Exhibit 99.2

|

MasterCard Incorporated

Third-Quarter 2013 Financial Results Conference Call

October 31, 2013

©2013 MasterCard. Proprietary

|

Business Update

Recap of 3rd Quarter Results

Economic Update

Business Highlights

©2013 MasterCard.

Proprietary

2

|

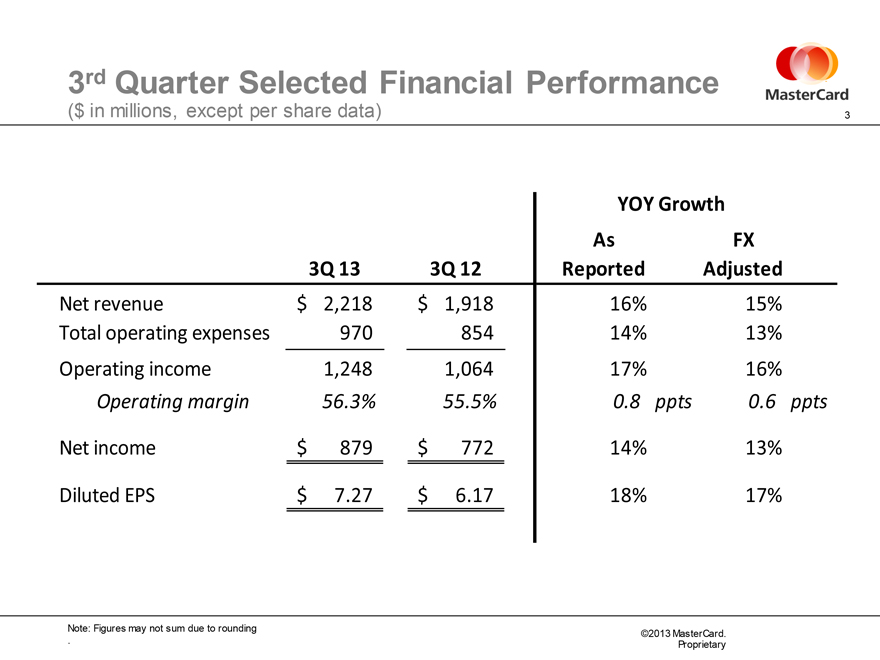

3rd Quarter Selected Financial Performance

($ in millions, except per share data)

YOY Growth

As FX

3Q 13 3Q 12 Reported Adjusted

Net revenue $ 2,218 $ 1,918 16% 15%

Total operating expenses 970 854 14% 13%

Operating income 1,248 1,064 17% 16%

Operating margin 56.3% 55.5% 0.8 ppts 0.6 ppts

Net income $ 879 $ 772 14% 13%

Diluted EPS $ 7.27 $ 6.17 18% 17%

Note: Figures may not sum due to rounding .

©2013 MasterCard.

Proprietary

3

|

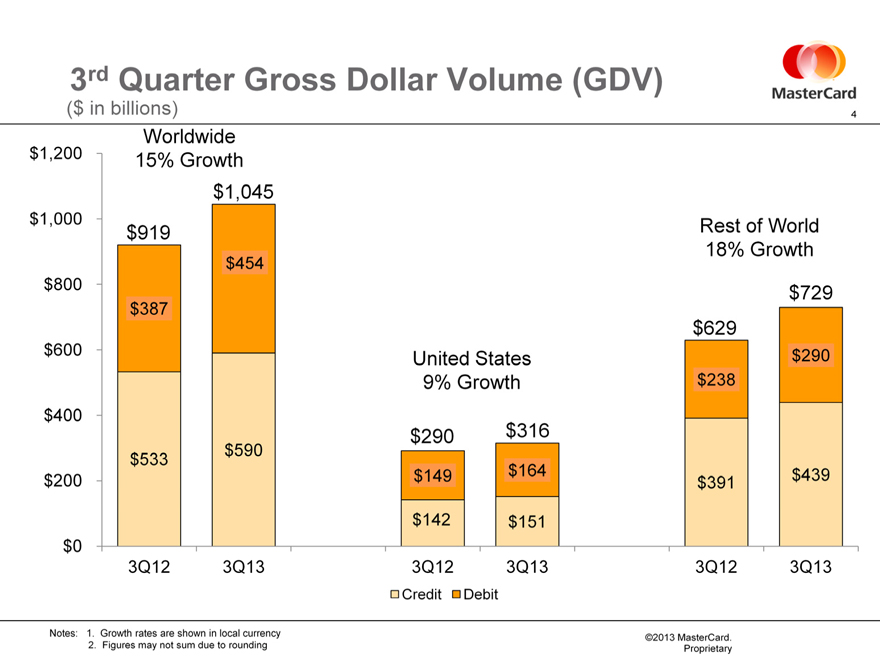

3rd Quarter Gross Dollar Volume (GDV)

($ in billions)

$1,200 15% Growth

$1,045

$1,000

$919 Rest of World

18% Growth

$454

$800 $729

$387

$629

$600 United States $290

9% Growth $238

$400

$290 $ 316

$533 $590

$200 $149 $164 $391 $439

$142 $151

$0

3Q12 3Q13 3Q12 3Q13 3Q12 3Q13

Credit Debit

Notes: 1. Growth rates are shown in local currency

2. Figures may not sum due to rounding

©2013 MasterCard.

