Investment Community Meeting May 31, 2007 Exhibit 99.1 |

2 Today’s presentations may contain, in addition to historical information, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on our current assumptions, expectations and projections about future events which reflect the best judgment of management and involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by our comments today. You should review and consider the information contained in our filings with the SEC regarding these risks and uncertainties. MasterCard disclaims any obligation to publicly update or revise any forward-looking statements or information provided during today’s presentations. Forward-Looking Statements |

Strategic Update Bob Selander President and Chief Executive Officer May 31, 2007 |

2 The Opportunity Grow business with high-potential customers Grow business with high-potential customers Leverage scalable, global processing platform Leverage scalable, global processing platform Expand consumer usage and merchant acceptance Expand consumer usage and merchant acceptance Further penetrate fast growing geographic markets Further penetrate fast growing geographic markets |

3 Our Approach |

4 Delivering Customized Solutions Approach: Deliver customized solutions for target financial institutions by leveraging our expertise in brand, consulting, processing, products and technology. • Dedicated account teams • Advanced Customer Relationship Management • Integrated customer planning • Intelligence/market research • MasterCard Advisors Result: We’re winning new business. |

5 Strengthening Merchant Relationships Approach: Merchants are a key constituent in the payments chain. We need them to build profitability for our customers. • Dedicated acceptance teams • Merchant Advisory Group meetings • Rules/Interchange transparency • MasterCard merchant connect • Intelligence/data Result: New acceptance channels and numerous co-brand wins. |

6 Managing Our Reputation • Independent governance • Financial transparency • Public policy group • New Payment Systems Integrity group • Enterprise risk management Result: Building trust with key constituents. Approach: We’re proactively managing our reputation and operating environment. |

7 Key Strengths/Differentiators • Unified global organization • World-renowned brands • Enhanced payment solutions • Advanced processing platform • Strong relationships • Knowledge leadership • Strong management/industry expertise |

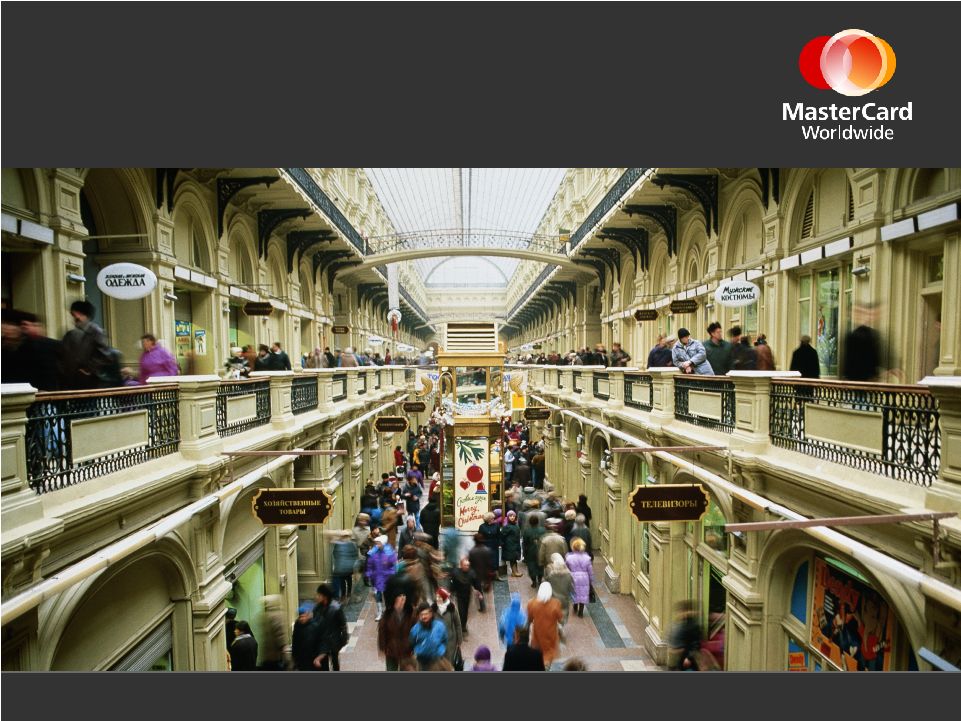

8 |

Delivering on our Customer-Focused Strategy Alan Heuer Chief Operating Officer May 31, 2007 |

2 Strategy Development Market trends Competitive analysis Strategic options • Consolidation & globalization • Increasing regulatory & legal risks • Shift to electronic forms of payment • Changing role/power of merchants • Traditional • Non-traditional • Emerging Players • Historical functions • Price leader • Product innovation • Customer focus |

