Exhibit 99.2

MasterCard Incorporated Third-Quarter 2012 Financial Results Conference Call

October 31, 2012

Business Update

Operational Overview

Economic Update

Business Highlights

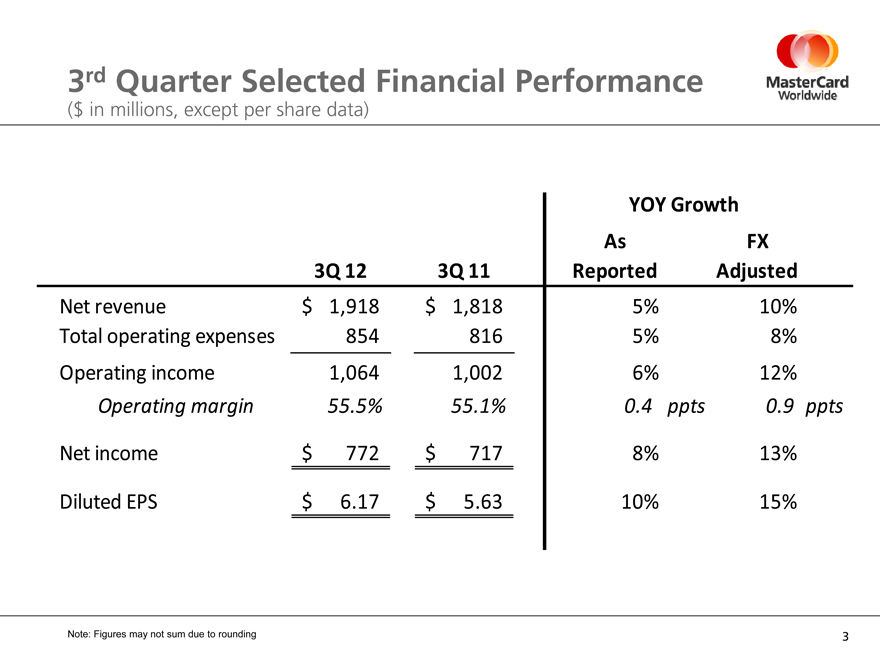

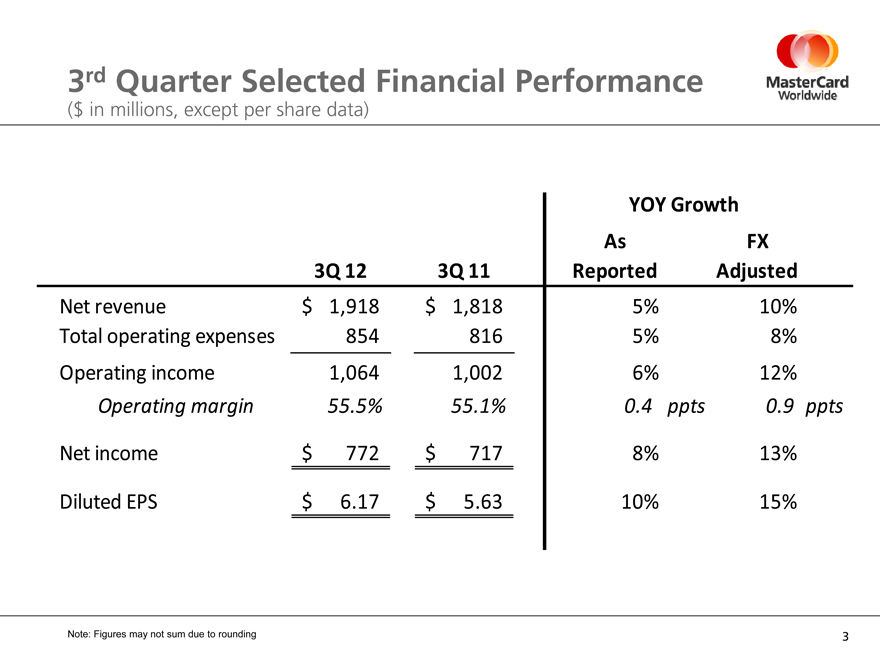

3rd Quarter Selected Financial Performance ($ in millions, except per share data)

