SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

¨ Preliminary Proxy Statement | | ¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

þ Definitive Proxy Statement | | |

¨ Definitive Additional Materials | | |

¨ Soliciting Material under Rule 14a-12 | | |

ABRAXIS BIOSCIENCE, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

ABRAXIS BIOSCIENCE, INC.

NOTICE OF 2006 ANNUAL MEETING OF STOCKHOLDERS

Dear Stockholders:

We cordially invite you to attend the 2006 Annual Meeting of Stockholders of Abraxis BioScience, Inc., to be held at offices located at the Fairmont Miramar Hotel, 101 Wilshire Blvd., Santa Monica, CA 90401 at 10 a.m. Pacific Daylight Saving Time (registration will begin at 9:30 a.m.), on August 1, 2006, for the following purposes:

1.Election of Directors.To elect directors to hold office until the 2007 Annual Meeting of Stockholders, or until their successors are elected and qualified.

2.Ratification and Approval of the Appointment of Independent Auditors.To ratify and approve the appointment of Ernst & Young LLP as our independent auditors for the fiscal year ending December 31, 2006.

3.Other Business.To transact such other business as may properly come before the Annual Meeting of Stockholders and any adjournment or postponement thereof.

The above items of business are more fully described in the proxy statement which is attached to this notice. Stockholders who owned stock in Abraxis BioScience, Inc. at the close of business on June 7, 2006 may attend and vote at the meeting.

Whether or not you expect to attend the 2006 Annual Meeting of Stockholders in person, you are urged to vote as promptly as possible to ensure your representation and the presence of a quorum at the 2006 Annual Meeting. Instructions are set forth on the enclosed proxy card. Stockholders may vote their shares by marking, signing, dating and returning the proxy card in the enclosed postage-prepaid envelope. If you send in your proxy card and then decide to attend the 2006 Annual Meeting to vote your shares in person, you may still do so. Your proxy is revocable in accordance with the procedures set forth in the proxy statement.

We look forward to seeing you at the meeting.

|

| Sincerely, |

|

|

| Dr. Patrick Soon-Shiong |

| Executive Chairman/Chief Executive Officer |

Los Angeles, CA

July 5, 2006

ABRAXIS BIOSCIENCE, INC.

11777 San Vicente Blvd., Suite 550

Los Angeles, CA 90049

PROXY STATEMENT

General Information

This proxy statement is furnished to the stockholders of Abraxis BioScience, Inc. in connection with the solicitation by our board of directors of proxies in the accompanying form for use in voting at the 2006 Annual Meeting of Stockholders (the “2006 Annual Meeting”). Our 2006 Annual Meeting will be held on August 1, 2006, at the Fairmont Miramar Hotel, 101 Wilshire Blvd., Santa Monica, CA 90401 at 10 a.m. Pacific Daylight Saving Time, and any adjournment or postponement thereof. The shares represented by the proxies received by us properly marked, dated, executed and not revoked will be voted at the 2006 Annual Meeting.

Revocability of Proxies

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before it is exercised by delivering a written notice of revocation or a duly executed proxy bearing a later date to the attention of our Corporate Secretary or by attending the 2006 Annual Meeting and voting in person. Attendance at the Annual Meeting will not, in itself, constitute revocation of a previously granted proxy.

Solicitation and Voting Procedures

This proxy statement and the accompanying proxy card were first sent by mail to stockholders on or about July 5, 2006. The costs of this solicitation are being borne by us. We may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding proxy material to such beneficial owners. Proxies may also be solicited by certain of our directors, officers and regular employees, without additional compensation, personally or by telephone, fax or telegram.

The close of business on June 7, 2006 has been fixed as the record date (the “Record Date”) for determining the holders of shares of our common stock entitled to notice of and to vote at the 2006 Annual Meeting. As of the close of business on the Record Date, we had approximately 158,837,983 shares of common stock outstanding and entitled to vote at the 2006 Annual Meeting. Holders of common stock on the Record Date will vote at the 2006 Annual Meeting as a single class on all matters, with each holder of common stock entitled to one vote per share held.

A majority of the shares entitled to vote, present in person or represented by proxy, shall constitute a quorum at the 2006 Annual Meeting. For the election of directors, the candidates receiving the greatest number of affirmative votes will be elected, provided a quorum is present and voting. The affirmative vote by holders of a majority of the outstanding shares of our common stock present, in person or represented by proxy, at the 2006 Annual Meeting shall be required to approve Proposal No. 2 being submitted to the stockholders for their consideration.

Under the General Corporation Law of the State of Delaware, an abstaining vote and a broker “non-vote” are counted as present and are, therefore, included for purposes of determining whether a quorum of shares is present at a meeting. A broker “non-vote” occurs when a nominee holding shares for a beneficial owner does not

1

vote on a particular proposal because the nominee does not have the discretionary voting power with respect to that item and has not received instructions from the beneficial owner. Broker “non-votes” and shares as to which proxy authority has been withheld with respect to any matter are not deemed to be entitled to vote for purposes of determining whether stockholder approval of that matter has been obtained. As a result, broker “non-votes” are not included in the tabulation of the voting results on the election of directors or issues requiring approval of a majority of the shares of common stock entitled to vote and, therefore, do not have the effect of votes in opposition in such tabulations. With respect to Proposal No. 2 requiring the affirmative vote of a majority of the common stock voting together as a class, present and entitled to vote, broker “non-votes” have no effect. Because abstentions will be included in tabulations of the shares of common stock entitled to vote for purposes of determining whether a proposal has been approved, abstentions have the same effect as negative votes on Proposal No. 2.

Shares of common stock cannot be voted until a signed proxy card is returned. Any stockholder may change their vote prior to the meeting by revoking their proxy or by submitting a proxy bearing a later date.

We have retained American Stock Transfer to tabulate votes cast by proxy at the 2006 Annual Meeting and one or more of our officers will tabulate votes cast in person at the 2006 Annual Meeting.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Our bylaws provide that the number of directors on the board shall be fixed by our board of directors from time to time. The number of directors is currently fixed at eight. The board of directors has nominated (i) Patrick Soon-Shiong, M.D., (ii) David S. Chen, Ph.D., (iii) Stephen D. Nimer, M.D., (iv) Leonard Shapiro (v) Kirk K. Calhoun, (vi) Sir Richard Sykes, (vii) Michael D. Blaszyk and (viii) Michael Sitrick for election to the board of directors until the 2007 annual meeting of stockholders and until each of their successors are duly elected and qualified. Other than Sir Richard Sykes, Michael D. Blaszyk and Michael Sitrick, each of the nominees are incumbent directors. The proxies for the 2006 Annual Meeting of Stockholders, however, will not be voted for a greater number of persons than the nominees named. Unless individual stockholders specify otherwise, each returned proxy will be voted for the election of the six nominees who are listed above.

If any of the nominees named above is unable to serve or declines to serve at the time of the 2006 Annual Meeting, the persons named in the enclosed proxy will exercise discretionary authority to vote for substitutes. The nominees for election have agreed to serve if elected, and our management has no reason to believe that any of the nominees will be unable or unwilling to serve as a director if elected.

Votes withheld from any nominee are counted for purposes of determining the presence or absence of a quorum. Unless otherwise instructed, the proxy holders will vote the proxies received by themin favor of the election of each of the nominees named above.

THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR THE ELECTION OF

THE NOMINEES NAMED ABOVE.

2

Nominees for Directors

Patrick Soon-Shiong, M.D.has served as our Chief Executive Officer since December 2005 and as our Executive Chairman since November 2004. Dr. Soon-Shiong previously served as our Chief Executive Officer and Chairman of the board of directors since our inception in March 1996 to November 2004 and as our President from July 2001 to November 2004. From our inception to August 1997, Dr. Soon-Shiong also served as our Chief Financial Officer. Since June 1994, Dr. Soon-Shiong has also served as president, chief financial officer and a director of American BioScience, Inc., our majority-owned parent. From June 1994 to June 1998, he served as chief executive officer and chairman of the board of directors of VivoRx, Inc., a biotechnology company. Dr. Soon-Shiong is named as a co-inventor on over 30 issued U.S. patents. Dr. Soon-Shiong is a fellow of the American College of Surgeons and the Royal College of Physicians and Surgeons of Canada. Dr. Soon-Shiong holds a degree in Medicine from the University of the Witwatersrand and a M.S.C. in Science from the University of British Columbia.