3 Affirmation of Customer Focus Build competitive advantage around the way we work with customers and the value we bring them. |

4 What Customer Relationship Management (CRM) is to MasterCard Competitive Intelligence Cross Functional Alignment CRM Best Practice Information Sales Management Discipline Integrated Planning Customer Value |

5 Customized Solutions Advisors Marketing Processing Product Technology Customer Value |

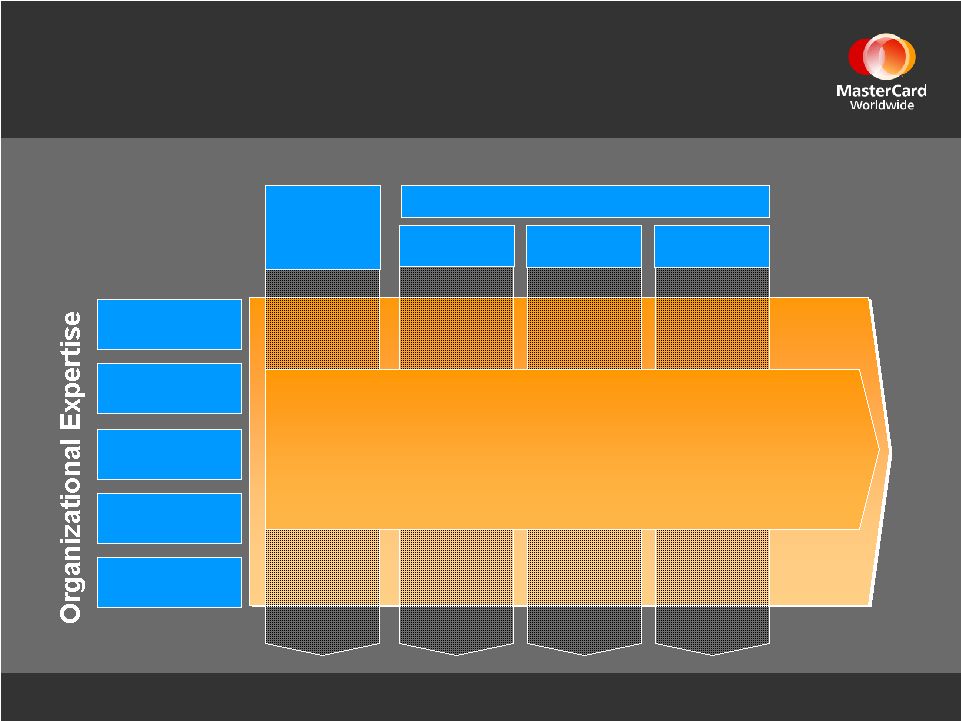

6 Leveraging Our Expertise Americas Europe A/P Integrated customer planning process Target Customers Product Brand Processing Technology Advisors Global Key Accounts Regional Key Accounts |

7 People Capabilities Process Critical Success Factors Alignment It’s Not Easy |

8 Strategic Relationship Scale Vendor Business Enhancer Value Driver Business Partner |

9 We’re Seeing Results • Relationships are stronger • Mutual commitments have been established • Incremental customer business opportunities have been created |