YOY Growth

As FX

3Q 12 3Q 11 Reported Adjusted

Net revenue $ 1,918 $ 1,818 5% 10%

Total operating expenses 854 816 5% 8%

Operating income 1,064 1,002 6% 12%

Operating margin 55.5% 55.1% 0.4 ppts 0.9 ppts

Net income $ 772 $ 717 8% 13%

Diluted EPS $ 6.17 $ 5.63 10% 15%

Note: Figures may not sum due to rounding

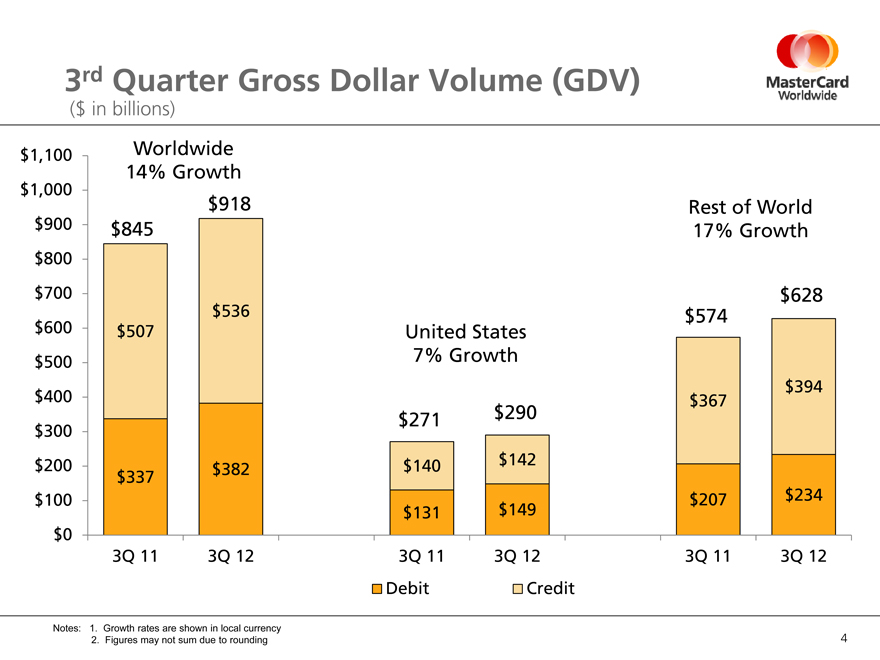

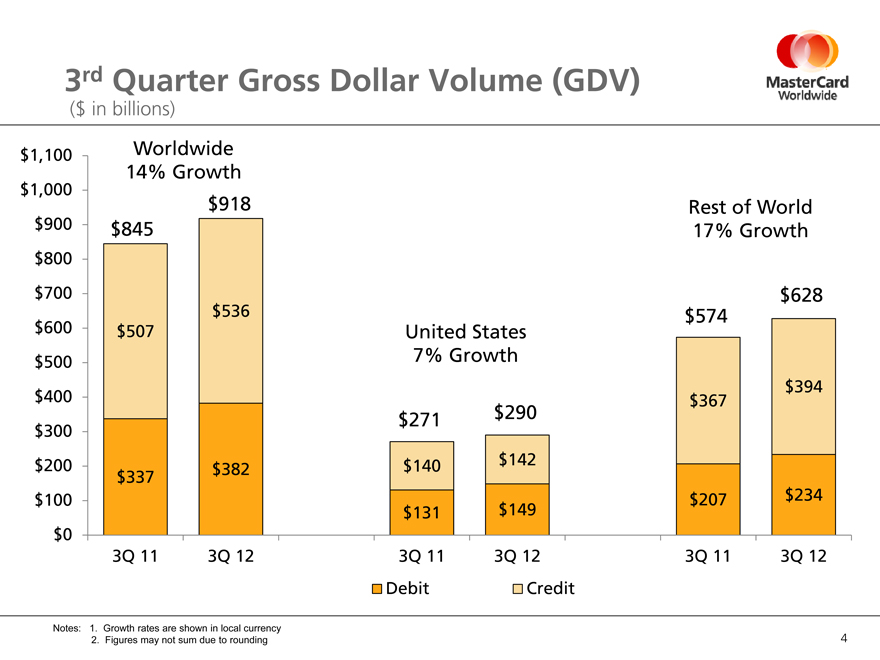

3rd Quarter Gross Dollar Volume (GDV)

($ in billions)