David S. Chen, Ph.D.has served as a director since June 1998. Since February 2004, Dr. Chen has been Senior Executive Vice President of China Development Industrial Bank. Dr. Chen was chairman of Cypac Investment Management Limited from 1998 to 2003. He served as chief executive officer from July 1996 to February 2000 and chief financial officer from May 1991 to February 1994 of Central Investment Holdings Company. Dr. Chen holds a B.S. in Agricultural Economics from National Taiwan University, an M.B.A. from California State University at Long Beach and a Ph.D. in Business Administration from Nova University, Florida. Dr. Chen has served as a director since 1998 and is a member of our Audit Committee and Compensation Committee.

Stephen D. Nimer, M.D.has served as a director since May 2001. Dr. Nimer has been associated with Memorial Sloan-Kettering Cancer Center since 1993 and has been Head of the Division of Hematologic Oncology since 1996 and Chief of the Hematology Service since 1993. He has also taught medicine at the Cornell University School of Medicine since 1993. Dr. Nimer holds an M.D. from the University of Chicago and a B.S. in biology from Massachusetts Institute of Technology. Dr. Nimer has served as a director since 2001 and is a member of our Compensation Committee.

Leonard Shapiro has served as a director since October 2002. Mr. Shapiro has over 50 years of business experience as an entrepreneur and founder of Shapco, Inc., a manufacturer and distributor of pipe products, where he has been the Chief Executive Officer since 1948. As Chief Executive Officer of Shapco, he presided over the firm’s real estate investment activities in addition to its manufacturing and distribution operations. Shapco, Inc., together with its subsidiaries, employs over 300 employees in various locations throughout the Western United States. Mr. Shapiro has served as a director since 2002 and is a member of our Audit Committee.

Kirk K. Calhoun has served as a director since October 2002. Mr. Calhoun joined Ernst & Young LLP in 1965 and served as a partner of the firm from 1975 until his retirement in June 2002, where his responsibilities included both area management and serving clients in a variety of industries. Mr. Calhoun is a Certified Public Accountant with a background in auditing and accounting. Mr. Calhoun serves on the Board of Directors of Myogen, Inc., Aspeva Pharmaceuticals Corporation, Adams Respiratory Therapeutics, Inc. and Replidyne, Inc. Mr. Calhoun holds a B. S. in Accounting from University of Southern California. Mr. Calhoun has served as a director since 2002 and is a member and Chairman of our Audit Committee.

Sir Richard Sykes is a nominee as a director. Sir Richard has served as the Chairman of the Bioscience Leadership Council since November 2003, and recently accepted the role of Chair of the WHO International Advisory Board that oversees the International Clinical Trials Registry Platform. He is currently Chairman of the Biomedical Sciences International Council, Singapore, and a board member of Rio Tinto Limited and the Lonza Group Limited. He served as President of the British Association for the Advancement of Science from 1998 to 1999, and holds a number of honorary degrees and awards from institutions both in the UK and overseas. He is a Fellow of the Royal Society, an Honorary Fellow of the Royal Society of Chemistry and a Fellow of the Academy of Medical Sciences. He is a Fellow of Imperial College School of Medicine, King’s College, London,

3

a Fleming Fellow at Lincoln College, Oxford, an Honorary Fellow of the Royal College of Physicians, an Honorary Fellow of the University of Wales, Cardiff and an Honorary Fellow of the University of Central Lancashire. Sir Richard was awarded a Ph.D. in Microbial Biochemistry from Bristol University and a D.Sc. from the University of London.

Michael D. Blaszyk is a nominee as a director. Mr. Blaszyk is currently the chief financial officer for Catholic Healthcare West. Prior to joining Catholic Healthcare West, Mr. Blaszyk was the senior vice president and chief financial officer for University Hospitals Health System in Cleveland, Ohio. Mr. Blaszyk also previously served as the managing partner of the Northeast region Health Care Provider Consulting Practice for William M. Mercer and the executive vice president at Boston Medical Center. Mr. Blaszyk received his bachelor’s degree in life sciences from Wayne State University and his master’s degree in health services administration from the University of Colorado.

Michael S. Sitrick is a nominee as a director. Mr. Sitrick is the founder, chairman and chief executive officer of Sitrick and Company, one of the nation’s leading public relations firms. Prior to forming Sitrick and Company, Mr. Sitrick served as senior vice president—communications for Wickes Companies, Inc. and a member of that company’s senior management group. Before joining Wickes, Mr. Sitrick headed corporate communications for National Can Corporation, was a Group Supervisor for a Chicago public relations firm and served as an assistant director of public information in the Richard J. Daley administration in Chicago. He holds a B.S. degree in Business Administration and Journalism from the University of Maryland, College Park.

Committees

The board of directors currently has two standing committees: the audit committee and the compensation committee.

Audit Committee. The audit committee currently consists of Kirk K. Calhoun, David S. Chen and Leonard Shapiro, each of whom is an “independent” as defined in the NASDAQ Marketplace Rules. Kirk Calhoun is currently the chairman of the audit committee. The board of directors has determined that Mr. Calhoun meets the SEC’s definition of “audit committee financial expert” based on his prior experience as a partner of a major public accounting firm.

The audit committee reviews our financial reporting process and the integrity of our financial statements, the system of internal controls, the internal and external audit process, and the process for monitoring compliance with laws and regulations. The audit committee also has the responsibility to review, consider and approve related party transactions including any transaction or proposed transaction between us and American BioScience.

Compensation Committee. The compensation committee currently consists of David S. Chen and Stephen D. Nimer, each of whom is an “independent director.” The Compensation Committee’s responsibilities include (i) determining the salary and bonus of corporate officers, including the chief executive officer, and (ii) acting as administrator to our stock incentive plans, and exercising the authority conferred by the board concerning such plans. The Board adopted a Compensation Committee Charter on July 21, 2005, a copy of which is attached hereto as Exhibit A.

Meetings and Attendance

During the year ended December 31, 2005, the board of directors met eight times. The audit committee held five formal meetings during the year ended December 31, 2005. The compensation committee held two meetings during the year ended December 31, 2005. In 2005, all directors attended at least 75% of all meetings of the board of directors and the committees on which he served after becoming a member of the board or committee.

4

Controlled Company Status and Director Independence

Under the NASDAQ Marketplace Rules, we are a “Controlled Company” since Dr. Soon-Shiong and entities affiliated with him beneficially own approximately 84% of the voting power of our securities. As a Controlled Company we are exempt from certain NASDAQ listing requirements including the requirement (i) to have a majority of independent directors, (ii) to have the compensation of executive officers determined or recommended by a majority of independent directors or a compensation committee comprised solely of independent directors, and (iii) to have director nominees selected or recommended for the board of directors’ selection either by a majority of independent directors or a nominating committee comprised solely of independent directors.

The board of directors has evaluated the relationships between the directors and us and has determined that Messrs. Calhoun, Chen, Nimer and Shapiro are “independent” as defined in the NASDAQ Marketplace Rules.

Executive Sessions of Non-Management Directors

The non-management directors of our board meet in executive session, generally at regularly scheduled meetings of the board of directors or at other times as considered necessary or appropriate. A presiding director is chosen by the non-management directors to preside at each meeting and does not need to be the same director at each meeting.

Relationships Among Directors or Executive Officers

There are no family relationships among any of our directors or executive officers.

Compensation Committee Interlocks and Insider Participation

No interlocking relationship exists between any member of our board of directors or compensation committee and any member of the board of directors or compensation committee of any other company, nor has such interlocking relationship existed in the past.

