SCHEDULE 14A

(RULE 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement | | ¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

þ Definitive Proxy Statement |

|

¨ Definitive Additional Materials |

|

¨ Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

AMERICAN PHARMACEUTICAL PARTNERS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | ¨ | | Fee paid previously with preliminary materials. |

| | ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

AMERICAN PHARMACEUTICAL PARTNERS, INC.

NOTICE OF 2002 ANNUAL MEETING OF STOCKHOLDERS

Dear Stockholders:

We cordially invite you to attend the 2002 Annual Meeting of Stockholders of American Pharmaceutical Partners, Inc., to be held at the Fairmont Miramar Hotel, Veranda Room, 101 Wilshire Boulevard, Santa Monica, California 90401 at 10:30 a.m. Pacific Daylight Time (registration will begin at 9:30 a.m.), on October 25, 2002, for the following purposes:

| | 1. | | Election of Directors. To elect seven directors to hold office until the 2003 Annual Meeting of Stockholders or until their successors are elected and qualified. |

| | 2. | | Ratification and Approval of the Appointment of Independent Auditors. To ratify and approve the appointment of Ernst & Young LLP as the Company’s independent auditors for the fiscal year ending December 31, 2002. |

| | 3. | | Other Business. To transact such other business as may properly come before the Annual Meeting of Stockholders and any adjournment or postponement thereof. |

The above items of business are more fully described in the proxy statement which is attached to this notice. Stockholders who owned stock in American Pharmaceutical Partners, Inc. at the close of business on September 6, 2002 may attend and vote at the meeting.

Whether or not you expect to attend the 2002 Annual Meeting of Stockholders in person, you are urged to vote as promptly as possible to ensure your representation and the presence of a quorum at the 2002 Annual Meeting. Instructions are set forth on the enclosed proxy card. Stockholders may vote their shares by marking, signing, dating and returning the proxy card in the enclosed postage-prepaid envelope. If you send in your proxy card and then decide to attend the 2002 Annual Meeting to vote your shares in person, you may still do so. Your proxy is revocable in accordance with the procedures set forth in the proxy statement.

We look forward to seeing you at the meeting.

Sincerely,

Patrick Soon-Shiong, M.D.

President, Chief Executive Officer and

Chairman of the Board

Los Angeles, California

September 23, 2002

AMERICAN PHARMACEUTICAL PARTNERS, INC.

11777 San Vicente Boulevard, Suite 550

Los Angeles, California 90049

PROXY STATEMENT

General Information

This proxy statement is furnished to the stockholders of American Pharmaceutical Partners (the “Company”) by the Company in connection with the solicitation by its board of directors of proxies in the accompanying form for use in voting at the 2002 Annual Meeting of Stockholders (the “2002 Annual Meeting”). The Company’s 2002 Annual Meeting will be held on October 25, 2002, at the Fairmont Miramar Hotel, Veranda Room, 101 Wilshire Boulevard, Santa Monica, California 90401 at 10:30 a.m. Pacific Daylight Time, and any adjournment or postponement thereof. The shares represented by the proxies received by the Company properly marked, dated, executed and not revoked will be voted at the 2002 Annual Meeting.

Revocability of Proxies

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before it is exercised by delivering a written notice of revocation or a duly executed proxy bearing a later date to the attention of the Secretary of the Company, Derek J. Brown, or by attending the 2002 Annual Meeting and voting in person.

Solicitation and Voting Procedures

This proxy statement and the accompanying proxy card were first sent by mail to stockholders on or about September 23, 2002. The costs of this solicitation are being borne by the Company. The Company may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding proxy material to such beneficial owners. Proxies may also be solicited by certain directors, officers and regular employees of the Company, without additional compensation, personally or by telephone, fax or telegram.

The close of business on September 6, 2002 has been fixed as the record date (the “Record Date”) for determining the holders of shares of the Company’s common stock entitled to notice of and to vote at the 2002 Annual Meeting. As of the close of business on the Record Date, the Company had approximately 47,107,313 shares of common stock outstanding and entitled to vote at the 2002 Annual Meeting. Holders of common stock on the Record Date will vote at the 2002 Annual Meeting as a single class on all matters, with each holder of common stock entitled to one vote per share held.

A majority of the shares entitled to vote, present in person or represented by proxy, shall constitute a quorum at the 2002 Annual Meeting. For the election of directors, the seven candidates receiving the greatest number of affirmative votes are elected, provided a quorum is present and voting. The affirmative vote by holders of a majority of the outstanding shares of the Company’s common stock present in person or represented by proxy at the 2002 Annual Meeting shall be required to approve Proposal No. 2 being submitted to the stockholders for their consideration.

1

Under the General Corporation Law of the State of Delaware, an abstaining vote and a broker “non-vote” are counted as present and are, therefore, included for purposes of determining whether a quorum of shares is present at a meeting. A broker “non-vote” occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have the discretionary voting power with respect to that item and has not received instructions from the beneficial owner. Broker “non-votes” and shares as to which proxy authority has been withheld with respect to any matter are not deemed to be entitled to vote for purposes of determining whether stockholder approval of that matter has been obtained. As a result, broker “non-votes” are not included in the tabulation of the voting results on the election of directors or issues requiring approval of a majority of the shares of common stock entitled to vote and, therefore, do not have the effect of votes in opposition in such tabulations. With respect to Proposal No. 2 requiring the affirmative vote of a majority of the common stock voting together as a class, present and entitled to vote, broker “non-votes” have no effect. Because abstentions will be included in tabulations of the shares of common stock entitled to vote for purposes of determining whether a proposal has been approved, abstentions have the same effect as negative votes on Proposal No. 2.

Shares of common stock cannot be voted until a signed proxy card is returned. Any stockholder may change their vote prior to the meeting by revoking their proxy or by submitting a proxy bearing a later date.

The Company has retained American Stock Transfer to tabulate votes cast by proxy at the 2002 Annual Meeting and one or more officers of the Company will tabulate votes cast in person at the 2002 Annual Meeting.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Seven (7) directors are to be elected to the board of directors at the 2002 Annual Meeting to hold office until their successors are duly elected and qualified. Each returned proxy cannot be voted for a greater than seven persons, which is the total number of nominees. Unless individual stockholders specify otherwise, each returned proxy will be voted for the election of the seven nominees who are listed below. If, however, any of the nominees named below is unable to serve or declines to serve at the time of the 2002 Annual Meeting, the persons named in the enclosed proxy will exercise discretionary authority to vote for substitutes. The nominees for election have agreed to serve if elected, and the Company’s management has no reason to believe that any of the nominees will be unavailable to serve.

The board of directors has nominated (i) Patrick Soon-Shiong, M.D. (ii) Derek J. Brown, (iii) Jeffrey M. Yordon, (iv) David S. Chen, Ph.D., (v) Stephen D. Nimer, M.D., (vi) Leonard Shapiro and (vii) Kirk K. Calhoun to serve on the board of directors until the 2003 annual meeting of stockholders and until each of their successors are duly elected and qualified. The board of directors has no reason to believe that the selected nominees will be unable or unwilling to to serve as a director if elected.

The seven nominees for the board of directors receiving a plurality of the votes of stockholders present in person or represented by proxy shall be elected as directors. Votes withheld from any nominee are counted for purposes of determining the presence or absence of a quorum. Unless otherwise instructed, the proxy holders will vote the proxies received by themin favor of the election of each of the nominees named above.

THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR THE ELECTION OF

THE NOMINEES NAMED ABOVE.

