|

Exhibit 99.2

|

MasterCard Incorporated Fourth-Quarter and Full-Year 2012 Financial Results Conference Call

January 31, 2013

Business Update

Operational Overview Economic Update Business Highlights

2

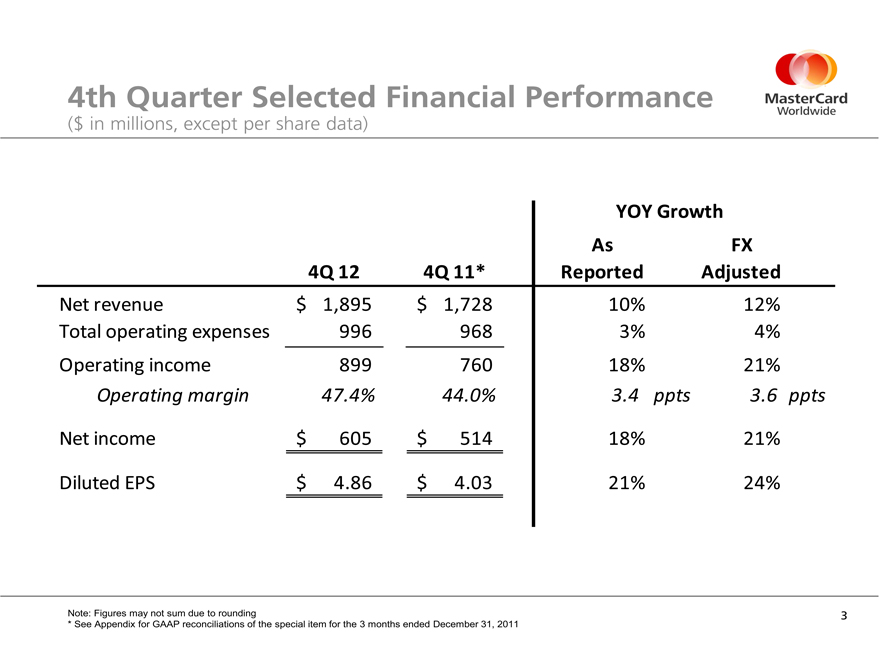

4th Quarter Selected Financial Performance

($ in millions, except per share data)

YOY Growth

As FX

4Q 12 4Q 11* Reported Adjusted

Net revenue $ 1,895 $ 1,728 10% 12%

Total operating expenses 996 968 3% 4%

Operating income 899 760 18% 21%

Operating margin 47.4% 44.0% 3.4 ppts 3.6 ppts

Net income $ 605 $ 514 18% 21%

Diluted EPS $ 4.86 $ 4.03 21% 24%

Note: Figures may not sum due to rounding

* See Appendix for GAAP reconciliations of the special item for the 3 months ended December 31, 2011

3

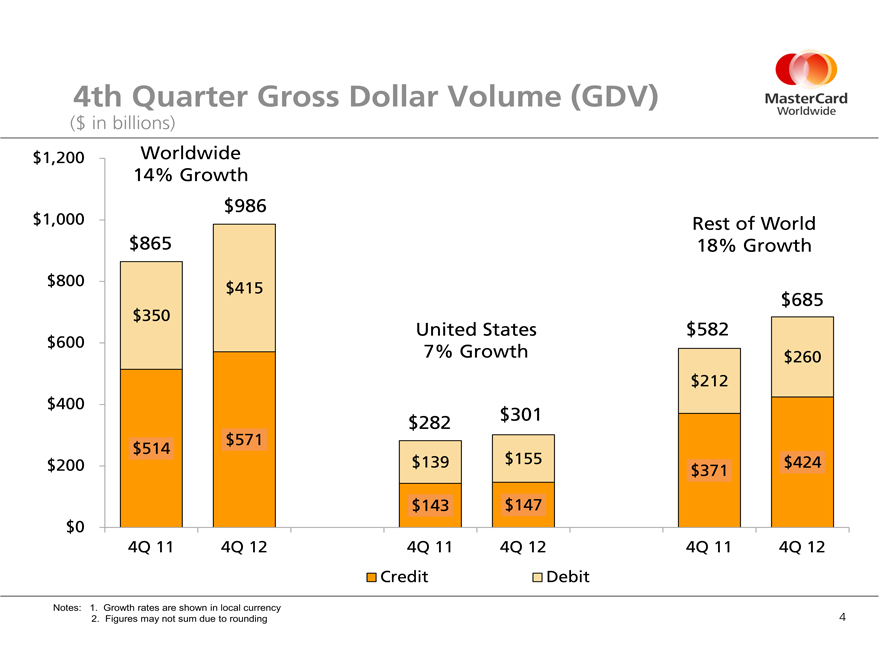

4th Quarter Gross Dollar Volume (GDV)

