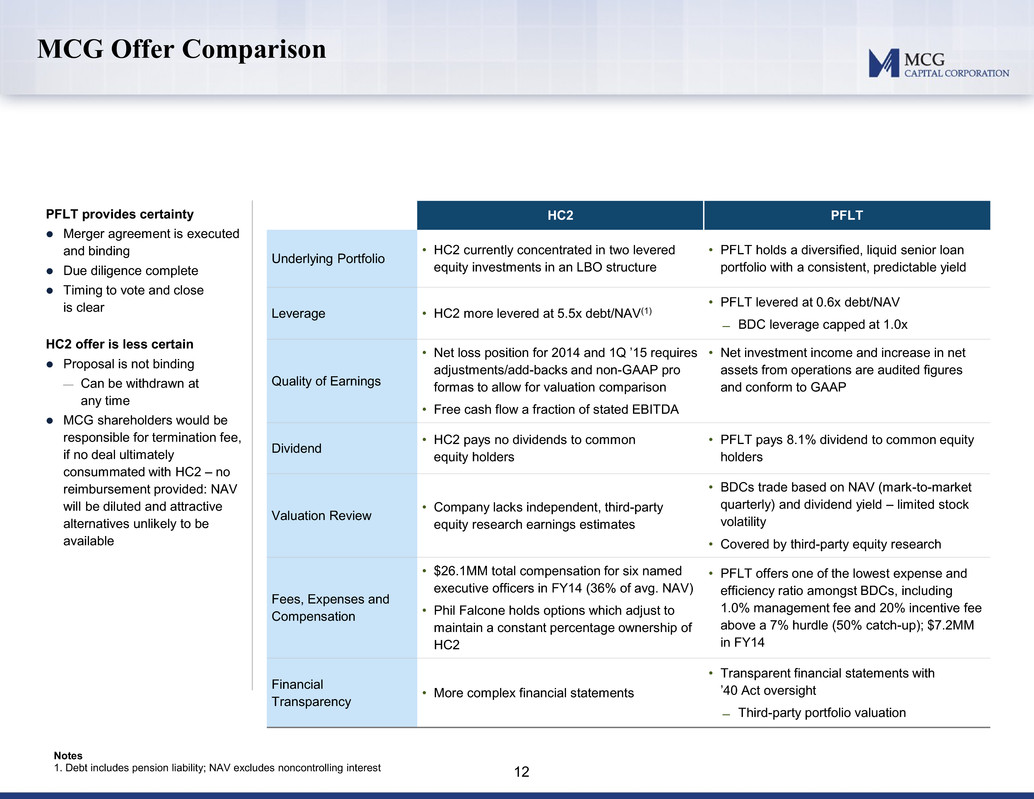

12 MCG Offer Comparison Notes 1. Debt includes pension liability; NAV excludes noncontrolling interest HC2 PFLT Underlying Portfolio • HC2 currently concentrated in two levered equity investments in an LBO structure • PFLT holds a diversified, liquid senior loan portfolio with a consistent, predictable yield Leverage • HC2 more levered at 5.5x debt/NAV(1) • PFLT levered at 0.6x debt/NAV ̶ BDC leverage capped at 1.0x Quality of Earnings • Net loss position for 2014 and 1Q ’15 requires adjustments/add-backs and non-GAAP pro formas to allow for valuation comparison • Free cash flow a fraction of stated EBITDA • Net investment income and increase in net assets from operations are audited figures and conform to GAAP Dividend • HC2 pays no dividends to common equity holders • PFLT pays 8.1% dividend to common equity holders Valuation Review • Company lacks independent, third-party equity research earnings estimates • BDCs trade based on NAV (mark-to-market quarterly) and dividend yield – limited stock volatility • Covered by third-party equity research Fees, Expenses and Compensation • $26.1MM total compensation for six named executive officers in FY14 (36% of avg. NAV) • Phil Falcone holds options which adjust to maintain a constant percentage ownership of HC2 • PFLT offers one of the lowest expense and efficiency ratio amongst BDCs, including 1.0% management fee and 20% incentive fee above a 7% hurdle (50% catch-up); $7.2MM in FY14 Financial Transparency • More complex financial statements • Transparent financial statements with ’40 Act oversight ̶ Third-party portfolio valuation PFLT provides certainty Merger agreement is executed and binding Due diligence complete Timing to vote and close is clear HC2 offer is less certain Proposal is not binding — Can be withdrawn at any time MCG shareholders would be responsible for termination fee, if no deal ultimately consummated with HC2 – no reimbursement provided: NAV will be diluted and attractive alternatives unlikely to be available

