Exhibit 99.1

September 15, 2011

MasterCard Incorporated

Investment Community Meeting

©2011 MasterCard. Proprietary.

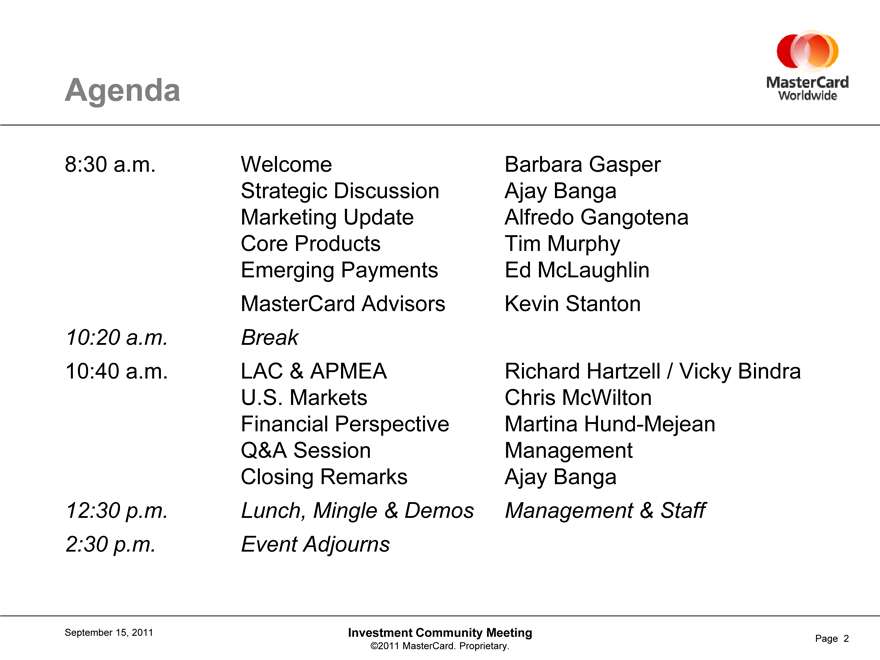

Agenda

8:30 a.m.

Welcome

Strategic Discussion

Marketing Update Core Products Emerging Payments MasterCard Advisors

Barbara Gasper

Ajay Banga

Alfredo Gangotena Tim Murphy Ed McLaughlin Kevin Stanton

10:20 a.m. Break

10:40 a.m.

LAC & APMEA

U.S. Markets Financial Perspective Q&A Session Closing Remarks

Richard Hartzell / Vicky Bindra

Chris McWilton Martina Hund-Mejean Management Ajay Banga

12:30 p.m. Lunch, Mingle & Demos Management & Staff

2:30 p.m. Event Adjourns

September 15, 2011 Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 2

Forward-Looking Statements

Today’s presentation may contain, in addition to historical information, forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995.

These forward-looking statements are based on our current assumptions, expectations and projections about future events which reflect the best judgment of management and involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by our comments today. You should review and consider the information contained in our filings with the SEC regarding these risks and uncertainties.

MasterCard disclaims any obligation to publicly update or revise any forward-looking statements or information provided during today’s presentations.

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 3

Ajay Banga

President and Chief Executive Officer September 15, 2011

Executing on the Strategy

Investment Community Meeting

©2011 MasterCard. Proprietary.

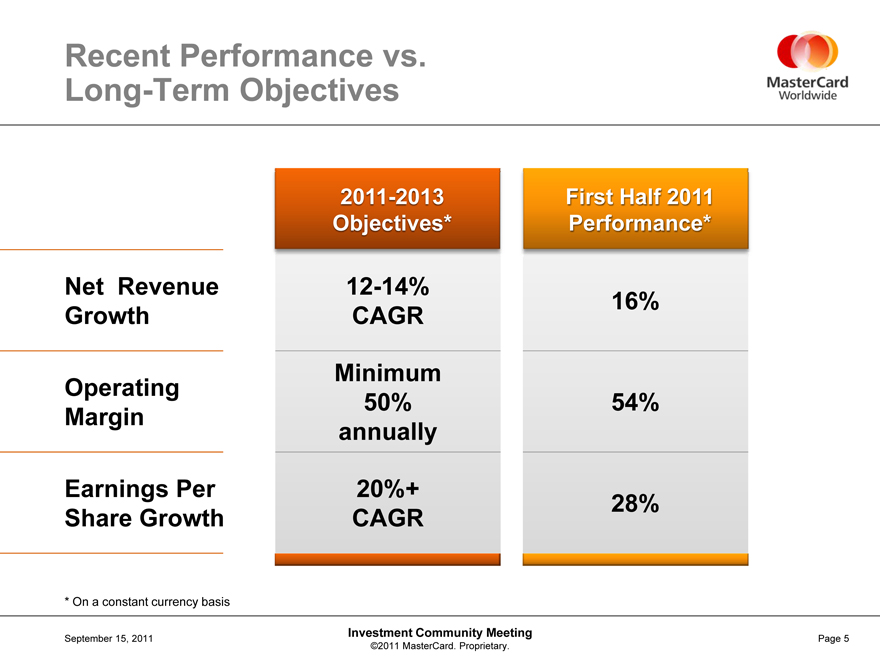

Recent Performance vs. Long-Term Objectives

2011-2013 First Half 2011

Objectives* Performance*

Net Revenue 12-14% 16%

Growth CAGR

Operating Minimum

Margin 50% 54%

annually

Earnings Per 20%+

Share Growth CAGR 28%

2011-2013 First Half 2011

Objectives* Performance*

Net Revenue 12-14% 16%

Growth CAGR

Operating Minimum

Margin 50% 54%

annually

Earnings Per 20%+

Share Growth CAGR 28%

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 5

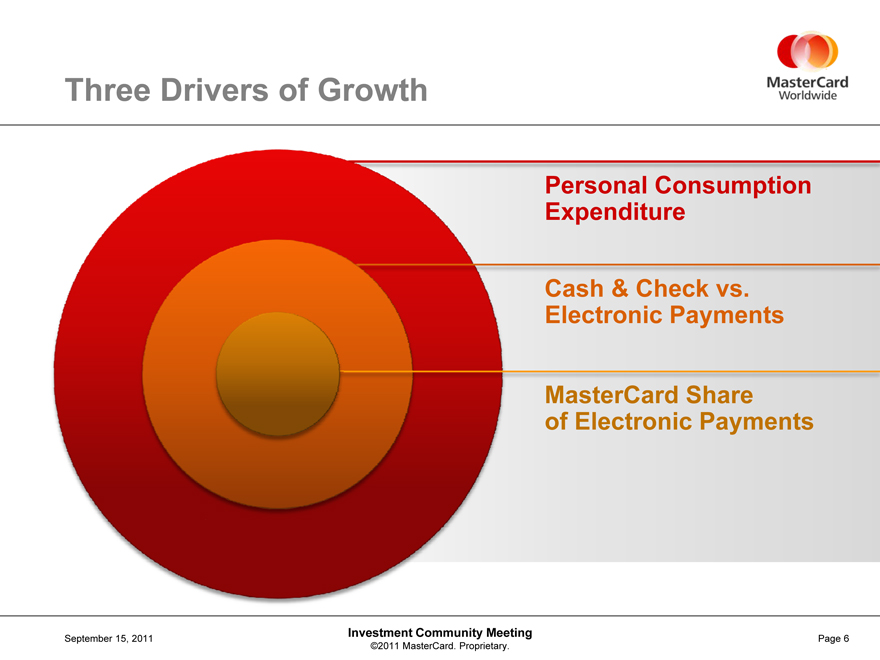

Three Drivers of Growth

Personal Consumption Expenditure

Cash & Check vs. Electronic Payments

MasterCard Share of Electronic Payments

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 6

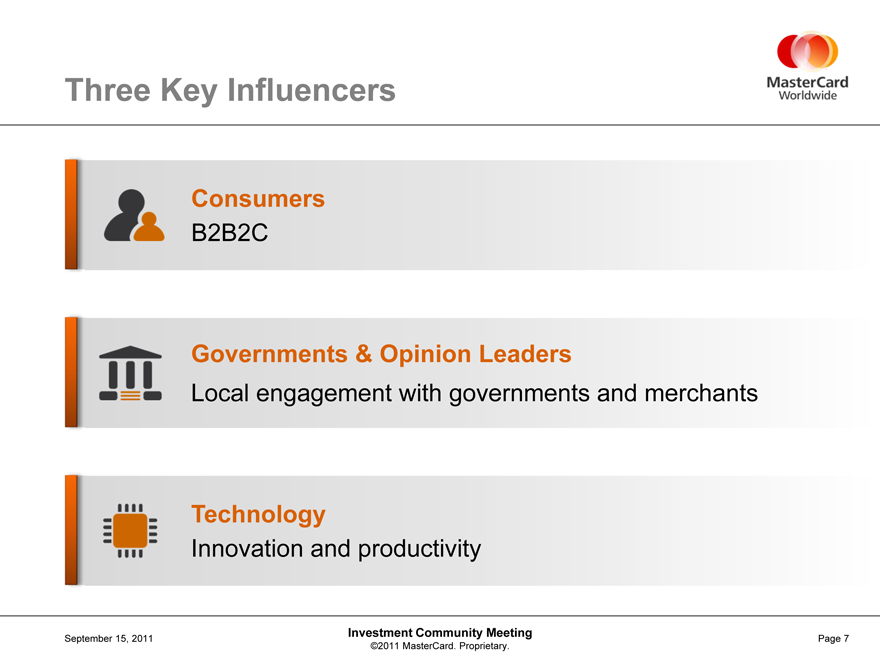

Three Key Influencers

Consumers

B2B2C

Governments & Opinion Leaders

Local engagement with governments and merchants

Technology

Innovation and productivity

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 7

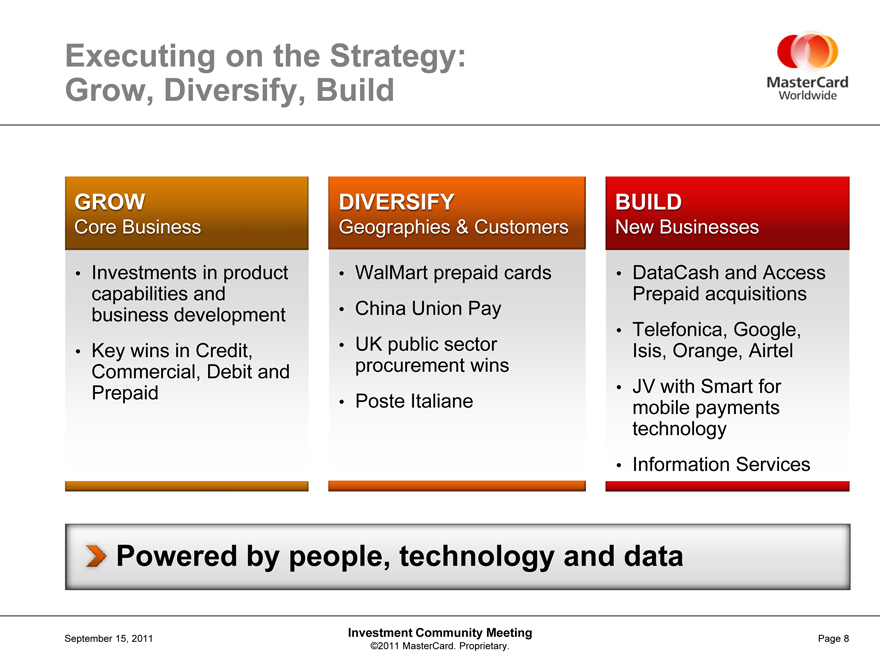

Executing on the Strategy: Grow, Diversify, Build

GROW

Core Business

• Investments in product capabilities and business development

• Key wins in Credit, Commercial, Debit and Prepaid

DIVERSIFY

Geographies & Customers

• WalMart prepaid cards

• China Union Pay

• UK public sector procurement wins

• Poste Italiane

BUILD

New Businesses

• DataCash and Access

Prepaid acquisitions

• Telefonica, Google, Isis, Orange, Airtel

• JV with Smart for mobile payments technology

• Information Services

Powered by people, technology and data

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 8

Margins and Profitability

Deliver 50% plus operating margin annually

Pursue efficiency in A&M, technology spend and G&A

Use pricing selectively

Invest in growth and innovation

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 9

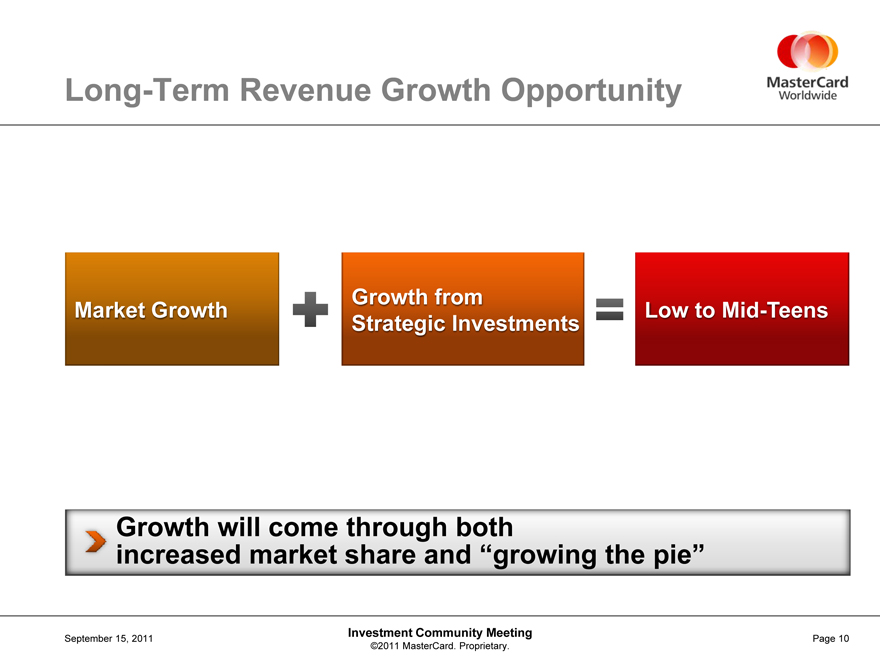

Long-Term Revenue Growth Opportunity

Market Growth

Growth from

Strategic Investments

Low to Mid-Teens

Growth will come through both increased market share and “growing the pie”

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 10

Alfredo Gangotena, Chief Marketing Officer September 15, 2011

From Awareness to Preference:

MasterCard Marketing

Investment Community Meeting

©2011 MasterCard. Proprietary.