Compensation of Directors

Directors who are also our employees receive no additional compensation for their services as directors. Our non-employee directors receive cash compensation as follows: (i) an annual retainer of $20,000, (ii) $2,500 for each board meeting attended in person and $500 for each board meeting attended telephonically, (iii) an annual retainer for the Audit Committee Chair of $5,000; (iv) $2,000 for attendance at each Audit Committee meeting in person and $500 for each Audit Committee meeting attended telephonically; and (v) $1,000 for attendance at each Compensation Committee meeting in person and $500 for each Compensation Committee meeting attended telephonically. Non-employee directors are also reimbursed for travel expenses and other out-of-pocket costs of attending board and committee meetings. In addition, non-employee directors are eligible to receive options and shares of common stock directly under our 2001 non-employee director stock option program established under our 2001 Stock Incentive Plan. Non-employee directors are eligible to be granted an initial option to purchase 7,500 shares of common stock upon their initial appointment to the board of directors with subsequent annual option grants to purchase 10,000 shares of common stock, in both instances at an exercise price per share equal to the fair market value of the common stock at the date of grant. Directors who are also our employees are eligible to receive options and shares of common stock directly under our 2001 Stock Incentive Plan.

Director Nominations

Our board of directors as a whole considers and evaluates nominations for the board of directors. Our board of directors considers candidates for the board of directors who may be recommended by board members, management, stockholders and other appropriate sources. Although the board of directors has not set forth any specific minimum qualifications that it believes must be met in order for an individual to be nominated for a position on the board of directors, potential nominees should possess sound judgment, business or professional

5

skills and experience, high integrity and the capability and willingness to represent the long-term interests of our stockholders. As a Controlled Company under the NASDAQ Marketplace Rules, we are not required, and do not have, a nominating committee. Accordingly, we do not have a nominating committee charter. Also, as noted above, as a Controlled Company we are exempt from the NASDAQ Marketplace Rules that require nominees for our board of directors be selected or recommended either by a majority of independent directors or a nominating committee comprised solely of independent directors. We have a policy for considering director candidates recommended by stockholders, and in general, candidates recommended by stockholders will be considered on the same basis as candidates from other sources. As set forth in our bylaws, if you wish to recommend a candidate for the board of directors, your recommendation should be submitted in writing to our Secretary on a timely basis. To be timely, a stockholder’s recommendation must be delivered to or mailed and received at our principal executive offices, not less than 120 days prior to the anniversary of the date on which we first mailed our proxy materials for the prior year’s annual meeting of stockholders (if an annual meeting of stockholders is to be held more than thirty days before or after the anniversary of the prior years’ meeting, then the recommendation must be submitted in a reasonable time, determined at the board’s discretion, prior to our mailing of the proxy materials for such annual meeting). All such recommendations may be sent to the attention of our Corporate Secretary at 11777 San Vicente Blvd., Suite 550, Los Angeles, CA 90049.

Stockholder Communications with the Board of Directors

Generally, stockholders who have questions or concerns should contact our investor relations department through our website at www.appdrugs.com, or by contacting our headquarters at (310) 826-8505. However, stockholders who wish to communicate with our board or any individual director regarding our business should send such communication by mail to the attention of the Corporate Secretary at 11777 San Vicente Blvd., Suite 550, Los Angeles, CA 90049.

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

Ernst & Young LLP has served as our independent auditors since our inception in 1996 and has been appointed by our board of directors to continue as our independent auditors for the fiscal year ending December 31, 2006. In the event that ratification of this selection of auditors is not approved by holders of a majority of the shares of common stock voting at the 2006 Annual Meeting in person or by proxy, management and the audit committee of the board of directors will review our future selection of auditors.

A representative of Ernst & Young is expected to be present at the 2006 Annual Meeting. The representative will have an opportunity to make a statement and to respond to appropriate questions.

We have been informed by Ernst & Young that neither Ernst & Young nor any of its members or their associates has any direct financial interest or material indirect financial interest in us.

Audit and Related Fees

Fees for professional services provided by our independent auditors, Ernst & Young, LLP, in each of the last two fiscal years, were as follows:

| | | | | | |

| | | 2005 | | 2004 |

| | | (in thousands) |

Audit Fees | | $ | 757 | | $ | 747 |

Audit-Related Fees | | | 79 | | | 30 |

Tax Fees | | | 12 | | | 120 |

All Other Fees | | | — | | | 10 |

| | | | | | |

Total | | $ | 848 | | $ | 907 |

| | | | | | |

6

Our audit committee pre-approves all audit and non-audit services provided by our independent auditor, as described in the audit committee’s charter. All of the above fees were billed to us by Ernst & Young for the services categorized above, and all such services were pre-approved by our audit committee. Audit fees included fees associated with the audit of our year-end financial statements and the review of documents filed with the Securities and Exchange Commission including our quarterly reports on Form 10-Q and annual report on Form 10-K. Audit-related fees principally included fees in connection with accounting consultations and the audit of our 401(k) plan. Tax fees included fees for tax compliance, tax advice and tax planning services.

The audit committee considered whether the provision of other non-audit services is compatible with the principal accountants’ independence and concluded that provision of other non-audit services are compatible with maintaining the independence of our external auditors.

THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR RATIFICATION OF THE

APPOINTMENT OF ERNST & YOUNG LLP AS THE COMPANY’S INDEPENDENT

AUDITORS FOR THE YEAR ENDING DECEMBER 31, 2006.

7

MANAGEMENT

The following sets forth certain information with respect to our executive officers and key employees as of June 1, 2006

| | | | |

Name | | Age | | Position(s) |

Patrick Soon-Shiong, M.D. | | 53 | | Executive Chairman and Director |

| | |

David S. Chen, Ph.D | | 57 | | Director |

| | |

Stephen D. Nimer, M.D. | | 52 | | Director |

| | |

Leonard Shapiro | | 77 | | Director |

| | |

Kirk K. Calhoun | | 62 | | Director |

| | |

Shahid Ahmed | | 54 | | Vice President of Regulatory Affairs |

| | |

Margaret Foss | | 51 | | Vice President of Quality Assurance & Quality Control |

| | |

J. Frank Harmon | | 51 | | Executive Vice President Global Operations |

| | |

Richard E. Maroun | | 51 | | Chief Administrative Officer |

| | |

Carlo Montagner | | 39 | | President of Abraxis Oncology |

| | |

Scott W. Meacham | | 47 | | Vice President, Sales USA Generic Business |

| | |

Ronald E. Pauli | | 45 | | Chief Financial Officer |

| | |

Deena Reyes | | 40 | | Vice President of Marketing |

| | |

Daniel S. Robins | | 40 | | Vice President of Product Development |

| | |

Thomas H. Silberg | | 59 | | Executive Vice President |

| | |

Sam Trippie | | 65 | | Vice President of Manufacturing |

| | |

Bruce J. Wendel | | 52 | | Vice President of Corporate Development |

| | |

John Weidenbruch | | 45 | | General Counsel and Assistant Secretary |

Patrick Soon-Shiong, M.D.has served as our Chief Executive Officer since December 2005 and as our Executive Chairman since November 2004. Dr. Soon-Shiong previously served as our Chief Executive Officer and Chairman of the board of directors since our inception in March 1996 to November 2004 and as our President from July 2001 to November 2004. From our inception to August 1997, Dr. Soon-Shiong also served as our Chief Financial Officer. Since June 1994, Dr. Soon-Shiong has also served as president, chief financial officer and a director of American BioScience, Inc., our majority-owned parent. From June 1994 to June 1998, he served as chief executive officer and chairman of the board of directors of VivoRx, Inc., a biotechnology company. Dr. Soon-Shiong is named as a co-inventor on over 30 issued U.S. patents. Dr. Soon-Shiong is a fellow of the American College of Surgeons and the Royal College of Physicians and Surgeons of Canada. Dr. Soon-Shiong holds a degree in Medicine from the University of the Witwatersrand and a M.S.C. in Science from the University of British Columbia.

David S. Chen, Ph.D.has served as a director since June 1998. Since February 2004, Dr. Chen has been Senior Executive Vice President of China Development Industrial Bank. Dr. Chen was chairman of Cypac Investment Management Limited from 1998 to 2003. He served as chief executive officer from July 1996 to February 2000 and chief financial officer from May 1991 to February 1994 of Central Investment Holdings Company. Dr. Chen holds a B.S. in Agricultural Economics from National Taiwan University, an M.B.A. from California State University at Long Beach and a Ph.D. in Business Administration from Nova University, Florida. Dr. Chen has served as a director since 1998 and is a member of our Audit Committee and Compensation Committee.