2

The following sets forth certain information with respect to executive officers, key employees, directors and nominees for the board of directors of the Company as of August 30, 2002:

Name

| | Age

| | Position(s)

|

| Patrick Soon-Shiong, M.D. | | 50 | | Chairman, President and Chief Executive Officer of the Company |

|

| Derek J. Brown | | 52 | | Co-Chief Operating Officer, Secretary and Director of the Company |

|

| Jeffrey M. Yordon | | 54 | | Co-Chief Operating Officer and Director of the Company |

|

| Nicole S. Williams | | 58 | | Executive Vice President and Chief Financial Officer of the Company |

|

| Jack C. Silhavy | | 46 | | Vice President, General Counsel and Assistant Secretary of the Company |

|

| David S. Chen, Ph.D.(1)(2) | | 53 | | Chairman of Cypac Investment Management Limited and Director of the Company |

|

| Stephen D. Nimer, M.D.(2) | | 48 | | Physician, Researcher and Chief of Hematology Service, Memorial Sloan-Kettering Cancer Center and Director of the Company |

|

| Leonard Shapiro(1) | | 74 | | Chief Executive Officer of Shapco, Inc. and Director of the Company |

|

| Kirk K. Calhoun | | 58 | | Certified Public Accountant and nominee for Director of the Company |

|

| Mia Igyarto | | 48 | | Vice President of Human Resources of the Company |

|

| Rajesh Kapoor, Ph.D. | | 49 | | Vice President of Quality Assurance/Quality Control of the Company |

|

| Thomas Shea | | 63 | | Vice President of Corporate Marketing of the Company |

|

| Dennis Szymanski, Ph.D. | | 52 | | Vice President of Product Development of the Company |

|

| Sam Trippie | | 61 | | Vice President of Manufacturing of the Company |

| (1) | | Member of the audit committee. |

| (2) | | Member of the compensation committee. |

Patrick Soon-Shiong, M.D. has served as President since July 2001 and Chief Executive Officer and Chairman of the board of directors of the Company since its inception in March 1996. From its inception to August 1997, Dr. Soon-Shiong served as the Chief Financial Officer of the Company. Since June 1994, Dr. Soon-Shiong has also served as president, chief financial officer and a director of American BioScience, Inc., the Company’s parent. From June 1994 to June 1998, he served as chief executive officer and chairman of the board of directors of VivoRx, Inc., a biotechnology company. Dr. Soon-Shiong is named as a co-inventor on over 30 issued U.S. patents. Dr. Soon-Shiong is a fellow of the American College of Surgeons and the Royal College

3

of Physicians and Surgeons of Canada. Dr. Soon-Shiong holds a degree in Medicine from the University of the Witwatersrand and a M.S.C. in Science from the University of British Columbia.

Derek J. Brown has served as the Co-Chief Operating Officer since June 2000 and Secretary and a director of the Company since August 1997. From August 1997 to August 2002, Mr. Brown also served as Chief Financial Officer of the Company. From November 1995 to June 1998, he served as vice president of finance and administration and as chief financial officer of VivoRx, Inc. Mr. Brown serves as a director of American BioScience, Inc. Mr. Brown also has over eight years of public accounting experience, having served as a manager at Price Waterhouse. Mr. Brown is a Chartered Accountant and holds a Bachelor of Commerce in Economics and an M.B.A. from the University of the Witwatersrand.

Jeffrey M. Yordon has served as Co-Chief Operating Officer since June 2000 and a director of the Company since August 1997. From August 1997 to July 2001, Mr. Yordon served as President of the Company. From January 1994 to June 1996, Mr. Yordon served as president of Faulding Pharmaceuticals, Inc. Mr. Yordon has also held various senior management positions at several pharmaceutical companies, including Gensia, Inc. and LyphoMed, Inc. Mr. Yordon holds a B.S. in Political Science and Business from Northern Illinois University.

Nicole S. Williams joined the Company as Executive Vice President and Chief Financial Officer in August 2002. From 1999 until her appointment as EVP and CFO, Ms. Williams was President of the Nicklin Capital Group, an advisor and investor in early-stage businesses in the information technology and life sciences industries. From 1992 until 1999, Ms. Williams was Executive Vice President, Finance, and Corporate Secretary of R.P. Scherer Corporation, a global drug delivery company.

Jack C. Silhavy has served as Vice President and General Counsel of the Company since September 1999. From October 1986 to August 1999, Mr. Silhavy worked as an attorney for Monsanto Company, a diversified company with food ingredient, pharmaceutical, agricultural and other businesses. He served as assistant general counsel for Monsanto from May 1992 to August 1999. Mr. Silhavy holds a B.A. in American Studies from the University of Notre Dame and a J.D. from Loyola University of Chicago.

David S. Chen, Ph.D. has served as a director since June 1998. Since June 1998, Dr. Chen has been chairman of Cypac Investment Management Limited. He served as chief executive officer from July 1996 to February 2000 and chief financial officer from May 1991 to February 1994 of Central Investment Holdings Company. Dr. Chen holds a B.S. in Agricultural Economics from National Taiwan University, an M.B.A. from California State University at Long Beach and a Ph.D. in Business Administration from Nova University, Florida.

Stephen D. Nimer, M.D. has served as a director since May 2001. Dr. Nimer has been associated with Memorial Sloan-Kettering Cancer Center since 1993 and has been Head of the Division of Hematologic Oncology since 1996 and Chief of the Hematology Service since 1993. He has also taught medicine at Cornell University School of Medicine since 1993. Dr. Nimer holds an M.D. from the University of Chicago and a B.S. in biology from Massachusetts Institute of Technology.

Leonard Shapiro has over 50 years of business experience as an entrepreneur and founder of Shapco, Inc., a manufacturer and distributor of pipe products, where he has been the Chief Executive Officer since 1948. As Chief Executive Officer of Shapco, he presided over the firm’s real estate investment activities in addition to its manufacturing and distribution operations. Shapco, Inc., together with its subsidiaries, employs over 300 employees in various locations throughout the Western United States.

Kirk K. Calhoun joined Ernst & Young LLP in 1965 and served as a partner of the firm from 1975 until his retirement in June 2002. His responsibilities included both area management and serving clients in a variety of industries. He is a Certified Public Accountant with a background in auditing and accounting. Mr. Calhoun has served as the Chairman of the Board of Governors of the California State University Foundation since July 2000. Mr. Calhoun holds a B. S. in Accounting from University of Southern California.

4

Mia Igyarto has served as the Company’s Vice President of Human Resources since July 2001. From March 1995 to July 2001, she served as vice president of human resources for McWhorter Technologies, Inc., a specialty chemicals company that was acquired by Eastman Chemical Company in July 2000. She holds a B.S. in biology from Northern Illinois University and an M.B.A. from Northwestern University, Kellogg School of Management.

Rajesh Kapoor, Ph.D. has served as the Company’s Vice President of Quality Assurance/Quality Control since February 2000. From March 1997 to February 2000, Dr. Kapoor was a director of quality assurance/quality control at American Home Products Corporation, a pharmaceutical company. From November 1995 to March 1997, he served as director of quality assurance/quality control at Regeneron Pharmaceuticals, Inc., a biotechnology company. From September 1993 to November 1995, Dr. Kapoor served as a manager of quality assurance development at Bayer Corporation, a pharmaceutical company. Dr. Kapoor holds a B.S. in Biochemistry from the University of Essex in England, an M.B.A. from Suffolk University and a Ph.D. in Biochemistry from the University of Lancaster, England.

Thomas Shea has served as the Company’s Vice President of Corporate Marketing since April 2000. From June 1998 to April 2000, he served as the Company’s Senior Director of Corporate Marketing. From October 1989 to June 1998, Mr. Shea served as senior director of corporate marketing at Fujisawa Healthcare, Inc., a pharmaceutical company. Prior to that, he held various positions at LyphoMed, Inc., a pharmaceutical company, including director of national accounts and marketing and senior director of corporate marketing. Mr. Shea holds a M.A. from Catholic University.