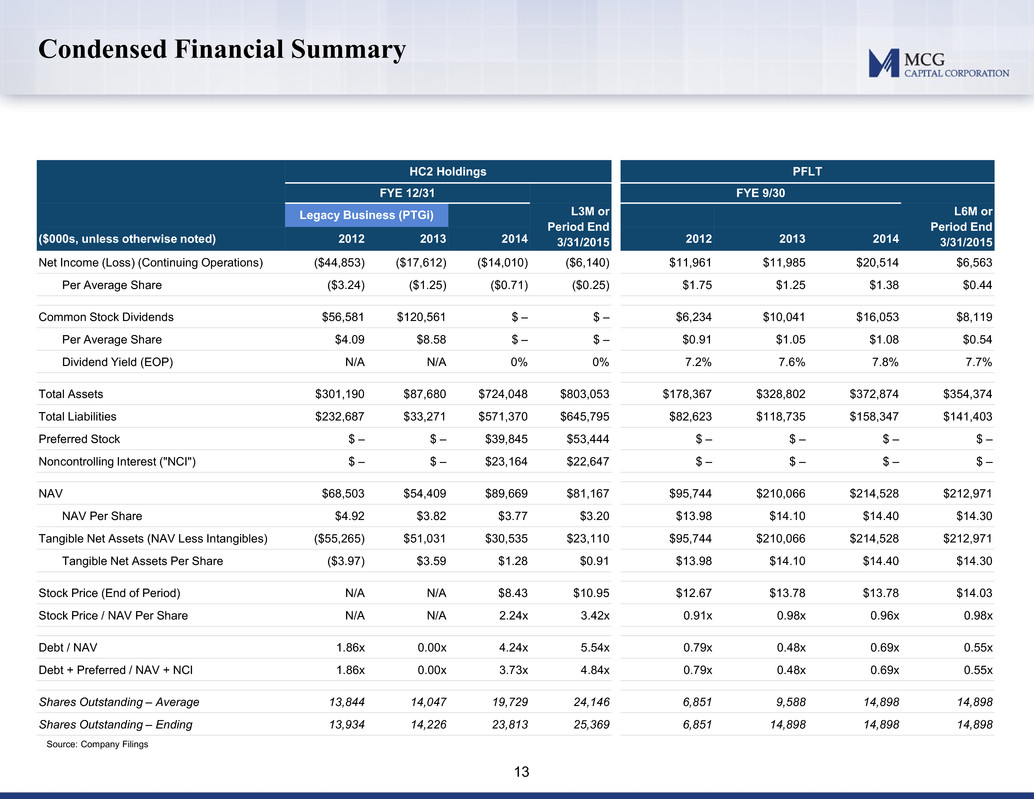

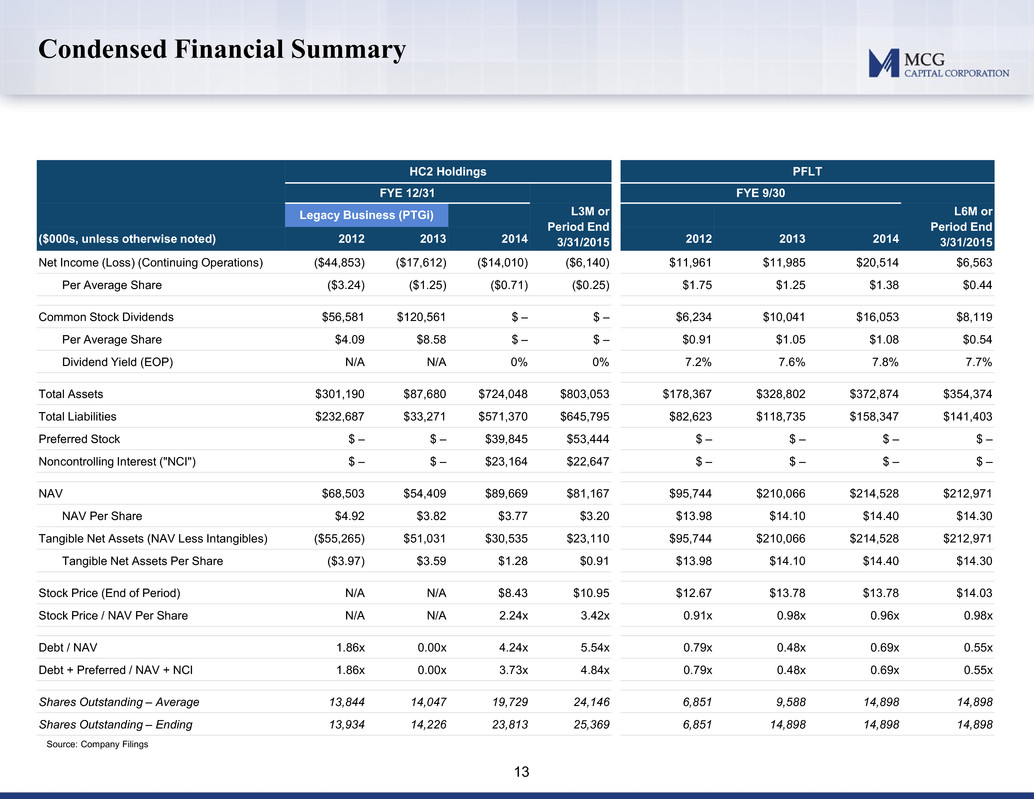

13 Condensed Financial Summary HC2 Holdings PFLT FYE 12/31 FYE 9/30 Legacy Business (PTGi) L3M or Period End 3/31/2015 L6M or Period End 3/31/2015 ($000s, unless otherwise noted) 2012 2013 2014 2012 2013 2014 Net Income (Loss) (Continuing Operations) ($44,853) ($17,612) ($14,010) ($6,140) $11,961 $11,985 $20,514 $6,563 Per Average Share ($3.24) ($1.25) ($0.71) ($0.25) $1.75 $1.25 $1.38 $0.44 Common Stock Dividends $56,581 $120,561 $ – $ – $6,234 $10,041 $16,053 $8,119 Per Average Share $4.09 $8.58 $ – $ – $0.91 $1.05 $1.08 $0.54 Dividend Yield (EOP) N/A N/A 0% 0% 7.2% 7.6% 7.8% 7.7% Total Assets $301,190 $87,680 $724,048 $803,053 $178,367 $328,802 $372,874 $354,374 Total Liabilities $232,687 $33,271 $571,370 $645,795 $82,623 $118,735 $158,347 $141,403 Preferred Stock $ – $ – $39,845 $53,444 $ – $ – $ – $ – Noncontrolling Interest ("NCI") $ – $ – $23,164 $22,647 $ – $ – $ – $ – NAV $68,503 $54,409 $89,669 $81,167 $95,744 $210,066 $214,528 $212,971 NAV Per Share $4.92 $3.82 $3.77 $3.20 $13.98 $14.10 $14.40 $14.30 Tangible Net Assets (NAV Less Intangibles) ($55,265) $51,031 $30,535 $23,110 $95,744 $210,066 $214,528 $212,971 Tangible Net Assets Per Share ($3.97) $3.59 $1.28 $0.91 $13.98 $14.10 $14.40 $14.30 Stock Price (End of Period) N/A N/A $8.43 $10.95 $12.67 $13.78 $13.78 $14.03 Stock Price / NAV Per Share N/A N/A 2.24x 3.42x 0.91x 0.98x 0.96x 0.98x Debt / NAV 1.86x 0.00x 4.24x 5.54x 0.79x 0.48x 0.69x 0.55x Debt + Preferred / NAV + NCI 1.86x 0.00x 3.73x 4.84x 0.79x 0.48x 0.69x 0.55x Shares Outstanding – Average 13,844 14,047 19,729 24,146 6,851 9,588 14,898 14,898 Shares Outstanding – Ending 13,934 14,226 23,813 25,369 6,851 14,898 14,898 14,898 Source: Company Filings

14 Stock Price Volatility HC2 Historical Volatility (1) 15-Day Vol. 30-Day Vol. 30-Day Avg. 48.6 69.7 60-Day Avg. 52.9 59.6 90-Day Avg. 46.6 52.0 PFLT Historical Volatility (1) 15-Day Vol. 30-Day Vol. 30-Day Avg. 7.8 8.0 60-Day Avg. 7.7 8.7 90-Day Avg. 11.0 12.7 HC2’s stock volatility has been in excess of 50% PFLT’s stock volatility is ~10% The primary consideration to be received by MCG shareholders is common stock of the buyer; historical volatility is important to consider in evaluating the value of the per share consideration Volatility measures potential stock price over next 12 months within one standard deviation — Assuming 60% volatility for HC2 and an $11.15 stock price, a 12-month price range could be between $4.46 and $17.84 (within one standard deviation – 68% probability) — Assuming 10% volatility for PFLT and a $14.15 stock price, a 12-month price range could be between $12.74 and $15.57 (within one standard deviation – 68% probability) Note 1. As of 5/26/2015 Valuation Consideration

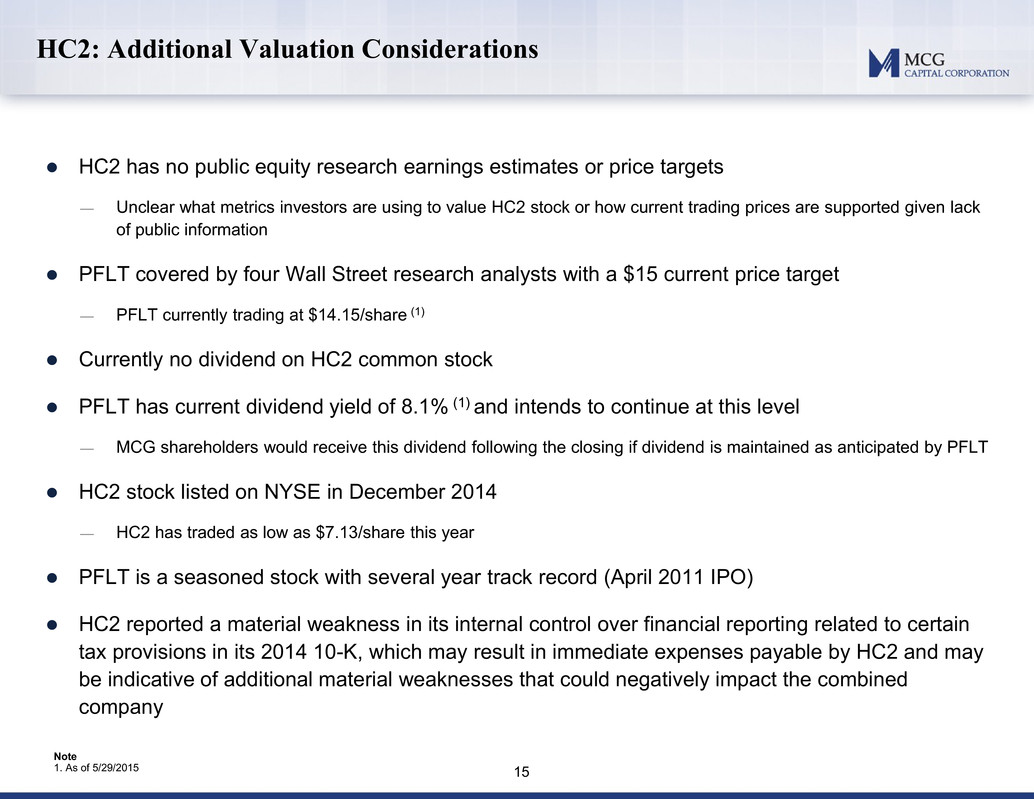

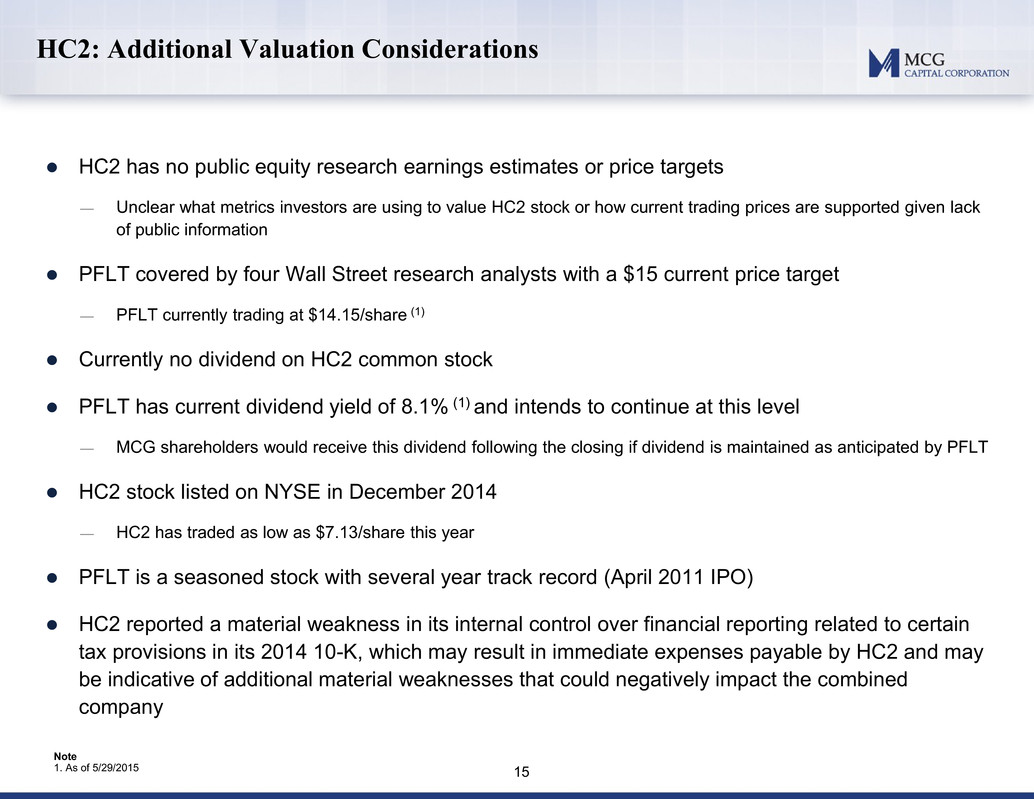

15 HC2: Additional Valuation Considerations HC2 has no public equity research earnings estimates or price targets — Unclear what metrics investors are using to value HC2 stock or how current trading prices are supported given lack of public information PFLT covered by four Wall Street research analysts with a $15 current price target — PFLT currently trading at $14.15/share (1) Currently no dividend on HC2 common stock PFLT has current dividend yield of 8.1% (1) and intends to continue at this level — MCG shareholders would receive this dividend following the closing if dividend is maintained as anticipated by PFLT HC2 stock listed on NYSE in December 2014 — HC2 has traded as low as $7.13/share this year PFLT is a seasoned stock with several year track record (April 2011 IPO) HC2 reported a material weakness in its internal control over financial reporting related to certain tax provisions in its 2014 10-K, which may result in immediate expenses payable by HC2 and may be indicative of additional material weaknesses that could negatively impact the combined company Note 1. As of 5/29/2015