$1,100

Worldwide

14% Growth

$1,000

$918

Rest of World

$900

$845

17% Growth

$800

$700

$628

$536

$574

$600

$507

United States

$500

7% Growth

$394

$400

$367

$271

$290

$300

$200

$382

$140

$142

$337

$100

$207

$234

$131

$149

$0

3Q 11

3Q 12

3Q 11

3Q 12

3Q 11

3Q 12

Debit

Credit

Notes: 1. Growth rates are shown in local currency

2. Figures may not sum due to rounding

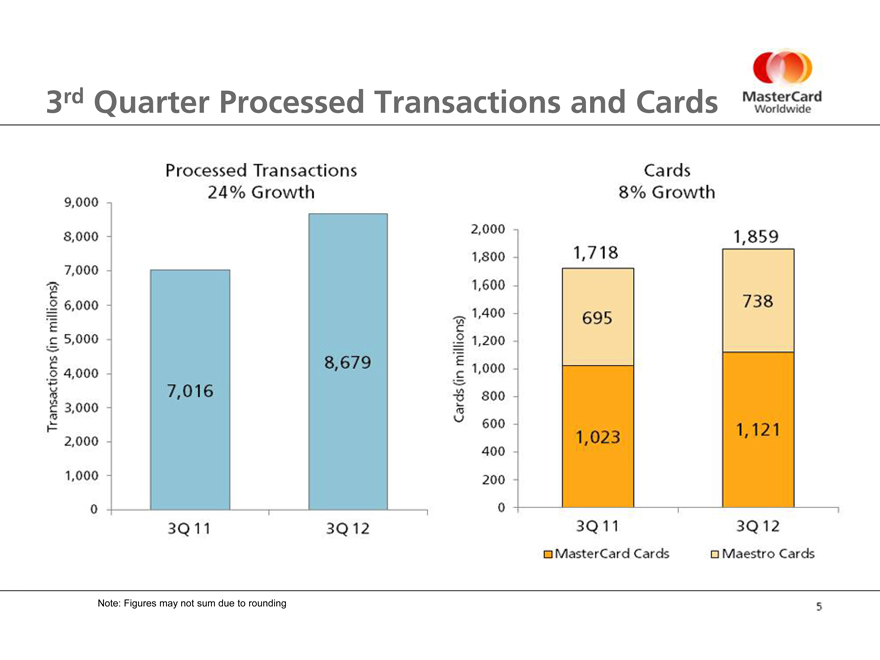

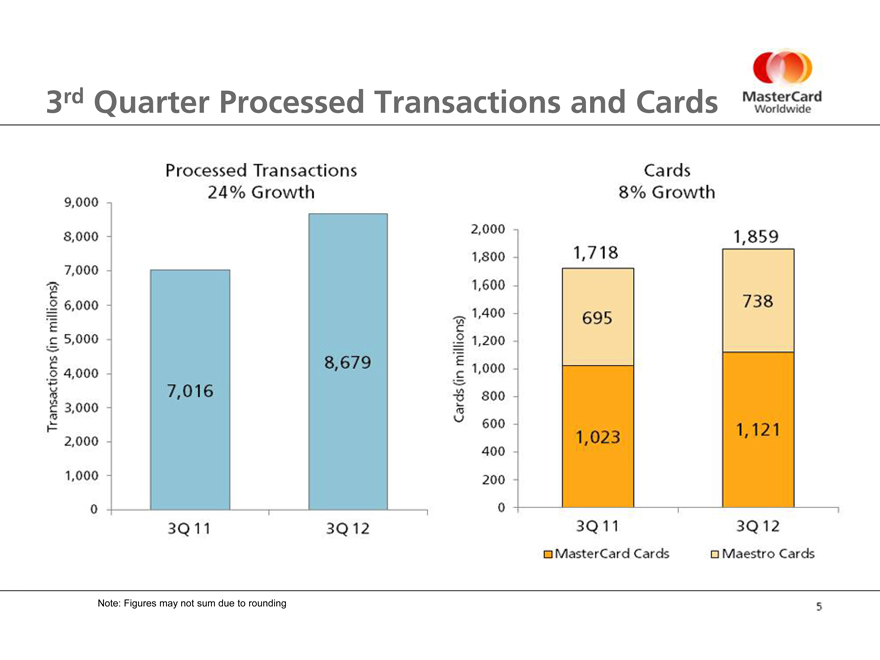

3rd Quarter Processed Transactions and Cards

Processed Transactions 24% Growth

9,000

8,000

7,000

6,000

5,000

8,679

4,000

7,016

Transactions (in millions)

3,000

2,000

1,000

0

3Q 11

3Q 12

Cards

8% Growth

2,000

1,859

1,800

1,718

1,600

738

1,400

695

Cards (in millions)