Marketing Strategic Focus for Growth

GROW

Brand Preference

• Revenues

• Market Share

DIVERSIFY

New Segments and Markets

• New Consumers

• New Geographies

BUILD

Consumer Adoption

• e-Commerce / Mobile

• Social Media

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 12

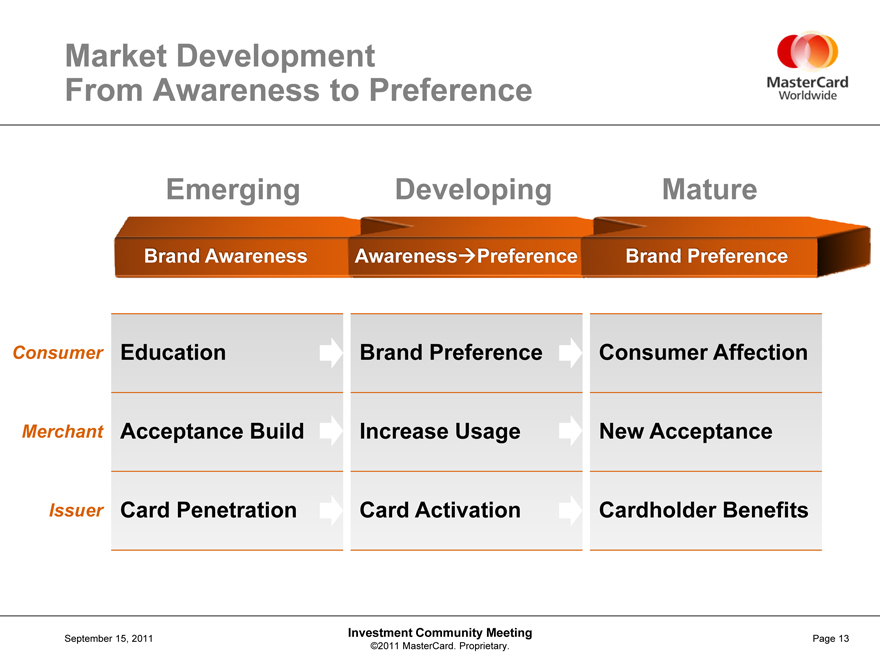

Market Development

From Awareness to Preference

Emerging Developing Mature

Brand Awareness Awareness Preference Brand Preference

Consumer Education Merchant Acceptance Build Issuer Card Penetration

Brand Preference Increase Usage Card Activation

Consumer Affection New Acceptance Cardholder Benefits

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 13

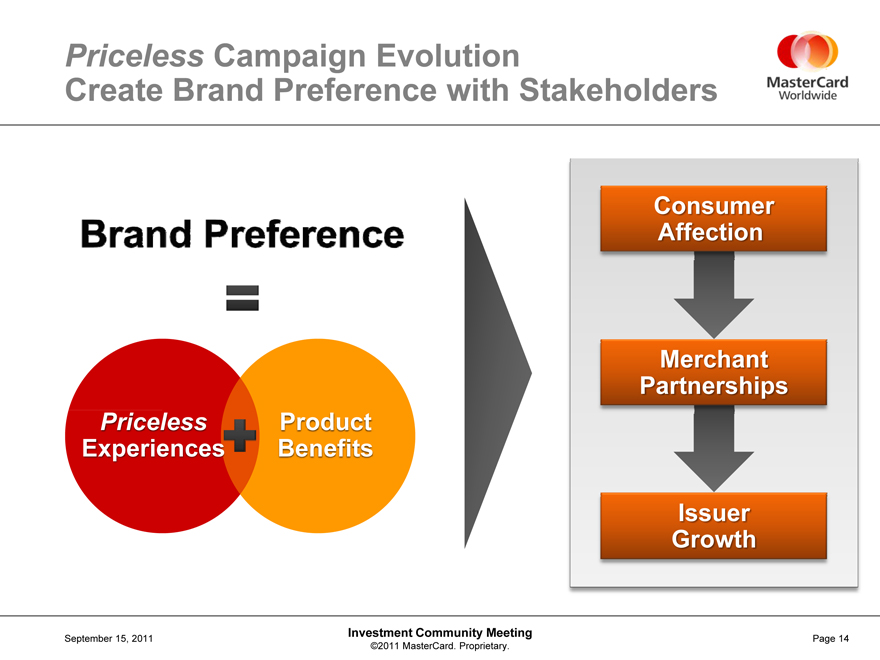

Priceless Campaign Evolution

Create Brand Preference with Stakeholders

Brand Preference

Priceless

Experiences

Product Benefits

Consumer Affection

Merchant Partnerships

Issuer Growth

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 14

Consumer Affection

Connecting People to their Passions

Celebrating products in advertising

Experiences are more valuable than things

Experiences Access Offers

Delight consumers

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 15

WORLD ELITE MASTERCARD

Consumer Affection

Connecting People to their Passions

“Priceless New York”

Experiences are more valuable than things

- Launch: July 2011 -

Shopping Dining Sports

Music & Movies

Arts & Culture

Theater Attractions Travel

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 17

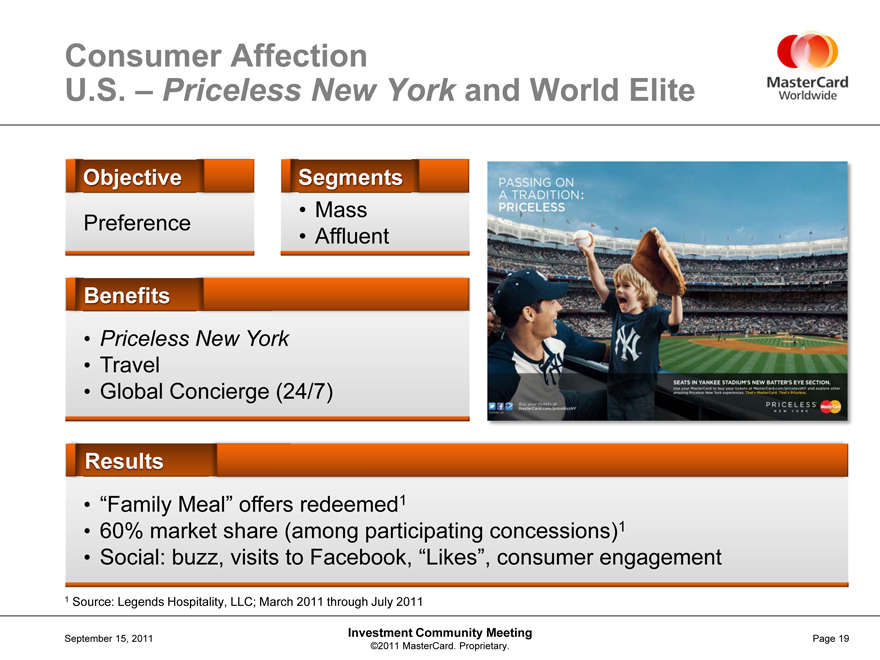

PASSION ON A TRADITION PRICELESS

Consumer Affection

U.S. – Priceless New York and World Elite

Objective

Preference

Segments

• Mass

• Affluent

Benefits

• Priceless New York

• Travel

• Global Concierge (24/7)

Results

• “Family Meal” offers redeemed1

• 60% market share (among participating concessions)1

• Social: buzz, visits to Facebook, “Likes”, consumer engagement

1 Source: Legends Hospitality, LLC; March 2011 through July 2011

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 19

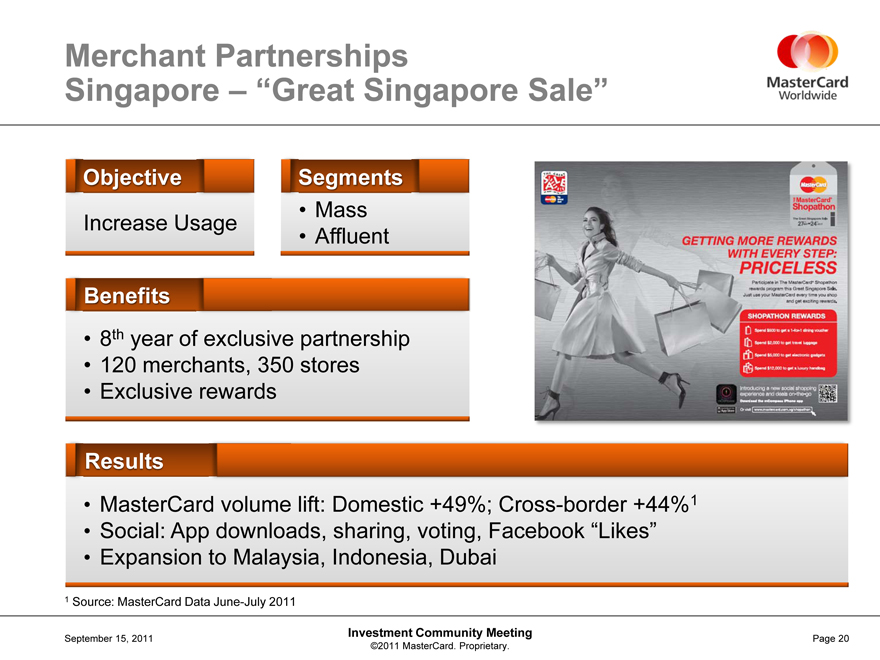

Merchant Partnerships

Singapore – “Great Singapore Sale”

Objective

Increase Usage

Segments

• Mass

• Affluent

Benefits

• 8th year of exclusive partnership

• 120 merchants, 350 stores

• Exclusive rewards

Results

• MasterCard volume lift: Domestic +49%; Cross-border +44%1

• Social: App downloads, sharing, voting, h “Likes”

• Expansion to Malaysia, Indonesia, Dubai

1 Source: MasterCard Data June-July 2011

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 20

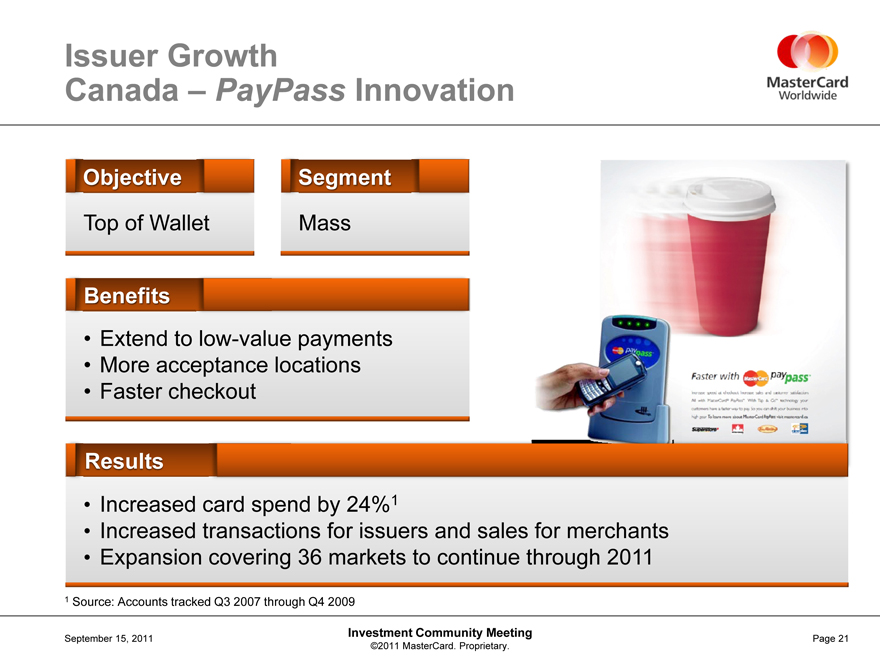

Issuer Growth

Canada – PayPass Innovation

Objective

Top of Wallet

Segment

Mass

Benefits

• Extend to low-value payments

• More acceptance locations

• Faster checkout

Results

• Increased card spend by 24%1

• Increased transactions for issuers and sales for merchants

• Expansion covering 36 markets to continue through 2011

1 Source: Accounts tracked Q3 2007 through Q4 2009

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 21

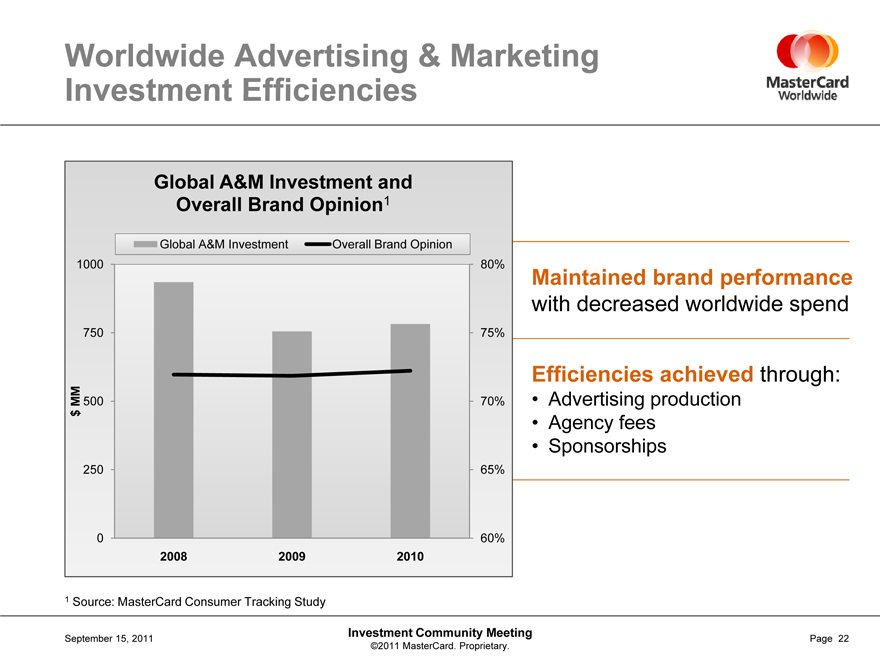

Worldwide Advertising & Marketing Investment Efficiencies

Global A&M Investment and Overall Brand Opinion1

Global A&M Investment

Overall Brand Opinion

1000

750

$MM 500

250

0

2008 2009 2010

80% 75% 70% 65% 60%

Maintained brand performance with decreased worldwide spend

Efficiencies achieved through:

• Advertising production

• Agency fees

• Sponsorships

1 Source: MasterCard Consumer Tracking Study

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 22

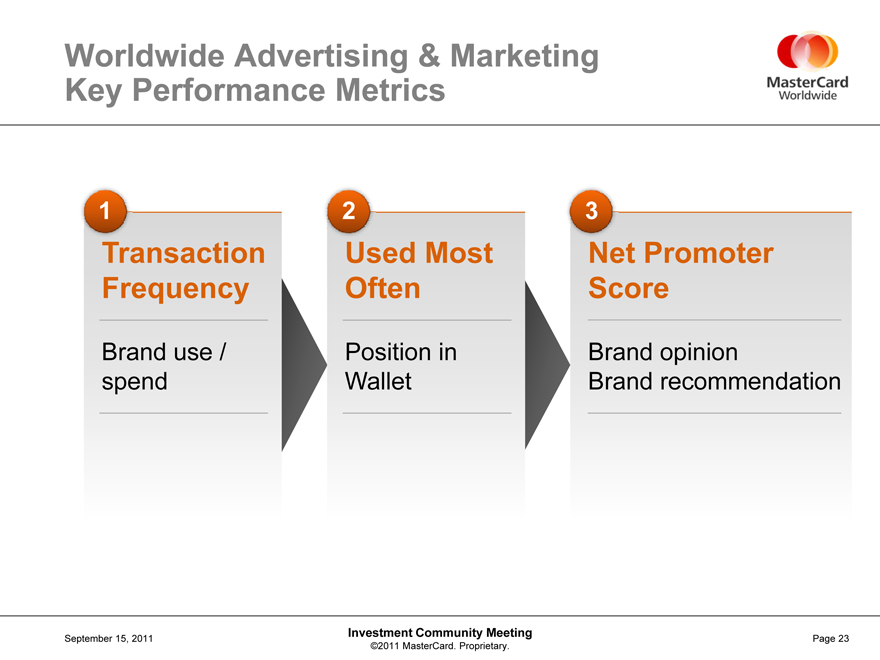

Worldwide Advertising & Marketing Key Performance Metrics

1

Transaction Frequency

Brand use / spend

2

Used Most Often

Position in Wallet

3

Net Promoter Score

Brand opinion

Brand recommendation

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 23

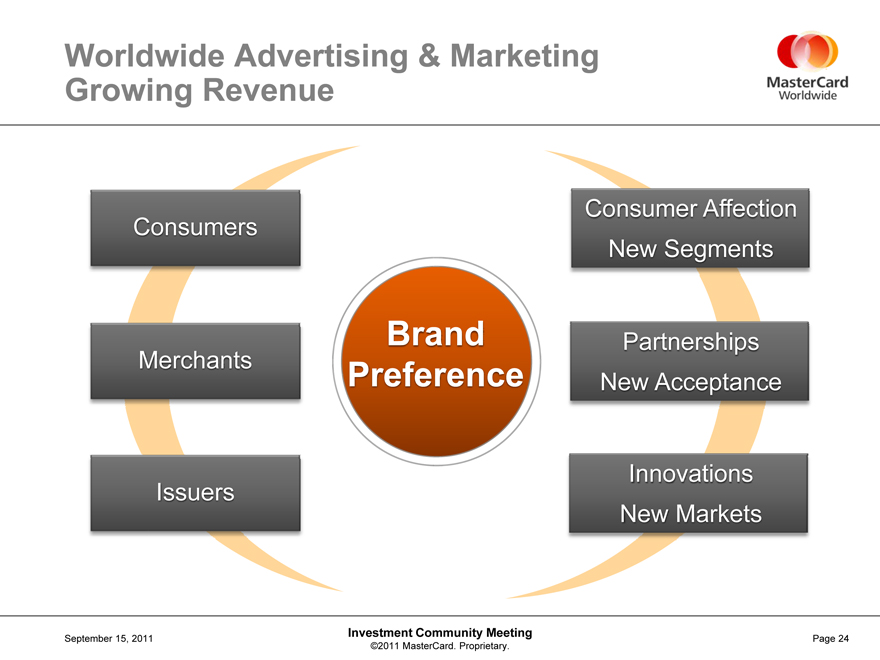

Worldwide Advertising & Marketing Growing Revenue

Consumers Merchants Issuers

Brand Preference

Consumer Affection New Segments

Partnerships New Acceptance

Innovations New Markets

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 24

Tim Murphy

Chief Product Officer September 15, 2011

A World Beyond Cash:

Core Products

Investment Community Meeting

©2011 MasterCard. Proprietary.

