UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | | | |

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material under §240.14a-12 |

|

|

| Mastercard Incorporated |

| (Name of Registrant as Specified in its Charter) |

|

| (Name of Person(s) Filing Proxy Statement, if other than Registrant) |

| Payment of Filing Fee (Check all boxes that apply): |

| x | No fee required |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

ANNUAL LETTERS FROM MASTERCARD LEADERSHIP 2023

| | | | | | | | |

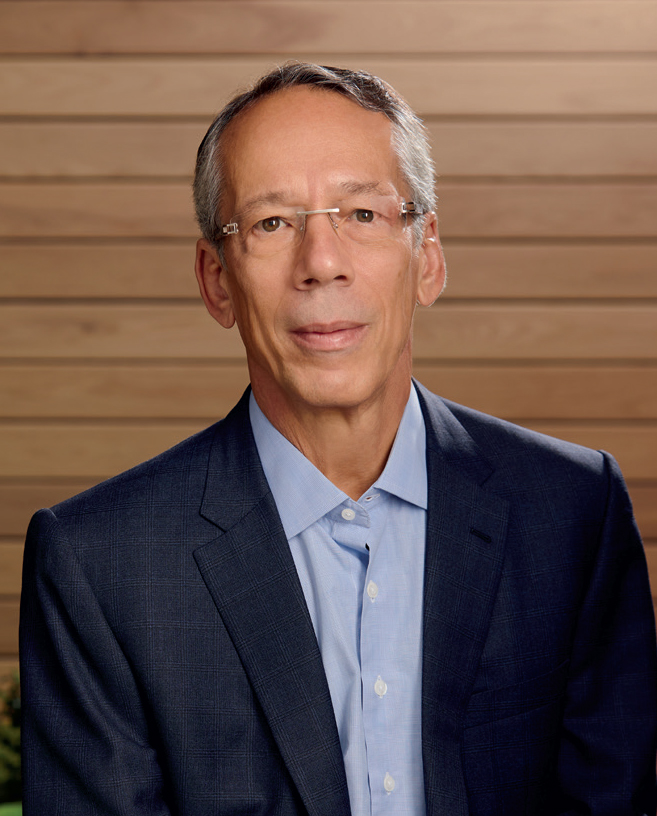

| Powering economies and empowering people through good and challenging times Dear Fellow Stockholder: April 28, 2023 |

The global economy has faced one crisis after another in recent years. In early 2023, we’re seeing the continued challenges of higher inflation and shocks to the banking industry. Yet, I remain a pragmatic optimist. That's because I have seen just how resilient people can be, how quickly they can recover and the positive impact they can have. The payments industry has and will continue to play an important role in these efforts. Shaping our future Our company has been built over decades to be the payments backbone for an increasingly digital world. Mastercard is a uniquely well-diversified business across geographies, customer segments, products and services. That has helped us to create value and to be a constant, reliable resource through economic cycles and geopolitical changes. Mastercard is leading today's digital evolution, enabling a broader set of payment flows, critical services and digital tools in more places. We’re delivering better experiences, helping to speed up commerce, grow local economies and support more resilient communities. We’re making commerce safer and smarter by building new tools in cybersecurity, biometrics, personalization and sustainability. Our teams have shown time and again the flexibility, commitment and know-how to grow our business and navigate through uncertainty. They take the foundations of our franchise and rules and evolve for today’s needs. Our results prove it. Last year, Mastercard was recognized as one of only seven all-star companies in The Wall Street Journal-Drucker Institute Best Managed Companies list and we again led our industry in the IMD Future Readiness list. We celebrated the 25th anniversary of Priceless, a key differentiator for our brand and our business. We were recognized for our world-changing ideas, as a great place to work, and as one of the world’s most ethical companies. As we reported this past January, 2022 was a strong year that brought significant momentum into the new year. We grew gross dollar volume (GDV) on our network in 2022, rising 12% to $8.2 trillion. That growth includes how our teams drove the business to make up for any impacts from the suspension of our Russian operations. Cross-border volume increased 45%. Last year, we surpassed 2 billion tokenized transactions a month across more than 110 countries. With that as a foundation for 2023, here’s how we plan to keep growing and deepening the digital economy all over the world: |

ANNUAL LETTERS FROM MASTERCARD LEADERSHIP 2023

| | | | | | | | |

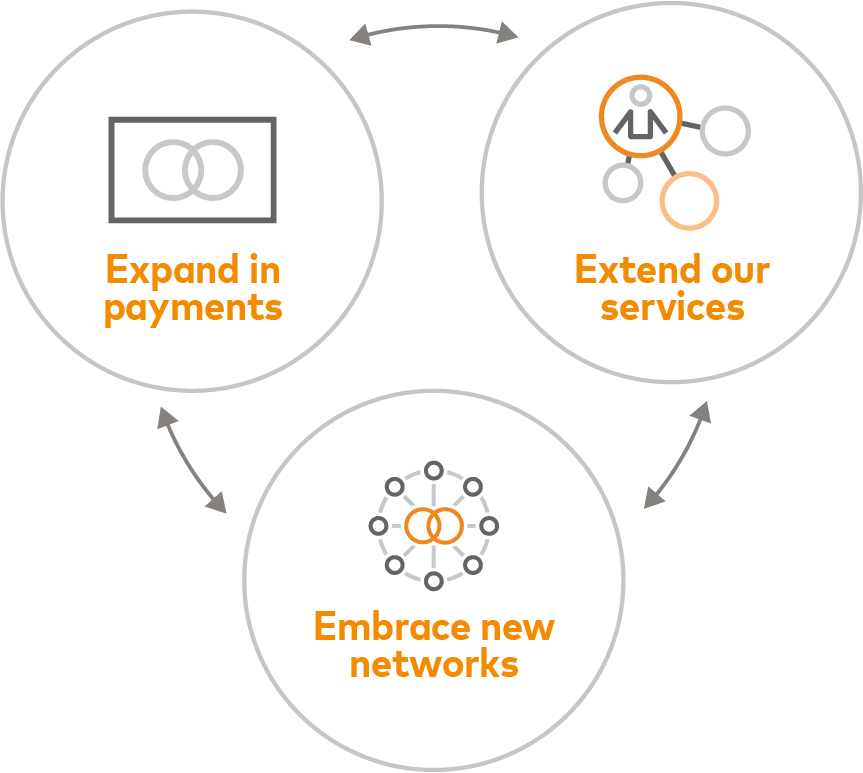

Delivering on commitments At our investor day just over a year ago, we shared a strategy that is based on three central pillars -- to expand in payments, extend our services and embrace new networks. Expand in Payments For much of our history, Mastercard has been known for card payments. It is the core of what we deliver in expanded relationships with partners and customers including Citizens Bank, Santander and NatWest. This consumer card business continues to be healthy. There’s plenty of runway ahead – in both the consumer and commercial segments – as seen in the continued shift to electronic payments. People are looking for more opportunities to tap into the convenience and safety they associate with Mastercard. While it may seem like you can use a card virtually everywhere, our work on acceptance is never finished. In the past six years, the number of merchants accepting Mastercard payments has more than doubled – to nearly 100 million locations. We are growing through Cloud Commerce, a cloud-native service that makes it easy for the smallest business to start accepting payments without an investment in new hardware. However, we also recognize there’s not a one-size-fits-all approach. There are areas where a card payment may not be the best fit. That’s why we are working to support the range of ways people and businesses want to pay and get paid. It comes down to being simple, frictionless and secure in every instance. We’re doing that in consumer card payments and by focusing on four additional flows – disbursements and remittances, commercial point of sale, business-to-business accounts payable and consumer bill payments. These areas are increasingly becoming a larger part of our business with more growth potential – an estimated $80 trillion in GDV. In commercial, we’re building on a strong foundation and expanding into small business, travel and entertainment, and fleet cards – similar to programs people use in their personal lives but with tailored benefits for their business. Mastercard Send and our cross-border services expand our ability to deliver domestic and international payments securely to 90% of the world’s population. There’s also our industry-leading work with virtual cards, providing businesses with an effective solution to do more with their capital and their data. And we continue to responsibly explore and evolve our activities with blockchain technology, working with players and partners across the industry. This complements our work with governments as they explore digital currencies and learn what may be required, from interoperability with traditional systems and commerce to connecting across borders. Extend our services Services are constantly driving greater value and enhancing our payments solutions. Building trust. Delivering insights. Making our customers smarter and stronger. Our consulting and managed services teams have a long history in helping financial institutions understand the trends and make their portfolios perform even better. We continue to integrate our acquisitions to make services a growing part of our revenue. Recently, our Dynamic Yield team introduced a new platform that brings aggregated consumer spending insights into its proprietary software to help retailers and brands deliver even greater personalized offers. We challenge ourselves to look beyond the traditional set of solutions. We're applying foundational principles and controls around privacy and data responsibility while pushing ourselves -- and our partners -- to think differently so data can be used to create efficiencies and make smarter decisions. |

We challenge ourselves to look beyond the traditional set of solutions. We're applying foundational principles and controls around privacy and data responsibility while pushing ourselves -- and our partners -- to think differently so data can be used to create efficiencies and make smarter decisions. |