16 HC2: Compensation Considerations 2014 HC2 Compensation Review Bonus pool driven by NAV Return, defined as percent increase in NAV/share (over fiscal year) multiplied by starting NAV (1) 12% of excess NAV Return set aside to fund the 2014 bonus pool; minimum NAV Return threshold in 2014 of zero NAV Return of $136MM in 2014 under bonus pool calculations, resulting in bonus pool of $16MM (12% of NAV Return) — Per GAAP financial statements, NAV increased $35MM in 2014 (2) — NAV per share decreased; HC2 incurred a net loss in 2014 2014 Compensation Comparison vs. PFLT HC2: $26.1MM total compensation for six named executive officers (36% of avg. FY14 NAV) (2) – $15.8MM to Philip Falcone alone PFLT: $7.2MM of total fees paid to PFLT Advisor in FY14 Notes 1. NAV formula used by HC2 begins with NAV as defined in its Preferred Stock Certificates and adjusts: i) subtract deferred tax liabilities, ii) add capital contributions to fund start-up businesses (up to $10MM), iii) add deferred financing costs, iv) add fair value of assets not appraised in GAAP financial statements (up to $20MM), v) subtract settling of legacy liabilities associated with predecessor businesses (up to $5MM), vi) add acquisition expenses over last twelve months and vii) subtract accretion on preferred stock and conversion impacts 2. NAV excludes noncontrolling interest Impact from potential MCG acquisition NAV/share increase of ~90% Appears that it would significantly expand HC2's 2015 bonus pool NAV per Audited Financials (000s, except per share figures) Continuing Operations Year Ending HC2 NAV HC2 Shares Per Share HC2 Loss Diluted EPS 12/31/2013 $54,409 14,226 $3.82 ($17,612) ($1.25) 12/31/2014 $89,669 23,813 $3.77 ($14,010) ($0.71) Difference $35,260 9,587 ($0.06) $3,602 $0.54 Source: Company Filings

17 HC2: Offer Overview Total nominal consideration of $5.25 per share offered by HC2 — $4.75 in HC2 stock + $0.50 in cash Floating exchange ratio with a collar so that $5.25 per share received as long as HC2 stock trades within $9.48 – $12.82 range (from $11.15 base price) — If HC2 stock trades below $9.48, per share consideration will be below $5.25 — If HC2 stock trades above $12.82, per share consideration will be above $5.25 HC2 Offer Overview (000s, except per share data) Aggregate Value (Assumes 37,074 MCGC Shares) Per share Stock Offered (0.426 exchange ratio @ $11.15 share price) $176,102 $4.75 Cash Offered $18,537 $0.50 Total Consideration $194,639 $5.25 HC2 Assumed Stock Price $11.15 Shares Issued ($176,102 / $11.15) 15,794 Current MCG NAV $176,138 $4.75 Termination Fee ($7,000) ($0.19) Transaction Related Expenses ($8,339) ($0.22) Pro Forma NAV $160,799 $4.34 Goodwill $33,840 $0.91 Purchase Price $194,639 $5.25