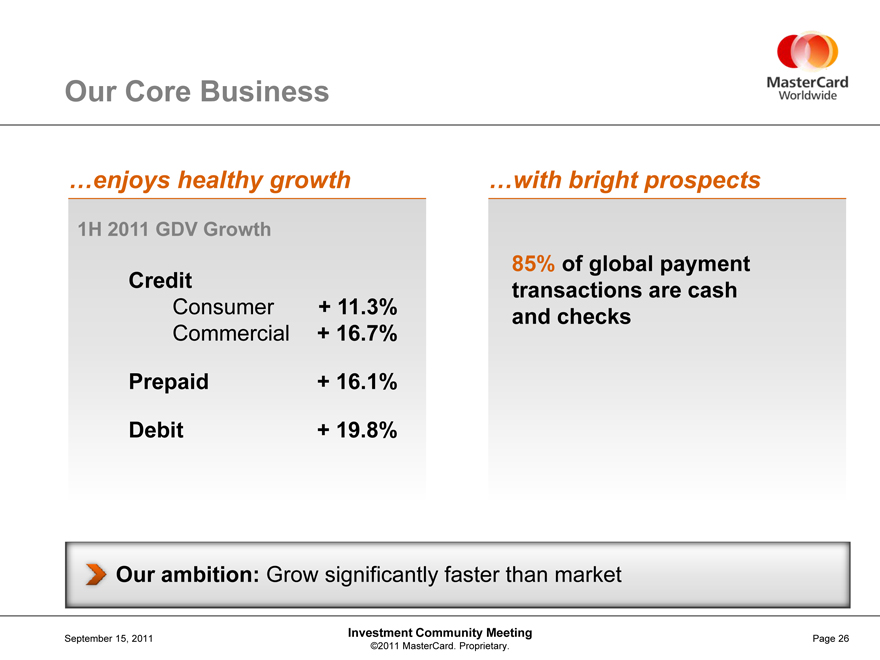

Our Core Business

…enjoys healthy growth

1H 2011 GDV Growth

Credit

Consumer + 11.3% Commercial + 16.7%

Prepaid + 16.1%

Debit + 19.8%

…with bright prospects

85% of global payment transactions are cash and checks

Our ambition: Grow significantly faster than market

Investment Community Meeting

September 15, 2011

©2011 MasterCard. Proprietary.

Page 26

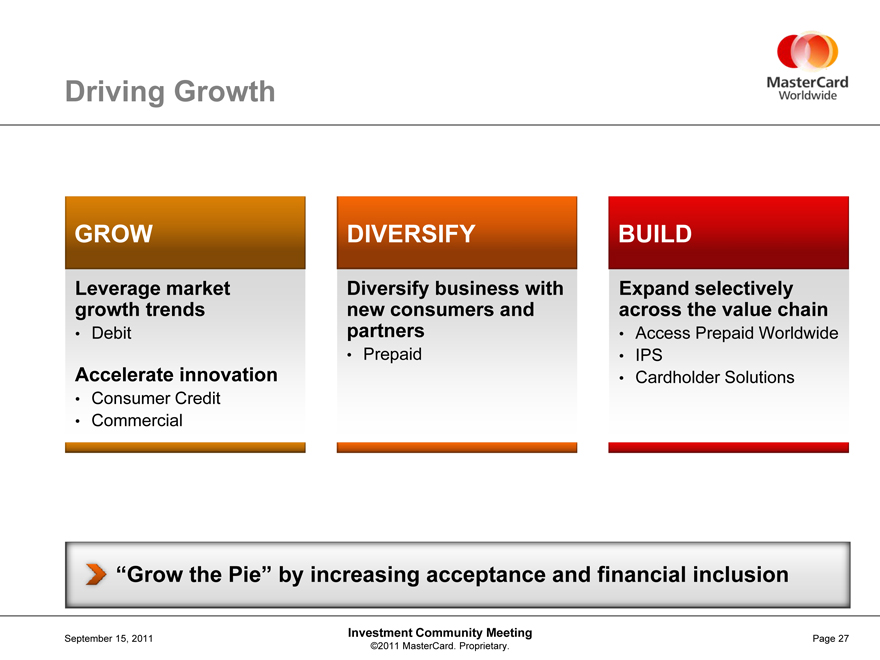

Driving Growth

GROW DIVERSIFY BUILD

Leverage market Diversify business with Expand selectively

growth trends new consumers and across the value chain

• Debit partners • Access Prepaid Worldwide

• Prepaid • IPS

Accelerate innovation • Cardholder Solutions

• Consumer Credit

• Commercial

“Grow the Pie” by increasing acceptance and financial inclusion

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 27

Grow: Leverage Market Growth Trends

Debit

Multi-generational shift to electronic payments

Debit is a natural replacement for cash

Rising middle class in emerging markets fuels Debit growth

Win with Issuers

Accelerate Cash Conversion

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 28

Grow: Leverage Market Growth Trends

Debit

Win with Issuers

Sovereign and Swedbank

8 million Cards $50+ billion annual GDV

Promote Usage

Drive spend with leading

merchant coalition program,

powered by MasterCard

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 29

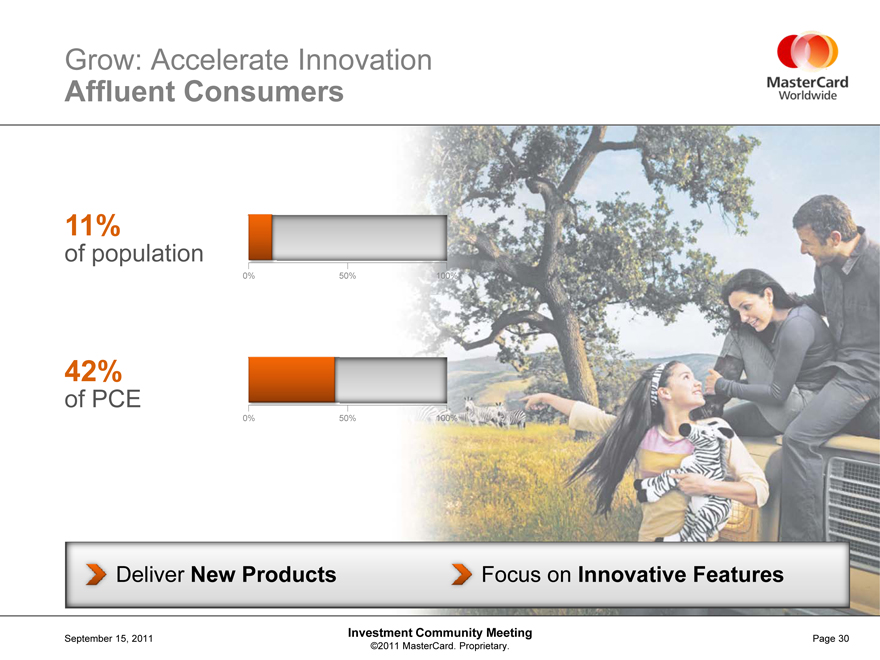

Grow: Accelerate Innovation

Affluent Consumers

11%

of population

0% 50% 100%

42%

of PCE

0% 50% 100%

Deliver New Products Focus on Innovative Features

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 30

Grow: Accelerate Innovation

Affluent Consumers

Total Annual GDV Potential: $20+ billion

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 31

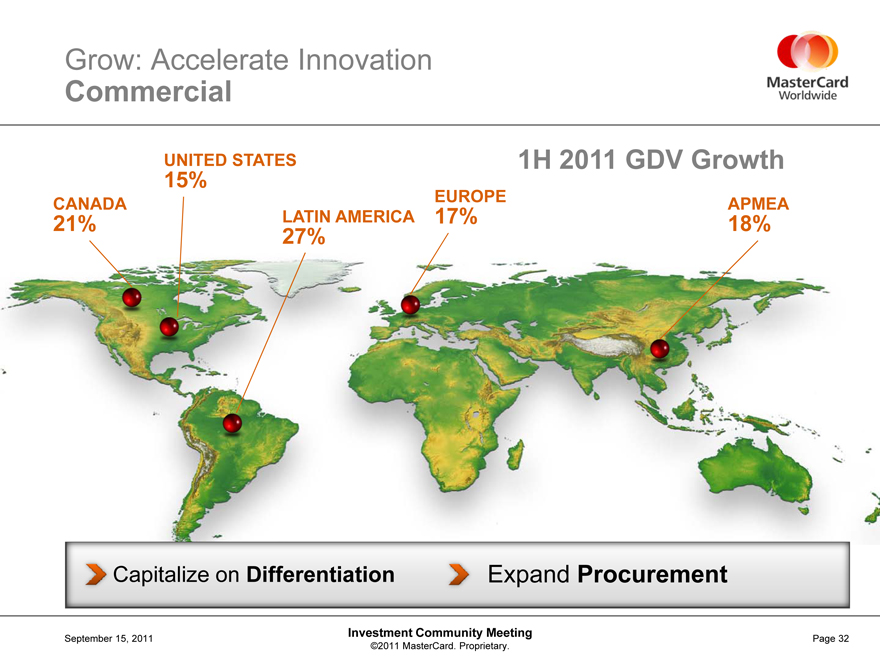

Grow: Accelerate Innovation

Commercial

CANADA

21%

UNITED STATES

15%

LATIN AMERICA

27%

EUROPE

17%

1H 2011 GDV Growth

APMEA

18%

Capitalize on Differentiation Expand Procurement

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 32

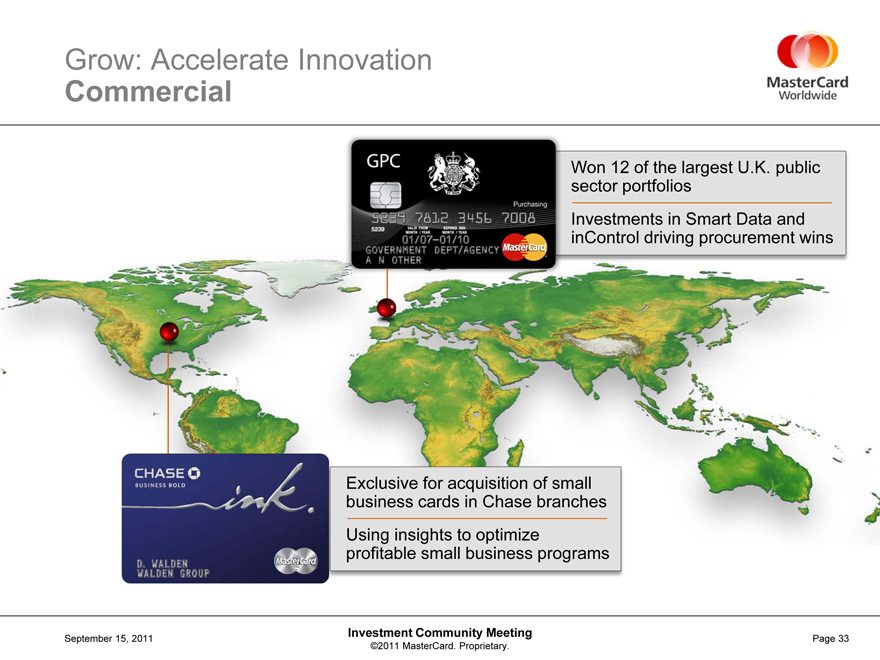

Grow: Accelerate Innovation

Commercial

Won 12 of the largest U.K. public sector portfolios

Investments in Smart Data and in Control driving procurement wins

Exclusive for acquisition of small business cards in Chase branches Using insights to optimize profitable small business programs

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 33

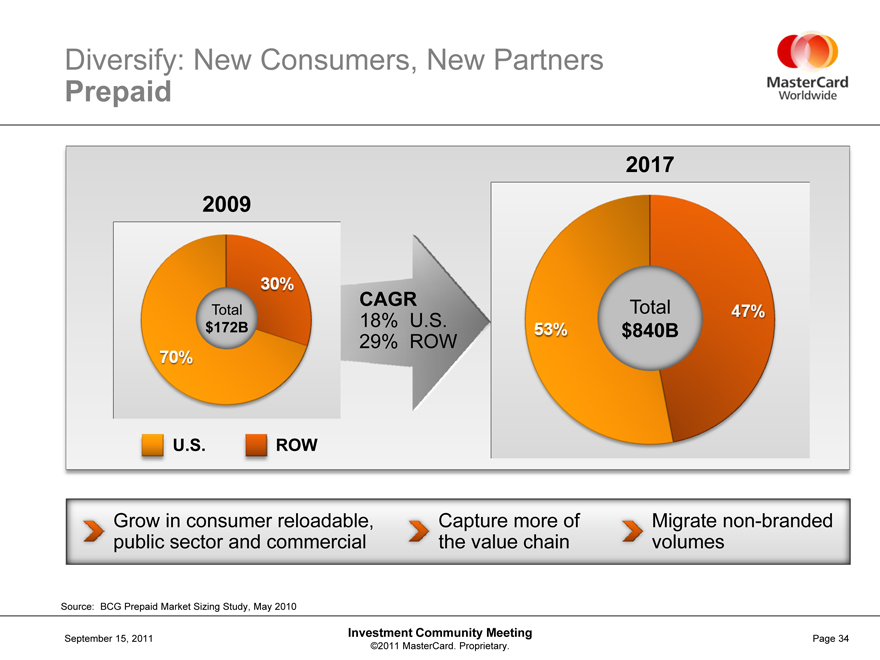

Diversify: New Consumers, New Partners

Prepaid

2009

30% 70%

Total $172B

CAGR

18% U.S. 29% ROW

U.S. ROW

2017

Total $840B

53% 47%

Grow in consumer re loadable, public sector and commercial

Capture more of the value chain

Migrate non-branded volumes

Source: BCG Prepaid Market Sizing Study, May 2010

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 34

Diversify: New Consumers, New Partners

Prepaid – Financial Inclusion for Underserved

2.5 billion underserved adults worldwide

Governments leading the way

Public Sector

Benefits

Payroll

State Benefits

U.S.