Dennis Szymanski, Ph.D. has served as the Company’s Vice President of Product Development since February 1999. From December 1997 to January 1999, Dr. Szymanski served as vice president of U.S. research and development at Pharmascience Laboratories Inc., a pharmaceutical company. From April 1988 to December 1997, Dr. Szymanski served as vice president of research and development at Lemmon Company, a pharmaceutical company that was acquired by Teva Pharmaceuticals USA in 1990. Prior to that, Dr. Szymanski held various positions at Baxter International, a pharmaceutical company, and G.D. Searle Pharmaceuticals. Dr. Szymanski holds a B.S. in Pharmacy and a Ph.D. in Pharmaceutics from Wayne State University.

Sam Trippie has served as the Company’s Vice President of Manufacturing since June 1998. From September 1992 to June 1998, Mr. Trippie served as vice president of manufacturing at Fujisawa USA, Inc., a pharmaceutical company. Prior to that, Mr. Trippie was vice president of manufacturing at Sanofi Animal Health Ltd. and held various positions in quality assurance and manufacturing at Baxter International. Mr. Trippie holds a B.S. in Microbiology from the University of Southwest Louisiana.

Relationships Among Directors or Executive Officers

There are no family relationships among any of the directors or executive officers of the Company.

Committees and Meetings of the Board of Directors

During the fiscal year ended December 31, 2001, the board of directors met 14 times. The board of directors currently has two committees: the audit committee and the compensation committee. In the 2001 fiscal year, all directors attended more than 75% of all the meetings of the board of directors and the committees on which he or she served after becoming a member of the board or a committee, except that Mr. Chen attended fewer than 75% of these meetings.

The audit committee was formed in 1998, and held one meeting during the fiscal year ended December 31, 2001. The audit committee currently consists of David S. Chen and Leonard Shapiro, with a third member whose appointment by the board of directors is anticipated to take place following the 2002 Annual Meeting. The audit committee reviews the scope and results of the annual audit and other services provided by independent auditors

5

and reviews and evaluates the Company’s accounting policies and systems of internal accounting controls. The board of directors approved a charter for the audit committee in July 2001, a copy of which is attached hereto asAppendix A. The board of directors has determined that all members of the audit committee are “independent” as that term is defined in Rule 4200 of the listing standards of the National Association of Securities Dealers.

The compensation committee held one meeting during the fiscal year ended December 31, 2001. The compensation committee currently consists of David S. Chen and Stephen D. Nimer, with a third member whose appointment by the board of directors is anticipated to take place following the 2002 Annual Meeting. The compensation committee reviews and approves the salaries, bonuses and other compensation payable to the Company’s executive officers, and administers and makes recommendations concerning the Company’s employee benefit plans.

Compensation of Directors

Directors who are also employees of the Company receive no additional compensation for their services as directors. Our non-employee directors do not receive a fee for attendance in person at meetings of the board of directors or committees of the board of directors, but they are reimbursed for travel expenses and other out-of-pocket costs of attending board and committee meetings. In addition, non-employee directors of the Company are eligible to receive options and shares of common stock directly under the Company’s 2001 non-employee director stock option program. Non-employee directors are eligible to be granted an initial option to purchase 7,500 shares of common stock upon their initial appointment to the board of directors with subsequent annual option grants to purchase 3,000 shares of common stock, both at an exercise price per share equal to the fair market value of the common stock at the date of grant. Directors who are also employees of the Company are also eligible to receive options and shares of common stock directly under the Company’s 2001 stock incentive plan.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of common stock of the Company as of August 7, 2002, for (i) each person who is known by the Company to beneficially own more than 5% of common stock of the Company, (ii) each of the directors, (iii) each of the named executive officers appearing in the Summary Compensation Table below, and (iv) all of the directors and executive officers as a group.

| | | Common Stock Beneficially Owned(1)

|

Directors and Named Executive Officers(3)

| | Number of

Shares

| | Option Shares(2)

| | Percent of Class (%)

|

| Patrick Soon-Shiong, M.D.(4) | | 32,585,690 | | 96,250 | | 69.24 |

| Derek J. Brown | | 607,125 | | 112,500 | | 1.29 |

| Jeffrey M. Yordon | | 362,500 | | 112,500 | | * |

| Sam Trippie | | 34,160 | | 34,000 | | * |

| David S. Chen, Ph.D. | | 25,000 | | 25,000 | | * |

| Jack C. Silhavy | | 22,075 | | 21,250 | | * |

| Stephen D. Nimer, M.D. | | 11,300 | | 7,500 | | * |

| Leonard Shapiro | | 3,000 | | — | | * |

| All named executive officers and directors as a group (eight persons) | | 33,650,850 | | 409,000 | | 71.50 |

|

5% Stockholders

| | | | | | |

| American BioScience, Inc.(5) | | 31,989,440 | | — | | 67.97 |

| Biotechnology Development Fund, L.P. and its affiliate(6) | | 2,819,035 | | — | | 5.99 |

6

| * | | Represents beneficial ownership of less than 1% of issued and outstanding common stock on August 7, 2002. |

| (1) | | Beneficial ownership as reported in the above table has been determined in accordance with Rule 13d-3 of the Securities Exchange Act of 1934. The percentage of shares beneficially owned is based on 47,064,607 shares of common stock outstanding as of August 7, 2002. Except as indicated in the footnotes to this table, such persons have sole voting and investment power with respect to all shares of common stock of the Company shown as beneficially owned by them. |

| (2) | | Includes shares of common stock subject to options that are currently exercisable or exercisable within 60 days after August 7, 2002, which are deemed to be outstanding and beneficially owned by the person holding such options for the purpose of computing the number of shares beneficially owned and the percentage ownership of such person, but are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person. |

| (3) | | Nicole S. Williams, who was appointed Executive Vice President and Chief Financial Officer as of August 19, 2002, beneficially owns 6,000 shares of common stock all of which are directly held. |

| (4) | | Includes 31,989,440 shares held of record by American BioScience, Inc., of which Dr. Soon-Shiong is the president and chairman of the board of directors, and in such capacity may be deemed to have shared voting and investment power over the shares. Dr. Soon-Shiong disclaims beneficial ownership of these shares except to the extent of his pecuniary interest in this entity. |

| (5) | | The business address of American BioScience, Inc. is 2730 Wilshire Boulevard, Suite 110, Santa Monica, California 90403. A majority of the outstanding capital stock of American BioScience, Inc. is held by a trust of which Dr. Soon-Shiong and his spouse are beneficiaries. |

| (6) | | Includes 939,685 shares held of record by Biotechnology Development Fund, L.P. and 1,879,350 shares held of record by Biotechnology Development Fund III, L.P., in each of which BioAsia Investments, LLC, a California limited liability company, is the general partner. These entities may be deemed to share voting and investment power over the shares. On August 28, 2002, Biotechnology Development Fund, L.P. entered into a stock purchase agreement with the Company under which it agreed to sell 452,284 shares of common stock to the Company, a transaction that was concluded on September 11, 2002. The business address of BioAsia Investments, LLC is 575 High Street, Suite 201, Palo Alto, California 94301. |

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

Ernst & Young LLP has served as independent auditors of the Company since its inception in 1996 and has been appointed by the board of directors to continue as independent auditors of the Company for the fiscal year ending December 31, 2002. In the event that ratification of this selection of auditors is not approved by holders of a majority of the shares of common stock voting at the 2002 Annual Meeting in person or by proxy, management will review its future selection of auditors.

A representative of Ernst & Young LLP is expected to be present at the 2002 Annual Meeting. The representative will have an opportunity to make a statement and to respond to appropriate questions.

The Company has been informed by Ernst & Young LLP that neither Ernst & Young LLP nor any of its members or their associates has any direct financial interest or material indirect financial interest in American Pharmaceutical Partners, Inc. During the fiscal year ended December 31, 2001, the Company was billed the following aggregate fees by Ernst & Young LLP:

Audit Fees. The aggregate fees billed by Ernst & Young LLP for professional services rendered for the audit of the Company’s consolidated financial statements for the fiscal year ended December 31, 2001 was $183,714.