ANNUAL LETTERS FROM MASTERCARD LEADERSHIP 2023

| | | | | | | | |

| Culture can be a competitive advantage, and it is strongest when teams feel a powerful connection to each other and have shared goals and a clear path to grow and win. | Then there’s the world of cyber. We switched (authorized, cleared and settled) 126 billion payment transactions last year. Each and every one was supported with the highest levels of security. In the last three years, Mastercard prevented $30 billion in potential customer fraud losses through AI-powered systems that we have built and evolved over the years. Our recent acquisition of Baffin Bay Networks adds to this by helping to identify and mitigate cyber threats our customers might face. Embrace new networks We’re extending into adjacent spaces and networks to leave no white space uncontested. Open banking and digital identity present new opportunities to extend the value of our brand, both as standalone offerings and in synergy with our core payments capabilities. Just look at the continued growth in open banking – the secure, permissioned access to financial data – and the demand for lending use cases, among others. Our technology is helping to power a Pay by Bank offering, an ACH payment directly from a bank account wherever Mastercard is accepted. It starts with the consumer saying how and where they want to securely share their account information. And it has the potential to take the pain out of – and add security into – recurring payments such as rent, utilities and healthcare. Similarly, our identity services activities are using consent-driven insights to help banks, merchants and other businesses determine if their “customer” is a genuine user or if it’s a fraudster. We are providing risk-based analysis, peace of mind and brilliant customer experiences across transactions and other digital interactions like new account openings. Defining new technology and value We have come a long way from the creation of the Mastercard network. We have made it easier for our customers to connect with Mastercard for whatever their needs might be. Today, our hybrid approach blends legacy and cloud technologies to enable more innovation, deliver greater reliability and do so in a regulatory-compliant and sustainable manner. The emerging technologies we’re creating and constantly innovating enable new partners and power new opportunities through the agility and scale enabled by the cloud, the speed and intelligence in quantum computing, and the potential of blockchain. It's our responsibility to ensure that these technologies can come together and solve real problems. This future of payments requires an equal focus on privacy and security, including a responsible approach to activate AI. Without that foundational trust, people will not embrace new technologies, potentially weakening the digital economy’s growth. Fueling a strong culture What we do is important. As an organization, we place great emphasis on how we work together, deliver impact and, with that, ensure our resiliency. Culture can be a competitive advantage, and it is strongest when teams feel a powerful connection to each other and have shared goals and a clear path to grow and win. Today, the Mastercard Way focuses on three areas -- creating value, growing together and moving fast, all with a foundation of doing the right thing.

|

ANNUAL LETTERS FROM MASTERCARD LEADERSHIP 2023

| | | | | | | | |

Our 29,900 colleagues across the globe have diverse backgrounds and experiences, but they all are mission-driven, talented and passionate people. Whether they are engineers or programmers, product managers, consultants or finance specialists, they all are pulling toward a shared goal and common purpose. Ensuring a sustainable social impact We have the fundamental belief that businesses cannot thrive in an unhealthy and unequal world. That’s why our significant commitment to sustainable economies and social impact is necessary. Addressing our environmental impacts and enabling financial inclusion are smart for our business and are the right thing to do for society. They give people full access to their money. They bring a farmer’s crops to a wider digital marketplace. They help with greater connectivity and allow more people to participate in today’s economy, no matter where they are. That strengthens the resilience of our communities, grows prosperity and delivers long-term value creation with new customers. We are only one part of a much larger story, but I am proud of the role that we play with our partners across the public and private sectors. Delivering on the vision, executing on our strategy Yes, there are many external challenges, but there are also clear opportunities. I believe in our long-term growth potential because of our differentiated strategy, people, production and solutions. Earlier, I talked about our momentum coming into this year. We are using that to our advantage – to reinforce our value to our customers, to deliver on our commitments and to imagine new ways to apply our skills, creativity and experience. It’s what we have continually committed to. It’s what we have consistently delivered on. That track record is what makes Mastercard valuable and integral to our partners. Our ambition is to power economies and empower people. Our activities and programs enable a stronger ecosystem that helps us all be more resilient to whatever lies ahead. That is why I’m optimistic about our future. Thank you for your continued support. Sincerely, | Our ambition is to power economies and empower people. Our activities and programs enable a stronger ecosystem that helps us all be more resilient to whatever lies ahead. |

| | |

Michael Miebach

President and CEO | | |

ANNUAL LETTERS FROM MASTERCARD LEADERSHIP 2023

| | | | | | | | |

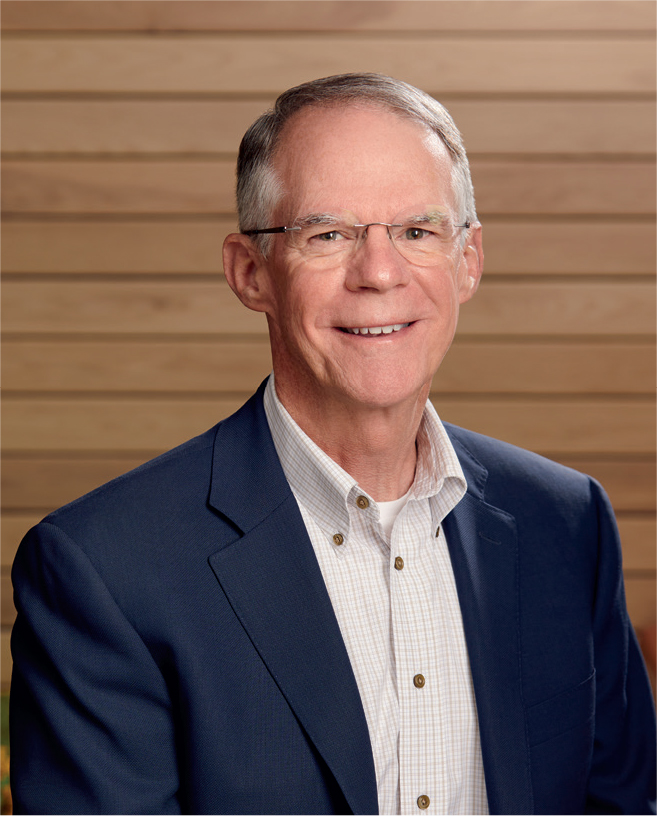

| Successful Management in a Period of Disruption Dear Fellow Stockholder, |

Great companies devise powerful and purposeful strategies and execute them with excellent management teams. They distinguish themselves even further if they have the resilience and ability to pivot when faced with disruptive forces. | The global community has faced periods of stress and turmoil in the past, but currently we are all experiencing an unusually large number of disruptions that are economic, geopolitical, and technological. Great companies devise powerful and purposeful strategies and execute them with excellent management teams. They distinguish themselves even further if they have the resilience and ability to pivot when faced with disruptive forces. It is my view that Mastercard and its management team led by Michael, are demonstrating these characteristics and the results are evident. Looking over the accomplishments of 2022, I am impressed by how this team has strategically and deliberately navigated the complexities they faced. Their priorities were clear: to ensure the strong continuity of the business, deliver on the needs of customers and partners, and take care of the people that bring the strategy to life. The management team delivered on today’s commitments with steady growth in every quarter. As importantly, Mastercard continued to make strong progress on creating further long-term value, devising innovative technology, advancing financial inclusion, meeting environmental goals, and maintaining the responsible use of data. Mastercard has an obligation to its stockholders, employees and customers, but we also play a critical role in the lives of so many people across the globe: connecting buyers and sellers, enabling everyday commerce, helping to power data-driven decisions and having a positive social impact. I am also proud of the commitment of the Board of Directors. Our role as an independent Board is to provide oversight of the strategy, management and execution of these activities in a manner that ensures a continued high-level of performance and strong delivery of value to all stakeholders, including you, the company’s stockholders. Our Board of Directors is a group of capable and diverse leaders with relevant experiences across many industries and geographies. The Board’s relationship with the Mastercard team has been one that emphasizes thoughtful debate, excellence, commonality of values, candor, and a strong commitment to work together to deliver on the objectives set for Mastercard’s growth and success. Finally, I would also like to thank all of Mastercard’s employees for their hard work throughout this year and our stockholders and customers for their continued support. We know that success is a shared journey, and we look forward to a strong year ahead. Despite many uncertainties, it is an exciting time. Michael and I look forward to sharing more with you at our upcoming annual meeting. |

| | |

| Merit E. Janow

Board Chair | |

| | |

|

|

|

|

Back row, standing, from left: Harit Talwar; Youngme Moon, Risk Committee Chair; Rima Qureshi; Michael Miebach, President and CEO; Candido Bracher Middle row, seated, from left: Richard K. Davis, HRCC Chair; Merit E. Janow, Board Chair and NCG Chair; Julius Genachowski, Audit Committee Chair Front row, seated, from left: Choon Phong Goh; Lance Uggla; Oki Matsumoto; Gabrielle Sulzberger |

|

NOTICE OF 2023 ANNUAL MEETING OF STOCKHOLDERS

| | | | | | | | | | | | | | | | | | | | | | | |

| Notice of 2023 annual meeting of stockholders | | |

| When Tuesday, June 27, 2023

at 8:30 a.m. (Eastern time) | | Record date April 28, 2023 | | Who can vote Holders of Mastercard’s Class A common stock at the close of business on April 28, 2023 | | Location Live webcast at: www.virtualshareholdermeeting.com/MA2023 |

| | | | | | | | | | | | | | | | | |

Dear Stockholder: You are invited to attend the Annual Meeting of Stockholders of Mastercard Incorporated (Annual Meeting), which will be held virtually on Tuesday, June 27, 2023 at 8:30 a.m. (Eastern time) at www.virtualshareholdermeeting.com/MA2023. |

|

|

| Items of business | Board vote recommendation | For more

information |

| | | | | |

| | | | | |

| 1 | Election of the 12 nominees named in this proxy statement to serve on Mastercard’s Board of Directors | FOR each director nominee | |

| | | | | |

| | | | | |

| 2 | Advisory approval of Mastercard’s executive compensation | FOR | |

| | | | | |

| | | | | |

| 3 | Advisory approval of the frequency of future advisory votes on executive compensation | 1 YEAR | |

| | | | | |

| | | | | |

| 4 | Approval of Mastercard Incorporated Employee Stock Purchase Plan | | FOR | | |

| 5 | Ratification of the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm for Mastercard for 2023 | | FOR | | |

| | | | | |

| | | | | |

| 6-10 | Stockholder proposals | ☒ | AGAINST | | |

| | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | |

Annual meeting website and voting in advance We have created an annual meeting website to make it easy for you to access our Annual Meeting materials at www.mastercardannualmeeting.com. There you will find an overview of the voting items, the proxy statement and the annual report to read online or download, as well as a link to vote your shares. Your vote is important. Please vote as soon as possible by one of the methods shown below. Be sure to have your proxy card, voting instruction form or Notice of Internet Availability of Proxy Materials in hand and follow the below instructions: |

| By telephone You can vote your shares by calling 800.690.6903 toll-free | | By Internet You can vote your shares online at www.proxyvote.com | | By mail Complete, sign, date and return your proxy card or voting instruction form in the postage-paid envelope provided |