1,200

1,000

800

600

1,023

1,121

400

200

0

3Q 11

3Q 12

MasterCard Cards

Maestro Cards

Note: Figures may not sum due to rounding

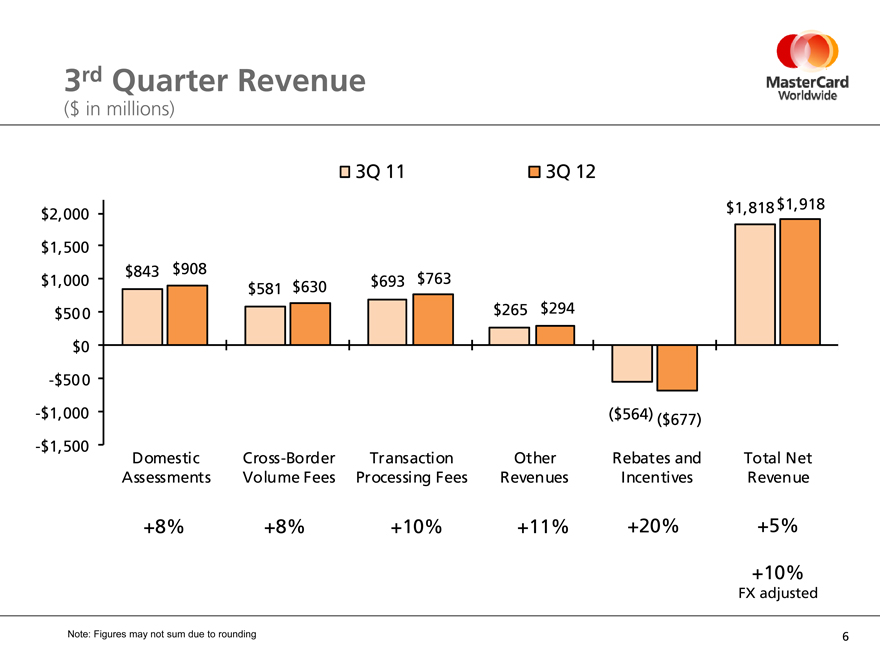

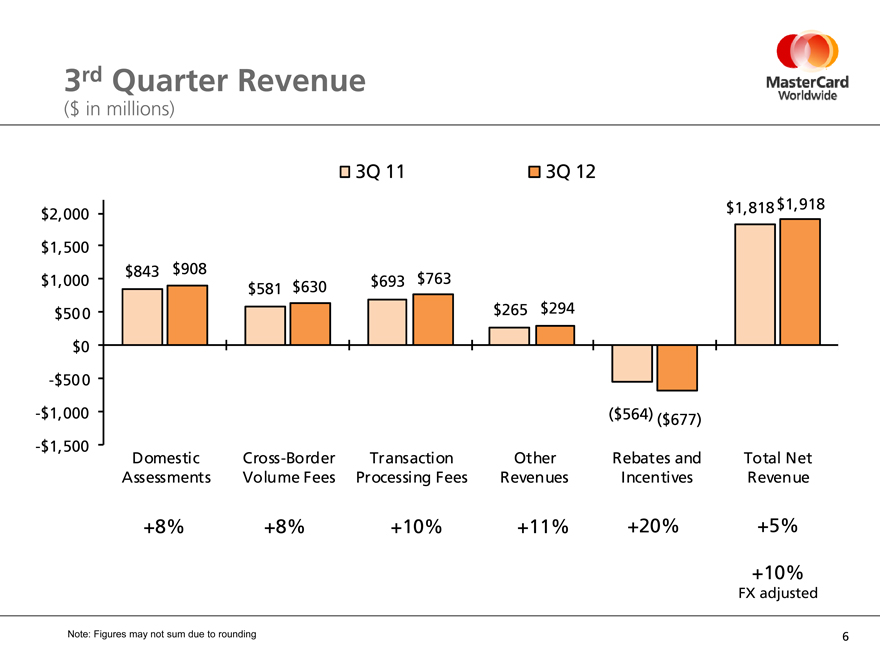

3rd Quarter Revenue

($ in millions)

3Q 11

3Q 12

$2,000

$1,818

$1,918

$1,500

$843

$908

$1, 000

$693

$763

$581

$630

$500

$265

$294

$0

-$500

-$1,000

($564)

($677)