($ in billions)

$1,200 Worldwide

14% Growth

$ 986

$1,000 Rest of World

$865 18% Growth

$800 $415

$685

$350

United States $582

$600

7% Growth $260

$212

$400

$282 $301

$514 $571

$200 $139 $155 $371 $424

$143 $147

$0

4Q 11 4Q 12 4Q 11 4Q 12 4Q 11 4Q 12

Credit Debit

Notes: 1. Growth rates are shown in local currency

2. Figures may not sum due to rounding

4

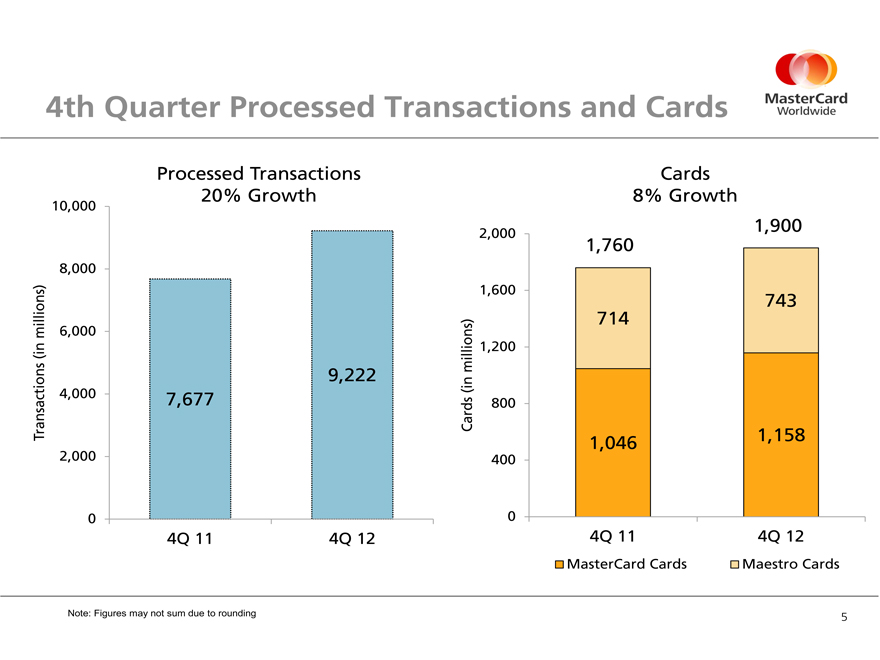

4th Quarter Processed Transactions and Cards

Transactions (in millions)

0 2,000 4,000 6,000 8,000 10,000

Processed Transactions 20% Growth

9,222 7,677

4Q 11 4Q 12

Cards (in millions)