|

The SEPA Opportunity Javier Perez President, MasterCard Europe May 31, 2007 |

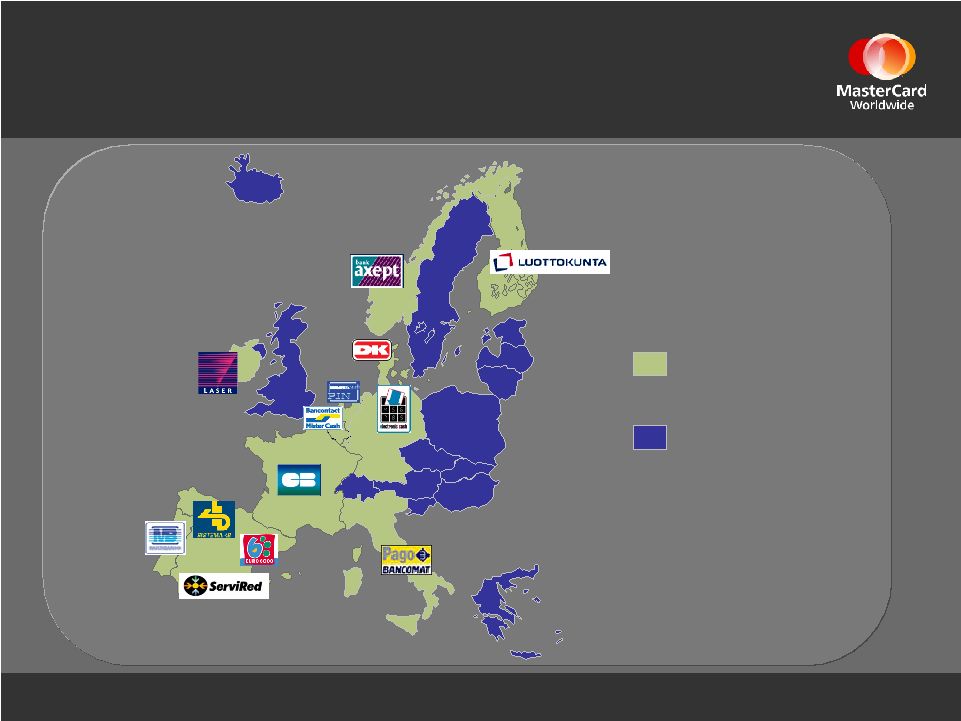

2 European Card Payments Industry Still Fragmented International Brands with consistent cardholder experience Domestic use only Debit |

3 Objectives of SEPA • • SEPA will . . . SEPA will . . . – Provide cardholders with a payment card they can use across Europe with the same convenience – Increase competition and transparency in the payments industry – Lower barriers to entry for acquirers, issuers and equipment providers – Benefit European society by reducing the overall cost of payments * Source: ECB Blue Book, 2006, Total EU SEPA is not just about the 3% of card business cross-border . . . but also about the 97% of domestic transactions which are often not open to competition* • • Current situation Current situation – 16 national debit schemes in Europe – Heterogeneous cardholder experience, not all domestic debit cards are accepted everywhere in Europe – Limited competition at national level, many countries have only one acquirer, issuer or processor and few terminal vendors |

4 SEPA Cards Framework (SCF) Timeline Final approval by EPC of SEPA Cards Framework National and international schemes presented finalized SEPA cards framework migration plans by end 1Q 2006 SEPA compliant products available by banks/providers to consumers and merchants No non-SEPA Cards Framework compliant schemes in operation |

5 SEPA Options for Banks • Migration to existing international schemes • Extend national schemes pan-Europe • “Co-brand” international and domestic scheme Three different routes (or a combination) to achieve full SCF/SEPA compliance: + or or ? |

6 Retail Banking Trends in Europe • Consolidation / M&A • Operations in multiple markets – pan-Europe and globally • Developing Global Brand Recognition • Direct Banking leveraging new channels • Consolidation of technology platforms across countries • Europe Region centralization business management Moving Towards SEPA despite Regulatory Incentive |

7 Many Have Already Recognized the Benefits 1995 • UK – Access to MasterCard 1998 • Austria – Bankomat to Maestro • Sweden – Bancomat to Maestro and MasterCard 2002 • UK – Switch to Maestro 2005 • Switzerland ec Karte to Maestro 2006 • Sparda German electronic cash to Maestro |

8 MasterCard: A Solid Choice as a SEPA Solution • Majority of debit cards in Europe are already Maestro branded, limiting investment required to migrate • Maestro is a proven, pan-SEPA product with broad- based issuance and acceptance • Tried and tested product in market for over 14 years |

9 |

Global Debit Momentum Rick Lyons Global Debit and Prepaid May 31, 2007 |

2 Agenda • U.S. Debit Growth • The Debit Value Proposition • Global Focus |

3 U.S. Debit Building Momentum 103 million 43 million Debit MasterCard cards Brands Switch of First Resort Switch of Last Resort PIN debit Current 2002 Bank of the West/First Hawaiian/CFB Eastern Bank First Midwest/MB Financial/Citadel FCU Washington Mutual Associated Bank BankAtlantic Chittenden Business Business that moved that moved to MasterCard to MasterCard |

4 MasterCard Debit Programs Q107 v. Q106 — % Growth 28.3 19.8 Cards 30.8 32.0 Cash Volume 40.5 48.2 Purchase Transactions 36.3 45.5 Purchase Volume Worldwide U.S. Double digit growth for 13 consecutive quarters |

5 Continued Growth in the U.S. • Grow the business we have • Gain brand preference with current customers • Move debit business to MasterCard Source: First Annapolis Consulting analysis and published sources including CIA World Factbook, Geohive global statistics and The Nilson Report • Population: 293 million • GDP per capita: $43,981 • Card purchase volume per capita: $7,990 • Card purchase volume as a percentage of GDP: 18.2% |

6 Debit Value Proposition • Product Capability and Development • Risk Management • Processing • Economics • Acceptance • Brand |