NOTICE OF 2023 ANNUAL MEETING OF STOCKHOLDERS

| | | | | |

Attending the Annual Meeting As a result of the COVID-19 pandemic, we held our annual stockholder meeting in 2020, 2021 and 2022 virtually. Based on our experience over the last three years, our Board and management believe that holding our annual meeting in a virtual format offers a wider group of stockholders the opportunity to participate in the meeting. Our Board intends to continue with the use of the virtual meeting format. The Annual Meeting will be a virtual-only meeting held on June 27, 2023 at 8:30 a.m. (Eastern time). Our Board will be taking the following steps to ensure adequate participation: •Stockholders are able to vote their shares electronically online during the meeting by going to www.virtualshareholdermeeting.com/MA2023 and logging in using their unique 16-digit control number •Stockholders may submit relevant questions in advance of the meeting by submitting a question under the “Questions for Management” tab at proxyvote.com •Stockholders may submit relevant questions during the meeting by entering a question in the Q&A field •We will respond to relevant questions as time permits. If substantially similar questions are received, management may group them together and provide a single response to avoid repetition and allow time for additional topics to be discussed. We expect to address certain unanswered relevant questions on our investor relations site in due course after the meeting. |

•Additional rules of conduct will be posted in advance on the “Investor Relations” section of the company’s website at https://investor.mastercard.com •Those without a control number may attend as guests of the meeting but will not have the option to vote their shares, ask questions or otherwise participate in the Annual Meeting Stockholders are encouraged to log in to the webcast up to 15 minutes before the virtual Annual Meeting’s start time. You can find more information under “About the Annual Meeting and voting” on pg 138 of the proxy statement that follows. Audio webcast In addition to participating in the virtual Annual Meeting, you can listen to a live audio webcast of our virtual Annual Meeting by visiting https://investor.mastercard.com/overview/default.aspx the “Investor Relations” page of our website, beginning at 8:30 a.m. (Eastern time) on June 27, 2023. Date of mailing We will begin mailing our Proxy Materials on or about April 28, 2023. Unless you attend (and vote at) the virtual Annual Meeting, Mastercard must receive your vote either by telephone, Internet, proxy card or voting instruction form by 11:59 p.m. (Eastern time) on June 26, 2023 for your vote to be counted. Telephone and Internet voting facilities will close at that time. Voting by telephone or Internet or by returning your proxy card or voting instruction form in advance of the virtual Annual Meeting does not deprive you of your right to attend or vote at the virtual Annual Meeting. |

| By Order of the Board of Directors, |

| |

| Adam Zitter

Corporate Secretary Purchase, New York April 28, 2023 |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS Mastercard Incorporated’s Proxy Statement for the 2023 Annual Meeting of Stockholders (the Proxy Statement) and the 2022 Annual Report on Form 10-K (the 2022 Form 10-K) are available at www.proxyvote.com. |

Proxy summary

This summary highlights information contained elsewhere in this proxy statement and does not contain all of the information that you should consider. You should read the entire proxy statement carefully before voting.

Our mission and purpose and the Mastercard Way

At Mastercard, we are powering economies and empowering people, building a sustainable economy where everyone prospers. We deliver on this vision by connecting and powering an inclusive, digital economy that benefits everyone, everywhere by making transactions safe, simple, smart and accessible. Using secure data and networks, partnerships and passion, our innovations and solutions help individuals, financial institutions, governments and businesses realize their greatest potential. Collectively, these efforts are helping us cultivate and grow long-term opportunities and deliver continual value for all stakeholders. With connections across more than 210 countries and territories, we are building a sustainable world that unlocks priceless possibilities for all.

The Mastercard Way is the statement of our culture: how we work and why we work that way. It consists of three principles that address where we are going as an organization, how we work together, and how we deliver for our customers and each other. • Create value • Grow together • Move fast

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Director

since | | | | | Committee membership |

| Name | | | Age | | | Primary occupation | | Audit | | HRCC | | NCG | | Risk |

| Merit E. Janow, Board Chair | | 65 | | 2014 | | Dean Emerita, School of International and Public Affairs, and Professor of Practice, International Economic Law and International Affairs, Columbia University | | ● | | | | | | |

| Candido Bracher | | 64 | | 2021 | | Former CEO, Itaú Unibanco Group | | ● | | | | | | ● |

| Richard K. Davis | | 65 | | 2018 | | Former Executive Chairman & CEO, U.S. Bancorp | | | | | | ●* | | |

| Julius Genachowski | | 60 | | 2014 | | Managing Director, The Carlyle Group | | | | ● | | | | ● |

| Choon Phong Goh | | 59 | | 2018 | | CEO, Singapore Airlines Limited | | | | | | ● | | ● |

| Oki Matsumoto | | 59 | | 2016 | | Founder, Chairman and CEO, Monex Group, Inc. | | | | ● | | | | |

| Michael Miebach | | 55 | | 2021 | | President and CEO | | | | | | | | |

| Youngme Moon | | 59 | | 2019 | | Donald K. David Professor of Business Administration, Harvard Business School | | | | ● | | | | |

| Rima Qureshi | | 58 | | 2011 | | Executive Vice President and Chief Strategy Officer, Verizon Communications Inc. | | ● | | | | | | ● |

| Gabrielle Sulzberger | | | 63 | | 2018 | | Senior Advisor, Two Sigma Impact | | ● | | | | ● | | |

| Harit Talwar | | 62 | | 2022 | | Former Partner and Chairman of Consumer Business (Marcus), Goldman Sachs | | | | ● | | | | |

| Lance Uggla | | | 61 | | 2019 | | CEO, BeyondNetZero | | ● | | ● | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Committee chair | | ● | Committee member | | | Audit Committee financial expert *Non-voting observer, until the Annual Meeting | | | | | | |

Our director nominees’ experience, tenure, independence and diversity

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| 92% | | | 64% | | | 64% | | | 36% |

11 of our 12 director nominees are independent | | | 7 of our 11 independent director nominees identify as racially or ethnically diverse | | | 7 of our 11 independent director nominees are non-U.S. citizens and/or have international experience | | | 4 of our 11 independent director nominees identify as female |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | |

Average tenure in years of our independent director nominees as of the date of the Annual Meeting 5.6 | |

| 36% 4 of our 11 independent director nominees have a tenure of 4 years or less | | | 61 Average age of our independent director nominees as of the date of the Annual Meeting | | | |

Director skills (including number of nominees possessing these skills)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| Consumer | C-suite experience | Financial and risk | Global perspective | Information

security | Payments | Public company board experience | Regulatory and governmental | Sustainability | Technology, digital and innovation |

| 9 | 11 | 11 | 10 | 7 | 7 | 10 | 8 | 12 | 11 |

Our engagement and transparency

During the past year, we engaged with our stockholders, as well as a broad range of our stakeholders, on a variety of topics.

| | | | | |

| We engaged with stockholders owning more than 2/3 of our shares |

| | | | | | | | | | | | | | |

| | | | |

| | | | |

Stockholder engagement Management and, where appropriate, directors engage with stockholders through various means, including in the boardroom, at conferences, and via video conference and telephone on a variety of topics. The exchanges we and our Board have had with stockholders provide us with a valuable understanding of our stockholders’ perspectives and meaningful opportunities to share views with them. | | Sustainability engagement We welcome the views of a broad range of stakeholders who serve as critical partners in identifying our key sustainability areas of impact. We regularly engage with these stakeholders to better understand their views and sustainability concerns and ensure we are prioritizing issues important to both our stakeholders and our long-term business success. | | Commitment to transparency Our website disclosures address critical matters of interest to our stakeholders, including our commitment to social responsibility. |

| | | | |

| | | | |

•Board refreshment •Business strategy and performance •Compensation practices •Data privacy •Diversity, equity and inclusion •Risk oversight •Sustainability •Talent and culture | | •Community and non-governmental organizations •Employees, financial institutions, merchants and customers •Governments and regulators •International organizations •Stockholders •Suppliers | | •Center for Inclusive Growth •Diversity, equity and inclusion •Global Tax Principles •Human Rights Statement •Modern Slavery Statement •Political activity/political spending •Privacy and data protection •Sustainability Bond Report •Sustainability Report •Talent and culture |

| | | | |

| | | | |

| Engagement and transparency |

Our performance

The following are our key financial and operational highlights for 2022, including growth rates over the prior year:

| | | | | | | | | | | | | | | | | | | | | | | |

| GAAP |

| Net revenue | | Net income | | Diluted EPS |

| $22.2B | | $9.9B | | $10.22 |

| |

| up | 18% | | up | 14% | | up | 17% |

| | | | | | | |

NON-GAAP1 (currency-neutral) |

| Adjusted net revenue | | Adjusted net income | | Adjusted diluted EPS |

| $22.2B | | $10.3B | | $10.65 |

| |

| up | 23% | | up | 32% | | up | 34% |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gross dollar volume