7

Financial Information Systems Design and Implementation Fees. No fees were billed by Ernst & Young LLP to the Company for financial information systems design and implementation services (as described in Paragraph (c)(4)(ii) of Rule 2-01 of Regulation S-X). No such services were rendered by Ernst & Young LLP to the Company for the fiscal year ended December 31, 2001.

All Other Fees. The aggregate fees billed by Ernst & Young LLP to the Company for professional services rendered for the fiscal year ended December 31, 2001, other than the Audit Fees and Financial Information Systems Design and Implementation Fees described in the preceeding two paragraphs was $497,366, comprised principally of services related to our initial public offering on December 14, 2001 with the remainder relating to a special audit report and the audit of our 401(k) plan.

The audit committee did consider whether the provision of other non-audit services is compatible with the principal accountants’ independence and concluded that provision of other non-audit services are compatible with maintaining the independence of the Company’s external auditors.

THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR RATIFICATION OF THE

APPOINTMENT OF ERNST & YOUNG LLP AS THE COMPANY’S INDEPENDENT AUDITORS FOR

THE FISCAL YEAR ENDING DECEMBER 31, 2002.

EXECUTIVE COMPENSATION AND RELATED INFORMATION

Summary Compensation Table

The following table sets forth certain information concerning compensation of (i) each person that served as Chief Executive Officer during the last fiscal year and (ii) the four other most highly compensated executive officers whose aggregate cash compensation exceeded $100,000 during the last fiscal year (collectively, the “Named Executive Officers”):

| | | Annual Compensation

| | Long-Term Compensation

|

Name

| | Fiscal Year(1)

| | Salary ($)

| | Bonus and Commission ($)(2)

| | Securities Underlying Options (#)

|

| Patrick Soon-Shiong, M.D. | | 2001 | | 329,029 | | 275,000 | | 135,000 |

| President and | | 2000 | | 307,308 | | 337,500 | | 125,000 |

| Chief Executive Officer | | 1999 | | 298,846 | | 268,750 | | — |

|

| Derek J. Brown | | 2001 | | 264,616 | | 200,000 | | 125,000 |

| Co-Chief Operating Officer, | | 2000 | | 247,500 | | 216,000 | | 125,000 |

| Chief Financial Officer and Secretary(3) | | 1999 | | 239,769 | | 112,500 | | — |

|

| Jeffrey M. Yordon | | 2001 | | 264,616 | | 200,000 | | 225,000 |

| Co-Chief Operating Officer | | 2000 | | 247,500 | | 216,000 | | 125,000 |

| | | 1999 | | 242,513 | | 100,000 | | — |

|

| Jack C. Silhavy(4) | | 2001 | | 179,531 | | 50,406 | | 10,000 |

| Vice President and General Counsel | | 2000 | | 172,792 | | 16,210 | | — |

| | | 1999 | | 52,312 | | — | | 25,000 |

|

| Sam Trippie | | 2001 | | 191,806 | | 47,244 | | 4,000 |

| Vice President of Manufacturing | | 2000 | | 181,707 | | 54,512 | | 6,000 |

| | | 1999 | | 179,378 | | 30,286 | | — |

8

| (1) | | Compensation reported for the fiscal years ending December 31, 1999, December 31, 2000, and December 31, 2001. |

| (2) | | Reflects bonus amounts paid in the fiscal year. |

| (3) | | Mr. Brown acted as Chief Financial Officer until August 19, 2002 at which date Nicole S. Williams was appointed Executive Vice President and Chief Financial Officer; Mr. Brown currently holds the title of Co-Chief Operating Officer and Secretary. |

| (4) | | Mr. Silhavy became an employee of the Company in September 1999. |

Employment Contracts, Termination of Employment and Change of Control Arrangements

In November 2001, the Company entered into a compensation protection agreement with each of Derek J. Brown, Jeffrey M. Yordon and Jack C. Silhavy. These agreements have been filed with the SEC on November 20, 2001 as exhibits to Amendment No. 1 to Form S-1. Under these agreements, if the Company terminates a protected officer’s employment for any reason other than for cause, disability, retirement, death or good reason within 12 months following a change of control of the Company, or if that officer’s employment is terminated without cause prior to a change of control of the Company, then the Company must pay that officer (a) his accrued compensation, including unpaid base salary, pro rata bonus, vacation pay and reimbursement for reasonable and necessary expenses incurred on the Company’s behalf during the period up to the termination date, and (b) twice the sum of his annual base salary and annual bonus. In addition, upon termination of a protected officer’s employment within 12 months of a change of control of the Company, the Company must provide that officer with benefits for a period of two years after the date of termination, and any unvested stock options held by that officer will immediately vest. Each of these agreements have three year terms subject to automatic annual extensions.

In August 2002, the Company entered into a compensation protection agreement with Nicole S. Williams in connection with her recent appointment as Executive Vice President and Chief Financial Officer of the Company, providing the same terms as the agreements with Mr. Brown, Mr. Yordon and Mr. Silhavy.

Option Grants in Last Fiscal Year

The following table provides certain information with respect to stock options granted to the Named Executive Officers during the fiscal year ended December 31, 2001. In addition, as required by the Securities and Exchange Commission rules, the table sets forth the potential realizable value over the term of the option (the period from the grant to the expiration date) based on assumed rates of stock appreciation of 5% and 10%, compounded annually. These amounts are based on certain assumed rates of appreciation and do not represent an estimate of future stock price. Actual gains, if any, on stock option exercises will be dependent on the future performance of the common stock.

| | | Individual Grants

| | | | |

| | | Number of Securities Underlying Options Granted (#)(1)

| | % of Total Options Granted to Employees in Fiscal Year

| | | Exercise Price ($/Share)(2)

| | Expiration Date

| | Potential Realizable Value at Assumed Annual Rate of Stock Price Appreciation for Option Term ($) (3)

|

Name

| | | | | | 5%

| | 10%

|

| Patrick Soon-Shiong, M.D. | | 135,000 | | 10.76 | % | | 6.00 | | 3/8/11 | | 1,916,770 | | 3,531,925 |

| Derek J. Brown | | 125,000 | | 9.96 | % | | 6.00 | | 3/8/11 | | 1,774,787 | | 3,270,301 |

| Jeffrey M. Yordon | | 225,000 | | 17.94 | % | | 6.00 | | 3/8/11 | | 3,194,616 | | 5,886,541 |

| Jack C. Silhavy | | 10,000 | | 0.80 | % | | 10.00 | | 9/25/11 | | 152,479 | | 302,030 |

| Sam Trippie | | 4,000 | | 0.32 | % | | 10.00 | | 9/25/11 | | 60,991 | | 120,812 |

| (1) | | Each of these options vest (and become exercisable) over a four year period beginning from the date they were granted and have a 10-year term, except that, subject to the terms and conditions set forth in each |

9

| | respective option agreement, (i) the option granted to Mr. Brown became immediately vested with respect to 25,000 shares on the date of grant, and his option becomes vested with respect to an additional 25,000 shares annually thereafter, and (ii) the option granted to Mr. Yordon became immediately vested with respect to 25,000 shares on the date of grant, and his option becomes vested with respect to an additional 25,000 shares annually thereafter, and becomes vested with respect to the remaining 100,000 shares on March 8, 2006. |

| (2) | | The exercise price per share of options granted represented the fair value of the underlying shares of common stock, as defined in the 1997 Stock Option Plan, at the date the options were granted. |

| (3) | | The dollar amounts under these columns are the result of calculations at the 5 percent and 10 percent rates required by applicable regulations of the Securities Exchange Commission and, therefore, are not intended to forecast possible future appreciation, if any, of the common stock price. Assumes all options are exercised at the end of their respective ten-year terms. Actual gains, if any, on stock option exercises depend on the future performance of the common stock and overall market conditions, as well as the optionee’s continued employment through the vesting period. The amounts reflected in this table may not be achieved. |