8

Stephen D. Nimer, M.D.has served as a director since May 2001. Dr. Nimer has been associated with Memorial Sloan-Kettering Cancer Center since 1993 and has been Head of the Division of Hematologic Oncology since 1996 and Chief of the Hematology Service since 1993. He has also taught medicine at the Cornell University School of Medicine since 1993. Dr. Nimer holds an M.D. from the University of Chicago and a B.S. in biology from Massachusetts Institute of Technology. Dr. Nimer has served as a director since 2001 and is a member of our Compensation Committee.

Leonard Shapiro has served as a director since October 2002. Mr. Shapiro has over 50 years of business experience as an entrepreneur and founder of Shapco, Inc., a manufacturer and distributor of pipe products, where he has been the Chief Executive Officer since 1948. As Chief Executive Officer of Shapco, he presided over the firm’s real estate investment activities in addition to its manufacturing and distribution operations. Shapco, Inc., together with its subsidiaries, employs over 300 employees in various locations throughout the Western United States. Mr. Shapiro has served as a director since 2002 and is a member of our Audit Committee.

Kirk K. Calhoun has served as a director since October 2002. Mr. Calhoun joined Ernst & Young LLP in 1965 and served as a partner of the firm from 1975 until his retirement in June 2002, where his responsibilities included both area management and serving clients in a variety of industries. Mr. Calhoun is a Certified Public Accountant with a background in auditing and accounting. Mr. Calhoun serves on the Board of Directors of Myogen, Inc., Aspeva Pharmaceuticals Corporation and Adams Respiratory Therapeutics, Inc., as well as the Board of Governors of the California State University Foundation. Mr. Calhoun holds a B. S. in Accounting from University of Southern California. Mr. Calhoun has served as a director since 2002 and is a member and Chairman of our Audit Committee.

Shahid Ahmed has served as our Vice President of Regulatory Affairs since October 2002. From 2001 to 2002, Mr. Ahmed served as Senior Vice President, Regulatory Affairs, QA, QC for Akorn, Inc. From 1994 to 2001, Mr. Ahmed served in various regulatory affairs capacities with the Ben Venue Laboratories, Division of Boehringer-Ingelheim, most recently as Vice President, Regulatory Affairs, QC and Microbiology. Mr. Ahmed holds a M.S. in Analytical Chemistry from Manitoba University.

Margaret Foss was appointed Vice President of Quality Assurance & Quality Control in September of 2004. Prior to joining us, Ms. Foss spent 22 years at Baxter Healthcare where she most recently served as vice president of quality management, where she led the planning, development, implementation and improvement of systems to ensure product quality and adherence to prescribed standards. Ms. Foss holds a nursing degree from Trumbull Memorial Hospital School of Nursing.

Frank Harmon has served as our Executive Vice President of Global Operations since May 2006. Prior to joining us, Mr. Harmon served as the senior vice president, manufacturing operations for the Sterile Technologies Group at Cardinal Health where he was responsible for multiple sites throughout the United States and Puerto Rico. Mr. Harmon has also served as vice president, biopharmaceutical operations for Aventis Behring. Mr. Harmon earned an MBA from St. Louis University and undergraduate B.S. degrees in Biology and Chemistry from Western Kentucky University.

Richard E. Maroun has served as or Chief Administrative Officer since May 2006. Previously, Mr. Maroun served as the General Counsel and Vice President of Corporate Development of American BioScience, Inc. (our former parent company) since 2004. Prior to joining American BioScience, Mr. Maroun served as Director at Merrill Lynch in its advisory services business unit for four years. In addition, Mr. Maroun previously practiced law in Northern California specializing in business and tax matters and was a Senior Tax Manager with Deloitte & Touche, an accounting firm. Mr. Maroun holds a B.S. in Economics from John Carroll University, a J.D. from Santa Clara University and an L.L.M in Taxation from Boston University.

9

Scott W. Meacham has served as our Vice President, Sales USA Generic Business since February 2005. In 2004, Mr. Meacham held the position of Vice President, Sales with ReddShell Corporation. From 2001 through 2004, he served as Vice President, National Accounts, US Renal Division, with Baxter Healthcare. Mr. Meacham holds a B.S. degree in Pharmacy from Butler University.

Carlo Montagner has served as President of Abraxis Oncology, a division of our company since April 2006. Prior to that date, Mr. Montagner served as President of American BioScience’s Commercial Development Division since January 2006. From February 2005 to January 2006, he served as Executive Vice President and Head of the Global Oncology Business Unit of Schering, A.G., responsible for clinical development and commercial operations. Mr. Montagner served as Oncology & Cardiovascular Business Unit Head & Member, Board of Management for Sanofi-Aventis Japan from June 2003 to January 2005 and as Global Business Team Leader Taxotere®/Taxanes for Aventis Pasteur from June 2000 to May 2003. From September 1998 to May 2000, he served as Commercial Director Oncology/Cardiovascular, Aventis Australia. From April 1991 to August 1998, he served as various sales management and product/marketing management roles for Aventis Pasteur. Mr. Montagner holds a B.S. from La Trobe University in Australia and an M.S. in Psychology from the Royal Melbourne Institute of Technology.

Ronald E. Paulihas served as our interim Chief Financial Officer since May 2006. He previously served as our corporate controller since 2002. From 2000 to 2002, Mr. Pauli served as Vice President, Controller and Chief Financial Officer of ERSCO Corporation, a distributor and fabricator of concrete construction products and materials. Prior to 2000, Mr. Pauli served as Corporate Controller for each of Applied Power, Inc. and the R.P. Scherer Corporation, held various accounting, finance and investor relations positions at Kmart Corporation and audit positions at Ernst & Young. Mr. Pauli earned a CPA and holds a B.A. in Accounting from Michigan State University and a M.S. in Finance from Walsh College.

Deena Reyeswas appointed Vice President of Marketing on March 1, 2004. Ms. Reyes joined us in January 2001 as Director of Marketing. Prior to that Ms. Reyes served as Senior Product Manager for Pharmacia. Ms. Reyes holds a B.S. degree in Molecular, Cellular and Developmental Biology from the University of Colorado and an M.B.A. from St. Louis University.

Daniel Robins has served as our Vice President of Product Development since January 2005. During 2002 through 2004, Mr. Robins served as Senior Director, Analytical Research & Development with Duramed Research, Inc. He also served as Director, Analytical Research & Development with Barr Laboratories from 2000 to 2002. Mr. Robins has a Ph.D. and M.S. in Analytical Chemistry from Ohio State University, an M.B.A. from Leonard N. Stern School of Business, New York University, and B.A. in Chemistry from LaSalle University.

Thomas H. Silberghas served as our Executive Vice President, Commercial Operations & Operational Excellence since May 2006. Previously Mr. Silberg served as chief operating officer of Tercica, Inc., where his direct responsibilities included regulatory, clinical development, medical affairs, manufacturing, quality assurance/quality control, sales and marketing, business development, and project management. Prior to his work at Tercica, Mr. Silberg was executive vice president and chief operating officer of Ligand Pharmaceuticals after serving as senior vice president of commercial operations. Mr. Silberg began his career in 1972 with Hoffmann-LaRoche, Inc., where, over a 27-year span he held a variety of positions and rose through the management ranks to vice president of business operations. Mr. Silberg earned a bachelor of science degree in marketing and advertising from the University of Minnesota.

Sam Trippie has served as our Vice President of Manufacturing since June 1998. From September 1992 to June 1998, Mr. Trippie served as vice president of manufacturing at Fujisawa USA, Inc., a pharmaceutical company. Prior to that, Mr. Trippie was vice president of manufacturing at Sanofi Animal Health Ltd. and held various positions in quality assurance and manufacturing at Baxter International. Mr. Trippie holds a B.S. in Microbiology from the University of Southwest Louisiana.

10

Bruce J. Wendel was appointed our Executive Vice President of Corporate Development in May 2006. Previously Mr. Wendel served as our Senior Vice President, Mergers and Acquisition since October 2004. Before joining us in August 2004, Mr. Wendel served as Vice President Business Development & Licensing for IVAX Corporation, a generic drug manufacturer. Prior to this, Mr. Wendel held various positions at Bristol-Myers Squibb over a period of 14 years, where he last served as Vice President Corporate Development International Medicines. Mr. Wendel holds a J.D. from Georgetown University Law School where he was an editor of Law & Policy in International Business, and a bachelor of science degree from Cornell University.