7 Latin America & Caribbean • Highly varied economies • Industry transactions growing at 30+% annually • Spotlight on Brazil – Unsurpassed acceptance: 100% of municipalities with electricity, phone service and cards • Population: 562 million • GDP per capita: $7,653 • Card purchase volume per capita: $206 • Card purchase volume as percentage of GDP: 2.7% Brazil Venezuela Argentina Mexico Source: First Annapolis Consulting analysis and published sources including CIA World Factbook, Geohive global statistics and The Nilson Report |

8 Europe • Emerging Markets – Cash is main payment product – Continued economic expansion • Mature Markets – Highly confident use of cards – Switch to Maestro – Launching Debit MasterCard • Population: 729 million • GDP per capita: $9,792 – $29,567 • Card purchase volume per capita: $23 - $7,989 • Card purchase volume as percentage of GDP: 0.2% - 27.0% . Source: First Annapolis Consulting analysis and published sources including World Bank, CIA World Factbook, Geohive global statistics and The Nilson Report |

9 Asia Pacific and South Asia/Middle East and Africa • Market of extremes • Sizable populations, significant cash economies • Segmentation opportunities • Population: 5 billion • GDP per capita: $3,116 – $30,718 • Card purchase volume per capita: $18 - $5,421 • Card purchase volume percentage of GDP: 0.13% - 17.7% China Australia India Indonesia Taiwan Source: First Annapolis Consulting analysis and published sources including CIA World Factbook, Geohive global statistics and The Nilson Report |

10 Summary • Continue U.S. momentum • Evolve debit value proposition • Global capabilities, local execution Two Global Debit Solutions |

|

Successful Debit Partnerships Bill Mathis U.S. Business Development May 31, 2007 |

Transforming our debit value proposition into real business… Conversion Portfolio Optimization |

Associated Conversion Challenge Solution Results Associated Bank tapped MasterCard to help derive greater value from its debit card portfolio. Key Priorities • • A closer relationship with A closer relationship with debit card partners debit card partners • • Differentiating products Differentiating products • • Customer satisfaction and Customer satisfaction and retention retention • • Card portfolio growth Card portfolio growth |

Associated Conversion Challenge Solution Results Implemented a custom conversion process Assembled a team of experts MasterCard and Associated jointly created a conversion and communications plan Designed a unique product |

A flawless execution with significant cardholder satisfaction Associated Conversion Challenge Solution Results • Converted entire portfolio within 6 months • Conversion enabled Associated to achieve brand differentiation within their market • Our relationship with Associated continues to expand • Exceeded all acquisition, activation and usage targets |

BECU Portfolio Optimization Challenge Solution Results Key Priorities • • Deeper connection with its Deeper connection with its cardholders cardholders • • Simplify processes, greater Simplify processes, greater control control • • Continued flexibility, Continued flexibility, convenience and security convenience and security • • Differentiation through targeted Differentiation through targeted programs and offers programs and offers BECU asked MasterCard to help optimize its debit card portfolio. |

BECU Portfolio Optimization Challenge Solution Results Dedicated support CRM, Debit Product Sales, Customer Marketing Data analysis and intelligence Consolidated network participation MasterCard Debit Brand Exclusivity MasterCard Advisors |

BECU Portfolio Optimization Challenge Solution Results • BECU gained greater control over routing of members’ transaction and can enhance the experience and value to its members • Five-year Debit MasterCard and PIN brand exclusivity agreement with BECU • BECU gained a 360°-degree view of its debit portfolio A holistic view of all debit transactions |

|

Merchant Initiatives Gareth Forsey U.S. Commerce Development May 31, 2007 |

2 Merchant Initiatives • Protect & Grow Core Acceptance • Enhance Merchant Relationships • Expand Presence in Rapidly Growing Categories • Extend Merchant Value Proposition |

3 Protect & Grow Core Acceptance Underpin the Foundations • “A seat at the table” – Core component of Customer Focused Strategy – Merchant Advisory Groups – POI Advisory Group (Issuers, Acquirers, Merchants) • Transparency • End-to-End Product Development • Operational Excellence • Security & Risk |

4 Enhance Merchant Relationships Unlock Business Potential • Sales Process Discipline – Adoption of tailored CRM approach • “Feet on the Street” – Moving resources out to the merchants/acquirers – Regional acceptance teams – Global co-ordination, local execution • Co-brand development & optimization • Leverage full suite of MasterCard assets – Marketing & Sponsorships – Processing & Technology |

5 Expand Presence in Rapidly Growing Categories • Drive increased acceptance into new categories – Healthcare – Bill Payment – Cable & Telecom – Insurance – Utilities – Rent/Property Management • Leverage cross border flows to drive preference and spend |