(growth on a local currency basis) | | Cross-border

volume growth

(on a local currency basis) | | Switched transactions

|

| $8.2T | 125.7B |

| up 45% |

| up 12% | up 12% |

1 Non-GAAP results (including growth rates) exclude the impact of gains and losses on equity investments, Special Items and/or foreign currency. Refer to Appendix A for the reconciliation to the most direct comparable GAAP financial measures and our reasons for presenting them.

| | | | | | | | | | | | | | |

| Capital returned to stockholders in 2022 | | Cash flow from operations |

| | | | |

| Total | Repurchased shares | Dividends paid | | 2022 |

| $10.7B | $8.8B | $1.9B | | $11.2B |

| | | | |

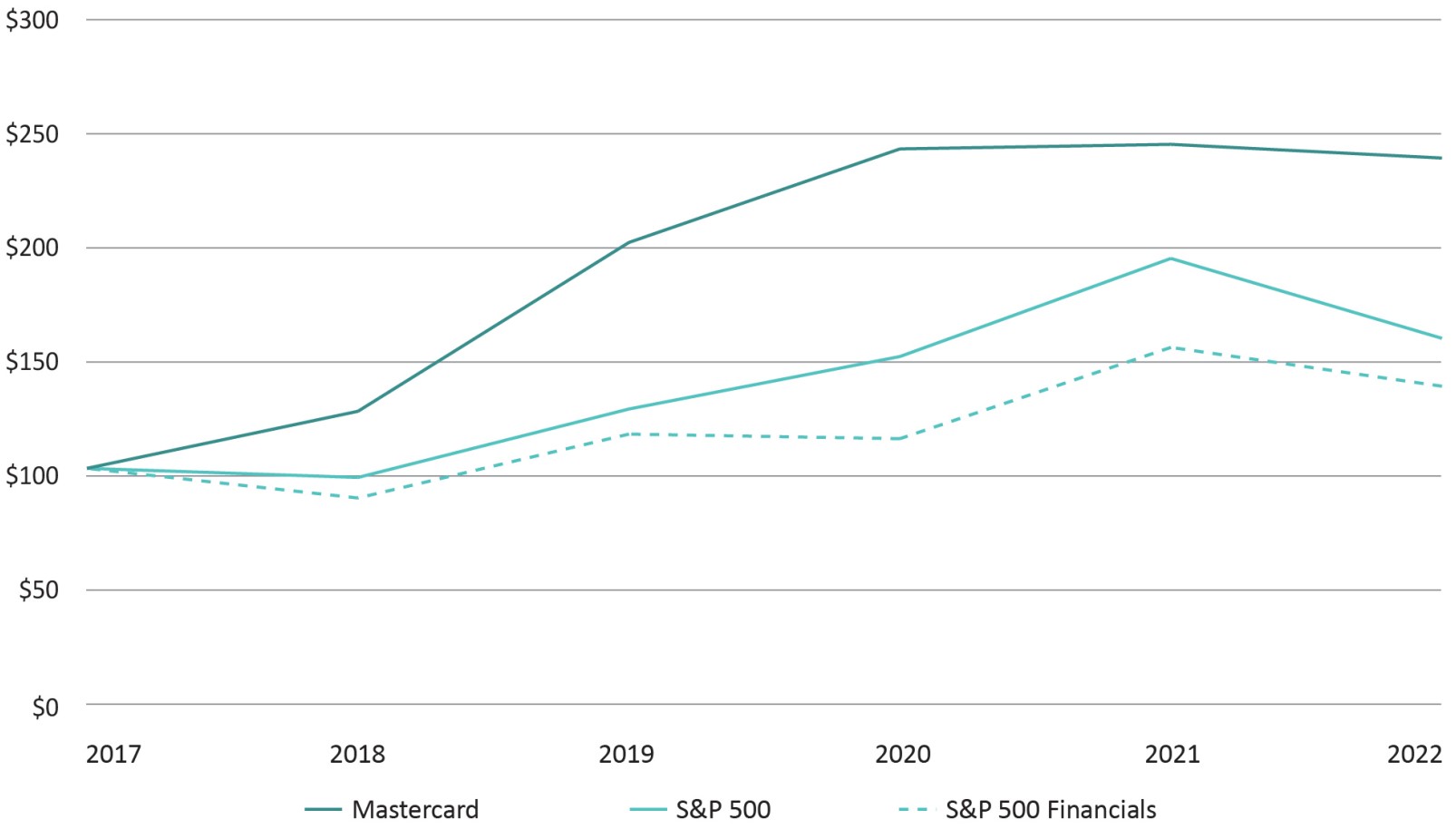

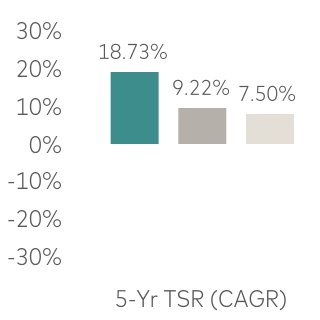

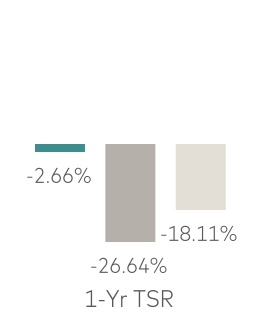

Our strong performance over the years has resulted in substantial stock price appreciation.

Comparison of cumulative five-year total return*

* Assumes a $100 investment in our Class A common stock and both of the indices and the reinvestment of dividends. Mastercard’s Class B common stock is not publicly traded or listed on any exchange or dealer quotation system.

| | | | | | | | |

Stock price at IPO

May 2006 | Stock price

December 31, 2022 | Increased by

more than |

| | |

| $3.90 | $347.73 | 89 times |

| | |

Environmental, social and governance

Environmental, social and governance (ESG) matters are fundamental to our business strategy, and we leverage our employees, technology, resources, partnerships and expertise to drive positive, lasting impact. Our ESG strategy is expressed through three pillars — People, Prosperity, Planet — and all the work we do is grounded in strong governance principles. Our commitment to environmental and social responsibility — and our core value of operating ethically, responsibly and with decency — is directly connected to our continuing success as a business.

To help further align our actions with our ESG goals, and to help ensure all Mastercard employees share in the responsibility to uphold these goals, we link our annual incentive programs for executives and employees to ESG performance measures, including quantitative objectives for financial inclusion, gender pay equity and GHG emissions. See pg 73 of Compensation Discussion & Analysis for additional detail.

Our progress on key ESG goals in 2022

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | People | | | | Prosperity | | | | Planet | |

| | | | | | | | | | | |

| •Toward our goal to close the global gender median pay gap at Mastercard, in 2022, we increased the median pay for female employees to 94.0% of median pay for male employees, up 0.8% from 2021.1 Females continue to earn $1 for every $1 males earn, with the median pay gap predominantly due to the fact that we have more men in senior roles, not because men are paid more •Toward our goal to grow U.S. Black leadership at the vice president level and above at Mastercard by 50% by 2025, we grew the number of Black leaders at the vice president level and above from 62 to 72 in 2022. Since 2020, the percentage of Black representation in leadership at the vice president level and above has grown by 7% | | | •Toward our goal to connect 1 billion people to the digital economy by 2025, we worked with our partners to connect more than 100 million in 2022. Since 2015, with partners, we have connected more than 780 million people to the digital economy | | | •Toward our goal of net zero greenhouse gas (GHG) emissions by 2040, and our science-based targets of 38% absolute reduction in Scope 1 and 2 GHG emissions and 20% absolute reduction in Scope 3 GHG emissions by 2025 from our 2016 base year, in 2022, we reduced emissions by 44% and 40%, respectively, from our 2016 base year

| |

| | | | | |

| | | | | | | | | | | |

1The gender pay gap shown above uses a 2021 baseline pay gap of 93.2%. The resulting 2022 pay gap of 94.0% (+0.8 percentage points (ppt)) uses data as of September 30, 2022 and neutralizes for currency fluctuations over the measurement period by using 2021 foreign exchange (FX) rates.

Compensation

Mastercard’s strategy

Our strategy centers on growing our payments capabilities, diversifying our customers and geographies, and building new capabilities through a combination of organic and inorganic strategic initiatives. We are executing on this strategy through a focus on three key priorities:

•expand in payments for consumers, businesses and governments

•extend our services to enhance transactions and drive customer value

•embrace new network opportunities to enable open banking, digital identity and other adjacent network capabilities

These priorities are supported by six key drivers: People, Brand, Data, Technology, Franchise, and Doing well by doing good. For more information on our strategy, please see the section titled “Strategy” on pg 19.