John Weidenbruch has served as our General Counsel since January 2006. He was also the Vice President of Global Commercial Operations for American BioScience since October 2005. Prior to joining ABI, Mr. Weidenbruch served in various positions at Amgen Inc. for approximately 11 years, most recently as Senior Associate General Counsel where he led a team of attorneys in support of Amgen’s Global Commercial Operations. In this capacity, he provided oversight for all aspects of sales, marketing, contracting and pricing across all therapeutic areas. Mr. Weidenbruch was directly involved in the launch of four new products, including two blockbuster products with sales in excess of $1 billion annually. Prior to joining Amgen, Mr. Weidenbruch was involved with State Government Affairs for Syntex Laboratories from 1992 to 1995 and the Nonprescription Drug Manufacturers Association from 1988 to 1992. Mr. Weidenbruch holds a B.A. from Loyola College in Baltimore, Maryland and a J.D. from Georgetown University Law Center.

11

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of our common stock as of June 7, 2006, for (i) each person who is known by us to beneficially own more than 5% of our common stock, (ii) each of the directors, (iii) each of the named executive officers appearing in the Summary Compensation Table below, and (iv) all of the directors and executive officers as a group.

| | | | |

Name and Address of Beneficial Owner | | Number of Common

Stock Shares Beneficially Owned

(1) | | Percent of

Class (%) |

5% Stockholders | | | | |

| | |

Steven Hassen, Trustee(2) Themba 2005 Trust I 10182 Culver Boulevard Culver City, CA 90232 | | 39,616,143 | | 24.94 |

| | |

Steven Hassen, Trustee(3) Themba 2005 Trust II 10182 Culver Boulevard Culver City, CA 90232 | | 39,616,143 | | 24.94 |

| | |

California Capital Limited Partnership(4) 10182 Culver Boulevard Culver City, CA 90232 | | 37,015,318 | | 23.30 |

| | |

Sands Capital Management, LLC(5) 1100 Wilson Blvd., Suite 3050 Arlington, VA 22209 | | 7,979,707 | | 5.02 |

| | |

Directors and Named Executive Officers(6) | | | | |

| | |

Patrick Soon-Shiong, M.D.(7)(8) | | 133,616,041 | | 84.12 |

| | |

Alan L. Heller | | 0 | | * |

| | |

Nicole S. Williams(9) | | 62,750 | | * |

| | |

Mark Van Ausdal | | 123 | | * |

| | |

David S. Chen, Ph.D.(10) | | 22,000 | | * |

| | |

Stephen D. Nimer, M.D.(11) | | 50,200 | | * |

| | |

Leonard Shapiro(12) | | 53,250 | | * |

| | |

Kirk K. Calhoun(13) | | 28,750 | | * |

| | |

All named executive officers and directors as a group (eight persons)(14) | | 133,833,114 | | 84.34 |

| * | Represents beneficial ownership of less than 1% of issued and outstanding common stock on January 31, 2006. |

| (1) | Beneficial ownership as reported in the above table has been determined in accordance with Rule 13d-3 of the Securities Exchange Act of 1934. The percentage of shares beneficially owned is based on 158,837,983 shares of common stock outstanding as of June 7, 2006. To our knowledge, except as indicated in the footnotes to this table, and subject to applicable community property laws, such persons have sole voting and investment power with respect to the shares of common stock set forth opposite such person’s name. |

| (2) | The amount shown and the following information were provided by Themba 2005 Trust I pursuant to a Schedule 13D filed on May 1, 2006. The Schedule 13D indicated that Themba 2005 Trust I has shared voting power of 39,616,143 shares and has shared dispositive power and is deemed to be the beneficial owner of 39,616,143 shares. |

12

| (3) | The amount shown and the following information were provided by Themba 2005 Trust II pursuant to a Schedule 13D filed on May 1, 2006. The Schedule 13D indicated that Themba 2005 Trust II has shared voting power of 39,616,143 shares and has shared dispositive power and is deemed to be the beneficial owner of 39,616,143 shares. |

| (4) | The amount shown and the following information were provided by California Capital Limited Partnership pursuant to a Schedule 13D filed on May 1, 2006. The Schedule 13D indicated that California Capital Limited Partnership has shared voting power of 37,015,318 shares and has shared dispositive power and is deemed to be the beneficial owner of 37,015,318 shares. |

| (5) | The amount shown and the following information were provided by Sands Capital Management, LLC pursuant to a Schedule 13G filed on May 5, 2006 . The Schedule 13G indicated that Sands Capital Management, LLC is an investment adviser registered under Section 203 of the Investment Advisers Act of 1940 and has indicated that it has sole voting power of 5,578,624 shares and has sole dispositive power and is deemed to be the beneficial owner of 7,979,707 shares as a result of acting as an investment adviser to investment companies registered under the Investment Act of 1940 and or employee benefit plans, pension funds, endowment funds or other institutional clients. |

| (6) | Except as otherwise indicated, the address of each of the executive officers and directors is c/o Abraxis BioScience, Inc., 11777 San Vicente Blvd., Suite 550, Los Angeles, CA 90049. |

| (7) | Includes 133,088,093 comprised of 79,232,286 shares of common stock held by Themba 2005 Trust I and Themba 2005 Trust II, of which Dr. Soon-Shiong is a protector; 13,286,860 shares of common stock held by certain grantor annuity trusts of which Dr. Soon-Shiong is the trustee and certain family members of Dr. Soon-Shiong are beneficiaries; 37,015,318 shares of common stock held by California Capital Limited Partnership, of which an entity controlled by Dr. Soon-Shiong is the general partner; and 3,553,629 shares of common stock held by RSU Plan LLC, of which Dr. Soon-Shiong is the manager. Dr. Soon-Shiong disclaims beneficial ownership of these shares except to the extent of his pecuniary interest in these entities. |

| (8) | Includes 405,000 shares of common stock subject to options that are currently exercisable or will become exercisable with 60 days of May 31, 2006. |

| (9) | Includes 53,750 shares of common stock subject to options that are currently exercisable or will become exercisable with 60 days of May 31, 2006. |

| (10) | Includes 22,000 shares of common stock subject to options that are currently exercisable or will become exercisable with 60 days of May 31, 2006. |

| (11) | Includes 44,500 shares of common stock subject to options that are currently exercisable or will become exercisable with 60 days of May 31, 2006. |

| (12) | Includes 28,750 shares of common stock subject to options that are currently exercisable or will become exercisable with 60 days of May 31, 2006. |

| (13) | Includes 28,750 shares of common stock subject to options that are currently exercisable or will become exercisable with 60 days of May 31, 2006. |

| (14) | See footnotes (8) through (13). Includes 582,750 shares of common stock subject to options that are currently exercisable or will become exercisable with 60 days of May 31, 2006. |

13

EXECUTIVE COMPENSATION AND RELATED INFORMATION

The following table sets forth certain information concerning compensation of (i) each person that served as Chief Executive Officer during the last fiscal year, (ii) the other most highly compensated executive officers whose aggregate cash compensation exceeded $100,000 during the last fiscal year (collectively, the “Named Executive Officers”):

| | | | | | | | | | | | | | |

| | | | | Annual Compensation | | Long-TermCompensation | | |

Name | | Fiscal

Year(1) | | Salary ($) | | Bonus

($)(2) | | Other Annual

Compensation(3) | | Restricted Stock

Awards ($) (4) | | Securities

Underlying Options (#) | | All Other

Compensation ($)(5) |

Patrick Soon-Shiong, M.D. Executive Chairman and Chief Executive Officer(6) | | 2005

2004

2003 | | 600,000

419,596

366,231 | | 225,000

410,000

405,000 | | —

—

— | | —

—

110,150 | | 40,000

20,000

— | | 6,656

6,867

6,716 |

| | | | | | | |

Alan L. Heller Former President and Chief Executive Officer(7) | | 2005

2004

2003 | | 553,846

78,462

— | | —

—

— | | —

—

— | | —

1,487,500

— | | —

150,000

— | | 6,589

93

— |

| | | | | | | |

Nicole S. Williams Former Executive Vice President and Chief Financial Officer | | 2005