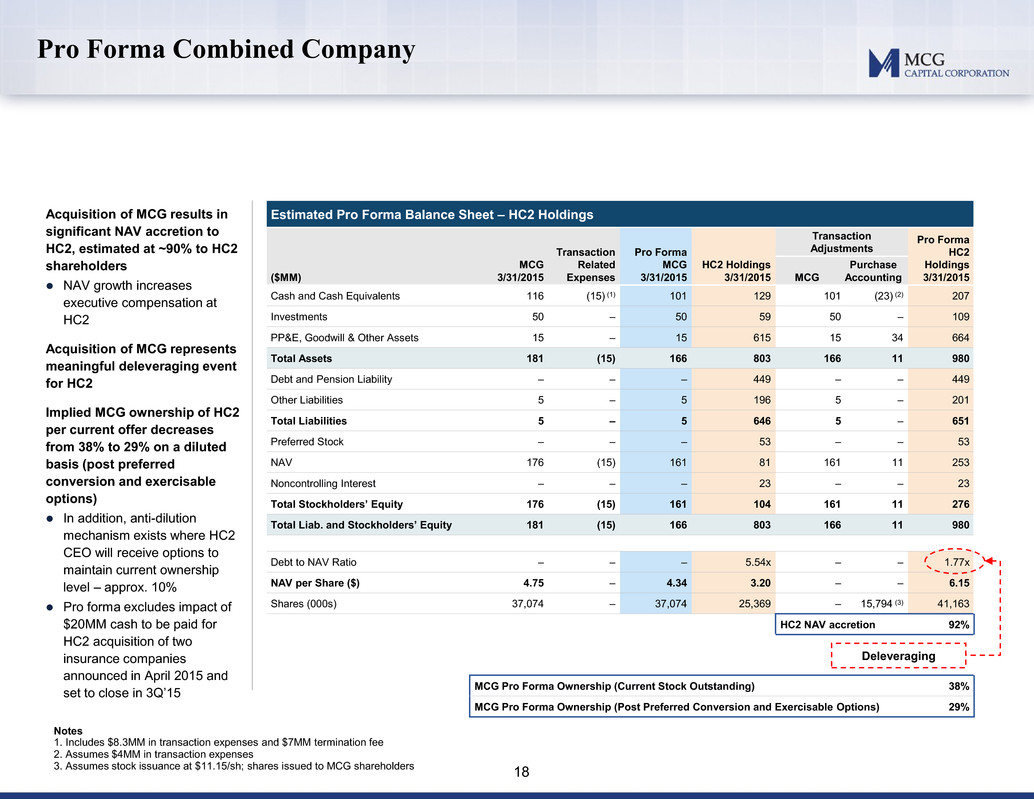

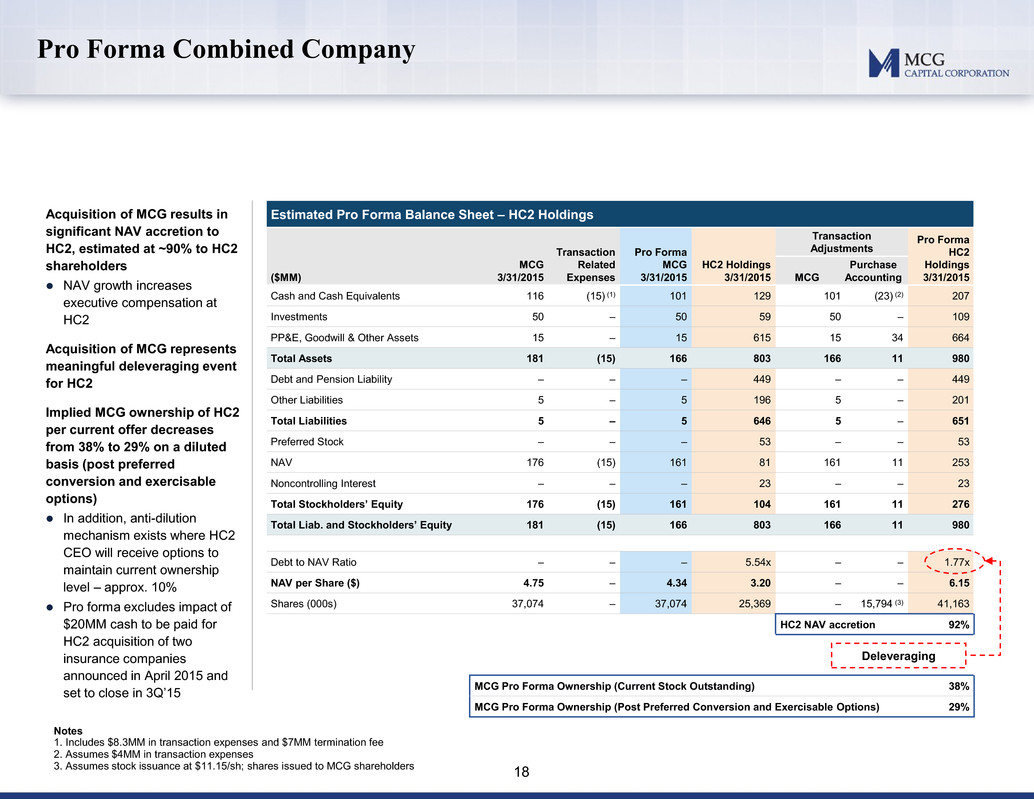

18 Pro Forma Combined Company Acquisition of MCG results in significant NAV accretion to HC2, estimated at ~90% to HC2 shareholders NAV growth increases executive compensation at HC2 Acquisition of MCG represents meaningful deleveraging event for HC2 Implied MCG ownership of HC2 per current offer decreases from 38% to 29% on a diluted basis (post preferred conversion and exercisable options) In addition, anti-dilution mechanism exists where HC2 CEO will receive options to maintain current ownership level – approx. 10% Pro forma excludes impact of $20MM cash to be paid for HC2 acquisition of two insurance companies announced in April 2015 and set to close in 3Q’15 Estimated Pro Forma Balance Sheet – HC2 Holdings ($MM) MCG 3/31/2015 Transaction Related Expenses Pro Forma MCG 3/31/2015 HC2 Holdings 3/31/2015 Transaction Adjustments Pro Forma HC2 Holdings 3/31/2015 MCG Purchase Accounting Cash and Cash Equivalents 116 (15) (1) 101 129 101 (23) (2) 207 Investments 50 – 50 59 50 – 109 PP&E, Goodwill & Other Assets 15 – 15 615 15 34 664 Total Assets 181 (15) 166 803 166 11 980 Debt and Pension Liability – – – 449 – – 449 Other Liabilities 5 – 5 196 5 – 201 Total Liabilities 5 – 5 646 5 – 651 Preferred Stock – – – 53 – – 53 NAV 176 (15) 161 81 161 11 253 Noncontrolling Interest – – – 23 – – 23 Total Stockholders’ Equity 176 (15) 161 104 161 11 276 Total Liab. and Stockholders’ Equity 181 (15) 166 803 166 11 980 Debt to NAV Ratio – – – 5.54x – – 1.77x NAV per Share ($) 4.75 – 4.34 3.20 – – 6.15 Shares (000s) 37,074 – 37,074 25,369 – 15,794 (3) 41,163 HC2 NAV accretion 92% MCG Pro Forma Ownership (Current Stock Outstanding) 38% MCG Pro Forma Ownership (Post Preferred Conversion and Exercisable Options) 29% Notes 1. Includes $8.3MM in transaction expenses and $7MM termination fee 2. Assumes $4MM in transaction expenses 3. Assumes stock issuance at $11.15/sh; shares issued to MCG shareholders Deleveraging