Egyptian Bank Co. (EBC) Payroll

Egypt

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 35

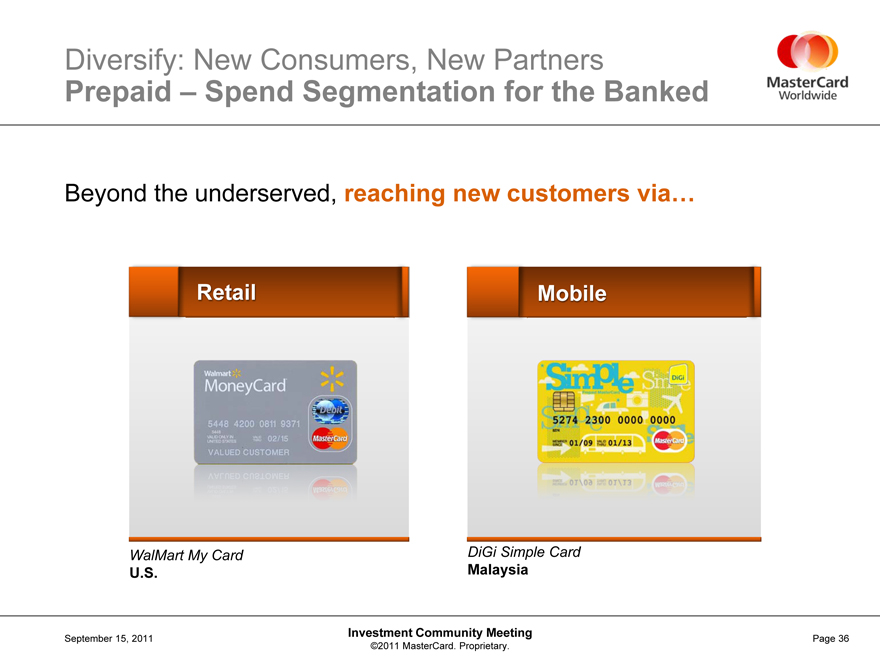

Diversify: New Consumers, New Partners

Prepaid – Spend Segmentation for the Banked

Beyond the underserved, reaching new customers via…

Retail Mobile

WalMart My Card DiGi Simple Card

U.S. Malaysia

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 36

Build: New Businesses

Access Prepaid Worldwide

£290 million acquisition closed April 2011

Provides critical program management capabilities

Integration on plan

Executing growth strategy

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 37

Driving Growth

Executing on our Grow, Diversify,

Build initiatives to gain share

“Growing the Pie” of electronic payments

Driving faster-than-market growth

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 38

Ed McLaughlin

Chief Emerging Payments Officer September 15, 2011

A World Beyond Plastic:

Emerging Payments

Investment Community Meeting

©2011 MasterCard. Proprietary.

Driving Growth through Innovation

GROW

Enhance Payments

• PayPass

• M/Chip EMV

• Transit

DIVERSIFY

Expand Capabilities

• inControl

• Bill Pay

• MoneySend

• Offers and Redemption

BUILD

Extend Value Chain

• DataCash

• Mobile Payments Solutions (MPS)

• Remote Payments

• Mobile Money

New consumer experiences accelerate the transition to electronic payments

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 40

Changing Consumer Experiences

Established Emerging

e/m-

Commerce

Remote

Payments

PC-based e-Commerce Internet connected devices

Proximity

Payments

Card at Point of Sale PayPass at Point of Sale

Mobile Money

Cash Mobile Money Services

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 41

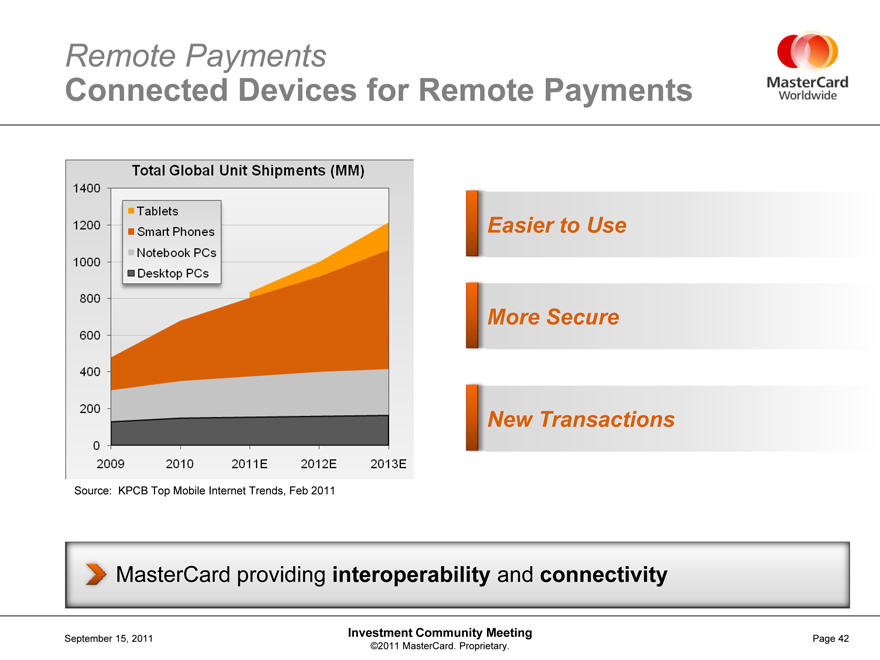

Remote Payments

Connected Devices for Remote Payments

Total Global Unit Shipments (MM)

Tablets

Smart Phones

Notebook PCs

Desktop PCs

1400

1200

1000

800

600

400

200

0

2009

2010

2011E

2012E

2013E

Source: KPCB Top Mobile Internet Trends, Feb 2011

Easier to Use More Secure New Transactions

Source: KPCB Top Mobile Internet Trends, Feb 2011

MasterCard providing interoperability and connectivity

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 42

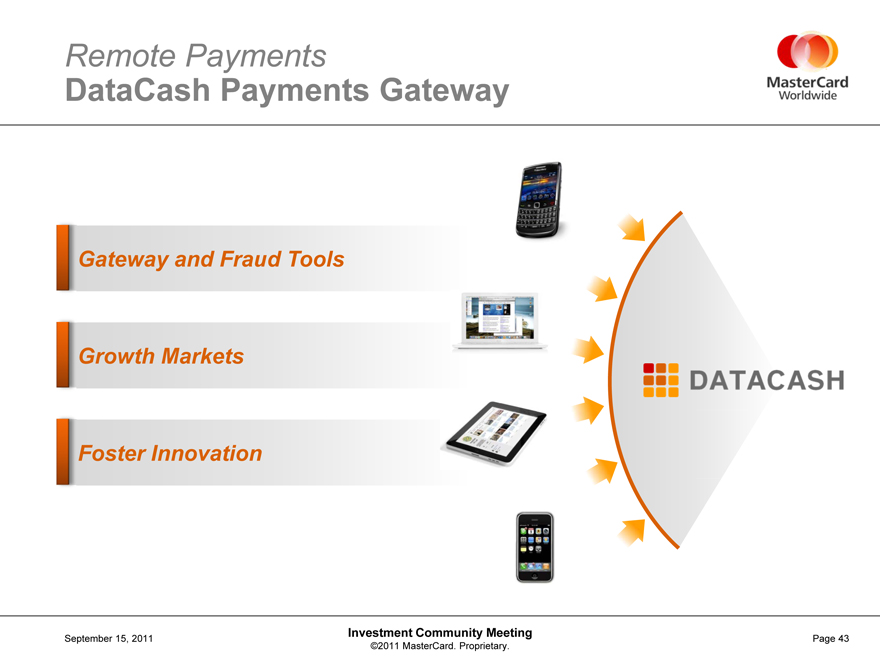

Remote Payments

DataCash Payments Gateway

Gateway and Fraud Tools Growth Markets Foster Innovation

DATACASH

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 43

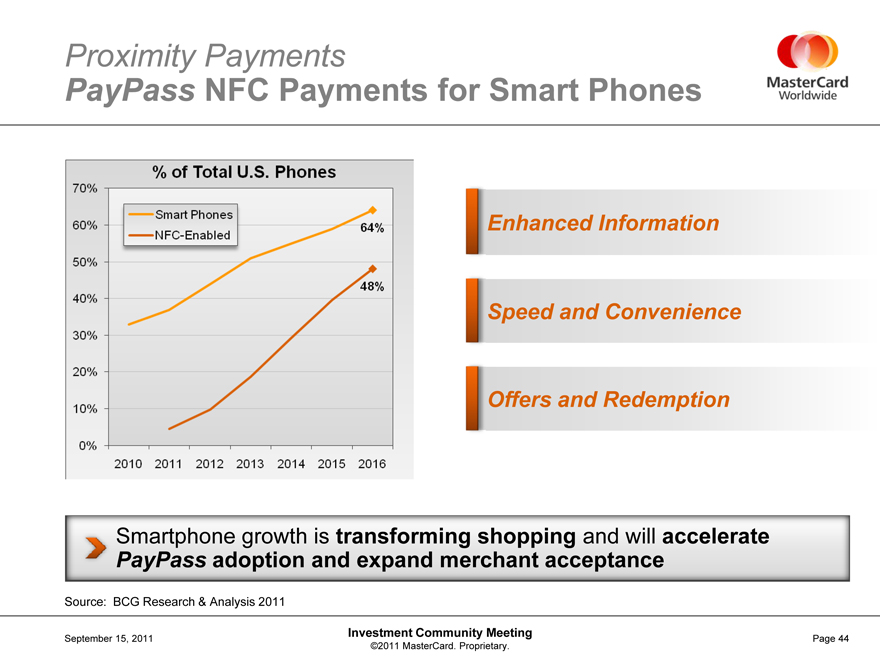

Proximity Payments

PayPass NFC Payments for Smart Phones

Enhanced Information Speed and Convenience Offers and Redemption

Smartphone growth is transforming shopping and will accelerate PayPass adoption and expand merchant acceptance

% of Total U.S. Phones

Smart Phones

NFC-Enabled

64%

48%

70%

60%

50%

40%

30%

20%

10%

0%

2010

2011

2012

2013

2014

2015

2016

Source: BCG Research & Analysis 2011

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 44

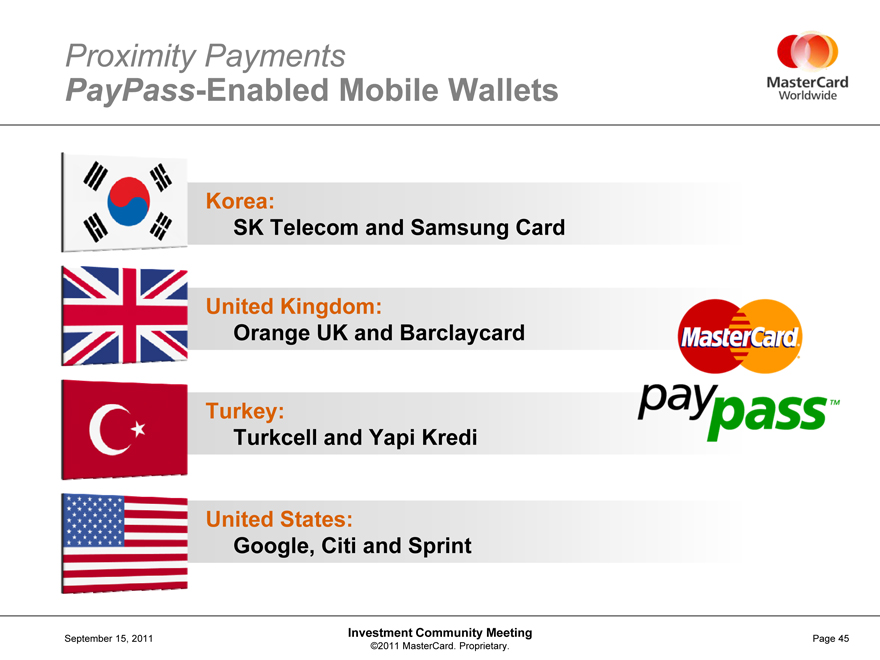

Proximity Payments

PayPass-Enabled Mobile Wallets

Korea:

SK Telecom and Samsung Card

United Kingdom:

Orange UK and Barclaycard

Turkey:

Turkcell and Yapi Kredi

United States:

Google, Citi and Sprint

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 45

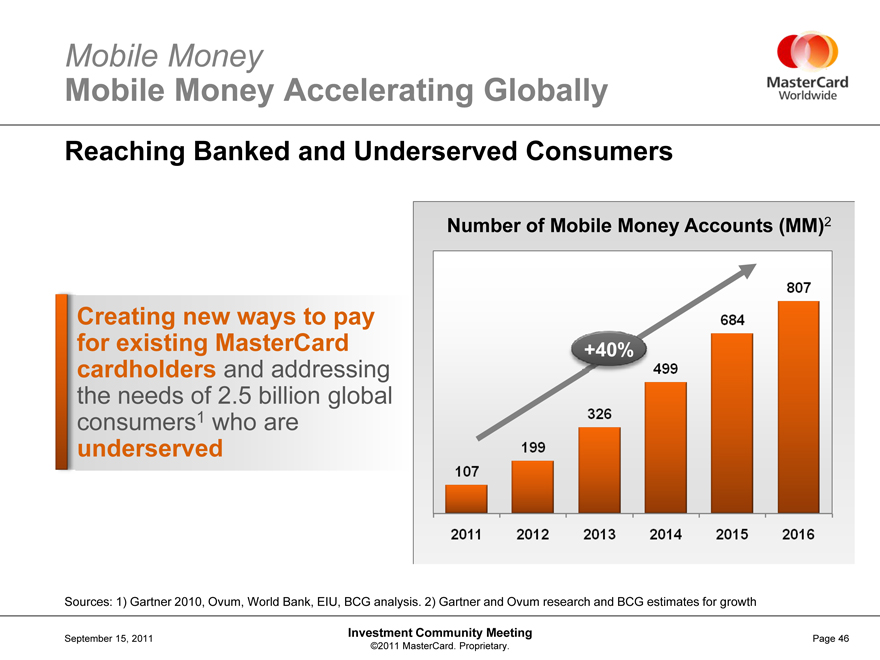

Mobile Money

Mobile Money Accelerating Globally

Reaching Banked and Underserved Consumers

Number of Mobile Money Accounts (MM)2

Creating new ways to pay for existing MasterCard cardholders and addressing the needs of 2.5 billion global consumers1 who are underserved

107 199 326 499 684 807 2011 2012 2013 2014 2015 2016 +40%

Sources: 1) Gartner 2010, Ovum, World Bank, EIU, BCG analysis. 2) Gartner and Ovum research and BCG estimates for growth

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 46

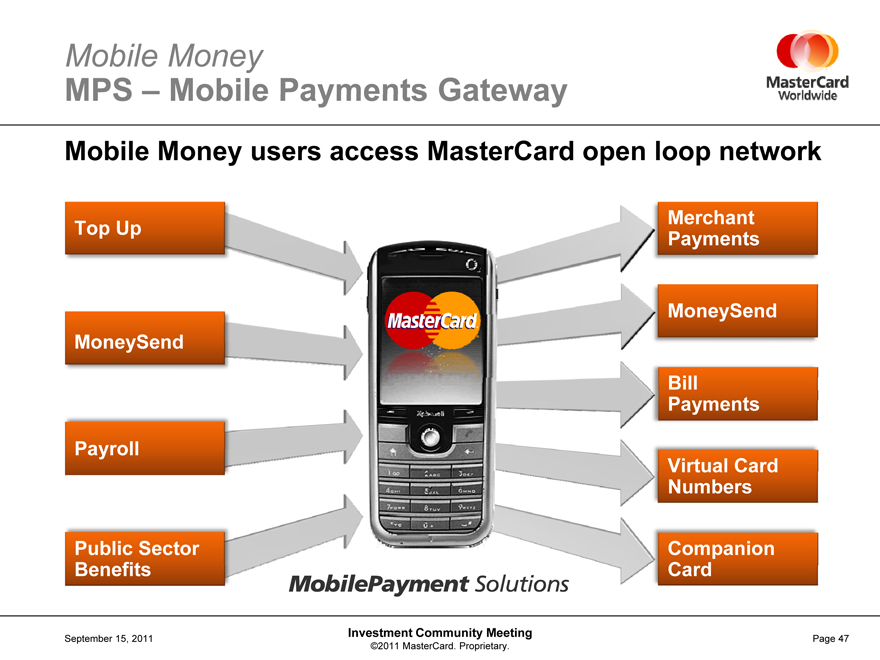

Mobile Money

MPS – Mobile Payments Gateway

Mobile Money users access MasterCard open loop network

Top Up MoneySend Payroll

Public Sector Benefits

Merchant Payments

MoneySend

Bill Payments

Virtual Card Numbers

Companion Card

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 47

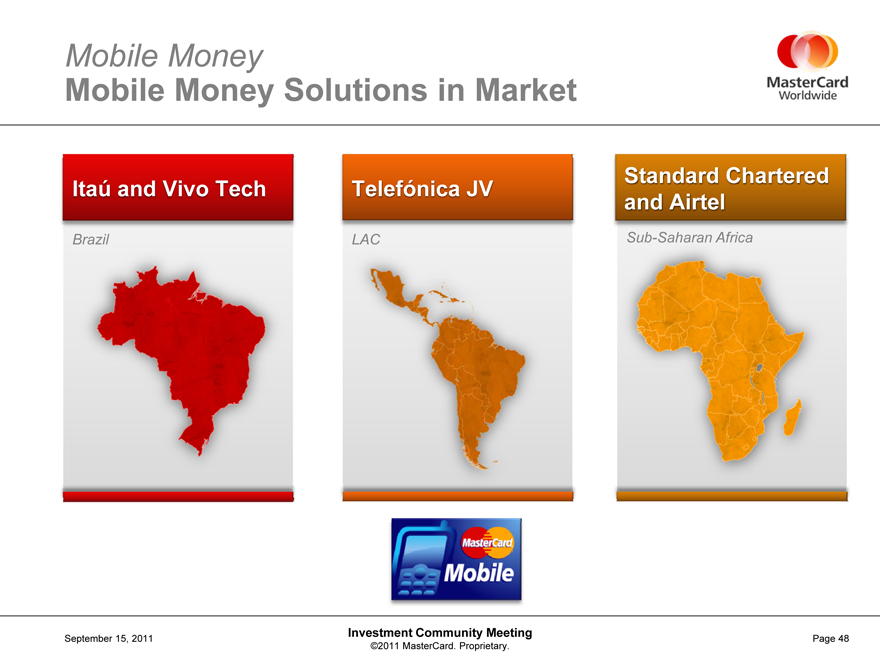

Mobile Money

Mobile Money Solutions in Market

Itaú and Vivo Tech

Brazil

Telefónica JV

LAC

Standard Chartered and Airtel

Sub-Saharan Africa

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 48

Emerging Payments

Transforming consumer behavior globally

Increasing electronic transactions and network reach

Driving growth and preference for MasterCard

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 49

Kevin Stanton

President, MasterCard Advisors September 15, 2011

Differentiated Services:

MasterCard Advisors

Investment Community Meeting

©2011 MasterCard. Proprietary.