2004

2003 | | 295,384

288,077

257,692 | | 176,000

303,000

100,000 | | —

—

�� | | —

—

— | | 20,000

15,000

— | | 8,119

8,055

7,115 |

| | | | | | | |

Mark Van Ausdal Former Vice President and General Counsel(8) | | 2005

2004

2003 | | 219,231

—

— | | —

—

— | | —

—

— | | —

—

— | | 10,000

—

— | | 6,149

—

— |

| (1) | Compensation reported for the fiscal years ending December 31, 2003, December 31, 2004, and December 31, 2005. |

| (2) | Reflects bonus amounts paid in each fiscal year. |

| (3) | We provided Dr. Soon-Shiong with the use of a car and a trained security driver, security systems for his residences, and 24 hour personal and family protection services at his office and residences and on other appropriate occasions. The non-business costs of these systems and services have been reported as other annual compensation. These costs were incurred as a result of business-related concerns and are not maintained as perquisites or otherwise for the personal benefit of this officer. As a result, we have not included such costs in the column on Other Annual Compensation, but we note that the aggregate costs to us for providing these systems and services in 2005 was $355,151. In addition, for security and management efficiency reasons, we pay for a chartered private aircraft for business use to certain of our named executive officers. In the event an officer brings guests for personal reasons or for reasons un-related to our business on business-related flights, such officer is required to pay to us the pro-rata costs associated with the non-business use of the chartered private aircraft. |

| (4) | As of December 31, 2005, the aggregate value of the restricted stock held by Dr. Soon-Shiong based on the closing price of our common stock of $38.79 was $290,925. The restricted stock grant to Mr. Heller terminated prior to vesting and had no value as of December 31, 2005. |

| (5) | With respect to fiscal year 2005, amounts reported include contributions to our 401(k) Plan for Messrs. Soon-Shiong and Heller in the amount of $5,953 per individual, for Ms. Williams in the amount of $6,138, and for Mr. Van Ausdal in the amount of $5,189. The amounts reported for fiscal year 2005 also consist of the dollar value of life insurance premiums paid by us. These amounts include $703 for Dr. Soon-Shiong, $636 for Mr. Heller, $1,981 for Ms. Williams and $960 for Mr. Van Ausdal. |

| (6) | Dr. Soon-Shiong continued to serve as our Executive Chairman during 2005 and replaced Mr. Heller as our Chief Executive Officer on November 26, 2005. |

| (7) | Mr. Heller acted as our President and Chief Executive Officer until November 26, 2005 at which date Dr. Soon-Shiong was appointed Chief Executive Officer. |

| (8) | Mr. Van Ausdal acted as our Vice President and General Counsel from March 7, 2005 until December 31, 2005. |

14

Employment Contracts, Termination of Employment and Change of Control Arrangements

Compensation Protection Agreement with Nicole S. Williams

In August 2002, we entered into a compensation protection agreement with Nicole S. Williams in connection with her appointment as our Executive Vice President and Chief Financial Officer, containing substantially the same terms as the compensation protection agreements filed as exhibits to Amendment No. 1 to form S-1 on November 20, 2001. Pursuant to the terms of the agreements, we have elected not to extend the agreement beyond its initial three-year terms. As a result, the compensation protection agreement between us and Ms. Williams expired on August 19, 2005.

Employment and Severance Agreements with Alan L. Heller

In November 2004, we entered into an executive employment agreement with Alan L. Heller in connection with his appointment as our President and Chief Executive Officer, a copy of which was filed as Exhibit 10.21 to our Form 10-K on March 16, 2005. Effective November 23, 2005, Mr. Heller resigned from all offices and directorships he held with the Company. In substantial accordance with the terms of Mr. Heller’s employment agreement, the Company agreed to provide the specified severance benefits to Mr. Heller, except that the Company agreed to make a lump sum payment of $1,680,000 to Mr. Heller in six months rather than over a two-year period as set forth in his employment agreement. See “Other Information.”

Separation Agreements

On November 30, 2005, we entered into a separation agreement with Mark Van Ausdal. Pursuant to this agreement, Mr. Van Ausdal’s employment with us terminated on December 31, 2005. We agreed to pay Mr. Van Ausdal separation pay equal to twelve months of his last base salary, payable over a twelve-month period. In addition, we agreed to provide Mr. Van Ausdal with executive outplacement assistance, a lump sum payment for executive benefits and unused vacation, and our contribution toward premiums for health benefits and life insurance for one year or until he secures other employment with comparable benefits, whichever is earlier.

On December 21, 2005, we entered in a transition agreement with Antonio R. Pera, pursuant to which, Mr. Pera’s would continue to serve as our Executive Vice President, Generics Business through March 31, 2006. Pursuant to the terms of this agreement, we provided Mr. Pera with separation pay upon his termination equal to twelve months of his base salary payable over a twelve-month period. In addition, we provided Mr. Pera with executive outplacement assistance, our contributions toward premiums for Mr. Pera’s health benefits and life insurance for one year or until he secures other employment with comparable benefits, whichever is earlier. We agreed to reimburse Mr. Pera for his apartment rental costs ($1,305 per month) for the remainder of his lease, which is scheduled to end on October 31, 2006, and we accelerated the vesting of his option to purchase 5,000 shares of our common stock as of Mr. Pera’s termination date. This stock option would have otherwise vested on October 31, 2006.

Employment Agreement with Carlo Montagner

On April 26, 2006, our board ratified an employment agreement with Carlo Montagner, the President of Abraxis Oncology, a division of our company, that he entered into with American BioScience in January 2006. Under the terms of the agreement, Mr. Montagner receives an annual base salary of $675,000, subject to annual review by our board of directors, and will be eligible to participate in our bonus plan designed for other executive officers. Mr. Montagner’s bonus target will be 50% of his base salary for the first year of employment. In addition, consistent with the terms of the agreement, Mr. Montagner received an option to purchase 50,000 shares of our common stock on April 26, 2006 with an exercise price of $30.45, which was the closing price of our common stock on the date of grant. This option will vest in four equal annual installments with the first installment vesting on the first anniversary of the grant date. The agreement also provided that Mr. Montagner would be paid $400,000 in cash and/or our common stock in four equal annual installments provided that Mr. Montagner is employed by us upon the date of each annual installment payment. Mr. Montagner is also entitled to reimbursement of relocation expenses.

15

In the event that Mr. Montagner’s employment is terminated by us for cause, or because of his death or disability, he (or his estate in the event of death) will receive his salary up to the termination date, and any benefits required to be provided under our employee benefit plans.

In the event that Mr. Montagner’s employment is terminated by us without cause, he will receive (in addition to his salary up to the termination date and post-termination benefits under company benefit plans) continuation of salary based on his then-current base salary and a bonus (if applicable) paid in monthly installments calculated based on prior bonuses paid, for a twenty four month period after such termination (the “Severance Period”). In addition, Mr. Montagner’s stock option for the purchase of 50,000 shares of common stock would accelerate up to the end of the Severance Period. In the event Mr. Montagner receives severance payments he has agreed to not compete with us during the Severance Period.