6 Extend Merchant Value Proposition Enhance Revenue Streams • Merchant Preference Partnerships • New Product Development • Decision Analytics – Commerce IntelligenceTM – Commerce Coalition • PayPass • Priceless.com TM TM |

7 Decision Analytics Driving Sales & Loyalty Merchant X Merchant X Segmentation Targeting Merchant Preferences Consumer Preferences Commerce Intelligence Services TM |

8 The Commerce Coalition Program Integrated Campaign Management • New consumers • Increased revenue • Increased transaction size • Preference and usage • Loyalty Spend Targeted Opportunity Best Customers Low Opportunity Prospects High Opportunity Prospects Do Nothing Attract Reward Convert TM |

9 PayPass™ Driving Speed and Convenience “For a large pharmacy chain such as “For a large pharmacy chain such as CVS…the potential payoff is a 20% to CVS…the potential payoff is a 20% to 30% up tick on purchases…” 30% up tick on purchases…” Jonathan Roberts Senior Vice President for Store Operations, CVS “It’s an issue of speed and “It’s an issue of speed and convenience. The contactless convenience. The contactless card can cut 30 seconds to 45 card can cut 30 seconds to 45 seconds off a person’s wait in seconds off a person’s wait in line, depending on the line, depending on the circumstances.” circumstances.” Brad Alberts VP, Sponsorship Sales, Texas Rangers Sources: Smart Card Alliance 2005 Annual Meeting: RF Payment at CVS / pharmacy 4/1/06, Cards & Payments |

10 Priceless.com Linking Consumers with Merchants • “Priceless Picks” • Promotions • Sponsorship activation • Integration of assets |

|

Financial Perspective Chris McWilton Chief Financial Officer May 31, 2007 |

2 Revenue • Secular shift from paper to electronic payments • International volume growth • Competitive wins • Pricing |

3 Direct and Indirect Business Drivers Direct Drivers • Gross Dollar Volume: – Cross-border activity • Processed Transactions • Currency fluctuation (US$ versus euro) • Global events that impact travel • Pricing Indirect Drivers • Retail Spending • Consumer Confidence • Inflation • Gas prices |

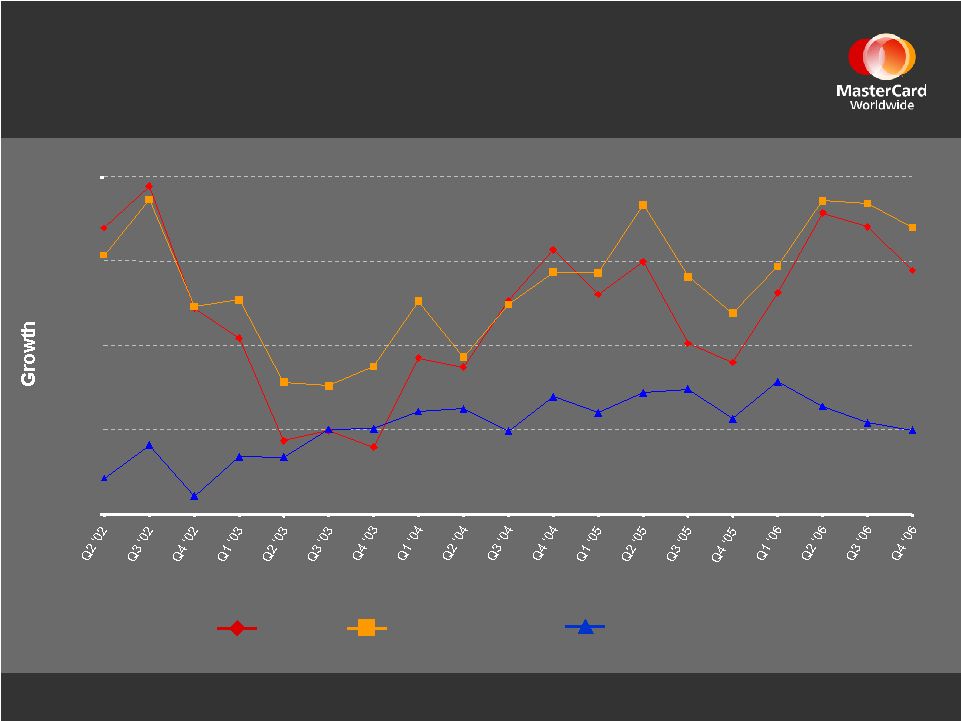

4 Volume vs. Retail Sales Trends in the U.S. U.S. GDV U.S. Purchase Volume U.S. Retail Sales 0% 5% 10% 15% 20% Source: U.S. Census Bureau |