Proprietary

4

|

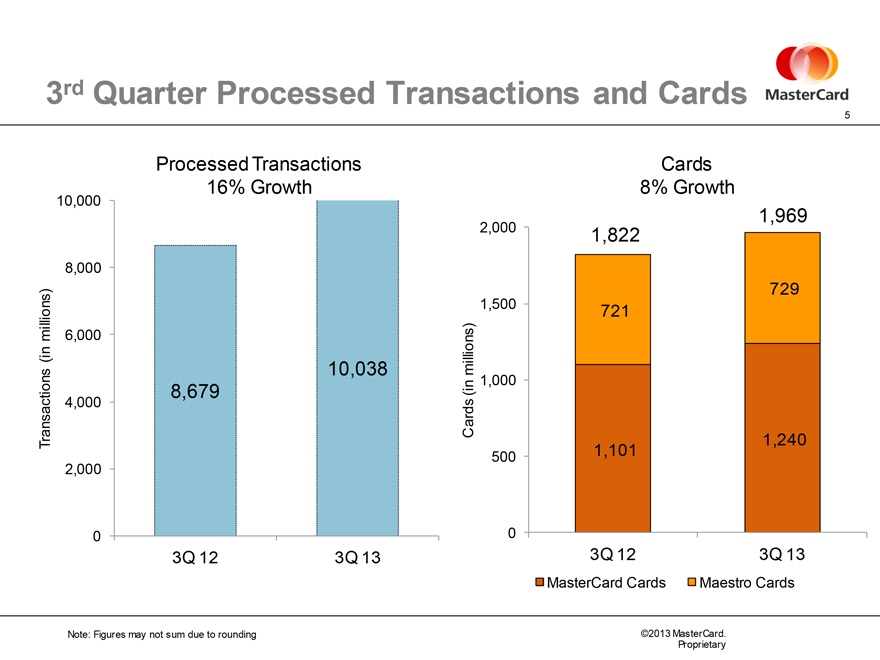

3rd Quarter Processed Transactions and Cards

Processed Transactions

16% Growth

10,000

8,000

millions) 6,000

(in

10,038

Transactions 4,000 8,679

2,000

0

3Q 12 3Q 13

Cards

8% Growth

1,969

2,000 1,822

729

1,500 721

(in millions) 1,000

Cards 1,240

500 1,101

0

3Q 12 3Q 13

MasterCard Cards Maestro Cards

Note: Figures may not sum due to rounding

©2013 MasterCard.

Proprietary

5

|

3rd Quarter Revenue

($ in millions)

3Q 12 3Q 13

$2,218

$2,000 $1,918

$1,000 $883 $963 $760 $763 $865

$630

$294 $336

$0

($652) ($706)

-$1,000

Domestic Cross-Border Transaction Other Rebates and Total Net

Assessments Volume Fees Processing Fees Revenues Incentives Revenue

As reported +9% +21% +13% +14% +8% +16%

FX adjusted +9% +19% +13% +13% +8% +15%

Note: Certain prior period amounts have been reclassified to conform to the 2013 presentation. Net revenue is not impacted. Figures may not sum due to rounding

©2013 MasterCard.

Proprietary

6

|

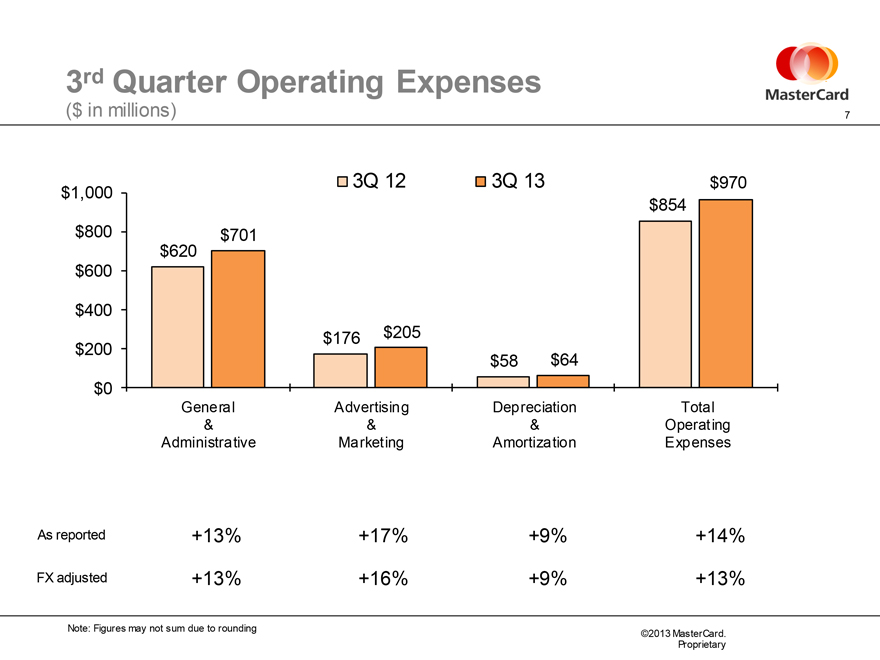

3rd Quarter Operating Expenses

($ in millions)

$1,000 3Q 12 3Q 13 $970

$854

$800 $701

$620

$600

$400

$176 $205

$200 $58 $64

$0

General Advertising Depreciation Total

& & & Operating

Administrative Marketing Amortization Expenses

As reported +13% +17% +9% +14%

FX adjusted +13% +16% +9% +13%

Note: Figures may not sum due to rounding

©2013 MasterCard.

Proprietary

7

|

Thoughts for the Future

Business update through October 28

Long-Term Performance Objectives

Thoughts for 2013 Revenue Operating Expenses Tax Rate FX sensitivity

©2013 MasterCard.

Proprietary

8

|

MasterCard

9