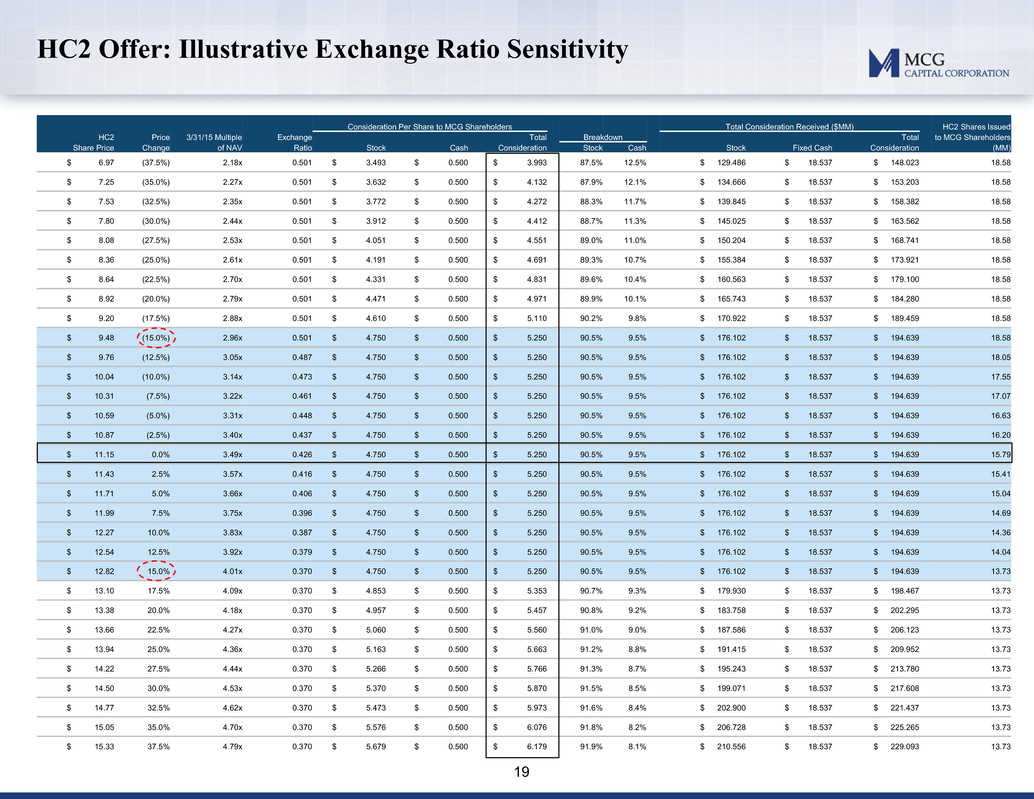

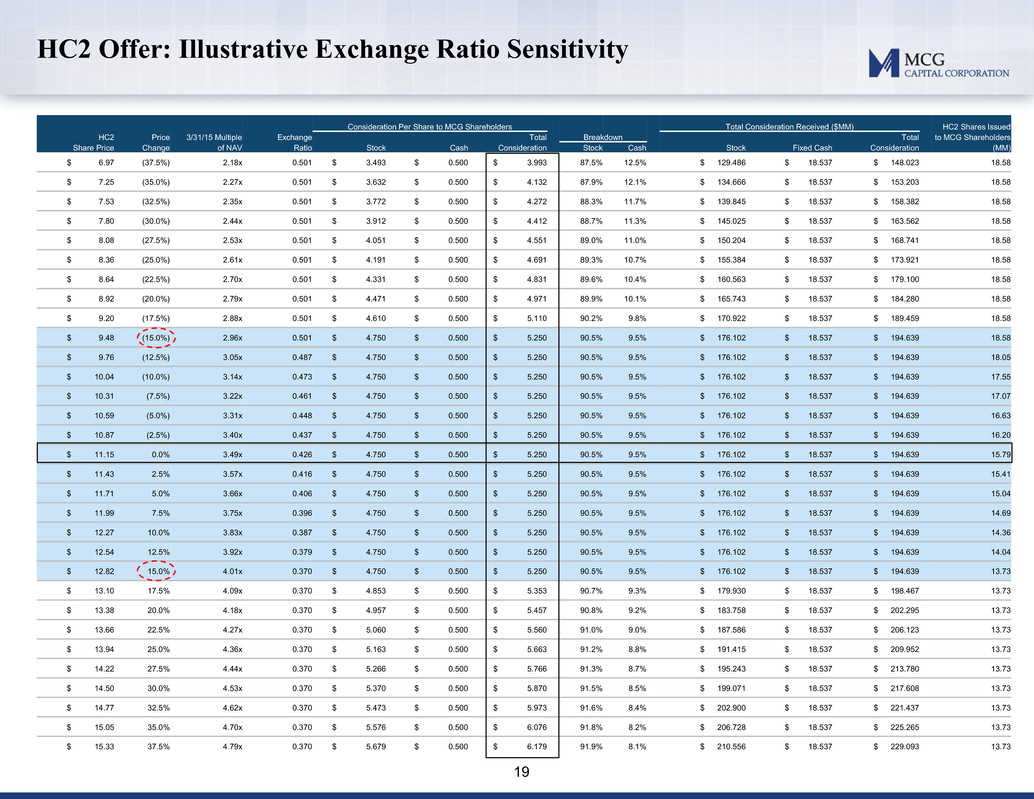

19 HC2 Offer: Illustrative Exchange Ratio Sensitivity Consideration Per Share to MCG Shareholders Total Consideration Received ($MM) HC2 Shares Issued HC2 Price 3/31/15 Multiple Exchange Total Breakdown Total to MCG Shareholders Share Price Change of NAV Ratio Stock Cash Consideration Stock Cash Stock Fixed Cash Consideration (MM) $ 6.97 (37.5%) 2.18x 0.501 $ 3.493 $ 0.500 $ 3.993 87.5% 12.5% $ 129.486 $ 18.537 $ 148.023 18.58 $ 7.25 (35.0%) 2.27x 0.501 $ 3.632 $ 0.500 $ 4.132 87.9% 12.1% $ 134.666 $ 18.537 $ 153.203 18.58 $ 7.53 (32.5%) 2.35x 0.501 $ 3.772 $ 0.500 $ 4.272 88.3% 11.7% $ 139.845 $ 18.537 $ 158.382 18.58 $ 7.80 (30.0%) 2.44x 0.501 $ 3.912 $ 0.500 $ 4.412 88.7% 11.3% $ 145.025 $ 18.537 $ 163.562 18.58 $ 8.08 (27.5%) 2.53x 0.501 $ 4.051 $ 0.500 $ 4.551 89.0% 11.0% $ 150.204 $ 18.537 $ 168.741 18.58 $ 8.36 (25.0%) 2.61x 0.501 $ 4.191 $ 0.500 $ 4.691 89.3% 10.7% $ 155.384 $ 18.537 $ 173.921 18.58 $ 8.64 (22.5%) 2.70x 0.501 $ 4.331 $ 0.500 $ 4.831 89.6% 10.4% $ 160.563 $ 18.537 $ 179.100 18.58 $ 8.92 (20.0%) 2.79x 0.501 $ 4.471 $ 0.500 $ 4.971 89.9% 10.1% $ 165.743 $ 18.537 $ 184.280 18.58 $ 9.20 (17.5%) 2.88x 0.501 $ 4.610 $ 0.500 $ 5.110 90.2% 9.8% $ 170.922 $ 18.537 $ 189.459 18.58 $ 9.48 (15.0%) 2.96x 0.501 $ 4.750 $ 0.500 $ 5.250 90.5% 9.5% $ 176.102 $ 18.537 $ 194.639 18.58 $ 9.76 (12.5%) 3.05x 0.487 $ 4.750 $ 0.500 $ 5.250 90.5% 9.5% $ 176.102 $ 18.537 $ 194.639 18.05 $ 10.04 (10.0%) 3.14x 0.473 $ 4.750 $ 0.500 $ 5.250 90.5% 9.5% $ 176.102 $ 18.537 $ 194.639 17.55 $ 10.31 (7.5%) 3.22x 0.461 $ 4.750 $ 0.500 $ 5.250 90.5% 9.5% $ 176.102 $ 18.537 $ 194.639 17.07 $ 10.59 (5.0%) 3.31x 0.448 $ 4.750 $ 0.500 $ 5.250 90.5% 9.5% $ 176.102 $ 18.537 $ 194.639 16.63 $ 10.87 (2.5%) 3.40x 0.437 $ 4.750 $ 0.500 $ 5.250 90.5% 9.5% $ 176.102 $ 18.537 $ 194.639 16.20 $ 11.15 0.0% 3.49x 0.426 $ 4.750 $ 0.500 $ 5.250 90.5% 9.5% $ 176.102 $ 18.537 $ 194.639 15.79 $ 11.43 2.5% 3.57x 0.416 $ 4.750 $ 0.500 $ 5.250 90.5% 9.5% $ 176.102 $ 18.537 $ 194.639 15.41 $ 11.71 5.0% 3.66x 0.406 $ 4.750 $ 0.500 $ 5.250 90.5% 9.5% $ 176.102 $ 18.537 $ 194.639 15.04 $ 11.99 7.5% 3.75x 0.396 $ 4.750 $ 0.500 $ 5.250 90.5% 9.5% $ 176.102 $ 18.537 $ 194.639 14.69 $ 12.27 10.0% 3.83x 0.387 $ 4.750 $ 0.500 $ 5.250 90.5% 9.5% $ 176.102 $ 18.537 $ 194.639 14.36 $ 12.54 12.5% 3.92x 0.379 $ 4.750 $ 0.500 $ 5.250 90.5% 9.5% $ 176.102 $ 18.537 $ 194.639 14.04 $ 12.82 15.0% 4.01x 0.370 $ 4.750 $ 0.500 $ 5.250 90.5% 9.5% $ 176.102 $ 18.537 $ 194.639 13.73 $ 13.10 17.5% 4.09x 0.370 $ 4.853 $ 0.500 $ 5.353 90.7% 9.3% $ 179.930 $ 18.537 $ 198.467 13.73 $ 13.38 20.0% 4.18x 0.370 $ 4.957 $ 0.500 $ 5.457 90.8% 9.2% $ 183.758 $ 18.537 $ 202.295 13.73 $ 13.66 22.5% 4.27x 0.370 $ 5.060 $ 0.500 $ 5.560 91.0% 9.0% $ 187.586 $ 18.537 $ 206.123 13.73 $ 13.94 25.0% 4.36x 0.370 $ 5.163 $ 0.500 $ 5.663 91.2% 8.8% $ 191.415 $ 18.537 $ 209.952 13.73 $ 14.22 27.5% 4.44x 0.370 $ 5.266 $ 0.500 $ 5.766 91.3% 8.7% $ 195.243 $ 18.537 $ 213.780 13.73 $ 14.50 30.0% 4.53x 0.370 $ 5.370 $ 0.500 $ 5.870 91.5% 8.5% $ 199.071 $ 18.537 $ 217.608 13.73 $ 14.77 32.5% 4.62x 0.370 $ 5.473 $ 0.500 $ 5.973 91.6% 8.4% $ 202.900 $ 18.537 $ 221.437 13.73 $ 15.05 35.0% 4.70x 0.370 $ 5.576 $ 0.500 $ 6.076 91.8% 8.2% $ 206.728 $ 18.537 $ 225.265 13.73 $ 15.33 37.5% 4.79x 0.370 $ 5.679 $ 0.500 $ 6.179 91.9% 8.1% $ 210.556 $ 18.537 $ 229.093 13.73

20 HC2: Existing Capital Structure HC2 currently has a levered consolidated capital structure Current Debt/NAV of 5.5x compared to PFLT’s Debt/NAV of 0.6x As a result of more levered capital structure, current blended debt costs of 9.43% for HC2 compared to PFLT’s debt cost of 2.46% (1) Total debt and preferred stock represents 7.3x 2014 EBITDA and 6.2x NAV 9.67% weighted average cost Notes 1. Weighted average cost of debt for 6 months ended 3/31/15 inclusive of the fee on the undrawn commitment but excluding amendment costs 2. 7.50% cash dividend plus PIK of up to 4.00% HC2 Capital Structure ($000’s) 3/31/2015 Cumul. Debt / 2014 EBITDA Cost 11% Senior Secured Notes due 2019 300,000 4.4x 11.00% Collateralized Notes – GMSL & Schuff 33,296 4.8x 3.95 – 5.50% Secured ABL Revolver – Schuff 27,391 5.2x 3.30% Capital Leases – GMSL 56,648 6.1x 7.20% Other LTD 28 6.1x OID (2,003) 6.0x Pension Liability 34,081 6.5x Total Debt 449,441 6.5x 9.43% Preferred Stock 53,444 7.3x 11.50% (2) Total Debt and Preferred Stock 502,885 7.3x 9.67% Leverage Statistics Debt / 2014 EBITDA 6.5x Debt / NAV 5.5x Debt & Preferred / 2014 EBITDA 7.3x Debt & Preferred / NAV 6.2x Source: Company Filings

Additional Materials

22 HC2: Illustrative Corporate Structure HC2 Holdings (NYSE: HCHC) Global Marine Systems Limited ’14 EBITDA: $43MM International Carrier Services ’14 EBITDA: ($1MM) Securities and Other Investments Schuff International ’14 EBITDA: $46MM • American Natural Gas • DMi • GemDerm Aesthetics • Genovel Orthopedics • NerVve Technologies • Novatel Wireless • Other minor investments Source: Company Filings • Fully integrated fabricator and erector of structural steel and heavy steel plate for commercial and industrial construction • 91% ownership • Global offshore engineering company focused on specialist subsea services across three market sectors, namely telecommunications, oil & gas and offshore power • 97% ownership • Telecommunications company that operates direct routes and provides premium voice communication services for national telecom operators, mobile operators, wholesale carriers, prepaid operators, VoIP service operators and Internet service providers • 100% ownership