5 Expenses • Hiring will continue through at least 2008 to focus on customers and strategic initiatives • Professional fees likely to increase as a result of litigations • Shift in A&M spend to later quarters in 2007 |

6 Modeling Considerations • Corporate tax rate: 36% • Diluted shares outstanding: approximately 136.6 million* • No changes to 3-5 year, long-term performance objectives: – One year as a public company – Competitive landscape is evolving *As of Q1 2007 10-Q filed on May 2, 2007 |

7 |

Driving Product Innovation Wendy Murdock Chief Product Officer May 31, 2007 |

1 The Global Payments Opportunity $80 Trillion+ and Growing… Source: WEFA Study $1.4 Trillion |

2 Market Shifts Present Opportunities • New ways to make payments are continuously emerging • New kinds of partners are at the table • Cash and check payments are migrating to electronic payment types • Regional variations add complexity • Under-served and affluent consumers are driving specialized solutions |

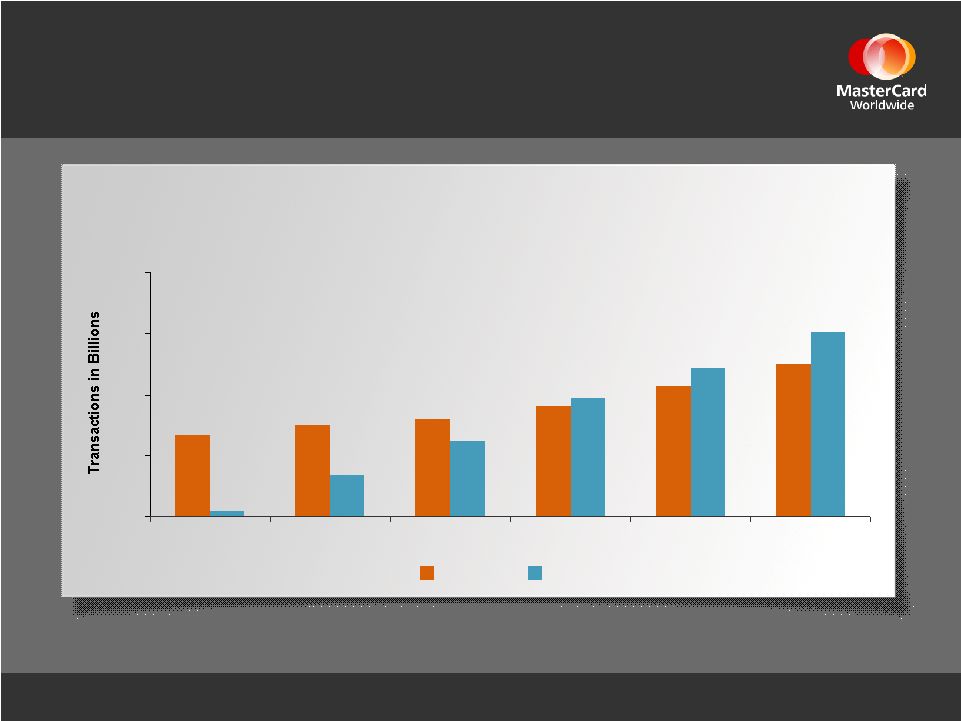

3 U.S. Debit Continues Expansion Surpassed Credit in 2004 Source: The Bank of International Settlements 17.5 18.0 16.7 22.5 20.7 19.1 22.2 19.7 25.1 16.2 13.4 10.5 10 15 20 25 30 2001 2002 2003 2004 2005 2006E Credit Debit |

