Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

Filing exhibits

MA similar filings

- 5 Nov 07 Departure of Directors or Principal Officers

- 31 Oct 07 Record quarterly net revenues up 20.1% to $1.08 billion

- 15 Aug 07 Other Events

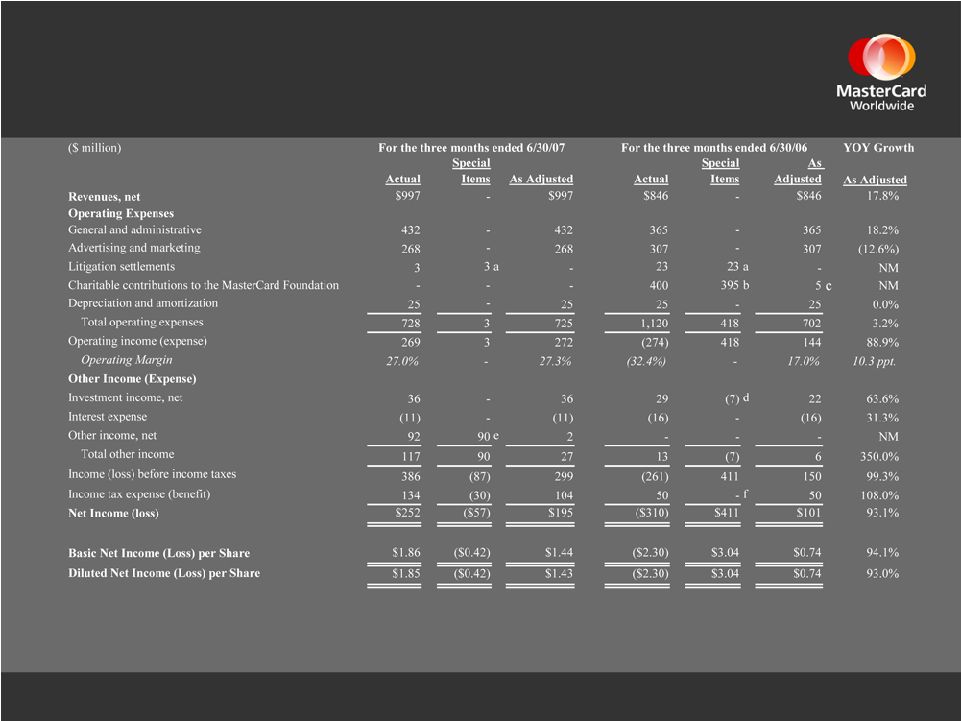

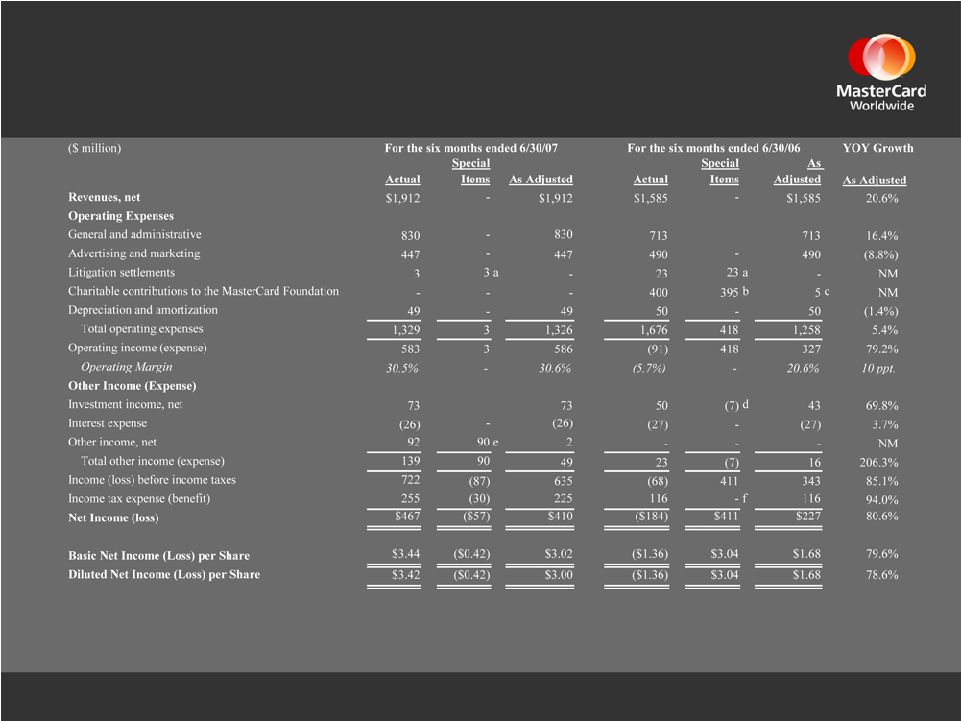

- 1 Aug 07 Quarterly net income up 93.1% to $195 million, or $1.43 per share, excluding special items

- 21 Jun 07 Other Events

- 7 Jun 07 Departure of Directors or Principal Officers

- 31 May 07 Regulation FD Disclosure

Filing view

External links