Our core executive compensation principles

Our executive compensation program is based on three core principles:

| | | | | | | | |

| Align the long-term interest of our executives with stockholders | Pay for performance | Pay competitively |

Program design

To address these three core principles, we have designed a compensation program that supports our strategic objectives to expand in payments, extend our services, and embrace new network opportunities and that attracts, motivates and retains executives critical to Mastercard’s long-term success:

•The majority of our executives’ compensation is variable and at-risk and is tied to pre-established goals linked to financial, ESG and strategic objectives designed to create long-term stockholder value.

•Total direct compensation for our executives is weighted more toward long-term equity awards rather than on cash compensation.

Executive compensation program highlights

•Based on performance outcomes for 2022, the corporate score for purposes of paying annual incentives under the Senior Executive Annual Incentive Compensation Plan (SEAICP) was 151% of target (see pgs 72-74 for more information).

•Based on performance outcomes over the three-year performance period, the payout rate for 2020 PSU awards was 19.2% (see pg 78 for more information).

•At our 2022 annual meeting of stockholders, 95% of the votes cast for the say-on-pay proposal were in favor of our executive compensation program and policies. We view this level of stockholder support as affirmation of our current pay programs and our pay for performance philosophy.

The Human Resources and Compensation Committee (HRCC) and management regularly review our compensation and benefit programs. Accordingly, we have adopted a number of practices over the last several years that affect our executive compensation program:

| | | | | |

| What we do |

| Pay for performance |

| Align executive compensation with stockholder returns through long-term incentives |

| Reinforce the importance of sustainability by linking annual incentive compensation to ESG metrics |

| Maintain significant stock ownership requirements and guidelines, as well as a post-vest holding period on PSUs |

| Use appropriate peer groups when establishing competitive compensation |

| Review management succession and leadership development programs |

| Reward individual performance but with limits that cap individual payouts in executive incentive plans |

| Regularly assess compensation programs to mitigate undue risk taking by executives |

| Mandate “double-trigger” provisions for all plans that contemplate a change in control |

| Maintain robust clawback and equity award forfeiture policies |

| Retain an independent compensation consultant |

| Hold an annual say-on-pay advisory vote |

| | | | | |

| What we don’t do |

| No hedging or pledging of Mastercard stock |

| No excise tax gross-ups for executive officers |

| No tax gross-ups, other than under our global mobility programs |

| No repricing of stock options |

| No new evergreen employment agreements |

| No dividend equivalents on unvested equity awards |

| No guaranteed annual salary increases or bonuses |

| No granting of discounted or reload stock options |

| No spring loading of equity grants |

Connecting pay to ESG in 2022

To reinforce the importance of sustainability, which is already a critical part of our culture of decency, for 2022, the HRCC approved the expansion of the ESG modifier under the annual incentive program to apply to all employees (previously in place for only senior executives). See pgs 72-74 for more information on the ESG modifier in our 2022 annual incentive plan.

| | | | | | | | | | | | | | | | | |

| | | | | |

| | Strategy |

| | |

| | Our strategy centers on growing our payment capabilities, diversifying our customers and geographies, and building new capabilities through a combination of organic and inorganic strategic initiatives. We are executing on this strategy through a focus on three key priorities: •expand in payments for consumers, businesses and governments •extend our services to enhance transactions and drive customer value •embrace new network opportunities to enable open banking, digital identity and other adjacent network capabilities. | 01 | | |

Strategy

Mastercard is a technology company in the global payments industry. We connect consumers, financial institutions, merchants, governments, digital partners, businesses and other organizations worldwide by enabling electronic payments instead of cash and checks and making those payment transactions safe, simple, smart and accessible. We make payments easier and more efficient by providing a wide range of payment solutions and services using our family of well-known and trusted brands, including Mastercard®, Maestro® and Cirrus®. We operate a multi-rail payments network that provides choice and flexibility for consumers, merchants and our customers. Through our unique and proprietary core global payments network, we switch (authorize, clear and settle) payment transactions. We have additional payments capabilities that include automated clearing house transactions (both batch and real-time account-based payments). Using these capabilities, we offer integrated payment products and services and capture new payment flows. Our value-added services include, among others, cyber and intelligence solutions to allow all parties to transact easily and with confidence, as well as other services that provide proprietary insights, drawing on our principled use of secure consumer and merchant data. Our investments in new networks, such as open banking solutions and digital identity capabilities, support and strengthen our payments and services solutions. Our franchise model sets the standards and ground rules for our core global payments network that balance value and risk across all stakeholders and allows for interoperability among them. Our payment solutions are designed to ensure safety and security for the global payments ecosystem.

Our key strategic priorities

Our strategy centers on growing our payments capabilities, diversifying our customers and geographies, and building new capabilities through a combination of organic and inorganic strategic initiatives. We are executing on this strategy through a focus on three key priorities:

•expand in payments for consumers, businesses and governments

•extend our services to enhance transactions and drive customer value

•embrace new network opportunities to enable open banking, digital identity and other adjacent network capabilities

Our priorities support and build upon one another and are fundamentally interdependent.

Expand in payments. We focus on expanding upon our core payments network to enable payment flows for consumers, businesses, governments and others, as well as providing them with choice and flexibility to transact across multiple payment rails (including cards, real-time payments, account-to-account transactions, crypto and others), all while ensuring that all payments are safe, secure and seamless.

We do so by:

•Driving growth in consumer payments with a focus on accelerating digitization, growing acceptance and pursuing an expanded set of use cases, including through partnerships

•Capturing new payment flows by expanding our multi-rail capabilities and applications to penetrate key flows such as disbursements and remittances, commercial point-of-sale transactions, business-to-business (B2B) accounts payable flows and consumer bill payments

•Leaning into new payment innovations such as our piloting in 2022 of Mastercard Installments (our buy-now-pay-later solution) and developing solutions that support digital currencies and blockchain applications

Extend our services. Our services drive value for our customers and the broader payments ecosystem. These services include cyber and intelligence solutions, insights and analytics, consulting, marketing services, loyalty, processing and payment gateway solutions for e-commerce merchants. As we drive value, our services generate revenue which can also help accelerate our overall financial performance by supporting revenue growth in payments and new network opportunities.

We extend our services by:

•Enhancing the value of payments by making payments safe, secure, intelligent and seamless

•Expanding services to new segments and use cases to address the needs of a larger set of customers, including financial institutions, merchants, governments, digital players and others, while expanding our geographic reach

•Supporting and strengthening new network capabilities, including expanding services associated with digital identities and deploying our expertise in open banking and open data, including with improved analytics

Embrace new network opportunities. We are building and managing new adjacent network capabilities to power commerce and payments, creating new opportunities to develop and embed services.

We do so by:

•Applying our open banking solutions to help institutions and individuals exchange consumer-permissioned data securely and easily by enabling the reliable access, transmission and management of consumer data (including for opening new accounts, securing loans, increasing credit scores and enabling consumer choice in money movement and personal finance management)

•Enabling digital identity solutions to instill trust in the digital world and ensure that payments across consumers, companies, devices and virtual entities are efficient, safe and secure

Each of our priorities supports and builds upon each other and are fundamentally interdependent.

•Payments provide data and distribution to drive scale and differentiation in services and enable the development and adoption of new network capabilities

•Services improve the security, efficiency and intelligence of payments, improve portfolio performance, differentiate our offerings, strengthen our customer relationships and support our open banking and digital identity platforms

•New network opportunities strengthen our digital payments value proposition, including improved authentication with digital identity, and new opportunities to develop and embed services in our expanding product offerings

Powering our success

These priorities are supported by six key drivers:

People. Our success is driven by the skills, experience, integrity and mindset of our people. We attract and retain top talent from diverse backgrounds and industries. Our people and our winning culture are based on decency, respect and inclusion where people have opportunities to perform purpose-driven work that impacts communities, customers and co-workers on a global scale. The diversity and skill sets of our people underpin everything we do.

Brand. Our brands and brand identities serve as a differentiator for our business, representing our values and enabling us to accelerate growth in new areas.

Data. We use our data assets, infrastructure and platforms to create a range of products and services for our customers while incorporating our data principles in how we design, implement and deliver those solutions. Our Privacy by Design and Data by Design processes have been developed to ensure we embed privacy, security and data controls in all of our products and services, keeping a clear focus on protecting customers’ and individuals’ data.

Technology. Our technology provides resiliency, scalability and flexibility in how we serve customers. It enables broader reach to scale digital payment services to multiple channels, including mobile devices. Our technology standards, services and governance model help us to serve as the connection that allows financial institutions, financial technology companies (fintechs) and others to interoperate and enable consumers, businesses, governments and merchants to engage through digital channels.

Franchise. We manage an ecosystem of stakeholders who participate in our network. Our franchise creates and sustains a comprehensive series of value exchanges across our ecosystem. We provide a balanced ecosystem where all participants benefit from the availability, innovation, and safety and security of our network and platforms. Our franchise enables the scale of our payments network and helps ensure our multiple payments capabilities operate under a single governance structure, which can be extended to new opportunities.

Doing well by doing good. Sustainable impact is fundamental to our business strategy, and we leverage our employees, technology, resources, partnerships and expertise to address social, economic and environmental challenges. Our ESG priorities are expressed through three pillars - People, Prosperity, Planet - and all of the work we do is grounded in strong governance principles.