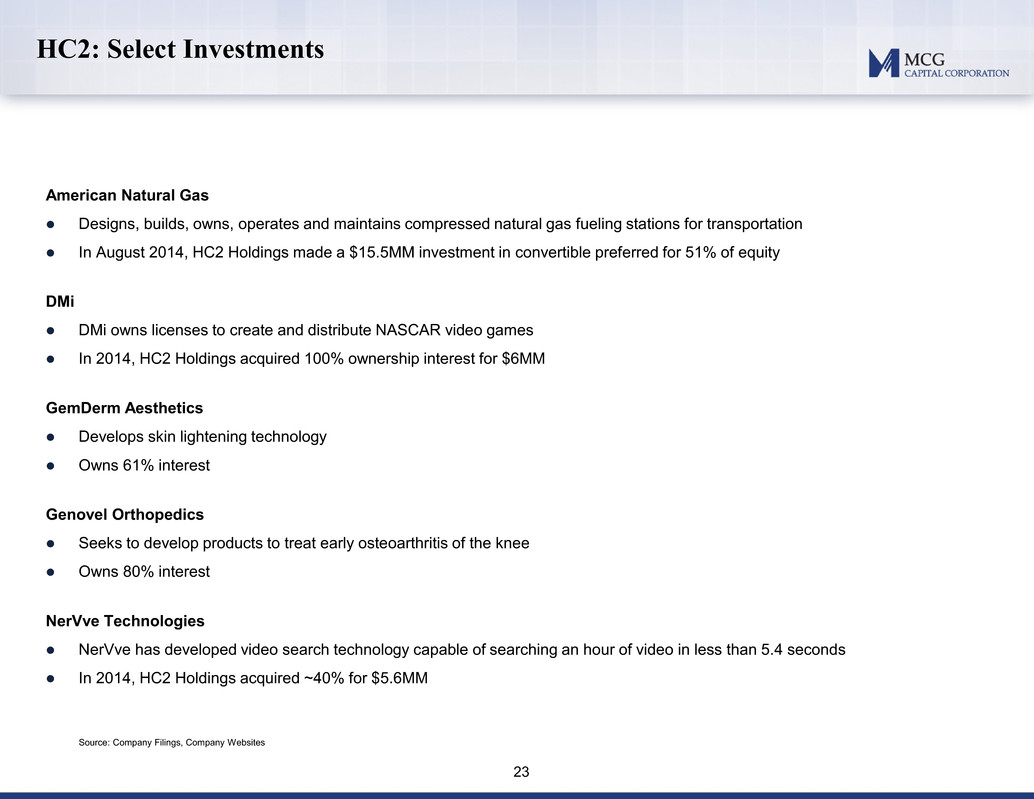

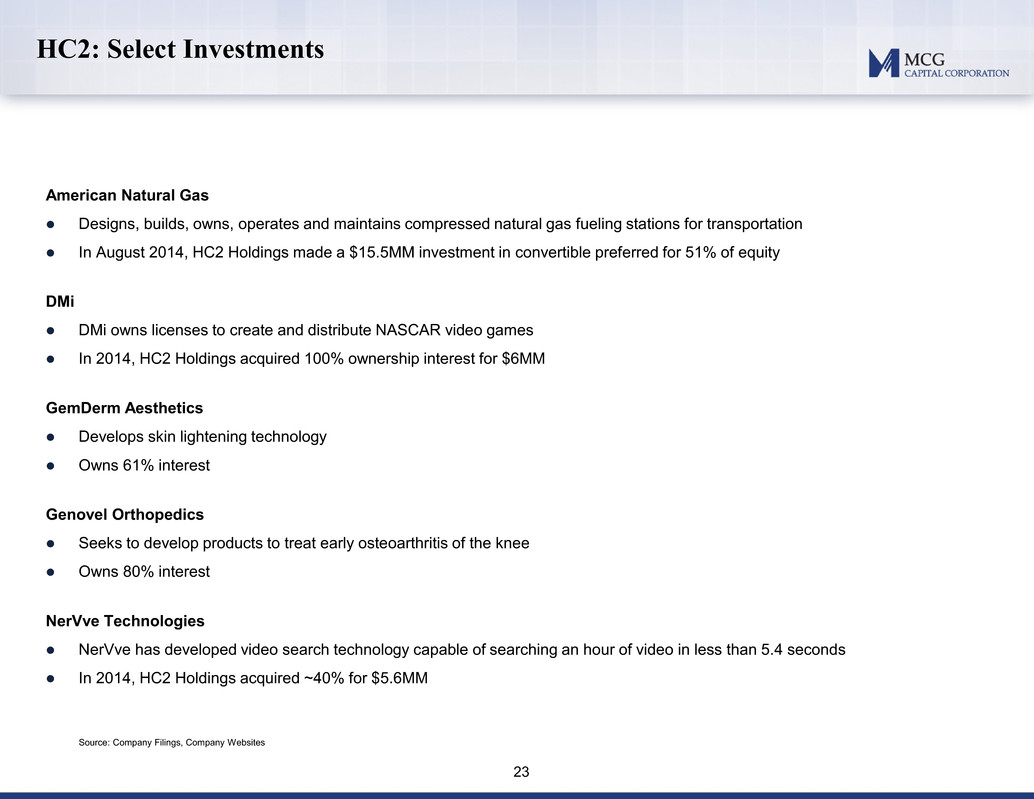

23 HC2: Select Investments Source: Company Filings, Company Websites American Natural Gas Designs, builds, owns, operates and maintains compressed natural gas fueling stations for transportation In August 2014, HC2 Holdings made a $15.5MM investment in convertible preferred for 51% of equity DMi DMi owns licenses to create and distribute NASCAR video games In 2014, HC2 Holdings acquired 100% ownership interest for $6MM GemDerm Aesthetics Develops skin lightening technology Owns 61% interest Genovel Orthopedics Seeks to develop products to treat early osteoarthritis of the knee Owns 80% interest NerVve Technologies NerVve has developed video search technology capable of searching an hour of video in less than 5.4 seconds In 2014, HC2 Holdings acquired ~40% for $5.6MM