0 400 800 1,200 1,600 2,000

1,900 1,760

743 714

1,046 1,158

4Q 11 4Q 12

Cards

8% Growth

MasterCard Cards Maestro Cards

Note: Figures may not sum due to rounding

5

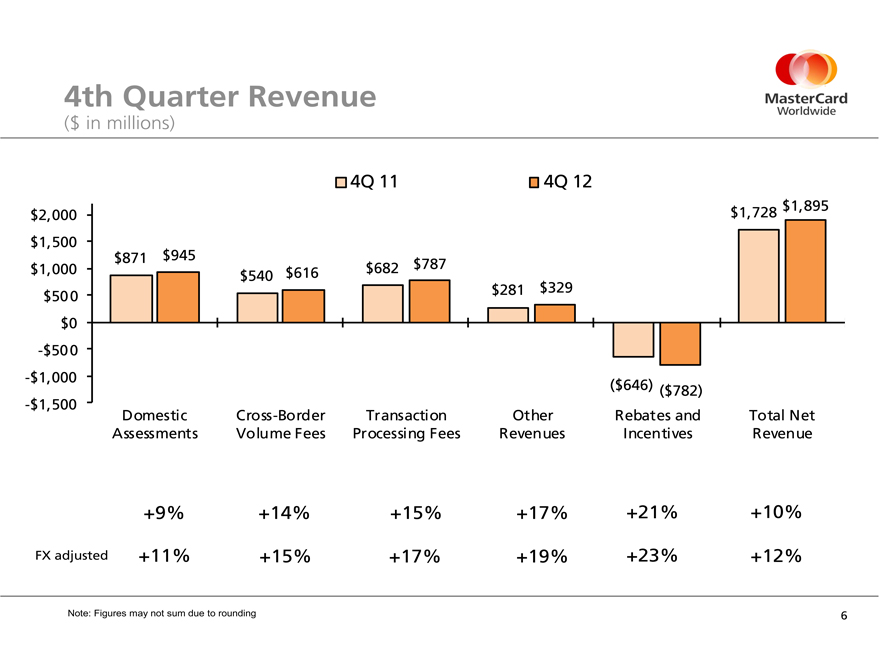

4th Quarter Revenue

($ in millions)

4Q 11 4Q 12

$2,000 $1,500 $1,000 $500 $0

-$500

-$1,000

-$1,500

$871 $945 $682 $787 $540 $616 $281 $329

$1,728 $1,895

($646) ($782)

Domestic Cross -Border Transaction Other Rebates and Total Net

Assessments Volume Fees Processing Fees Revenues Incentives Revenue

+9% +14% +15% +17% +21% +10%

FX adjusted +11% +15% +17% +19% +23% +12%

Note: Figures may not sum due to rounding

6

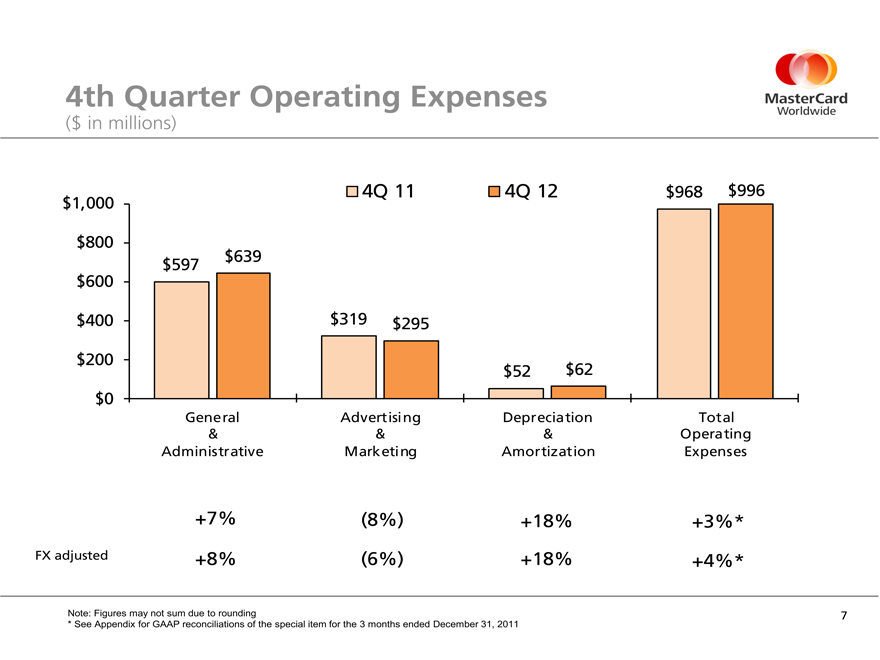

4th Quarter Operating Expenses

($ in millions)

$1,000 4Q 11 4Q 12 $968 $996

$800

$597 $639

$600

$400 $319 $295

$200 $52 $62

$0

General Advertising Depreciation Total

& & & Operating

Administrative Marketing Amortization Expenses

+7% (8%) +18% +3%*

FX adjusted +8% (6%) +18% +4%*

Note: Figures may not sum due to rounding

* See Appendix for GAAP reconciliations of the special item for the 3 months ended December 31, 2011

7

Thoughts for the Future

Business update through January 28 Long-term Performance Objectives Thoughts for 2013

