|

Exhibit 99.1

|

Martina Hund-Mejean Chief Financial Officer September 11, 2013

Financial Perspective

2013 Investment Community Meeting

©2013 MasterCard. Proprietary and Confidential

Topics for Today

Page 2

2013 Outlook

Investments for Growth Capital Planning Long-Term Outlook

MasterCard Investment Community Meeting ©2013 MasterCard. September 11, 2013

Proprietary and Confidential

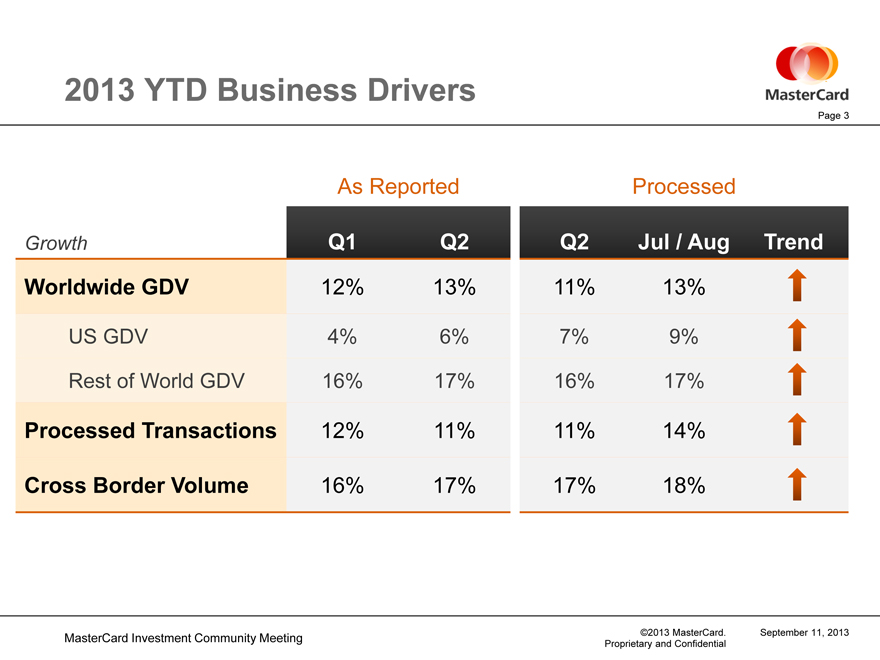

2013 YTD Business Drivers

Page 3

As Reported Processed

Growth Q1 Q2 Q2 Jul / Aug Trend Worldwide GDV 12% 13% 11% 13%

US GDV 4% 6% 7% 9%

Rest of World GDV 16% 17% 16% 17%

Processed Transactions 12% 11% 11% 14%

Cross Border Volume 16% 17% 17% 18%

MasterCard Investment Community Meeting ©2013 MasterCard. September 11, 2013

Proprietary and Confidential

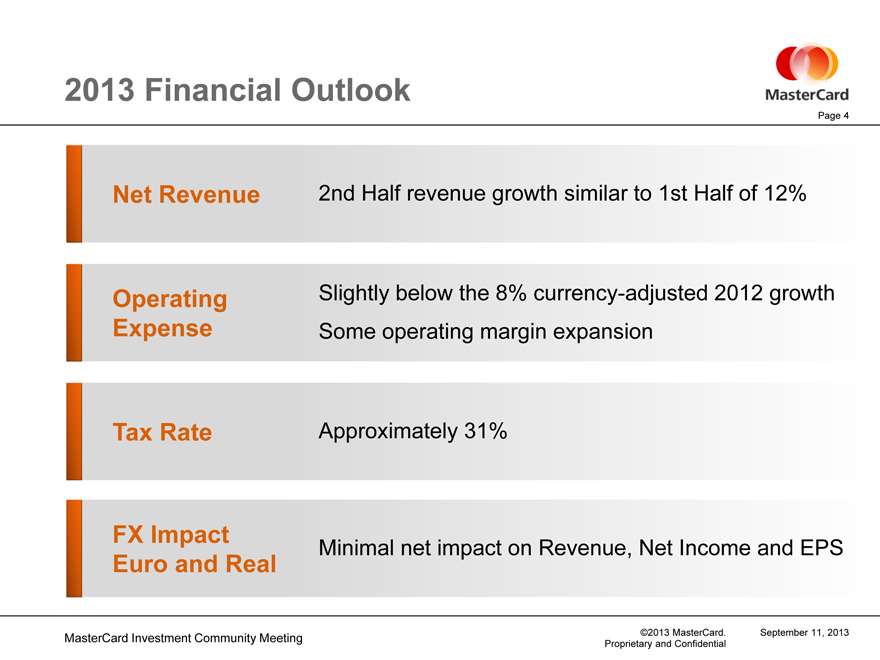

2013 Financial Outlook

Page 4

Net Revenue

2nd Half revenue growth similar to 1st Half of 12%

Operating Slightly below the 8% currency-adjusted 2012 growth Expense Some operating margin expansion