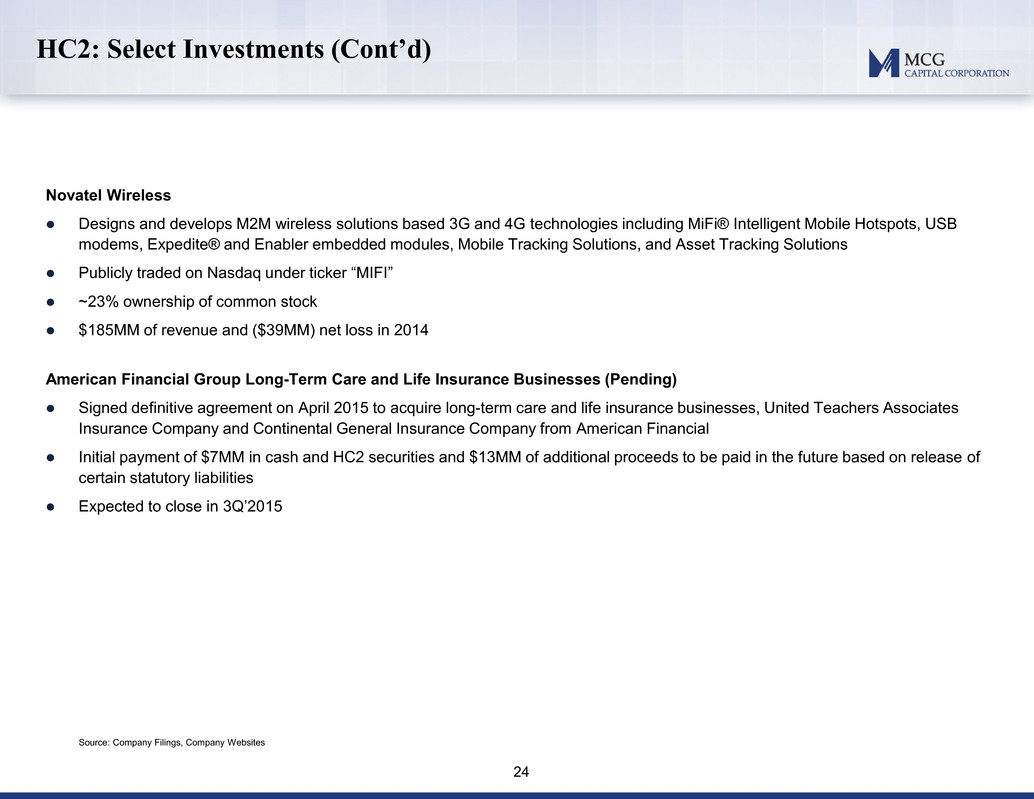

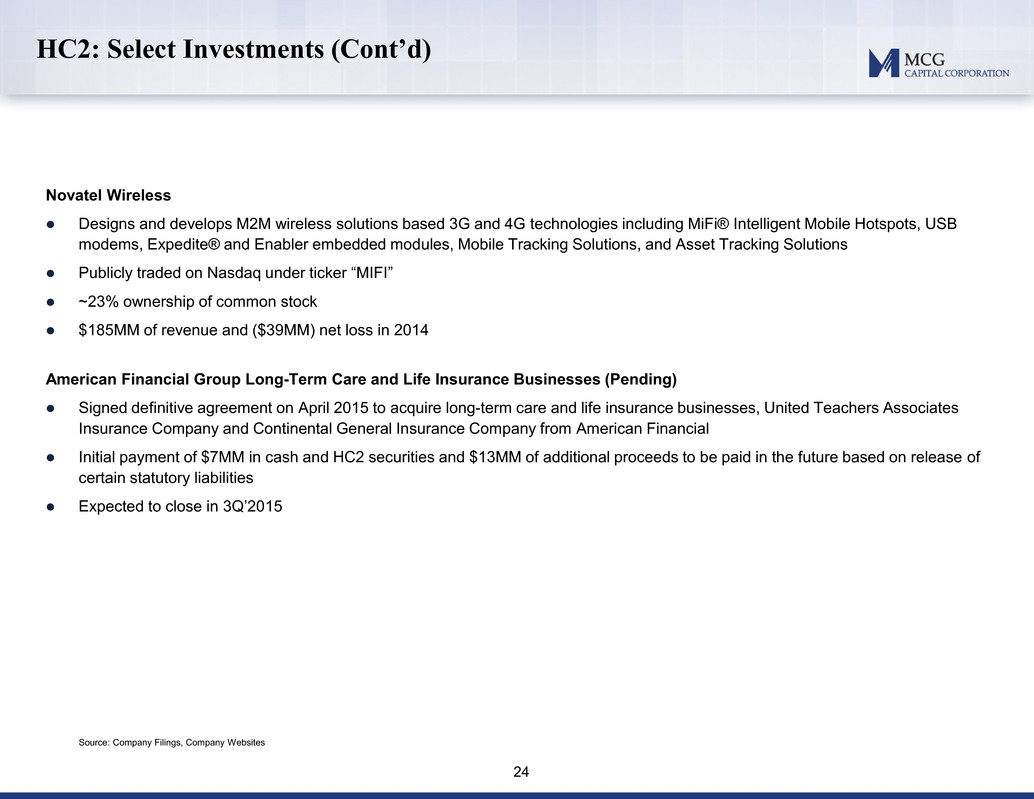

24 HC2: Select Investments (Cont’d) Source: Company Filings, Company Websites Novatel Wireless Designs and develops M2M wireless solutions based 3G and 4G technologies including MiFi® Intelligent Mobile Hotspots, USB modems, Expedite® and Enabler embedded modules, Mobile Tracking Solutions, and Asset Tracking Solutions Publicly traded on Nasdaq under ticker “MIFI” ~23% ownership of common stock $185MM of revenue and ($39MM) net loss in 2014 American Financial Group Long-Term Care and Life Insurance Businesses (Pending) Signed definitive agreement on April 2015 to acquire long-term care and life insurance businesses, United Teachers Associates Insurance Company and Continental General Insurance Company from American Financial Initial payment of $7MM in cash and HC2 securities and $13MM of additional proceeds to be paid in the future based on release of certain statutory liabilities Expected to close in 3Q’2015

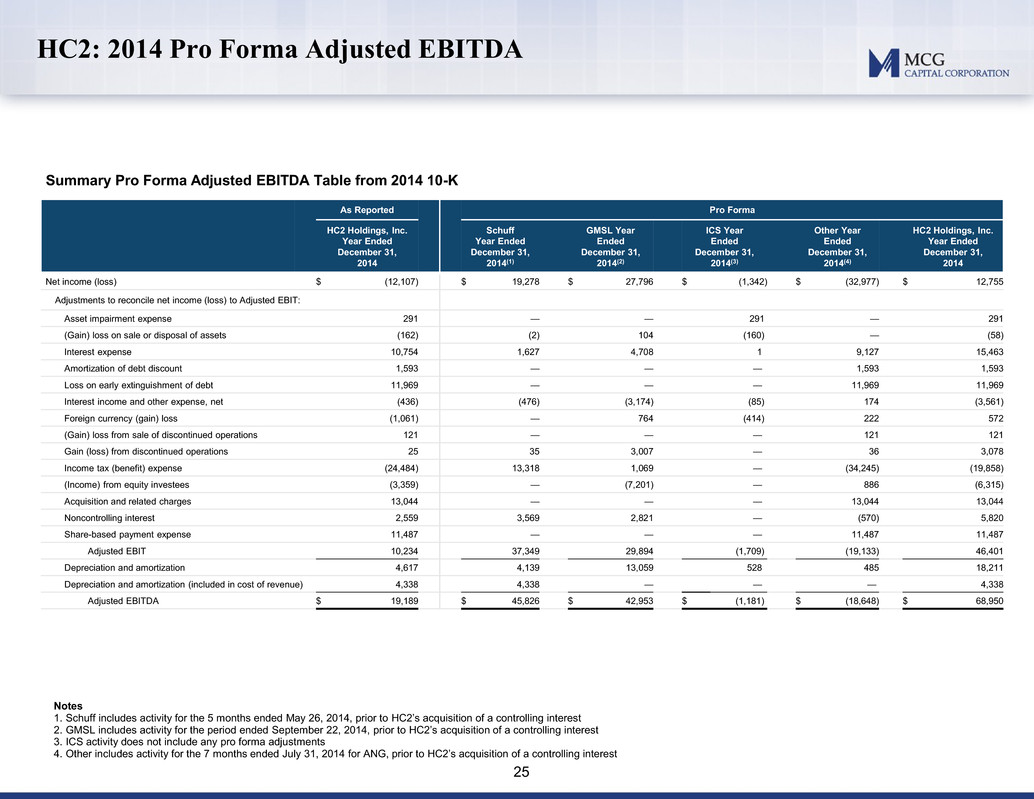

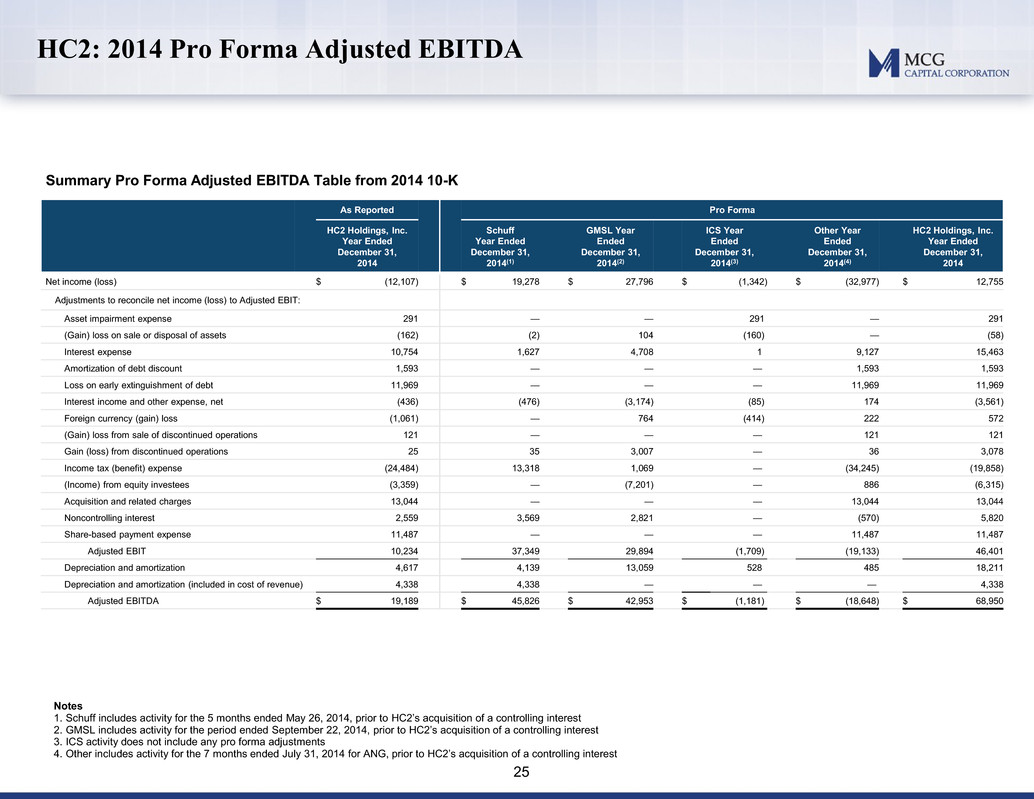

25 HC2: 2014 Pro Forma Adjusted EBITDA As Reported Pro Forma HC2 Holdings, Inc. Year Ended December 31, 2014 Schuff Year Ended December 31, 2014(1) GMSL Year Ended December 31, 2014(2) ICS Year Ended December 31, 2014(3) Other Year Ended December 31, 2014(4) HC2 Holdings, Inc. Year Ended December 31, 2014 Net income (loss) $ (12,107) $ 19,278 $ 27,796 $ (1,342) $ (32,977) $ 12,755 Adjustments to reconcile net income (loss) to Adjusted EBIT: Asset impairment expense 291 — — 291 — 291 (Gain) loss on sale or disposal of assets (162) (2) 104 (160) — (58) Interest expense 10,754 1,627 4,708 1 9,127 15,463 Amortization of debt discount 1,593 — — — 1,593 1,593 Loss on early extinguishment of debt 11,969 — — — 11,969 11,969 Interest income and other expense, net (436) (476) (3,174) (85) 174 (3,561) Foreign currency (gain) loss (1,061) — 764 (414) 222 572 (Gain) loss from sale of discontinued operations 121 — — — 121 121 Gain (loss) from discontinued operations 25 35 3,007 — 36 3,078 Income tax (benefit) expense (24,484) 13,318 1,069 — (34,245) (19,858) (Income) from equity investees (3,359) — (7,201) — 886 (6,315) Acquisition and related charges 13,044 — — — 13,044 13,044 Noncontrolling interest 2,559 3,569 2,821 — (570) 5,820 Share-based payment expense 11,487 — — — 11,487 11,487 Adjusted EBIT 10,234 37,349 29,894 (1,709) (19,133) 46,401 Depreciation and amortization 4,617 4,139 13,059 528 485 18,211 Depreciation and amortization (included in cost of revenue) 4,338 4,338 — — — 4,338 Adjusted EBITDA $ 19,189 $ 45,826 $ 42,953 $ (1,181) $ (18,648) $ 68,950 Notes 1. Schuff includes activity for the 5 months ended May 26, 2014, prior to HC2’s acquisition of a controlling interest 2. GMSL includes activity for the period ended September 22, 2014, prior to HC2’s acquisition of a controlling interest 3. ICS activity does not include any pro forma adjustments 4. Other includes activity for the 7 months ended July 31, 2014 for ANG, prior to HC2’s acquisition of a controlling interest Summary Pro Forma Adjusted EBITDA Table from 2014 10-K