Our priorities support and build upon one another and are fundamentally interdependent.

| | | | | | | | | | | |

| Our strategy | Our key priorities | Powering our success |

| | | |

| | | |

| | | |

Grow our core | People | Brand |

| | |

| | |

Diversify into new customers and geographies | Data | Technology |

| | |

| | |

Build new areas for the future | Franchise | Doing well by

doing good |

| | | |

| | | | | | | | | | | | | | | | | |

| | | | | |

| | Corporate governance | | | |

| | We are committed to enhancing our corporate governance practices, which we believe help us sustain our success and build long-term value for our stockholders. Our Board of Directors oversees Mastercard’s strategic direction and the performance of our business and management. Our governance structure enables independent, experienced, diverse and accomplished directors to provide advice, insight, guidance and oversight to advance the interests of the company and our stockholders. We have long maintained strong governance standards and a commitment to transparent financial reporting and strong internal controls. | 02 | | |

| | | | | | | | | | | |

Proposal 1: Election of directors

| | The Board unanimously recommends that stockholders vote FOR each nominee to serve as director. | |

Election process

Each member of our Board is elected annually by our Class A stockholders for a one-year term that expires at our next annual meeting. When our Board members are elected, they also are automatically appointed as directors of our operating subsidiary, Mastercard International Incorporated (Mastercard International). Our directors are elected by an affirmative vote of the majority of the votes cast at the annual meeting of stockholders, subject to our majority voting policy. You can find more about this in “About the Annual Meeting and voting” on pg 138. Refreshing the Board and nominating directors

Our Nominating and Corporate Governance Committee (NCG) reviews and selects candidates for nomination to our Board in accordance with its charter. Based on its review, coupled with our age and tenure limits, the NCG determines whether Board refreshment is needed in the near future. The NCG then identifies nominees who would be valuable assets to our Board and to Mastercard. Consistent with the limits of our bylaws, the size of our Board may fluctuate depending on our evolving strategic needs. As we identify individuals with the right talent and skills, we may seek to have them join our Board. As a result, you may see the Board size fluctuate over time.

Identifying director candidates

You can find out more about our nomination process in the NCG’s charter and our Corporate Governance Guidelines at https://investor.mastercard.com/corporate-governance/board-committees/default.aspx.

| | | | | |

Stockholder recommendations of director candidates |

| |

| Submit recommendations to: Office of the Corporate Secretary 2000 Purchase Street Purchase, NY 10577 Attention: Corporate Secretary |

The NCG evaluates stockholder recommendations using the same process it follows for other candidates. Recommendations do not constitute candidate nominations, which must meet our bylaw requirements. The NCG may request such additional information as it deems appropriate. |

| |

Board refreshment process

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Board composition, including director skills, is analyzed at least annually to ensure alignment with our long-term growth strategy and robust diversity | | Potential candidate list is developed based on a number of inputs and recommendations, including self-evaluation results | | Personal qualities, skills and background of potential candidates are considered | | The NCG meets with qualified candidates and makes recommendations | | Board recommends nominees for election by the stockholders | | Stockholders vote on nominees | | Four new independent directors have been nominated to our Board in the past four years |

Key factors the Board considers when selecting directors and refreshing the Board

Diversity

While the Board does not have a specific diversity policy, our Corporate Governance Guidelines provide that the NCG should seek to foster diversity on the Board when nominating directors for election by taking into account geographic diversity to reflect the geographic regions in which we operate in a manner approximately proportional to our business activity, as well as diversity of viewpoints, age, gender, sexual orientation, race, ethnicity, nationality and cultural background.

| | | | | | | | |

| | |

| | |

64%

7 of our 11 independent director nominees identify as racially or ethnically diverse •5 identify as Asian •1 identifies as Black •1 identifies as Latino | 36% 4 of our 11 independent director nominees identify as female | 64% 7 of our 11 independent director nominees are non-U.S. citizens and/or have international experience |

Age and tenure as of the date of the Annual Meeting

Our Corporate Governance Guidelines generally require that our non-employee directors not stand for re-election following the earlier of their 15th anniversary on the Board or their 72nd birthday. The Board considers these requirements as part of a broader discussion of our directors’ experience and qualifications, as well as when and how to refresh its membership.

| | | | | | | | | | | | | | | | | |

Average tenure in years of our independent director nominees | | |

|

| 5.6 | 36% 4 of our 11 independent director nominees have a tenure of 4 years or less | 61 Average age of independent director nominees |

Director criteria, qualifications and experience

The NCG believes that all directors should:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| meet the highest standards of professionalism, integrity and ethics | | | be committed to representing the long-term interests of our stockholders | | | possess strength of character and maturity in judgment | | | reflect our corporate values, including trust, agility, initiative and partnership | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Nominees for election as directors

At the Annual Meeting, the Board recommends the election of the following 12 nominees, each to hold office until the next annual meeting of stockholders or until their successor is elected and qualified, subject to their earlier resignation, death or removal:

| | | | | | | | |

| Merit E. Janow, Board Chair | | Michael Miebach

(President and CEO) |

| Candido Bracher | | Youngme Moon |

| Richard K. Davis | | Rima Qureshi |

| Julius Genachowski | | Gabrielle Sulzberger |

| Choon Phong Goh | | Harit Talwar |

| Oki Matsumoto | | Lance Uggla |

Jackson Tai is not standing for re-election at the Annual Meeting, in accordance with our age limits policy.

Each of our director nominees was approved by the NCG and recommended to the Board for approval following an evaluation of his or her qualifications and prior board service. Each nominee has agreed to be named in this proxy statement and to serve if elected. Should any nominee be unable to serve, the persons designated as proxies reserve full discretion to vote for another person or the Board may reduce its size.

Experience

The NCG strives for a Board that spans a range of leadership and skills and represents other experience relevant to Mastercard’s strategic vision and global activities. Experience and skills that the NCG believes are desirable to be represented on the Board and the director nominees who have each such experience or skill are indicated below. In light of the individual experiences and qualifications of each of our director nominees, our Board has concluded that each of our director nominees should be elected at the Annual Meeting. The strong qualifications that make each of our director nominees highly valuable assets to our Board are described below and in the biographies that follow.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Skills & experience | | Diversity & gender |

| Name | | Consumer | | C-suite experience | | Financial

& risk | | Global perspective | | Information security | | Payments | | Public company board experience | | Regulatory &

governmental | | Sustainability | | Technology, digital & innovation | | Race/ethnic

diversity | | Gender |

| Janow | | | | | | | | | | | | | | | | | | | | | | | | F |

| Bracher | | | | | | | | | | | | | | | | | | | | | | | | M |

| Davis | | | | | | | | | | | | | | | | | | | | | | | | M |

| Genachowski | | | | | | | | | | | | | | | | | | | | | | | | M |

| Goh | | | | | | | | | | | | | | | | | | | | | | | | M |

| Matsumoto | | | | | | | | | | | | | | | | | | | | | | | | M |

| Miebach | | | | | | | | | | | | | | | | | | | | | | | | M |

| Moon | | | | | | | | | | | | | | | | | | | | | | | | F |

| Qureshi | | | | | | | | | | | | | | | | | | | | | | | | F |

| Sulzberger | | | | | | | | | | | | | | | | | | | | | | | | F |

| Talwar | | | | | | | | | | | | | | | | | | | | | | | | M |

| Uggla | | | | | | | | | | | | | | | | | | | | | | | | M |

| Total | | 9 | | 11 | | 11 | | 10 | | 7 | | 7 | | 10 | | 8 | | 12 | | 11 | | 7 | | 4F/8M |

| | | | | | | | | | | | | | | | | | | | |

| Skills & experience descriptions |

| | Consumer including brand, marketing and retail experience and other merchant background | | | | Payments including within retail banking, payments infrastructure, telecommunications, technology and data |

| | C-suite experience including service as a chief executive officer at a publicly traded or private company | | | | Public company board experience both U.S. and non-U.S. |

| | Financial & risk including risk management orientation | | | | Regulatory & governmental including deep engagement with regulators as part of a business and/or through positions with governments and regulatory bodies |

| | Global perspective including significant experience in the geographic regions in which we operate | | | | Sustainability including environmental/climate change, talent and culture, and social responsibility initiatives |

| | Information security including cybersecurity and data privacy | | | | Technology, digital & innovation including application of technology in payments, mobile and digital, as well as Internet, retail and social media experience |

Merit E. Janow

Dean Emerita (since March 2022), School of International and Public Affairs, and Professor of Practice (since 1993), International Economic Law and International Affairs, Columbia University, a private university

| | | | | | | | | | | |

Board Chair since January 2022 Former Lead Director January 2021-December 2021 Director since June 2014 Age at Annual Meeting 65 | Professor Janow contributes extensive global perspective as a dean and professor of international economic law and international affairs, especially with respect to the Asia Pacific region, where she has an extensive background. Her university career, public board service and other initiatives provide significant insight on technology, innovation, digital matters, cybersecurity and sustainability (including oversight of academic-related initiatives in the ESG space). She brings deep experience in dealing with governments and regulatory bodies through her past government service, and her academic and legal career, as well as through her service on not-for-profits and advisory bodies. | Board committees •Nominating and Corporate Governance (chair) •Audit Current public company boards •Aptiv PLC (Compensation and Human Resources, and Nominating and Governance committees) Additional positions •Lead, SIPA entrepreneurship initiative •Board member and proxy committee member of American Funds (a mutual fund family of the Capital Group) (more than 20 funds) •Director of Japan Society and National Committee on U.S.-China Relations •Member, Council on Foreign Relations •Member, Mitsubishi UFJ Financial Group, Inc. global advisory board | Previous experience •Several leadership positions at Columbia University (since 1994), including Dean, SIPA; and chairman, Advisory Committee on Socially Responsible Investing •Member, Appellate Body of the World Trade Organization •Executive director, the International Competition Policy Advisory Committee of the U.S. Department of Justice •Deputy Assistant U.S. Trade Representative, Japan and China •Past chairperson, Nasdaq Stock Market, Inc. Past public company boards •Trimble Inc. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| Consumer | C-suite experience | Financial and risk | Global perspective | Information security | Payments | Public company board experience | Regulatory and governmental | Sustainability | Technology, digital and innovation | Audit Committee financial expert |