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table sets forth certain information with respect to stock options exercised by the Named Executive Officers during fiscal year ending December 31, 2001, including the aggregate value of gains on the date of exercise. In addition, the table sets forth the number of shares covered by stock options as of December 31, 2001, and the value of “in-the-money” stock options, which represents the difference between the exercise price of a stock option and the market price of the shares subject to such option on December 31, 2001.

| | | Shares Acquired on Exercise (#)

| | Value Realized ($)(1)

| | Number of Securities Underlying Unexercised Options at December 31, 2001 (#)

| | Value of Unexercised

In-the-Money Options at

December 31, 2001 ($)(2)

|

Name

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

| Patrick Soon-Shiong, M.D. | | 500,000 | | 2,975,000 | | 31,250 | | 228,750 | | 525,000 | | 3,573,000 |

| Derek J. Brown | | 500,000 | | 2,975,000 | | 56,250 | | 193,750 | | 895,000 | | 3,055,000 |

| Jeffrey M. Yordon | | 250,000 | | 1,487,500 | | 56,250 | | 293,750 | | 895,000 | | 4,535,000 |

| Jack C. Silhavy | | — | | — | | 12,500 | | 22,500 | | 210,000 | | 318,000 |

| Sam Trippie | | — | | — | | 31,500 | | 8,500 | | 559,200 | | 118,800 |

| (1) | | The value realized upon the exercise of stock options represents the positive spread between the exercise price of stock options and the fair market value of the shares subject to such options on the exercise date. |

| (2) | | The value of “in-the-money” stock options represents the positive spread between the exercise price of options and the fair market value of the underlying shares subject to those options on December 31, 2001. |

Equity Compensation Plan Information

We maintain three compensation plans that provide for the issuance of our common stock to officers, directors, other employees or consultants: the (i) 1997 Stock Option Plan (the “1997 Plan”), (ii) 2001 Stock Incentive Plan (the “2001 Stock Incentive Plan”) and (iii) 2001 Employee Stock Purchase Plan (the “2001 Stock Purchase Plan”). Each of these plans have been approved by the stockholders of the Company.

10

The following table provides information about the 1997 Plan, the 2001 Stock Incentive Plan and the 2001 Stock Purchase Plan as of December 31, 2001:

| | | (a) | | (b) | | (c) | |

Plan Category

| | Number of Securities to be Issued Upon Exercise of Outstanding Options

| | Weighted-

Average Exercise Price of Outstanding Options

| | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans

| |

| Equity Compensation Plans Approved by Security Holders | | 3,454,439 | | $ | 5.29 | | 4,202,826 | (1) |

| Equity Compensation Plans Not Approved by Security Holders | | — | | | — | | — | |

| | |

| |

|

| |

|

|

| Total | | 3,454,439 | | $ | 5.29 | | 4,202,826 | |

| (1) | | Represents shares available for issuance under the Company’s 1997 Plan, 2001 Stock Incentive Plan and 2001 Stock Purchase Plan as of December 31, 2001. The 2001 Stock Incentive Plan contains an evergreen formula pursuant to which on January 1 of each year, the aggregate number of shares reserved for issuance under the 2001 Stock Incentive Plan will increase by a number of shares equal to 5% of the outstanding shares of common stock on such date or a lesser number determined by the administrator of the plan. The 2001 Stock Purchase Plan contains an evergreen formula pursuant to which on January 1 of each year, the aggregate number of shares reserved for issuance under the 2001 Stock Purchase Plan is increased by an amount equal to the lesser of (i) one million five hundred thousand (1,500,000) shares, (ii) two percent (2%) of the outstanding shares of common stock on such date, or (iii) a lesser number of shares determined by the administrator of the plan. |

11

AUDIT COMMITTEE REPORT

The following is the report of the audit committee with respect to the Company’s audited financial statements for the fiscal year ended December 31, 2001, which include consolidated balance sheets as of December 31, 2001 and 2000, and the related consolidated statements of operations, stockholders’ equity (deficit) and cash flows for each of the three years for the period ended December 31, 2001, and the notes thereto.The information contained in this report shall not be deemed to be “soliciting material” or to be “filed” with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933, as amended or the 1934 Securities Exchange Act, as amended, except to the extent that the Company specifically incorporates it by reference in such filing.

Review with Management

The audit committee oversees the Company’s financial reporting process on behalf of the board of directors. Management has the primary responsibility for the financial statements and the reporting process including the systems of internal controls. In fulfilling its oversight responsibilities, the audit committee reviewed the audited financial statements with management, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements.

Review and Discussion with Independent Accountants

The audit committee has discussed with Ernst & Young LLP, independent auditors of the Company, the matters required to be discussed by SAS 61 (Codification of Statements on Accounting Standards) which includes, among other items, matters related to the conduct of the audit of the financial statements.

The audit committee reviewed with the independent auditors, who are responsible for expressing an opinion on the conformity of audited financial statements with generally accepted accounting principles, their judgments as to the quality, not just the acceptability, of the Company’s accounting principles and such other matters as are required to be discussed with the audit committee under generally accepted auditing standards. In addition, the audit committee has discussed with the independent auditors the auditors’ independence from the Company and its management including the matters in the written disclosures required by the Independence Standards Board and considered the compatibility of nonaudit services with the auditors’ independence.

The audit committee discussed with the Company’s independent auditors the overall scope and plans for their respective audits. The audit committee meets with the independent auditors, with and without management present, to discuss the results of their examinations, their evaluations of the Company’s internal controls, and the overall quality of the Company’s financial reporting.

Conclusion

In reliance on the reviews and discussions referred to above, the audit committee recommended to the board of directors, and the board has approved, that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2001 for filing with the Securities and Exchange Commission. The audit committee and the board of directors have also recommended, subject to stockholder approval, the selection of the Company’s independent auditors.

MEMBERS OF THE AUDIT COMMITTEE

David S. Chen, Ph.D.

Leonard Shapiro

12

COMPENSATION COMMITTEE REPORT

Notwithstanding anything to the contrary set forth in any of the Company’s previous filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate future filings, including this proxy statement, in whole or in part, the following report shall not be deemed to be incorporated by reference into any such filings.

The compensation committee currently consists of David S. Chen and Stephen D. Nimer, with a third member whose appointment by the board of directors is anticipated to take place following the 2002 Annual Meeting. Decisions concerning the compensation of the President, Chief Executive Officer, Co-Chief Operating Officers, Chief Financial Officer and Secretary (the “Senior Executive Officers”) of the Company are made by the compensation committee and reviewed by the full board of directors, excluding interested directors.

Senior Executive Officer Compensation

The objectives of the compensation committee in establishing compensation for Senior Executive Officers are to:

| | • | | provide competitive levels of compensation to enable the Company to attract, retain, and motivate talented management personnel; |

| | • | | reward individuals for their contributions to the Company’s achievement of its business objectives; and |

| | • | | align the interests of management with the interests of the Company’s stockholders in order to maximize stockholder value. |

Base Salaries. Salaries for Senior Executive Officers of the Company are determined primarily on the basis of the officer’s responsibility, general salary practices of peer companies and the officer’s individual qualifications and experience. The base salaries are reviewed annually and may be adjusted by the compensation committee in accordance with certain criteria which include individual performance, the functions performed by the officer, the scope of the officer’s on-going duties, general changes in the compensation peer group in which the Company competes for executive talent, and general financial performance of the Company. The weight given each such factor by the compensation committee may vary from individual to individual.

Bonuses. The compensation committee believes that periodic bonus awards can serve to motivate the Senior Executive Officers to address annual performance goals, using more immediate measures for performance than those reflected in the appreciation in value of stock options. The bonus amounts are based upon a subjective consideration of factors including each officer’s level of responsibility, individual performance, contributions to the success and financial performance of the Company generally.