26 0.00 2.00 4.00 6.00 8.00 10.00 12.00 14.00 16.00 May-14 Jul-14 Sep-14 Nov-14 Jan-15 Mar-15 May-15 HC2: Price Performance Last Twelve Months ($) HC2 Holdings Price Performance Source: Capital IQ (5/29/2015) 3-Sep-14 Novatel investment (~23% ownership) 22-Sep-14 Acquires Global Marine Systems (97% ownership) 29-May-14 Acquires Schuff International (91% ownership) 20-Nov-14 $250MM senior secured notes issued 23-Mar-15 $50MM of senior secured notes issued 14-Apr-15 Purchased American Financial Group’s long- term care insurance business 16-Mar-15 Full year earnings announced 23-Dec-14 NYSE listing announced Insider Sale-Open Market Dispositions: DG Capital sells ~300K shares over 9 trading days $11.17

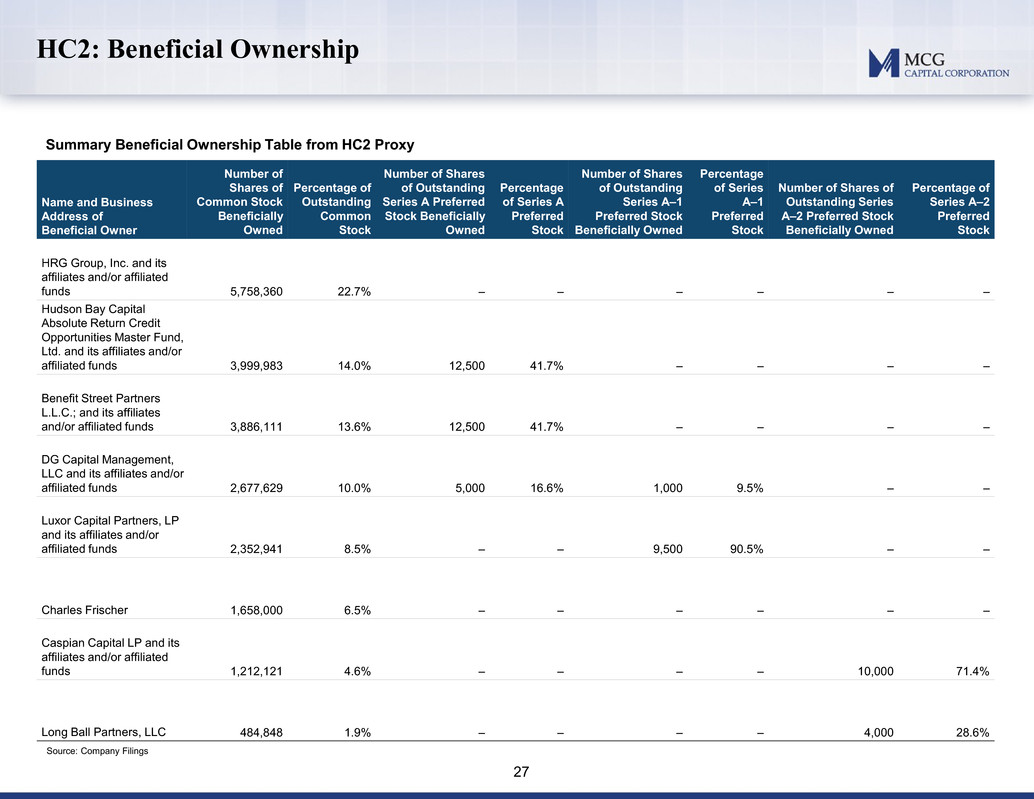

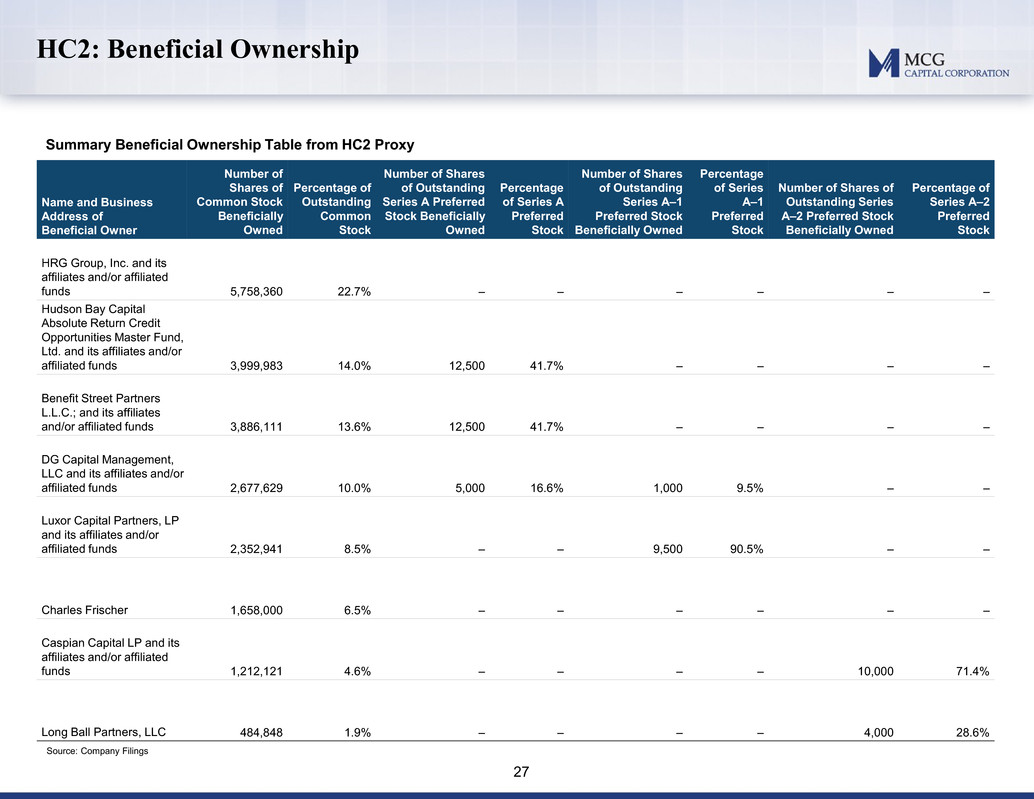

27 HC2: Beneficial Ownership Name and Business Address of Beneficial Owner Number of Shares of Common Stock Beneficially Owned Percentage of Outstanding Common Stock Number of Shares of Outstanding Series A Preferred Stock Beneficially Owned Percentage of Series A Preferred Stock Number of Shares of Outstanding Series A–1 Preferred Stock Beneficially Owned Percentage of Series A–1 Preferred Stock Number of Shares of Outstanding Series A–2 Preferred Stock Beneficially Owned Percentage of Series A–2 Preferred Stock HRG Group, Inc. and its affiliates and/or affiliated funds 5,758,360 22.7% – – – – – – Hudson Bay Capital Absolute Return Credit Opportunities Master Fund, Ltd. and its affiliates and/or affiliated funds 3,999,983 14.0% 12,500 41.7% – – – – Benefit Street Partners L.L.C.; and its affiliates and/or affiliated funds 3,886,111 13.6% 12,500 41.7% – – – – DG Capital Management, LLC and its affiliates and/or affiliated funds 2,677,629 10.0% 5,000 16.6% 1,000 9.5% – – Luxor Capital Partners, LP and its affiliates and/or affiliated funds 2,352,941 8.5% – – 9,500 90.5% – – Charles Frischer 1,658,000 6.5% – – – – – – Caspian Capital LP and its affiliates and/or affiliated funds 1,212,121 4.6% – – – – 10,000 71.4% Long Ball Partners, LLC 484,848 1.9% – – – – 4,000 28.6% Summary Beneficial Ownership Table from HC2 Proxy Source: Company Filings

28 HC2: Executive Compensation Summary Name and Principal Position Salary ($) Bonus ($) Stock Awards ($) Option Awards ($) Non-Equity Incentive Plan Compensation ($) All Other Compensation ($) Total ($) Falcone, Philip A. Chairman, President and Chief Executive Officer — — 7,941,210 5,874,803 1,922,400 13,938 15,752,351 Pons, Robert M. Former Executive Chairman; Former President and Chief Executive Officer; Executive Vice President of Business Development (Current) 184,231 100,000 946,957 119,968 393,247 24,157 1,768,560 Demise, Mesfin Chief Financial Officer, Chief Compliance Officer, Corporate Controller and Treasurer 154,548 30,551 78,576 6,853 58,000 5,553 334,081 Voigt, Paul Senior Managing Director, Investments 75,000 100,000 2,917,939 381,274 993,783 — 4,467,996 Hladek, Keith Chief Operating Officer 184,231 — 1,624,319 201,076 572,454 — 2,582,080 Estus, Ian Managing Director, Investments 184,231 — 575,734 75,554 317,220 — 1,152,739 Summary Compensation Table from HC2 Proxy: 2014 Compensation Source: Company Filings

29 PFLT: Price Performance Last Twelve Months ($) PFLT Price Performance Source: Capital IQ (5/29/2015) 10.00 12.00 14.00 16.00 May-14 Jul-14 Sep-14 Nov-14 Jan-15 Mar-15 May-15 $14.15