Tax Rate

Approximately 31%

FX Impact

Minimal net impact on Revenue, Net Income and EPS

Euro and Real

MasterCard Investment Community Meeting ©2013 MasterCard. September 11, 2013

Proprietary and Confidential

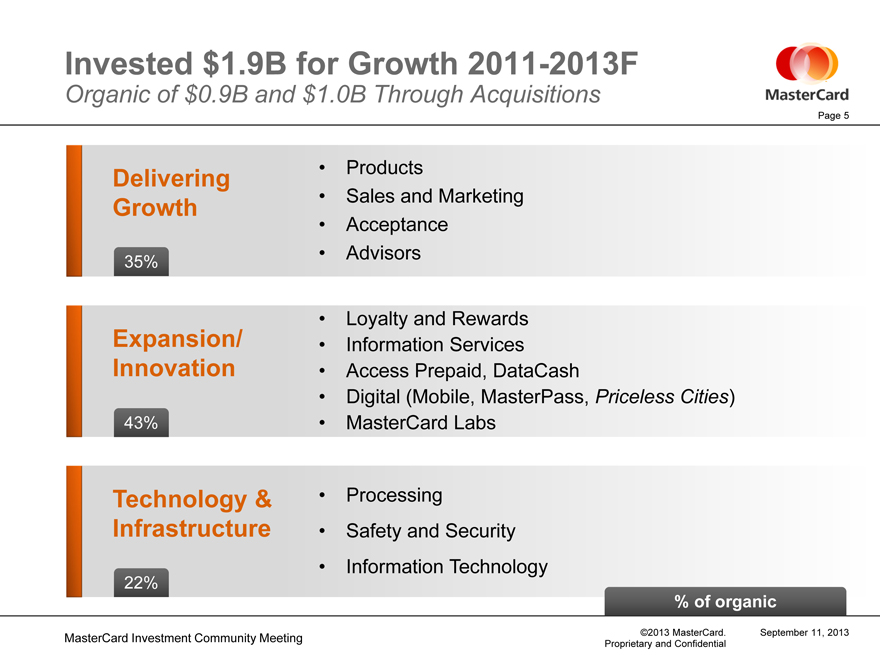

Invested $1.9B for Growth 2011-2013F

Organic of $0.9B and $1.0B Through Acquisitions

Page 5

Delivering • Products

Sales and Marketing

Growth

Acceptance

Advisors

35%

Expansion/ • Loyalty and Rewards

Information Services Innovation Access Prepaid, DataCash

Digital (Mobile, MasterPass, Priceless Cities) 43% MasterCard Labs

Technology & • Processing

Infrastructure • Safety and Security

Information Technology

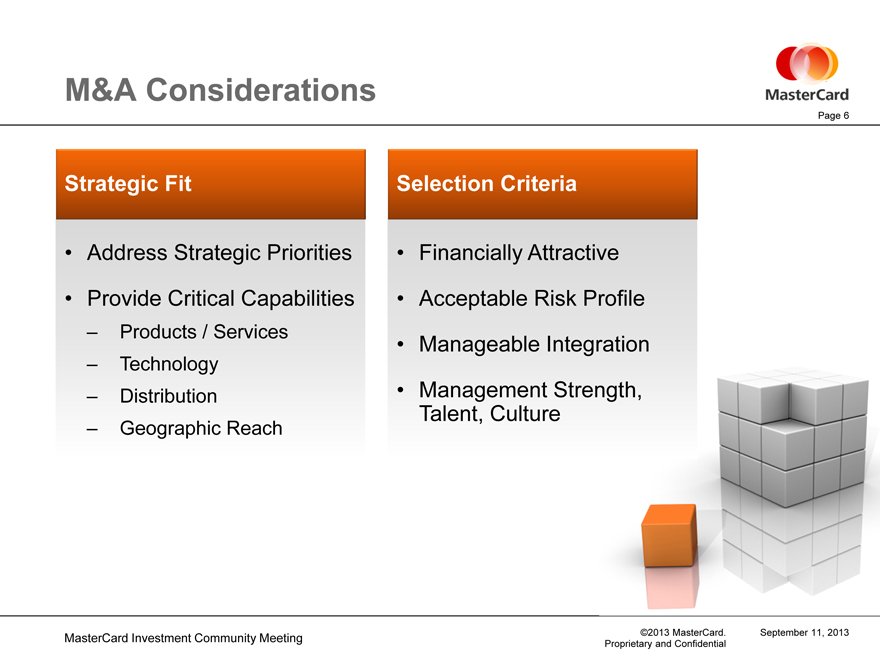

M&A Considerations

Page 6

Strategic Fit Selection Criteria

• | | Address Strategic Priorities |

• | | Provide Critical Capabilities |

– Products / Services

– Technology

– Distribution

– Geographic Reach

• | | Acceptable Risk Profile |