Stock Option Grants. The compensation committee believes that stock ownership by management is beneficial in aligning management and stockholder interests, thereby enhancing stockholder value. Stock options may be granted to management including the Senior Executive Officers and other employees under the Company’s option plans, which are currently administered by the board of directors. The compensation committee advises the board of directors with respect to, and approves all option grants made to, the Senior Executive Officers of the Company. Because of the direct relationship between the value of an option and the stock price, the compensation committee believes that options motivate the Senior Executive Officers to manage the Company’s business in a manner that is consistent with stockholder interests. Stock option grants are intended to focus the attention of the recipient on the Company’s long-term performance which the Company believes results in improved stockholder value, and to retain the services of the Senior Executive Officers in a competitive job market by providing significant long-term earnings potential. To this end, stock options generally

13

vest and become fully exercisable over a four-year period. However, under the Company’s option plans, options may be granted with differing vesting periods. The principal factors considered in granting stock options to the Senior Executive Officers of the Company are prior performance, level of responsibility, other compensation and the officer’s ability to influence long-term growth and profitability of the Company. However, the Company’s option plans do not provide any quantitative method for weighting these factors, and the compensation committee’s decisions with respect to grant awards are primarily based upon subjective evaluations of the past as well as future anticipated performance.

Other Compensation Plans. The Company has adopted certain general employee benefit plans in which the Senior Executive Officers are permitted to participate on parity with other employees. The Company also provides a 401(k) deferred compensation pension plan. Benefits under these plans are indirectly tied to the Company’s performance.

Deductibility of Compensation. Section 162(m) of the Internal Revenue Code (“IRC”) disallows a deduction by the Company for compensation exceeding $1.0 million paid to certain executive officers, excluding, among other things, performance based compensation. Since non-performance based compensation has not exceeded $1.0 million for any executive officer to date, there has been no limitation as to the deductibility of executive compensation. The compensation committee remains aware of the IRC Section 162(m) limitations, and the available exemptions, and will address the issue of deductibility when and if circumstances warrant the use of such exemptions.

In the past several years, including the fiscal year ended December 31, 2001, the Company has achieved year-to-year increases in net sales and gross margins. The compensation committee approved and established the base salaries, bonus levels, and stock option grants to the Senior Executive Officers for the fiscal year ended December 31, 2001 in part to reward each of their contributions to the Company’s operating results.

Chief Executive Officer Compensation

The compensation of the Chief Executive Officer is reviewed annually on the same basis as discussed above for all Senior Executive Officers. Based upon the magnitude of Dr. Soon-Shiong’s responsibilities and leadership, ability to influence the Company’s financial performance, and the Company’s operating results, the compensation committee established Dr. Soon-Shiong’s base salary at $336,000 for the fiscal year ended December 31, 2001. Also based on the foregoing, Dr. Soon-Shiong was granted stock options to purchase up to 135,000 shares at fair market value as of the date granted, and a bonus level of up to $275,000 for the fiscal year ended December 31, 2001.

MEMBERS OF THE COMPENSATION COMMITTEE

David S. Chen, Ph.D.

Stephen D. Nimer, M.D.

14

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The following is a description of certain transactions and relationships entered into or existing during the fiscal year ended December 31, 2001 between the Company and certain affiliated parties. The Company believes that the terms of such transactions were no less favorable to the Company than could have been obtained from an unaffiliated party.

In October 2001, we received a $23.0 million demand promissory note for a loan balance outstanding from American BioScience. The note was amended and restated in December 2001 to make reference to the Company’s credit facility with Canadian Imperial Bank of Commerce established in December 2001. The note bears interest at a rate equal to the rate of interest on our credit facility (5.6% at June 30, 2002). In connection with this promissory note, as security for payment of the obligations under the note, we entered into a pledge agreement with American BioScience under which American BioScience pledged and granted to us a security interest in shares of our common stock held by it having a fair market value equal to 120% of the balance of the note.

In November 2001, we entered into a license agreement with American BioScience under which we acquired the exclusive rights to market and sell ABI-007 in North America, and which provided for initial license payments of $60.0 million. The $60.0 million was paid to American BioScience in January of 2002. American BioScience is responsible for substantially all costs associated with the development of ABI-007, except that we agreed to provide up to $2.0 million of ABI-007 for use in clinical trials. We are also required to make milestone payments of up to (a) $60 million for indications related to breast, ovarian and lung cancers and (b) $32.5 million for indications relating to prostate cancer and other indications as agreed upon between American BioScience and us. We also may be required to make additional milestone payments of up to an aggregate of $110.0 million based upon the achievement of particular annual sales levels. Profits from sales of ABI-007 will be shared equally with American BioScience after deducting costs of goods sold, selling expenses and other appropriate deductions. All costs and expenses related to product recalls and product liability claims generally will be split equally between American BioScience and us.

In November 2001, we entered into a manufacturing agreement with American BioScience under which we agreed to manufacture ABI-007 for American BioScience and its licensees for sales outside North America during the term of the agreement. Under this Agreement, we were granted the exclusive right to manufacture ABI-007 for sales in North America for a period of three years and the non-exclusive right to manufacture ABI-007 for sales (a) outside North America and (b) in North America after expiration of the three-year exclusivity period. If, however, we fail to make a milestone payment for a particular indication under the license agreement, our license to manufacture ABI-007 for that particular indication will become non-exclusive. We will charge American BioScience and its licensees a customary margin on our manufacturing costs based on whether the product will be used for clinical trials or commercial sale. All costs and expenses related to product recalls for products sold by us will be split equally between American BioScience and us. The initial term of the agreement is ten years. The agreement may be extended for successive two-year terms by American BioScience and may be terminated at any time by mutual consent of American BioScience and us.

In July 2001, we entered into an agreement with American BioScience under which American BioScience agreed to make all remaining payments due to VivoRx in connection with the settlement of certain litigation to which we and American BioScience were both parties and, in the event American BioScience fails to timely make any such payment, to surrender to us shares of our common stock held by it having a fair market value equal to 120% of the unpaid amount.

15

In July 2001, we entered into a tax sharing and indemnification agreement with American BioScience that provides for, among other things, the allocation and payment of taxes for periods during which we and American BioScience were included in the same consolidated group for federal income tax purposes and the same consolidated, combined or unitary returns for state tax purposes, the allocation of responsibility for the filing of tax returns, the conduct of tax audits and the handling of tax controversies, and various related items.

In July 2001, we entered into an agreement with American BioScience under which we acknowledged and agreed that Dr. Soon-Shiong and Mr. Brown may devote time to the business of, receive remuneration from and present business opportunities to American BioScience, and that American BioScience’s business and operations may compete with us.

On July 26, 2002, we entered into an agreement with Premier Purchasing Partners, L.P. under which we purchased 2,914,593 shares of our common stock, representing all of the common stock of the Company then held by Premier, for approximately $29.8 million in cash.

On August 28, 2002, we entered into an agreement with Biotechnology Development Fund, L.P. under which we purchased 452,284 shares of our common stock then held by Biotechnology Development Fund, L.P. for approximately $6.0 million in cash.

The Company has entered into indemnification agreements with each executive officer and each nominee for election to the board of directors. The indemnification agreements require the Company to indemnify these individuals to the fullest extent permitted by Delaware law.

The Company has entered into compensation protection agreements with Derek J. Brown, Jeffrey M. Yordon, Jack C. Silhavy and Nicole S. Williams. See “Employment Contracts, Termination of Employment and Change of Control Arrangements” above.

Compensation Committee Interlocks and Insider Participation

No interlocking relationship exists between any member of board of directors or compensation committee of the Company and any member of the board of directors or compensation committee of any other company, nor has such interlocking relationship existed in the past.