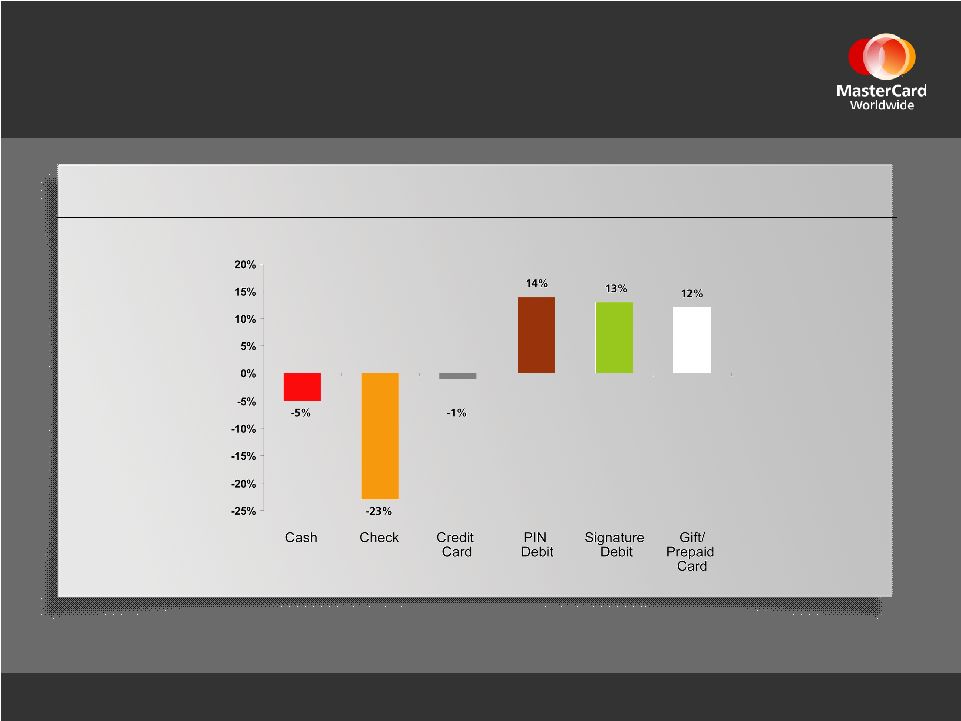

4 Debit and Prepaid Projected to Become Dominant U.S. In-Store Payment Methods Projected Change in Use of In-Store Payment Methods in the U.S. Planned change in usage over next two years. Source: Dove Consulting, 2005/2006 Study of Consumer Payment Preferences |

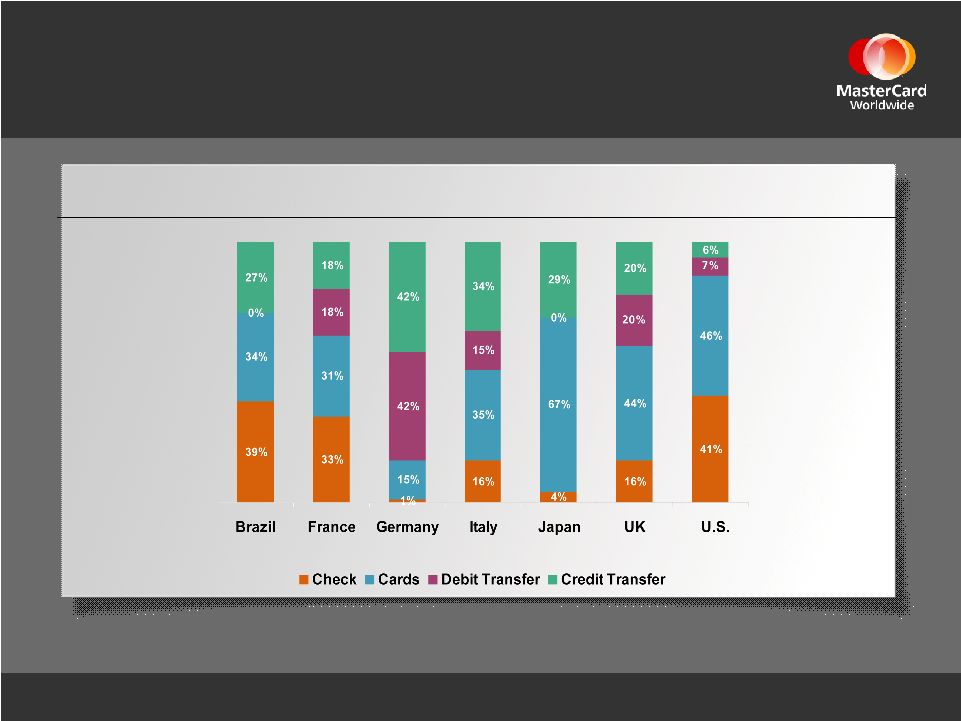

5 National Payments Systems Reflect Significant Diversity Source: Capgemini analysis. 2006. ECB Website: Blue Book - 2004 Figures. Release: April 2005, MasterCard Advisors analysis, BIS CPSS payment statistics. Payment Options |

6 MasterCard’s Product Mission Positioning Positioning MasterCard “Heart of Commerce” Business Model Business Model Franchisor Franchisor Processor Processor Advisor Advisor To develop and grow compelling To develop and grow compelling product propositions for issuers, product propositions for issuers, acquirers, merchants, consumers acquirers, merchants, consumers and corporations that capitalize on and corporations that capitalize on current market opportunities, current market opportunities, leverage the company’s assets and leverage the company’s assets and create a sustainable competitive create a sustainable competitive advantage for MasterCard. advantage for MasterCard. |