• | | Management Strength, Talent, Culture |

MasterCard Investment Community Meeting ©2013 MasterCard. September 11, 2013

Proprietary and Confidential

Capital Planning – Priorities

Page 7

Strong Preserve strong balance sheet, liquidity and Balance Sheet credit ratings

Long-Term Investments in organic opportunities and M&A

Business Growth

Return Excess Cash Continue to return excess cash with bias to Shareholders towards share repurchases

MasterCard Investment Community Meeting ©2013 MasterCard. September 11, 2013

Proprietary and Confidential

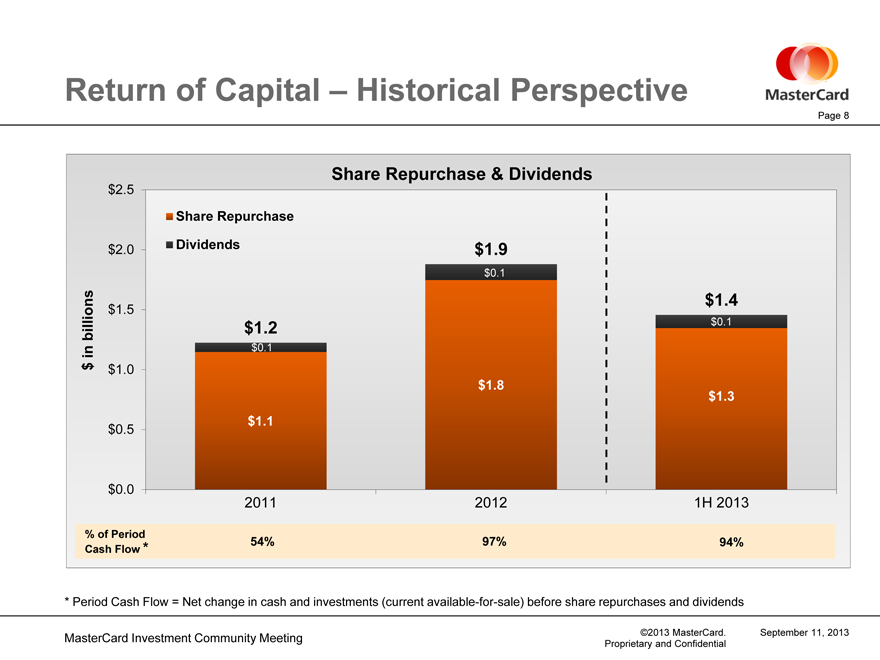

Return of Capital – Historical Perspective

Page 8

Share Repurchase & Dividends

$2.5

Share Repurchase

$2.0 Dividends $1.9

$0.1

$1.4

$1.5 billions $1.2 $0.1

in $0.1

$ $1.0 $1.8 $1.3 $1.1

$0.5

$0.0 2011 2012 1H 2013

% of Period

Cash Flow

* Period Cash Flow = Net change in cash and investments (current available-for-sale) before share repurchases and dividends