16

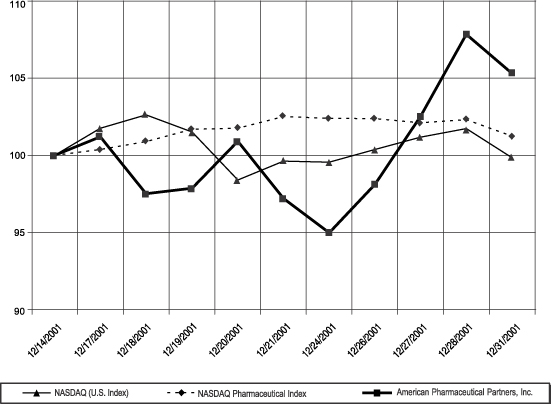

STOCK PERFORMANCE GRAPH

Notwithstanding anything to the contrary set forth in any of the Company’s previous filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate future filings, including this proxy statement, in whole or in part, the following graph shall not be deemed to be incorporated by reference into any such filings.

The following graph compares the percentage change in the cumulative total stockholder return on the Company’s common stock from December 14, 2001, the date of the Company’s initial public offering, through the end of the Company’s fiscal year ended December 31, 2001, with the percentage change in the cumulative total return for the NASDAQ Pharmaceutical Index and the NASDAQ stock market (U.S. Index). The comparison assumes an investment of $100 on December 14, 2001 in the Company’s common stock and in each of the foregoing indices and assumes reinvestment of dividends.The stock performance shown on the graph below is not necessarily indicative of future price performance.

American Pharmaceutical Partners, Inc.

NASDAQ Pharmaceutical Index

NASDAQ Stock Market (U.S. Index)

17

STOCKHOLDER PROPOSALS

Requirements for Stockholder Proposals to be Brought Before an Annual Meeting. For stockholder proposals to be considered properly brought before an annual meeting by a stockholder, the stockholder must have given timely notice therefor in writing to the Secretary of the Company. To be timely for the 2003 Annual Meeting, a stockholder’s notice must be delivered to or mailed and received by the Secretary of the Company at its principal executive offices no earlier than August 26, 2003 (60 days prior to the date which occurs one year after the 2002 Annual Meeting date) and no later than September 25, 2003 (30 days prior to the date which occurs one year after the 2002 Annual Meeting date), however, these dates are subject to change in the event that next year’s annual meeting is held later than November 24, 2003 or earlier than September 25, 2003. A stockholder’s notice to the Secretary must set forth as to each matter the stockholder proposes to bring before the annual meeting (i) a brief description of the business desired to be brought before the annual meeting and the reasons for conducting such business at the annual meeting, (ii) the name and record address of the stockholder proposing such business, (iii) the class and number of shares which are beneficially owned by the stockholder, and (iv) any material interest of the stockholder in such business.

Requirements for Stockholder Proposals to be Considered for Inclusion in the Proxy Materials. Stockholder proposals submitted pursuant to Rule 14a-8 under the Exchange Act and intended to be presented at the 2003 Annual Meeting of Stockholders must be received by the Company at its principal executive offices no later than June 27, 2003 in order to be considered for inclusion in the Company’s proxy materials for that meeting however, this date is subject to change in the event that next year’s annual meeting is held later than November 24, 2003 or earlier than September 25, 2003.

Stockholders should refer to the Company’s most recent available quarterly report on Form 10-Q following the 2002 Annual Meeting for updates to the foregoing deadlines for stockholder proposals to be submitted for the 2003 Annual Meeting.

OTHER MATTERS

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act of 1934, as amended (the “Exchange Act”) requires the Company’s directors, executive officers and persons who own more than 10% of common stock of the Company (collectively, “Reporting Persons”) to file reports of ownership and changes in ownership of common stock of the Company. Reporting Persons are required by Securities and Exchange Commission regulations to furnish the Company with copies of all Section 16(a) reports they file. Based solely on its review of the copies of such reports received or written representations from the Reporting Persons, the Company believes that during the fiscal year ended December 31, 2001 all Reporting Persons complied with these filing requirements on a timely basis, except that one Form 5 was inadvertently filed late by each of Dr. Nimer, Mr. Chen and Mr. Frank Kung (fomerly a director of the Company), and that a Form 5 was filed to report purchases of common stock by each of Mr. Kung and Mr. Derek Brown in December 2001 that were not timely reported on Form 4.

Other Matters

The board of directors knows of no other business which will be presented at the 2002 Annual Meeting. If any other business is properly brought before the 2002 Annual Meeting, it is intended that proxies in the enclosed form will be voted in respect thereof in accordance with the judgments of the persons voting the proxies.

It is important that the proxies be returned promptly and that your shares be represented. Stockholders are urged to submit a proxy by returning the accompanying proxy card in the enclosed envelope.

The Company has furnished its financial statements to stockholders in its 2001 Annual Report which accompanies this proxy statement. The 2001 Annual Report contains a complete copy of the Company’s Form 10-K for

18

the year ended December 31, 2001. In addition, the Company will provide, for a fee, upon written request by any stockholder, copies of exhibits to the 10-K. Requests for copies of such exhibits should be addressed to the Company’s Corporate Secretary, 11777 San Vicente Boulevard, Suite 550, Los Angeles, California 90049.

FORM 10-K ANNUAL REPORT

UPON WRITTEN REQUEST TO THE CORPORATE SECRETARY, AMERICAN PHARMACEUTICAL PARTNERS, INC., 11777 SAN VICENTE BOULEVARD, SUITE 550, LOS ANGELES, CALIFORNIA 90049, THE COMPANY WILL PROVIDE WITHOUT CHARGE TO EACH PERSON SOLICITED A COPY OF THE 2001 ANNUAL REPORT ON FORM 10-K, INCLUDING FINANCIAL STATEMENTS AND FINANCIAL STATEMENT SCHEDULES FILED THEREWITH.

By Order of the Board of Directors,

Patrick Soon-Shiong, M.D.

President, Chief Executive Officer, and

Chairman of the Board

September 23, 2002

Los Angeles, California

19

APPENDIX A

CHARTER OF THE AUDIT COMMITTEE

PURPOSE AND AUTHORITY

The audit committee (the “Committee”) for American Pharmaceutical Partners, Inc., a Delaware corporation (the “Corporation”), is appointed by the Corporation’s board of directors (the “Board”) to assist the Board in monitoring (1) the integrity of the financial statements of the Corporation, (2) the compliance by the Corporation with legal and regulatory requirements and (3) the independence and performance of the Corporation’s internal and external auditors.

The Committee shall have the authority to retain special legal, accounting or other consultants to advise the Committee and, if necessary, to institute special investigations in furtherance of the foregoing purposes. The Committee may request any officer or employee of the Corporation or the Corporation’s outside counsel or independent auditor to attend a meeting of the Committee or to meet with any members of, or consultants to, the Committee.

In addition, the Committee shall undertake those specific duties and responsibilities listed below and such other duties as the Board shall from time to time prescribe.