Differentiated Professional Services

Data advantage

Talent advantage

Consulting

Implementation

Information

New customers New places

Increasing loyalty

Full suite of complementary services drives growth for MasterCard and its customers

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 51

Data Advantage

Anonymous Transactional

• Actual

• Real-time

• Consumer / business spend

Multi-sourced

• 32 million merchants

• 22,000 issuers

Massive

• 1.7 billion cards

• 160 million transactions / hour

Worldwide

Available from few others

Differentiation starts with data sourced from a massive worldwide payments network

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 52

Unparalleled Data Advantage

Cleansed, aggregated, augmented

• 700,000 automated rules

• Continuously tested

Warehoused

• 1.3 petabytes

• 5+ year historic global view

• Rapid retrieval

• Above-and-beyond privacy protection and security

Transformed into actionable insights

• Reports, indexes, benchmarks

• Behavioral variables

• Models, scores, forecasting

• Econometrics

Available only from MasterCard

Consumer insights are unmatched, proprietary and 15 years in the making

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 53

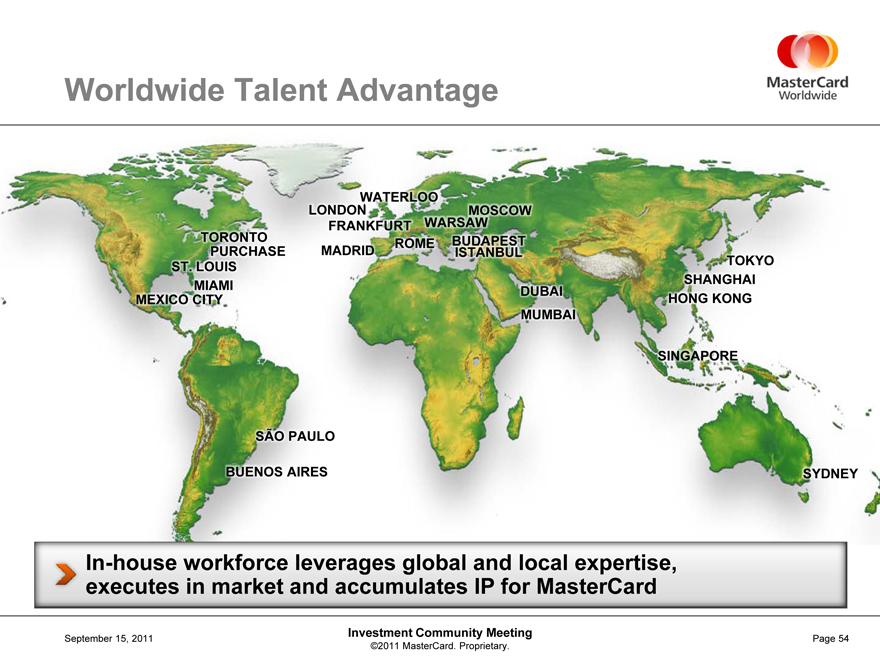

Worldwide Talent Advantage

TORONTO PURCHASE

ST. LOUIS MIAMI

MEXICO CITY

WATERLOO

LONDON WARSAW MOSCOW FRANKFURT

ROME BUDAPEST MADRID ISTANBUL

DUBAI MUMBAI

TOKYO SHANGHAI

HONG KONG

SÃO PAULO

BUENOS AIRES

SINGAPORE

SYDNEY

In-house workforce leverages global and local expertise, executes in market and accumulates IP for MasterCard

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 54

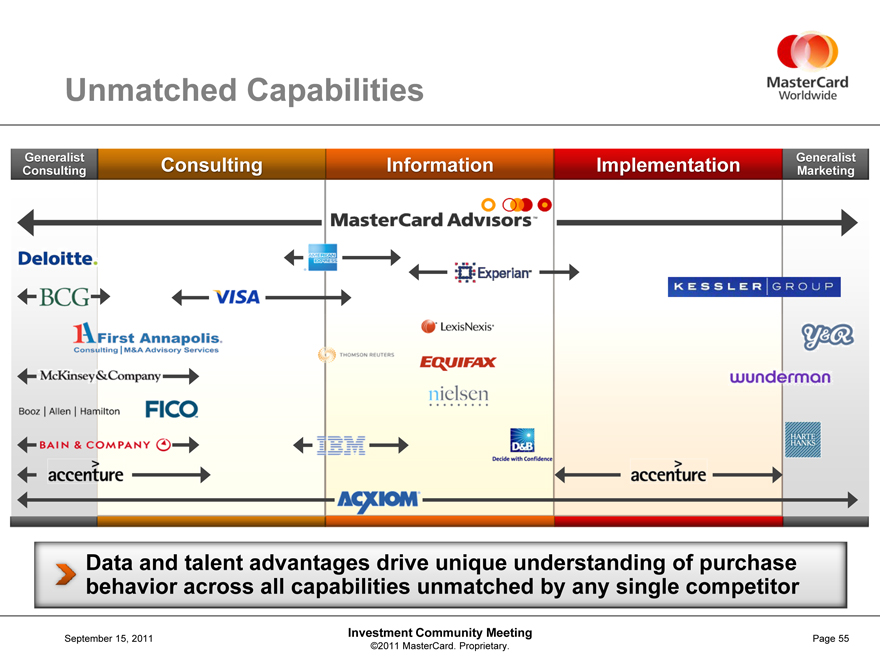

Unmatched Capabilities

Generalist Consulting

Consulting Information Implementation Generalist

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 55

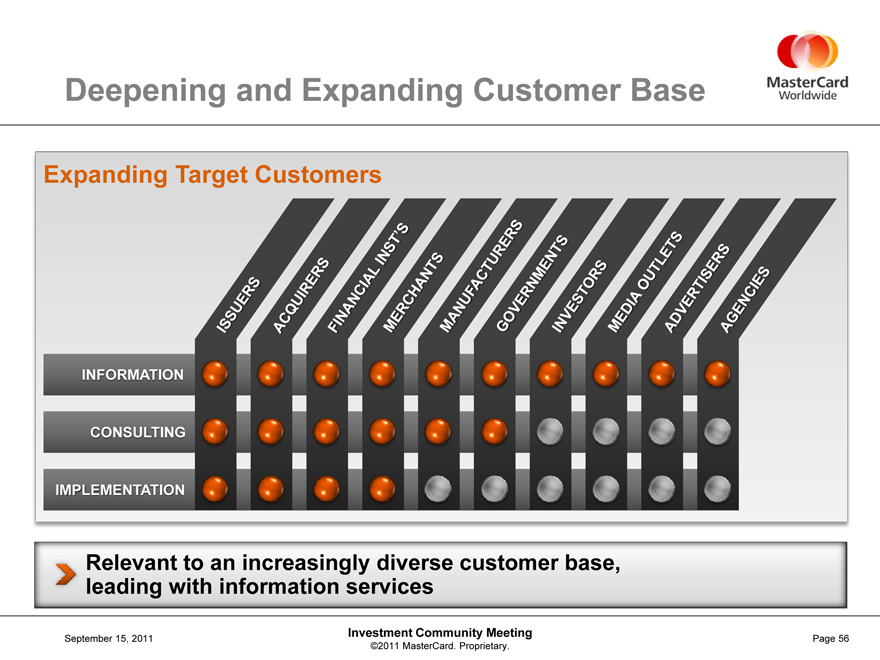

Deepening and Expanding Customer Base

Expanding Target Customers

INFORMATION

CONSULTING

IMPLEMENTATION

Relevant to an increasingly diverse customer base, leading with information services

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 56

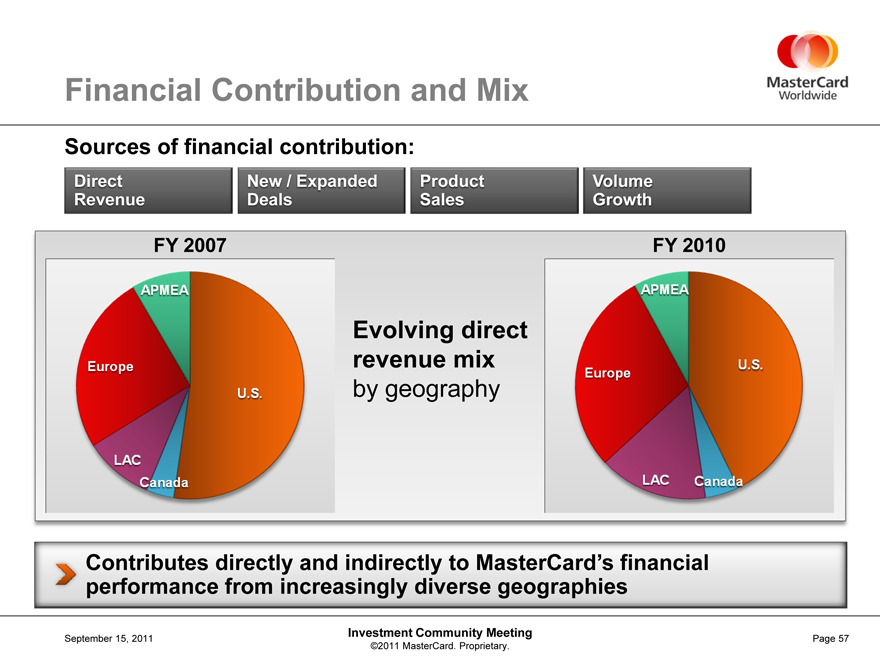

Financial Contribution and Mix

Sources of financial contribution:

Direct Revenue

New / Expanded Deals

Product Sales

Volume Growth

FY 2007

APMEA Europe U.S. LAC Canada

APMEA Europe U.S. LAC Canada

Evolving direct revenue mix by geography

Contributes directly and indirectly to MasterCard’s financial performance from increasingly diverse geographies

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 57

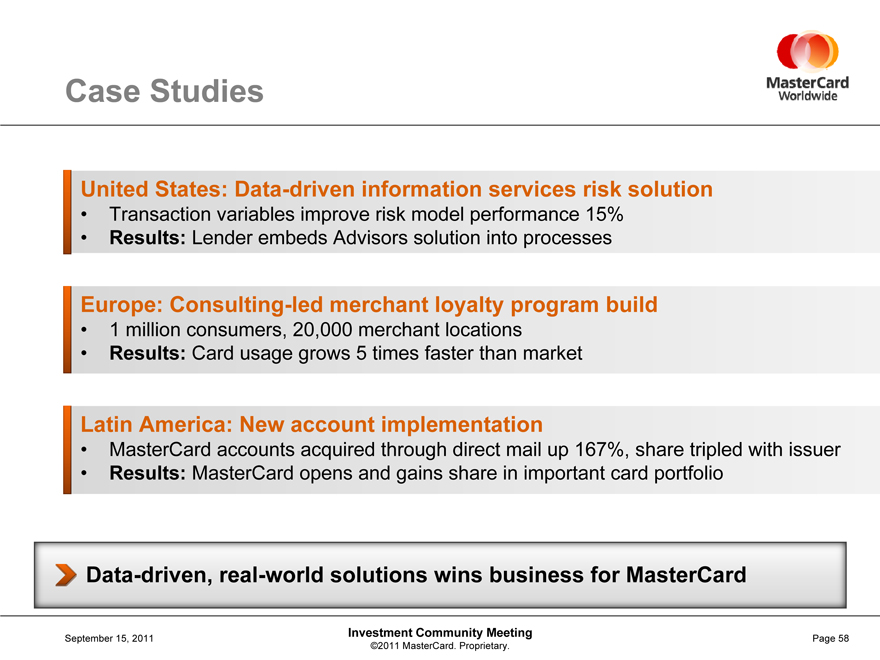

Case Studies

United States: Data-driven information services risk solution

• Transaction variables improve risk model performance 15%

• Results: Lender embeds Advisors solution into processes

Europe: Consulting-led merchant loyalty program build

• 1 million consumers, 20,000 merchant locations

• Results: Card usage grows 5 times faster than market

Latin America: New account implementation

• MasterCard accounts acquired through direct mail up 167%, share tripled with issuer

• Results: MasterCard opens and gains share in important card portfolio

Data-driven, real-world solutions wins business for MasterCard

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 58

Advisors Advantage

Differentiated Assets

• Data advantage

• Talent advantage

• Worldwide advantage

Differentiated Services

• Information

• Consulting

• Implementation

Differentiated Results

• Data-driven intelligence, strategy and implementation to advance commerce

Delivers a competitive advantage that grows the core business, diversifies income streams and builds new businesses

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 59

Richard Hartzell, President, Latin America & the Caribbean Vicky Binda, President, Asia Pacific / Middle East / Africa September 15, 2011

High-Growth Market Opportunities:

LAC and APMEA Regions

Investment Community Meeting

©2011 MasterCard. Proprietary.