Candido Bracher

Former CEO, Itaú Unibanco Group, a Brazilian bank

| | | | | | | | | | | |

Director since September 2021 Age at Annual Meeting 64 | Mr. Bracher brings to the Board extensive payments experience and consumer insight as a former CEO and director of a publicly traded financial institution. His experience in highly regulated industries provides valuable perspective on engaging and partnering with regulators. Mr. Bracher’s extensive experience in financial services contributes strong financial understanding. As a former CEO, he brings extensive experience with respect to culture development and talent management, as well as focus on social responsibility and environmental initiatives. | Board committees •Audit •Risk Current public company boards •Itaú Unibanco Group Additional positions •Director, BM & FBOVESPA (now known as B3 — Brasil Bolsa Balcão S.A. (Brazil Stock Exchange and Over-the Counter Market) (2009-2014) •Director, Pão de Açúcar — Companhia Brasileira de Distribuição (2005-2013) (alternate member of the Board of Directors (1999 to 2005)) | Previous experience •Various senior positions at Itaú Unibanco Group, including CEO (January 2017-February 2021); General Director, Banco Wholesale (2015-2017); and Vice President (2004-2015) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| Consumer | C-suite experience | Financial and risk | Global perspective | Information security | Payments | Public company board experience | Regulatory and governmental | Sustainability | Technology, digital and innovation | Audit Committee financial expert |

Richard K. Davis

Former Executive Chairman and CEO, U.S. Bancorp, parent company of U.S. Bank, one of the largest commercial banks in the United States

| | | | | | | | | | | |

Director since June 2018 Age at Annual Meeting 65 | Mr. Davis brings to the Board extensive payments experience and consumer insight as former CEO of a publicly traded financial holding company and former chairman of a banking association and payments company. His experience in highly regulated industries and as a former Federal Reserve representative provides a valuable perspective on engaging and partnering with regulators. Mr. Davis’ extensive experience in financial services and his membership on public company audit and finance committees contribute strong financial understanding. As a CEO, he brings extensive experience with respect to culture development and talent management. | Board committees •Human Resources and Compensation (chair) •Nominating and Corporate Governance (Non-voting observer, until the Annual Meeting) Current public company boards •Dow Inc. (lead director, audit committee chair, corporate governance committee) •Wells Fargo & Company (risk committee) Additional positions •Trustee, Mayo Clinic

| Previous experience •CEO, Make-A-Wish America (January 2019-November 2022) •Several executive positions at U.S. Bancorp (2004-2018), including Executive Chairman (April 2017-April 2018); Chairman (2007-April 2017); CEO (December 2006-April 2017); and President (2004-January 2016) Past public company boards •DowDuPont Inc. and The Dow Chemical Company (Dow Inc. predecessor boards) •U.S. Bancorp •Xcel Energy, Inc. . |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| Consumer | C-suite experience | Financial and risk | Global perspective | Information security | Payments | Public company board experience | Regulatory and governmental | Sustainability | Technology, digital and innovation | Audit Committee financial expert |

Julius Genachowski

Managing Director, The Carlyle Group, a global investment firm (since January 2014)

| | | | | | | | | | | |

Director since June 2014 Age at Annual Meeting 60 | Mr. Genachowski brings to the Board extensive regulatory and government experience, digital, technology and media expertise, information security insight, a global perspective, and engagement with both consumer and enterprise companies through a career as a senior government official, senior business executive, investor and director at or with technology, media and communications companies. Mr. Genachowski also adds valuable financial knowledge through experience in private equity, at a large public operating company and on public audit committees. | Board committees •Audit (chair) •Human Resources and Compensation •Risk Current public company boards •Sonos Inc. (audit committee and nominating and corporate governance committee chair) Additional positions •Former member, President’s Intelligence Advisory Board (U.S.) | Previous experience •Chairman, U.S. Federal Communications Commission (2009-2013) •Several other U.S. government roles, including chief counsel to FCC Chairman; law clerk to U.S. Supreme Court Justice David Souter; and congressional staff member, including for then-Representative Charles Schumer, and for the joint select committee investigating the Iran-Contra affair •Senior executive roles with IAC/InterActiveCorp (Internet and media), including chief of business operations and general counsel Past public company boards •AsiaSat •Sprint Corporation |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| Consumer | C-suite experience | Financial and risk | Global perspective | Information security | Payments | Public company board experience | Regulatory and governmental | Sustainability | Technology, digital and innovation | Audit Committee financial expert |

Choon Phong Goh

CEO, Singapore Airlines Limited, a multinational airline (since January 2011)

| | | | | | | | | | | |

Director since April 2018 Age at Annual Meeting 59 | Mr. Goh brings to the Board strong consumer insight, global perspective and payments experience as the CEO and longtime senior executive of a publicly traded multinational airline. His prior positions in finance and information technology contribute valuable information security experience and financial understanding. As CEO of an airline, Mr. Goh brings extensive experience in talent management, culture development and sustainability, including with respect to climate change. | Board committees •Nominating and Corporate Governance •Risk Current public company boards •Singapore Airlines Limited Additional positions •Chairman, Budget Aviation Holdings Pte Ltd (100% owned by Singapore Airlines Limited) •Director, SIA Engineering Company Limited (majority owned by Singapore Airlines Limited) •Member, Board of Governors of the International Air Transportation Association | Previous experience •Several executive positions at Singapore Airlines Limited (since 1990), including leadership positions such as Executive Vice President, Marketing and the Regions; President, Cargo; Senior Vice President, Finance; and Senior Vice President, Information Technology |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| Consumer | C-suite experience | Financial and risk | Global perspective | Information security | Payments | Public company board experience | Regulatory and governmental | Sustainability | Technology, digital and innovation | Audit Committee financial expert |

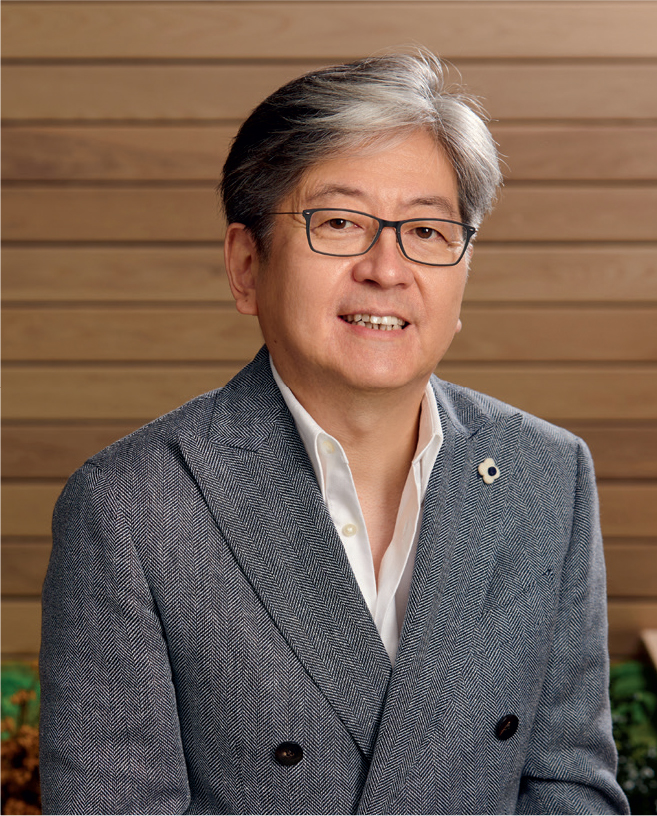

Oki Matsumoto

Founder, Chairman and CEO, Monex Group, Inc., an online securities brokerage firm

(since February 2011) | | | | | | | | | | | |

Director since June 2016 Age at Annual Meeting 59 | Mr. Matsumoto is the founder and CEO of a Japan-based, publicly traded financial services holding company and former director of a stock exchange. Through a career in investment banking, Mr. Matsumoto provides global perspective and extensive financial expertise to the Board. His leadership of a global online securities brokerage firm provides valuable digital and innovation experience. He brings extensive talent management, culture development and sustainability experience. | Board committees •Human Resources and Compensation Current public company boards •Monex Group, Inc. (nominating and compensation committees) Additional positions •Chairman, Coincheck, Inc.; TradeStation Group, Inc.; and Japan Catalyst, Inc.; and Founder, Monex, Inc., each a subsidiary of Monex Group, Inc. •International Board member and Vice Chair, Human Rights Watch •Councilor, International House of Japan •Former member, Economic Counsel to the Prime Minister of Japan •Former director, Tokyo Stock Exchange (2008-2013) | Previous experience •Several executive positions at Monex, Inc., including representative director and CEO (since 1999) •Several leadership positions at Goldman Sachs entities (1990-1998), including General Partner, Goldman Sachs Group, L.P. Past public company boards •JIN Co., Ltd. •Kakaku.com, Inc. •UZABASE, Inc. |

| | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| Consumer | C-suite experience | Financial and risk | Global perspective | Information security | Payments | Public company board experience | Regulatory and governmental | Sustainability | Technology, digital and innovation | Audit Committee financial expert |