Option/SAR Grants in Last Fiscal Year

The following table sets forth certain information concerning options/SARs granted during 2005 to the named executives:

| | | | | | | | | | | | | | | | |

| | | Individual Grants | | Potential Realizable Value at

Assumed Annual Rates of

Stock Price Appreciation For

Option Term(1) |

Name | | Number of

Securities

Underlying

Options

Granted (#) | | % of Total

Options

Granted to

Employees

in Fiscal

Year | | | Exercise

or Base

Price

($/Share) | | Expiration

Date | | 5%($)(2) | | 10% ($)(2) |

Patrick Soon-Shiong, M.D. | | 2,163 | | .28 | % | | $ | 50.85 | | 2/16/2010 | | $ | 17,627 | | $ | 51,048 |

Patrick Soon-Shiong, M.D. | | 37,837 | | 5 | % | | $ | 46.23 | | 2/16/2015 | | $ | 1,100,065 | | $ | 2,787,781 |

Alan L. Heller | | — | | — | | | | — | | — | | | — | | | — |

Nicole S. Williams | | 20,000 | | 2 | % | | $ | 46.23 | | 2/16/2015 | | $ | 581,475 | | $ | 1,473,574 |

Mark Van Ausdal | | 30,000 | | 3 | % | | $ | 50.40 | | 3/29/06 | | $ | 75,600 | | $ | 151,200 |

| (1) | The amounts shown in this table represent hypothetical gains that could be achieved for the respective options if exercised at the end of the option term. These gains are based on assumed rates of stock appreciation of 5% and 10% compounded annually from the date the options were granted to their expiration date. The gains shown are net of the option exercise price, but do not include deductions for taxes or other expenses associated with the exercise. Actual gains, if any, on stock options exercises will depend on the future performance of our common stock, the optionee’s continued employment through the option period and the date on which the options are exercised. These amounts should not be used to predict stock performance. |

| (2) | Dollar amounts are reported to the nearest $1,000. |

Aggregated Option/SAR Exercises in Last Fiscal Year and Fiscal Year-End Option/SAR Values

The following table sets forth certain information with respect to stock options exercised by the Named Executive Officers during fiscal year ending December 31, 2005, including the aggregate value of gains on the date of exercise. In addition, the table sets forth the number of shares covered by stock options as of December 31, 2005, and the value of “in-the-money” stock options, which represents the difference between the exercise price of a stock option and the market price of the shares subject to such option on December 31, 2005.

| | | | | | | | | | | | |

Name | | Shares

Acquired on

Exercise (#) | | Value

Realized

($)(1) | | Number of Securities

Underlying Unexercised Options

at December 31, 2004 (#) | | Value of Unexercised

In-the-Money Options at

December 31, 2004 ($)(2) |

| | | | | | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable |

Patrick Soon-Shiong, M.D. | | — | | — | | 395,000 | | 55,000 | | 13,852,676 | | 105,603 |

Alan L. Heller | | — | | — | | 112,500 | | — | | 1,171,125 | | — |

Nicole S. Williams | | — | | — | | 37,500 | | 42,500 | | 1,092,188 | | 535,163 |

Mark Van Ausdal | | — | | — | | — | | — | | — | | — |

16

| (1) | The value realized upon the exercise of stock options represents the positive spread between the exercise price of stock options and the fair market value of the shares subject to such options on the exercise date. |

| (2) | The value of “in-the-money” stock options represents the positive spread between the exercise price of options and the fair market value of the underlying shares subject to those options on December 31, 2005. |

Equity Compensation Plan Information

We maintain three compensation plans that provide for the issuance of our common stock to officers, directors, other employees or consultants: the (i) 1997 Stock Option Plan (the “1997 Plan”), (ii) 2001 Stock Incentive Plan (the “2001 Stock Incentive Plan”) and (iii) 2001 Employee Stock Purchase Plan (the “2001 Stock Purchase Plan”). Each of these plans has been approved by the stockholders.

The following table provides information about the 1997 Plan, the 2001 Stock Incentive Plan and the 2001 Stock Purchase Plan as of December 31, 2005:

| | | | | | | | |

| | | (a) | | (b) | | (c) | |

Plan Category | | Number of

Securities to be

Issued Upon

Exercise of

Outstanding

Options | | Weighted-Average

Exercise Price of

Outstanding Options | | Number of

Securities

Remaining

Available for Future

Issuance Under

Equity

Compensation Plans | |

Equity Compensation Plans Approved by Security Holders | | 3,571,997 | | $ | 21.38 | | 24,132,529 | (1) |

Equity Compensation Plans Not Approved by Security Holders | | — | | | — | | — | |

| | | | | | | | |

Total | | 3,571,997 | | $ | 21.38 | | 24,132,529 | |

| | | | | | | | |

| (1) | Represents shares available for issuance under our 1997 Plan, 2001 Stock Incentive Plan and 2001 Stock Purchase Plan as of December 31, 2005. The 2001 Stock Incentive Plan contains an evergreen formula pursuant to which on January 1 of each year, the aggregate number of shares reserved for issuance under the 2001 Stock Incentive Plan will increase by a number of shares equal to lesser of (i) six million five hundred thousand (6,000,000) shares, (ii) five percent (5%) of the outstanding shares of common stock on such date, or (iii) a lesser number of shares determined by the administrator of the plan. The 2001 Stock Purchase Plan contains an evergreen formula pursuant to which on January 1 of each year, the aggregate number of shares reserved for issuance under the 2001 Stock Purchase Plan is increased by an amount equal to the lesser of (i) three million (3,000,000) shares, (ii) two percent (2%) of the outstanding shares of common stock on such date, or (iii) a lesser number of shares determined by the administrator of the plan. |

17

AUDIT COMMITTEE REPORT

The information contained in this report shall not be deemed to be “soliciting material” or to be “filed” with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933, as amended or the 1934 Securities Exchange Act, as amended, except to the extent that we specifically incorporate it by reference in such filing.

The following is the report of the audit committee with respect to our audited financial statements for the fiscal year ended December 31, 2005, which include consolidated balance sheets as of December 31, 2004 and December 31, 2003, and the related consolidated statements of operations, stockholders’ equity and cash flows for each of the three fiscal years for the period ended December 31, 2005, and the notes thereto.

The ultimate responsibility for good corporate governance rests with the board of directors, whose primary roles are oversight, counseling and direction to our management in our best long-term interest and that of our stockholders. The audit committee has been established for the purpose of overseeing our accounting and financial reporting processes, the systems of internal accounting and financial controls and audits of our financial statements.

The audit committee currently consists of Kirk K. Calhoun, David S. Chen and Leonard Shapiro, each of whom are “independent” as currently defined in the NASDAQ Marketplace Rules. Mr. Calhoun is currently the chairman of the audit committee. The board of directors has determined that Mr. Calhoun meets the SEC’s definition of “audit committee financial expert” based on his prior experience as a partner of a major public accounting firm.

As more fully described in its charter, one of the primary purposes of the audit committee is to assist the board of directors in its general oversight of our financial reporting, internal accounting and financial controls, and audit function.

Management has the primary responsibility for the preparation, presentation and integrity of our financial statements and the reporting process including the systems of internal controls. We have engaged Ernst & Young LLP (“E&Y”) to perform an independent audit of our financial statements in accordance with generally accepted auditing standards and to issue a report on those statements. The audit committee has ultimate authority and responsibility to select, compensate and evaluate our independent auditors.

The audit committee members are not currently professional accountants or auditors, and their functions are not intended to duplicate or to certify the activities of management and the independent auditors, nor can the audit committee certify that the independent auditors are “independent” under applicable rules. The audit committee serves a board-level oversight role, in which it provides advice, counsel and direction to management and the auditors on the basis of information it receives, discussions with management and the external and internal auditors and the experience of the audit committee’s members in business, finance and accounting matters. The audit committee has the authority to engage its own outside advisers, including experts in particular areas of accounting, as it determines appropriate, apart from counsel or advisors hired by management.

In fulfilling its oversight responsibilities, the audit committee:

| | • | | engaged E&Y as our external auditors; |

| | • | | discussed with E&Y the overall scope and plan for their annual audit and discussed the results of their examinations, their evaluations of our internal controls, and the overall quality of our financial reporting; |

| | • | | reviewed and discussed the scope and results of the internal audit annual plan; |

| | • | | reviewed and approved our whistleblower policies and procedures; |

18

| | • | | reviewed with management and E&Y and approved all significant related party transactions and activities; |

| | • | | met with representatives of E&Y, without management present, and with management representatives without E&Y present; |

| | • | | reviewed and discussed, with management and E&Y, the audited financial statements for the fiscal year ended December 31, 2005, as well as the unaudited financial statements for each of the 2005 fiscal quarters, along with the relevant Management Discussion Analysis in our annual and quarterly reports on Form 10-K and Form 10-Q before such reports are filled with the Securities and Exchange Commission; |

| | • | | discussed with E&Y matters required to be discussed by SAS 61 (Codification of Statements on Accounting Standards) which includes, among other items, matters related to the conduct of the audit of the financial statements; |

| | • | | received the written disclosures and letter from E&Y required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees; |

| | • | | reviewed periodically with management and E&Y the process and progress related to the documentation, assessment and testing of internal accounting controls in accordance with Section 404 of the Sarbanes-Oxley Act; |

| | • | | discussed with representatives of E&Y the public accounting firm’s independence from us and management; and |

| | • | | considered whether E&Y’s provision of non-audit services to us is compatible with maintaining E&Y’s auditor independence. |

In accordance with the Sarbanes-Oxley Act, all services to be provided by the independent auditors are subject to pre-approval by the audit committee. These include audit services, audit related services, tax services and other services. In some cases, pre-approval is provided by the full committee for a particular category or group of services, subject to a specific budget. In other cases, the chairman of the audit committee may be delegated authority from the committee to pre-approve services up to preset specified amounts and such pre-approvals are then communicated to the full audit committee at is next scheduled meeting. The Sarbanes-Oxley Act prohibits us from obtaining certain non-audit services from our independent auditing firm to avoid certain potential conflicts of interest. We have not obtained any of these services from E&Y in recent years.