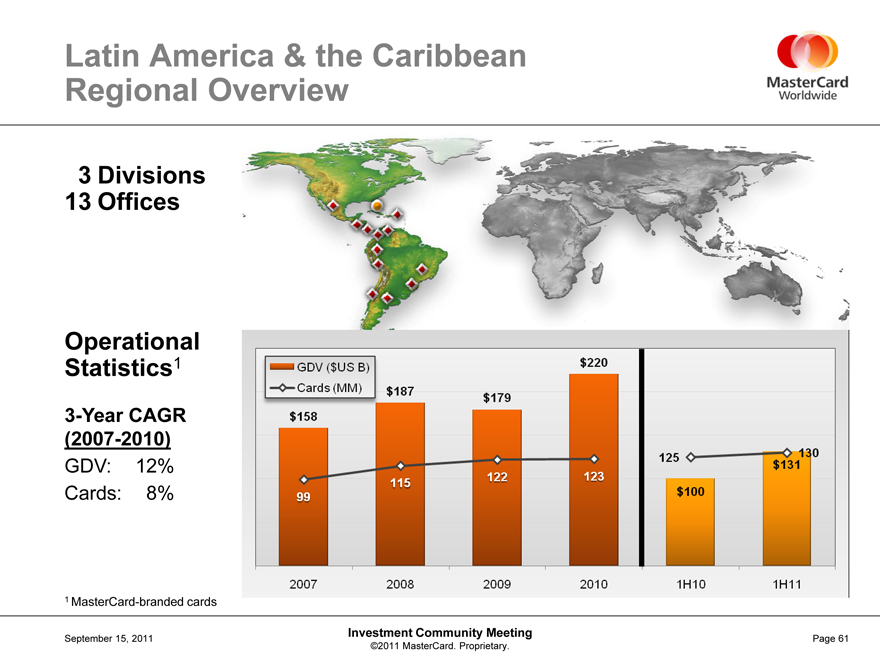

Latin America & the Caribbean Regional Overview

13 Offices

Operational Statistics1

3-Year CAGR (2007-2010)

GDV: 12% Cards: 8%

GDV ($US B) Cards (MM) $158 $187 $179 $220

99 115 122 123 125 $100 $131 130

2007 2008 2009 2010 1H10 1H11

1 MasterCard-branded cards

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 61

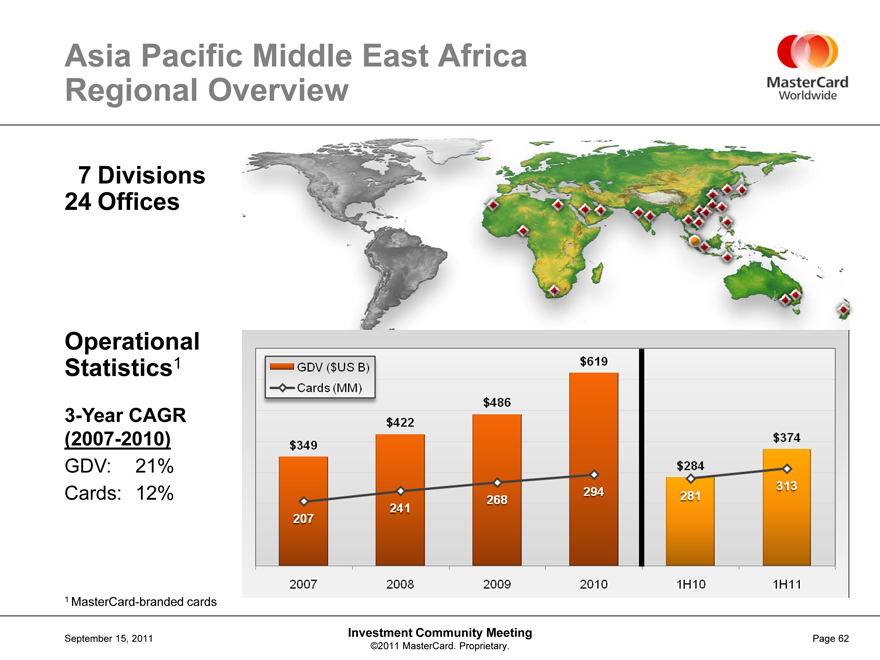

Asia Pacific Middle East Africa Regional Overview

7 Divisions

24 Offices

Operational Statistics1

3-Year CAGR (2007-2010)

GDV: 21% Cards: 12%

GDV ($US B) Cards (MM)

$349 $422 $486 $619 $284 $374

207 241 268 294 281 313 2007 2008 2009 2010 1h10 1h11

1 MasterCard-branded cards

1 MasterCard-branded cards

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 62

Focus on Growth

Similar Objectives with Market-Specific Delivery

Focus Areas for Growth

• Acceptance

• Processing / Switching

• Innovation

• Regulators

• Financial Inclusion

Key Imperatives

• Drive consumer preference

• Lead in Prepaid solutions

• Implement emerging payments solutions, including mobile

• Support partnerships and new models

• Deploy value-added services

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 63

Chris McWilton

President, U.S. Markets September 15, 2011

From Challenge to Growth:

U.S. Markets

Investment Community Meeting

©2011 MasterCard. Proprietary.

U.S. Markets: Focused to Win

Strong business performance despite protracted economic recovery

Significant deal momentum, particularly in Debit

Strategically positioned as mobile payments unfold

Developing resources to deal with growing, diverse customer base

Well aligned with U.S. consumer trends

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 65

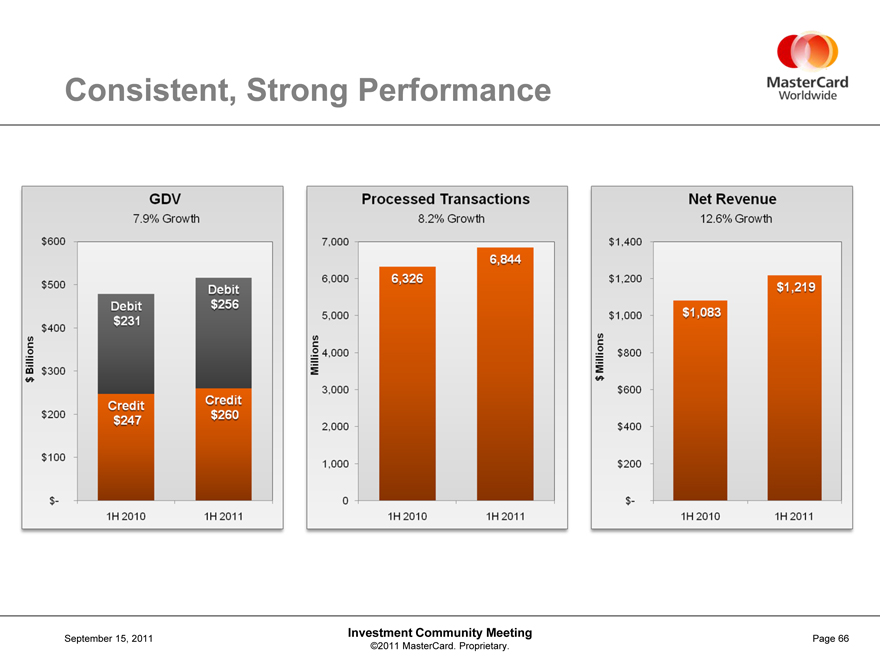

Consistent, Strong Performance

GDV 7.9% Growth $ Billions $600 $500 $400 $300 $200 $100 $- IH2010 IH2011

Debit $231 Debit $256

Credit Credit

$247 $260

Processed Transactions

8.2% Growth

7,000

6,000

5,000 4,000 3,000 2,000 1,000 0 6,326 6,844

IH2010 IH2011

Net Revenue 12.5% Growth $1,400 $1,200 $1,000 $800 $600 $400 $200 $- IH2010 IH2011 $1,083 $1,219

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 66

Significant Deal Activity and Momentum

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 67

Strategically Positioned in Mobile

Drive innovation in payments through

partnerships and alliances

across multiple industries

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 68

Moving Beyond Durbin

Reinforcing value Debit continues to provide

Leveraging advantages of MasterCard signature and PIN debit offerings

Operationalizing Fed rules to provide a competitive product and price

Solidifying key acquirer and merchant partnerships

Strategic, surgical approach

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 69

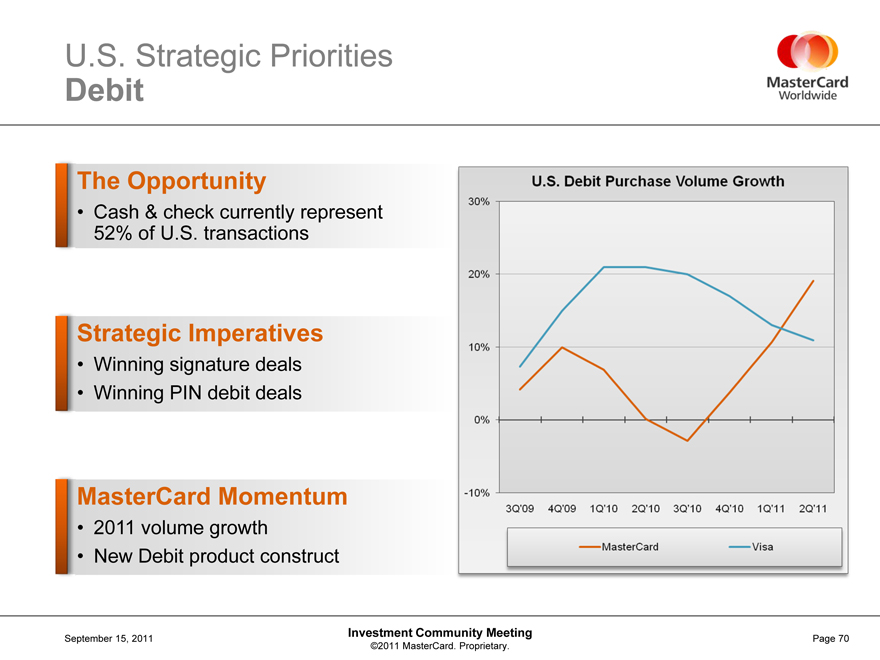

U.S. Strategic Priorities

Debit

The Opportunity

• Cash & check currently represent 52% of U.S. transactions

Strategic Imperatives

• Winning signature deals

• Winning PIN debit deals

MasterCard Momentum

• 2011 volume growth

• New Debit product construct

U.S. Debit Purchase Volume Growth

30% 20% 10% 0% -10% 3Q’09 4Q’09

1Q’10 2Q’10 3Q’10 4Q’10 1Q’11 2Q’11

MasterCard Visa

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 70

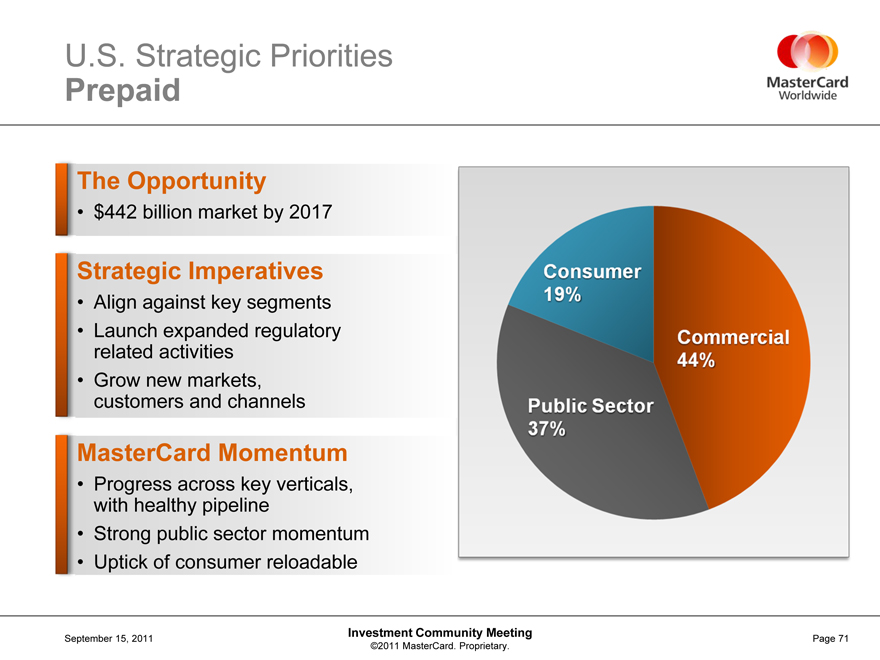

U.S. Strategic Priorities

Prepaid

The Opportunity

• $442 billion market by 2017

Strategic Imperatives

• Align against key segments

• Launch expanded regulatory related activities

• Grow new markets, customers and channels

MasterCard Momentum

• Progress across key verticals, with healthy pipeline

• Strong public sector momentum

• Uptick of consumer reloadable

Consumer 19%

Commercial 44%

Public Sector 37%

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 71

U.S. Strategic Priorities

Commercial

The Opportunity

• Estimated $10 trillion segment

Strategic Imperatives

• Demonstrate differentiated product suite

• Develop distinct needs-based solutions

• Enhance issuer and end-customer performance

MasterCard Momentum

• Significant portfolio flips

• Differentiated value proposition

• Smart Data expansion

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 72

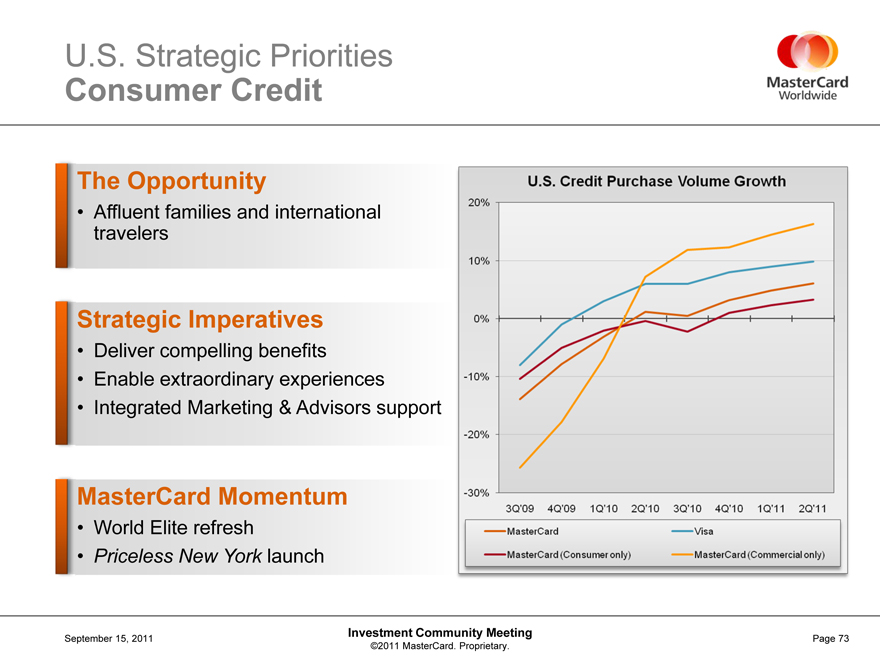

U.S. Strategic Priorities

Consumer Credit

The Opportunity

• Affluent families and international travelers

Strategic Imperatives

• Deliver compelling benefits

• Enable extraordinary experiences

• Integrated Marketing & Advisors support

MasterCard Momentum

• World Elite refresh

• Priceless New York launch

20% 10% 0% -10% -20% -30%

U.S. Credit Purchase Volume Growth

3Q’09 4Q’09 1Q’10 2Q’10 3Q’10 4Q’10 1Q’11 2Q’11

MasterCard

Visa

MasterCard (Consumer only)

MasterCard (Commercial only)

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 73

U.S. Strategic Priorities

Acceptance Channels

The Opportunity

• Merchants and acquirers core to business portion of U.S. revenue

Strategic Imperatives

• Broaden focus on merchant proposition

• Target high-yield vertical channels

• Identify innovative partnership opportunities

MasterCard Momentum

• Open new channels

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 74

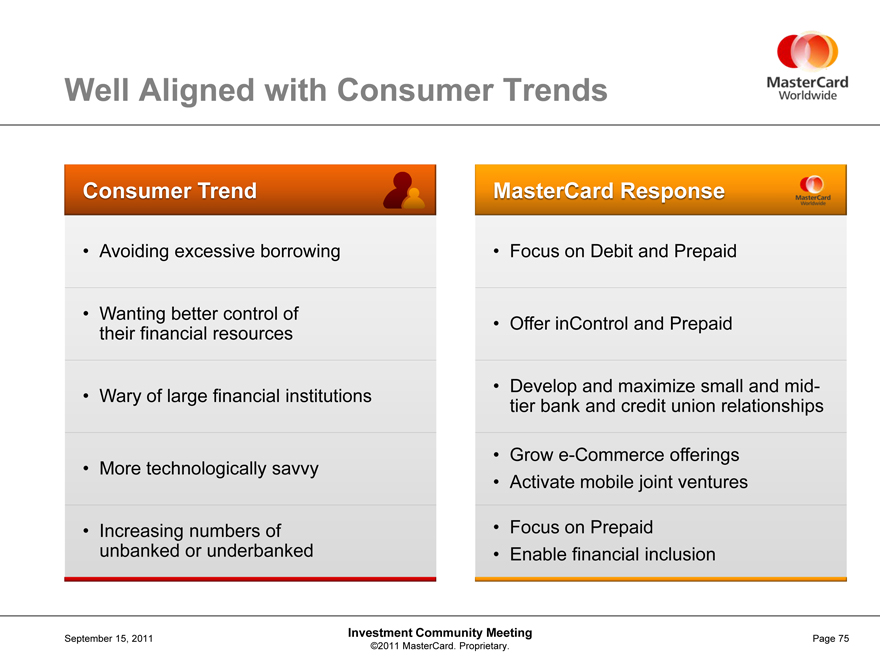

Well Aligned with Consumer Trends

Consumer Trend

• Avoiding excessive borrowing

• Wanting better control of their financial resources

• Wary of large financial institutions

• More technologically savvy

• Increasing numbers of unbanked or underbanked

MasterCard Response

• Focus on Debit and Prepaid

• Offer inControl and Prepaid

• Develop and maximize small and mid-tier bank and credit union relationships

• Grow e-Commerce offerings

• Activate mobile joint ventures

• Focus on Prepaid

• Enable financial inclusion

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 75

U.S. Markets: Focused to Win

Leveraging significant deal activity and momentum

Exercising prudence in financial negotiations

Investing in innovative products and solutions

Focusing on both traditional and non-traditional customers

Building, Growing and Diversifying revenue streams

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 76

Martina Hund-Mejean Chief Financial Officer September 15, 2011

Financial Perspective

Investment Community Meeting

©2011 MasterCard. Proprietary.