Net Revenue Operating Expenses Tax Rate FX sensitivity

8

Master Card Worldwide

The Heart of CommerceTM

9

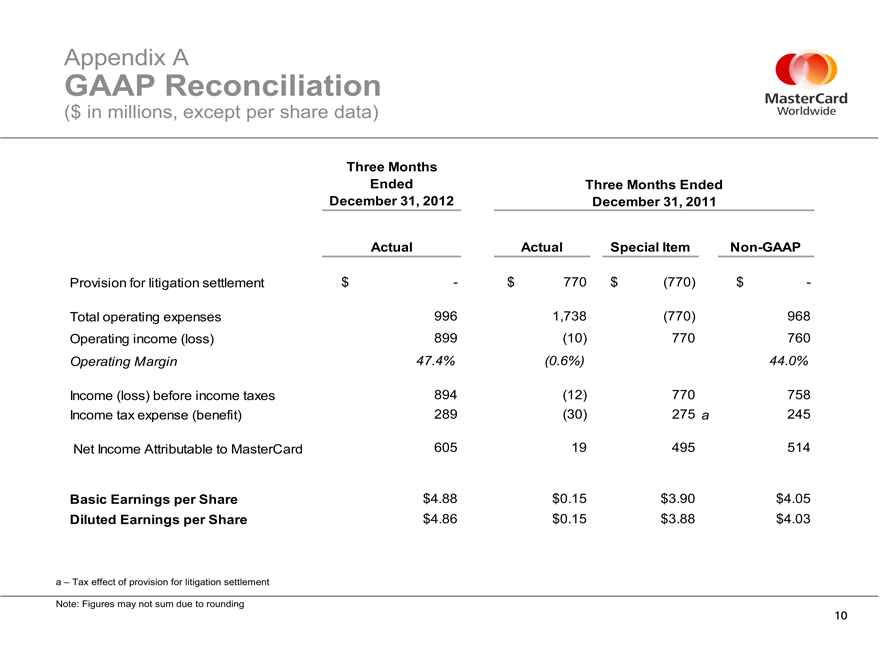

Appendix GAAP Reconciliation A

($ in millions, except per share data)