-$1,500

Domestic Assessments

Cross-Border Volume Fees

Transaction Processing Fees

Other Revenues

Rebates and Incentives

Total Net Revenue

+8%

+8%

+10%

+11%

+20%

+5%

+10%

FX adjusted

Note: Figures may not sum due to rounding

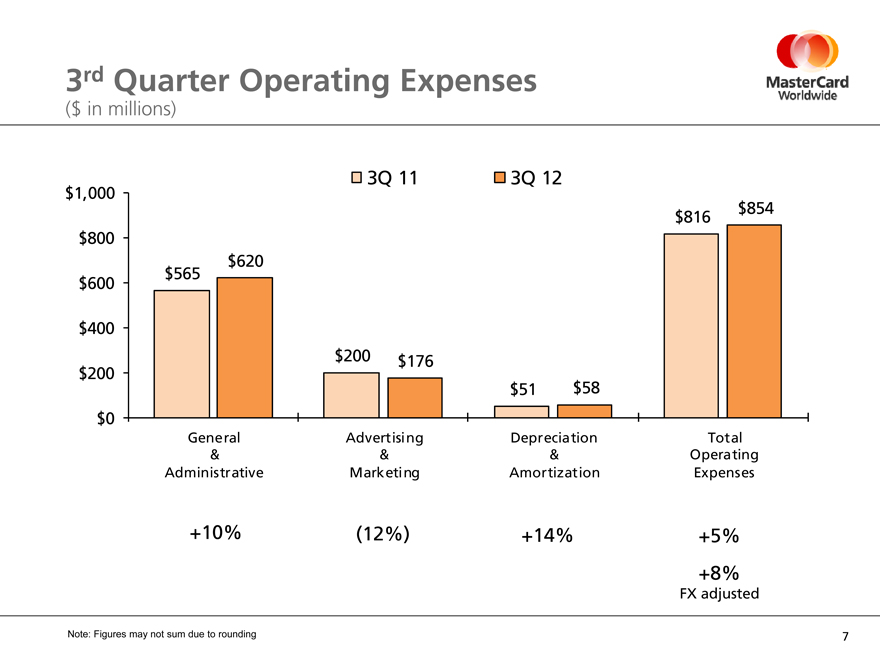

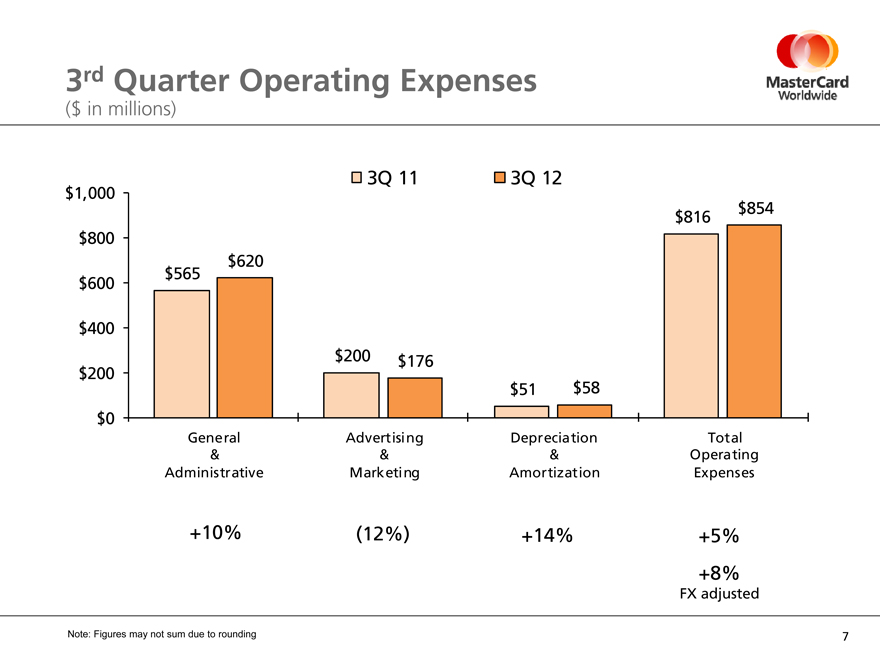

3rd Quarter Operating Expenses

($ in millions)

3Q 11

3Q 12

$1,000

$816

$854

$800

$620

$565

$600

$400

$200

$176

$200

$51

$58

$0

General & Administrative

Advertising & Marketing

Depreciation & Amortization

Total Operating Expenses

+10%

(12%)

+14%

+5%

+8%

FX adjusted

Note: Figures may not sum due to rounding

Thoughts for the Future

Business update through October 28

Thoughts for 2012

Net Revenue Operating Expenses Tax Rate

Long-term financial objectives

The Heart of Commerce™

9