Filed Pursuant to Rule 424B2

Registration No. 333-277032

PROSPECTUS SUPPLEMENT

(To Prospectus dated February 13, 2024)

$1,250,000,000

Mastercard Incorporated

$300,000,000 Floating Rate Notes due 2028

$450,000,000 4.550% Notes due 2028

$500,000,000 4.950% Notes due 2032

We are offering $300,000,000 aggregate principal amount of our Floating Rate Notes due 2028 (the “Floating Rate Notes”), $450,000,000 aggregate principal amount of our 4.550% Notes due 2028 (the “2028 Notes”) and $500,000,000 aggregate principal amount of our 4.950% Notes due 2032 (the “2032 Notes” and, together with the 2028 Notes, the “Fixed Rate Notes”). We refer to the Fixed Rate Notes and the Floating Rate Notes collectively as the “Notes.”

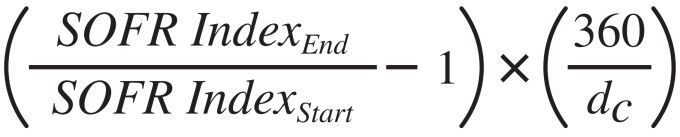

The Floating Rate Notes will bear interest at a floating rate, reset quarterly, equal to Compounded SOFR (as defined herein), plus 0.440%. We will pay interest on the Floating Rate Notes quarterly in arrears on March 15, June 15, September 15 and December 15 of each year, commencing on June 15, 2025. Interest will accrue on the Floating Rate Notes from the date of original issuance. The Floating Rate Notes will mature on March 15, 2028.

The 2028 Notes will bear interest at the rate of 4.550% per annum. We will pay interest on the 2028 Notes semi-annually in arrears on March 15 and September 15 of each year, beginning on September 15, 2025. The 2028 Notes will mature on March 15, 2028.

The 2032 Notes will bear interest at the rate of 4.950% per annum. We will pay interest on the 2032 Notes semi-annually in arrears on March 15 and September 15 of each year, beginning on September 15, 2025. The 2032 Notes will mature on March 15, 2032.

We may not redeem the Floating Rate Notes prior to maturity. We may redeem the Fixed Rate Notes in whole or in part at any time or from time to time at the applicable redemption prices described under the heading “Description of Notes—Optional Redemption” in this Prospectus Supplement.

The Notes of each series will be issued in book-entry form only, in minimum denominations of $2,000 and integral multiples of $1,000 in excess thereof.

Investing in the Notes involves risks. You should consider the risk factors described under the heading “Risk Factors” beginning on page S-5 of this Prospectus Supplement and the accompanying Prospectus or any documents we incorporate by reference before buying the Notes.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this Prospectus Supplement or the accompanying Prospectus. Any representation to the contrary is a criminal offense.

| | | | | | | | | | | | |

| | | Public

Offering

Price(1) | | | Underwriting

Discounts | | | Proceeds, before

expenses, to

Mastercard(1) | |

Per Floating Rate Note | | | 100.000 | % | | | 0.250 | % | | | 99.750 | % |

Total | | $ | 300,000,000 | | | $ | 750,000 | | | $ | 299,250,000 | |

Per 2028 Note | | | 99.924 | % | | | 0.250 | % | | | 99.674 | % |

Total | | $ | 449,658,000 | | | $ | 1,125,000 | | | $ | 448,533,000 | |

Per 2032 Note | | | 99.820 | % | | | 0.400 | % | | | 99.420 | % |

Total | | $ | 499,100,000 | | | $ | 2,000,000 | | | $ | 497,100,000 | |

| (1) | Plus accrued interest, if any, from February 27, 2025. |

The Notes will not be listed on any securities exchange. The Notes of each series are a new issue of securities with no established trading markets.

The underwriters expect to deliver the Notes through the book-entry delivery system of The Depository Trust Company and its direct participants, including Clearstream Banking, société anonyme, Luxembourg (“Clearstream”) and Euroclear Bank S.A./N.V. (“Euroclear”), as operator of the Euroclear System, on or about February 27, 2025, which will be the seventh business day from the date of pricing of the Notes (this settlement cycle referred to as “T+7”). Under Rule 15c6-1 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), trades in the secondary market generally are required to settle in one business day, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the Notes on the date of this Prospectus Supplement or the next succeeding business day will be required, by virtue of the fact that the Notes initially will settle in T+7, to specify an alternate settlement cycle at the time of any such trade to prevent a failed settlement. Purchasers of the Notes who wish to make such trades should consult their own advisor. See “Underwriting.”

Joint Book-Running Managers

| | | | | | | | | | | | |

| Deutsche Bank Securities | | Citigroup | | HSBC | | NatWest | | PNC Capital Markets LLC | | SOCIETE GENERALE | | |

| | | | |

COMMERZBANK | | Lloyds Securities | | Santander |

Senior Co-Managers

| | | | | | |

BMO Capital Markets | | Commonwealth Bank of Australia | | ICBC Standard Bank | | Loop Capital Markets |

Co-Managers

| | |

| Cabrera Capital Markets LLC | | CastleOak Securities, L.P. |

The date of this Prospectus Supplement is February 18, 2025.