Michael Miebach

President and CEO (since January 2021)

| | | | | | | | | | | |

Director since January 2021 Age at Annual Meeting 55 | Mr. Miebach contributes to the Board extensive global payments experience. As CEO of the company and a previous region president, he provides valuable perspective on engaging and partnering with regulators, as well as experience with talent management, culture development and sustainability. Mr. Miebach’s prior experience as our Chief Product Officer provides strong consumer insights, as well as a deep focus on information security and innovation, including with digital and payments technology. | Additional Mastercard positions •President (February 2020- December 2020) •Chief Product Officer (January 2016-February 2020) •President, Middle East and Africa (2010-2015) Additional positions •Director, Accion.org •Advisory Director, Metropolitan Opera •Director, World Resources Institute •Member, U.S. Treasury’s Advisory Committee on Racial Equity

| Previous experience •Managing Director, Middle East and North Africa, Barclays Bank PLC (2008-2010) •Managing Director, Sub-Saharan Africa, Barclays Bank PLC (2007-2008) •Several executive positions at Citigroup in Germany, Austria, U.K. and Turkey (1994-2007)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| Consumer | C-suite experience | Financial and risk | Global perspective | Information security | Payments | Public company board experience | Regulatory and governmental | Sustainability | Technology, digital and innovation | Audit Committee financial expert |

Youngme Moon

Donald K. David Professor of Business Administration, Harvard Business School, a private university (since July 2014)

| | | | | | | | | | | |

Director since June 2019 Age at Annual Meeting 59 | Professor Moon provides to the Board a deep understanding of strategy and innovation as a long-tenured professor at Harvard Business School. She brings strong global perspective and consumer and sustainability experience based on her exposure to research at Harvard Business School. She contributes sustainability insight through her service as a director at several retail and retail-centric consumer products companies (including as a member of ESG and corporate responsibility committees). | Board committees •Human Resources and Compensation •Risk (chair) Current public company boards •Sweetgreen, Inc. (compensation committee; nominating, environmental, social and governance committee) •Unilever (corporate responsibility committee) •Warby Parker Inc. (compensation committee) | Previous experience •Several positions at Harvard Business School (since 1998), including Senior Associate Dean for Strategy and Innovation and Chair of the MBA Program Past public company boards •Avid Technology, Inc. •Rakuten, Inc. •Zulily, Inc. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| Consumer | C-suite experience | Financial and risk | Global perspective | Information security | Payments | Public company board experience | Regulatory and governmental | Sustainability | Technology, digital and innovation | Audit Committee financial expert |

Rima Qureshi

Executive Vice President and Chief Strategy Officer, Verizon Communications Inc., a multinational telecommunications conglomerate (since November 2017)

| | | | | | | | | | | |

Director since April 2011 Age at Annual Meeting 58 | Ms. Qureshi contributes to the Board global perspective, digital expertise and innovation insight through her extensive senior-level experience at global telecommunications equipment and services providers, including roles in strategy, mergers and acquisitions, research and development, sales and services. Her work in the telecommunications and information technology industries and her completion of the NACD/Carnegie Mellon CERT certification in cybersecurity oversight provide the Board with relevant payments and information security expertise. Ms. Qureshi’s experience affords her with a deep background in sustainability. | Board committees •Audit •Risk Additional positions •Director, GSMA Board (telecom industry association board) (audit committee) •Director, Verizon Foundation •Deputy Chair, Edison Alliance, World Economic Forum •Member, McGill University International Advisory Board | Previous experience •Several executive positions at Ericsson (1993-2017), including President, North America (2017); Senior Vice President, chief strategy officer and head of M&A (2014-2016); and Senior Vice President and head of business unit CDMA mobile systems Past public company boards •Great-West Lifeco Inc. •Wolters Kluwer |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| Consumer | C-suite experience | Financial and risk | Global perspective | Information security | Payments | Public company board experience | Regulatory and governmental | Sustainability | Technology, digital and innovation | Audit Committee financial expert |

Gabrielle Sulzberger

Senior Advisor, Two Sigma Impact, a private equity fund (since August 2020)

| | | | | | | | | | | |

Director since December 2018 Age at Annual Meeting 63 | Ms. Sulzberger brings to the Board extensive financial experience and insight as a senior advisor and former general partner of private equity firms, chief financial officer of several companies, and a U.S. public company audit committee financial expert and former Board Chair. She contributes strong consumer insight, global perspective and payments experience, as well as extensive involvement with sustainability as leader of a consulting firm’s ESG advisory practice and as a former director at several U.S. public company merchants, including her service as chairman of a major merchant in the quality retail food business. Her experience as chief financial officer of an open-source software company also provides valuable digital and innovation experience. | Board committees •Audit •Nominating and Corporate Governance Current public company boards •Cerevel Therapeutics Holdings, Inc. (audit committee chair; nominating and corporate governance committee) •Eli Lilly and Company (audit, and directors and corporate governance committees) •Warby Parker Inc. (compensation committee; nominating and corporate governance committee chair)

| Additional positions •Director, Acorns •Chair, Global ESG Advisory, Teneo Previous experience •General Partner, Fontis Partners, L.P. (2005-2018) •CFO, Gluecode Software Inc. (open-source software company) •CFO, Crown Services (commercial contractors) Past public company boards •Bright Horizons Family Solutions Inc. •Brixmor Property Group Inc. •The Stage Stores, Inc. •Teva Pharmaceutical Industries Limited •Whole Foods Market, Inc.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| Consumer | C-suite experience | Financial and risk | Global perspective | Information security | Payments | Public company board experience | Regulatory and governmental | Sustainability | Technology, digital and innovation | Audit Committee financial expert |

Harit Talwar

Former Partner and Chairman of Consumer Business (Marcus), an online only bank, Goldman Sachs

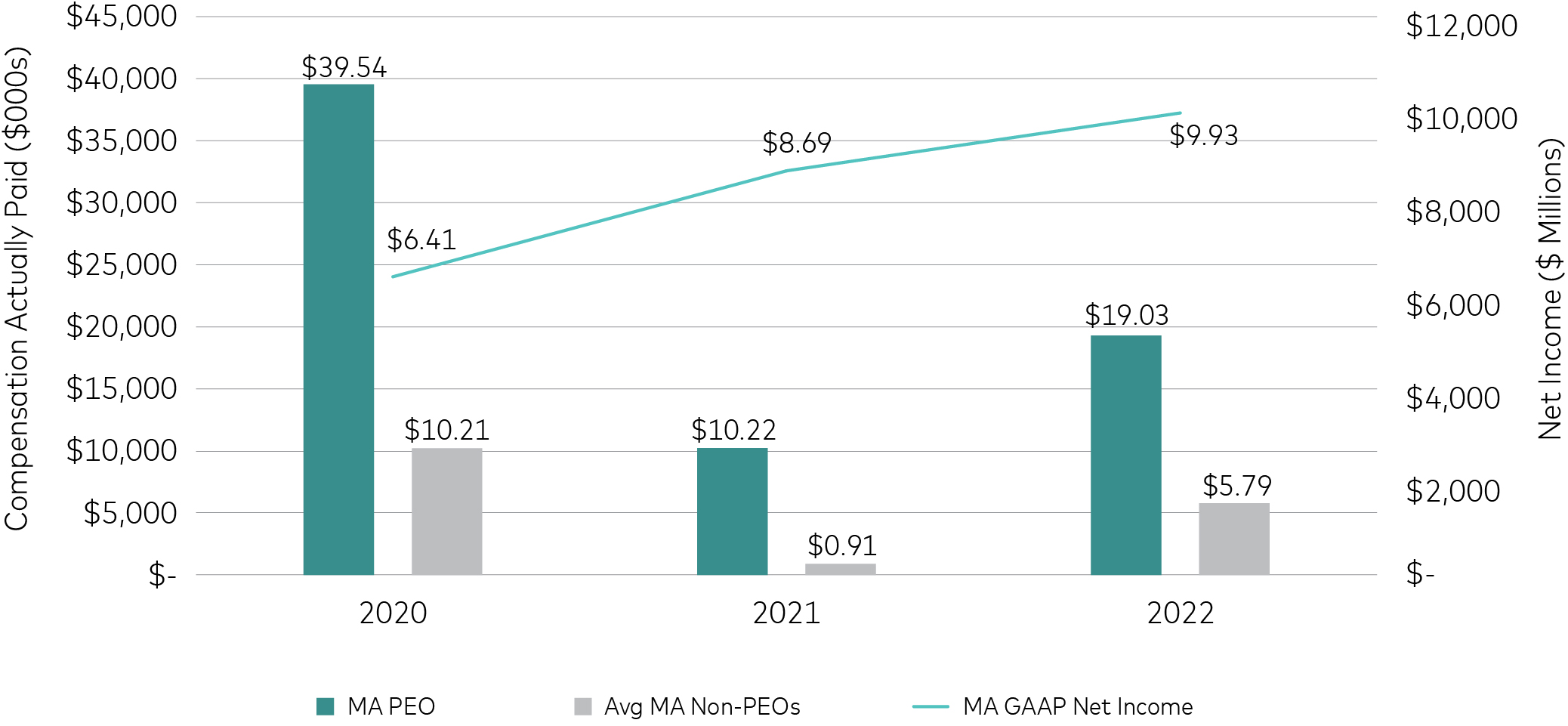

| | | | | | | | | | | |