Three Months

Ended Three Months Ended

December 31, 2012 December 31, 2011

Actual Actual Special Item Non-GAAP

Provision for litigation settlement $ —$ 770 $ (770) $ -

Total operating expenses 996 1,738 (770) 968

Operating income (loss) 899 (10) 770 760

Operating Margin 47.4% (0.6%) 44.0%

Income (loss) before income taxes 894 (12) 770 758

Income tax expense (benefit) 289 (30) 275 a 245

Net Income Attributable to MasterCard 605 19 495 514

Basic Earnings per Share $ 4.88 $ 0.15 $ 3.90 $ 4.05

Diluted Earnings per Share $ 4.86 $ 0.15 $ 3.88 $ 4.03

a – Tax effect of provision for litigation settlement

Note: Figures may not sum due to rounding

10

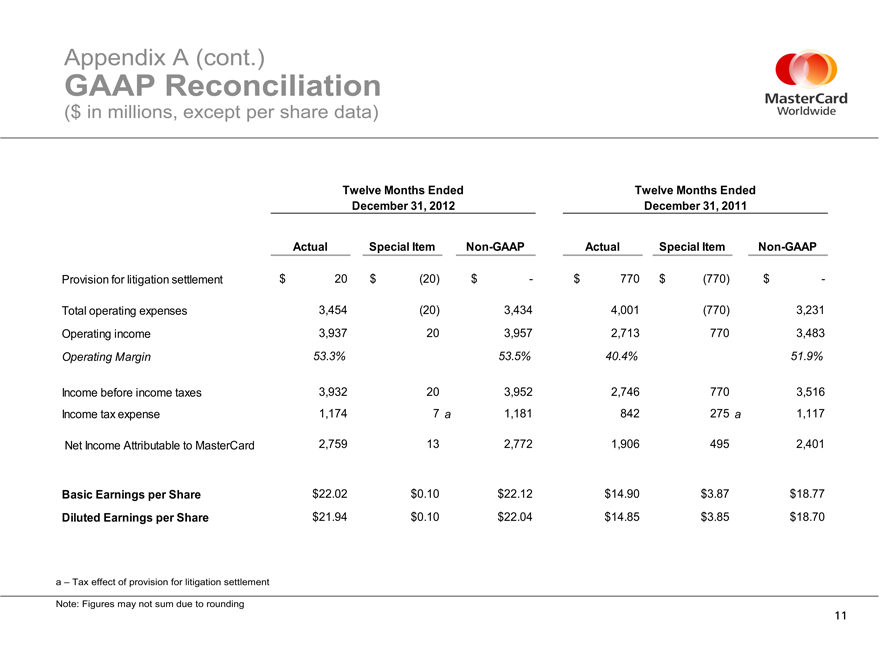

Appendix GAAP Reconciliation A (cont.)

($ in millions, except per share data)

Twelve Months Ended Twelve Months Ended

December 31, 2012 December 31, 2011

Actual Special Item Non-GAAP Actual Special Item Non-GAAP

Provision for litigation settlement $ 20 $ (20) $—$ 770 $ (770) $ -

Total operating expenses 3,454 (20) 3,434 4,001 (770) 3,231

Operating income 3,937 20 3,957 2,713 770 3,483

Operating Margin 53.3% 53.5% 40.4% 51.9%

Income before income taxes 3,932 20 3,952 2,746 770 3,516

Income tax expense 1,174 7 a 1,181 842 275 a 1,117

Net Income Attributable to MasterCard 2,759 13 2,772 1,906 495 2,401

Basic Earnings per Share $22.02 $ 0.10 $22.12 $14.90 $3.87 $18.77

Diluted Earnings per Share $21.94 $ 0.10 $22.04 $14.85 $3.85 $18.70

a – Tax effect of provision for litigation settlement

Note: Figures may not sum due to rounding

11

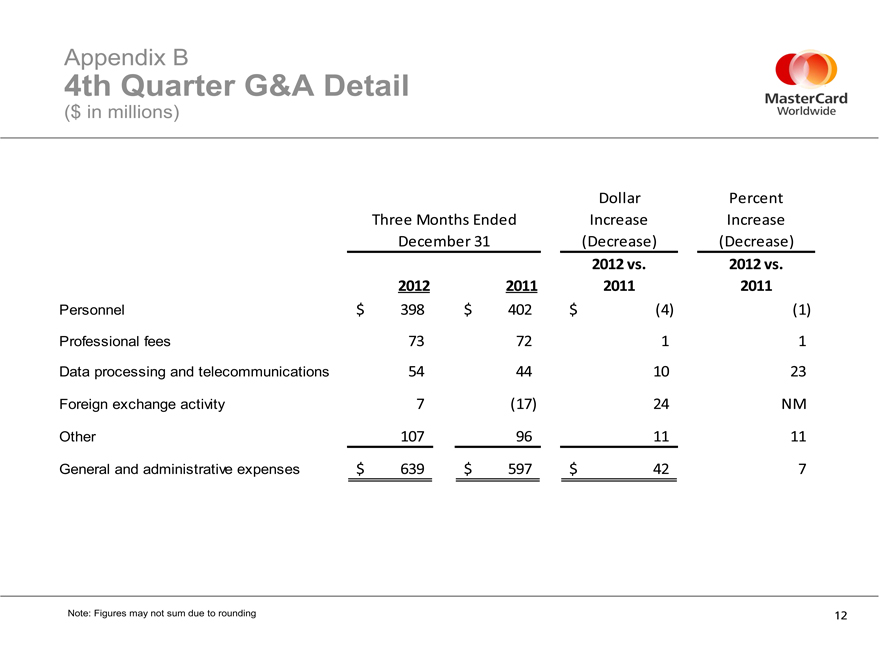

4th Appendix Quarter B G&A Detail

($ in millions)

Dollar Percent

Three Months Ended Increase Increase

December 31 (Decrease) (Decrease)

2012 vs. 2012 vs.

2012 2011 2011 2011

Personnel $ 398 $ 402 $ (4) (1)

Professional fees 73 72 1 1

Data processing and telecommunications 54 44 10 23

Foreign exchange activity 7 (17) 24 NM

Other 107 96 11 11

General and administrative expenses $ 639 $ 597 $ 42 7

Note: Figures may not sum due to rounding

12