COMMITTEE MEMBERSHIP

The Committee members (the “Members”) shall be appointed by the Board on the recommendation of the members of the Corporation’s Board of Directors and management and will serve at the discretion of the Board. The Committee will consist of at least three (3) members of the Board subject to the following requirements:

| | i. | | each of the Members must be able to read and understand fundamental financial statements, including the Corporation’s balance sheet, income statement, and cash flow statement or must become able to do so within a reasonable time period after his or her appointment to the Committee; |

| | ii. | | at least one (1) of the Members must have past employment experience in finance or accounting, requisite professional certification in accounting, or other comparable experience or background, including a current or past position as a chief executive or financial officer or other senior officer with financial oversight responsibilities; and |

| | iii. | | each Member must be either (a) an independent director or (b) the Board must determine it to be in the best interests of the Corporation and its stockholders to have one (1) director who is not independent, and the Board must disclose the reasons for its determination in the Corporation’s first annual proxy statement or information statement subsequent to such determination, as well as the nature of the relationship between the Corporation and director. Under such circumstances the Corporation may appoint one (1) director who is not independent to the Committee, so long as the director is not a current employee or officer, or an immediate family member of a current employee or officer. |

DUTIES AND RESPONSIBILITIES

The Committee shall report, at least annually, to the Board. Further, the Committee shall:

| | 1. | | Review and reassess the adequacy of this Charter annually and recommend any proposed changes to the Board for approval; |

A-1

| | 2. | | Review the annual audited financial statements with management, including a review of major issues regarding accounting and auditing principles and practices, and evaluate the adequacy of internal controls that could significantly affect the Corporation’s financial statements; |

| | 3. | | Review an analysis prepared by management and the Corporation’s independent auditor of significant financial reporting issues and judgments made in connection with the preparation of the Corporation’s annual audited financial statements; |

| | 4. | | Review with management and the Corporation’s independent auditor the Corporation’s quarterly financial statements prior to the filing of its Form 10-Q; |

| | 5. | | Meet periodically with management to review the Corporation’s major financial risk exposures and the steps management has taken to monitor and control such exposures; |

| | 6. | | Review major changes to the Corporation’s auditing and accounting principles and practices as suggested by the Corporation’s independent auditor, internal auditors or management; |

| | 7. | | Recommend to the Board the appointment of the Corporation’s independent auditor, which firm is ultimately accountable to the Committee and the Board; |

| | 8. | | Approve the fees to be paid to the Corporation’s independent auditor; |

| | 9. | | Receive periodic reports from the Corporation’s independent auditor regarding the auditor’s independence consistent with Independence Standards Board Standard 1, discuss such reports with the auditor, and if deemed necessary by the Committee, take or recommend that the full Board take appropriate action to oversee the independence of the auditor; |

| | 10. | | Evaluate together with the Board the performance of the independent auditor and, if deemed necessary by the Committee, recommend that the Board replace the independent auditor; |

| | 11. | | Review the appointment of, and any replacement of, the Corporation’s senior internal auditing executive; |

| | 12. | | Review the significant reports to management prepared by the internal auditing department and management’s responses; |

| | 13. | | Meet with the Corporation’s independent auditor prior to the audit to review the planning and staffing of the audit; |

| | 14. | | Obtain from the Corporation’s independent auditor assurance that Section 10A of the Securities Exchange Act of 1934, as amended, has not been implicated. |

| | 15. | | Obtain reports from management, the Corporation’s senior internal auditing executive and the Corporation’s independent auditor that the Corporation’s subsidiary/foreign affiliated entities are in conformity with applicable legal requirements, including the Foreign Corrupt Practices Act. |

| | 16. | | Discuss with the Corporation’s independent auditor the matters required to be discussed by Statement on Auditing Standards No. 61 relating to the conduct of the audit. |

| | 17. | | Review with the independent auditor any problems or difficulties the auditor may have encountered, any management letter provided by the auditor, and the Corporation’s response to that letter. Such review should include: |

| | a. | | Any difficulties encountered in the course of the audit work, including any restrictions on the scope of activities or access to required information; |

| | b. | | Any changes required in the planned scope of the internal audit; and |

| | c. | | The internal audit department responsibilities, budget and staffing. |

A-2

| | 18. | | Prepare the report required by the rules of the Securities and Exchange Commission to be included in the Corporation’s annual proxy statement in accordance with the requirements of Item 306 of Regulation S-K and S-B and Item 7(e)(3) of Schedule 14A; |

| | 19. | | Advise the Board as to the Corporation’s policies and procedures regarding compliance with applicable laws and regulations; |

| | 20. | | Review with the Corporation’s outside counsel and General Counsel legal matters that may have a material impact on the financial statements, the Corporation’s compliance policies and any material reports or inquiries received from regulators or governmental agencies; |

| | 21. | | Review related party transactions for potential conflict of interest; and |

| | 22. | | Provide oversight and review of the Corporation’s asset management policies, including an annual review of the Corporation’s investment policies and performance for cash and short-term investments. |

While the Committee has the responsibilities and powers set forth in this Charter, it is not the duty of the Committee to plan or conduct audits or to determine that the Corporation’s financial statements are complete and accurate and are in accordance with generally accepted accounting principles. This is the responsibility of management and the independent auditor. Nor is it the duty of the Committee to conduct investigations, to resolve disagreements, if any, between management and the Corporation’s independent auditor or to assure compliance with laws and regulations.

MEETINGS

The Committee will meet at least two times each year. The Committee may establish its own schedule which it will provide to the Board in advance.

The Committee will meet at least annually with the Corporation’s chief financial officer, its senior internal auditing executive, and its independent auditor in separate executive sessions. The Committee will meet with the Corporation’s independent auditors, at such times as it deems appropriate, to review the independent auditor’s examination and management report.

MINUTES

The Committee will maintain written minutes of its meetings, which minutes will be filed with the minutes of the meetings of the Board.

A-3

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

AMERICAN PHARMACEUTICAL PARTNERS, INC.

ANNUAL MEETING OF STOCKHOLDERS

October 25, 2002

The undersigned hereby appoints Jack C. Silhavy and Derek J. Brown, or either of them, each with the power of substitution, and hereby authorizes each of them to represent and to vote as designated below all of the shares of Common Stock of American Pharmaceutical Partners, Inc. that the undersigned is entitled to vote at the 2002 Annual Meeting of Stockholders to be held at 10:30 a.m., Pacific Daylight Time on October 25, 2002 at the Fairmont Miramar Hotel, Veranda Room, located at 101 Wilshire Boulevard, Santa Monica, California 90401, or any adjournment or postponement thereof.

THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED AS DIRECTED BY THE UNDERSIGNED STOCKHOLDER. IF NO SUCH DIRECTIONS ARE MADE, THIS PROXY WILL BE VOTED “FOR” THE ELECTION OF THE NOMINEES LISTED ON THE REVERSE SIDE FOR THE BOARD OF DIRECTORS AND “FOR” PROPOSAL NO. 2.

CONTINUED AND TO BE SIGNED ON REVERSE SIDE

ê Please Detach and Mail in the Envelope Provided ê

A | | x | | Please mark your votes as indicated in this example. | | |

| | | | | FOR ALL NOMINEES | | WITHHOLD ALL NOMINEES | | | | | | | | FOR | | AGAINST | | ABSTAIN |

| 1. | | Election of Directors. The Board of Directors recommends a vote for election of the nominees listed at right: | | ¨ | | ¨ | | Nominees: (1) Patrick Soon-Shiong, M.D. (2) Derek J. Brown (3) Jeffrey M. Yordon (4) David S. Chen, Ph.D. (5) Stephen D. Nimer, M.D. (6) Leonard Shapiro (7) Kirk K. Calhoun | | 2. | | Ratification of Appointment of Auditors.To ratify the selection of Ernst & Young LLP as the independent auditors of the Company for the fiscal year ending December 31, 2002. | | ¨ | | ¨ | | ¨ |

WITHHOLD AUTHORITY TO VOTE FOR ANY INDIVIDUAL NOMINEE. WRITE NUMBER(S) OF NOMINEE(S) BELOW. USE NUMBER ONLY | | | | | | PLEASE MARK, SIGN, DATE AND RETURN THIS PROXY CARD PROMPTLY USING THE ENCLOSED REPLY ENVELOPE. |

| | | | | | | | | | | | | |

| | | | | | | | | | | | |

SIGNATURE(S) DATE: , 2002

| NOTE: | | Please sign as or on behalf of the stockholder whose name appears on this proxy card. If shares are held jointly, each person should sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If a corporation, please sign in full corporate name by President or other authorized officer. If a partnership, please sign in partnership name by an authorized person. |