In reliance on the reviews and discussions referred to above, the audit committee recommended to the board of directors, and the board has approved, that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2005 for filing with the Securities and Exchange Commission. The audit committee and the board of directors have also recommended, subject to stockholder approval, the selection of E&Y as our independent auditors.

MEMBERS OF THE AUDIT COMMITTEE

Kirk K. Calhoun

David S. Chen, Ph.D.

Leonard Shapiro

19

COMPENSATION COMMITTEE REPORT

Notwithstanding anything to the contrary set forth in any of our previous filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate future filings, including this proxy statement, in whole or in part, the following report shall not be deemed to be incorporated by reference into any such filings.

The compensation committee currently consists of David S. Chen and Stephen D. Nimer. Decisions concerning the compensation of our executive officers (including the Named Executive Officers), are made by the compensation committee and reviewed by the full board of directors.

Executive Officer Compensation

The objectives of the compensation committee in establishing compensation for executive officers are to:

| | • | | provide competitive levels of compensation to enable us to attract, retain, and motivate talented management personnel; |

| | • | | reward individuals for their contributions to our achievement of our business objectives; and |

| | • | | align the interests of management with the interests of our stockholders in order to maximize stockholder value. |

Base Salaries.Salaries for our executive officers are determined primarily on the basis of the officer’s responsibility, general salary practices of peer companies and the officer’s individual qualifications and experience. The base salaries are reviewed annually and may be adjusted by the compensation committee in accordance with certain criteria which include individual performance, the functions performed by the officer, the scope of the officer’s on-going duties, general changes in the compensation peer group in which we compete for executive talent, and our general financial performance. The weight given each such factor by the compensation committee may vary from individual to individual.

Bonuses. The compensation committee believes that periodic bonus awards can serve to motivate the executive officers to address annual performance goals, using more immediate measures for performance than those reflected in the appreciation in value of stock options. In 2005, the compensation committee established a discretionary corporate bonus plan (the “Bonus Plan”) to reward our executives for assisting us to achieve our operational goals. Under the Bonus Plan, cash bonuses could range from 0% to a maximum of 150% of the executive’s 2005 base salary depending upon certain target performance goals being achieved. In determining the target performance goals, the committee considered the uncertainty in the budget related to sales of the Abraxane launch and the anticipated effects on our stock price. These target performance goals were based on our meeting the following budgeted criteria: (i) net revenue excluding sales of Abraxane, (ii) gross profit including sales of Abraxane and (iii) gross profit excluding sales of Abraxane, and (iv) cash flow from operations (including capital expenses). In addition, the compensation committee authorized management to set specified individual goals and grant discretionary bonuses for executive officers based upon personal performance. For 2005, the individual goals were tied to corporate performance, functional area performance and individual performance.

Stock Option Grants.The compensation committee believes that stock ownership by management is beneficial in aligning management and stockholder interests, thereby enhancing stockholder value. Stock options may be granted to management including the executive officers and other employees under our option plans, which are currently administered by the board of directors through the compensation committee. The compensation committee advises the board of directors with respect to, and approves all option grants made to, our executive officers. Because of the direct relationship between the value of an option and the stock price, the compensation committee believes that options motivate the executive officers to manage our business in a manner that is consistent with stockholder interests. Stock option grants are intended to focus the attention of the recipient on our long-term performance which we believe results in improved stockholder value, and to retain the services of the executive officers in a competitive job market by providing significant long-term earnings potential. To this end, stock options generally vest and become fully exercisable over a four-year period.

20

However, under our option plans, options may be granted with differing vesting periods. The principal factors considered in granting stock options to our executive officers are prior performance, level of responsibility, other compensation and the officer’s ability to influence our long-term growth and profitability. However, our option plans do not provide any quantitative method for weighting these factors, and the compensation committee’s decisions with respect to grant awards are primarily based upon subjective evaluations of the past as well as future anticipated performance.

Other Compensation Plans.We have adopted certain general employee benefit plans in which the executive officers are permitted to participate on parity with other employees. We also provide a 401(k) deferred compensation pension plan. Benefits under these plans are indirectly tied to our performance.

Deductibility of Compensation.Section 162(m) of the Internal Revenue Code (“IRC”) disallows a deduction by us for compensation exceeding $1.0 million paid to certain executive officers, excluding, among other things, performance based compensation. Since non-performance based compensation has not exceeded $1.0 million for any executive officer to date, there has been no limitation as to the deductibility of executive compensation. The compensation committee remains aware of the IRC Section 162(m) limitations, and the available exemptions, and will address the issue of deductibility when and if circumstances warrant the use of such exemptions.

Chief Executive Officer Compensation

Two persons served as our chief executive officer during 2005. Alan Heller served as our chief executive officer through November 23, 2005 and Dr. Patrick Soon-Shiong has served as our chief executive officer since that date.

The compensation of Alan Heller was determined pursuant to his employment agreement dated November 15, 2004. In determining the compensation package for Mr. Heller, the board reviewed comparative data of the overall compensation packages given to chief executive officers of peer companies and approved the employment agreement with Mr. Heller. The employment agreement provided for a base salary of $600,000 and a right to participate in our discretionary corporate cash bonus plan, with the amount of any cash bonus being equal to 0 to 120% of his base salary based upon the achievement of the performance goals established by the compensation committee. In addition, under the terms of the employment agreement, Mr. Heller also received a grant of an option to purchase 150,000 shares of our common stock at an exercise price of $28.38 (the fair market value of our common stock on the date of grant), and a restricted stock award of 50,000 shares of our common stock that vests on the earlier of five years or the date on which we have achieved an EBIDTA of $500 million in any given fiscal year.

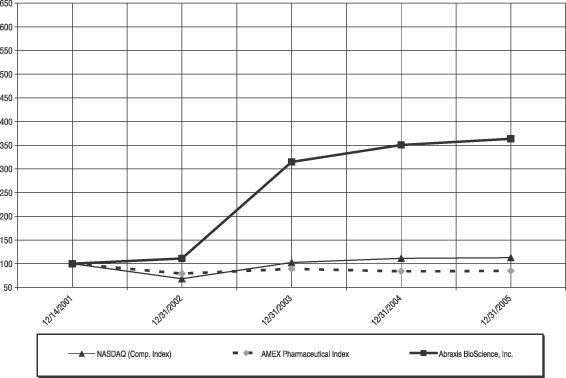

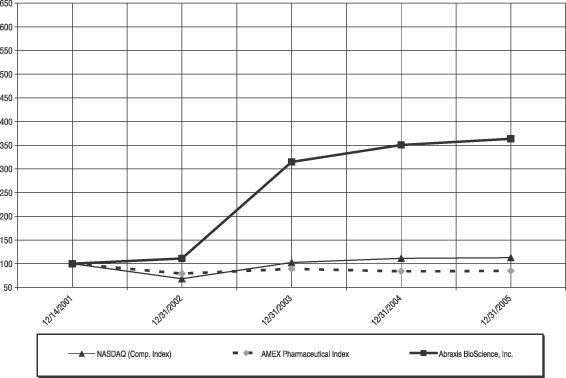

Upon termination of Mr. Heller’s employment in November 2005, Mr. Heller received a lump sum payment of $1,680,000 and we accelerated the vesting of his stock option to purchase 12,500 shares of our common stock.