MasterCard Investment Community Meeting ©2013 MasterCard. September 11, 2013

Proprietary and Confidential

Three Drivers of Growth

Page 9

Personal Consumption Expenditure

Cash & Check vs. Electronic Payments

MasterCard Share of Electronic Payments

MasterCard Investment Community Meeting ©2013 MasterCard. September 11, 2013

Proprietary and Confidential

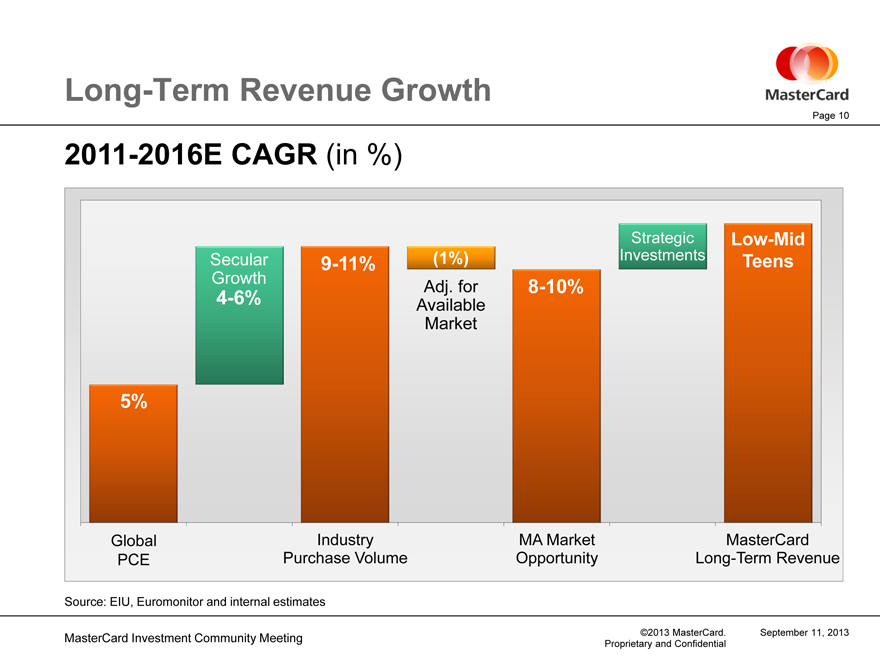

Long-Term Revenue Growth

Page 10

2011-2016E CAGR (in %)

Strategic Low-Mid Secular 9-11% (1%) Investments Teens

Growth

Adj. for 8-10% 4-6% Available Market

5%

Global Industry MA Market MasterCard PCE Purchase Volume Opportunity Long-Term Revenue

Source: EIU, Euromonitor and internal estimates

MasterCard Investment Community Meeting ©2013 MasterCard. September 11, 2013

Proprietary and Confidential

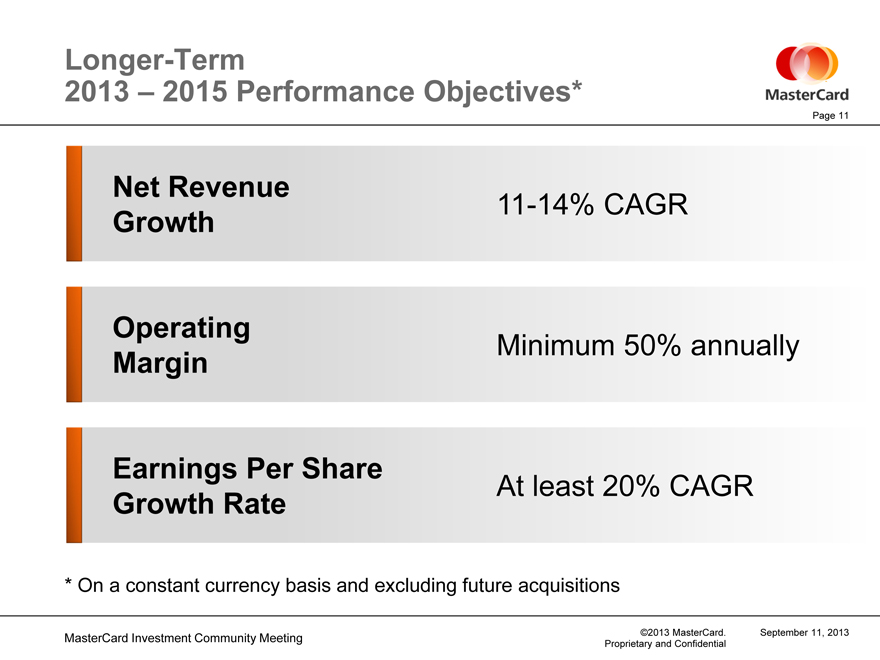

Longer-Term

2013 – 2015 Performance Objectives*

Page 11

Net Revenue

11-14% CAGR

Growth

Operating

Minimum 50% annually

Margin

Earnings Per Share

At least 20% CAGR

Growth Rate

* | | On a constant currency basis and excluding future acquisitions |

MasterCard Investment Community Meeting ©2013 MasterCard. September 11, 2013

Proprietary and Confidential

Forward-Looking Statements

Today’s presentation may contain, in addition to historical information, forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995.

These forward-looking statements are based on our current assumptions, expectations and projections about future events which reflect the best judgment of management and involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by our comments today. You should review and consider the information contained in our filings with the SEC regarding these risks and uncertainties.

MasterCard disclaims any obligation to publicly update or revise any forward-looking statements or information provided during today’s presentations.

Any non-GAAP information contained in today’s presentations is reconciled to its GAAP equivalent in the Company’s periodic SEC filings.