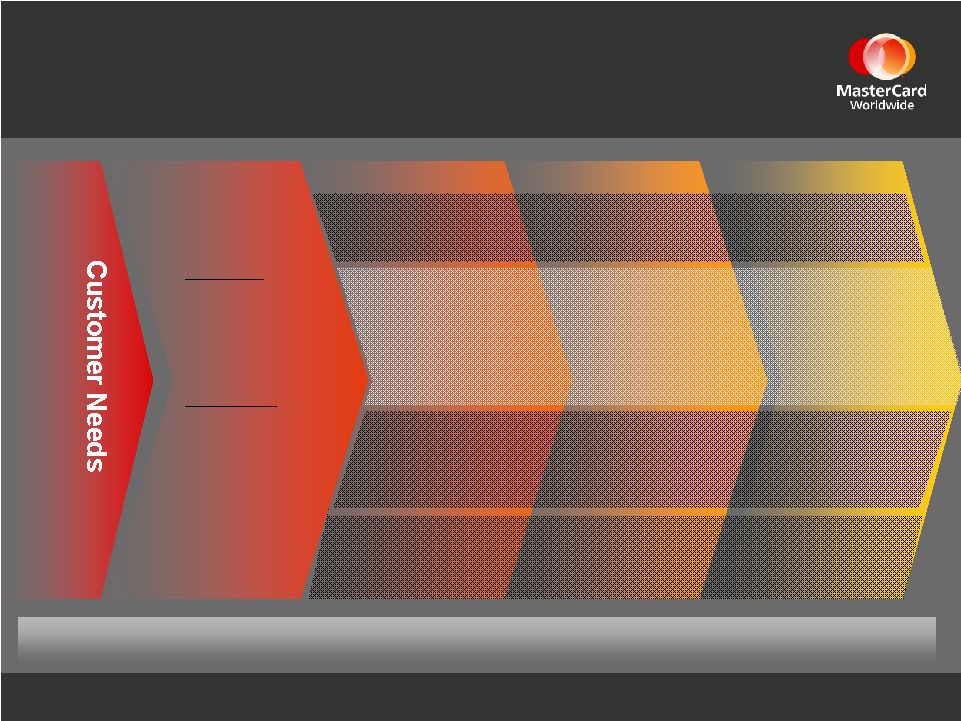

7 Our Value Chain Focus Consolidation Product expansion Cross-selling Cost management Customer retention Margin improvement Geographic expansion POI innovation Product relevance Rewards New travel experiences Online/Mobile Working capital optimization Supply chain management Operating efficiency |

8 Product Development: A Consistent, Repeatable Process Over 100+ New Product Development Initiatives Ideate Evaluate Develop Deliver Monitor 20% 35% 45% Strategy Optimize |

9 Product Innovation at MasterCard Foundational Elements • The Brand • Technology Infrastructure • Cardholder Services • Franchise Rules • Acceptance Network Payment Device Design • Packaging • Form Factors Intelligence • Data Analytics • Portfolio Insights Features • Rewards • Benefits and Enhancements • Point of Interaction Enhancements • Targeted Offers • Advertising & Promotions |

10 MasterCard and Issuers Partner to Create Unique Payment Solutions We create and package “ingredient” product components • Features • Device Design • Intelligence • Foundational Elements • Systems • Features • Marketing • Economics • Customer Service • Risk Management New Payment Solutions Issuers take MasterCard ingredients and add their own distinctive elements Financial Institutions MasterCard |

11 Products Consumer • Credit • Debit • Prepaid Commercial • Credit • Debit • Prepaid Franchisor – Processor – Advisor Delivering Differentiated Customer Solutions Solutions Programs Platforms • PayPass ® • Mobile • Money Send™ • Quick Service Merchant • Telecom • Contactless • Mobile • Remittance • Purchasing Card • Smart Data Online™ • Corporate Purchasing • Corporate T&E • Payment Gateway™ • Enhanced Authorization • Global Data Repository™ • Commerce Coalition™ • Enhanced Value • Affluent Consumer • Commerce Intelligence™ • Account Level Mgt. • Bill Pay • Bill Pay • Bill Pay Network • Automated Biller Update |

12 What’s Next? Advancing Commerce Through Emerging Consumer Spend Ed McLaughlin, Bill Payment and Healthcare The Affluent Segment Jeff Portelli, Global Consumer Credit Products Commercial Products – Leveraging Information Technology Steve Abrams, Global Commercial Products MasterCard Mobile – Mobilizing Commerce Art Kranzley, Advanced Payments MasterCard PayPass ® – Expanding Commerce Cathleen Conforti, Global PayPass |

13 |