Topics for Today

2011 Outlook

Capital Structure Considerations

Long-Term Growth Opportunity

Long-Term Performance Targets

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 78

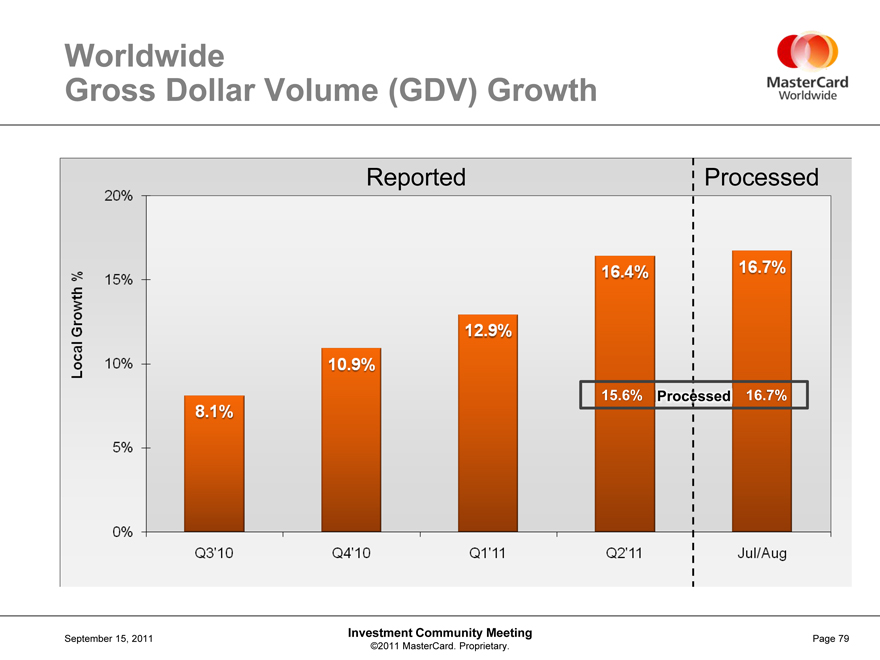

Worldwide

Gross Dollar Volume (GDV) Growth

Reported

Processed

15.6% Processed 16.7%

Local Growth %

20% 15% 10% 5% 0%

8.1% 10.9% 12.9% 16.4% 16.7%

Q3’10 Q4’10 Q1’11 Q2’11 Jul/Aug

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 79

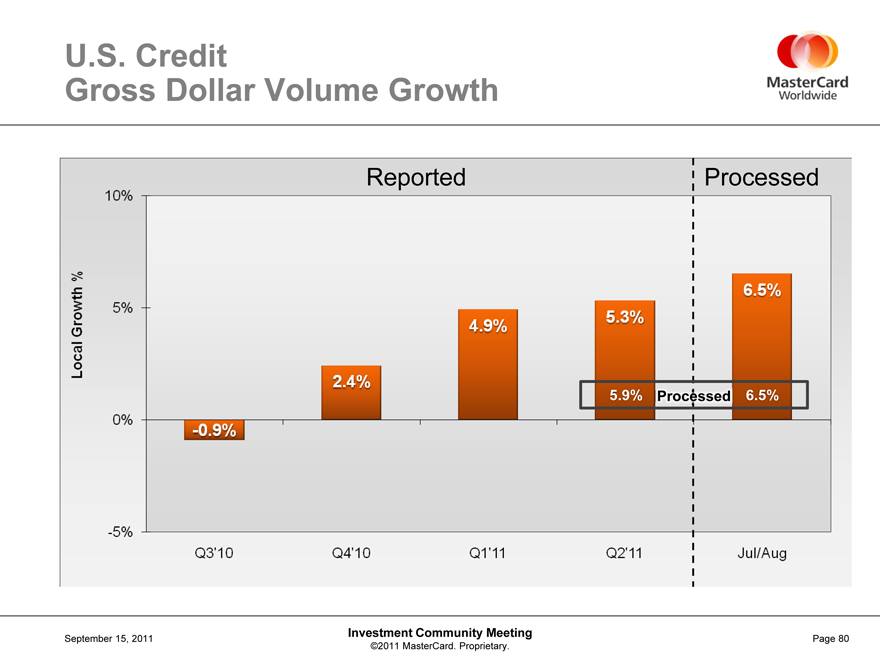

U.S. Credit

Gross Dollar Volume Growth

Reported Processed

5.9% Processed 6.5%

Local Growth %

10% 5% 0% -5%

-0.9% 2.4% 4.9% 5.3% 6.5%

Q3’10 Q4’10 Q1’11 Q2’11 Jul/Aug

Page 80

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

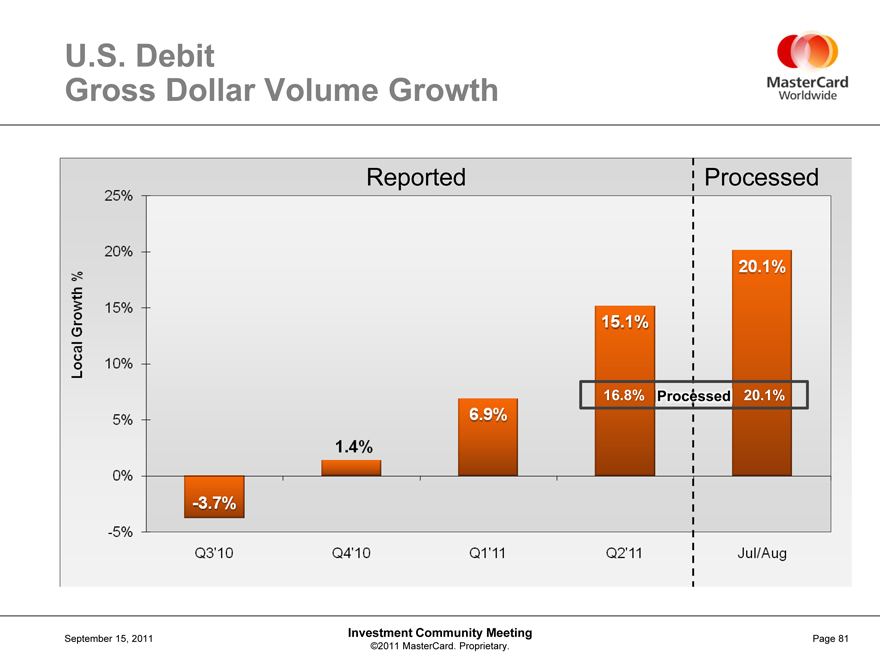

U.S. Debit

Gross Dollar Volume Growth

Reported Processed

16.8% Processed 20.1%

Local Growth %

25% 20% 15% 10% 5% 0% -5%

Q3’10 Q4’10 Q1’11 Q2’11 Jul/Aug

-3.7% 1.4% 6.9% 15.1% 20.1%

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 81

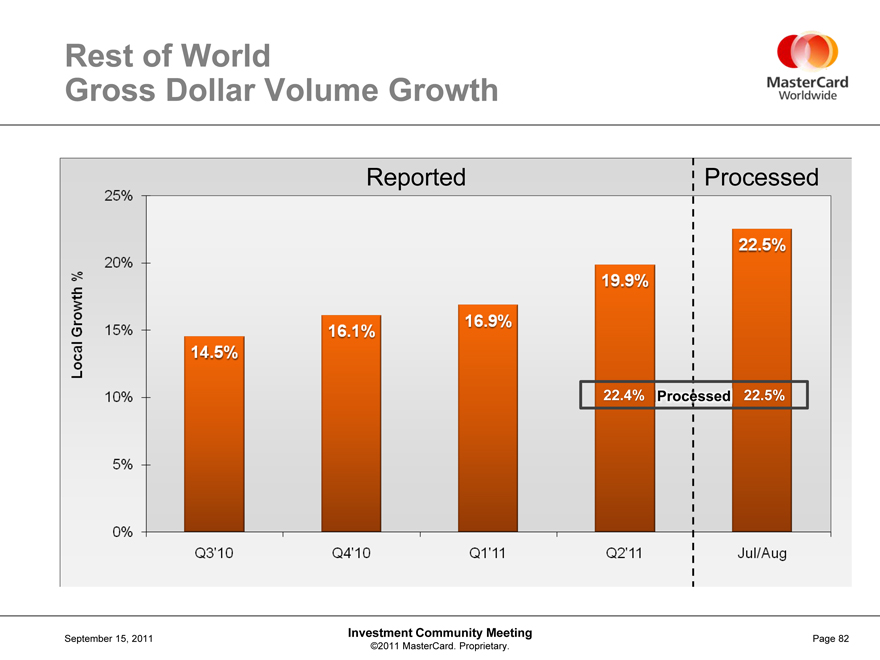

Rest of World

Gross Dollar Volume Growth

Reported Processed

22.4% Processed 22.5%

Local Growth %

25% 20% 15% 10% 5% 0%

Q3’10 Q4’10 Q1’11 Q2’11 Jul/Aug

14.5% 16.1% 16.9% 19.9% 22.5%

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 82

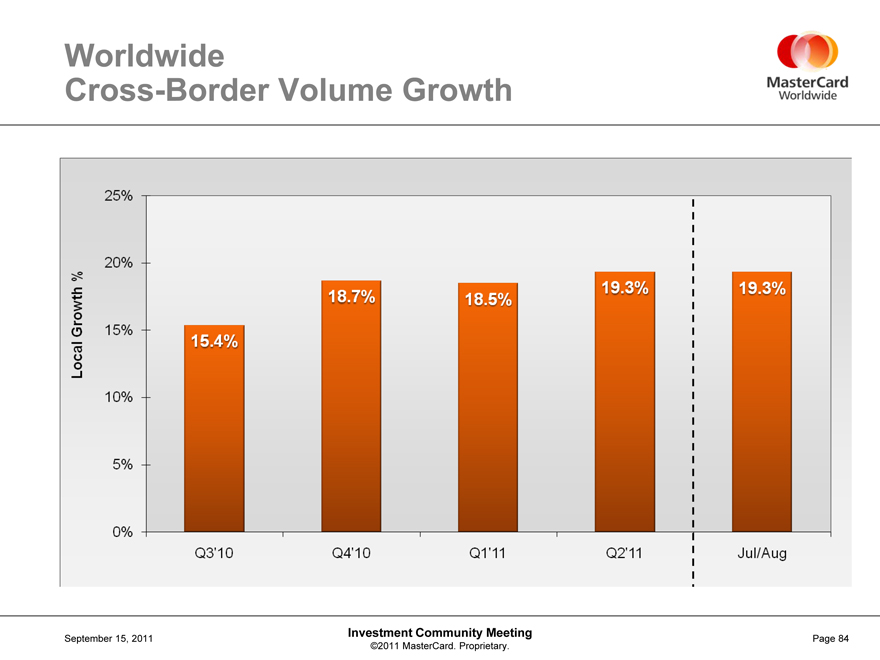

Worldwide

Processed Transactions

Local Growth %

24% 16% 8% 0%

Q3’10 Q4’10 Q1’11 Q2’11 Jul/Aug

0.6% 6.3% 11.1% 17.4% 20.3%

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 83

Worldwide

Cross-Border Volume Growth

Local Growth %

25% 20% 15% 10% 5% 0%

Q3’10 Q4’10 Q1’11 Q2’11 Jul/Aug

15.4% 18.7% 18.5% 19.3% 19.3%

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 84

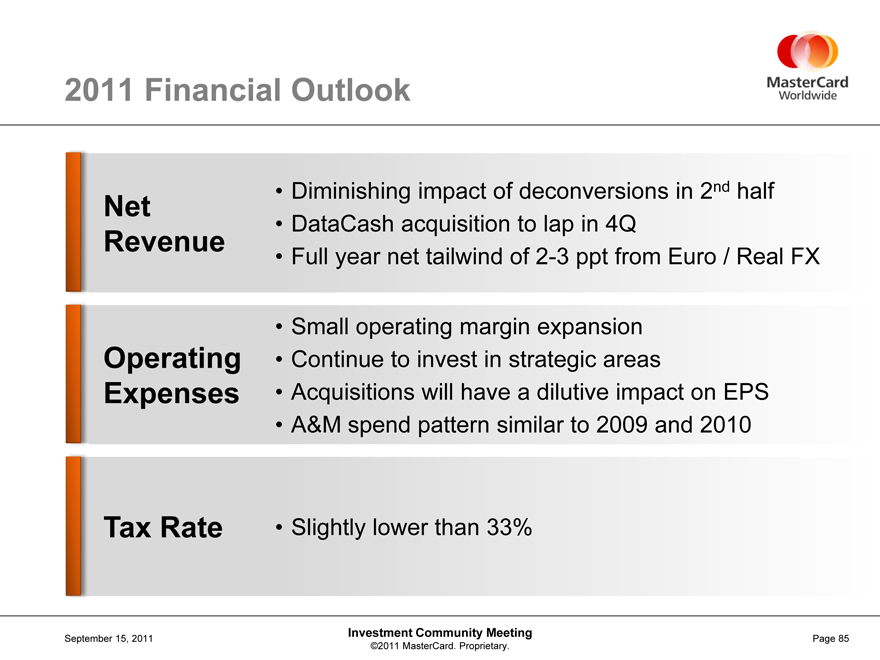

2011 Financial Outlook

Net Revenue

• Diminishing impact of deconversions in 2nd half

• DataCash acquisition to lap in 4Q

• Full year net tailwind of 2-3 ppt from Euro / Real FX

Operating Expenses

• Small operating margin expansion

• Continue to invest in strategic areas

• Acquisitions will have a dilutive impact on EPS

• A&M spend pattern similar to 2009 and 2010

Tax Rate

• Slightly lower than 33%

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 85

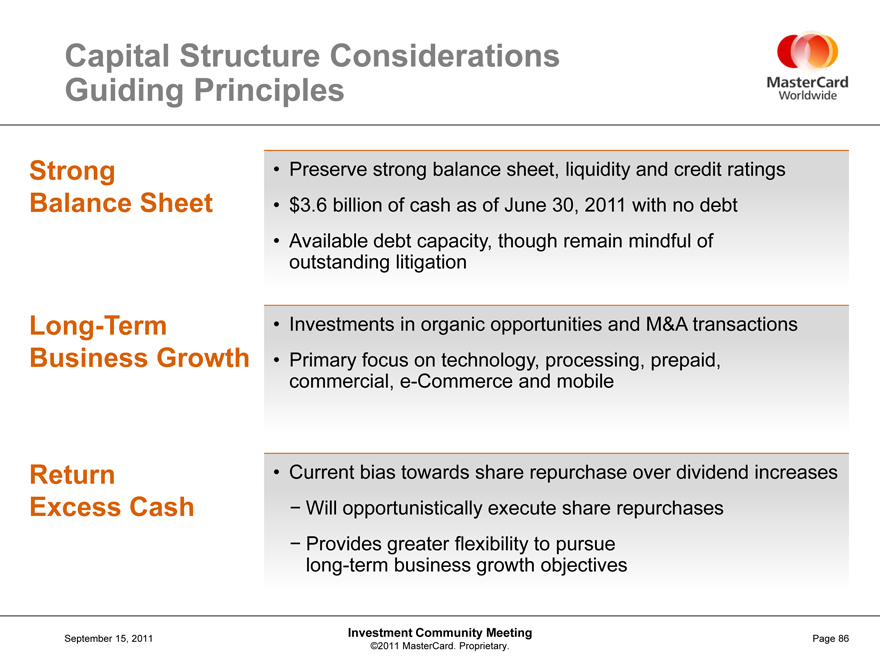

Capital Structure Considerations Guiding Principles

Strong Balance Sheet

Long-Term Business Growth

Return Excess Cash

• Preserve strong balance sheet, liquidity and credit ratings

• $3.6 billion of cash as of June 30, 2011 with no debt

• Available debt capacity, though remain mindful of outstanding litigation

• Investments in organic opportunities and M&A transactions

• Primary focus on technology, processing, prepaid, commercial, e-Commerce and mobile

• Current bias towards share repurchase over dividend increases

Will opportunistically execute share repurchases

Provides greater flexibility to pursue long-term business growth objectives

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 86

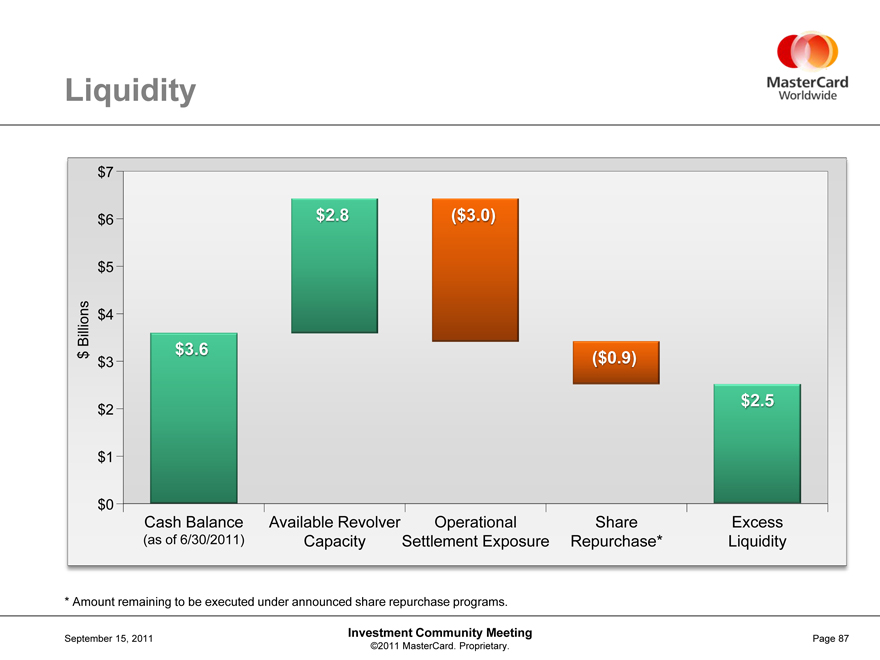

Liquidity

$7 $6 $5 $4 $3 $2 $1 $0

$ Billions

$3.6 $2.8 ($3.0) ($0.9) $2.5

Cash Balance

(as of 6/30/2011)

Available Revolver Capacity

Operational Settlement Exposure

Share Repurchase*

Excess Liquidity

* Amount remaining to be executed under announced share repurchase programs.

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 87

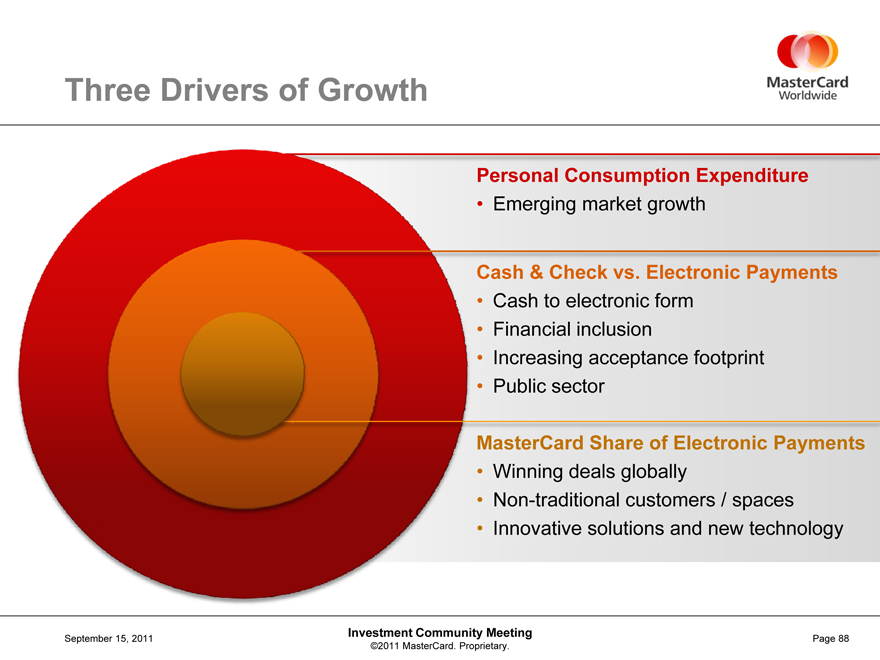

Three Drivers of Growth

Personal Consumption Expenditure

• Emerging market growth

Cash & Check vs. Electronic Payments

• Cash to electronic form

• Financial inclusion

• Increasing acceptance footprint

• Public sector

MasterCard Share of Electronic Payments

• Winning deals globally

• Non-traditional customers / spaces

• Innovative solutions and new technology

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 88

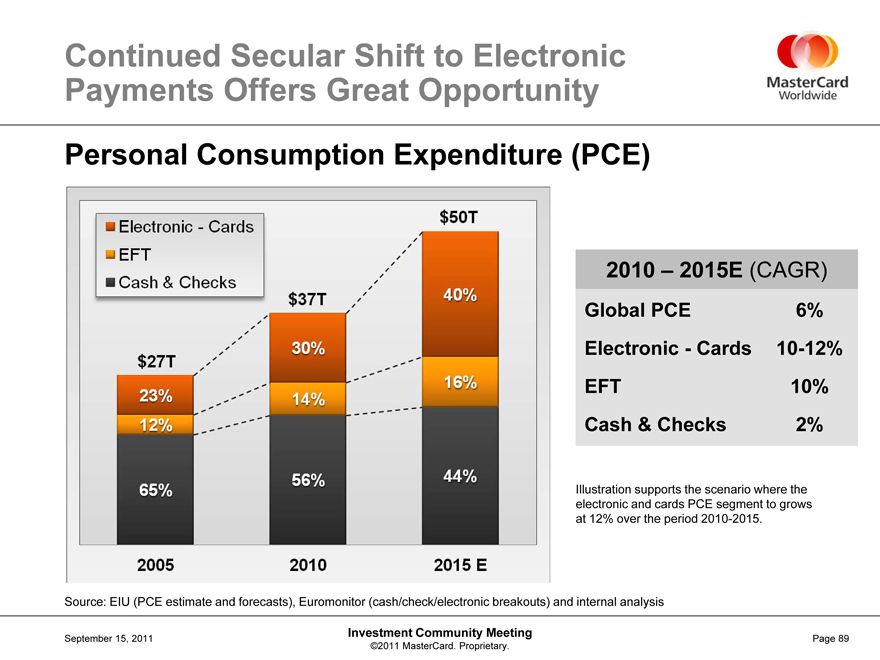

Continued Secular Shift to Electronic Payments Offers Great Opportunity

Personal Consumption Expenditure (PCE)

Electronic – Cards

EFT

Cash & Checks

$27T 23% 12% 65% $37T 30% 14% 56% $50T 40% 16% 44%

2005 2010 2015E

2010 – 2015E (CAGR) Global PCE 6% Electronic—Cards 10-12% EFT 10% Cash & Checks 2%

Illustration supports the scenario where the electronic and cards PCE segment to grows at 12% over the period 2010-2015.

Source: EIU (PCE estimate and forecasts), Euromonitor (cash/check/electronic breakouts) and internal analysis

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 89

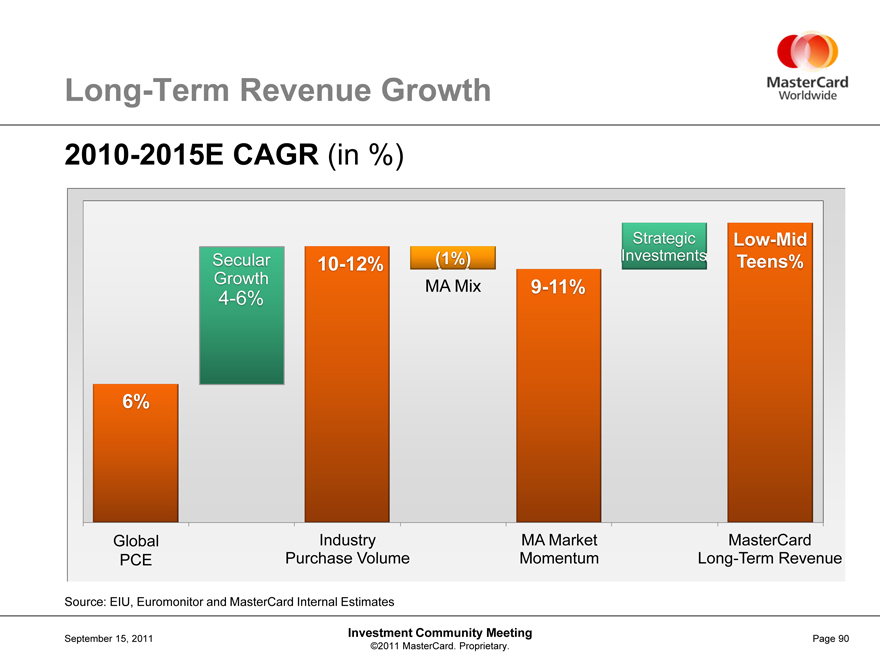

Long-Term Revenue Growth

2010-2015E CAGR (in %)

6% Secular Growth 4-6% 10-12% (1%) MA Mix 9-11% Strategic Investments Low-Mid Teens% Global PCE

Industry Purchase Volume

MA Market Momentum

MasterCard Long-Term Revenue

Source: EIU, Euromonitor and MasterCard Internal Estimates

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 90

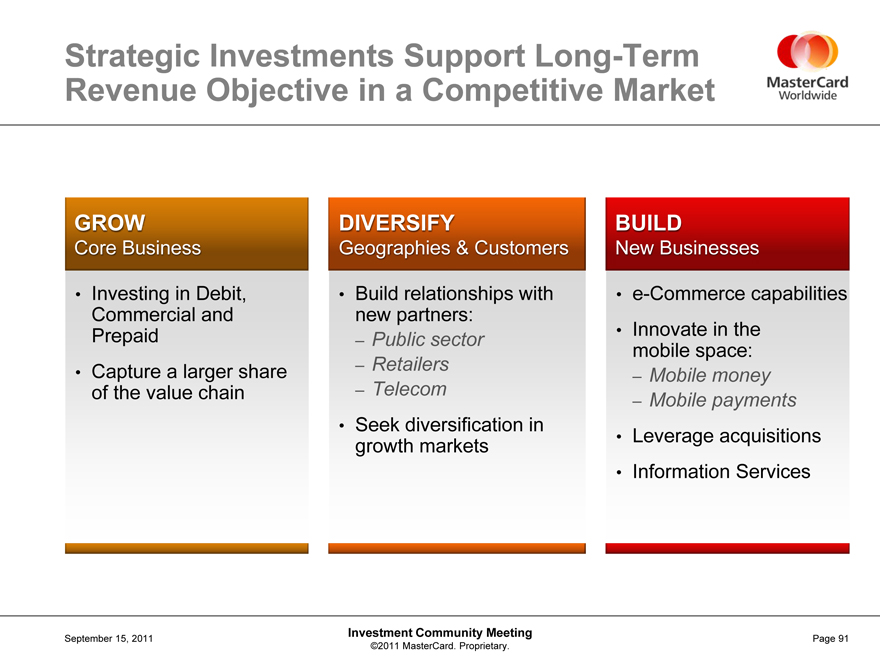

Strategic Investments Support Long-Term Revenue Objective in a Competitive Market

GROW

Core Business

• Investing in Debit, Commercial and Prepaid

• Capture a larger share of the value chain

DIVERSIFY

Geographies & Customers

• Build relationships with new partners:

– Public sector

– Retailers

– Telecom

• Seek diversification in growth markets

BUILD

New Businesses

• e-Commerce capabilities

• Innovate in the mobile space:

– Mobile money

– Mobile payments

• Leverage acquisitions

• Information Services

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 91

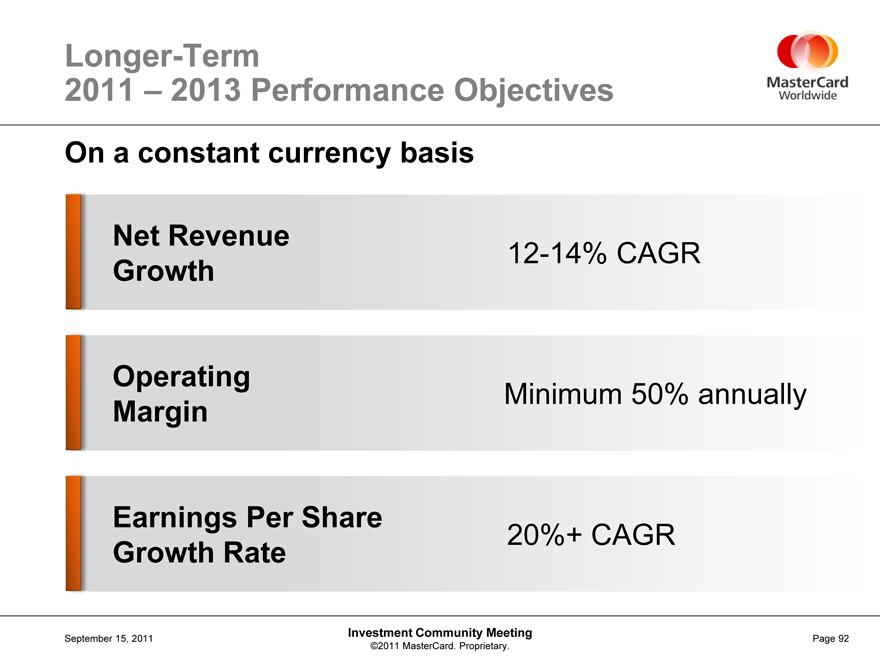

Longer-Term

2011 – 2013 Performance Objectives On a constant currency basis

Net Revenue Growth

12-14% CAGR

Operating Margin

Minimum 50% annually

Earnings Per Share Growth Rate

20%+ CAGR

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 92

September 15, 2011

Question & Answer Session

Investment Community Meeting

©2011 MasterCard. Proprietary.

September 15, 2011

Product Demos and Experience

Investment Community Meeting

©2011 MasterCard. Proprietary.

Ajay Banga

President and Chief Executive Officer September 15, 2011

Closing Comments

Investment Community Meeting

©2011 MasterCard. Proprietary.

Our Focus

Use technology and innovation – powered by our people, insights and expertise – to grow the payments space and our presence within it

Execute through the grow, diversify, build roadmap

Deliver on our commitments

September 15, 2011

Investment Community Meeting

©2011 MasterCard. Proprietary.

Page 95

MasterCard Worldwide

The Heart of Commerce